Rapid growth in leveraged lending, a relatively complex form of credit, in the current economic expansion has raised concerns with some policymakers because they have noted similarities between leveraged lending and mortgage lending and mortgage-backed securities (MBS) markets in the lead-up to the 2007-2009 financial crisis. This report explains how leveraged lending works; identifies the borrowers, lenders, and investors who participate in the market; and examines the characteristics of a leveraged loan. It then explains the characteristics of collateralized loan obligations (CLOs)—securities backed by cash flow from pools of leveraged loans—and their investors. Understanding CLOs is crucial to a discussion of the policy issues surrounding leveraged lending because more than 60% of investment in leveraged lending occurs through CLOs. The report also provides data on trends and investor composition. Once these basics are explained, the report explores the regulation of—and some of the potential risks posed by—leveraged lending and CLOs. Finally, it discusses how policymakers have addressed leveraged lending issues to date.

What Is Leveraged Lending?

Put simply, leveraged lending refers to loans to companies that are highly indebted (in financial jargon, highly leveraged). Conceptually, a leveraged loan is understood to be a relatively high-risk loan made to a corporate borrower, but there is no consensus definition of leveraged lending for measurement purposes.1 Instead, different observers or industry groups use various working definitions that may refer to the borrower's corporate credit rating2 or a ratio of the company's debt to some measure of its ability to repay that debt, such as earnings or net worth.3 Because they are high risk, leveraged loans typically have relatively high interest rates, and thus offer higher potential returns for lenders.4

Who Are the Borrowers?

Leveraged loans are made to companies from all industries, and the concentration of leveraged lending in each industry varies over time based on industries' economic conditions. In the second quarter of 2018, healthcare and service were the top two industries using leveraged lending.5 Leveraged loans are often used to complete a buyout or merger, restructure a company's balance sheet (by buying back shares, for example), or refinance existing debt.6

Who Are the Lenders?

Several types of institutions provide funds to borrowers in leveraged lending, including banks, insurance companies, pension funds, mutual funds, hedge funds, and other private investment funds. Put simply, those institutions are the lenders. However, this concise explanation does not capture certain important characteristics and dynamics within the leveraged lending market.

The institution that originates a leveraged loan rarely, if ever, subsequently holds the loan entirely on its own balance sheet, because a lender often would be wary of taking on a large exposure to a single highly indebted company. Instead, the originating lender typically will either (1) partner with colenders, (2) sell pieces of a single loan to investors, or (3) bundle part or all of the loan into a pool of other leveraged loans in a process called securitization, then sell pieces of the pool to investors. The first two options—referred to as syndication and participation, respectively—are described in more detail below. The third option creates securities called collateralized loan obligations (CLOs), which are described in more detail in the "What Are CLOs?" section. When examining statistics or regulations related to leveraged loans, this report will distinguish between institutions that issue (i.e., originate or create) leveraged loans and institutions that hold (i.e., invest in or purchase pieces of) leveraged loans or CLOs.

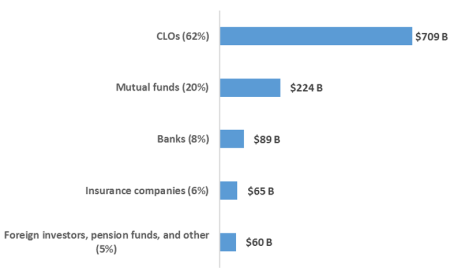

One notable recent trend is the migration of activity from the banking sector to the nonbank sector. Historically, banks played a primary role in both issuing and holding leveraged loans. However, in recent decades, nonbank credit investors, such as private investment funds and finance companies,7 have increasingly overtaken market share.8 As shown in Figure 1, in the primary market, where leveraged loans are first created, bank financing has fallen from about 70% in the mid-1990s to below 10% in 2018, whereas all other nonbank financing combined now comprises more than 90% of leveraged loan investments.9 As discussed below, this migration of activity from the banking industry to nonbank institutions has implications for systemic risk and how leveraged loans are regulated.

|

Figure 1. U.S. Leveraged Loan Investor Base (1994-2018) (Percentage of primary market issuance) |

|

|

Source: International Monetary Fund (IMF). |

What Are Loan Syndication and Participation?

In general, a single lender does not want to hold a whole leveraged loan because such loans are large and risky. Instead, lenders typically use economically similar but contractually different arrangements—syndication and participation—to divide the loan among multiple lenders. Under both arrangements, multiple lenders provide a portion of the loan's funding and share in its risk and returns.

