Medicare Part B: Enrollment and Premiums

Changes from July 5, 2018 to April 4, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- Medicare Part B Eligibility and Enrollment

- Initial Enrollment Periods

- General Enrollment Period

- Late-Enrollment Premium Penalty and Exemptions

- Calculation of Penalty

- Penalty Exemptions

- Current Workers

- International Volunteers

- Equitable Relief

- Collection of the Part B Premium

- Deduction of Part B Premiums from Social Security Checks

- Part B Enrollees Who Do Not Receive Social Security Benefits

- Determining the Part B Premium

- Premium Calculation for

20182019

- Contingency Margin

- Income-Related Premiums

- Determination of Income

- Income Categories and Premium Adjustments

- Income Thresholds

- Premium Assistance for Low-Income Beneficiaries

- Qualified Medicare Beneficiaries

- Specified Low-Income Medicare Beneficiaries

- Qualifying Individuals

- Protection of Social Security Benefits from Increases in Medicare Part B Premiums

- Some Beneficiaries Are Not Protected by the Hold-Harmless Provision

- Application of the Hold-Harmless Rule in Years Prior to 2016

- Application of the Hold-Harmless Rule in 2016

- Application of the Hold-Harmless Rule in 2017

- Application of the Hold-Harmless Rule in 2018

- Application of the Hold-Harmless Rule in 2019

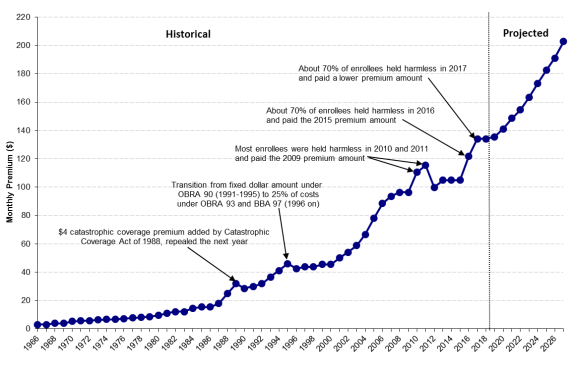

Part B Premiums over Time- Current Issues

- Premium Amount and Annual Increases

- Impact of the Hold-Harmless Provision on Those Not Held Harmless

- Proposals to Modify the Late-Enrollment Penalty

- Deficit Reduction Proposals

- Increasing Medicare Premiums

- Impose a Part B Premium Surcharge for Beneficiaries in Medigap Plans with Near First-Dollar Coverage

- Limit Federal Subsidies

- Considerations

Tables

- Table 1. Initial Enrollment Period

- Table 2. Monthly Medicare Part B Premiums for

20182019

- Table 3. Part B Premium Adjustment for Married Beneficiaries Filing Separately for

20182019

- Table 4. Medicare High-Income Premium Thresholds: 2017 to 2019

- Table 5.

20182019 Medicare Savings Program Eligibility Standards - Table A-1. Monthly Part B Premiums, 1966-

20182019

- Table B-1. Income Levels for Determining Part B Premium Adjustment and Per Person Premium Amounts, 2007-

20182019

- Table B-2. Income Levels for Determining Part B Premium Adjustment for Married Beneficiaries Filing Separately and Associated Premiums, 2007-

20182019

- Table C-1. Projected Part B Premiums

Appendixes

- Appendix A. History of the Part B Premium Statutory Policy and Legislative Authority

- Appendix B. Standard and High-Income Part B Premiums and Income Thresholds: 2007-

20182019

- Appendix C. Estimated Future Part B Premiums

- Appendix D. Bipartisan Budget Act of 2015 Changes to 2016 Part B Premiums

- Appendix E. Part A Premiums

Summary

Medicare is a federal insurance program that pays for covered health care services of most individuals aged 65 and older and certain disabled persons. In calendar year 20182019, the program is expected to cover about 6061 million persons (5152 million aged and 9 million disabled) at a total cost of $745798 billion. Most individuals (or their spouses) aged 65 and older who have worked in covered employment and paid Medicare payroll taxes for 40 quarters receive premium-free Medicare Part A (Hospital Insurance). Those entitled to Medicare Part A (regardless of whether they are eligible for premium-free Part A) have the option of enrolling in Part B, which covers such things as physician and outpatient services and medical equipment.

Beneficiaries have a seven-month initial enrollment period, and those who enroll in Part B after this initial enrollment period and/or reenroll after a termination of coverage may be subject to a late-enrollment penalty. This penalty is equal to a 10% surcharge for each 12 months of delay in enrollment and/or reenrollment. Under certain conditions, some beneficiaries are exempt from the late-enrollment penalty; these exempt beneficiaries include working individuals (and their spouses) with group coverage through their current employment, some international volunteers, and those granted "equitable relief."

Whereas Part A is financed primarily by payroll taxes paid by current workers, Part B is financed through a combination of beneficiary premiums and federal general revenues. The standard Part B premiums are set to cover 25% of projected average per capita Part B program costs for the aged, with federal general revenues accounting for the remaining amount. In general, if projected Part B costs increase or decrease, the premium rises or falls proportionately. However, some Part B enrollees are protected by a provision in the Social Security Act (the hold-harmless provision) that prevents their Medicare Part B premiums from increasing more than the annual increase in their Social Security benefit payments. This protection does not apply to four main groups of beneficiaries: low-income beneficiaries whose Part B premiums are paid by the Medicaid program; high-income beneficiaries who are subject to income-related Part B premiums; those whose Medicare premiums are not deducted from Social Security benefits; and new Medicare and Social Security enrollees.

Most Part B participants must pay monthly premiums, which do not vary with a beneficiary's age, health status, or place of residence. However, since 2007, higher-income enrollees pay higher premiums to cover a higher percentage of Part B costs. Additionally, certain low-income beneficiaries may qualify for Medicare cost-sharing and/or premium assistance from Medicaid through a Medicare Savings Program. The premiums of those receiving benefits through Social Security are deducted from their monthly payments.

Each year, the Centers for Medicare & Medicaid Services (CMS) determines the Medicare Part B premiums for the following year. The standard monthly Part B premium for 2018 is $134.00. However, due to a relatively low (2.0%) Social Security cost-of-living adjustment (COLA) in 20182019 is $135.50. However, in 2019, the hold-harmless provision applies to about 283.5% of Part B enrollees, and these individuals pay lower premiums. (The premiums of those held harmless vary depending on the dollar amount of the increase in their Social Security benefits.) Higher-income beneficiaries, currently defined as individuals with incomes over $85,000 per year or couples with incomes over $170,000 per year, pay $187.50, $267.90, $348.30, or $428.60189.60, $270.90, $352.20, $433.40, or $460.50 per month, depending on their income levels.

Starting in 2018, the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; P.L. 114-10) reducesreduced the income thresholds in the highest two income tiers so that more enrollees will pay higher premiums. The Bipartisan Budget Act of 2018 (BBA 18; P.L. 115-123) addsadded an additional income tier beginning in 2019 for individuals with annual incomes of $500,000 or more or couples filing jointly with incomes of $750,000 or more.

Current issues related to the Part B premium that may come before Congress include the amount of the premium and its rate of increase (and the potential net impact on Social Security benefits), the impact of the hold-harmless provision on those not held harmless, modifications to the late-enrollment penalty, and possible increases in Medicare premiums as a means to reduce federal spending and deficits.

Introduction

Medicare is a federal insurance program that pays for covered health care services of most individuals aged 65 and older and certain disabled persons. Medicare serves approximately one in six Americans and virtually all of the population aged 65 and over. In calendar year (CY) 20182019, the program is expected to cover about 6061 million persons (5152 million aged and 9 million disabled) at a total cost of about $745798 billion, accounting for approximately 3.78% of gross domestic product.1 The Medicare program is administered by the Centers for Medicare & Medicaid Services (CMS) within the Department of Health and Human Services (HHS), and individuals enroll in Medicare through the Social Security Administration (SSA).

