Most of the funding for the activities of the Department of Housing and Urban Development (HUD) comes from discretionary appropriations provided each year in annual appropriations acts, typically as a part of the Transportation, HUD, and Related Agencies appropriations bill (THUD).

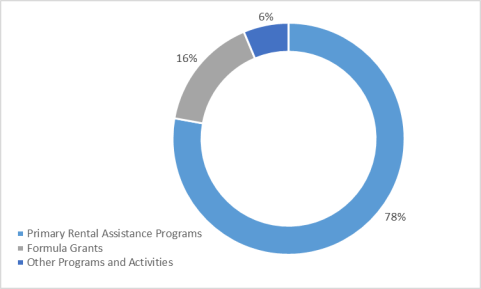

HUD's programs are designed primarily to address housing problems faced by households with very low incomes or other special housing needs and to expand access to homeownership.1 Three main rental assistance programs—Section 8 tenant-based rental assistance (which funds Section 8 Housing Choice Vouchers), Section 8 project-based rental assistance, and public housing—account for the majority of the department's funding (about 78% of total HUD appropriations in FY2018; see Figure 1). All three programs provide deep subsidies allowing low-income recipients to pay below-market, income-based rents. Additional, smaller programs are targeted specifically to persons who are elderly and persons with disabilities.

Two flexible block grant programs—the HOME Investment Partnerships grant program and the Community Development Block Grant (CDBG) program—help states and local governments finance a variety of housing and community development activities designed to serve low-income families. Following disasters, special supplemental CDBG disaster recovery (CDBG-DR) grants are funded by Congress to help communities rebuild damaged housing and community infrastructure. Native American tribes receive their own direct housing grants through the Native American Housing Block Grant.

Other, more-specialized grant programs help communities meet the needs of homeless persons, through the Homeless Assistance Grants and the Continuum of Care and Emergency Solutions Grants programs, as well as those living with HIV/AIDS. Additional programs fund fair housing enforcement activities and healthy homes activities, including lead-based paint hazard identification and remediation.

HUD's Federal Housing Administration (FHA) insures mortgages made by lenders to homebuyers with low down payments and to developers of multifamily rental buildings containing relatively affordable units. FHA collects fees from insured borrowers, which are used to sustain its insurance funds. Surplus FHA funds have been used to offset the cost of the HUD budget.

This In Brief report tracks progress on FY2019 HUD appropriations and provides detailed account-level, and in some cases subaccount-level, funding information (Table 1) as well as a discussion of selected key issues.

For more information about any of the programs, accounts, or funding levels discussed, please contact the relevant CRS expert, as labeled in the "Key Policy Staff" table at the end of this report. For more information about the Transportation, HUD, and Related Agencies appropriations bill as a whole, and relevant budget and appropriations concepts, see CRS Report R45022, Transportation, Housing and Urban Development, and Related Agencies (THUD): FY2018 Appropriations. For more information on trends in HUD funding, see CRS Report R42542, Department of Housing and Urban Development (HUD): Funding Trends Since FY2002.

|

Figure 1. Composition of HUD's Budget, FY2018 Gross Budget Authority |

|

|

Source: Prepared by CRS, based on data in Table 1. Notes: Primary rental assistance programs include Tenant-based Rental Assistance (Housing Choice Voucher Program), Public Housing Capital Fund, Public Housing Operating Fund, Choice Neighborhoods, Family Self Sufficiency Program, and Project-based Rental Assistance. Formula grants include CDBG, HOME, Homeless Assistance Grants, Housing for Persons with AIDS (HOPWA), and Native American Housing Block Grants. Other programs and activities encompass the remainder of HUD accounts. |

Status of Appropriations

President's Budget

On February 12, 2018, the Trump Administration submitted its FY2019 budget request to Congress. The budget request was released before final FY2018 appropriations were enacted and only shortly after enactment of the Bipartisan Budget Act of FY2018 (BBA; P.L. 115-123), which, among other things, increased the statutory limits on discretionary spending for FY2018 and FY2019.2

The President's FY2019 request proposed $41.4 billion in gross discretionary appropriations for HUD, which is the amount of new budget authority available for HUD programs and activities, not accounting for savings from offsets and other sources. That amount is about $11.3 billion (21.5%) less than was provided in FY2018. Most of that reduction ($7.7 billion) is attributable to program eliminations proposed by the President, including CDBG, HOME, Public Housing Capital Funding, Choice Neighborhoods grants, and the programs funded in the Self-Help Homeownership Opportunity Program (SHOP) account.

