Low Interest Rates, Part 1: Economic and Fiscal Implications

Since the 2007-2009 financial crisis, U.S. interest rates have been unusually low by historical standards. This Insight discusses the implications of low interest rates for households and fiscal policy. It is the first of three parts. Low Interest Rates, Part 2 discusses implications for monetary policy. Low Interest Rates, Part 3 discusses potential causes.

Low Interest Rates

When describing interest rate trends, each debt instrument is different. The interest rate on every debt instrument is determined by market supply and demand for that instrument, and each instrument has different characteristics, including issuer, maturity length, and liquidity. Analysts often focus on two specific interest rates to gauge overall interest rate trends—the yield on Treasuries (marketable federal debt instruments) and the federal funds rate (the overnight interbank lending rate).

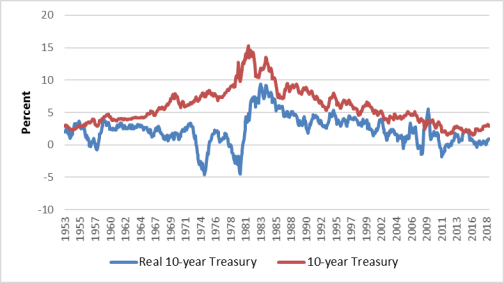

Treasury yields play a central role in financial markets because they are highly liquid (easily tradeable) and are seen as posing negligible default risk, whereas default risk varies from company to company for private debt. A common benchmark for long-term rates is the 10-year Treasury yield. Figure 1 illustrates how Treasury yields fell during the financial crisis and have not yet recovered to precrisis levels. Since 2008, 10-year Treasury yields have remained below 4%. Prior to that, yields had not been below 4% since the early 1960s. Typically, yields rise as an expansion strengthens, but yields are lower today, with the economy near full employment, than they were at the onset of the recovery. Yields on mortgages and corporate debt have followed a similar pattern.

|

Figure 1. 10-Year Treasury Yields 1953-2018 |

|

|

Source: CRS calculations using data downloaded from St. Louis Fed, FRED. Notes: Real 10-year Treasury yields are calculated using the Consumer Price Index. |

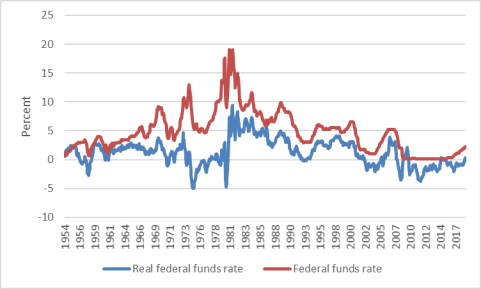

The federal funds rate is important because it is the Federal Reserve's primary monetary policy target. It influences, but does not directly determine, other interest rates. The federal funds rate is a very short-term interest rate; changes in the federal funds rate generally lead to proportionately larger changes in other short-term interest rates relative to long-term rates. As shown in Figure 2, the Federal Reserve reduced the federal funds rate to zero in response to the financial crisis—the first time the federal funds rate reached zero since data were first collected in 1954. Since 2015, the Federal Reserve has been gradually raising its federal funds target range, currently set at 2.25%-2.5%. Even after these increases, rates have been this low only once between the early 1960s and the financial crisis (following the 2001 recession).

|

1954-2018 |

|

|

Source: CRS calculations using data downloaded from St. Louis Fed, FRED. Note: Real federal funds rate is calculated using the Consumer Price Index. |

The United States is not the only country with unusually low interest rates—they are low across advanced economies. Currently, short-term interest rates and 10-year government bond yields are lower in all other members of the G-7 than in the United States.

One reason that interest rates have been low in this decade is because of low inflation. To compare interest rates over time, real interest rates are adjusted for differences in inflation. Even after making this adjustment, interest rates are relatively low by historical standards. The real federal funds rate has been negative (meaning it is lower than the inflation rate) in most months since the financial crisis. It is not uncommon for the real federal funds rate to be negative during a recession or when inflation turns out to be higher than expected. (Because inflation was high at times in the 1970s-1980s, it was probably not the intention of policymakers or the expectation of market participants for real rates to be negative in those cases.) But it is uncommon for the real federal funds rate to remain negative throughout the expansion, even when the economy is currently near full employment. Similarly, 10-year Treasury yields have been close to zero in real terms since the financial crisis, a phenomenon that has not persisted throughout an expansion before—although it has happened briefly—in the period covered by Figure 1.

Implications for Households and Businesses

In general, low interest rates are bad for net savers, who earn less on their savings, but good for net borrowers, who pay less in debt service. When rates are low, they make interest-sensitive spending by firms and households more affordable. For example, firms make physical investments in plant and equipment on credit, whereas households purchase consumer durables (e.g., automobiles, appliances) and housing on credit. Whether low rates are good or bad overall depends on the economic context—arguably, the economy is currently in a "sweet spot," where interest rates, inflation, and unemployment are all low.

Implications for Fiscal Policy

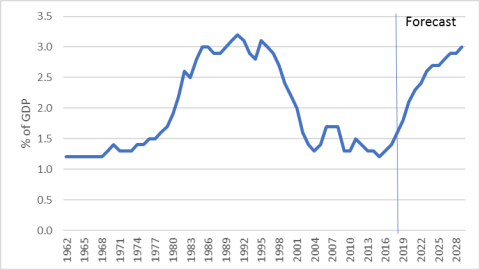

Low interest rates have significantly reduced the federal government's borrowing costs relative to gross domestic product (GDP). Although the publicly held debt as a share of GDP has more than doubled since the financial crisis, reaching its highest level since 1948, interest payments relative to GDP have remained below their 1980-2000 average, as shown in Figure 3. Lower borrowing costs reduce the overall budget deficit in a given year, all else equal, reducing the need to cut other spending or raise taxes. However, this trend is not projected to continue. The Congressional Budget Office (CBO) projects that borrowing costs will nearly double as a share of GDP over the next 10 years under current policy as the debt increases and interest rates rise (but remain below precrisis rates).

|

Figure 3. Net Federal Interest as a % of GDP FY1962-FY2029 |

|

|

Note: Forecast for 2019-2029 is January 2019 CBO Baseline. |

Low interest rates—if they persist—may also assuage fears that the increase in federal debt would "crowd out" private investment. The crowding out effect occurs when government borrowing pushes up public and private interest rates, leading private firms to cut back on their investment spending. If crowding out does not occur, then one of the main negative economic effects of budget deficits is not present.