Natural Gas Discoveries in the Eastern Mediterranean

Since 2009, a series of large natural gas discoveries in the Levant Basin have altered the dynamics of the Eastern Mediterranean region. Israel’s discovery of the Tamar Field and subsequent discovery of the larger Leviathan Field created the potential for the country to become a regional player in the natural gas market. Since the initial Israeli discoveries, Cyprus and Egypt have also found new gas deposits in the Mediterranean. The Aphrodite Field was discovered by U.S. firm Noble Energy in Cypriot waters in late 2011 and the massive Zohr Field was found in Egyptian waters by Italian firm Eni in 2015.These discoveries create the potential for Cyprus to export gas and for Egypt to meet more of its domestic gas needs. Lebanon has not yet discovered recoverable gas reserves, but geologic data indicates that there is the potential for Lebanon to possess significant gas resources. Israeli gas discoveries have been contested by Lebanon, which disputes an area of about 300 square miles along the countries’ unsettled maritime border. The Administration has sought to mediate the maritime dispute between Israel and Lebanon.

New gas reserves could change how energy is used in the region. Since the Tamar find, Israel’s electricity energy mix has begun to shift from oil to natural gas-fired power plants. Gas-fired plants emit less carbon than oil-fired plants, and continuing to convert oil plants could help Israel meet long-term carbon emissions goals. The development of gas infrastructure in Cyprus could also help the country transition from oil to gas-fired power generation. A similar shift could also occur in Lebanon should gas be discovered and related infrastructure developed. Lebanon currently uses no natural gas.

Israel now has the potential to become a gas exporter. There are a number of potential buyers for Israeli gas. Egypt, currently facing an energy crisis, will need to import gas to cover domestic demand in the near future. While Israeli gas imports are politically unpopular in Egypt, private Egyptian firms have already begun to negotiate agreements with Noble Energy to import Israeli gas. Jordan is another possible destination for Israeli gas. Repeated attacks on Egypt’s Arab Gas Pipeline have decreased Jordan’s energy security and increased the need for it to find alternate, reliable sources of gas. Finally, recent progress on improving diplomatic relations has opened the possibility of Israeli gas exports to Turkey. These exports could either be shipped by the construction of a direct pipeline or by liquefied natural gas (LNG) tankers crossing the Mediterranean.

Although the United States is essentially independent in its natural gas resources, it has expressed interest in the Eastern Mediterranean natural gas resources, particularly in the development of Israel’s resources. Congress and the Obama Administration have undertaken a variety of efforts in regard to the region’s natural gas. Legislation has been introduced in both Houses of Congress, and has become law, during the last couple of sessions that address the region’s natural gas resources.

Natural Gas Discoveries in the Eastern Mediterranean

Jump to Main Text of Report

Contents

- Introduction

- Cyprus—Slow to Use Its Gas

- Aphrodite Field—A First Step

- Possibility of Additional Discoveries

- Turkish Relations

- Egypt—Domestic Demand Key

- Domestic Gas Shortage

- Zohr Field—A Big Find

- Lebanon—Still Waiting

- Possible Resources

- Dispute with Israel

- Israel—Natural Gas Enters Its Market

- Natural Gas Resources—Growing Fast

- Gas Transforms the Electricity Sector

- Israel's Natural Gas Export Potential

- Egypt

- Jordan

- Palestinian Authority

- Turkey

- Reducing Carbon Emissions

- U.S. Interest in the Region's Natural Gas Development

Figures

Summary

Since 2009, a series of large natural gas discoveries in the Levant Basin have altered the dynamics of the Eastern Mediterranean region. Israel's discovery of the Tamar Field and subsequent discovery of the larger Leviathan Field created the potential for the country to become a regional player in the natural gas market. Since the initial Israeli discoveries, Cyprus and Egypt have also found new gas deposits in the Mediterranean. The Aphrodite Field was discovered by U.S. firm Noble Energy in Cypriot waters in late 2011 and the massive Zohr Field was found in Egyptian waters by Italian firm Eni in 2015.These discoveries create the potential for Cyprus to export gas and for Egypt to meet more of its domestic gas needs. Lebanon has not yet discovered recoverable gas reserves, but geologic data indicates that there is the potential for Lebanon to possess significant gas resources. Israeli gas discoveries have been contested by Lebanon, which disputes an area of about 300 square miles along the countries' unsettled maritime border. The Administration has sought to mediate the maritime dispute between Israel and Lebanon.

New gas reserves could change how energy is used in the region. Since the Tamar find, Israel's electricity energy mix has begun to shift from oil to natural gas-fired power plants. Gas-fired plants emit less carbon than oil-fired plants, and continuing to convert oil plants could help Israel meet long-term carbon emissions goals. The development of gas infrastructure in Cyprus could also help the country transition from oil to gas-fired power generation. A similar shift could also occur in Lebanon should gas be discovered and related infrastructure developed. Lebanon currently uses no natural gas.

