The Committee on Foreign Investment in the United States (CFIUS)

Changes from July 3, 2018 to May 15, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Committee on Foreign Investment in the United States (CFIUS)

Contents

- Background

- The Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA)

- Foreign Investment Data

- Origins of CFIUS

Establishment of CFIUS- The "Exon-Florio" Provision

- Treasury Department Regulations

- The "Byrd Amendment"

- The Amended CFIUS Process

- FIRRMA Legislation: Key Provisions

- CFIUS: Major Provisions

- National Security Reviews

- Informal Actions

- Formal Actions

- National Security Review

- National Security Investigation

- Presidential Determination

- Committee Membership

- Covered Transactions

- Critical Infrastructure / Critical Technologies

- Foreign Ownership Control

- Factors for Consideration

- Confidentiality Requirements

- Mitigation and Tracking

- Congressional Oversight

- Recent CFIUS Reviews

- Foreign Investment National Security Policies of Foreign Jurisdictions

- Government-Sponsored Firms and National Security

- House Permanent Select Committee on Intelligence

- U.S.-China Economic and Security Review Commission

- CFIUS-DIUx Report

- Other National Security Concerns

- Issues for Congress

- Proposed Legislation

- H.R. 2810, National Defense Authorization Act for Fiscal Year 2018

- H.R. 2932, the Foreign Investment and Economic Security Act of 2017

- S. 616, the Food Security is National Security Act of 2017

- S. 2987/H.R. 5515, the Foreign Investment Risk Review Modernization Act of 2018

Figures

Figure 1Funding and Staff Requirements- Congressional Oversight

- Recent CFIUS Reviews

- Issues for Congress

Figures

- Figure 1. Foreign Direct Investment, Annual Inflows, World and Major Country Groups

Figure 2. Figure 2. Steps of a CFIUS Foreign Investment National Security Review- Figure 2. Number of State-Owned Enterprises by Country, 2016

Tables

- Table 1. Selected Indicators of International Investment and Production,

2008-20152011-2017

- Table 2. Foreign Investment Transactions Reviewed by CFIUS, 2008-2015

- Table 3. Industry Composition of Foreign Investment Transactions Reviewed by CFIUS, 2008-2015

- Table 4. Country of Foreign Investor and Industry Reviewed by CFIUS, 2013-2015

- Table 5. Home Country of Foreign Acquirer of U.S. Critical Technology, 2013-2015

Appendixes

Summary

The Committee on Foreign Investment in the United States (CFIUS) is an interagency body comprised of nine Cabinet members, two ex officio members, and other members as appointed by the President, that assists the President in overseeingreviewing the national security aspects of foreign direct investment in the U.S. economy. While the group often operated in relative obscurity, the perceived change in the nation's national security and economic concerns following the September 11, 2001, terrorist attacks and the proposed acquisition of commercial operations at six U.S. ports by Dubai Ports World in 2006 placed CFIUS's review procedures under intense scrutiny by Members of Congress and the public. Prompted by this case, some Members of Congress questioned the ability of Congress to exercise its oversight responsibilities given the general view that CFIUS's operations lacked transparency. The current CFIUS process reflects changes Congress initiated in the first session of the 110th Congress, when the House and Senate adopted S. 1610, the Foreign Investment and National Security Act of 2007 (FINSA). In the 115th Congress, the House and Senate adopted measures that would mark the most comprehensive reform of CFIUS since FINSA in 2007 (S. 2987/H.R. 5515), the Foreign Investment Risk Review Modernization Act of 2017In 2018, prompted by concerns over Chinese and other foreign investment in U.S. companies with advanced technology, Members of Congress and the Trump Administration enacted the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which became effective on November 11, 2018. This measure marked the most comprehensive revision of the foreign investment review process under CFIUS since the previous revision in 2007, the Foreign Investment and National Security Act (FINSA).

Generally, efforts to amend CFIUS have been spurred by a specific foreign investment transaction that raised national security concerns. Despite various changeschanges to the CFIUS statute, some Members and others are questioning question the nature and scope of CFIUS's reviews. scope of CFIUS reviews. The CFIUS process is governed by statute that sets a legal standard for the President to suspend or block block a transaction if if no other laws apply and if there isis "credible evidence" that the transaction threatens to impair the national security, which is interpreted as transactions that pose a national security risk.

The U.S. policy approach to international investment traditionally has been to establish and supportestablished and supported an open and rules-based trading system that is in line with U.S. economic and national security interests. RecentThe current debate over CFIUS reflects long-standing concerns long-standing concerns about the impactthe impact of foreign investment oninvestment on the economy and the role of economics as a component of national security. Some Some Members question CFIUS's performance and the way the Committee reviews cases involving foreign governments, particularly with the emergence of state-owned enterprises. Some policymakers have suggested expanding, and acquisitions involving leading-edge or foundational technologies. Recent changes expand CFIUS's purview to include a broader focus on the economic implications of individual foreign investment transactions and the cumulative effect of foreign investment on certain sectors of the economy or by investors from individual countries.

Changes in U.S. foreign investment policy have potentially large economy-wide implications, since the United States is the largest recipient and the largest overseas investor of foreign direct investment. To date, fivesix investments have been blocked, although proposed transactions may have been terminatedwithdrawn by the firms involvedinvolved in lieu of having a transaction blocked. President Obama used the FINSA authority in 2012 to block an American firm, Ralls Corporation, owned by Chinese nationals, from acquiring a U.S. wind farm energy firm located near a DOD facility and located near a Department of Defense (DOD) facility and to block a Chinese investment firm in 2016 from acquiring Aixtron, a GermanyGermany-based firm with assets in the United States. . In 2017, President Trump blocked the acquisition of Lattice Semiconductor Corp. by the Chinese investment firm Canyon Bridge Capital Partners; in 2018, he blocked the acquisition of Qualcomm by Broadcom; and in 2019, he directed Beijing Kunlun Co. to divest itself of Grindr LLC, an online dating site, over concerns of foreign access to personally identifiable information of U.S. citizens. Given the number of regulatory changes mandated by FIRRMA, Congress may well conduct oversight hearings to determine the status of the changes and their implications.

