Federal-Aid Highway Program (FAHP): In Brief

Changes from December 13, 2018 to June 5, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Federal-Aid Highway Program (FAHP): In Brief

Contents

- Federal-Aid Highway Program (FAHP)

- How the Program Works

- The Highway Trust Fund

- Funding Federal-Aid Highways

- Inflation Impacts

- Formulas and Apportionments

- Calculation of State Amounts

- Division of State Shares of Apportionments Among Programs

- Bipartisan Budget Act of 2018: Additional Appropriated Amounts

- Core Highway Formula Programs

- National Highway Performance Program (NHPP; FAST Act §1106)

- Surface Transportation Block Grant Program (STBG; FAST Act §1109)

- Highway Safety Improvement Program (HSIP; FAST Act §1113)

- Congestion Mitigation and Air Quality Improvement Program (CMAQ; FAST Act §1114)

- National Highway Freight Program (NHFP; FAST Act §1116)

- Transferability Among the Core Programs

- Other Highway Programs

- Nationally Significant Freight and Highway Projects (NSFHP; FAST Act §1105)

- Emergency Relief Program (ER; FAST Act §1107)

- Territorial and Puerto Rico Highway Program (FAST Act §1115)

- Appalachian Development Highway System Program (ADHS; FAST Act §1435)

- Construction of Ferry Boats and Ferry Facilities (FAST Act §1112)

- Federal Lands and Tribal Transportation Programs (FAST Act §§1117-1121)

- Transportation Infrastructure Finance and Innovation Act Program (TIFIA; FAST Act §2001)

- Tolling

Figures

Federal-Aid Highway Program (FAHP)

The federal government has provided some form of highway funding to the states for roughly 100 years. The major characteristics of the federal highway program have been constant since the early 1920s. First, most funds are apportioned to the states by formula and implementation is left primarily to state departments of transportation (state DOTs). Second, the states are required to provide matching funds. Until the 1950s, each federal dollar had to be matched by an identical amount of state and local money. The federal share is now 80% for non-Interstate System road projects and 90% for Interstate System projects. Third, generally, federal money can be spent only on designated federal-aid highways, which make up roughly a quarter of U.S. public roads.

How the Program Works

The Federal-Aid Highway Program (FAHP) is an umbrella term for the separate highway programs administered by the Federal Highway Administration (FHWA). These programs are almost entirely focused on highway construction, and generally do not support operations (such as state DOT salaries or fuel costs) or routine maintenance (such as mowing roadway fringes or filling potholes). Each state is required to have a State Transportation Improvement Plan, which sets priorities for the state's use of FAHP funds. State DOTs largely determine which projects are funded, let the contracts, and oversee project development and construction. More recently, metropolitan planning organizations (MPOs) have played a growing role in project decisionmaking in urban areas, but federal project funding continues to flow through state DOTs.

Under the 2015 surface transportation reauthorization act, the Fixing America's Surface Transportation Act (FAST Act; P.L. 114-94), which authorized funding for FY2016-FY2020, 92% of FAHP funding is distributed through five core programs.1 All five are formula programs, meaning that each state's share of each program's total annual authorization is based on a mathematical calculation set out in the law. The remaining programs, generally referred to as discretionary programs, are administered more directly by FHWA, but the funding distribution of some of these programs is formulaic as well. The FAHP does not provide money in advance. Rather, a state receives bills from private contractors for work completed and pays those bills according to its own procedures. The state submits vouchers for reimbursement to FHWA. FHWA certifies the claims for payment and notifies the Department of the Treasury, which disburses money electronically to the state's bank, often on the same day the voucher is submitted by the state.2

The FAHP, unlike most other federal programs, does not rely on appropriated budget authority. Instead, FHWA exercises contract authority over monies in the Highway Trust Fund (HTF) and may obligate (promise to pay) funds for projects funded with contract authority prior to an appropriation. Once funds have been obligated, the federal government has a legal commitment to provide the funds. This approach shelters highway construction projects from annual decisions about appropriations.

|

Highway Program Terminology A distinctive terminology is used to describe highway program financing: 3 Distribution of funds is FHWA notification to the states of the availability of federal funds. Once a distribution is announced, the funds usually remain available to the states to obligate for four years. The states do not receive the funds prior to undertaking work. Apportionment is the distribution of funds among the states as prescribed by a statutory formula. Allocation is an administrative distribution of funds (often for specific projects) under programs that do not have statutory distribution formulas. Reimbursement occurs once a project is approved, the work is started, costs are incurred, and the state submits a voucher to FHWA. The reimbursable structure is designed to curb waste, fraud, and abuse. Contract authority is a type of budget authority that is available for obligation even without an appropriation (although appropriators must eventually provide liquidating authority to pay the obligations). Obligation of contract authority for a project by FHWA legally commits the federal government to reimburse the state for the federal share of a project. This can be done prior to an appropriation. Limitation on obligations, known as ObLim or Oblimit, is used to control annual FHWA spending in place of an appropriation. The ObLim sets a limit on the total amount of contract authority that can be obligated in a single fiscal year. For practical purposes, the ObLim is analogous to an appropriation.4 |

