The Airport and Airway Trust Fund (AATF): An Overview

The Airport and Airway Trust Fund (AATF), sometimes referred to as the aviation trust fund, has been the primary funding source for federal aviation programs since 1972. It provides all funding for three major accounts of the Federal Aviation Administration (FAA): the Airport Improvement Program (AIP), Facilities and Equipment (F&E), and Research, Engineering, and Development (RE&D). It also pays for most spending from FAA’s Operations and Maintenance (O&M) account.

The trust fund is funded principally by a variety of taxes paid by users of the national aviation system. Revenue sources for the trust fund include taxes on airline passenger ticket sales, the flight segment tax, air cargo taxes, and aviation fuel taxes paid by both commercial and general aviation aircraft. In FY2016, the trust fund received revenues of over $14.4 billion in aviation taxes and fees. Between FY2012 and FY2016, the trust fund provided between 71% and 93% of FAA’s total appropriations, with the remainder coming from the general fund of the U.S. Treasury.

In order to avoid disruptions, both the authority to collect aviation excise taxes and to spend from the trust fund must be reauthorized periodically by Congress. The latest such legislation, P.L. 114-190, reauthorized FAA, other civil aviation programs, and the collection of taxes to fund the AATF through FY2017. However, a full FY2017 appropriation has not been enacted. P.L. 114-254 extended funding of FAA programs and activities at the FY2016 annualized level of $16,281 million through April 28, 2017.

The balance in the aviation trust fund is projected to increase over the next few years. However, the AATF’s long-term vitality remains subject to a variety of forces. Poor economic conditions or external events could curb demand for air travel, reducing revenue from the ticket taxes that are the main source of AATF funding. Changing airline business practices, particularly unbundling of ancillary fees for particular amenities from airfares, are adversely affecting AATF revenue, as only base airfares are subject to ticket taxes. The financial future of the trust fund also depends on future spending decisions, including FAA plans for substantial investment in the Next Generation Air Transportation System (NextGen) satellite-based air traffic control system.

Proposals to shift air traffic control services from FAA to a government-owned corporation with an independent board of directors, which are expected to reemerge, raise a number of issues regarding AATF revenues and expenditures. A version of such a proposal approved by the House Transportation and Infrastructure Committee in 2016 would have allowed the corporation to impose user fees on some flights, principally commercial aviation. If user fees were to fund air traffic services, FAA would no longer require aviation tax revenues for this purpose. Congress might then consider options to restructure FAA’s financing mechanisms, such as lowering the aviation taxes that flow into the AATF or eliminating the general fund component of FAA funding.

The Airport and Airway Trust Fund (AATF): An Overview

Jump to Main Text of Report

Contents

- Introduction

- Trust Fund Income

- Aviation Taxes and Fees

- Lapses of Aviation Trust Fund Taxes

- Aviation User Fees

- The General Fund Share and the "Public Interest"

- FAA's Budget

- Annual Appropriations

- Spending Guarantees

- Status of the Trust Fund

- Congressional Budget Office Forecast

- Cost of NextGen

- Air Traffic Control Reform

Summary

The Airport and Airway Trust Fund (AATF), sometimes referred to as the aviation trust fund, has been the primary funding source for federal aviation programs since 1972. It provides all funding for three major accounts of the Federal Aviation Administration (FAA): the Airport Improvement Program (AIP), Facilities and Equipment (F&E), and Research, Engineering, and Development (RE&D). It also pays for most spending from FAA's Operations and Maintenance (O&M) account.

The trust fund is funded principally by a variety of taxes paid by users of the national aviation system. Revenue sources for the trust fund include taxes on airline passenger ticket sales, the flight segment tax, air cargo taxes, and aviation fuel taxes paid by both commercial and general aviation aircraft. In FY2016, the trust fund received revenues of over $14.4 billion in aviation taxes and fees. Between FY2012 and FY2016, the trust fund provided between 71% and 93% of FAA's total appropriations, with the remainder coming from the general fund of the U.S. Treasury.