The contractual relationship between the parties differs in syndications and participations. In a syndicated loan, the borrower enters into a single loan agreement with multiple lenders. Hence, all lenders have a direct contractual relationship with the borrower.10 Alternatively, a single lender could enter into the loan agreement with the borrower, and this originating lender could then sell portions of the loan, called participations, to other lenders. In this case, the borrower has a direct contractual relationship with the originating lender, who in turn has contractual relationships with the other participants.11 In either case, the loan has in effect been split up between multiple lenders, even though the particulars of the various parties' contractual rights and responsibilities differ.

Syndication and participation require a relatively high degree of coordination among various institutions and stakeholders, and industry practice is that one company acts as an arranger of the deal. The arranger gathers information about the borrower and the loan's purpose, determines appropriate pricing and loan terms, and brings together lenders to join a loan syndication or buy participations. After the deal is closed, the arranger or another company acts as the loan's agent by collecting the payments and fees and passing the appropriate amounts to the loan's holders. The arranger and agent collect fees for these services.12

Traditionally, arrangers and agents were banks, who would also hold a large portion of the loan, and the colenders were also banks. Since the mid-1990s, colenders have increasingly been nonbank lenders, such as finance companies and private investment funds, and the portions of loans held by banks have decreased. In some cases, nonbank lenders have taken on the arranger and agent roles.13 How syndications and participations are regulated is covered in "How Are Leveraged Loans Regulated?"

What Are Covenants and Covenant-Lite Loans?

Leveraged loan agreements typically include covenants—provisions in the loan contract that set conditions the borrower must meet to avoid technical default (as opposed to a payment default, wherein a scheduled payment is missed). Often these conditions relate to indications of the borrower's ability to repay the loan, such as cash flow and financial performance, or restrict certain actions the borrower may take, such as management changes or asset sales.14 If the borrower violates a covenant, the lender can accelerate or call the loan (possibly forcing the borrower into bankruptcy), but often lenders will instead restructure the loan with stricter terms that may include additional restrictions on the borrower's behavior.15

Lenders see covenants as an important mechanism to monitor the borrower's ability to repay the loan and avoid repayment defaults. Loan agreements that include fewer or more lax covenants than are found in traditional leveraged lending contracts are often characterized as covenant-lite. A number of industry observers have noted that covenant-lite loans are becoming more common, and some have argued this indicates credit standards are declining and could lead to higher losses in the future. However, the causes of the increase in covenant-lite loans and the level of concern this trend warrants are subject to debate.16

What Is the Size of the Leveraged Lending Market, and How Much Has It Grown Recently?

The Federal Reserve states that there were approximately $1.15 trillion of leveraged loans outstanding at the end of 2018.17 For comparison, this amount was similar to U.S. auto loans ($1.16 trillion) or credit card debt ($1.06 trillion) outstanding.18

In recent years, leveraged lending has grown much faster than other categories of credit reported by the Federal Reserve (see Table 1). The $1.15 trillion outstanding was a 20.1% increase from a year earlier—more than four times the growth of overall business credit—and annual growth has averaged 15.8% since 2000. By comparison, student loans outstanding grew 5.3% last year and have averaged 9.7% annual growth since 1997.19

|

Loan Type |

Amount Outstanding |

Growth in 2018 |

Long-Term Average Annual Growth |

|

|

Business Credit |

$15.24 trillion |

3.7% |

5.7% |

|

|

Of which: Leveraged Loans |

$1.15 trillion |

20.1% |

15.8% |

|

|

Bonds and Commercial Paper |

$6.24 trillion |

1.4% |

5.7% |

|

|

Bank Lending |

$1.52 trillion |

11.4% |

3.3% |

|

|

Consumer Credit |

$15.63 trillion |

3.2% |

5.5% |

|

|

Of which: Student Loans |

$1.57 trillion |

5.3% |

9.7% |

|

|

Credit Card Loans |

$1.16 trillion |

3.7% |

5.1% |

|

|

Auto Loans |

$1.06 trillion |

3.1% |

3.5% |

|

Source: Federal Reserve, Financial Stability Report, May 2019, Table 2.

Note: Due to data availability, the growth period is 1997-2018 for student, auto, and credit card loans, and 2000-2018 for leveraged loans.

In part, the rapid growth in leveraged loans reflects growing nonfinancial business indebtedness, but overall nonfinancial business indebtedness grew only about a fifth as quickly as leveraged lending. This suggests that leveraged lending growth may reflect a substitution of one type of debt for another.20

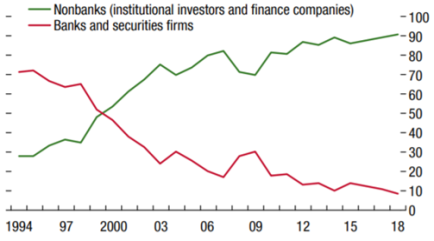

Who Holds Leveraged Loans?

Investors can hold leveraged loans by either (1) investing directly in individual leveraged loans, typically through syndications and participations or (2) investing in CLOs. Institutions that directly hold large shares of outstanding leveraged loans include mutual funds (19%), banks (8%), and insurance companies (6%), as shown in Figure 2.21 According to one study, mutual fund holdings are split fairly evenly between funds offered to institutional investors and funds offered to retail investors.22 Nearly all of the remainder of leveraged loans (62%) are held by CLOs. Portions, or tranches, of CLOs are then sold, largely to the same types of investors that invest directly in leveraged loans. CLOs will be discussed in more detail in the next section. As discussed above, banks' share of funding in the leveraged loan market has exhibited a long-term decline.23

What Are CLOs?

Collateralized loan obligations are securities backed by portfolios of corporate loans.24 Although CLOs can be backed by a pool of any type of business loan, in practice, U.S. CLOs are primarily backed by leveraged loans, according to the Federal Reserve. The outstanding value of U.S. CLOs has grown from around $200 billion at year-end 2006 to $617 billion at year-end 2018.25 As noted above, about 60% of leveraged loans are held in CLOs.

CLOs offer a way for investors to receive cash flows from many loans, instead of being completely exposed to potential payments or defaults on a single loan. To isolate financial risks, CLOs are structured as bankruptcy-remote special purpose vehicles (SPVs) that are separate legal entities. Each CLO has a portfolio manager, who is responsible for constructing the initial portfolio as well as the CLO's ongoing trading activities. CLO managers are primarily banks, investment firms (including hedge funds), and private equity firms.26

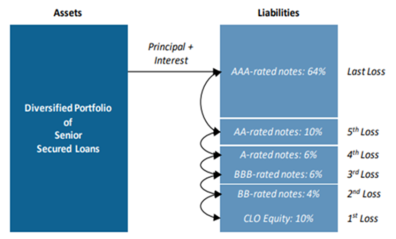

CLOs are sold in separate tranches, which give the holder the right to the payment of cash flow on the underlying loans. The different tranches are assigned different payment priorities, so some will incur losses before others. This tranche structure redistributes the loan portfolios' credit risk. The tranches are often known as senior, mezzanine, and equity tranches, in order from highest to lowest payment priority, credit quality, and credit rating.27 Through this process, the loan portfolio's risks are redistributed to the lower tranches first, and tranches with higher credit ratings are formed.

|

|

Source: Ares Management Corporation, Investing in CLOs, 2019, at http://aresmgmt.com/media/526684/Ares_Investing-in-CLOs-White-Paper_RETAIL_1H-2019.pdf. Note: Hypothetical example for illustration purposes only. |

In general, the financial industry views CLOs' tranched structure as an effective method for providing economic protection against unexpected losses. As Figure 3 illustrates, in the event of default, the lower CLO tranches would incur losses before others. Hence, tranches with higher payment priority have additional protection from losses and receive a higher credit rating. The pricing of the tranches also reflects this difference in asset quality and credit risk, with lower tranches offering potentially higher returns to compensate for greater risks taken.

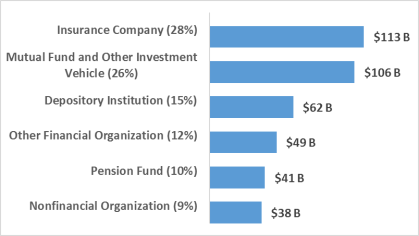

Who Holds CLOs?

CLOs are often sold to institutional investors, including asset managers, banks, insurance companies, and others. The asset management industry, which includes hedge funds and mutual funds, mainly holds the riskier mezzanine and equity tranches, and banks and insurers hold most of the lower-risk senior CLO tranches.28 The Federal Reserve estimated that U.S. investors held approximately $556 billion in CLOs based on U.S. loans at the end of 2018. Of this, an estimated $147 billion in U.S. CLO holdings were issued domestically. Detailed data on domestic CLOs' holders are not available; certain detailed data, however, can be found in the reporting of cross-border financial holdings, which comprise a large majority of U.S. CLOs.29 The cross-border financial reporting indicates that $409 billion of U.S. CLO holdings were issued in the Cayman Islands, apparently the only offshore issuer.30 Figure 4 provides an overview by investor type for domestic holdings of these CLOs.31

|

Figure 4. Domestic Holdings of Cayman-Issued U.S. CLO Securities by Investor Type ($Billions, as of 2018) |

|

|

Source: CRS, following calculations based on Treasury data in Emily Liu and Tim Schmidt-Eisenlohr, "Who Owns U.S. CLO Securities?" at https://www.federalreserve.gov/econres/notes/feds-notes/who-owns-us-clo-securities-20190719.htm. Notes: "Other Financial Organization" includes bank holding companies. "Nonfinancial Organization" includes households. |

Could Leveraged Loans Exacerbate an Economic Downturn?

The rapid growth of leveraged lending has led to concerns that this source of credit could dry up in the next downturn. A slowdown in leveraged loan issuance could pose challenges for the (primarily) nonfinancial companies relying on leveraged loans for financing. Were these firms to lose access to financing, they could be forced to reduce their capital spending, among other operational constraints, if they were unable to find alternative funding sources.32 Capital spending (physical investment) by businesses is typically one of the most cyclical components of the economy, meaning it is highly sensitive to expansions and recessions. Overall borrowing by nonfinancial firms is historically high at present.33 This raises concerns that heavily indebted firms could experience a debt overhang—where high levels of existing debt curtail a firm's ability to take on new debt—in the next downturn. If a debt overhang at nonfinancial firms leads to a larger-than-normal reduction in capital spending or more corporate failures, this might exacerbate the overall downturn.

If a downturn in the leveraged loan market had a negative effect on financial stability, as discussed in the next section, negative effects on the overall economy could be greater.

What Are the Risks Associated with Leveraged Loans and CLOs?

Leveraged loans and CLOs pose potential risks to investors and overall financial stability. Some risks, such as potential unexpected losses for investors, are presented by both leveraged loans and CLOs. Some apply to only one, such as risks posed by securitization presented by CLOs. This section considers the risks posed by both, highlighting differences between the two where applicable.

Risks to investors. Like any financial instrument, leveraged loans and CLOs pose various types of risk to investors. In particular, they pose credit risk—the risk that loans will not be repaid in full (due to default, for example). Credit risk is heightened because the borrowers are typically relatively indebted, have low credit ratings, and, in the case of covenant-lite loans, certain common risk-mitigating protections have been omitted. The ways borrowers often use the funds raised from leveraged loans, such as for leveraged buyouts, can also be high risk. Nevertheless, the overall risk of leveraged loans should not be exaggerated—leveraged loans have historically had lower default rates and higher recovery rates in default than high-yield (junk) bonds, another form of debt issued by financially weaker firms.34 Credit risk is mitigated to a certain degree because leveraged loans are typically secured and their holders stand ahead of the firm's equity holders to be repaid in the event of bankruptcy.35 Furthermore, leveraged loans typically have floating interest rates, so interest rate risk is borne by the borrower, not the investor.

As mentioned in the "What Are CLOs?" section, when leveraged loans are securitized and packaged into CLOs, the credit risk of the original leveraged loans is redistributed by the CLOs' tranched structure, with senior tranches (mostly held by banks and insurers) often receiving the highest credit rating (e.g., AAA) and junior tranches (mostly held by hedge funds and other asset managers) receiving lower credit ratings.36 Subordinated debt and equity positions provide additional protection to the senior tranches. Tranching distributes CLO credit risk differently across investors in different tranches.

Up to this point in the credit cycle, the risks associated with leveraged loans and CLOs have largely not materialized—leveraged loan default rates have been relatively low because of low interest rates and robust business conditions. But some analysts fear that default rates could spike if economic conditions worsen, interest rates rise, or both—and these possibilities may not have been properly priced in. Default rates on leveraged loans rose from below 1% to almost 11% during the last recession.37 An unanticipated spike in default rates would impose unexpected losses on leveraged loan and CLO holders.

Systemic risk. Investment losses associated with changing asset values, by themselves, are routine in financial markets across many types of assets and pose no particular policy concern if investors have the opportunity to make informed decisions. The main policy concern is whether leveraged loans and CLOs pose systemic risk; that is, whether a deterioration in leveraged loans' performance—particularly if it were large and unexpected—could lead to broader financial instability.38 This depends on whether channels exist through which problems with leveraged loans could spill over to cause broader problems in financial markets. Losses on leveraged loans or liquidity problems with leveraged loans could lead to financial instability through various transmission channels discussed below.

During the financial crisis, problems with mortgage-backed securities (MBS) demonstrated how a class of securities can pose systemic risk.39 Similar to CLOs, MBS are complex, opaque securities backed by a pool of underlying assets that are typically tranched, with the senior tranches receiving the highest credit rating. Unexpected declines in housing prices and increases in mortgage default rates revealed that MBS—both highly rated and lowly rated tranches—had been mispriced, with the previous pricing not accurately reflecting the underlying risks. The subsequent repricing led to a cascade of systemic distress in the financial system: liquidity in the secondary market for MBS rapidly declined and fire sales pushed all MBS prices even lower. MBS losses caused certain leveraged and interconnected financial institutions, including banks, investment firms, and insurance companies, to experience capital shortfalls and lose access to the short-term borrowing markets on which they relied. Ultimately, these problems caused financial panic and a broader decline in credit availability as financial institutions deleveraged—reducing new lending activity to restore their capital levels—in response to MBS losses. The resulting reduction in credit in turn caused a sharp decline in real economic activity.

CLOs today share some similarities with MBS before the crisis, but there are important differences. Similarities include the rapid growth in available credit and erosion of underwriting standards. Both types of securities are relatively complex and opaque, potentially obfuscating the underlying assets' true risks. Outstanding leveraged loans and CLOs are small relative to overall securities markets, which in isolation is prima facie evidence that they pose limited systemic risk, even if they were to become illiquid or subject to fire sales. However, before the financial crisis, policy concerns were mainly focused on potential problems in subprime mortgage markets, which were also relatively small. Nevertheless, problems with subprime mortgages turned out to be the proverbial tip of the iceberg, as the deflating housing bubble caused losses in the much-larger overall mortgage market.40 Analogously, a disruption in the leveraged lending market could create spillover effects in related asset classes, similar to how problems that started with subprime mortgages eventually spread to the entire mortgage market and nonmortgage asset-backed securities in the financial crisis. Ultimately, the underlying cause of the MBS meltdown was the bursting of the housing bubble. Despite the high share of business debt to gross domestic product (GDP) at present, experts are divided on whether there is any underlying asset bubble in corporate debt markets (analogous to the housing bubble) that could lead to a destabilizing downturn.41

In addition, it is not clear whether unexpected losses in leveraged lending would lead to broader systemic deleveraging by financial firms or problems for systemically important institutions. Losses on leveraged loans or CLOs might not cause problems for leveraged financial institutions, such as banks, because (1) their leveraged loan and CLO holdings are small relative to total assets and limited mostly to AAA tranches; and (2) banks face higher capital and liquidity requirements to protect against losses or a liquidity freeze, respectively, than they did before the crisis.42 Furthermore, the largest holders of leveraged loans and CLOs are asset managers. They generally hold these assets as agents on their clients' behalf and thus are normally not vulnerable to insolvency from asset losses because those losses are directly passed on to account holders, who own the assets.43

Another source of systemic risk relates to a liquidity mismatch for certain holders. There is potentially an incentive for investors in leveraged loan mutual funds and exchange traded funds (ETFs), respectively, to redeem their shares on demand for cash or sell their shares during episodes of market or systemic distress, similar to a bank run. Because the underlying leveraged loans and CLOs are illiquid, investors who are first to exit could limit their losses if they redeem them while the fund still has cash on hand and is not forced to sell the underlying assets at fire sale prices.44 This incentive could act as a self-fulfilling prophecy, as the incentive to run could cause mass redemptions that then force fire sales that reduce the fund's value. Leveraged loan mutual funds generally allow withdrawal on demand,45 but other run risk may be limited because "U.S. CLOs are not required to mark-to-market their assets, and early redemption by investors is generally not permissible"46 and other private investment funds, such as hedge funds, often feature redemption restrictions.47

Although the financial crisis is a cautionary tale, there are other historical examples where a sudden shift in an asset class's performance did not lead to financial instability. For example, a collapse in the junk bond market following a spike in defaults from 1989 to 1990 did not pose problems for the broader financial system or economy.48 In addition, while CLO issuance slowed during the last financial crisis, the rating agency and data provider Standard & Poor's reports that CLO default rates remained low and "no tranches originally rated AAA or AA experienced a loss" throughout the crisis.49 However, the amount of CLOs outstanding was much smaller then compared to now, and product features have changed over time. More recently, in December 2018, relatively large investor withdrawals from bank loan mutual funds did not result in instability in the leveraged loan market.50

How Are Leveraged Loans Regulated?

The goals of financial regulation, and the tools used to achieve those goals, vary based on the type of financial institution, market, or instrument involved.51 Thus, to answer this question, it is useful to break down leveraged loan regulation by the type of institution and activity (issuance, investment, and securitization).

Leveraged lending falls under the purview of multiple regulators with different regulatory approaches and authorities. This regulatory fragmentation could encourage activities to migrate to less-regulated sectors, limits the official data available, and may complicate the evaluation and mitigation of any potential systemic risk to financial stability associated with leveraged lending.

Following the 2007-2009 financial crisis, the Financial Stability Oversight Council (FSOC), an interagency council of regulators headed by the Treasury Secretary, was created to address threats to financial stability and issues where regulatory fragmentation hinders an effective policy response. In its 2018 Annual Report, FSOC recommended that the financial regulators "continue to monitor levels of nonfinancial business leverage, trends in asset valuations, and potential implications for the entities they regulate."52 Outside of monitoring risk, FSOC has not, to date, recommended any regulatory or legislative changes to address leveraged lending.

How Are Leveraged Loan Issuance and Syndication Regulated?

The regulations applicable to leveraged loan issuance and syndication differ between banks and nonbank lenders. In both cases, though, leveraged lending falls under the laws and regulations applied to business lending in general, rather than rules that apply specifically to leveraged lending.53

In general, banks are required to act in a safe and sound manner to mitigate the potential for failure and are subject to supervision to ensure that they are doing so. As such, regulators generally will check banks' leverage loan origination, syndication, and participation practices as part of regular examinations. This supervision could uncover cases in which a bank is originating or syndicating excessively risky leveraged loans. In addition, the bank regulators have issued guidance documents, most recently in 2013, describing certain standards and practices and communicating regulator expectations related to leveraged lending. Whether this guidance qualifies as regulation that must go through the rulemaking process is a matter of debate examined in the "What Is the Status of the Bank Regulators' Leveraged Loan Guidance?" section later in this report. In any case, the guidance covers only the leveraged loan activities of banks, is not meant to cover nonbank activity or bank investment in CLOs, and cannot address potential systemic risk originating outside of the banking system.

Nonbank participants, with the exception of insurance companies, generally are not subject to similar oversight. To the extent that banks' role in leveraged lending is decreasing, and particularly in cases where a bank is not involved in a leveraged loan at all, this could result in reduced regulatory oversight of leveraged loan issuance and syndication.54

What Regulations Do Investors Face When They Hold Leveraged Loans or CLOs?

Regulations applicable to holding leveraged loans or CLOs depend on what type of entity is involved. Nonbank investment funds, banks, and insurance companies all face different requirements. As with regulations applying to issuance, these rules generally are not uniquely or specifically applied to leveraged loans and CLOs, but rather to all types of loans and assets held by these institutions.

Banks. Banks face a number of prudential (or safety and soundness) regulations related to all bank activities, including leveraged lending. Capital requirements and the Volcker Rule are notable prudential regulations banks must consider when engaged in leveraged lending.

Certain payments banks make on capital are flexible, unlike the rigid payment obligations they face on deposits and liabilities. Thus, capital gives banks the ability to absorb some amount of losses without failing.55 Banks are required to satisfy several requirements to ensure they hold enough capital. In general, these requirements are expressed as minimum ratios between certain balance sheet items that banks must maintain. Leverage ratios require banks to hold a certain amount of capital for all loans regardless of riskiness, whereas risk-weighted ratios require banks to hold an amount of capital based on the riskiness of the loan. When a bank holds leveraged loans or CLO tranches or makes credit available to others to finance leveraged loans or CLOs, it must comply with both types of requirements. Based on the characteristics of individual loans and assets, a bank might be required to hold a relatively large amount of capital for leveraged loans and CLOs to comply with risk-weighted ratios.56

Banks also face certain permissible activity restrictions, which prohibit them from engaging in certain risky activities. Section 619 of the Dodd-Frank Act (called the Volcker Rule) is one such regulation that prohibits banks from proprietary trading and certain relationships with hedge funds and certain other funds.57 The latter restriction may be pertinent to banks' involvement in CLOs, depending on how they are structured. Although CLOs may be structured in a manner similar to loan participations (which generally are allowed under the Volcker Rule), they can also be structured such that banks' ownership interests appear similar to those associated with hedge funds (which is generally not allowed under the Volcker Rule). The Volcker Rule establishes criteria for a CLO to qualify for an exemption. Moreover, the final rule provides guidance on how banks may construct CLO structures to avoid retaining impermissible ownership or equity interests that resemble hedge funds.58

In addition, banks are subject to periodic examination by federal bank regulators. If examiners determine a bank is holding overly risky loans, they can give it a worse rating (which in turn could increase the fees it pays for deposit insurance or restrict it from certain activities) or direct it to take corrective action.59 Because leveraged loans are considered more risky than other loan types, they may be more likely to draw examiners' attention and elicit a response.

Furthermore, the bank regulators established the Shared National Credit Program in 1977 to more closely monitor and assess risk related to large syndicated loans. The program requires banks to report data on syndicated loans larger than $100 million.60

To inform banks of their regulatory obligations and regulator expectations related to leveraged lending, the federal bank regulatory agencies have issued a guidance document to banks. Whether this document qualifies as an official regulation, as well as, whether it inappropriately discouraged banks from engaging in leveraged lending, is a subject of debate covered in this report's section "What Is the Status of the Bank Regulators' Leveraged Loan Guidance?" below.

Asset management.61 Relative to banking, investment funds in the asset management industry involve different operational frameworks and regulatory requirements. The asset management industry's operating framework is an agent-based model that separates investment management functions from investment ownership.62 In this model, risk is largely borne by the investors who own the assets, not by the companies managing them. This is different from the model used for banking, in which banks own and retain the assets and risks. Asset managers are generally not subject to safety and soundness regulations that apply to banks.

The Securities and Exchange Commission (SEC) is the primary regulator overseeing the asset management industry. The main components of the SEC's asset management regulatory regime include disclosure requirements, investor access restrictions, examinations, and risk mitigation controls. In addition, the SEC's Office of Compliance Inspections and Examinations (OCIE) is responsible for conducting examinations and certain other risk oversight of the asset management industry.63 Examples of violations involving leveraged loan capital markets participants that could trigger a SEC investigation include market manipulation and violation of fiduciary duties. Industry self-regulatory organizations under SEC oversight, such as the Financial Industry Regulatory Authority (FINRA), could also examine broker-dealers involved with leveraged lending.64

Restrictions or requirements for investment funds in the leveraged lending and CLO markets depend on whether a fund is public (broadly accessible by investors of all types) or private (accessible only by institutional and individual investors who meet certain size and sophistication criteria). Public funds that invest in leveraged lending and CLOs include mutual funds and exchange-traded funds (ETFs), whereas private fund investors include hedge funds and private equity.65 Depending on the types of the funds, they could also be subject to other requirements, such as disclosure of portfolio holdings through prospectus, conflict of interest mitigation through fiduciary requirements, liquidity and leverage restrictions, as well as operational compliance requirements to safeguard client assets.66

Insurance.67 Insurance firms are regulated for safety and soundness, but at the state level rather than by a federal entity.68 Insurance firms also face risk-based capital requirements that affect how many leveraged loans and CLOs they hold. Insurance capital requirements focus significantly on the riskiness of insurers' contingent liabilities (i.e., potential claims), in addition to the riskiness of the assets they hold. The National Association of Insurance Commissioners (NAIC) assigns a risk assessment to the assets (including leveraged loans and CLOs) insurance companies purchase to back their claims. Riskier assets get less credit toward fulfilling those capital requirements. Thus, the risk assessment assigned to individual leveraged loans and CLOs largely determines the limits that capital requirements impose on insurers' holdings of those loans and securities. In 2017, 97% of CLOs held by insurers received an investment-grade rating from the NAIC (NAIC-1 or NAIC-2), posing less expected risk and requiring less capital to guard against that risk than lower-rated holdings.69

A significant difference between the insurance and banking industries, and thus how they are regulated for safety and soundness, is the importance of matching the durations of assets and liabilities in insurance, particularly life insurance. Insurance often entails much longer-term liabilities than does banking, allowing insurers to safely hold longer-term assets to match these longer-term liabilities. This allowance for duration matching may influence the leveraged loans and CLOs an insurer can safely hold. However, insurance regulators have recently increased their focus on the liquidity of insurers' assets, which could discourage insurers from holding many leveraged loans and CLOs because of their relative illiquidity.

How Is the Securitization Process to Create CLOs Regulated?

Through the securitization process, securities (CLOs) backed by leveraged loans are issued and sold to investors. This section highlights the regulatory requirements applied to CLOs and CLO managers. Notably, it discusses the initial application of risk-retention rules to CLOs, and their subsequent partial removal.

The securitization process traditionally allowed managers creating the securities to fully transfer their portfolio assets (and risks) to capital markets investors. This process could result in a misalignment of incentives between managers and investors because the managers did not share much of the securitized products' risks, which has been referred to as a lack of "skin in the game." The 2007-2009 financial crisis revealed this misalignment as a structural flaw that contributed to the crisis. To address the issue, the SEC and other financial regulators adopted credit risk-retention rules under the Dodd-Frank Wall Street Reform and Consumer Protection Act (P.L. 111-203) for securitization structures, including CLOs, in December 2016.70 The risk retention rule requires CLO managers to retain 5% of the original value of CLO assets, thus aligning their own interests with those of investors (i.e., imposing skin in the game).71 Subsequently, in 2018, the U.S. Court of Appeals ruled that managers of open-market CLOs, which are reportedly the most common form of CLOs, are no longer subject to risk-retention rules.72 However, other types of CLOs are still subject to risk-retention requirements.

CLOs are securities instruments. The federal securities laws, including the Securities Act of 1933 (P.L. 73-22) and the Securities Exchange Act of 1934 (P.L. 73-291), require all offers and sales of CLO securities to either be registered under its provisions or qualify for an exemption from registration. Registration requires public disclosure of material information, such as the underlying security's financial details. However, most CLOs are created under private exemptions, which require less registration than public offerings but confine offerings to a more limited investor base.73

As discussed above, a CLO manager oversees the securitization process. CLO managers are generally registered as investment advisers under the Investment Advisers Act of 1940. As a result, they are subject to the SEC's registration and compliance requirements as well as the fiduciary duties that obligate them to place clients' interests above their own.74

What Is the Status of the Bank Regulators' Leveraged Loan Guidance?

Bank regulators use guidance to provide clarity to banks on supervision, such as how supervisors treat specific activities in their exams. In 2013, the federal bank regulators jointly issued an updated 15-page guidance document that described their "expectations for the sound risk management of leveraged lending activities."75 Subsequently, banks asserted that following the guidance constrained them from making sound loans and that regulators enforced the guidance as if it were a binding regulation.76 As opposed to guidance, a regulation can be issued only if the agency follows the Administrative Procedure Act's requirements (5 U.S.C. §551 et seq.), including the notice and comment process and other relevant requirements.77 Under the Congressional Review Act (CRA; P.L. 104-121), regulators must submit new regulations and certain guidance documents to Congress, which can then prevent a regulation or guidance from taking effect by enacting a joint resolution of disapproval.78 Because the bank regulators appeared to have the view that the document did not meet the CRA's definition of "rule," they did not submit it to Congress.79

In 2017, Senator Pat Toomey asked the Government Accountability Office (GAO) to analyze the guidance and determine whether it qualified as a rule subject to CRA review.80 GAO concluded that the guidance is a rule subject to CRA review.81 Following GAO's determination, the bank regulators reportedly sent letters to Congress indicating they would seek further feedback on the guidance,82 and Federal Reserve Chairman Jerome Powell indicated at a hearing on February 27, 2018, that the Federal Reserve has emphasized to its bank supervisors that the guidance was nonbinding.83 The Comptroller of the Currency, Joseph Otting, reportedly stated in 2018 that the guidance provides flexibility for leveraged loans that do not meet its criteria, provided banks operate in a safe and sound manner.84 To date, no changes have been made to the guidance and no joint resolution of disapproval under the CRA has been introduced. The Congressional Research Service has been unable to locate a submission of the guidance to Congress following the GAO finding that it was required under the CRA.85

How Has Congress Responded to Leveraged Lending?

The House Financial Services Committee held a hearing on June 4, 2019, entitled Emerging Threats to Stability: Considering the Systemic Risk of Leveraged Lending.86 Two unnumbered draft bills related to leveraged lending were considered at this hearing. The draft Leveraged Lending Data and Analysis Act would require the Office of Financial Research, a Treasury office that supports FSOC, to gather information, assess risks, and make recommendations in a report to Congress on leveraged lending. The draft Leveraged Lending Examination Enhancement Act would require the Federal Financial Institutions Examination Council (FFIEC), an interagency council of federal bank regulators, to set prudential standards for leveraged lending by depository institutions. It would also require the FFIEC to report quarterly on leveraged lending by depository institutions.87