Solar Energy: Frequently Asked Questions

Changes from January 27, 2020 to January 5, 2023

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- How Does Solar Energy Work?

- Solar Photovoltaic (PV)

- Concentrating Solar Power

- How Much Electricity Comes From Solar Energy?

- How Much Does a Solar PV System Cost?

- How Does Solar Energy Impact Electricity Costs for Consumers?

- Comparing Electricity Costs

- Is Solar Energy Reliable?

- What Federal Tax Incentives Support Solar Energy Development?

- Tax Incentives for Businesses

- Tax Incentives for Individuals

- How Much Do Solar Tax Incentives Cost?

- What State Policies Support Solar Energy Development?

- How Are U.S. Tariffs Affecting Domestic Solar Manufacturing?

- What U.S. Jobs Are Supported by the Solar Industry?

- What Land Requirements Does Solar Energy Have?

- What Are Potential Impacts of Solar Energy Development on Agriculture?

Figures

- Figure 1. Crystalline-Silicon Photovoltaic (PV) Manufacturing Process

- Figure 2. U.S. Electricity Generation from Solar Energy, 2014-2018

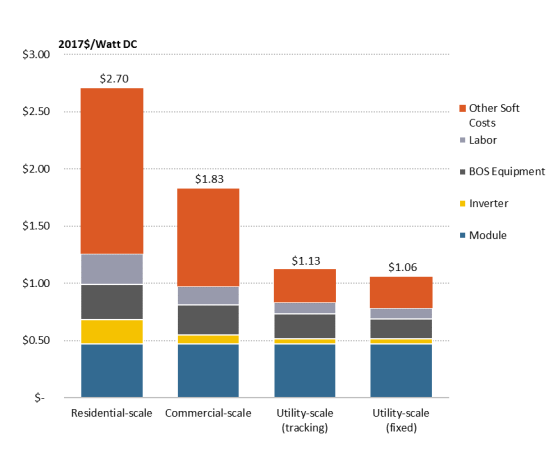

- Figure 3. Q1 2018 Average U.S. Solar PV System Costs

- Figure 4. Solar PV Total System Costs, 2010-Q1 2018

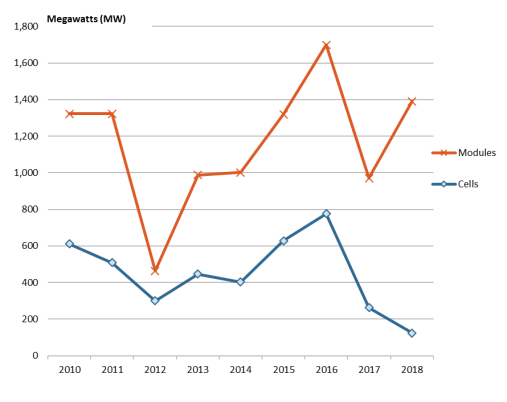

- Figure 5. U.S. Cell and Module Production

- Figure 6. Domestic Solar Industry Employment

Summary

Solar Energy: Frequently Asked Questions

January 5, 2023

Use of solar energy for electricity generation is growing in the United States and globally. In the United States, solar energy overall accounted for 2.23.9% of total electricity generation in 2018, up from 0.7% in 2014.

This report addresses a dozen frequently asked questions that may be of interest to lawmakers as the growing use of solar energy potentially affects a variety of areas of congressional interest. 2021,

Ashley J. Lawson,

compared to 0.7% in 2014.

Coordinator Analyst in Energy Policy

Overview and Cost Considerations

The first set of questions looks at different technologies that use solar energy to generate

Molly F. Sherlock

electricity and their costs and prevalence over time. Costs for all components of solar

Specialist in Public Finance

photovoltaic (PV) systems, —including cells, modules (also referred to as panels), inverters, and

other related equipment, —have generally declined in recent years. Assessing solar energy costs

Manpreet Singh

for consumers is challenging because there are many local factors to consider. Another question

Analyst in Industrial

considers whether using solar energy is a reliable form of electricity generation given its variable nature.

Organization and Business

nature.

Federal and State Policy Incentives

Morgan Smith Analyst in Energy Policy

The second set of questions discusses federal and state policies aimed at promoting deployment

of solar energy in the United States. At the federal level, tax incentives reduce the after-tax cost of investing in solar property, thereby encouraging taxpayers to invest in more solar property

Lisa S. Benson

than they would have absent tax incentives. Federal tax incentives include an investment tax

Analyst in Agricultural Policy

credit for businesses, eligibility for accelerated depreciation for businesses, and a residential

energy efficient property tax credit for individuals. At the state level, renewable portfolio standards (or, more broadly, electricity portfolio standards) require some electric utilities to

procure a specified amount of electricity from designated, eligible sources. Twenty-nineThirty states, three U.S. territories, and the District of Columbia are implementing electricity portfolio standards. All of these policies include solar energy as an eligible source. Utility-scale solar systems typically benefitbenefits from electricity portfolio standards, while commercial- and residential-scale systems typically benefit from a different state policy called net metering. Net metering allows individual electricity consumers to receive payment for the electricity produced by systems installed on their property (or, in some cases, systems not installed on their property but with which consumers have a contractual arrangement).

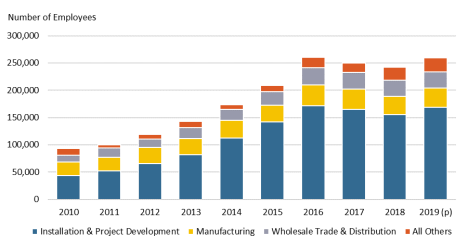

Domestic Manufacturing and Jobs Another set of questions considers the U.S. manufacturing base for solar products and U.S. tariffs, which have been applied over the years on imports of solar equipment. The results on the nation'’s solar manufacturing industry have been mixed. Different parts of the solar PV supply chain have responded differently to the tariffs. For some components, such as the assembly of solar modulespanels, domestic production has increased since the imposition of tariffs. By one count, about 20 factories assembled PV modules in the United States in 2018. For other components, such as solar cell production, tariffs have not had this effect. At present, there is one major domestic producer of crystalline-silicon solar cells; several producers of solar cells have closed U.S. plants since 2012. A related question discusses the number of U.S. jobs supported by the domestic solar industry, which employed more than 240,000 full-time equivalent workers in 2018. Of these positions, 64% involved two solar sectors, the installation of solar systems and project development.

. In 2020, the industry counted 231,574 jobs in the electricity generation sector (over two-thirds of which were in installation and development) and about 31,050 workers in the manufacturing sector.

Land and Agricultural Considerations The final questions address some potential environmental considerations associated with the use of solar energy, such as land use. Standard metrics for measuring land use impacts for different energy technologies do not exist. When considering total land area occupied, solar typically requires more land to produce the same amount of electricity than many other sources. Other aspects of land requirements affect comparisons among energy sources, including technology developments over time, land cover change, and time-to-recovery. Possiblethe time it takes land to revert to its previous condition after a solar energy system is decommissioned. Dual-use solar power, in which panels are installed in such a way that allows simultaneous use of the land for another purpose, is a potential solution to some land use concerns. Examples of dual-use solar power includes rooftop solar, aquavoltaics and floatovoltaics (solar panels associated with bodies of water), and agrivoltaics (solar panels associated with agricultural activities). Possible effects on agricultural production are also discussed. Some farmers view solar energy favorably as an income supplement, but others raise concerns about long-term damage to soil health and agricultural productivity.