In order to avoid disruptions, both the authority to collect aviation excise taxes and to spend from the trust fund must be reauthorized periodically by Congress. The latest such legislation, P.L. 114-190, reauthorized FAA, other civil aviation programs, and the collection of taxes to fund the AATF through FY2017. However, a full FY2017 appropriation has not been enacted. P.L. 114-254 extended funding of FAA programs and activities at the FY2016 annualized level of $16,281 million through April 28, 2017.

The balance in the aviation trust fund is projected to increase over the next few years. However, the AATF's long-term vitality remains subject to a variety of forces. Poor economic conditions or external events could curb demand for air travel, reducing revenue from the ticket taxes that are the main source of AATF funding. Changing airline business practices, particularly unbundling of ancillary fees for particular amenities from airfares, are adversely affecting AATF revenue, as only base airfares are subject to ticket taxes. The financial future of the trust fund also depends on future spending decisions, including FAA plans for substantial investment in the Next Generation Air Transportation System (NextGen) satellite-based air traffic control system.

Proposals to shift air traffic control services from FAA to a government-owned corporation with an independent board of directors, which are expected to reemerge, raise a number of issues regarding AATF revenues and expenditures. A version of such a proposal approved by the House Transportation and Infrastructure Committee in 2016 would have allowed the corporation to impose user fees on some flights, principally commercial aviation. If user fees were to fund air traffic services, FAA would no longer require aviation tax revenues for this purpose. Congress might then consider options to restructure FAA's financing mechanisms, such as lowering the aviation taxes that flow into the AATF or eliminating the general fund component of FAA funding.

Introduction

The Airport and Airway Trust Fund (AATF), sometimes referred to as the aviation trust fund, is the major funding source for federal aviation programs. The trust fund finances Federal Aviation Administration (FAA) capital investments in the airport and airway system as well as supports FAA research and operations costs.

In order to for avoid disruptions, both the authority to collect aviation excise taxes and to spend from the trust fund must be reauthorized periodically by Congress. The most recent reauthorization, the FAA Extension, Safety, and Security Act of 2016 (P.L. 114-190), expires on September 30, 2017. If FAA's authorization were to expire without a reauthorization or extension, there would be lapses in aviation excise tax collection authority, and the agency would be unable to spend any revenues allocated from the trust fund.

Trust Fund Income

Congress established the AATF in the Airport and Airway Revenue Act of 1970 (P.L. 91-258) to provide a dedicated source of federal funding for the aviation system in the United States.

Aviation Taxes and Fees

Trust fund revenue is derived principally from a variety of taxes paid by users of the national aviation system. Revenue sources for the trust fund include taxes on airline passenger ticket sales, segment fees, air cargo fees, and aviation fuel taxes paid by both commercial and general aviation aircraft (see Table 1). The trust fund also accrues interest on its cash balance.

|

Tax or Fee |

Rate |

|

Passenger ticket tax (on domestic ticket purchases and frequent flyer awards) |

7.5% |

|

Flight segment tax (domestic, indexed annually to Consumer Price Index) |

$4.10 |

|

Cargo waybill tax |

6.25% |

|

General aviation gasoline* |

19.4 cents/gallon |

|

General aviation jet fuel* (kerosene) |

21.9 cents/gallon |

|

Commercial jet fuel* (kerosene) |

4.4 cents/gallon |

|

International arrival/departure tax (indexed annually to Consumer Price Index) |

$18.00 |

|

Tax on transportation between continental United States and Alaska/Hawaii |

$9.00 |

|

Fractional ownership surtax on general aviation jet fuel |

14.1 cents/gallon |

Source: Federal Aviation Administration, Current Aviation Excise Tax Structure, updated January 2017.

Notes: * Does not include 0.1 cents/gallon for the Leaking Underground Storage Tank (LUST) trust fund.

Table 1 does not include other fees on airlines and air passengers, such as immigration, customs, and agricultural inspection fees and passenger and airline security fees, because they are either deposited into the U.S. Treasury general fund or linked to the cost of providing inspection services.

