Since the U.S. Small Business Administration's (SBA's) creation in 1953, the SBA Disaster Loan Program has provided low-interest disaster loans to businesses to help them repair, rebuild, and recover from federally declared disasters.1 SBA business disaster loans fall into two categories: (1) Economic Injury Disaster Loans (EIDL), and (2) business physical disaster loans.

EIDLs provide up to $2 million for working capital to help small businesses meet financial obligations and operating expenses that could have been met had the disaster not occurred. Loan amounts for EIDLs are based on actual economic injury and financial needs, regardless of whether the business suffered any property damage.

Business physical disaster loans provide up to $2 million to businesses of all sizes to repair or replace damaged physical property, including machinery, equipment, fixtures, inventory, and leasehold improvements that are not covered by insurance. In addition to repairing and replacing damaged physical property, a portion of the loans can also be applied toward mitigation measures, including grading or contouring land, installing sewer backflow valves, relocating or elevating utilities or mechanical equipment, building retaining walls, and building safe rooms or similar structures designed to protect occupants from natural disasters. The limits on post-disaster mitigation loans are the lesser of either the measure or 20% of the verified loss.

An important aspect of the SBA Disaster Loan Program is that a business must already be damaged and be located in a federally declared disaster area to apply a portion of its disaster loan toward mitigation measures. As will be discussed in this report, Congress experimented with business pre-disaster mitigation (PDM) through a pilot program operated by the SBA from FY2000 to FY2006.

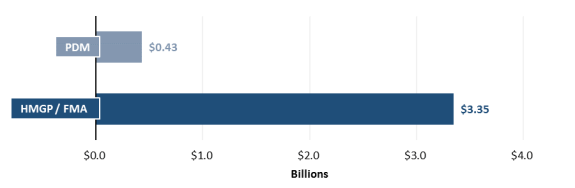

Providing mitigation assistance to businesses after a disaster is arguably consistent with the mitigation policies of other federal programs. For example, the Federal Emergency Management Agency (FEMA) provides both pre-disaster and post-disaster mitigation grants to states and localities, but post-disaster mitigation grants are substantially larger than pre-disaster grants. For example, from FY2014 to FY2018, $3.35 billion was spent on post-disaster mitigation grants through FEMA's Hazard Mitigation Grant Program (HMGP) and Fire Management Assistance Grants (FMAGs). In contrast, during the same period, $430 million was spent on FEMA's Pre-Disaster Mitigation (PDM) program (see Figure 1).2

|

Figure 1. FEMA Pre-Disaster Mitigation Funding and Post-Disaster Mitigation Funding FY2014-FY2018 |

|

|

Source: Data obtained from FEMA, Data Feeds, https://www.fema.gov/data-feeds. Notes: PDM denotes FEMA's Pre-Disaster Mitigation Program. HMGP denotes FEMA's Hazard Mitigation Grant Program. FMA denotes fire management assistance provided by FEMA's Fire Management Assistance Grants. |

Funding for pre-disaster mitigation, however, may increase with the enactment of the Disaster Recovery Reform Act of 2018 (DRRA, Division D of P.L. 115-254).3 Section 1234 of DRRA authorized the National Public Infrastructure Pre-Disaster Mitigation Fund (NPIPDM), which allows the President to set aside 6% from the Disaster Relief Fund (DRF) with respect to each declared major disaster under the Robert T. Stafford Disaster Relief and Emergency Assistance Act (Stafford Act, P.L. 93-288, as amended; 42 U.S.C. §§5121 et seq.).4 This 6% "set aside" is the aggregate amount funded by the following sections of the Stafford Act:

- 403 (essential assistance);

- 406 (repair, restoration, and replacement of damaged facilities);

- 407 (debris removal);

- 408 (federal assistance to individuals and households);

- 410 (unemployment assistance);

- 416 (crisis counseling assistance and training); and

- 428 (public assistance program alternative procedures).