House

On May 23, 2018, the House Appropriations Committee approved its version of a FY2019 THUD appropriations bill (H.R. 6072; H.Rept. 115-750), about a week after THUD subcommittee approval (May 16, 2018). The bill includes $53.2 billion in gross funding for HUD, or $43.7 billion after accounting for savings from offsets and rescissions. This is about 29% more in gross funding than was requested by the President and slightly more (1%) than was provided in FY2018. The bill does not include the program eliminations proposed by the President, and instead funds CDBG and the Public Housing Capital Fund at FY2018 levels while reducing funding for the HOME and SHOP accounts (-12% and -7%, respectively).

Senate

On June 7, 2018, the Senate Appropriations Committee approved its version of a FY2019 THUD appropriations bill (S. 3023; S.Rept. 115-268), two days after THUD subcommittee approval. It includes more than $54 billion in gross funding for HUD, or $44.5 billion after accounting for savings from offsets and rescissions. This is 30% more in gross funding than was requested by the President, and about 2.5% more than was provided in FY2018. Like the House committee-passed bill, S. 3023 does not include the President's proposed program eliminations, and instead funds those programs at their prior-year levels.

On August 1, 2018, the Senate approved H.R. 6147, the Financial Services Appropriations bill, which was amended to include four regular appropriations acts, including the text of S. 3023 as Division D. Several HUD-related amendments were approved during floor consideration, none of which changed funding levels.