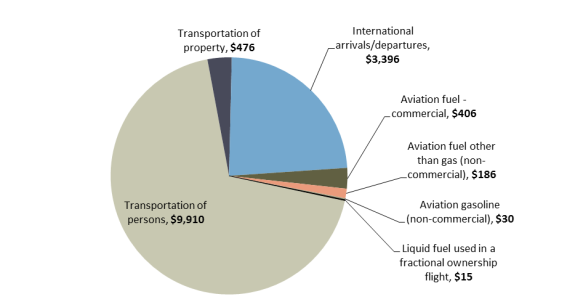

In FY2016, the AATF received revenues of over $14.4 billion, with nearly 70% coming from taxes and fees levied on transportation of passengers. Figure 1 illustrates the composition of AATF excise tax revenues collected in FY2016.

Trust fund revenue can be volatile, as external factors affect demand for air travel. For example, when the terrorist attacks of September 11, 2001, substantially reduced demand for air travel, trust fund revenues plummeted. The Severe Acute Respiratory Syndrome (SARS) epidemic, which caused passengers to curtail travel to Asia in 2003, had a similar effect. During the last recession, the airline industry responded to a weak economy, lower consumer demand for air travel, and high fuel prices by reducing domestic capacity in 2008 and 2009, which resulted in a decrease in fuel consumption and lower fuel and gasoline tax receipts.1

Although the stream of trust fund revenues has been relatively stable in recent years, the long-term vitality of the AATF remains a concern for many. AATF revenue is largely dependent on airlines' ticket sales and, therefore, is affected by air travel demand. However, the spread of low-cost air carrier models may have held down ticket prices and, subsequently, AATF receipts.

AATF revenues have also been adversely affected by the recent trend among airlines to impose fees for a variety of add-on services and amenities such as checked bags, onboard Wi-Fi access, or seats with additional legroom. Generally, fees not included in the base ticket price are not subject to the federal excise taxes. Air carriers generated over $3.8 billion in baggage fees alone in 2015,2 which translates into more than $285 million that the trust fund could have received had those fees been subject to the 7.5% excise tax. If airlines continue to seek additional revenue from ancillary fees as an alternative to increasing base ticket prices, federal aviation programs and activities may become more dependent on contributions from the general fund.

Lapses of Aviation Trust Fund Taxes

Because authority to collect taxes for the trust fund must be authorized, any lapse in aviation tax authority would halt the flow of tax revenues into the trust fund. This has happened three times over the past two decades: in 1996, 1997, and 2011. On January 1, 1996, authority to collect taxes for the AATF expired. Spending from the trust fund, however, continued. The lapse continued until August 27, 1996, when the tax authority was extended to the end of the calendar year by the Small Business Job Protection Act of 1996 (P.L. 104-188). Tax-collection authority then lapsed again on January 1, 1997, until it was authorized by the Airport and Airways Trust Fund Reinstatement Act of 1997 (P.L. 105-2), enacted on February 28, 1997. The trust did not receive an estimated $4 billion in forgone tax collections during the first lapse and another $1 billion during the second.

The 1996 and 1997 lapses in the aviation tax authorization and the approaching possibility of another lapse increased support in Congress for a longer-term resolution that would ensure a stable funding source for the trust fund. The Taxpayer Relief Act (TRA) of 1997 (P.L. 105-34) extended the aviation trust fund taxes for 10 years, through FY2007. It also modified the taxes to form the aviation tax structure in place today. These changes3 included a reduction of the ticket tax to 7.5%4, imposition of a flat fee on each domestic flight segment, a tax on frequent flyer awards, and a tax on passengers departing or arriving in the United States on international flights.

Another lapse in FAA's authority to collect trust fund revenues and expend money from the trust fund occurred in 2011 and lasted for two weeks, from July 23 to August 5. FAA estimated the 2011 lapse to have resulted in approximately $200 million of forgone trust fund revenues each week, or about $400 million for the entire lapse. Although the Airport and Airway Extension Act of 2011 (P.L. 112-27), signed into law on August 5, 2011, retroactively reinstated the taxes as though they never expired, the Internal Revenue Service granted relief to airlines and to taxpayers who purchased tickets during those two weeks.5

Aviation User Fees

Airlines have long contended that general aviation operators, particularly corporate jets, should provide a larger share of the revenues supporting the trust fund. General aviation interests dispute this, arguing that the air traffic system mainly supports the airlines and that nonairline users pay a reasonable share given the relatively small incremental costs arising from their flights.