Background

The Committee on Foreign Investment in the United States (CFIUS) is an interagency committee that serves the President in overseeing the national security implications of foreign direct investment (FDI) in the economy. Since its inception, CFIUS has operated at the nexus of shifting concepts of national security and major changes in technology, especially relative to various notions of national In 2018, Congress and the Trump Administration adopted the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), Subtitle A of Title XVII of P.L. 115-232 (Aug. 13, 2018), which became effective on November 11, 2018.1 The impetus for FIRRMA was based on concerns that ''the national security landscape has shifted in recent years, and so has the nature of the investments that pose the greatest potential risk to national security ....''2 As a result, FIRRMA provided for some programs to become effective upon passage, while a pilot program was developed to address immediate concerns relative to other provisions and allow time for additional resources to be directed at developing a more permanent response in these areas. Interim rules for the pilot program developed by the Treasury Department cover an expanded scope of transactions subject to a review by CFIUS to include noncontrolling investments by foreign persons in U.S. firms involved in critical technologies. A second part of the pilot program implements FIRRMA's mandatory declarations provision for all transactions that fall within the specific scope of the pilot program. The pilot program is to end no later than March 5, 2020. Upon enactment, FIRRMA: (1) expanded the scope and jurisdiction of CFIUS by redefining such terms as "covered transactions" and "critical technologies"; (2) refined CFIUS procedures, including timing for reviews and investigations; and (3) required actions by CFIUS to address national security risks related to mitigation agreements, among other areas. Treasury's interim rules updated and amended existing regulations in order to implement certain provisions immediately. FIRRMA also required CFIUS to take certain actions within prescribed deadlines for various programs, reporting, and other plans. FIRRMA also broadened CFIUS' mandate by explicitly including for review certain real estate transactions in close proximity to a military installation or U.S. government facility or property of national security sensitivities. In addition, FIRRMA: provides for CFIUS to review any noncontrolling investment in U.S. businesses involved in critical technology, critical infrastructure, or collecting sensitive data on U.S. citizens; any change in foreign investor rights; transactions in which a foreign government has a direct or indirect substantial interest; and any transaction or arrangement designed to evade CFIUS. Through a "sense of Congress" provision in FIRRMA, CFIUS reviews potentially can discriminate among investors from certain countries that are determined to be a country of "special concern" (specified through additional regulations) that has a "demonstrated or declared strategic goal of acquiring a type of critical technology or critical infrastructure that would affect U.S. leadership in areas related to national security."3 Information on international investment and production collected and published by the United Nations indicates that global annual inflows of FDI peaked in 2015, surpassing the previous record set in 2007, but has fallen since, as indicated in Figure 1. Similarly, from 2012 through 2014, international flows of FDI fell below the levels reached prior to the 2008-2009 financial crisis, but revived in 2015. Between 2015 and 2017, FDI inflows fell by nearly $500 million to $1.4 billion, largely reflecting lower inflows to developed economies as a result of a 22% decline in cross-border merger and acquisition activity (M&As). FDI inflows to developing economies also declined, but at a slower rate than among flows to developed economies, while investment flows to economies in transition continued to increase at a steady pace. Other cross-border capital flows (portfolio investments and bank loans) continued at a strong pace in 2017, contrary to the trend in direct investment. Globally, the foreign affiliates of international firms employed 73 million people in 2017, as indicted in Table 1. Globally, the stock, or cumulative amount, of FDI in 2017 totaled about $31 trillion. Other measures of international production, sales, assets, value-added production, and exports generally indicate higher nominal values in 2017 than in the previous year, providing some indication that global economic growth was recovering.

($ in billions) Source: World Investment Report, United Nations Conference on Trade and Development. According to the United Nations,4 the global FDI position in the United States, or the cumulative amount of inward foreign direct investment, was recorded at around $7.8 trillion in 2017, with the U.S. outward FDI position of about $7.9 trillion. The next closest country in investment position to the United States was Hong Kong with inward and outward investment positions of about one-fourth that of the United States. In comparison, the 28 counties comprising the European Union (EU) had an inward investment position of $9.1 trillion in 2017 and an outward position of $10.6 trillion. ($ in billions) 2011 2012 2013 2014 2015 2016 2017 FDI inflows $1,700 $1,403 $1,427 $1,277 $1,921 $1,868 $1,430 FDI outflows 1,712 1,284 1,311 1,318 1,622 1,473 1,430 FDI inward stock 21,117 22,073 24,533 25,113 25,665 27,663 31,524 FDI outward stock 21,913 22,527 24,665 24,810 25,514 26,826 30,838 Cross-border M&As (number) 556 328 263 432 735 887 694 887 887 694 694 887 694 Sales of foreign affiliates 28,516 31,687 31,865 34,149 27,559 29,057 30,823 Value-added (product) of foreign affiliates 6,262 7,105 7,030 7,419 6,457 6,950 7,317 Total assets of foreign affiliates 83,754 88,536 95,671 101,254 94,781 98,758 103,429 Exports of foreign affiliates 7,463 7,469 7,469 7,688 NA NA NA GDP 71,314 73,457 75,887 77,807 74,407 75,463 79,841 Employment by foreign affiliates (thousands) 63,416 69,359 72,239 76,821 69,683 71,157 73,209 Source: World Investment Report, United Nations Conference on Trade and Development, June 2018. Established by an Executive Order of President Ford in 1975, CFIUS initially operated in relative obscurity.5 According to a Treasury Department memorandum, the Committee was established in order to "dissuade Congress from enacting new restrictions" on foreign investment, as a result of growing concerns over the rapid increase in investments by Organization of the Petroleum Exporting Countries (OPEC) countries in American portfolio assets (Treasury securities, corporate stocks and bonds), and to respond to concerns of some that much of the OPEC investments were being driven by political, rather than by economic, motives.6 Thirty years later in 2006, public and congressional concerns about the proposed purchase of commercial port operations of the British-owned Peninsular and Oriental Steam Navigation Company (P&O)7 in six U.S. ports by Dubai Ports World (DP World)8 sparked a firestorm of criticism and congressional activity during the 109th Congress concerning CFIUS and the manner in which it operated. As a result of the attention by the public and Congress, DP World officials decided to sell off the U.S. port operations to an American owner.9 On December 11, 2006, DP World officials announced that a unit of AIG Global Investment Group, a New York-based asset management company with large assets, but no experience in port operations, had acquired the U.S. port operations for an undisclosed amount.10 The DP World transaction revealed that the September 11, 2001, terrorist attacks fundamentally altered the viewpoint of some Members of Congress regarding the role of foreign investment in the economy and the potential impact of such investment on U.S. national security. Some Members argued that this change in perspective required a reassessment of the role of foreign investment in the economy and of the implications of corporate ownership on activities that fall under the rubric of critical infrastructure. The emergence of state-owned enterprises as commercial economic actors has raised additional concerns about whose interests and whose objectives such firms are pursuing in their foreign investment activities. More than 25 bills were introduced in the second session of the 109th Congress that addressed various aspects of foreign investment following the proposed DP World transaction. In the first session of the 110th Congress, Congress passed, and President Bush signed, the Foreign Investment and National Security Act of 2007 (FINSA) (P.L. 110-49), which altered the CFIUS process in order to enable greater oversight by Congress and increased transparency and reporting by the Committee on its decisions. In addition, the act broadened the definition of national security and required greater scrutiny by CFIUS of certain types of foreign direct investment. Not all Members were satisfied with the law: some Members argued that the law remained deficient in reviewing investment by foreign governments through sovereign wealth funds (SWFs). Also left unresolved were issues concerning the role of foreign investment in the nation's overall security framework and the methods that are used to assess the impact of foreign investment on the nation's defense industrial base, critical infrastructure, and homeland security.economiceconomic security, and a changing global economic order that is marked in part by emerging economies such as China that are playing a more active role in the global economy. As a basic premise, the U.S. historical approach to international investment has aimed to establish an open and rules-based international economic system that is consistent across countries and in line with U.S. economic and national security interests. This policy also has fundamentally maintained that FDI has positive net benefits for the U.S. and global economy, except in certain cases in which national security concerns outweigh other considerations. More recently and for prudential reasons.

Recently, some policymakers have argued that certain foreign investment transactions, particularly by entities owned or controlled by a foreign government, investments with leading-edge or foundational technologies, or investments that may compromise personally identifiable information, are affectingare compromising U.S. national economic security and argue for. As a result, they supported greater CFIUS scrutiny of foreign investment transactions, including a mandatory approval process for some transactions. Some policymakers also argueargued that the CFIUS review process should have a more robust economic component, possibly even to the extent of an industrial policy-type approach that uses the CFIUS national security review process to protect and promote certain industrial sectors in the economy. Others argueargued, however, that thisthe CFIUS review process should be expanded to include certain transactions that had not previously been reviewed, but that CFIUS' overall focus should remain fairly narrow.

The Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA)

review process should maintain its current focus on national security issues.