The Highway Trust Fund

The Highway Trust Fund is financed from a number of sources, including taxes on fuels, heavy truck tires, truck and trailer sales, and a weight-based heavy-vehicle use tax.5 However, approximately 85%-90% of trust fund revenue comes from excise taxes on motor fuels, 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel. The HTF consists of two separate accounts—highway and mass transit. The highway account receives an allocation equivalent to 15.44 cents of the gasoline tax and the mass transit account receives the revenue generated by 2.86 cents of the tax.6 Because the fuel taxes are set in terms of cents per gallon rather than as a percentage of the sale price, their revenues do not increase with inflation. The fuel tax rates were last raised in 1993.

Sluggish growth in vehicle travel and improved vehicle efficiency have depressed the growth of fuel consumption and therefore the growth of fuel tax revenue.7 Since FY2008, the revenues flowing into the highway account of the HTF have been insufficient to fund the expenditures authorized under the Federal-Aid Highway Program.8 Congress has resolved this discrepancy by transferring money from the general fund to the HTF.

The FAST Act provided for $70 billion in general fund transfers and a $300 million transfer from the Leaking Underground Storage Tank Trust Fund (LUST) fund.9 The FAST Act also includes a July 1, 2020, rescission of $7.569 billion in contract authority.

|

|

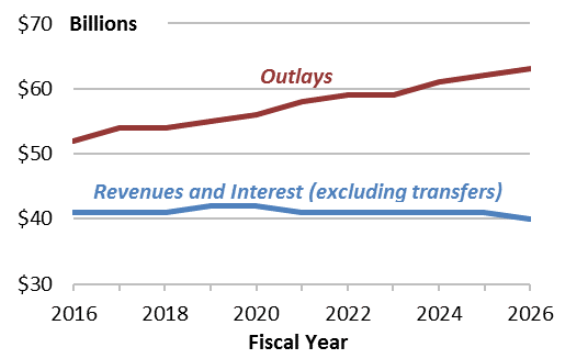

Source: Congressional Budget Office, Projections of Highway Trust Fund Accounts: |

A gap between dedicated HTF revenues and outlays is expected to persist after the FAST Act expires at the end of FY2020 based on current tax rates and levels of spending adjusted for inflation (Figure 1). The Congressional Budget Office (CBO) projects that beginning in FY2021, revenues credited to the highway and transit accounts of the HTF will be insufficient to meet the fund's obligations, and that HTF receipts will fall $8574.5 billion short of the amount needed to fund surface transportation programs as presently configured from FY2021 through FY2025.10 Congress will face the need to approve some combination of new taxes, an increase in existing fuel taxes, continued expenditures from the general fund, increased federally supported debt financing, or reductions in the scope of the federal surface transportation program if the FAST Act is replaced or extended in 2020.11

Funding Federal-Aid Highways

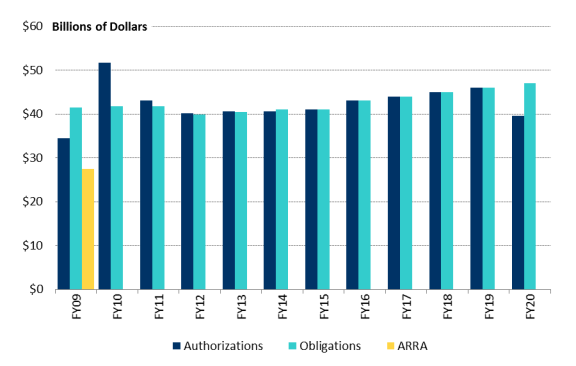

After several years of flat funding in terms of nominal dollars, the FAST Act provided highway funding increases of 4.2% above previous law adjusted for expected future inflation (see Table 1 and Figure 2). The Federal-Aid Highway and research titles authorize an average of $45 billion annually for FY2016-FY2020. The FAST Act made limited programmatic changes, but did increase emphasis on the movement of freight. This was reflected in a new formula freight program, the National Highway Freight Program, and a new competitive discretionary grant program, the Nationally Significant Freight and Highway Projects Program. Under the FAST Act, 92% of the Federal-Aid Highway Program funding is apportioned by formula (see Table 3). The act included no new congressional earmarks.

