Social Security: Taxation of Benefits

Changes from November 1, 2019 to June 12, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Social Security: Taxation of Benefits

Contents

- Introduction

- Determining the Portion of Social Security Benefits Subject to Federal Income Taxation

- Special Considerations

- State Taxation

- Growth in Social Security Benefits Subject to Taxation

- Federal Income Taxes Owed on Social Security Benefits by Income Level

- Impact on the Trust Funds

- History of Taxing Social Security Benefits

- Current Proposals Addressing the Taxation of Social Security Benefits

Figures

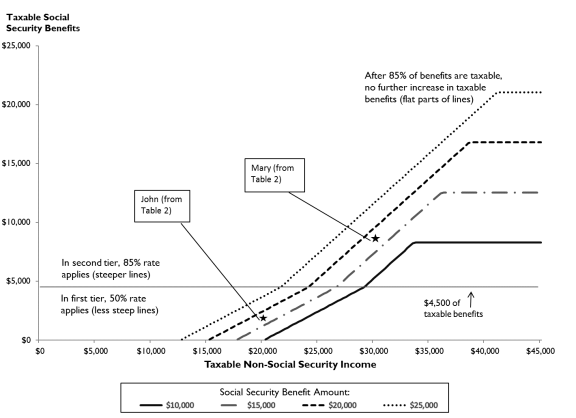

- Figure 1. Taxable Social Security Benefits as Annual Non-Social Security Income Increases

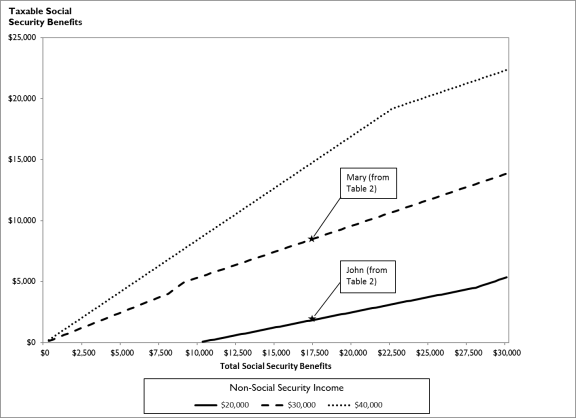

- Figure 2. Taxable Social Security Benefits as Total Annual Social Security Benefits Increase

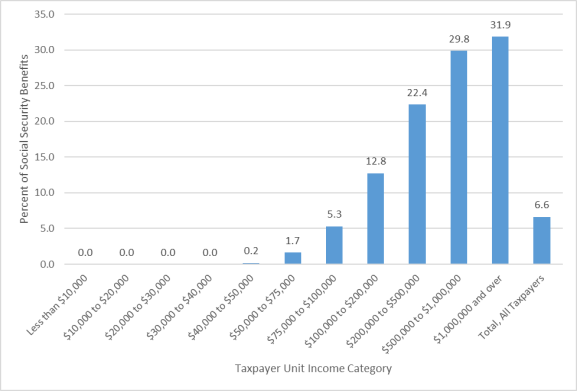

- Figure 3. Federal Income Tax Liability on Social Security Benefits as a Percentage of Social Security Benefits, by Taxpayer Unit Income Category

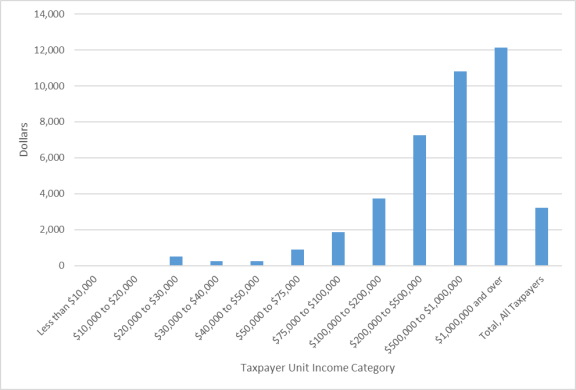

- Figure 4. Average Federal Income Tax Liability on Social Security Benefits Among Social Security Taxpayer Units, by Taxpayer Unit Income Category

Tables

- Table 1. Calculation of Taxable Social Security and Railroad Retirement Tier I Benefits

- Table 2. Calculation of Taxable Social Security Benefits for Single Social Security Recipients with a $17,500 Benefit and Different Levels of Other Income: An Example

- Table 3. State Income Taxation of Social Security Benefits, Tax Year 2017

- Table 4. Income Taxation of Social Security Benefits, 1999-2016

Summary

Social Security: Taxation of Benefits

Updated June 12, 2020

Congressional Research Service

https://crsreports.congress.gov

RL32552

Social Security: Taxation of Benefits

Summary

Social Security provides monthly cash benefits to retired or disabled workers and their family

members and to the family members of deceased workers. Those benefits were initially exempt

from federal income tax, but in 1983, Congress approved recommendations from the National

Commission on Social Security Reform (also known as the Greenspan Commission) as part of the

Social Security Amendments of 1983 to tax the benefits of some higher-income Social Security

beneficiaries. In the congressional debate leading to the Social Security Amendments of 1983 and

the Omnibus Budget Reconciliation Act of 1993 (OBRA 1993), the committee reports noted a

desire to treat Social Security benefits more like private pension benefits, where benefits are

subject to income tax except for the portion attributable to the individual'’s own contributions to

the system (on which the individual had already paid income tax).

Beginning in 1984, up to 50% of Social Security and Railroad Retirement Tier I benefits became

taxable for individuals whose provisional income exceeds $25,000 and couples whose provisional

income exceeds $32,000. Provisional income equals adjusted gross income (total income from all

sources recognized for tax purposes) plus certain otherwise tax-exempt income, including half of

Social Security and Railroad Retirement Tier I benefits. The proceeds from taxing this portion of

Social Security and Railroad Retirement Tier I benefits are credited to the Old-Age and Survivors

Insurance (OASI) trust fund, the Disability Insurance (DI) trust fund, and the Railroad Retirement

system, respectively, based on the source of the benefit taxed.

OBRA 1993 increased the taxable share of Social Security and Railroad Retirement Tier I

benefits for some beneficiaries. That law taxes up to 85% of benefits for individuals whose

provisional income exceeds $34,000 and for married couples whose provisional income exceeds

$44,000. The additional proceeds from that law are credited to the Medicare Hospital Insurance

(HI) trust fund.

The Congressional Budget Office (CBO) estimated that 49% of Social Security beneficiaries

were affected by the income taxation of Social Security benefits in tax year 2014. That share is

expected to grow over time because the income thresholds used to determine the taxable share of

benefits are not indexed for inflation or wage growth. A Social Security Administration analysis

projected that over 56% of Social Security beneficiary families will owe income tax on their

Social Security benefits in 2050. Among those who owe income tax on their Social Security

benefits, the tax liability increases with income.

In 2018

In 2019, the Social Security trust funds were credited with $35.036.5 billion in revenue from taxation

of benefits, accounting for 3.54% of total income. The Medicare HI trust fund was credited with $24.2

$23.8 billion in revenue from taxation of benefits, which equaled 7.94% of total income. In 2017, 2018,

the Railroad Retirement system was credited with $292255 million in revenue from taxation of

Railroad Retirement Tier I benefits, representing about 2.31.9% of total income.

Under the intermediate assumptions of the 20192020 Social Security Trustees Report, income taxes on

benefits are projected to reach $92.398 billion in 20282029, representing 5.76.1% of total income to the Social

Security trust funds. Under the intermediate assumptions of the 20192020 Medicare HI Trustees

Report, income taxes on benefits are projected to be $63.768.8 billion in 20282029, accounting for 12.4% 13.3%

of total income to the Medicare HI trust fund.

In the 116th The 2020 intermediate assumptions reflect the

Board of Trustees’ understanding of Social Security and Medicare at the start of 2020; they do not

include potential effects of the Coronavirus Disease 2019, or COVID-19.

In the 116th Congress, four bills have been introduced that would affect the taxation of Social

Security and Railroad Retirement Tier 1 benefits: H.R. 860 (Representative Larson) and its corresponding measure

Congressional Research Service

Social Security: Taxation of Benefits

companion bill S. 269 (Senator Blumenthal), H.R. 3966 (Representative Lipinski), and H.R. 3971

(Representative Massie).