Until 2015, the Obama Administration proposed a per-flight user charge of $100 on commercial and general aviation jets and turboprops that fly in controlled airspace as an additional revenue source for the AATF.6 The proposal, estimated to generate roughly $1.1 billion annually, was opposed by general aviation interests, which saw this as a first step toward funding the air traffic control system wholly or substantially through user charges. The Administration's budgets for FY2016 and FY2017 did not include such a proposal.

Proposals by the Clinton Administration and the George W. Bush Administration to establish user charges for air traffic services also failed to gain congressional support. A 2007 Senate proposal (the Aviation Investment and Modernization Act of 2007; S. 1300; S.Rept. 110-144) to finance air traffic system modernization with a $25-per-flight user charge faced similar opposition from business and general aviation interests, and failed to gain traction in Congress. The concept of user-fee funding for air traffic services has resurfaced in current debate over proposals to transfer FAA's air traffic system to a private entity or an independent government-owned corporation. Under some proposals, the air traffic control organization would fund its capital and operating costs from user fees that would not flow into the aviation trust fund. Federal aviation taxes would remain in place to fund other FAA operations.

The General Fund Share and the "Public Interest"

The U.S. aviation system has historically been funded in part from the AATF and in part from the Treasury general fund (Table 2). The general fund share of FAA appropriations has varied widely, ranging from 0% in FY2000 to 38% in FY1997. The general fund share tends to follow a cyclical trend, typically rising when trust fund revenues fall during economic slowdowns. The only FAA program that can receive funding from general fund contributions is the Operations and Maintenance (O&M) account, which covers air traffic services and FAA safety oversight. General revenues have funded 12% to 48% of annual O&M appropriations since FY2012.

|

|

FY2012 |

FY2013* |

FY2014 |

FY2015 |

FY2016 |

|

Operations and Maintenance—AATF % |

52% |

54% |

67% |

88% |

80% |

|

Operations and Maintenance—General Fund % |

48% |

46% |

33% |

12% |

20% |

|

FAA Total—AATF % |

71% |

71% |

80% |

93% |

88% |

|

FAA Total—General Fund % |

29% |

29% |

20% |

7% |

12% |

Source: FAA.

Note: * FY2013 split reflects transfer of $253 million from the Airport Improvement Program to O&M ($247.2 million) and Facilities and Equipment ($5.8 million) per the Reducing Flight Delays Act of 2013 (P.L. 113-9).

Between FY2012 and FY2016, the general fund provided between 7.2% (FY2015) and 28.9% (FY2012) of FAA's total annual funding.7 The philosophical basis for a general fund contribution to FAA costs is the claim that aviation safety is a public good.8 Some elements of the aviation industry, especially general aviation, have long maintained that the airways system is a pure public good and should therefore be paid for exclusively by government rather than by users of the system. At the other extreme, critics might assert that many Americans make little or no use of civil aviation while others use it intensively, and that the costs of air traffic control and aviation safety are properly borne by those who use the system rather than by taxpayers at large. Conceptually, that portion of the cost of operating the airway system that is appropriated from the general fund is supposed to equate to the amount military, government, and untaxed beneficiaries of the aviation system might have contributed to the trust fund through the payment of user fees, if there were user fees to be paid. This is sometimes referred to as a "public interest" contribution.

Having both general government revenue and AATF revenue to fund FAA provides congressional appropriators with the flexibility of raising or lowering the contribution from the general fund to respond to changing needs or economic conditions. In addition, having some general fund revenues available allows certain FAA operations, such as air traffic control, to continue during a lapse in AATF reauthorization.

