SBA’s Office of Inspector General: Overview, Impact, and Relationship with Congress

Changes from December 11, 2018 to February 22, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- SBA's OIG

- Statutory Authorities

- Reporting Requirements

- Funding

- Staffing and Organizational Structure

- Recent Activities

- Audit Reports

- The State Trade Expansion Program

- 7(a) Loans to Poultry Farmers

- Oversight of 8(a) Program Continuing Eligibility Processes

- Investigations, Debarment Referrals, and Training Activities

- Monetary Savings and Recoveries

- Most Serious Management and Performance Challenges Facing the SBA

- Impact on Program Efficiency and Effectiveness

- Enhancing Programmatic and Operational Efficiency and the Achievement of Program Goals Through Audits

- Reducing Waste, Fraud, and Abuse Through Investigations

- Recommendations Concerning the Impact of Legislation and Regulations

- Facilitating the SBA's Relationships with Other Governmental and Nongovernmental Entities

- Keeping the SBA Administrator and Congress Fully and Currently Informed

- Relationship with Congress

Tables

- Table 1. SBA OIG's Appropriations, FY2010-FY2019

- Table 2. SBA OIG's Full-Time Equivalent Employees, FY2000-FY2019

- Table 3. SBA OIG's Audits, FY2010-FY2018

- Table 4. SBA OIG's Investigations, FY2010-FY2018

- Table 5. Legislation, Regulations, Standard Operating Procedures (SOPs), and Other Issuances Reviewed and Comments Provided, FY2010-FY2018

- Table 6. Outreach and Training Sessions, FY2010-FY2018

Summary

Congress created offices of inspector general (OIGs) to assist in its oversight of the executive branch. OIGs provide independent, nonpartisan analysis, conducted in accordance with generally accepted government auditing standards, to identify and recommend ways to limit waste, fraud, and abuse in federal programs and enhance program and operational efficiency and effectiveness. OIGs' activities supplement and complement those of the Government Accountability Office (GAO), which serves a similar, though not identical, role in assisting congressional oversight of the executive branch. Together, OIGs and GAO provide Congress with information and analysis needed to conduct effective oversight and, in the process, help Congress maintain its balance of power with the presidency.

OIGs exist in more than 70 federal agencies, including all departments and larger agencies, numerous boards and commissions, and other entities. The U.S. Small Business Administration's Office of Inspector General (SBA OIG) was created under authority of the Inspector General Act of 1978 (P.L. 95-452, as amended). Its three primary statutory purposes are to

- 1. conduct and supervise audits and investigations of the SBA's programs and operations;

- 2. recommend policies designed to promote the economy, efficiency, and effectiveness of the SBA's programs and operations and to prevent and detect fraud and abuse; and

- 3. keep both the SBA Administrator and Congress "fully and currently informed about problems and deficiencies relating to the administration of such programs and operations and the necessity for and progress of corrective action."

During FY2018, the SBA OIG issued 26 audit reports containing 111 recommendations for improving the SBA's programs and operations, and its investigations resulted in 62 indictments or informations and 43 convictions. The SBA OIG claimed that its recommendations resulted in monetary savings and recoveries of nearly $224.5 million in FY2018. In addition, the SBA OIG's annual Report on the Most Serious Management and Performance Challenges Facing the SBA focuses attention "on areas that are particularly vulnerable to fraud, waste, error, and mismanagement, or otherwise pose a significant risk and generally have been subject to one or more OIG or GAO reports."

This report examines the SBA OIG's statutory authorities; reporting requirements; funding ($26.9 million in FY2018, including $7 million in supplemental appropriations for overseeing SBA disaster assistance22.9 million in FY2018); staffing and organizational structure; and recent activities (audits, investigations, etc.). It also examines the SBA OIG's impact on monetary savings, SBA programs and operations, and legislation affecting the agency. The report concludes with observations concerning the SBA OIG's relationship with Congress.

Some areas of possible congressional interest, other than SBA OIG funding and staffing issues, include exploring ways to more accurately quantify the SBA OIG's claims of monetary savings and to determine if the SBA OIG should undertake additional tracking and monitoring activities to more accurately quantify the office's impact on SBA programs, operations, and legislation.

Introduction

Congress created offices of inspector general (OIGs) in 1978 (via P.L. 95-452, the Inspector General Act of 1978, or the IG Act) to assist in its oversight of the executive branch. At that time, Congress determined that there were serious deficiencies in the executive branch's auditing and investigative activities designed to curb waste, fraud, and abuse and promote agency operational and program efficiency.1 For example, the House and Senate reports accompanying the bill that became the IG Act argued that

- auditing and investigative activities were scattered throughout the various federal departments and were often conducted in response to a complaint as opposed to having in place "affirmative programs to look for possible fraud or abuse";

- investigators in some agencies (including the Small Business Administration, SBA) were not allowed to initiate investigations without clearance from officials responsible for the programs involved;

- many agency representatives engaged in auditing and investigative activities (including those within the SBA) reported that their office lacked sufficient budgets to do its job, many of the auditing and investigative offices (including those at the SBA) often reported to those who were responsible for the program being audited or investigated; and

- some auditors and investigators were unable to devote full time to their audit or investigative responsibilities.2

The House report concluded that independent OIGs "are urgently needed."3 The Senate report concluded that "with rare exceptions, the agencies have not adequately policed their own operations and programs."4

OIGs were designed to provide Congress and federal agency heads independent, nonpartisan analysis, conducted in accordance with generally accepted government auditing standards, to identify and recommend ways to limit waste, fraud, and abuse in federal programs and enhance operational and program efficiency and effectiveness.

OIGs' activities were to supplement and complement those of the Government Accountability Office (GAO), which serves a similar, though not identical, role in assisting Congress fulfill its oversight function.5 Together, OIGs and GAO (along with the Congressional Research Service [CRS] and the Congressional Budget Office [CBO]) provide Congress with information and analysis needed to conduct effective oversight and, in the process, help Congress maintain its balance of power with the presidency.

OIGs currently exist in more than 70 federal agencies, including all departments and larger agencies, numerous boards and commissions, and other entities.6 They are predominantly located in executive branch agencies, but several legislative branch entities—for example, the Library of Congress (LOC), GAO, and the Government Publishing Office (GPO)—also have OIGs.

The overwhelming majority of OIGs, including the U.S. Small Business Administration OIG (SBA OIG), are governed by the IG Act. It structures inspector general (IG) appointments and removals, powers and authorities, and duties and responsibilities. Other laws have established or amended IG powers and authorities in specified agencies or programs. As a result, IG statutory powers and authorities are not identical across the federal government and, in certain cases, these differences are significant. Nonetheless, in general, statutory OIGs follow the IG Act's standards, guidelines, and directives.

For example, the IG Act provides IGs five statutory duties and responsibilities as follows:

- 1. Conduct, supervise, and coordinate audits and investigations of their agency's programs and operations.7

- 2. Review existing and proposed legislation and regulations relating to their agency and make recommendations in mandated semiannual reports concerning the impact of such legislation or regulations on their agency's programs and operations or on the prevention and detection of fraud and abuse in those programs and operations.

- 3. Recommend policies to improve their agency's administration of its programs and operations and prevent and detect fraud and abuse in those programs and operations.

- 4. Recommend policies to facilitate relationships between their agency and other federal, state, and local government agencies and nongovernmental entities to promote the economy and efficiency of their agency's administration of its programs and operations and prevent and detect fraud and abuse in those programs and operations.

- 5. Keep both their agency head and Congress fully and currently informed concerning fraud and other serious problems, abuses, and deficiencies relating to their agency's administration of its programs and operations and to report on the progress made in implementing recommended corrective action.8

This report examines the SBA OIG's statutory authorities; reporting requirements; funding; staffing and organizational structure; and recent activities (audits, investigations, etc.). The SBA OIG's impact on monetary savings, SBA programs and operations, and legislation affecting the agency is also examined. The report concludes with some observations concerning the SBA OIG's relationship with Congress.

