Introduction

This report presents background information and issues for Congress concerning the Navy's force structure and shipbuilding plans. The current and planned size and composition of the Navy, the annual rate of Navy ship procurement, the capacity of the naval shipbuilding industry, and the prospective affordability of the Navy's shipbuilding plans have been oversight matters for the congressional defense committees for many years.

The Navy states that its proposed FY2021 budget requests the procurement of eight new ships, but this figure includes LPD-31, an LPD-17 Flight II amphibious ship that Congress procured (i.e., authorized and appropriated procurement funding for) in FY2020. Excluding this ship, the Navy's proposed FY2021 budget requests the procurement of seven new ships rather than eight, including one Columbia-class ballistic missile submarine (SSBN), one Virginia-class attack submarine (SSN), two DDG-51 destroyers, one FFG(X) frigate, and two TATS towing, salvage, and rescue ships.

The issue for Congress is whether to approve, reject, or modify the Navy's proposed FY2021 shipbuilding program and the Navy's longer-term shipbuilding plans. Decisions that Congress makes on this issue can substantially affect Navy capabilities and funding requirements, and the U.S. shipbuilding industrial base.

Detailed coverage of certain individual Navy shipbuilding programs can be found in the following CRS reports:

- CRS Report R41129, Navy Columbia (SSBN-826) Class Ballistic Missile Submarine Program: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report RL32418, Navy Virginia (SSN-774) Class Attack Submarine Procurement: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report RS20643, Navy Ford (CVN-78) Class Aircraft Carrier Program: Background and Issues for Congress, by Ronald O'Rourke. (This report also covers the issue of the Administration's FY2020 budget proposal, which the Administration withdrew on April 30, to not fund a mid-life refueling overhaul [called a refueling complex overhaul, or RCOH] for the aircraft carrier Harry S. Truman [CVN-75], and to retire CVN-75 around FY2024.)

- CRS Report RL32109, Navy DDG-51 and DDG-1000 Destroyer Programs: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report R44972, Navy Frigate (FFG[X]) Program: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report R43543, Navy LPD-17 Flight II and LHA Amphibious Ship Programs: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report R43546, Navy John Lewis (TAO-205) Class Oiler Shipbuilding Program: Background and Issues for Congress, by Ronald O'Rourke.

- CRS Report R45757, Navy Large Unmanned Surface and Undersea Vehicles: Background and Issues for Congress, by Ronald O'Rourke.

For a discussion of the strategic and budgetary context in which U.S. Navy force structure and shipbuilding plans may be considered, see Appendix A.

Background

Navy's 355-Ship Ship Force-Structure Goal

Introduction

On December 15, 2016, the Navy released a force-structure goal that calls for achieving and maintaining a fleet of 355 ships of certain types and numbers.1 The force level of 355 ships is a goal to be attained in the future; the actual size of the Navy in recent years has generally been between 270 and 300 ships. Table 1 shows the composition of the 355-ship force-level objective.

|

Ship Category |

Number of ships |

|

Ballistic missile submarines (SSBNs) |

12 |

|

Attack submarines (SSNs) |

66 |

|

Aircraft carriers (CVNs) |

12 |

|

Large surface combatants (i.e., cruisers [CGs] and destroyers [DDGs]) |

104 |

|

Small surface combatants (i.e., frigates [FFGs], Littoral Combat Ships, and mine warfare ships) |

52 |

|

Amphibious ships |

38 |

|

Combat Logistics Force (CLF) ships (i.e., at-sea resupply ships) |

32 |

|

Command and support ships |

39 |

|

TOTAL |

355 |

Source: U.S. Navy, Report to Congress on the Annual Long-Range Plan for Construction of Naval Vessels for Fiscal Year 2020, Table A-1 on page 10.

355-Ship Goal Resulted from 2016 Force Structure Assessment (FSA)

The 355-ship force-level goal is the result of a Force Structure Assessment (FSA) conducted by the Navy in 2016. An FSA is an analysis in which the Navy solicits inputs from U.S. regional combatant commanders (CCDRs) regarding the types and amounts of Navy capabilities that CCDRs deem necessary for implementing the Navy's portion of the national military strategy and then translates those CCDR inputs into required numbers of ships, using current and projected Navy ship types. The analysis takes into account Navy capabilities for both warfighting and day-to-day forward-deployed presence.2

Although the result of the FSA is often reduced for convenience to single number (e.g., 355 ships), FSAs take into account a number of factors, including types and capabilities of Navy ships, aircraft, unmanned vehicles, and weapons, as well as ship homeporting arrangements and operational cycles. Thus, although the number of ships called for by an FSA might appear to be a one-dimensional figure, it actually incorporates multiple aspects of Navy capability and capacity. The Navy conducts a new FSA or an update to the existing FSA every few years, as circumstances require, to determine its force-structure goal.

355-Ship Goal Made U.S. Policy by FY2018 NDAA

Section 1025 of the FY2018 National Defense Authorization Act, or NDAA (H.R. 2810/P.L. 115-91 of December 12, 2017), states the following:

SEC. 1025. Policy of the United States on minimum number of battle force ships.

(a) Policy.—It shall be the policy of the United States to have available, as soon as practicable, not fewer than 355 battle force ships, comprised of the optimal mix of platforms, with funding subject to the availability of appropriations or other funds.

(b) Battle force ships defined.—In this section, the term "battle force ship" has the meaning given the term in Secretary of the Navy Instruction 5030.8C.

The term battle force ships in the above provision refers to the ships that count toward the quoted size of the Navy in public policy discussions about the Navy.3

355-Ship Goal Is an Administration Priority

The Trump Administration has identified the achievement of a Navy of 355 or more ships within 10 years as a high priority. The Navy states that it is working as well as it can, within a Navy budget top line that is essentially flat in real (i.e., inflation-adjusted terms), toward achieving that goal while also adequately funding other Navy priorities, such as restoring eroded ship readiness and improving fleet lethality. Navy officials state that while the 355-ship goal is a priority, they want to avoid creating a so-called hollow force, meaning a Navy that has an adequate number of ships but is unable to properly crew, arm, operate, and maintain those ships.

Large Unmanned Vehicles and Navy Ship Count

Because large unmanned surface and underwater vehicles now being developed by the Navy could be deployed directly from pier (rather than from a manned Navy ship) to perform missions that might otherwise be assigned to manned ships and submarines, some observers raised a question as to whether the large UVs unmanned surface and underwater vehicles should be included in the top-level count of the number of ships in the Navy.

In December 2019, it was reported that the Office of Management and Budget (OMB) had directed the Navy to include in its FY2021 budget submission a legislative proposal to formally change the definition of which ships count toward the quoted size of the Navy (known as the number of battle force ships) to include not only manned ships, but also large UVs that operate essentially as unmanned ships.4 In January 2020, however, Admiral Michael Gilday, the Chief of Naval Operations, stated that the top-level expression of the ship force-level goal resulting from the Navy's next FSA (discussed later in this report), will not include UVs.5

Navy's FY2021, Five-Year, and 30-Year Shipbuilding Plans

Treatment of Procurement Dates of CVN-81, LPD-31, and LHA-9

The Navy's FY2021 budget submission presents the aircraft carrier CVN-81 as a ship that Congress procured in FY2020. Consistent with congressional action on the Navy's FY2019 budget regarding the procurement of CVN-81, this CRS report treats CVN-81 as a ship that Congress procured (i.e., authorized and provided procurement funding for) in FY2019. Discussion in this CRS report of the Navy's FY2021 budget submission is adjusted to show CVN-81 as a ship that was procured in FY2019.

The Navy's FY2021 budget submission presents LPD-31, an LPD-17 Flight II amphibious ship, as a ship requested for procurement in FY2021, and the amphibious assault ship LHA-9 as a ship projected for procurement in FY2023. Consistent with congressional action on the Navy's FY2020 budget regarding the procurement of LPD-31 and LHA-9, this CRS report treats LPD-31 and LHA-9 as ships that Congress procured (i.e., authorized and provided procurement funding for) in FY2020. Discussion in this CRS report of the Navy's FY2021 budget submission is adjusted to show LPD-31 and LHA-9 as ships that were procured in FY2020.

For additional discussion regarding the treatment in this report of the procurement dates of CVN-81, LPD-31, and LHA-9, see Appendix I.