Congressional Research Service

link to page 4 link to page 4 link to page 6 link to page 6 link to page 7 link to page 11 link to page 11 link to page 12 link to page 13 link to page 15 link to page 15 link to page 16 link to page 16 link to page 18 link to page 18 link to page 20 link to page 20 link to page 20 link to page 25 link to page 27 link to page 29 link to page 31 link to page 32 link to page 5 link to page 7 link to page 9 link to page 10 link to page 21 link to page 26 link to page 27 link to page 32 link to page 35 Solar Energy: Frequently Asked Questions

Contents

How Does Solar Energy Work? ....................................................................................................... 1

Solar Photovoltaic (PV) ............................................................................................................ 1 Concentrating Solar Power ....................................................................................................... 3

How Much Electricity Comes from Solar Energy? ......................................................................... 3 How Much Does a Solar PV System Cost? ..................................................................................... 4 How Does Solar Energy Impact Electricity Costs for Consumers? ................................................ 8

Utility-Scale Solar ..................................................................................................................... 8 Distributed Solar ....................................................................................................................... 9

Is Solar Energy Reliable? .............................................................................................................. 10 What Federal Tax Incentives Support Solar Energy Development? ............................................. 12

Solar Manufacturing ................................................................................................................ 12 Solar Deployment.................................................................................................................... 13

Tax Incentives for Businesses and Tax-Exempt Entities .................................................. 13 Tax Incentives for Individuals........................................................................................... 15

How Much Do Solar Tax Incentives Cost? ................................................................................... 15 What State Policies Support Solar Energy Development? ............................................................ 17 How Are Tariffs and Trade Restrictions Affecting Solar Imports and Domestic Solar

Manufacturing? .......................................................................................................................... 17

What U.S. Jobs Are Supported by the Solar Industry? .................................................................. 22 How Much Land Is Needed for Solar Energy? ............................................................................. 24 What Are the Potential Impacts of Solar Energy Development on Land? .................................... 26 What Is Dual-Use Solar Power? .................................................................................................... 28 What Are Potential Impacts of Solar Energy Development on Agriculture? ................................ 29

Figures Figure 1. Crystalline-Silicon Photovoltaic (PV) Manufacturing Process ........................................ 2 Figure 2. U.S. Electricity Generation from Solar Energy, 2014-2021............................................. 4 Figure 3. Q1 2022 Benchmark U.S. Solar PV System Costs .......................................................... 6 Figure 4. Solar PV System Costs by Size and Component, 2010-2020 .......................................... 7 Figure 5. Upstream CS PV Value Chain ........................................................................................ 18 Figure 6. U.S. Solar Employment Breakdown by Sector 2020 ..................................................... 23 Figure 7. Domestic PV Manufacturing.......................................................................................... 24 Figure 8. Diagram of a Floating Solar Photovoltaic System ......................................................... 29

Contacts Author Information ........................................................................................................................ 32

Congressional Research Service

link to page 5 Solar Energy: Frequently Asked Questions

productivity. Some researchers are investigating options for dual-use solar PV systems known as agrivoltaics, in which the same land could be used for simultaneous crop production and electricity generation.

How Does Solar Energy Work?1

How Does Solar Energy Work?1 The energy in sunlight can be converted into electricity in either of two ways: by using solar photovoltaic cells or by concentrating solar energy to produce heat for electricity generation. Solar energy can also be used to heat water for direct use, but this report focuses only on electricity generation applications.

2 Solar Photovoltaic (PV)

Sunlight can interact with certain materials to directly produce electricity in a process known as the photovoltaic (PV) effect. Silicon (more specifically, crystalline-silicon, or c-Si) is the most commonly used material today, but other materials (e.g., cadmium telluride) also can can also be used. Research is ongoing into alternative materials and designs that might be more efficient or less expensive than c-Si.2

3

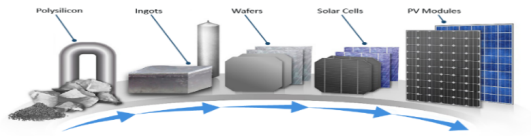

To construct a PV cell to generate electricity, PV material is manufactured into ingots, which are then cut into wafers (Figure 1). Wafers are typically 15 centimeters (cm) wide along each side and around one-hundredth of a centimeter thick, although exact dimensions may vary by manufacturing process.34 Wafers are processed into cells, which are then assembled into modules, also called panels. A modulepanel typically consists of 60 to 72 cells mounted on a plastic backing within a frame. ModulesPanels are typically installed in groups, known as arrays, with the number of modulespanels in the array depending upon the available space and the desired generation capacity of the project.4

(i.e., panels).

A PV system includes modulespanels and a variety of structural and electronic components, known as balance of system (BOS) equipment, to tie the system together.56 Structural BOS equipment includes brackets, on which the modulespanels are mounted. For ground-mounted systems, these brackets can be either fixed or able to rotate during the day to face the sun. Mounting systems that can rotate are known as tracking systems. ModulesPanels mounted on tracking systems tend to generate more electricity than modulespanels on fixed-mount systems, all else being equal, because the tracking systems can optimize the amount of sunlight hitting the modulepanel over the course of a day.67 One key piece of BOS equipment is an inverter, an electronic device that converts the electricity generated by PV modulespanels into a form that is usable in the U.S. electric system. Other electronic BOS equipment includes charge controllers, circuit breakers, meters, and switch gear. Some PV systems also include integrated energy storage systems such as batteries.7

8

PV systems can be divided into three categories, based primarily on capacity.8

- 9

Utility-scale systems (i.e., solar farms) may range in capacity from a few

megawatts (MW) to a few hundred MW. They are typically owned and operated like other central power plants. Utility-scale projects are typically connected to the electricity transmission system (i.e., the network of high-voltage lines that move electricity over long distances

. - ).

Commercial-scale systems typically range in capacity from a few kilowatts (kW;

1,000 kW = 1 MW) to a few hundred kW. They may be installed on the ground or on rooftops, and are typically owned or hosted by commercial, industrial, or institutional entities. Some may be connected to the transmission system, and some may be connected to the electricity distribution system, the network of low-voltage lines that deliver electricity directly to most consumers.

Residential-scale6 Balance of system (BOS) equipment is sometimes called balance of plant (BOP) equipment. 7 Generally, tracking systems can be installed only on ground-mounted systems. In other words, rooftop systems do not typically include tracking systems. 8 For a discussion of energy storage systems, see CRS Report R45980, Electricity Storage: Applications, Issues, and Technologies, by Richard J. Campbell. 9 This report provides illustrative capacity thresholds because the industry does not have established capacity thresholds. For example, some analysis defines 1 MW as the minimum size for utility-scale projects, while other analysis uses 5 MW. Also, the industry has not reached consensus on whether capacity is the best metric for categorizing projects. This report uses capacity for consistency with the data shown throughout. Other analyses may define utility-scale projects based on agreements for how the electricity will be purchased (e.g., power purchase agreement versus net metering). Another option is to use total project cost as the defining characteristic. See Mark Bolinger and Joachim Seel, September 2018. Congressional Research Service 2 link to page 7 Solar Energy: Frequently Asked Questions Residential-scale systems typically have generation capacity of a few kW. Mostsystemstypically have generation capacity of a few kW. Mostresidential-scale projects are installed on rooftops and connected to the distribution system.

Another way to categorize PV systems is by ownership model. Systems connected to the transmission system (typically utility-scale) are generally owned by utilities or independent power producers, as is the case for other central power plants. Smaller systems may use other ownership models, depending on what applicable state laws allow.

- Customer-owned systems are owned directly by the electricity consumer benefiting from the system. The consumer might buy the system outright or finance it in the same way as for other property improvements (e.g., loan).

-

Third-party ownership (i.e., solar leasing) is an ownership model in which an

electric consumer, such as a homeowner, allows a company to build a solar system on the consumer

'’s property. The company owns and maintains the solar system while the consumer uses the electricity produced by the system. The consumer pays back the cost of the system to the company through either lease payments or a power purchase agreement. -

Community solar (i.e., solar gardens) is an ownership model in which multiple

electricity consumers may purchase or lease shares of a solar system through a subscription. Subscribers can benefit from the project by receiving electricity, financial payments, or both. Community solar systems are usually not installed on a subscriber

'’s property, and the systems may be owned by a utility or another type of entity.