Some areas of possible congressional interest, other than SBA OIG funding and staffing issues, include exploring ways to more accurately quantify the SBA OIG's claims of monetary savings and to determine if the SBA OIG should undertake additional tracking and monitoring activities to more accurately quantify the office's impact on SBA programs, operations, and legislation.

SBA's OIG

The SBA OIG is a separate, independent office that provides "independent, objective oversight to improve the integrity, accountability, and performance of the SBA and its programs for the benefit of the American people."9 The SBA IG (Hannibal "Mike" Ware) directs the office and is "appointed by the President, by and with the advice and consent of the Senate, without regard to political affiliation and solely on the basis of integrity and demonstrated ability in accounting, auditing, financial analysis, law, management analysis, public administration, or investigations."10

The SBA is a Cabinet-level agency. Although the SBA is one of the smaller Cabinet-level agencies (with an annual budget of $2.359 billion in FY2018, including $1.659 billion in supplemental appropriations for disaster assistance715.4 billion in FY2019), it administers a relatively wide range of programs to support small businesses, including loan guaranty and venture capital programs to enhance small business access to capital; contracting programs to increase small business opportunities in federal contracting; direct loan programs for businesses, homeowners, and renters to assist their recovery from natural disasters; and small business management and technical assistance training programs to assist business formation and expansion.11 The SBA OIG is responsible for examining these programs and the various SBA offices that administer them.

IGs report to the head of their agency or establishment, but are provided various powers and protections that support their independence. For example, the SBA IG reports to the SBA Administrator, but

- may be removed from office only by the President, or through the impeachment process in Congress.12

- has the authority to hire staff.13

- determines priorities and projects (e.g., audits, reviews and investigations) without outside direction.14

- cannot be prevented or prohibited "from initiating, carrying out, or completing any audit or investigation, or from issuing any subpoena during the course of any audit or investigation."15

- must be provided "access to all records, reports, audits, reviews, documents, papers, recommendations, or other material available ... which relate to programs and operations with respect to which [the SBA] Inspector General has responsibilities under this Act."16

- must be provided "appropriate and adequate office space" and "such equipment, office supplies, and communications facilities and services as may be necessary for the operation of" the SBA OIG, including any "necessary maintenance services for such offices and the equipment and facilities located therein."17

Statutory Authorities

The IG Act provides all IGs nine statutory authorities:

- 1. Access to all records, reports, audits, reviews, documents, papers, recommendations, or other material available relating to the IG's responsibilities under the IG Act.18

- 2. Make such investigations and reports relating to their agency's administration of its programs and operations as are, in the judgment of the IG, necessary or desirable.

- 3. Request such information or assistance as may be necessary for carrying out the duties and responsibilities provided by the IG Act from any federal, state, or local governmental agency or unit thereof.

- 4. Require by subpoena the production of all information, documents, reports, answers, records, accounts, papers, and other data in any medium necessary in the performance of the functions assigned by the IG Act; provided that procedures other than subpoenas shall be used by the IG to obtain documents and information from federal agencies.

- 5. Administer to or take from any person an oath, affirmation, or affidavit, whenever necessary in the performance of the functions assigned by the IG Act.

- 6. Have direct and prompt access to their agency head when necessary for any purpose pertaining to the performance of functions and responsibilities under the IG Act.

- 7. Select, appoint, and employ such officers and employees as may be necessary for carrying out the functions, powers, and duties of the Office subject to the provisions of title 5, United States Code, governing appointments in the competitive service, and the provisions of chapter 51 and subchapter III of chapter 53 of such title relating to classification and General Schedule pay rates.

- 8. Obtain services as authorized by Section 3109 of title 5, United States Code, at daily rates not to exceed the equivalent rate prescribed for grade GS-18 of the General Schedule by Section 5332 of title 5, United States Code.

- 9. To the extent and in such amounts as may be provided in advance by appropriations acts, to enter into contracts and other arrangements for audits, studies, analyses, and other services with public agencies and with private persons, and to make such payments as may be necessary to carry out the provisions of the IG Act.19

In addition, the IG Act provides 25 OIGs, including the SBA OIG, direct law enforcement authority.20 It also authorizes the U.S. Attorney General to delegate law enforcement authority to other OIGs under specified circumstances.21

Reporting Requirements

The IG Act requires IGs to prepare and transmit semiannual reports (two per year) to their agency's head, not later than April 30 and October 31 of each year, summarizing the OIG's activities during the immediately preceding six-month periods ending on March 31 and September 30. Agency heads are to transmit these reports to the appropriate committees or subcommittees of Congress in unaltered form within 30 days after receipt. Agency heads may provide any additional comments deemed appropriate. Agency heads must also provide specified information, such as statistical tables showing the total number of audit reports, inspection reports, and evaluation reports for which final action had not been taken by the commencement of the reporting period; on which management decisions were made during the reporting period; and for which no final action had been taken by the end of the reporting period.22 Copies of the semiannual reports must be made available to the public upon request and at a reasonable cost within 60 days of their transmission to Congress.23

The OIG's semiannual reports are required to include, but not limited to, 16 informational items. For example, the SBA OIG's report must include, among other items, the following:

- A description of significant problems, abuses, and deficiencies relating to the SBA's administration of programs and operations identified during the reporting period.

- A description of the SBA OIG's recommendations for corrective action.

- An identification of each significant recommendation described in previous semiannual reports on which corrective action has not been completed.

- A summary of matters referred to prosecutive authorities and the prosecutions and convictions that have resulted.

- A summary of each report made to the SBA Administrator relating to instances when information or assistance requested has, in the IG's judgment, been unreasonably refused or not provided during the reporting period.

- A listing of each audit report, inspection report, and evaluation report issued during the reporting period and for each report, where applicable, the total dollar value of questioned costs (including a separate category for the dollar value of unsupported costs) and the dollar value of recommendations that funds be put to better use.

- A summary of each audit report, inspection report, and evaluation report issued before the commencement of the reporting period for which no management decision has been made by the end of the reporting period (including the date and title of each such report), an explanation of the reasons such management decision has not been made, and a statement concerning the desired timetable for achieving a management decision on each such report.

- Information concerning any significant management decision with which the SBA IG is in disagreement.24

IGs are also required to report suspected violations of federal criminal law directly and expeditiously to the U.S. Attorney General, and any "particularly serious or flagrant problems, abuses, or deficiencies" relating to their agency's operations and administration of programs immediately to the agency's head.25

In addition, pursuant to P.L. 106-531, the Records Consolidation Act of 2000,26 and the Office of Management and Budget (OMB) Circular A-136,27 the SBA OIG issues an annual Report on the Most Serious Management and Performance Challenges Facing the SBA. This report is, arguably, the SBA OIG's signature oversight document, focusing attention "on areas that are particularly vulnerable to fraud, waste, error, and mismanagement, or otherwise pose a significant risk and generally have been subject to one or more OIG or GAO reports."28

Funding

The IG Act provides presidentially appointed IGs a separate appropriations account, known colloquially as a "line item," for their offices. This provision prevents federal administrators from limiting, transferring, or otherwise reducing OIG funding once it has been specified in law.29

IGs are authorized to transmit a budget estimate and request to their respective agency head each fiscal year. Each IG's request must include amounts for operations, training, and for the support of the Council of the Inspectors General on Integrity and Efficiency (CIGIE).30

The agency's budget request to the President must include the OIG's original budget request and any comments the affected IG has regarding the proposal.31 The President is required tomust include in the Administration's budget submission to Congress the IG's original request; the amount requested by the President for the OIG's operations, training, and support for CIGIE; and any comments the affected IG has regarding the proposal if the IG concludes that the President's budget would substantially inhibit the IG from performing the duties of the office.32

Each year, the SBA OIG transmits a budget justification document to the SBA Administrator, which is available online.33 That document includes the SBA OIG's budget request, an overview of the SBA OIG's mission and authorities, a list of critical risks facing the SBA, an accounting of the office's oversight activities during the previous fiscal year, areas of emphasis for the coming fiscal year, and a table of statistical highlights and accomplishments for the previous fiscal year (such as the number of reports and recommendations issued, estimated amounts saved or recouped, number of indictments and convictions).