|

|

Source: Federal Highway Administration. Notes: Totals are unadjusted for inflation. The FY2009 authorization figure reflects rescission of $8.708 billion, and the FY2010 figure reflects the restoration of the rescission. Authorizations are contract authority. Obligations are annual FAHP obligation limitations plus exempt obligations. ARRA refers to funding under the American Recovery and Reinvestment Act of 2009 (P.L. 111-5). FY2020 authorization column reflects the $7.569 billion rescission scheduled for July 1, 2020, under Section 1438 of the FAST Act. |

Table 1. Highway Authorizations: FAST Act

(contract authority from the highway account of the HTF, except as noted, in millions of dollars)

|

Program |

FY2016 |

FY2017 |

FY2018 |

FY2019 |

FY2020 |

Total |

||||||

|

Title I: Federal-Aid Highways (FAHP formula) |

|

|

|

|

|

|

||||||

|

Nationally Significant Freight and Highway Projects (NSFH) |

|

|

|

|

|

|

||||||

|

Transportation Infrastructure Finance and Innovation Program (TIFIA) |

|

|

|

|

|

|

||||||

|

Tribal Transportation Program |

|

|

|

|

|

|

||||||

|

Federal Lands Transportation Program |

|

|

|

|

|

|

||||||

|

Federal Lands Access Program |

|

|

|

|

|

|

||||||

|

Territorial and Puerto Rico Highway Program |

|

|

|

|

|

|

||||||

|

FHWA Administrative Expenses |

|

|

|

|

|

|

||||||

|

Emergency Relief |

|

|

|

|

|

|

||||||

|

Construction of Ferry Boats |

|

|

|

|

|

|

||||||

|

Appalachian Regional Development Program [Gen. Fund] |

|

|

|

|

|

|

||||||

|

Regional Infrastructure Accelerator Demonstration Program [Gen. Fund] |

|

|

|

|

|

|

||||||

|

Nationally Significant Federal Lands and Tribal Projects [Gen. Fund] |

|

|

|

|

|

|

||||||

|

Total Authorizations: Title I |

|

|

|

|

|

|

||||||

|

Title IV: Transportation Research |

|

|

|

|

|

|

||||||

|

Total Contract Authority (HTF) |

|

|

|

|

|

|

||||||

|

Total Obligations |

|

|

|

|

|

|

||||||

|

Total General Fund Authorizations |

|

|

|

|

|

|

||||||

|

Total Authorizations |

|

|

|

|

|

|

Source: Federal Highway Administration, FAST Act: Funding Tables, Washington, DC, 2015, http://www.fhwa.dot.gov/fastact/estfy20162020auth.pdf. For breakout of formula programs, see Table 3.

Notes: Total Obligations are the annual obligation limitations plus exempt obligations. Totals do not include funding for the safety operations of the National Highway Traffic Safety Administration or the Federal Motor Carrier Safety Administration. The obligation limitation plus exempt obligation amounts are equal to the total contract authority under the FAST Act. The total contract authority figure does not reflect the $7.569 billion rescission scheduled for July 1, 2020.

Inflation Impacts

Table 2 displays the current-dollar obligations from FY2013 through FY2018, with adjustments for inflation.

Table 2. Trends in FAHP Obligations, FY2012-FY2018

(current and inflation-adjusted dollars in millions)

|

FY2012 |

FY2013 |

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 |

|

|

Total (Current $) |

$39,883 |

$40,438 |

$40,995 |

$40,995 |

$43,100 |

$44,005 |

$44,973 |

|

% Change from Previous Year |

— |

+1.4% |

+1.4% |

0.0% |

+5.1% |

+2.1% |

+2.2% |

|

Total (Inflation-Adjusted, 2012 $) |

$39,883 |

$39,659 |

$39,590 |

$39,467 |

$41,397 |

$41,256 |

NA |

|

% Change from Previous Year |

— |

-0.6% |

-0.2% |

-0.3% |

+4.9% |

-0.3 |

NA |

Sources: FHWA. Cost adjustments calculated by CRS using Bureau of Economic Analysis, Price Indexes for Gross Government Fixed Investment by Type, National Income and Product Accounts Table 5.9.4B, Line 40: State and local highways and streets. Weighted average used to approximate FY2013 through FY2017.

Note: NA means not available.

Formulas and Apportionments

The apportioned programs include five "core" programs plus the Metropolitan Planning Program. The core programs are the National Highway Performance Program (NHPP), the Surface Transportation Block Grant Program (STBG), the Highway Safety Improvement Program (HSIP), the Congestion Mitigation and Air Quality Improvement Program (CMAQ), and the National Highway Freight Program (NHFP). The FAST Act does not use separate formulas to determine each state's apportionments under each core program. Instead, the act provides for a single gross apportionment to each of the states, which is then divided up among the programs. A summary of the process follows.

