The Interaction Between Medicare Premiums and Social Security COLAs

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workers’ past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services (Part B) and prescription medications (Part D). Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

Although annual adjustments are made to both the Social Security benefit an individual receives and the Medicare premiums an individual pays, these adjustments are indexed to different inflation measures. The Social Security annual cost-of-living adjustment (COLA) is based on the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W), which is a measure of general inflation. Medicare premium growth, by contrast, is based on program expenditure growth, which reflects spending for covered medical services.

These different adjustment measures have resulted in Medicare premiums that typically increase at a rate greater than Social Security COLAs. From 2000 to 2018, Social Security COLAs have averaged a 2.2% annual increase, resulting in a cumulative benefit increase of approximately 50%, considerably less than the average 6.1% annual increase in standard Medicare Part B premiums, which has resulted in Medicare Part B premium growth of close to 195% over the same period. As a result, a greater percentage of total Social Security benefits is being deducted to pay for Medicare premiums.

Congress has acted several times to protect beneficiaries from the impact of large Medicare Part B premium increases. The hold-harmless provision, made permanent by P.L. 110-360 Section 211(b), modified the Social Security Act to prevent certain Social Security beneficiaries’ monthly benefit amount from decreasing from one year to the next due to an increase in Medicare Part B premiums. The hold-harmless provision does not apply to Medicare Part D premiums and does not cover several groups of beneficiaries including high-income individuals, Medicare Part B enrollees who do not receive Social Security benefits, new enrollees, and low-income beneficiaries (typically, Medicaid will pay low-income beneficiaries’ Medicare Part B premiums). When a majority of beneficiaries are held harmless, such as in years with no Social Security COLA, premiums are typically still calculated to cover 25% of the expected costs of the Medicare Part B program; thus, those not held harmless may bear the burden of meeting any resulting increase in premiums disproportionately.

The Medicare Trustees’ long-range projections indicate that Medicare per capita cost growth will increase greater than inflation as measured by the CPI-W, increasing Medicare premiums at a faster rate than Social Security COLAs. The Medicare Trustees therefore project that a larger portion of Medicare beneficiaries’ Social Security benefits will be required to pay standard Medicare Part B and Part D base premiums in the future. For example, in 2018, Medicare Part B and Part D premiums account for approximately 12.4% of the average Social Security benefit; the Medicare Trustees project that this will increase to approximately 14.0% in 2028 and to approximately 16.8% of the average Social Security benefit in 2092.

The Interaction Between Medicare Premiums and Social Security COLAs

Jump to Main Text of Report

Contents

- Introduction

- Social Security

- Social Security Eligibility

- Social Security Benefits

- Social Security Financing

- Social Security Annual Cost-of-Living Adjustments

- Medicare

- Medicare Eligibility

- Medicare Financing

- Medicare Part B Premiums

- Medicare Part D Premiums

- Social Security Benefits and Medicare Part B Premiums from 2000 to 2018

- Hold-Harmless Provision for Medicare Part B Premiums

- Groups Not Covered by the Hold-Harmless Provision

- Medicare Part B Premiums for Those Held Harmless

- Medicare Part B Premiums for Those Not Held Harmless

- Projected Impact of Medicare Premium Growth on Social Security Benefits

Figures

Summary

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workers' past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services (Part B) and prescription medications (Part D). Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

Although annual adjustments are made to both the Social Security benefit an individual receives and the Medicare premiums an individual pays, these adjustments are indexed to different inflation measures. The Social Security annual cost-of-living adjustment (COLA) is based on the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W), which is a measure of general inflation. Medicare premium growth, by contrast, is based on program expenditure growth, which reflects spending for covered medical services.

These different adjustment measures have resulted in Medicare premiums that typically increase at a rate greater than Social Security COLAs. From 2000 to 2018, Social Security COLAs have averaged a 2.2% annual increase, resulting in a cumulative benefit increase of approximately 50%, considerably less than the average 6.1% annual increase in standard Medicare Part B premiums, which has resulted in Medicare Part B premium growth of close to 195% over the same period. As a result, a greater percentage of total Social Security benefits is being deducted to pay for Medicare premiums.

Congress has acted several times to protect beneficiaries from the impact of large Medicare Part B premium increases. The hold-harmless provision, made permanent by P.L. 110-360 Section 211(b), modified the Social Security Act to prevent certain Social Security beneficiaries' monthly benefit amount from decreasing from one year to the next due to an increase in Medicare Part B premiums. The hold-harmless provision does not apply to Medicare Part D premiums and does not cover several groups of beneficiaries including high-income individuals, Medicare Part B enrollees who do not receive Social Security benefits, new enrollees, and low-income beneficiaries (typically, Medicaid will pay low-income beneficiaries' Medicare Part B premiums). When a majority of beneficiaries are held harmless, such as in years with no Social Security COLA, premiums are typically still calculated to cover 25% of the expected costs of the Medicare Part B program; thus, those not held harmless may bear the burden of meeting any resulting increase in premiums disproportionately.

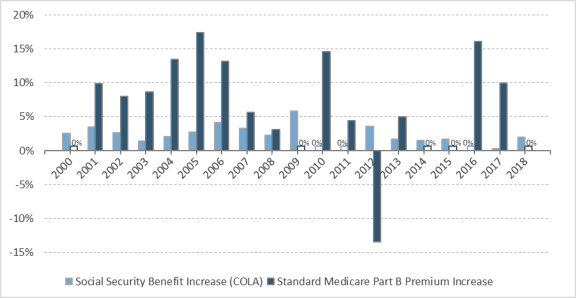

The Medicare Trustees' long-range projections indicate that Medicare per capita cost growth will increase greater than inflation as measured by the CPI-W, increasing Medicare premiums at a faster rate than Social Security COLAs. The Medicare Trustees therefore project that a larger portion of Medicare beneficiaries' Social Security benefits will be required to pay standard Medicare Part B and Part D base premiums in the future. For example, in 2018, Medicare Part B and Part D premiums account for approximately 12.4% of the average Social Security benefit; the Medicare Trustees project that this will increase to approximately 14.0% in 2028 and to approximately 16.8% of the average Social Security benefit in 2092.

