Low Interest Rates, Part 2: Implications for the Federal Reserve

Interest rates have been unusually low by historical standards since the 2007-2009 financial crisis. This Insight discusses the implications for monetary policy, and it frames this discussion in terms of the neutral interest rate. It is the sequel to a previous Insight, Low Interest Rates, Part 1. For background on monetary policy, see CRS Report RL30354, Monetary Policy and the Federal Reserve: Current Policy and Conditions, by Marc Labonte.

The Neutral Interest Rate

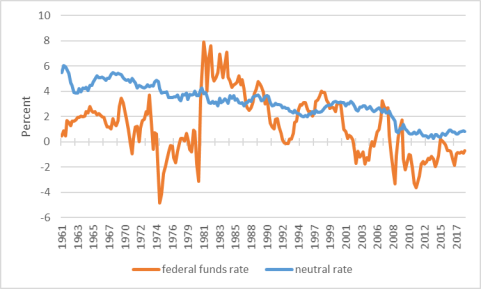

The neutral interest rate (sometimes called r*) is conceptual and not directly observed—it is the idea that at any given time there is some level for the federal funds rate that will neither stimulate nor hold back economic activity. The Federal Reserve (Fed) implements monetary policy by targeting the federal funds rate. The Fed raises or lowers the federal funds rate in an attempt to properly balance the tradeoff between its statutorily mandated goals—full employment and stable price inflation. Economists judge monetary policy to be contractionary or stimulative based on whether the actual federal funds rate is above or below, respectively, the neutral rate. As shown in Figure 1, monetary policy was contractionary for most of the 1980s because the federal funds rate was above the estimated neutral rate. Since the crisis, monetary policy has been stimulative because the federal funds rate has been below the estimated neutral rate.

|

Figure 1. Real Neutral Rate and Federal Funds Rate 1961-2018 |

|

|

Source: New York Fed; St. Louis Fed, FRED database. Note: Rates are adjusted for inflation using Consumer Price Index. |

Since the crisis, the federal funds rate (as well as long-term rates) has been very low by historical standards; it was nearly zero from 2008 to 2015. Before the crisis, many economists assumed that the real (inflation-adjusted) neutral rate was about 2% and fairly constant over time; at the prevailing inflation rate of 2%, that would translate to a neutral rate of about 4%. If the actual federal funds rate is consistently below the neutral rate—in other words, if monetary policy is persistently stimulative—at full employment, inflation would be expected to rise. Yet the actual federal funds rate has now been below 4% since 2008 without any noticeable sustained increase in inflation, even as the economy has returned to full employment. This outcome implies that the neutral rate must have fallen. According to the estimate shown in Figure 1, the real neutral rate has fallen by more than a percentage point since 2008.

Implications for Monetary Policy

The decline in the neutral rate has implications for monetary policy. It means that any given federal funds rate is less stimulative or more contractionary than it would have been before the neutral rate fell. As a result, a simple historical comparison of prevailing federal funds rates before and after the crisis would give the misleading impression that monetary policy since the crisis has been more stimulative than it actually was. (Also, inflation has been lower since the crisis than it was in earlier decades, so the difference in real rates is smaller than the difference in actual rates.)

Although the neutral rate is a useful concept for framing monetary policy decisions, uncertainty about its true value points to the difficulty of basing policy on a variable that cannot be directly observed. Current policy illustrates why that is the case. Fed Chairman Jerome Powell stated in January that "our policy rate is now in the range of the [Fed's] estimates of neutral." If the Fed is correct, the Fed faces some risk that the economy will overheat and inflation will rise with a neutral monetary policy at full employment. But if the Fed has incorrectly estimated that the neutral rate has fallen more than it has, then monetary policy is still stimulative and the risk of inflation rising is greater.

In light of this uncertainty, the neutral rate could be de-emphasized in policymaking, but without it, policy decisions may become less forward-looking, which could lead to worse outcomes because of lags between policy changes and economic outcomes. De-emphasizing the neutral rate would also be problematic for those advocating that the Fed rely on policy rules, as the neutral rate is a key variable in standard policy rules (such as the "Taylor rule"). H.R. 10, which passed the House in the 115th Congress, is an example of legislation that would have required the Fed to compare its monetary policy decisions to a policy rule.

A lower neutral rate also has implications for the Fed's ability to use monetary stimulus to fight the next economic downturn. Because the neutral rate is low and the inflation rate is low, the federal funds rate is currently closer to the "zero lower bound" than it has been in previous expansions. That means the Fed has limited ability to use conventional monetary stimulus to respond to a future downturn because interest rates cannot be cut (significantly) below zero. As a result, the Fed is more likely to need to use unconventional monetary stimulus, such as "quantitative easing," to combat a future downturn.