Introduction

The Social Security system provides monthly benefits to qualified retirees, disabled workers, and their spouses and dependents; it also provides monthly benefits to qualified survivors of deceased workers. Before 1984, Social Security benefits were exempt from the federal income tax. Congress passed legislation in 1983 to tax a portion of Social Security and Railroad Retirement Tier I benefits, with the share of benefits subject to taxation gradually increasing as a person's

Congressional Research Service

Social Security: Taxation of Benefits

Contents

Introduction ................................................................................................................... 1

Determining the Portion of Social Security Benefits Subject to Federal Income Taxation ........... 2

Special Considerations ............................................................................................... 7

State Taxation ........................................................................................................... 8

Growth in Social Security Benefits Subject to Taxation ......................................................... 8

Federal Income Taxes Owed on Social Security Benefits by Income Level............................. 10

Impact on the Trust Funds .............................................................................................. 12

History of Taxing Social Security Benefits ........................................................................ 13

Current Proposals Addressing the Taxation of Social Security Benefits.................................. 17

Figures

Figure 1. Taxable Social Security Benefits as Annual

Non-Social Security Income Increases ............................................................................. 6

Figure 2. Taxable Social Security Benefits as Total Annual

Social Security Benefits Increase .................................................................................... 7

Figure 3. Federal Income Tax Liability on Social Security Benefits as a Percentage of

Social Security Benefits, by Taxpayer Unit Income Category ............................................ 11

Figure 4. Average Federal Income Tax Liability on Social Security Benefits Among

Social Security Taxpayer Units, by Taxpayer Unit Income Category................................... 12

Tables

Table 1. Calculation of Taxable Social Security and Railroad Retirement Tier I Benefits ............ 3

Table 2. Calculation of Taxable Social Security Benefits for Single Social Security

Recipients with a $17,500 Benefit and Different Levels of Other Income: An Example ........... 4

Table 3. State Income Taxation of Social Security Benefits, Tax Year 2020 .............................. 8

Table 4. Income Taxation of Social Security Benefits, 1999-2017........................................... 9

Appendixes

Appendix. Taxation of Benefits Under Special Situations .................................................... 19

Contacts

Author Information ....................................................................................................... 21

Acknowledgments......................................................................................................... 21

Congressional Research Service

Social Security: Taxation of Benefits

Introduction

The Social Security system provides monthly benefits to qualified retirees, disabled workers, and

their spouses and dependents; it also provides monthly benefits to qualified survivors of deceased

workers. Before 1984, Social Security benefits were exempt from the federal income tax.

Congress passed legislation in 1983 to tax a portion of Social Security and Railroad Retirement

Tier I benefits, with the share of benefits subject to taxation gradually increasing as a person’s

income rose above a specified income threshold. 1income rose above a specified income threshold.1 In 1993, a second income threshold was added

that increased the taxable share of benefits. These two thresholds are often referred to as first tier

and second tier.

.

In the congressional debate leading to the Social Security Amendments of 1983 and the Omnibus

Budget Reconciliation Act of 1993 (OBRA 1993), the committee reports noted a desire to

-

treat Social Security benefits more like private pension benefits, in which

individual'individual’s own contributions to the system (on which the individual had -

protect lower-income beneficiaries from taxation of benefits; and

-

improve the Social Security program

'’s solvency.2

2

Today, approximately half of Social Security beneficiaries pay federal income taxes on a portion

of their benefits. That percentage is projected to increase over time because the income thresholds

used to determine the taxable share of benefits are not indexed for inflation or wage growth.

In 2020, Social Security tax liability (federal income taxes owed on Social Security benefits) is

projected to be 6.6% of Social Security benefits, with higher tax liabilities associated with higher

income categories. Among affected taxpayer units, the average dollar value of Social Security tax

liability is projected to be $3,211, again with higher projected tax liabilities for those in higher

income brackets.

Overall in 2016, 31.42017, 33.0% of all Social Security benefit payments were taxable. Revenue from the

federal taxation of benefits is directed to the Social Security trust funds, the Medicare Hospital

Insurance (HI) trust fund, and the Railroad Retirement system,3 3 and it makes up 3.54%, 7.94%, and 2.3

1.9% of total income to the respective systems. In 20282029, income from the taxation of benefits is

projected to reach 5.76.1% of revenue to the Social Security trust funds and 12.413.3% of revenue to the Medicare HI trust fund.

This report details the rules for determining the portion of Social Security benefits subject to federal income taxation, provides statistics about Social Security benefits subject to taxation and the amount of taxes owed, and discusses the impacts on the Social Security and Medicare HI trust funds. It also explains the history of the federal income taxation of Social Security benefits and briefly describes current legislative proposals that would change the taxation of Social Security benefits.

Determining the Portion of Social Security Benefits

1

Railroad Retirement T ier I benefits are paid to a qualified railroad retiree who has met the quarterly work

requirements for Social Security benefit eligibility. T he retiree receives Social Security benefits based on the work

history that qualified the retiree for Social Security benefits, and the retiree receives T ier I benefits based on both the

Social Security and railroad work histories. T he actual Social Security benefits received are subtracted from this

calculation of T ier I benefits to get actual T ier I benefits. See CRS Report RS22350, Railroad Retirement Board:

Retirement, Survivor, Disability, Unemployment, and Sickness Benefits. In this report, references to Social Security

benefits generally also apply to T ier I benefits.

Larry DeWitt, “Research Note #12: T axation of Social Security Benefits,” Social Security Administration Historian’s

Office, February 2001, at https://www.ssa.gov/history/taxationofbenefits.html.

2

3

T he Railroad Retirement Board, an independent federal agency, administers retirement, survivor, disability,

unemployment, and sickness insurance for railroad workers and their families. T he Railroad Retirement Act authorizes

retirement, disability, and survivor benefits for railroad workers and their families, financed primarily by payroll taxes,

financial interchanges from Social Security, and transfers from the National Railroad Ret irement Investment T rust. See

CRS Report RS22350, Railroad Retirement Board: Retirement, Survivor, Disability, Unemployment, and Sickness

Benefits.

Congressional Research Service

1

Social Security: Taxation of Benefits

Medicare HI trust fund. The Social Security and Medicare projections for 2029 do not include

potential effects of the Coronavirus Disease 2019, or COVID-19.

This report details the rules for determining the portion of Social Security benefits subject to

federal income taxation, provides statistics about Social Security benefits subject to taxation and

the amount of taxes owed, and discusses the impacts on the Social Security and Medicare HI trust

funds. It also explains the history of the federal income taxation of Social Security benefits and

briefly describes current legislative proposals that would change the taxation of Social Security

benefits.

Determining the Portion of Social Security Benefits

Subject to Federal Income Taxation

Subject to Federal Income Taxation

In general, about half of Social Security beneficiaries pay federal income taxes on a portion of

their benefits. Up to 85% of Social Security benefits can be included in taxable income for

recipients whose "“provisional income"” exceeds either of two statutory thresholds (based on filing

status).4

4

Provisional income is adjusted gross income,5 plus 5 plus certain otherwise tax-exempt income (tax-exempttaxexempt interest), plusplus the addition of certain income specifically excluded from federal income

taxation (interest on certain U.S. savings bonds,6 6 employer-provided adoption benefits, foreign

earned income or foreign housing, and income earned in Puerto Rico or American Samoa by bona

fide residents), plusplus 50% of Social Security benefits.

The first-tier thresholds, below which no Social Security benefits are taxable, are $25,000 of

provisional income for taxpayers filing as single, head of household, or qualifying widow(er) and

$32,000 of provisional income for taxpayers filing a joint return. In the case of taxpayers who are

married filing separately, the threshold is also $25,000 of provisional income if the spouses lived

apart all year, but it is $0 for those who lived together at any point during the tax year.7

If provisional income is between the first-tier thresholds and the second-tier thresholds of $34,000 (for single filers) or $44,000 (for married couples filing jointly), the amount of Social Security benefits subject to tax is the lesser of (1) 50% of Social Security benefits or (2) 50% of 7

4

For additional information on calculating taxable Social Security benefits, see U.S. Department of the Treasury,

Internal Revenue Service, “Social Security and Equivalent Railroad Retirement Benefits,” Publication 915, at

http://www.irs.gov/pub/irs-pdf/p915.pdf. T he term provisional income is not defined in the Internal Revenue Code but

was referred to in the conference report accompanying the Omnibus Budget Reconciliation Act of 1993 ( P.L. 103-66),

which established the second-tier threshold. See U.S. Congress, Committee on the Budget, Omnibus Budget

Reconciliation Act of 1993, conference report to accompany H.R. 2264, 103th Cong., 1 st sess., August 4, 1993, H.Rept.