Originally established by an Executive Order of President Ford in 1975, the Committee generally operated in relative obscurity.1 According to a Treasury Department memorandum, the Committee originally was established in order to "dissuade Congress from enacting new restrictions" on foreign investment, as a result of growing concerns over the rapid increase in investments by Organization of the Petroleum Exporting Countries (OPEC) countries in American portfolio assets (Treasury securities, corporate stocks and bonds), and to respond to concerns of some that much of the OPEC investments were being driven by political, rather than by economic, motives.2

Thirty years later, public and congressional concerns about the proposed purchase of commercial port operations of the British-owned Peninsular and Oriental Steam Navigation Company (P&O)3 in six U.S. ports by Dubai Ports World (DP World)4 sparked a firestorm of criticism and congressional activity during the 109th Congress concerning CFIUS and the manner in which it operated. As a result of the attention by the public and Congress, DP World officials decided to sell off the U.S. port operations to an American owner.5 On December 11, 2006, DP World officials announced that a unit of AIG Global Investment Group, a New York-based asset management company with large assets, but no experience in port operations, had acquired the U.S. port operations for an undisclosed amount.6

The DP World transaction revealed that the September 11, 2001, terrorist attacks fundamentally altered the viewpoint of some Members of Congress regarding the role of foreign investment in the economy and the impact of such investment on the national security framework. Some Members argued that this change in perspective required a reassessment of the role of foreign investment in the economy and of the implications of corporate ownership on activities that fall under the rubric of critical infrastructure. The emergence of state-owned enterprises as commercial economic actors has raised additional concerns about whose interests and whose objectives such firms are pursuing in their foreign investment activities.

Members of Congress introduced more than 25 bills in the second session of the 109th Congress that addressed various aspects of foreign investment following the proposed DP World transaction. In the first session of the 110th Congress, Members approved, and President Bush signed, the Foreign Investment and National Security Act of 2007 (FINSA), (P.L. 110-49), which altered the CFIUS process in order to enable greater oversight by Congress and increased transparency and reporting by the Committee on its decisions. In addition, the act broadened the definition of national security and required greater scrutiny by CFIUS of certain types of foreign direct investments. Not all Members were satisfied with the law: some Members argued that the law remained deficient in reviewing investment by foreign governments through sovereign wealth funds (SWFs), an issue that was attracting attention when the law was adopted. Also left unresolved were issues concerning the role of foreign investment in the nation's overall security framework and the methods that are used to assess the impact of foreign investment on the nation's defense industrial base, critical infrastructure, and homeland security.

Information on international investment and production collected and published by the United Nations indicates that FDI peaked in 2007 prior to the global financial crisis and has not fully recovered. Similarly, from 2012 through 2014, international flows of FDI fell below the levels reached prior to the 2008-2009 financial crisis. Cross-border merger and acquisition activity (M&As) picked up in 2014, after lagging behind the pace set in 2008, although global nominal gross domestic product (GDP) generally has risen since 2009. Globally, at 79 million, employment in 2015 by the foreign affiliates of international firms, as indicted in Table 1, has surpassed the 77 million recorded in 2007. Globally, foreign direct investment in 2015 totaled about $25 trillion. Other measures of international production, sales, assets, value-added production, and exports all indicate higher nominal values in 2015 than in previous years, which provides further indication that global economic growth was recovering, although at a slow pace.

According to the United Nations,7 the global FDI position in the United States, or the cumulative amount, was recorded at around $5.6 trillion in 2015, with the U.S. outward FDI position of about $6.0 trillion. The next closest country in investment position to the United States was Germany with inward and outward investment positions of about one-fifth that of the United States.

Table 1. Selected Indicators of International Investment and Production, 2008-2015

(Billions of dollars)

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

|

FDI inflows |

$1,744.0 |

$1,198.0 |

$1,409.0 |

$1,700.0 |

$1,403.0 |

$1,427.0 |

$1,277.0 |

$1,762.0 |

|

FDI outflows |

1,911.0 |

1,175.0 |

1,505.0 |

1,712.0 |

1,284.0 |

1,311.0 |

1,318.0 |

$1,474.0 |

|

FDI inward stock |

15,295.0 |

18,041.0 |

20,380.0 |

21,117.0 |

22,073.0 |

24,533.0 |

25,113.0 |

24,983.0 |

|

FDI outward stock |

15,988.0 |

19,326.0 |

21,130.0 |

21,913.0 |

22,527.0 |

24,665.0 |

24,810.0 |

25,045.0 |

|

Cross-border M&As (number) |

707 |

250 |

344 |

556 |

328 |

263 |

432 |

721 |

|

Sales of foreign affiliates |

33,300.0 |

23,866.0 |

22,574.0 |

28,516.0 |

31,687.0 |

31,865.0 |

34,149.0 |

36,668.0 |

|

Value-added (product) of foreign affiliates |

6,216.0 |

6,392.0 |

5,735.0 |

6,262.0 |

7,105.0 |

7,030.0 |

7,419.0 |

7,903.0 |

|

Total assets of foreign affiliates |

64,423.0 |

74,910.0 |

78,631.0 |

83,754.0 |

88,536.0 |

95,671.0 |

101,254.0 |

105,778.0 |

|

Exports of foreign affiliates |

6,599.0 |

5,060.0 |

6,320.0 |

7,463.0 |

7,469.0 |

7,469.0 |

7,688.0 |

7,803.0 |

|

GDP |

61,147.0 |

57,920.0 |

63,468.0 |

71,314.0 |

73,457.0 |

75,887.0 |

77,807.0 |

73,152.0 |

|

Employment by foreign affiliates (thousands) |

64,484.0 |

59,877.0 |

63,043.0 |

63,416.0 |

69,359.0 |

72,239.0 |

76,821.0 |

79,505.0 |

Source: World Investment Report, United Nations Conference on Trade and Development, June 2016.

Establishment of CFIUS

President Ford's 1975 Executive Order established the basic structure of CFIUS, and directed that the "representative"8 of the Secretary of the Treasury be the chairman of the Committee. The Executive Order also stipulated that the Committee would have "the primary continuing responsibility within the executive branch for monitoring the impact of foreign investment in the United States, both direct and portfolio, and for coordinating the implementation of United States policy on such investment." In particular, CFIUS was directed to (1) arrange for the preparation of analyses of trends and significant developments in foreign investment in the United States; (2) provide guidance on arrangements with foreign governments for advance consultations on prospective major foreign governmental investment in the United States; (3) review investment in the United States which, in the judgment of the Committee, might have major implications for United StatesU.S. national interests; and (4) consider proposals for new legislation or regulations relating to foreign investment as may appear necessary.9

President Ford's Executive Order also stipulated that information submitted "in confidence shall not be publicly disclosed" and that information submitted to CFIUS be used "only for the purpose of carrying out the functions and activities" of the order. In addition, the Secretary of Commerce was directed to perform a number of activities, including

(1) obtainingObtaining, consolidating, and analyzing information on foreign investment in the United States;

(2) improvingImproving the procedures for the collection and dissemination of information on such foreign investment;

(3) the close observing ofObserving foreign investment in the United States;

(4) preparingPreparing reports and analyses of trends and of significant developments in appropriate categories of such investment;

(5) compilingCompiling data and preparing evaluation of significant transactions; and

(6) submittingSubmitting to the Committee on Foreign Investment in the United States appropriate reports, analyses, data, and recommendations as to how information on foreign investment can be kept current.

|

CFIUS Legislative History 1975 CFIUS established by Executive Order. 1988 "Exon-Florio" amendment to Defense Production Act. Codified the process CFIUS used to review foreign investment transactions. 1992 "Byrd Amendment" to Defense Production Act. Required reviews in cases where foreign acquirer was acting on or in behalf of a foreign government. 2007 Foreign Investment and National Security Act of 2007 2018 Foreign Investment Risk Review Modernization Act of 2018 provided a comprehensive reform of the CFIUS process. |