FY2021 Shipbuilding Request

The Navy states that its proposed FY2021 budget requests the procurement of eight new ships, but this figure includes LPD-31, an LPD-17 Flight II amphibious ship that Congress procured (i.e., authorized and appropriated procurement funding for) in FY2020 (see previous section.) Excluding this ship, the Navy's proposed FY2021 budget requests the procurement of seven new ships rather than eight, including

- one Columbia-class ballistic missile submarine (SSBN),

- one Virginia-class attack submarine (SSN),

- two DDG-51 destroyers,

- one FFG(X) frigate, and

- two TATS towing, salvage, and rescue ships.

A figure of seven new ships is less than:

- the 11 ships that the Navy requested for FY2020 (a figure that excludes CVN-81, an aircraft carrier that Congress authorized in FY2019);

- the 13 ships that Congress procured in FY2020 (a figure that again excludes CVN-81, but includes the above-mentioned LPD-17 Flight II amphibious ship as well as an LHA amphibious assault ship that Congress also procured in FY2020);

- the 10 ships that the Navy projected under its FY2020 budget submission that it would request for FY2021; and

- the average ship procurement rate that would be needed over the long run, given current ship service lives, to achieve and maintain a 355-ship fleet.

In dollar terms, the Navy is requesting a total of about $19.9 billion for its shipbuilding account for FY2021. This is about

- $3.9 billion (16.3%) less than the Navy requested for the account for FY2020;

- $4.1 billion (17.0%) less than Congress provided for the account for FY2020; and

- $3.6 billion (15.3%) less than the $23.5 billion that the Navy projected under its FY2020 budget submission that it would request for the account for FY2021.

FY2021 Five-Year (FY2021-FY2025) Shipbuilding Plan

The Navy states that its FY2021 five-year (FY2021-FY2025) shipbuilding plan (Table 2) includes 44 new ships, but this figure includes the above-mentioned LPD-31 and LHA amphibious ships that Congress procured in FY2020. Excluding these two ships, the Navy's FY2021 five-year shipbuilding plan includes 42 new ships, which is

- 13 ships less than the 55 that were included in the FY2020 (FY2020-FY2024) five-year plan, and

- 12 ships less than the 54 that were projected for the period FY2021-FY2025 under the Navy's FY2020 30-year shipbuilding plan.

Table 2 also shows, for reference purposes, the ships funded for procurement in FY2020.

|

FY20 (enacted) |

FY21 (req.) |

FY22 |

FY23 |

FY24 |

FY25 |

FY21-FY25 Total |

|

|

Columbia (SSBN-826) class ballistic missile submarine |

|||||||

|

Gerald R. Ford (CVN-78) class aircraft carrier |

[a] |

1 |

1 |

2 |

|||

|

Virginia (SSN-774) class attack submarine |

2 |

1 |

2 |

2 |

2 |

2 |

9 |

|

Arleigh Burke (DDG-51) class destroyer |

3 |

2 |

2 |

1 |

2 |

1 |

8 |

|

FFG(X) frigate |

1 |

1 |

1 |

2 |

2 |

3 |

9 |

|

LHA amphibious assault ship |

1 [b] |

[b] |

|||||

|

LPD-17 Fight II amphibious ship |

1 [b] |

[b] |

1 |

1 |

2 |

||

|

Expeditionary Fast Transport (EPF) ship |

1 |

||||||

|

Submarine tender (AS[X]) |

1 |

1 |

|||||

|

John Lewis (TAO-205) class oiler |

2 |

1 |

2 |

1 |

4 |

||

|

TATS towing, salvage, and rescue ship |

2 |

2 |

1 |

3 |

|||

|

TAGOS(X) ocean surveillance ship |

1 |

1 |

1 |

1 |

4 |

||

|

TOTAL |

13 |

7 |

7 |

8 |

11 |

9 |

42 |

Source: Table prepared by CRS based on FY2021 Navy budget submission, with adjustments as noted below.

Notes: [a] The Navy's FY2021 budget submission presents the aircraft carrier CVN-81 as a ship that Congress procured in FY2020. Consistent with congressional action on the Navy's FY2019 budget regarding the procurement of CVN-81, this CRS report treats CVN-81 as a ship that Congress procured (i.e., authorized and provided procurement funding for) in FY2019. For additional discussion, see Appendix I. [b] The Navy's FY2021 budget submission presents LPD-31, an LPD-17 Flight II amphibious ship, as a ship requested for procurement in FY2021, and the amphibious assault ship LHA-9 as a ship projected for procurement in FY2023. Consistent with congressional action on the Navy's FY2020 budget regarding the procurement of LPD-31 and LHA-9, this CRS report treats LPD-31 and LHA-9 as ships that Congress procured (i.e., authorized and provided procurement funding for) in FY2020. For additional discussion, see Appendix I.

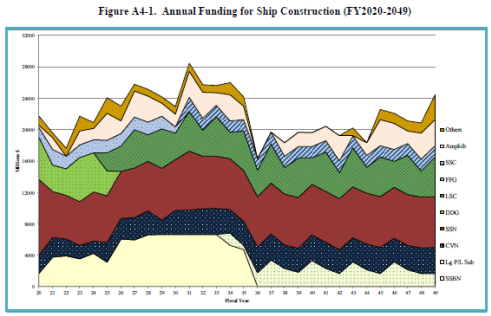

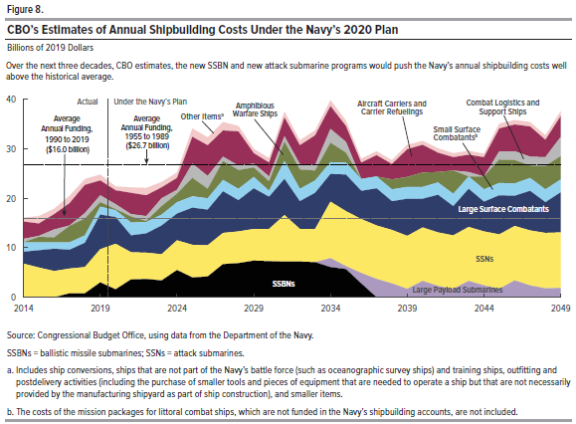

The Navy has not yet submitted its FY2021 30-year (FY2021-FY2050) shipbuilding plan. As a placeholder pending the submission of that plan, Table 3 shows the Navy's FY2020 30-year (FY2020-FY2049) 30-year shipbuilding plan. As shown in Table 3, the Navy's FY2020 30-year shipbuilding plan included 304 new ships, or an average of about 10 per year.

In devising a 30-year shipbuilding plan to move the Navy toward its ship force-structure goal, key assumptions and planning factors include but are not limited to ship construction times and service lives, estimated ship procurement costs, projected shipbuilding funding levels, and industrial-base considerations.

|

FY |

CVNs |

LSCs |

SSCs |

SSNs |

LPSs |

SSBNs |

AWSs |

CLFs |

Supt |

Total |

|

20 |

1 |

3 |

1 |

3 |

2 |

2 |

12 |

|||

|

21 |

2 |

2 |

2 |

1 |

1 |

1 |

1 |

10 |

||

|

22 |

2 |

2 |

2 |

1 |

2 |

9 |

||||

|

23 |

3 |

2 |

2 |

1 |

2 |

3 |

13 |

|||

|

24 |

3 |

2 |

2 |

1 |

1 |

1 |

1 |

11 |

||

|

25 |

3 |

2 |

2 |

1 |

1 |

2 |

11 |

|||

|

26 |

2 |

2 |

2 |

1 |

1 |

1 |

2 |

11 |

||

|

27 |

3 |

2 |

2 |

1 |

2 |

1 |

1 |

12 |

||

|

28 |

1 |

2 |

2 |

2 |

1 |

1 |

1 |

1 |

11 |

|

|

29 |

3 |

2 |

2 |

1 |

1 |

1 |

1 |

11 |

||

|

30 |

2 |

1 |

2 |

1 |

1 |

1 |

2 |

10 |

||

|

31 |

3 |

2 |

2 |

1 |

2 |

1 |

2 |

13 |

||

|

32 |

1 |

2 |

2 |

2 |

1 |

1 |

1 |

2 |

12 |

|

|

33 |

3 |

2 |

2 |

1 |

1 |

1 |

2 |

12 |

||

|

34 |

2 |

2 |

2 |

1 |

2 |

2 |

11 |

|||

|

35 |

3 |

2 |

2 |

1 |

1 |

9 |

||||

|

36 |

1 |

2 |

2 |

2 |

1 |

8 |

||||

|

37 |

3 |

2 |

2 |

7 |

||||||

|

38 |

2 |

2 |

2 |

1 |

7 |

|||||

|

39 |

3 |

2 |

2 |

1 |

8 |

|||||

|

40 |

1 |

2 |

2 |

2 |

1 |

8 |

||||

|

41 |

3 |

2 |

2 |

1 |

8 |

|||||

|

42 |

2 |

2 |

2 |

1 |

1 |

8 |

||||

|

43 |

3 |

2 |

2 |

1 |

8 |

|||||

|

44 |

1 |

2 |

2 |

2 |

1 |

8 |

||||

|

45 |

3 |

2 |

2 |

1 |

2 |

2 |

12 |

|||

|

46 |

2 |

2 |

2 |

1 |

2 |

9 |

||||

|

47 |

3 |

2 |

2 |

1 |

2 |

10 |

||||

|

48 |

1 |

2 |

2 |

2 |

1 |

2 |

2 |

12 |

||

|

49 |

3 |

2 |

2 |

1 |

2 |

3 |

13 |

|||

|

Total |

7 |

76 |

58 |

61 |

5 |

12 |

28 |

27 |

30 |

304 |

Source: U.S. Navy, Report to Congress on the Annual Long-Range Plan for Construction of Naval Vessels for Fiscal Year 2020, Table A2-1 on page 13.