Table 1 shows the SBA OIG's appropriations over the FY2010-FY2019 period. The SBA OIG received an appropriation of $26.9 million for FY2018: $19.9 million in new budget authority (including $160,000 for training and $42,000 for CIGIE) and $7 million in supplemental appropriations (provided by P.L. 115-123, the Bipartisan Budget Act of 2018) for investigative costs related to supplemental funding for SBA disaster loans.34

The SBA OIG has requested $22.9 million for FY2019: $21.9 million in new budget authority (including $160,000 for training and $51,000 for CIGIE) and a $1 million transfer from the SBA Disaster Loan Program account for investigative costs related to SBA disaster loans.35

|

Fiscal Year |

New Budget Authority |

Transfer from the Disaster Loan Program Account |

Other Adjustments |

Total |

|||||||||||

|

2019 request

|

|

|

|

|

|||||||||||

|

2018

|

|

|

|

|

|||||||||||

|

2017

|

|

|

|

|

|||||||||||

|

2016

|

|

|

|

|

|||||||||||

|

2015

|

|

|

|

|

|||||||||||

|

2014

|

|

|

|

|

|||||||||||

|

2013

|

|

|

|

|

|||||||||||

|

2012

|

|

|

|

|

|||||||||||

|

2011

|

|

|

|

|

|||||||||||

|

2010

|

|

|

|

|

Sources: P.L. 111-117, the Consolidated Appropriations Act, 2010; P.L. 112-10, the Department of Defense and Full-Year Continuing Appropriations Act, 2011; P.L. 112-25, the Budget Control Act of 2011; P.L. 112-74, the Consolidated Appropriations Act, 2012; P.L. 112-175, the Continuing Appropriations Resolution, 2013; P.L. 113-2, the Disaster Relief Appropriations Act, 2013; P.L. 113-6, the Consolidated and Further Continuing Appropriations Act, 2013; P.L. 113-76, the Consolidated Appropriations Act, 2014; P.L. 113-235, the Consolidated and Further Continuing Appropriations Act, 2015; P.L. 114-113, the Consolidated Appropriations Act, 2016; P.L. 115-56, the Continuing Appropriations Act, 2018 and Supplemental Appropriations for Disaster Relief Requirements Act, 2017; P.L. 115-123, the Bipartisan Budget Act of 2018; P.L. 115-141, the Consolidated Appropriations Act, 2018; and U.S. Small Business Administration, Office of Inspector General, "FY2019 Congressional Budget Justification," p. 219, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2019_CBJ_Office_of_Inspector_General.pdfP.L. 116-6, the Consolidated Appropriations Act, 2019.

Notes:

a. In FY2018, P.L. 115-123, the Bipartisan Budget Act of 2018 provided the SBA OIG $7.0 million for investigative costs related to supplemental funding for SBA disaster loans.

b. In FY2013, P.L. 113-2 provided the SBA OIG $5.0 million to remain available until expended for expenses related to oversight of disaster loans following Hurricane Sandy. In addition, P.L. 112-25 and P.L. 113-6 imposed a federal government-wide sequestration process and a required 0.2% across-the-board rescission, resulting in a $1.101 million reduction from the SBA OIG's budget.

c. In FY2011, P.L. 112-10 imposed a 0.2% rescission on federal agencies, resulting in a reduction of $0.033 million from the SBA OIG's budget.

Staffing and Organizational Structure

As shown in Table 2, the SBA OIG's FTEs have remained relatively stable since FY2000, ranging from a low of 93 FTEs in FY2014 to a high of 112 FTEs in FY2000. The SBA OIG had 101 FTEs in FY2017, anticipates having 107 FTEs in FY2018, and has requested funding to support 114113 FTEs in FY2019.36 Approximately 85% of the SBA OIG's expenditures are attributed to payroll expenses.3735

In 2013, then-SBA IG Peggy Gustafson testified that "resource constraints do sometime preclude us from initiating or continuing a number of investigations" and if she were provided additional resources, she would "target early defaulted loans, fraud, and lender negligence, and ... increase the capacity of our existing investigative personnel."38

|

Fiscal Year |

Full-Time Equivalent Employees |

Fiscal Year |

Full-Time Equivalent Employees |

||

|

|

114 |

2009 |

104 |

||

|

|

107 |

2008 |

106 |

||

|

|

101 |

2007 |

103 |

||

|

|

96 |

2006 |

95 |

||

|

|

103 |

2005 |

95 |

||

|

|

93 |

2004 |

98 |

||

|

|

106 |

2003 |

100 |

||

|

|

110 |

2002 |

108 |

||

|

|

110 |

2001 |

108 |

||

|

|

110 |

2000 |

112 |

Sources: U.S. Small Business Administration, Office of Inspector General, "Correspondence with the author," June 23, 2016, and February 1, 2017; U.S. Small Business Administration, Office of Inspector General, "FY2018 Congressional Budget Justification," p. 3, at https://www.sba.gov/sites/default/files/aboutsbaarticle/Office_of_Inspector_General_-_FY_2018_CBJ.pdf; and U.S. Small Business Administration, "FY2019 Congressional Budget Justification and FY2017 Annual Performance Report," p. 17, at https://www.sba.gov/sites/default/files/aboutsbaarticle/SBA_FY_2019_CBJ_APR_2_12_post.pdf; U.S. Small Business Administration, "SBA Plan for Operating in the Event of a Lapse in Appropriations," effective December 2018, p. 22; and U.S. Small Business Administration, "SBA Plan for Operating in the Event of a Lapse in Appropriations," effective February 14, 2019, p. 22, at https://www.sba.gov/document/report--sba-plan-operating-event-lapse-appropriations.

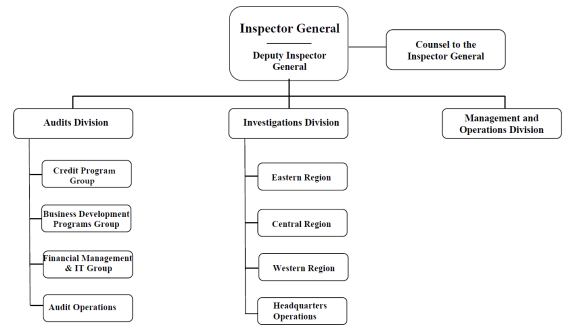

The SBA OIG's staff is organized into three divisions and several support offices

- The Auditing Division performs and oversees audits and reviews of SBA programs and operations, focusing on SBA business and disaster loans, business development and government contracting programs, as well as mandatory and other statutory audit requirements involving computer security, financial reporting, and other work.

- The Investigations Division manages a program to detect and deter illegal and improper activities involving SBA's programs, operations, and personnel. The division has criminal investigations staff who carry out a full range of traditional law enforcement functions and security operations staff who conduct name checks and, where appropriate, fingerprint checks on program applicants to prevent known criminals and wrongdoers from participating in SBA programs. Security operations staff also conduct required employee background investigations.

- The Management and Administration Division provides business support (e.g., budget and financial management, human resources, IT, and procurement) for the various OIG functions and activities.

- The Office of Counsel provides legal and ethics advice to all OIG components; represents the OIG in litigation arising out of or affecting OIG operations; assists with the prosecution of criminal, civil, and administrative enforcement matters; processes subpoenas; responds to Freedom of Information and Privacy Act requests; and reviews and comments on proposed policies, regulations, legislation, and procedures.

- The OIG Hotline, under the purview of the Chief of Staff, reviews allegations of waste, fraud, abuse, or serious mismanagement within the SBA or its programs from employees, contractors, and the public.

39

37The SBA OIG's headquarters is located in Washington, DC. The SBA OIG's Investigations Division has 12 field offices located across the United States.4038

The SBA OIG's structure is shown in its organizational chart (see Figure 1).

|

|

Source: U.S. Small Business Administration, Office of Inspector General, "SBA OIG Organization Chart," at https://www.sba.gov/sites/default/files/oig/SBA_OIG_Organization_Chart.pdf. |

Recent Activities

As mentioned previously, the SBA OIG conducts and supervises audits and investigations of the SBA's programs and operations. As a complement to its criminal and civil fraud investigations, the SBA OIG also recommends to the SBA suspensions, debarment, and other administrative enforcement actions against SBA lenders, borrowers, contractors, and others who have engaged in fraud or have otherwise exhibited a lack of business integrity.4139 The SBA OIG also conducts, supervises, and participates in various training activities to counter fraud in SBA programs.

Audit Reports

During FY2018, the SBA OIG issued 26 audit reports containing 111 recommendations for improving the SBA's operations. The SBA's OIG provided several examples in its FY2018 semi-annual reports to Congress of what it considered to be among its more noteworthy audits, including the following:

The State Trade Expansion Program

An audit of the SBA's State Trade Expansion Program (STEP) determined that "while SBA has made significant progress in improving the overall management and effectiveness of STEP since the audit of the pilot program in 2012, SBA needs to improve its performance measures and its program oversight" or be "at risk of not fully realizing the impact of the program in increasing the number of small businesses exploring significant new trade opportunities."4240 The OIG made six recommendations to improve the program. The SBA planned actions to resolve five of the six recommendations and had already implemented actions to resolve one of the recommendations by the audit's completion.43

7(a) Loans to Poultry Farmers

The OIG examined a sample of 11 7(a) loans (out of about 1,500 7(a) loans) made to poultry farmers from FY2012 to FY2016 and determined that these loans did not meet regulatory and SBA requirements for eligibility because the large chicken companies (integrators) in their sample "exercised such comprehensive control over the growers [through a series of contractual restrictions, management agreements, oversight inspections, and market controls] that SBA OIG believes the concerns appear affiliative under SBA regulations."4442 The OIG concluded that "therefore, SBA and lenders approved 7(a) loans that were apparently ineligible under SBA size standard regulations and requirements."4543

The OIG found that integrator controls overcame practically all of a grower's ability to operate their business independent of integrator mandates and concluded that, as a result, "from FY2012 to FY2016, SBA guaranteed approximately $1.8 billion in loans that may be ineligible."4644 The OIG recommended that (1) the SBA review the loans cited in the evaluation sample to determine their eligibility and take appropriate corrective action and (2) review the arrangements between integrators and growers and "establish and implement controls, such as supplemental guidance, to ensure SBA loan specialists and lenders make appropriate affiliation determinations."4745 The SBA agreed with both recommendations.4846

Soon after the OIG's report was released, the SBA issued a statement indicating that it had reviewed the 11 loans cited in the report and confirmed that the loans "were correctly made in accordance with agency policy at the time."4947 The SBA also assured borrowers and lenders that existing 7(a) loan guarantees to poultry famers would continue to be honored and that the SBA is "examining the policies and procedures around poultry loans to ensure SBA loans continue to be directed towards those small businesses most in need of assistance."5048 The SBA subsequently held several public forums "to better understand the use of SBA guaranteed loans by small farmers in the poultry industry."51

Oversight of 8(a) Program Continuing Eligibility Processes

The OIG audited the SBA's oversight of the Minority Small Business and Capital Ownership Development Program (commonly known as the "8(a) program") continuing eligibility processes "to determine whether SBA's oversight ensured 8(a) program participants met continuing eligibility requirements."5250 The 8(a) program is designed to assist small businesses unconditionally owned and controlled by one or more socially and economically disadvantaged individuals with training, technical assistance, and contracting opportunities.5351

The OIG found that 20 of the 25 firms it reviewed should have been removed from the 8(a) program and that these firms received $126.8 million in new 8(a) set-aside contract obligations in FY2017 "at the expense of eligible disadvantaged firms."5452 The OIG concluded that the SBA "did not consistently identify ineligible firms in the 8(a) program," "did not always act to remove firms it determined were no longer eligible for the program," "did not perform required continuing eligibility reviews when it received specific and credible complaints regarding firms' eligibility," and "did not log all complaints."5553

The OIG made 11 recommendations to improve the overall management of the 8(a) program continuing eligibility processes. The SBA agreed with 7 of the recommendations, partially agreed with the other 4 recommendations, and reported that it planned to conduct continuing eligibility reviews for the firms that the OIG identified as ineligible and take appropriate action.56

Investigations, Debarment Referrals, and Training Activities

In FY2018, the SBA OIG's investigations resulted in 62 indictments or informations and 43 convictions.5755 For example,

- A Missouri man was sentenced in federal court to 30 months in prison and five years of supervised release and ordered to pay $1,675,495 in restitution following an OIG investigation that revealed that the man committed bank fraud and made false statements to a financial institution in connection with his role in defrauding the SBA and a bank. The man was involved in a scheme to obtain a $2.9 million SBA loan through the use of straw companies and false business records. A co-conspirator had previously entered into a settlement agreement with the bank wherein he agreed to pay back $1.8 million of misappropriated SBA loan proceeds.

5856

- An employee of a large defense contractor was sentenced in federal court to five years of imprisonment and three years of supervised release, was fined $50,000, and ordered to forfeit $1,273,440 after an OIG investigation revealed that he "had utilized a retired U.S. Army colonel's Section 8(a) communications and engineering firm as a front company to obtain government contracts."

5957 The retired colonel (and owner) was sentenced in federal court to five years of imprisonment and three years of supervised release, was fined $100,000, and forfeited $3 million in proceeds earned by his now defunct 8(a) firm.6058

- A Missouri veteran pled guilty to wire fraud and major program fraud following an OIG investigation that revealed that he was involved in a scheme to fraudulently claim service-disabled veteran-owned small business status for a firm to enable that firm to obtain a $40 million DOD contract. The veteran posed as a figurehead for the firm in exchange for monetary compensation for his participation in the scheme.

61

59The SBA OIG also sent 84 present responsibility actions (suspension and debarment referrals) to the SBA that resulted in 25 proposed debarments and 17 final debarments.6260 As will be discussed later, the SBA OIG also annually provides training and outreach sessions, attended by more than 1,000 government employees, lending officials, and law enforcement representatives, on topics related to fraud in government lending and contracting programs.63

Monetary Savings and Recoveries

The SBA OIG reports that its audits and investigations resulted in monetary savings and recoveries of nearly $224.5 million in FY2018 ($55.4 million from potential investigative recoveries and fines, $22.9 million from asset forfeitures, $0.73 million for loans or contracts not approved or canceled, and $145.4 million in disallowed costs agreed to by management).64

Most OIGs, including the SBA OIG, quantify their monetary savings by identifying and reporting amounts affected by their activities. This methodological approach, arguably, provides a fairly good overview of the OIG's activities' scope, nature, and impact. However, this approach has limitations. For example, precise data concerning monetary savings are not always readily available. Also, from a budgetary perspective, the monetary savings identified is sometimes less than the actual monetary savings realized. For example,

- Savings from potential recoveries and fines ($55.4 million in FY2018) is derived from the actual amount imposed by courts in criminal sentencings (including fines and restitution), criminal settlements, and civil settlements. These recoveries are deemed "potential" because the court ordered them in FY2018, but they may not have been collected yet. The SBA OIG does not track collections resulting from these orders. As a result, the SBA OIG is not able to report the final amount of money actually recovered.