The Executive Order, however, raised questions among various observers and government officials who doubted that federal agencies had the legal authority to collect the types of data that were required by the order. As a result, Congress and the President sought to clarify this issue, and in the following year President Ford signed the International Investment Survey Act of 1976.1013 The act gave the President "clear and unambiguous authority" to collect information on "international investment." In addition, the act authorized "the collection and use of information on direct investments owned or controlled directly or indirectly by foreign governments or persons, and to provide analyses of such information to the Congress, the executive agencies, and the general public."11

By 1980, some Members of Congress had come to believeraised concerns that CFIUS was not fulfilling its mandate. Between 1975 and 1980, for instance, the Committee had met only 10 times and seemed unable to decide whether it should respond to the political or the economic aspects of foreign direct investment in the United States.1215 One critic of the Committee argued in a congressional hearing in 1979 that, "the Committee has been reduced over the last four years to a body that only responds to the political aspects or the political questions that foreign investment in the United States poses and not with what we really want to know about foreign investments in the United States, that is: Is it good for the economy?"13

From 1980 to 1987, CFIUS investigated a number of foreign investmentsinvestment transactions, mostly at the request of the Department of Defense. In 1983, for instance, a Japanese firm sought to acquire a U.S. specialty steel producer. The Department of Defense subsequently classified the metals produced by the firm because they were used in the production of military aircraft, which caused the Japanese firm to withdraw its offer. Another Japanese company attempted to acquire a U.S. firm in 1985 that manufactured specialized ball bearings for the military. The acquisition was completed after the Japanese firm agreed that production would be maintained in the United States. In a similar case in 1987, the Defense Department objected to a proposed acquisition of the computer division of a U.S. multinational company by a French firm because of classified work engaged inconducted by the computer division. The acquisition proceeded after the classified contracts were reassigned to the U.S. parent company.1417

The "Exon-Florio" Provision

In 1988, amid concerns over foreign acquisition of certain types of U.S. firms, particularly by Japanese firms, Congress approved the Exon-Florio amendment to the Defense Production Act, which specifies the process by which foreign investments are reviewed.15 This statute grantsspecified the basic review process of foreign investments.18 The statute granted the President the authority to block proposed or pending foreign "mergers, acquisitions, or takeovers" of "persons engaged in interstate commerce in the United States" that threatenthreatened to impair the national security. Congress directed, however, that before this authority can be invoked the President must concludethe President could invoke this authority only after he had concluded that (1) other U.S. laws arewere inadequate or inappropriate to protect the national security; and (2) he must have "credible evidence" existed that the foreign investment will impair theinterest exercising control might take action that threatened to impair U.S. national security. This same standard was maintained in an update to the Exon-Florio provision in 2007, the Foreign Investment and National Security Act of 2007.

By the late 1980s, Congress and the public had grown increasingly concerned about the sharp increase in foreign investment in the United States and the potential impact such investment might have on the U.S. economy. In particular, the proposed sale in 1987 of Fairchild Semiconductor Co. by Schlumberger Ltd. of France to Fujitsu Ltd. of Japan touched off strong opposition in Congress and provided much of the impetus behind the passage of the Exon-Florio provision. The proposed Fairchild acquisition generated intense concern in Congress in part because of general difficulties in trade relations with Japan at that time and because some Americans felt that the United States was declining as an international economic and world power. The Defense Department opposed the acquisition because some officials believed that the deal would have given Japan control over a major supplier of computer chips for the military and would have made U.S. defense industries more dependent on foreign suppliers for sophisticated high-technology products.16

Although Commerce Secretary Malcolm Baldridge and Defense Secretary Caspar Weinberger failed in their attempt to have President Reagan block the Fujitsu acquisition, Fujitsu and Schlumberger called off the proposed sale of Fairchild.17 While Fairchild was acquired some months later by National Semiconductor Corp. for a discount,18 the Fujitsu-Fairchild incident marked an important shift in the Reagan Administration's support for unlimited foreign direct investment in U.S. businesses and boosted support within the Administration for fixed guidelines for blocking foreign takeovers of companies in national security-sensitive industries.19

In 1988, after, and in FIRRMA.

After three years of often contentious negotiations between Congress and the Reagan Administration, Congress passed and President Reagan signed the Omnibus Trade and Competitiveness Act of 1988.2019 During consideration of the Exon-Florio proposal as an amendment to the 1988 Omnibus Tradeomnibus trade bill, debate focused on three issues that generated a clash of viewscontroversial issues: (1) what constitutes foreign control of a U.S. firm?; (2) how should national security be defined?; and (3) which types of economic activities should be targeted for a CFIUS review? Of these issues, the most controversial and the most far-reaching was the lack of a definition of national security. As originally drafted, the provision would have considered investments which affected the "national security and essential commerce" of the United States. The term "essential commerce" was the focus of intense debate between Congress and the Reagan Administration.

The Treasury Department, headed by Secretary James Baker, objected to the Exon-Florio amendment, and the Administration vetoed the first version of the omnibus trade legislation, in part due to its objections to the language in the measure regarding "national security and essential commerce." The Reagan Administration argued that the language would broaden the definition of national security beyond the traditional concept of military/defense to one which included a strong economic component. Administration witnesses argued against this aspect of the proposal and eventually succeeded in prodding Congress to remove the term "essential commerce" from the measure and in narrowingnarrow substantially the factors the President must consider in his determination.

The final Exon-Florio provision was included as Section 5021 of the Omnibus Trade and Competitiveness Act of 1988. The provision originated in bills reported by the Commerce Committee in the Senate and the Energy and Commerce Committee in the House, but the measure was transferred to the Senate Banking Committee as a result of a dispute over jurisdictional responsibilities.2120 Through Executive Order 12661, President Reagan implemented provisions of the Omnibus Trade Act. In the Executive Order, President Reagan delegated his authority to administer the Exon-Florio provision to CFIUS,2221 particularly to conduct reviews, undertake investigations, and make recommendations, although the statute itself does not specifically mention CFIUS. As a result of President Reagan's action, CFIUS was transformed from an administrative body with limited authority to review and analyze data on foreign investment to an important component of U.S. foreign investment policy with a broad mandate and significant authority to advise the President on foreign investment transactions and to recommend that some transactions be suspended or blocked.

In 1990, President Bush directed the China National Aero-Technology Import and Export Corporation (CATIC) to divest its acquisition of MAMCO Manufacturing, a Seattle-based firm producing metal parts and assemblies for aircraft, because of concerns that CATIC might gain access to technology through MAMCO that it would otherwise have to obtain under an export license.2322

Part of Congress's motivation in adopting the Exon-Florio provision apparently arose from concerns that foreign takeovers of U.S. firms could not be stopped unless the President declared a national emergency or regulators invoked federal antitrust, environmental, or securities laws. Through the Exon-Florio provision, Congress attempted to strengthen the President's hand in conducting foreign investment policy, while limiting its own role as a means of emphasizing that, as much as possible, the commercial nature of investment transactions should be free from political considerations. Congress also attempted to balance public concerns about the economic impact of certain types of foreign investment with the nation's long-standing international commitment to maintaining an open and receptive environment for foreign investment.