Key: FY = Fiscal Year; CVNs = aircraft carriers; LSCs = surface combatants (i.e., cruisers and destroyers); SSCs = small surface combatants (i.e., Littoral Combat Ships [LCSs] and frigates [FFG(X)s]); SSNs = attack submarines; LPSs = large payload submarines; SSBNs = ballistic missile submarines; AWSs = amphibious warfare ships; CLFs = combat logistics force (i.e., resupply) ships; Supt = support ships.

Projected Force Levels Under FY2020 30-Year Shipbuilding Plan

The Navy has not yet submitted its FY2021 30-year (FY2021-FY2050) shipbuilding plan. As a placeholder pending the submission of that plan, Table 4 shows the Navy's projection of ship force levels for FY2020-FY2049 that would result from implementing the FY2020 30-year (FY2020-FY2049) 30-year shipbuilding plan shown in Table 3.

|

CVNs |

LSCs |

SSCs |

SSNs |

SSGN/LPSs |

SSBNs |

AWSs |

CLFs |

Supt |

Total |

|

|

355-ship goal |

12 |

104 |

52 |

66 |

0 |

12 |

38 |

32 |

39 |

355 |

|

FY20 |

11 |

94 |

30 |

52 |

4 |

14 |

33 |

29 |

34 |

301 |

|

FY21 |

11 |

92 |

33 |

53 |

4 |

14 |

34 |

30 |

34 |

305 |

|

FY22 |

11 |

93 |

33 |

52 |

4 |

14 |

34 |

31 |

39 |

311 |

|

FY23 |

11 |

95 |

32 |

51 |

4 |

14 |

35 |

31 |

41 |

314 |

|

FY24 |

11 |

94 |

35 |

47 |

4 |

14 |

36 |

32 |

41 |

314 |

|

FY25 |

10 |

95 |

35 |

44 |

4 |

14 |

37 |

32 |

42 |

313 |

|

FY26 |

10 |

96 |

36 |

44 |

2 |

14 |

38 |

31 |

43 |

314 |

|

FY27 |

9 |

100 |

38 |

42 |

1 |

13 |

37 |

32 |

44 |

316 |

|

FY28 |

10 |

102 |

41 |

42 |

13 |

38 |

32 |

44 |

322 |

|

|

FY29 |

10 |

104 |

43 |

44 |

12 |

36 |

32 |

44 |

325 |

|

|

FY30 |

10 |

107 |

45 |

46 |

11 |

36 |

32 |

44 |

331 |

|

|

FY31 |

10 |

110 |

47 |

48 |

11 |

36 |

32 |

43 |

337 |

|

|

FY32 |

10 |

112 |

49 |

49 |

11 |

36 |

32 |

44 |

343 |

|

|

FY33 |

10 |

115 |

50 |

51 |

11 |

38 |

32 |

44 |

351 |

|

|

FY34 |

10 |

117 |

52 |

53 |

11 |

36 |

32 |

44 |

355 |

|

|

FY35 |

10 |

114 |

55 |

54 |

11 |

34 |

32 |

45 |

355 |

|

|

FY36 |

10 |

109 |

57 |

56 |

11 |

35 |

32 |

45 |

355 |

|

|

FY37 |

10 |

107 |

58 |

58 |

10 |

35 |

32 |

45 |

355 |

|

|

FY38 |

10 |

108 |

59 |

57 |

10 |

35 |

32 |

44 |

355 |

|

|

FY39 |

10 |

105 |

61 |

58 |

10 |

37 |

32 |

42 |

355 |

|

|

FY40 |

9 |

105 |

62 |

59 |

10 |

37 |

32 |

41 |

355 |

|

|

FY41 |

10 |

104 |

61 |

59 |

11 |

37 |

32 |

41 |

355 |

|

|

FY42 |

9 |

106 |

60 |

61 |

12 |

36 |

32 |

39 |

355 |

|

|

FY43 |

9 |

108 |

57 |

61 |

1 |

12 |

36 |

32 |

39 |

355 |

|

FY44 |

9 |

109 |

55 |

62 |

1 |

12 |

36 |

32 |

39 |

355 |

|

FY45 |

10 |

107 |

55 |

63 |

1 |

12 |

36 |

32 |

39 |

355 |

|

FY46 |

9 |

106 |

54 |

64 |

2 |

12 |

37 |

32 |

39 |

355 |

|

FY47 |

9 |

107 |

54 |

65 |

2 |

12 |

35 |

32 |

39 |

355 |

|

FY48 |

9 |

109 |

51 |

66 |

2 |

12 |

35 |

32 |

39 |

355 |

|

FY49 |

10 |

108 |

50 |

67 |

3 |

12 |

35 |

31 |

39 |

355 |

Source: U.S. Navy, Report to Congress on the Annual Long-Range Plan for Construction of Naval Vessels for Fiscal Year 2020, Table A2-4 on page 13.

Note: Figures for support ships include five JHSVs transferred from the Army to the Navy and operated by the Navy primarily for the performance of Army missions.

Key: FY = Fiscal Year; CVNs = aircraft carriers; LSCs = surface combatants (i.e., cruisers and destroyers); SSCs = small surface combatants (i.e., frigates, Littoral Combat Ships [LCSs], and mine warfare ships); SSNs = attack submarines; SSGNs/LPSs = cruise missile submarines/large payload submarines; SSBNs = ballistic missile submarines; AWSs = amphibious warfare ships; CLFs = combat logistics force (i.e., resupply) ships; Supt = support ships.

New FSA To Replace 355-Ship Goal; Could Alter Distribution of Shipbuilding Work

New FSA Is Called an Integrated FSA (INFSA)

A new FSA—referred to as the Integrated Naval FSA (INFSA), with the term naval referring to both the Navy and Marine Corps (i.e., the two naval services)—is now underway as the successor to the 2016 FSA.6 Department of the Navy (DON) officials have stated that they are referring to the new FSA as an integrated naval FSA to emphasize that it will integrate Marine Corps requirements into the FSA process more fully than previous FSAs. DON officials state that the INFSA will take into account the Trump Administration's December 2017 National Security Strategy document and its January 2018 National Defense Strategy document, both of which put an emphasis on renewed great power competition with China and Russia,7 as well as updated information on Chinese and Russian naval and other military capabilities and recent developments in new technologies, including those related to unmanned vehicles (UVs).8

INFSA to Be Released This Year, Perhaps During Spring of 2020

Through much of 2019, Navy officials stated that the INFSA was to be completed by the end of 2019. A September 27, 2019, press report stated that an interim version was to be completed by September 2019, in time to inform programmatic decisions on the FY2022 Program Objective Memorandum (POM), meaning the in-house DOD planning document that will guide the development of DOD's FY2022 budget submission.9 A December 6, 2019, memorandum from Acting Secretary of the Navy Thomas Modly stated that he expected the final INFSA to be published no later than January 15, 2020.10 A January 23, 2020, press report quoted Modly as saying that the January 15 date was an internal Navy deadline, and that the Navy expects that the INFSA will be released to outside audiences sometime during the spring of 2020,11 which would be well after the submission of the Navy's proposed FY2021 budget on February 10, 2020, and perhaps after the defense committees have completed most or all of their FY2021 budget-review hearings moved into markup on the FY2021 National Defense Authorization Act.