Israel now has the potential to become a gas exporter. There are a number of potential buyers for Israeli gas. Egypt, currently facing an energy crisis, will need to import gas to cover domestic demand in the near future. While Israeli gas imports are politically unpopular in Egypt, private Egyptian firms have already begun to negotiate agreements with Noble Energy to import Israeli gas. Jordan is another possible destination for Israeli gas. Repeated attacks on Egypt's Arab Gas Pipeline have decreased Jordan's energy security and increased the need for it to find alternate, reliable sources of gas. Finally, recent progress on improving diplomatic relations has opened the possibility of Israeli gas exports to Turkey. These exports could either be shipped by the construction of a direct pipeline or by liquefied natural gas (LNG) tankers crossing the Mediterranean.

Although the United States is essentially independent in its natural gas resources, it has expressed interest in the Eastern Mediterranean natural gas resources, particularly in the development of Israel's resources. Congress and the Obama Administration have undertaken a variety of efforts in regard to the region's natural gas. Legislation has been introduced in both Houses of Congress, and has become law, during the last couple of sessions that address the region's natural gas resources.

Introduction

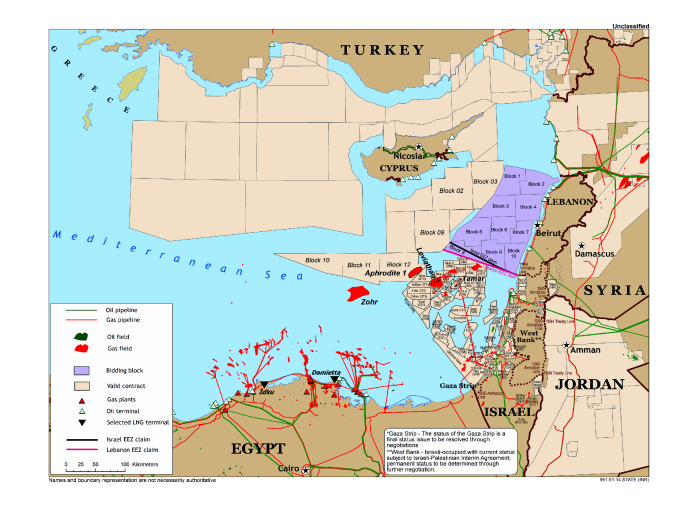

Interest in the Eastern Mediterranean as a natural gas resource base has been growing since Israel made its first large-scale natural gas discovery in 2009. (See Figure 1.) The Tamar Field off the Israeli coast was the first of a series of large-scale natural gas discoveries in the region. Significant subsequent discoveries have been made in Israel (Leviathan), Cyprus (Aphrodite), and Egypt (Zohr), while Lebanon has been actively trying to assess its resources. In 2010, the United States Geological Survey (USGS) estimated that there could be up to an additional 122 trillion cubic feet of undiscovered natural gas resources in the Levant Basin, which underlays a large portion of the Eastern Mediterranean Sea.1 The USGS report also indicated that there could be up to 1.7 billion barrels of recoverable oil in the Levant Basin, making future oil discovery possible.

However, the downturn in global oil and natural gas prices, starting in mid-2014, has constrained the development of resources and made markets more competitive. Projects that are deemed costly, difficult, or problematic have been put on hold in many circumstances. Many companies no longer have the financial resources or motivation to develop resources in challenging environments. For the Eastern Mediterranean, this has meant a slowdown in developing some of the natural gas that has been discovered, delaying the exploration for new discoveries, and requiring greater effort to find markets for the region's natural gas.

Europe, given its proximity to the Eastern Mediterranean, is the most logical market for Eastern Mediterranean natural gas production.2 In the aggregate, though, European natural gas consumption has generally been in decline since 2010, offsetting some of the decline in European production. Imports to Europe rose by more than 10% in 2015, negating the drop in imports from 2011 to 2014. Should Eastern Mediterranean natural gas enter the European natural gas market, it will face strong competition from Europe's traditional suppliers—Russia, Norway, and Algeria—as well as from U.S. liquefied natural gas (LNG) exports, which started in 2016.

|

|

Source: U.S. Department of State, Bureau of Intelligence and Research, Office of the Geographer, Geographic Information Unit, 2014. Notes: Zohr Field added by Jim Uzel, GIS analyst at CRS. Not all regional facilities are included on the map. |

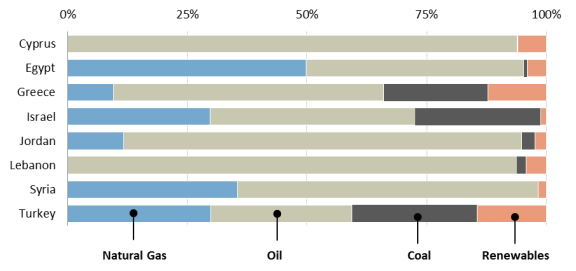

For the most part, the Eastern Mediterranean countries either do not use natural gas as a fuel (i.e., Cyprus and Lebanon3) or are essentially self-sufficient in natural gas (i.e., Israel and Syria) (see Figure 2 and Table 1), except for Greece and Turkey, which are heavily dependent upon imports. Egypt, which has large natural gas resources, started importing natural gas in 2015 to meet its subsidized demand (Table 1 data is from 2014 and shows Egypt as a net exporter of natural gas). Egypt's situation may change in the medium term if it can curb its subsidies for natural gas or change its policies to promote more natural gas development. Development of the region's natural gas resources could meet the potential growing needs of most of the countries in Table 1, and add some diversification of supply for Turkey. For this to occur, many geopolitical hurdles would need to be overcome and new infrastructure would have to be built.