FAA's Budget

Annual FAA expenditures have been in the range of $15 billion to $17 billion in recent years. The FAA budget is divided into four major accounts:

- Grants-in-Aid for Airports (Airport Improvement Program, or AIP)

- Facilities and Equipment (F&E)

- Research, Engineering, and Development (RE&D)

- Operations and Maintenance (O&M) (partly supported by the trust fund, with the remainder coming from the general fund)

The first two accounts, AIP and F&E, are considered "capital" accounts or programs because they deal with the development of airport and airway infrastructure. The AIP provides federal grants for projects such as new runways and taxiways; runway lengthening, rehabilitation, and repair; and noise mitigation near airports.9 The F&E account provides funding for the acquisition and maintenance of air traffic facilities and equipment, and for the engineering, development, testing, and evaluation of technologies related to the federal air traffic system. It funds the technological improvements to the air traffic control system, including installation of a satellite-based air traffic control system referred to as the Next Generation Air Transportation System (NextGen).

The RE&D account funds research on issues related to aviation safety, mobility, and NextGen technologies, including research on improving aviation safety and operational efficiency and reducing environmental impacts of aviation operations. Only the O&M account, which funds FAA operations, including the air traffic control system and safety inspections, receives monies from the general fund.

Annual Appropriations

Most FAA spending, including most spending from the AATF, requires annual appropriations by Congress. Approximately 20% of FAA's total funds are disbursed as contract authority for AIP, and may be committed prior to appropriations action.10 The rest may be spent only with a congressional appropriation. This represents a major difference between the AATF and another major transportation trust fund, the Highway Trust Fund (HTF). Almost all money in the HTF can be expended through the Federal Highway Administration's contract authority without an appropriation, although Congress must eventually provide liquidating authority and may place a limitation on obligations for a given year.11

FAA's O&M account, which principally funds air traffic operations and aviation safety programs, receives more than 60% of total FAA appropriations. The other three accounts are funded entirely through the AATF. Recent authorizations and appropriations for these FAA accounts are shown in Table 3.

|

Account |

FY2012 |

FY2013 |

FY2014 |

FY2015 |

FY2016 |

FY2017* |

|

Operations and Maintenance (O&M) |

||||||

|

Authorized levels |

9,653 |

9,539 |

9,596 |

9,653 |

9,910 |

9,910 |

|

Appropriated amounts |

9,653 |

9,148 |

9,651 |

9,741 |

9,909 |

9,994 |

|

Airport Improvement Program (AIP) |

||||||

|

Authorized levels |

3,350 |

3,350 |

3,350 |

3,350 |

3,350 |

3,350 |

|

Appropriated amounts |

3,350 |

3,343 |

3,480 |

3,350 |

3,350 |

2,900 |

|

Facilities and Equipment (F&E) |

||||||

|

Authorized levels |

2,731 |

2,715 |

2,730 |

2,730 |

2,855 |

2,855 |

|

Appropriated amounts |

2,731 |

2,588 |

2,600 |

2,600 |

2,855 |

2,838 |

|

Research, Engineering, and Development (RE&D) |

||||||

|

Authorized levels |

168 |

168 |

168 |

168 |

166 |

166 |

|

Appropriated amounts |

168 |

159 |

133 |

157 |

166 |

168 |

|

TOTALS |

||||||

|

Authorized levels |

15,902 |

15,772 |

15,814 |

15,901 |

16,281 |

16,281 |

|

Appropriated amounts |

15,902 |

15,238 |

15,864 |

15,848 |

16,281 |

16,281 |

Source: CRS analysis of P.L. 114-190, P.L. 112-55 (FY2012 Appropriations), P.L. 113-6 (FY2013 Appropriations), P.L. 113-76 (FY2014 Appropriations), P.L. 113-235 (FY2015 Appropriations), P.L. 114-190, and for FY2017, the President's Budget Request.

Note: * A full FY2017 appropriation has not been enacted. P.L. 114-223 extended funding through December 9, 2016; P.L. 114-254 further extended funding at the FY2016 annualized level through April 28, 2017.