Although post-disaster and pre-disaster mitigation are not mutually exclusive, there are reasons why one may be favored over the other. The following section provides the underlying rationale for the two approaches to mitigation.

Rationale for Post-Disaster vs. Pre-Disaster Mitigation

Over the years, scholars, researchers, and policymakers have debated whether mitigation is more effective before or after an incident. The following sections list the rationales for each approach.

Post-Disaster Mitigation

The underlying rationales for providing post-disaster mitigation include

- incidents such as floods and hurricanes are known to recur in the same areas. Post-disaster mitigation targets those areas to protect them from future disasters;

- post-disaster mitigation helps ensure that the opportunity to take mitigation measures to reduce the loss of life and property from disasters is not lost during the reconstruction process following a disaster;

- the recovery phase of an incident may be the most ideal time to introduce new structural changes because damaged structures are already in the process of being replaced and rebuilt;

- post-disaster mitigation can be used to support a "build back better" approach to avoid or reduce future disaster damages;

- providing mitigation funding after an incident is programmatically easier to administer because the grants are concomitant with a federally declared incident. In contrast, pre-disaster projects have generally been awarded on a competitive basis—each application must be scrutinized and prioritized over other applications; and

- policymakers may find it difficult to justify or defend expenditures for incidents that may not occur for long periods of time (or never occur). This may be particularly true during periods of heightened concern over the federal budget.

Pre-Disaster Mitigation

Others may argue that mitigation is more effective when implemented before rather than after an incident. The rationales for pre-disaster mitigation include

- post-disaster mitigation may fail to address vulnerable areas that have not had a major disaster declaration; and

- studies indicate that mitigation can significantly reduce recovery costs. For example, a study published by the National Institute of Building Sciences found that for every $1 that FEMA spent on mitigation grants, there is a $6 dollar return of avoided losses in the future.5 Those savings, however, cannot be calculated until there are subsequent disasters.

SBA Pre-Disaster Mitigation Loan Pilot Program

Based on findings similar to the one issued by the National Institute of Building Sciences,6 Congress in 1999 passed P.L. 106-24 which amended the Small Business Act7 to include a Pre-Disaster Mitigation (PDM) pilot program. The program authorized SBA to make low-interest (4% or less) fixed-rate loans of no more than $50,000 per year to small businesses to implement mitigation measures designed to protect small businesses from future disaster-related damage. Section 1(a) of P.L. 106-24 authorized the SBA

during fiscal years 2000 through 2004, to establish a predisaster mitigation program to make such loans (either directly or in cooperation with banks or other lending institutions through agreements to participate on an immediate or deferred (guaranteed) basis), as the Administrator may determine to be necessary or appropriate, to enable small businesses to use mitigation techniques in support of a formal mitigation program established by the Federal Emergency Management Agency, except that no loan or guarantee may be extended to a small business under this subparagraph unless the Administration finds that the small business is otherwise unable to obtain credit for the purposes described in this subparagraph.

The SBA PDM pilot program was developed in support of "Project Impact," a new FEMA mitigation program that emphasized disaster prevention rather than solely relying on response and recovery activities.8 Similarly, SBA PDM loans were intended to lessen or prevent future damages to businesses. According to the House report on H.R. 818 (the companion bill to S. 388, which became P.L. 106-24)

The cost of disaster assistance has risen over the past several years due to increases in construction and other costs. By implementing a program to help small businesses use techniques that would lessen damage in the event of natural disasters the possibility exists to save millions of dollars in potential losses.9

The report also stated that

the Administrator of the Small Business Administration, testified concerning the SBA's request for $934 million dollars in disaster loans for anticipated damage in the coming year. She also discussed FEMA and SBA's current efforts at mitigation and stated that FEMA estimates a $2 saving for every $1 spent on mitigation. The Administrator expressed strong support for H.R. 818.10

Section 1(c) of P.L. 106-24 required the SBA Administrator to submit a report to Congress on the effectiveness of the pilot program. The report required information and analysis on

- the areas served under the pilot program;

- the number and dollar value of loans made under the pilot program;

- the estimated savings to the federal government resulting from the pilot program; and

- other relevant information as the Administrator determines to be appropriate for evaluating the pilot program.