103-213, (Washington: GPO, 1993), p. 594, at https://www.finance.senate.gov/imo/media/doc/confrpt103-213.pdf.

5

Adjusted gross income (AGI) is the main measure of income used when computing income taxes. T he Internal

Revenue Service refers to provisional income as modified adjusted gross income. See IRS Publication 915 for details

on the sources of income included in computing provisional income.

6 Interest on qualified U.S. savings bonds used to pay certain educational expenses is exempt from federal income

taxation.

“T he base amount is zero for married individuals filing separate returns because the committee believes that the

family should be treated as the integral unit in determining the amount of social security benefit that is included in

gross income under this provision. If the base amount for these individuals were higher, couples who are otherwise

subject to tax on their benefits and whose incomes are relatively equally divided would be able to reduce substantially

the amount of benefits subject to tax by filing separate returns.” U.S. Congress, House Committee on Ways and Means,

Social Security Act Amendments of 1983, report to accompany H.R. 1900, 98 th Cong., 1 st sess., H.Rept. 98-25 Part 1

(Washington, DC: GPO, 1983), p. 24, at https://www.ssa.gov/history/pdf/Downey%20PDFs/

Social%20Security%20Amendments%20of%201983%20Vol%201.pdf .

7

Congressional Research Service

2

Social Security: Taxation of Benefits

If provisional income is between the first-tier thresholds and the second-tier thresholds of $34,000

(for single filers) or $44,000 (for married couples filing jointly), the amount of Social Security

benefits subject to tax is the lesser of (1) 50% of Social Security benefits or (2) 50% of

provisional income in excess of the first threshold.

provisional income in excess of the first threshold.

If provisional income is above the second-tier thresholds, the amount of Social Security benefits

subject to tax is the lesser of (1) 85% of benefits or (2) 85% of provisional income above the

second threshold, plus the smaller of (a) $4,500 (for single filers) or $6,000 (for married filers)8 8

or (b) 50% of benefits.

Because the threshold for married taxpayers filing separately who have lived together any time

during the tax year is $0, the taxable benefits in such a case are the lesser of 85% of Social

Security benefits or 85% of provisional income. None of the thresholds are indexed for inflation

or wage growth. Table 1 summarizes the thresholds and calculation of taxable benefits.

Table 1. Calculation of Taxable Social Security and Railroad Retirement Tier I

Benefits

Tier I Benefits

| Taxable Social Security and | |

|

Single Taxpayer |

||

|

(A) |

Less than $25,000 |

None |

|

(B) |

$25,000 to $34,000 |

$25,000 to $34,000 Lesser of (1) 50% of benefits or (2) 50% of provisional income above $25,000 (maximum of $4,500) |

|

(C) |

(C) Greater than $34,000 | Lesser of (1) 85% of benefits or (2) 85% of provisional income above $34,000 plus amount from line (B) |

|

Married Taxpayer |

||

|

(D) |

Less than $32,000 |

None |

|

(E) |

Married Taxpayer

(D)

Less than $32,000

None

(E)

$32,000 to $44,000

| Lesser of (1) 50% of benefits or (2) 50% of provisional income above $32,000 (maximum of $6,000) |

|

(F) |

Greater than $44,000 |

(F) Greater than $44,000 Lesser of (1) 85% of benefits or (2) 85% of provisional income above $44,000 plus amount in line (E) |

Source:

Source: Internal Revenue Service (IRS), Publication 915, "“Social Security and Equivalent Railroad Retirement

Benefits."

a. ”

a.

Provisional income is adjusted gross income plus certain income exclusions plusplu s 50% of Social Security

benefits.

The two examples in Table 2 illustrate how taxable Social Security benefits may be calculated for single

single (nonmarried) retirees in tax year 2018. In the examples, John and Mary are at least 62 years of age and

receive $17,500 in annual Social Security benefits—about the average for a retired worker in 2018.9. 9 John has non-Social Security income of

$20,000, whereas Mary has non-Social Security income of $30,000. John'’s provisional income is

between the first-tier and second-tier thresholds, resulting in taxable Social Security benefits of

$1,875. Because Mary'’s provisional income is higher than John'’s and exceeds the second-tier

threshold, a larger amount of her Social Security benefits ($8,537.50) is subject to income

8

T he $4,500 and $6,000 amounts are the maximum taxes for the first-tier calculation, and they are equivalent to 50%

of the difference between the first - and second-tier thresholds.

9 Information on monthly Social Security benefit payments is available in the Social Security Administrat ion’s (SSA’s)

Monthly Statistical Snapshot at https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/.

Congressional Research Service

3

Social Security: Taxation of Benefits

taxation. Because of the differences in non-Social Security income, 10.7% of John'’s Social

Security benefits are subject to income taxation, compared with 48.8% of Mary'’s. The amount of

income tax John and Mary owe on their taxable Social Security benefits is determined separately

through the federal income tax system based on their other taxable income and their marginal tax

rates.

rates.

Table 2. Calculation of Taxable Social Security Benefits for Single Social Security

Recipients with a $17,500 Benefit and Different Levels of Other Income: An Example

Step 1: Calculate Provisional Income

Other income

+ 50% of Social Security (assume annual Social Security benefits are $17,500)

= Provisional income

John

Mary

$20,000

$30,000

$8,750

$8,750

$28,750

$38,750

$25,000

$25,000

$3,750

$9,000

$1,875

$4,500 a

$34,000

$34,000

$0

$4,750

$0

$4,037.50

$1,875

$8,537.50

Step 2: Compare Provisional Income to First-Tier Threshold

First-tier threshold

Recipients with a $17,500 Benefit and Different Levels of Other Income: An Example

|

Step 1: Calculate Provisional Income |

John |

Mary |

|

Other income |

$20,000 |

$30,000 |

|

+ 50% of Social Security (assume annual Social Security benefits are $17,500) |

$8,750 |

$8,750 |

|

= Provisional income |

$28,750 |

$38,750 |

|

Step 2: Compare Provisional Income to First-Tier Threshold |

||

|

First-tier threshold |

$25,000 |

$25,000 |

Excess over first-tier threshold

|

$3,750 |

$9,000 |

First tier taxable benefits equals

|

$1,875 |

|

Step 3: Compare | ||

|

Second-tier threshold |

$34,000 |

$34,000 |

Calculate excess over second tier

|

$0 |

$4,750 |

Second tier taxable benefits Second tier taxable benefits

85% of excess

| $0 | $4,037.50 |

Step 4: Calculate Total Taxable Social Security Benefits | ||

For John: Provisional income is less than $34,000, so total taxable benefits equal first tier

For Mary: Provisional income is greater than $34,000, so total taxable benefits equal the

|

$1,875 |

$8,537.50 |

Source:

Source: Congressional Research Service (CRS).

a.

a.

The maximum amount of first tier taxable benefits is 50% of the difference between the second - and first-tierfirsttier thresholds ($34,000 - $25,000 = $9,000 × 50% = $4,500).

Congressional Research Service

4

Social Security: Taxation of Benefits

The calculation of taxable Social Security benefits depends on the level of benefits and the level

of non-Social Security income.

Holding benefits Holding benefits constant, as non-Social Security income increases, provisional-

Holding non-Social Security income constant, as Social Security benefits

Those two perspectives are illustrated in the two figures below. (The figures are for single retirees

only, but they would be similar for married couples.)

Figure 1 shows taxable Social Security benefits for single retirees with four different amounts of

annual Social Security benefits ($10,000, $15,000, $20,000, and $25,000) as non-Social Security

income increases from zero to $45,000. (Provisional income, which equals non-Social Security

income plus half of Social Security benefits, is not shown directly in the figure.) Once provisional

income exceeds the first-tier threshold of $25,000, each additional dollar of non-Social Security

income results in 50 cents of additional taxable income. For example, for someone with Social

Security benefits of $10,000, no benefits are taxable unless non-Social Security income exceeds

$20,000, in which case provisional income would exceed $25,000 (which equals $20,000 plus

half of $10,000).