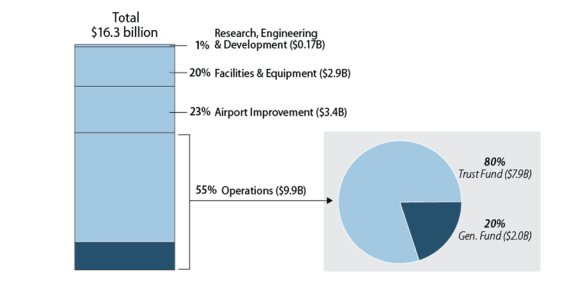

In FY2016, the split of the AATF and the general fund contribution to finance FAA operations was approximately 80-20. Figure 2 shows the composition of FAA expenditures in FY2016.

|

|

Source: CRS analysis of FAA data. |

In addition to excise taxes deposited into the trust fund, FAA imposes air traffic service fees on flights that transit U.S.-controlled airspace but do not take off from or land in the United States. These overflight fees partially fund the Essential Air Service program, which subsidizes airline flights to eligible small communities that otherwise would not receive commercial airline service. This program is administered by the Office of the Secretary of the U.S. Department of Transportation, not by FAA.12

Spending Guarantees

Since the creation of the trust fund, there has been disagreement over the appropriate use of its revenues. This led to the enactment of a series of legislative mechanisms designed to ensure that the AIP and the F&E account, the main sources of federal capital spending for U.S. airports and airways, are funded at their fully authorized levels.

From the establishment of the trust fund in 1970 through the late 1990s, revenues deposited into it have generally exceeded spending commitments from FAA's appropriations, resulting in a growing uncommitted balance—the amount remaining in the trust fund after funds have been appropriated and a limitation on obligation established. To ensure that revenues deposited into the trust fund are used for aviation purposes and that FAA's capital accounts get funded at their fully authorized levels, the Wendell H. Ford Aviation Investment and Reform Act for the 21st Century of 2000 (AIR21; P.L. 106-181) and Vision 100: Century of Aviation Reauthorization Act of 2003 (Vision 100; P.L. 108-176) included provisions to require that the total budget resources made available each fiscal year from the trust fund be equal to the level of receipts plus interest paid to the trust fund in that fiscal year. These are known as spending guarantee mechanisms.

The current mechanism dates back to 2000, when AIR21 created a budgetary regimen for aviation programs that was closely linked to the availability of funds in the trust fund. In simple terms, appropriators were required to fully fund AIP and F&E at authorized levels, and were directed to further account for all trust fund revenues prior to determining the general fund share that would be provided for O&M in a fiscal year. The spending guarantees were extended by Vision 100. The FAA Modernization and Reform Act of 2012 (P.L. 112-95) amended the trust fund guarantee to require that the total amounts made available from the trust fund be equal to 90% of the estimated receipts plus interest for the year.13

This would allow a modest accumulation of an unexpended balance in the trust fund that could be used as a buffer if overly optimistic revenue projections or unfavorable economic conditions lead to spending at levels that exceed the amount of revenue going into the trust fund.

Status of the Trust Fund

At the end of FY2016, the aviation trust fund was projected to have a cash balance of over $14.3 billion. The uncommitted balance—the amount of funds not yet obligated—was estimated to be approximately $5.7 billion at the end of FY2016, reversing several years of decline.14

While the financial vitality of the trust fund can be evaluated by looking at its uncommitted balance and the cash balance, there are considerable differences between the two indicators. FAA considers the committed balance of the trust fund to include the appropriated amounts from the trust fund plus obligated AIP contract authority for the year. The uncommitted balance, which is the revenue that would remain in the trust fund after subtracting the committed balance, is often used to evaluate FAA's ability to enter into future commitments as provided in authorization and appropriations acts. A low uncommitted balance means that limited funds are available to incur new obligations while still covering expenditures on existing obligations, limiting FAA's ability to move forward with planned projects and programs.

The cash balance includes money required to satisfy outstanding obligations as well as funds for which no commitments have been made. It is often used to evaluate the trust fund's ability to pay outstanding bills as they are due. If the cash balance falls below the amount of outstanding obligations, FAA will have to delay payments until it receives sufficient trust fund revenue to cover the obligations, or until Congress increases contributions from the general fund.

Congressional Budget Office Forecast

In August, 2016, the Congressional Budget Office (CBO) projected that if current law remains in place and if appropriations grow at the rate of inflation, total annual spending by FAA would increase from over $16 billion in FY2016 to $19.7 billion in FY2026. Trust fund receipts, including aviation excise tax revenues and interest earnings, are projected to grow from over $14 billion in FY2016 to more than $20.5 billion in FY2026. According to CBO, the FY2016 uncommitted balance of approximately $5.7 billion is projected to grow to nearly $17 billion by the end of FY2026.