|

|

Sources: BP, Statistical Review of World Energy, 2016; Eurostat; and International Energy Agency data. Note: For each country, the latest data available was used. |

Although the relatively recent discoveries are large for the region, they represent only a small amount globally. The natural gas reserves of the countries represented in Table 1 are less than 1.5% of the world's reserves. Regional production in 2014 was under 2% of global production, while consumption was over 3%.

|

Country |

Reserves (bcf) |

Production (bcf) |

Consumption (bcf) |

Net Imports (bcf) |

||||

|

Cyprus |

|

|

|

|

||||

|

Egypt |

|

|

|

|

||||

|

Greece |

|

|

|

|

||||

|

Israel |

|

|

|

|

||||

|

Jordan |

|

|

|

|

||||

|

Lebanon |

|

|

|

|

||||

|

Syria |

|

|

|

|

||||

|

Turkey |

|

|

|

|

Source: Cedigaz databases.

Notes: 2014 is the latest year for all countries presented in the table. Production plus Net Imports may not equal Consumption due to rounding. Units = billion cubic feet (bcf).

Cyprus—Slow to Use Its Gas4

Cyprus is politically and territorially divided between the Greek Cypriot Republic of Cyprus and Turkish Cypriot administered area of northern Cyprus. Efforts by the Republic of Cyprus and other Eastern Mediterranean countries—most notably Israel—to agree on a division of offshore energy drilling rights without a plan for unification of the island have been opposed by Turkey and Turkish Cypriots. The Republic of Cyprus appears to anticipate considerable future export revenue from drilling in the Aphrodite Field, a natural gas field off Cyprus's southern coast.5 However, contention on this issue appears to have been deemphasized in negotiations between Greek and Turkish Cypriots, which have resumed via U.N. mediation following the election of Mustafa Akinci as Turkish Cypriot leader in April 2015.

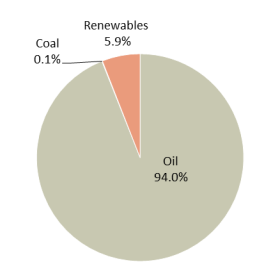

Cyprus is heavily dependent on foreign oil imports to meet its energy needs (see Figure 3). Most electricity in Cyprus is generated by oil-fired power plants. Domestically using gas from the Aphrodite Field could help relieve some of this dependence and natural gas could supplant oil as the primary fuel for power generation. However, using natural gas for power generation would require new infrastructure to be built, especially natural gas-fired fueled power plants. Relieving dependence on oil imports for power generation could help Cyprus reduce carbon emissions.

Aphrodite Field—A First Step

Noble Energy discovered the Aphrodite Field offshore of Cyprus in 2011. The field was estimated to hold between 5 and 8 trillion cubic feet (tcf) of natural gas reserves.6 Cyprus has announced its intention to develop the field and begin exporting gas by 2019. Cyprus currently has no natural gas infrastructure. The lack of natural gas infrastructure on the island makes it difficult and potentially costly for Cyprus to utilize gas from the Aphrodite Field domestically. Doing so would require the construction of both overland pipelines in Cyprus to deliver the gas and power plants or industrial facilities that could use the gas. Cyprus could either build an LNG export terminal to send gas to Europe or route the gas through LNG terminals in neighboring countries. Constructing a pipeline connecting Aphrodite to Egyptian LNG export terminals would be far less expensive than constructing an LNG facility in Cyprus. Exporting gas from Aphrodite through Egypt would take advantage of Egypt's underutilized Idku terminal, which is currently operating at 10% of its 2013 capacity because of subsidized domestic demand.

Possibility of Additional Discoveries

Cyprus concluded its third licensing round for offshore exploration in July 2016.7 This latest round includes blocks adjacent to the Egyptian Zohr supergiant field and has attracted the interest of a small number of international companies. Exploration rights for this round of licensing are expected to be awarded in early 2017.

Turkish Relations

The Republic of Cyprus is globally recognized as the legitimate government of Cyprus and is a member of the European Union. Turkey refuses to recognize the Republic of Cyprus and instead recognizes the Turkish Republic of Northern Cyprus. Turkey maintains up to 40,000 troops in Northern Cyprus. Negotiations to unify the island under one equally administered federation between Turkish Cyprus and the Republic of Cyprus accelerated in 2015.8 While some commenters are optimistic about potential agreements, no resolution has yet been reached. Although Turkey has not specifically contested ownership of the Aphrodite Field, Turkey strongly opposes the development of Cypriot natural gas resources unless the Turkish Cypriots will share in the financial benefits or until a resolution of the "Cyprus problem" is found.

Since its recent reconciliation with Israel, Turkey has stepped up interest in importing Israeli natural gas via a pipeline that would run through the Cypriot economic zone. Cyprus has maintained, and again stated in early July, that it would not allow any gas pipeline connecting Israel and Turkey to be constructed in its exclusive economic zone until a Cyprus solution is found. A Cyprus government spokesperson characterized Cyprus as "a state under occupation" and reiterated the belief of the Greek Cypriot government that it would be unreasonable to approve a pipeline going to "an occupying power." This development has stalled further progress on a potential pipeline connecting Israel and Turkey.

Egypt—Domestic Demand Key9

The Egyptian government's attempt to spark economic growth in order to stave off public unrest has had mixed results. In 2015, Egypt's economy grew at its fastest rate (4.2%) since 2010. On the other hand, Egypt's government is facing a shortage of dollar-denominated currency, which is affecting its ability to import food and fuel. Additionally, tourism receipts in 2015 have declined because of terrorism fears, as have revenues from transit fees from the Suez Canal, a major source of foreign exchange. Although Egypt is a large producer of natural gas, it became a net importer in 2015, primarily because of government policies subsidizing domestic consumption. The country's budget outlays have benefitted by the drop in prices for its imports of natural gas and oil.

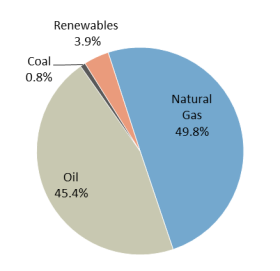

Natural gas is the largest source of energy in Egypt, accounting for just under half of primary energy consumption (see Figure 4). In addition, natural gas fueled 77% of Egypt's electricity generation in 2013.10 Oil is also a major component of Egypt's domestic energy mix. Egypt is a major producer of both natural gas and oil, and has yet to begin utilizing large quantities of renewable energy.

Domestic Gas Shortage

Formerly a net exporter of natural gas, Egypt is currently facing a natural gas shortage. This is primarily caused by the government subsidizing the cost of fuel consumption and creating more demand. Additionally, domestic policies that force natural gas producers to sell a percentage of their production domestically at lower than international prices have, in the past, curbed interest in developing new natural gas resources. Egyptian natural gas production peaked at 6.1 bcf/d in 2009 and dropped 27% to 4.4 bcf/d between 2009 and 2015.11 Decreases in production have been largely due to decreasing offshore resources, political unrest, and domestic policies. The political uprising against then-President Hosni Mubarak in 2011 also decreased investment in discovering new sources of gas.12 The resulting shortage caused disruptions to industrial production and power outages. Demand for gas from the industrial and power sectors, which account for 85% of gas use in Egypt, is set to rise 22% by 2021.13

Egypt stopped regular LNG exports in 2014 and is actively seeking new sources of natural gas. Egypt currently imports between 1.0 and 1.1 bcf/d of natural gas, but is projected to increase to 2.0 bcf/d.14 In the spring of 2016, Egypt exported two cargoes of LNG from the Idku LNG facility. These shipments are not likely part of a trend towards greater LNG exports, and Egypt expects to be an LNG importer until at least 2022. Including the Zohr Field, Egypt is developing 12 natural gas projects, with a total investment of $33 billion.

Zohr Field—A Big Find

The supergiant Zohr Field was discovered in August 2015 by Eni SPA, an Italian company. The Zohr Field, which holds up to 30 tcf and is valued at over $100 billion, is the largest discovery to date in the Eastern Mediterranean.15 It is also one of the largest natural gas discoveries in the world in recent years. Driven by high domestic demand for natural gas, Egypt has begun efforts to bring the Zohr Field online quickly and believes that developing the field will help it reduce gas imports. Gas produced at the Zohr site could reach domestic markets in Egypt by 2017. Egypt does not have any plans to export gas from the Zohr project.

Lebanon—Still Waiting16

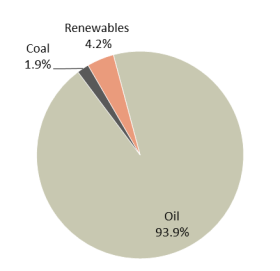

Rivalries in the wider Middle East region have exacerbated recurring challenges for Lebanon, which have contributed to a divided government and a weakened business environment. A politically and communally diverse cabinet, led by Prime Minister Tammam Salam since early 2014, has not made major steps toward development of Lebanon's energy resources. Lebanon is almost entirely dependent on oil imports for its energy consumption (see Figure 5). Lebanon does not currently consume any natural gas. Repeated attacks on the Arab Gas pipeline from Egypt, which has supplied Lebanon with gas in the past, have made it infeasible for Lebanon to import natural gas.

Possible Resources

By one industry estimate, Lebanon could have up to 15 tcf of recoverable offshore gas resources.17 Lebanon has not yet authorized any companies to begin exploratory work to discover possible resources, nor have state agencies confirmed possible gas deposits. In 2013, Lebanon began screening companies for pre-qualification to bid on exploration rights in the Mediterranean. While 46 companies pre-qualified, political gridlock prevented Lebanon from awarding exploration rights. Lebanon still must issue decrees defining both a taxation policy and which blocks are to be opened for exploration.

There are a number of factors in Lebanon that could potentially inhibit future progress on the exploration and development of possible gas resources.18 First, more than one million refugees displaced by the Syrian civil war have entered Lebanon. The state has had to divert substantial resources to address the refugee crisis, and persistent Syria-related domestic security challenges may distract from efforts to develop gas in the Mediterranean. Second, the Lebanese parliament has remained gridlocked and has failed to elect a new president over two dozen times since 2014. Until a political compromise is reached, the gridlocked parliament may have trouble moving forward with an agreement to grant exploration rights.

Dispute with Israel

Lebanon and Israel are currently locked in a dispute over maritime boundaries. The 1949 Israel-Lebanon armistice line serves as the de facto land border between the two countries, and Lebanon claims roughly 330 square miles of waters that overlap with areas claimed by Israel based in part on differences in interpretation of relative points on the armistice line.19 Lebanon has threatened to use its military to defend its claims and has called on foreign powers to help resolve the dispute.20 To date, there has been no violence. Neither the Tamar Field nor the planned development of the Leviathan Field is located within the disputed area. Lebanon has cited its boundary dispute with Israel as a primary obstacle to the exploration and development of its gas resources. Development of Israel's natural gas resources has not been delayed by Lebanese claims. It is possible that the disputed area could be the cause of additional tension between Israel and Lebanon as Israel continues to develop its gas reserves.

Critics of the Lebanese government allege that mismanagement, not disputes with Israel, is the primary reason why Lebanon has lagged behind Israel in natural gas exploration and development.21

U.S. officials are working with Lebanese and Israeli leaders to resolve the dispute.22 Lebanon objects to a 2010 Israel-Cyprus agreement that draws a specific maritime border delineation point relative to the 1949 armistice line.

In seeking to help Israel and Lebanon resolve their differences on this question, the United States appears to be interested in facilitating a more hospitable commercial environment for all parties involved (including U.S. energy companies), and in preventing the dispute from exacerbating long-standing animosities between the two countries. It is unclear to what extent U.S. diplomacy on this issue can facilitate changes in the current Israeli and Lebanese stances.

Israel—Natural Gas Enters Its Market23

Israeli officials routinely express optimism that the economic promise of Israel's energy resources can attract the industrial help it needs to be realized, and this optimism may prove justified. However, given that Israel does not have a significant offshore exploration and production (E&P) sector, it relies on the expertise of international companies. The obstacles posed by antitrust deliberations, along with other energy industry concerns about Israel's regulatory regime pertaining to domestic consumption requirements and possible price ceilings could create difficulties for future development.

Israel has 6.4 tcf of proven reserves, which are the second largest in the Eastern Mediterranean region behind Egypt. After making significant natural gas discoveries in 2009 and 2010, Israel began to focus its future energy needs on natural gas, including discussions on exporting natural gas regionally and globally. Israel has begun to integrate natural gas into its energy mix, comprising almost 30% of its 2015 primary fuel needs.

Natural Gas Resources—Growing Fast

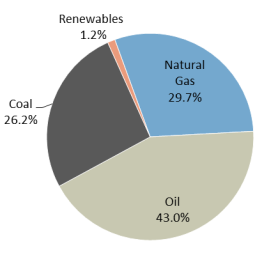

Oil makes up the largest component of Israel's energy mix, primarily from imports, while domestic natural gas is the fastest growing fuel (see Figure 6). Israel did not consume natural gas in large quantities before 2003. Natural gas consumption grew steadily from 2003 to 2009, and doubled between 2009 and 2015. The discovery of the Tamar, Dalit, and Leviathan fields by U.S.-based Noble Energy in 2009 and 2010 created the potential for Israel to become a net exporter of natural gas. Israel's natural gas reserves—natural gas that has been discovered and can be expected to be economically produced—prior to the Noble Energy discoveries were estimated at 1.5 tcf or about 16-years' worth at pre-2011 production levels. Production from the Tamar Field has spurred a dramatic increase in Israeli natural gas use. Natural gas now accounts for almost 30% of all Israeli fuel consumption (up from 11% in 2008) and over half of the country's electricity production.

Production at the Tamar Field began in 2013, and production of the Leviathan Field is now scheduled to begin within the next four years. Producing at expected capacity, the Leviathan and Tamar fields, along with Israel's other existing natural gas fields, hold up to almost 22 years' worth of gas.

Development of the Leviathan Field could increase Israel's energy security in the short term. Currently, all of Israel's domestically consumed gas comes from a single pipeline in the Tamar Field. Development of the Leviathan Field would add diversity to Israel's domestic supply and provide enough resources to meet Israel's natural gas needs on its own. It could also increase Israel's energy security in the long term by creating the potential for Israel to become a net exporter of natural gas. Noble Energy has already signed an agreement to export gas from the Leviathan Field to Egypt.

Gas Transforms the Electricity Sector

Israel's use of natural gas for electric power generation has increased from 33% in 2009, when the Tamar Field was discovered, to 42% when the Tamar Field went into production in 2013. As of 2016, it is estimated that natural gas comprises more than half of Israel's electricity needs.24

In late May of 2016, the Leviathan partners signed an 18-year agreement worth $3 billion to provide up to 459 bcf of natural gas to a new privately operated power plant in central Israel.25 The Leviathan partners also signed a $1.3 billion deal with Edeltech, Israel's largest private power producer, in January for 212 bcf to be delivered over 18 years. Fulfilling both domestic agreements could be achieved through Leviathan's projected initial daily production.

Continued integration of natural gas into Israel's electrical sector and overall energy mix would allow the country to increase the domestic share of energy production. Israel imports all of its coal and most of its oil. Conversion to natural gas from coal for power generation would also likely decrease Israel's greenhouse gas and other emissions. However, this would require major investment and take many years to achieve.

Israel's Natural Gas Export Potential

Israel has also expressed interest in exporting gas, but this has been delayed by a number of factors. Israel's antitrust regulator initially held up Leviathan's development because of concerns regarding monopolistic effects on Israel's energy market. After the government reached new terms with the stakeholders in Tamar and Leviathan, it overrode the antitrust regulator's action.26 In March 2016, Israel's Supreme Court invalidated the development agreement because it ruled that the agreement did not give future governments sufficient flexibility to change pricing or other key terms.27 The energy companies and the Israeli government negotiated a second agreement in late May 2016, and Israel is expected to start exporting gas by 2019.28 Exports from the Leviathan Field have the potential to generate billions of dollars of revenue over the next several decades.

There are a number of possible destinations in the region for Israeli natural gas exports, which may have geopolitical benefits. However, questions exist regarding Israel's ability to create and sustain energy ties with Arab and other Muslim-majority neighbors whose relations with Israel are marked by ongoing or intermittent political disputes and/or sensitivities based on strong, long-standing anti-Israel public sentiment. It is unclear to what extent political difficulties with neighbors might be mitigated by the potential material benefits of energy cooperation or by other considerations, and how satisfactory logistical and transportation frameworks and security measures might be implemented. Israel might calculate that a prominent role for Noble Energy, a U.S. company, in projects linked with export deals might make the deals less vulnerable to anti-Israel populism.

Egypt

Rapidly rising domestic demand forced Egypt to halt LNG exports in 2014. Egyptian natural gas supply has been further hampered relative to demand due to numerous attacks and service disruptions on the Arab Gas Pipeline. Egypt is seeking additional sources of gas, and the Tamar consortium, which includes U.S. Noble Energy, has already signed an agreement with a private Egyptian firm promising to provide Egypt with natural gas via an undersea pipeline.29 Although Israeli gas imports are politically unpopular in Egypt, Cairo has indicated that it will not intervene in private agreements to import Israeli gas. However, domestic disputes could complicate the construction of the pipeline, which needs legal approval from the government.

Jordan

Attacks on the Arab Gas Pipeline from Egypt have caused shortfalls of natural gas supply in Jordan. That, coupled with growing demand, has led Jordan to look to import natural gas as LNG. In May 2015, Jordan began importing LNG through a floating storage and regasification unit (FSRU). Noble Energy signed two agreements worth $500 million with private Jordanian mineral companies and reached a preliminary $15 billion agreement with Jordan's National Electric Power Co. Israel has approved the construction of pipelines connecting Israel and Jordan to supply the gas. The approval of the pipelines is an indication that exporting gas to Jordan enjoys significant political support from within Israel.

Palestinian Authority

The Palestinian Authority (PA) and the Leviathan consortium led by Noble Energy reached agreement in January 2014 on a 20-year supply of gas to a proposed power plant in the West Bank city of Jenin when Leviathan comes online.30 Analysts have speculated on the possibility for Israeli gas or gas from the PA-administered Marine (sometimes known as "Marine A") field to supply the Gaza Strip's energy-starved power plant.31 Political and security concerns, particularly Hamas's presence in Gaza, have complicated this issue. Depending on a number of variables, potentially reunified PA rule over the West Bank and Gaza might either present opportunities to make energy arrangements for the Gaza plant, or lead to further obstacles. Uncertainty regarding Israeli-Palestinian relations and the PA's future could affect Israeli control over offshore resources and the shipment of gas from these resources to the West Bank and Gaza.

Turkey

In June 2016, Israel and Turkey agreed to fully normalize diplomatic relations that had worsened in 2010. For more information, see CRS Report R44000, Turkey: Background and U.S. Relations In Brief, by Jim Zanotti. Reportedly, prospects of a natural gas pipeline between Israel and Turkey partly contributed to the improvement in relations, though discussions remain in preliminary stages and any project would likely take years to complete. Exporting gas to Turkey via pipeline could allow Israeli gas to reach the European market and supply markets in Turkey.

However, as referenced above, the development of a pipeline connecting Leviathan to Turkey could be hindered by the ongoing conflict in Cyprus. Any pipeline constructed would likely have to pass through the exclusive economic zone of Cyprus, giving it the ability to veto potential projects.

Reducing Carbon Emissions

Israel is a signatory to the Paris Accords and has pledged to reduce greenhouse gas emissions to 26% below 2005 levels by 2030.32 Shifting remaining coal power production would nearly achieve this goal. Natural gas fired power plants typically emit only 58% as much CO2 per kWh generated as coal fired plants. Converting all coal capacity to natural gas would reduce CO2 emissions by about 13.95 million tons per year, or about 24.4% of Israel's 2005 level of emissions. Actual emissions reductions will probably be lower than this figure because it is unlikely that Israel will completely abandon coal power.

U.S. Interest in the Region's Natural Gas Development

Although the United States is essentially independent in its natural gas resources, it has expressed interest in the Eastern Mediterranean natural gas resources, particularly in the development of Israel's resources. Congress and the Obama Administration have undertaken a variety of efforts in regard to the region's natural gas.

In May 2016, Senators Murkowski and Cantwell sent a letter to the Secretary of Energy, Ernest Moniz, regarding the establishment of the U.S.-Israel Energy Center.33 The creation of the center was included in the U.S.-Israel Strategic Partnership Act of 2014 (P.L. 113-296). In addition to the creation of the center, the act stated, " ... United States-Israel energy cooperation and the development of natural resources by Israel are in the strategic interest of the United States." Both the United States and Israel, albeit on a different scale, have undergone major transformations in their energy sectors, especially in natural gas development. The new law (in Section 12) highlights these changes and encourages closer ties in the energy sector between the two countries. Additionally, H.R. 5066 was introduced during the 114th Congress, which would authorize the President to provide assistance to Israel in protecting its offshore natural gas fields.

In May 2016, the State Department's U.S. Special Envoy and Coordinator for International Energy Affairs, Amos Hochstein, delivered the keynote address at Lebanon's Third Forum on Oil and Gas.34 According to press accounts, Hochstein encouraged Lebanese officials to take advantage of their country's hydrocarbon potential.35 The State Department has been actively engaged in mediating the maritime dispute between Lebanon and Israel. Additionally, Hochstein visited Cyprus in November 2014 to discuss energy development, including Cyprus' Exclusive Economic Zone (EEZ) and issues it is having with Turkey.36

Author Contact Information

Acknowledgments

Joseph Schnide, an intern with the Energy and Minerals section of CRS, greatly contributed to the research, drafting, and completion of this report.

Footnotes

| 1. |

C.J. Schenk et al., Assessment of Undiscovered Oil and Gas Resources of the Levant Basin Province, Eastern Mediterranean, U.S. Geological Survey, March 12, 2010, p. 2, https://pubs.usgs.gov/fs/2010/3014/pdf/FS10-3014.pdf. |

| 2. |

For additional information on European natural gas issues, see CRS Report R42405, Europe's Energy Security: Options and Challenges to Natural Gas Supply Diversification, coordinated by Michael Ratner. |

| 3. |

Lebanon has consumed natural gas as recently as 2010, receiving supplies from Egypt through the Arab Gas Pipeline. However, repeated attacks against the pipeline after the ouster of then Egyptian President Hosni Mubarak, declining production, and subsidized demand have all contributed to the curtailment of Egyptian natural gas exports. |

| 4. |

Vince Morelli, Section Research Manager for Europe and the Americas, contributed to this section. |

| 5. |

See, e.g., "Cyprus, Egypt Proceed with Plans for Natural Gas Deal," Xinhua, September 10, 2015. |

| 6. |

"Nicosia Evaluates Natgas Import Bids," Oil Daily, November 1, 2012, online. As the field has not been developed, the estimated reserves are not counted towards the actual reserves of the country. For a natural gas deposit to be classified as a reserve, the natural gas must be able to be produced at current prices using existing technology, and be able to reach a market. |

| 7. |

Republic of Cyprus, Ministry of Energy, Commerce, Industry, and Tourism, "Applications Submitted for the 3rd Licensing Round for Hydrocarbon Exploration," press release, July 27, 2016, http://www.mcit.gov.cy/mcit/mcit.nsf/7DF75846053512BDC2257F6A002284E7/$file/Applications%20submitted%20for%20the%203rd%20Licensing%20Round%20for%20hydrocarbon%20exploration.pdf. |

| 8. |

For more information on Turkish-Cyprus relations, see CRS Report R41136, Cyprus: Reunification Proving Elusive, by Vincent L. Morelli. |

| 9. |

Jeremy Sharp, Specialist in Middle Eastern Affairs, contributed to this section. |

| 10. |

International Energy Agency, Egypt: Electricity and Heat for 2013, database accessed August 2016, https://www.iea.org/statistics/statisticssearch/report/?year=2013&country=Egypt&product=ElectricityandHeat. |