In his December 6, 2019, memorandum, Acting Secretary Modly stated that "my staff and I will become involved" in the INFSA, and that one of his five immediate objectives as acting secretary is to "establish an Integrated Plan to achieve a [fleet of] 355 (or more) ships, Unmanned Underwater Vehicles (UUVs), and Unmanned Surface Vehicles (USVs) for greater global naval power, within 10 years."

INFSA Could Call for a Navy of About 390 Manned Ships

Statements from Navy officials in the early months of 2020 suggest that the INFSA could result in a new Navy force-level goal for a fleet of about 390 manned ships plus about 45 unmanned or optionally manned ships, for a total of about 435 manned and unmanned or optionally manned ships. Navy officials have provided few additional details about the composition of this 390/435-ship force-level goal.12 Navy officials have stated that the INFSA is being closely reviewed by the Secretary of Defense Mark Esper; it is possible that this review could lead to a change in the figures of 390 manned ships and 45 unmanned or optionally manned ships.13

INFSA Could Result in Once-in-a-Generation Change in Fleet Architecture and Distribution of Shipbuilding Work

Statements from DON officials suggest that the INFSA could result in a once-in-a-generation change in the Navy's fleet architecture, meaning the mix of ships that make up the Navy and how those ships are combined into formations and used to perform various missions. As detailed in the following sections of this report, statements from DON officials suggest that the INFSA could shift the fleet to a more distributed architecture that includes a reduced proportion of larger ships, an increased proportion of smaller ships, and a newly created category of large unmanned surface vehicles (USVs) and large unmanned underwater vehicles (UUVs). Such a change in fleet architecture could alter, perhaps substantially, the mix of ships to be procured for the Navy and the distribution of Navy shipbuilding work among the nation's shipyards. A February 3, 2020, press report, for example, stated

The Navy's plans to get to 355 manned ships by 2030 will rely on new classes of ships that don't exist yet—including new kinds of amphibious and supply ships as well as "lightly manned" ships—the acting Navy secretary told USNI News.

The Force Structure Assessment that will lay out the Navy's path to this larger fleet, which leadership has described as "355-plus, plus unmanned," has been delayed and won't come out until after the Fiscal Year 2021 budget request is released next week. FY 2021 will put the Navy on a path to crest over 300 ships, Acting Secretary of the Navy Thomas Modly told USNI News in a phone interview, but the real growth will come in the FY 2022 request.

Still, Modly previewed what the FSA might hold.

"We haven't done a really comprehensive force structure assessment in a couple of years; 2016 was the last one. So we started on a new path for that last fall, and what we're finding in that force structure assessment is that the number of ships we need are going to be more than 355. And when you add in some of the unmanned vessels and things like that that we're going through experimental phases on, it's probably going to be significantly more than [355]," he said.

"There are certain ship classes that don't even exist right now that we're looking at that will be added into that mix, but the broad message is, it's going to be a bigger fleet, it's going to be a more distributed fleet, it's going to be a more agile fleet. And we need to figure out what that path is and also understand our topline limitations, because no one wants a 355-plus fleet that's hollow, that we can't maintain. So we're looking at balancing all those things."

Asked what new ship classes the service is considering, Modly mentioned new amphibious ships, as well as new kinds of supply ships and "lightly manned" ships that are "more like missile magazines that would accompany surface action groups."

Talk of a new class of amphibious warships began last summer, when Commandant of the Marine Corps Gen. David Berger called for alternative kinds of amphibious lift for Marines in his Commandant's Planning Guidance. Since that time, Marine Corps and Navy officials at various conferences have suggested that the services are narrowing in on the Offshore Support Vessel [OSV] as a model for what they want. Having several OSVs instead of one dock landing ship (LSD), for example, might be able to carry the same number of Marines but distribute them across the littorals instead of concentrating them on one hull—which defensively makes them harder to target and offensively allows them to be more agile under the Distributed Maritime Operations and Expeditionary Advance Base Operations concepts.

On the other hand, public talk of a "lightly manned" ship type is new. The Navy had previously envisioned its Large Unmanned Surface Vehicle [LUSV] to serve as a magazine ship for manned combatants, but Congress used its annual defense bill to block the Navy from building an unmanned ship with vertical launch tubes. Making these ships "lightly manned" could keep the magazine ship concept alive while alleviating congressional concerns, and could create the added benefit of allowing the small crews to use their hulls to train with other nations' navies during peacetime….

Modly, when asked why the Navy was betting so much of its ability to get to 355 ships by the end of the decade on quickly acquiring brand new ship classes that haven't gone through the Navy and industry design and construction process yet, said, "I think 'quickly' is going to have to define everything we do, because the world is changing pretty quickly and we're going to have to react more quickly."

"You look at the frigate [FFG(X)] program: we think, because of the way we've approached that program, we've probably taken three years off the product development lifecycle for that. So we have to start doing the same type of thing: looking at proven hulls, things that can be adaptable for different areas. I understand the Hill's concerns about unmanned, and we get that. … We have to convince them with data: we have to wargame this, we have to iterate it over and over again."

The acting secretary added that President Donald Trump ran in 2016 on a larger fleet, and Congress passed the 355 figure into law in 2017. Though the Navy only has assumptions from wargames and simulations today regarding these new classes of ships, he said the service needed to settle on a "north star" and begin the research and development and construction to get hulls in the water, and then it could refine its vision as needed once fleet leaders understand how the new and old ships work together to bring naval power to a distributed fight.…

Modly said the FY 2021 budget—expected to be released next week—will allow the Navy to grow some, ahead of what he expects will be a much stronger 2022 budget.

"I think what you'll see is mostly an emphasis on readiness—we don't want to have a hollow force, and so we had to make some trades in the end game, but we're still on a path to grow the Navy," he said.

"This year, this budget will keep us on a path to grow to over 300, but the ultimate goal was to grow to an even bigger fleet than that," and the Navy is already looking at its 2022 planning and eyeing multiple paths to grow faster.14

The following sections provide details on how the Navy's new fleet architecture could alter the mix of ships within various parts of the Navy.

Potential New Surface Combatant Force Architecture

Statements from Navy officials suggest that the new FSA might shift the Navy's surface combatant force to a more distributed architecture that includes a reduced proportion of large surface combatants (i.e., cruisers and destroyers), an increased proportion of small surface combatants (i.e., frigates and LCSs), and a newly created third tier of unmanned surface vehicles (USVs). In presenting its proposed FY2020 and FY20201 budgets, the Navy has highlighted its plans for developing and procuring USVs in coming years.

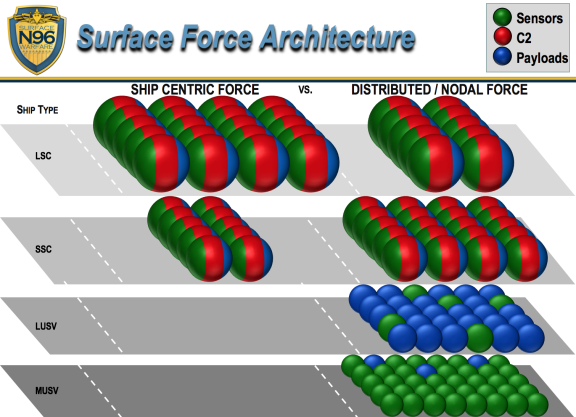

Figure 1 provides, for the surface combatant portion of the Navy,15 a conceptual comparison of the current fleet architecture (shown on the left as the "ship centric force") and the new, more distributed architecture (shown on the right as the "distributed/nodal force"). The figure does not depict the entire surface combatant fleet, but rather a representative portion of it.

In the figure, each sphere represents a manned ship or USV. As shown in the color coding, under both the current fleet architecture and the more distributed architecture, the manned ships (i.e., the LSCs and SSCs) are equipped with a combination of sensors (green), command and control (C2) equipment (red), and payloads other than sensors and C2 equipment, meaning principally weapons (blue).

Under the more distributed architecture, the manned ships would be on average smaller (because a greater share of them would be SSCs), and this would be possible because some of the surface combatant force's weapons and sensors would be shifted from the manned ships to USVs, with weapon-equipped Large USVs (LUSVs) acting primarily as adjunct weapon magazines and sensor-equipped Medium USVs (MUSVs) contributing to the fleet's sensor network.

As shown in Figure 1, under the Navy's current surface combatant force architecture, there are to be 20 LSCs for every 10 SSCs (i.e., a 2:1 ratio of LSCs to SSCs), with no significant contribution from LUSVs and MUSVs. This is consistent with the Navy's current force-level objective, which calls for achieving a 355-ship fleet that includes 104 LSCs and 52 SSCs (a 2:1 ratio). Under the more distributed architecture, the ratio of LSCs to SSCs would be reversed, with 10 LSCs for every 20 SSCs (a 1:2 ratio), and there would also now be 30 LUSVs and 40 MUSVs.

