Salaries of Members of Congress: Recent Actions and Historical Tables

Changes from May 17, 2019 to January 13, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Salaries of Members of Congress: Recent Actions and Historical Tables

Contents

- Member Pay: Constitutional Background, Source of Appropriations, and Current Rates

- Selected CRS Products

- Methods for Member Pay Adjustment

- January 2020

PotentialMember Pay Adjustment Denied

- January 2019 Member Pay Adjustment Denied

- January 2018 Member Pay Adjustment Denied

- January 2017 Member Pay Adjustment Denied

- January 2016 Member Pay Adjustment Denied

- January 2015 Member Pay Adjustment Denied

- January 2014 Member Pay Adjustment Denied

- January 2013 Member Pay Adjustment Delayed and Then Denied

- Partial Year Pay Freeze Enacted

- Executive Order Issued and Subsequent Pay Freeze Enacted

- January 2011 and January 2012 Member Pay Adjustments Denied

- January 2010 Member Pay Adjustment Denied

- Member Pay: Other Proposals and Actions by Congress

- 116th Congress

- 115th Congress

- 114th Congress

- Linking Salaries to Passage of a Concurrent Resolution on the Budget

- 113th Congress

- Linking Salaries to Passage of a Concurrent Resolution on the Budget

- Linking Salaries to the Debt Limit

- 112th Congress

- Actions Related to Member Pay During a Lapse in Appropriations

- Additional Legislation Receiving Floor Action but Not Enacted

- Reference and Historical Information and Explanation of Tables

Summary

Congress is required by Article I, Section 6, of the Constitution to determine its own pay. In the past, Congress periodically enacted specific legislation to alter its pay; the last time this occurred affected pay in 1991. More recently, pay has been determined pursuant to laws establishing formulas for automatic adjustments.

The Ethics Reform Act of 1989 established the current automatic annual adjustment formula, which is based on changes in private sector wages as measured by the Employment Cost Index (ECI). The adjustment is automatic unless denied statutorily, although the percentage may not exceed the percentage base pay increase for General Schedule (GS) employees. Member pay has since been frozen in two ways: (1) directly, through legislation that freezes salaries for Members but not for other federal employees, and (2) indirectly, through broader pay freeze legislation that covers Members and other specified categories of federal employees.

Members of Congress last received a pay adjustment in January 2009. At that time, their salary was increased 2.8%, to $174,000. A provision in P.L. 111-8 prohibited any pay adjustment for 2010. Under the pay adjustment formula, Members were originally scheduled to receive an adjustment in January 2010 of 2.1%, although this would have been revised downward automatically to 1.5% to match the GS base pay adjustment. Members next were scheduled to receive a 0.9% pay adjustment in 2011. The pay adjustment was prohibited by P.L. 111-165. Additionally, P.L. 111-322 prevented any adjustment in GS base pay before December 31, 2012. Since the percentage adjustment in Member pay may not exceed the percentage adjustment in the base pay of GS employees, Member pay was also frozen during this period. If not limited by GS pay, Member pay could have been adjusted by 1.3% in 2012. The ECI formula established a maximum potential pay adjustment in January 2013 of 1.1%. P.L. 112-175 extended the freeze on GS pay rates for the duration of this continuing resolution, which also extended the Member freeze since the percentage adjustment in Member pay may not exceed the percentage adjustment in GS base pay. Subsequently, Member pay for 2013 was further frozen in P.L. 112-240. The maximum potential 2014 pay adjustment of 1.2%, or $2,100, was denied by P.L. 113-46. The maximum potential January 2015 Member pay adjustment was 1.6%, or $2,800. President Obama proposed a 1.0% increase in the base pay of GS employees, which would automatically have limited any Member pay adjustment to 1.0%. P.L. 113-235 contained a provision prohibiting any Member pay adjustment. The maximum potential January 2016 pay adjustment of 1.7%, or $3,000, would have been limited to 1.0%, or $1,700, due to the GS base pay increase. Member pay for 2016 was frozen by P.L. 114-113. The maximum potential January 2017 pay adjustment of 1.6%, or $2,800, would have been limited to 1.0%, or $1,700, due to the GS base pay increase. Member pay for 2017 was frozen by P.L. 114-254. The maximum potential January 2018 pay adjustment of 1.8%, or $3,100, was automatically limited to 1.4%, or $2,400, before being frozen by P.L. 115-141. The maximum potential January 2019 pay adjustment of 2.3%, or $4,000, was automatically limited to 1.4%, or $2,400, before being frozen at the 2009 level by P.L. 115-244. The maximum potential January 2020 pay adjustment isof 2.6%, or $4,500, was prohibited by P.L. 116-94.

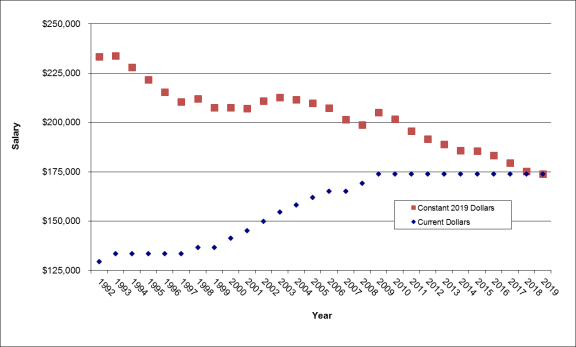

If Members of Congress had received every adjustment prescribed by the ECI formula since 1992, and the 2 U.S.C. §4501 limitation regarding the percentage base pay increase for GS employees remained unchanged, the 20192020 salary would be $210,900216,400. When adjusted for inflation, Member salaries have decreased 1516% since the last pay adjustment in 2009.

Both the automatic annual adjustments and funding for Members' salaries are provided pursuant to other laws (2 U.S.C. §4501)—not the annual appropriations bills—and a provision prohibiting a scheduled adjustment could be included in any bill, or introduced as a separate bill.

Member Pay: Constitutional Background, Source of Appropriations, and Current Rates

Article I, Section 6, of the U.S. Constitution, states that the compensation of Members of Congress shall be "ascertained by law, and paid out of the Treasury of the United States." Additionally, the Twenty-Seventh Amendment to the Constitution states, "No law, varying the compensation for the services of the Senators and Representatives, shall take effect, until an election of Representatives shall have intervened." This amendment was submitted to the states on September 25, 1789, along with 11 other proposed amendments, 10 of which were ratified and became the Bill of Rights. It was not ratified until May 7, 1992.

Since FY1983, Member salaries have been funded in a permanent appropriations account.1

The most recent pay adjustment for Members of Congress was in January 2009. Since then, the compensation for most Senators, Representatives, Delegates, and the Resident Commissioner from Puerto Rico has been $174,000. The only exceptions include the Speaker of the House ($223,500) and the President pro tempore of the Senate and the majority and minority leaders in the House and Senate ($193,400).

Selected CRS Products

This report provides historical tables on the rate of pay for Members of Congress since 1789; details on enacted legislation with language prohibiting the automatic annual pay adjustment since the most recent adjustment; the adjustments projected by the Ethics Reform Act as compared with actual adjustments in Member pay; and Member pay in constant and current dollars since 1992.

Additional CRS products also address pay and benefits for Members of Congress:

- For information on actions taken each year since the establishment of the Ethics Reform Act adjustment procedure, see CRS Report 97-615, Salaries of Members of Congress: Congressional Votes, 1990-

2018, by Ida A. Brudnick2019. - Members of Congress only receive salaries during the terms for which they are elected. Following their service, former Members of Congress may be eligible for retirement benefits, which are discussed in CRS Report RL30631, Retirement Benefits for Members of Congress

, by Katelin P. Isaacs..

- For information on health insurance options available to Members, see CRS Report R43194, Health Benefits for Members of Congress and Designated Congressional Staff: In Brief

, by Ada S. Cornell..

- For an overview of compensation, benefits, allowances, and selected limitations, see CRS Report RL30064, Congressional Salaries and Allowances: In Brief

, by Ida A. Brudnick.

. Methods for Member Pay Adjustment

There are three basic ways to adjust Member pay.

Specific legislation was enacted to adjust Member pay prior to 1968. It has been used periodically since, most recently affecting pay for 1991.