The size of future trust fund balances, however, depends on the amount of actual revenues generated in the future by various aviation taxes and fees that are largely determined by the number of airline passengers and average airfares. Balances will also depend on how future outflows from the trust fund compare to revenue inflows, including general fund appropriations from Congress. Two budgetary issues likely to have major impacts on the AATF are FAA's plan for substantial investment in NextGen and possible reforms of air traffic services to incorporate direct fees on users of the air traffic control system.

Cost of NextGen

NextGen refers to a multifaceted ensemble of technologies and operational procedures to modernize the national air traffic system, shifting from reliance on ground-based radar and navigation to satellite-based navigation and aircraft tracking. Work on NextGen began about 10 years ago, and currently accounts for about $1 billion in annual FAA spending, mostly on activities included under FAA's F&E account.

Thus far, NextGen's impact on the AATF has been limited, since NextGen has been planned and funded within the framework of FAA's existing funding structure; there is no separate dedicated funding stream for NextGen. Pressure to accelerate NextGen development, however, could prompt additional annual spending that could have a more pronounced effect on AATF balances.

Notably, most aircraft will be required to equip with technology compatible with the NextGen system.15 The technology, called Automatic Dependent Surveillance-Broadcast (ADS-B), allows aircraft to be identified and tracked by air traffic facilities more precisely than is possible with existing radar technology. This is intended to allow for better airspace utilization and greater efficiency in the form of more direct routings and closer aircraft spacing.

Efficiency gains from ADS-B will be realized only when FAA completes and deploys complementary technologies in its facilities, not only to track aircraft with ADS-B, but also to utilize various analytic tools to increase airspace efficiency. Operators of aircraft equipped with ADS-B are likely to be interested in accelerating the deployment of these NextGen technologies over the next three to five years in order to benefit from their investments. This may be an issue of particular congressional debate in the context of pending FAA reauthorization legislation.

According to FAA, future NextGen costs through FY2030 will total more than $14 billion in addition to the roughly $6 billion that has already been spent. Moreover, FAA anticipates that annual federal spending on NextGen will accelerate over the next six years, peaking at about $1.6 billion in FY2022 before trailing off to a steady level of about $400 million annually in 2028 and beyond.16 Accelerating NextGen spending could take the form of shifting peak spending to an earlier fiscal year or distributing it more evenly over a number of earlier fiscal years. Accelerated spending could have the effect of reducing the total cost through 2030 by completing projects at less inflated prices and also by potentially reaping anticipated NextGen benefits earlier.

The impacts of NextGen acceleration on the AATF, however, would depend on the continued availability of uncommitted balances that can be tapped for such purposes. Moreover, accelerating NextGen funding may not be feasible if FAA is unable to obligate funds for such purposes at these earlier dates because of administrative or technical constraints that could limit its ability to expedite specific NextGen projects.

To the extent that Congress or FAA deems acceleration of NextGen feasible and seeks to speed up NextGen activities, funding needs for NextGen projects could increase demand for AATF funds. Although dedicated funding accounts for NextGen have been proposed in the past as a means to avoid potential strain on the AATF, these proposals have proven controversial, as airspace users, particularly business and general aviation interests, have balked at proposals to impose per-flight user fees to fund NextGen.

Air Traffic Control Reform

User fees as an alternative to traditional AATF revenue sources have also been discussed in the context of funding day-to-day air traffic control operations, particularly in conjunction with proposals to reform air traffic control services by creating a stand-alone air traffic corporation separate from FAA.

In the 114th Congress, the Aviation Innovation, Reform, and Reauthorization Act of 2016 (H.R. 4441) included language that would have created a not-for-profit government-chartered air traffic control corporation, wholly funded by user fees, to run the air traffic system. Under the proposal, a corporate board would have been able to set fees based on projected operating costs and forecast aviation activity. This proposal was not adopted by the House, but the concept may reemerge during the likely FAA reauthorization debate in the 115th Congress.