Congress initially authorized appropriations of $15 million each fiscal year to carry out the PDM pilot program for FY2000 through FY2004.11 Congress later extended the program until the end of FY2006 and authorized an additional $15 million for the program in FY2005 and $15 million in FY2006.12 Since its expiration at the end of FY2006, many Members have discussed the possibility of reauthorizing the PDM pilot program.

SBA PDM Pilot Program Performance

According to SBA, four loans were approved during the SBA PDM pilot program, with a total gross approval amount of $101,400 (a small fraction compared to the $105 million Congress authorized to be appropriated to the program over the seven-year period of its existence). Two of the loans defaulted and the other two loans (amounting to $52,400) were repaid in full.13

As mentioned previously, Section 1(c) of P.L. 106-24 required the SBA Administrator to submit a report to Congress on the effectiveness of the pilot program, including the areas served and dollar amounts provided under the program, estimated savings resulting from the SBA PDM pilot program, and other relevant information. A CRS search of databases could not locate the required report on the effectiveness of the pilot program and the SBA could not verify whether the report was ever submitted.14

The following sections describe the possible reasons for the lack of participation in the SBA PDM pilot program.

Challenges to the Success of the SBA PDM Pilot Program

The limited number of businesses that participated in the SBA PDM pilot program may be attributable to its alignment with FEMA programs. Aligning the two programs may have (1) limited the time frame to obtain a PDM loan, and (2) limited the number of businesses eligible for PDM loans. Additionally, businesses may not have been aware that pre-disaster loans were being made available through the SBA PDM pilot program.

Limited Time Frame

The SBA PDM pilot loan program was created in conjunction with FEMA's pre-disaster mitigation program, dubbed Project Impact. Because the two programs were aligned, the time frame in which businesses could apply for PDM loans was limited by a series of delays in the implementation of the FEMA program. That may help explain, in part, why so few businesses obtained SBA PDM loans.

According to SBA, the PDM program rules were effective as of October 1, 1999.15 However, communities could not apply to be accepted as a pre-disaster mitigation eligible community because FEMA had not yet implemented Project Impact.16 Project Impact's implementation was further delayed "pending appropriations in the FY2002 Departments of Veterans Affairs, Housing and Urban Development and Independent Agencies Appropriations Act."17 On November 26, 2001, the appropriations act provided $25 million to FEMA for its pre-disaster mitigation grant program. Upon receiving the appropriation, FEMA decided to reevaluate and revamp Project Impact before its full implementation—further delaying the program. Once Project Impact was implemented, SBA revised rules (some in response to FEMA comments) concerning the SBA PDM pilot program before it was put into effect (see Appendix for additional information on both Project Impact and the SBA PDM pilot program).18

The sequence of events described above shortened the timeframe for applying for PDM loans. A CRS search of the Federal Register indicates that PDM loans first became available July 16, 2003.19