The second method by which Member pay can be increased is pursuant to recommendations from the President, based on those made by a quadrennial salary commission. In 1967, Congress established the Commission on Executive, Legislative, and Judicial Salaries to recommend salary increases for top-level federal officials (P.L. 90-206). Three times (in 1969, 1977, and 1987) Congress received pay increases made under this procedure; on three occasions it did not. Effective with passage of the Ethics Reform Act of 1989 (P.L. 101-194), the commission ceased to exist. Its authority was assumed by the Citizens' Commission on Public Service and Compensation. Although the first commission under the 1989 act was to have convened in 1993, it did not meet.

The third method by which the salary of Members can be changed is by annual adjustments. Prior to 1990, the pay of Members, and other top-level federal officials, was tied to the annual comparability increases provided to General Schedule (GS) federal employees. This procedure was established in 1975 (P.L. 94-82). Such increases were recommended by the President, subject to congressional acceptance, disapproval, or modification. Congress accepted 5 such increases for itself—in 1975, 1979 (partial), 1984, 1985, and 1987—and declined 10 (1976, 1977, 1978, 1980, 1981, 1982, 1983, 1986, 1988, and 1989).

The Ethics Reform Act of 1989 changed the method by which the annual adjustment is determined for Members and other senior officials. This procedure employs a formula based on changes in private sector wages and salaries as measured by the Employment Cost Index (ECI). The annual adjustment automatically goes into effect unless

- 1. Congress statutorily prohibits the adjustment;

- 2. Congress statutorily revises the adjustment; or

- 3. The annual base pay adjustment of GS employees is established at a rate less than the scheduled adjustment for Members, in which case Members would be paid the lower rate.2

Under this revised method, annual adjustments were

- accepted 13 times (adjustments scheduled for January 1991, 1992, 1993, 1998, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2008, and 2009) and

- denied

1617 times (adjustments scheduled for January 1994, 1995, 1996, 1997, 1999, 2007, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, and 2020and 2019).3

Although discussion of the Member pay adjustment sometimes occurs during consideration of annual appropriations bills, these bills do not contain funds for the annual salaries or pay adjustment for Members. Nor do they contain language authorizing an increase. The use of appropriations bills as vehicles for provisions prohibiting the automatic annual pay adjustments for Members developed by custom. A provision prohibiting an adjustment to Member pay could be offered to any bill, or be introduced as a separate bill.4

January 2020 PotentialMember Pay Adjustment

Denied

The maximum potential January 2020 Member pay adjustment of 2.6%, or $4,500, was known when the Bureau of Labor Statistics (BLS) released data for the change in the Employment Cost Index (ECI) during the 12-month period from December 2017 to December 2018 on January 31, 2019.5

Each year, the adjustment takes effect automatically unless it is either denied or modified statutorily by Congress, or limited by the General Schedule (GS)GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase.

This adjustment was prohibited by Section 7 of P.L. 116-94, the Further Consolidated Appropriations Act, 2020, which was enacted December 20, 2019. No separate votes were held on this provision.6

January 2019 Member Pay Adjustment Denied

The maximum potential January 2019 Member pay adjustment of 2.3%, or $4,000, was known when the BLS released data for the change in the ECI during the 12-month period from December 2016 to December 2017 on January 31, 2018.6

Each year, the adjustment takes effect automatically unless it is either denied or modified statutorily by Congress, or limited by the GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase. The 2019 GS base pay adjustment was 1.4%, automatically limiting any Member pay adjustment to $2,400.

The House-passed (H.R. 5894) and Senate-reported versions (S. 3071) of the FY2019 legislative branch appropriations bill both contained provisions to prevent this adjustment. The Member pay provision was included in the bills as introduced and no separate votes were held on this provision. Division B of P.L. 115-244, enacted September 21, 2018, included the pay freeze provision.

January 2018 Member Pay Adjustment Denied

The maximum potential January 2018 member pay adjustment of 1.8%, or $3,100, was known when the BLS released data for the change in the ECI during the 12-month period from December 2015 to December 2016 on January 31, 2017.78

Each year, the adjustment takes effect automatically unless it is either denied or modified statutorily by Congress, or limited by the GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase. The 2018 GS base pay adjustment was 1.4%, automatically limiting any Member pay adjustment to $2,400.

The House-passed (H.R. 3162) and Senate-reported versions (S. 1648) of the FY2018 legislative branch appropriations bill both contained provisions to prevent this adjustment. The Member pay provision was included in the bills as introduced and no separate votes were held on this provision.

Neither bill was enacted prior to the start of FY2018, and legislative branch activities were initially funded through a series of continuing appropriations resolutions (CRs) (P.L. 115-56, through December 8, 2017; P.L. 115-90, through December 22, 2017; P.L. 115-96, through January 19, 2018; P.L. 115-120, through February 8, 2018; P.L. 115-123, through March 23, 2018). P.L. 115-56 contained a provision, extended in the subsequent CRs, continuing "section 175 of P.L. 114-223, as amended by division A of P.L. 114-254." This provision prohibited a Member pay adjustment in FY2017. Section 7 of the FY2018 Consolidated Appropriations Act (P.L. 115-141) prohibited the adjustment for the remainder of the year.8

January 2017 Member Pay Adjustment Denied

The maximum potential January 2017 Member pay adjustment of 1.6%, or $2,800, was known when the BLS released data for the change in the ECI during the 12-month period from December 2014 to December 2015 on January 30, 2016.910

Both the House-passed (H.R. 5325) and Senate-reported (S. 2955) versions of the FY2017 legislative branch appropriations bill—which would provide approximately $4.4 billion in funding for the activities of the House of Representatives, Senate, and legislative branch support agencies1011—contained a provision that would prohibit this adjustment. The Member pay provision was included in the bills as introduced and no separate votes were held on this provision. No further action was taken on H.R. 5325 or S. 2955, but the pay prohibition language was included in the Further Continuing and Security Assistance Appropriations Act, 2017 (P.L. 114-254).

Absent the statutory prohibition on a Member pay adjustment, Members of Congress would have automatically been limited to a 1.0% ($1,700) salary increase to match the increase in base salaries for GS employees.11

January 2016 Member Pay Adjustment Denied

The maximum potential January 2016 Member pay adjustment of 1.7%, or $3,000, was known when the BLS released data for the change in the ECI during the 12-month period from December 2013 to December 2014 on January 30, 2015.1213

The House-passed and Senate-reported versions of the FY2016 legislative branch appropriations bill (H.R. 2250) both contained a provision prohibiting this adjustment.

The pay adjustment prohibition was subsequently included in the Consolidated Appropriations Act, 2016 (P.L. 114-113).

Absent the statutory prohibition on a Member pay adjustment, Members of Congress would have automatically been limited to a 1.0% ($1,700) salary increase to match the increase in base salaries for GS employees.13

January 2015 Member Pay Adjustment Denied

The maximum potential January 2015 pay adjustment of 1.6%, or $2,800, was known when the BLS released data for the change in the ECI during the 12-month period from December 2012 to December 2013 on January 31, 2014.1415

Each year, the adjustment takes effect automatically unless it is either denied statutorily by Congress, or limited by the GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase.

The FY2015 legislative branch appropriations bill (H.R. 4487), as reported by the Committee on Appropriations and passed by the House on May 1, 2014, contained a provision prohibiting this adjustment.1516 This provision was continued in the House-passed and Senate-reported versions of this bill, with no separate vote on the Member pay provision. No further action on this bill was taken, but the provision was subsequently included in Section 8 of Division Q of the FY2015 Consolidated and Further Continuing Appropriations Act, which was enacted on December 16, 2014.

On August 29, 2014, President Obama issued an "alternative pay plan for federal civilian employees," which called for a 1.0% increase in base salaries for General Schedule employees.1617 Absent the statutory prohibition on a Member pay adjustment, Members of Congress would have automatically been limited to a 1.0% ($1,700) salary increase.

