The Earned Income Tax Credit (EITC): Legislative History

Changes from March 20, 2018 to April 28, 2022

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Earned Income Tax Credit (EITC): A Brief Legislative History

Contents

- Introduction

- Did P.L. 115-97 Modify the EITC?

- An Overview of the History of the EITC

- Before Enactment

- 1975-1986: An Earnings-Based Credit for Workers with Children

- 1990s: Expanding the Credit Amount While Limiting Eligibility

- Adjusting the Credit for Family Size and Expanding Availability to Childless Workers

- Targeting the Credit

- 2000s: Adjusting the Credit for Marital Status and Family Size

- Reducing the "Marriage Penalty"

- Expanding the EITC for Families with Three or More Children

- 2010s: Addressing Some of the Administrative and Compliance Challenges with the EITC

- Reducing Improper Payments of Refundable Credits

Figures

Tables

Appendixes

Summary

The earned income tax credit (EITC), when first enacted on a temporary basis in 1975, was a modest tax credit that provided financial assistance to low-income, working families with children. After various legislative changes over the past 40 years, the credit is now one of the federal government's largest antipoverty programs. Since the EITC's enactment, Congress has shown increasing interest in using refundable tax credits for a variety of purposes, from reducing the tax burdens of families with children (the child tax credit), to helping families afford higher education (the American opportunity tax credit), to subsidizing health insurance premiums (the premium assistance tax credit). The legislative history of the EITC may provide context to current and future debates about these refundable tax credits.

The origins of the EITC can be found in the debate in the late 1960s and 1970s over how to reform welfare—known at the time as Aid to Families with Dependent Children (AFDC). During this time, there was increasing concern over growing welfare rolls. Senator Russell Long proposed a "work bonus" plan that would supplement the wages of poor workers. The intent of the plan was to encourage the working poor to enter the labor force and thus reduce the number of families needing AFDC.

This "work bonus" plan, renamed the earned income tax credit, was enacted on a temporary basis as part of the Tax Reduction Act of 1975 (P.L. 94-12). As originally enacted, the credit was equal to 10% of the first $4,000 in earnings. Hence, the maximum credit amount was $400. The credit phased out between incomes of $4,000 and $8,000. The credit was also viewed as a means to encourage economic growth in the face of the 1974 recession and rising food and energy prices.

Over the subsequent 40 years, numerous legislative changes have been made to this credit. Some changes increased the amount of the credit by changing the credit formula. Major laws that increased the amount of the credit include the following:

- P.L. 101-508, which adjusted the credit amount for family size and created a credit for workers with no qualifying children;

- P.L. 103-66, which increased the maximum credit for tax filers with children and created a new credit formula for certain low-income, childless tax filers;

- P.L. 107-16, which increased the income level at which the credit phased out for married tax filers in comparison to unmarried tax filers (referred to as "marriage penalty relief"); and

P.L. 111-5,which increased the credit amount for families with three or more children andThe Earned Income Tax Credit (EITC): April 28, 2022 Legislative History Margot L. Crandall-Hollick The earned income tax credit (EITC), when first enacted on a temporary basis in 1975, was a Specialist in Public Finance modest tax credit that provided financial assistance to low-income, working families with children. After various legislative changes over the past 45 years, the credit is now one of the federal government’s largest antipoverty programs providing cash assistance to low-income working families, illustrated in the figure on the following page. A summary of major legislative changes over the past five decades is provided below. Law Year First in Effect Summary of Legislative Change Tax Reduction Act of 1975 The EITC was enacted on a temporary basis (1975 only) as part of TRA75. The maximum (TRA75; P.L. 94-12) credit amount was $400. The credit was extended several times before being made permanent by the Revenue Act of 1978 (P.L. 95-600). P.L. 95-600 also increased the 1975 maximum amount of the credit to $500. Tax Reform Act of 1986 TRA86 modified the credit formula, resulting in a larger credit—a maximum statutory (TRA86; P.L. 99-514) credit of $800. The bil also permanently adjusted the credit’s monetary parameters for inflation beginning in 1987 (so the maximum credit in 1987 was $851). 1987 The Omnibus Budget OBRA90 modified the EITC formula for family size: one formula for families with one Reconciliation Act of 1990 qualifying child and a slightly larger credit for those with two or more qualifying children. (OBRA90; P.L. 101-508) As a result, in 1991 the maximum credit was $1,192 for families with one qualifying child and $1,235 for families with two or more qualifying children. 1991 The Omnibus Budget OBRA93 further increased the maximum credit for households with one qualifying child Reconciliation Act of 1993 and two or more qualifying children. The law also created a new credit formula for low- (OBRA93; P.L. 103-66) income workers with no qualifying children (sometimes referred to as the “childless” EITC). As a result of these changes, the maximum credit in 1994 for a family with no 1994 qualifying children was $306; one qualifying child, $2,038; and two or more qualifying children, $2,528. The larger credit for taxpayers with qualifying children phased in to permanent levels over two to three years, depending on the number of qualifying children. The Personal Responsibility and PRWORA required taxpayers to provide Social Security numbers (SSNs) for work Work Opportunity Reconciliation purposes for themselves, spouses if married filing jointly, and any qualifying children, in Act of 1996 order to receive the credit. (PRWORA; P.L. 104-193) 1996 The Economic Growth and Tax EGTRRA temporarily increased the income level at which the credit began to phase out Relief Reconciliation Act for married taxpayers in comparison to unmarried taxpayers (the additional amount is (EGTRRA; P.L. 107-16) referred to as “marriage penalty relief”). Marriage penalty relief was equal to $1,000 between 2002 and 2004, $2,000 between 2005 and 2007, and $3,000 between 2008 and 2002 2010. The American Recovery and ARRA temporarily created a new larger credit for families with three or more children. Reinvestment Act As a result, in 2009, the maximum credit for a family with three or more qualifying (ARRA; P.L. 111-5) children was $5,657 (in comparison, prior to ARRA it would have been $5,028 in 2009). The law also temporarily expanded the marriage penalty relief enacted as part ofP.L. 107-16.