Concentrating Solar Power

Concentrating solar power (CSP) technologies collect and concentrate energy from sunlight to heat certain fluids (liquids or gases). CSP plants use these heated fluids to produce electricity, either by creating steam to drive a steam turbine or by directly running a generator. CSP plants can be designed with thermal energy storage systems.9, which allow the plant to produce electricity when the sun is not shining.10 At least one CSP plant with storage operating in the United States is capable of generating electricity 24 hours a day.10

11 Most U.S. and international solar energy development focuses on PV technology.

How Much Electricity Comes Fromfrom Solar Energy?11

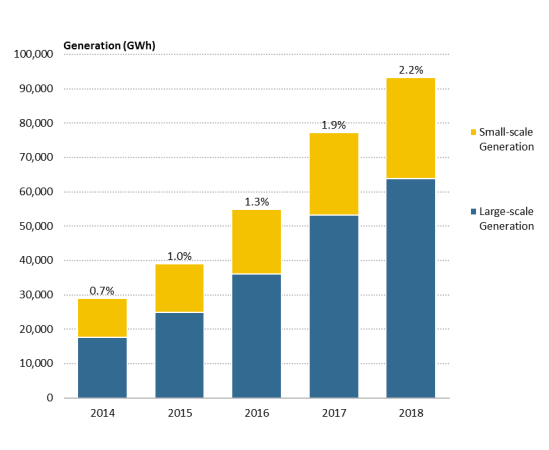

12 Electricity generation from solar energy has grown in recent years, as shown inin Figure 2. Solar energy overall (PV and CSP combined) accounted for 0.7% of total U.S. electricity generation in 2014 and 2.22014, rising to 3.9% of the total in 20182021, according to data from the U.S. Energy Information Administration (EIA).1213 Most generation (9698% in 20182021) from solar energy comes from PV 10 For an overview, see DOE, Concentrating Solar Power Thermal Storage System Basics, August 21, 2013. 11 One example is reported in Thomas W. Overton, “Top Plant: Crescent Dunes Solar Energy Project, Tonopah, Nevada,” Power Magazine, December 1, 2016, https://www.powermag.com/crescent-dunes-solar-energy-project-tonopah-nevada-2/.

12 Ashley Lawson, Analyst in Energy Policy, was the author of this section. 13 CRS analysis of data from EIA, “Electricity Data Browser,” accessed July 11, 2022, https://www.eia.gov/electricity/data/browser/. EIA began collecting data on generation from small-scale solar PV sources, defined by EIA as installations with capacity less than 1 MW, in 2014. The EIA statistics reported in this report include solar sources above and below this threshold.

Congressional Research Service

3

link to page 9

Solar Energy: Frequently Asked Questions

) from solar energy comes from PV systems. Large-scale systems, defined by EIA as those greater than 1 MW, accounted for 61% of overall generation from solar energy in 2014, the first year for which EIA reported generation data for different size categories. By 20182021, the share from large-scale systems had increased to 68%.

How Much Does a Solar PV System Cost?13

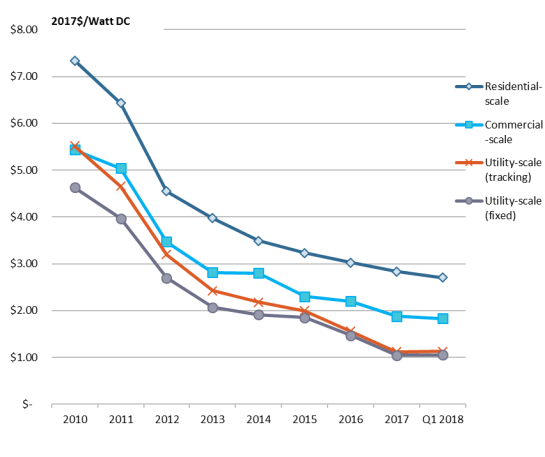

14 Costs for solar PV systems vary by size, as shown in Figure 3. The figure shows an estimate of average cost of installing a average U.S. solar PV system costs per unit of capacity, as of the first quarter of 2018 (Q1 20182022 (Q1 2022), based on an analysis by the Department of Energy'’s National Renewable Energy Laboratory (NREL). Costs for any individual project could differ based on project-specific circumstances. NREL’s estimated costs are not the price customers pay for systems (i.e., the 14 Ashley Lawson, Analyst in Energy Policy, was the author of this section.

Congressional Research Service

4

link to page 9 Solar Energy: Frequently Asked Questions

estimates do not account for tax credits, other incentives, or financing costs). circumstances. Two general findings from NREL'’s analysis are supported by numerous other studies, namely that larger projects tend to be cheaper on a per-unit basis, and that costs for projects of all sizes have declined in recent years.

Utility-scale systems have the lowest per-unit costs, ranging from an average of $1.06at $0.99 per watt of direct current (hereinafter, W) to $1.13/W in 2018, depending on whether projects were mounted on fixed brackets or tracking systems, respectively.14 Commercial-scale systems cost $1.83/W on average in Q1 2018, and residential-scale systems cost $2.70/W on average. The total system cost differences shown inin Q1 2022.15 Benchmark commercial-scale systems cost $1.84/W or $1.94/W in Q1 2022, depending on if they were installed on commercial rooftops or the ground, respectively. Benchmark residential-scale systems cost $2.95/W in Q1 2022. Adding storage increased the per-unit costs for systems of all sizes. The total system cost differences shown in Figure 3 are driven primarily by higher "“soft costs."” These costs include, for example, costs associated with permitting, interconnecting with the grid, and installer overhead costs. The soft costs are much higher for smaller-scale systems, per watt, than for utility-scale systems.

|

|

Source: Vignesh Ramasamy et al., U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, with Minimum Sustainable Price Analysis: Q1 2022, NREL, September 2022. Notes: DC = direct current; BOS = balance of system; 2021$ = 2021 dol ars. Labels show total system costs. Costs are for solar PV systems without energy storage. Prices that customers pay for systems may be different than estimated costs, especial y if tax credits or other policy incentives are available.

PV system costs declined from 2010 to 2020, as shown by data from a 2021 NREL analysis of systems of different size and components (Figure 4).

Congressional Research Service

6

Solar Energy: Frequently Asked Questions

Figure 4. Solar PV System Costs by Size and Component, 2010-2020

2019$ per Watt DC

Source: NREL, “Documenting a Decade of Cost Declines for PV Systems,” February 2021. Notes: DC = direct current; 2019$ = 2019 dol ars. PII = permitting, inspection, and interconnection; BOS = balance of system. Prices that customers pay for systems may be different than estimated costs, especial y if tax credits or other policy incentives are available. NREL changed its modeling approach before its analysis of calendar year 2020 data. The dark blue bars indicate how this methodological change affected cost estimates.

Congressional Research Service

7

link to page 10 link to page 9 link to page 13 Solar Energy: Frequently Asked Questions

|

PV system costs have declined, as shown by data from the NREL analysis shown in Figure 4. NREL reported costs from 2010 to Q1 2018. NREL credits cost declines over this time period to cost declines in all system components (i.e., modules, inverters, BOS equipment, labor, and other soft costs).15

PV module costs increased between 2017 and 2018 as a result of tariffs discussed in the section "How Are U.S. Tariffs Affecting Domestic Solar Manufacturing?," offsetting cost declines in other system components, according to the NREL report.

How Does Solar Energy Impact Electricity Costs for Consumers?16 Utility-scale solar and distributed solar (commercial or residential) have different cost impacts for consumers. At a high level, utility-scale cost impacts can be considered in the same way as other power plants and affect all consumers within a utility service territory equally. In contrast, distributed solar cost impacts are more similar to energy efficiency improvements in that they primarily affect costs for the consumer using the distributed solar resource.17

Utility-Scale Solar In parts of the country, new utility-scale solar PV systems are among the least-cost Consumers?16

Generalizing the cost impacts to consumers for solar systems is challenging because costs for these systems vary across the United States. Additionally, solar system costs are declining in both absolute terms (as discussed in the previous section) and relative to other sources of electric power. In parts of the country, new solar systems are sometimes among the least cost-options for generating electricity.18 This was not generally the case a few years ago but has been driven by the cost declines for solar shown in Figure 4.

One way to compare costs for different power plants is the levelized cost of electricity (LCOE, also called levelized cost of energy). LCOE is a measure of the cost of generating electricity from a given type of power plant over its lifetime. It can also be thought of as the amount of revenue a power plant would require to fully cover its costs. LCOE estimates attempt an “apples-to-apples” comparison among generation options, typically accounting for all construction and installation costs (such as those shown in Figure 3), plus operation, maintenance, and fuel costs over the lifetime of power plants. LCOE estimates may include financing costs as well. They typically account for the amount of electricity power plants are expected to generate over their lifetimes. LCOE estimates are normalized per unit of electricity (e.g., dollars per megawatt-hour) and expressed in net present value terms. LCOE estimates do not reflect all costs associated with building new power plants. In particular, indirect costs are not included in LCOE. Indirect costs might include transmission system expansions or network upgrades that might be required to bring new power plants online. Additionally, LCOE estimates do not include operational constraints such as reliability requirements that may be especially important considerations for solar, given its unique nature (see additional discussion in “Is Solar Energy Reliable?”). LCOE estimates sometimes include the effect of tax credits or other policy incentives.