January 2014 Member Pay Adjustment Denied

The maximum potential 2014 pay adjustment of 1.2%, or $2,100, was known when the BLS released data for the change in the ECI during the 12-month period from December 2011 to December 2012 on January 31, 2013.1718 The Continuing Appropriations Act, 2014 (P.L. 113-46, enacted October 17, 2013), however, prohibited the scheduled 2014 pay adjustment for Members of Congress.

Each year, the adjustment takes effect automatically unless it is either

- denied statutorily by Congress, or

- limited by the GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase. The scheduled January 2014 across-the-board increase in the base pay of GS employees under the annual adjustment formula was 1.3%. A scheduled GS annual pay increase may be altered only if the President issues an alternative plan or if a different increase, or freeze, is enacted. The President issued an alternate pay plan for civilian federal employees on August 30, 2013.

1819 This plan called for a January 2014 across-the-board pay increase of 1.0% for federal civilian employees, the same percentage as proposed in the President's FY2014 budget. Legislation was not enacted to prohibit or alter the GS adjustment,1920 and Executive Order 13655, issued on December 23, 2013, implemented a 1.0% increase for GS employees.2021 Had the Member pay adjustment not been prohibited by law, the GS base pay adjustment would have automatically limited a salary adjustment for Members of Congress to 1.0% ($1,700).

January 2013 Member Pay Adjustment Delayed and Then Denied

The maximum potential 2013 pay adjustment of 1.1%, or $1,900, was known when the BLS released data for the change in the ECI during the 12-month period from December 2010 to December 2011 on January 31, 2012.2122 The adjustment takes effect automatically unless (1) denied statutorily by Congress or (2) limited by the GS base pay adjustment, since the percentage increase in Member pay is limited by law to the GS base pay percentage increase.

The President's budget, submitted on February 13, 2012, proposed an average (i.e., base and locality) 0.5% adjustment for GS employees.2223

Partial Year Pay Freeze Enacted

President Obama later stated in a letter to congressional leadership on August 21, 2012, that the current federal pay freeze should extend until FY2013 budget negotiations are finalized.2324 Section 114 of H.J.Res. 117, the Continuing Appropriations Resolution, 2013, which was introduced on September 10, 2012, extended the freeze enacted by P.L. 111-322 through the duration of this continuing resolution. H.J.Res. 117 was passed by the House on September 13 and the Senate on September 22. It was signed by the President on September 28, 2012 (P.L. 112-175). A delay in the implementation of pay adjustments for GS employees automatically delays any scheduled Member pay adjustment.

Executive Order Issued and Subsequent Pay Freeze Enacted

On December 27, 2012, President Obama issued Executive Order 13635, which listed the rates of pay for various categories of officers and employees that would be effective after the expiration of the freeze extended by P.L. 112-175. The executive order included a 0.5% increase for GS base pay, which automatically lowered the maximum potential Member pay adjustment from 1.1% to 0.5%.

As in prior years, schedule 6 of the 2012 executive order listed the pay rate for Members of Congress for the upcoming year.2425 This executive order indicated that an annual adjustment would take effect after the expiration of the freeze included in P.L. 112-175. As stated above, the annual adjustments take effect automatically if legislation is not enacted preventing them. The executive order, however, by establishing the GS pay adjustment at a lower rate than the scheduled Member pay adjustment, automatically lowered the Member pay adjustment rate since by law Member pay adjustments cannot be higher than GS pay adjustments.

Subsequently, a provision in H.R. 8, the American Taxpayer Relief Act of 2012, which was enacted on January 2, 2013 (P.L. 112-240), froze Member pay at the 2009 level for 2013. The language was included in S.Amdt. 3448, a substitute amendment agreed to by unanimous consent. The bill, as amended, passed the Senate (89-8, vote #251) and the House (257-167, roll call #659) on January 1, 2013. This freeze was subsequently reflected in Executive Order 13641, which was signed April 5, 2013.

This represented the second time, the first being in 2006, that Member pay was statutorily frozen for only a portion of the following year at the time of the issuance of the executive order. In both instances, the executive order listed new pay rates and indicated an effective date following the expiration of the statutory freeze. Pay adjustments in both years were further frozen pursuant to subsequent laws.25

January 2011 and January 2012 Member Pay Adjustments Denied

As stated above, projected Member pay adjustments are calculated based on changes in the ECI. The projected 2011 adjustment of 0.9% was known when the BLS released data for the ECI change during the 12-month period from December 2008 to December 2009 on January 29, 2010.2627 This adjustment would have equaled a $1,600 increase, resulting in a salary of $175,600.

The 2011 pay adjustment was prohibited by the enactment of H.R. 5146 (P.L. 111-165) on May 14, 2010. H.R. 5146 was introduced in the House on April 27 and was agreed to the same day (Roll no. 226). It was agreed to in the Senate the following day by unanimous consent. Other legislation was also introduced to prevent the scheduled 2011 pay adjustment.27

Additionally, P.L. 111-322, which was enacted on December 22, 2010, prevents any adjustment in GS base pay before December 31, 2012. Since the percentage adjustment in Member pay may not exceed the percentage adjustment in the base pay of GS employees, Member pay is also frozen during this period. If not limited by GS pay, Members could have received a salary adjustment of 1.3% in January 2012 under the ECI formula.2829 Pay for Members of Congress remained $174,000.

January 2010 Member Pay Adjustment Denied

Under the formula established in the Ethics Reform Act, Members were originally scheduled to receive a pay adjustment in January 2010 of 2.1%.2930 This adjustment was denied by Congress through a provision included in the FY2009 Omnibus Appropriations Act. Section 103 of Division J of the act states, "Notwithstanding any provision of section 601(a)(2) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31(2)), the percentage adjustment scheduled to take effect under any such provision in calendar year 2010 shall not take effect."3031

Had this provision not been enacted, the 2.1% projected adjustment would have been automatically reduced to 1.5% to match the 2010 GS base pay adjustment.31

Member Pay: Other Proposals and Actions by Congress

116th Congress

As in previous Congresses, legislation was introduced in the 116th Congress to

- repeal the automatic pay adjustment provision (for example, H.R. 751

and H.R. 1466, H.R. 1466, H.R. 3260, and S. 1444); - change the procedure by which pay for Members of Congress is adjusted or disbursed by linking it to congressional actions or economic indicators, including passage of a budget resolution, passage of appropriations, or reaching the debt limit (for example, S. 39, S. 44, S. 949, S. 1877, H.R. 86, H.R. 102, H.R. 129, H.R. 236, H.R. 298, H.R. 834, H.R. 1172, H.R. 1178, H.R. 1466, H.R. 1612, H.R. 3118, H.R. 3271, H.R. 3440, H.J.Res. 10, and H.J.Res. 51); and

- prohibit pay for Members of Congress during a lapse in appropriations resulting in a government shutdown (for example, S. 74, S. 949, H.R. 26, H.R. 211, H.R. 845, and H.R. 1612).

115th Congress

Legislation was introduced in the 115th Congress to

- prohibit adjustments in pay (for example, H.R. 342);

- repeal the automatic pay adjustment provision (for example, H.R. 668 and H.R. 5946);

- change the procedure by which pay for Members of Congress is adjusted or disbursed by linking it to congressional actions or economic indicators, including passage of a budget resolution or reaching the debt limit (for example, H.R. 429, H.R. 536, H.R. 646, H.R. 1779, H.R. 1951, H.R. 2153, H.R. 2665, H.R. 3675, H.R. 4512, and H.R. 5946, and S. 14);

- reduce the pay of Members of Congress (for example, H.R. 1786 and H.R. 5539); and

- prohibit pay for Members of Congress during a lapse in appropriations resulting in a government shutdown (for example, H.R. 1789, H.R. 1794, H.R. 2214, H.R. 4852, H.R. 4870, and S. 2327).

114th Congress

Legislation was introduced in the 114th Congress to

- prohibit adjustments in pay (for example, H.R. 109 and H.R. 302);

- repeal the automatic pay adjustment provision (for example, H.R. 179, H.R. 513, H.R. 688, H.R. 1585, and S. 17);

- change the procedure by which pay for Members of Congress is adjusted or disbursed by linking it to congressional actions or economic indicators, including the passage of a budget resolution or existence of a deficit (for example, H.Con.Res. 27, S.Con.Res. 11, H.R. 92, H.R. 110, H.R. 174, H.R. 187, H.R. 3757, H.R. 4814, H.R. 4476, and S. 39);

- reduce the pay of Members of Congress (for example, H.R. 179 and H.R. 688); and

- prohibit or reduce pay for Members of Congress during a lapse in appropriations resulting in a government shutdown (for example, S. 2074, H.R. 3562, H.R. 2023, and H.R. 1032).