6563

- Savings from loans or contracts not approved or cancelled ($0.73 million in FY2018) is "comprised of the sum of the amounts that would have been borrowed as loans or awarded via contracts had there been no involvement by the OIG Investigations Division."

6664 From a budgetary perspective, the actual monetary savings generated by these actions is less than the amount cited.6765 When a SBA loan is not approved, no funds are returned to the SBA because the loan amount has not been issued yet. When a SBA business loan is cancelled, the loan amount is ultimately returned to the lender, not to the SBA, because the SBA did not make the loan, it guaranteed a portion of it. When a small business contract is not approved, no funds are returned to the agency sponsoring the contract because the contracted amount has not been awarded yet. When a small business contract is cancelled, the contracted amount is typically made available to other contractors. - Savings from disallowed costs agreed to by management ($145.4 million in FY2018) could result in actual budgetary savings, but the recovery process typically takes time. As a result, the final savings for disallowed costs is often not known during the fiscal year in which it is reported.

Finally, estimating the monetary savings from the SBA OIG's activities is challenging because it is difficult, if not impossible, to determine what changes the SBA might have made to its programs and operations if the SBA OIG did not exist.

Perhaps indicative of these methodological challenges, the SBA OIG's semiannual reports and annual congressional budget justification document's statistical highlights sections refer to these figures as "office-wide dollar accomplishments" as opposed to monetary savings.68

Most Serious Management and Performance Challenges Facing the SBA

Pursuant to P.L. 106-531, the Records Consolidation Act of 2000, and OMB Circular A-136, the SBA OIG issues an annual Report on the Most Serious Management and Performance Challenges Facing the SBA. This report is, arguably, the SBA OIG's signature oversight document, focusing attention "on areas that are particularly vulnerable to fraud, waste, error, and mismanagement, or otherwise pose a significant risk and generally have been subject to one or more OIG or GAO reports."69

The FY2019 Report on the Most Serious Management and Performance Challenges Facing the SBA lists the following eight challenges:

- 1. Weaknesses in small business contracting programs and inaccurate procurement data undermine the reliability of contracting goals achievements.

- 2. SBA needs to continue to improve information technology controls to address operational risks.

- 3. SBA needs effective human capital strategies to carry out its mission successfully and become a high-performing organization.

- 4. SBA needs to improve its risk management and oversight practices to ensure its loan programs operate effectively and will continue to benefit small businesses.

- 5. SBA needs to ensure that the Section 8(a) business development program identifies and addresses the needs of program participants, only eligible firms are admitted into the program, and standards for determining economic disadvantage are justifiable.

- 6. SBA can improve its loan programs by ensuring quality deliverables and reducing improper payments at SBA loan operation centers.

- 7. SBA's disaster assistance programs must balance competing priorities to deliver timely assistance and reduce improper payments.

- 8. SBA needs robust oversight of its grant management.

70

68The SBA OIG provides a series of recommended actions within each of the reported challenges to enhance the effectiveness of the SBA's programs and operations. The management challenges are "driven by SBA's current needs" and based on the SBA OIG's understanding of the SBA's programs and operations, as well as challenges presented in other agency reports, principally GAO reports. Accordingly, the challenges presented each year may change based on the SBA's actions or inactions "to remedy past weaknesses."71

For example, in its FY2019 report, the SBA OIG reported that the SBA had "increased its oversight of the acquisition program, updated its policies and procedures, and implemented a requirement for management to conduct annual reviews of the acquisition process controls."7270 As a result, the SBA OIG removed SBA's acquisition process from the list of the SBA's most serious challenges and added a new challenge regarding SBA's grant management oversight.73

Impact on Program Efficiency and Effectiveness

OIGs are, arguably, best known for investigations addressing waste, fraud, and abuse and audits containing recommendations to enhance programmatic and operational efficiencies. However, a full and complete assessment of an OIG's impact should address all of the office's statutory responsibilities, including its efforts to

- enhance programmatic and operational efficiencies and the OIG's agency's effectiveness in achieving program goals through audits;

- reduce waste, fraud, and abuse through investigations;

- assist Congress and the OIG's agency by making recommendations concerning the impact of legislation and regulations on programmatic and operational efficiencies and waste, fraud, and abuse;

- assist the OIG's agency by making recommendations to facilitate the agency's relationships with other governmental and nongovernmental entities; and

- keep the OIG's agency head and Congress fully and currently informed of its findings and the agency's progress in implementing recommended corrective actions.

Enhancing Programmatic and Operational Efficiency and the Achievement of Program Goals Through Audits

As shown in Table 3, over the past nine fiscal years, the SBA OIG

- issued 204 audit reports (an average of 22.66 audit reports per fiscal year);

- provided 1,011 recommendations for improving SBA operations, identifying improper payments, and strengthening controls to reduce fraud and unnecessary losses in SBA programs (an average of 112.3 recommendations per fiscal year), with the SBA taking action on 992 recommendations (an average of 110.2 recommendations addressed per fiscal year);

- generated $372.3 million in savings and efficiencies (an average of $41.4 million per fiscal year) in disallowed costs agreed to by SBA management and recommendations that funds be put to better use agreed to by SBA management;

- questioned $571.3 million in costs (an average of $63.5 million per fiscal year);

7472 and - recommended that $141.1 million be put to better use (an average of $15.7 million per fiscal year).

|

Fiscal Year |

Number of Audit Reports |

Number of Recommendations Issued/Acted Upona |

Dollar Amount in Accomplishmentsb |

Value of Costs Questioned |

Value of Recommendations That Funds Be Put to Better Use |

||||||||

|

2018 |

|

|

|

|

|

||||||||

|

2017 |

|

|

|

|

|

||||||||

|

2016 |

|

|

|

|

|

||||||||

|

2015 |

|

|

|

|

|

||||||||

|

2014 |

|

|

|

|

|

||||||||

|

2013 |

|

|

|

|

|

||||||||

|

2012 |

|

|

|

|

|

||||||||

|

2011 |

|

|

|

|

|

||||||||

|

2010 |

|

|

|

|

|

||||||||

|

Total |

|

|

|

|

|

Sources: U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification, FY2012," pp. 1, 12, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FINAL%20FY%202012%20CBJ%20FY%202010%20APR_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification, FY2013," p. 11, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20FY%202013%20Office%20of%20Inspector%20General%20CBJ2(1).pdf; U.S. Small Business Administration, Office of Inspector General, "FY2014 Congressional Budget Justification," p. 16, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20OIG%20FY%202014%20CBJ.PDF; U.S. Small Business Administration, Office of Inspector General, "FY2015 Congressional Budget Justification," pp. 1, 17, at https://www.sba.gov/sites/default/files/files/SBA%20OIG%20FY%202015%20Congressional%20Submission%20508%20FINAL%20post.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2016 Congressional Budget Justification," pp. 1, 22, at https://www.sba.gov/sites/default/files/files/4-Office_of_the_Inspector_General_FY_2016_CBJ_508.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2017 Congressional Budget Justification," pp. 1, 21, at https://www.sba.gov/sites/default/files/FY17-CBJ-oig.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2018 Congressional Budget Justification," p. 23, at https://www.sba.gov/sites/default/files/aboutsbaarticle/Office_of_Inspector_General_-_FY_2018_CBJ.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2019 Congressional Budget Justification," p. 220, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2019_CBJ_Office_of_Inspector_General.pdf; and U.S. Small Business Administration, Office of Inspector General, "Fall 2018 Semiannual Report to Congress: April 1, 2018-September 30, 2018," October 29, 2018, p. 29, at https://www.sba.gov/sites/default/files/oig/SBA-OIG-Fall-2018-Semiannual-Report.pdf.