Once provisional income exceeds the second-tier threshold, each additional dollar of non-Social

Security income results in an additional 85 cents of taxable income. As described above, the

second-tier threshold occurs when provisional income exceeds $34,000, at which point taxable

Social Security benefits exceed $4,500. In the figure, a horizontal line marks $4,500 of taxable

Social Security benefits.

The taxable amount of Social Security benefits continues to increase as non-Social Security

income increases until 85% of Social Security benefits are taxable. After that, the amount of

taxable benefits is constant, as shown by the flat portions of the lines on the right-hand side of the

figure.

Stars in the figure identify Table 2'’s example retirees, John and Mary. Both have the same

amount of Social Security benefits ($17,500); however, Mary has greater taxable Social Security

benefits than John because her non-Social Security income is larger ($30,000 for Mary, $20,000

for John). Mary is in the second tier of the calculation of taxable Social Security benefits, whereas

John is in the first tier.

Note that the additional tax owed is less than the additional taxable income. The additional tax

owed equals the additional taxable income multiplied by the taxpayer'’s marginal tax rate. That is,

the additional taxable income is the additional amount subject to federal income taxation, not the

additional amount paid in taxes.

Figure 2 shows taxable Social Security benefits for single retirees with three different levels of

non-Social Security income ($20,000, $30,000, and $40,000) as Social Security benefits increase.

(Provisional income, which equals non-Social Security income plus half of Social Security

benefits, is not shown directly in the figure.) For people with $10,000 of Social Security benefits,

those benefits would be untaxed unless non-Social Security income exceeded $20,000, at which

point provisional income would exceed the $25,000 threshold (which equals half of $10,000 plus

$20,000).

Stars in the figure identify Table 2'’s example retirees, John and Mary. Although they have the

same amount of Social Security benefits ($17,500), they are on different lines in the figure,

representing the differences in their non-Social Security income. If John or Mary were to

experience an increase or decrease in their Social Security benefits, holding non-Social Security

income constant, their new amount of taxable Social Security benefits would be found by moving

to the right or left, respectively, along their same non-Social Security income lines in the figure.

Congressional Research Service

6

Social Security: Taxation of Benefits

As noted above, the additional taxtax owed is less than the additional taxable income, because the

additional tax owed equals the additional taxable income multiplied by the taxpayer'’s marginal

tax rate.

tax rate.

For the same levels of non-Social Security income and Social Security benefits, a married couple

will have lower taxable Social Security benefits than a single retiree. Consequently, Figure 1 and

Figure 2 do not reflect the impact of taxation on a married couple filing a joint tax return.

Special Considerations

Special Considerations

The application of the benefit taxation formula may vary within special considerations. These

include lump-sum distributions, repayments, workers'’ compensation coordination, nonresident aliens'

aliens’ treatment, and wage withholdings. Each consideration is discussed in more detail in the Appendix

Appendix to this report.

State Taxation

Congressional Research Service

7

Social Security: Taxation of Benefits

State Taxation

Although the Railroad Retirement Act prohibits states from taxing railroad retirement benefits, ,

including any federally taxable Tier I benefits (45 U.S.C. §231m), states may tax Social Security

benefits. In general, state personal income taxes follow federal taxes. That is, many states use

federal adjusted gross income, federal taxable income, or federal taxes paid as a beginning point

for state income tax calculations. All of these beginning points include the federally taxed portion

of Social Security benefits. States with these beginning points for state taxation must then make

an adjustment, or subtraction from income (or taxes), for railroad retirement benefits. A state may

also make an adjustment for all or part of the federally taxed Social Security benefits. Some states

do not begin state income tax calculation with these federal tax values, but instead begin with a

calculation based on income by source. The state may then include part or all of Social Security

benefits in the state income calculation. 10

10

As shown in Table 3, as of, in tax year 2017, 292020, 30 states and the District of Columbia fully exclude Social

Security benefits from the state personal income tax. NineTwelve states tax all or part of Social

Security benefits but differ from the federal government, and five states followone state follows the federal

government in theirits tax treatment of Social Security benefits. The remaining seven states have no

personal income tax.

|

Alabama, Arizona, Arkansas, California, Delaware, District of Columbia, |

|

Colorado, Connecticut, |

|

New Mexico, North Dakota, Utah, Vermont, West Virginia |

Seven states do not have an income tax | Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming |

Source: Rick Olin, Wisconsin Legislative Fiscal Bureau, Individual Income Tax Provisions in the States, Informational

Paper 4, January 2019, available at http://docs.legis.wisconsin.gov/misc/lfb/informational_papers/ january_2019/

0004_individual_income_tax_provisions_in_the_states_informational_paper_4.pdf.

Growth in Social Security Benefits Subject to Taxation

Historical data from 1999 through 2016 show that the number and percentage of beneficiaries ; Tax Foundation, “Does Your

State Tax Social Security Benefits?,” available at https://taxfoundation.org/states-that-tax-social-security-benefits/;

and AARP, “How is Social Security taxed?,” available at https://www.aarp.org/retirement/social-security/

questions-answers/how-is-ss-taxed/.

Growth in Social Security Benefits Subject to

Taxation

Historical data from 1999 through 2017 show that the number and percentage of beneficiaries

subject to taxation of Social Security benefits is growing over time because the provisional

income thresholds used to determine the taxable share of benefits are not indexed for inflation or

wage growth. Table 4 shows that the percentage of all tax returns with taxable Social Security

benefits has grown from 7.4% in 1999 to 13.37% in 20162017. In the aggregate, Table 4 shows that the

10

States that tax Social Security benefits generally tax up to the federally taxed amount.

Congressional Research Service

8

Social Security: Taxation of Benefits

amount of taxable Social Security benefits as a percentage of all Social Security benefit payments

has grown from 19.5% in 1999 to 31.433% in 2017.

% in 2016.

|

Year |

2017

Year

Percentage of All Tax |

Benefits

Taxable Social |

|

1999 |

7.4 |

19.5 |

|

2000 |

8.2 |

22.1 |

|

2001 |

8.3 |

21.7 |

|

2002 |

8.2 |

20.6 |

|

2003 |

8.4 |

20.8 |

|

2004 |

8.8 |

22.4 |

|

2005 |

9.4 |

24.0 |

|

2006 |

9.9 |

26.4 |

|

2007 |

10.5 |

28.6 |

|

2008 |

10.5 |

27.3 |

|

2009 |

10.9 |

25.9 |

|

2010 |

11.3 |

27.2 |

|

2011 |

11.5 |

27.8 |

|

2012 |

12.3 |

28.9 |

|

2013 |

12.6 |

30.0 |

|

2014 |

12.8 |

30.8 |

|

2015 |

13.1 |

31.3 |

|

2016 |

13.3 |

31.4 |

Source: CRS calculations from Internal Revenue Service, Statistics of Income Bulletin Historical Table 11, at https://www.irs.gov/statistics/

soi-tax-stats-historical-table-1, IRS, SOI Tax Stats – Individual Income Tax Returns, Preliminary Data, Table 1, at

https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns, and Social Security Administration,

Office of the Chief Actuary, Trust Fund Tables, OASI and DI Trust Funds, Combined, 1957 and later, at

https://www.ssa.gov/oact/STATS/table4a3.html.

.

a. IRS data for 2017 are preliminary; 2017 is the most recent year for which data are available.

The Congressional Budget Office (CBO) estimated that 49% of Social Security beneficiaries

(25.5 million people) were affected by the income taxation of Social Security benefits in tax year

2014.11 11 That share has almost doubled since 1998, when 26% of beneficiaries were affected by

taxation of benefits.12 12 A 2015 Social Security Administration (SSA) analysis projected that the

Congressional Budget Office (CBO), “Effect of T axing Social Security Benefits by income Class Estimated for T ax

Year 2014,” February 12, 2015, https://www.cbo.gov/publication/49949.

11

12

Ibid.

Congressional Research Service

9

Social Security: Taxation of Benefits

share will continue to rise, with more than 56% of Social Security beneficiary families owing

income tax on their Social Security benefits in 2050.13

13

Federal Income Taxes Owed on Social Security

Benefits by Income Level

Federal income tax liability on Social Security benefits increases with income. 14 14 Figure 3 shows

that the overall projected share of Social Security benefits that will be paid as federal income

taxes is projected to be 6.6% in 2020. Among Social Security beneficiaries in taxpayer units with

economic income less than $50,000, the share is projected to be either zero or nearly zero. 15 15 The

share is projected to increase for economic income categories above $50,000 and is projected to

reach 12.8% among Social Security beneficiaries in taxpayer units with economic income

between $100,000 and $200,000 in 2020, going up to 31.9% among Social Security beneficiaries

in taxpayer units with economic income over $1,000,000 in 2020.