3233

Linking Salaries to Passage of a Concurrent Resolution on the Budget

The House budget resolution for FY2016, H.Con.Res. 27, included a policy statement that Congress should agree to a concurrent budget resolution each year by April 15, and if not, congressional salaries should be held in escrow (Section 819). The statement proposed that salaries would be released from the escrow account either when a chamber agrees to a concurrent resolution on the budget or the last day of the Congress, whichever is earlier. The House agreed to this resolution on March 25, 2015, and no further action was taken. The Senate agreed to its resolution on the FY2016 budget, S.Con.Res. 11, on March 27, 2015, without this language. The conference report for S.Con.Res. 11—agreed to in the House on April 30 and in the Senate on May 5, 2015—contains a "Policy Statement on 'No Budget, No Pay'" (Section 6216), which refers to actions by the House.

113th Congress

Legislation was introduced in the 113th Congress to

- prohibit adjustments in pay (for example, H.R. 54, H.R. 243, H.R. 636, S. 18, S. 30);

3334

- repeal the automatic pay adjustment provision (for example, H.R. 134, H.R. 150, H.R. 196, S. 65, and H.R. 398);

- change the procedure by which pay for Members of Congress is adjusted or disbursed by linking it to congressional actions or economic indicators, including passage of a budget resolution or reaching the debt limit (for example, H.R. 108, H.R. 167, H.R. 284, H.R. 308, H.R. 310, H.R. 325, H.R. 372, H.R. 397, H.R. 396, H.R. 522, H.R. 593, H.R. 1884, H.R. 2335, H.R. 3234, S. 18, S. 30, and S. 263);

- reduce the pay of Members of Congress (for example, H.R. 37, H.R. 150, H.R. 391, H.R. 396, H.R. 398, and H.R. 1467);

- prohibit pay for Members of Congress during a lapse in appropriations resulting in a government shutdown (for example, H.R. 3160, H.R. 3215, H.R. 3224, H.R. 3234, and H.R. 3236); and

- apply any sequester to Member pay (for example, S. 436, H.R. 1181, H.R. 1478, and H.R. 2677).

34

35Linking Salaries to Passage of a Concurrent Resolution on the Budget

H.R. 325, which (1) included language holding congressional salaries in escrow if a concurrent resolution on the budget was not agreed to by April 15, 2013, and (2) provided for a temporary extension of the debt ceiling through May 18, 2013, was introduced on January 21, 2013.3536 Salaries would have been held in escrow for Members in a chamber if that chamber had not agreed to a concurrent resolution by that date. Salaries would have been released from the escrow account either when that chamber agreed to a concurrent resolution on the budget or the last day of the 113th Congress, whichever was earlier. H.R. 325 was agreed to in the House on January 23, 2013, and the Senate on January 31, 2013. It was enacted on February 4, 2013 (P.L. 113-3). Both the House and Senate agreed to a budget resolution prior to that date, however, and salaries were not held in escrow.

Linking Salaries to the Debt Limit

H.R. 807, the Full Faith and Credit Act, was introduced in the House on February 25, 2013. The bill would have prioritized certain payments in the event the debt reaches the statutory limit. An amendment, H.Amdt. 61, was offered on May 9, 2013, that would clarify that these obligations would not include compensation for Members of Congress. It was agreed to the same day. The bill passed the House on May 13, 2013. No further action was taken in the 113th Congress.

The House-passed version of H.J.Res. 59, the Continuing Appropriations Resolution, 2014, also contained a provision addressing actions by the Secretary of the Treasury in the event that the debt limit is reached and not raised. The provision (Section 138) would, in part, prohibit borrowing to provide pay for Members of Congress in the event that the debt reaches the statutory limit prior to December 15, 2014. The bill passed the House on September 20, 2013. It was enacted on December 26, 2013, without this section.

112th Congress

Legislation was introduced in the 112th Congress to

- repeal the automatic pay adjustment provision (for example, S. 133, S. 148, H

..R. 187, H.R. 235, H.R. 246, H.R. 343, H.R. 431, H.R. 3673); - change the procedure by which pay for Members of Congress is adjusted or disbursed by linking it to other action or economic indicators (for example, H.R. 124, H.R. 172, H.R.

236236, H.R. 994, H.R. 1454, H.R. 3136, H.R. 3565, H.R. 3774, H.R. 3799, H.R. 3883, H.R. 4036, H.R. 6438, S. 1442); - reduce the pay of Members of Congress (for example, H.R. 204, H.R. 270, H.R. 335, H.R. 1012, H.R. 4399);

- otherwise alter or restrict pay for Members under certain conditions (for example, H.R. 6108); and

- freeze Member pay (for example, S. 1931, S. 1936, S. 2065, S. 2079, S. 2210, H.R. 3858, H.R. 6474, H.R. 6720, H.R. 6721, H.R. 6722).

Actions Related to Member Pay During a Lapse in Appropriations

Legislation was also introduced in the 112th Congress that would have affected Member pay in the event of a lapse of appropriations resulting in a government shutdown. These included H.R. 819, H.R. 1255, H.R. 1305, H.Con.Res. 56, and S. 388.

The Senate passed S. 388 on March 1, 2011.3637 The bill would have prohibited Members of the House and Senate from receiving pay, including retroactive pay, for each day that there is a lapse in appropriations or the federal government is unable to make payments or meet obligations because of the public debt limit. The House passed H.R. 1255 on April 1, 2011. The bill would have prohibited the disbursement of pay to Members of the House and Senate during either of these situations.3738 No further action was taken on either bill.

On April 8, 2011, the Speaker of the House issued a "Dear Colleague" letter indicating that in the event of a shutdown, Members of Congress would continue to be paid pursuant to the Twenty-Seventh Amendment to the Constitution, which as stated above, states: "No law, varying the compensation for the services of the Senators and Representatives, shall take effect, until an election of Representatives shall have intervened"—although Members could elect to return any compensation to the Treasury.

Additional Legislation Receiving Floor Action but Not Enacted

Additional legislation to prohibit any Member pay adjustment in 2013 was introduced but not enacted in the 112th Congress, including the following:

- Section 5421(b)(1) of H.R. 3630, as introduced in the House, would have prohibited any adjustment for Members of Congress prior to December 31, 2013. Section 706 of the motion to recommit also contained language freezing Member pay.

3839 On December 13, 2011, the motion to recommit failed (183-244, roll call #922), and the bill passed the House (234-193, roll call #923). The House-passed version of the bill was titled the "Middle Class Tax Relief and Job Creation Act of 2011." The Senate substitute amendment, which did not address pay adjustments, passed on December 17. It was titled the "Temporary Payroll Tax Cut Continuation Act of 2011." The bill was enacted on February 22, 2012 (P.L. 112-96), without the pay freeze language. - H.R. 3835, introduced on January 27, 2012, also would have extended the pay freeze for federal employees, including Members of Congress, to December 31, 2013. This bill passed the House on February 1, 2012.

- H.R. 6726, introduced on January 1, 2013, would have extended the pay freeze for federal employees, including Members of Congress, to December 31, 2013. This bill passed the House on January 2, 2013.

Reference and Historical Information and Explanation of Tables

Table 1 provides a history of the salaries of Members of Congress since 1789. For each salary rate, both the effective date and the statutory authority are provided.3940

Table 2 provides information on pay adjustments for Members since 1992, which was the first full year after the Ethics Reform Act that Representatives and Senators received the same salary. The table provides the projected percentage changes under the formula based on the Employment Cost Index and the actual percentage adjustment. The differences between the projected and actual Member pay adjustments resulted from

- the enactment of legislation preventing the increase (adjustments for 1994, 1995, 1996, 1997, 1999, 2007, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, and 2020

and 2019); - limits on the percentage increase of Member pay because of the percentage increase in GS base pay (adjustments for 1994, 1995, 1996, 1998, 1999, 2001, 2003, 2007, 2008, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, and 2019); and

- a combination of the above. In some years, the percentage adjustment for Member pay would have been lowered to match the percentage adjustment in GS base pay if Congress had not passed legislation denying the adjustment (adjustments for 1994, 1995, 1996, 1999, 2007, 2010, 2011, 2013, 2014, 2015, 2016, 2017, 2018, and 2019).

If Members of Congress had received every adjustment prescribed by the ECI formula since 1992, and the 2 U.S.C. §4501 limitation regarding the percentage base pay increase for GS employees remained unchanged, the 20192020 salary would be $210,900.40216,400.41

Table 3 lists the laws which have previously delayed or prohibited Member pay adjustments, the dates these laws were enacted, and the text of the provision. While many of the bills in this list are appropriations bills, a prohibition on Member pay adjustments could be included in any bill, or be introduced as a separate bill.41

Figure 1, which follows, shows the salary of Members of Congress in current and constant (inflation adjusted) dollars since 1992. It shows that Member salaries, when adjusted for inflation, decreased 1516% from 2009 until 2019.42

|

Payable Salary (Current Dollars)a |

Effective Date |

Statutory Authority |

|

$6 per diemb |

March 4, 1789 |

1 Stat. 70-71 |

|

$6 per diem (Representatives) $7 per diem (Senators) |

March 4, 1795 |

1 Stat. 70-71 |

|

$6 per diem |

March 3, 1796 |

1 Stat. 448 |

|

$1,500 |

December 4, 1815 |

3 Stat. 257 |

|

$6 per diem (Representatives) $7 per diem (Senators) |

March 3, 1817 |

3 Stat. 345 |

|

$8 per diem |

March 3, 1817 |

3 Stat. 404 |

|

$3,000 |

December 3, 1855 |

11 Stat. 48 |

|

$3,000c |

December 23, 1857 |

11 Stat. 367 |

|

$5,000 |

December 4, 1865 |

14 Stat. 323 |

|

$7,500 |

March 4, 1871 |

17 Stat. 486 |

|

$5,000 |

January 20, 1874 |

18 Stat. 4 |

|

$7,500 |

March 4, 1907 |

34 Stat. 993 |

|

$10,000 |

March 4, 1925 |

43 Stat. 1301 |

|

$9,000d |

July 1, 1932 |

47 Stat. 401 |

|

$8,500 |

April 1, 1933 |

48 Stat. 14 |

|

$9,000 |

February 1, 1934 |

48 Stat. 521 |

|

$9,500 |

July 1, 1934 |

48 Stat. 521 |

|

$10,000 |

April 4, 1935 |

49 Stat. 24 |

|

$12,500 |

January 3, 1947 |

60 Stat. 850 |

|

$22,500 |

March 1, 1955 |

69 Stat. 11 |

|

$30,000 |

January 3, 1965 |

78 Stat. 415 |

|

$42,500 |

March 1, 1969 |

81 Stat. 642 |

|

$44,600 |

October 1, 1975 |

89 Stat. 421 |

|

$57,500 |

March 1, 1977 |

81 Stat. 642 |

|

$60,662.50 |

October 1, 1979 |

89 Stat. 421 |

|

$69,800 |

December 18, 1982 (Representatives) July 1, 1983 (Senators) |

96 Stat. 1914 97 Stat. 338 |

|

$72,600 |

January 1, 1984 |

89 Stat. 421 |

|

$75,100 |

January 1, 1985 |

89 Stat. 421 |

|

$77,400 |

January 1, 1987 |

89 Stat. 421 |

|

$89,500 |

February 4, 1987 |

81 Stat. 642 |

|

$96,600e (Representatives) |

February 1, 1990 |

103 Stat. 1767-1768 |

|

$98,400 (Senators) |

February 1, 1990 |

103 Stat. 1767-1768 |

|

$125,100 (Representatives) |

January 1, 1991 |

103 Stat. 1768-1769 |

|

$101,900 (Senators) |

January 1, 1991 |

103 Stat. 1769 |

|

$125,100 (Senators) |

August 14, 1991 |

105 Stat. 450 |

|

$129,500 |

January 1, 1992 |

103 Stat.1769 |

|

$133,600 |

January 1, 1993 |

103 Stat. 1769 |

|

$136,700 |

January 1, 1998 |

103 Stat. 1769 |

|

$141,300 |

January 1, 2000 |

103 Stat. 1769 |

|

$145,100 |

January 1, 2001 |

103 Stat. 1769 |

|

$150,000 |

January 1, 2002 |

103 Stat. 1769 |

|

$154,700 |

January 1, 2003 |

103 Stat. 1769 |

|

$158,100 |

January 1, 2004 |

103 Stat. 1769 |

|

$162,100 |

January 1, 2005 |

103 Stat. 1769 |

|

$165,200 |

January 1, 2006 |

103 Stat. 1769 |

|

$169,300 |

January 1, 2008 |

103 Stat. 1769 |

|

$174,000 |

January 1, 2009 |

103 Stat. 1769 |

Source: Congressional Research Service.

a. Pay rates listed are applicable for Senators and Representatives unless otherwise specified. From 1976 to 1983, the salary actually paid to Members was less than the salary to which Members were entitled. The difference arose because Members were entitled to salaries authorized pursuant to the annual pay comparability procedure (P.L. 94-82). However, on several occasions Congress did not appropriate funds to pay any or part of the new salary increases authorized by P.L. 94-82. Accordingly, the salaries shown in this table are the payable rates, indicating the salaries actually paid to Members of Congress.

b. From 1789 to 1856, Senators and Representatives received a per diem pay rate for their attendance while Congress was in session, except for the period December 1815-March 1817, when they received $1,500 a year. First established at $6 a day in 1789 for Senators and Representatives, the per diem for Senators was increased to $7 beginning March 4, 1795, pursuant to language in the 1789 act. A March 10, 1796, act returned the per diem for Senators to $6 for each day of attendance while the Senate was in session. Although a law providing for annual salaries was enacted during the 14th Congress, it was repealed on February 6, 1817, and pay reverted to a per diem basis. The per diem rate was raised to $8 in 1818 (retroactive to March 3, 1817) and remained there until 1856, when Members of Congress began to receive annual salaries. A list of all session dates and lengths is available at http://history.house.gov/Institution/Session-Dates/Session-Dates/.

c. In 1857, Congress provided for pay at the rate of $250 per month while in session, or a maximum of $3,000 per annum.

d. The act authorized the restoration of pay as of February 1, 1934, and the restoration of pay as of July 1, 1934.

e. The Ethics Reform Act of 1989 (103 Stat. 1767-1768) increased pay for Representatives and Senators at different rates. The pay of Representatives was increased to reflect the previously denied 1989 and 1990 pay adjustments (4.1% and 3.6%), compounded at 7.9%, effective February 1, 1990. The act further provided for a 25% increase in Representatives' pay, effective January 1, 1991. As a result, the pay of Representatives increased from $89,500 to $96,600 on February 1, 1990, and increased to $125,100 on January 1, 1991. The pay of Senators was increased to reflect the previously denied 1988, 1989, and 1990 comparability pay adjustments (2%, 4.1%, and 3.6%), compounded at 9.9%, effective February 1, 1990. As a result, the pay of Senators increased from $89,500 to $98,400 on February 1, 1990. The Ethics Act did not provide for any other pay increase for Senators, as it did in providing a 25% increase for Representatives. The reason is that Senators elected to deny themselves the 25% increase while retaining the ability to receive honoraria. Subsequently, the Senate voted to increase its pay rate to that of Representatives and to prohibit receipt of honoraria by Senators, effective August 14, 1991. As a result, Senate pay increased from $101,900 to $125,100 per annum.

|

Yeara |

Projected Percentage Adjustment Under |

Maximum |

Actual Percentage Adjustment |

||

|

1992 |

3.5% |

|

3.5% |

||

|

1993 |

3.2% |

|

3.2% |

||

|

1994 |

2.1% |

|

0 |

||

|

1995 |

2.6% |

|

0 |

||

|

1996 |

2.3% |

|

0 |

||

|

1997 |

2.3% |

|

0 |

||

|

1998 |

2.9% |

|

2.3% |

||

|

1999 |

3.4% |

|

0 |

||

|

2000 |

3.4% |

|

3.4% |

||

|

2001 |

3.0% |

|

2.7% |

||

|

2002 |

3.4% |

|

3.4% |

||

|

2003 |

3.3% |

|

3.1% |

||

|

2004a |

2.2% |

|

2.2% |

||

|

2005 |

2.5% |

|

2.5% |

||

|

2006 |

1.9% |

|

1.9% |

||

|

2007 |

2.0% |

|

0 |

||

|

2008 |

2.7% |

|

2.5% |

||

|

2009 |

2.8% |

|

2.8% |

||

|

2010 |

2.1% |

|

0 |

||

|

2011 |

0.9% |

|

0 |

||

|

2012 |

1.3% |

|

0 |

||

|

2013 |

1.1% |

|

0 |

||

|

2014 |

1.2% |

|

0 |

||

|

2015 |

1.6% |

|

0 |

||

|

2016 |

1.7% |

|

0 |

||

|

2017 |

1.6% |

|

0 |

||

|

2018 |

1.8% |

|

0 |

||

|

2019 |

2.3% |

|

0 |

||

|

2020 |

2.6% |

|

TBD |

Source: Congressional Research Service analysis of BLS data, public laws, and executive orders.

a. As seen in Table 1, since 1992, Member pay adjustments have been effective in January. In 2004, the adjustment was effective in two stages. The first adjustment increased Members' salary by 1.5%, to which they were initially limited because by law they may not receive an annual adjustment greater than the increase in the base pay of GS federal employees. After the passage of the FY2004 Consolidated Appropriations Act, Members received the full 2.2% pay increase, with 0.7% retroactive to the first pay period in January 2004.

b. Projected increase is based on the formula established in the Ethics Reform Act. This is equivalent to the percentage change in the Employment Cost Index (private industry wages and salaries, not seasonally adjusted) reflected in the quarter ending December 31 for the two preceding years, minus 0.5%.

|

Pay Year |

Bill |

Public Law |

Enacted Date |

Bill Title |

||||

|

1994 |

H.R. 920, 103rd Congress |

March 4, 1993 |

Emergency Unemployment Compensation Amendments of 1993a |

|||||

|

1995 |

H.R. 4539, 103rd Congress |

September 28, 1994 |

Treasury, Postal Service and General Government Appropriations Act, 1995b |

|||||

|

1996 |

H.R. 2020, 104th Congress |

November 15, 1995 |

Treasury, Postal Service, and General Government Appropriations Act, 1996c |

|||||

|

1997 |

H.R. 3610, 104th Congress |

September 30, 1996 |

Omnibus Consolidated Appropriations Act, 1997d |

|||||

|

1999 |

H.R. 4328, 105th Congress |

October 21, 1998 |

Omnibus Consolidated and Emergency Supplemental Appropriations Act, 1999e |

|||||

|

2007 |

H.J.Res. 102, 109th Congress |

December 9, 2006 |

Making further continuing appropriations for the FY2007, and for other purposesg |

|||||

|

2007 |

H.J.Res. 20, 110th Congress |

February 15, 2007 |

Revised Continuing Appropriations Resolution, 2007h |

|||||

|

2010 |

H.R. 1105, 111th Congress |

March 11, 2009 |

Omnibus Appropriations Act, 2009i |

|||||

|

2011 |

H.R. 5146, 111th Congress |

May 14, 2010 |

To provide that Members of Congress shall not receive a cost of living adjustment in pay during fiscal year 2011j |

|||||

|

2012 |

H.R. 3082, 111th Congress |

December 22, 2010 |

Continuing Appropriations and Surface Transportation Extensions Act, 2011k |

|||||

|

2013 |

H.J.Res. 117, 112th Congress |

September 28, 2012 |

Continuing Appropriations Resolution, 2013l |

|||||

|

2013 |

H.R. 8, 112th Congress |

January 2, 2013 |

American Taxpayer Relief Act of 2012m |

|||||

|

2014 |

H.R. 2775, 113th Congress |

October 17, 2013 |

Continuing Appropriations Act, 2014n |

|||||

|

2015 |

H.R. 83, 113th Congress |

December 16, 2014 |

Consolidated and Further Continuing Appropriations Act, 2015o |

|||||

|

2016 |

December 18, 2015 |

Consolidated Appropriations Act, 2016p |

||||||

|

2017 |

December 10, 2016 |

Further Continuing and Security Assistance Appropriations Act, 2017q |

||||||

|

2018f (partial year) |

September 8, 2017 |

FY2018 Continuing Appropriations Resolutionr |

||||||

|

2018 |

March 23, 2018 |

FY2018 Consolidated Appropriations Acts |

||||||

|

2019 |

September 21, 2018 |

Energy and Water, Legislative Branch, and Military Construction and Veterans Affairs 2020 December 20, 2019 |

Source: Congressional Research Service examination of enacted legislation.

Notes: The provisions footnoted below have been delayed or prohibited Member pay adjustments.

a. "Notwithstanding section 601(a)(2) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31(2)), the cost of living adjustment (relating to pay for Members of Congress) which would become effective under such provision of law during calendar year 1994 shall not take effect."

b. "For purposes of each provision of law amended by section 704(a)(2) of the Ethics Reform Act of 1989 (5 U.S.C. 5318 note), no adjustment under section 5303 of title 5, United States Code, shall be considered to have taken effect in fiscal year 1995 in the rates of basic pay for the statutory pay systems."

c. "For purposes of each provision of law amended by section 704(a)(2) of the Ethics Reform Act of 1989 (5 U.S.C. 5318 note), no adjustment under section 5303 of title 5, United States Code, shall be considered to have taken effect in fiscal year 1996 in the rates of basic pay for the statutory pay systems."

d. "For purposes of each provision of law amended by section 704(a)(2) of the Ethics Reform Act of 1989 (5 U.S.C. 5318 note), no adjustment under section 5303 of title 5, United States Code, shall be considered to have taken effect in fiscal year 1997 in the rates of basic pay for the statutory pay systems."

e. "For purposes of each provision of law amended by section 704(a)(2) of the Ethics Reform Act of 1989 (5 U.S.C. 5318 note), no adjustment under section 5303 of title 5, United States Code, shall be considered to have taken effect in fiscal year 1999 in the rates of basic pay for the statutory pay systems."

f. The partial year pay freezes for 2007, 2013, and 2018 were included in joint resolutions providing continuing funding for a portion of the fiscal year and continued for the duration of the continuing resolution.

g. "Notwithstanding any other provision of this division and notwithstanding section 601(a)(2) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31), the percentage adjustment scheduled to take effect under such section for 2007 shall not take effect until February 16, 2007."

h. "Notwithstanding any other provision of this division and notwithstanding section 601(a)(2) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31), the percentage adjustment scheduled to take effect under such section for 2007 shall not take effect."

i. "Notwithstanding any provision of section 601(a)(2) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31(2)), the percentage adjustment scheduled to take effect under any such provision in calendar year 2010 shall not take effect."

j. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31) (relating to cost of living adjustments for Members of Congress) during fiscal year 2011."

k. "Notwithstanding any other provision of law, except as provided in subsection (e), no statutory pay adjustment which (but for this subsection) would otherwise take effect during the period beginning on January 1, 2011, and ending on December 31, 2012, shall be made."

l. "(a) Section 147 of P.L. 111-242, as added by P.L. 111-322, shall be applied by substituting the date specified in section 106(3) of this joint resolution for `December 31, 2012' each place it appears (b) Notwithstanding any other provision of law, any statutory pay adjustment (as defined in section 147(b)(2) of the Continuing Appropriations Act, 2011 (P.L. 111-242)) otherwise scheduled to take effect during fiscal year 2013 but prior to the date specified in section 106(3) of this joint resolution may take effect on the first day of the first applicable pay period beginning after the date specified in section 106(3)."

m. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31) (relating to cost of living adjustments for Members of Congress) during fiscal year 2013."

n. "Notwithstanding any other provision of law, no adjustment shall be made under section 610(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31) (relating to cost of living adjustments for Members of Congress) during fiscal year 2014."

o. "Notwithstanding any other provision of law, no adjustment shall be made under section 610(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 31) (relating to cost of living adjustments for Members of Congress) during fiscal year 2015."

p. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 4501) (relating to cost of living adjustments for Members of Congress) during fiscal year 2016."

q. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 4501) (relating to cost of living adjustments for Members of Congress) during fiscal year 2017."

r. "(9) The Legislative Branch Appropriations Act, 2017 (division I of P.L. 115-31) and section 175 of P.L. 114-223, as amended by division A of P.L. 114-254."

s. "(a) Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 4501) (relating to cost of living adjustments for Members of Congress) during fiscal year 2018."

t. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 4501) (relating to cost of living adjustments for Members of Congress) during fiscal year 2019."

u. "Notwithstanding any other provision of law, no adjustment shall be made under section 601(a) of the Legislative Reorganization Act of 1946 (2 U.S.C. 4501) (relating to cost of living adjustments for Members of Congress) during fiscal year 2020."

Author Contact Information

Acknowledgments

This report was originally written by Paul E. Dwyer, formerly a Specialist in American National Government at CRS, who has since retired.

Footnotes

| 1. |

P.L. 97-51; 95 Stat. 966; September 11, 1981. See also, for example: "Table 32-1. Federal Programs By Agency and Account" in Analytical Perspectives, Budget of the United States Government, Fiscal Year 2014 (Washington, GPO: 2013), pp. 2, 3. |

|

| 2. |

Base pay is the pay rate before locality pay is added. This limitation was included in P.L. 103-356, 108 Stat. 3410-3411, October 13, 1994; 2 U.S.C. 4501(2)(B). |

|

| 3. |

For additional information on these annual adjustments, including actions to modify or deny the scheduled increases, see CRS Report 97-615, Salaries of Members of Congress: Congressional Votes, 1990- |

|

| 4. |

For a list of the laws that have previously prohibited Member pay adjustments, see Table 3, "Legislative Vehicles Used for Pay Prohibitions, Enacted Dates, and Pay Language." |

|

| 5. |

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the 12-month percentage change reported for the quarter ending December 31, minus 0.5%. The 2.6% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2017 and December 2018, which was 3.1%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2018 (Washington: January 31, 2019), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

|

| 6. |

On June 3, the House Committee on Rules announced its intention to consider and report a resolution that would structure consideration in the House of H.R. 2740, the Labor, Health and Human Services, and Education Appropriations bill. The committee indicated that the resolution reported from the Rules Committee would add the text of four additional appropriations bills to the text of H.R. 2740. This proposal would include the text of H.R. 2779, the legislative branch appropriations bill as reported by the House Committee on Appropriations (to be included as Division B of H.R. 2740). The Rules Committee made available the legislative text that included the five appropriations bills and directed Members to draft their amendments to that text (House Rules Committee Print 116-17). Following reported discussions related to the automatic Member pay adjustment, the resolution reported from the House Rules Committee further altered the version of H.R. 2740 that would be considered by the House, removing the text of the legislative branch appropriations bill. H.R. 2779, as reported, did not contain a provision prohibiting the automatic Member pay adjustment. Although discussion of the Member pay adjustment sometimes occurs during consideration of annual appropriations bills, these bills do not contain funds for the annual salaries or pay adjustment for Members, nor do they contain language authorizing an increase. The use of appropriations bills as vehicles for provisions prohibiting the automatic annual pay adjustments for Members developed by custom. A provision prohibiting an adjustment to Member pay could be offered to any bill, or be introduced as a separate bill. H.R. 2740, the Labor, Health and Human Services, Education, Defense, State, Foreign Operations, and Energy and Water Development Appropriations Act, 2020, was ultimately agreed to in the House on June 19, 2019, without the legislative branch appropriations funding. S. 2581, as reported by the Senate Appropriations Committee, contained a provision prohibiting the Member pay adjustment. None of these bills (H.R. 2779, H.R. 2740, or S. 2581) were enacted, and the legislative branch operated pursuant to continuing resolutions from October 1 until the enactment of P.L. 116-94.

|

|

|

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the 12-month percentage change reported for the quarter ending December 31, minus 0.5%. The 1.8% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2015 and December 2016, which was 2.3%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2016 (Washington: January 31, 2017), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

||

|

Although this provision refers to fiscal year, since 1992, Member pay adjustments have been effective in January. |

||

|

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the 12-month percentage change reported for the quarter ending December 31, minus 0.5%. The 1.6% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2014 and December 2015, which was 2.1%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2015 (Washington: January 29, 2016), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

||

|

For additional information on funding provided by the legislative branch appropriations bill, see CRS Report R44515, Legislative Branch: FY2017 Appropriations |

||

|

On August 31, 2016, President Obama issued an "alternative pay plan for federal civilian employees," which called for a 1.0% base pay adjustment for GS employees (available at https://www.whitehouse.gov/the-press-office/2016/08/31/letter-president-pay-federal-civilian-employees-2017). This proposal became effective with the issuance of Executive Order 13756. As in prior years, schedule 6 of Executive Order 13756 lists the pay rate for Members of Congress for the upcoming year. See discussion of Executive Order 13635 (issued December 27, 2012) below for additional information on the inclusion of Member pay information in executive orders. |

||

|

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the 12-month percentage change reported for the quarter ending December 31, minus 0.5%. The 1.7% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2013 and December 2014, which was 2.2%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2014 (Washington: January 30, 2015), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

||

|

On August 28, 2015, President Obama issued an "alternative pay plan for federal civilian employees," which called for a 1.0% base pay adjustment for GS employees (available at https://www.whitehouse.gov/the-press-office/2015/08/28/letter-president-alternative-pay-plan-federal-civilian-employees). This proposal became effective with the issuance of Executive Order 13715. As in prior years, schedule 6 of Executive Order 13715 lists the pay rate for Members of Congress for the upcoming year. See discussion of Executive Order 13635 (issued December 27, 2012) below for additional information on the inclusion of Member pay information in executive orders. |

||

|

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 1.6% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2012 and December 2013, which was 2.1%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2013 (Washington: January 31, 2014), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

||

|

As stated above, although discussion of Member pay is often associated with appropriations bills, the legislative branch bill does not contain language funding or increasing Member pay, and a provision prohibiting the automatic Member pay adjustments could be included in any bill, or be introduced as a separate bill. |

||

|

Available at http://www.whitehouse.gov/the-press-office/2014/08/29/letter-president-alternative-pay-plan-federal-civilian-employees. |

||

|

The potential Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 1.2% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2011 and December 2012, which was 1.7%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2012 (Washington: January 31, 2013), p. 3. Pursuant to 2 U.S.C. 4501(2)(A), this amount is "rounded to the nearest multiple of $100." |

||

|

Available at http://m.whitehouse.gov/the-press-office/2013/08/30/letter-president-regarding-alternate-pay-civilian-federal-employees. |

||

|

See, however, language in two House Appropriations Committee reports (H.Rept. 113-90 and H.Rept. 113-91) stating: "The Committee does not include requested funding for a civilian pay increase. Should the President provide a civilian pay raise for fiscal year 2014, it is assumed that the cost of such a pay raise will be absorbed within existing appropriations for fiscal year 2014," pp. 2-3 and pp. 3-4. |

||

|

As in prior years, schedule 6 of the executive order listed the pay rate for Members of Congress for the upcoming year. See discussion of Executive Order 13635 (issued December 27, 2012) below for additional information on the inclusion of Member pay information in executive orders. |

||

|

The annual Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 1.1% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2010 and December 2011, which was 1.6%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2011 (Washington: January 31, 2012), p. 3. |

||

|

Office of Management and Budget, Analytical Perspectives, Budget of the United States Government, Fiscal Year 2013, Performance and Management (Washington, GPO: 2012), Table 2-1: Economic Assumptions, p. 17 and p. 114. |

