Introduction

Individuals and households that suffer uninsured or underinsured losses caused by an incident1 that results in an emergency or major disaster declaration typically apply for Individual Assistance (IA), administered by the Federal Emergency Management Agency (FEMA).2 They may also apply for disaster loans, administered by the Small Business Administration (SBA).3 This report opens with an overview of the two programs and a discussion about how declarations, including presidential declarations of emergency or major disaster under the Robert T. Stafford Disaster Relief and Emergency Assistance Act (Stafford Act; P.L. 93-288, as amended; 42 U.S.C. §§5121 et seq.), and SBA declarations under the Small Business Act (P.L. 83-163, as amended; 15 U.S.C. §§631 et seq.), are used to put them into effect. This report also discusses the application processes and eligibility criteria used by the SBA and FEMA to make loan and grant determinations, respectively. The report then describes the appeals processes, and concludes with policy observations and potential considerations for Congress about computer matching agreements, duplication of benefits, and the use of income tests as a screening device for SBA disaster loans and FEMA grants.

The SBA Disaster Loan Program and FEMA IA are interlaced to a certain degree. Functionally, the SBA and FEMA have a computer matching agreement (CMA) to share real-time data on assistance provided to applicants.4 The SBA and FEMA use the interface between their systems to identify and prevent a duplication of benefits (DOB) because the SBA disaster loans and FEMA grants both provide assistance for damage to personal property, moving and storage expenses, and transportation assistance.5 The CMA also helps determine loan and grant eligibility because, from an administrative perspective, eligibility and assistance from one source can impact eligibility and assistance from the other source.6

While the overlap between the two programs may have some benefits, it arguably also causes some confusion. Some say there are elements of the application process that are not entirely known or understood by those outside the agencies. For instance, some Members have asked for clarification concerning the criteria used to determine eligibility for loans and/or grants, as well as how decisions are made with respect to whether an applicant is provided a loan, grant, or both. Others have questioned whether determinations are made on a case-by-case basis, or if the determination criteria are applied uniformly to all applicants seeking disaster assistance.

Overview of Programs

The following sections provide descriptions of the SBA and FEMA programs that provide assistance to individuals and households. In many cases, disaster survivors find that they need assistance from both programs in addition to other sources of assistance, including private insurance, state and local government assistance, and assistance from voluntary organizations, to fully recover.

SBA Home Disaster Loans

Homeowners, renters, and personal property owners located in a declared disaster area are eligible to apply for an SBA home disaster loan.7 SBA home disaster loans can be conceptualized as two categories of loans according to how the proceeds are put to use: Personal Property Loans and Real Property Loans. These loans cover only uninsured or underinsured property and primary residences in a declared disaster area.

Personal Property Loans

A Personal Property Loan provides a creditworthy homeowner or renter located in a declared disaster area with up to $40,000 to repair or replace personal property owned by the disaster survivor.8 Eligible items include furniture, appliances, clothing, and automobiles damaged or lost in a disaster. Eligibility of luxury items with functional use, such as antiques and rare artwork, is limited to the cost of an ordinary item meeting the same functional purpose. Interest rates for Personal Property Loans cannot exceed 8% per annum, or 4% per annum if the applicant is found by SBA to be unable to obtain credit elsewhere. Generally, borrowers pay equal monthly installments of principal and interest, beginning five months from the date of the loan. Loan maturities may be up to 30 years.

Real Property Loans

Real Property Loans provide creditworthy homeowners with uninsured or underinsured loss located in a declared disaster area with up to $200,000 to repair or replace the homeowner's primary residence to its predisaster condition.9 The loans may not be used to upgrade a home or build additions to the home, unless the upgrade or addition is required by city or county building codes, such as a code-required elevation. Repair or replacement of landscaping and/or recreational facilities cannot exceed $5,000. A homeowner may borrow funds to cover the cost of improvements to protect their property against future damage (e.g., elevation, retaining walls, sump pumps, etc.). Mitigation funds may not exceed 20% of the disaster damage, as verified by SBA, to a maximum of $200,000 for home loans.10 As previously mentioned, interest rates cannot exceed 8% per annum, or 4% per annum if the applicant is unable to obtain credit elsewhere. Generally, borrowers pay equal monthly installments of principal and interest, beginning five months from the date of the loan. Loan maturities may be up to 30 years.

FEMA Individual Assistance

Various types of FEMA IA may be provided to disaster survivors, depending on whether an emergency or major disaster is declared, and the type(s) of IA requested by the governor of the affected state or the tribal chief executive and authorized by FEMA.11 FEMA's IA program includes (1) Mass Care and Emergency Assistance, (2) the Crisis Counseling Assistance and Training Program, (3) Disaster Unemployment Assistance, (4) Disaster Legal Services, (5) Disaster Case Management, and (6) the Individuals and Households Program.12 The Individuals and Households Program provides assistance to meet the housing and other needs of disaster survivors, and is the IA program that is often the subject of the most congressional interest. A brief description of each form of IA is included below.

Mass Care and Emergency Assistance

Mass Care and Emergency Assistance (MC/EA) involves the provision of life-sustaining services to disaster survivors prior to, during, and following an incident through short-term recovery.13 MC/EA includes seven service "activities": (1) sheltering; (2) feeding; (3) distribution of emergency supplies; (4) support for individuals with disabilities and others with access and functional needs; (5) reunification services for adults and children; (6) support for household pets, service animals, and assistance animals; and (7) mass evacuee support.14

Crisis Counseling Assistance and Training Program

The Crisis Counseling Assistance and Training Program (CCP)15 provides grant funding to eligible local, state, territorial, and Indian tribal governments, as well as nongovernmental organizations (e.g., a private mental health organization that the governor has designated to receive funds). CCP supplements efforts to assist individuals and communities with recovering from the effects of a disaster through community-based outreach and the provision of services, such as crisis counseling, psycho-education,16 and coping skills development.17 CCP also provides support by linking the disaster survivor with other resources, such as individuals and agencies that help survivors in the recovery process.18 The program provides short- to intermediate-term assistance to support mental and emotional health needs; two CCP programs provide assistance for different lengths of time: (1) the Immediate Services Program provides funding for up to 60 days following a major disaster declaration; and (2) the Regular Services Program provides funding for up to 9 months from the notice of award.19

Disaster Unemployment Assistance

Disaster Unemployment Assistance (DUA) provides benefits to individuals who were previously employed or self-employed, were rendered jobless or whose employment was interrupted as a direct result of a major disaster, and are ineligible for regular unemployment insurance.20 DUA may also provide reemployment assistance.21 DUA benefits may continue for up to 26 weeks following the declaration of a major disaster.22

Disaster Legal Services

Disaster Legal Services (DLS) are provided for free to low-income individuals who require them as a result of a major disaster. The provision of services is "confined to the securing of benefits under the [Stafford] Act and claims arising out of a major disaster."23 Assistance may include help with insurance claims, drawing up new wills and other legal documents lost in the disaster, help with home repair contracts and contractors, and appeals of FEMA decisions.24 DLS is provided through an agreement with the American Bar Association's Young Lawyers Division.25 Neither the statute nor the regulations establish cost-share requirements or time limitations for DLS.

Disaster Case Management

The Disaster Case Management (DCM) program partners case managers with disaster survivors to develop and implement disaster recovery plans that address their unmet needs.26 The program is time-limited, and shall not exceed 24 months from the date of the major disaster declaration.27

Individuals and Households Program

The Individuals and Households Program (IHP) is the primary vehicle for FEMA assistance to individuals and households after the President issues an emergency or major disaster declaration, when authorized.28 It is intended to meet basic needs and support recovery efforts, but it cannot compensate disaster survivors for all losses.29 Under the IHP, financial assistance (i.e., funding provided to an applicant) and/or direct assistance (i.e., assistance provided by FEMA/state/territorial/Indian tribal government) may be available to eligible individuals and households who have uninsured or underinsured necessary expenses and serious needs, as a result of a disaster, that cannot be met through other means or forms of assistance.30 There are two categories of IHP assistance: Housing Assistance, and Other Needs Assistance (ONA) (see Table 1 for the subcategories of Housing Assistance and ONA). The period of assistance is generally limited to 18 months following the date of the emergency or major disaster declaration.31

|

Housing Assistance: |

Housing Assistance: |

ONA: |

ONA: |

|

Lodging Expense Reimbursement Rental Assistance Home Repair Assistance Home Replacement Assistance |

Multifamily Lease and Repair Transportable Temporary Housing Units Direct Lease Permanent Housing Construction |

Personal Property Moving and Storage Transportation Assistance Group Flood Insurance Policy |

Funeral Assistance Medical and Dental Assistance Childcare Assistance Assistance for Miscellaneous Items Critical Needs Assistance Clean and Removal Assistance |

Source: FEMA, Individual Assistance Program and Policy Guide (IAPPG), FP 104-009-03, March 2019, p. 7, at https://www.fema.gov/media-library-data/1551713430046-1abf12182d2d5e622d16accb37c4d163/IAPPG.pdf.

Notes: The different types of Housing Assistance may constitute either financial or direct assistance; however, all types of ONA are forms of financial assistance.

Housing Assistance

Housing Assistance may include financial or direct assistance, including the following:

- Lodging Expense Reimbursement (LER) for hotels, motels, or other short-term lodging;

- Rental Assistance for alternate housing accommodations while the applicant is displaced from their primary residence;

- Home Repair Assistance for an owner-occupied primary residence;

- Replacement Assistance for an owner-occupied primary residence when the residence is destroyed;

- Multifamily Lease and Repair (MLR) to place disaster survivors in FEMA-leased multifamily temporary housing;

- Transportable Temporary Housing Units (TTHUs)32 to place disaster survivors in FEMA-purchased or -leased temporary housing units;

- Direct Lease to place disaster survivors in FEMA-leased residential properties; and

- Permanent Housing Construction (PHC) to provide home repair and construction services in insular areas outside the continental United States and other locations where no alternative housing resources are available and where types of FEMA housing assistance that are normally provided (such as rental assistance) are unavailable, infeasible, or not cost-effective.33

In addition to IHP temporary housing assistance, FEMA may provide short-term, emergency sheltering accommodations under Section 403—Essential Assistance—of the Stafford Act (e.g., the Transitional Sheltering Assistance [TSA] program, which provides short-term hotel/motel accommodations to disaster survivors).34

Other Needs Assistance (ONA)

ONA provides financial assistance for other disaster-related necessary expenses and serious needs. There are two categories of ONA: (1) SBA-dependent, and (2) non-SBA-dependent.

SBA-Dependent ONA

FEMA and the SBA collaborate in determining applicant eligibility for SBA-dependent ONA.35 To receive SBA-dependent types of ONA, applicants must first apply for an SBA disaster loan.36 SBA-dependent ONA is only available to individuals or households who do not qualify for an SBA disaster loan or whose SBA disaster loan amount is insufficient. Types of SBA-Dependent ONA include the following:

- Personal Property Assistance to repair or replace eligible items (i.e., appliances, essential clothing, furnishings, accessibility items as defined by the Americans with Disabilities Act, and essential, specialized tools and equipment required by an employer or education);37

- Transportation Assistance to repair or replace a vehicle damaged by a disaster and cover other transportation-related costs;38

- Moving and Storage Assistance to relocate and store personal property from the damaged primary residence while repairs are made, and return the property to the repaired primary residence;39 and

- Group Flood Insurance Policy to enable FEMA or the state, territorial, or Indian tribal government to pay $600 for three years of flood insurance for real and personal property through the National Flood Insurance Program (NFIP).40

Non-SBA-Dependent ONA

Non-SBA-dependent types of ONA may be awarded regardless of the individual or household's SBA disaster loan status and may include the following:

- Funeral Assistance for expenses incurred as a direct result of a declared emergency or major disaster (e.g., interment or reinterment, officiant services, and death certificates);41

- Medical and Dental Assistance for expenses caused by a declared emergency or major disaster (e.g., injury, illness, loss of prescribed medication and equipment, and insurance deductibles and copayments);42

- Childcare Assistance in the form of a one-time payment that covers up to eight cumulative weeks of child care expenses to care for children aged 13 and under, and/or children up to age 21 with a disability as defined by federal law who need assistance with activities of daily living;43

- Miscellaneous Expenses to provide reimbursement for eligible items purchased or rented after a major disaster to assist with recovery, such as gaining access to the property or assisting with cleaning efforts (e.g., chainsaw, dehumidifier, etc.);44

- Critical Needs Assistance in the form of a one-time payment of $500 to individuals or households who need life-saving and life-sustaining items because they are displaced from their primary dwelling as a result of a disaster;45 and

- Clean and Removal Assistance in the form of a one-time payment to address floodwater contamination for individuals and households whose primary residences experienced flood damage.46

Maximum Amount of IHP Financial Assistance

The amount of IHP financial assistance an individual or household may receive is limited. Housing assistance may not exceed $34,900 (FY2019; adjusted annually),47 and separate from that, financial assistance for ONA also may not exceed $34,900 (FY2019; adjusted annually).48 In addition, financial assistance to rent alternate housing accommodations is not subject to the cap.49 Households may need both IHP assistance and an SBA disaster loan to repair or rebuild their home, or meet other disaster-caused needs.

Stafford Act and SBA Disaster Declarations, and Designations

Two declaration authorities put FEMA IA and the SBA Disaster Loan Program into effect: (1) the Stafford Act and (2) the Small Business Act.

Stafford Act Declarations

The Stafford Act authorizes the President to issue major disaster declarations50 that provide local, state, territorial, and Indian tribal governments with a range of federal assistance in response to natural and human-caused incidents.51 Each presidential major disaster declaration includes a "designation" listing the counties eligible for assistance, as well as the types of assistance FEMA is to provide under the declaration.52 Potential types of assistance include (1) Public Assistance (PA) for emergency protective measures, debris removal, and repair or replacement of damaged public infrastructure;53 (2) Hazard Mitigation Grant Program (HMGP) grants to fund projects to lessen the effects of future disaster incidents; and (3) Individual Assistance (IA) to provide housing and other needs assistance to individuals and households. Under FEMA regulations:

The Assistant Administrator for the Disaster Assistance Directorate has been delegated authority to determine and designate the types of assistance to be made available. The initial designations will usually be announced in the declaration. Determinations by the Assistant Administrator for the Disaster Assistance Directorate of the types and extent of FEMA disaster assistance to be provided are based upon findings whether the damage involved and its effects are of such severity and magnitude as to be beyond the response capabilities of the state, the affected local governments, and other potential recipients of supplementary federal assistance. The Assistant Administrator for the Disaster Assistance Directorate may authorize all, or only particular types of, supplementary federal assistance requested by the governor.54

Not all major disaster declarations provide IA. Often, major declarations only provide PA and HMGP (these are sometimes referred to as "PA-only" major disaster declarations).

Stafford Act major disaster declarations also trigger the SBA Disaster Loan Program.55 The assistance designation, however, determines what loan types become available. In particular, the IA designation is important because it determines whether SBA disaster loans will be made available to individuals and households. For example, if the President declares a major disaster and designates IA for a county, then all SBA disaster loan types become available to that county.56 On the other hand, if the President issues a PA-only major declaration, SBA disaster loans are generally only available to private nonprofit organizations. In many cases, a major disaster is declared for an incident that designates IA for some counties, and designates PA for others. Only counties authorized to receive IA pursuant to a major disaster declaration are eligible for SBA home disaster loans.

SBA Disaster Declarations

SBA disaster loans can also be triggered by the SBA Administrator, who is authorized under the Small Business Act to issue an "Agency" or "SBA declaration" that makes SBA disaster loans available for homeowners, renters, businesses, and nonprofit organizations.57 The SBA declaration by itself does not, however, trigger FEMA IA.58

Applications for Assistance

The following sections describe the application process for FEMA and SBA disaster loan assistance. They include a discussion concerning eligibility criteria for the two programs in addition to a description of how applicants are screened to determine whether the applicant should be provided a grant, a loan, or both. Although integrated to a large extent, ultimately each agency is responsible for determining eligibility based on the applicant's losses and the forms of assistance they have received.

Applying for FEMA Individual Assistance

Applicants in a declared disaster area may register for FEMA IA and SBA disaster loan assistance after a major disaster declaration has been issued and IA has been designated. Individuals and households can register for assistance online, by telephone, or in-person at a Disaster Recovery Center (DRC).59 Individuals and households generally have 60 days from the date of a declaration to apply for FEMA IHP assistance.60 The registration process requires the following information:

- certification that the applicant is a U.S. citizen, noncitizen national, a qualified alien, or the parent or guardian of a minor who is a U.S. citizen, noncitizen national, or qualified alien;61

- the primary applicant's social security number (or the social security number of a minor child in the household who is a U.S. citizen, noncitizen national, or qualified alien if the parent or legal guardian is not a legal citizen);

- current and predisaster address;

- names of predisaster household occupants;

- contact information;

- insurance information;

- financial information (i.e., predisaster household annual gross income);

- losses caused by the disaster; and

- banking information for direct deposit of financial assistance.62

Other forms of IA include other application requirements and processes.63 For example, local, state, territorial, or Indian tribal governments may apply for a grant to administer the Crisis Counseling Assistance and Training Program, which includes different application requirements.64 The provision of Disaster Legal Services, however, only requires the affected state, territorial, or Indian tribal government to request the program through the "Request for Presidential Disaster Declaration—Major Disaster or Emergency" form (FEMA Form 010-0-13), and there is no formal application process for individuals and households to access Disaster Legal Services once the government activates the program.65

Applying for SBA Disaster Loans

Applicants can apply for SBA disaster loans online, in-person at a DRC, or by mail.66 Applicants must fill out SBA Form 5C and IRS Form 4506-T.67 The forms require information about the applicant, including their social security number, income, insurance, assets, debt amounts, and tax information. The applicant may also be required to indicate whether their employment has changed in the last two years, as well as provide deed and proof of residency information. If the applicant is claiming automobile damage they may be required to provide proof of ownership (e.g., a copy of the registration, title, bill of sale).

Eligibility for SBA Disaster Loans

In the case of SBA disaster loans, the SBA's Office of Disaster Assistance (ODA) determines eligibility based on the applicant's disaster-related losses, as verified by the SBA.68 According to the SBA, three main criteria are used for making credit decisions: (1) eligibility, which is based on the applicant's disaster-related losses; (2) satisfactory credit; and (3) repayment ability, including minimum income levels. The SBA would not decline an application for not having collateral to secure a loan but, to the extent it is available, a borrower may be required to pledge collateral for loans over certain amounts (e.g., $25,000 for physical damage loans).69

Eligibility for FEMA Individual Assistance

In the case of IA, each form of assistance includes general conditions of eligibility, which are outlined in FEMA's Individual Assistance Program and Policy Guide (IAPPG).70 For example, FEMA IHP assistance includes general conditions of eligibility as follows:

- the applicant must be a U.S. citizen, noncitizen national, or qualified alien (or the parent or guardian of a minor child who is a U.S. citizen, noncitizen national, or qualified alien);

- FEMA must be able to verify the applicant's identity;

- the applicant's insurance, or other forms of disaster assistance received, cannot meet their disaster-caused needs; and

- the applicant's necessary expenses and serious needs are directly caused by a declared disaster.71

In addition, each category of FEMA IHP assistance includes additional eligibility requirements (e.g., to receive ONA, an applicant must satisfy occupancy and ownership eligibility requirements).72

The standard mechanism for verifying IHP loss and eligibility is an on-site inspection conducted by a FEMA inspector (or other method of verification, such as a geospatial inspection or a review of documentation for losses that cannot be verified through an inspection).73

Eligibility for SBA-Dependent ONA

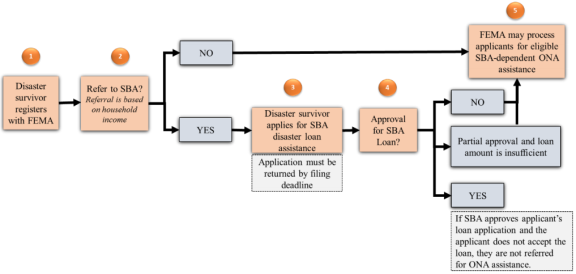

As stated above, FEMA and the SBA collaborate in determining applicant eligibility for ONA (see the "Other Needs Assistance (ONA)" section).74 There are two pathways for individuals and households to be considered for SBA-Dependent ONA: (1) FEMA refers applicant registrations to the SBA Disaster Loan Program if an applicant's income meets the SBA minimum guidelines (described below); or (2) FEMA considers the applicant for SBA-dependent ONA assistance if the applicant's income does not meet the SBA's minimum threshold (in which case FEMA does not refer the applicant's registration to the SBA).75 The general process for determining eligibility is outlined in Figure 1 and described in more detail below.

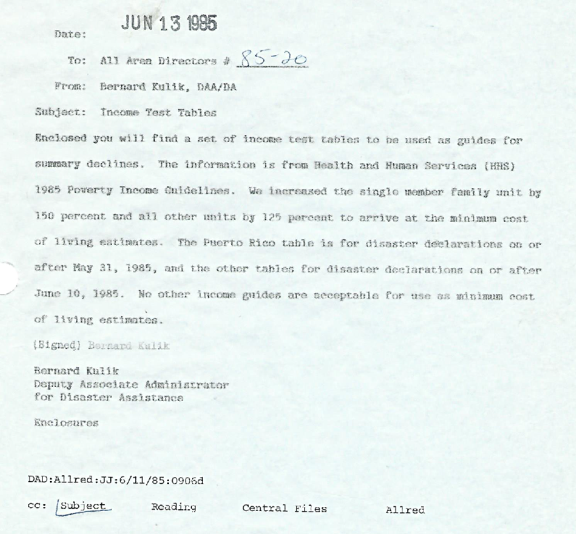

Based on income information provided as part of the FEMA registration process, FEMA applies an income test developed by SBA for its initial applicant screening (see stage 2 of Figure 1).76 The SBA developed the minimum income levels or "minimum cost of living estimates" by applying a formula to the U.S. Department of Health and Human Services Federal Poverty Guidelines.77 FEMA automatically refers applicant registrations to the SBA Disaster Loan Program if an applicant's income meets the SBA minimum guidelines (see stage 3 of Figure 1).78 As shown in Table 2, the SBA establishes minimum income levels by multiplying the poverty level for a family of one by a factor of 1.5, and multiplying the poverty level for families of greater than one by a factor of 1.25.79 The income test formula is not specifically authorized in statute and is not published in SBA regulations. Rather, the formula was first introduced as agency policy in 1985 by SBA Memorandum 85-20 as a means to help determine the applicant's ability to repay the loan and is still in use today (see Appendix B).

SBA disaster loan applicants with income below the minimum income level are classified as Failed Income Test (FIT). FIT applicants are notified that their SBA disaster loan application has been denied and advised that they will be notified if there are any changes to the decision.80 Additionally, if the SBA denies the applicant or the loan amount is insufficient to meet their recovery needs, the applicant would be referred back to FEMA to be considered for SBA-dependent ONA assistance (see stage 5 of Figure 1).81

|

|

Source: Federal Emergency Management Agency, Individual Assistance Program and Policy Guide (IAPPG), FP 104-009-03, March 2019, p. 133, at https://www.fema.gov/media-library-data/1551713430046-1abf12182d2d5e622d16accb37c4d163/IAPPG.pdf. Note: Other Needs Assistance (ONA) provides financial assistance for other disaster-related expenses and needs. |

|

Number of Persons |

HHS Poverty Guidelines for 2019 |

SBA Income Threshold |

|

1 |

$12,490 |

$18,735 |

|

2 |

$16,910 |

$21,138 |

|

3 |

$21,330 |

$26,663 |

|

4 |

$25,750 |

$32,188 |

|

5 |

$30,170 |

$37,713 |

|

6 |

$34,590 |

$43,238 |

|

7 |

$39,010 |

$48,763 |

|

8 |

$43,430 |

$54,288 |

Notes: Amounts have been rounded (to the nearest dollar).

Source: Based on CRS interpretation of U.S. Department of Health and Human Services, U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Federal Programs, Washington, DC, at https://aspe.hhs.gov/poverty-guidelines; and formula applied in SBA Memorandum 85-20: Bernard Kulik, Deputy Associate Administrator for Disaster Assistance, U.S. Small Business Administration, Income Test Tables:, SBA Memorandum 85-20, June 13, 1985.

Appealing Eligibility and Assistance Determinations

FEMA Appeals

Applicants for IA assistance—using the IHP as an example—may appeal FEMA's determinations, including related to eligibility;82 amount and/or types of assistance;83 FEMA recoupment of improper payments;84 and denials of late application submissions.85 Applicants may also appeal decisions related to the specific type of IHP assistance they are receiving (e.g., a denial for Continued Rental Assistance, a denial of a request to purchase a FEMA-provided Mobile Housing Unit, etc.).86

Appeals of any IHP assistance-related FEMA determination must be submitted in writing. However, "FEMA does not accept multiple appeals for the same reason, but may have to request additional information and conduct additional reviews as new information is received."87 Appeals must explain the reason for the appeal, and should include documentation supporting the appeal request.88 They must also be signed by the applicant (or person they have authorized to act on his/her behalf).89 Once FEMA receives an appeal, the agency will either (1) contact the applicant to request additional information with a deadline of 30 days; (2) contact a third party to verify the supporting documentation; and/or (3) schedule an appeal inspection.90 FEMA's appeal determinations are provided to the applicant within 90 days of receiving the written appeal letter, and the decision is final.91

IA applicants can also include local, state, territorial, and Indian tribal governments. For example, these nonfederal entities may appeal FEMA's decision to deny an application to provide Disaster Case Management (DCM) or the Crisis Counseling Assistance and Training Program (CCP). In these cases, the nonfederal entity must submit a written appeal to the IA Division Director (IADD) within 60 days of the date of the application decision,92 and the appeal must include additional information that was not included in the original application (e.g., a new budget and associated training and implementation plans) in the case of DCM,93 or information justifying a reversal of the decision in the case of CCP.94 Nonfederal entity applicants may also appeal other FEMA decisions, such as appeals related to disallowed costs or termination of approved DCM prior to the end of the period of performance.95

SBA Appeals

SBA disaster loan applicants have six months to request a reconsideration of an SBA decline and have 30 days to appeal a subsequent SBA decline decision.96

Policy Observations and Considerations

Computer Matching Agreement (CMA) and Duplication of Benefits (DOB)

Following a major disaster, homeowners and businesses may have access to a number of resources to assist in the response, recovery, and rebuilding process. The range of resources include insurance payouts, state and local government assistance, charitable donations from private institutions and individuals, as well as certain forms of federal assistance. In addition to FEMA and SBA disaster assistance, individuals and households may be eligible for the Department of Housing and Urban Development's (HUD's) Community Development Block Grant Disaster Recovery (CDBG-DR) program.97 Compensation from multiple sources that exceeds the total loss amount is generally considered a duplication of benefits.98 When duplication occurs, the recipient is liable to the United States to pay back the duplicated benefit.99

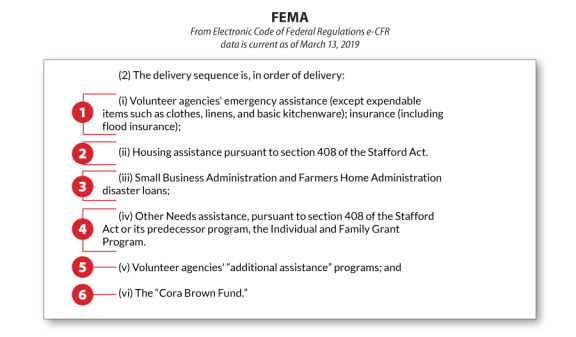

Section 312 of the Stafford Act requires federal agencies to ensure that individuals (and businesses) do not receive disaster assistance for losses for which they have already been compensated or may expect to be compensated.100 The uniformity requirement set forth in Section 312 is located in FEMA regulation 44 C.F.R. §206.191, which establishes a delivery sequence of disaster assistance provided by federal agencies and organizations (see Figure 2).

|

44 C.F.R. §206.191(d)(2) |

|

|

Source: Based on CRS interpretation of 44 C.F.R. §206.191. Note: Housing assistance under Section 408—Federal Assistance to Individuals and Households includes assistance to individuals and households who are displaced from their predisaster primary residences or whose predisaster primary residences are rendered uninhabitable, or, with respect to individuals with disabilities, rendered inaccessible or uninhabitable as a result of a major disaster. Section 408 includes temporary housing assistance, as well as repairs. Other Needs Assistance (ONA) under Section 408 includes both SBA-dependent and non-SBA-dependent ONA. SBA-dependent ONA may be available for applicants who do not qualify for an SBA disaster loan, or whose loan amount is insufficient; this type of ONA includes personal property, transportation, and moving and storage assistance. Non-SBA-dependent ONA includes financial assistance for medical, dental, funeral, childcare, and miscellaneous expenses. Cora Brown of Kansas City, MO, died in 1977. She left a portion of her estate to the United States to be used as a special fund to relieve human suffering caused by natural disasters. For more information on the Cora Brown Fund, see https://www.fema.gov/media-library-data/1434639028239-341e17807cb06b0bf000d21cc7552b2c/CoraBrown-FactSheet-final508.pdf. |

An organization's position within the sequence determines the order in which it should provide assistance and what other resources must be considered before that assistance is provided. Further, each organization is responsible for delivering assistance without regard to duplication later in the sequence.

According to FEMA regulations, the agency or organization that is later in the delivery sequence should not provide assistance that duplicates assistance provided by an agency or organization earlier in the sequence (e.g., SBA disaster loans should be provided before SBA-Dependent ONA). When the delivery sequence has been disrupted, the disrupting agency is responsible for rectifying the duplication.

As mentioned previously in this report, SBA and FEMA have a computer matching agreement to share real-time data on assistance provided to applicants.101 Both the SBA and FEMA also share relevant data—including personally identifiable information (PII) related to applicants—with local, state, territorial, and Indian tribal governments, and voluntary agencies.102 This is done to prevent a duplication of benefits, as well as to potentially enable applicants to receive additional disaster assistance.103 In cases where the data includes PII, a Memorandum of Understanding (MOU) must first be prepared and signed by both SBA and the authorized requesting party (state, territory, tribe, local government, or voluntary entity) to help avoid duplication of benefits,104 and FEMA must follow the routine uses outlined in the DHS/FEMA-008 Disaster Recovery Assistance Files System of Records Notice.105

The SBA and FEMA entered into the CMA pursuant to Section (o) of the Privacy Act of 1974 (5 U.S.C. §552a).106 As outlined in the SBA-FEMA Computer Matching Agreement Federal Register notice, "the financial and administrative responsibilities will be evenly distributed between SBA and DHS/FEMA unless otherwise set forth in this agreement."107 The Federal Register notice further stated that the CMA is "part of a [g]overnment-wide initiative, Executive Order 13411—Improving Assistance for Disaster Victims (August 29, 2006) ... to identify and prevent duplication of benefits received by individuals, businesses, or other entities for the same disaster."108

Although the CMA is part of a government-wide initiative to prevent duplication of benefits, it is solely used by the SBA and FEMA. Some may argue that the CMA should also be used by other federal agencies that offer disaster assistance (such as HUD, which administers CDBG-DR). Others, however, might argue using the CMA with agencies other than the SBA and FEMA is problematic or potentially ineffective. For example, HUD provides funds to state and local jurisdiction grantees. HUD does not have the individual award data to match up with SBA disaster loan applicant data to determine instances of duplication.

If Congress is concerned about the use of the CMA, it could investigate how the CMA could be used in conjunction with other disaster assistance programs. If CMA is not being universally used by federal agencies, Congress could investigate why it is not being used, evaluate challenges preventing its use, and mandate its use across the federal government. Additionally, Congress could use oversight to investigate how effective the CMA has been at preventing duplication since its implementation.

Similarly, Congress could also review how applicant information is being used by local, state, territorial, and Indian tribal governments, as well as voluntary agencies, to determine the effectiveness of information sharing with regard to reducing duplication.

SBA Income Test

According to SBA Memorandum 85-20 (see Appendix B), the income test table is used as a guide "for summary declines." It is unclear, however, if income levels are a hard limit to screen out applicants, or if there is discretion in the process.109

Congress may consider whether the SBA should continue to use established thresholds and formulas based on SBA Memorandum 85-20 to determine eligibility, or provide SBA with some measure of discretion in the process. Some might argue that uniformity would ensure equitable determinations. Others might argue that a one size-fits-all approach does not address special or mitigating circumstances. In general, SBA disaster loan eligibility is assigned to the person (or entity in the case of businesses) that legally owns or is responsible for the repair or replacement of the disaster-damaged property and is based on that person's ability to repay the loan. It could be argued, however, that the ability to pay a loan is not solely determined by income and that a range of factors and circumstances should also be considered. For example, a retired person may not meet a certain minimum income level, but may own assets that could be liquidated for repayment purposes. Another example is the parent of a university student who is willing to cosign for their child's SBA disaster loan. In both of these examples, strict adherence to an income test might prevent people from obtaining loans despite their being able to repay them through nontraditional methods. Congress may also consider whether the income test is an effective screening tool for identifying applicants that meet the income test but cannot repay their disaster loan; for example, a person who earns more than the minimum income level, but has debt that impedes their ability to repay the loan.

If Congress is concerned about how income factors into assistance determinations, it could consider requiring the SBA and FEMA to publish specific determination criteria in their respective regulations and policy guidance documents. Congress may also consider putting the income determination formula into statute.

Appendix A. Relevant Duplication of Benefits Statutory Authorities and Regulations

The following is a listing of selected authorities and regulations pertaining to the duplication of disaster assistance benefits. This list should be considered representative, not exhaustive.

Stafford Act (42 U.S.C. §5155)

The Stafford Act is the primary statute governing the provision of federal disaster assistance, particularly FEMA assistance. Section 312 of the Stafford Act requires federal agencies that provide financial disaster assistance to ensure that individuals, businesses, or other entities suffering losses as a result of a major disaster or emergency do not receive assistance for losses for which they have already been compensated. Section 312 also requires the President to establish procedures that ensure uniformity in preventing duplication of benefits. Under Section 312, any person, business, or other entity that has received or is entitled to receive federal disaster assistance is liable to the United States for the repayment of such assistance to the extent that such assistance duplicates benefits available for the same purpose from another source, including insurance and other federal programs.

Stafford Act (42 U.S.C. §5174)

Section 408(a)(1) states that the President may provide assistance to individuals and households who, as a result of a major disaster, "have necessary expenses and serious needs in cases in which the individuals and households are unable to meet such expenses or needs through other means."

FEMA Regulations

44 C.F.R. §206.191 establishes the policies implementing Section 312 of the Stafford Act, and states that it is FEMA's policy to prevent the duplication of benefits between its own programs, other assistance programs, and insurance benefits. The regulation requires individuals to repay all duplicated assistance to the agency providing the assistance. Under 44 C.F.R. §206.191, a federal agency providing disaster assistance is responsible for preventing or rectifying duplication of benefits when they occur. 44 C.F.R. §206.191 also includes a "delivery sequence" hierarchy intended to prevent waste, fraud, and abuse of program assistance, including the duplication of benefits (see Figure 2).

44 C.F.R. §206.111 defines the financial ability of the applicant to pay housing costs. According to 44 C.F.R. §206.111 if the "household income has not changed subsequent to or as a result of the disaster then the determination is based upon the amount paid for housing before the disaster. If the household income is reduced as a result of the disaster then the applicant will be deemed capable of paying 30 percent of gross post disaster income for housing. When computing financial ability, extreme or unusual financial circumstances may be considered by the Regional Administrator."

Small Business Act (15 U.S.C. §636(b)(1)(A))

The first proviso in 15 U.S.C. §636(b)(1)(A) states that the SBA is authorized to make disaster loans "[p]rovided, [t]hat such damage or destruction is not compensated for by insurance or otherwise."

Small Business Act (15 U.S.C. §647)

15 U.S.C. §647(a) prohibits the SBA from providing benefits that duplicate the assistance provided by another department or agency of the federal government. It also states that if loan applications are refused or denied by a department or agency due to administrative withholding or due to an administratively declared moratorium, then no duplication is deemed to have occurred.

SBA Regulation

13 C.F.R. §123.101(c) states that applicants for SBA Disaster Loan assistance are not eligible for a home disaster loan if their damaged property can be repaired or replaced with the proceeds of insurance, gifts, or other compensation. These amounts must either be deducted from the amount of the claimed losses or, if received after SBA has disbursed the loan, must be paid to SBA as principal payments on the loan.

Appendix B. SBA Memorandum 85-20

|

Appendix C. FEMA and SBA Constituent Resources

The following provides various FEMA and SBA resources and information that may be of use for constituents in declared disaster areas.

Application Websites

FEMA Assistance:

https://www.disasterassistance.gov/

SBA Assistance:

https://disasterloan.sba.gov/ela/

Contact Numbers

FEMA

1-800-621-FEMA (3362)

TTY: 1-800-462-7585

SBA

1-800-659-2955

TTY: 1-800-877-8339

Frequently Asked Questions About FEMA Individual Assistance

https://www.fema.gov/individual-disaster-assistance

https://www.fema.gov/disaster-assistance-available-fema

Frequently Asked Questions About the SBA Disaster Loan Program

https://www.sba.gov/sites/default/files/articles/sba-disaster-loans-faq.pdf

SBA Form 5C

SBA Form 5C in Spanish

https://disasterloan.sba.gov/ela/Documents/Loan%20Application%20Home%20Spanish%20(Form%205C).pdf

IRS Form 4506-T Instructions

IRS Form 4506-T

https://www.sba.gov/sites/default/files/articles/f4506-t-2015-09-00.pdf