Limited Number of Eligible Applicants

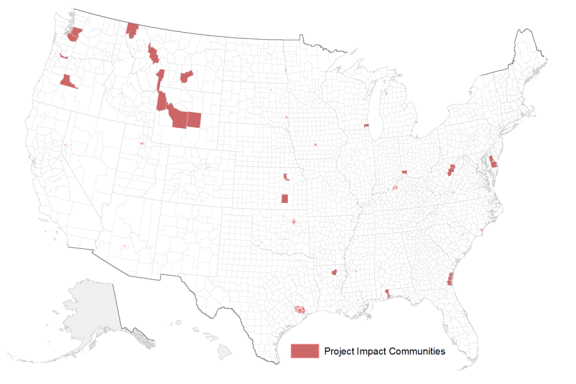

The Project Impact requirement significantly reduced the number of businesses eligible for the SBA PDM pilot program. The SBA PDM pilot program was intended to complement Project Impact by participating in the "whole of community approach" to disaster mitigation; SBA PDM loan eligibility was contingent on whether the business was located in a Project Impact community. The Project Impact requirement may have unintentionally limited the number of businesses eligible for PDM disaster loans. As demonstrated in Figure 2, few communities participated in the Project Impact program. There may have been businesses in "non-Project Impact" areas that wanted SBA PDM loans but were ineligible because of the Project Impact requirement.

|

|

Source: Based on CRS interpretation of data provided by the Federal Emergency Management Agency. |

Further limiting participation, businesses that were in Project Impact communities but not in a Special Flood Hazard Area (SFHA) were not eligible for an SBA PDM loan if it was for flood prevention measures.

Finally, though the SBA PDM loan pilot program continued until FY2006, Project Impact was replaced by the Pre-Disaster Mitigation (PDM) program in FY2002. According to then-FEMA Director Joe M. Allbaugh:

I want to take the "concept" of Project Impact and fold it in to the program of mitigation. Project Impact is not mitigation. It is an initiative to get "consumer buy-in." In many communities it became the catch-phrase to get local leaders together to look at ways to do mitigation.20

The PDM program does not designate participating communities. Rather, state and local governments submit mitigation planning and project applications to FEMA. Once FEMA reviews the application for eligibility and completeness, FEMA makes funding decisions "based on the agency's priorities for the most effective use of grant funds and the availability of funds posted in the Notice of Funds Opportunity announcement."21

Eligibility requirements for the SBA PDM loan pilot program were not changed to reflect the new FEMA PDM program. It is unclear what effect this may have had on the SBA PDM loan pilot program.

Outreach and Notifications

As mentioned previously, SBA published notices in the Federal Register announcing the availability of pre-disaster mitigation loans. The notice designated a 30-day application filing period with a specific opening date and filing deadline, as well as the locations for obtaining and filling applications. In addition to the Federal Register notification, SBA coordinated with FEMA to issue press releases to inform potential applicants of the loan program. It is unclear, however, how effective these efforts were at letting businesses know PDM loans were available.

Considerations for Congress and Policy Options

Reauthorizing the SBA PDM Pilot Program

The following considerations may help increase business participation should Congress decide to reauthorize the SBA PDM pilot program.

First, implementation delays and eligibility restrictions, such as the ones described above, may not be an issue if Congress reauthorized the SBA PDM pilot program, because the pilot would no longer need to be tied to Project Impact. If Congress should desire that the program align with or support FEMA mitigation efforts, Congress may consider tying a reauthorized SBA PDM loan program to FEMA's Pre-Disaster Mitigation program, or, instead, making them available to all small U.S. domestic businesses.22

Second, if the SBA PDM pilot program were to be reauthorized, one option available to address outreach would be to require SBA to spend a portion of the PDM loan appropriation money on outreach, including advertising to educate businesses on the importance of mitigation to protect their investment from being damaged or destroyed by a disaster, and to help businesses become aware that PDM loans are available. Additionally, SBA could be required to provide information to Congress concerning its efforts to make businesses aware of the program, including where they could apply for a PDM loan.

Further, as mentioned previously, Section 1(c) of P.L. 106-24 required the SBA Administrator to submit a report to Congress on the effectiveness of the pilot program. The report required information and analysis on:

- the areas served under the pilot program;

- the number and dollar value of loans made under the pilot program;

- the estimated savings to the federal government resulting from the pilot program; and

- other relevant information as the Administrator determines to be appropriate for evaluating the pilot program.