12Calculation of State Amounts

Each year, the process begins by calculating the apportionment total for each state. For the amounts available for apportionment in each year, see Table 3.

Prior to making the calculation of state apportionments, FHWA is to reserve for NHPP $54 million for FY2019 and $67 million for FY2020, and for STBG $981 million in FY2019 and $1.020 billion for FY2020. Each state's share of the reserve funds is determined by multiplying the reserved totals for the year by the ratio that each state's FY2015 apportionments bear to the nationwide total for FY2015. This increases the support for these programs relative to total funds available without changing the percentages mentioned below.1213 The total amount available for apportionment after reserving these funds is the "base apportionment amount."

The base apportionment amount for each state is then determined by multiplying the nationwide base apportionment amount by the ratio that each state's FY2015 apportionments bear to the nationwide total for FY2015.13

Next, the initial amounts are adjusted, if necessary, to assure that if any state's total base apportionment plus reserve funds is less than 95 cents for every dollar the state contributed to the highway account of the HTF (based on the most recent fiscal year for which data are available), the state's share is raised to that level. The money to raise these states' shares would come from a pro rata reduction of funds of states whose apportionments are in excess of a 95% return on contributions.

Division of State Shares of Apportionments Among Programs

The division among programs of the states' share of base apportionments is as follows.

The amount determined for the NHFP is set aside from each state's base apportionment. Each state's portion of the set-aside is calculated by multiplying the nationwide set-aside total by the ratio of each state's total base apportionment to the total base apportionment of all states (in effect, the FY2015 state share ratio). Within each state's freight program set-aside, a Metropolitan Planning (MP) Program set-aside is determined based on each state's FY2009 MP apportionment ratio to the state's total apportionment for FY2009.

Second, of the amounts remaining of each state's base apportionments after the NHFP set-aside, an amount is distributed for the Congestion Management and Air Quality Improvement (CMAQ) program based on the ratio of the state's FY2009 CMAQ apportionment to that state's total FY2009 apportionments.

Third, an amount is distributed for each state's MP program from the amount remaining after the NHFP set-aside. Each state's amount is calculated based on the relative size of the state's apportionments for FY2009 to its total apportionments. These amounts are added to the MP program totals taken from the NHFP.

Fourth, the remainder of each state's base apportionment is divided among the three remaining core programs as follows: 63.7% is apportioned to the NHPP, 29.3% to the STBG, and 7% to the HSIP. (HSIP has two internal set-asides: first, $225 million for FY2016, growing to $245 million for FY2020, is annually set aside for the Rail-Highways Crossings Program, and $3.5 million annually is set aside for safety grants.)

Fifth, the STBG (each year) and NHPP (for FY2019-FY2020 only) reserve funds are added to each state's STBG and NHPP amounts calculated from the state's base apportionments.

After the state amounts are determined, each state's amount is divided up among the core programs according to statute. For more details on highway formulas see CRS Report R45727, The Highway Funding Formula: History and Current Status. Table 3 shows the dollar amounts of the aggregate programmatic split.14

|

Program |

FY2016 |

FY2017 |

FY2018 |

FY2019 |

FY2020 |

Total |

|

National Highway Performance Program (NHPP) |

22,332 |

22,828 |

23,262 |

23,741 |

24,236 |

116,399 |

|

Surface Transportation Block Grant Program (STBG) |

11,163 |

11,424 |

11,668 |

11,876 |

12,137 |

58,268 |

|

Highway Safety Improvement Program (HSIP) |

2,226 |

2,275 |

2,318 |

2,360 |

2,407 |

11,585 |

|

Safety-related programs (HSIP set-aside) |

3.5 |

3.5 |

3.5 |

3.5 |

3.5 |

17.5 |

|

Railway-highway crossings (HSIP set-aside) |

225 |

230 |

235 |

240 |

245 |

1,175 |

|

National Highway Freight Program (NHFP) |

1,140 |

1,091 |

1,190 |

1,339 |

1,487 |

6,247 |

|

Congestion Mitigation & Air Quality Improvement Program (CMAQ) |

2,309 |

2,360 |

2,405 |

2,449 |

2,499 |

12,023 |

|

Metropolitan Transportation Planning |

329 |

336 |

343 |

350 |

359 |

1,718 |

|

Total |

39,728 |

40,548 |

41,424 |

42,359 |

43,373 |

207,432 |

Source: Federal Highway Administration. STBG amounts include the transportation alternatives annual set-aside of $751 million. Totals may not add due to rounding. NHFP figures represent net amounts after a portion is applied to the Metropolitan Planning Program under §1104(b)(6). Totals represent gross authorizations. State-by-state apportionments are available at http://www.fhwa.dot.gov/fastact/estfy20162020apports.pdf.