Introduction

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. In 2017, 61.9 million individuals received Social Security benefits, of which 69% were retired workers aged 62 or older and 14% were disabled workers aged 61 or younger.1 In 2017, nearly 90% of the U.S. population aged 65 or older received Social Security benefits, representing approximately 33% of income for this population. For half of married elderly couples in 2017, Social Security represented 50% or more of their income and for 23% of married elderly couples, Social Security represented 90% or more of their income.2 In Medicare, 58.4 million individuals were enrolled in 2017, of which 85% were aged 65 or older and 15% were disabled and aged 64 or younger.3 In 2017, total Social Security expenditures were $952.5 billion (4.9% of gross domestic product, or GDP).4 In the same year, total Medicare expenditures were $710.2 billion (3.7% of GDP).5

Eligible individuals may enroll in one program and not the other; however, for individuals who are enrolled in both Social Security and Medicare, certain interactions between the two programs may have important financial implications. For instance, individuals who are both Social Security beneficiaries and Medicare Part B enrollees have their Medicare Part B premium automatically deducted from their monthly Social Security benefit. Although annual adjustments are made to both the Social Security benefit an individual receives and the Medicare premiums an individual pays, these adjustments are indexed to different inflation measures. The Social Security annual cost-of-living adjustment (COLA) is based on the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W), which is a measure of general inflation. Medicare premium growth, by contrast, is based on program expenditure growth, which reflects spending for covered medical services. These different inflation measures can mean that, over time, Medicare premiums absorb a larger portion of an individual's Social Security benefit.

Congress has acted several times to protect beneficiaries from the impact of large Medicare Part B premium increases. For example, Congress established a hold-harmless provision in the Social Security Act for those enrolled in both Social Security and Medicare.6 This provision protects an individual from being charged a higher Medicare Part B premium if the increase would cause the dollar amount of his or her Social Security benefit to decrease from one year to the next. However, several groups of beneficiaries are not held harmless and increases in the Medicare Part D premium are not considered in this provision.

This report discusses the relationship between Social Security COLAs and Medicare premiums and provides data on recent experience of the annual adjustments to Social Security benefits and Medicare premiums. The report explains how and when the hold-harmless provision is activated for certain beneficiaries and discusses the projected impact of Medicare premium growth on Social Security benefits over the next 75 years.

Social Security

Social Security, established by Title II of the Social Security Act of 1935 and administered by the Social Security Administration, provides monthly cash benefits to retired or disabled workers and their family members and to family members of deceased workers.7

Social Security Eligibility

Workers become eligible for Social Security benefits for themselves and their family members by working in Social Security-covered employment. Generally, a worker needs 40 earnings credits (10 years of Social Security-covered employment) to be eligible for Social Security retired-worker benefits.8 Full Social Security retirement benefits are payable at an individual's full retirement age. The full retirement age historically was 65; however, this age has been raised from 65 to 67 so that workers born in 1960 or later will be eligible for full retirement benefits at the age of 67.9 Retired workers are able to receive Social Security benefits as early as age 62, though the benefits will be permanently reduced. In 2017, 31% of new retired-worker Social Security beneficiaries were 62 years old and 54% of new retired-worker beneficiaries were younger than 66 years old (the full retirement age in that year). Therefore, more than half of new retirees in 2017 had not reached the full retirement age before claiming their Social Security benefits.10

Social Security benefits also are available to disabled workers and their dependents and to survivors of deceased workers.11 In 2017, this population accounted for 27% of the total Social Security beneficiary population.12

Social Security Benefits

A retired worker's initial monthly benefit is based on his or her past earnings. The benefits are calculated by applying a progressive benefit formula to the worker's career-average earnings in Social Security-covered employment, adjusted for wage growth. The first step in calculating an individual's Social Security benefit is to determine his or her average indexed monthly earnings (AIME), a summarized measure of a worker's career-average earnings indexed (i.e., adjusted) to average earnings growth in the national economy.13 The next step is to compute the primary insurance amount by applying a progressive benefit formula to the AIME, which replaces a greater share of career-average earnings for low-paid workers than that for high-paid workers.14 Because the AIME is indexed to the average wage, the average benefits that new beneficiaries receive keep pace with growth in average earnings in the economy.

Social Security benefits may be adjusted based on several factors, including the age at which an individual first claims his or her benefit, whether an individual is receiving a pension from non-Social Security-covered earnings, and whether an individual continues to work and earn above a certain amount.

In July 2018, the average monthly benefit for retired workers was $1,414.73.15

Social Security Financing

Social Security income and outgo are accounted for in two separate trust funds: the Federal Old-Age and Survivors Insurance (OASI) Trust Fund and the Federal Disability Insurance (DI) Trust Fund.16 Funding for these two trust funds comes from three different sources—payroll taxes, income taxes on a portion of Social Security beneficiaries' benefits, and interest income on Social Security trust fund balances. Payroll taxes include Federal Insurance Contributions Act (FICA) taxes and Self-Employment Contributions Act (SECA) taxes.17 The OASI and DI Trust Funds were credited with asset reserves of more than $2.89 trillion at the end of 2017.18

Social Security Annual Cost-of-Living Adjustments

Social Security beneficiaries' monthly benefit amount is adjusted annually to maintain purchasing power over time. In October each year, the Social Security Administration announces the cost-of-living adjustment (COLA) payable in January of the following year.19 The Social Security COLA is a reflection of inflation measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W),20 calculated by the Bureau of Labor Statistics. The CPI-W, representing 29% of the population, is an estimate of the average change in prices of the goods and services purchased by households whose income is earned primarily from a clerical or wage occupation. The CPI-W gathers prices on thousands of items and services across the United States, including food, beverages, clothing, transportation, medical care, education, housing, recreation, and energy.21 An average CPI-W is calculated from these prices each quarter. The Social Security COLA equals the percentage increase in the average CPI-W from the third quarter of the base year (the last year for which a Social Security COLA was applied) to the third quarter of the current year. If the CPI-W indicates deflation, the Social Security COLA will equal 0.0% and Social Security benefits will not decrease.

In most years since 1975, when the first COLA was applied to Social Security benefits, a COLA has been payable to beneficiaries. However, due to negative or low inflation, there have been several years recently with no (2010, 2011, and 2016) or a relatively low (0.3% in 2017) Social Security COLA.22 The Social Security COLA in 2018 was 2.0%.23

Medicare

Medicare is a federal program that provides health insurance coverage for elderly and permanently disabled individuals.24 Medicare was established in 1965 under Title XVIII of the Social Security Act and is administered by the Centers for Medicare and Medicaid Services (CMS).

Medicare consists of four main programs, or parts:

- Part A (Hospital Insurance, or HI) covers inpatient hospital services, skilled nursing care, hospice care, and some home health services. Most individuals are entitled to premium-free Part A coverage. Individuals pay certain deductibles,25 co-payments, and other out-of-pocket expenses depending on the services used.

- Part B (Supplementary Medical Insurance, or SMI) covers physician services, outpatient services, and certain home health and preventive services. Enrollees pay a monthly premium, an annual deductible ($183 in 2018),26 and a 20% coinsurance rate for most services.27

- Part C (Medicare Advantage, or MA) is a private plan option for beneficiaries that covers all Medicare Part A and Part B services, except hospice. Typically, MA plans offer additional benefits or require smaller co-payments or deductibles than Medicare Part A and Part B.

- Part D covers outpatient prescription drug benefits. Medicare Part D plans offer either standard coverage or alternative coverage, which must have actuarially equivalent benefits. Plans may also offer enhanced coverage for additional premiums. Enrollees pay a monthly premium, an annual deductible (set at a maximum of $405 in 2018 for standard coverage), and other cost-sharing requirements.28

Medicare Eligibility

Similar to Social Security eligibility requirements, an individual is entitled to premium-free Medicare Part A coverage if he or she (or his or her spouse) is aged 65 or older, worked in covered employment, and paid Medicare payroll taxes for at least 40 quarters (10 years).29 Individuals aged 65 or older who are not entitled to premium-free Medicare Part A may enroll in the program but must pay a premium. Unlike Social Security, an individual may not claim Medicare benefits sooner than the age of 65 unless he or she has a certain disability. An individual does not need to be a Social Security beneficiary to be eligible for Medicare.

Medicare Part B is a voluntary, premium-based program for individuals enrolled in Medicare Part A.30 Approximately 91% of those eligible for Medicare Part B are enrolled in 2018.31

As an alternate option, any individual eligible for Medicare Part A and Part B benefits may choose to enroll in Medicare Advantage for coverage of those benefits. As of July 2018, approximately 36% of Medicare beneficiaries are enrolled in Medicare Advantage plans.32

In general, anyone who is entitled to Medicare Part A and/or enrolled in Part B is eligible to enroll in Medicare Part D. As of July 2018, approximately 76% of those eligible are enrolled in Medicare Part D.33

Medicare Financing

Medicare is financed through two separate trust funds: the Hospital Insurance (HI) Trust Fund, which finances Medicare Part A, and the Supplementary Medical Insurance (SMI) Trust Fund, which finances Medicare Part B and Part D.34 For Medicare program costs attributable to beneficiaries enrolled in Medicare Advantage, funds are taken in appropriate proportions from the HI and SMI Trust Funds. The HI Trust Fund is funded primarily by payroll taxes, and the SMI Trust Fund is funded primarily through general revenue transfers and beneficiary premiums.

Medicare Part B Premiums

Beneficiaries enrolled in Medicare Part B must pay premiums (or have premiums paid on their behalf).35 By law, individuals receiving Social Security benefits have their Medicare Part B premiums automatically deducted from their benefit checks.36 In 2017, approximately 75% of Medicare Part B enrollees (39.7 million) had their Medicare Part B premiums deducted from their monthly Social Security benefit checks.37 Those not receiving Social Security are billed by Medicare, usually on a quarterly basis.38 Individuals who are enrolled in Medicare Part B but do not receive Social Security may include individuals who are waiting to reach full retirement age (65-67 years of age) and individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers.

Standard Medicare Part B premiums are set each year at a rate equal to 25% of average expected per capita Medicare Part B program costs for the aged for the year.39 Monthly Medicare Part B premiums are based on the estimated amount that would be needed to finance Medicare Part B expenditures on an incurred basis during the year. Therefore, changes in the Part B premium over time generally reflect the growth in total Part B expenditures. The expected program costs for the aged, that is, the monthly actuarial rate for the aged, is defined as one-half of the expected average monthly per capita program costs for the aged plus any contingency margin adjustments. The contingency margin is the amount set aside to cover an appropriate degree of variation between actual and projected costs in a given year. Since 2016, a $3.00 surcharge has been added to the standard monthly premium.40 The Medicare Part B premium is applied nationally and does not vary with a beneficiary's age, health status, or place of residence. The standard Medicare Part B premium is the premium amount paid by beneficiaries not held harmless (see "Medicare Part B Premiums for Those Not Held Harmless") and not paying a high-income-related premium.41

The standard monthly Medicare Part B premium in 2018 is $134.00. This premium applies to individuals with a modified adjusted gross income (MAGI) of $85,000 or less and to couples with a MAGI of $170,000 or less.42 Enrollees earning more than those respective amounts pay higher premiums based on their income, as shown in Table 1.

|

Modified Adjusted Gross Income (MAGI)a |

|||

|

Single (in dollars) |

Married Couple (in dollars) |

Monthly Per Person Part B Premium (in dollars) |

Percentage of Per Capita Part B Costs Covered by Premiumsb |

|

$85,000 or less |

$170,000 or less |

$134.00 |

25% |

|

85,001-107,000 |

170,001-214,000 |

187.50 |

35% |

|

107,001-133,500 |

214,001-267,000 |

267.90 |

50% |

|

133,501-160,000 |

267,001-320.000 |

348.30 |

65% |

|

Above 160,000 |

Above 320,000 |

428.60 |

80% |

Source: Centers for Medicare & Medicaid Services (CMS), 2018 Medicare Costs, December 2017, at https://www.medicare.gov/Pubs/pdf/11579-Medicare-Costs.pdf, and CMS, "Medicare Program: Medicare Part B Monthly Actuarial Rates, Premium Rates, and Annual Deductible Beginning January 1, 2018," 82 Federal Register 55370, November 21, 2017, at https://www.federalregister.gov/documents/2017/11/21/2017-24877/medicare-program-medicare-part-b-monthly-actuarial-rates-premium-rates-and-annual-deductible.

Notes: Each member of a couple pays the applicable premium. Lower thresholds are rounded up to the nearest dollar and upper thresholds are rounded down to the nearest dollar.

a. Modified Adjusted Gross Income (MAGI) is defined as gross income from all sources (excluding nontaxable Social Security benefits and other statutory exclusions) adjusted to reflect a number of deductions (including trade and business deductions and losses from sale of property) plus certain foreign-earned income and tax-exempt interest.

b. Standard Medicare Part B premiums are set at a rate to cover 25% of Medicare Part B per capita costs. Enrollees at higher income levels pay premiums that represent a higher percentage of per capita costs.

Since 2007,43 high-income beneficiaries have paid higher premiums set to cover a greater percentage of Medicare Part B costs than the standard premium. Adjustments known as income-related monthly adjustment amounts are made to the standard Medicare Part B premiums for high-income beneficiaries, with the share of expenditures paid by beneficiaries increasing with income. This share ranges from 35% to 80% of the projected per capita Medicare Part B expenditures (see Table 1). Those subject to a high-income-related premium are determined based on their MAGI and the most recent federal tax return provided to the Social Security Administration by the Internal Revenue Service.44 In 2018, individuals with a MAGI greater than $85,000 and couples with a MAGI greater than $170,000 are defined as high-income beneficiaries and pay an income-related monthly adjustment amount ranging from $53.50 to $294.60, based on income level.45 Approximately 6% of Medicare Part B enrollees (3.5 million individuals) pay high-income-related premiums in 2018.46

Low-income Medicare Part B enrollees may qualify for assistance with premiums and other out-of-pocket expenses through Medicare Savings Programs. Depending on an enrollee's income and the eligibility requirements of his or her state Medicaid program,47 a Medicare enrollee may be eligible for full Medicare and Medicaid benefits paid for by Medicaid through the Qualified Medicare Beneficiary program. Low-income Medicare Part B enrollees who do not meet their respective state's Medicaid eligibility criteria may be eligible to have their Medicare Part B premiums paid either by Medicaid, through the Specified Low-Income Medicare Beneficiaries program, or by the federal government, through the Qualifying Individuals program.48

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits (the base beneficiary premium) each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

Since 2011, high-income Medicare Part D enrollees have paid Medicare Part D premiums higher than the Part D base premium. Those subject to a high-income-related premium are determined based on their MAGI, using the same income thresholds as Medicare Part B income-related premiums. The income-related monthly adjustment amount (IRMAA) is calculated as the difference between the Medicare Part D base beneficiary premium (which represents 25.5% of the average national bid amount) and 35%, 50%, 65%, or 80% of the national average cost for providing Medicare Part D benefits.53 The surcharge is based on beneficiary income, with higher-income beneficiaries facing a larger monthly premium adjustment. The amount of the Medicare Part D high-income-related premium is determined using the Medicare Part D base premium, and the IRMAA calculated from this is added onto the Medicare Part D enrollee's actual Part D premium.

Some Medicare Part D enrollees with low incomes and limited assets may qualify for premium and cost-sharing assistance. These low-income subsidies are offered on either a full or a partial basis, depending on an individual's level of income. Enrollees who are eligible for Medicaid, those eligible for one of the three Medicare Savings Programs for Medicare Part B assistance, and those eligible for Supplemental Security Income assistance are automatically eligible for full low-income subsidies,54 which cover the cost of the monthly premium and the annual deductible and also reduce cost sharing. Individuals who do not qualify for one of the above programs and have incomes below 150% of the federal poverty level (FPL) and limited assets may be eligible for a partial subsidy.55 These individuals pay a percentage of the base beneficiary premium on a sliding scale based on income as well as a reduced deductible ($83 rather than the maximum $405 in 2018) and reduced cost-sharing amounts.56

Social Security Benefits and Medicare Part B Premiums from 2000 to 2018

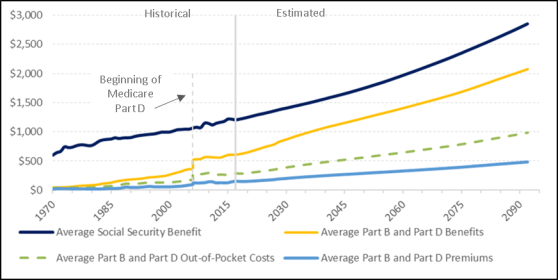

Social Security benefits and Medicare Part B premium amounts are adjusted annually using different methods, which typically has resulted in a higher percentage increase in Medicare Part B premiums than in Social Security benefit increases. Specifically, Social Security benefits are adjusted for inflation annually by COLAs. The Social Security COLA is a measure of general inflation based on the CPI-W. By contrast, Medicare Part B premiums are adjusted annually to account for changes in Medicare program expenditures for covered medical services. Medicare Part B premiums represent a percentage of the actual costs of the program, and thus premiums rise as health care costs rise. The annual percentage increase in Social Security benefits and Medicare Part B premiums for years 2000 to 2018 is shown in Figure 1.

|

Figure 1. Annual Percentage Increase in Social Security Benefits and Standard Medicare Part B Premiums, 2000-2018 |

|

|

Sources: Board of Trustees, Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, June 5, 2018, at https://www.ssa.gov/OACT/TR/2018/tr2018.pdf (hereinafter cited as the 2018 Social Security Trustees Report); and Board of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, 2018 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, June 5, 2018, at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2018.pdf (hereinafter cited as the 2018 Medicare Trustees Report). Notes: Social Security cost-of-living adjustments (COLAs) are payable starting in January of year shown. Social Security did not pay COLAs in January 2010, 2011, or 2016. In 2017, there was only a 0.3% Social Security COLA. The standard Medicare Part B premium is the premium amount paid by enrollees not held harmless and not paying a high-income-related premium amount. Some individuals may have experienced different growth rates than those shown if their premiums were adjusted for the hold-harmless provision or high-income-related premiums. There was no Medicare Part B standard premium increase in 2000, 2009, 2012, 2014, 2015, or 2018. In 2012, the standard Medicare Part B premium declined by 13.4%, primarily as a result of a large number of individuals no longer being held harmless because of the 3.6% COLA after two years of 0.0% COLAs. |

Since 2000, Social Security COLAs have ranged from 0.0% to 5.8% with an average Social Security COLA of 2.2%. There was no Social Security COLA increase in 2010, 2011, or 2016 and only a relatively small (0.3%) Social Security COLA in 2017.

Although Medicare Part B premium changes also have varied from year to year, there is a general trend of increasing premiums paid by beneficiaries. Standard Medicare Part B premium changes have ranged from -13.4% to 17.4% since 2000, with an average increase of 6.1%.57 The 13.4% decline in the standard Medicare Part B premium in 2012 occurred primarily as a result of a large number of individuals no longer being held harmless because of the 3.6% COLA following two years of 0.0% COLAs. The 3.6% COLA allowed for the full amount of the previous years' premium increases to be spread to most beneficiaries, rather than the minority of beneficiaries not held harmless during the 0.0% COLA years (see "Hold-Harmless Provision for Medicare Part B Premiums"). Other than the years in which there was no Medicare Part B premium increase (2000, 2009, 2012, 2014, 2015, and 2018), increases in Medicare Part B premiums historically have been greater than the Social Security COLA increases.

Since 2000, the Social Security annual COLA has resulted in a cumulative benefit increase of approximately 50%, considerably less than the Medicare Part B premium growth of close to 195%.58

Hold-Harmless Provision for Medicare Part B Premiums

A hold-harmless provision in the Social Security Act prevents certain Social Security beneficiaries' benefit amount from decreasing from one year to the next due to an increase in standard Medicare Part B premiums.59 If, in a given year, the increase in the standard Medicare Part B premium would cause a beneficiary's Social Security check to be less, in dollar terms, than it was the year before, the Medicare Part B premium is reduced to ensure that the nominal amount of the individual's Social Security check stays the same.60

The number of individuals held harmless can vary widely from year to year, depending on annual inflation rates and projected Medicare Part B program costs. In a typical year, few individuals are held harmless. However, in years in which there is no Social Security COLA, many individuals may be affected by this provision. For example, there was a 2% Social Security COLA in 2018 and 28% of Medicare Part B enrollees were held harmless. By contrast, in 2016, there was no Social Security COLA and 70% of Medicare Part B enrollees were held harmless from the standard Medicare Part B premium increase.61

The hold-harmless provision does not apply to Medicare Part D premiums. Therefore, a beneficiary is not held harmless if the increase in his or her Medicare Part D premium or the combined increase in Medicare Part B and Part D premiums causes his or her Social Security check to decline. In other words, an individual's Social Security check may decrease as a result of a Medicare Part D premium increase.62

Groups Not Covered by the Hold-Harmless Provision

Several groups are not covered by the hold-harmless provision. The following groups may receive reduced Social Security benefit payments due to Medicare premium increases that are greater than the Social Security COLA:

- New enrollees to either Medicare or Social Security;63

- Medicare Part B enrollees who do not receive Social Security benefits;

- High-income individuals who pay income-related Medicare Part B premiums;

- Low-income beneficiaries who are in a Medicare Savings Program (Medicaid typically pays the premiums on their behalf).

Medicare Part B enrollees who do not receive Social Security may include individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers. This includes civilian federal employees who were hired before 1984 and are receiving Civil Service Retirement System (CSRS) benefits. Although CSRS benefits are increased annually by the same COLA applied to Social Security benefits, the benefits are not Social Security benefits and thus its beneficiaries are not protected under the hold-harmless provision.64

Medicare Part B Premiums for Those Held Harmless

Whether a beneficiary is held harmless or not depends on the amount of the standard Medicare Part B premium increase relative to the amount of his or her Social Security COLA in a given year.

|

Calculating When the Hold-Harmless Provision Is Activated Formula: Hold-Harmless Activated if: (current Social Security monthly benefit x COLA payable in next year) – dollar amount of Medicare Part B premium increase in next year < 0 Example: Assume the Social Security COLA payable in the next year is 2.0% and the standard monthly Medicare Part B premium increases by $20.00 in the next year. Individual 1 currently receives a $1,200 monthly Social Security benefit. The 2.0% COLA would increase this benefit by $24.00. Hold-Harmless Activation: ($1,200.00 x 0.02) – $20.00 = $4.00 > 0 Interpretation: Because this individual's COLA is $4.00 greater than the Medicare Part B premium increase, the hold-harmless provision would not be activated for this individual. Therefore, this individual would pay the entire $20.00 increase in the standard monthly Medicare Part B premium. Individual 2 currently receives a $750 monthly Social Security benefit. The 2.0% COLA would increase this benefit by $15.00. Hold-Harmless Activation: ($750.00 x 0.02) – $20.00 = –$5.00 < 0 Interpretation: Because this individual's COLA is $5.00 less than the Medicare Part B premium increase, the hold-harmless provision would be activated for this individual. Therefore, this individual would pay as much of the Medicare Part B premium increase as possible without decreasing his or her Social Security benefit amount. In this case, the individual would pay a $15.00 monthly Medicare Part B increase and would be held harmless from paying the remaining $5.00. |

The Medicare Part B premium an individual pays when held harmless may affect his or her future Medicare Part B premium amounts. For example, an individual held harmless in a year with no Social Security COLA may pay an increase in Medicare Part B premiums in a later year in which he or she is not held harmless, even if the standard Medicare Part B premium does not increase.

As an illustration, Table 2 shows how the activation of the hold-harmless provision might affect future Medicare Part B premiums for a hypothetical individual who retired in 2008, receives an average Social Security benefit amount, and is eligible for the hold-harmless provision beginning in 2009. For example, in 2012, the standard Medicare Part B premium decreased by $15.50, yet the Medicare Part B premium paid by this hypothetical individual, who would have been held harmless in 2010 and 2011 but not in 2012, would have increased by $3.50 from the premium he or she would have paid in 2011 ($96.40) to the standard Medicare Part B premium of $99.90 in 2012. A similar situation would have occurred in 2018. In 2018, the standard Medicare Part B premium remained the same as the 2017 standard Medicare Part B premium, yet the Medicare Part B premium paid by this hypothetical individual, who would have been held harmless in 2017 and previous years but not in 2018, would have increased by approximately $25.30 from the premium he or she would have paid in 2017 ($108.70) to the standard Medicare Part B premium of $134.00 in 2018.

Table 2. Illustration of the Activation of the Hold-Harmless Provision for a Hypothetical Individual Over Time (2009-2018)

(for a hypothetical individual who is retired, received an average Social Security benefit amount of $1,111 in 2008, and is eligible for the hold-harmless provision in all years shown)

|

Year |

Social Security COLAa |

Average Social Security Monthly Benefitb |

Increase of Average Social Security Benefit Amountc |

Amount of Standard Medicare Part B Premiumd (in dollars) |

Amount of Standard Medicare Part B Premium Increasee |

Average Social Security Monthly Benefit Increase less the Standard Medicare Part B Premium Increasef |

Hold- Harmless Provision Activated?g |

Medicare Part B Premium Paid by the Individualh |

Net Social Security Benefit Check Change After Hold-Harmless Activationi |

|

2009 |

5.8% |

$1,175.71 |

$64.45 |

$96.40 |

$0.00 |

$64.45 |

No |

$96.40 |

$65.45 |

|

2010 |

0.0% |

1,175.71 |

0.00 |

110.50 |

14.10 |

-14.10 |

Yes |

96.40 |

0.00 |

|

2011 |

0.0% |

1,175.71 |

0.00 |

115.40 |

4.90 |

-4.90 |

Yes |

96.40 |

0.00 |

|

2012 |

3.6% |

1,218.04 |

42.33 |

99.90 |

-15.50 |

57.83 |

No |

99.90 |

38.83j |

|

2013 |

1.7% |

1,238.74 |

20.71 |

104.90 |

5.00 |

15.71 |

No |

104.90 |

15.71 |

|

2014 |

1.5% |

1,257.32 |

18.58 |

104.90 |

0.00 |

18.58 |

No |

104.90 |

18.58 |

|

2015 |

1.7% |

1,278.70 |

21.37 |

104.90 |

0.00 |

21.37 |

No |

104.90 |

21.37 |

|

2016 |

0.0% |

1,278.70 |

0.00 |

121.80 |

16.90 |

-16.90 |

Yes |

104.90 |

0.00 |

|

2017 |

0.3% |

1,282.54 |

3.84 |

134.00 |

12.20 |

-8.36 |

Yes |

108.70 |

0.00 |

|

2018 |

2.0% |

1,308.19 |

25.65 |

134.00 |

0.00 |

25.65 |

No |

134.00 |

0.35k |

Source: CRS analysis based on data in 2018 Medicare Trustees Report and 2018 Social Security Trustees Report.

Notes: This chart assumes the individual is eligible for the hold-harmless provision (the individual is not new to Social Security or Medicare Part B, receives Social Security benefits, does not pay high-income-related Medicare Part B premiums, and is not eligible for a Medicare Savings Program).

a. COLA = Cost-of-living adjustment.

b. This amount is based on the average monthly Social Security benefit amount for a retired worker in 2008 ($1,111.00), increased annually by the Social Security COLA.

c. Increase from the previous year.

d. The standard Medicare Part B premium is the premium amount paid by enrollees not held harmless and not subject to high-income-related premiums.

e. Increase from previous year. A negative value indicates a decreased premium.

f. Equals the dollar amount increase of the average Social Security benefit minus the dollar amount of the standard Medicare Part B premium increase, before it is determined if the hold-harmless provision is activated. If a value in this column is negative, the hold-harmless provision will be activated whereas if the value is positive, the hold-harmless provision will not be activated.

g. If the dollar amount increase in the Medicare Part B premium that the individual would pay that year (the standard Medicare Part B premium of that year minus the Medicare Part B premium paid by the individual in the previous year) exceeds the dollar amount increase in the individual's Social Security benefit amount that year, then the individual would be held harmless.

h. The Medicare Part B premium the individual pays is reduced so that the Social Security benefit does not decrease from the previous year. Conventional rounding standards dictate that Medicare premiums are rounded down to the nearest dime value.

i. Equals the dollar amount increase of the average Social Security benefit minus the approximate Medicare Part B premium increase paid by the individual (after the hold-harmless provision activation is determined). This represents the approximate increase in Social Security benefit amount the individual would receive after the Medicare Part B premium is deducted from the Social Security benefit.

j. In 2012, although there was a $15.50 decrease in the standard Medicare Part B premium from 2011, this hypothetical individual would have experienced a $3.50 increase in his or her Medicare Part B premium from 2011 to 2012. This hypothetical individual would have benefited from the hold-harmless provision in 2010 and 2011; thus, the actual premium paid by this individual increased from the premium the individual paid in 2011 (when held harmless) to the standard Medicare Part B premium in 2012 ($99.90-$96.40 = $3.50). Therefore, this individual would receive approximately a $38.83 Social Security benefit check increase after the COLA is applied and the standard Medicare Part B premium is deducted.

k. In 2018, although the standard Medicare Part B premium did not increase from 2017, this hypothetical individual would have experienced a $25.30 increase in his or her Medicare Part B premium from 2017 to 2018. This hypothetical individual would have benefited from the hold-harmless provision in 2016 and 2017; thus, the actual premium paid by this individual increased from the premium the individual paid in 2017 (when held harmless) to the standard Medicare Part B premium in 2018 ($134.00-$108.70 = $25.30). Therefore, rather than a $25.65 increase in the monthly Social Security benefit check due to the COLA, this individual would receive approximately a $0.35 Social Security benefit check increase after the COLA is applied and the standard Medicare Part B premium is deducted.

Medicare Part B Premiums for Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 (the 2009 standard Medicare Part B premium rate) whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 (or higher if paying a high-income-related premium).65

As an additional illustration, in 2016, there was no Social Security COLA but there was a Medicare Part B premium increase, causing approximately 70% of Medicare Part B beneficiaries to be held harmless from the Medicare Part B premium increase. In order for premiums to cover 25% of expected per capita expenditures (as is typical), the cost increase would have been shifted to those not held harmless. The Medicare Trustees estimated that, in this scenario, the premiums for those not held harmless in 2016 would therefore need to have increased to approximately $159.00 per month (approximately a $54.10 increase from the 2015 standard Medicare Part B premium of $104.90). In anticipation of this large premium increase that would have been paid by those not held harmless in 2016, the Bipartisan Budget Act of 2015 (BBA 15, P.L. 114-74) altered the Medicare Part B premium calculation methods for 2016. In that year, the standard Medicare Part B premium (paid by those not held harmless) was calculated as if all enrollees were paying the same annually adjusted standard premium (i.e., as if the hold-harmless provision were not in effect).66 As a result, the standard Medicare Part B premium paid by those not held harmless in 2016 was $121.80 (or higher if paying a high-income-related premium).67

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premium—Medicaid will typically pay low-income beneficiaries' Medicare Part B premium—the costs of low-income beneficiaries' rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.

Projected Impact of Medicare Premium Growth on Social Security Benefits

Medicare per capita cost growth is expected to continue to increase at a faster rate than inflation measured by the CPI-W, thus increasing Medicare premiums at a faster rate than Social Security COLAs. The Medicare Trustees project that Medicare beneficiaries will use a larger portion of their Social Security benefits to pay Medicare Part B and Part D premiums in the future. For example, in 2018, the Medicare Part B and Part D premiums account for 12.4% of the average Social Security benefit;68 the Medicare Trustees project that this will increase to approximately 14.0% in 2028 and to 16.8% in 2092.69 Out-of-pocket costs are also expected to continue to absorb an increasing amount of the average Social Security benefit; the Medicare Trustees project that out-of-pocket costs as a percentage of the average Social Security benefit will increase from approximately 23.6% in 2018 to approximately 26.9% in 2028 and to approximately 34.5% in 2092.70

The historical and estimated increases in average Social Security benefits, the average Medicare Part B and Part D benefits, average Medicare Part B and Part D premiums, and average out-of-pocket costs as indicated by the Medicare Trustees' long-range projections are shown in Figure 2.

Author Contact Information

Acknowledgments

This report was originally authored by Kristanna H. Peris, National Academy of Social Insurance Intern.

Footnotes

| 1. |

The other 17% of Social Security beneficiaries are survivors, spouses, or dependents of retired or disabled workers. Social Security Administration, Annual Statistical Supplement, 2018, Table 5.A1, at https://www.ssa.gov/policy/docs/statcomps/supplement/2018/5a.html. |

| 2. |

In the unmarried elderly population in 2017, 71% received 50% or more of their income from Social Security benefits and 42% received 90% or more of their income from Social Security benefits. Social Security Administration, "Snapshot of a Month: December 2017 Beneficiary Data Fact Sheet," December 2017, at https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf. |

| 3. |

Board of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, 2018 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, June 5, 2018, p. 11, at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/index.html. (Hereinafter cited as the 2018 Medicare Trustees Report.) |

| 4. |

Board of Trustees, Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, June 5, 2018, p. 7, at https://www.ssa.gov/OACT/TR/2018/. (Hereinafter cited as the 2018 Social Security Trustees Report.) |

| 5. |

2018 Medicare Trustees Report, p. 11. |

| 6. |

42 U.S.C. §1839(f). |

| 7. |

For more information on Social Security, see CRS Report R42035, Social Security Primer, and CRS In Focus IF10426, Social Security Overview. |

| 8. |

A worker can earn up to four earnings credits per calendar year. In 2018, a worker earns one credit for each $1,320 of covered earnings, up to a maximum of four credits for covered earnings of $5,280 or more. Earnings credits are also called quarters of coverage. Disabled workers are generally required to have worked fewer years, depending on the age at which the worker became disabled. Social Security Administration, Benefits Planner: Social Security Credits, 2018, at https://www.ssa.gov/planners/credits.html#h0. |

| 9. |

For more information about the full retirement age, see CRS Report R44670, The Social Security Retirement Age. |

| 10. |

Social Security Administration, Annual Statistical Supplement, 2018, Table 6.A4, at https://www.ssa.gov/policy/docs/statcomps/supplement/2018/index.html. |

| 11. |

For more information on Social Security for disabled workers and their dependents, see CRS In Focus IF10506, Social Security Disability Insurance (SSDI), and CRS Report R44948, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI): Eligibility, Benefits, and Financing. For more information on Social Security survivors benefits, see CRS Report RS22294, Social Security Survivors Benefits. |

| 12. |

Social Security Administration, Annual Statistical Supplement, 2018, Table 5.A1, at https://www.ssa.gov/policy/docs/statcomps/supplement/2018/5a.pdf. |

| 13. |

For retired workers, the average indexed monthly earnings (AIME) equals the average of the 35 highest years of indexed earnings, divided by 12 (to change from an annual to a monthly measure). If the person worked fewer than 35 years in employment subject to Social Security payroll taxes, the computation includes some years of zero earnings. |

| 14. |

For more information on how Social Security benefits are calculated, see CRS Report R43542, How Social Security Benefits Are Computed: In Brief. |

| 15. |

Social Security Administration, "Monthly Statistical Snapshot, July 2018," August 2018, at https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/. |

| 16. |

Title II of the Social Security Act (SSA). 42 U.S.C. §401. |

| 17. |

Both of these taxes are used as revenue for the Federal Old-Age and Survivors Insurance (OASI) Trust Fund, the Federal Disability Insurance (DI) Trust Fund, and the Medicare Hospital Insurance (HI) Trust Fund. A larger percentage of the tax is allocated to the Social Security trust funds than to the Medicare HI trust fund. |

| 18. |

2018 Social Security Trustees Report, p. 7. |

| 19. |

For more information on Social Security cost-of-living adjustments (COLAs), see CRS Report 94-803, Social Security: Cost-of-Living Adjustments. |

| 20. |

For more information on the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W), see CRS Report R43363, Alternative Inflation Measures for the Social Security Cost-of-Living Adjustment (COLA). |

| 21. |

See Bureau of Labor Statistics, "Consumer Price Index," at https://www.bls.gov/cpi/. |

| 22. |

Social Security Administration, "Cost-of-Living Adjustment (COLA) Information for 2018," November 2017, at https://www.ssa.gov/cola/. |

| 23. |

Ibid. |

| 24. |

For more information on Medicare, see CRS Report R40425, Medicare Primer. |

| 25. |

A deductible is the amount an enrollee must pay for covered services before the program begins to pay for services. |

| 26. |

In 2018, a Medicare Part B enrollee will pay $183 for covered services (e.g., doctors' visits) before Medicare begins to pay for services. See 2018 Medicare Trustees Report, p. 198. |

| 27. |

A 20% coinsurance rate means that an enrollee will pay 20% of every bill for covered services after the deductible is met. The other 80% of the bill is covered by Medicare. |

| 28. |

In 2018, Medicare Part D enrollees with standard coverage have a 25% coinsurance rate for costs between $405 and $3,750. Beyond $3,750, the coinsurance rate for individuals is higher than 25% until the individual pays $5,000 in out-of-pocket costs, after which the individual will have a 5% coinsurance rate or will pay a small fee for each drug, whichever is lower. See 2018 Medicare Trustees Report, p. 198. |

| 29. |

Earnings covered by the Railroad Retirement Board system also entitle individuals to Medicare Part A. |

| 30. |

Medicare Part B is voluntary for those entitled to premium-free Medicare Part A. In most cases, those enrolled in Medicare Part A by paying a premium must enroll in Medicare Part B. |

| 31. |

2018 Medicare Trustees Report, p. 181. |

| 32. |

Centers for Medicare and Medicaid Services (CMS), "Medicare Advantage/Part D Contract and Enrollment Data; Monthly MA Enrollment by State/County/Contract," July 2018, at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/MCRAdvPartDEnrolData/index.html. |

| 33. |

CMS, "Monthly Contract Summary Report," July 2018 at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/MCRAdvPartDEnrolData/Monthly-Contract-and-Enrollment-Summary-Report-Items/Contract-Summary-2018-07.html?DLPage=1&DLEntries=10&DLSort=1&DLSortDir=descending. |

| 34. |

For more information on Medicare financing, see CRS Report R43122, Medicare Financial Status: In Brief. |

| 35. |

For more information on Medicare Part B premiums, see CRS Report R40082, Medicare: Part B Premiums. |

| 36. |

Defined at SSA §1840(a)(1). |

| 37. |

Statistics provided by CMS, April 2018. Medicare Part B premiums of low-income enrollees who receive Social Security may instead be paid by Medicaid. |

| 38. |

Those not receiving Railroad Retirement Board benefits are also billed by Medicare. |

| 39. |

The exact relationship between Medicare Part B expenditures covered by the Medicare Part B premium has been changed by statute at various points. Most recently, the Balanced Budget Act of 1997 (BBA 97; P.L. 105-33) permanently set the standard Medicare Part B premiums to total 25% of estimated program costs for the aged. |

| 40. |

Established by the Bipartisan Budget Act of 2015 (P.L. 114-74). See Appendix D in CRS Report R40082, Medicare: Part B Premiums for more information. |

| 41. |

Medicare beneficiaries who pay penalties for late enrollment may pay a premium surcharge. See CRS Report R40082, Medicare: Part B Premiums for more information. |