If Congress reauthorized the SBA PDM pilot program, it could consider requiring SBA to provide similar information. Additionally, Congress could tie the report to appropriations to communicate legislative intent to carry out the reporting measure once it becomes law. Although report language itself is not law and thus not binding in the same manner as language in statute, agencies usually seek to comply with the directives contained therein.23 According to one congressional scholar, "the criticisms and suggestions carried in the reports accompanying each bill are expected to influence the subsequent behavior of the agency. Committee reports are not the law, but it is expected that they be regarded almost as seriously."24

Restructuring Existing Business Physical Disaster Loans

As mentioned previously, the limits on post-disaster mitigation loans are the lesser of either the measure or 20% of the verified loss. If Congress wanted to encourage mitigation, one option would be to consider increasing this percentage to a higher amount in addition to, or instead of, reauthorizing the SBA PDM loan program. Congress could also consider doing the same for home physical disaster loans.

Assistance with Continuity and Disaster Response Plans

Research indicates that many businesses do not have contingency or disaster recovery plans. For example, a survey of Certified Public Accounting (CPA) firms located on Staten Island, NY, indicated that 7% of the respondents had a formal continuity or disaster recovery plan in place prior to Hurricane Sandy. The survey found that nearly 42% of those firms that had a formal continuity or disaster recovery plan admitted that they never tested their plan. Approximately 40% had an informal plan that had been discussed but not documented. More than half of the responding firms did not have a contingency or disaster recovery plan. Of those that did not have any type of a plan, 60% thought the plans were unnecessary and 20% said that establishing a plan was too time-consuming.25

Congress could investigate methods that would incentivize businesses to develop contingency and disaster recovery plans. This could be done through new programs or through existing ones, such as FEMA's Ready Business Program or through SBA's emergency preparedness efforts. The Ready Business Program is designed to help businesses plan and prepare for disasters by providing businesses various online toolkits that can help them identify their risks and develop a plan to address those risks.26 The SBA provides a range of resources to help businesses develop plans to protect employees, reduce the financial impact of a disaster, and reopen the business more quickly.27

Pre-Disaster Mitigation Loans for Homeowners

In addition to disaster loans for businesses, SBA also provides disaster loans to homeowners. In fact, roughly 80% of SBA disaster assistance goes to individuals and households rather than businesses. Homeowners located in a declared disaster area (and in contiguous counties) may apply to SBA for loans up to $200,000 to help repair and rebuild their primary residence. Similar to businesses, only damaged homes in declared disaster areas are eligible for disaster loans. According to regulations 20% "of the verified loss (not including refinancing or malfeasance), before deduction of compensation from other sources, up to a maximum of $200,000 for post-disaster mitigation."28 Homeowners seeking mitigation assistance before a disaster strikes, however, must look to other sources for the assistance.

In addition to mitigation measures, such as retrofitting structures, contouring land, and relocating utilities, Section 4 of the Recovery Improvements for Small Entities After Disaster Act of 2015 (RISE Act, P.L. 115-88) allows homeowners to use a portion of their physical damage disaster loans for the construction of safe rooms or similar storm shelters designed to protect property and occupants from tornadoes or other natural disasters. Some homeowners may wish to build a safe room or storm shelter before a disaster. If that is the case, they may be interested in a pre-disaster mitigation loan to fund its construction. Homeowners may also be interested in other pre-disaster mitigation measures. The SBA PDM pilot program, however, only provided pre-disaster loans to businesses. If reauthorized, Congress could consider expanding the program by making pre-disaster loans available to homeowners. In addition to making the program available to homeowners, Congress could consider making home pre-disaster mitigation loans contingent on homeowners insurance. This could help protect the home from future disasters and have the additional benefit of making sure that the homeowner has adequate insurance to repair and rebuild their home without additional federal assistance.