A January 15, 2019, press report states

The Navy plans to spend this year taking the first few steps into a markedly different future, which, if it comes to pass, will upend how the fleet has fought since the Cold War. And it all starts with something that might seem counterintuitive: It's looking to get smaller.

"Today, I have a requirement for 104 large surface combatants in the force structure assessment; [and] I have [a requirement for] 52 small surface combatants," said Surface Warfare Director Rear Adm. Ronald Boxall. "That's a little upside down. Should I push out here and have more small platforms? I think the future fleet architecture study has intimated 'yes,' and our war gaming shows there is value in that."16

Another way of summarizing Figure 1 would be to say that the surface combatant force architecture (reading vertically down the figure) would change from 20+10+0+0 (i.e., a total of 30 surface combatant platforms, all manned, and a platform ratio of 2-1-0-0) for a given portion of the surface combatant force, to 10+20+30+40 (i.e., a total of 100 surface combatant platforms, 70 of which would be LUSVs and MUSVs, and a platform ratio of 1-2-3-4) for a given portion of the surface combatant force. The Navy refers to the more distributed architecture's combination of LSCs, SSCs, LUSVs, and MUSVs as the Future Surface Combatant Force (FSCF).

Figure 1 is conceptual, so the platform ratios for the more distributed architecture should be understood as notional or approximate rather than exact. The point of the figure is not that relative platform numbers under the more distributed architecture would change to the exact ratios shown in the figure, but that they would evolve over time toward something broadly resembling those ratios.17

A January 23, 2020, press report states that

The Navy is expected to finalize next month a major new analysis of its future surface combatant fleet....

The findings are expected to influence force structure decisions in fiscal year 2021 as well as budget and shipbuilding plans beginning in FY-22.

The Future Surface Combatant Force analysis of alternatives [AOA], a 16-month effort, will provide a key input into the Navy's Integrated Force Structure Assessment….

The AOA, according to a senior official, validated a key Navy hypothesis posed in 2018, that a fleet of unmanned surface vessels packed with sensors or loads of missiles give U.S. commanders more options and complicate the calculus for an adversary.18

Potential New Amphibious Ship Architecture

Statements from the Commandant of the Marine Corps suggest strongly that the new FSA might change the Navy's amphibious ship force to an architecture based on a new amphibious lift target and a new mix of amphibious ships.

The current 38-ship amphibious ship force-level goal shown in Table 1 is intended to meet a requirement for having enough amphibious lift to lift the assault echelons of two Marine Expeditionary Brigades (MEBs), a requirement known as the 2.0 MEB lift requirement. The 2.0 MEB lift requirement dates to 2006. The translation of this lift requirement into a Marine Corps-preferred force-level goal of 38 ships dates to 2009, and the Navy's formal incorporation of the 38-ship goal (rather than a more fiscally constrained goal of 33 or 34 ships) into the Navy's overall ship force-structure goal dates to the 2016 FSA.19

In July 2019, General David H. Berger, the Commandant of the Marine Corps, released a document entitled Commandant's Planning Guidance that states that the Marine Corps wants to, among other things, move away from the 38-ship amphibious ship force-level goal and the 2.0 MEB lift force-planning metric, and shift to a new and different mix of amphibious ships that includes not only the LHA/LHD-type amphibious assault ships and LPD/LPD-type amphibious ships called for in the 2016 FSA, but other kinds of ships as well, including smaller amphibious ships, ships like the Navy's Expeditionary Sea Base (ESB) and Expeditionary Fast Transport (EPF) ships (referred to collectively as E-class ships), ships based on commercial-ship hull designs, and unmanned surface vehicles (USVs). The Commandant's Planning Guidance, which effectively announces a once-in-a-generation change in Marine Corps thinking on this and other issues relating to the Marine Corps, states in part (emphasis as in the original):

Our Nation's ability to project power and influence beyond its shores is increasingly challenged by long-range precision fires; expanding air, surface, and subsurface threats; and the continued degradation of our amphibious and auxiliary ship readiness. The ability to project and maneuver from strategic distances will likely be detected and contested from the point of embarkation during a major contingency. Our naval expeditionary forces must possess a variety of deployment options, including L-class [amphibious ships] and E-class [expeditionary ships] ships, but also increasingly look to other available options such as unmanned platforms, stern landing vessels, other ocean-going connectors, and smaller more lethal and more risk-worthy platforms. We must continue to seek the affordable and plentiful at the expense of the exquisite and few when conceiving of the future amphibious portion of the fleet.

We must also explore new options, such as inter-theater connectors and commercially available ships and craft that are smaller and less expensive, thereby increasing the affordability and allowing acquisition at a greater quantity. We recognize that we must distribute our forces ashore given the growth of adversary precision strike capabilities, so it would be illogical to continue to concentrate our forces on a few large ships. The adversary will quickly recognize that striking while concentrated (aboard ship) is the preferred option. We need to change this calculus with a new fleet design of smaller, more lethal, and more risk-worthy platforms. We must be fully integrated with the Navy to develop a vision and a new fleet architecture that can be successful against our peer adversaries while also maintaining affordability. To achieve this difficult task, the Navy and Marine Corps must ensure larger surface combatants possess mission agility across sea control, littoral, and amphibious operations, while we concurrently expand the quantity of more specialized manned and unmanned platforms….

We will no longer use a "2.0 MEB requirement" as the foundation for our arguments regarding amphibious ship building, to determine the requisite capacity of vehicles or other capabilities, or as pertains to the Maritime Prepositioning Force. We will no longer reference the 38-ship requirement memo from 2009, or the 2016 Force Structure Assessment, as the basis for our arguments and force structure justifications. The ongoing 2019 Force Structure Assessment will inform the amphibious requirements based upon this guidance. The global options for amphibs [types of amphibious ships] include many more options than simply LHAs, LPDs, and LSDs. I will work closely with the Secretary of the Navy and Chief of Naval Operations (CNO) to ensure there are adequate numbers of the right types of ships, with the right capabilities, to meet national requirements.

I do not believe joint forcible entry operations (JFEO) are irrelevant or an operational anachronism; however, we must acknowledge that different approaches are required given the proliferation of anti-access/area denial (A2AD) threat capabilities in mutually contested spaces. Visions of a massed naval armada nine nautical miles off-shore in the South China Sea preparing to launch the landing force in swarms of ACVs [amphibious combat vehicles], LCUs [utility landing craft], and LCACs [air-cushioned landing craft]are impractical and unreasonable. We must accept the realities created by the proliferation of precision long-range fires, mines, and other smart-weapons, and seek innovative ways to overcome those threat capabilities. I encourage experimentation with lethal long-range unmanned systems capable of traveling 200 nautical miles, penetrating into the adversary enemy threat ring, and crossing the shoreline—causing the adversary to allocate resources to eliminate the threat, create dilemmas, and further create opportunities for fleet maneuver. We cannot wait to identify solutions to our mine countermeasure needs, and must make this a priority for our future force development efforts….

Over the coming months, we will release a new concept in support of the Navy's Distributed Maritime Operations (DMO) Concept and the NDS called – Stand-in Forces. The Stand-in Forces concept is designed to restore the strategic initiative to naval forces and empower our allies and partners to successfully confront regional hegemons that infringe on their territorial boundaries and interests. Stand-in Forces are designed to generate technically disruptive, tactical stand-in engagements that confront aggressor naval forces with an array of low signature, affordable, and risk-worthy platforms and payloads. Stand-in forces take advantage of the relative strength of the contemporary defense and rapidly-emerging new technologies to create an integrated maritime defense that is optimized to operate in close and confined seas in defiance of adversary long-range precision "stand-off capabilities."

Creating new capabilities that intentionally initiate stand-in engagements is a disruptive "button hook" in force development that runs counter to the action that our adversaries anticipate. Rather than heavily investing in expensive and exquisite capabilities that regional aggressors have optimized their forces to target, naval forces will persist forward with many smaller, low signature, affordable platforms that can economically host a dense array of lethal and nonlethal payloads.

By exploiting the technical revolution in autonomy, advanced manufacturing, and artificial intelligence, the naval forces can create many new risk-worthy unmanned and minimally-manned platforms that can be employed in stand-in engagements to create tactical dilemmas that adversaries will confront when attacking our allies and forces forward.20

A February 20, 2020, press report about a potential new type of stern-landing amphibious ship states:

The Navy's research and development portfolio will devote $30 million to a "next-generation medium amphibious ship design" that will likely be based on an Australian designer's stern landing vessel….