Several organizations estimate LCOE. One commonly cited estimate is from the energy firm Lazard. As of 2021, Lazard estimates that new U.S. utility-scale solar has LCOE ranging from $28 to $41 per MWh (before accounting for tax credits).19 For comparison, Lazard estimates the next lowest-cost LCOE for new power plants is for land-based wind, ranging from $26/MWh to

16 Ashley Lawson, Analyst in Energy Policy, was the author of this section. 17 As is also true for energy efficiency, some community-level cost impacts (increase or decreases) could occur when an individual consumer adds distributed solar generation. These impacts are negligible at low levels of solar penetration but can be meaningful when high levels of distributed solar generation are developed in an area. Additional discussion of these potential cost impacts is available in CRS Report R46010, Net Metering: In Brief, by Ashley J. Lawson.

18 The costs for developing utility-scale solar vary across the country depending upon solar resource quality, land and labor costs, and other factors. State policies can also influence costs as well. For example, state renewable portfolio standards (discussed in this report) can effectively lower the cost of developing solar by providing policy certainty and an additional revenue stream to utility-scale projects. On the other hand, state or local permitting or siting restrictions can create hurdles to project development, effectively increasing costs. For example, multiple counties in Ohio have banned most utility-scale solar (and wind) energy development under authority of a state law passed in 2021. John Fitzgerald Weaver, “Ten Ohio Counties Have Banned Large Scale Wind and Solar,” PV Magazine, August 24, 2022. 19 Lazard, Lazard’s Levelized Cost of Energy Analysis, Version 15.0, October 2021.

Congressional Research Service

8

Solar Energy: Frequently Asked Questions

$50/MWh. Lazard estimates that the lower end of the range for solar (and wind) is less expensive than generating electricity from existing nuclear ($29/MWh) or coal ($42/MWh) power plants.

All else being equal, generation from power plants with lower LCOE should lead to lower electricity prices. For solar, LCOE estimates suggest that an increased use of solar energy would lower electricity prices because of solar’s lower LCOE.20 This has been observed for wholesale electricity prices, though the effect is modest under current deployment rates. Wholesale electricity prices have declined in recent years but largely because of lower U.S. natural gas prices.21 In states with carbon pricing policies in place, solar energy development could reduce the potential for cost increases arising from the carbon price.22

The downward pressure that utility-scale solar energy puts on electricity prices has a limit. At some level of solar penetration (5% or so, based on observations in California), adding more solar has a diminishing effect on electricity prices.23 This is largely because solar panels produce energy when the sun is shining, which is not necessarily when more electricity generation is needed. An area with a relatively high penetration of solar might have excess generation during mid-day, and adding more solar capacity would not change electricity supply or demand (or prices) then. The electricity grid sometimes needs upgrades or expansions to access utility-scale solar, which can potentially put upward pressure on electricity prices.

Distributed Solar What consumers pay for electricity is influenced by the rate they pay—that is, how many cents per kilowatt-hour (kWh) of usage—and how much they use. Utility-scale solar can affect electricity rates, while distributed solar primarily affects how much electricity consumers buy from the grid.

Distributed solar can be installed at the point of use, namely a home, business, or other building. In these cases, the onsite solar panels generate electricity that is used in the building, reducing the need to buy electricity from the local utility. Some consumers may be eligible for net metering arrangements with their utilities, which compensate them for any excess electricity their panels produce (i.e., electricity the customers do not use themselves).24 Net metering compensation reduces bills above and beyond the effect of buying less electricity.

Community solar (sometimes called solar gardens) is another form of distributed solar. The U.S. Department of Energy (DOE) defines community solar as “any solar project or purchasing program, within a geographic area, in which the benefits of a solar project flow to multiple 20 Policy incentives, such as federal tax credits, can lower utilities’ costs for procuring electricity from solar PV systems beyond what is reflecting in the LCOE estimates provided in this report. Policy incentives may have the effect of making solar energy a more attractive investment option beyond what favorable LCOE comparisons would suggest.

21 Researchers at Lawrence Berkeley National Lab estimated that wind and solar contributed less than $3/MWh to the observed decline in electricity prices between 2008 and 2017, compared to $7-$53/MWh contributed by natural gas. Andrew D. Mills et al., “The Impact of Wind, Solar, and Other Factors on the Decline in Wholesale Power Prices in the United States,” Applied Energy, vol. 238 (February 1, 2021), p. 116266. 22 As of the cover date of this report, carbon pricing policies are in effect in California and in the states participating in the Regional Greenhouse Gas Initiative (RGGI), a cap-and-trade program that covers carbon dioxide emissions from electric power. The number of RGGI states has changed in recent years. For more details on the RGGI program and its participating states, see https://www.rggi.org/. In addition, Washington State established cap-and-trade program that is scheduled to start in 2023 (https://ecology.wa.gov/Air-Climate/Climate-Commitment-Act/Cap-and-invest).

23 Andrew D. Mills et al., Solar-to-Grid: Trends in System Impacts, Reliability, and Market Value in the United States with Data Through 2019, Lawrence Berkeley National Lab, February 2021.

24 For an overview of net metering policies, see CRS Report R46010, Net Metering: In Brief, by Ashley J. Lawson.

Congressional Research Service

9

Solar Energy: Frequently Asked Questions

customers such as individuals, businesses, nonprofits, and other groups.”25 Typically, a consumer can subscribe to a community solar project (through upfront payments or ongoing subscription fees) for a share of the project’s output. The local utility lowers the consumer’s bill based upon the amount of electricity generated and the consumer’s share of the project. Community solar projects are not necessarily installed at the point of use, making them an option for the estimated 49% of households that do not live in buildings suitable for rooftop solar.26 In general, state laws set community solar rules, and not all states allow them.27 As of the end of 2020, about 72% of community solar capacity was installed in four states: Minnesota, Florida, Massachusetts, and New York.28 The Biden Administration set a goal of expanding community solar capacity from 3 gigawatts (GW) in 2020 to 20 GW in 2025.29

Like utility-scale solar, grid upgrades are sometimes required to support new distributed solar installations. In many cases, individual consumers may be required to pay for any upgrades, and those added costs can discourage development. Some states are exploring options to address these situations.30

This was not generally the case a few years ago.

Policies aimed at promoting solar energy make an assessment of costs more complex. For example, tax incentives, as discussed in the section "What Federal Tax Incentives Support Solar Energy Development?," can reduce the ownership costs for businesses or individuals that purchase solar energy systems. Some of those costs are then transferred to taxpayers. The following discussion focuses on electricity costs only from a consumer's point of view.

Consumers' electricity costs can be measured in two ways. The first way is the electricity rate, typically expressed in cents per kilowatt-hour (cents/kWh). The second way is the electricity bill, typically the total costs for electricity that consumers pay each month expressed in dollars. In most cases, an electricity bill reflects the costs to produce electricity (typically, the applicable electricity rate times the amount of electricity consumed), the costs to deliver electricity to the consumer, and any other fees as determined by state or local regulators (e.g., contributions to funds that provide bill relief to low-income households). Electricity rates can go down while bills go up, and vice versa.

Multiple factors can determine how solar energy might affect what consumers pay for electricity. Many of these factors vary based on local circumstances. They can also change over time as the profile of electricity sources changes.

Comparing Electricity Costs

One way to compare electricity costs is by estimating the lifetime costs of energy systems. Lifetime costs include the initial construction and installation cost plus operation and maintenance (O&M) costs, fuel costs, and other costs. Electricity rates are strongly influenced by total lifetime costs for all the electricity generators serving a given area. Lifetime costs for solar energy have historically been higher than for many other sources, but that is changing in many parts of the United States.17 For example, one commonly used measure of lifetime costs is the levelized cost of electricity (LCOE), usually expressed in dollars per megawatt-hour of generation ($/MWh) and averaged over the lifetime of a project. LCOE estimates attempt "apples-to-apples" comparisons among technologies because the estimates account for how much electricity a given power plant is expected to produce over its lifetime.18 According to widely cited estimates from one consulting firm, 2019 LCOE for new utility-scale solar systems ranged from $32/MWh to $42/MWh. By comparison, LCOE for new wind generation was $28/MWh-$54/MWh and for natural gas combined cycle generation was $44/MWh-$68/MWh.19

Another factor in consumers' bills is the extent to which electricity from solar energy displaces electricity generation from existing sources. If existing power plants are called upon to produce less electricity than planned when they were first built due to the availability of power from less expensive sources, the owners still need to pay the construction cost of their unneeded capacity. Such costs are known as stranded costs. Depending on each state's regulatory framework, stranded costs might be borne by power plant owners or be passed through to consumers in electric bills.