Concluding Observations

For nearly a century, Congress has contemplated how to help businesses repair and rebuild after a disaster and protect their investments from future incidents. Though businesses can use a portion of their SBA disaster loans for mitigation measures, critics might question why only damaged businesses are eligible for disaster loans. The SBA's PDM pilot program addressed this criticism, but the program had few participants. As described in this report, the lack of participation could have been a result of its alignment with FEMA programs related to delays in the implementation of FEMA's Project Impact, eligibility limitations, and the number of businesses that were aware that the program was available. If Congress were to reauthorize the SBA PDM pilot program, among the policy options available are decoupling the PDM loan program from FEMA programs and requiring enhanced advertising and outreach efforts. Another option would be to restructure business physical disaster loans so that a greater portion of the loan can be used for mitigation. Finally, Congress could examine methods that would help businesses develop business continuity and disaster response plans.

Businesses may be more receptive to pre-disaster mitigation loans as a result of the large-scale disasters that have occurred since 2005. Prior to Hurricane Katrina, the salience of disaster issues generally, and mitigation specifically, may have been on the periphery of business concerns. While there were some large-scale disasters, the scope of those disasters tended to be regional rather than national. Furthermore, the focus of emergency management during that time was arguably more oriented toward terrorism concerns resulting from the 9/11 attacks. Consequently, the need to mitigate against future disasters may have been just one concern coequal with other, competing concerns. The policy environment may have changed as a result of hurricanes Katrina, Harvey, Irma, Maria, and Michael. These disasters, in addition to increasing concerns about the impact of climate change on the frequency and severity of disasters, may make businesses more amenable to the idea of pre-disaster mitigation loans to protect their investment from future disasters.

Appendix. Project Impact and SBA PDM Pilot Loan Program Information

Project Impact

P.L. 104-20429 established a mitigation program (which FEMA named Project Impact) to help communities make mitigation investments prior to disasters to reduce their vulnerability to future disasters. The program was based on a "whole of community" approach involving all sectors of the nation. According to the House report on the bill:

The conferees agree that up to $5,000,000 of the amount provided for pre-disaster mitigation is available immediately to fund up to seven pilot projects approved by the Director of FEMA. Prior to the expenditure of the remaining funds for any specific pre-disaster mitigation program or project, the conferees direct that the appropriate level of funding be used by the Agency to conduct a formal needs-based analysis and cost/benefit study of all of the various mitigation alternatives. The results of these analyses and studies, along with any relevant information learned from the aforementioned seven pilot projects, shall be incorporated into a comprehensive, long-term National Pre-disaster Mitigation Plan. The plan should be developed, independently peer-reviewed, and submitted to the Committees on Appropriations not later than March 31, 1998. FEMA is directed to involve in this planning effort participants which shall include, but are not limited to, representatives of FEMA and other federal agencies, state and local governments, industry, universities, professional societies, the National Academy of Sciences, The Partnership for Natural Disaster Reduction, and [Centers for Protection Against Natural Disasters] CPAND. The conferees intend that none of the remaining funds provided herein be obligated until the plan has been completed and submitted as outlined above. The conferees note that this approach is intended to be the foundation for providing the best and most cost-effective solution to reduce the tremendous human and financial costs associated with natural disasters.30

Project Impact was designed to serve as a model for promoting mainstream emergency management and mitigation practices into every community in America. The program asked communities to identify risks and establish plans to reduce those risks. It also asked communities to establish partnerships with community stakeholders, including the business sector.31

Primary Tenets of Project Impact

- mitigation is a local issue that is best addressed through local partnerships involving the government, business, and citizens;

- the participation of the private sector is essential because disasters threaten the economic and commercial growth of communities; and

- mitigation consists of long-term efforts and requires long-investments.32

Methodology

- members of the community, including elected officials, local, state, and federal disaster personnel, business representatives, environmental groups, and citizens, joined together to form a Disaster Resistant Community Planning Committee that (1) examined risks hazards and identified vulnerabilities to them; (2) prioritized risk reduction actions based on the hazard identification and vulnerability assessment; and (3) communicated its findings and mitigation plan to other community leaders and residents.33