The Navy and Marines announced in the Fiscal Year 2021 budget request that they will seek a medium amphibious ship that can support the kind of dispersed, agile, constantly relocating force described in the Littoral Operations in Contested Environment (LOCE) and Expeditionary Advanced Base Operations (EABO) concepts the Marine Corps has written, as well as the overarching Distributed Maritime Operations (DMO) from the Navy. According to a budget overview document, "a next-generation medium amphibious ship will be a stern landing vessel to support amphibious ship-to-shore operations."

"FY 2021 funds support concept evaluation/design, industry studies and exploration for a medium-lift intra-theater amphibious support vessel. Efforts include requirements development, systems engineering, naval architecture and marine engineering, and operations research analysis," reads a justification book that accompanies the budget request.

The Navy and Marines had previously cited the Offshore Support Vessel as a possible inspiration for their new design….

However, since that time, Marine Corps planners took another look at the features they'd need on this medium amphibious ship, rather than limiting their talks to existing ship designs, USNI News understands. Those talks led to a realization that they not only wanted a ship that could move Marines around with some range, but they also wanted the ship to be able to beach itself like a landing craft does, to help offload gear and vehicles as needed. These talks led to a new focus on the stern landing vessel designed by Australian company Sea Transport, which could serve as the new inspiration for the medium amphibious vehicle as requirements development and EABO wargaming and simulations take place….

The Navy and Marines are not committed yet to this design or to Sea Transport, but USNI News understands that something like a SLV would combine a surface ship's ability to have great enough endurance and range to be operationally useful to commanders and a landing craft's ability to beach itself to offload larger equipment.21

A March 26, 2020, press report stated:

The Navy is asking industry for input on a future Light Amphibious Warship, as the Marine Corps recalculates its force design to prepare for a near-peer fight in the Pacific.

A recent request for information says the Navy will hold a virtual industry day on April 9….

The Navy anticipates purchasing the first ships in fiscal year 2023, according to slides from the March 4 industry day. A preliminary schedule anticipates the service buying three vessels in FY-23, six in FY-24, 10 in FY-25 and nine in FY-26. The Navy also envisions utilizing a commercial design that it could alter for the military.22

A May 5, 2020, press report stated:

The U.S. Navy wants to buy as many as 30 of a new class of Light Amphibious Warships that would be significantly smaller and cheaper to operate than its existing fleets of large amphibious ships. The service is already exploring possible designs, including a roll-on-roll-off type with a stern ramp.…

Navy officials… said that the "objective number" of Light Amphibious Warships (LAW) it hopes to buy is between 28 and 30 at a briefing for defense industry representatives on Apr. 9, 2020….

The Navy is still in an information-gathering phase, but does already have some key requirements for any potential LAW design, which it expects to be about 200 feet long overall and have 8,000 square feet of cargo space in total. Each LAW will have a crew of no more than 40 sailors and be able to accommodate at least 75 Marines….

The Navy says that it is willing to consider either adapting an existing commercial design, using a commercial hullform as a starting place, or a so-called "Build to Print" ship based on proven design elements and components. The goal in all of these courses of action is to focus on relatively low-risk, low-cost, mature designs, or at least design features, in order to both keep the ships cheap and make them faster and easier to build. The Navy has said it is interested in awarding at least one preliminary design contract by the end of this year with the hope that it could begin buying actual ships as early as late 2022.

The service has also indicated that it might be willing to accept ship designs with relatively short expected service lives in order to help keep production costs low and speed up construction. The requirements now say that the LAWs have to have a life span of just 10 years, at a minimum.23

Potential New Aircraft Carrier/Naval Aviation Force Architecture

Statements from Navy officials reported in the press beginning in February 2019 indicate that the Navy is currently considering moving to a new aircraft carrier/naval aviation force architecture that might supplement today's CVNs with smaller and perhaps nonnuclear-powered aircraft carriers.24

According to these press reports, one option for a smaller carrier is the so-called Lighting Carrier, a term referring to an LHA-type amphibious assault ship equipped with an air wing consisting largely of F-35B Joint Strike Fighter (JSFs). (The alternate name for the F-35 is the Lighting II. The B variant of the F-35, which is currently being procured for the Marine Corps, is short takeoff, vertical landing [STOVL] variant that can be operated off of ships with flight decks that are shorter than the flight decks of CVNs.) The Navy and Marine Corps have conducted experiments with the Lightning Carrier concept.25

Another option for a smaller carrier is one whose air wing would consist mostly or entirely of unmanned aerial vehicles (UAVs). The Navy in recent years has periodically studied the potential of UAV carriers.

The current discussion both inside and outside the Navy over the aircraft carrier to be procured after CVN-81 appears to reflect several considerations, including the following:

- concerns over China's improving capabilities for detecting surface ships and attacking them with anti-ship ballistic missiles (ASBMs) and advanced anti-ship cruise missiles (ASCMs);

- the procurement and operating and support (O&S) costs of CVNs and their air wings, particularly in a context of constraints on Navy funding and funding demands from other competing Navy programs; and

- the potential capabilities of smaller carriers operating air wings consisting of unmanned aerial vehicles (UAVs) and/or F-35B Joint Strike Fighters (i.e., the short-takeoff, vertical landing [STOVL] version of the F-35 now being procured for the Marine Corps).

A March 9, 2020, Navy news release stated:

Acting Secretary of the Navy Thomas B. Modly announced today he is commissioning a Blue-Ribbon Future Carrier 2030 (FC-2030) Task Force to conduct a six-month study to reimagine the future of the aircraft carrier and carrier-based naval aviation (manned and unmanned) for 2030 and beyond.

FC-2030 will be complementary to, and informed by a broad review of national shipbuilding requirements being conducted by Deputy Secretary of Defense David L. Norquist. Navy and Marine Corps uniformed and civilian leadership will be engaged in both efforts. FC-2030 will attract current and former leaders from Congress, leaders from the U.S. shipbuilding and supporting technology industries, current and former Department of Defense leaders, as well as thought leaders at War Colleges, think-tanks, and futurists from around the nation.

"The long-term challenges facing our nation and the world demand clear-eyed assessments and hard choices," said Modly. "Because we have four new Ford carriers under contract, we have some time to reimagine what comes next. Any assessment we do must consider cost, survivability, and the critical national requirement to sustain an industrial base that can produce the ships we need—ships that will contribute to a superior, integrated naval force for the 2030s and far beyond.

"Aircraft carrier construction sustains nearly 60,000 skilled jobs in over 46 states," Modly added. "It can't be simply turned on and off like a faucet. We must be thoughtful in how we approach changes as they will have lasting impacts on our national industrial competitiveness and employment."

The task force will be led by an Executive Director chosen from within the Department of the Navy's Secretariat staff, and assisted on a collateral-duty basis by representatives from the Office of Naval Research and the Deputy Chief of Naval Operations for Warfighting Development.

Along with an executive director, the FC-2030 Senior Executive Panel will consist of thought leaders with historical records of leading and contributing to large change in maritime defense strategies and programs. Former Senator John Warner of Virginia has agreed to serve as the Honorary Chairman of the Executive Panel. Former Secretary of the Navy John Lehman, former acting Deputy Secretary of Defense Christine Fox, former Deputy Undersecretary of the Navy Seth Cropsey, and former Congressman Randy Forbes have agreed to serve as Executive members of the panel.

"Our future strength will be determined as much by the gray matter we apply to our challenges as the gray hulls we build," said Modly. "We need the best minds from both inside and outside of government focused on this issue."

The study will be conducted with the assistance of the Naval University System (U.S. Naval Academy, Naval War College, Marine Corps University, and Naval Postgraduate School) as well as eligible Federally Funded Research and Development Centers (FFRDCs) and Naval Warfare Centers.

The goal at the end of the study is to provide a report to the secretary of the Navy detailing a vision of the competitive global security environment and the role of carrier-based naval aviation in that future context. Considerations will include expected principles of deterrence, global presence missions, protection of American economic security, as well as potential combat with possible adversaries.

The study will also define likely constraints of means in terms of future defense budgets, as well as avenue to contemplate future possible technologies not yet invented that could change the stakes of carrier-based naval aviation in all phases of global competition.