Bipartisan Budget Act of 2018: Additional Appropriated Amounts

On February 9, 2018, President Trump signed the Bipartisan Budget Act of 2018 (P.L. 115-123), which raised the ceilings on nondefense discretionary spending for FY2018 and FY2019 by $63.3 billion and $67.5 billion, respectively. House and Senate leaders agreed to work with the appropriators to ensure that at least $10 billion per year of these additional outlays would be provided for infrastructure, including surface transportation. The Consolidated Appropriations Act, 2018 (P.L. 115-141), provided additional infrastructure funding from the general fund in accordance with the Bipartisan Budget Act, including $2.525 billion for FHWA programs. The vast majority of these funds, $1.98 billion, was to be for road and bridge projects eligible under the Surface Transportation Block Grant Program, and was apportioned to the states in the same ratio as the FY2018 obligation limitation distribution.15 The remainder was for the Puerto Rico Highway Program ($15.8 million), the Territorial Highway Program ($4.2 million), the Nationally Significant Federal Lands and Tribal Projects Program ($300 million), and a competitive bridge program for states that have a population density of less than 100 individuals per square mile ($225 million). These funds are general funds and were not credited to the HTF.

Core Highway Formula Programs

Although each core program has specific objectives, the core programs also have many areas of overlapping eligibility to increase states' ability to use the funds as they prefer.

National Highway Performance Program (NHPP; FAST Act §1106)

NHPP is the largest of the federal-aid highway programs, with annual authorizations averaging over $23 billion. The program supports improvement of the condition and performance of the National Highway System (NHS), which includes Interstate System highways and bridges as well as virtually all other major highways. NHPP funds projects to achieve national performance goals for improving infrastructure condition, safety, mobility, and freight movement, consistent with state and metropolitan planning; construction, reconstruction, or operational improvement of highway segments; construction, replacement, rehabilitation, and preservation of bridges, tunnels, and ferry boats and ferry facilities; inspection costs and the training of inspection personnel for bridges and tunnels; bicycle transportation infrastructure and pedestrian walkwaysinfrastructure; intelligent transportation systems; and environmental restoration, as well as natural habitat and wetlands mitigation within NHS corridors. If Interstate System and NHS bridge conditions in a state fall below the minimum conditions established by the Secretary of Transportation, certain amounts would be transferred from other specified programs in the state. NHPP funds may be used for Appalachian Development Highway System projects with no state match. NHPP may be used to pay subsidy and administrative costs under the Transportation Infrastructure Finance and Innovation Act (TIFIA). States also may use NHPP funds on bridges not on the NHS as long as the bridge is on the federal-aid highway system. Additionally, states may use NHPP funds for projects intended to reduce the risk of failure of critical infrastructure.

Surface Transportation Block Grant Program (STBG; FAST Act §1109)

STBG is the federal-aid highway program with by far the broadest eligibility criteria. Funds can be used on any federal-aid highway, on bridge projects on any public road, on transit capital projects, on routes for nonmotorized transportation, and on bridge and tunnel inspection and inspector training. The FAST Act authorizes an annual average of almost $11.7 billion for STBG. The STBG replaces the former Surface Transportation Program. The Transportation Alternatives Program, which funded such projects as bicycle paths and walkways, is effectively absorbed into the STBG program. The FAST Act provides that $850 million per year from the STBG apportionment be set aside for transportation alternative-like uses. States and MPOs obligating these funds are to develop a competitive process for local public entities to submit projects for funding. A portion of the set-aside is directed toward the recreational trails program, from which states may apply to opt out.

STBG funds may be used for Appalachian Development Highway System projects with no state match. Virtually any federally eligible mass transit use may receive STBG funds. Carpool projects and electronic toll collection and congestion management projects are eligible for STBG funding. Repairs to off-system bridges and bridge replacement at the same location are generally eligible for STBG funding.

Congress required that a portion of a state's STBG funding be allocated by the state's DOT for projects in specified locations based on a population formula. The percentage allocated to areas in the state by population increases by one percentage point each year over the life of the FAST Act, from 51% for FY2016 to 55% for FY2020. The remainder may be spent anywhere in the state. STP funds equal to 15% of the state's highway bridge apportionment for FY2009 are to be set aside for off-system bridges, but there is no upper percentage limit on bridge spending. Some STBG funds reserved for rural areas may be used on minor collector roads.