|

Transactions Blocked by Presidents Since the creation of CFIUS, the President has blocked five transactions based on a recommendation from the Committee: 1. In 1990, President Bush directed the China National Aero-Technology Import and Export Corporation (CATIC) to divest its acquisition of MAMCO Manufacturing. 2. In 2012, President Obama directed the Ralls Corporation to divest itself of an Oregon wind farm project. 3. In 2016, President Obama blocked the Chinese firm Fujian Grand Chip Investment Fund from acquiring Aixtron, a German-based semiconductor firm with U.S. assets. 4. In 2017, President Trump blocked the acquisition of Lattice Semiconductor Corp. of Portland, OR, for $1.3 billion by Canyon Bridge Capital Partners, a Chinese investment firm. 5. In 2018, President Trump blocked the acquisition of semiconductor chip maker Qualcomm by Singapore-based Broadcom for $117 billion. |

Furthermore, Congress did not intend to have the Exon-Florio provision alter the generally open foreign investment climate of the country or to have it inhibit foreign direct investment in industries that could not be considered to be of national security interest. At the time, some analysts believed the provision could potentially widen the scope of industries that fell under the national security rubric. CFIUS, however, is not free to establish an independent approach to reviewing foreign investment transactions, but operates under the authority of the President and reflects his attitudes and policies. As a result, the discretion CFIUS uses to review and to investigate foreign investment cases reflects policy guidance from the President. Foreign investors also are constrained by legislation that bars foreign direct investment in such industries as maritime, aircraft, banking, resources, and power. Generally, these sectors were closed to foreign investors prior to passage of the Exon-Florio provision in order to prevent public services and public interest activities from falling under foreign control, primarily for national defense purposes.

Treasury Department Regulations

After extensive public comment, the Treasury Department issued its final regulations in November 1991 implementing the Exon-Florio provision.2423 Although these procedures were amended through FINSA, they continued to serve as the basis for the Exon-Florio review and investigation until new regulations were released on November 21, 2008.2524 These regulations created an essentially voluntary system of notification by the parties to an acquisition, and they allowed for notices of acquisitions by agencies that are members of CFIUS. Despite the voluntary nature of the notification, firms largely complycomplied with the provision, because the regulations stipulate that foreign acquisitions that are governed by the Exon-Florio review process that do not notify the Committee remain subject indefinitely to possible divestment or other appropriate actions by the President. Under most circumstances, notice of a proposed acquisition that is given to the Committee by a third party, including shareholders, is not considered by the Committee to constitute an official notification. The regulations also indicated that notifications provided to the Committee would be considered confidential and the information would not be released by the Committee to the press or commented on publicly.

The "Byrd Amendment"

In 1992, Congress amended the Exon-Florio statute through Section 837(a) of the National Defense Authorization Act for Fiscal Year 1993 (P.L. 102-484). Known as the "Byrd" amendment after the amendment's sponsor, Senator Byrd, the provision requires CFIUS to investigate proposed mergers, acquisitions, or takeovers in cases where two criteria are met:

(1) the acquirer is controlled by or acting on behalf of a foreign government; and

(2) the acquisition results in control of a person engaged in interstate commerce in the United States that could affect the national security of the United States.26

This amendment came under scrutiny by the 109th Congress as a result of the DP World transaction. Many Members of Congress and others believed that this amendment required CFIUS to undertake a full 45-day investigation of the transaction because DP World was "controlled by or acting on behalf of a foreign government." The DP World acquisition, however, exposed a sharp rift between what some Members apparently believed the amendment directed CFIUS to do and how the members of CFIUS were interpretinginterpreted the amendment. In particular, some Members of Congress apparently interpreted the amendment to direct CFIUS to conduct a mandatory 45-day investigation if the foreign firm involved in a transaction is owned or controlled by a foreign government.

Representatives of CFIUS argued that they interpreted the amendment to mean that a 45-day investigation was discretionary and not mandatory. In the case of the DP World acquisition, CFIUS representatives argued that they had concluded as a result of an extensive review of the proposed acquisition prior to the case being formally filed with CFIUS and during the then-existing 30-day review that the DP World case did not warrant a full 45-day investigation. They conceded that the case met the first criterion under the Byrd amendment, because DP World was controlled by a foreign government, but that it did not meet the second part of the requirement, because CFIUS had concluded during the 30-day review that the transaction "could not affect the national security."27

The intense public and congressional reaction that arose from the proposed Dubai Ports World acquisition spurred the Bush Administration in late 2006 to make an important administrative change in the way CFIUS reviewed foreign investment transactions. CFIUS and President Bush approved the acquisition of Lucent Technologies, Inc. by the French-based Alcatel SA, which was completed on December 1, 2006. Before the transaction was approved by CFIUS, however, Alcatel-Lucent was required to agree to a national security arrangement, known as a Special Security Arrangement, or SSA, that restricts Alcatel's access to sensitive work done by Lucent's research arm, Bell Labs, and the communications infrastructure in the United States.

The most controversial feature of this arrangement iswas that it allowsallowed CFIUS to reopen a review of the deala transaction and to overturn its approval at any time if CFIUS believed the companies "materially fail to comply" with the terms of the arrangement. This marked a significant change in the CFIUS process. Prior to this transaction, CFIUS reviews and investigations were portrayed and considered to be final. As a result, firms were willing to subject themselves voluntarily to a CFIUS review, because they believed that once an investment transaction was scrutinized and approved by the members of CFIUS the firms could be assured that the investment transaction would be exempt from any future reviews or actions. This administrative change, however, meant that a CFIUS determination may no longer be a final decision, and it added a new level of uncertainty to foreign investors seeking to acquire U.S. firms. A broad range of U.S. and international business groups objected to this change in the Bush Administration's policy.28

The Amended CFIUS Process

CFIUS Risk Assessment In assessing the risk posed to national security by a foreign investment transaction, CFIUS considers three issues: 1. What is the threat posed by the foreign investment in terms of intent and capabilities? 2. What aspects of the business activity pose vulnerabilities to national security? 3. What are the national security consequences if the vulnerabilities are exploited?In the first session of the 110th27

Recent Legislative Reforms

S. 1610S1610, the Foreign Investment and National Security Act of 2007 (FINSA). On June 29, 2007, the Senate adopted S. 1610 in lieu of H.R. 556 by unanimous consent. On July 11, 2007, the House accepted the Senate's version of H.R. 556 by a vote of 370-45 and sent the measure to President Bush, who signed it on July 26, 2007.2928 On January 23, 2008, President Bush issued Executive Order 13456 implementing the law.

|

CFIUS Risk Assessment In assessing the risk posed to national security by a foreign investment transaction, CFIUS considers three issues: 1. What is the threat posed by the foreign investment in terms of intent and capabilities? 2. What aspects of the business activity pose vulnerabilities to national security? 3. What are the national security consequences if the vulnerabilities are exploited? |

FINSA made a number of major changes, including: During the 115th Congress, many Members expressed concerns over China's growing investment in the United States, particularly in the technology sector. On November 8, 2017, Senators John Cornyn and Dianne Feinstein and Representative Robert Pittenger introduced companion measures in the Senate (S. 2098) and the House (H.R. 4311), respectively, identified as the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) to provide comprehensive revision of the CFIUS process. On May 22, 2018, the Senate Banking and House Financial Services Committees held their respective markup sessions and approved different versions of the legislation. The Senate version of FIRRMA was added as Subtitle A of Title 17 of the Senate version of the National Defense Authorization Act for Fiscal Year 2019 (S. 2987, incorporated into the Senate amendments to H.R. 5515), which passed the Senate on June 18, 2018. The House version of FIRRMA, H.R. 5841 was passed as a standalone bill under suspension vote on June 26, 2018. On August 13, 2018, President Trump signed FIRRMA, identified as P.L. 115-232.Similar to the Exon-Florio Amendment, FINSA grants the President the authority to block or suspend proposed or pending foreign "mergers, acquisitions, or takeovers" of "persons engaged in interstate commerce in the United States"

FIRRMA Legislation: Key Provisions

that threaten to impair the national security. Congress directed, however, that before this authority can be invoked the President must conclude that (1) other U.S. laws are inadequate or inappropriate to protect the national security; and (2) he/she must have "credible evidence" that the foreign interest exercising control might take action that threatens to impair the national security. According to CFIUS, it has interpreted this last provision to mean an investment that poses a risk to the national security. In assessing the national security risk, CFIUS looks at (1) the threat, which involves an assessment of the intent and capabilities of the acquirer; (2) the vulnerability, which involves an assessment of the aspects of the U.S. business that could impact national security; and (3) the potential national security consequences if the vulnerabilities were to be exploited.30

Major changes made by FINSA included the following:

- Codified the Committee on Foreign Investment in the United States (CFIUS), giving it statutory authority.