Medicare consists of four parts—Parts A through D. Part A covers hospital services, skilled nursing facility services, home health visits, and hospice services. Part B covers a broad range of medical services and supplies, including physician services, laboratory services, durable medical equipment, and outpatient hospital services. Enrollment in Part B is voluntary; however, most Medicare beneficiaries (about 91%) are enrolled in Part B. Part C (Medicare Advantage) provides private plan options, such as managed care, for beneficiaries who are enrolled in both Part A and Part B. Part D provides optional outpatient prescription drug coverage.2

Each part of Medicare is funded differently.3 Part A is financed primarily through payroll taxes imposed on current workers (2.9% of earnings, shared equally between employers and workers), which are credited to the Hospital Insurance (HI) Trust Fund. Beginning in 2013, workers with annual wages over $200,000 for single tax filers or $250,000 for joint filers pay an additional 0.9%.4 Beneficiaries generally do not pay premiums for Part A. In 20182019, total Part A expenditures are expected to reach about $311328 billion, representing about 4241% of program costs.5 Parts B and D, the voluntary portions, are funded through the Supplementary Medical Insurance (SMI) Trust Fund, which is financed primarily by general revenues (transfers from the U.S. Treasury) and premiums paid by enrollees. In 20182019, about $4.12.8 billion in fees on manufacturers and importers of brand-name prescription drugs also will be used to supplement the SMI Trust Fund.6 In 20182019, Part B expenditures are expected to reach about $340367 billion, and Part D expenditures are expected to reach about $95104 billion, representing 46% and 13% of program costs, respectively. (Part C is financed proportionately through the HI and SMI Trust Funds; expenditures for Parts A and B services provided under Part C are included in the above expenditure figures.)

Part B beneficiary premiums are normally set at a rate each year equal to 25% of average expected per capita Part B program costs for the aged for the year.7 Higher-income enrollees pay higher premiums set to cover a greater percentage of Part B costs,8 while those with low incomes may qualify for premium assistance through one of several Medicare Savings Programs administered by Medicaid.9 Individuals who receive Social Security or Railroad Retirement Board (RRB) retirement or disability benefits have their Part B premiums automatically deducted from their benefit checks. Part B premiums are generally announced in the fall prior to the year that they are in effect (e.g., the 20182019 Part B premiums were announced in November 2017October 2018).10

In 20182019, the standard monthly Part B premium is $134.00135.50.11 However, about 283.5% of Part B enrollees are protected by a provisionhold-harmless provision in the Social Security Act (the hold-harmless provision) that prevents their Medicare Part B premiums from increasing more than the annual dollar amount of the increase in their Social Security benefit payments. These individuals pay premiums of less than $134.00.12 About 72% of beneficiaries do not qualify for protection under the hold-harmless provision in 2018. This includes those who had been held harmless in 2017 but whose 2018 Social Security COLA benefit increases were large enough to cover their Medicare premium increases (42% of enrollees), along with the approximately 30% of enrollees who do not normally qualify to be held harmless, such as high-income enrollees, those who do not receive Social Security benefits, and those whose premiums are paid by Medicaid.13

|

433.40 Greater than or equal to $500,000 Greater than or equal to $750,000 460.50 |

In addition to premiums, Part B beneficiaries may pay other out-of-pocket costs when they use services. The annual deductible for Part B services is $183185.00 in 2018.142019.13 After the annual deductible is met, beneficiaries are responsible for coinsurance costs, which are generally 20% of Medicare-approved Part B expenses.

This report provides an overview of Medicare Part B premiums, including information on Part B eligibility and enrollment, late-enrollment penalties, collection of premiums, determination of annual premium amounts, premiums for high-income enrollees, premium assistance for low-income enrollees, protections for Social Security recipients from rising Part B premiums, and historical Medicare Part B premium trends. This report also provides a summary of various premium-related issues that may be of interest to Congress. Specific Medicare and Social Security publications and other resources for beneficiaries, and those who provide assistance to them, are cited where appropriate.

Medicare Part B Eligibility and Enrollment

An individual (or the spouse of an individual) who has worked in covered employment and paid Medicare payroll taxes for 40 quarters is entitled to receive premium-free Medicare Part A benefits upon reaching the age of 65. Those who have paid in for fewer than 40 quarters may enroll in Medicare Part A by paying a premium.1514 All persons entitled to Part A (regardless of whether they are eligible for premium-free Part A) are also entitled to enroll in Part B. An aged person not entitled to Part A may enroll in Part B if he or she is aged 65 or over and either a U.S. citizen or an alien lawfully admitted for permanent residence who has resided in the United States continuously for the immediately preceding five years.

Those who are receiving Social Security or RRB benefits are automatically enrolled in Medicare, and coverage begins the first day of the month they turn 65.1615 These individuals will receive a Medicare card and a "Welcome to Medicare" package about three months before their 65th birthday.1716 Those who are automatically enrolled in Medicare Part A also are automatically enrolled in Part B.1817 However, because beneficiaries must pay a premium for Part B coverage, they have the option of turning it down.1918 Disabled persons who have received cash payments for 24 months under the Social Security or RRB disability programs also automatically receive a Medicare card and are enrolled in Part B unless they specifically decline such coverage.2019 Those who choose to receive coverage through a Medicare Advantage plan (Part C) must enroll in Part B.

Persons who are not receiving Social Security or RRB benefits, for example because they are still working2120 or have chosen to defer enrollment because they have not yet reached their full retirement benefit eligibility age,2221 must file an application with the SSA or RRB for Medicare benefits.2322 There are two kinds of enrollment periods, one that occurs when individuals are initially eligible for Medicare and one annual general enrollment period for those who missed signing up during their initial enrollment period. A beneficiary may drop Part B enrollment and reenroll an unlimited number of times; however, premium penalties may be incurred.

Initial Enrollment Periods

Those who are not automatically enrolled in Medicare may sign up during a certain period when they first become eligible. The initial enrollment period is seven months long and begins three months before the month in which the individual first turns 65. (See Table 1.) Beneficiaries who do not file an application for Medicare benefits during their initial enrollment period could be subject to the Part B late-enrollment penalty. (See "Late-Enrollment Premium Penalty and Exemptions.") If an individual accepts the automatic enrollment in Medicare Part B, or enrolls in Medicare Part B during the first three months of the initial enrollment period, coverage will start with the month in which an individual is first eligible, that is, the month of the individual's 65th birthday. Those who enroll during the last four months will have their coverage start date delayed from one to three months after enrollment.2423 The initial enrollment period of those eligible for Medicare based on disability or permanent kidney failure is linked to the date the disability or treatment began.25

|

3 Months Before the Month One Turns 65 |

The Month During Which One Turns 65 |

Up to 3 Months After the Month One Turns 65 |

|

|

Effective Dates |

If one signs up during the first 3 months of one's initial enrollment period, Part B coverage starts the 1st day of one's birthday month.a |

If one enrolls during one's birthday month, the start date will be the 1st day of the next month. |

The start date will be delayed if one enrolls during the last 3 months of the initial enrollment period.

|

|

Example for Someone Turning 65 During the Month of June (The seven-month initial enrollment period would run from March 1 through September 30.) |

If one enrolls in March, April, or May, coverage begins June 1. |

If one enrolls in June, coverage begins July 1. |

|

Source: Table prepared by CRS based on Social Security Administration, "Medicare," Publication No. 05-10043, at https://www.ssa.gov/pubs/EN-05-10043.pdf.

a. If one's birthday falls on the 1st of the month, then the enrollment period starts a month earlier and coverage may begin on the 1st day of the month prior to one's birthday month.

General Enrollment Period

An individual who does not sign up for Medicare during the initial enrollment period must wait until the next general enrollment period. In addition, persons who decline Part B coverage when first eligible, or terminate Part B coverage, must also wait until the next general enrollment period to enroll or reenroll. The general enrollment period lasts for three months from January 1 to March 31 of each year, with coverage beginning on July 1 of that year. A late-enrollment penalty may apply.26

Late-Enrollment Premium Penalty and Exemptions

Beneficiaries who do not sign up for Part B when first eligible, or who drop it and then sign up again later, may have to pay a late-enrollment penalty for as long as they are enrolled in Part B.2726 Monthly premiums for Part B may go up 10% for each full 12-month period that one could have had Part B but did not sign up for it. (See "Calculation of Penalty.") Some may be exempt from paying a late-enrollment penalty if they meet certain conditions that allow them to sign up for Part B during a special enrollment period (SEP). (See "Penalty Exemptions.") In 20172018, about 1.34% of Part B enrollees (about 701760,000) paid this penalty.2827 On average, their total premiums (standard premium plus penalty) were about 3128% higher than what they would have been had they not been subject to the penalty.

Those who receive premium assistance through a Medicare Savings Program do not pay the late-enrollment penalty.2928 Additionally, for those disabled persons under the age of 65 subject to a premium penalty, once the individual reaches the age of 65, he or she qualifies for a new enrollment period and no longer pays a penalty.

The penalty provision was included in the original Medicare legislation enacted in 1965 to help prevent adverse selection by creating a strong incentive for all eligible beneficiaries to enroll in Part B.3029 Adverse selection occurs when only those persons who think they need the benefits actually enroll in the program. When this happens, per capita costs are driven up and premiums go up, causing more enrollees (presumably the healthier and less costly ones) to drop out of the program.3130 With most eligible persons over the age of 65 enrolled in Part B, the costs are spread over the majority of this population and per capita costs are less than would be the case if adverse selection had occurred.

As the Part B late-enrollment penalty is tied to Medicare eligibility and not to access to covered services, individuals who live in areas where Medicare benefits are generally not provided, such as outside of the United States or in prison, could still be subject to the Part B late-enrollment penalty if they do not sign up for (or if they drop) Part B when eligible.3231 To illustrate, if a retired Medicare-eligible individual stopped paying Part B premiums while living overseas for a three-year period and reenrolled when returning to the United States, he or she would not be entitled to ana SEP. This individual would instead need to enroll during the general enrollment period and could also be subject to late-enrollment penalties based on that three-year lapse in coverage.

Additionally, Part B does not have a "creditable" coverage exemption similar to that under the Part D outpatient prescription drug benefit.3332 Except for certain circumstances discussed below, having equivalent coverage does not entitle one to ana SEP should one decide to enroll in Part B later. For example, an individual who has retiree coverage similar to Part B and therefore decides not to enroll in Part B when first eligible could be subject to late-enrollment penalties if he or she enrolls in Part B at a later time (for example, because the retiree coverage was discontinued).

Calculation of Penalty

The late-enrollment penalty is equal to a 10% premium surcharge for each full 12 months of delay in enrollment and/or reenrollment during which the beneficiary was eligible for Medicare.3433 The period of the delay is equal to (1) the number of months that elapse between the end of the initial enrollment period and the end of the enrollment period in which the individual actually enrolls or (2) for a person who reenrolls, the months that elapse between the termination of coverage and the close of the enrollment period in which the individual enrolls.

Generally, individuals who do not enroll in Part B within a year of the end of their initial enrollment period would be subject to the premium penalty. For example, if an individual's initial enrollment period ended in September 20152016 and the individual subsequently enrolled during the 20162017 general enrollment period (January 1 through March 31), the delay would be less than 12 months and the individual would not be subject to a penalty. However, if that individual delayed enrolling until the 20182019 general enrollment period, the premium penalty would be 20% of that year's standard premium. (Although the elapsed time covers a total of 30 months of delayed enrollment, the episode includes only two full 12-month periods.) An individual who waits 10 years to enroll in Part B could pay twice the standard premium amount.

The late-enrollment surcharge is calculated as a percentage of the monthly standard premium amount (e.g., $134.00 in 2018),35135.50 in 2019),34 and that amount is added to the beneficiary's premium each month. The hold-harmless provision does not provide protection from increases in the penalty amounts. This means that although those who are held harmless in 2018 pay reduced premiums, any late-enrollment penalties are based on the 20182019 premium of $134.00135.50 per month.

Using the example above in which an individual is subject to a 20% premium penalty, the total monthly premium in 20182019 would be calculated as follows (see text box):

|

Calculation of Late-Enrollment Penalty

Example of a 20% penalty in 201

Premium Penalty = $ Penalty-Adjusted Premium = $

Premium Penalty = $ Penalty-Adjusted Premium = $ *Premium amounts are rounded to the nearest 10 cents. **Actual premiums of those held harmless in |

For those subject to the high-income premium (see "Income-Related Premiums"), the late-enrollment surcharge applies only to the standard monthly premium amount and not to the higher-income adjustment portion of their premiums. Using the example of a 20% penalty for a beneficiary with an income of between $85,000 and $107,000, the applicable income-related adjustment of $53.5054.10 would be added on to the penalty-adjusted premium of $160.80 ($134.00 + $26.80162.60 ($135.50 + $27.10 penalty), for a total monthly premium of $214.30.36

There is no upper limit on the amount of the surcharge that may apply, and the penalty continues to apply for the entire time the individual is enrolled in Part B. Each year, the surcharge is calculated using the standard premium amount for that particular year. Therefore, if premiums increase in a given year, the dollar value of the surcharge will increase as well.

Penalty Exemptions

Under certain conditions, select beneficiaries may be exempt from the late-enrollment penalty. Beneficiaries who are exempt include working individuals (and their spouses) with group coverage, some international volunteers, and those who based their nonenrollment decision on incorrect information provided by a federal representative. Individuals who are permitted to delay enrollment have their own SEPs.

Current Workers

A working individual and/or the spouse of a working individual may be able to delay enrollment in Medicare Part B without being subject to the late-enrollment penalty. Delayed enrollment is permitted when an individual aged 65 or older has group health insurance coverage based on the individual's or spouse's current employment (with an employer with 20 or more employees). About 1.9In 2018, about 2.0 million of the 3.38 million working aged population arewere enrolled in Part A only, with most of the rest enrolled in both Parts A and B.3736 Delayed enrollment is also permitted for certain disabled persons who have group health insurance coverage based on their own or a family member's current employment with a large group health plan. For the disabled, a large group health plan is defined as one that covers 100 or more employees.

Specifically, persons permitted to delay coverage without penalty are those persons whose Medicare benefits are determined under the Medicare Secondary Payer program.3837 Under Medicare Secondary Payer rules, an employer (with 20 or more employees) is required to offer workers aged 65 and over (and workers' spouses aged 65 and over) the same group health insurance coverage that is made available to other employees.3938 The worker has the option of accepting or rejecting the employer's coverage. If he or she accepts the coverage, the employer plan is primary (i.e., pays benefits first) for the worker and/or spouse aged 65 or over, and Medicare becomes the secondary payer (i.e., fills in the gaps in the employer plan, up to the limits of Medicare's coverage). Similarly, a group health plan offered by an employer with 100 or more employees is the primary payer for its employees under 65 years of age, or their dependents, who are entitled to Medicare because of disability.40

Such individuals may sign up for Medicare Part B (or Part A) anytime that they (or their spouse) are still working, and they are covered by a group health plan through the employer or union based on that work. Additionally, those who qualify for Medicare based on age may sign up during the eight-month period after employment or retirement or the ending of group health plan coverage ends, whichever happens first. (If an individual's group health plan coverage, or the employment on which it is based, ends during the initial enrollment period, that individual would not qualify for ana SEP.)4140 Disabled individuals whose group plan is involuntarily terminated have six months to enroll without penalty.4241

Individuals who fail to enroll during this special enrollment period are considered to have delayed enrollment and thus could be subject to the penalty. For example, even though an individual may have continued health coverage through the former employer after retirement or have COBRA coverage,4342 he or she must sign up for Part B within eight months of retiring to avoid paying a Part B penalty if he or she eventually enrolls. Individuals who return to work and receive health care coverage through that employment may be able to drop Part B coverage, qualify for a new special enrollment period upon leaving that employment, and reenroll in Part B without penalty as long as enrollment is completed within the specified time frame.

International Volunteers

Some international volunteers may also be exempt from the Part B late-enrollment penalty. The Deficit Reduction Act of 2005 (P.L. 109-171) permits certain individuals to delay enrollment in Part B without a late-enrollment penalty if they volunteered outside of the United States for at least 12 months through a program sponsored by a tax-exempt organization defined under Section 501(c)(3) of the Internal Revenue Code.4443 These individuals must demonstrate that they had health insurance coverage while serving in the international program. Individuals permitted to delay enrollment have a six-month SEP, which begins on the first day of the first month they no longer qualify under this provision.

Equitable Relief

Under certain circumstances, a SEP may be created and/or late-enrollment penalties may be waived if a Medicare beneficiary can establish that an error, misrepresentation, or inaction of a federal worker or an agent of the federal government (such as an employee of the Social Security Administration, CMS, or a Medicare administrative contractor) resulted in late Part B enrollment.4544 To qualify for an exception under these conditions, the beneficiary must provide documentary evidence of the error, which "can be in the form of statements from employees, agents, or persons in authority that the alleged misinformation, misadvice, misrepresentation, inaction, or erroneous action actually occurred."46

Time-limited equitable relief also may be granted for certain categories of individuals. For example, CMS is providing equitable relief during September 1, 2017, through May 31, 2018, to individuals affected by recent hurricanes who were unable to enroll in Medicare during their initial enrollment periods.47may provide a special enrollment period to those affected by a weather related emergency or a major disaster.46 Additionally, as described in more detail below, CMS determined that it did not provide adequate information regarding Part B enrollment to certain individuals with exchange coverage who enrolled in Medicare Part A and is allowing equitable relief to these individuals through September 20182019.

Limited Time Equitable Relief for Individuals with Medicare Part A and Exchange Coverage

CMS generally encourages those who have coverage through an individual exchange (also known as marketplace) plan, and subsequently become eligible for Medicare, to drop the exchange coverage and enroll in Medicare during their initial enrollment period. After an individual has become eligible for Medicare Part A, any tax credits and cost-sharing reductions that individual receives through an exchange plan end.4847 CMS recognized that "many of these individuals did not receive the information necessary at the time of their Medicare [initial enrollment period or initial enrollment in coverage through the [exchange]], Part B SEP for the working aged or disabled, or initial enrollment in the Exchange to make an informed decision regarding their Medicare Part B enrollment."4948 This may have resulted in these individuals not enrolling in Part B, or enrolling in Part B late and being subject to a late enrollment penalty.

CMS is thus offering time-limited equitable relief through September 30, 20182019, for certain individuals enrolled in both premium-free Medicare Part A and in a plan provided through the health insurance exchanges.5049 Specifically, those who are currently, or had previously been, enrolled in an exchange plan and in premium-free Medicare Part A, and had an initial enrollment period that began on or after April 1, 2013, (or a Part B SEP that ended on or after October 1, 2013) may enroll in Part B without penalty through September 30, 20182019. Additionally, the Part B late enrollment penalties of those who had both Part A and exchange coverage and signed up for Part B outside of their initial enrollment period may be reduced or eliminated. To request this equitable relief, qualifying individuals must contact the Social Security Administration and provide appropriate documentation indicating that they were enrolled in an exchange plan and eligible for Medicare during the specified period.51

Collection of the Part B Premium

Part B premiums may be paid in a variety of ways.5251 If an enrollee is receiving Social Security or Railroad Retirement benefits,5352 the Part B premiums must, by law, be deducted from these benefits. Additionally, Part B premiums are deducted from the benefits of those receiving a Federal Civil Service Retirement annuity.5453 The purpose of collecting premiums by deducting them from benefits is to keep premium collection costs at minimum.

This withholding does not apply to those beneficiaries receiving state public assistance through a Medicare Savings Program because their premiums are paid by their state Medicaid program. (See "Premium Assistance for Low-Income Beneficiaries.") Additionally, premium payments may be made on behalf of Medicare beneficiaries by an employee, union, lodge, or other organization, or by an entity of a state or local government if it enters into a group-billing arrangement with CMS. Those approved as group billers include such entities as city and county governments, state teacher retirement systems, and certain religious orders.

Any

Part B enrollees whose premiums are not deducted from Social Security, Railroad Retirement, or Civil Service Retirement monthly benefits; are paid by Medicaid; or paid under an approved group-billing arrangement by a privateare paid by another person or organization must pay premiums directly to CMS.55

Deduction of Part B Premiums from Social Security Checks

By law, a Social Security beneficiary who is enrolled in Medicare Part B must have the Part B premium automatically deducted from his or her Social Security benefits.5655 Automatic deduction from the Social Security benefit check also applies to Medicare Advantage participants who are enrolled in private health care plans in lieu of traditional Medicare.5756 In 20172018, about 7568% of Medicare Part B enrollees (3940.7 million) had their Part B premiums deducted from their Social Security benefit checks.5857

Social Security beneficiaries who do not pay Medicare Part B premiums include those who are under the age of 65 and do not yet qualify for Medicare (e.g., began receiving Social Security benefits at the age of 62); receive low-income assistance from Medicaid to pay the Part B premium; have started to receive Social Security disability insurance (SSDI) but are not eligible for Medicare Part B because they have not received SSDI for 24 months; or chose not to enroll in Medicare Part B.

The amount of an individual's Social Security benefits cannot go down from one year to the next as a result of the annual Part B premium increase, except in the case of higher-income individuals subject to income-related premiums. (See "Protection of Social Security Benefits from Increases in Medicare Part B Premiums.") For those beneficiaries "held harmless," the dollar amount of their Part B premium increases would be held below or equal to the amount of the increase in their monthly Social Security benefits.

Part B Enrollees Who Do Not Receive Social Security Benefits

A small percentage of Medicare Part B enrollees do not receive Social Security benefits. For example, some individuals aged 65 and older may have deferred signing up for Social Security for various reasons, for instance if they have not yet reached their full Social Security retirement age5958 or are still working. Additionally, certain persons who spent their careers in employment that was not covered by Social Security—including certain federal, state, or local government workers and certain other categories of workers—do not receive Social Security benefits but may still qualify for Medicare. For those who receive benefit payments from the RRB6059 or the Civil Service Retirement System (CSRS),6160 Part B premiums are deducted from the enrollees' monthly benefit payments. While RRB retirement benefit amounts are protected by the hold-harmless provision, CSRS benefits are not held harmless from annual increases in the Part B premium.

For those who do not receive these types of benefit payments, Medicare will generally bill directly for their premiums every three months.6261 The enrollee who is being billed does not necessarily have to pay his or her own premiums; premiums may be paid by the enrollee, a relative, friend, organization, or anyone else.63 Additionally, in62 In cases where an organization wants to be billed for the Part B premiums of a number of Medicare beneficiaries, it may enter into a formal group-billing arrangement with CMS.63 Those approved as group billers include such entities as city and county governments, state teacher retirement systems, and certain religious orders.

In instances in which a beneficiary's monthly Social Security benefit is not sufficient to cover the entire Part B premium amount, Medicare may bill the beneficiary for the balance.64 Nonpayment of premiums results in termination of enrollment in the Part B program, although a grace period (through the last day of the third month following the month of the due date) is allowed for beneficiaries who are billed and pay directly.65

Determining the Part B Premium

Each year, the CMS actuaries estimate total per capita Part B costs for beneficiaries aged 65 and older over for the following year and set the Part B premium to cover 25% of expected Part B expenditures.66 However, because prospective estimates may differ from the actual spending for the year, contingency margin adjustments are made to ensure sufficient income to accommodate potential variation in actual expenditures during the year. (See "Contingency Margin.") The Part B premium is a single national amount that does not vary with a beneficiary's age, health status, or place of residence. Premiums may be adjusted upward for late enrollment (see "Late-Enrollment Premium Penalty and Exemptions") and for beneficiaries with high incomes (see "Income-Related Premiums"), or they may be adjusted downward for those protected by the hold-harmless provision (see "Protection of Social Security Benefits from Increases in Medicare Part B Premiums").

Monthly Part B premiums are based on the estimated amount that would be needed to finance Part B expenditures on an incurred basis during the year. In estimating needed income and to account for potential variation, CMS takes into consideration the difference in prior years of estimated and actual program costs, the likelihood and potential impact of potential legislation affecting Part B in the coming year, and the expected relationship between incurred and cash expenditures (e.g., payments for some services provided during a particular year may not be paid until the following year). Once the premium has been set for a year, it will not be changed during that year.

While both aged and disabled Medicare beneficiaries may enroll in Part B, the statute provides that Part B premiums are to be based only on the expected program costs—that is, the monthly actuarial rate—for the aged (those 65 years of age and older).67 The actuarial rate for the aged is defined as one-half of the expected average monthly per capita program costs for the aged plus any contingency margin adjustments. Standard Part B premiums are one-half of the actuarial rate. (See Appendix A for a discussion of the history of the premium methodology.) Part B costs not covered by premiums are paid for through transfers from the General Fund of the Treasury. The monthly actuarial rates for both aged and disabled enrollees are used to determine the needed amount of matching general revenue funding.68

Starting in 2016, a $3.00 per month surcharge is being added onto the standard premium (higher amounts for high-income individuals). To mitigate the expected large premium increases for those not held harmless in 2016, the Bipartisan Budget Act of 2015 (BBA 15; P.L. 114-74) required that 2016 Medicare Part B premiums be set as if the hold-harmless rule were not in effect—in other words, to calculate premiums as if all enrollees were paying the same annual inflation-adjusted standard premium. (For additional information on the changes made by BBA 15, see Appendix D.) To compensate for the lost premium revenue (below the required 25%) and to ensure that the SMI Trust Fund had adequate income to cover payments for Part B benefits in 2016, the act allowed for additional transfers from the General Fund of the Treasury to the SMI Trust Fund. To offset the approximately $9 billion in increased federal spending in 2016 resulting from the reduction in standard premiums for those not held harmless, a $3.00 surcharge was added to the monthly premium in 2016, and will continue to be applied in subsequent years until the additional federal costs are fully offset.69 For those who pay high-income premiums, the surcharge increases on a sliding scale up to $9.60. (See "Income Categories and Premium Adjustments.") It is estimated that the surcharge will be applied to premiums through 2021.70

Premium Calculation for 2018

2019

To determine the 20182019 monthly Part B premium amount,71 CMS first estimated the monthly actuarial rate for enrollees aged 65 and older using actual per-enrollee costs by type of service from program data through 20162017 and projected these costs through 20182019. CMS estimated that the monthly amount needed to cover one-half of the total benefit and administration costs for the aged in 20182019 would be $247.91263.47. However, because of expected variations between projected and actual costs, a contingency adjustment of $15.883.74 was added to this amount. (See "Contingency Margin," below.) After a reduction of $1.892.31 to account for expected interest on trust fund assets, the monthly actuarial rate for the aged was determined to be $261264.90. The 20182019 Part B standard premium is one-half of $261264.90, or $131.00132.50 per month72 (25% of the monthly expected per capita costs of the aged). The BBA 15 repayment surcharge of $3.00 was then added onto that amount for a total monthly premium of $134.00135.50. (As noted, only those not held harmless pay the standard 20182019 premium and surcharge. Those held harmless in 20182019 pay lower amounts.)

Contingency Margin

The contingency margin is the amount set aside to cover an appropriate degree of variation between actual and projected costs in a given year. For example, in some years, legislation that resulted in increased Medicare Part B expenditures for the year was enacted after the premium for the year had been set. The Medicare actuaries consider a contingency reserve ratio—net assets at the end of a year in the Part B account of the SMI Trust Fund compared to the following year's expected expenditures—in the amount of 15% to 20% to be adequate, and normally aim for a 17% ratio when determining Part B financing for the upcoming year. Financing fell short of this goal in 20172018; however, the CMS actuaries estimate that the 20182019 premium rates will allow asset levels in the Part B account to increase to appropriate levels by the end of 20182019.

The contingency margin in 20182019 is affected by a number of factors. Because about 283.5% of Part B enrollees are being held harmless and pay reduced premiums in 20182019, the premiums of the remaining 7296.5% were adjusted so that aggregate premiums would still cover 25% of Part B costs in 20182019. This increase is included in the contingency margin. Additionally, starting in 2011, manufacturers and importers of brand-name drugs began paying a fee that is allocated to the SMI Trust Fund. The contingency margin was thus reduced to account for this additional revenue. Further, certain payment incentives to encourage the development and use of health information technology (HIT) by Medicare physicians are excluded from premium determinations. (HIT bonuses or penalties are directly offset through transfers of general funds from the Treasury.) The 20182019 contingency margin adjustment of $15.883.74 reflects the expected net effects of all of the above factors.

Income-Related Premiums

For the first 41 years of the Medicare program, all Part B enrollees paid the same Part B premium, regardless of their income. However, the Medicare Modernization Act of 2003 (MMA; P.L. 108-173)73 required that, beginning in 2007, high-income enrollees pay higher premiums.74 About 3.56 million Medicare Part B enrollees (about 6.6%) paid%) pay these higher premiums in 2018.75

Adjustments, known as income-related monthly adjustment amounts (IRMAA), are made to the standard Part B premiums for high-income beneficiaries, with the share of expenditures paid by beneficiaries increasing with income. This share ranges from 35% to 8085% of the value of Part B coverage. In 20182019, individuals whose incomes exceed $85,000 and couples whose combined income exceeds $170,000 are subject to higher premium amounts.76 The hold-harmless provision that prevents a beneficiary's Social Security benefits from decreasing from one year to the next as a result of the Part B premium increase does not apply to those subject to an income-related increase in their Part B premiums. (See "Protection of Social Security Benefits from Increases in Medicare Part B Premiums.")

Determination of Income

To determine those subject to the high-income premium, Social Security uses the most recent federal tax return provided by the Internal Revenue Service. In general, the taxable year used in determining the premium is the second calendar year preceding the applicable year. For example, the 20172018 tax return (20162017 income) was used to determine who wouldwould pay the 20182019 high-income premiums.77

The income definition on which the high-income premiums are based is modified adjusted gross income (MAGI),78 which is different from gross income. Specifically, gross income is all income from all sources, minus certain statutory exclusions (e.g., nontaxable Social Security benefits).79 From gross income, adjusted gross income (AGI)80 is calculated to reflect a number of deductions, including trade and business deductions and losses from sale of property. MAGI is defined as AGI plus certain foreign-earned income and tax-exempt interest.81

If a person had a one-time increase in taxable income in a particular year (such as from the sale of income-producing property), that increase would be considered in determining the individual's total income for that year and thus his or her liability for the income-related premium two years ahead. It would not be considered in the calculations for future years.

In the case of certain major life-changing events that result in a significant reduction in MAGI, an individual may request to have the determination made for a more recent year than the second preceding year.82 Major life-changing events include (1) death of a spouse; (2) marriage; (3) divorce or annulment; (4) partial or full work stoppage for the individual or spouse; (5) loss by individual or spouse of income from income-producing property when the loss is not at the individual's direction (such as in the case of a natural disaster); and (6) reduction or loss for individual or spouse of pension income due to termination or reorganization of the plan or scheduled cessation of the pension.83 Certain types of events, such as those that affect expenses but not income or those that result in the loss of dividend income because of the ordinary risk of investment, are not considered major life-changing events.84

If Medicare enrollees disagree with decisions regarding their IRMAAs, they may file an appeal with Social Security. Enrollees may either submit a "Request for Reconsideration"85 or contact their local Social Security office to file an appeal. (An enrollee does not need to file an appeal if he or she is requesting a new decision based on a life-changing event described above or if the enrollee has shown that Social Security used the wrong information to make the original decision.)

Income Categories and Premium Adjustments

Depending on their level of income, Medicare beneficiaries may be classified into one of fivesix income categories.86 In 20182019, individuals with incomes less than $85,000 a year ($170,000 for a couple) pay the standard premium, which is based on 25% of the average Part B per capita cost. Individuals with incomes over $85,000 per year and couples with combined income over $170,000 per year pay a higher percentage of Part B costs. Depending on one's level of income over these threshold amounts, premiums may be adjusted to cover 35%, 50%, 65%, 80%, or 85or 80% of the value of Part B coverage (with the rest being subsidized through federal general revenues).87 Additionally, high-income individuals pay surcharges ranging from $4.20 to $9.6010.20 per month to offset increased federal spending in 20182019 due to premium reductions under BBA 15 (compared to a $3.00 surcharge for those who pay the standard premium). In 20182019, total IRMAAs for the fourfive high-income levels, including the additional BBA 15 surcharges, are $53.50, $133.90, $214.30, and $294.60,54.10, $135.40, $216.70, $297.90, and $325.00 respectively.

The income categories and associated premiums for 20182019, including the applicable BBA 15 repayment surcharges, are shown below in Table 2. When both members of a couple are enrolled in Part B, each pays the applicable premium amount.

|

Levels of Premium Adjustment and Percentage of Costs Covered by Premiums |

Beneficiaries Who File an Individual Tax Return with Income |

Beneficiaries Who File a Joint Tax Return with Incomea |

Income-Related Monthly Adjustment Amount (IRMAA)b |

Total Monthly Premium (premium + surcharge) |

||||

|

Held Harmless |

Less than or equal to $85,000 |

Less than or equal to $170,000 |

n/a |

Less than $ |

||||

|

Not Held Harmless |

||||||||

|

Standard (25%) |

Less than or equal to $85,000 |

Less than or equal to $170,000 |

n/a |

134.00 |

||||

|

High Income |

||||||||

|

Level 1 (35%) |

Greater than $85,000 and less than or equal to $107,000 |

Greater than $170,000 and less than or equal to $214,000 |

$ |

187.50 |

||||

|

Level 2 (50%) |

Greater than $107,000 and less than or equal to $133,500 |

Greater than $214,000 and less than or equal to $267,000 |

133.90 |

|

||||

|

Level 3 (65%) |

Greater than $133,500 and less than or equal to $160,000 |

Greater than $267,000 and less than or equal to $320,000 |

214.30 |

348.30 |

||||

|

Level 4 (80%) |

Greater than $160,000 and less than $500,000 |

Greater than $320,000 and less than $750,000 |

294.60 |

428.60

|

Level 5 (85%)

|

Greater than or equal to $500,000

|

Greater than or equal to $750,000

|

325.00 460.50 |

Source: CMS, "Medicare Program: Medicare Part B Monthly Actuarial Rates, Premium Rate, and Annual Deductible Beginning January 1, 2018," 822019," 83 Federal Register 55370, November 21, 201752462, October 17, 2018.

Notes: The hold-harmless provision does not apply to individuals in the high-income categories. n/a = not applicable.

a. Couples with a joint income of $170,000 or less could pay different premium amounts if one of them qualifies to be held harmless and the other does not. Members of a couple in the high-income categories both pay the same applicable income-adjusted premium amount.

b. Total income-related monthly adjustment amounts (IRMAAs) are the amounts by which total monthly premiums exceed the standard premium ($134.00).

c. Because there was a relatively small Social Security COLA in 2018, the135.50).

c. The premiums of those protected under the hold-harmless rule may vary depending on the amount of the actual increase in their Social Security benefits.

Married persons who lived with their spouse at some point during the year but who filed separate returns are subject to different premium amounts. The income levels and premium amounts are shown in Table 3.

|

Beneficiaries Who Are Married and Lived with Their Spouse at Any Time During the Year but File a Separate Tax Return from Their Spouse with Income |

Income-Related Monthly Adjustment Amount (IRMAA)a |

Total Monthly Premium (premium + surcharge) |

||||

|

Held Harmless |

||||||

|

Less Than or Equal to $85,000 |

n/a |

Less than $ |

||||

|

Not Held Harmless |

||||||

|

Less Than or Equal to $85,000 |

n/a |

134.00 |

||||

|

Greater Than $85,000 |

$294.60 |

428.60

|

$297.90

|

433.40

|

Greater than or equal to $415,000

|

325.00 460.50 |

Source: CMS, "Medicare Program: Medicare Part B Monthly Actuarial Rates, Premium Rate, and Annual Deductible Beginning January 1, 2018," 822019," 83 Federal Register 55370, November 21, 201752462, October 17, 2018.

Notes: n/a = not applicable.

a. Total income-related monthly adjustment amounts (IRMAAs) are the amounts by which total monthly premiums exceed the standard premium ($134.00).

b. Because there was a small Social Security COLA in 2018, the135.50).

b. The premiums of those protected under the hold-harmless rule may vary depending on the amount of the actual increase in their Social Security benefits.

Income Thresholds

The original provision establishing the Part B income-related premiums set the initial income threshold and high-income-level ranges. Prior to 2010, annual adjustments to these levels were based on annual changes in the consumer price index for urban consumers (CPI-U), rounded to the nearest $1,000. However, Section 3402 of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) froze the income thresholds and ranges at the 2010 level through 2019 rather than allowing them to rise with inflation.88 As a result, as incomes have increased with inflation, a greater share of Medicare enrollees are reaching the high-income thresholds and paying the high-income premiums than would have been the case without this freeze.

Additionally, beginning in 2018, the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; P.L. 114-10) changed the income thresholds inof the top two income categories at that time.89 Individuals with incomes between $133,500 and $160,000 per year are now in the 65% applicable percentage category (which previously applied to those with incomes between $160,000 and $214,000 in 2010-2017). The income threshold for the highest category (80%) is nowat that time (80%) was changed to $160,000 (which previously applied to $214,000 in 2010-2017). The thresholds for the lower two income categories remain unchangedwere not changed. (See Table 4.)

In 2019, the With the exception of the addition of a new top threshold category described below, the 2019 income thresholds for the current categories will remainhigh-income categories are the same as in 2018. For years 2020 and after, the thresholds will be adjusted annually for inflation based on the new (2018 and 2019) threshold levels.90

Section 53114 of the Bipartisan Budget Act of 2018 (BBA 18; P.L. 115-123) addsadded an additional high-income category beginning in 2019 for individuals with annual income of $500,000 or more or couples filing jointly with income of $750,000 or more. (See Table 4.) Enrollees with income equal to or exceeding these thresholds will pay premiums that cover 85% of the average per capita cost of the Parts B and D benefits instead of 80%. The threshold for couples filing jointly in this new income tier will beis calculated as 150% of the individual income level rather than 200% as in the other income tiers. This new top income threshold will be frozen through 2027 and will be adjusted annually for inflation starting in 2028 based on the CPI-U.91

|

Levels of Premium Adjustment and Percentage of Costs Covered by Premiums |

Beneficiaries Who File Individual Tax Returns with Income: |

Beneficiaries Who File Joint Tax Returns with Income: |

||||||

|

2017 |

2018 |

2019 |

2017 |

2018 |

2019 |

|||

|

Standard (25%) |

Less than or equal to $85,000 |

Less than or equal to $85,000 |

Less than or equal to $85,000 |

Less than or equal to $170,000 |

Less than or equal to $170,000 |

Less than or equal to $170,000 |

||

|

High Income |

||||||||

|

Level 1 (35%) |

$85,001*- $107,000 |

$85,001-$107,000 |

$85,001-$107,000 |

$170,001-$214,000 |

$170,001-$214,000 |

$170,001-$214,000 |

||

|

Level 2 (50%) |

$107,001-$160,000 |

$107,001-$133,500 |

$107,001-$133,500 |

$214,001-$320,000 |

$214,001-$267,000 |

$214,001-$267,000 |

||

|

Level 3 (65%) |

$160,001-$214,000 |

$133,501-$160,000 |

$133,501-$160,000 |

$320,001-$428,000 |

$276,001-$320,000 |

$267,001-$320,000 |

||

|

Level 4 (80%) |

More than $214,000 |

More than $160,000 |

$160,001-$499,999 |

More than $428,000 |

More than $320,000 |

$320,001-$749,999* |

||

|

Level 5 (85%) |

n/a |

n/a |

$500,000 or more |

n/a |

n/a |

$750,000 or more |

||

Source: CMS, Annual Notices, "Medicare Program; Medicare Part B Monthly Actuarial Rates, Premium Rate, and Annual Deductible," for 2017 and, 2018, and §53114 of BBA 18 for 2019.

Notes: * Bottom thresholds in Levels 2 through 4 rounded up to the nearest dollar and upper threshold in 2019 Level 4 rounded down to the nearest dollar; n/a = not applicable.

Premium Assistance for Low-Income Beneficiaries

Medicare beneficiaries with limited incomes and resources may be able to qualify for assistance with their premiums and other out-of-pocket expenses.92 About one in five Medicare beneficiaries receives Part B premium subsidies.