Notes:

a. The number of the SBA OIG's recommendations acted upon by the SBA in a fiscal year may exceed the number of recommendations issued by the SBA OIG because the number acted upon may include recommendations issued in previous fiscal years.

b. Sum of disallowed costs agreed to by management and recommendations that funds be put to better use agreed to by management.

In terms of impact, the data presented in Table 3 suggest that the SBA has made hundreds of changes to its internal operating procedures and programs as a direct result of the SBA OIG's audits.7573 In addition, comments by members of the House Committee on Small Business and Senate Committee on Small Business and Entrepreneurship during congressional oversight hearings suggest that they view the SBA OIG's audits as helpful in their oversight of the SBA, especially in terms of identifying management weaknesses and recommending solutions to remedy those weaknesses.7674 For example, in his opening remarks at a March 2016 congressional oversight hearing concerning the SBA's management and performance challenges, Representative Steve Chabot, then-chair of the House Committee on Small Business, stated

It is clear that the Inspector General plays a critical role in ensuring effective management of the SBA. By conducting audits to identify program mismanagement, by investigating fraud or other wrongdoing, or by recommending changes to increase the efficiency of SBA operations, she has provided independent and objective reviews of agency actions.77

However, some Members have also noted that the SBA OIG's impact is limited because the SBA OIG has no enforcement authority and the SBA has chosen to ignore many of its recommendations. As Representative Nydia Velazquez noted during that March 2016 congressional oversight hearing, some of the management challenges reported in the SBA OIG's annual Report on the Most Serious Management and Performance Challenges Facing the SBA "were first highlighted over a decade ago."7876 In addition, Peggy Gustafson (SBA IG from October 2, 2009 to January 9, 2017) testified at that hearing that the SBA currently "has 144 open OIG recommendations pertaining to reviews conducted in recent years and not so recent years across SBA programs."7977 She also testified that the SBA

did demonstrate positive progress in resolving recommendations associated with five of the identified challenges [in the annual report on the most serious challenges facing the SBA]. However, they remained at status quo on four of the challenges and demonstrated no progress on one recommendation in an area related to information technology. Now, clearly these results I would say paint a mixed picture relative to SBA's commitment to addressing these challenges in earnest and their ability to overcome these challenges.

Having said that, I think it also has to be acknowledged that SBA has shown that with a sustained, committed effort over time, they can achieve successful results in these challenges. For example, they moved to green [implemented the SBA OIG's recommendations concerning] … the very large challenge related to their LMAS [Loan Management and Accounting System Modernization] IT system. So I think that really shows that these are challenges that with the right effort can really be conquered and met.80

Others have suggested that OIGs in general, including the SBA OIG, focus their auditing efforts on identifying and addressing programmatic and operational inefficiencies and spend less time addressing "whether the agency program operations were providing the outputs intended by Congress."8179 In their view, Congress passed P.L. 103-62, the Government Performance and Results Act of 1993, and P.L. 111-352, the Government Performance and Results Act Modernization Act of 2010, to provide mechanisms to assess the effectiveness of federal programs in a way that supplements the efforts of OIGs (e.g., by establishing statutory requirements for most agencies to set goals, measure performance, and submit related plans and reports to Congress for its potential use).8280

In sum, the evidence suggests that the SBA OIG's audits have helped to increase the efficiency of the SBA's programs and operations. However, it could also be argued that the SBA OIG's impact is muted because OIGs lack enforcement authority, meaning that the SBA may proceed with, or without, taking into account the recommendations presented in the SBA OIG's audits.

Reducing Waste, Fraud, and Abuse Through Investigations

As shown in Table 4, over the past nine fiscal years, the SBA OIG

- opened 672 cases (an average of 74.7 cases opened per fiscal year);

- issued 570 indictments or informations (an average of 63.3 indictments or informations per fiscal year), with 431 convictions (an average of 47.8 convictions per fiscal year);

- generated $1,057.4 million in investigative recoveries and fines, asset forfeitures attributed to OIG investigations, and loans or contracts not approved or cancelled as a result of investigations (an average of $117.5 million per fiscal year); and

- recommended 571 suspensions or disbarments (an average of 63.4 per fiscal year), with the SBA suspending or disbarring 273 of these firms or owners (an average of 30.3 firms/owners per fiscal year).

The SBA OIG also reported that it has an active, annual caseload of about 255 criminal and civil fraud investigations of potential loan and contracting fraud and other wrongdoing and that "many of these investigations involve complex, multi-million-dollar fraudulent financial schemes perpetrated by multiple suspects."8381

|

Fiscal Year |

Number of |

Number of Indictments and Informations |

Number of Convictionsa |

Recoveries and Management Avoidancesb |

Number of Suspensions and Debarments Recommended/ Issuedc |

||||||

|

2018 |

|

|

|

|

|

||||||

|

2017 |

|

|

|

|

|

||||||

|

2016 |

|

|

|

|

|

||||||

|

2015 |

|

|

|

|

|

||||||

|

2014 |

|

|

|

|

|

||||||

|

2013 |

|

|

|

|

|

||||||

|

2012 |

|

|

|

|

|

||||||

|

2011 |

|

|

|

|

|

||||||

|

2010 |

|

|

|

|

|

||||||

|

Total |

|

|

|

|

|

Sources: U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2010," p. 24, at https://www.sba.gov/sites/default/files/oig/oig%20spring%202010%20sar.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2010," p. 24, at "https://www.sba.gov/sites/default/files/oig/Semiannual%20Report%20to%20Congress%20-%20Fall%202010_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification FY2012," pp. 1, 12, 13, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FINAL%20FY%202012%20CBJ%20FY%202010%20APR_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification, FY2013," pp. 11-12, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20FY%202013%20Office%20of%20Inspector%20General%20CBJ2(1).pdf; U.S. Small Business Administration, Office of Inspector General, "FY2014 Congressional Budget Justification," pp. 2, 16, 17, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20OIG%20FY%202014%20CBJ.PDF; U.S. Small Business Administration, Office of Inspector General, "FY2015 Congressional Budget Justification," pp. 1, 15, 17, 18, at https://www.sba.gov/sites/default/files/files/SBA%20OIG%20FY%202015%20Congressional%20Submission%20508%20FINAL%20post.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2016 Congressional Budget Justification," pp. 1, 22, 23, at https://www.sba.gov/sites/default/files/files/4-Office_of_the_Inspector_General_FY_2016_CBJ_508.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2017 Congressional Budget Justification," pp. 1, 22, 23, at https://www.sba.gov/sites/default/files/FY17-CBJ-oig.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2018 Congressional Budget Justification," pp. 23, 24, at https://www.sba.gov/sites/default/files/aboutsbaarticle/Office_of_Inspector_General_-_FY_2018_CBJ.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2019 Congressional Budget Justification," pp. 220, 221, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2019_CBJ_Office_of_Inspector_General.pdf; and U.S. Small Business Administration, Office of Inspector General, "Fall 2018 Semiannual Report to Congress: April 1, 2018-September 30, 2018," October 29, 2018, p. 29, at https://www.sba.gov/sites/default/files/oig/SBA-OIG-Fall-2018-Semiannual-Report.pdf.

Notes:

a. The number of convictions may exceed the number of indictments and informations in a fiscal year because a conviction in any fiscal year could result from an indictment or information issued in that fiscal year or a previous fiscal year.

b. Sum of potential investigative recoveries and fines, asset forfeitures attributed to OIG investigations, loans or contracts not approved or cancelled as a result of investigations, and loans not made as a result of name checks.

c. The number of suspensions and debarments issued by the SBA in response to a recommendation from the SBA OIG does not include the number of recommended suspensions and debarments pending at the end of the fiscal year.

The data presented in Table 4 suggest that the SBA OIG's investigations have resulted in hundreds of criminal convictions and millions of dollars in recovered funds. In addition, comments by members of the House Committee on Small Business and Senate Committee on Small Business and Entrepreneurship suggest that, generally speaking, they acknowledge and value the SBA OIG's investigations as a means to identify and reduce waste, fraud, and abuse.8482 However, the SBA's former IG, Peggy Gustafson, has testified that the SBA OIG's investigative efforts, in initiating and continuing investigations, are constrained by resource limitations.

Recommendations Concerning the Impact of Legislation and Regulations

The SBA OIG reports that it routinely reviews and comments on proposed changes to the SBA's program directives.8583 These changes "include regulations, internal operating procedures, agency policy notices, and SBA forms completed by the public."8684

The SBA OIG also tracks, reviews, and comments on legislation affecting the SBA and participates in OMB's Legislative Referral Memoranda (LRM) process for reviewing and coordinating agency recommendations on proposed, pending, and enrolled legislation.8785 The SBA OIG also "receives, through the SBA Office of Congressional and Legislative Affairs, congress-related documents being circulated by OMB, including pending legislation for consideration of Administration views and perspectives."8886

When the SBA OIG identifies "material weaknesses" in changes proposed by the SBA, it "works with the Agency to implement recommended revisions to promote controls that are more effective and deter waste, fraud, or abuse."8987 The SBA OIG provides the SBA with both formal and informal comments. Formal comments are provided "through the Agency's internal document control process, the Correspondence Management System (CMS),9088 and as a reviewing party in the Agency's Paperwork Reduction Act (PRA) process."9189 Informal comments "occur in the context of program officials seeking SBA OIG guidance when preparing new guidance."9290

In terms of legislation, the SBA OIG provides comments and suggestions "directly with congressional stakeholders" and shares its views with SBA officials and OMB if the legislation is being "circulated for solicited views by OMB through its LRM process, or if determined by the OIG to be a necessary course of action."93

As shown in Table 5, over the past nine fiscal years, the SBA OIG

- conducted 1,035 reviews of legislation, regulations, standard operating procedures, and other issuances (an average of 115.0 reviews per fiscal year);

9492 and - submitted comments on 515 of these initiatives (an average of 57.2 initiatives commented on per fiscal year).

Table 5. Legislation, Regulations, Standard Operating Procedures (SOPs), and Other Issuances Reviewed and Comments Provided, FY2010-FY2018

|

Fiscal Year |

Legislation, Regulations, SOPs, and Other Issuances Reviewed |

Number of Initiatives for Which Comments Were Provided |

||

|

2018 |

|

|

||

|

2017 |

|

|

||

|

2016 |

|

|

||

|

2015 |

|

|

||

|

2014 |

|

|

||

|

2013 |

|

|

||

|

2012 |

|

|

||

|

2011 |

|

|

||

|

2010 |

|

|

||

|

Total |

|

|

Sources: U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2010," p. 22, at https://www.sba.gov/sites/default/files/oig/oig%20spring%202010%20sar.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2010," p. 21, at "https://www.sba.gov/sites/default/files/oig/Semiannual%20Report%20to%20Congress%20-%20Fall%202010_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification FY2012," p. 12, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FINAL%20FY%202012%20CBJ%20FY%202010%20APR_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2011," p. 17, at https://www.sba.gov/sites/default/files/oig/Semi-Annual%20Report%20to%20Congress%20-%20Spring%202011.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2011," p. 17, at https://www.sba.gov/sites/default/files/oig/Fall%202011%20SBA%20OIG%20SAR.pdf; U.S. Small Business Administration, Office of Inspector General, "Congressional Budget Justification, FY2013," p. 11, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20FY%202013%20Office%20of%20Inspector%20General%20CBJ2(1).pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2012," p. 20, at https://www.sba.gov/sites/default/files/oig/SBA%20OIG%20SAR%20Spring%202012%20.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2012," p. 20, at https://www.sba.gov/sites/default/files/oig/FINAL_FALL%202012_SAR.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2014 Congressional Budget Justification," p. 17, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20OIG%20FY%202014%20CBJ.PDF; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2013," p. 19, at https://www.sba.gov/sites/default/files/oig/SBA%20OIG%20_Spring_%202013_SAR.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2013," p. 18, at https://www.sba.gov/sites/default/files/oig/Fall_2013_-_SBA_OIG_SAR_0.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2015 Congressional Budget Justification," p. 15, at https://www.sba.gov/sites/default/files/files/SBA%20OIG%20FY%202015%20Congressional%20Submission%20508%20FINAL%20post.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2016 Congressional Budget Justification," p. 23, at https://www.sba.gov/sites/default/files/files/4-Office_of_the_Inspector_General_FY_2016_CBJ_508.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2017 Congressional Budget Justification," p. 22, at https://www.sba.gov/sites/default/files/FY17-CBJ-oig.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2018 Congressional Budget Justification," p. 24, at https://www.sba.gov/sites/default/files/aboutsbaarticle/Office_of_Inspector_General_-_FY_2018_CBJ.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2019 Congressional Budget Justification," p. 221, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2019_CBJ_Office_of_Inspector_General.pdf; and U.S. Small Business Administration, Office of Inspector General, "Fall 2018 Semiannual Report to Congress: April 1, 2018-September 30, 2018," October 29, 2018, p. 30, at https://www.sba.gov/sites/default/files/oig/SBA-OIG-Fall-2018-Semiannual-Report.pdf.

Note: Other issuances include policy notices, procedural notices, the SBA Administrator's action memoranda, and other SBA initiatives, which frequently involve the implementation of new programs or policies.

The data in Table 5 suggest that the SBA OIG actively reviews and comments on legislation and SBA program directives. However, it is difficult to determine the impact of these reviews and comments because the SBA OIG does not track or report data concerning the SBA's response to these comments. The SBA OIG indicated that

neither the dynamic nature of the informal comment process nor the collaborative follow-up procedures from formal comments are conducive to quantification.... Our sense of these comments is that the Agency will generally act upon SBA OIG comments. Typically, the Agency modifies clearances and PRA packages in response to material SBA OIG concerns. An accurate tracking and quantification of these clearances, however, is unlikely to yield particularly useful data relative to the resource expenditure necessary for that collection.9593

Facilitating the SBA's Relationships with Other Governmental and Nongovernmental Entities

The SBA OIG provides training and outreach sessions on topics related to fraud in government lending and contracting programs. These training and outreach sessions are designed to facilitate the SBA's relationships with other governmental and nongovernmental entities in identifying and ameliorating fraud.

The SBA OIG's outreach and training sessions are attended by SBA and other government employees, lending officials, and law enforcement representatives.9694 Topics include "types of fraud, fraud indicators and trends; how to report suspicious activity that may be fraudulent; suspension and debarment, the Program Fraud Civil Remedies Act, and other topics related to deterring and detecting fraud in government lending and contracting programs."9795

As shown in Table 6, the SBA OIG provided 609 outreach and training sessions from FY2010 to FY2018 (an average of 67.7 sessions per fiscal year) to 13,278 attendees (an average of 1,475 attendees per fiscal year).