- Made CFIUS membership permanent and added the Secretary of Energy; added the Director of National Intelligence (DNI) and Secretary of Labor as ex officio members with the DNI providing intelligence analysis; also granted authority to the President to add members on a case-by-case basis.

- Required the Secretary of the Treasury to designate an agency with lead responsibility for reviewing a covered transaction.

- Increased the number of factors the President could consider in making his determination.

- Required that an individual no lower than an Assistant Secretary level for each CFIUS member must certify to Congress that a reviewed transaction has no unresolved national security issues; for investigated transactions, the certification must be at the Secretary or Deputy Secretary level.

- Provided Congress with confidential briefings upon request on cleared transactions and annual classified and unclassified reports.

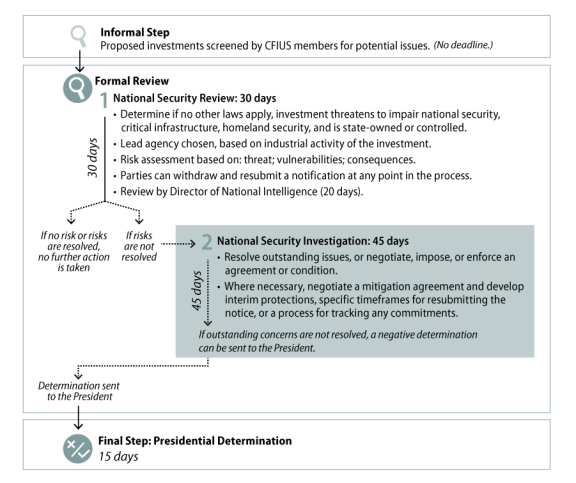

As indicated in Figure 1 below, the CFIUS foreign investment review process is comprised of an informal step and three formal steps: a National Security Review; a National Security Investigation; and a Presidential Determination.

|

|

|

Source: Chart developed by CRS. |

In general, FIRRMA:- Broadens the scope of transactions under CFIUS' purview by including for review real estate transactions in close proximity to a military installation or U.S. Government facility or property of national security sensitivities; any nonpassive investment in a critical industry or critical technologies; any change in foreign investor rights regarding a U.S. business; transactions in which a foreign government has a direct or indirect substantial interest; and any transaction or arrangement designed to evade CFIUS regulations.

- Mandates various deadlines, including: a report on Chinese investment in the United States, a plan for CFIUS members to recuse themselves in cases that pose a conflict of interest, an assessment of CFIUS resources and plans for additional staff and resources, a feasibility study of assessing a fee on transactions reviewed unofficially prior to submission of a written notification, and a report assessing the national security risks related to investments by state-owned or state-controlled entities in the manufacture or assembly of rolling stock or other assets used in freight rail, public transportation rail systems, or intercity passenger rail system in the United States.

- Allows CFIUS to discriminate among foreign investors by country of origin in reviewing investment transactions by labeling some countries as "a country of special concern"—a country that has a demonstrated or declared strategic goal of acquiring a type of critical technology or critical infrastructure that would affect United States leadership in areas related to national security.

- Shifts the filing process for foreign firms from voluntary to mandatory in certain cases and provides for a two-track method for reviewing investment transactions, with some transactions requiring a declaration to CFIUS and receiving an expedited process, while transactions involving investors from countries of special concern would require a written notification of a proposed transaction and would receive greater scrutiny.

- Provides for additional factors for consideration that CFIUS and the President may use to determine if a transaction threatens to impair U.S. national security, as well as formalizes CFIUS' use of risk-based analysis to assess the national security risks of a transaction by assessing the threat, vulnerabilities, and consequences to national security related to the transaction.

- Lengthens most time periods for CFIUS reviews and investigations and for a national security analysis by the Director of National Intelligence.

- Provides for more staff to handle an expected increased workload and provides for additional funding for CFIUS through a filing fee structure for firms involved in a transaction and a $20 million annual appropriation.

- Modifies CFIUS' annual reporting requirements, including its annual classified report to specified Members of Congress and nonclassified reports to the public to provide for more information on foreign investment transactions.

- Mandates separate reforms related to export controls, with requirements to establish an interagency process to identify so-called "emerging and foundational technologies"—such items are to also fall under CFIUS review of critical technologies—and establish controls on the export or transfer of such technologies.

CFIUS: Major Provisions

As indicated in Figure 2 below, the CFIUS foreign investment review process is comprised of an informal step and three formal steps: a Declaration or written notice; a National Security Review; and a National Security Investigation. Depending on the outcome of the reviews, CFIUS may forward a transaction to the President for a Presidential Determination. FIRRMA increases the allowable time for reviews and investigations: (1) 30 days to review a declaration or written notification to determine of the transaction involves a foreign person in which a foreign government has a substantial interest; (2) a 45-day national security review (from 30 days), including an expanded time limit for analysis by the Director of National Intelligence (from 20 to 30 days); (3) a 45-day national security investigation, with an option for a 15 day extension for "extraordinary circumstances;" and a 15-day Presidential determination (unchanged).

Neither Congress nor the Administration has attempted to define the term "national security." Treasury Department officials have indicated, however, that during a review or investigation each CFIUS member is expected to apply that definition of national security that is consistent with the representative agency's specific legislative mandate.31 The concept of national security was broadened by P.L. 110-49 to include, "those issues relating to 'homeland security,' including its application to critical infrastructure." As presently construed, national security includes "those issues relating to 'homeland security,' including its application to critical infrastructure," and "critical technologies."

FIRRMA broadens CFIUS' role by explicitly including for review certain real estate transactions in close proximity to a military installation or U.S. government facility or property of national security sensitivities; any noncontrolling investment in U.S. businesses involved in critical technology, critical infrastructure, or collecting sensitive data on U.S. citizens; any change in foreign investor rights; transactions in which a foreign government has a direct or indirect substantial interest; and any transaction or arrangement designed to evade CFIUS.

While specific countries are not singled out, FIRRMA allows CFIUS to potentially discriminate among foreign investors by country of origin in reviewing certain investment transactions. Greater scrutiny could be directed on transactions tied to certain countries, pending specific criteria defined by regulations.

Figure 2. Figure 2. Steps of a CFIUS Foreign Investment National Security Review

Source: Chart developed by CRS.

FIRRMA provides a "sense of Congress" concerning six additional factors that CFIUS and the President may consider to determine if a proposed transaction threatens to impair U.S. national security. These include:

- 1. Covered transactions that involve a country of "special concern" that has a demonstrated or declared strategic goal of acquiring a type of critical technology or critical infrastructure that would affect U.S. leadership in areas related to national security;

- 2. The potential effects of the cumulative control of, or pattern of recent transactions involving, any one type of critical infrastructure, energy asset, critical material, or critical technology by a foreign government or person;

- 3. Whether any foreign person engaged in a transaction has a history of complying with U.S. laws and regulations;

- 4. Control of U.S. industries and commercial activity that affect U.S. capability and capacity to meet the requirements of national security, including the availability of human resources, products, technology, materials, and other supplies and services;

- 5. The extent to which a transaction is likely to expose personally identifiable information, genetic information, or other sensitive data of U.S. citizens to access by a foreign government or person that may exploit that information to threaten national security; and

- 6. Whether a transaction is likely to exacerbate or create new cybersecurity vulnerabilities or is likely to result in a foreign government gaining a significant new capability to engage in malicious cyber-enabled activities.