|

FY2018 Enacted |

FY2019 Request |

FY2019 House Cmte. |

FY2019 Senate |

FY2019 Enacted |

|

|

1,342 |

1,302 |

1,341 |

1,398 |

||

|

Tenant-Based Rental Assistance (Sec. 8 Housing Choice Vouchers)a |

22,015 |

20,550 |

22,477 |

22,781 |

|

|

Voucher Renewals (non-add)b |

19,600 |

18,749 |

20,107 |

20,520 |

|

|

Administrative Fees (non-add) |

1,760 |

1,550 |

1,800 |

1,957 |

|

|

Veterans Affairs Supportive Housing Vouchers (VASH) (non-add) |

40 |

0 |

40 |

40 |

|

|

Family Unification Program vouchers (FUP) (non-add) |

20 |

0 |

0 |

20 |

|

|

Mobility Demonstration (non-add) |

- |

- |

50 |

0 |

|

|

Public Housing Capital Fund |

2,750 |

0 |

2,750 |

2,775 |

|

|

Public Housing Operating Fund |

4,550 |

3,279 |

4,550 |

4,756 |

|

|

Choice Neighborhoods |

150 |

0 |

150 |

100 |

|

|

Family Self Sufficiency |

75 |

75 |

75 |

80 |

|

|

Native American housing block grants |

755 |

600 |

755 |

755 |

|

|

Native American Housing Block Grants (non-add) |

646 |

598 |

646 |

646 |

|

|

Competitive Grants (non-add) |

100 |

0 |

100 |

100 |

|

|

Indian housing loan guarantee |

1 |

0c |

1 |

1 |

|

|

Native Hawaiian block grant |

2 |

0c |

0 |

2 |

|

|

Housing, persons with AIDS (HOPWA) |

375 |

330 |

393 |

375 |

|

|

Community Development Fund |

3,365 |

0 |

3,365 |

3,365 |

|

|

CDBG Formula Grants |

3,300 |

0 |

3,300 |

3,300 |

|

|

Indian Tribes |

65 |

0 |

65 |

65 |

|

|

HOME Investment Partnerships |

1,362 |

0 |

1,200 |

1,362 |

|

|

Self-Help Homeownership |

54 |

0 |

50 |

54 |

|

|

Self-Help and Assisted Homeownership Opportunity Program |

10 |

0 |

10 |

10 |

|

|

Section 4 Capacity Building |

35 |

0 |

35 |

35 |

|

|

Rural Capacity Building |

5 |

0 |

5 |

5 |

|

|

Veterans Home Rehabilitation Pilot Program |

4 |

0 |

0 |

4 |

|

|

Homeless Assistance Grants |

2,513 |

2,383 |

2,571d |

2,612d |

|

|

Project-Based Rental Assistance (Sec. 8)e |

11,515 |

11,147 |

11,747 |

11,747 |

|

|

Contract Renewals |

11,230 |

10,902 |

11,547 |

11,502 |

|

|

Contract Administrators |

285 |

245 |

200 |

245 |

|

|

Rental Assistance Demonstration |

0 |

100 |

0 |

0 |

|

|

Housing for the Elderly (Section 202) |

678 |

601 |

678 |

678f |

|

|

Housing for Persons with Disabilities (Section 811) |

230 |

140 |

154 |

154 |

|

|

Housing Counseling Assistance |

55 |

45 |

56 |

45 |

|

|

Manufactured Housing Fees Trust Fundg |

11 |

12 |

12 |

12 |

|

|

Rental Housing Assistance |

14 |

5 |

5 |

5 |

|

|

Federal Housing Administration (FHA) Expensesg |

130 |

150 |

130 |

130 |

|

|

Government National Mortgage Assn. (GNMA) Expensesg |

28 |

24 |

25 |

28 |

|

|

Research and technology |

89 |

85 |

92 |

100 |

|

|

Fair housing activities |

65 |

62 |

65 |

65 |

|

|

Fair Housing Assistance Program (non-add) |

24 |

24 |

24 |

24 |

|

|

Fair Housing Initiatives Program (non-add) |

40 |

36 |

39 |

40 |

|

|

Office, lead hazard control |

230 |

145 |

230 |

260 |

|

|

Information Technology Fund |

267 |

260 |

240 |

280 |

|

|

Inspector General |

128 |

128 |

128 |

128 |

|

|

Gross Appropriations Subtotal |

52,749 |

41,423 |

53,241 |

54,049 |

|

|

Offsetting Collections and Receipts |

|||||

|

Manufactured Housing Fees Trust Fund |

-11 |

-12 |

-12 |

-12 |

|

|

FHA |

-8,320 |

-7,570 |

-7,550 |

-7,550 |

|

|

GNMA |

-1,735 |

-2,004 |

-2,004 |

-2,004 |

|

|

Offsets Subtotal |

-10,066 |

-9,586 |

-9,566 |

-9,566 |

|

|

Rescissions |

|||||

|

Native Hawaiian Loan Guarantee Fund |

0 |

-5 |

-5 |

0 |

|

|

Choice Neighborhoods |

0 |

-138h |

0 |

0 |

|

|

Indian Housing Loan Guarantee |

0 |

0 |

<-1 |

0 |

|

|

Rescissions Subtotal |

0 |

-143 |

-5 |

0 |

|

|

Total Net Discretionary Budget Authority |

42,683 |

31,694 |

43,669 |

44,483 |

|

|

Disaster Relief Funding (CDBG-DR)i |

28,000 |

0 |

0 |

0 |

|

|

Total w/ Disaster Funding |

70,683 |

31,694 |

43,623 |

44,483 |

Source: Table prepared by CRS based on P.L. 115-14, and accompanying Explanatory Statement, as published in the Congressional Record, March 22, 2018, beginning on p. H2872; HUD FY2019 Congressional Budget Justifications; H.R. 6072 and H.Rept. 115-750; S. 3023 and S.Rept. 115-268; and H.R. 6147.