Highway Safety Improvement Program (HSIP; FAST Act §1113)

HSIP supports projects that improve the safety of road infrastructure by correcting hazardous road locations, such as dangerous intersections, or making road improvements, such as adding rumble strips. Under the FAST Act, HSIP is funded at an annual average ofaverages $2.556 billion, annually. The Rail-Highway Grade Crossing Program continues as an HSIP set-aside and averagesaveraging $235 million per year. The FAST Act broadened the eligibility to make vehicle-to-vehicle technology, median separations, and other infrastructure projects eligible. A smaller set-aside of $3.5 million annually is provided for discretionary safety grants.16

Congestion Mitigation and Air Quality Improvement Program (CMAQ; FAST Act §1114)

CMAQ was established to fund projects and programs that may reduce emissions of transportation-related pollutants. In recent years, well over $1 billion of the annual CMAQ funding has been transferred to the Federal Transit Administration.1718 Under the FAST Act, CMAQ's average annual authorization is $2.405 billion. The act expands eligibility to include port-related freight operations, or projects to reduce emissions from port-related road or nonroad equipment within a nonattainment or maintenance area. The installation of vehicle-to-infrastructure communication equipment has also been made CMAQ-eligible.

National Highway Freight Program (NHFP; FAST Act §1116)

Annual apportionments for NHFP will average about $1.249 billion annually through FY2020. This new program is to help states and MPOs remove impediments to the movement of goods. Section 1116 requires FHWA to establish the NHFN, made up of the primary highway freight system, critical rural freight corridors, critical urban freight corridors, and any Interstate System highways not so designated. Large states (any states that have over 2% of the total mileage on the NHFN) would beare required to spend their apportionment on the primary, rural, or urban freight system roads. A stateStates with less than 2% of total NHFN miles couldcan spend itstheir funds on any part of the NHFN within the state. States can commit upstate's NHFN. Up to 10% of their NHFP funds tocan be spent on intermodal or freight rail projects.

Transferability Among the Core Programs

States may transfer up to 50% of any apportionment to any other apportioned program. However, no transfers are permitted of funds that are suballocated to areas by population (such as STBG) or of Metropolitan Planning funds. The broad areas of eligibility overlap among the core programs under the FAST Act should make it easier for states to operate within the 50% restriction on transfers.

Other Highway Programs

Nationally Significant Freight and Highway Projects (NSFHP; FAST Act §1105)

The NSFHP, also referred to as Infrastructure for Rebuilding America (INFRA), provides an average of $900 million per year in discretionary grants for projects of regional or national importance, as determined by the Office of the Secretary of Transportation. States, groups of states, municipal governments, special purpose districts or transportation authorities, Indian tribes, federal land agencies, and other public entities may apply. Applicants may apply directly to the Secretary of Transportation, circumventing the state DOTs.1819 Applications must meet eligibility requirements that emphasize improving freight movement and must involve work on the National Highway Freight Network, highway or bridge projects on the National Highway System, intermodal projects, or railway-highway grade crossing or separation projects. Grants for projects of $100 million or more are to be the primary focus (with a $500 million upper limitation over the life of the program for freight intermodal or freight rail projects). However, 10% of funds are to be reserved for small projects. Also, 25% of available funds are to be reserved for projects in rural areas. The federal project share is not to exceed 60%. Applicants may use NSFHP funds to pay subsidy and administrative costs of financing arranged under the Transportation Infrastructure Finance and Innovation Act (TIFIA).

Emergency Relief Program (ER; FAST Act §1107)

ER funds are made available following natural disasters or catastrophic failures (from an external cause) for emergency repairs, restoration of federal-aid highway facilities to predisaster conditions, and debris removal from roads on tribal and federal lands. The program is funded by an annual authorization of $100 million from the HTF and general fund appropriations authorized on a "such sums as necessary" basis, usually in supplemental appropriations bills. ER funds can only be used on federal-aid highways. Generally, the Federal Emergency Management Agency, not FHWA, funds off-system road damage and debris removal after major disasters.19

Territorial and Puerto Rico Highway Program (FAST Act §1115)

The Puerto Rico and Territorial Highway programs are funded at $158 million and $42 million annually, respectively, through FY2020.

Appalachian Development Highway System Program (ADHS; FAST Act §1435)

The ADHS is made up of designated corridors in the 13 participating Appalachian states. The ADHS program is a road-building program intended to break Appalachia's isolation and encourage economic development. Construction has been ongoing since the mid-1960s. The ADHS is not a free-standing federal-aid program with a separate authorization, but eligibilities for ADHS projects are incorporated into the eligibilities of NHPP and STBG. ADHS projects may have a federal share of up to 100% as determined by the states.20

Construction of Ferry Boats and Ferry Facilities (FAST Act §1112)

The Ferry Boats and Ferry Terminal Facilities Program is a formula program that includes no set-asides for specific states.2122 The FAST Act provides $80 million annually, available until expended, for the construction of ferry boats and terminal facilities. The funding is to be apportioned according to a formula weighted by passengers (40%), vehicles carried (35%), and total route miles (30%). The FAST Act requires that unused allocations be withdrawn and redistributed after four years. Ferry boats and facilities are also eligible for formula funds under the NHPP.

Federal Lands and Tribal Transportation Programs (FAST Act §§1117-1121)

The program has three main components:

- The Tribal Transportation Program distributes funds among tribes mainly under a statutory formula based on road mileage, tribal population, and relative need. The FAST Act provides an average annual authorization of $485 million. The FAST Act establishes a Tribal Transportation Self-Governance Program to allow the Secretary to delegate the administration of the program to tribes that meet certain financial and managerial criteria.

- The Federal Lands Transportation Program is funded at an average annual authorization of $355 million. Of this amount, an average of $284 million is provided for the National Park Service, $30 million annually for the Fish and Wildlife Service, and $17 million on average annually for the Forest Service for transportation activities. The remaining funding is allocated among other federal land management agencies, the Forest Service, the Corps of Engineers, the Bureau of Land Management, the Bureau of Reclamation, and the agencies with natural resource and land management responsibilities.

- The Federal Lands Access Program supports projects that are on, adjacent to, or provide access to federal lands. Funding is allocated among the states by a formula based on the amount of federal land, the number of recreational visitors, federal road mileage, and the number of federally owned bridges. The FAST Act provides an average annual authorization of $260 million for this program.

In addition, the FAST Act established the Nationally Significant Federal Lands and Tribal Projects Program (NSFLTP) under Section 1123 to support large projects on federal and tribal lands. Projects must have an estimated cost of at least $25 million, with priority given to projects costing over $50 million. NSFLTP is authorized at $100 million annually, but requires an appropriation to make funds available. To date, Congress has provided $300 million for the program in the Consolidated Appropriations Act, 2018 (P.L. 115-141).

Transportation Infrastructure Finance and Innovation Act Program (TIFIA; FAST Act §2001)

The TIFIA program provides secured loans, loan guarantees, and lines of credit for major surface transportation projects.2223 Loans must be repaid with a dedicated revenue stream, typically a project-related user fee, such as a toll. TIFIA is funded at $300 million for FY2019 and FY2020. Assuming an average subsidy cost of 7%, this funding may allow lending of roughly $4.3 billion in each year.2324 States may use their NHPP and STBG funds to pay the administrative and subsidy costs of the program. Discretionary INFRA grants can also be used to pay these costs.

The minimum amount of TIFIA assistance for a single project is $50 million, except for intelligent transportation system projects ($15 million), rural projects ($10 million), transit-oriented development ($10 million), and local government projects ($10 million).2425 Ten percent of program funds are set aside to assist rural projects. Additionally, whereas loans for urban projects must be charged interest not less than the Treasury rate, projects assisted by the rural set-asiderural projects are offered loans at half the Treasury rate. Rural projects are defined to include any project in an area outside of an urbanized area with a population greater than 150,000 individuals. TIFIA funds may be used to capitalize state infrastructure banks and to build infrastructure in support of transit-oriented development.

TIFIA assistance is permitted for any eligible project, subject to certain eligibility criteria. One of the key criteria is creditworthiness. To be eligible, a project's senior debt obligations and the borrower's ability to repay the federal credit instrument must receive investment-grade ratings from at least one nationally recognized credit rating agency. The TIFIA assistance must also be determined to have several beneficial effects: fostering a public-private partnership, if appropriate; enabling the project to proceed more quickly; and reducing the contribution of federal grant funding. Other eligibility criteria include satisfying planning and environmental review requirements and being ready to contract out construction within 90 days after the obligation of assistance.

Tolling

Tolling of non-Interstate federal-aid highways has been allowed since 1992.2526 Totally new Interstate Highway routes or extensions of existing routes may be built as toll roads. Toll lanes may be added to an existing Interstate route as long as the number of "free" lanes is maintained. Public authorities may impose tolls on single occupant vehicles for access to high occupancy vehicle (HOV) lanes. Under the Interstate System Construction Toll Pilot Program, up to three toll-free Interstate Highway segments in three states may be subject to tolls when that is the only way to provide funding for rehabilitation or reconstruction. If the selected states have not started construction within three years of approval, their approval lapses and other states may apply to participate in the pilot program. States may use congestion pricing on tolled road segments, and intercity buses must have the same access to toll roads and pay the same tolls as public transportation buses. Tolls are important revenue streams for many public-private partnerships and alternative financing mechanisms, which have received strong support in Congress. FHWA does not regulate toll rates.