National Security Reviews

Informal Actions

Over time, the three-step CFIUS process has evolved to include an informal stage of unspecified length of time that consists of an unofficial CFIUS determination prior to the formal filing with CFIUS. This type of informal review likely developed because it serves the interests of both CFIUS and the firms that are involved in an investment transaction. According to Treasury Department officials, this informal contact enabled "CFIUS staff to identify potential issues before the review process formally begins."31

Firms that are party to an investment transaction apparently benefit from this informal review in a number of ways. For one, it allows firms additional time to work out any national security concerns privately with individual CFIUS members. Secondly, and perhaps more importantly, it provides a process for firms to avoid risking potential negative publicity that could arise if a transaction were blocked or otherwise labeled as impairing U.S. national security interests. For some firms, public knowledge of a CFIUS investigation has had a negative effect on the value of the firm's stock price.

For CFIUS members, the informal process is beneficial because it gives them as much time as they considerdeem necessary to review a transaction without facing the time constraints that arise under the formal CFIUS review process. This informal review likely also gives the CFIUS members added time to negotiate with firms involved in a transaction to restructure the transaction in ways that can address any potential security concerns or to develop other types of conditions that members feel are appropriate in order to remove security concerns.

According to the amended CFIUS provision, the President or any member of CFIUS can initiate a review of an investment transaction, in addition to a review that is initiated by the parties to a transaction providing a formal notification. CFIUS has 30 days after it receives the initial formal notification by the parties to a merger, acquisition, or takeover to review the transaction to decide whether to investigate a case as a result of its determination that the investment "threatens to impair the national security of the United States." National security also includes "those issues relating to 'homeland security,' including its application to critical infrastructure," and "critical technologies." In addition, CFIUS is required to conduct an investigation of a transaction if the Committee determines that the transaction would result in foreign control of any person engaged in interstate commerce in the United States. During such a review, CFIUS members are required to consider the 12 factors mandated by Congress in assessing the impact of the investment. If during this 30-day period all members conclude that the investment does not threaten to impair the national security, the review is terminated. If, however, at least one member of the Committee determines that the investment threatens to impair the national security, CFIUS proceeds to a 45-day investigation.

According to anecdotal evidence, some firms believe the CFIUS process is not market neutral, but adds to market uncertainty that can negatively affect a firm's stock price and lead to economic behavior by some firms that is not optimal for the economy as a whole. Such behavior might involve firms expending resources to avoid a CFIUS investigation, or terminating a transaction that potentially could improve the optimal performance of the economy to avoid a CFIUS investigation. While such anecdotal accounts generally are not a basis for developing public policy, they raise concerns about the possible impact a CFIUS review may have on financial markets and the potential costs of redefining the concept of national security relative to foreign investment.

Formal Actions

FINSA codified CFIUS, gave it statutory authority, and designated the Secretary of the Treasury to serve as the chairman. The measure followed the same pattern that had been set by Executive Order 11858. The formal process has clear deadlines for action

- 30 days to conduct a review;

- 45 days to conduct an investigation; and

- 15 days for a presidential determination.

At any point during the CFIUS process, parties can withdraw and refile their notice, for instance, to allow additional time to discuss CFIUS's proposed resolution of outstanding issues. Under FINSA, the President retained his authority as the only officer capable of suspending or prohibiting mergers, acquisitions, and takeovers, and the measure placed additional requirements on firms that resubmitted a filing after previously withdrawing a filing before a full review was completed.

National Security Review

FIRRMA shifts the filing requirement for foreign firms from voluntary to mandatory in certain cases and provides a two-track method for reviewing transactions. Some firms are permitted to file a declaration with CFIUS and could receive an expedited review process, while transactions involving a foreign person in which a foreign government has, directly or indirectly, a substantial interest (to be defined by regulations, but not including stakes of less than 10% voting interest) would be required to file a written notification and receive greater scrutiny. Mandatory declarations may be subject to other criteria as defined by regulations. The chief executive officer of any party to a merger, acquisition, or takeover must certify in writing that the information contained in a written notification to CFIUS fully complies with the CFIUS requirements and that the information is accurate and complete. This written notification would also include any mitigation agreement or condition that was part of a CFIUS approval. The mandatory filing and review process (via a declaration) are required for foreign investments in certain U.S. businesses that produce, design, test, manufacture, fabricate, or develop one or more critical technologies in 27 specified industries.33 This requirement applies to critical technologies that are used either in connection with the U.S. business's activity in one or more of the industries specified under the pilot program, or designed by the U.S. business specifically for use in one or more of the specified industries. The shift also expands CFIUS reviews of transactions beyond those that give foreign investors a controlling interest to include investments in which foreign investors do not have a controlling interest in a U.S. firm as a result of the foreign investment. Specifically, such noncontrolling investments are covered, or subject to a review, if they would grant the foreign investor access to "material nonpublic technical information" in possession of the U.S. business; membership or observer rights on the board of directors; or any involvement in substantive decisionmaking regarding critical technology. Prior to this change, a controlling interest was determined to be at least 10% of the voting shares of a publicly traded company, or at least 10% of the total assets of a nonpublicly traded U.S. company. This shift was precipitated by concerns that investments in which foreign firms have a noncontrolling interest could nevertheless "affect certain decisions made by, or obtain certain information from, a U.S. business with respect to the use, development, acquisition, or release of critical technology." New authorities granted by FIRRMA for CFIUS to review noncontrolling investments were not immediately effective upon passage of the Act, but were included as part of the Treasury Department's pilot program. The Treasury Department's pilot program also includes provisions for declarations and written notices. The program indicates that declarations and written notices are distinguished according to three criteria: the length of the submission, the time for CFIUS' consideration of the submission, and the Committee's options for disposition of the submission. Declarations are described as short notices that do not exceed five pages. The parties to a transaction could voluntarily stipulate that a transaction is a covered transaction, whether the transaction could result in control of a U.S. business by a foreign person, and whether the transaction is a foreign-government controlled transaction. CFIUS would be required to respond within 30 days to the filing of a declaration, whereas CFIUS would have 45 days to respond to a written notification. CFIUS would also be required to respond in one of four ways to a declaration: (1) request that the parties file a written notice; (2) inform the parties that CFIUS cannot complete the review on the basis of the declaration and that they can file a notice to seek a written notification from the Committee that it has completed all the action relevant to the transaction; (3) initiate a unilateral review of the transaction through an agency notice; or (4) notify the parties that CFIUS has completed its action under the statute. At any point during the CFIUS process, parties can withdraw and refile their notice, for instance, to allow additional time to discuss CFIUS's proposed resolution of outstanding issues. Under FINSA and FIRRMA, the President retains his authority as the only officer capable of suspending or prohibiting mergers, acquisitions, and takeovers, and the measures place additional requirements on firms that resubmitted a filing after previously withdrawing a filing before a full review was completed. After a transaction is filed with CFIUS and depending on an initial assessment, the transaction can be subject to a 45-day national security review. During a review, CFIUS members are required to consider the 12 factors mandated by Congress through FINSA and six new factors in FIRRMA that reflect the "sense of Congress" in assessing the impact of an investment. If during the 45-day review period all members conclude that the investment does not threaten to impair the national security, the review is terminated. During the 30-day review stage, the Director of National Intelligence (DNI), an ex officio member of CFIUS, is required to carry out a thorough analysis of "any threat to the national security of the United States" of any merger, acquisition, or takeover. This analysis is required to be completed "within 20 days" of the receipt of a notification by CFIUS, but the statute directs that the DNI must be given "adequate time," presumably if this national security review cannot be completed within the 20-day requirement. This analysis wouldanecdotal evidence, some firms believe the CFIUS process is not market neutral, but adds to market uncertainty that can negatively affect a firm's stock price and lead to economic behavior by some firms that is not optimal for the economy as a whole. Such behavior might involve firms expending resources to avoid a CFIUS investigation, or terminating a transaction that potentially could improve the optimal performance of the economy to avoid a CFIUS investigation. While such anecdotal accounts generally are not a basis for developing public policy, they raise concerns about the possible impact a CFIUS review may have on financial markets and the potential costs of redefining the concept of national security relative to foreign investment.

