HUD FY2019 Appropriations: In Brief

The programs and activities of the Department of Housing and Urban Development (HUD) are designed primarily to address housing problems faced by households with very low incomes or other special housing needs and to expand access to homeownership. Nearly all of the department’s budget comes from discretionary appropriations provided each year in the annual appropriations acts, typically as a part of the Transportation, HUD, and Related Agencies appropriations bill (THUD). On February 12, 2018, the Trump Administration submitted its FY2019 budget request to Congress, including $41.4 billion in gross new budget authority for HUD (not accounting for savings from offsets or rescissions). That is about $11.3 billion (21.5%) less than was provided in FY2018. Most of that reduction ($7.7 billion) is attributable to proposed program eliminations, including Community Development Block Grants (CDBG), the HOME Investment Partnerships grant program, Public Housing Capital Funding, Choice Neighborhoods grants, and the programs funded in the Self-Help Homeownership Opportunity Program (SHOP) account. On May 23, 2018, the House Appropriations Committee approved its version of a FY2019 THUD appropriations bill (H.R. 6072; H.Rept. 115-750), which proposed $53.2 billion in gross funding for HUD. This was about 29% more in gross funding than was requested by the President and slightly more (1%) than was provided in FY2018. The bill did not include the program eliminations proposed by the President, and instead proposed to fund CDBG and the Public Housing Capital Fund at FY2018 levels while reducing funding for the HOME and SHOP accounts (-12% and -7%, respectively). On August 1, 2018, the Senate approved H.R. 6147, the Financial Services Appropriations bill, which had been amended to include the Senate Appropriations Committee-approved version of a FY2019 THUD appropriations bill (S. 3023, incorporated as Division D), along with three other appropriations bills. It included more than $54 billion in gross funding for HUD. This is 30% more in gross funding than was requested by the President, and about 2.5% more than was provided in FY2018. Like H.R. 6072, the Senate-passed bill did not include the President’s proposed program eliminations, and instead proposed to fund those programs at their prior-year levels. Final FY2019 appropriations were not completed before the start of the fiscal year. Funding for HUD and most other federal agencies was continued under a series of continuing resolutions until December 21, 2018, at which point funding lapsed and a partial government shutdown commenced. It continued until January 25, 2019, when another short-term continuing resolution was enacted. Final FY2019 HUD appropriations were enacted on February 15, 2019 as a part of the Consolidated Appropriations Act, 2019 (P.L. 116-6). Appropriations for Selected HUD Accounts, FY2018-FY2019 (dollars in millions)

FY2018 EnactedFY2019 RequestFY2019 House Comm. (H.R. 6072, 115th Cong.)FY2019 Senate (H.R. 6147, 115th Cong.)FY2019 Enacted Section 8 Housing Choice Vouchers 22,015 20,550 22,477 22,781 22,598

Public Housing Capital Fund 2,750 0 2,750 2,775 2,775

Public Housing Operating Fund 4,550 3,279 4,550 4,756 4,653

CDBG 3,365 0 3,365 3,365 3,365

HOME 1,362 0 1,200 1,362 1,250

Homeless Assistance Grants 2,513 2,383 2,571 2,612 2,636

Source: Table prepared by CRS based on P.L. 115-14, and accompanying Explanatory Statement, as published in the Congressional Record, March 22, 2018, beginning on p. H2872; HUD FY2019 Congressional Budget Justifications; H.R. 6072 and H.Rept. 115-750; S. 3023 and S.Rept. 115-268; H.R. 6147; and P.L. 116-6 and H.Rept. 116-9.

HUD FY2019 Appropriations: In Brief

Jump to Main Text of Report

Contents

- Status of Appropriations

- Action in the 115th Congress

- President's Budget

- House Action

- Senate Action

- Continuing Resolutions and Funding Lapse

- 116th Congress

- Legislative Action During the Funding Lapse

- Enactment of Third Continuing Resolution

- Enactment of Full-Year Appropriations

- Selected Issues

- Housing Choice Voucher Renewal Funding

- Funding for Public Housing

- Funding for HUD Grant Programs

- FHA and Ginnie Mae Offsets

Summary

The programs and activities of the Department of Housing and Urban Development (HUD) are designed primarily to address housing problems faced by households with very low incomes or other special housing needs and to expand access to homeownership. Nearly all of the department's budget comes from discretionary appropriations provided each year in the annual appropriations acts, typically as a part of the Transportation, HUD, and Related Agencies appropriations bill (THUD).

On February 12, 2018, the Trump Administration submitted its FY2019 budget request to Congress, including $41.4 billion in gross new budget authority for HUD (not accounting for savings from offsets or rescissions). That is about $11.3 billion (21.5%) less than was provided in FY2018. Most of that reduction ($7.7 billion) is attributable to proposed program eliminations, including Community Development Block Grants (CDBG), the HOME Investment Partnerships grant program, Public Housing Capital Funding, Choice Neighborhoods grants, and the programs funded in the Self-Help Homeownership Opportunity Program (SHOP) account.

On May 23, 2018, the House Appropriations Committee approved its version of a FY2019 THUD appropriations bill (H.R. 6072; H.Rept. 115-750), which proposed $53.2 billion in gross funding for HUD. This was about 29% more in gross funding than was requested by the President and slightly more (1%) than was provided in FY2018. The bill did not include the program eliminations proposed by the President, and instead proposed to fund CDBG and the Public Housing Capital Fund at FY2018 levels while reducing funding for the HOME and SHOP accounts (-12% and -7%, respectively).

On August 1, 2018, the Senate approved H.R. 6147, the Financial Services Appropriations bill, which had been amended to include the Senate Appropriations Committee-approved version of a FY2019 THUD appropriations bill (S. 3023, incorporated as Division D), along with three other appropriations bills. It included more than $54 billion in gross funding for HUD. This is 30% more in gross funding than was requested by the President, and about 2.5% more than was provided in FY2018. Like H.R. 6072, the Senate-passed bill did not include the President's proposed program eliminations, and instead proposed to fund those programs at their prior-year levels.

Final FY2019 appropriations were not completed before the start of the fiscal year. Funding for HUD and most other federal agencies was continued under a series of continuing resolutions until December 21, 2018, at which point funding lapsed and a partial government shutdown commenced. It continued until January 25, 2019, when another short-term continuing resolution was enacted. Final FY2019 HUD appropriations were enacted on February 15, 2019 as a part of the Consolidated Appropriations Act, 2019 (P.L. 116-6).

Appropriations for Selected HUD Accounts, FY2018-FY2019 (dollars in millions)

|

FY2018 Enacted |

FY2019 Request |

FY2019 House Comm. (H.R. 6072, 115th Cong.) |

FY2019 Senate |

FY2019 Enacted |

|

|

Section 8 Housing Choice Vouchers |

22,015 |

20,550 |

22,477 |

22,781 |

22,598 |

|

Public Housing Capital Fund |

2,750 |

0 |

2,750 |

2,775 |

2,775 |

|

Public Housing Operating Fund |

4,550 |

3,279 |

4,550 |

4,756 |

4,653 |

|

CDBG |

3,365 |

0 |

3,365 |

3,365 |

3,365 |

|

HOME |

1,362 |

0 |

1,200 |

1,362 |

1,250 |

|

Homeless Assistance Grants |

2,513 |

2,383 |

2,571 |

2,612 |

2,636 |

Source: Table prepared by CRS based on P.L. 115-14, and accompanying Explanatory Statement, as published in the Congressional Record, March 22, 2018, beginning on p. H2872; HUD FY2019 Congressional Budget Justifications; H.R. 6072 and H.Rept. 115-750; S. 3023 and S.Rept. 115-268; H.R. 6147; and P.L. 116-6 and H.Rept. 116-9.

Most of the funding for the activities of the Department of Housing and Urban Development (HUD) comes from discretionary appropriations provided each year in annual appropriations acts, typically as a part of the Transportation, HUD, and Related Agencies appropriations bill (THUD).

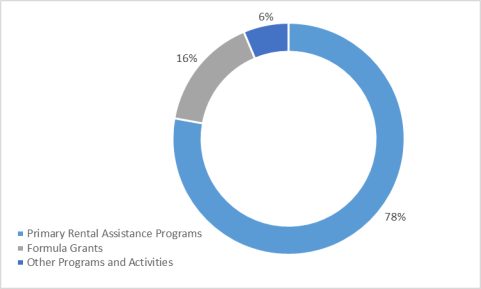

HUD's programs are designed primarily to address housing problems faced by households with very low incomes or other special housing needs and to expand access to homeownership.1 Three main rental assistance programs—Section 8 tenant-based rental assistance (which funds Section 8 Housing Choice Vouchers), Section 8 project-based rental assistance, and public housing—account for the majority of the department's funding (about 78% of total HUD appropriations in FY2018; see Figure 1). All three programs provide deep subsidies allowing low-income recipients to pay below-market, income-based rents. Additional, smaller programs are targeted specifically to persons who are elderly and persons with disabilities.

Two flexible block grant programs—the HOME Investment Partnerships grant program and the Community Development Block Grant (CDBG) program—help states and local governments finance a variety of housing and community development activities designed to serve low-income families. Following disasters, special supplemental CDBG disaster recovery (CDBG-DR) grants are funded by Congress to help communities rebuild damaged housing and community infrastructure. Native American tribes receive their own direct housing grants through the Native American Housing Block Grant.

Other, more-specialized grant programs help communities meet the needs of homeless persons, through the Homeless Assistance Grants and the Continuum of Care and Emergency Solutions Grants programs, as well as those living with HIV/AIDS. Additional programs fund fair housing enforcement activities and healthy homes activities, including lead-based paint hazard identification and remediation.

HUD's Federal Housing Administration (FHA) insures mortgages made by lenders to homebuyers with low down payments and to developers of multifamily rental buildings containing relatively affordable units. FHA collects fees from insured borrowers, which are used to sustain its insurance funds. Surplus FHA funds have been used to offset the cost of the HUD budget.

This In Brief report tracks progress on FY2019 HUD appropriations and provides detailed account-level, and in some cases subaccount-level, funding information (Table 1) as well as a discussion of selected key issues.

For more information about the Transportation, HUD, and Related Agencies appropriations bill see CRS Report R45487, Transportation, Housing and Urban Development, and Related Agencies (THUD) Appropriations for FY2019: In Brief, by Maggie McCarty and David Randall Peterman. For more information on trends in HUD funding, see CRS Report R42542, Department of Housing and Urban Development (HUD): Funding Trends Since FY2002.

|

Figure 1. Composition of HUD's Budget, FY2018 Gross Budget Authority |

|

|

Source: Prepared by CRS, based on data in Table 1. Notes: Primary rental assistance programs include Tenant-based Rental Assistance (Housing Choice Voucher Program), Public Housing Capital Fund, Public Housing Operating Fund, Choice Neighborhoods, Family Self Sufficiency Program, and Project-based Rental Assistance. Formula grants include CDBG, HOME, Homeless Assistance Grants, Housing for Persons with AIDS (HOPWA), and Native American Housing Block Grants. Other programs and activities encompass the remainder of HUD accounts. |

Status of Appropriations

The FY2019 appropriations process spanned two Congresses, both of which took action, as summarized below.

Action in the 115th Congress

President's Budget

On February 12, 2018, the Trump Administration submitted its FY2019 budget request to Congress. The budget request was released before final FY2018 appropriations were enacted and shortly after enactment of the Bipartisan Budget Act of FY2018 (BBA; P.L. 115-123), which, among other things, increased the statutory limits on discretionary spending for FY2018 and FY2019.2

The President's FY2019 request proposed $41.4 billion in gross discretionary appropriations for HUD, which is the amount of new budget authority available for HUD programs and activities, not accounting for savings from offsets and other sources. That amount is about $11.3 billion (21.5%) less than was provided in FY2018. Most of that reduction ($7.7 billion) is attributable to program eliminations proposed by the President, including CDBG, HOME, Public Housing Capital Funding, Choice Neighborhoods grants, and the programs funded in the Self-Help Homeownership Opportunity Program (SHOP) account.

House Action

On May 23, 2018, the House Appropriations Committee approved its version of a FY2019 THUD appropriations bill (H.R. 6072; H.Rept. 115-750), about a week after THUD subcommittee approval (May 16, 2018). The bill included $53.2 billion in gross funding for HUD, or $43.7 billion after accounting for savings from offsets and rescissions. This is about 29% more in gross funding than was requested by the President and slightly more (1%) than was provided in FY2018. The bill did not include the program eliminations proposed by the President, and instead funded CDBG and the Public Housing Capital Fund at FY2018 levels while reducing funding for the HOME and SHOP accounts (-12% and -7%, respectively).

Senate Action

On June 7, 2018, the Senate Appropriations Committee approved its version of a FY2019 THUD appropriations bill (S. 3023; S.Rept. 115-268), two days after THUD subcommittee approval. It included more than $54 billion in gross funding for HUD, or $44.5 billion after accounting for savings from offsets and rescissions. This is 30% more in gross funding than was requested by the President, and about 2.5% more than was provided in FY2018. Like the House committee-passed bill, S. 3023 did not include the President's proposed program eliminations, and instead proposed funding those programs at their prior-year levels.

On August 1, 2018, the Senate approved H.R. 6147, the Financial Services Appropriations bill, which was amended to include four regular appropriations acts, including the text of S. 3023 as Division D. Several HUD-related amendments were approved during floor consideration, none of which changed funding levels.

Continuing Resolutions and Funding Lapse

On September 28, 2018, a continuing resolution (CR) through December 7, 2018, was enacted as part of a consolidated full-year Defense and Labor, Health and Human Services, and Education spending bill (P.L. 115-245, Division C). The CR covered the agencies and activities generally funded under seven regular FY2019 appropriations bills that had not been enacted before the end of the fiscal year, including THUD.

On December 7, 2018, the previous CR was extended through December 21, 2018 (P.L. 115-298).

No further funding action was completed before the expiration of the CR on December 21, 2018, and a funding lapse affecting the unfunded portions of the federal government, including HUD, commenced on December 22, 2018.

|

FY2019 Funding Lapse As a result of a funding lapse, portions of the operations of the departments and agencies funded under THUD, along with those generally funded under six other annual appropriations acts, were suspended for 35 days, ending late on January 25, 2019. In some cases, operations were simply suspended, and employees were furloughed without pay. In other cases, operations continued because they were considered essential for protection of life or property, or because an agency had funding available to continue operations. Agency contingency plans, posted on the website of the Office of Management and Budget (https://www.whitehouse.gov/omb/information-for-agencies/agency-contingency-plans/), provided information about how agencies planned to handle a lapse in appropriations. In some cases, those plans were updated over the course of the funding lapse to reflect changes in policy or operations; in other cases they were not. Department of Housing and Urban Development According to HUD's contingency plan dated 2018, during a funding lapse the majority of agency staff would be furloughed and operations would be suspended. However, the plan stated that the operations of the Federal Housing Administration (FHA) related to insuring single family mortgages largely would continue unaffected. The plan further stated that HUD's rental assistance programs, which serve roughly 5 million low-income families, would continue to receive funding for as long as the agency was able to identify available resources. Agency statements during the FY2019 funding lapse indicated funding would be available to provide federal payments through February, with the exception of expiring project-based rental assistance contracts. |

116th Congress

Legislative Action During the Funding Lapse

Following the start of the 116th Congress and during the funding lapse, the House passed several full-year THUD funding bills, none of which were taken up in the Senate. These include the following:

- H.R. 21, an omnibus funding bill, which included THUD language identical to that which had passed the Senate in the 115th Congress in H.R. 6147;

- H.R. 267, a standalone THUD bill, again containing language identical to the 115th Congress Senate-passed THUD language; and

- H.R. 648, an omnibus funding bill containing provisions and funding levels characterized by the chairwoman of the House Appropriations Committee as reflecting House-Senate conference negotiations on H.R. 6147 from the 115th Congress.3 (The Transportation, HUD, and Related Agencies Appropriations Act of 2019 was included as Division F.)

On January 16, 2019, the House passed H.R. 268, a supplemental appropriations bill. As passed by the House, the bill would have provided supplemental appropriations to HUD (as well as other agencies) in response to the major disasters of 2018. The bill also contained CR provisions to extend regular appropriations through February 8, 2019, for agencies and programs affected by the funding lapse.

On January 24, 2019, the Senate considered H.R. 268, the supplemental appropriations bill that previously passed the House. One amendment, S.Amdt. 5, offered by Senator Shelby, included additional funding for border security, as well as full-year appropriations for those agencies affected by the funding lapse. The THUD provisions in Division G were identical to those that had passed the Senate in the 115th Congress in H.R. 6147. The Senate voted not to invoke cloture on S.Amdt. 5 on January 24, 2019.

Enactment of Third Continuing Resolution

Late on January 25, 2019, a CR (H.J.Res. 28; P.L. 116-5) was enacted, providing funding through February 15, 2019, for THUD and the six other funding bills that had not received full-year funding, allowing HUD and the other agencies that had been subject to the funding lapse to resume full operations.

Enactment of Full-Year Appropriations

On February 15, 2019, the Consolidated Appropriations Act, 2019 (P.L. 116-6) was enacted providing full-year appropriations for the remaining agencies that had lacked full-year appropriations. The Transportation, HUD, and Related Agencies Appropriations Act of 2019 was included as Division G and its text mirrored that of H.R. 648.

|

FY2018 Enacted |

FY2019 Request |

FY2019 House Cmte. |

FY2019 Senate |

FY2019 Enacted |

||

|

115th Congress |

116th Congress |

|||||

|

1,342 |

1,302 |

1,341 |

1,398 |

1,379 |

||

|

Tenant-Based Rental Assistance (Sec. 8 Housing Choice Vouchers)a |

22,015 |

20,550 |

22,477 |

22,781 |

22,598 |

|

|

Voucher Renewals (non-add)b |

19,600 |

18,749 |

20,107 |

20,520 |

20,313 |

|

|

Administrative Fees (non-add) |

1,760 |

1,550 |

1,800 |

1,957 |

1,886 |

|

|

Veterans Affairs Supportive Housing Vouchers (VASH) (non-add) |

40 |

0 |

40 |

40 |

40 |

|

|

Family Unification Program vouchers (FUP) (non-add) |

20 |

0 |

0 |

20 |

20 |

|

|

Mobility Demonstration (non-add) |

- |

- |

50c |

0 |

25c |

|

|

Public Housing Capital Fund |

2,750 |

0 |

2,750 |

2,775d |

2,775d |

|

|

Public Housing Operating Fund |

4,550 |

3,279 |

4,550 |

4,756 |

4,653 |

|

|

Choice Neighborhoods |

150 |

0 |

150 |

100 |

150 |

|

|

Family Self Sufficiency |

75 |

75 |

75 |

80 |

80 |

|

|

Native American housing block grants |

755 |

600 |

755 |

755 |

755 |

|

|

Native American Housing Block Grants (non-add) |

646 |

598 |

646 |

646 |

646 |

|

|

Competitive Grants (non-add) |

100 |

0 |

100 |

100 |

100 |

|

|

Indian housing loan guarantee |

1 |

0e |

1 |

1 |

1 |

|

|

Native Hawaiian block grant |

2 |

0e |

0 |

2 |

2 |

|

|

Housing, persons with AIDS (HOPWA) |

375 |

330 |

393 |

375 |

393 |

|

|

Community Development Fund |

3,365 |

0 |

3,365 |

3,365 |

3,365 |

|

|

CDBG Formula Grants |

3,300 |

0 |

3,300 |

3,300 |

3,300 |

|

|

Indian Tribes |

65 |

0 |

65 |

65 |

65 |

|

|

HOME Investment Partnerships |

1,362 |

0 |

1,200 |

1,362 |

1,250 |

|

|

Self-Help Homeownership |

54 |

0 |

50 |

54 |

54 |

|

|

Self-Help and Assisted Homeownership Opportunity Program |

10 |

0 |

10 |

10 |

10 |

|

|

Section 4 Capacity Building |

35 |

0 |

35 |

35 |

35 |

|

|

Rural Capacity Building |

5 |

0 |

5 |

5 |

5 |

|

|

Veterans Home Rehabilitation Pilot Program |

4 |

0 |

0 |

4 |

4 |

|

|

Homeless Assistance Grants |

2,513f |

2,383 |

2,571g |

2,612 |

2,636f |

|

|

Project-Based Rental Assistance (Sec. 8)h |

11,515 |

11,147 |

11,747 |

11,747 |

11,747 |

|

|

Contract Renewals |

11,230 |

10,902 |

11,547 |

11,502 |

11,502 |

|

|

Contract Administrators |

285 |

245 |

200 |

245 |

245 |

|

|

Rental Assistance Demonstration |

0 |

100 |

0 |

0 |

0 |

|

|

Housing for the Elderly (Section 202) |

678 |

601 |

678 |

678 |

678i |

|

|

Housing for Persons with Disabilities (Section 811) |

230 |

140 |

154 |

154 |

184 |

|

|

Housing Counseling Assistance |

55 |

45 |

56 |

45 |

50 |

|

|

Manufactured Housing Fees Trust Fundj |

11 |

12 |

12 |

12 |

12 |

|

|

Rental Housing Assistance |

14 |

5 |

5 |

5 |

5 |

|

|

Federal Housing Administration (FHA) Expensesj |

130 |

150 |

130 |

130 |

130 |

|

|

Government National Mortgage Assn. (GNMA) Expensesj |

28 |

24 |

25 |

28 |

28 |

|

|

Research and technology |

89 |

85 |

92 |

100 |

96 |

|

|

Fair housing activities |

65 |

62 |

65 |

65 |

65 |

|

|

Fair Housing Assistance Program (non-add) |

24 |

24 |

24 |

24 |

24 |

|

|

Fair Housing Initiatives Program (non-add) |

40 |

36 |

39 |

40 |

40 |

|

|

Office, lead hazard control |

230 |

145 |

230 |

260 |

279k |

|

|

Information Technology Fund |

267 |

260 |

240 |

280 |

280 |

|

|

Inspector General |

128 |

128 |

128 |

128 |

128 |

|

|

Gross Appropriations Subtotal |

52,749 |

41,423 |

53,241 |

54,049 |

53,774 |

|

|

Offsetting Collections and Receipts |

||||||

|

Manufactured Housing Fees Trust Fund |

-11 |

-12 |

-12 |

-12 |

-12 |

|

|

FHA |

-8,320 |

-7,570 |

-7,550 |

-7,550 |

-7,550 |

|

|

GNMA |

-1,735 |

-2,004 |

-2,004 |

-2,004 |

-2,004 |

|

|

Offsets Subtotal |

-10,066 |

-9,586 |

-9,566 |

-9,566 |

-9,566 |

|

|

Rescissions |

||||||

|

Native Hawaiian Loan Guarantee Fund |

0 |

-5 |

-5 |

0 |

0 |

|

|

Choice Neighborhoods |

0 |

-138l |

0 |

0 |

0 |

|

|

Indian Housing Loan Guarantee |

0 |

0 |

<1 |

0 |

<1 |

|

|

Rescissions Subtotal |

0 |

-143 |

-5 |

0 |

<1 |

|

|

Total Net Discretionary Budget Authority |

42,683 |

31,694 |

43,669 |

44,483 |

44,208 |

|

|

Disaster Relief Funding (CDBG-DR)m |

28,000 |

0 |

0 |

0 |

0 |

|

|

Total w/ Disaster Funding |

70,683 |

31,694 |

43,623 |

44,483 |

44,208 |

|

Source: Table prepared by CRS based on P.L. 115-14, and accompanying Explanatory Statement, as published in the Congressional Record, March 22, 2018, beginning on p. H2872; HUD FY2019 Congressional Budget Justifications; H.R. 6072 and H.Rept. 115-750; S. 3023 and S.Rept. 115-268; H.R. 6147; and P.L. 116-6 and H.Rept. 116-9.

Notes: Totals may not add due to rounding. Only selected set-asides are presented in this table. Figures include advance appropriations provided in the bills. Table does not include figures from appropriations bills considered, but not enacted at the start of the 116th Congress, during the funding lapse.

a. Account includes $4 billion in advance appropriations.

b. Total reflects funding for renewal of most vouchers, but does not reflect renewal of Tribal VASH Vouchers or Mainstream Vouchers, which are provided through separate set-asides.

c. This set-aside is to fund a voucher mobility demonstration program at HUD. Legislation to authorize a mobility demonstration was passed by the House in the 115th Congress (H.R. 5793) but was not considered by the Senate before the end of that Congress. Similar language to H.R. 5793 was enacted into law as Sec. 235, Title II, Division G of P.L. 116-6.

d. Of this amount, $25 million is for lead-based paint hazard remediation grants for PHAs. This set-aside was first funded in FY2017, but was not funded in FY2018.

e. HUD's FY2019 Budget Justifications state that HUD is not requesting new budget authority for this program because it has sufficient balances of prior years' budget authority remaining to continue program activities in FY2019.

f. Includes targeted assistance also included in the FY2018 appropriation—$50 million to assist survivors of domestic violence and $80 million to assist homeless youth.

g. The House committee bill included a set-aside of $40 million to provide rapid rehousing assistance in areas with high rates of unsheltered homelessness.

h. Account includes $400 million in advance appropriations.

i. Provides $10 million from the Housing for the Elderly account to assist low-income elderly households with home modifications.

j. Some or all of the cost of funding these accounts is offset by the collection of fees or other receipts, shown later in this table.

k. Of this amount, H.Rept. 116-9 directs that $64 million be awarded, via seven five-year grants of no less than $6 million, for a demonstration to test how "intensive, multi-year intervention can reduce the presence of lead-based paint hazards in low-income pre-1940 homes by achieving economies of scale that can lower the cost of remediation activities."

l. Section 233 of the General Provisions of HUD's budget proposal requested that prior-year funding be rescinded for the program before it is awarded by HUD.

m. P.L. 115-123, the Bipartisan Budget Act of FY2018, in Division B, Subdivision 1, provided $28 billion in emergency CDBG-DR funding. Of this amount, $16 billion is for 2017 disasters and the remaining $12 billion is to be awarded proportionally to communities that received CDBG-DR funding in P.L. 115-123 or specified prior laws, to be used for mitigation activities.

Selected Issues

Housing Choice Voucher Renewal Funding

The cost of renewing existing Section 8 Housing Choice Vouchers is generally one of the most high-profile HUD funding issues each year. It is the largest single expense in the largest account (the tenant-based rental assistance account) in HUD's budget. All of the roughly 2 million portable rental vouchers that are currently authorized and in use are funded annually, so for the low-income families currently renting housing with their vouchers to continue to receive assistance (i.e., renew their leases at the end of the year), new funding is needed each year.

If the amount ultimately provided proves to be less than the amount needed to fund all vouchers currently in use, then several things may happen. The Public Housing Authorities (PHAs)—the state-chartered entities that administer the program at the local level—with reserve funding from prior years, may spend some of those reserves to maintain current services. PHAs without reserve funding may apply to HUD for a share of the set-aside funding that is generally provided in the annual appropriations acts to the department and allowed to be used to prevent termination of assistance. And PHAs may undertake cost-saving measures, such as not reissuing vouchers to families on their waiting lists when currently assisted families leave the program. Conversely, if the amount is greater than the amount needed to renew existing vouchers, PHAs may be able to serve additional families from their waiting lists.

Although the President's budget request, the House committee-reported HUD appropriations bill, and the Senate bill all included different funding levels for voucher renewals for FY2019, each purported to provide enough to fund all vouchers currently in use.4 The final FY2019 enacted funding level was $22.598 billion, an amount between the House committee-reported and Senate-passed levels. Advocacy groups have estimated that the amount provided will be enough at least to renew all existing voucher holders' leases, as well as potentially serve some additional families.5

Funding for Public Housing

The low-rent public housing program houses approximately 1 million families in properties owned by local PHAs but subsidized by the federal government. PHAs' budgets for public housing are made up of rent paid by tenants and formula grant funding from the federal government to make up the difference between the rents collected from tenants and the cost of maintaining the properties. The two primary formula funding programs are Operating Fund program and Capital Fund program. Additionally, PHAs may apply for competitive Choice Neighborhood Initiative grants.

The largest source of federal funding to support the low-rent public housing program is provided through the public housing Operating Fund account. Operating funds are allocated to PHAs according to a formula that estimates what it should cost PHAs to maintain their public housing properties based on the characteristics of those properties. When the amount of appropriations provided is insufficient to fully fund the amount PHAs qualify for under the formula, their allocation is prorated. Assuming the Operating Fund formula accurately reflects the costs of maintaining public housing, less than full funding means PHAs either will not be able to meet their full operating needs (e.g., maintenance, staffing, services for residents) or will have to spend down reserves they may have accumulated or seek other sources of funding.

According to HUD's Congressional Budget Justifications, the amount requested in the President's budget for the Operating Fund for FY2019 (a 28% decrease from FY2018) would be sufficient to fund an estimated 54% of PHAs' formula eligibility in CY2019 (the program runs on a calendar year basis). Both the House committee-passed bill and the Senate bill proposed more funding than requested, but neither proposed the full amount the President's budget estimated would be needed to fully fund PHAs' formula eligibility in CY2019.6 The final HUD appropriations law provided $4.65 billion for operating funding in FY2019, which is more than the House committee-passed bill, but less than the Senate level. While it is not expected to fund 100% of formula eligibility in CY2019, the funding increase may result in a higher proration level than CY2018.7

The other major source of federal funding for public housing is the Capital Fund. Capital Fund formula grants are used to meet the major modernization needs of public housing, beyond the day-to-day maintenance expenses included among operating expenses. The most recent national assessment of public housing capital needs sponsored by HUD found that inadequate funding had resulted in a backlog of about $25.6 billion in capital/modernization needs across the public housing stock, with new needs accruing nationally at a rate of about $3.4 billion per year.8

For FY2019, the President's budget requested no funding for the Capital Fund, citing federal fiscal constraints and a desire to "strategically reduce the footprint of Public Housing." Both the House committee bill and the Senate bill would have provided funding for the Capital Fund, with H.Rept. 115-750 explicitly stating that it rejected the Administration's proposed strategic reduction of public housing. The final FY2019 appropriations law provided $2.775 billion for the Capital Fund, a $25 million increase over FY2018 funding. That $25 million is provided as a set-aside to provide grants to PHAs to address lead hazards in public housing.9

Similarly, the Administration's budget requested no new funding for competitive Choice Neighborhoods grants that are used to redevelop distressed public housing and other assisted housing. Both the House committee bill and the Senate bill proposed to fund the program. The House committee bill proposed even funding with FY2018 ($150 million) and the Senate bill proposed a decrease in funding relative to FY2018 (a reduction of $50 million, or 33%). The final FY2019 appropriations law funded the account at the FY2018 level of $150 million.

Funding for HUD Grant Programs

The President's budget request included a proposal to eliminate funding for several HUD grant programs that support various affordable housing and community development activities. Most notable among these are HUD's two largest block grant programs for states and localities, CDBG and HOME, as well as competitive grants funded in the SHOP account (i.e., funding for sweat-equity programs, like Habitat for Humanity, and certain capacity building programs). These grant programs were also slated for elimination in the President's FY2018 budget request, although they were ultimately funded in FY2018.

The press release accompanying the budget request suggested that the activities funded by these grant programs should be devolved to the state and local levels.10 Both the House committee bill and the Senate bill would have continued funding for these programs. The House committee bill would have provided level funding for CDBG, but funding reductions for the other accounts. The Senate bill would have provided level funding for all three accounts. Like the House committee and Senate bills, the final FY2019 appropriations law continued funding for all three accounts. In the case of CDBG and SHOP, it provided level funding with FY2018 at $3.365 billion and $54 million, respectively; in the case of HOME, the FY2019 law decreased funding by 8.2% relative to FY2018, bringing it down to $1.250 billion.

FHA and Ginnie Mae Offsets

Under the terms of the Budget Control Act, as amended, discretionary appropriations are generally subject to limits, or caps, on the amount of funding that can be provided in a fiscal year. In addition, the annual appropriations bills also are individually subject to limits on the funding within them that are associated with the annual congressional budget resolution.11 Congressional appropriators can keep these bills within their respective limits in a number of ways, including by providing less funding for certain purposes to allow for increases elsewhere in the bill. In certain circumstances, appropriators also can credit "offsetting collections" or "offsetting receipts" against the funding in the bill, thereby lowering the net amount of budget authority in that bill.12

In the THUD bill, the largest source of these offsets is generally the Federal Housing Administration (FHA). FHA generates offsetting receipts when estimates suggest that the loans that it will insure during the fiscal year are expected to collect more in fees paid by borrowers than will be needed to pay default claims to lenders over the life of those loans.13 While usually not as large a source, the Government National Mortgage Association (GNMA), or Ginnie Mae, generally provides significant offsets within the THUD bill as well. GNMA guarantees mortgage-backed securities made up of government-insured mortgages (such as FHA-insured mortgages) and similarly generates offsetting receipts when the associated fees it collects are estimated to exceed any payments made on its guarantee.

The amount of offsets available from FHA and GNMA varies from year to year based on estimates of the amount of mortgages that FHA will insure, and that GNMA will guarantee, in a given year and how much those mortgages are expected to earn for the government. These estimates, in turn, are based on expectations about the housing market, the economy, the credit quality of borrowers, and relevant fee levels, most of which are factors outside of the immediate control of policymakers. If the amount of available offsets increases from one year to the next, then additional funds could be appropriated relative to the prior year's funding level while still maintaining the same overall net level of budget authority. If the amount of offsets decreases, however, then less funding would need to be appropriated relative to the prior year to avoid increasing the overall net level of budget authority, all else equal.

For FY2019, the Congressional Budget Office (CBO) estimated that offsetting receipts available from FHA would be lower than in FY2018 ($7.6 billion compared to $8.3 billion) while the amount of offsets available from Ginnie Mae would be higher (about $2 billion compared to $1.7 billion). The total combined amount of offsets, then, was estimated at about $500 million less in FY2019 as compared to the prior year. As a result of this lower amount of offsets, the increase in net budget authority proposed in both the House committee bill and the Senate bill, as well as that ultimately provided by the final FY2019 appropriations law, as compared to FY2018 is greater than the increase in gross appropriations for HUD programs and activities.

Author Contact Information

Footnotes

| 1. |

For more information about federal housing assistance programs, see CRS Report RL34591, Overview of Federal Housing Assistance Programs and Policy. |

| 2. |

As a result, the President's budget documents did not have final FY2018 funding levels with which to compare the FY2019 request when it was released. Thus, the FY2018 funding column in the President's budget documents does not reflect actual enacted FY2018 funding levels. Additionally, the President's FY2019 budget was released contemporaneously with an addendum outlining proposed changes to the budget request in response to the increased spending limits enacted in the BBA, including an additional $2 billion for HUD rental assistance programs. That additional $2 billion is not reflected in the President's budget documents from the Office of Management and Budget (OMB), but is reflected in HUD's Congressional Budget Justifications, which were released at a later date. |

| 3. |

House Committee on Appropriations, "Chairwoman Lowey Floor Statement on H.R. 648, Bipartisan Bills To Reopen Most of Federal Government," press release, January 23, 2019, https://appropriations.house.gov/news/press-releases/25chairwoman-lowey-floor-statement-on-hr-648-bipartisan-bills-to-reopen-most-of. |

| 4. |

The President's Congressional Budget Justifications stated that their estimates assume the enactment of rent reforms that would increase tenant rents and result in cost savings. No action was taken by Congress on those proposed reforms. The press release accompanying the House Appropriations Committee release of its FY2019 HUD bill stated, "This funding level will continue assistance to families and individuals currently served by these programs and provide additional assistance for vulnerable populations"; https://appropriations.house.gov/news/documentsingle.aspx?DocumentID=395298. S.Rept. 115-268 states, "In recognition of the Section 8 program's central role in ensuring housing for vulnerable Americans, the Committee recommendation and existing reserves will provide sufficient resources to ensure that no current voucher holders are put at risk of losing their housing assistance." |

| 5. |

For example, see Center on Budget and Policy Priorities, Funding Bill and Carryover Funding Should Enable Agencies to Issue More Housing Vouchers in 2019, February 21, 2019, available at https://www.cbpp.org/research/housing/funding-bill-and-carryover-funding-should-enable-agencies-to-issue-more-housing. As of the date of this report, HUD had not yet published its calculation of CY2019 renewal allocations. |

| 6. |

With a request of $2.674 billion for formula grants representing a 54% proration level, according to HUD's Congressional Budget Justifications (p. 7-1), it can be estimated that $4.95 billion would be required for full funding of formula grants. |

| 7. |

As of the date of this report, final proration levels for CY2019 had not been announced. The CY2018 final proration level was 94.74% of formula eligibility, the highest level it had been since 2012. |

| 8. |

See Meryl Finkel, Ken Lam et al., Capital Needs in the Public Housing Program (Cambridge, MA: November 24, 2011). |

| 9. |

This set-aside was first funded in FY2017 at $25 million, but was not funded in FY2018. |

| 10. |

HUD, "Trump Administration Proposes 2019 HUD Budget," press release, February 12, 2018, https://www.hud.gov/press/press_releases_media_advisories/HUD_No_18_012. |

| 11. |

For background on these limits, which are referred to as "302(b) allocations" or "302(b) subdivisions," see CRS Report R40472, The Budget Resolution and Spending Legislation. |

| 12. |

According to Congressional Quarterly's American Congressional Dictionary, offsetting receipts are funds collected by the federal government, either from certain government accounts or the public as part of a business oriented transaction. They are not counted as revenue, but instead are deducted from spending because they are counted as "negative spending." The Government Accountability Office's Budget Glossary defines offsetting collections as collections authorized by law to be credited to appropriations or expenditure accounts that result from businesslike transactions, market-oriented activities with the public, intergovernmental transfers, and collections from the public that are governmental in nature but are required by law to be classified as offsetting. (GAO-05-734SP) |

| 13. |

The Federal Credit Reform Act of 1990 (FCRA) provided that the cost of federal loan insurance in a given fiscal year be recorded in the budget as the net present value of all expected cash flows from loans insured in that year. For the FHA accounts, the cash inflows are mainly the insurance premiums paid by borrowers, and the cash outflows are mainly the payments to lenders for the cost of loan defaults. If the estimated cash inflows are expected to exceed cash outflows for the loans insured in that year, then offsetting receipts are available; if cash outflows are expected to exceed cash inflows for the loans insured in that year, appropriations are needed to supplement the program. For more information, see CRS Report R42875, FHA Single-Family Mortgage Insurance: Financial Status of the Mutual Mortgage Insurance Fund (MMI Fund). |