Medicare beneficiaries who qualify for full Medicaid benefits (full dual-eligibles) have most of their health care expenses paid for by either Medicare or Medicaid. For these individuals, Medicaid covers the majority of Medicare premium and cost-sharing expenses, and it supplements Medicare by providing coverage for services not covered under Medicare, such as dental services and long-term services and supports. In cases where services are covered by both Medicare and Medicaid, Medicare pays first and Medicaid picks up most of the remaining costs. Each state has different rules about eligibility and applying for Medicaid.93

Beneficiaries who do not meet their respective state's eligibility criteria for Medicaid may still qualify for assistance with Part B premiums if they have incomes of less than 135% of the federal poverty level (FPL) and assets of less than $7,560730 for an individual or $11,340600 for a couple in 20182019.94 These assistance programs are commonly referred to as Medicare Savings Programs (MSPs).95 Three of these programs provide assistance with Part B premiums. The type of assistance is based on a beneficiary's level of income.

Qualified Medicare Beneficiaries

Aged or disabled persons with incomes at or below FPL may qualify for the Qualified Medicare Beneficiary (QMB) program.96 In 20182019, the QMB monthly qualifying income levels are $1,032061 for individuals and $1,392430 for a couple (annual income of $12,384732 and $16,70417,160, respectively).97 QMBs are entitled to have their Medicare Parts A and B cost-sharing charges, including the Part B premium and all deductibles and coinsurance, paid by Medicaid.98 (See Table 5.) For QMBs, Medicaid coverage is limited to the payment of Medicare premiums and cost-sharing charges (i.e., the Medicare beneficiary is not entitled to coverage of Medicaid plan services, unless the individual is otherwise entitled to Medicaid).

Specified Low-Income Medicare Beneficiaries

Individuals whose income is more than 100% but less than 120% of FPL may qualify for assistance as a Specified Low-Income Medicare Beneficiary (SLMB). In 20182019, the monthly income limits are $1,234269 for an individual and $1,666711 for a couple (annual income of $14,808 and $19,99215,228 and $20,532, respectively).99 Medicaid pays the Medicare Part B premiums for SLMBs, but not other cost sharing.

Qualifying Individuals

Individuals whose income is between 120% and 135% of FPL may qualify for assistance as Qualifying Individuals (QIs). In 20182019, the monthly income limit for a QI is $1,386426 for an individual, and for a couple, it is $1,872923 (annual income of $16,632 and $22,46417,112 and $3,076, respectively). Medicaid protection for these individuals is limited to payment of the monthly Medicare Part B premium. Expenditures under the QI program are, however, paid for (100%) by the federal government from the Medicare SMI Trust Fund up to the state's allocation level.100 A state is required to cover only the number of people that would bring the state's spending on these population groups in a year up to its allocation level. Any expenditures beyond that level are voluntary and paid entirely by the state.

Funding for the QI program was first made available by the Balanced Budget Act of 1997 (BBA97; P.L. 105-33).101 Subsequent legislation extended the program and the amounts available through allocation.102 MACRA permanently extended the QI program.103

|

Monthly Incomea |

Resourcesb |

Benefits |

|

|

Qualified Medicare Beneficiary (QMB) |

At or Below 100% FPLc $1, $1, |

$7, $11, |

Part B Premiumd Coverage of Parts A and B Deductibles and Coinsurance |

|

Specified Low-Income Medicare Beneficiary (SLMB) |

Above 100% but Less Than 120% FPLc $1, $1, |

$7, $11, |

Part B Premium |

|

Qualifying Individual (QI) |

At or Above 120% but Less Than 135% FPLc $1, $1, |

$7, $11, |

Part B Premium |

Source: Social Security Program Operations Manual, HI 00815.023 Medicare Savings Programs Income Limits, at https://secure.ssa.gov/poms.nsf/lnx/0600815023.

a. These amounts include a $20 general income exclusion, under which $20 from any income is not counted toward the income limits. CMS rounds up to the nearest dollar when computing monthly income limits.

b. Resources include money in checking and savings accounts, stocks, bonds, mutual funds, and Individual Retirement Accounts (IRAs). Resources do not include one's primary residence, a life insurance policy worth up to $1,500, one car, burial plots, up to $1,500 per person for burial expenses, and household items. Some states have no limits on resources.

c. Federal Poverty Levels (FPLs) are updated each year, usually in January or February. Income levels are higher for Hawaii and Alaska and for those living with dependents.

d. Most people do not pay a premium for Part A because they have worked 40 or more quarters in covered employment. For those without sufficient work history to qualify for premium-free Part A, Medicaid will also pay Part A premiums for QMBs.

Protection of Social Security Benefits from Increases in Medicare Part B Premiums

After a person becomes eligible to receive Social Security benefits, his or her monthly benefit amount is adjusted annually to compensate for increases in the prices of goods and services over time.104 Near the end of each year, the Social Security Administration announces the cost-of-living adjustment (COLA) payable in January of the following year. The amount of the COLA is based on inflation as measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers (CPI-W).105 If the CPI-W decreases, Social Security benefits stay the same—benefits are not reduced during periods of deflation.

When the annual Social Security COLA is not sufficient to cover the standard Medicare Part B premium increase, most Medicare beneficiaries are protected by a hold-harmless provision in the Social Security Act.106 Specifically, if in a given year the increase in the standard Part B premium would cause a beneficiary's Social Security check to be less, in dollar terms, than it was the year before, then the Part B premium is reduced to ensure that the amount of the individual's Social Security check does not decline.107 This determination is made by the Social Security Administration.

To be held harmless in a given year, a Social Security beneficiary must have received Social Security benefit checks in both December of the previous year and January of the current year, and the beneficiary must also have had Part B premiums deducted from both checks.108 The hold-harmless provision operates by comparing the net dollar amounts of the two monthly benefit payments; if the net Social Security benefit for January of the current year is lower than in December of the previous year, then the hold-harmless provision applies to that person. Premiums of those held harmless are then reduced to an amount that would not cause their Social Security benefits to decline in the next year. The premium paid by those held harmless is called the Variable Supplementary Medical Insurance premium.109 Those not held harmless pay the standard premium as determined for that year.

Typically, the hold-harmless provision affects only a small number of beneficiaries and has had minimal impact on Part B financing.110 In most years, this rule primarily protects those with relatively low Social Security payments. However, in years in which there is no or a very low Social Security COLA, such as in 2010, 2011, 2016, and 2017, a large number of beneficiaries may be protected by this provision. (See "Application of the Hold-Harmless Rule in Years Prior to 2016," "Application of the Hold-Harmless Rule in 2016," and "Application of the Hold-Harmless Rule in 2017.")

Some Beneficiaries Are Not Protected by the Hold-Harmless Provision

Not all beneficiaries are protected by the hold-harmless provision and, under some circumstances, may be subject to significantly higher premiums than those who are held harmless. Groups that are not protected include the following:

- Higher-Income Beneficiaries. Higher-income beneficiaries who are required to pay income-related Part B premiums are explicitly excluded by law from protection under the hold-harmless provision. They are required to pay the full amount of any increase in their Part B premiums. (See "Income-Related Premiums.")

- Lower-Income Beneficiaries. Lower-income beneficiaries who receive premium assistance from Medicaid are not held harmless as their premiums are not deducted from their Social Security benefits. However, the Medicaid program pays the full amount of any increase in their Part B premiums. (See "Premium Assistance for Low-Income Beneficiaries.")

- Those Who Do Not Receive Social Security. This group includes those who have not yet signed up for Social Security for various reasons, for example because they have deferred signing up because they have not reached full retirement age111 or are still working. It also includes disabled beneficiaries whose Social Security Disability Insurance (SSDI) cash benefits have been discontinued because they have returned to work but who are still eligible for Medicare.112 Additionally, those who receive benefits exclusively through a different retirement plan are not held harmless.113 This group includes certain federal retirees under the Civil Service Retirement System114 as well as certain state and local government workers—such as teachers, law-enforcement personnel, and firefighters—who have their own pension programs.115

- Those Who Did Not Have Medicare Premiums Deducted from Their Social Security Checks at the End of One Year and the Beginning of the Next. This category includes those who enroll in Social Security or Medicare during the year in which the hold-harmless provision is in effect, including SSDI recipients who become eligible for Medicare that year after the 24-month waiting period.116 It also includes those who had Medicare premiums paid on their behalf one year, for example by Medicaid, but lost that coverage during the next year.

