Currency Manipulation and Countervailing Duties

On February 4, 2020, the Commerce Department issued a final rule that paves the way for imposing tariffs on imports from countries determined by the U.S. government to be undervaluing their currency relative to the U.S. dollar. Various Members of Congress have debated such a policy for years, including in 2013 and 2015, but Congress has refrained from legislating it due to a variety of concerns.

Currency Manipulation

For more than a decade, some policymakers and analysts have expressed concerns that U.S. exports and jobs have been harmed by unfair exchange rate policies of other countries ("currency manipulation"). They argue that other countries have purposefully weakened their currency relative to the dollar to boost exports, at the expense of U.S. firms and workers. However, there are a number of factors that drive exchange rates, and it is difficult to estimate the extent to which a currency is undervalued, and why it is undervalued.

The United States currently combats currency manipulation with unilateral and multilateral tools. Under U.S. law, the Treasury Department produces a semiannual report on exchange rate policies in other countries and, in specified instances, must initiate action against countries engaged in currency manipulation. The United States also addresses currency manipulation through the G-7 and the G-20, multilateral forums where major economies discuss and coordinate economic policies. The United States is also a member of the International Monetary Fund (IMF), an international organization through which countries have committed to refrain from currency manipulation, although there are questions about the IMF's ability to enforce currency commitments.

The Commerce Department's Rule Change

During the 2016 presidential campaign, Donald Trump raised currency manipulation, particularly by China, as a key concern. Since assuming office, the Trump Administration has taken various actions to address it. The United States-Mexico-Canada Agreement (USMCA) includes enforceable commitments on exchange rates, the first time such a provision has been included in a U.S. trade agreement; the Treasury Department designated China as a currency manipulator under the 1988 Trade Act between August 2019 and January 2020, the first time such a designation has been made in 25 years; and currency commitments were included as part of the U.S.-China Phase One deal. President Trump has also expressed concerns about the exchange rate policies of the Eurozone, Brazil, and Argentina.

The Administration's most recent action on currency relates to countervailing duties. Under current U.S. law and World Trade Organization (WTO) agreements, countervailing duties (CVD) may be applied as a remedy for material injury or threatened material injury to domestic industries caused by unfairly subsidized imports. For years, some analysts have argued that currency undervaluation is the functional equivalent of an unfair subsidy, and thus CVD should be available in this case as a remedy for injured domestic producers (or those threatened with injury). Some Members of Congress have routinely introduced legislation to amend U.S. countervailing laws to that end. However, due to a variety of concerns (many of which have been raised again in the current debate and are discussed below) Congress refrained from legislating on the issue. The rule-change by the Commerce Department in February 2020 administratively implements the policy by modifying existing regulations, without the need for legislation.

It is unclear which countries might be targets under the proposed policy, partly because there is disagreement among economists about whether countries are able to manipulate their currencies and if so, the best economic models for estimating currency undervaluation. Treasury maintains a Monitoring List of major trading partners whose currency practices merit close attention, which in January 2020 included China, Japan, Korea, Germany, Italy, Ireland, Singapore, Malaysia, Vietnam, and Switzerland.

Implementation

The new rule allows Commerce to "consider whether a benefit is conferred [to foreign producers] from the exchange of United States dollars for the currency of a country under review." Commerce will only make an affirmative finding if there has been "government action on the exchange rate" and "will not normally include monetary and related credit policy of an independent central bank or monetary authority."

When making its consideration, Commerce has stated that it "intend[s] to defer to Treasury's expertise with respect to currency undervaluation," but noted that Treasury's analysis is "distinct from the analysis as to whether there is undervaluation for purposes of a CVD proceeding." Thus, Commerce will "retain ultimate authority on administering the CVD law" with respect to determining the existence of undervaluation.

On April 6, 2020, the rule is to go into effect and U.S. industries can begin submitting petitions for potential relief to the U.S. International Trade Commission and Commerce's International Trade Administration.

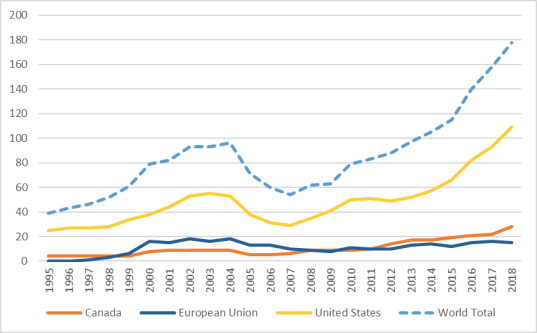

Currently, Customs and Border Protection (CBP) assesses more than $200 million per year in CVD. Officials estimate duties assessed from cases brought under the new rule would amount to between $4 million and $21 million a year, or between approximately 2% and 10% of the more than $200 million currently assessed. This new rule comes amidst a substantial increase in the use of CVD orders and other forms of contingent protection (antidumping and safeguards) globally in recent years. The United States is currently the most active user of CVD worldwide (Figure 1).

|

Figure 1. CVD Orders in Force (1995-2018) Top Three Users and World Total |

|

|

Source: World Trade Organization. |

Views on the Commerce Proposal

The Commerce Department proposed the rule change in May 2019, and accepted public comments through June 27. The 47 comments filed diverge. Firms and trade groups associated with steel, the auto industry, and kitchen cabinets, among others, supported the proposed change as a first step in ending "predatory currency undervaluation." Several policy experts, including a former Treasury official, academics, and think tank experts, as well as retail firms and the China Chamber of International Commerce opposed the change. Concerns raised by such opponents include that there is "no precise way" to measure exchange rate undervaluation, whether the rule change is consistent with WTO agreements, whether CVD was the most affective avenue for addressing currency manipulation, and whether delegating at least some authority over exchange rate issues from Treasury to Commerce is appropriate. A former Treasury official argues that Commerce's rule-change is "keeping with the protectionist 'currency war' mentality of the 1930s."

Role of Congress

Congress has considered legislation to enact the proposed rule change for years and consistently declined to act. Some Members may be content to delegate this policy decision to the executive branch. Other Members may want to examine the policy change through hearings or actively prevent, encourage, or shape the regulatory changes through legislation.

Related CRS Products

- CRS Report R43242, Debates over Exchange Rates: Overview and Issues for Congress, by Rebecca M. Nelson.

- CRS In Focus IF10049, Debates over Currency Manipulation, by Rebecca M. Nelson.

- CRS In Focus IF10406, Currency Exchange Rate Policies and the World Trade Organization Subsidies Agreement, by Brandon J. Murrill.

- CRS In Focus IF10018, Trade Remedies: Antidumping and Countervailing Duties, by Vivian C. Jones and Christopher A. Casey.