Exchange-Traded Funds (ETFs): Issues for Congress

Exchange-traded funds (ETFs) are common ways for Americans to invest. An ETF is an investment vehicle that, similar to a mutual fund, offers public investors shares of a pool of assets; unlike a mutual fund, however, an ETF can be traded on exchanges like a stock. The catchall category of exchange-traded products (ETPs) includes all portfolio products that trade on exchanges.

U.S. ETF domestic listings stand at more than $3.4 trillion, making ETFs among the most important investment methods and critical components of the financial system. The first U.S. ETF was introduced in 1993 to track the S&P 500 stock index. That was the first time a public investor could buy or sell a basket of stocks in a single publicly traded share. It was considered as one of the most important financial innovations in decades and one that transformed the asset management industry. In the ensuing 25 years, ETFs have grown to become a mainstream investment vehicle held by 6% of U.S. households and representing 30% of all U.S. equity trading, according to data from Investment Company Institute and iShares.

The rapid growth of the ETF market has simultaneously elevated its importance in the global financial system and brought risk and regulatory considerations to the fore. A key consideration is ETFs’ behavior under market stress. ETFs drew media attention when market distress occurred in 2010, 2015, and 2018. These events have led to global discussions of ETFs’ effects on financial stability. Although the events did not seem to leave long-lasting impacts on financial markets, they revealed aspects of ETFs’ vulnerability that could not be observed under normal market conditions.

Given ETFs’ scale of representation in financial markets, it is likely that they would be affected by any future financial crisis (e.g., their value would fall with the value of other assets), but it is uncertain whether ETFs would also amplify it. At the center of the debate over ETFs and financial stability is “liquidity mismatch,” which is often discussed under the context of the difficulty of buying and selling ETFs during a market downturn. This mismatch points to a relatively complex ETF operational structure that has generated misunderstanding.

Not all ETFs are created equal. The majority of ETFs are “plain vanilla” index-tracking products that are considered lower risk. There is also a growing subset of complex, higher-risk ETFs that are sources of concern over financial stability and investor protection. To add to the confusion, the industry does not currently have a consistent naming convention to differentiate the types of products that vary in risk exposure.

Lastly, despite ETFs’ common usage, the Securities and Exchange Commission (SEC) has not yet established a comprehensive listing standard. As such, each aspiring issuer must typically be approved by the SEC under an exemption to the Investment Company Act of 1940 and other securities regulations. The SEC proposed a new ETF approval process on June 28, 2018, that would replace individual exemptive orders with a single rule for plain vanilla ETFs. The proposed approach excludes certain higher-risk ETFs and mandates new disclosures and other conditions generally on index-based and actively managed ETFs.

Exchange-Traded Funds (ETFs): Issues for Congress

Jump to Main Text of Report

Contents

- Introduction

- How ETFs Work

- ETF General Structure and Mechanics

- Underlying Basket of Securities (Primary Market)

- ETF Shares (Secondary Market)

- Dealer Inventory (Nondisplayed Liquidity)

- Arbitrage Mechanism

- Regulatory Framework

- Proposed SEC Rulemaking

- Policy Issues

- Financial Stability

- "Liquidity Mismatch" Related Systemic Risk Discussions

- Higher-Risk Products

- Issuer Concentration

- Behavior Under Real Market Stress

- Passive and Active Investment Styles

- Investor Protection

Figures

- Figure 1. Growth of the U.S. ETF Market ($Billions)

- Figure 2. ETF Key Features Compared with Mutual Funds and Stocks

- Figure 3. ETF General Structure and Mechanics

- Figure 4. Global ETP Assets Under Management (AUM) and Classification

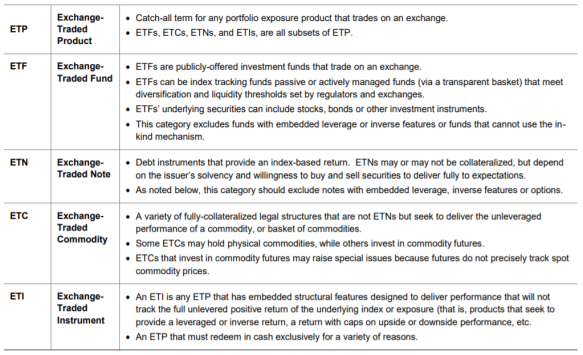

- Figure 5. Suggested Classifications of ETPs

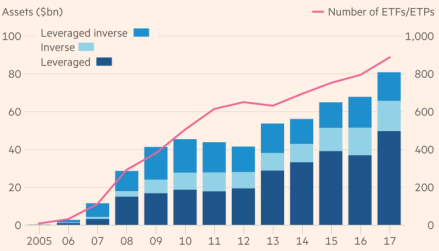

- Figure 6. Increase of "Exotic" ETFs

Summary

Exchange-traded funds (ETFs) are common ways for Americans to invest. An ETF is an investment vehicle that, similar to a mutual fund, offers public investors shares of a pool of assets; unlike a mutual fund, however, an ETF can be traded on exchanges like a stock. The catchall category of exchange-traded products (ETPs) includes all portfolio products that trade on exchanges.

U.S. ETF domestic listings stand at more than $3.4 trillion, making ETFs among the most important investment methods and critical components of the financial system. The first U.S. ETF was introduced in 1993 to track the S&P 500 stock index. That was the first time a public investor could buy or sell a basket of stocks in a single publicly traded share. It was considered as one of the most important financial innovations in decades and one that transformed the asset management industry. In the ensuing 25 years, ETFs have grown to become a mainstream investment vehicle held by 6% of U.S. households and representing 30% of all U.S. equity trading, according to data from Investment Company Institute and iShares.

The rapid growth of the ETF market has simultaneously elevated its importance in the global financial system and brought risk and regulatory considerations to the fore. A key consideration is ETFs' behavior under market stress. ETFs drew media attention when market distress occurred in 2010, 2015, and 2018. These events have led to global discussions of ETFs' effects on financial stability. Although the events did not seem to leave long-lasting impacts on financial markets, they revealed aspects of ETFs' vulnerability that could not be observed under normal market conditions.

Given ETFs' scale of representation in financial markets, it is likely that they would be affected by any future financial crisis (e.g., their value would fall with the value of other assets), but it is uncertain whether ETFs would also amplify it. At the center of the debate over ETFs and financial stability is "liquidity mismatch," which is often discussed under the context of the difficulty of buying and selling ETFs during a market downturn. This mismatch points to a relatively complex ETF operational structure that has generated misunderstanding.

Not all ETFs are created equal. The majority of ETFs are "plain vanilla" index-tracking products that are considered lower risk. There is also a growing subset of complex, higher-risk ETFs that are sources of concern over financial stability and investor protection. To add to the confusion, the industry does not currently have a consistent naming convention to differentiate the types of products that vary in risk exposure.

Lastly, despite ETFs' common usage, the Securities and Exchange Commission (SEC) has not yet established a comprehensive listing standard. As such, each aspiring issuer must typically be approved by the SEC under an exemption to the Investment Company Act of 1940 and other securities regulations. The SEC proposed a new ETF approval process on June 28, 2018, that would replace individual exemptive orders with a single rule for plain vanilla ETFs. The proposed approach excludes certain higher-risk ETFs and mandates new disclosures and other conditions generally on index-based and actively managed ETFs.

Introduction

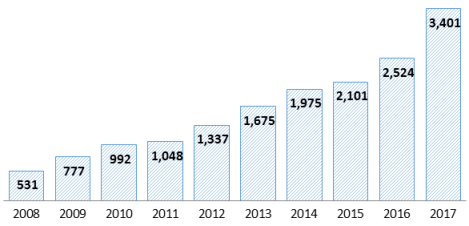

Exchange-traded funds (ETFs) offer investors a way to pool money in a fund that invests in multiple stocks, bonds, or other combinations of financial assets.1 The first U.S. ETF was introduced in 1993 to track the S&P 500 index.2 Over the past 25 years, ETFs have become common investment vehicles to help American retail investors build financial nest eggs and to help institutional investors meet financial obligations. They are a major type of investment within a broader financial product category called exchange-traded products (ETPs), which is a catchall term for all portfolio products that trade on exchanges. Global ETP assets grew 61-fold from $79 billion in 2000 to $4.8 trillion as of March 2018.3 U.S. ETFs represent the majority of that market, with 1,832 ETFs totaling $3.4 trillion in assets under management (Figure 1).

|

Figure 1. Growth of the U.S. ETF Market ($Billions) (1,832 U.S. ETFs Totaled $3.4 Trillion as of Year-End 2017) |

|

|

Source: CRS, based on data from Investment Company Institute (ICI), 2018 Investment Company Fact Book, at https://www.ici.org/pdf/2018_factbook.pdf. |

The rapid growth in ETFs is attributable to their perceived advantages: (1) low costs4 and fee savings; (2) comparable or even higher investment returns relative to other comparable portfolio investment alternatives, namely mutual funds;5 (3) U.S. tax efficiency;6 (4) exchange-trading-related advantages, including additional liquidity and price transparency; and (5) portfolio hedging and diversification benefits.

The report first explains how ETFs work. This section clarifies a number of technical points on ETF design, trading, and classification that are common sources of confusion. The report also discusses other key policy issues, including ETFs' relevance to financial stability considerations, the implication of the rise of passively managed funds (a category that encompasses the majority of ETFs), the higher risks often associated with nontraditional ETPs, investor protection issues, and the SEC's recent ETF rulemaking, among other topics.

|

ETF and ETP Naming Convention Because the industry has not conformed to a standardized naming convention for ETFs and ETPs, the two terms may appear to refer to the same products within one source and context and different products within another. The report explains the challenges of the naming convention. Where feasible, the report uses the term ETF to refer to more traditional and physically backed products, whereas the term ETP is a broader category that includes all ETFs as well as some of the more complex, nontraditional products.7 |

How ETFs Work

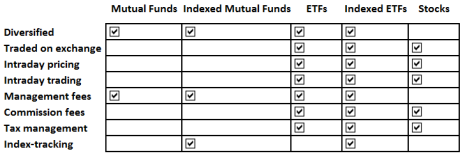

ETFs are often compared to mutual funds. They are both SEC-registered investment companies that pool money from many investors and invest the proceeds in a portfolio of bonds, stocks, and other securities assets. However, ETFs can be traded on exchanges, whereas mutual funds are bought or sold only by fund companies or intermediaries like financial advisors or brokers.

ETFs combine common features of both mutual funds and stocks. They package a portfolio of assets like a mutual fund and can be traded on exchanges like a stock. As Figure 2 illustrates, when compared to mutual funds, ETFs provide additional trading and cost advantages. When compared to stocks, ETFs allow for the trading of a basket of assets at the same time, instead of one stock per trade, for each transaction. This characteristic allows ETFs to achieve price transparency through intraday trading for a basket of assets.

|

Figure 2. ETF Key Features Compared with Mutual Funds and Stocks |

|

|

Source: CRS, based on iShares, Comparing ETFs to Mutual Funds, at https://www.ishares.com/us/education/comparing-etfs-to-mutual-funds. |

ETF General Structure and Mechanics8

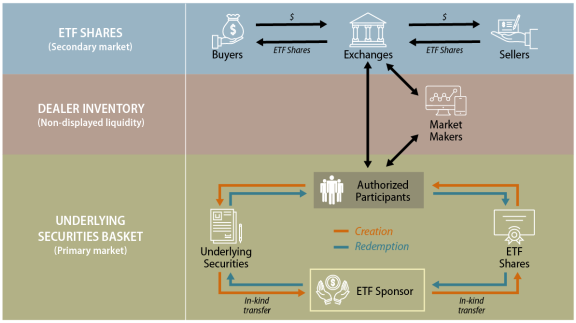

ETF sponsors typically assemble a collection of securities and then divide the basket of securities into tradable shares. In terms of operational structure, unlike mutual funds that sell and redeem shares directly with investors, ETFs have a unique creation and redemption process that involves third-party specialists called authorized participants (APs).

When purchasing an ETF share, public investors are buying and selling a collective exposure to the underlying basket of securities. As such, the ETF architecture generally consists of the primary market, where the underlying basket of securities is assembled, and the secondary market, where the ETF shares are publicly traded. Dealer inventory, which is the ETF shares held by dealers, is referred to as an additional layer of "liquidity."9 The three layers are depicted in Figure 3, defined in the Glossary of Terms textbox, and explained further in the following sections.

|

|

Source: CRS. Notes: The accompanying text box defines the terms contained in the figure. The structure generally applies to traditional types of physically backed ETFs, not including synthetic ETFs or nontraditional ETPs. The illustration refers to typical transactions only and is not inclusive of all transactions. |

|

Glossary of Terms for Figure 3 ETF sponsors, also called issuers or asset managers, originate the funds and set the investment objectives. They perform a role similar to mutual fund managers when selecting the indexes or individual securities to be included in the ETF portfolio.10 Authorized participants (APs) fill an essential "back office" function for ETF creation and redemption. They are well-capitalized market specialists or financial institutions capable of managing complex securities settlements.11 Broker-dealers are companies or individuals that buy and sell securities on behalf of their customers (as brokers), or for their own accounts (as dealers), or both.12 Market makers are broker-dealers that regularly provide both buy and sell quotations to clients. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price.13 The market makers ease the process of trading. In the absence of another buyer or seller, a market maker may often match the other side of a pending order. Many ETF issuers designate a lead market maker for their ETFs. Although APs and market makers are distinct roles, firms can be both APs and market makers at the same time. Primary market is where securities, including ETF securities, are created. The primary market for ETF creation and redemption is available only to APs and APs' clients. Secondary market is where the securities created in the primary market, including ETF shares, are traded. Exchanges, as depicted in Figure 3, generally refer to the trading platforms as well as other liquidity providers. ETFs could trade through national exchanges (such as NYSE, NASDAQ, and Bats), through electronic communications networks, and through over-the-counter trading among institutions.14 In-kind transfer means that the ETFs require APs to exchange ETF shares for a basket of securities rather than cash. This allows ETFs to avoid selling securities to raise cash to meet redemptions. As such, it could also avoid certain capital-gains-triggering events and create tax advantages. |

Underlying Basket of Securities (Primary Market)

In a typical ETF creation process, the ETF sponsor would first publish a list of securities in an ETF share basket. The APs have the option to assemble and deliver the securities basket to the ETF sponsor. Once the sponsor receives the basket of securities, it would deliver new ETF shares to the AP. The AP could then sell the ETF shares on a stock exchange to all investors. The redemption process is in reverse, with the APs transferring ETF shares to sponsors and receiving securities.15

ETF shares are created and redeemed by authorized participants in the primary market. The fund sponsors do not sell their ETF shares directly to investors; instead, they issue the shares to APs in large blocks called "creation units" that usually consist of 50,000 or more shares. The APs' creation and redemption process often involves the purchase of the created units "in-kind" rather than in cash. This means that the shares are exchanged for a basket of securities instead of cash settlements.

The supply of ETF shares is flexible, meaning that the shares can be created or redeemed to offset changes in demand; however, only authorized participants can create or redeem ETF shares from the sponsors. A large ETF may have dozens of APs, whereas smaller ETFs could use fewer of them.

ETF Shares (Secondary Market)

Most ETF shares are traded on national exchanges, creating a visible source of liquidity through public trading activities. The ETF liquidity on an exchange is driven largely by supply and demand of the public secondary market participants. This is very different from open-end mutual funds16 that derive liquidity only from the fund providers.

Most ETF shares trade many more times on exchanges in the secondary market than through the primary market creation/redemption process. For example, $2.1 trillion in total U.S. ETFs were involved in around $18 trillion of secondary market transactions in the 12 months that ended June 2015.17 Many consider secondary market liquidity to be additive, meaning ETFs' liquidity is at least as great as that of its underlying assets. This is because secondary market trading does not require underlying securities transactions.18

Dealer Inventory (Nondisplayed Liquidity)

In addition to primary and secondary market liquidity, large broker-dealers serving as market makers assemble their own inventory of ETF shares through direct contacts with APs for price quotes, instead of going through the exchanges. This is called "nondisplayed" liquidity, meaning the transaction information is not part of readily accessible public records. In other words, there are multiple quotes at which an investor can transact. For most ETFs, market makers will publish quotes beyond the national best bid and offer quotes. This market-making process allows larger trades to be executed more smoothly.19

Arbitrage Mechanism

Both mutual funds and ETFs are required to calculate their funds' worth as measured by net asset value (NAV)20 each business day. But ETF shares are traded intraday on exchanges; as such, an ETF's market share price (in the secondary market) could differ, at a particular time, from the value of its underlying basket (in the primary market) as expressed in the fund's NAV. The arbitrage process is a common ETF mechanism to help align the ETF share trading price with its underlying NAV.

Arbitrage is the simultaneous buying and selling of securities to profit from price imbalance without being subject to additional risks. With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market (via APs) or the secondary market (via ordinary open-market participants). Arbitrageurs would simultaneously buy or sell ETF shares and their underlying assets. AP-enabled arbitrage activities are done in the primary market involving creation units, whereas ordinary market participants would conduct arbitrage through open-market operations in the secondary market.

To illustrate the process, when an ETF's price is far above the price of its underlying stocks or bonds, the arbitrageurs would buy the underlying securities and exchange them for ETF shares. This activity would create new supply and demand dynamics that would align the price of the shares with their underlying assets. When ETF shares trade at below NAV, arbitrageurs would purchase the shares and exchange them for the underlying securities.21 The arbitrageurs are motivated by the transactions' economic incentives to bridge the gap between the market price and the value of the underlying assets.

The APs are not obligated to create or redeem shares to enable the arbitrage mechanism through the creation and redemption process. Should market stress or some other event cause APs to simultaneously exit the market, then the ETFs would trade like closed-end funds, which would still have access to secondary-market liquidity, but would be unable to create or redeem shares.22 Closed-end funds are investment companies that generally sell a fixed number of shares at an initial public offering and then trade on a secondary market thereafter without continuously offering their shares for sale.23 The expectations are that if the ETFs trading as closed-end funds widen their arbitrage opportunities, the increased economic incentives would attract new APs to enter the market and resume creation and redemption.

Regulatory Framework

The first U.S. ETF was introduced in 1993 to track the S&P 500 index.24 Because it was an innovative product at the time, it did not fit completely within any of the existing statutory schemes for securities, investment companies, or listing standards.25 As such, ETFs "piggybacked" off the existing regulation for mutual funds and securities; the first-ever ETF took four years to gain SEC approval.26 Even at their current scale (Figure 1), ETFs continue to operate within a "patchwork" of regulations.

ETFs in the United States are generally registered as open-end investment companies or unit investment trusts27 under the Investment Company Act of 1940.28 Although ETFs combine the characteristics of both mutual funds and stocks, they are structurally different from stocks and mutual funds, and do not fit into existing securities or investment company regulations. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions.29 ETFs generally have the following characteristics:

- Investment companies that comply with and gain exemptive relief from the Investment Company Act of 1940 (1940 Act).30 ETFs often obtain exemptions from certain structural and operational requirements under the SEC 1940 Act that are not consistent with their operations.

The 1940 Act differs from other major U.S. securities laws. Whereas other securities laws (for example, the Securities Act and the Exchange Act) largely focus on disclosures, the 1940 Act also focuses on requirements and prohibitions. When enacting the 1940 Act, Congress concluded that full disclosure alone was not sufficient to deter the abuses in the investment management industry it uncovered in the 1920s and 1930s. The 1940 Act's focus is on disclosure as well as direct regulation and the principle that investment companies should act in the interests of their investors to minimize conflicts of interest.

- Securities that comply with the Securities Act of 1933 (Securities Act).31 The offer or sale of ETF shares must be registered under the SEC Securities Act.

- Traded on exchanges and comply with the Securities Exchange Act of 1934 (Exchange Act)32 and national exchange listing standards. The provisions in the SEC Exchange Act govern the trading of ETFs. The exchange-listed ETFs also have to be in compliance with the national exchanges' listing standards in order to be traded on an exchange.

- Sold by broker-dealers that follow Financial Industry Regulatory Authority (FINRA) sales practice guidance. Broker-dealers recommending ETF purchases or sells are generally subject to FINRA regulations. Examples of these duties include suitability analysis, fair communication and compensation, and other requirements.33

A small number of ETFs are not registered under the 1940 Act. These ETFs primarily invest in commodities, currencies, and futures. They represent 2%, or $67 billion, of the $3.4 trillion U.S. ETF market as of 2017.34 The regulatory framework is different for these ETFs, which invest in commodities and currency markets through either physical assets or the derivative futures markets. Although these products are generally not regulated by the 1940 Act that governs asset management firms, they are regulated under securities regulations. Certain commodity pool ETFs could also be subject to the Commodity Exchange Act and be governed by the Commodity Futures Trading Commission (CFTC).35

Proposed SEC Rulemaking

In a 2017 report examining capital markets regulation, the Department of the Treasury recommended that the SEC adopt a rule for plain-vanilla ETFs to reduce the costs and delays confronted by new entrants. It describes the current ETF exemptive relief orders as "unpredictable, lengthy, and expensive" and urges the SEC to propose new rules to streamline ETF approvals.36

The SEC proposed a new ETF approval process37 on June 28, 2018. This is 10 years after the first notice of proposed rulemaking (NPRM) occurred in 2008, but was never finalized.38 The SEC's new ETF proposal incorporates comments from the 2008 proposal and would make major adjustments to account for new market conditions. The 2018 proposed rule would apply to the vast majority of the 1940 Act open-end ETFs. It would replace individual exemptive orders with a single rule for index-based and actively managed open-end ETFs (in-scope ETFs).39

- Regarding leveraged and inverse ETFs, two of the more complex ETFs discussed in more detail in the "Higher-Risk Products" section of the report, the proposed rule states that they cannot rely on it.40 In addition to being excluded from the proposed process, the SEC states that it has not approved new exemptive relief for leveraged ETFs since 2009.41 A broader consideration of the use of derivatives by the whole asset management industry is under way. The SEC is concurrently evaluating the use of derivatives by funds and business development companies.42

- Regarding existing exemptions, the new rule proposes to generally rescind all existing ETF exemptive orders to level the playing field for the ETF industry.43

- Regarding new conditions and requirements, the proposal sets conditions for in-scope ETFs that include (1) daily portfolio transparency; (2) website disclosure of certain key risk-measurement-related historic data and information on the baskets of underlying assets, among others; and (3) policy and procedures for custom securities baskets.44

The SEC anticipates the new rule would provide a more efficient approval process and a leveled playing field for new entrants and additional competition. This ETF proposal, if adopted, may have implications for some issues discussed in the next section.

Policy Issues

ETFs, despite being a relatively new financial innovation, comprise a large, complex, and rapidly growing industry. Given the industry's significance, there are many policy issues for Congress to consider, including the following:

- financial stability concerns, including the topics of liquidity jam, high-risk ETF products, and issuer concentration;

- investor education and protection; and

- passive versus active investment styles and the related asset management transformation.

Financial Stability

With U.S. ETFs accounting for more than $3.4 trillion in assets under management and 30% of all U.S. equity trading volume,45 ETFs' scale and continued growth give rise to financial stability considerations. ETFs' involvement in any future financial crisis is likely, given their scale of representation in financial markets. However, it is uncertain whether ETFs would simply be affected by the next financial crisis (e.g., their value would fall with the value of other assets) or would amplify it.

ETFs' capability to provide additional liquidity "wrappers" for less-liquid assets enables them to execute some of the higher-risk and lower-liquidity investment strategies that are considered sources of potential systemic threat.46 In addition, ETFs now have a much larger market share that includes riskier, more complex instruments than 10 years ago, when the 2007-2009 global financial crisis occurred.47 As such, some consider ETFs to have not yet experienced a truly extreme market downturn.

Discussed in detail below are issues related to ETF "liquidity mismatch" and the related results of three real market tests. Other topics related to financial stability, such as high-risk products and issuer concentration, are also examined.

"Liquidity Mismatch" Related Systemic Risk Discussions

Liquidity refers to the ability for market participants to buy or sell securities quickly without affecting the price.48 "Liquidity mismatch" pertains to the perceived difference between secondary and primary market liquidity for ETF shares and their underlying assets. It is generally understood that ETFs increase liquidity through secondary-market trading. As mentioned in earlier parts of the report, this trading is additive, meaning the trading of ETF shares provides additional liquidity to the primary-market creation and redemption process. The ETFs are at least as liquid as their underlying assets. But some question ETFs' behavior in a market downturn, when markets often become significantly less liquid. In those situations liquidity mismatch is perceived to pose challenges to investors seeking to sell the illiquid ETF shares for cash.49 Some argue that liquidity mismatch could induce systemic risk and lead to financial instability through the following channels:

- Contagion risk.50 Contagion risk, also referred to as "spillover," often occurs when investors cannot obtain liquidity for the financial assets they wish to dispose, and in turn, are forced into selling other assets, spreading the pricing and liquidity pressure across the financial system. The IMF states that this is more likely to occur in the case of ETFs made up of less-liquid assets. These ETFs are said to have the potential to increase contagion risk and amplify price movements during periods of stress by spreading selling pressure on to other non-ETF asset holdings of the issuers for liquidity.51

- Fire sale and negative feedback loop. Some argue that in liquidity mismatch situations, in which ETF shares are liquid and underlying assets are illiquid and volatile, there is risk of a negative feedback loop.52 This would occur when selling or redemption needs of ETF shares in a market downturn place pressure on illiquid underlying assets, thus further amplifying the liquidity constraints of the underlying assets, driving their prices down even further ("fire sale")53 and in turn triggering additional redemption pressure on ETF shares.54

- Arbitrage mechanism malfunction under illiquid conditions. Real market events illustrate that ETFs are not guaranteed active trading by APs and other market participants under illiquid conditions. As noted previously, if APs withdraw, ETFs would function as closed-end funds. But that does not foreclose the possibility of the instrument creating market disruption. In prior times of real market stress, when arbitrage mechanisms broke down even for traditional plain-vanilla products, price disconnection between ETF shares and underlying assets was significant (see the "Behavior Under Real Market Stress" section below for more detail).

The SEC acknowledges that during market stress, the arbitrage mechanism may work less efficiently for a period of time.55 It also recognizes that secondary market investors could be harmed by trading ETF shares during such time because of the different liquidity and pricing between the primary and secondary markets.56 But the SEC believes that investors could weigh an ETF's harm against its benefits (e.g., low cost and intraday trading) when making investment decisions.57 It also states that it has taken a number of steps to address the disruptions in the arbitrage mechanisms.58

Many industry practitioners assert that liquidity mismatch is among the most widely misunderstood aspects of ETF structure and mechanics.59 Some argue that certain ETF design features work to mitigate systemic risk, such as the fact that investors do not engage in cash redemptions, which was a major liquidity concern for other funds. The main arguments countering the financial stability concerns include the following:

- ETFs are largely not subject to cash redemption. Unlike mutual funds, ETF sponsors do not sell individual shares to or redeem them directly from retail investors.60 When an investor wants to exchange their share for cash, they sell the share in the secondary market and do not redeem it with the sponsor. When this occurs, the sponsor would not need to dispose the ETF's underlying assets for cash. As such, some believe that the liquidity mismatch induced concern regarding illiquid underlying assets is not as much of a concern for ETFs as other funds in which cash redemption does occur. The Financial Stability Oversight Council (FSOC) states that "ETFs may not be subject to the same types of liquidity and redemption risks as some other pooled investment vehicles," thus avoiding incentives to run.61

- ETFs provide "emergency brakes" in a market downturn. ETFs have relatively transparent pricing because intraday trading allows investors the capability to monitor the portfolio value continuously, in contrast to end-of-the-day pricing for mutual funds. As such, mutual funds' design mechanisms would not allow for timely pricing responses as seen with ETFs. Some believe that "during periods of stress, price discovery can help set a market bottom so that trading can normalize. Think of it as an emergency brake on an elevator with a broken cable."62 For example, in the three market events discussed below, ETF price movements have signaled market dysfunction and potentially prevented market conditions from eroding undetected or without sufficient attention.

- ETFs are less susceptible to liquidity events. The International Organization of Securities Commissions (IOSCO) states that ETFs are not considered riskier than mutual funds. In addition, ETFs have secondary-market trading and in-kind redemption characteristics that make them less susceptible to liquidity events than other types of collective investment schemes, such as mutual funds.63 Though it is possible a more significant liquidity mismatch with ETFs could occur in some market conditions, they are no more likely to cause a market disruption compared to other similar investment products. The Bank of England also acknowledges that ETFs may present benefits to financial stability through extra secondary-market liquidity and the potential to help reduce fire sales.64

Higher-Risk Products

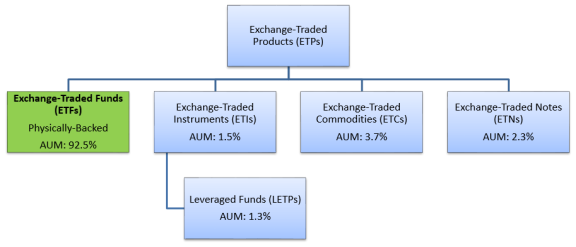

ETFs are one main type of investment within a broader category of all portfolio products that trade on exchanges called exchange-traded products (ETPs). Not all ETPs are created equal. Certain ETPs that represent a relatively small portion of the overall market are highly controversial. To add to the confusion, many of the complex and high-risk ETPs are also referred to as ETFs.65

The industry has not adopted a consistent naming convention for ETFs and ETPs. Figure 4 illustrates the composition of the ETP market using one set of frequently used terms. The vast majority (92.5%) of the global market consists of plain-vanilla ETFs that are physically backed, and the rest of the market (7.5%) is relatively small, yet filled with more complex ETPs. Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. It suggested that the ETF label should be reserved only for noncomplex funds.66 The types of ETPs that appear in Figure 4 are individually defined in Figure 5.

|

Figure 4. Global ETP Assets Under Management (AUM) and Classification |

|

|

Source: CRS re-creation of Figure 2.4 in Ananth Madhavan, Exchange-Traded Funds and the New Dynamics of Investing (Oxford, UK: Oxford University Press, 2016). Note: Refer to Figure 5 for definition of terms. Data as of June 2015. For the definition of leveraged ETFs, see discussions following Figure 5. |

|

|

Source: BlackRock, A Primer on ETF Primary Trading and the Role of Authorized Participants, March 2017, at https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-etf-primary-trading-role-of-authorized-participants-march-2017.pdf. |

Although plain-vanilla physically backed ETFs, which make up the vast majority of the ETP market, are generally considered lower risk, a small subset of ETPs is the source of concerns over investor protection and systemic risk. Included in these higher-risk products are leveraged and inverse ETFs. Leveraged ETFs use derivatives and debt to produce multiples of daily returns or losses based on their underlying benchmark. The investment strategy of leveraged ETFs allows them to amplify gains as well as losses.67 Inverse ETFs use derivatives to profit from a decline in the value of underlying assets or instruments. They are designed to move in the opposite direction of the market indexes they track. The leveraged and inverse ETFs have shown rapid increases in numbers and total assets under management in recent years (Figure 6).

|

|

Source: ETFGI, in Robin Wigglesworth, "Worries over Exotic Exchange Traded Funds Deepen," Financial Times, February 14, 2018, at https://www.ft.com/content/6c4f40dc-1113-11e8-940e-08320fc2a277. |

As mentioned earlier, some ETFs are not physically backed. These ETFs could subject investors to counterparty risk—the credit risk of a contracted party not meeting its obligations. For example, synthetic ETFs, which can track an index without actually owning any of its securities, would produce such risk. Because they rely on counterparty derivatives agreements to ensure ETF returns, losses could potentially occur when counterparties fail to follow through on the agreed-upon payments.68 Other higher-risk ETPs include volatility-tracking ETPs, which are said to have triggered a major market event in February 2018 when several such funds incurred a loss of 90% (for more details, see the "Behavior Under Real Market Stress" section of this report).69

The policy debate related to ETFs can be unclear at times because the term ETF is not clearly defined.70 Some argue that traditional ETFs and other ETPs have vastly different constructions and thus warrant separate risk discussions. Multiple organizations have expressed concerns regarding these nontraditional ETPs. Some of these concerns are described below.

- The Financial Stability Board notes that for nontraditional ETFs, "liquidity is typically thinner and transparency lower."71 It suggests closer regulatory surveillance given the increased complexity and opacity of the products outside the standardized market. Product complexity generates additional financial risks, while opacity can lead to information asymmetry and distortion of investor understanding of certain products and their risks.

- The Bank for International Settlements (BIS) has issued comments on ETFs' systemic risk and discussed similar concerns. BIS has emphasized more complex ETFs that lengthen the "financial intermediation chain" (for example, through the use of derivatives and counterparties). Specifically, BIS notes that the complex products' risk exposures are less transparent and more difficult to assess. The growth of such complex ETF products could lead to systemic risk build-up.72

- The Bank of England states that certain nontraditional ETFs, including cash redemption ETFs and leveraged ETFs, could behave procyclically and amplify market stress.73

Issuer Concentration

The top three ETF sponsors (also known as asset managers or issuers)—BlackRock (40%), Vanguard (25%), and State Street (18%)—account for around 83% of U.S. ETF market share.74 This has led to multifaceted discussions of concentration risk. One way to analyze issuer concentration is to understand scenarios of issuer default and other implications of such concentration for markets and consumers, some of which are discussed below.

- Credit risk could be low for traditional ETFs, but there could be operational risks. Some argue that once ETF shares are created, they are independent of issuers. Investors in physically backed ETFs, which represent the vast majority of the ETF market, would each own a small share of the underlying securities and would generally not be exposed to credit risk in the event of issuer default. But issuer default could potentially create operational disruptions relating to the time and costs of unwinding ETF shares absent an issuer's involvement in ETF share redemption.

- There could be fewer and larger investment decisions. Some believe that the increased concentration of asset management and investment decisionmaking could lead to a potential increase in market volatility. This is because assets and decisions are controlled by fewer products, and fewer individuals are making larger decisions.75

- There could be entry barriers for new competition. ETFs' overall cost structure may benefit from increased scale. As the funds increase in size, their total expense ratio would go down, and in turn attract even more investors based on cost advantages. This would create entry barriers for newer ETFs that inevitably have smaller scale and higher cost structures.

Behavior Under Real Market Stress

Following the discussion of various financial-stability-related theories and opinions, this section explores ETPs' actual behavior under market stress. Results from three selected market events indicate that although ETPs were generally not regarded as root causes of market turbulence, ETPs as an asset class were disproportionately affected by market stress when compared to stocks. Abnormal behavior was observed for both index-based plain-vanilla products and the more complex product types, even though the former were considered lower risk and the latter were viewed as having a higher likelihood of causing concerns.

These market events are evidence of stress but are not representative of truly extreme scenarios. This is because ETPs have had a short operating history. They gained meaningful scale only in the recent decade, right after the last financial crisis. Whereas supporters praise ETPs' liquidity provision capabilities, critics argue that their "promise of ample liquidity has yet to be tested in a major bear market."76

May 6, 2010, Event

On May 6, 2010, U.S. capital markets experienced an abnormal decline and subsequent recovery of significant scale. Many individual equity securities and ETFs saw price declines and reversals of 15% or even 60% within one day.77 This event was later referred to as a "flash crash." The SEC and CFTC staff report on the event did not point to ETFs as a root cause, but explained that ETFs were disproportionately affected by price volatility. The reasons include the following: (1) the market makers paused their market making for a considerable period of time; (2) many automated trading systems took trading pauses78 during the sudden price decline; and (3) a disproportionate amount of ETF orders were hitting "stub-quote" levels.79 The SEC later took action, including adopting new rules to implement a volatility-based trading pause program on stocks and ETFs80 and prohibiting market maker stub quotes in order to prevent future flash crashes.

August 24, 2015, Event

On August 24, 2015, the Dow Jones Industrial Average index81 experienced the largest intraday decline in history.82 ETFs, including large plain-vanilla index-based ETFs, experienced substantial price swings. More than a dozen ETFs were trading at prices far below the value of their underlying baskets, a phenomenon largely unexpected.83 Around 40% of all ETPs examined by the SEC declined by more than 10% in value on that day.84

According to SEC staff research, ETPs as an asset class experienced more severe volatility than stocks. In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs."85 In other words, ETPs behaved outside of their expected norms (more so than stocks) under that market distress. During the event, similarly constructed index-based ETPs that ought to have priced similarly were trading at significantly different price points.86 The arbitrage mechanism87 broke down, and the prices of ETPs deviated significantly from their underlying assets for a short period of time.

In addition to market sentiments that produced selling pressure and liquidity withdrawals, an SEC staff paper points to ETP creation and redemption activity and certain market rules and processes, among other things, as potential reasons for the volatility. Widely discussed concerns regarding the more exotic types of ETPs were not highlighted by the 2015 market event.88

February 5, 2018, Event

On February 5, 2018, the U.S. stock market fell 4% and the Wall Street "fear gauge" VIX index89 increased 20 points, its largest one-day move within the index's 28-year history.90 The event was generally considered a significant market "correction" that followed a prolonged period of low volatility.91 Volatility is a proxy for market risk that refers to the magnitude of price movements. The U.S. ETF market at the time experienced severe volatility and trading volume rose to more than $1 trillion, doubling its norm.92

Experts generally did not attribute the root cause of the market event to ETFs. For example, Federal Reserve Board Chairman Jerome Powell commented that "ETFs are a particular form of fund and I don't think they were particularly at the heart of what went on those days."93 But the event has deepened the concerns many have over exotic ETFs.

At the center of the debate about the causes of the event are several VIX-tracking ETPs that shorted volatility, meaning that they bet on the volatility or price movements to stay low, and saw their fund value evaporate by around 90%, or $3 billion, within a day following the volatility increases.94

Passive and Active Investment Styles

The vast majority of all ETF assets are passively managed or index-based, meaning the fund managers do not take an active role in asset selection. Index-based ETFs are designed to track a market index either by replicating an index (for example, the S&P 500),95 or using a subset of an index. As of year-end 2017, more than 99% of all ETF assets were invested in passively managed index-based ETFs.96 These ETFs aim to deliver a return in line with the underlying assets of the index they track.97 The index-based investment style is deployed by both mutual funds and ETFs. In recent years, index-based ETFs have surpassed index-based mutual funds in terms of total assets under management.98 There are also actively managed ETFs that rely on fund managers to actively select, trade, and manage ETF assets to achieve a particular investment objective. These ETFs represent a small portion of all ETF assets under management (AUM). According to the SEC, there are 200 actively managed ETFs with combined AUM of $46 billion, or 1.4% of all ETF AUM as of year-end 2017.99

The rise of ETFs in recent years has heightened the debate over active versus passive investment styles, and how ETFs, representing the passive asset management style, have transformed the investment management industry. At the core of the debate are two main issues: investment returns and market efficiency.

Investment Return

Some argue that passively managed funds provide a better value proposition than actively managed funds. The passive style generates lower costs through management fee savings and is considered to be able to also outperform actively managed funds. For example, one S&P Global study indicates that active stock managers underperformed their index targets more than 80% of the time over 1-year, 5-year, and 10-year periods.100

Another more famous case study is the 10-year bet between Warren Buffett and Protégé Partners. Buffett bet with the hedge fund manager of Protégé Partners in 2007 that the S&P 500 index would outperform the five funds that Protégé selected for the next 10 years. By the time the bet was officially concluded, the index outperformed all five funds by large margins.101

Market Efficiency

The rise of ETFs has prompted a wave of criticism from some of the world's most influential money managers. Their concerns are that the emergence of passively managed funds would undermine price discovery102 through reduced fundamental research by active asset management. They claim this would create systemic risk concerns through correlations and volatility, and affect the efficient allocation of capital. Some assert that "passive investing is in danger of devouring capitalism" and could "rewrite how markets function."103

Others argue that actively managed funds would provide more value when market conditions are less efficient. If the asset management trend drifts toward predominately passive investment, market inefficiencies would occur, thus creating economic incentives for active management to excel and attract capital inflow. As such, actively managed funds would grow.

Investor Protection

As mentioned earlier, there are many types of ETPs with often vastly different risk exposures. However, all ETPs, despite their different levels of risk, are generally publicly traded. This means that less-sophisticated retail investors could be exposed to high risks they may not be able to comprehend or financially positioned to tolerate. For example, certain high-risk ETPs are said to "become a means for hedge funds to speculate on the market."104 Although hedge funds are generally restricted to more sophisticated investors,105 certain ETFs facing risk exposure similar to hedge funds are accessible to all investors.

Investor protection is a concern even for industry experts who would normally promote the products. For example, leveraged funds are widely criticized for their retail investor education practices, because they can multiply both investment gains and losses, thus amplifying the risks and the needs for investor education and understanding of the product features.106 An inventor of the first U.S. ETF characterized leveraged ETFs as "akin to gambling" and as presenting "extreme" retail investor education challenges.107 In addition to price volatility, certain synthetic products also subject investors to counterparty108 credit risks that are absent from physically backed products.109 Issuer default is another concern, as it could also adversely affect ETF investors, especially synthetic ETF investors. For example, some failed ETPs issued through defaulted issuer Lehman Brothers lost more than 90% of their value during the 2008 financial crisis.110

Some worry about the role of authorized participants who are also market makers. They question APs' potential conflict of interest, especially at times of stress, when APs serve dual roles as both dealers and arbitrageurs for a particular ETF. In those cases, some have raised concerns that APs could front run111 their own trades.

To address investor protection concerns regarding exotic ETPs, in addition to regulation and disclosure requirements set in the 1940 Act and securities laws, the SEC has issued investor alerts regarding certain high-risk ETFs.112 With the newly proposed ETF rule, the SEC stresses certain new disclosures that would require ETFs to publish on their websites trading information and related costs, among other things.113 These requirements would allow investors to be more aware of the risks when making investment decisions. FINRA also has existing rules and standards that require broker-dealers to perform "suitability analysis" and other assessments for investor protection. It also issued investor alerts and FAQs on nontraditional ETFs.114

The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs. Some industry players have gone beyond calling for a standardized naming convention to suggest an ETF rating system that could further segment the different risk exposures of the more than 1,800 different ETFs in the U.S. market.115

Author Contact Information

Footnotes

| 1. |

SEC, Mutual Funds and ETFs, at https://www.sec.gov/reportspubs/investor-publications/investorpubsinwsmfhtm.html. |

| 2. |

State Street SPDR S&P 500 ETF, launched on January 29, 1993, was the first ETF. It is also currently the largest ETF as measured by assets under management. For more details see State Street, "The First ETF Turns 20: Innovation That Leveled the Playing Field for All Investors Reaches New Milestone," January 29, 2013, at http://newsroom.statestreet.com/press-release/state-street-global-advisors/first-etf-turns-20-innovation-leveled-playing-field-all-i. |

| 3. |

BlackRock, BlackRock Global ETP Landscape, March 2018, at https://www.ishares.com/ch/institutional/en/literature/etp-landscape-report/monthly-industry-highlights-march-2018-en-emea-pc-etp-landscape-report.pdf. |

| 4. |

The average U.S.-based ETF has an expense ratio of 0.44%, compared to the average U.S.-based mutual fund expense ratio of 1.22% and U.S.-based index mutual fund expense ratio of 0.91% in 2015. Expense ratio refers to the annual fees that traditional mutual funds charge investors relative to assets under management. For more details, see Financial Industry Regulatory Authority, ETFs: What You Need to Know, December 8, 2015, at http://www.finra.org/investors/etfs-what-you-need-know. |

| 5. |

Mutual funds are SEC-registered open-end investment companies. SEC, Mutual Funds and Exchange-Traded Funds (ETFs) – A Guide for Investors, at https://www.sec.gov/reportspubs/investor-publications/investorpubsinwsmfhtm.html#MF3. |

| 6. |

U.S. ETFs are considered more tax efficient than other common investment vehicles, including mutual funds and stocks. Tax efficiency comes from their in-kind redemption process that allows for fewer taxable events. In-kind redemptions refers to the fact that ETFs require authorized participants to exchange ETF shares for a basket of securities rather than cash. This allows the ETF to avoid selling securities to raise cash to meet redemptions. As such, it could avoid certain capital-gains-tax triggering events. For more details, see WisdomTree and Barron's, "What Makes ETFs Tax Efficient?" April 27, 2017, at https://www.barrons.com/articles/sponsored/what-makes-etfs-tax-efficient-1493223526. |

| 7. |

See the "Higher-Risk Products" section of this report for more detail. |

| 8. |

This section discusses typical ETF structures. Structures of nontraditional ETPs may differ. |

| 9. |

Liquidity describes the speed and ease with which transactions occur without affecting the price. |

| 10. |

KPMG, ETF Playbook Glossary, 2016, at https://home.kpmg.com/content/dam/kpmg/us/pdf/etf-playbook-glossary.pdf. |

| 11. |

BlackRock, A Primer on ETF Primary Trading and the Role of Authorized Participants, March 2017, at https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-etf-primary-trading-role-of-authorized-participants-march-2017.pdf. |

| 12. |

Financial Industry Regulatory Authority, Brokers, at http://www.finra.org/investors/brokers. |

| 13. |

SEC, Market Maker, at https://www.sec.gov/fast-answers/answersmktmakerhtm.html. |

| 14. |

BlackRock, A Primer on ETF Primary Trading and the Role of Authorized Participants, March 2017, at https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-etf-primary-trading-role-of-authorized-participants-march-2017.pdf. |

| 15. |

Vanguard, Understanding ETF Liquidity and Trading, at https://www.vanguard.nl/documents/understanding-etf-liquidity.pdf. |

| 16. |

Open-end funds sell and redeem shares on a continuous basis. They are in contrast to closed-end funds that sell a fixed number of shares at an initial public offering and then trade on a secondary market thereafter. SEC Investor Publications, Mutual Funds and Exchange-Traded Funds—A Guide for Investors, at https://www.sec.gov/reportspubs/investor-publications/investorpubsinwsmfhtm.html. |

| 17. |

Eric Balchunas, The Institutional ETF Toolbox (Hoboken, NJ: Wiley and Bloomberg Press, 2016). |

| 18. |

Ananth Madhavan, Exchange-Traded Funds and the New Dynamics of Investing (Oxford, UK: Oxford University Press, 2016). |

| 19. |

American Century Investments, Understanding ETF Liquidity, April 19, 2018, at http://americancenturyblog.com/2018/04/understanding-etf-liquidity. |

| 20. |

NAV is the per-share value of a fund's assets minus liabilities. It is one way to calculate how much a fund is worth. |

| 21. |

Bradley Kay, "Has the ETF Arbitrage Mechanism Failed?" Morningstar, March 11, 2009, at http://www.morningstar.com/articles/283302/has-the-etf-arbitrage-mechanism-failed.html. |

| 22. |

Ananth Madhavan, Exchange-Traded Funds and the New Dynamics of Investing (Oxford, UK: Oxford University Press, 2016). |

| 23. |

SEC Fast Answers, Closed-End Fund Information, at https://www.sec.gov/fast-answers/answersmfclosehtm.html. |

| 24. |

State Street SPDR S&P 500 ETF, launched on January 29, 1993, was the first ETF. It is also currently the largest ETF as measured by assets under management. For more details see State Street, "The First ETF Turns 20: Innovation That Leveled the Playing Field for All Investors Reaches New Milestone," January 29, 2013, at http://newsroom.statestreet.com/press-release/state-street-global-advisors/first-etf-turns-20-innovation-leveled-playing-field-all-i. |

| 25. |

Investment Company Institute, Understanding the Regulation of Exchange-Traded Funds Under the Securities Exchange Act of 1934, August 2017, at https://www.ici.org/pdf/ppr_17_etf_listing_standards.pdf. |

| 26. |

Eric Balchunas, The Institutional ETF Toolbox (Hoboken, NJ: Wiley and Bloomberg Press, 2016). |

| 27. |

A unit investment trust is a type of investment company that "makes a one-time public offering of only a specific, fixed number of redeemable securities called units, and which will terminate and dissolve on a date that is specified at the time of creation." For more details see SEC, Mutual Funds and ETFs, at https://www.sec.gov/investor/pubs/sec-guide-to-mutual-funds.pdf. |

| 28. |

P.L. 76-768. |

| 29. |

SEC, Request for Comments on Exchange-Traded Products, at https://www.sec.gov/rules/other/2015/34-75165.pdf. |

| 30. |

P.L. 76-768. |

| 31. |

P.L. 73-22. |

| 32. |

P.L. 73-291. |

| 33. |

Financial Industry Regulatory Authority, Non-Traditional ETFs FAQ, at http://www.finra.org/industry/non-traditional-etf-faq. |

| 34. |

ICI, 2018 Investment Company Fact Book, at https://www.ici.org/pdf/2018_factbook.pdf. |

| 35. |

P.L. 74-675. |

| 36. |

U.S. Department of the Treasury, A Financial System That Creates Economic Opportunities Asset Management and Insurance, October 2017, at https://www.treasury.gov/press-center/press-releases/Documents/A-Financial-System-That-Creates-Economic-Opportunities-Asset_Management-Insurance.pdf. |

| 37. |

SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 38. |

73 Federal Register 14618, at https://www.gpo.gov/fdsys/pkg/FR-2008-03-18/pdf/E8-5239.pdf#page=2. |

| 39. |

SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 40. |

SEC Rule 6c-11. |

| 41. |

Footnote 77 of SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 42. |

Footnote 77 of SEC Rule 6c-11. |

| 43. |

Footnote 77 of SEC Rule 6c-11. |

| 44. |

SEC Press Release, "SEC Proposes New Approval Process for Certain Exchange-Traded Funds," June 28, 2018, at https://www.sec.gov/news/press-release/2018-118. |

| 45. |

iShares, iShares 2018 ETF and Derivatives Guide, at https://www.ishares.com/us/resources/institutional-investors/etf-derivatives-guide. |

| 46. |

Mohamed El-Erian, "The Risky Lure of Passive Investment Proxies," Bloomberg, December 1, 2017, at https://www.bloomberg.com/view/articles/2017-12-01/the-risky-lure-of-passive-investment-proxies. |

| 47. |

John Authers, "ETFs to Play Main Role in the Next Financial Crisis," Financial Times, December 28, 2015, https://www.ft.com/content/53b5b728-a9ae-11e5-9700-2b669a5aeb83. |

| 48. |

Investment Company Institute, Frequently Asked Questions About Mutual Fund Liquidity, at https://www.ici.org/faqs/faq/mfs/faqs_mf_liquidity. |

| 49. |

Using bond ETFs as an example, bond ETFs with underlying assets in less-liquid bonds are believed to have especially benefited from enhanced liquidity. This could help offset other bond market trends that have reduced liquidity. For instance, one source states that bond dealer inventories have declined 70% since 2008 and only 2% of U.S. bonds trade every day, compared to 3.5% in 2008, prior to the financial crisis. Certain bond ETFs are regarded as having provided a liquidity "wrapper" for an otherwise less-liquid basket of assets. But the mismatch between higher liquidity ETF shares and lower liquidity underlying bonds has also created concerns about liquidity mismatch induced systemic risk. The liquidity mismatch concern has drawn regulatory attention to ETFs globally. More details at iShares, Guide to ETFs, at https://www.ishares.com/us/resources/institutional-investors/etf-derivatives-guide/page-1. Data cited from Federal Reserve, Securities Industry and Financial Market Association, as of December 31, 2017; and Mike Bird, "Could ETFs Fall Into a Liquidity Jam?" Wall Street Journal, March 21, 2018, at https://www.wsj.com/articles/return-of-volatility-raises-liquidity-question-for-etfs-1521627574. |

| 50. |

Contagion risk is defined as "the transmission of idiosyncratic shocks among financial institutions." For more details on the definition, see IMF, Contagion Risk in the International Banking System and Implications for London as a Global Financial Center, Working Paper, April 2007, at https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Contagion-Risk-in-the-International-Banking-System-and-Implications-for-London-As-a-Global-20577. |

| 51. |

IMF, Global Financial Stability Report, April 2018, at http://www.imf.org/en/Publications/GFSR/Issues/2018/04/02/Global-Financial-Stability-Report-April-2018. |

| 52. |

Matt Levine, "CEOs Still Don't Like Short-Termism," Bloomberg, June 7, 2018, at https://www.bloomberg.com/view/articles/2018-06-07/ceos-still-don-t-like-short-termism. |

| 53. |

A fire sale is the selling of financial assets at deeply discounted prices. |

| 54. |

For more on negative feedback loops, see Bank of England, Simulating Stress Across the Financial System: The Resilience of Corporate Bond Markets and the Role of Investment Funds, Financial Stability Paper No. 42, July 2017, at https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-paper/2017/simulating-stress-across-the-financial-system-resilience-of-corporate-bond-markets. |

| 55. |

SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 56. |

SEC Rule 6c-11. |

| 57. |

SEC Rule 6c-11. |

| 58. |

Footnote 131 of SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 59. |

SEC Fixed Income Market Structure Advisory Committee Meeting, April 9, 2018, transcript at https://www.sec.gov/spotlight/fixed-income-advisory-committee/fimsa-040918transcript.txt. |

| 60. |

SEC Investor Bulletin, Exchange-Traded Funds, at https://www.sec.gov/investor/alerts/etfs.pdf. |

| 61. |

FSOC, Update on Review of Asset Management Products and Activities, at https://www.treasury.gov/initiatives/fsoc/news/Documents/FSOC%20Update%20on%20Review%20of%20Asset%20Management%20Products%20and%20Activities.pdf. |

| 62. |

iShares, "Do ETFs Add Market Volatility?" at https://www.ishares.com/us/education/etf-trends-and-market-volatility. |

| 63. |

IOSCO, Recommendations for Liquidity Risk Management for Collective Investment Schemes, February 2018, at http://www.iosco.org/library/pubdocs/pdf/IOSCOPD590.pdf. |

| 64. |

Bank of England, Financial Stability Report, November 2017, at https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-report/2017/november-2017.pdf. |

| 65. |

David Abner, The ETF Handbook, Second Edition (Hoboken, NJ: Wiley, 2016). |

| 66. |

BlackRock, ETFs: A Call for Greater Transparency and Consistent Regulation, 2011, at https://www.blackrock.com/corporate/literature/whitepaper/transparency-and-consistent-regulation-oct-2011.pdf. |

| 67. |

SEC, Leveraged and Inverse ETFs, at https://www.investor.gov/system/files/news/documents/english/Leveraged%20and%20Inverse%20ETFs.pdf. |

| 68. |

Vanguard, ETF Education Centre, at https://www.vanguard.com.hk/portal/etfeducation.htm#/basics/different-types-of-etfs. |

| 69. |

Two of the most-cited volatility tracking ETPs are ProShares Short VIX Short-Term Futures (SVXY) and the VelocityShares Daily Inverse VIX Short-Term (XIV). The two ETPs had $3 billion in assets under management combined prior to the market event and experienced 92% and 96% one-week total losses, respectively, in February 2018. For more details see exhibit in Crystal Kim, "Where Volatility Goes to Die," Barron's, February 10, 2018, at https://www.barrons.com/articles/where-volatility-goes-to-die-1518237491. |

| 70. |

Henry Hu and John Morley, "A Regulatory Framework for Exchange-Traded Funds," Southern California Law Review, vol. 91, March 10, 2018, at https://ssrn.com/abstract=3137918. |

| 71. |

Financial Stability Board, Potential Financial Stability Issues Arising from Recent Trends in Exchange-Traded Funds, April 2011, at http://www.fsb.org/wp-content/uploads/r_110412b.pdf. |

| 72. |

Bank for International Settlements, Market Structures and Systemic Risks of Exchange-Traded Funds, April 2011, at https://www.bis.org/publ/work343.pdf. |

| 73. |

Bank of England, Financial Stability Report, November 2017, at https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-report/2017/november-2017.pdf. |

| 74. |

For more details, see "BlackRock's Weird Wish: ETF Rules That Help the Competition," Bloomberg, October 24, 2017, at https://www.bloomberg.com/news/articles/2017-10-24/blackrock-s-unusual-wish-an-etf-rule-that-helps-the-competition. |

| 75. |

Owen Walker, "Funds 'Snowball' Means Big Firms Can Only Get Bigger," Financial Times, June 9, 2018, at https://www.ft.com/content/1611bea8-68d3-11e8-b6eb-4acfcfb08c11. |

| 76. |

Chris Flood, "Record ETF Inflows Fuel Price Bubble Fears," Financial Times, August 13, 2017, https://www.ft.com/content/8720939e-7e82-11e[phone number scrubbed]-edda0bcbc928. |

| 77. |

SEC and CFTC, Findings Regarding the Market Events of May 6, 2010, September 30, 2010, at https://www.sec.gov/news/studies/2010/marketevents-report.pdf. |

| 78. |

A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements. |

| 79. |

A stub quote is an offer to buy or sell a stock at a price so far away from the prevailing market that it is not intended to be executed—for example, an order to buy or sell a common stock at a penny or at $100,000 per share. A market maker may enter into stub quotes to nominally comply with its obligation to maintain a two-sided quotation at those times when it does not wish to actively provide liquidity. SEC reports that "executions against stub quotes represented a significant proportion of the trades that were executed at extreme prices on May 6, and subsequently broken." SEC, SEC Approves New Rules Prohibiting Market Maker Stub Quotes, November 8, 2010, at https://www.sec.gov/news/press/2010/2010-216.htm. |

| 80. |

For more details on the event and related regulatory changes, see Roberta Karmel, "A Look Back at the Flash Crash and Regulatory Initiatives," New York Law Journal, June 18, 2015, at https://www.brooklaw.edu/newsandevents/news/2015/~/media/8CC4393DD2A7470F9765E66558D606EB.ashx. |

| 81. |

The Dow Jones Industrial Average is a price-weighted average of stock prices of 30 large U.S. publicly traded companies. It is a widely used index to gauge market performance over time. |

| 82. |

FINRA, ETFs: What You Need to Know, December 8, 2015, at http://www.finra.org/investors/etfs-what-you-need-know. |

| 83. |

Chris Dieterich, "Many ETFs Saw Wacky Trading In Monday's Selloff," Barron's, August 25, 2015, at https://www.barrons.com/articles/many-etfs-saw-wacky-trading-in-mondays-selloff-1440510727; and Chris Dieterich, "SEC Pubs Report On Aug. 24 'Flash Crash,'" Barron's, December 29, 2015, at https://www.barrons.com/articles/sec-pubs-report-on-aug-24-flash-crash-1451408869. |

| 84. |

"Of the 50 largest capitalization ETPs, 20 (40.0%) declined by 10% or more, while 36.5% of more than 1,300 other ETPs also declined by 10% of more." SEC, Research Note: Equity Market Volatility on August 24, 2015, December 2015, at https://www.sec.gov/marketstructure/research/equity_market_volatility.pdf. |

| 85. |

SEC, Research Note: Equity Market Volatility on August 24, 2015, December 2015, at https://www.sec.gov/marketstructure/research/equity_market_volatility.pdf. |

| 86. |

"SPY, for example, traded at a premium to its NAV until 9:37, while the next largest ETP—the iShares Core S&P 500 ('IVV')—traded at a substantial discount to the SPY, EMini, and SPY NAV until 9:43." SEC, Research Note: Equity Market Volatility on August 24, 2015, December 2015, at https://www.sec.gov/marketstructure/research/equity_market_volatility.pdf. |

| 87. |

See the "Arbitrage Mechanism" section of the report for more detail. |

| 88. |

SEC, Research Note: Equity Market Volatility on August 24, 2015, December 2015, at https://www.sec.gov/marketstructure/research/equity_market_volatility.pdf. |

| 89. |

The VIX index refers to the Cboe volatility index, a benchmark index that measures the market's expectation of future volatility over a period of time. For more details, see Cboe Volatility Index FAQs, at http://www.cboe.com/products/vix-index-volatility/vix-options-and-futures/vix-index/vix-faqs. |

| 90. |

Saqib Ahmed, "February Volatility 'Hurricane' Upended VIX-Linked Trading," Reuters, April 30, 2018, at https://www.reuters.com/article/us-usa-stocks-volatility-analysis/february-volatility-hurricane-upended-vix-linked-trading-idUSKBN1I122J; and John Authors, "Two Cheers for the Return of Volatility," Financial Times, February 16, 2018, at https://www.ft.com/content/b1b44de0-1283-11e8-940e-08320fc2a277. |

| 91. |

Jeff Cox, "The Stock Market Correction Two Weeks Later: How It Happened and If It Can Happen Again," CNBC, February 18, 2018, at https://www.cnbc.com/2018/02/16/the-stock-market-correction-two-weeks-later.html. |

| 92. |

BlackRock, February 2018 Case Study: ETF Trading in a High-Velocity Market, March 2018, at https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-case-study-etf-trading-high-velocity-market-february-2018.pdf. |

| 93. |

"ETFs Weren't to Blame for the Market Correction, Powell Says," Bloomberg, February 27, 2018, at https://www.bloomberg.com/news/articles/2018-02-27/etfs-weren-t-to-blame-for-the-market-correction-powell-says. |

| 94. |

Two of the most-cited volatility tracking ETPs are ProShares Short VIX Short-Term Futures (SVXY) and the VelocityShares Daily Inverse VIX Short-Term (XIV). The two ETPs had $3 billion in assets under management combined prior to the market event and experienced 92% and 96% one-week total losses, respectively, in February 2018. For more details see exhibit in Crystal Kim, "Where Volatility Goes to Die," Barron's, February 10, 2018, at https://www.barrons.com/articles/where-volatility-goes-to-die-1518237491. |

| 95. |

The S&P 500 index tracks the performance of the largest publicly traded companies in the United States. |

| 96. |

Vanguard and Bloomberg, "What Types of ETFs Are There?" December 31, 2017, at https://advisors.vanguard.com/VGApp/iip/site/advisor/etfcenter/article/ETF_WhatTypesETFs. |

| 97. |

SEC, "SEC Investor Bulletin: Exchange-Traded Funds," August 10, 2012, at https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-exchange-traded-funds-etfs; Barclays, Four Differences Between Active and Passive Investing, at https://www.smartinvestor.barclays.co.uk/invest/investment-insight/investment-ideas-and-strategies/four-differences-between-active-and-passive-investing.html. |

| 98. |

BlackRock, "Index Investing Supports Vibrant Capital Markets," October 2017, at https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-index-investing-supports-vibrant-capital-markets-oct-2017.pdf. |

| 99. |

SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 100. |

S&P Global, SPIVA U.S. Scorecard, September 15, 2016, at https://www.spglobal.com/our-insights/SPIVA-US-Scorecard.html. |

| 101. |

Berkshire Hathaway, 2018 shareholder letter, at http://www.berkshirehathaway.com/letters/2017ltr.pdf. |

| 102. |

Price discovery is the process by which buyers and sellers determine the price of a security. It involves markets, market participants, and information. For more details, see Simon Constable, "What Is 'Price Discovery' and Why Does It Matter?" Wall Street Journal, January 8, 2017, at https://www.wsj.com/articles/what-is-price-discovery-and-why-does-it-matter-1483930860. |

| 103. |

Robin Wigglesworth, "ETF Growth Is in Danger of Devouring Capitalism," Financial Times, February 4, 2018, at https://www.ft.com/content/09cb4a5e-e4dc-11e7-a685-5634466a6915. |

| 104. |

"Too Much of a Good Thing The Risks Created by Complicating a Simple Idea," The Economist, June 23, 2011, at https://www.economist.com/node/18864254. |

| 105. |

SEC Investor Bulletin, Hedge Funds, at https://www.sec.gov/investor/alerts/ib_hedgefunds.pdf. |

| 106. |

Min Lee and Shoko Oda, "Father of ETFs Warns About Leveraged Funds," Bloomberg, April 29, 2018, at https://www.bloomberg.com/news/articles/2018-04-29/the-father-of-etfs-warns-about-the-dangers-of-leveraged-funds. |

| 107. |

Min Lee and Shoko Oda, "Father of ETFs Warns About Leveraged Funds." |

| 108. |

A counterparty is the institutions on the other side of a financial transaction. |

| 109. |

See the "Higher-Risk Products" section of this report for more details. |

| 110. |

Larry Swedroe, "An ETN Credit-Risk Reality Check," EFT.com, July 22, 2013, at http://www.etf.com/sections/index-investor-corner/19351-an-etn-credit-risk-reality-check.html?nopaging=1. |

| 111. |

Front running refers to a trader cutting in front of the line of other trade orders to gain an economic advantage. |

| 112. |

SEC, Leveraged and Inverse ETFs, at https://www.investor.gov/system/files/news/documents/english/Leveraged%20and%20Inverse%20ETFs.pdf. |

| 113. |

For example, the proposal suggests ETFs to disclose median bid-ask spreads for the most recent fiscal year and other key historic data that could inform ETF investors of the risks. SEC Rule 6c-11, at https://www.sec.gov/rules/proposed/2018/33-10515.pdf. |

| 114. |

FINRA, Non-Traditional ETFs FAQ, at http://www.finra.org/industry/non-traditional-etf-faq; FINRA, Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors, at http://www.finra.org/investors/alerts/leveraged-and-inverse-etfs-specialized-products-extra-risks-buy-and-hold-investors. For more capital acquisition broker rules, see FINRA, FINRA Manual, at http://finra.complinet.com/en/display/display_main.html?rbid=2403&element_id=12442. |

| 115. |

Eric Balchunas, The Institutional ETF Toolbox (Hoboken, NJ: Wiley and Bloomberg Press, 2016). |