|

Fiscal Year |

Number of Sessions |

Number of Attendees |

||

|

2018 |

|

|

||

|

2017 |

|

|

||

|

2016 |

|

|

||

|

2015 |

|

|

||

|

2014 |

|

|

||

|

2013 |

|

|

||

|

2012 |

|

|

||

|

2011 |

|

|

||

|

2010 |

|

|

||

|

Total |

|

|

Sources: U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2010," p. 22, at https://www.sba.gov/sites/default/files/oig/oig%20spring%202010%20sar.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2010," p. 21, at "https://www.sba.gov/sites/default/files/oig/Semiannual%20Report%20to%20Congress%20-%20Fall%202010_0.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2011," p. 17, at https://www.sba.gov/sites/default/files/oig/Semi-Annual%20Report%20to%20Congress%20-%20Spring%202011.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2011," p. 16, at https://www.sba.gov/sites/default/files/oig/Fall%202011%20SBA%20OIG%20SAR.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Spring 2012," p. 21, at https://www.sba.gov/sites/default/files/oig/SBA%20OIG%20SAR%20Spring%202012%20.pdf; U.S. Small Business Administration, Office of Inspector General, "Semiannual Report to Congress, Fall 2012," p. 17, at https://www.sba.gov/sites/default/files/oig/FINAL_FALL%202012_SAR.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2014 Congressional Budget Justification," p. 15, at https://www.sba.gov/sites/default/files/files/4-508%20Compliant%20OIG%20FY%202014%20CBJ.PDF; U.S. Small Business Administration, Office of Inspector General, "FY2015 Congressional Budget Justification," p. 16, at https://www.sba.gov/sites/default/files/files/SBA%20OIG%20FY%202015%20Congressional%20Submission%20508%20FINAL%20post.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2016 Congressional Budget Justification," pp. 3, 20, at https://www.sba.gov/sites/default/files/files/4-Office_of_the_Inspector_General_FY_2016_CBJ_508.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2017 Congressional Budget Justification," pp. 2, 19, at https://www.sba.gov/sites/default/files/FY17-CBJ-oig.pdf; U.S. Small Business Administration, Office of Inspector General, "FY2019 Congressional Budget Justification," p. 197, at https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2019_CBJ_Office_of_Inspector_General.pdf; and U.S. Small Business Administration, Office of Inspector General, "Correspondence with the author," December 7, 2018.

The data presented in Table 6 suggest that the SBA OIG actively provides training and outreach sessions related to identifying and addressing fraud. The office also participates in a number of activities involving federal agencies and others with an interest in fraud prevention activities. It is difficult to measure the impact of these training and outreach activities on the SBA's interaction with other federal agencies. The SBA OIG reports that these sessions are well-attended, and receive high ratings from attendees.

Keeping the SBA Administrator and Congress Fully and Currently Informed

As mentioned previously, the IG Act requires IGs to keep their agency's administrator and Congress fully and currently informed concerning fraud and other serious problems, abuses, and deficiencies relating to the agency's administration of its programs and operations and to report on the progress made in implementing recommended corrective action. The SBA OIG's informational role is conducted through both formal and informal communication.

Formal communication occurs through (1) the publication of audits, investigations, semiannual reports, and the annual Report on the Most Serious Management and Performance Challenges Facing the SBA; (2) correspondence with SBA officials, congressional staff, and Members of Congress; (3) briefings with SBA officials, congressional staff, and Members of Congress (as needed or as requested); (4) press releases; and occasionally (5) congressional testimony.9896 Informal communication occurs primarily through telephone consultation or by email with SBA officials, congressional staff, and Members of Congress (often facilitated by the SBA OIG's chief of staff).99

In terms of communication with Congress, the SBA OIG reports that it "has regular communications and meetings (as needed or requested) to keep the Congress apprised of significant findings or issues identified during our oversight of SBA" and that the "OIG has a staff member that is responsible for congressional relations."10098 In addition, because its semiannual reports to Congress are published every six months, the SBA OIG finds that those reports' "utility as a viable means to make a recommendation for legislation advancing through the legislative process is limited in the context of current legislative affairs."10199 As a result, because "the legislative process is very dynamic," the SBA OIG often relies on "frequent and informal" communication with congressional staff and Members of Congress to provide its input on legislation and other matters affecting the SBA, often by telephone and email.102100

The SBA OIG reports frequent and, in its view, meaningful consultation with both the SBA and Congress in an attempt to keep them fully informed of its activities and recommendations. It is difficult to determine the impact and/or extent of the SBA OIG's communication with SBA officials, congressional staff, and Members of Congress because much of that communication occurs through informal means, is not tracked, and data concerning the SBA's or congressional response to the provided comments and recommendations are not compiled or reported. However, at the aforementioned March 2016 congressional hearing on the SBA's management and performance challenges, Representative Steve Chabot stated that,

By clarifying the specific areas in which improvement is needed and highlighting possible paths forward for the agency, the insights offered by the Inspector General are invaluable as the Committee continues to work with the SBA to develop meaningful solutions to its management and performance challenges.103

Relationship with Congress

Generally speaking, OIGs' relationships with Congress tend to ebb and flow over time, varying with the personalities, interests, needs, and actions of the principals involved. One constant has been a genuine interest from Members of Congress of both political parties in OIGs' efforts to identify and reduce waste, fraud, and abuse and enhance program efficiency and effectiveness. The congressional interest in these issues can take on a partisan, contentious tone, especially during periods of divided government. The House and Senate Committees on Small Business, however, have traditionally tried to avoid partisanship. For example, at a potentially contentious Senate Committee on Small Business and Entrepreneurship hearing in 2007, then-Senate Committee Chair John Kerry stated, "Senator Snowe [then-ranking Member] and I and all Members of this Committee manage a Committee that works in a very bipartisan way and try very hard to keep the politics off the table."104102 More recently, Representative Steve Chabot stated the following during House floor consideration of H.R. 208, the Recovery Improvements for Small Entities After Disaster Act of 2015:

I want to offer a special thanks to our committee's ranking member, Ms. Velazquez, for her insight and leadership on this issue and for working in a bipartisan, bicameral manner, as she does. I have seen that as chair of the Small Business Committee that I chair now, but I have also been the ranking member under her when she was chair, and it was always bipartisan. We have worked together in a very collegial manner, and I thank her for that.105

The extent to which the small business committees have been able to avoid partisan conflict has varied somewhat over time, reflecting the personalities of committee leaders and the nature of the issues that have presented themselves at any given time. Nonetheless, the small business committees' tradition of valuing bipartisanship has served to reduce the potential for conflict with the SBA OIG, primarily because committee members generally do not feel a need to question the SBA OIG's motives when its investigations and audits find perceived weaknesses in the Administration's implementation of the SBA's programs or in the Administration's efforts to identify and address waste, fraud, and abuse. The expectation that both committee members and the SBA IG do not, and should not, pursue a political agenda may help to explain why small business committee members rarely ask the SBA OIG to undertake specific studies.106104 In their view, the SBA IG is expected to aggressively pursue perceived weaknesses in the SBA's programs and operations regardless of potential political consequences. Requesting specific studies could be seen as suggesting that the SBA OIG is not doing its job well, or as a partisan effort to embarrass the Administration.

The SBA OIG's relationship with Congress has not always been without controversy. For example, in October 2008, then-Senator John Kerry, chair of the Senate Committee on Small Business and Entrepreneurship, criticized the SBA OIG on the Senate floor for issuing what he described as "a heavily redacted report" concerning the SBA's oversight of one of the agency's largest 7(a) lenders. Speaking on behalf of himself and then-Ranking Member Senator Olympia Snowe, he accused the SBA OIG of not exercising "independent authority on what was redacted and instead let the agency it was investigating dictate that large sections of the report be redacted ... contrary to the usual process that occurs with SBA OIG reports."107105 He argued that the SBA OIG's action had "the potential to render the OIG useless," and "prevented accountability in Government by keeping from the public information about the oversight capabilities of an agency that, though comparatively small, can have a huge impact on our economy."108

Senator Kerry's comments illustrate how quickly an OIG's relationship with Congress can change. Prior to the publication of that redacted report, the SBA OIG was generally praised by Members of both political parties for its efforts concerning the oversight of the SBA's response to the 2005 Gulf Coast hurricanes, audits of the SBA's oversight of lenders, and investigations leading to numerous indictments and convictions of fraudulent SBA lenders and borrowers.

In sum, comments by House and Senate small business committee leaders seem to suggest that they view the SBA OIG and GAO as two valuable assets that can assist and enhance the committees' oversight role. However, history has shown that an apparent harmonious relationship between an OIG and congressional committees can change quickly as circumstances change.