| 42. |

Modified adjusted gross income (MAGI) is defined at SSA §1839(i)(4). MAGI is defined as gross income from all sources (excluding nontaxable Social Security benefits and other statutory exclusions) adjusted to reflect a number of deductions (including trade and business deductions and losses from sale of property) plus certain foreign-earned income and tax-exempt interest. |

| 43. |

Income-related premiums were established by the Medicare Modernization Act of 2003 (MMA; P.L. 108-173). The Deficit Reduction Act of 2005 (P.L. 109-171) accelerated the phase-in period for income-related premiums. |

| 44. |

The MMA set the initial income threshold and high-income ranges. Prior to 2010, annual adjustments to these levels were based on annual changes in the consumer price index for urban consumers (CPI-U). The Affordable Care Act (P.L. 111-148, as appended §3402) froze the income thresholds and ranges at the 2010 level through 2019. Beginning in 2018, the Medicare Access and CHIP Reauthorization Act of 2015 (P.L. 114-10) lowered the income thresholds in the top two income categories. The Bipartisan Budget Act of 2018 (P.L. 115-123) adds a fifth income category beginning in 2019 in which individuals will pay premiums representing 85% of average per capita Medicare Part B costs. |

| 45. |

High-income individuals pay surcharges higher than the standard $3.00 surcharge due to BBA 15. In 2018, these surcharges range from $4.20 to $9.60 per month. |

| 46. |

See CRS Report R40082, Medicare: Part B Premiums. |

| 47. |

For more information, see CRS Report R43357, Medicaid: An Overview. |

| 48. |

To be eligible for either the Specified Low-Income Medicare Beneficiaries program or the Qualifying Individuals program, an individual must have an income less than 120% of the federal poverty level (FPL) and between 120% and 135% of FPL, respectively, and have limited assets (in 2018, this means assets less than $7,560 for an individual and less than $11,340 for a couple). |

| 49. |

For more information on Medicare Part D, see CRS Report R40611, Medicare Part D Prescription Drug Benefit. |

| 50. |

Social Security deductions are limited to $300 per month, the harm limit. Social Security Administration, Program Operations Manual System, HI 03001.001, "Description of the Medicare Part D Prescription Drug Program," at https://secure.ssa.gov/poms.nsf/lnx/0603001001. |

| 51. |

CMS, 2018 Medicare Costs, December 2017, https://www.medicare.gov/Pubs/pdf/11579-Medicare-Costs.pdf. |

| 52. |

Juliette Cubanski, Anthony Damico, and Tricia Neuman, Medicare Part D in 2018: The Latest on Enrollment, Premiums, and Cost Sharing, Kaiser Family Foundation, May 17, 2018, at https://www.kff.org/medicare/issue-brief/medicare-part-d-in-2018-the-latest-on-enrollment-premiums-and-cost-sharing/. |

| 53. |

This calculation is based on a national average cost for providing Medicare Part D benefits which excludes federal reinsurance or subsidies. CMS, Annual Release of Part D National Bid Amount and Other Part C & D Bid Information, July 31, 2017, at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2018.pdf. |

| 54. |

Supplemental Security Income is a means-tested federal income supplement program funded by general tax revenues (not Social Security taxes). It is designed to help aged, blind, and disabled individuals who have little or no income or resources, and it provides cash to meet basic needs for food, clothing, and shelter. |

| 55. |

In 2018, an income of below 150% of the federal poverty level equals $18,210 or less for an individual and $24,690 for a couple. Limited assets is defined here as below $12,600 for an individual and below $25,150 for a couple in 2018. |

| 56. |

CRS Report R40611, Medicare Part D Prescription Drug Benefit. |

| 57. |

These calculations are based on the standard Medicare Part B premium. Medicare Part B premiums adjusted for the hold-harmless provision (or late-enrollment penalties) or high-income-related premiums may have experienced a different trend. |

| 58. |

CRS Report R40082, Medicare: Part B Premiums. |

| 59. |

Social Security Act. §1839(f). This provision was originally created by the Deficit Reduction Act of 1984 (P.L. 98-369, §2302), extended by subsequent legislation, and made permanent by the Catastrophic Coverage Act of 1988 (P.L. 100-360, §211(b); this provision was not repealed when that law was repealed in 1989). Those who receive Railroad Retirement Board benefits are also protected by this provision. The hold-harmless provision was first implemented in January 1987. |

| 60. |

If a beneficiary's benefit amount changes during a year in which he or she is held harmless (e.g. a beneficiary begins to be affected by the government pension offset), the Medicare Part B premium amount does not change. |

| 61. |

CMS, "2018 Medicare Parts A & B Premiums and Deductibles," November 17, 2017, at https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-11-17.html. |

| 62. |

Beneficiaries may choose to switch Medicare Part D plans during open season each year and premiums may increase, decrease, or not change as a result of such decisions. |

| 63. |

To be held harmless in a given year, a beneficiary must have had Medicare Part B premiums deducted from both the December check of the prior year and the January check of the current year. |

| 64. |

For more information on the Civil Service Retirement System, see CRS Report 98-810, Federal Employees' Retirement System: Benefits and Financing. |

| 65. |

In 2010, the Medicare Part B high-income-related monthly premium amounts representing 35%, 50%, 65%, and 80% of the per capita Medicare Part B costs were $154.70, $221.00, $287.30, and $353.60 respectively. |

| 66. |

To compensate for the lost premium revenue, the act allowed for additional transfers from the General Fund of the Treasury to the Supplementary Medical Insurance Trust Fund. A $3.00 monthly surcharge is being added to all Medicare Part B premiums until this amount is paid back. (P.L. 114-74, §601). The $3.00 monthly surcharge is automatically included in the Medicare Part B premium amount. |

| 67. |

The Bipartisan Budget Act of 2015 (BBA 15, P.L. 114-74) premium calculation changes resulted in a standard Medicare Part B premium that was $37.20 less than projected without the BBA 15, ($159.00 - $121.80 = $37.20). In 2016, the Medicare Part B high-income-related monthly premium amounts representing 35%, 50%, 65%, and 80% of the per capita Medicare Part B costs were $170.50, $243.60, $316.70, and $389.80, respectively. |

| 68. |

The Medicare Trustees estimate the average 2018 Social Security benefit at $1,222. See 2018 Medicare Trustees Report, Expanded and Supplementary Tables and Figures, Figure II.F2. |

| 69. |

CRS analysis of 2018 Medicare Trustees Report data. See 2018 Medicare Trustees Report, Expanded and Supplementary Tables and Figures, Figure II.F2. |

| 70. |

Ibid. |