Some people protected by the hold-harmless provision may still see a decrease in their Social Security checks due to an increase in Medicare Part D premiums. Part D premiums are not covered by the hold-harmless provision, although beneficiaries with low-income subsidies would not be affected.

Additionally, those who pay the late-enrollment penalty are not fully protected from the hold-harmless rule. (See "Late-Enrollment Premium Penalty and Exemptions.") In a year in which the hold-harmless provision is in effect, the late-enrollment surcharges are calculated as a percentage of the premiums of those not held harmless. These surcharges are considered "nonstandard" premiums and thus are not limited by the hold-harmless provision.

Application of the Hold-Harmless Rule in Years Prior to 2016

As described earlier, an individual's Social Security COLA is determined by multiplying his or her benefit amount by the inflation rate, the CPI-W. Part B premiums are determined by projected Part B program costs. Thus, the number of people held harmless can vary widely from year to year, depending on inflation rates and projected Part B costs. For most years, the hold-harmless provision has affected a relatively small number of beneficiaries.117 However, due to low inflation, no COLA adjustments were made to Social Security benefits in 2010 and 2011. Most Medicare beneficiaries (about 73%) were protected by the hold-harmless provision and continued to pay the 2009 standard monthly premium of $96.40 in both 2010 and 2011.118 Because Part B expenditures were still expected to increase in those years, and because beneficiary premiums are required to cover 25% of those costs, the premiums for those not held harmless (27% of beneficiaries) were higher than they would have been had the rest of the beneficiaries not been held harmless. The standard monthly premiums paid by those not held harmless were $110.50 in 2010 and $115.40 in 2011.119 In 2011, of the 27% who were not eligible to be held harmless, about 3% were new Medicare enrollees, about 5% were high-income, about 17% had their premiums paid for by Medicaid, and the remaining 2% did not have their premiums withheld from Social Security benefit payments.

In 2012 and 2013, Social Security beneficiaries received a 3.6% and a 1.7% COLA, respectively, which more than covered the Part B premium increases in those years; therefore, the hold-harmless provision was not applicable for most beneficiaries. Similarly, in 2014 and 2015, with a Social Security COLA increase of 1.5% and 1.7%, respectively, and no increase in Part B premiums, the hold-harmless provision also was not broadly applicable in those years.120

Application of the Hold-Harmless Rule in 2016

In 2016, for a third time, there was no Social Security COLA increase, but there was a projected increase in Medicare Part B premiums—from $104.90 per month in 2015 to about $121 per month in 2016.121 Similar to its application in 2010 and 2011, the hold-harmless provision as applied in 2016 protected some beneficiaries but not others. In 2016, about 70% of Part B enrollees were held harmless and continued to pay the 2015 monthly premium amount of $104.90 through 2016. Those not held harmless included those eligible for premium assistance through their state Medicaid programs (about 19%), those who paid the high-income premiums (about 6%), those who did not receive Social Security benefits (3%), and new enrollees in 2016 (5%).122

Absent legislation, the premiums of those not held harmless (the remaining 30%) would have been higher than the premiums would have been had the hold-harmless provision not been in effect.123 However, BBA 15 mitigated the expected large increases for those not held harmless and required that their premiums be calculated as if the hold-harmless rule were not in effect. BBA 15 also required that a monthly surcharge of $3.00 be added to standard premiums (more for those with high incomes) until the increased cost to the federal government of reducing the premiums is offset. (See Appendix D.) The total standard premium amount for those Part B enrollees not held harmless in 2016, including the $3.00 per month surcharge, was $121.80.124

Application of the Hold-Harmless Rule in 2017

Should there have been a 0% Social Security COLA in 2017, BBA 15 would have allowed for a similar Medicare Part B premium setting mechanism for 2017 as in 2016. However, as there was a very small (0.3%) Social Security COLA in 2017, this provision did not apply.

Because the Social Security COLA was not large enough to cover the full Medicare Part B premium increase, about 70% of enrollees were held harmless in 2017. Those held harmless in 2017 paid, on average, about $109.00 per month for their Part B premiums. However, their actual premiums varied depending on the dollar amount of the increase in their Social Security benefit.125 Additionally, many of those not held harmless in 2016 because they were new to Medicare in that year may have qualified to be held harmless in 2017. If they qualified, the premiums for those individuals would have been equal to the 2016 premium of $121.80, plus the dollar amount of the increase in their monthly Social Security benefit.

As the premiums of those not held harmless (the remaining 30% of enrollees) had to cover both their share of the premium increases plus that of the 70% held harmless,126 the Medicare trustees estimated that their 2017 Part B premiums could be as high as $149 per month.127 However, in setting the 2017 premiums, the Secretary "exercised her statutory authority to mitigate projected premium increases for these beneficiaries"128 by setting a lower-than-normal contingency reserve ratio for the SMI Trust Fund in 2017. This had the effect of reducing premiums below what they might have been had the ratio been set at a more conventional level.129 In 2017, those not held harmless paid monthly premiums of $134.00.

Application of the Hold-Harmless Rule in 2018

In 2018, there was a 2.0% Social Security COLA and no increase in the 2018 Medicare Part B premiums (i.e., the Part B premium was $134.00 per month in both 2017 and 2018).130 For many Part B enrollees who were held harmless in 2017, the Social Security COLA was large enough to cover the difference between the full Medicare premium of $134.00 and the reduced premium amount they paid in 2017. Therefore, many of those held harmless in 2017 are no longer seeingsaw reduced premiums in 2018 and have returned to paying the standard premium amounts (which include the $3.00 BBA 15 surcharge).

To illustrate, for someone receiving a Social Security benefit of $1,404.00 per month in 2017 (the average amount for retired workers in that year),131 a 2.0% Social Security COLA would have resulted in an increased benefit of about $28.00 per month in 2018. If that person had been held harmless in 2017 and was paying a Medicare Part B premium of $109.00 per month, this Social Security benefit increase would have been more than enough to cover the $25.00 difference between that individual's reduced Part B 2017 premium amount of $109.00 and the 2018 premium of $134.00. Therefore, that person's Medicare Part B premiums could have increased up to the full premium amount of $134.00 in 2018.

CMS estimatesestimated that about 72% of Part B enrollees are not being were not held harmless in 2018.132 About 42% of enrollees were held harmless in 2017 but no longer qualifyqualified for reduced premiums in 2018 because they did not meet the requirement that their Social Security benefits would decrease as a result of the increase in their Part B premiums. The remaining 30% includesincluded those who normally do not qualify to be held harmless, for instance, because they paypaid high-income premiums, havehad their premiums paid on their behalf by Medicaid, or dodid not receive Social Security benefits.

About 28% of Part B enrollees did not receive a large enough increase in their Social Security COLAs to cover the full amount of the Part B premium and thus The 2019 Social Security COLA of 2.8% was large enough to increase the benefits of most of those who were held harmless in 2018 to levels sufficient to cover the difference between the amount of the (reduced) premiums they paid in 2018 and the 2019 premiums of $135.50. In 2019, only about 3.5% of beneficiaries (about 2 million) are being held harmless and pay premiums lower than the 2019 premium of $135.50.qualifyqualified to be held harmless and paypaid reduced premiums in 2018. Their premiums could increasehave increased from the premium amount they paid in 2017, plus the dollar amount of the increase in their monthly 2018 Social Security benefit. For example, for someone with a monthly Social Security benefit of $600.00 in 2017, the 2.0% 2018 COLA would have provided an increase of about $12.00. If that individual had been paying $109.00 per month for Medicare premiums in 2017, the $12.00 increase would not behave been sufficient to cover the full $134.00 per month. In this example, the individual would payhave paid $109.00 plus $12.00 ($121.00) per month in 2018.

Application of the Hold-Harmless Rule in 2019

$109.00 plus $12.00 ($121.00) per month in 2018.

Part B Premiums over Time