The prospect of user-fee funding for air traffic services could raise a number of issues regarding AATF revenues and expenditures. If a user-fee scheme is created to fund air traffic services, almost $10 billion in annual expenditures that are currently funded by a combination of AATF and general fund revenues could instead be covered by user fees. To offset user-fee collections, Congress may consider options to restructure AATF revenues, such as lowering fuel, ticket, and cargo taxes. Within the context of such a debate, Congress may also consider whether to continue to rely on the general fund component of FAA funding—for example, to fund safety-related functions like oversight of airlines and the proposed air traffic corporation—or whether FAA expenditures should be wholly funded with AATF revenue.

Author Contact Information

Footnotes

| 1. |

U.S. Government Accountability Office, Airport and Airways Trust Fund: Factors Affecting Revenue Forecast Accuracy and Realizing Future FAA Expenditures, GAO-12-222, January 2012. |

| 2. |

Bureau of Transportation Statistics (BTS), "Baggage Fees by Airline 2015," May 2, 2016. http://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/subject_areas/airline_information/baggage_fees/html/2015.html. |

| 3. |

The Taxpayer Relief Act of 1997 also redirected the revenues from the 4.3-cent-per-gallon tax on aviation fuels imposed under Omnibus Budget Reconciliation Act of 1993 (OBRA93; P.L. 103-66) to the aviation trust fund. This was the first tax on commercial jet fuel. The revenue was initially deposited in the general fund for deficit reduction purposes. |

| 4. |

The Taxpayer Relief Act of 1997 phased in a reduction of the ticket tax rate from 10% to 9% as of October 1, 1997; to 8% as of October 1, 1998; and to 7.5% from October 1 to December 1, 1999. Since that time the ticket tax has remained at 7.5%. |

| 5. |

U.S. Government Accountability Office, Airport and Airways Trust Fund: Factors Affecting Revenue Forecast Accuracy and Realizing Future FAA Expenditures, GAO-12-222, January 23, 2011. |

| 6. |

Office of Management and Budget, Living Within Our Means and Investing in the Future: The President's Plan for Economic Growth and Deficit Reduction, September 2011, pp. 22-23. |

| 7. |

Federal Aviation Administration, Airport and Airway Trust Fund (AATF) Fact Sheet, http://www.faa.gov/about/budget/aatf/media/aatf_fact_sheet.pdf. |

| 8. |

A public good is usually viewed as something that cannot be produced efficiently in the marketplace. A classic example is defense, which is normally viewed as a service that only government can adequately provide. |

| 9. |

For more information about the AIP, see CRS Report R43327, Financing Airport Improvements, by Rachel Y. Tang and Robert S. Kirk. |

| 10. |

Contract authority is a type of budget authority that allows the federal government to incur an obligation in advance of an appropriation. Liquidating authority is eventually needed to pay off the obligations incurred using contract authority. The annual obligation limitation is analogous to an appropriation. In effect, limitations of obligations restrict the amount of contract authority that may be committed under the AIP. |

| 11. |

See CRS Report R44674, Funding and Financing Highways and Public Transportation, by Robert S. Kirk and William J. Mallett, for more details on the HTF. |

| 12. |

See CRS Report R44176, Essential Air Service (EAS), by Rachel Y. Tang. |

| 13. |

P.L. 112-95 §104. Spending guarantees are enforceable only if a point of order is raised and if it has not been waived. For historical and more detailed information of aviation spending guarantee mechanisms, see CRS Report RL33654, Aviation Spending Guarantee Mechanisms, by Robert S. Kirk. |

| 14. |

Congressional Budget Office, Projected Balances of the Airport and Airway Trust Fund, August 2016; U.S. Government Accountability Office, Airport and Airways Trust Fund: Declining Balance Raises Concerns over Ability to Meet Future Demands, GAO-11-358T, February 3, 2011. |

| 15. |

See 14 C.F.R. §91.225. |

| 16. |

Federal Aviation Administration, Update to the Business Case for the Next Generation Air Transportation System Based on the Future of the NAS Report, July 2016, https://www.faa.gov/nextgen/media/BusinessCaseForNextGen-2016.pdf. |