The SSA'’s 2015 analysis projected that, among all Social Security beneficiary families, the mean

percentage of Social Security benefits owed as taxes will be 10.9% in 2050, ranging from 1.1%

among beneficiary families in the lowest quartile of the income distribution to 16.1% for

beneficiaries in the top quartile.16

Projected for 2020 |

|

Source: CRS calculations from Joint Committee on Taxation, Background on Revenue Sources for the Social id=5216.

Notes: Taxpayer units include nonfilers, but exclude dependent filers and returns with negative income. The |

Corresponding to the share of Social Security benefits payable as federal income tax in Figure 3, ,

Figure 4 shows the projected average federal income tax liability on Social Security benefits

among Social Security taxpayer units, by taxpayer unit economic income category in 2020.17 17

Average federal income tax liability in 2020 for Social Security taxpayer units with economic

income less than $50,000 is projected to be either zero or nearly zero. Average federal income tax

liability in 2020 is projected to rise steadily with economic income above $50,000, reaching

approximately $3,700 for Social Security taxpayer units with economic income between

$100,000 and $200,000 and just over $12,000 for Social Security taxpayer units with economic

income above $1,000,000. Average federal income tax liability on Social Security benefits across

all Social Security taxpayer units is projected to be about $3,200 in 2020.

17

Social Security taxpayer units are those federal income taxpayer units that owe federal income taxes on their Social

Security benefits.

Congressional Research Service

11

Social Security: Taxation of Benefits

Figure 4. Average Federal Income Tax Liability on Social Security Benefits Among Projected for 2020 |

|

(projected for 2020)

Source: CRS and Joint Committee on Taxation, Background on Revenue Sources for the Social Security Trust Funds, id=5216.

Notes: Social Security taxpayer units are those federal income taxpayer units that owe federal income taxes on |

Impact on the Trust Funds

The proceeds from taxing up to 50% of Social Security and Railroad Retirement Tier I benefits

for beneficiaries with provisional income between the first-tier and second-tier thresholds are

credited to Social Security'’s two trust funds—the Old-Age and Survivors Insurance (OASI) and

Disability Insurance (DI) trust funds—and to the Railroad Retirement system, on the basis of the

source of the benefits taxed. Proceeds from taxing up to 85% of benefits for beneficiaries with

provisional income above the second-tier thresholds are credited to Medicare'’s HI trust fund.

In 2018

In 2019, the OASI and DI (collectively referred to as OASDI) trust funds were credited with $35.0

$36.5 billion from taxation of benefits, or 3.54% of the funds'’ total income.18 18 Income from the

18

Board of T rustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance T rust Funds,

Congressional Research Service

12

Social Security: Taxation of Benefits

taxation of benefits in the HI trust fund in 20182019 was $24.223.8 billion, or 7.94% of total HI fund

income.19 In 2017 19 In 2018, the Railroad Retirement system was credited with $292255 million in revenue

from taxation of Railroad Retirement Tier I benefits, representing about 2.31.9% of its total

income.20

20

As noted above, because the income thresholds used to determine the taxable share of benefits are

not indexed for inflation or wage growth, income taxes on benefits will become an increasingly

important source of tax revenuesrevenues for Social Security and Medicare. In 20162017, about 3133.0% of the

total Social Security benefits were subject to income tax (Table 4). CBO estimated that

proportion will increase to more than 50% by 2046.21 21 The income taxes collected from Social

Security benefits are projected to grow from 0.2% of gross domestic product (GDP) in 2019 to

0.3% of GDP in 2028 and 0.4% of GDP in 2078.22

22

Under the intermediate assumptions, the Social Security and Medicare Trustees project that over

the next 10 years, income taxes will grow from 3.54% of Social Security'’s income to 5.76.1%. In

addition, the share will continue to grow, to 7.47% by 2095.23 23 For Medicare, income tax on

benefits as a share of total revenue increases from 7.94% to 12.4% in 2028.24

13.3% in 2029. 24 The 2020 intermediate assumptions reflect the Board of Trustees’ understanding of Social Security and Medicare at the start of 2020; they do not include potential effects of the Coronavirus Disease 2019, or COVID-19. History of Taxing Social Security Benefits

Until 1984, Social Security benefits were exempt from the federal income tax. The exclusion was

based on rulings made in 1938 and 1941 by the Department of the Treasury, Bureau of Internal

Revenue (the predecessor of the Internal Revenue Service). The 1941 bureau ruling on Social

Security payments viewed benefits as being for general welfare and reasoned that subjecting the

payments to income taxation would be contrary to the purposes of Social Security.25

25

Under these rules, the treatment of Social Security benefits was similar to that of certain types of

government transfer payments (such as Aid to Families with Dependent Children, Supplemental Security Income, and benefits under the Black Lung Benefits Act). This was in sharp contrast to then-current rules for retirement benefits under private pension plans, the federal Civil Service

2020 Annual Report, April 22, 2020 (hereinafter “OASDI Board of T rustees, 2020 Annual Report”), at

https://www.ssa.gov/oact/T R/2020/tr2020.pdf, and CRS calculations. Of the $36.5 billion, $34.9 billion was credited to

the OASI trust fund and $1.6 billion to the DI trust fund (totals do not necessarily equal the sums of rounded

components).

19

Boards of T rustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance T rust Funds,

2020 Annual Report, April 22, 2020 (hereinafter “HI and SMI Boards of T rustees, 2020 Annual Report”), at

https://www.cms.gov/files/document/2020-medicare-trustees-report.pdf.

20

United States Railroad Retirement Board, 2019 Annual Report, https://rrb.gov/sites/default/files/2019-11/

2019%20ANNUAL%20REPORT _0.pdf.

21

CBO, The 2016 Long-Term Budget Outlook, July 2016, p. 60, at http://www.cbo.gov/sites/default/files/114thcongress-2015-2016/reports/51580-LTBO.pdf.

22

CBO, Supplemental Information to The 2019 Long-Term Budget Outlook, T able 6, June 2019, at

https://www.cbo.gov/system/files/2019-07/51119-CBO-2019-06-ltbo.xlsx.

23 CRS calculations based on OASDI Board of T rustees, 2020 Annual Report, at https://www.ssa.gov/oact/T R/2020/

tr2020.pdf, and Social Security Administration, Office of the Chief Actuary, “ Components of Annual Income Rates—

2020 OASDI T rustees Report ,” at https://www.ssa.gov/OACT /T R/2020/IV_B_LRest.html#506020.

24

CRS calculations based on HI and SMI Boards of T rustees, 2020 Annual Report, at https://www.cms.gov/files/

document/2020-medicare-trustees-report.pdf.

25

U.S. Congress, Senate Committee on Finance, Tax Free Status of Social Security Benefits, report to accompany

S.Res. 87, S.Rept. 97-135, June 15, 1981.

Congressional Research Service

13

Social Security: Taxation of Benefits

Security Income, and benefits under the Black Lung Benefits Act). This was in sharp contrast to

then-current rules for retirement benefits under private pension plans, the federal Civil Service

Retirement System, and other government pension systems.26Retirement System, and other government pension systems.26 Benefits from those pension plans

were fully taxable, except for the portion of total lifetime benefits (using projected life

expectancy) attributable to the employee'’s own contributions to the system (and on which he or

she had already paid income tax).

Currently (and as in 1941), under Social Security, the worker'’s contribution to the system is half

of the payroll tax, officially known as the Federal Insurance Contributions Act (FICA) tax. The

amount the worker pays into the Social Security system in FICA taxes is not subtracted to

determine income subject to the federal income tax, and is therefore taxed. The employer's ’s

contributions to the system are not considered part of the employee'’s gross income, and they are

deductible from the employer'’s business income as a business expense.27 27 Consequently, neither

the employee nor the employer pays taxes on the employer'’s contribution.28

28

The 1979 Advisory Council on Social Security concluded that because Social Security benefits

are based on earnings in covered employment, the 1941 ruling was wrong and the tax treatment

of private pensions was a more appropriate model for treating Social Security benefits.29 29 The

council estimated that the most anyone who entered the workforce in 1979 would pay in payroll

taxes during his or her lifetime would equal 17% of the Social Security benefits he or she would

ultimately receive. (This was the most any individual would pay; in the aggregate, workers would

make payroll tax payments amounting to substantially less than 17% of their ultimate benefits.)

Because of the administrative difficulties involved in determining the taxable amount of each

individual benefit and to avoid "“taxing more of the benefit than most people would consider

appropriate,"” the council recommended instead that half of everyone'’s benefit be taxed. It

justified this ratio as a matter of "“rough justice"” and noted that it coincided with the portion of the

tax (the employer'’s share) on which income taxes had not been paid.30

30

The council'’s position on taxing Social Security benefits contrasted with that of the National

Commission on Social Security, established by Congress in the Social Security Amendments of

1977 (P.L. 95-216). The commission did not, in its 1981 final report, include a recommendation

to tax Social Security benefits. Also in 1981, the Senate passed a resolution by a roll-call vote of

98-0 against enacting legislation to tax Social Security benefits, stating that taxing Social Security

benefits would be tantamount to a benefit cut and noting that the prospect of taxing benefits could

undermine older Americans'’ confidence in the Social Security program:

Resolved, That it is the sense of the Senate that any proposals to make social security benefits subject to taxation would adversely affect social security recipients and undermine their confidence in the social security programs, that social security benefits are and should remain exempt from Federal taxation, and that the Ninety-seventh Congress will not enact

26

Most federal civilian employees hired before 1984 are covered by the Civil Service Retirement System; those hired

later are covered by the Federal Employees’ Retirement System. See CRS Report 98-810, Federal Employees’

Retirement System: Benefits and Financing.

27

Employers can generally deduct the amount they pay their employees for the services they perform, including wages,

salaries, bonuses, commissions, and other noncash employee benefit programs (e. g., accident and health plans,

adoption assistance, cafeteria plans, dependent care assistance, education assistance, life insurance coverage). See IRS

Publication 535, Business Expenses, at https://www.irs.gov/pub/irs-pdf/p535.pdf.

28 Under the Self-Employment Contributions Act, self-employed workers pay the full 12.4% payroll tax, but to ensure

parity with FICA, half of those payments are exempt from income tax.

29

Statement of Henry Aaron, Chairman of the Advisory Council on Social Security, in U.S. Congress, Senate Select

Committee on Aging, Hearings Before the Committee on Retirement Income And Employment, Oversight on

Recommendations of the 1979 Social Security Advisory Council, S.Rept. 96-230, March 11 and 13, 1980, p. 13.

30

Social Security Administration (SSA), Social security financing and benefits, Report of the 1979 Advisory Council,

1981, pp. 64-65.

Congressional Research Service

14

Social Security: Taxation of Benefits

Resolved, That it is the sense of the Senate that any proposals to make social security

benefits subject to taxation would adversely affect social security recipients and undermine

their confidence in the social security programs, that social security benefits are and should

remain exempt from Federal taxation, and that the Ninety-seventh Congress will not enact

legislation to subject social security benefits to taxation.31

legislation to subject social security benefits to taxation.31

The National Commission on Social Security Reform (often referred to as the "Greenspan Commission"“Greenspan

Commission”), appointed by President Reagan in 1981, recommended in its 1983 report that,

beginning in 1984, 50% of Social Security cash benefits and Railroad Retirement Tier I benefits

be taxable for individuals whose adjusted gross income, excluding Social Security benefits,

exceeded $20,000 for a single taxpayer and $25,000 for a married couple, with the proceeds of

such taxation credited to the Social Security trust funds.3232 The commission did not include any

provisions for indexing the thresholds. The commission estimated that 10% of Social Security

beneficiaries would be subject to taxation of benefits. The commission acknowledged that the

proposal had a "notch"“notch” problem, in that people with income at the thresholds would pay

significantly higher taxes than those with only one dollar less, but trusted that it would be

rectified during the legislative process.

In enacting the 1983 Social Security Amendments (P.L. 98-21), Congress adopted the commission'

commission’s recommendation to tax Social Security benefits, but with a formula that gradually

increased the taxable share as a person'’s income rose above the thresholds, up to a maximum of

50% of benefits. The formula calculated taxable benefits as the lesser of 50% of benefits or 50%

of the excess of the taxpayer'’s provisional income over thresholds of $25,000 (for single filers)

and $32,000 (for married filers). Provisional income equaled adjusted gross income plus tax-exempttaxexempt interest plus certain income exclusions plus 50% of Social Security benefits.

The House Ways & Means Committee reported the following:

Your Committee believes that social security benefits are in the nature of benefits received

under other retirement systems, which are subject to taxation to the extent they exceed a worker'

worker’s after-tax contributions and that taxing a portion of social security benefits will

improve tax equity by treating more nearly equally all forms of retirement and other income

that are designed to replace lost wages (for example, unemployment compensation and sick

pay).33,34

pay).33,34

The Senate Finance Committee reported the following:

... by taxing social security benefits and appropriating these revenues to the appropriate

trust funds, the financial solvency of the social security trust funds will be strengthened ....

By taxing only a portion of social security and railroad retirement benefits (that is, up to one-half of benefits in excess of a certain base amount), the Committee's bill assures that lower-income individuals, many of whom rely upon their benefits to afford basic necessities, will not be taxed on their benefits. The maximum proportion of benefits taxed is one-half in recognition of the fact that social security benefits are partially financed by after-tax employee contributions. The bill's method for taxing benefits assures that only those taxpayers who have substantial taxable income from other sources will be taxed on

31

U.S. Congress, Senate, A resolution expressing the sense of the Senate that the Congress not enact legislation to tax

Social Security benefits, and for other purposes, 97 th Cong., 1 st sess., S.Res. 87, S.Rept. 97-135 (Washington, DC:

GPO, 1981), p. 2.

32

SSA, Report of the National Commission on Social Security Reform , January 1983, pp. 2-10 through 2-11, available

at http://www.ssa.gov/history/reports/gspan.html.

33

U.S. Congress, House Committee on Ways and Means, Social Security Act Amendments of 1983, report to

accompany H.R. 1900, 98 th Cong., 1 st sess., H.Rept. 98-25 Part 1 (Washington, DC: GPO, 1983), p. 24, at

https://www.ssa.gov/history/pdf/Downey%20PDFs/

Social%20Security%20Amendments%20of%201983%20Vol%201.pdf .

34

Unemployment compensation including benefits paid by the Federal Unemployment T rust Fund and by states or the

District of Columbia is reported on IRS Form 1099-G and is taxable as other income on IRS Form 1040. For additional

information on the tax treatment of unemployment compensation and sickness and injury benefits, see the sections on

“Unemployment Benefits” and “Sickness and Injury Benefits” in IRS Publication 525, Taxable and Nontaxable

Income, at https://www.irs.gov/pub/irs-pdf/p525.pdf.

Congressional Research Service

15

Social Security: Taxation of Benefits

one-half of benefits in excess of a certain base amount), the Committee’s bill assures that

lower-income individuals, many of whom rely upon their benefits to afford basic

necessities, will not be taxed on their benefits. The maximum proportion of benefits taxed

is one-half in recognition of the fact that social security benefits are partially financed by

after-tax employee contributions. The bill’s method for taxing benefits assures that only

those taxpayers who have substantial taxable income from other sources will be taxed on

a portion of the benefits they receive.35

a portion of the benefits they receive.35

In 1993, the SSA'’s Office of the Actuary estimated that, if pension tax rules were applied to

Social Security, the ratio of total employee Social Security payroll taxes to expected benefits for

current recipients (in 1993) would be approximately 4% or 5%. For workers just entering the

workforce, the actuaries estimated that the ratio would be, on average, about 7%.36 36 Because

Social Security benefits replaced a higher proportion of earnings for workers who were lower

paid and had dependents, and because women had longer life expectancies, the workers with the

highest ratio of taxes to benefits would be single, highly paid males. The estimated ratio for these

workers (highly paid males) entering the workforce in 1993 was 15%.37

37

Applying the tax rules for private and public pensions presents practical administrative problems.

Determining the proper exclusion would be complex for several reasons, including the difficulty

of calculating the ratio of contributions to benefits for each individual when several people may

receive benefits on the basis of the same worker'’s account.38

38

President William Clinton proposed (as part of his FY1994 budget proposal) that the portion of

Social Security benefits subject to taxation be increased from 50% to 85%, effective in tax year

1994. As under then-current law, only Social Security recipients whose provisional income

exceeded the thresholds of $25,000 (for single filers) and $32,000 (for married filers) were to pay

taxes on their benefits. In addition, the first step was to add 50%, not 85%, of benefits to adjusted

gross income. Because the thresholds and definition of provisional income did not change, the

measure would only affect recipients already paying taxes on benefits. However, the ratio used to

compute the amount of taxable benefits was increased from 50% to 85%. Taxing no more than

85% of Social Security benefits (the estimated portion not based on contributions by a recipient,

including highly paid males) would ensure that no one would have a higher percentage of Social

Security benefits subject to tax than if the tax treatment of private and civil service pensions were

actually applied.

The proceeds from the increase (from 50% to 85%) were slated to be credited to the Medicare HI Medic are HI

program, which had a less favorable financial outlook than Social Security. Doing so also avoided

possible procedural obstacles (budget points of order that can be raised regarding changes to the

Social Security program in the budget reconciliation process). This measure was included in the

OBRA 1993, which passed the House on May 27, 1993.

The Senate version of the bill included a provision to tax Social Security benefits up to 85% but

imposed it only after provisional income exceeded new thresholds of $32,000 (for single filers)

and $40,000 (for married filers). The conference agreement adopted the Senate version of the

35

U.S. Congress, Senate Committee on Finance, Social Security Act Amendments of 1983, report to accompany S. 1,

98 th Cong., 1 st sess., S.Rept. 98-23 (Washington, DC: GPO, 1983), pp. 25-26, at https://www.ssa.gov/history/pdf/

Downey%20PDFs/Social%20Security%20Amendments%20of%201983%20Vol%202.pdf.

36

Unpublished memo from Stephen C. Goss, Social Security Office of the Actuary, April 7, 1993. T he ratios were

computed using nominal dollar values for both taxes and benefits.

37

38

Ibid.

See section on “Benefits for the Worker’s Family Members” in CRS Report R42035, Social Security Primer.

Congressional Research Service

16

Social Security: Taxation of Benefits

taxation of Social Security benefits provision and raised the thresholds to $34,000 (for single

filers) and $44,000 (for married filers).

President Clinton signed the measure into law (as part of P.L. 103-66) on August 10, 1993.

Although other changes in tax law have since affected the amount of taxes paid on Social

Security benefits, there have been no direct legislative changes regarding taxation of Social

Security benefits since 1993.

Current Proposals Addressing the Taxation of Social

Security Benefits

In the 116th116th Congress, four bills that would alter the taxation of Social Security benefits have been

introduced. Each is described briefly below.

H.R. 567, the Save Social Security Act of 2019,, was introduced in the House on January 15,

2019, by Representative Crist. In addition to applying the Social Security payroll tax to annual

earnings above $300,000 and providing benefit credits for annual earnings above the current-law

taxable maximum amount, H.R. 567 would replace the current-law provisional income thresholds

for federal income taxation of Social Security benefits with a higher threshold and tax up to 85%

of Social Security benefits for individuals and couples with provisional income above that

threshold. The separate provisional income thresholds under current law for single individuals

and married couples filing jointly would be replaced with one provisional income threshold. The

separate thresholds under current law for taxation of up to 50% of Social Security benefits and up

to 85% of Social Security benefits also would be replaced with a single threshold. H.R. 567

would tax up to 85% of Social Security benefits for tax filers with provisional income greater

than $100,000. The new provisional income threshold would not be indexed to changes in prices

or average wages. If enacted, H.R. 567 would result in less income tax revenue to the Social

Security trust funds, the Medicare HI trust fund, and the Railroad Retirement system. General

revenues would be appropriated in amounts required to make up the lost revenue to each fund.

H.R. 860, the Social Security 2100 Act, was introduced in the House on January 30, 2019, by

Representative Larson. An identicalA companion bill, S. 269, was introduced in the Senate on the same date

by Senator Blumenthal. The bills would increase the Social Security payroll tax rate, expand the

share of aggregate covered earnings subject to the Social Security payroll tax, increase benefits

for all beneficiaries, change the index used to calculate annual cost-of-living adjustments, and

change the federal income taxation of Social Security benefits. Specifically, the bills would

replace the separate provisional income thresholds under current law for taxation of up to 50% of

Social Security benefits and up to 85% of Social Security benefits with new, higher thresholds for

taxation of up to 85% of Social Security benefits, set at $50,000 for single filers and $100,000 for

married couples filing jointly. As a result, the bills would reduce the number of beneficiaries who

pay federal income taxes on their Social Security benefits. They would require that the Medicare

HI trust fund be held harmless in light of the lost income tax revenue.39

H.R. 3971, the Senior Citizens Tax Elimination Act, was introduced in the House on July 25, 2019, by Representative Massie. It would eliminate the federal income taxation of Social Security 39

T he SSA’s Office of the Chief Actuary and the CBO produced estimates that assume that a proportion of the revenue

attributable to the federal income taxation of Social Security benefits would be directed to the HI trust fund to replicate

the approximate total revenue that would have been designated as HI trust fund revenue under current law. T he

remaining portion of revenue from the federal income taxation of Social Security benefits would be directed to the

Social Security trust funds. Letter from Stephen C. Goss, chief actuary, Social Security Administration, to Chairman

Larson, Senator Blumenthal, and Senator Van Hollen, September 18, 2019, at https://www.ssa.gov/oact/solvency/

LarsonBlumenthalVanHollen_20190918.pdf. Letter from Phillip L. Swagel, director, CBO, to Chairman Larson,

October 10, 2019, at https://www.cbo.gov/system/files/2019-10/hr860ltr_1.pdf.

39

Congressional Research Service

17

Social Security: Taxation of Benefits

H.R. 3971, the Senior Citizens Tax Elimination Act, was introduced in the House on July 25,

2019, by Representative Massie. It would eliminate the federal income taxation of Social Security

benefits and Railroad Retirement Tier I benefits. Under H.R. 3971, Section 86 of the Internal

Revenue Code of 1986, which provides for the federal income taxation of Social Security benefits

and Railroad Retirement Tier I benefits, would not apply to any taxable year beginning after the

date of enactment of H.R. 3971. General funds would be appropriated in amounts needed to hold

the Social Security trust funds and the Medicare HI trust fund harmless from the loss of income

tax revenues. General funds also would be appropriated to the Railroad Retirement system in

amounts needed to compensate for the lost income tax revenues.

Congressional Research Service

18

Social Security: Taxation of Benefits

Appendix. Taxation of Benefits Under Special Situations

Special Situations Lump-Sum Distributions

A Social Security beneficiary may receive a lump-sum distribution of benefits owed for one or

more prior years.40 40 In this situation, a beneficiary may choose between two methods for

calculating the taxable portion of the lump-sum distribution: (1) include all of the benefits for

prior years in calculating the taxable benefits for the current year or (2) recalculate the prior-year

taxable benefits using prior-year income and take the difference between the recalculated taxable

benefits and the taxable benefits reported in each prior year. In either case, the additional taxable

benefits are included in taxable income for the current year. In computing the taxable portion of

benefits in prior years, some income sources generally excluded from the provisional income

calculation are included.41

Repayments

41

Repayments

Sometimes a Social Security beneficiary must repay a prior overpayment of benefits. In this case,

the calculation of taxable Social Security benefits is based on the net benefits—gross benefits less

the repayment—even if the repayment is for a benefit received in a previous year. For married

taxpayers filing a joint return, net benefits equal the sum of the couple'’s Social Security gross

benefits less the repayment.

If, however, the repayment results in negative net Social Security benefits, two consequences

exist: (1) there are no taxable benefits and (2) the taxpayer may be able to deduct part of the

negative net Social Security benefit if it was included in gross income in an earlier year.42

42

Coordination of Workers'’ Compensation

For individuals under the full retirement age who receive Social Security disabled worker

benefits, Social Security benefits are reduced by a portion of any workers'’ compensation

payments (or payments from some other public disability programs) received by the individual.43 Workers' 43

Workers’ compensation is generally not taxable. Any reduction in Social Security benefits due to

the receipt of workers'’ compensation is still considered to be a Social Security benefit, however,

so income taxes are computed based on the full (unreduced) benefit amount.44

44

40

An individual originally denied benefits, but approved on appeal, may receive a lump -sum amount for the period

when benefits were denied (which may be prior years). See Internal Revenue Service, Publication 915, “Lump-Sum

Election.” T his is not the lump-sum death benefit, which is not subject to federal income tax.

41

See “Lump-Sum Election” in Internal Revenue Service, Publication 915.

For details on the repayment computations, see Internal Revenue Service, Publication 915, “ Repayments More T han

Gross Benefits.”

43 See section on “Workers’ Compensation and Public Disability Benefit Offset” in CRS Report R44948, Social

Security Disability Insurance (SSDI) and Supplemental Security Income (SSI): Eligibility, Benefits, and Financing .

42

44

Section 86(d)(3) of the Internal Revenue Code; see also United States T ax Court, T .C. Memo. 2012-249, August 28,

2012, at http://www.ustaxcourt.gov/InOpHistoric/moorermemo.TCM.WPD.pdf, and United States T ax Court, T .C.

Summary Opinion 2014-66, July 10, 2014, at https://www.ustaxcourt.gov/InOpHistoric/

EnglishSummary.Gerber.SUM.WPD.pdf.

Congressional Research Service

19

Social Security: Taxation of Benefits

Treatment of Nonresident Aliens

Treatment of Nonresident Aliens

Citizenship is not required to receive Social Security benefits. Nonresident aliens, under IRS

definitions, may receive benefits provided they have engaged in covered employment and

otherwise meet eligibility requirements. The IRS defines a nonresident alien as a noncitizen who

(1) is not a lawful permanent resident (this is known as the Green Card Test) and (2) has been

physically present in the United States for fewer than 31 days in the previous calendar year and

183 days in the previous three-year period, counting all the days in the calendar year and a

portion of the days in the two previous calendar years (this is known as the Substantial Presence Test).45

Test). 45 In general, 85% of the Social Security benefits for nonresident aliens are taxable (i.e.,

none of the thresholds apply) at a 30% rate. However, there are a number of exceptions to this

general rule on the basis of tax treaties such that nonresident aliens or U.S. citizens living abroad

may not have U.S. Social Security benefits subject to U.S. income taxes.46

Withholding

46

Withholding

In general, withholding for a wage earner is based on the estimated income taxes for a full year of

earnings at the periodic (weekly, biweekly, monthly, etc.) rate. Taxable Social Security benefits,

and the associated taxes, are based on the amount of non-Social Security income earned by a

recipient during the tax year. The Social Security Administration, without knowledge about the

amount of other income received by a beneficiary, is unable to properly determine the amount of

taxes that should be withheld from Social Security benefits. Like other taxpayers, Social Security

recipients can make quarterly estimated income tax payments. In addition, effective for payments

issued in February 1999, individuals may request voluntary tax withholding from Social Security

benefits.47

47

Nonresident aliens residing outside the United States are subject to different tax withholding

rules. Section 871 of the Internal Revenue Code imposes a 30% tax withholding rate on almost all

of the U.S. income of nonresident aliens, unless a lower rate is fixed by treaty. Thus, 30% of 85%

(or 25.5%) of a nonresident alien'’s Social Security benefits may be withheld for federal income

taxes.

See Internal Revenue Service, Publication 519, “U.S. T ax Guide for Aliens,” at https://www.irs.gov/pub/irs-pdf/

p519.pdf.

46

See Internal Revenue Service, Publication 519, and Internal Revenue Service, “T ax T reaty T ables,” at

https://www.irs.gov/individuals/international-taxpayers/tax-treaty-tables.

45

47

T he Uruguay Round Agreements Act (P.L. 103-465) amended the Internal Revenue Code to allow individuals to

request voluntary tax withholding from certain federal payments to satisfy their income tax liability. An amendment to

Section 207 of the Social Security Acct allowed voluntary tax withholding from Social Security benefits, effective with

payments issued in February 1999. T he Economic Growth and T ax Relief Reconciliation Act of 2001 (EGT RRA; P.L.

107-16) permitted voluntary withholding from Social Security benefits at rates of 7%, and equal to the bottom three tax

bracket tax rates (currently 10%, 15%, and 25%). T he T ax Relief, Unemployment Insurance Reauthorization, and Job

Creation Act of 2010 (P.L. 111-312) extended the EGT RRA provisions to tax year 2012. T h e American T axpayer

Relief Act of 2012 (AT RA; P.L. 112-240) made the EGT RRA provisions permanent. Because they are not subject to

the federal income tax, Supplemental Security Income payments, Black Lung payments, Medicare premium refunds,

Lump Sum Death Payments, returned check reissuances, and benefits due before January 1984 are not subject to

voluntary tax withholding.

Congressional Research Service

20

Social Security: Taxation of Benefits

Author Information

Paul S. Davies

Specialist in Income Security

Acknowledgments

Previous versions of this report were written by CRS Analyst Julie M. Whittaker and former CRS Analyst

Noah Meyerson.

Disclaimer

This document was prepared by the Congressional Research Service (CRS). CRS serves as nonpartisan

shared staff to congressional committees and Members of Congress. It operates solely at the behest of and

under the direction of Congress. Information in a CRS Report should not be relied upon for purposes other

than public understanding of information that has been provided by CRS to Members of Congress in

connection with CRS’s institutional role. CRS Reports, as a work of the United States Government, are not

subject to copyright protection in the United States. Any CRS Report may be reproduced and distributed in

its entirety without permission from CRS. However, as a CRS Report may include copyrighted images or

material from a third party, you may need to obtain the permission of the copyright holder if you wish to

copy or otherwise use copyrighted material.

Congressional Research Service

RL32552 · VERSION 44 · UPDATED

21

taxes.

Author Contact Information

Acknowledgments

Previous versions of this report were written by CRS Analyst Julie M. Whittaker and former CRS Analyst Noah Meyerson.

Footnotes

| 1. |

Railroad Retirement Tier I benefits are paid to a qualified railroad retiree who has met the quarterly work requirements for Social Security benefit eligibility. The retiree receives Social Security benefits based on the work history that qualified the retiree for Social Security benefits, and the retiree receives Tier I benefits based on both the Social Security and railroad work histories. The actual Social Security benefits received are subtracted from this calculation of Tier I benefits to get actual Tier I benefits. See CRS Report RS22350, Railroad Retirement Board: Retirement, Survivor, Disability, Unemployment, and Sickness Benefits. In this report, references to Social Security benefits generally also apply to Tier I benefits. |

| 2. |

Larry DeWitt, "Research Note #12: Taxation of Social Security Benefits," Social Security Administration Historian's Office, February 2001, at https://www.ssa.gov/history/taxationofbenefits.html. |

| 3. |

The Railroad Retirement Board, an independent federal agency, administers retirement, survivor, disability, unemployment, and sickness insurance for railroad workers and their families. The Railroad Retirement Act authorizes retirement, disability, and survivor benefits for railroad workers and their families, financed primarily by payroll taxes, financial interchanges from Social Security, and transfers from the National Railroad Retirement Investment Trust. See CRS Report RS22350, Railroad Retirement Board: Retirement, Survivor, Disability, Unemployment, and Sickness Benefits. |

| 4. |

For additional information on calculating taxable Social Security benefits, see U.S. Department of the Treasury, Internal Revenue Service, "Social Security and Equivalent Railroad Retirement Benefits," Publication 915, at http://www.irs.gov/pub/irs-pdf/p915.pdf. The term provisional income is not defined in the Internal Revenue Code but was referred to in the conference report accompanying the Omnibus Budget Reconciliation Act of 1993 (P.L. 103-66), which established the second-tier threshold. See U.S. Congress, Committee on the Budget, Omnibus Budget Reconciliation Act of 1993, conference report to accompany H.R. 2264, 103th Cong., 1st sess., August 4, 1993, H.Rept. 103-213, (Washington: GPO, 1993), p. 594, at https:// www.finance.senate.gov/imo/media/doc/confrpt103-213.pdf. |

| 5. |

Adjusted gross income (AGI) is the main measure of income used when computing income taxes. The Internal Revenue Service refers to provisional income as modified adjusted gross income. See IRS Publication 915 for details on the sources of income included in computing provisional income. |

| 6. |

Interest on qualified U.S. savings bonds used to pay certain educational expenses is exempt from federal income taxation. |

| 7. |