Finally, the report will provide options for the Department of the Navy in requirements for different various future aircraft (manned and unmanned, nuclear and/or conventional) carriers, to be used in future months and years in developing guidance to industry. The study will also examine how best to utilize and evolve the existing carrier fleet, including the more flexible and adaptable Ford Class, to meet the challenges of advanced long-range weapons that will extend and expand contested areas in the future.26

Potential New Combat Logistics Force (CLF) Architecture

The Navy's FY2020 30-year shipbuilding plan suggests that shifting to a more distributed fleet architecture could increase required numbers of Combat Logistics Force (CLF) ships—meaning the oilers, ammunition ships, and dry cargo ships that transport fuel, ammunition, and supplies Navy combat ships that are operating at sea—and augment today's CLF ships with additional "smaller, faster, multi-mission transports."27

Potential New Undersea Force Architecture

The new FSA might also change the Navy's undersea force to a more distributed architecture that includes, in addition to attack submarines (SSNs) and bottom-based sensors, a new element of extra-large unmanned underwater vehicles (XLUUVs), which might be thought of as unmanned submarines. In presenting its proposed FY2020 budget, the Navy highlighted its plans for developing and procuring UUVs in coming years.28

Rationale for a More Distributed Fleet Architecture

Some observers have long urged the Navy to shift to a more distributed fleet architecture, on the grounds that the Navy's current architecture—which concentrates much of the fleet's capability into a relatively limited number of individually larger and more expensive surface ships—is increasingly vulnerable to attack by the improving maritime anti-access/area-denial (A2/AD) capabilities (particularly anti-ship missiles and their supporting detection and targeting systems) of potential adversaries, particularly China.29 Shifting to a more distributed architecture, these observers have argued, would

- complicate an adversary's targeting challenge by presenting the adversary with a larger number of Navy units to detect, identify, and track;

- reduce the loss in aggregate Navy capability that would result from the destruction of an individual Navy platform;

- give U.S. leaders the option of deploying USVs and UUVs in wartime to sea locations that would be tactically advantageous but too risky for manned ships; and

- increase the modularity and reconfigurability of the fleet for adapting to changing mission needs.30

For a number of years, DON leaders acknowledged the views of those observers but continued to support the current fleet architecture. More recently, however, DON leaders appear to have shifted their thinking toward support for moving the fleet to a more distributed architecture. DON leaders appear to have shifted their thinking in favor of a more distributed architecture because they now appear to believe that such an architecture will be

- operationally necessary, as the observers have long argued, to respond effectively to the improving maritime A2/AD capabilities of other countries, particularly China;31

- technically feasible as a result of advances in technologies for UVs and for networking widely distributed maritime forces that include significant numbers of UVs; and

- affordable—no more expensive, and possibly less expensive, than the current architecture, so as to fit within future Navy budgets that Navy officials expect to be flat or declining in real (i.e., inflation-adjusted) terms compared to the Navy's current budget.

The more distributed architecture that Navy leaders now appear to support may differ in its details from distributed architectures that the observers have been advocating, but the general idea of shifting to a more distributed architecture, and of using large UVs as a principal means of achieving that, appears to be similar. The Department of Defense (DOD) states that

The FY 2020 budget request diversifies and expands sea power strike capacity through procurement of offensively armed Unmanned Surface Vessels (USVs). The USV investment, paired with increased investment in long-range maritime munitions, represents a paradigm shift towards a more balanced, distributed, lethal, survivable, and cost-imposing naval force that will better exploit adversary weaknesses and project power into contested environments.32

Distributed Maritime Operations (DMO)

Shifting to a more distributed force architecture, Navy officials have suggested, could be appropriate for implementing the Navy's new overarching operational concept, called Distributed Maritime Operations (DMO). The Navy's FY2020 30-year shipbuilding plan mentions DMO,33 and a December 2018 document from the Chief of Naval Operations states that the Navy will "Continue to mature the Distributed Maritime Operations (DMO) concept and key supporting concepts" and "Design and implement a comprehensive operational architecture to support DMO."34 While Navy officials have provided few details in public about DMO, then-Chief of Naval Operations Admiral John Richardson, in explaining DMO, stated in December 2018 that

Our fundamental force element right now in many instances is the [individual] carrier strike group. We're going to scale up so our fundamental force element for fighting is at the fleet[-wide] level, and the [individual] strike groups plug into those [larger] numbered fleets. And they will be, the strike groups and the fleet together, will be operating in a distributed maritime operations way.35

In its FY2020 budget submission, the Navy states that "MUSV and LUSV are key enablers of the Navy's Distributed Maritime Operations (DMO) concept, which includes being able to forward deploy (alone or in teams/swarms), team with individual manned combatants or augment battle groups."36 The Navy stated in its FY2020 budget submission that a Navy research and development effort focusing on concept generation and concept development (CG/CD) will

Continue CG/CD development efforts that carry-over from FY[20]19: Additional concepts and CONOPs [concepts of operation] to be developed in FY[20]20 will be determined through the CG/CD development process and additional external factors. Concepts under consideration include Unmanned Systems in support of DMO, Command and Control in support of DMO, Offensive Mine Warfare, Targeting in support of DMO, and Advanced Autonomous/Semi-autonomous Sustainment Systems.37

The Navy also stated in its FY2020 budget submission that a separate Navy research and development effort for fleet experimentation activities will include activities that "address key DMO concept action plan items such as the examination of Fleet Command and Maritime Operation Center (MOC) capabilities and the employment of unmanned systems in support of DMO."38

A May 16, 2019, press report states

The Deputy Chief of Naval Operations for Warfare Systems said Wednesday [May 15] he thinks the upcoming Force Structure Assessment (FSA) will focus on smaller surface combatants as the service looks to build up to a 355-ship Navy.

"I certainly don't see that [FSA fleet] number going down, but it is going to be more reflective of the DMO [Distributed Maritime Operations] construct and it includes not just the battle force ships, but the logistics ships, the trainers, the maritime operations centers, everything that we pull together to keep this machine running," Vice Adm. William Merz said during an event at the Center for Strategic and International Studies.

"What we think is going to happen with this FSA is there will be more emphasis on the smaller surface combatants, mostly because the frigate looks like it's coming along very well and it's going to be more lethal than we had planned," Merz said.

Merz explained the likely outcome by comparing it to how Rear Adm. Ron Boxall, director of surface warfare (N96), talks about how the Navy has too many large surface combatants and needs to get more balanced.

"When you look at the lethality of the frigate, yeah that makes sense. So we'll see how the FSA handles the lethality of that – and then how does that bleed over into the other accounts," Merz said….

Merz revealed there will also be "a hard look at the logistics side" because while some logistics ships count as battle force ships some do not. He said the FSA will make an opinion on the non-battle force logistics vessels as well because it does not limit itself to those strict definitions.

The FSA will also take into account the evolution of the air wing, the length of the air wing, the range of the air wing on carriers and amphibious vessels, and how the Navy will cover its responsibilities.39

Expeditionary Advanced Base Operations (EABO)

In parallel with DMO, the Marine Corps has developed a new operational concept, called Expeditionary Advanced Base Operations (EABO), that appears related to the earlier-quoted passage from the Commandant's Planning Guidance about changing the amphibious lift goal and the amphibious force architecture. Regarding EABO, the Commandant's Planning Guidance states the following (emphasis as in the original):

The 2016 Marine Corps Operating Concept (MOC) predates the current set of national strategy and guidance documents, but it was prescient in many ways. It directed partnering with the Navy to develop two concepts, Littoral Operations in a Contested Environment (LOCE) and Expeditionary Advanced Base Operations (EABO) that nest exceptionally well with the current strategic guidance. It is time to move beyond the MOC itself, however, and partner with the Navy to complement LOCE and EABO with classified, threat-specific operating concepts that describe how naval forces will conduct the range of missions articulated in our strategic guidance….

EABO complement the Navy's Distributed Maritime Operations Concept and will inform how we approach missions against peer adversaries….

EABO are driven by the aforementioned adversary deployment of long-range precision fires designed to support a strategy of "counter-intervention" directed against U.S. and coalition forces. EABO, as an operational concept, enables the naval force to persist forward within the arc of adversary long-range precision fires to support our treaty partners with combat credible forces on a much more resilient and difficult to target forward basing infrastructure. EABO are designed to restore force resiliency and enable the persistent naval forward presence that has long been the hallmark of naval forces. Most significantly, EABO reverse the cost imposition that determined adversaries seek to impose on the joint force. EABO guide an apt and appropriate adjustment in future naval force development to obviate the significant investment our adversaries have made in long-range precision fires. Potential adversaries intend to target our forward fixed and vulnerable bases, as well as deep water ports, long runways, large signature platforms, and ships. By developing a new expeditionary naval force structure that is not dependent on concentrated, vulnerable, and expensive forward infrastructure and platforms, we will frustrate enemy efforts to separate U.S. Forces from our allies and interests. EABO enable naval forces to partner and persist forward to control and deny contested areas where legacy naval forces cannot be prudently employed without accepting disproportionate risk….