Project Impact Grants

Project Impact grants were largely used to fund planning and outreach activities. The Project Impact grants could be used to fund costs associated with

- logistics and meetings, staff support, and travel to meetings with the community or to FEMA Project Impact meetings;

- training including costs to train state officials supporting Project Impact and to develop training packages for state and local officials;

- travel of local community officials to other communities, state meetings, or national conferences at state request to share Project Impact information;

- state costs in information development and dissemination to support Project Impact; and

- expert, short-term technical assistance support to Project Impact communities.34

According to a Government Accountability Office (GAO) report, state and local officials said that Project Impact has been successful in increasing awareness of and community support for mitigation efforts due to its funding of these types of activities.35 The same GAO report stated

During fiscal years 1997 through 2001, Project Impact provided a total of $77 million to communities within every state and certain U.S. territories. Unlike the HMGP, the amount of Project Impact funding available to communities within a state was not predicated upon the occurrence of a disaster; in fact, the program was structured so that under its funding formula, communities in every state participated in the program. By 2001, there were nearly 250 communities participating in the program, with Project Impact communities receiving grants between $60,000 and $1,000,000. Appendix III lists Project Impact grants by year and community. While states selected which communities received Project Impact grants, communities were responsible for selecting the mitigation measures to fund with these grants. Similar to the HMGP, however, communities were required to provide 25 percent of the costs for the mitigation measures.36

The George W. Bush Administration eliminated Project Impact from the FY2002 budget and FEMA rebranded Project Impact as the Pre-Disaster Mitigation (PDM) program. The PDM program retained some of Project Impact's themes, but placed the responsibility on the governor of each state to suggest up to five communities to be considered for pre-disaster mitigation assistance.37 While the governor nominated potential grantees, FEMA made the final selections. In addition, under the statute, FEMA had the discretion under "extraordinary circumstances" to award a grant to a local government that had not been recommended by a governor.38

Loan Application

SBA published notices in the Federal Register announcing the availability of pre-disaster mitigation loans in 2003.39 The notice designated a 30-day application filing period with specific opening dates and filing deadlines, as well as the locations for obtaining and filing applications. In additional to the Federal Register notification, SBA coordinated with FEMA to issue press releases to inform potential applicants of the loan program.

Businesses were required to submit a Pre-Disaster Mitigation Small Business Loan Application to SBA during the filing period. Applications had to include a written statement from the state or local coordinator confirming that the mitigation project was (1) located in a Project Impact community, and (2) in accordance with the specific priorities and goals of the community participating in the pre-disaster mitigation community.40 The completed application served as the loan request. Loans were provided on a first-come, first-served basis until SBA allocated all program funds.

If SBA declined a loan request, SBA notified the business in writing with the rationale for the denial. SBA also advised the business of the procedures to request reconsideration of the decision.

The SBA PDM pilot program provided businesses up to $50,000 per fiscal year to finance mitigation measures to protect commercial property, leasehold improvements, or contents from disaster-related damages that could occur in the future. Mitigation loans could also be used to relocate the business.41 Interest rates for the loans had a statutory ceiling set at 4% per annum.42

Businesses applying for SBA PDM loans had to meet certain criteria to be eligible for mitigation loans. Two, in particular, were designed to tie the SBA PDM pilot program to FEMA programs. First, as already noted, the business had to be located in a participating Project Impact community; and, second, if the mitigation measures were designed specifically to protect against flooding, the business had to be located in a Special Flood Hazard Area (SFHA).43

Additional criteria for loan eligibility required that

- the business and its affiliates lack the financial resources to fund the mitigation measures without undue hardship;44

- the business be a small business as defined by SBA regulations;45

- the business be in operation in the same location for at least one year;46 and

- the mitigation loan had to be used for the protection of a building leased primarily for commercial rather than residential purposes, if the business leased out real property.47

Businesses were not eligible for the SBA PDM Loan Program if the business: