Global Economic Effects of COVID-19

Changes from May 15, 2020 to June 1, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Global Economic Effects of COVID-19

June 1, 2020

Since the COVID-19 outbreak was first diagnosed, it has spread to over 190 countries and all U.S. states. The pandemic is having a noticeable impact on global economic growth. Estimates so

James K. Jackson,

far indicate the virus could trim global economic growth by as much as 2.0% per month if current

Coordinator

conditions persist and raise the risks of a global economic recession similar in magnitude to that

Specialist in International

experienced during the Great Depression of the 1930s . Global trade could also fall by 13% to

Trade and Finance

32%, depending on the depth and extent of the global economic downturn. The full impact will

not be known until the effects of the pandemic peak. This report provides an overview of the

Martin A. Weiss

global economic costs to date and the response by governments and international institutions to

Specialist in International

address these effects.

Trade and Finance

Andres B. Schwarzenberg Analyst in International Trade and Finance

Rebecca M. Nelson Specialist in International Trade and Finance

Congressional Research Service

link to page 5 link to page 8 link to page 8 link to page 13 link to page 14 link to page 16 link to page 18 link to page 24 link to page 28 link to page 30 link to page 31 link to page 34 link to page 36 link to page 40 link to page 45 link to page 47 link to page 47 link to page 48 link to page 48 link to page 49 link to page 49 link to page 49 link to page 50 link to page 51 link to page 52 link to page 53 link to page 54 link to page 56 link to page 57 link to page 59 link to page 7 link to page 11 link to page 17 link to page 18 link to page 23 link to page 32 link to page 33 link to page 40 link to page 53 Global Economic Effects of COVID-19

Contents

Overview ....................................................................................................................... 1 Economic Forecasts......................................................................................................... 4

Global Growth .......................................................................................................... 4 Global Trade ............................................................................................................. 9

Economic Policy Chal enges........................................................................................... 10 Economic Developments................................................................................................ 12

March 2020 ............................................................................................................ 14 April 2020 .............................................................................................................. 20 May 2020 ............................................................................................................... 24

Policy Responses .......................................................................................................... 26

The United States .................................................................................................... 27

Monetary Policy................................................................................................. 30

Fiscal Policy ...................................................................................................... 32

Europe ................................................................................................................... 36 The United Kingdom ............................................................................................... 41 Japan ..................................................................................................................... 43 China..................................................................................................................... 43

Multilateral Response .................................................................................................... 44

International Monetary Fund ..................................................................................... 44 World Bank and Regional Development Banks ............................................................ 45

Multilateral Response .................................................................................................... 45

International Monetary Fund ..................................................................................... 45 World Bank and Regional Development Banks ............................................................ 46 International Economic Cooperation........................................................................... 47

Estimated Effects on Developed and Major Economies ....................................................... 48 Emerging Markets ......................................................................................................... 49 International Economic Cooperation ................................................................................ 50 Looming Debt Crises and Debt Relief Efforts .................................................................... 52 Other Affected Sectors ................................................................................................... 53 Conclusions ................................................................................................................. 55

Figures Figure 1. IMF Projected Government Fiscal Balances Relative to GDP ................................... 3 Figure 2. Gross Domestic Product, Percentage Change ......................................................... 7 Figure 3. Dow Jones Industrial Average Index ................................................................... 13 Figure 4. U.S. Dollar Trade-Weighted Broad Index, Goods and Services ............................... 14 Figure 5. Brent Crude Oil Price per Barrel in Dollars .......................................................... 19 Figure 6. U.S. GDP, Percent Change From Preceding Quarter, 1st Quarter 2020 ...................... 28 Figure 7. Change in U.S. Employment by Major Industrial Sector ........................................ 29 Figure 8. U.S. Personal Income, Consumption, and Saving .................................................. 36 Figure 9. Capital Flows to Emerging Markets in Global Shocks ........................................... 49

Congressional Research Service

link to page 54 link to page 10 link to page 13 link to page 41 link to page 61 link to page 61 link to page 89 Global Economic Effects of COVID-19

Figure 10Effects of COVID-19

Contents

- Overview

- Economic Forecasts

- Global Growth

- Global Trade

- Economic Policy Challenges

- Economic Developments

- March 2020

- April 2020

- May 2020

- Policy Responses

- The United States

- Monetary Policy

- Fiscal Policy

- Europe

- The United Kingdom

- Japan

- China

- Multilateral Response

- International Monetary Fund

- World Bank and Regional Development Banks

- International Economic Cooperation

- Estimated Effects on Developed and Major Economies

- Emerging Markets

- International Economic Cooperation

- Looming Debt Crises and Debt Relief Efforts

- Other Affected Sectors

- Conclusions

Figures

- Figure 1. IMF Projected Government Fiscal Balances Relative to GDP

- Figure 2. Gross Domestic Product, Percentage Change

- Figure 3. Dow Jones Industrial Average

- Figure 4. U.S. Dollar Trade-Weighted Broad Index, Goods and Services

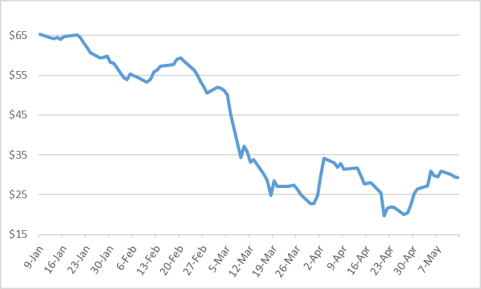

- Figure 5. Brent Crude Oil Price per Barrel in Dollars

- Figure 6. U.S. GDP, Percent Change From Preceding Quarter, 1st Quarter 2020

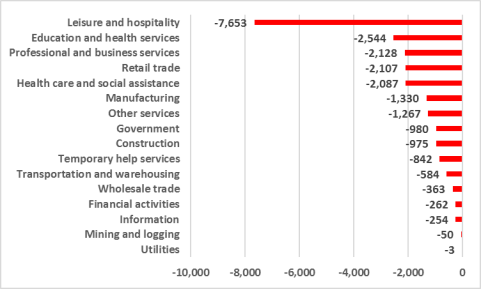

- Figure 7. Change in U.S. Employment by Major Industrial Sector, April 2020

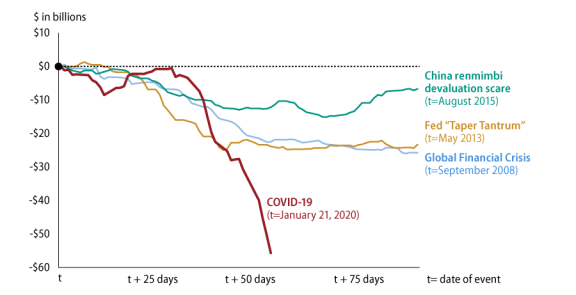

- Figure 8. Capital Flows to Emerging Markets in Global Shocks

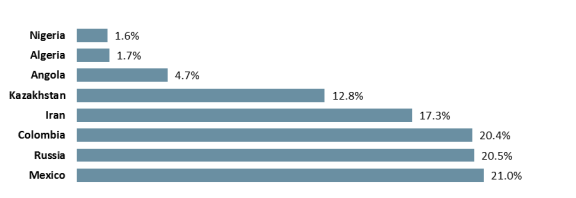

- Figure 9. Depreciation Against the Dollar Since January 1, 2020

Appendixes

- . Depreciation Against the Dollar Since January 1, 2020 ........................................ 50

Tables Table 1. OECD and IMF Economic Forecasts...................................................................... 6 Table 2. WTO Forecast: Merchandise Trade Volume and Real GDP 2018-2021 ........................ 9 Table 3. European Commission Economic Forecast May 2020 ............................................. 37

Appendixes Appendix. Table A-1. Select Measures Implemented and Announced by Major

Economies in Response to COVID-19 ........................................................................... 57

Contacts Author Information ....................................................................................................... 85

Congressional Research Service

Global Economic Effects of COVID-19

Overview The World Health Organization (WHO) first declared COVID-19 a world health emergency in January 2020. Since then, the emergency has evolved into a global public health and economic crisis that has affected the global economy beyond anything experienced in nearly a century. Governments are attempting to balance often-competing policy objectives that include, but are

not limited to:

Confronting bal ooning budget deficits weighed against increasing spending to

support unemployed workers and social safety nets;

Providing financial support for national health systems that are under pressure to

develop vaccines while also funding efforts to care for and safeguard citizens; and

Implementing monetary and fiscal policies that support credit markets and

sustain economic activity, while also assisting businesses under financial distress.

Differences in policy approaches are also threatening to impair international political, trade, and

economic relations, particularly between countries that promote nationalism and those that argue for a coordinated international response. Policy differences are also straining relations between developed and developing economies and between northern and southern members of the Eurozone, chal enging al iances and conventional concepts of national security, and raising questions about the future of global leadership. The pandemic-related economic and human costs

could have long-term repercussions for economies through the tragic loss of life and job losses that derail careers and permanently shutter businesses. In speaking about these costs for

Americans, Federal Reserve Chairman Powel said on May 19, 2020,

Since the pandemic arrived in force just two months ago, more than 20 million people have lost their jobs, reversing nearly 10 years of job gains. This precipitous drop in economic activity has caused a level of pain that is hard to capture in words, as lives are upended amid great uncertainty about the future.1

The virus was first diagnosed in Wuhan, China, but has been detected in over 200 countries and al

Economies in Response to COVID-19

Summary

Since the COVID-19 outbreak was first diagnosed, it has spread to over 190 countries and all U.S. states. The pandemic is having a noticeable impact on global economic growth. Estimates so far indicate the virus could trim global economic growth by as much as 2.0% per month if current conditions persist and raise the risks of a global economic recession similar in magnitude to that experienced during the Great Depression of the 1930s. Global trade could also fall by 13% to 32%, depending on the depth and extent of the global economic downturn. The full impact will not be known until the effects of the pandemic peak. This report provides an overview of the global economic costs to date and the response by governments and international institutions to address these effects.

Overview

The World Health Organization (WHO) first declared COVID-19 a world health emergency in January 2020. Since the virus was first diagnosed in Wuhan, China, it has been detected in over 190 countries and all U.S. states.1U.S. states.2 In early March 2020, the focal point of infections shifted from China to Europe, especiallyespecial y Italy, but by April 2020, the focus had shifted to the United States, where the number of infections was accelerating. The infection has sickened more than 4.5 million6.1 mil ion people, about one-third in the United States, with thousands ofnearly 370,000 fatalities. More than 80 countries have closed their

borders to arrivals from countries with infections, ordered businesses to close, instructed their

populations to self-quarantine, and closed schools to an estimated 1.5 billion children.2

Over the eightbil ion children.3

Over the ten-week period from mid-March to mid-late May 2020, more than 36.5 million40.8 mil ion Americans

filed for unemployment insurance.34 On May 8, 2020, the Bureau of Labor Statistics (BLS)

1 Powell, Jerome H. Coronavirus and CARES Act, T estimony before the Committee on Banking, Housing and Urban Affairs, U.S. Senate, May 19, 2020. 2 “Mapping the Spread of the COVID-19 in the U.S. and Worldwide,” Washington Post Staff, Washington Post, March 4, 2020. https://www.washingtonpost.com/world/2020/01/22/mapping-spread-new-COVID-19/?arc404=true.

3 “T he Day the World Stopped: How Governments Are Still Struggling to Get Ahead of the COVID-19,” The Econom ist, March 17, 2020. https://www.economist.com/international/2020/03/17/governments-are-still-struggling-to-get-ahead-of-the-COVID-19. 4 Unemployment Insurance Weekly Claims, Department of Labor, May 28, 2020. https://www.dol.gov/; Romm, T ony and Jeff Stein, 2,4 Million Americans Filed Jobless Claims Last Week, Bringing Nine Week T otal to 38.6 Million, The Washington Post, May 21, 2020. https://www.washingtonpost.com/business/2020/05/21/unemployment-claims-

Congressional Research Service

1

Global Economic Effects of COVID-19

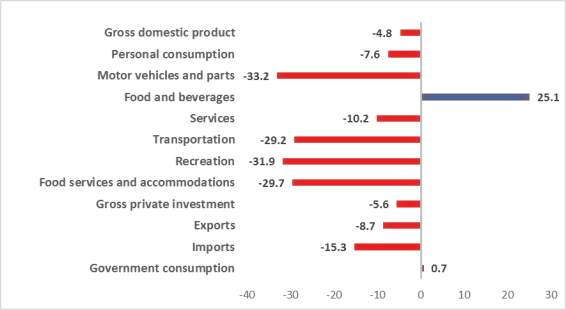

On May 8, 2020, the Bureau of Labor Statistics (BLS) reported that 20 millionmil ion Americans lost their jobs in April 2020, pushing the total number of unemployed Americans to 23 million,4 mil ion,5 out of a total civilian labor force of 156 millionmil ion. The increase pushed the national unemployment rate to 14.7%, the highest since the Great Depression of the 1930s.56 Preliminary data also indicate that U.S. GDP fell by 4.8fel by 5.0% in the first quarter of 2020, the largest quarterly decline in GDP since the fourth quarter of 2008 during the global financial crisis.6

In Europe, over 30 million 7 In its May 27 Beige Book analysis, the Federal Reserve reported that economic

activity had fal en sharply in each of the 12 Federal Reserve districts.8

In Europe, over 30 mil ion people in Germany, France, the UK, Spain, and Italy have applied for

state support of their wages, while first quarter 2020 data indicate that the Eurozone economy contracted by 3.8% at an annual rate, the largest quarterly decline since the series started in 1995.7 9 The European Commission released its economic forecast on’s May 6, 2020, which projects forecast projected that EU economic growth in 2020 willcould contract by 7.4% and only partiallypartial y recover in 2021.10 On May 27, 2020, however, European Central Bank (ECB) President Christine Lagarde characterized that forecast as outdated and warned that the Eurozone economy could contact by 8% to 12% in 2020, a level of damage

to the Eurozone economy that Lagarde characterized as being unsurpassed in peace time.11 Foreign investors have pulled an estimated $26 bil ion out of developing Asian economies not including more than $16 bil ion out of India, increasing concerns about a major economic recession in Asia. Some estimates indicate that 29 mil ion people in Latin America could fal into

poverty, reversing a decade of efforts to narrow income inequality.

recover in 2021.8 Foreign investors have pulled an estimated $26 billion out of developing Asian economies and more than $16 billion out of India, increasing concerns of a major economic recession in Asia. Some estimates indicate that 29 million people in Latin America could fall into poverty, reversing a decade of efforts to narrow income inequality.

The pandemic crisis is challenging governments to implement monetary and fiscal policies that support credit markets and sustain economic activity, while they are implementing policies to develop vaccines and safeguard their citizens. In doing so, however, differences in policy approaches are straining relations between countries that promote nationalism and those that argue for a coordinated international response. Differences in policies are also straining relations between developed and developing economies and between northern and southern members of the Eurozone, challenging alliances, and raising questions about the future of global leadership.

After a delayed response, central banks and monetary authorities are engaging in an ongoing series of interventions in financial markets and national governments are announcing fiscal policy initiatives initiatives to stimulate their economies. International organizations are also taking steps to

provide loans and other financial assistance to countries in need. These and other actions have been labeled " “unprecedented,"” a term that has been used frequently to describe the pandemic and

the policy responses.

As one measure of the global fiscal and monetary responses, the International Monetary Fund (IMF) estimated that government spending and revenue measures to sustain economic activity adopted through mid-April 2020 amounted to $3.3 trilliontril ion and that loans, equity injections and guarantees totaled an additional $4.5 trillion.9 $4.5 tril ion.12 The IMF also estimatesestimated that the increase in borrowing by governments globally willglobal y could rise from 3.7% of global gross domestic product coronavirus/ 5 T his total does not include 10.9 million workers who were working part time not by choice and 9.9 million individuals who were seeking employment.

6 The Employment Situation-April 2020, Bureau of Labor Statistics, May 8, 2020. https://www.bls.gov/. 7 Gross Domestic Product, First Quarter 2020 (Second Estimate), Bureau of Economic Analysis, May 28, 2020. https://www.bea.gov/data/gdp/gross-domestic-product . 8 The Beige Book, Federal Reserve System, May 27, 2020. https://www.federalreserve.gov/monetarypolicy/beige-book-default.htm.

9 Stott, Michael, Coronavirus Set to Push 29m Latin Americans Into Poverty, Financial Times, April 24, 2020. https://www.ft.com/content/3bf48b80-8fba-410c-9bb8-31e33fffc3b8; Hall, Benjamin, Coronavirus Pandemic T hreatens Livelihoods of 59m European Workers, Financial Tim es, April 19, 2020, https://www.ft.com/content/36239c82-84ae-4cc9-89bc-8e71e53d6649, Romei, Valentina and Martin Arnold, Eurozone Economy Shrinks by Fastest Rate on Record, Financial Tim es, April 30, 2020, https://www.ft.com/content/dd6cfafa-a56d-48f3-a9fd-aa71d17d49a8. 10 European Economic Forecast Spring 2020, European Commission, May 2020. 11 Arnold, Martin, Coronavirus Hit to Eurozone Economy Set to Dwarf Financial Crisis, Financial Times, May 27, 2020. https://www.ft.com/content/a01424e8-089d-4618-babe-72f88184ac57.

12 Global Financial Stability Report, International Monetary Fund, April 14, 2020. P. 2;

Congressional Research Service

2

Global Economic Effects of COVID-19

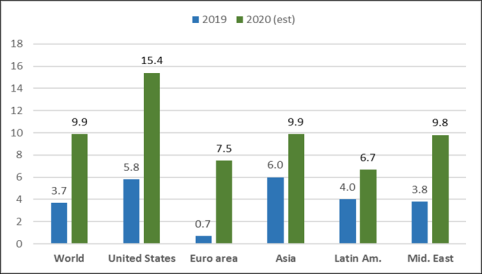

rise from 3.7% of global gross domestic product (GDP) in 2019 to 9.9% in 2020, as indicated in Figure 1. Among developed economies, the fiscal balance to GDP ratio is projected to rise from 3.0% in 2019 to 10.7% in 2020; the ratio for the United States is projected to rise from 5.8% to 15.74%. According to the IMF, France, Germany, Italy, Japan, and the United Kingdom have each announced public sector support measures totalingthat total more than 10% of their annual GDP.1013 For developing economies, the fiscal balance to GDP ratio is projected to rise from 4.8% to 9.1%, significantly increasing their debt burden and raising

prospects of defaults or debt rescheduling.1114 According to some estimates, the most fiscally fiscal y vulnerable countries are: Argentina, Venezuela, Lebanon, Jordan, Iran, Zambia, Zimbabwe, and

South Africa.12

15

Figure 1. IMF Projected Government Fiscal Balances Relative to GDP

In percentage shares of Gross Domestic Product

Source: Fiscal Monitor, International Monetary Fund, April 14, 2020. Created by CRS. Notes: Data for 2020 are estimates.

Among central banks, the Federal Reserve has taken extraordinary steps not experienced since the 2008-2009 global financial crisis to address the growing economic effects of COVID-19. The U.S. Congress also has approved historic fiscal spending packages. In other countries, central banksgovernments have abandoned traditional borrowing caps to sustain growth. Simultaneously,

central banks and monetary authorities have lowered interest rates and reserve requirements, announced new financing facilities, relaxed capital buffers and, in some cases, countercyclical capital buffers,1316 adopted after the 2008-2009 financial crisis, potentiallypotential y freeing up an estimated $5 tril ion $5 trillion in funds.1417 Capital buffers were raised after the financial crisis to assist banks in absorbing losses and staying solvent during financial crises. In some cases, governments have directed banks to freeze dividend payments and halt pay bonuses.

On March 11, the WHO announced that the outbreak was officially 13 Fiscal Monitor, International Monetary Fund, April 14, 2020, p. 2. 14 Ibid., p. 6. 15 Wheatley, Jonathan, T ommy Stubbington, Michael Stott, Andrew England, and Joseph Cotterill, Debt Relief: Whic h Countries ae Most Vulnerable? Financial Tim es, May 6, 2020. https://www.ft.com/content/31ac88a1-9131-4531-99be-7bfd8394e8b9.

16 Countercyclical capital buffers require banks to increase their capital buffers during periods of rapid growth in assets (when they are making a lot of loans), to ensure they have sufficient capital to absorb losses during a recession. Countercyclical Capital Buffers, Bank for International Settlements, April 3, 2020. https://www.bis.org/bcbs/ccyb/.

17 Arnold, Martin, “Regulators Free up $500bn Capital for Lenders to Fight Virus Storm,” Financial Times, April 7, 2020. https://www.ft.com/content/9a677506-a44e-4f69-b852-4f34018bc45f.

Congressional Research Service

3

Global Economic Effects of COVID-19

absorbing losses and staying solvent during financial crises. In some cases, governments have

directed banks to freeze dividend payments and halt pay bonuses.

On March 11, the WHO announced that the outbreak was official y a pandemic, the highest level

a pandemic, the highest level of health emergency.1518 A growing list of economic indicators makes it clear that the outbreak is negatively affecting global economic growth on a scale that has not been experienced since at least the global financial crisis of 2008-2009.1619 Global trade and GDP are forecast to decline sharplysharply, at least through the first half of 2020. The global pandemic is affecting a broad swath of international international economic and trade activities, from services generallygeneral y to tourism and hospitality,

medical supplies and other global value chains, consumer electronics, and financial markets to energy, transportation, food, and a range of social activities, to name a few. The health and economic crises could have a particularly negative impact on the economies of developing countries that are constrained by limited financial resources and where health systems could

quickly become overloaded.

Without a clear understanding of when the global health and economic effects may peak and a greater understanding of the impact on economies, forecasts must necessarily be considered preliminary. Similarly, estimates of when any recovery might begin and the speed of the recovery

are speculative. Efforts to reduce social interaction to contain the spread of the virus are disrupting the daily lives of most Americans and adding to the economic costs. Increasing rates of unemployment are raising the prospects of wide-spreadwidespread social unrest and demonstrations in developed economies where lost incomes and health insurance are threatening living standards and in developing economies where populations reportedly are growing concerned over access to basic necessities and the prospects of rising levels of poverty.1720 U.N. Secretary General Antonio

Guterres argued in a video conference before the U.N. Security Council on April 10, 2020, that the

:

…[T]he pandemic also poses a significant threat to the maintenance of international peace and security—potentially leading to an increase in social unrest and violence that would greatly undermine our ability to fight the disease.18

21 Economic Forecasts

Global Growth

The economic situation remains highly fluid. Uncertainty about the length and depth of the health crisis-related economic effects are fueling perceptions of risk and volatility in financial markets and corporate decision-making. In addition, uncertainties concerning the global pandemic and the effectiveness of public policies intended to curtail its spread are adding to market volatility. In a

growing number of cases, corporations are postponing investment decisions, laying off workers

18 Bill Chappell, “COVID-19: COVID-19 Is Now Officially a Pandemic, WHO Says,” National Public Radio, March 11, 2020, https://www.npr.org/sections/goatsandsoda/2020/03/11/814474930/COVID-19-COVID-19-is-now-officially-a-pandemic-who-says.

19 Mapping the Spread of the COVID-19. 20 Sly, Liz, Stirrings of Unrest Around the World Could Portend T urmoil as Economies Collapse, The Washington Post, April 19, 2020; Ingraham, Christopher, Coronavirus Recession Could Plunge T ens of Millions Into Poverty, New Report Warns, The Washington Post, April 20, 2020. https://www.washingtonpost.com/business/2020/04/20/coronavirus-recession-could-plunge-tens-millions-into-poverty-new-report-warns/.

21 Secretary-General’s Remarks to the Security Council on the COVID-19 Pandemic, United Nations, April 9, 2020. https://www.un.org/sg/en/content/sg/statement/2020-04-09/secretary-generals-remarks-the-security-council-the-covid-19-pandemic-delivered.

Congressional Research Service

4

link to page 10 link to page 10 link to page 10 Global Economic Effects of COVID-19

growing number of cases, corporations are postponing investment decisions, laying off workers who previously had been furloughed, and in some cases filing for bankruptcy. Compounding the economic situation is a historic drop in the price of crude oil that reflects the global decline in economic activity and prospects for disinflation, while also contributing to the decline of the global economy through various channels. On April 29, 2020, Federal Reserve Chairman Jay Powell Jerome Powel stated that the Federal Reserve would use its "“full range of tools"” to support economic activity as the U.S. economic growth rate dropped 4.85.0% at an annual rate in the first quarter of

2020. In assessing the state of the U.S. economy, the Federal Open Market Committee released a statement indicating that, "“The ongoing public health crisis will wil weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic

outlook over the medium term."19

”22

The Organization for Economic Cooperation and Development (OECD) on March 2, 2020, lowered its forecast of global economic growth by 0.5% for 2020 from 2.9% to 2.4%, based on the assumption that the economic effects of the virus would peak in the first quarter of 202020202023 (see Table 1). However, the OECD estimated that if the economic effects of the virus did not peak in

the first quarter, which is now apparent that it did not, global economic growth would increase by

1.5% in 2020. That forecast now seems to have been highly optimistic.

On March 23, 2020, OECD Secretary General Angel Gurria stated that

:

The sheer magnitude of the current shock introduces an unprecedented complexity to economic forecasting. The OECD Interim Economic Outlook, released on March 2, 2020, made a first attempt to take stock of the likely impact of COVID-19 on global growth, but it it now looks like we we have already moved well beyond even the more severe scenario envisaged then…. [T]he pandemic has also set in motion a major economic crisis that will wil burden our societies for years to come.21

24

On March 26, 2020, the OECD revised its global economic forecast based on the mounting

effects of the pandemic and measures governments have adopted to contain the spread of the virus. According to the updated estimate, the current containment measures could reduce global GDP by 2.0% per month, or an annualized rate of 24%, approaching the level of economic contraction not experienced since the Great Depression of the 1930s. The OECD estimates in

Table 1 will wil be revised when the OECD releases updated country-specific data.

Labeling the projected decline in global economic activity as the "“Great Lockdown,"” the IMF released an updatedits forecast on April 14, 2020. The IMF concluded that the global economy would experience its "“worst recession since the Great Depression, surpassing that seen during the global

financial crisis a decade ago."22”25 In addition, the IMF estimated that the global economy could decline by 3.0% in 2020, before growing by 5.8% in 2021; global trade is projected to fall fal in 2020 by 11.0% and oil prices are projected to fall fal by 42%, also shown inin Table 1.2326 This forecast assumes that the pandemic fades in the second half of 2020 and that the containment measures can be reversed quickly. The IMF also stated that many countries are facing a multi-layered crisis that

includes a health crisis, a domestic economic crisis, fallingfal ing external demand, capital outflows, and

22 Federal Reserve Issues FOMC Statement, Board of Governors of the Federal Reserve System, April 29, 2020. https://www.federalreserve.gov/newsevents/pressreleases/monetary20200429a.htm. 23 OECD Interim Economic Assessment: COVID-19: The World Economy at Risk, Organization for Economic Cooperation and Development. March 2, 2020. http://www.oecd.org/economic-outlook/#resources.

24 COVID-19: Joint Actions to Win the War, Organization for Economic Cooperation and Development, March 23, 2020. https://www.oecd.org/COVID-19/#op-ed.

25 World Economic Outlook, International Monetary Fund, April 14, 2020, p. v. 26 T he IMF database indicates that global GDP fell by 0.075% in 2009 during the height of the global financial crisis.

Congressional Research Service

5

Global Economic Effects of COVID-19

external demand, capital outflows, and a collapse in commodity prices. In combination, these various effects are interacting in ways that

make forecasting difficult.

Table 1. OECD and IMF Economic Forecasts

Percentage change in Real GDP Growth

OECD March 2020

IMF April 2020

Projections

Projections

2019

2020

2021

2019

2020

2021

World

2.9%

2.4%

3.3%

World

2.9%

–3.0%

5.8%

G20

3.1

2.7

3.5

Adv. Economies

1.7

–6.1

4.5

Australia

1.7

1.8

2.6

United States

2.3

–5.9

4.7

Canada

1.6

1.3

1.9

Euro Area

1.2

–7.5

4.7

Euro area

1.2

0.8

1.2

Germany

0.6

–7.0

5.2

Germany

0.6

0.3

0.9

France

1.3

–7.2

4.5

France

1.3

0.9

1.4

Italy

0.3

–9.1

4.8

Italy

0.2

0.0

0.5

Spain

2.0

–8.0

4.3

Japan

0.7

0.2

0.7

Japan

0.7

–5.2

3.0

Korea

2.0

2.0

2.3

United Kingdom

1.4

–6.5

4.0

Mexico

-0.1

0.7

1.4

Canada

1.6

–6.2

4.2

Turkey

0.9

2.7

3.3

China

6.1

1.2

9.2

United Kingdom

1.4

0.8

0.8

India

4.2

1.9

7.4

United States

2.3

1.9

2.1

Russia

1.3

–5.5

3.5

Argentina

-2.7

-2.0

0.7

Latin America

0.1

–5.2

3.4

Brazil

1.1

1.7

1.8

Brazil

1.1

–5.3

2.9

China

6.1

4.9

6.4

Mexico

–0.1

–6.6

3.0

India

4.9

5.1

5.6

Middle East

1.2

–2.8

4.0

Indonesia

5.0

4.8

5.1

Saudi Arabia

0.3

–2.3

2.9

Sub-Saharan

Russia

1.0

1.2

1.3

Africa

3.1

–1.6

4.1

Saudi Arabia

0.0

1.4

1.9

Nigeria

2.2

–3.4

2.4

South Africa

0.3

0.6

1.0

South Africa

0.2

–5.8

4.0

World Trade Volume

0.9

–11.0

8.4

Oil prices ($)

–10.2

–42.0

6.3

Percentage change in Real GDP Growth

|

OECD March 2020 Projections |

IMF April 2020 Projections |

||||||

|

2019 |

2020 |

2021 |

2019 |

2020 |

2021 |

||

|

World |

2.9% |

2.4% |

3.3% |

World |

2.9% |

–3.0% |

5.8% |

|

G20 |

3.1 |

2.7 |

3.5 |

Adv. Economies |

1.7 |

–6.1 |

4.5 |

|

Australia |

1.7 |

1.8 |

2.6 |

United States |

2.3 |

–5.9 |

4.7 |

|

Canada |

1.6 |

1.3 |

1.9 |

Euro Area |

1.2 |

–7.5 |

4.7 |

|

Euro area |

1.2 |

0.8 |

1.2 |

Germany |

0.6 |

–7.0 |

5.2 |

|

Germany |

0.6 |

0.3 |

0.9 |

France |

1.3 |

–7.2 |

4.5 |

|

France |

1.3 |

0.9 |

1.4 |

Italy |

0.3 |

–9.1 |

4.8 |

|

Italy |

0.2 |

0.0 |

0.5 |

Spain |

2.0 |

–8.0 |

4.3 |

|

Japan |

0.7 |

0.2 |

0.7 |

Japan |

0.7 |

–5.2 |

3.0 |

|

Korea |

2.0 |

2.0 |

2.3 |

United Kingdom |

1.4 |

–6.5 |

4.0 |

|

Mexico |

-0.1 |

0.7 |

1.4 |

Canada |

1.6 |

–6.2 |

4.2 |

|

Turkey |

0.9 |

2.7 |

3.3 |

China |

6.1 |

1.2 |

9.2 |

|

United Kingdom |

1.4 |

0.8 |

0.8 |

India |

4.2 |

1.9 |

7.4 |

|

United States |

2.3 |

1.9 |

2.1 |

Russia |

1.3 |

–5.5 |

3.5 |

|

Argentina |

-2.7 |

-2.0 |

0.7 |

Latin America |

0.1 |

–5.2 |

3.4 |

|

Brazil |

1.1 |

1.7 |

1.8 |

Brazil |

1.1 |

–5.3 |

2.9 |

|

China |

6.1 |

4.9 |

6.4 |

Mexico |

–0.1 |

–6.6 |

3.0 |

|

India |

4.9 |

5.1 |

5.6 |

Middle East |

1.2 |

–2.8 |

4.0 |

|

Indonesia |

5.0 |

4.8 |

5.1 |

Saudi Arabia |

0.3 |

–2.3 |

2.9 |

|

Russia |

1.0 |

1.2 |

1.3 |

Sub-Saharan Africa |

3.1 |

–1.6 |

4.1 |

|

Saudi Arabia |

0.0 |

1.4 |

1.9 |

Nigeria |

2.2 |

–3.4 |

2.4 |

|

South Africa |

0.3 |

0.6 |

1.0 |

South Africa |

0.2 |

–5.8 |

4.0 |

|

World Trade Volume |

0.9 |

–11.0 |

8.4 |

||||

|

Oil prices ($) |

–10.2 |

–42.0 |

6.3 |

||||

Source: OECD Interim Economic Assessment: COVID-19: The World Economy at Risk, Organization for Economic Cooperation and Development. March 2, 2020, p. 2; World Economic Outlook, International Monetary Fund, April 14, 2020, p. ix.

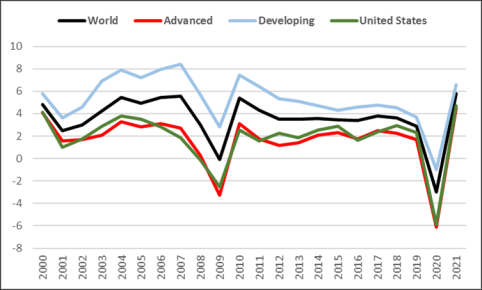

Advanced economies as a group are forecast to experience an economic contraction in 2020 of 7.8% of GDP, with the U.S. economy projected by the IMF to decline by 5.9%, about twice the rate of decline experienced in 2009 during the financial crisis, as indicated in Figure 2.. The rate

of economic growth in the Euro area is projected to decline by 7.5% of GDP. Most developing

Congressional Research Service

6

Global Economic Effects of COVID-19

and emerging economies are projected to experience a decline in the rate of economic growth of 2.0%, reflecting tightening global financial conditions and falling fal ing global trade and commodity prices. In contrast, China, India, and Indonesia are projected to experience smallsmal , but positive rates of economic growth in 2020. The IMF also argues that recovery of the global economy could be weaker than projected as a result of: lingering uncertainty about possible contagion, lack of confidence, and permanent closure of businesses and shifts in the behavior of firms and households.24

As a result of the various challengeschal enges, the IMF qualified its forecast by arguing that

:

A partial recovery is projected for 2021, with above trend growth rates, but the level of GDP will remain below GDP will remain below the pre-virus trend, with considerable uncertainty about the strength of the rebound. Much worse growth outcomes are possible and maybe even likely. This would follow if the pandemic and containment measures last longer, emerging and developing economies are even more severely hit, tight financial conditions persist, or if widespread scarring effects emerge due to firm closures and extended unemployment.25

28

Before the COVID-19 outbreak, the global economy was struggling to regain a broad-based

recovery as a result of the lingering impact of growing trade protectionism, trade disputes among major trading partners, fallingfal ing commodity and energy prices, and economic uncertainties in Europe over the impact of the UK withdrawal from the European Union. IndividuallyIndividual y, each of these issues presented a solvable challengechal enge for the global economy. Collectively, however, the issues weakened the global economy and reduced the available policy flexibility of many national

leaders, especiallyespecial y among the leading developed economies. In this environment, COVID-19 could have an outsized impact. While the level of economic effects will eventuallywil eventual y become clearer, the response to the pandemic could have a significant and enduring impact on the way

27 World Economic Outlook, p. 9. 28 Ibid., p. v.

Congressional Research Service

7

Global Economic Effects of COVID-19

businesses organize their work forces, on global supply chains, and how governments respond to

a global health crisis.26

29

The OECD estimates that increased direct and indirect economic costs through global supply

chains, reduced demand for goods and services, and declines in tourism and business travel mean that, "“the adverse consequences of these developments for other countries (non-OECD) are significant."27”30 Global trade, measured by trade volumes, slowed in the last quarter of 2019 and had been expected to decline further in 2020, as a result of weaker global economic activity associated with the pandemic, which is negatively affecting economic activity in various sectors,

including airlines, hospitality, ports, and the shipping industry.28

31 According to the OECD'’s updated forecast

- :

The greatest impact of the containment restrictions

willwil be on retail - Business closures could reduce economic output in advanced and major emerging economies by 15% or more; other emerging economies could experience a decline in output of 25%.

-

Countries dependent on tourism could be affected more severely, while countries

with large agricultural and mining sectors could experience less severe effects.

-

Economic effects likely

willwil vary across countries reflecting differences in the timing and degree of containment measures.29

32

In addition, the OECD argues that China'’s emergence as a global economic actor marks a significant departure from previous global health episodes. China'’s growth, in combination with globalization globalization and the interconnected nature of economies through capital flows, supply chains,

and foreign investment, magnify the cost of containing the spread of the virus through quarantines and restrictions on labor mobility and travel.3033 China'’s global economic role and globalization globalization mean that trade is playing a role in spreading the economic effects of COVID-19. More broadly, the economic effects of the pandemic are being spread through three trade channels: (1) directly through supply chains as reduced economic activity is spread from

intermediate goods producers to finished goods producers; (2) as a result of a drop overall in overal in economic activity, which reduces demand for goods in general, including imports; and (3) through reduced trade with commodity exporters that supply producers, which, in turn, reduces

their imports and negatively affects trade and economic activity of exporters.

Global Trade

According to an April

29 Rowland, Christopher and Peter Whoriskey, “U.S. Health System is Showing Why It’s Not Ready for a COVID-19 Pandemic,” Washington Post, March 4, 2020. https://www.washingtonpost.com/business/economy/the-us-health-system-is-showing-why-its-not-ready-for-a-COVID-19-pandemic/2020/03/04/7c307bb4-5d61-11ea-b29b-9db42f7803a7_story.html.

30 World Economic Outlook, p. 2. 31 Ibid., p. 4. 32 Evaluating the Initial Impact of COVID Containment Measures on Activity, Organization for Economic Cooperation and Development, March 27, 2020.

33 Goldin, Ian, “COVID-19 Shows How Globalization Spreads Contagion of All Kinds,” Financial Times, March 2, 2020. https://www.ft.com/content/70300682-5d33-11ea-ac5e-df00963c20e6.

Congressional Research Service

8

link to page 13 Global Economic Effects of COVID-19

Global Trade According to an April 8, 2020, forecast by the World Trade Organization (WTO), global trade

8, 2020, forecast by the World Trade Organization (WTO), global trade volumes are projected to decline between 13% and 32% in 2020 as a result of the economic impact of COVID-19, as indicated inin Table 2. The WTO argues that the wide range in the forecast represents the high degree of uncertainty concerning the length and economic impact of the pandemic and that the actual economic outcome could be outside this range, either higher or lower. The WTO'’s more optimistic scenario assumes that trade volumes recover quickly in the

second half of 2020 to their pre-pandemic trend, or that the global economy experiences a V-shaped recovery. The more pessimistic scenario assumes a partial recovery that lasts into 2021, or that global economic activity experiences more of a U-shaped recovery. The WTO concludes, however, that the impact on global trade volumes could exceed the drop in global trade during the

height of the 2008-2009 financial crisis.31

34 Table 2. WTO Forecast: Merchandise Trade Volume and Real GDP 2018-2021

Annual percentage change

Optimistic

Pessimistic

Historical

scenario

scenario

2018

2019

2020

2021

2020

2021

Volume of world merchandise trade

2.9%

-0.1%

-12.9%

21.3%

-31.9%

24.0%

Exports

North America

3.8

1.0

-17.1

23.7

-40.9

19.3

South and Central America

0.1

-2.2

-12.9

18.6

-31.3

14.3

Europe

2.0

0.1

-12.2

20.5

-32.8

22.7

Asia

3.7

0.9

-13.5

24.9

-36.2

36.1

Other regions

0.7

-2.9

-8.0

8.6

-8.0

9.3

Imports

North America

5.2

-0.4

-14.5

27.3

-33.8

29.5

South and Central America

5.3

-2.1

-22.2

23.2

-43.8

19.5

Europe

1.5

0.5

-10.3

19.9

-28.9

24.5

Asia

4.9

-0.6

-11.8

23.1

-31.5

25.1

Other regions

0.3

1.5

-10

13.6

-22.6

18.0

Real GDP at market exchange rates

2.9

2.3

-2.5

7.4

-8.8

5.9

North America

2.8

2.2

-3.3

7.2

-9.0

5.1

South and Central America

0.6

0.1

-4.3

6.5

-11

4.8

Europe

2.1

1.3

-3.5

6.6

-10.8

5.4

Asia

4.2

3.9

-0.7

8.7

-7.1

7.4

Other regions

2.1

1.7

-1.5

6.0

-6.7

5.2

Source: Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy, World Trade Organization, April 8, 2020.

34 Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy, World T radeAnnual percentage change

|

Historical |

Optimistic scenario |

Pessimistic scenario |

||||

|

2018 |

2019 |

2020 |

2021 |

2020 |

2021 |

|

|

Volume of world merchandise trade |

2.9% |

-0.1% |

-12.9% |

21.3% |

-31.9% |

24.0% |

|

Exports |

||||||

|

North America |

3.8 |

1.0 |

-17.1 |

23.7 |

-40.9 |

19.3 |

|

South and Central America |

0.1 |

-2.2 |

-12.9 |

18.6 |

-31.3 |

14.3 |

|

Europe |

2.0 |

0.1 |

-12.2 |

20.5 |

-32.8 |

22.7 |

|

Asia |

3.7 |

0.9 |

-13.5 |

24.9 |

-36.2 |

36.1 |

|

Other regions |

0.7 |

-2.9 |

-8.0 |

8.6 |

-8.0 |

9.3 |

|

Imports |

||||||

|

North America |

5.2 |

-0.4 |

-14.5 |

27.3 |

-33.8 |

29.5 |

|

South and Central America |

5.3 |

-2.1 |

-22.2 |

23.2 |

-43.8 |

19.5 |

|

Europe |

1.5 |

0.5 |

-10.3 |

19.9 |

-28.9 |

24.5 |

|

Asia |

4.9 |

-0.6 |

-11.8 |

23.1 |

-31.5 |

25.1 |

|

Other regions |

0.3 |

1.5 |

-10 |

13.6 |

-22.6 |

18.0 |

|

Real GDP at market exchange rates |

2.9 |

2.3 |

-2.5 |

7.4 |

-8.8 |

5.9 |

|

North America |

2.8 |

2.2 |

-3.3 |

7.2 |

-9.0 |

5.1 |

|

South and Central America |

0.6 |

0.1 |

-4.3 |

6.5 |

-11 |

4.8 |

|

Europe |

2.1 |

1.3 |

-3.5 |

6.6 |

-10.8 |

5.4 |

|

Asia |

4.2 |

3.9 |

-0.7 |

8.7 |

-7.1 |

7.4 |

|

Other regions |

2.1 |

1.7 |

-1.5 |

6.0 |

-6.7 |

5.2 |

Source: Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy, World Trade Organization, April 8, 2020.

Note Organization, April 8, 2020. https://www.wto.org/english/news_e/pres20_e/pr855_e.htm.

Congressional Research Service

9

Global Economic Effects of COVID-19

Note: Data for 2020 and 2021 are projections; GDP projections are based on scenarios simulated with the WTO Global Trade Model.

The estimates indicate that all al geographic regions will wil experience a double-digit drop in trade volumes, except for "“other regions,"” which consists of Africa, the Middle East, and the Commonwealth of Independent States. North America and Asia could experience the steepest declines in export volumes. The forecast also projects that sectors with extensive value chains,

such as automobile products and electronics, could experience the steepest declines. Although services are not included in the WTO forecast, this segment of the economy could experience the largest disruption as a consequence of restrictions on travel and transport and the closure of retail and hospitality establishments. Such services as information technology, however, are growing to

satisfy the demand of employees who are working from home.

The pandemic is also raising questions concerning the costs and benefits of the global supply chains businesses erected over the past three decades. Evidence indicates that growth in supply chains had slowed prior to the pandemic, but there is little consensus on the long-term impact of

the crisis. In some cases, businesses are reassessing their exposure to the risks posed by extensive supply chains that potential y are vulnerable to numerous points of disruption. Also, some governments are assessing the risks supply chains pose to national supplies of items considered to be of importance to national security as a result of firms shifting production offshore. For multinational businesses, changing suppliers and shifting production locations can be especial y

costly for some firms and can introduce additional risks.35 In addition, businesses may be reluctant to relocate from production locations, such as China, that not only serve as production platforms, but are also important markets for their output. For instance, the Bureau of Economic Analysis reports that 10% of the global sales of the majority-owned foreign affiliates of U.S. parent companies is shipped back to the U.S. parent company. In contrast, 60% of such sales take

place in the foreign country where the affiliate is located and another 30% is shipped to other foreign countries in close proximity. For China, about 6% of such sales are shipped to the U.S.

parent, while 82% is sold in China and another 12% is shipped to other foreign countries.36

Economic Policy Challenges The chal engeEconomic Policy Challenges

The challenge for policymakers has been one of implementing targeted policies that address what had been expected to be short-term problems without creating distortions in economies that can

outlast the impact of the virus itself. Policymakers, however, are being overwhelmed by the quickly changing nature of the global health crisis that appears to be turning into a global trade and economic crisis whose effects on the global economy are escalating. As the economic effects of the pandemic grow, policymakers are giving more weight to policies that address the immediate economic effects at the expense of longer-term considerations such as debt

accumulation. InitiallyDuring the early stages of the crisis, many policymakers had felt constrained in their ability ability to respond to the crisis as a result of limited flexibility for monetary and fiscal support within conventional standards, given the broad-based synchronized slowdown in global economic growth, especiallyespecial y in manufacturing and trade that had developed prior to the viral outbreak. The pandemic is also affecting global politics as world leaders are cancellingcancel ing international meetings,32 37 35 Beattie, Alan, Will Coronavirus Pandemic Finally Kill Off Global Supply Chains?, Financial Times, May 28, 2020. https://www.ft.com/content/4ee0817a-809f-11ea-b0fb-13524ae1056b.

36 Activities of U.S. Multinational Enterprises: U.S. Parent Companies and Their Foreign Affiliates, Preliminary 2017 Statistics, Bureau of Economic Analysis, August 23, 2019, T able II.E.2. https://www.bea.gov/news/2019/activities-us-multinational-enterprises-2017. 37 T aylor, Adam, T eo Armus, and Rick Noak, “ Live updates: COVID-19 T urmoil Widens as U.S. Death T oll Mounts;

Congressional Research Service

10

Global Economic Effects of COVID-19

competing for medical supplies, and some nations reportedly are stoking conspiracy theories that

shift blame to other countries.33

Initially, 38

Initial y, the economic effects of the virus were expected to be short-term supply issues as factory output fell

output fel because workers were quarantined to reduce the spread of the virus through social interaction. The drop in economic activity, initially initial y in China, has had international repercussions as firms experienced delays in supplies of intermediate and finished goods through supply chains. Concerns are growing, however, that virus-related supply shocks are creating more prolonged and wide-ranging demand shocks as reduced activity by consumers and businesses leads to a lower

rate of economic growth. As demand shocks unfold, businesses experience reduced activity and profits and potentiallypotential y escalating and binding credit and liquidity constraints. While manufacturing firms are experiencing supply chain shocks, reduced consumer activity through social distancing is affecting the services sector of the economy, which accounts for two-thirds of annual U.S. economic output. In this environment, manufacturing and serviceservices firms have tended to hoard cash, which affects market liquidity. In response, central banks have lowered interest

rates where possible and expanded lending facilities to provide liquidity to financial markets and

to firms potentiallypotential y facing insolvency.

The longer the economic effects persist, the greater the economic impacts are likely to be as the effects are spread through trade and financial linkages to an ever-broadening group of countries, firms and households. These growing economic effects potentiallypotential y increase liquidity constraints and credit market tightening in global financial markets as firms hoard cash, with negative fallout fal out effects on economic growth. At the same time, financial markets are factoring in an increase in government bond issuance in the United States, Europe, and elsewhere as government debt levels

are set to rise to meet spending obligations during an expected economic recession and increased fiscal spending to fight the effects of COVID-19. Unlike the 2008-2009 financial crisis, reduced demand by consumers, labor market issues, and a reduced level of activity among businesses, rather than risky trading by global banks, has led to corporate credit issues and potential insolvency. These market dynamics have led some observers to question if these events mark the

beginning of a full-scale global financial crisis.34

Liquidity 39

Liquidity and credit market issues present policymakers with a different set of challengeschal enges than addressing supply-side constraints. As a result, the focus of government policy has expanded

from a health crisis to macroeconomic and financial market issues that are being addressed through a combination of monetary, fiscal, and other policies, including border closures, quarantines, and restrictions on social interactions. EssentiallyEssential y, while businesses are attempting to address worker and output issues at the firm level, national leaders are attempting to implement fiscal policies to prevent economic growth from fallingfal ing sharply by assisting workers and

businesses that are facing financial strains, and central bankers are adjusting monetary policies to

address mounting credit market issues.

In the initial stages of the health crisis, households did not experience the same kind of wealth

losses they saw during the 2008-2009 financial crisis when the value of their primary residence dropped sharply. However, with unemployment numbers rising rapidly, job losses could result in

Xi Cancels Japan T rip, Washington Post, March 5, 2020, https://www.washingtonpost.com/world/2020/03/05/COVID-19-live-updates/.

38 Shih, Gerry, “ China Is Subtly Stoking COVID-19 Conspiracy T heories T hat Blame the U.S. for Outbreak,” Washington Post, March 5, 2020. https://www.washingtonpost.com/world/2020/03/05/COVID-19-live-updates/.

39 Foroohar, Rana, “ How COVID-19 Became a Corporate Credit Run,” Financial Times, March 15, 2020. https://www.ft.com/content/f1ea5096-6531-11ea-a6cd-df28cc3c6a68.

Congressional Research Service

11

Global Economic Effects of COVID-19

defaults on mortgages and delinquencies on rent payments, unless financial institutions provide loan forbearance or there is a mechanism to provide financial assistance. In turn, mortgage defaults could negatively affect the market for mortgage-backed securities, the availability of funds for mortgages, and negatively affect the overall overal rate of economic growth. Losses in the value of most equity markets in the U.S., Asia, and Europe could also affect household wealth, especiallyespecial y that of retirees living on a fixed income and others who own equities. Investors that

trade in mortgage-backed securities reportedly have been reducing their holdings while the Federal Reserve has been attempting to support the market.3540 In the current environment, even traditional policy tools, such as monetary accommodation, apparently have not been processed by markets in a traditional manner, with equity market indices displaying heightened, rather than lower, levels of uncertainty following the Federal Reserve'’s cut in interest rates. Such volatility is

adding to uncertainties about what governments can do to address weaknesses in the global

economy.

Economic Developments

Between late February and earlylate May, 2020, financial markets from the United States to Asia and Europe have been whipsawed as investors have grown concernedalternated between optimism and pessimism amid concerns that COVID-19 would create a global economic and financial crisis with few metrics to

indicate how prolonged and extensive the economic effects may be.3641 Investors have searched for safe-haven investments, such as the benchmark U.S. Treasury 10-year security, which experienced a historic drop in yield to below 1% on March 3, 2020.3742 In response to concerns that the global economy was in a freefallfreefal , the Federal Reserve lowered key interest rates on March 3, 2020, to shore up economic activity, while the Bank of Japan engaged in asset purchases to

provide short-term liquidity to Japanese banks; Japan'’s government indicated it would also assist workers with wage subsidies. The Bank of Canada also lowered its key interest rate. The International Monetary Fund (IMF) announced that it was making about $50 billionbil ion available through emergency financing facilities for low-income and emerging market countries and

through funds available in its Catastrophe Containment and Relief Trust (CCRT).38

43

Reflecting investors'’ uncertainties, the Dow Jones Industrial Average (DJIA) lost about one-third of its value between February 14, 2020, and March 23, 2020, as indicated in Figure 3. Expectations that the U.S. Congress would adopt a $2.0 trilliontril ion spending package moved the

DJIA up by more than 11% on March 24, 2020. From March 23 to April 15, the DJIA moved higher by18%, paring its initial losses by half. Since then, the DJIA has moved erraticallyerratical y as investors have weighed news about the human cost and economic impact of the pandemic and the prospects of various medical treatments. For some policymakers, the drop in equity prices has raised concerns that foreign investors might attempt to exploit the situation by increasing their

40 Armstrong, Robert, “ Mortgage Investment Funds Become ‘Epicenter’ of Crisis,” Financial Times, March 24, 2020. https://www.ft.com/content/18909cda-6d40-11ea-89df-41bea055720b.

41 Samson, Adam and Hudson Lockett , “Stocks Fall Again in Worst Week Since 2008 Crisis,” Financial Times, February 28. https://www.ft.com/content/4b23a140-59d3-11ea-a528-dd0f971febbc. 42 T he price and yield of a bond are inversely related; increased demand for T reasury securities raises their price, which lowers their yield. Levisohn, Ben, “ T he 10-Year Treasury Yield Fell Below 1% for the First T ime Ever. What T hat Means,” Barrons, March 3, 2020. https://www.barrons.com/articles/the-10-year-treasury-yield-fell-below-1-for-the-first-time-ever-what -that-means-51583267310.

43 Georgieva, Kristalina, “Potential Impact of the COVID-19 Epidemic: What We Know and What We Can Do,” International Monetary Fund, March 4, 2020. https://blogs.imf.org/2020/03/04/potential-impact-of-the-COVID-19-epidemic-what-we-know-and-what -we-can-do/.

Congressional Research Service

12

Global Economic Effects of COVID-19

raised concerns that foreign investors might attempt to exploit the situation by increasing their purchases of firms in sectors considered important to national security. For instance, Ursula von der Leyen, president of the European Commission, urged EU members to better screen foreign

investments, especiallyespecial y in areas such as health, medical research, and critical infrastructure.39

44

Similar to the 2008-2009 global financial crisis, central banks have implemented a series of monetary operations to provide liquidity to their economies. These actions, however, initially initial y were not viewed entirely positively by all al financial market participants who questioned the use of policy tools by central banks that are similar to those employed during the 2008-2009 financial crisis, despite the fact that the current and previous crisis are fundamentallyfundamental y different in origin.

During the previous financial crisis, central banks intervened to restart credit and spending by banks that had engaged in risky assets. In the current environment, central banks are attempting to address financial market volatility and prevent large-scale corporate insolvencies that reflect the

underlying economic uncertainty caused by the pandemic.

Figure 3. Dow Jones Industrial Average Index

February 14, 2020 |

|

|

Source: Financial Times. |

to June 1, 2020

Source: Financial Times. Created by CRS.

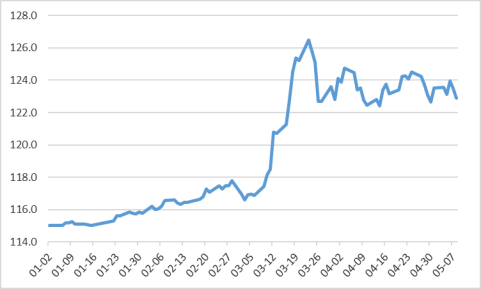

Similar to conditions during the 2008-2009 financial crisis, the dollar has emerged as the preferred currency by investors, reinforcing its role as the dominant global reserve currency. As indicated in Figure 4, the dollar appreciated more than 3.0% during the period between March 3 and March 13, 2020, reflecting increased international demand for the dollar and dollar-denominated assets. Since the highs reached on March 23, the dollar has given up some of its value against other currencies, but has remained about 10% higher than it was at the beginning of

the year. According to a recent survey by the Bank for International Settlements (BIS),4045 the dollar accounts for 88% of global foreign exchange market turnover and is key in funding an array of financial transactions, including serving as an invoicing currency to facilitate international trade. It also accounts for two-thirds of central bank foreign exchange holdings, half of non-U.S. banks foreign currency deposits, and two-thirds of non-U.S. corporate borrowings

44 Chazan, Guy and Jim Brunsden, “COVID-19 Crisis Pushes Europe into Nationalist Economic T urn,” Financial Tim es, March 26, 2020. https://www.ft.com/content/79c0ae80-6df1-11ea-89df-41bea055720b. 45 Foreign Exchange Turnover in April 2019, Bank for International Settlements, September 16, 2019. https://www.bis.org/statistics/rpfx19_fx.htm.

Congressional Research Service

13

Global Economic Effects of COVID-19

from banks and the corporate bond market.46from banks and the corporate bond market.41 As a result, disruptions in the smooth functioning of the global dollar market can have wide-ranging repercussions on international trade and financial transactions.

transactions.

The international role of the dollar also increases pressure on the Federal Reserve essentiallyessential y to assume the lead role as the global lender of last resort. Reminiscent of the financial crisis, the global economy has experienced a period of dollar shortage, requiring the Federal Reserve to take numerous steps to ensure the supply of dollars to the U.S. and global economies, including activating existing currency swap arrangements, establishing such arrangements with additional

central banks, and creating new financial facilities to provide liquidity to central banks and monetary authorities.42 Typically47 Typical y, banks lend long-term and borrow short-term and can only borrow from their home central bank. In turn, central banks can only provide liquidity in their own currency. Consequently, a bank can become illiquidil iquid in a panic, meaning it cannot borrow in private markets to meet short-term cash flow needs. Swap lines are designed to allowal ow foreign

central banks the funds necessary to provide needed liquidity to their country'’s banks in dollars.

Figure 4. U.S. Dollar Trade-Weighted Broad Index, Goods and Services |

|

January 2, 2020 through May 22, 2020

Source: St. Louis Federal Reserve

|

March 2020

The yield on U.S. Treasury securities dropped to historic levels on March 6, 2020, and March 9, 2020, as investors continued to move out of stocks and into Treasury securities and other sovereign bonds, including UK and German bonds, due in part to concerns over the impact the pandemic would have on economic growth and expectations the Federal Reserve and other central banks would lower short-term interest rates.4348 On March 5, the U.S. Congress passed a $8 billion spending bill to provide assistance for health care, sick leave, small 46 See CRS In Focus IF10112, Introduction to Financial Services: The International Foreign Exchange Market. 47 Politi, James, Brendan Greeley, and Colby Smith, “Fed Sets Up Scheme to Meet Booming Foreign Demand for Dollars,” Financial Tim es, March 31, 2020. https://www.ft.com/content/6c976586-a6ea-42ec-a369-9353186c05bb. 48 Smith, Colby, Richard Henderson, Philip Georgiadis, and Hudson Lockett, “ Stocks T umble and Government Bonds Hit Highs on Virus Fears,” Financial Tim es, March 6, 2020. https://www.ft.com/content/9f94d6f8-5f51-11ea-b0ab-339c2307bcd4.

Congressional Research Service

14

Global Economic Effects of COVID-19

bil ion spending bil to provide assistance for health care, sick leave, smal business loans, and international assistance. At the same time, commodity prices dropped sharply as a result of reduced economic activity and disagreements among oil producers over production cuts in crude

oil and lower global demand for commodities, including crude oil.

The drop in some commodity prices raised concerns about corporate profits and led some investors to sell sel equities and buy sovereign bonds. In overnight trading in various sessions between March 8, and March 24, U.S. stock market indexes moved sharply (both higher and lower), triggering automatic circuit breakers designed to halt trading if the indexes rise or fall by fal by

more than 5% when markets are closed and 7% when markets are open.4449 By early April, the global mining industry had reduced production by an estimated 20% in response to falling fal ing

demand and labor quarantines and as a strategy for raising prices.45

50

Ahead of a March 12, 2020, scheduled meeting of the European Central Bank (ECB), the German central bank (Deutsche Bundesbank) announced a package of measures to provide liquidity support to German businesses and financial support for public infrastructure projects.4651 At the same time, the Fed announced that it was expanding its repo market transactions (in the repurchase market, investors borrow cash for short periods in exchange for high-quality collateral

like Treasury securities) after stock market indexes fell fel sharply, government bond yields fell fel to record lows (reflecting increased demand), and demand for corporate bonds fellfel . Together these developments raised concerns for some analysts that instability in stock markets could threaten

global financial conditions.47

52

On March 11, as the WHO designated COVID-19 a pandemic, governments and central banks adopted additional monetary and fiscal policies to address the growing economic impact. European Central Bank (ECB) President-designate Christine Lagarde in a conference call cal to EU leaders warned that without coordinated action, Europe could face a recession similar to the 2008-2009

financial crisis.4853 The Bank of England lowered its key interest rate, reduced capital buffers for UK banks, and provided a funding program for small smal and medium businesses. The UK ChancellorChancel or of the Exchequer also proposed a budget that would appropriate £30 billionbil ion (about $35 bil ion) $35 billion) for fiscal stimulus spending, including funds for sick pay for workers, guarantees for loans to small smal businesses, and cuts in business taxes. The European Commission announced a €25 billion bil ion (about $28 billion) bil ion) investment fund to assist EU countries and the Federal Reserve

announced that it would expand its repo market purchases to provide larger and longer-term

funding to provide added liquidity to financial markets.