| 11. |

BP, Statistical Review of World Energy, June 2016, p. 22. |

| 12. |

Anna Shiryaevskaya, Tsuyoshi Inajima, and Dan Murtaugh, "Egypt Sends Rare LNG Cargo in Midst of Newfound Buying Binge," Bloomberg, June 16, 2016, pp. http://www.bloomberg.com/news/articles/2016-06-17/egypt-exports-rare-lng-cargo-in-midst-of-newfound-buying-binge. |

| 13. |

Data for current and projected gas demand from the Egyptian Ministry of Energy, quoted in the March 6 Levant Basin Energy Report. |

| 14. |

"Egypt to Up Gas Production by 2019," LNG World News, May 23, 2016, pp. http://www.lngworldnews.com/egypt-to-up-gas-production-by-2019/. |

| 15. |

"'Supergiant' Gas Find off Egypt Could Hurt Diplomacy Efforts," Energywire, October 30, 2015. |

| 16. |

Christopher Blanchard, Specialist in Middle Eastern Affairs, contributed to this section. |

| 17. |

Tom Pepper, "Exxon, Shell Among Firms Selected to Bid for Lebanon Blocks," International Oil Daily, April 19, 2013, online. |

| 18. |

For more information on Lebanese politics, see CRS Report R42816, Lebanon: Background and U.S. Policy, by Christopher M. Blanchard. |

| 19. |

For additional information, see CRS Report R42816, Lebanon: Background and U.S. Policy, by Christopher M. Blanchard. See also James Stocker, "No EEZ Solution: The Politics of Oil and Gas in the Eastern Mediterranean," Middle East Journal, vol. 66, no. 4 (autumn 2012), pp. 579-597; and The Daily Star (Beirut), "U.S. Plan May Break Maritime Border Deadlock," December 20, 2012. |

| 20. |

Adiv Sterman, "Lebanon to US: Help Settle Gas Dispute with Israel," The Times of Israel, June 5, 2014, online. |

| 21. |

Erika Solomon, "Domestic Politics Hinder Development of Lebanon's Gas Sector," Financial Times, June 29, 2015, online. |

| 22. |

A 1949 armistice line is not the final agreed border between Lebanon and Israel, but coastal points on the line appear likely to be incorporated into any future Lebanon-Israel border agreement. |

| 23. |

Jim Zanotti, Specialist in Middle Eastern Affairs, contributed to this section. |

| 24. |

U.S. Energy Information Administration, Israel, July 2016, http://www.eia.gov/beta/international/analysis.cfm?iso=ISR. |

| 25. |

Hedy Cohen, "Leviathan Will Supply 13 BCM over 18 Years to the IPM Power Plant in Be'er Tuvia," Globes, May 29, 2016, online. |

| 26. |

"Israel OKs Noble Energy's Leviathan Natural Gas Megaproject," Energywire, June 6, 2016, online. |

| 27. |

"Israel Court Rejects Deal to Develop Mammoth Leviathan Gas Field," Energywire, March 29, 2016, online. |

| 28. |

"Leviathan Gas Could Reach Markets by 2019," Reuters, February 4, 2016, online. |

| 29. |

"Israel OKs Natural Gas Exports to Egypt," Reuters, December 28, 2015, online. |

| 30. |

Tom Pepper, "Partners in Israeli Gas Field Sign Deal with Palestinians," International Oil Daily, January 7, 2014. |

| 31. |

A venture led by BG Group (formerly British Gas), now part of Shell, discovered the Marine field in 2000. It has an estimated resource base of 1 tcf. Development of Marine could contribute to greater Palestinian economic and political self-sufficiency, perhaps freeing up Israeli energy resources for domestic consumption or export to other places. Simon Henderson, "Natural Gas in the Palestinian Authority: The Potential of the Gaza Marine Offshore Field," German Marshall Fund of the United States, March 2014. Reduced Palestinian dependence on Israel could either heighten or reduce Israeli-Palestinian tensions. |

| 32. |

Government of Israel, "Israel's Intended Nationally Determined Contribution (INDC)," press release, September 29, 2015, http://www4.unfccc.int/submissions/INDC/Published%20Documents/Israel/1/Israel%20INDC.pdf. |

| 33. |

Senate Committee on Energy and Natural Resources, "Sens. Murkowski, Cantwell Call on Sec. Moniz to Work with Israel on Advancing Energy Innovation," press release, May 5, 2016, http://www.energy.senate.gov/public/index.cfm/2016/5/sens-murkowski-cantwell-call-on-sec-moniz-to-work-with-israel-on-advancing-energy-innovation. |

| 34. |

U.S. Department of State, "Special Envoy Amos J. Hochstein Travels to Saudi Arabia and Lebanon," press release, May 23, 2016, http://www.state.gov/r/pa/prs/ps/2016/05/257648.htm. |

| 35. |

"Hochstein Encourages Lebanon to Benefit from Energy Potential," Naharnet, May 27, 2016, online. |

| 36. |

Emine Davut Yitmen, "Interview with Acting Special Envoy and Coordinator for International Energy Affairs Amos Hochstein," Kibris, November 5, 2014, online. |