||

|

"Letter from the President Regarding an Alternative Plan for Pay Increases for Civilian Federal Employees," Text of a Letter from the President to the Speaker of the House of Representatives and the President of the Senate, August 21, 2012, available at http://www.whitehouse.gov/the-press-office/2012/08/21/letter-president-regarding-alternative-plan-pay-increases-civilian-feder. |

||

|

Prior executive orders listing the rates of pay for Members of Congress include Executive Order 12944 of December 28, 1994; Executive Order 12984 of December 28, 1995; Executive Order 13071 of December 29, 1997; Executive Order 13106 of December 7, 1998; Executive Order 13144 of December 21, 1999; Executive Order 13182 of December 23, 2000; Executive Order 13249 of December 28, 2001; Executive Order 13282 of December 31, 2002; Executive Order 13322 of December 30, 2003; Executive Order 13332 of March 3, 2004; Executive Order 13368 of December 30, 2004; Executive Order 13393 of December 22, 2005; Executive Order 13420 of December 21, 2006; Executive Order 13454 of January 4, 2008; Executive Order 13483 of December 18, 2008; Executive Order 13525 of December 23, 2009; Executive Order 13561 of December 22, 2010; and Executive Order 13594 of December 19, 2011. Pay rates for Members of Congress generally are listed in "Schedule 6." In most years, the Executive Orders state that the pay rates in this schedule are "effective on the first day of the first applicable pay period beginning on or after January 1." |

||

|

P.L. 110-5, for the 2007 scheduled pay adjustment, and P.L. 112-240, for the 2013 scheduled pay adjustment. |

||

|

The annual Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 0.9% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2008 and December 2009, which was 1.4%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2009 (Washington: January 29, 2010), p. 2. |

||

|

H.R. 4255, introduced December 9, 2009; H.R. 4423, introduced January 12, 2010; S. 3074, introduced March 4, 2010; S. 3198, introduced March 14, 2010; and S. 3244, introduced April 22, 2010. |

||

|

The annual Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 1.3% potential adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2009 and December 2010, which was 1.8%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2010 (Washington: January 28, 2011), p. 3. See also: "Schedule 6—Vice President and Members of Congress," Adjustments of Certain Rates of Pay, Executive Order 13594, December 23, 2011, Federal Register, vol. 76, no. 247 (Washington, GPO: 2011), pp. 80191-80196. |

||

|

The annual Member pay adjustment was determined by a formula using the Employment Cost Index (private industry wages and salaries, not seasonally adjusted), based on the percentage change reflected in the quarter ending December 31 for the two preceding years, minus 0.5%. The 2.1% adjustment was determined by taking the percentage increase in the Index between the quarters ending December 2007 and December 2008, which was 2.6%, and subtracting 0.5%. U.S. Department of Labor, Bureau of Labor Statistics, Employment Cost Index—December 2008 (Washington: January 31, 2009), pp. 2, 17. |

||

|

P.L. 111-8, March 11, 2009. |

||

|

The 1.5% GS base adjustment was finalized by U.S. President (Obama), "Adjustments of Certain Rates of Pay," Executive Order 13525, Federal Register, vol. 74, December 23, 2009, pp. 69231-69242. |

||

|

Members of Congress continue to receive their pay during a lapse in appropriations for a number of reasons. Member salaries have been provided by a permanent, mandatory, appropriation since the enactment of P.L. 97-51 (95 Stat. 966, September 11, 1981, 2 U.S.C. §4501 note). Article I, §6 of the Constitution states, "Senators and Representatives shall receive a Compensation for their Services, to be ascertained by Law, and paid out of the Treasury of the United States." The 27th Amendment to the Constitution added: "No law, varying the compensation for the services of the Senators and Representatives, shall take effect, until an election of Representatives shall have intervened." Finally, the Government Accountability Office's (GAO) Principles of Federal Appropriations Law states: "The salary of a Member of Congress is fixed by statute and therefore cannot be waived without specific statutory authority. B-159835, April 22, 1975; B-123424, March 7, 1975; B-123424, April 15, 1955; A-8427, March 19, 1925; B-206396.2, November 15, 1988 (nondecision letter). However, as each of these cases points out, nothing prevents a Senator or Representative from accepting the salary and then, as several have done, donate part or all of it back to the United States Treasury." (U.S. Government Accountability Office, Principles of Federal Appropriations Law, Volume II, Third Edition, February 2006, p. 6-105, http://www.gao.gov/assets/210/202819.pdf.) |

||

|

P.L. 112-240, the American Taxpayer Relief Act of 2012 (January 2, 2013), froze Member pay at the 2009 level for FY2013 (see notes for Table 3). Additional, broader, federal pay freeze legislation introduced in the 113th Congress may be potentially related (for example, H.R. 273 and H.R. 933), although under 2 U.S.C. 4501(2)(A), Member pay adjustments are "effective at the beginning of the first applicable pay period commencing on or after the first day of the month in which an adjustment takes effect under section 5303 of title 5 in the rates of pay under the General Schedule" and the "first day of the fiscal year in which such adjustment in the rates of pay under the General Schedule takes effect." Pursuant to 5 U.S.C. 5303, General Schedule adjustments are "Effective as of the first day of the first applicable pay period beginning on or after January 1 of each calendar year ... " Since 1992, pay adjustments for Members of Congress have been effective (or retroactive to) January 1 (see Table 1). |

||

|

As in previous years, OMB has determined that Member pay is not subject to sequestration (Appendix A. Preliminary Estimates of Sequestrable and Exempt Budgetary Resources and Reduction in Sequestrable Budgetary Resources by OMB Account–FY 2013 and Appendix B. Preliminary Sequestrable / Exempt Classification by OMB Account and Type of Budgetary Resource, in OMB Report Pursuant to the Sequestration Transparency Act of 2012 (P.L. 112-155).) Bills have been introduced in prior Congresses that would apply sequestration to Member salaries (for example, H.R. 4675, 99th Cong.; H.Res. 481, 101st Cong.; H.R. 5585, 101st Cong.; S.Amdt. 3044 to S.Amdt. 3209, 101st Cong.; S.Amdt. 2916 to H.R. 5558, 101st Cong.; S. 3051, 101st Cong.; H.R. 5587, 101st Cong.; H.R. 5718, 101st Cong.; S.Amdt. 2760 to S. 1224, 101st Cong.; S.Amdt. 2881 and S.Amdt. 2884 to S. 110, 101st Cong.; S. 99, 102nd Cong; S. 731, 103rd Cong.; and S.Amdt. 15 to S. 2, 104th Cong.). |

||

|

The bill states: "If by April 15, 2013, a House of Congress has not agreed to a concurrent resolution on the budget for fiscal year 2014 pursuant to section 301 of the Congressional Budget Act of 1974, during the period described in paragraph (2) the payroll administrator of that House of Congress shall deposit in an escrow account all payments otherwise required to be made during such period for the compensation of Members of Congress who serve in that House of Congress.... " |

||

|

Cong. Rec., March 1, 2011, pp. S1051-1052. |

||

|

Cong. Rec., April 1, 2011, pp.H2239-2251. |

||

|

Congressional Record, December 13, 2011, p. H8822. |

||

|

The salaries shown are the payable salaries, indicating the rate actually paid to Members of Congress. From 1976 to 1983, the salary actually paid to Members was less than the salary to which Members were entitled. The difference arose because Members were entitled to salaries authorized pursuant to the annual pay comparability procedure (P.L. 94-82). However, on several occasions Congress did not appropriate funds to pay any or a portion of the new salary increases authorized by P.L. 94-82. |

||

|

This calculation is based upon the adjustment of Member salaries since 1992 by the percentage in the "Maximum Member Pay Potential Adjustment (assuming GS Base Limit)" column in Table 2. |

||

|

Stand-alone bills prohibiting an adjustment in Member pay introduced in recent Congresses include, for example, (111th Congress) H.R. 4255, H.R. 4423, H.R. 156, H.R. 282, and H.R. 395; (110th Congress) H.R. 2916, H.R. 2934, H.R. 5087, H.R. 5091, and H.R. 6417; and (109th Congress) H.R. 4134 and H.R. 4047. |

||

|

Constant dollars based on Consumer Price Index for All Urban Consumers (CPI-U, Bureau of Labor Statistics, U.S. Department of Labor) |