President Trump imposed restrictions on travel from Europe to the United States on March 12, 2020, surprising European leaders and adding to financial market volatility.49 At its March 12 meeting, the ECB announced €27 billion (about $30 billion) 54 At its March 12

49 Georgiadis, Philip, Adam Samson, and Hudson Lockett, “Stocks Plummet as Oil Crash Shakes Financial Markets,” Financial Tim es, March 9, 2020. https://www.ft.com/content/8273a32a-61e4-11ea-a6cd-df28cc3c6a68.

50 Hume, Neil, “Mine Closures Bolster Metals Prices as Demand Collapses,” Financial Times, April 7, 2020. https://www.ft.com/content/06ef38c9-18d8-427e-8675-a567227397c0.

51 Chazan, Guy, David Keohane, and Martin Arnold, “Europe’s Policymakers Search for Answers to Virus Crisis,” Financial Tim es, March 9, 2020. https://www.ft.com/content/d46467da-61e1-11ea-b3f3-fe4680ea68b5. 52 Smith, Colby and Brendan Greeley, “Fed Pumps Extra Liquidity Into Overnight Lending Markets,” Financial Times, March 9, 2020. https://www.ft.com/content/e8c7b5f0-6200-11ea-a6cd-df28cc3c6a68.

53 O’Brien, Fergal, “ECB’s Lagarde Warns of 2008-Style Crisis Unless Europe Acts,” Washington Post, March 11, 2020. https://www.bloomberg.com/news/articles/2020-03-11/ecb-s-lagarde-warns-of-2008-style-crisis-without -urgent -action. 54 McAuley, James and Michael Birnbaum, “Europe Blindsided by T rump’s T ravel Restrictions, with Many Seeing Political Motive,” Washington Post, March 12, 2020. https://www.washingtonpost.com/world/europe/europe-

Congressional Research Service

15

Global Economic Effects of COVID-19

meeting, the ECB announced €27 bil ion (about $30 bil ion) in stimulus funding, combining measures to expand low-cost loans to Eurozone banks and small smal and medium-sized businesses and implement an asset purchase program to provide liquidity to firms. Germany indicated that it would provide tax breaks for businesses and "unlimited"“unlimited” loans to affected businesses. The ECB's ’s Largarde roiled markets by stating that it was not the ECB'’s job to "“close the spread"” between Italian and German government bond yields (a key risk indicator for Italy), a comment reportedly

interpreted as an indicator the ECB was preparing to abandon its support for Italy, a notion that was denied by the ECB.5055 The Fed also announced that it would further increase its lending in the repo market and its purchases of Treasury securities to provide liquidity. As a result of tight market conditions for corporate bonds, firms turned to their revolving lines of credit with banks to build up their cash reserves. The price of bank shares fellfel , reflecting sales by investors who

reportedly had grown concerned that banks would experience a rise in loan defaults.5156 Despite the various actions, the DJIA fell fel by nearly 10% on March 12, recording the worst one-day drop since 1987. Between February 14 and March 12, the DJIA fell fel by more than 8,000 points, or 28% of its value. Credit rating agencies began reassessing corporate credit risk, including the risk of firms

that had been considered stable.52

57

On March 13, President Trump declared a national emergency, potentiallypotential y releasing $50 billion in bil ion in disaster relief funds to state and local governments. The announcement moved financial markets sharply higher, with the DJIA rising 10%.5358 Financial markets also reportedly moved higher on

expectations the Fed would lower interest rates. House Democrats and President Trump agreed to a $2 tril ion a $2 trillion spending package to provide paid sick leave, unemployment insurance, food stamps, support for small smal businesses, and other measures.5459 The EU indicated that it would relax budget rules that restrict deficit spending by EU members. In other actions, the People'’s Bank of China cut its reserve requirements for Chinese banks, potentiallypotential y easing borrowing costs for firms and

adding $79 billion bil ion in funds to stimulate the Chinese economy; Norway'’s central bank reduced its key interest rate; the Bank of Japan acquired billionsbil ions of dollars of government securities (thereby increasing liquidity); and the Reserve Bank of Australia injected nearly $6 billion bil ion into its

financial system.5560 The Bank of Canada also lowered its overnight bank lending rate.

blindsided-by-trumps-travel-restrictions-with-many-seeing-political-motive/2020/03/12/42a279d0-6412-11ea-8a8e-5c5336b32760_story.html.

55 Arnold, Martin, “ECB Enters Damage-Limitation Mode with Pledge of More Action,” Financial Times, March 13, 2020. https://www.ft.com/content/f1cbd4f8-650f-11ea-b3f3-fe4680ea68b5.

56 Morris, Stephen, Laura Noonan, Henny Sender, and Olaf Storbeck, “Banks Scramble as Companies Rush to T ap Back-up Credit Lines,” Financial Tim es, March 12, 2020. https://www.ft.com/content/a3513a54-6486-11ea-b3f3-fe4680ea68b5.

57 Edgecliffe-Johnson, Andrew, Peggy Hollinger, Joe Rennison, and Robert Smith, “Will the COVID-19 T rigger a Corporate Debt Crisis?” Financial Tim es, March 12, 2020. https://www.ft.com/content/4455735a-63bc-11ea-b3f3-fe4680ea68b5. Sectors most exposed to debt financing issues include automotive, insurance, capital goods, utilities, oil and gas, technology, aerospace and defense, real estate, telecoms, consumer products, metals, mining and steel, healthcare, retail/restaurants, chemicals, packaging, transportation, media and entertainment, and forest products.

58 Fritz, Angela and Meryl Kornfield, “President T rump Declares a National Emergency, Freeing $50 Billion in Funding,” Washington Post, March 13, 2020. https://www.washingtonpost.com/world/2020/03/13/COVID-19-latest-news.

59 Werner, Erica, Mike DeBonis, Paul Kane, Jeff Stein, “White House, House Democrats Reach Deal on COVID-19 Economic Relief Package, Pelosi Announces,” Washington Post, March 13, 2020. https://www.washingtonpost.com/us-policy/2020/03/13/paid-leave-democrats-trump-deal-COVID-19/.

60 Georgiadis, Philip, Hudson Lockett, and Leo Lewis, “European Stocks and US Futures Soar After Historic Rout,” Financial Tim es, March 13, 2020. https://www.ft.com/content/3bab76ac-64cd-11ea-a6cd-df28cc3c6a68.

Congressional Research Service

16

Global Economic Effects of COVID-19

The Federal Reserve lowered its key interest rate to near zero on March 15, 2020, arguing that the pandemic had "“harmed communities and disrupted economic activity in many countries, including the United States"” and that it was prepared to use its "“full range of tools."56”61 It also announced an additional $700 billion bil ion in asset purchases, including Treasury securities and mortgage-backed securities, expanded repurchase operations, activated dollar swap lines with Canada, Japan, Europe, the UK, and Switzerland, opened its discount window to commercial

banks to ease household and business lending, and urged banks to use their capital and liquidity

buffers to support lending.57

62

Despite the Fed'’s actions the previous day to lower interest rates, interest rates in the U.S. commercial paper market, where corporations raise cash by sellingsel ing short-term debt, rose on March 16, 2020, to their highest levels since the 2008-2009 financial crisis, prompting investors to cal to call on the Federal Reserve to intervene.5863 The DJIA dropped nearly 3,000 points, or about 13%. Most automobile manufacturers announced major declines in sales and production;59 64 similarly, most airlines reported they faced major cutbacks in flights and employee layoffs due to

diminished economic activity.6065 Economic data from China indicated the economy would slow markedly in the first quarter of 2020, potentiallypotential y greater than that experienced during the global financial crisis.6166 The Bank of Japan announced that it would double its purchases of exchange traded funds and the G-7 countries62countries67 issued a joint statement promising "“a strongly coordinated international approach,"” although no specific actions were mentioned. The IMF issued a