Formal Actions

A review is exempted ifIf the Secretary of the Treasury and certain other specified officials determine that the transaction in question will not impair the national security.

National Security Investigation

Transactions Blocked by Presidents Since the creation of CFIUS, presidential action blocked six transactions based on CFIUS recommendations: 1. In 1990, President Bush directed the China National Aero-Technology Import and Export Corporation (CATIC) to divest its acquisition of MAMCO Manufacturing. 2. In 2012, President Obama directed the Ralls Corporation to divest itself of an Oregon wind farm project. 3. In 2016, President Obama blocked the Chinese firm Fujian Grand Chip Investment Fund from acquiring Aixtron, a German-based semiconductor firm with U.S. assets. 4. In 2017, President Trump blocked the acquisition of Lattice Semiconductor Corp. of Portland, OR, for $1.3 billion by Canyon Bridge Capital Partners, a Chinese investment firm. 5. In 2018, President Trump blocked the acquisition of semiconductor chip maker Qualcomm by Singapore-based Broadcom for $117 billion. 6. In 2019, President Trump ordered the divesture of Grindr LLC, an online dating site, by the Chinese firm Beijing Kunlun Tech. Co. Ltd. over concerns of foreign access to personally identifiable information of U.S. citizens. The, the investment is not subject to a formal review.

National Security Investigation

If a national security review indicates that at least one of three conditions exists, the President, acting through CFIUS, is required to conduct a National Security investigationInvestigation and to take any "necessary" actions as part of thean additional 45-day investigation if the review indicates that at least one of, with a possible 15-day extension. The three conditions existsare: (1) CFIUS determines that the transaction threatens to impair the national security of the United States and that the threat has not been mitigated during or prior to a review of the transaction; (2) the foreign person is controlled by a foreign government; or (3) the transaction would result in the control of any critical infrastructure by a foreign person, the transaction could impair the national security, and such impairment has not been mitigated. At the conclusion of the investigation or the 45-day review period, whichever comes first, the Committee can decide to offer no recommendation or it can recommend thatto the President that he/she suspend or prohibit the investment.

suspend or prohibit the investment.

During a review or an investigation, CFIUS and a designated lead agency have the authority to negotiate, impose, or enforce any agreement or condition with the parties to a transaction in order to mitigate any threat to U.S. national security. Such agreements are based on a "risk-based analysis" of the threat posed by the transaction. Also, if a notification of a transaction is withdrawn before any review or investigation by CFIUS is completed, the amended law grants the Committee the authority to take a number of actions. In particular, the Committee could develop (1) interim protections to address specific concerns about the transaction pending a resubmission of a notice by the parties; (2) specific time frames for resubmitting the notice; and (3) a process for tracking any actions taken by any parties to the transaction.

Presidential Determination

FINSA grants the President the authority to block As noted above, CFIUS authorities allow the President to block or suspend proposed or pending foreign "mergers, acquisitions, or takeovers" of "persons engaged in interstate commerce in the United States" that threaten to impair the national security. The President, however, is under no obligation to follow the recommendation of the Committee to suspend or prohibit an investment. Congress directed that before this authority can be invoked (1) the President must conclude that other U.S. laws are inadequate or inappropriate to protect the national security; and (2) the President must have "credible evidence" that the foreign investment will impair the national security. As a result, if CFIUS determines, as was the case in the Dubai Ports transaction, that it does not have credible evidence that an investment will impair the national security, then it may argue that it is not required to undertake a full 45-day investigation, even if the foreign entity is owned or controlled by a foreign government. After considering the two conditions listed above (other laws are inadequate or inappropriate, and he has credible evidence that a foreign transaction will impair national security), the President is granted almost unlimited authority to take "such action for such time as the President considers appropriate to suspend or prohibit any covered transaction that threatens to impair the national security of the United States." In addition, such determinations by the President are not subject to judicial review, although the process by which the disposition of a transaction is determined may be subject to judicial review to ensure that the constitutional rights of the parties involved are upheld, as was emphasized in the ruling by the U.S. District Court for the District of Columbia in the case of Ralls vs. the Committee on Foreign Investment in the United States.

Committee Membership

President Bush's January 23, 2008, Executive Order 13456 implementing FINSA made various changes to the law. The Committee consists of nine Cabinet members, including the Secretaries of State, the Treasury, Defense, Homeland Security, Commerce, and Energy; the Attorney General; the United States Trade Representative; and the Director of the Office of Science and Technology Policy.3234 The Secretary of Labor and the Director of National Intelligence serve as ex officio members of the Committee.3335 The Executive Order added five executive office members to CFIUS in order to "observe and, as appropriate, participate in and report to the President"::" the Director of the Office of Management and Budget; the Chairman of the Council of Economic Advisors; the Assistant to the President for National Security Affairs; the Assistant to the President for Economic Policy; and the Assistant to the President for Homeland Security and Counterterrorism. The President can also appoint members on a temporary basis to the Committee as he determines.

FIRRMA did not alter the membership of the Committee, but added two new positions within the Treasury Department. Both of the new positions are designated to be at the level of Assistant Secretary, with one of the positions an Assistant Secretary for Investment Security, whose primary responsibilities will be with CFIUS, under the direction of the Treasury Secretary.

Covered Transactions

The statuteCovered Transactions

FIRRMA also expanded CFIUS reviews to include unaffiliated businesses that may be affected by a foreign investment transaction if the business: (1) owns, operates, manufactures, supplies, or services critical infrastructure; (2) produces, designs, tests, manufactures, fabricates, or develops one or more critical technologies; or (3) maintains or collects sensitive personal data of United States citizens that may be exploited in a manner that threatens national security. FIRRMA also amended the existing CFIUS statute by mandating certain changes be adopted through new regulations. Seven of 15 changes mandated through regulations concern the definition of a covered transaction and broadening the scope of a CFIUS review. No deadlines were specified for these regulatory changes. The regulatory changes mandated by FIRRMA include:The law requires CFIUS to review all "covered" foreign investment transactions to determine whether a transaction threatens to impair the national security, or the foreign entity is controlled by a foreign government, or it would result in control of any "critical infrastructure that could impair the national security." A covered foreign investment transaction is defined as any merger, acquisition, or takeover which results in "foreign control of any person engaged in interstate commerce in the United States." According to CFIUS, the FINSA law increased accountability in the way CFIUS conducts its reviews. "that could result in foreign control of any United States business, including such a merger, acquisition, or takeover carried out through a joint venture." The term 'national security' is defined to include those issues relating to 'homeland security,' including its application to critical infrastructure and critical technologies. In addition, in reviewing a covered transaction, Congress directed that CFIUS and the President "may" consider the following: