After Prudential, Are There Any Systemically Important Nonbanks?

During the 2008 financial crisis, problems at AIG, Bear Stearns, and Lehman Brothers led to broader financial instability or government "bailouts" in order to prevent instability. At the time, these firms were nonbank financial institutions and not generally subject to effective safety and soundness regulation on a consolidated basis.

The Dodd Frank Act (P.L. 111-203) provided the Financial Stability Oversight Council (FSOC) with the authority to designate nonbanks for enhanced prudential oversight by the Federal Reserve as systemically important financial institutions (SIFIs). Since enactment, FSOC has designated three insurers (AIG, MetLife, and Prudential) and one other firm (GE Capital). Subsequently, all four designations have been removed, three by FSOC and one (MetLife) through a successful lawsuit. Most recently, Prudential was de-designated on October 17, 2018.

Proponents believe that designation could make it less likely that a large nonbank would experience a failure that destabilized the financial system. Opponents question whether any nonbank poses systemic risk, and if any does, whether institution-based regulation is the best way to address that risk. (For more information on an alternative, activities-based regulation, see this CRS Insight.)

FSOC Designations and De-Designations

The Dodd-Frank Act bases SIFI designations on whether the firm's "material distress" or "the nature, scope, size, scale, concentration, interconnectedness, or mix of (its) activities" could pose a threat to financial stability. In deciding whether to designate a firm, FSOC primarily considers (1) if the firm's distress would lead to financial instability for other firms or markets; (2) the extent to which the firm is already regulated; and (3) the firm's complexity, opacity, or difficulty to resolve in the event of its failure. (For more information, see CRS Report R45162, Regulatory Reform 10 Years After the Financial Crisis: Systemic Risk Regulation of Non-Bank Financial Institutions.)

FSOC annually reevaluates whether designated firms remain systemically important. FSOC de-designated AIG and GE Capital partly because of their reduction in size, through significant divestments and reductions in certain activities. AIG's total assets fell from $1,048 billion in 2007 to $498 billion in 2016 and GE Capital divested $272 billion in assets from 2012 to 2016. (The large majority of the AIG restructuring occurred prior to its initial SIFI designation, however.) Although it was ultimately a court case that resulted in its de-designation, MetLife also undertook a substantial restructuring after its designation, spinning off lines of business and approximately $220 billion in assets to a new firm in August 2017. MetLife is, however, still the second largest insurer in the United States.

Prudential, currently the largest U.S. insurer, has not undertaken any large-scale restructuring since SIFI designation—in fact, it has gotten larger. In its de-designation, FSOC found that Prudential has not significantly decreased its total market exposure, investment portfolio, market share, or resolvability. However, FSOC noted that Prudential had reduced its leverage and counterparty exposures to the largest banks, and that there had been changes to its state insurance regulation.

Do Nonbanks Pose Systemic Risk?

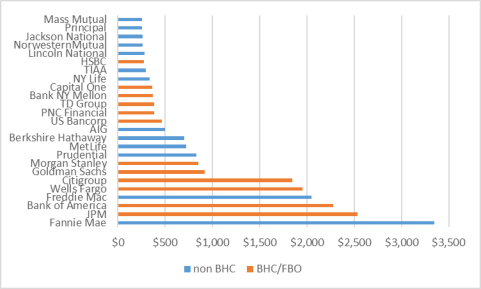

If systemic risk is mainly a function of size (i.e., "too big to fail"), then a failure to designate any large nonbank could increase the likelihood of financial instability. Figure 1 shows large financial firms based on asset size. P.L. 115-174 raised the asset threshold for automatically subjecting banks to enhanced prudential standards to $250 billion. For comparison, 10 insurers (including the three previously designated) and three other nonbanks have more than $250 billion in assets. The largest insurers (Prudential and MetLife) are comparable in size to banks such as Goldman Sachs and Morgan Stanley. However, differences in the nature of banking and other financial activities may mean that banks above $250 billion pose more systemic risk than nonbanks of the same size. For example, deposits are an important source of funding for most banks, and deposits can be withdrawn on demand. If enough deposits are withdrawn simultaneously, even strong banks would face a liquidity crisis. Insurers offer far fewer products where funds can be withdrawn on demand.

|

Figure 1. Financial Firms With Over $250 Billion in Assets (billions of $, latest annual) |

|

|

Source: Federal Reserve, S&P Capital IQ. Notes: BHC=Bank Holding Company, FBO=Foreign Banking Organization. For FBOs, includes U.S. assets only. Berkshire Hathaway includes companies engaged in financial and nonfinancial activities. |

Nevertheless, both large banks and nonbanks undertake other activities that could pose systemic risk. For example, both can participate in short-term debt markets where access to funding could quickly dry up in a panic, causing a liquidity crisis for the firm. Both can hold large portfolios of securities that, if sold quickly under duress (in a "fire sale"), could potentially push other firms or markets into crisis. Both typically have complex, multinational corporate structures that make their resolution complicated.

As noted above, one factor in SIFI designation is the firm's existing regulation. Insurers are regulated for safety and soundness at the state level, although there is no automatic enhanced prudential regime for large insurers analogous to that for large banks. AIG's problems during the crisis raised concerns that state-level regulation could not adequately mitigate systemic risk posed by an insurer's noninsurance activities (such as securities lending and credit default swaps) in the future. State regulators implemented changes after the financial crisis that attempted to address such issues, although these changes have not been tested by a crisis.

Large investment firms such as Lehman Brothers and Bear Stearns posed systemic risk in the crisis, but today, all large investment firms are parts of bank holding companies or foreign banks and therefore already subject to enhanced regulation. There are government sponsored enterprises with more than $250 billion in assets that are not designated, but are regulated for safety and soundness by the Federal Housing Finance Agency (one of the three factors for designation).

No asset managers or lending companies own over $250 billion in assets, but some asset managers that are not part of bank holding companies manage trillions of dollars in customer assets. Losses on assets under management, in isolation, do not pose risk to the firm because they would be borne by customers. Nevertheless, a (controversial) 2013 report by the Office of Financial Research detailed the ways that large asset managers might pose systemic risk.