Notes: Totals may not add due to rounding. Only selected set-asides are presented in this table. Figures include advance appropriations provided in the bills.

a. Account includes $4 billion in advance appropriations.

b. Total reflects funding for renewal of most vouchers, but does not reflect renewal of Tribal VASH Vouchers or Mainstream Vouchers, which are provided through separate set-asides.

c. HUD's FY2019 Budget Justifications state that HUD is not requesting new budget authority for this program because it has sufficient balances of prior years' budget authority remaining to continue program activities in FY2019.

d. Both the House committee bill and the Senate bill would set aside $50 million to assist survivors of domestic violence. The Senate bill would continue to set aside funds (up to $80 million) to serve homeless youth. And the House committee bill would require a set-aside of $40 million to provide rapid rehousing assistance in areas with high rates of unsheltered homelessness.

e. Account includes $400 million in advance appropriations.

f. The Senate bill would provide $10 million from the Housing for the Elderly account to assist low-income elderly households with home modifications.

g. Some or all of the cost of funding these accounts is offset by the collection of fees or other receipts, shown later in this table.

h. Section 233 of the General Provisions of HUD's budget proposal requested that prior-year funding be rescinded for the program before it is awarded by HUD.

i. P.L. 115-123, the Bipartisan Budget Act of FY2018, in Division B, Subdivision 1, provided $28 billion in emergency CDBG-DR funding. Of this amount, $16 billion is for 2017 disasters and the remaining $12 billion is to be awarded proportionally to communities that received CDBG-DR funding in P.L. 115-123 or specified prior laws, to be used for mitigation activities.

Selected Issues

Housing Choice Voucher Renewal Funding

The cost of renewing existing Section 8 Housing Choice Vouchers is generally one of the most high-profile HUD funding issues each year. It is the largest single expense in the largest account (the tenant-based rental assistance account) in HUD's budget. All of the roughly 2 million portable rental vouchers that are currently authorized and in use are funded annually, so in order for the low-income families currently renting housing with their vouchers to continue to receive assistance (i.e., renew their leases at the end of the year), new funding is needed each year. How much it will cost to renew those vouchers is difficult to estimate—since the cost of a voucher is driven by changes in market rents and tenant incomes—and estimates can change from the time the President's budget is released until final appropriations are enacted, as newer data are reported by the public housing agencies (PHAs) that administer the program and collected and aggregated by HUD.

Although the President's budget request, the House committee-reported HUD appropriations bill, and the Senate bill all include different funding levels for voucher renewals for FY2019, each purports to provide enough to fund all vouchers currently in use.3

If the amount ultimately provided proves to be less than the amount needed to fund all vouchers currently in use, then several things may happen. The PHAs—the state-chartered entities that administer the program at the local level—with reserve funding from prior years may spend some of those reserves to maintain current services. PHAs without reserve funding may apply to HUD for a share of the set-aside funding that is generally provided in the annual appropriations acts to the department and allowed to be used to prevent termination of assistance. And PHAs may undertake cost-saving measures, such as not reissuing vouchers to families on their waiting lists when currently assisted families leave the program.

Funding for Public Housing

The low-rent public housing program houses more than 1 million families in properties owned by local PHAs but subsidized by the federal government. PHAs' budgets for public housing are made up of rent paid by tenants and formula grant funding from the federal government to make up the difference between the rents collected from tenants and the cost of maintaining the properties. The two primary formula grants are Operating Fund grants and Capital Fund grants. Additionally, PHAs may apply for competitive Choice Neighborhood Initiative grants.

The largest source of federal funding to support the low-rent public housing program is provided through the public housing Operating Fund account. Operating funds are allocated to PHAs according to a formula that estimates what it should cost PHAs to maintain their public housing properties based on the characteristics of those properties. When the amount of appropriations provided is insufficient to fully fund the amount PHAs qualify for under the formula, their allocation is prorated. Assuming the Operating Fund formula accurately reflects the costs of maintaining public housing, less than full funding means PHAs either will not be able to meet their full operating needs (e.g., maintenance, staffing, services for residents) or will have to spend down reserves they may have accumulated or seek other sources of funding.

According to HUD's Congressional Budget Justifications, the amount requested in the President's budget for the Operating Fund for FY2019 (a 28% decrease from FY2018) would be sufficient to fund an estimated 54% of PHAs' formula eligibility. Both the House committee-passed bill and the Senate bill propose more funding than requested, but neither propose the full amount the President's budget estimated would be needed to fully fund PHAs' formula eligibility in FY2019.4

The other major source of federal funding for public housing is the Capital Fund. Capital Fund formula grants are used to meet the major modernization needs of public housing, beyond the day-to-day maintenance expenses included among operating expenses. The most recent national assessment of public housing capital needs sponsored by HUD found that inadequate funding had resulted in a backlog of about $25.6 billion in capital/modernization needs across the public housing stock, with new needs accruing nationally at a rate of about $3.4 billion per year.5

For FY2019, the President's budget requested no funding for the Capital Fund, citing federal fiscal constraints and a desire to "strategically reduce the footprint of Public Housing." Both the House committee bill and the Senate bill would provide funding for the Capital Fund, with H.Rept. 115-750 explicitly stating that it rejects the Administration's proposed strategic reduction of public housing.

Similarly, the Administration's budget requested no new funding for competitive Choice Neighborhoods grants that are used to redevelop distressed public housing and other assisted housing. Both the House committee bill and the Senate bill propose to fund the program. The House committee bill proposes even funding with FY2018 ($150 million) and the Senate proposes a decrease in funding relative to FY2018 (a reduction of $50 million, or 33%).

Funding for HUD Grant Programs

The President's budget request included a proposal to eliminate funding for several HUD grant programs that support various affordable housing and community development activities. Most notable among these are HUD's two largest block grant programs for states and localities, CDBG and HOME, as well as competitive grants funded in the SHOP account (i.e., funding for sweat-equity programs, like Habitat for Humanity, and certain capacity building programs). These grant programs were also slated for elimination in the President's FY2018 budget request, although they were ultimately funded in FY2018.

The press release accompanying the budget request suggested that the activities funded by these grant programs should be devolved to the state and local levels.6 Both the House committee bill and the Senate bill would continue funding for these programs. The House committee bill would provide level funding for CDBG, but funding reductions for the other accounts. The Senate bill would provide level funding for all three accounts.

FHA and Ginnie Mae Offsets

Under the terms of the Budget Control Act, as amended, discretionary appropriations are generally subject to limits, or caps, on the amount of funding that can be provided in a fiscal year. In addition, the annual appropriations bills also are individually subject to limits on the funding within them that are associated with the annual congressional budget resolution.7 Congressional appropriators can keep these bills within their respective limits in a number of ways, including by providing less funding for certain purposes to allow for increases elsewhere in the bill. In certain circumstances, appropriators also can credit "offsetting collections" or "offsetting receipts" against the funding in the bill, thereby lowering the net amount of budget authority in that bill.8

In the THUD bill, the largest source of these offsets is generally the Federal Housing Administration (FHA). FHA generates offsetting receipts when estimates suggest that the loans that it will insure during the fiscal year are expected to collect more in fees paid by borrowers than will be needed to pay default claims to lenders over the life of those loans.9 While usually not as large a source, the Government National Mortgage Association (GNMA), or Ginnie Mae, generally provides significant offsets within the THUD bill as well. GNMA guarantees mortgage-backed securities made up of government-insured mortgages (such as FHA-insured mortgages) and similarly generates offsetting receipts when the associated fees it collects are estimated to exceed any payments made on its guarantee.

The amount of offsets available from FHA and GNMA varies from year to year based on estimates of the amount of mortgages that FHA will insure, and that GNMA will guarantee, in a given year and how much those mortgages are expected to earn for the government. These estimates, in turn, are based on expectations about the housing market, the economy, the credit quality of borrowers, and relevant fee levels, most of which are factors outside of the immediate control of policymakers. If the amount of available offsets increases from one year to the next, then additional funds could be appropriated relative to the prior year's funding level while still maintaining the same overall net level of budget authority. If the amount of offsets decreases, however, then less funding would need to be appropriated relative to the prior year to avoid increasing the overall net level of budget authority, all else equal.

For FY2019, the Congressional Budget Office (CBO) estimates that offsetting receipts available from FHA will be lower than in FY2018 ($7.6 billion compared to $8.3 billion) while the amount of offsets available from Ginnie Mae will be higher (about $2 billion compared to $1.7 billion). The total combined amount of offsets, then, is about $500 million less in FY2019 as compared to the prior year. As a result of this lower amount of offsets, the increase in net budget authority provided in both the House committee bill and the Senate bill as compared to FY2018 is greater than the increase in gross appropriations that those bills provide for HUD programs and activities.