Author Contact Information

Footnotes

| 1. |

Federal Highway Administration, Fixing America's Surface Transportation Act or "FAST Act," December 2015, http://www.fhwa.dot.gov/fastact/. |

|

| 2. |

Federal Highway Administration, Funding Federal-Aid Highways, FHWA-PL-17-011, January 2017, pp. 37-39, https://www.fhwa.dot.gov/policy/olsp/fundingfederalaid/FFAH_2017.pdf. |

|

| 3. |

For a more detailed discussion see ibid., pp. 1-2, 5-14, and 23-29. |

|

| 4. |

Ibid., pp. 31-34. To be contract authority the authorization must refer to Title 23, Chapter 1 of the U.S. Code, and it must be funded out of the Highway Trust Fund. |

|

| 5. |

Federal Highway Administration, Highway Statistics, 2015: Federal Highway-User Fees, Table FE-21B, Washington, DC, August 2016, https://www.fhwa.dot.gov/policyinformation/statistics/2015/fe21b.cfm. |

|

| 6. |

Nonfuels taxes accrue only to the highway account. A separate 0.1-cents-per-gallon tax on all fuels goes into the leaking underground storage tank (LUST) trust fund, which is administered by the Environmental Protection Agency and the states. |

|

| 7. |

Federal Highway Administration, FHWA Forecasts of Vehicle Miles Traveled (VMT): Spring 2018, Washington, DC, May 2018, https://www.fhwa.dot.gov/policyinformation/tables/vmt/vmt_forecast_sum.pdf. |

|

| 8. |

The imbalance between revenues and outlays first emerged in FY2002, but the unexpended balances in the HTF were sufficient to cover the imbalance until FY2008. |

|

| 9. |

Since September 15, 2008, a total of $143.627 billion has been transferred to the HTF from Treasury general funds and the LUST trust fund, including $114.685 billion to the highway account. |

|

| 10. |

Congressional Budget Office, Projections of Highway Trust Fund Accounts Under CBO's |

|

| 11. |

CRS Report R45350, Funding and Financing Highways and Public Transportation, by Robert S. Kirk and William J. Mallett. |

|

| 12. |

CRS Report R45727, The Highway Funding Formula: History and Current Status, by Robert S. Kirk.

|

|

|

FAST Act §1104(c). Wording in Section 1401(c) breaks the authorization calculation into three parts: the "base apportionments" and the NHPP and STBG reserved funds. These components are equal to the total apportionment authorizations under Section 1104(a)(1). The apportionment calculation for FY2016 is available at http://www.fhwa.dot.gov/legsregs/directives/notices/n4510802/. |

||

|

Federal Highway Administration, Fixing America's Surface Transportation Act or FAST Act Funding tables, 2015, http://www.fhwa.dot.gov/fastact/funding.cfm. This site includes tables that set forth the authorizations as well as the estimated apportionments on a state-by-state basis over the life of the FAST Act. |

||

|

For the FY2019 state-by-state |

||

|

CRS Report R43026, Federal Traffic Safety Programs: In Brief, by David Randall Peterman. |

||

|

American Public Transportation Association, APTA Primer on Transit Funding, FY2016-FY2020, Final Edition, Washington, DC, April 2016, p. 85, https://www.apta.com/resources/reportsandpublications/Documents/APTA-Primer-FAST-Act.pdf. |

||

|

The NSFHP is administered by the National Surface Transportation and Innovation Finance Bureau, not by FHWA. |

||

|

CRS Report R45298, Emergency Relief for Disaster-Damaged Roads and Public Transportation Systems, by Robert S. Kirk and William J. Mallett. |

||

|

Federal Highway Administration, Guide to Federal-Aid Programs: Appalachian Development Highway Program, Washington, DC, April 14, 2016, https://www.fhwa.dot.gov/federalaid/projects.pdf#page=14. |

||

|

The program is part of the Federal-Aid Highway Program because it is designed to permit federal participation in the construction of ferry boats and terminals where it is not feasible to build a bridge, tunnel, or other highway structure. |

||

|

TIFIA is administered by the Build America Bureau within the U.S. Department of Transportation. |

||

|

These subsidy estimates do not reflect reductions for administrative costs and the application of the obligation limitation, which have not been released. The subsidy cost is "the estimated long-term cost to the government of a direct loan or a loan guarantee, calculated on a net present value basis, excluding administrative costs," Federal Credit Reform Act of 1990 (FCRA), §502 (5A). |

||

|

The law generally provides eligibility for projects whose total expected costs are $50 million or more or exceed 33.3% of the amount of federal highway assistance apportioned to a state in the most recent fiscal year to the state in which the project is located. |

||

|

CRS Report R44910, Tolling U.S. Highways and Bridges, by Robert S. Kirk. |