In February of 2019, the Commandant and Chief of Naval Operations co-signed the concept for EABO. The ideas contained in this document are foundational to our future force development efforts and are applicable in multiple scenarios.40

April 2020 Press Report of DOD Assessment on Revised Navy Force-Level Goal

An April 20, 2020, press report stated:

An internal Office of the Secretary of Defense assessment calls for the Navy to cut two aircraft carriers from its fleet, freeze the large surface combatant fleet of destroyers and cruisers around current levels and add dozens of unmanned or lightly manned ships to the inventory, according to documents obtained by Defense News.

The study calls for a fleet of nine carriers, down from the current fleet of 11, and for 65 unmanned or lightly manned surface vessels. The study calls for a surface force of between 80 and 90 large surface combatants, and an increase in the number of small surface combatants—between 55 and 70, which is substantially more than the Navy currently operates.

The assessment is part of an ongoing DoD-wide review of Navy force structure and seem to echo what Defense Secretary Mark Esper has been saying for months: the Defense Department wants to begin de-emphasizing aircraft carriers as the centerpiece of the Navy's force projection and put more emphasis on unmanned technologies that can be more easily sacrificed in a conflict and can achieve their missions more affordably….

There are about 90 cruisers and destroyers in the fleet: the study recommended retaining at least 80 but keeping about as many as the Navy currently operates at the high end.

The Navy's small surface combatant program is essentially the 20 littoral combat ships in commission today, with another 15 under contract, as well as the 20 next-generation frigates, which would get to the minimum number in the assessment of 55 small combatants, with the additional 15 presumably being more frigates.41

Issues for Congress

COVID-19 (Coronavirus) Impact on Shipbuilding Programs, Shipyards, Supplier Firms, and Employees

One issue for Congress concerns the potential impact of the COVID-19 (coronavirus) situation on the execution of Navy (and Coast Guard) shipbuilding programs, on the shipyards and associated supplier firms executing these programs, and the employees of these firms. The potential for the COVID-19 (coronavirus) situation to impact work efforts is not unique to Navy (and Coast Guard) shipbuilding—it is a possibility faced by many if not all DOD contractors.42 The discussion in this report focuses on potential impacts on Navy (and Coast Guard) shipbuilding.43 Aspects of the discussion below might also apply to impacts of the COVID-19 (coronavirus) situation on government-operated and private-sector shipyards that overhaul, repair, and maintain Navy (and Coast Guard) ships, their associated supplier firms, and their employees.

Potential Impact

Operations at shipyards and associated supplier firms could be affected by the COVID-19 (coronavirus) situation if employees remain home rather than report to work because they are ill with or have tested positive for the virus, are remaining home to maintain social distancing, are taking care of children who have been sent home from school, or are taking care of family members who have become ill from the virus. Impacts on operations at shipbuilding supplier firms could affect operations at the shipyards, even if staffing at the shipyards themselves is not substantially affected, due to reduced or delayed deliveries to the shipyards of supplier-provided components and materials.44

Delays in building ships and fabricating their components could put shipyards and supplier firms at risk of not being able to meet their contractual obligations, which in turn could affect their financial situations unless the government were to provide relief. Shipyard and supplier-firm employees who report to work could face a risk of exposure to the virus, while those who are sent home by their employer could face a loss of income for a period lasting weeks or months.

Although all U.S. Navy (and Coast Guard) shipbuilding programs could be affected, one shipbuilding program of potential particular note in this connection is Columbia-class ballistic missile submarine program, due to the program's high priority (it is the Navy's top program priority), the program's tight schedule for designing and building the lead boat in time for the boat to be ready to conduct its scheduled first strategic nuclear deterrent patrol in 2031, and the potential consequences for the nation's strategic nuclear deterrent posture if the lead boat is not ready in time to conduct that patrol. The COVID-19 (coronavirus) risk to the schedule for designing and building the lead boat in the Columbia-class program is discussed in the CRS report on that program.45

Past Examples of Assistance to Shipyards and Supplier Firms

Potential options for Congress for providing assistance to affected shipyards and supplier firms could take various forms. Some past instances of assistance relating to shipbuilding include the following:

- Following Hurricane Katrina in August 2005, Congress provided $1.7 billion in reallocated emergency supplemental appropriations to pay estimated higher shipbuilding costs for 11 Navy ships under construction at the Ingalls shipyard in Pascagoula, MS, and the Avondale shipyard upriver from New Orleans, LA.46

- The American Recovery and Reinvestment Act (ARRA) of 2009 (H.R. 1/P.L. 111-5 of February 17, 2009), which was enacted in response to the 2008-2009 recession, appropriated $100 million for the Maritime Administration (MARAD) to be used for making supplemental grants to small shipyards as authorized under Section 3508 of the Duncan Hunter National Defense Authorization Act for Fiscal Year 2009 (S. 3001/P.L. 110-417 of October 14, 2008) or 46 U.S.C. 54101.47

- Following Hurricane Michael in October 2018, the Department of Homeland Security (DHS), of which the Coast Guard is a part, announced on October 11, 2019, that DHS had granted extraordinary contractual relief to Eastern Shipbuilding Group (ESG) of Panama City, FL, the builder of the first of the Coast Guard's new Offshore Patrol Cutters (OPCs), under P.L. 85-804 as amended (50 U.S.C. 1431-1435). P.L. 85-804, originally enacted in 1958, authorizes certain federal agencies to provide certain types of extraordinary relief to contractors who are encountering difficulties in the performance of federal contracts or subcontracts relating to national defense.48 ESG reportedly submitted a request for extraordinary relief on June 30, 2019, after ESG's shipbuilding facilities were damaged by Hurricane Michael.49

The past instances listed above do not necessarily represent the full range of options available to Congress for assisting shipyards and supplier firms—additional options might be available through the Defense Production Act (DPA) or other federal authorities.50

Potential Oversight Questions

Potential oversight questions for Congress include the following:

- How might the COVID-19 (coronavirus) situation affect the execution of Navy (and Coast Guard) shipbuilding programs, the shipyards and associated supplier firms executing these programs, and the employees of these firms?

- How well do Navy (and Coast Guard) officials understand these potential impacts?

- What are Navy (and Coast Guard) officials doing to anticipate, monitor, and respond to this situation?

- Does Congress have adequate visibility into the impact of the COVID-19 (coronavirus) situation on the execution of Navy (and Coast Guard) shipbuilding programs, the shipyards and associated supplier firms executing these programs, and the employees of these firms? Are the Navy and industry doing enough to brief and keep Congress up to date on the situation?

Additional Background Information

For additional background information on the potential impact of the COVID-19 (coronavirus) situation on the execution of Navy (and Coast Guard) shipbuilding programs, on the shipyards and associated supplier firms executing these programs, and the employees of these firms, see Appendix J (which presents the texts of letters from Members of Congress) and Appendix K (which presents DOD and Navy memoranda and excerpts from press reports).

COVID-19 (Coronavirus) Impact on U.S. Defense Strategy and Budgets

Another potential oversight issue for Congress is how the COVID-19 (coronavirus) situation could affect future U.S. defense strategy and budgets, and consequently Navy planning for future fleet size and architecture. As discussed in another CRS report,51 some (but not all) observers argue that the COVID-19 pandemic could lead to a revised definition of U.S. national security that is less military-centric than traditional definitions, and that the substantial federal expenditures being made to support the U.S. economy during the pandemic stay-at-home period, and the effect that these expenditures will have on the federal budget deficit and U.S. debt, could lead to greater constraints in coming years on U.S. defense spending levels.

Such changes, some (but not all) observers argue, could lead to potentially significant changes in U.S. defense strategy and in funding levels for the Navy, which in turn could lead to changes in Navy force-level goals and associated shipbuilding programs that in theory could go beyond (or take Navy planning in a direction different from) those contemplated in the INFSA.

FY2021 Budget's Treatment of CVN-81, LPD-31, and LHA-9 Procurement Dates

A potentially significant institutional issue for Congress concerns the treatment in the Navy's proposed FY2021 budget of the procurement dates of the aircraft carrier CVN-81 and the amphibious ships LPD-31 and LHA-9.