To the extent that solar systems require new transmission lines to deliver electricity to consumers, the cost of building those lines may result in higher electricity bills. Utility-scale solar, which is frequently located in rural areas distant from consumers, may have higher associated cost impacts on bills than, for example, residential-scale solar, depending upon project details. On the other hand, installation of solar systems can sometimes avoid upgrades to transmission systems, resulting in potentially lower costs for consumers. In other cases, though, solar systems necessitate upgrades to local distribution systems, which might increase costs for customers. In states with carbon pricing policies in place, increased solar energy deployment could reduce the bill impacts associated with the carbon price.

Generating solar energy has approximately zero marginal cost. Marginal costs reflect the variable costs of producing incremental amounts of electricity from an existing source. Marginal costs are typically dominated by fuel costs, which are not relevant for solar energy. When solar energy is present in an area, fewer fuel-consuming electricity sources are required, which tends to drive down marginal costs for the regional electricity system overall. This effect may diminish as the number of solar electricity generators increases in an area, because nearby solar PV systems tend to maximize their electricity production at the same time (usually midday). If all of the midday electricity demand were to be met by solar PV, there would no incremental cost benefit to adding more solar PV systems to the region.20

The rate and bill impacts discussed above would apply to all electricity consumers within a region in which solar energy development is taking place. Consumers that install rooftop solar systems or participate in community solar projects ("solar customers") could have different bill impacts. Most states allow solar customers to be financially compensated for the electricity generated by the projects they host. The most common type of policy for this compensation is net metering, though some states have established net metering alternatives. Depending on a consumer's electricity demand and the size of the solar energy project, solar consumers participating in net metering or related policies could reduce their electricity bills to zero.21

Is Solar Energy Reliable?22

Is Solar Energy Reliable?31 One potential reliability concern for solar energy is due to its variable nature, dependent on the availability of sunlight.2332 For example, solar PV systems cannot produce electricity at night, and their output can vary during the day depending on local weather conditions (e.g., cloudiness). The physical requirements of the electricity system are such that the supply and demand of electricity must equal each other at all times. Currently, to ensure reliability, other sources of electricity generation are used when solar energy is not available. Expanding other types of electricity system infrastructure, such as transmission lines or energy storage assets, could also address this limitationlimitation and expand the use of solar energy into less sunny times of day. Alternatively, policies and regulatory frameworks that incent greater electricity consumption during daytime hours and less at night (i.e., load shifting) could reduce the reliability impact ofhelp address solar energy'’s variability.

Another potential reliability concern for solar energy arises from the mismatch between the hours of the day when generation from solar energy peaks (typically midday) and when electricity

25 DOE, “Community Solar Basics,” accessed September 15, 2022. 26 Residential buildings are considered unsuitable for solar if they (1) are rented, (2) are at least four stories tall, or (3) have roofs too small for a 1.5 kilowatt PV system. David Feldman et al., Shared Solar: Current Landscape, Market Potenial, and the Impact of Federal Securities Regulation, NREL, April 2015.

27 As of February 2021, 23 states and the District of Columbia had adopted community solar policies, and three additional states had adopted policies providing community solar as an option. DSIRE Insight, “Community Solar Policy Update: States Exploring Low-Income Access and New Program Models,” February 25, 2021. Even in states without community solar policies, publicly owned utilities (which are generally self-regulated and not subject to state jurisdiction) may implement community solar programs.

28 Jenny Heeter, Kaifeng Xu, and Gabriel Chan, Sharing the Sun: Community Solar Deployment, Subscription Savings, and Energy Burden Reduction, NREL, July 2021.

29 DOE, “About the National Community Solar Partnership,” accessed September 15, 2021, https://www.energy.gov/communitysolar/about-national-community-solar-partnership.

30 For a discussion of grid upgrade costs and state responses, see Erica McConnell and Laura Beaton, Sharing the Burden and the Benefits: The Quandary of Allocation DER Interconnection Costs, Interstate Renewable Energy Council, December 20, 2017.

31 Ashley Lawson, Analyst in Energy Policy, was the author of this section. 32 For further discussion see CRS In Focus IF11257, Variable Renewable Energy: An Introduction, by Ashley J. Lawson.

Congressional Research Service

10

Solar Energy: Frequently Asked Questions

of the day when generation from solar energy peaks (typically midday) and when electricity demand peaks (typically several hours later). To maintain reliability, some sources of electricity have to quickly increase their output to account for the simultaneous drop-off in output from solar generators and increase in demand. As more solar systems are installed, the need for other sources that can quickly change output levels typically increases. This situation is often referred to as the "“duck curve"” because the shape of the plot showing the difference between demand and output from solar generators resembles a duck.2433 Not all electricity generators are capable of quickly changing their output, and their deployment may not match the levels of deployment of solar generators. Load shifting, operational changes to non-solar sources, and deployment of more flexible resources (e.g., energy storage) are all possible ways to address the duck curve. Some analysis suggests that electric vehicle deployment might also act as a form of load shifting and address the duck curve, at least if vehicle charging occurs when output from solar sources is high.25

34

A third potential reliability concern comes from the fact that solar PV produces direct current (DC) electricity. Conventional generators produce alternating current (AC) electricity, and the grid is optimized for AC. An inverter is an electrical device that converts DC to AC; grid-connected solar PV systems require an inverter. For this reason, solar is sometimes referred to as an "“inverter-based resource."26”35 Generators that produce AC also inherently contribute to grid reliability by providing what are known as "“essential reliability services"” or "“ancillary services."27 ”36 Most of these services arise from the way generators physically respond to changes in the balance of electricity supply and demand over fractions of seconds. Inverter-based resources do not inherently provide these services, although inverters can be designed (and are being deployed) to provide some of these services.

The electric power industry and its federal and state regulators have been studying ways to protect system reliability from the unique nature of inverter-based resources since at least 2008. Additionally, Congress has funded a variety of research programs related to electric reliability.28 37 No widespread reliability issues due to solar appear to have occurred to date, though some local reliability issues have been reported.29

38

33 This mismatch and potential reliability concern have been recognized since at least 2008, but the term “duck curve” was popularized by a 2013 analysis by the California Independent System Operator (CAISO). NREL, Ten Years of Analyzing the Duck Chart, February 26, 2018.

34 Julia Pyper, “Electric Ridesharing Benefits the Grid, and EVgo Has the Data to Prove It,” Greentech Media, May 9, 2019, https://www.greentechmedia.com/articles/read/electric-ridesharing-benefit-the-grid-evgo.

35 Batteries and wind turbines are also inverter-based resources. Wind turbines do produce AC, but the quality is insufficient for the grid, so electricity from wind turbines is typically first converted to DC, then converted back to AC and delivered to the grid.

36 Essential reliability services include inertia, frequency response, and voltage control. For more information about these services, and the physical factors underlying them, see Federal Energy Regulatory Commission, Reliability Primer, 2016.

37 Some examples are provided in CRS Report R45764, Maintaining Electric Reliability with Wind and Solar Sources: Background and Issues for Congress, by Ashley J. Lawson.

38 For example, in 2016, a solar farm in Southern California stopped production after a wildfire caused a disturbance at another part of the electricity transmission system. Analysis of the event showed that the inverter’s design was responsible for the loss of power. Changes made since the event are meant to prevent similar occurrences in the future, but the event highlights how system operators are still evolving in their approach to maintaining reliability as solar energy is deployed to a larger extent. See North American Electric Reliability Corporation, 1,200 MW Fault Induced Solar Photovoltaic Resource Interruption Disturbance Report, June 2017.

Congressional Research Service

11

Solar Energy: Frequently Asked Questions

What Federal Tax Incentives Support Solar Energy Development?30

39 Various provisions in the Internal Revenue Code (IRC) support investment in solar energy equipment. These provisions reduce the after-tax cost of investing in solar property, thereby encouraging taxpayers to invest in more solar property than they would have absent tax incentives. Tax incentives for solar energy property were first enacted in 1978. Several incentives for solar are currently part of the tax code.31 Historically, the value of tax incentives for solar has fluctuated, although the current tax credit rates were established in 2005.32 Under current law, solar tax incentives are scheduled to phase down in the coming years from their 2019 rates.

Tax Incentives for Businesses

. P.L. 117-169, commonly referred to as the Inflation Reduction Act of 2022 (IRA), modified, expanded, and extended existing tax provisions supporting solar investment and deployment.40 The IRA provided additional funding for solar manufacturing tax credits while also creating a new tax credit for solar component manufacturing. Tax credits for solar manufacturing are broadly intended to increase the availability of domestically made components.41 Domestic manufacturing as a policy objective is also supported by domestic content elements in tax incentives supporting deployment.

Solar Manufacturing The IRA included two tax provisions designed to support solar (and other forms of energy) manufacturing. First, the IRA provided $10 billion in advanced energy manufacturing tax credit allocations under IRC Section 48C. The Internal Revenue Service (IRS) is to establish a program to allocate these credits.42 The IRS previously allocated $2.3 billion in advanced energy manufacturing tax credits that were provided in the American Recovery and Reinvestment Act of 2009 (P.L. 111-5). Many of the earlier advanced energy manufacturing tax credits were allocated for solar-related activities, including solar PV components and materials, CSP technologies, and related equipment such as inverters.43

Taxpayers can request tax credit allocation under the IRA for investments in projects that reequip, expand, or establish certain advanced energy manufacturing facilities.44 This includes manufacturing facilities designed to generate energy from the sun, as well as electric grid modernization equipment and components to support the transmission of intermittent sources of renewable energy.45 The base rate for the credit allocated under the IRA is 6%, with a 30% credit rate allowed for projects that pay prevailing wages and meet registered apprenticeship requirements. Of the $10 billion for allocations provided in the IRA, at least $4 billion are to be

39 Molly F. Sherlock, Specialist in Public Finance, was the author of this section. 40 Tax incentives for solar energy property were first enacted in 1978. Subsequently, tax incentives for solar have been extended and modified, most recently in the IRA. For a legislative history of the solar investment tax credit, see CRS In Focus IF10479, The Energy Credit or Energy Investment Tax Credit (ITC), by Molly F. Sherlock. For a legislative history of the tax credit for individuals purchasing residential solar, see Appendix B in CRS Report R42089, Residential Energy Tax Credits: Overview and Analysis, by Margot L. Crandall-Hollick and Molly F. Sherlock.

41 Marie Sapirie, “Powering Up Advanced Manufacturing,” Tax Notes Federal, September 26, 2022, pp. 1967-1969. 42 The IRS is directed to establish a program to certify projects and allocate credits by February 12, 2023. 43 Taxpayers receiving allocations were publicly disclosed. Recipients of first round allocations were disclosed in January 2010. See The White House, “Fact Sheet: $2.3 Billion in New Clean Energy Manufacturing Tax Credits,” press release, January 8, 2010, https://obamawhitehouse.archives.gov/the-press-office/fact-sheet-23-billion-new-clean-energy-manufacturing-tax-credits.

44 Tax-exempt organizations, including state and local governments and electric cooperatives, may be able to receive credit amounts as direct payments.

45 Selection criteria for projects are to include commercial viability; potential for domestic job creation; impact on air pollution or greenhouse gas emissions; potential for technological innovation and commercial deployment; levelized cost for energy generation, storage, or conservation; and the project’s expected time frame. Applicants accepting certifications for credits will have two years to provide evidence that the requirements of the certification have been met and to place property in service.

Congressional Research Service

12

link to page 5 Solar Energy: Frequently Asked Questions

allocated to projects in energy communities and not located in census tracts in which projects having received prior allocations under Section 48C are located.46

The second provision is a new tax credit for solar component manufacturing.47 Beginning in 2023 and through 2032, taxpayers may be able to claim tax credits for the production and sale of qualifying solar components.48 The amount of the credit is generally determined based on the particular component produced. (See Figure 1 for an overview of the solar manufacturing process.) Credit amounts for solar components are (1) for a thin-film PV cell or crystalline PV cell, 4 cents per direct current watt of capacity; (2) for PV wafers, $12 per square meter; (3) for solar grade polysilicon, $3 per kilogram; (4) for polymeric backsheet, 40 cents per square meter; and (5) for solar modules (i.e., panels), 7 cents per direct current watt of capacity.

Solar Deployment

Tax Incentives for Businesses and Tax-Exempt Entities

Tax incentives for some energy sources, including solar, were expanded and extended in the IRA.49 Investments in certain renewable energy property, including solar, qualify for an investment tax credit (ITC).3350 The amount of the credit is determined as a percentage of the taxpayer'taxpayer’s basis in eligible property. (Generally (generally, the basis is the cost of acquiring or constructing eligible property). The credit rate for solar was 30% through 2019, 26% in 2020 and 22% in 2021. Solar energy has a permanent 10% ITC that is to go into effect in 2022. The expiration dates for the ITC are commence construction deadlines.34 For example, solar property that was under construction by the end of 2019 may qualify for the 30% tax credit, even if the property is not placed in service (or ready for use) until a later date.

Special provisions in the tax code allow solar energy property to be depreciated over a shorter period of time than would normally be the case.35 Specifically, solar energy property is classified as five-year property in the Modified Accelerated Cost Recovery System (MACRS).36 The depreciable basis (the amount that is recovered through depreciation deductions over time) of solar energy property is reduced by 50% of any ITC claimed. Thus, if a 30% ITC was claimed on a $1 million investment in solar energy property, $850,000 would be depreciated under the schedule for five-year MACRS property. Accelerating depreciation reduces the after-tax cost of investing in solar energy property.

.) For solar energy property placed in service after December 31, 2021, the base credit amount is 6%. This base amount is multiplied by five (i.e., increased to 30%) for projects that satisfy prevailing wage and apprenticeship requirements or have a maximum net output of less than one MW of electrical or thermal energy.51

Taxpayers may qualify for additional credit amounts for projects that include domestically produced property or are located in qualifying geographic areas. Specifically:

A domestic content bonus credit is available for projects that certify that certain

steel, iron, and manufactured products used in the facility were domestically produced.52 The bonus credit amount is two percentage points, increased to 10 percentage points for projects that meet wage and apprenticeship requirements.

46 An energy community is defined as being a brownfield site; an area that has or had certain amounts of direct employment or local tax revenue related to oil, gas, or coal activities and has an unemployment rate at or above the national average; or a census tract or any adjoining tract in which a coal mine closed after December 31, 1999, or in which a coal-fired electric power plant was retired after December 31, 2009.

47 IRC §45X. 48 Tax-exempt organizations, including state and local governments and electric cooperatives, may be able to receive credit amounts as direct payments. Taxpayers who are not tax-exempt entities are allowed to elect direct pay for the advanced manufacturing production credit for the first five years starting with the year a facility is placed in service. The credit phases out for components sold after December 31, 2029. Components sold in 2030 will be eligible for 75% of the full credit amount. Components sold in 2031 and 2032 will be eligible for 50% and 25% of the full credit amount, respectively. No credits will be available for components sold after December 31, 2032.

49 For an overview of tax provisions in the IRA, see CRS Report R47202, Tax Provisions in the Inflation Reduction Act of 2022 (H.R. 5376), coordinated by Molly F. Sherlock. For an overview of climate-related provisions in the IRA, see CRS Report R47262, Inflation Reduction Act of 2022 (IRA): Provisions Related to Climate Change, coordinated by Jane A. Leggett and Jonathan L. Ramseur.

50 IRC §48. 51 Solar energy property qualifies for the 30% credit automatically if construction begins before 60 days after the Secretary of the Treasury publishes guidance on the wage and registered apprenticeship requirements.

52 CRS Insight IN11983, Proposed Tax Preference for Domestic Content in Energy Infrastructure, by Christopher D.

Congressional Research Service

13

link to page 16 Solar Energy: Frequently Asked Questions

Projects located in energy communities may qualify for an increased credit

amount of two percentage points, increased to 10 percentage points for projects that meet wage and apprenticeship requirements.53

The IRS has been directed to establish a program to allocate 1.8 gigawatts for

“environmental justice solar and wind capacity” credits in each of calendar years 2023 and 2024.54 Taxpayers receiving capacity allocations may be entitled to tax credits in addition to otherwise allowed ITCs. Specifically, projects located in low-income communities or on Indian land receiving allocations can claim a 10 percentage point bonus ITC. Projects that are part of low-income residential building projects or qualified low-income economic benefit projects can claim a 20 percentage point bonus ITC.

Starting in 2023, tax-exempt organizations, including state and local government and electric cooperatives, may be able to receive credit amounts as direct payments. In other words, entities that do not pay taxes may be able to receive the credit amount as payments. In 2024, the amount of the credit that can be received as direct pay will be limited to 90% for large facilities not meeting domestic content requirements. The Treasury Secretary can waive this limit if materials are not available domestically or if including domestic materials would increase the facility’s construction cost by more than 25%. A taxpayer can elect a one-time transfer of all or a portion of the tax credit. This option may be attractive to taxpayers with limited tax liability, as the taxpayer may be able to transfer his or her credit in exchange for a payment.

Taxpayers may claim the production tax credit (PTC) for electricity produced using qualifying solar energy property that was placed in service after 2021 if an ITC was not claimed for that same property. The PTC can be claimed for electricity produced at a qualifying facility during its first 10 years in operation. The credit amount is 1.3 cents per kWh (in 1993 dollars) adjusted annually for inflation. In 2022, the PTC was 2.6 cents per kWh for solar projects that qualify for this amount. Similar to the ITC, larger projects must pay prevailing wages and meet registered apprenticeship requirements to claim this credit amount, with the credit amount one-fifth of this value otherwise. Similar to the ITC, there are bonus amounts that can be added to the PTC for projects meeting domestic content requirements and facilities located in energy communities.

Beginning in 2024, solar energy facilities may be eligible for new clean electricity tax credits. Taxpayers can claim these credits either for investment in zero-emissions electricity generation facilities or for the production of zero-emissions electricity at qualifying facilities. Similar to the ITC and PTC above, limited credits are available for larger facilities that do not pay prevailing wages or meet registered apprenticeship requirements, and bonus credit amounts are available for projects in energy communities or facilities that meet domestic content requirements. After 2024, there is an annual allocation of 1.8 gigawatts in environmental justice solar and wind capacity credits, similar to what is available in 2023 and 2024. The clean electricity credits are scheduled to phase out when emissions reduction target levels are achieved or after 2032 (the later of the two).55

Watson and Molly F. Sherlock.

53 See footnote 46 for the energy community definition. 54 Qualifying solar facilities include those with a nameplate capacity of 5 MW or less. Qualifying property can include energy storage property installed in connection with the solar property and interconnection property.

55 The emissions target phaseout is scheduled to begin after the calendar year in which greenhouse gas emissions from the electric power sector are equal to or less than 25% of 2022 electric power sector emissions. Once phaseout begins, the full credit amount will remain available for facilities that begin construction the following year. The credit amount

Congressional Research Service

14

Solar Energy: Frequently Asked Questions

Special provisions in the tax code allow solar energy property to be depreciated over a shorter period of time than would normally be the case.56 Specifically, solar energy property is classified as five-year property in the Modified Accelerated Cost Recovery System (MACRS).57 Temporarily, through 2022, certain investments in solar energy property are eligible for 100% bonus depreciation.3758 This eligibility means that for these investments, the expense can be deducted immediately (i.e., expensed). Bonus depreciation is scheduled to phase down after 2022. It is scheduled to decrease to 80% in 2023, 60% in 2024, 40% in 2025, and 20% in 2026, before being 0% in 2027. Bonus depreciation may be claimed for new as well as used property. Regulated public utilities cannot claim bonus depreciation. Tax-exempt organizations, such as electric cooperatives, also cannot claim bonus depreciation, and typically are limited in their ability to benefit from tax incentives more broadly.

. Tax Incentives for Individuals

Individuals purchasing solar energy property may qualify for the residential energy-efficient property credit.3859 Through 20192032, the tax credit for individuals is 30% of the cost of solar electric property installed on the taxpayer'’s residence.3960 The tax credit rate is scheduled to be 26% in 20202033 and 22% in 20212034, with the credit expiring after 2021.402034.61 The tax credit is nonrefundable, meaning that the amount of the credit a taxpayer can claim in the tax year is limited to the taxpayer'taxpayer’s income tax liability. However, unused tax credits can be carried forward to the following tax year.

How Much Do Solar Tax Incentives Cost?

62 Tax expenditure estimates are one source of information on the "cost"“cost” of solar tax incentives. Tax expenditures are, by definition, the amount of forgone revenue associated with special provisions in the tax code, such as tax credits and accelerated cost recovery. For FY2019FY2021, the Joint Committee on Taxation (JCT) estimates that the amount of forgone revenue associated with the business ITC for solar was $37.4 billion.41 63 The amount of forgone revenue associated with the residential energy-efficient property credit for FY2019FY2021 was an estimated $2.0 billion. This figure, however, includes all eligible technologies.42 While most of this was due to solar energy property, JCT does not estimate the forgone revenue associated with solar separate from other eligible technologies. 1.0 billion, although

for facilities beginning construction in the second year will be 75% of the full credit amount. This will be reduced to 50% for facilities beginning construction in the third year and zero afterward.

56 Generally, assets used in the production of electricity are recovered over a 20-year period. See IRS Publication 946 (2018), “How to Depreciate Property,” available at https://www.irs.gov/publications/p946. 57 IRC §168(e)(3)(B). The depreciable basis (the amount that is recovered through depreciation deductions over time) of solar energy property is reduced by 50% of any ITC claimed. Thus, if a 30% ITC was claimed on a $1 million investment in solar energy property, $850,000 would be depreciated under the schedule for five-year MACRS property. Accelerating depreciation reduces the after-tax cost of investing in solar energy property.

58 The 2017 tax revision (P.L. 115-97, commonly referred to as the Tax Cuts and Jobs Act) included a temporary 100% bonus depreciation for qualified assets bought and placed in service between September 28, 2017, and December 31, 2022. This provision is not unique to solar, but it nonetheless reduces the after-tax cost of making investments in solar energy property. For more information on bonus depreciation generally, see CRS Report RL31852, The Section 179 and Section 168(k) Expensing Allowances: Current Law and Economic Effects, by Gary Guenther.

59 IRC §25D. 60 A taxpayer’s residence includes any dwelling unit used as a residence by the taxpayer. It is not limited to property installed on the taxpayer’s primary residence, so tax credits can be claimed for solar energy property installed on second or vacation homes.

61 The tax credit for solar panels was reduced to 26% in 2020 and 2021 before being increased back to 30% in the IRA. 62 Molly F. Sherlock, Specialist in Public Finance, was the author of this section. 63 JCT, Estimates of Federal Tax Expenditures for Fiscal Years 2020–2024, JCX-23-20, November 5, 2020, p. 25.

Congressional Research Service

15

Solar Energy: Frequently Asked Questions

the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Division EE of P.L. 116-260) later extended this provision, with the extension estimated to reduce federal revenue by $0.3 billion in FY2021.64 The figures for the residential tax credits includes all eligible technologies and are not strictly for solar.65 The revenue loss for five-year MACRS for all eligible energy property (primarily wind and solar, but other technologies are eligible) is estimated at less than $50 million in FY2021in FY2018. Because bonus depreciation is not a solar- or even energy-specific provision, a tax expenditure estimate for bonus depreciation for solar is not available.

Internal Revenue Service (IRS)

IRS data also provide information on individual claims of tax credits for solar electric property.43 In 2017, individuals filed 381,24266 In 2019, an estimated 517,664 individuals filed tax returns that claimed the residential energy-efficient property credit for solar electric property.4467 The total cost of solar electric property for which tax credits were claimed was $5.510.4 billion, generating approximately $1.6 billion in individual income tax credits.45

3.1 billion in individual income tax credits.68

The IRA’s expanded and modified tax credits for clean energy are expected to reduce federal revenues, with the JCT estimating the budgetary effect for the FY2022-FY2031 period.69 The JCT’s estimates apply to all technologies eligible for a provision and are not specific to solar. The IRA’s modification and extension of the ITC is estimated to reduce federal revenues by $14.0 billion, while the new clean electricity ITC is expected to reduce federal revenues by an additional $50.9 billion. Extending the five-year cost recovery period in the IRA, which includes solar and other technologies, is estimated to reduce federal revenue by $0.6 billion. The extension and modification of the residential energy efficient property, which can be claimed for residential solar panel installations, is expected to reduce federal revenue by $22.0 billion over the 10-year budget window. As discussed above, taxpayers investing in or engaged in solar manufacturing may also be able to claim federal tax credits for these activities. The estimated reduction in federal tax revenues due to the advanced energy manufacturing tax credit in the IRA is $6.3 billion, while the reduction in revenue due to the advanced manufacturing production credit is $30.6 billion.

64 The business ITC was also extended in P.L. 116-260, but there was not estimated to be a FY2021 fiscal impact for that extension. See JCT, Estimated Budget Effects of the Revenue Provisions Contained in Rules Committee Print 116-68, the “Consolidated Appropriations Act, 2021,” JCX-24-20, December 21, 2020. 65 Taxpayers can also claim the residential energy-efficient property credit for solar water heating, small wind energy, geothermal heat pump, and fuel cell property. While most of this was due to solar energy property, JCT does not estimate the forgone revenue associated with solar separate from other eligible technologies.

66 Data from the IRS Statistics of Income files are not directly comparable to JCT’s tax expenditure estimates. Tax expenditures are estimates of the forgone revenue associated with a tax provision in a given fiscal year. The IRS Statistics of Income data are estimates based on tax returns filed for a given calendar year.

67 Internal Revenue Service, Individual Income Tax Returns Line Item Estimates, 2019, Publication 4801 (Rev. 12-2021), 2019, pp. 128-129, https://www.irs.gov/pub/irs-pdf/p4801.pdf.

68 Ibid. 69 All estimates in this paragraph are 10-year estimates, as provided in JCT, Estimated Budget Effects of the Revenue Provisions of Title I – Committee on Finance, of an Amendment in the Nature of Substitute to H.R. 5376, “An Act to Provide for Reconciliation Pursuant to Title II of S. Con. Res. 14,” as Passed by the Senate on August 7, 2022, and Scheduled for Consideration by the House of Representatives on August 12, 2022, JCX-18-22, August 9, 2022.

Congressional Research Service

16

link to page 11 link to page 11 link to page 21 Solar Energy: Frequently Asked Questions

What State Policies Support Solar Energy Development?46

70 Per the Federal Power Act, states have jurisdiction over most aspects of electricity generation and distribution.4771 Consequently, many policies that affect the development of solar energy are implemented by states. This section discusses one common state policy, a renewable portfolio standard. Other state policies designed to accelerate the deployment of solar energy include net metering (mentioned in the section "“How Does Solar Energy Impact Electricity Costs for Consumers?")”), state tax credits, and allowing third-party ownership (i.e., solar leasing).48

72

Renewable portfolio standards (or, more broadly, electricity portfolio standards), as typically implemented, set requirements on utilities to procure a minimum share of their electricity sales from specified renewable sources such as solar.4973 Many factors influence solar energy development, but renewable portfolio standards are widely credited as being a key factor in the United States historically, as they have provided a policy-driven source of demand for renewable electricity generation. Twenty-nineThirty states, three U.S. territories, and the District of Columbia are implementing mandatory electricity portfolio standards, and an additional eight states and one territory have voluntary standards. Of these, nine jurisdictions have targets of 100% clean energy.74 Jurisdictions differ in their definitions of eligible clean energy sources, but solar is eligible in all cases.50 Nineteen of these policies include specific requirements or extra incentives for solar.75

How Are Tariffs and Trade Restrictions Affecting Solar Imports and Domestic Solar Manufacturing?76 While several different semiconducting materials may be used in panels, crystalline silicon (CS) was used in over 95% of solar panels produced globally in 2020. The remainder of panels were thin-film panels, which are typically less effective at converting incoming sunlight into electricity.

The CS PV supply chain consists of four primary manufacturing stages: (1) production of bulk polysilicon, (2) manufacture of thin sheets of CS known as wafers, (3) manufacture of solar cells, and (4) assembly of solar panels. In 2020, China accounted for over 70% of global production of each stage (Figure 5). The United States currently has manufacturing operations in the final stage, CS panel assembly, where imported cells are wired together and framed. While the U.S. assembly represents 3% of global CS PV panel assembly in 2020, U.S. CS PV panel production

70 Ashley Lawson, Analyst in Energy Policy, was the author of this section. 71 16 U.S.C. §824. For discussion of the Federal Power Act, see CRS In Focus IF11411, The Legal Framework of the Federal Power Act, by Adam Vann.

72 For more information of state solar energy policies, including details by state, see North Carolina Clean Energy Technology Center, Database of State Incentives for Renewables & Efficiency (DSIRE), https://www.dsireusa.org/.

73 Renewable portfolio standard policy design is discussed further in CRS Report R45913, Electricity Portfolio Standards: Background, Design Elements, and Policy Considerations, by Ashley J. Lawson.

74 DSIRE, Renewable & Clean Energy Standards, September 2020, https://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2020/09/RPS-CES-Sept2020.pdf.

75 Galen Barbose, U.S. Renewable Portfolio Standards: 2021 Status Update: Early Release, Lawrence Berkeley National Laboratory, February 2021, p. 10.

76 Manpreet Singh, Analyst in Industrial Organization and Business, was the author of this section.

Congressional Research Service

17

Solar Energy: Frequently Asked Questions

accounted for about 10% of apparent U.S. consumption of CS PV panels, highlighting the inability of current domestic production to satisfy U.S. demand.77

Figure 5. Upstream CS PV Value Chain

Share of Global Production by Geographic Area, 2020

Source: Figure created by CRS from G. Masson and I. Kaizuka, Trends in Photovoltaic Applications 2021, International Energy Agency, pp. 44-46.

The United States has applied tariffs on imports of certain solar energy equipment since 2012.78

The Obama Administration imposed double- and triple-digit antidumping and

countervailing duty tariffs on U.S. imports of CS PV cells and panels from China in 2012 and 2015 and on imports from Taiwan in 2015. These tariffs were extended in 2019 (China) and 2020 (China and Taiwan) until the next five-year review.79

In 2018, the Trump Administration—acting under Section 201 of the Trade Act

of 197480—responded to an industry petition by imposing tariffs of 30% on imports of CS PV cells exceeding a 2.5 GW annual tariff-free quota and on all

77 International Energy Agency (IEA), Photovoltaic Power Systems Program (PVPS), Trends 2018 in Photovoltaic Applications, December 3, 2018, p. 56. Apparent consumption accounts for total production plus imports minus exports. U.S. International Trade Commission (USITC), Crystalline Silicon Photovoltaic Cells, Whether or Not Partially or Fully Assembled Into Other Products, Investigation no. TA-201-75, December 2021.

78 See CRS Report R47093, U.S. Solar Photovoltaic Manufacturing, by Manpreet Singh. 79 The USITC conducts sunset reviews every five years to determine whether to extend antidumping and countervailing duties. For more information, see section 751(c) of the Tariff Act of 1930, 19 U.S.C. §1675(c).

80 Section 201 of the Trade Act of 1974 (19 U.S.C. §2251) provides temporary relief for a U.S. industry from import competition. See CRS In Focus IF10786, Safeguards: Section 201 of the Trade Act of 1974, by Vivian C. Jones.

Congressional Research Service

18

Solar Energy: Frequently Asked Questions

CS PV panels.81 For imports from China and Taiwan, the Section 201 tariffs were additional to antidumping and countervailing duties. The tariff rates and scope of coverage have subsequently been adjusted several times.82 On February 4, 2022, President Biden extended the Section 201 tariffs on CS PV cell and panel imports for another four years at a 14.75% rate and doubled the amount of CS PV cells exempt from tariffs to 5 GW annually.83

In 2018, the Trump Administration placed a 25% duty on steel and a 10% duty on

aluminum imported from most countries. These duties affect BOS equipment—such as PV brackets, panel frames, cabling, power electronics housing, batteries, and wiring84—and are projected to add 2%-5% to PV system costs.85

Additional tariffs on a long list of Chinese products, including inverters and other

solar equipment, were imposed at a 10% rate in September 2018. The rate was raised to 25% in May 2019.86

CS PV panel imports from China declined after antidumping and countervailing duties were imposed in 2012. Since 2018—the start of the Section 201 tariffs—the volume of CS PV panel imports increased from about 5 GW in 2018 to 19 GW in 2020, led by imports from Malaysia, Vietnam, and Thailand. In April 2022, in response to an industry petition, the Department of Commerce initiated an inquiry into whether Chinese manufacturers are circumventing duties by sending nearly finished products from China to Malaysia, Vietnam, and Thailand for minor processing before shipping them to the United States.87