Other legislative changes changed the eligibility rules for the credit. Major laws that changed the eligibility rules of the credit include the following:

- P.L. 103-66, which expanded the definition of an eligible EITC claimant to include certain individuals who had no qualifying children;

- P.L. 104-193, which required tax filers to provide valid Social Security numbers (SSNs) for work purposes for themselves, spouses if married filing jointly, and any qualifying children, in order to be eligible for the credit; and

- P.L. 105-34, which introduced additional compliance rules to reduce improper claims of the credit.

Together, these changes reflect congressional intent to expand this benefit while also better targeting it to certain recipients.

Introduction

|

The earned income tax credit (EITC), when first enacted in 1975, was a modest tax credit providing financial assistance to low-income working families with children. (It was also initially a temporary tax provision.) Today, the EITC is one of the federal government's largest antipoverty programs, having evolved through a series of legislative changes over the past 40 years. Since the EITC's enactment, Congress has shown increasing interest in using refundable tax credits for a variety of purposes, from reducing the tax burdens of families with children (the child tax credit), to helping families afford higher education (the American opportunity tax credit), to subsidizing health insurance premiums (the premium assistance tax credit). The legislative history of the EITC may provide context to current and future debates about refundable tax credits.

The report first provides a general overview of the current credit. The report then summarizes the key legislative changes to the credit and provides analysis of some of the congressional intentions behind these changes. An overview of the current structure of the EITC can be found in Appendix A at the end of this report. For more information about the EITC, see CRS Report R43805, The Earned Income Tax Credit (EITC): An Overview.

An Overview of the History of the EITC

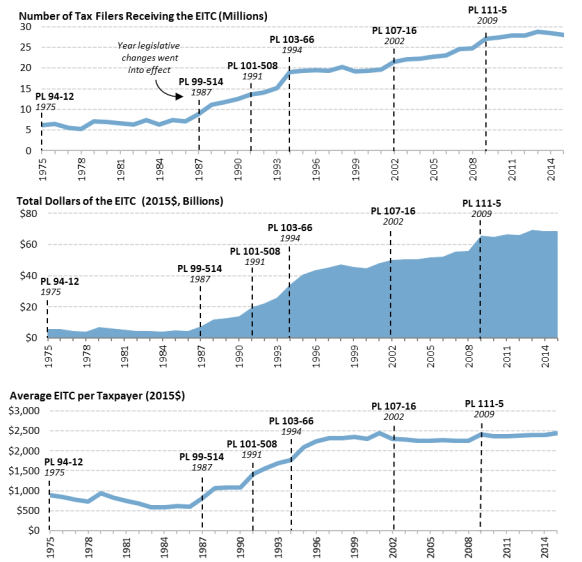

Major legislative changes to the EITC over the past 40 years can generally be categorized in one of two ways: those that increased the amount of the credit by changing the credit formula or those that changed eligibility rules for the credit, either expanding eligibility to certain workers (for example, certain servicemembers) or denying the credit to others (for example, workers not authorized to work in the United States). Together, these changes reflect congressional intent to expand this benefit while also better targeting it to certain recipients. A summary of some of the major changes to the EITC can be found in Table 1. A summary of the growth in the EITC in terms of both the amount of the credit and the number of claimantsP.L. 107-

2009

16 to $5,000 (adjusting this amount for inflation). These changes were extended several times and made permanent beginning in 2016 by P.L. 114-113.

The American Rescue Plan Act

ARPA temporarily expanded the amount of and eligibility for the childless EITC (for 2021

(ARPA; P.L. 117-2)

only), with the maximum childless EITC increasing from $543 to $1,052 in 2021. The law

2021

also included other temporary and permanent changes.

Congressional Research Service

The Earned Income Tax Credit (EITC): Legislative History

Congressional Research Service

link to page 6 link to page 7 link to page 7 link to page 10 link to page 10 link to page 10 link to page 11 link to page 13 link to page 13 link to page 14 link to page 16 link to page 16 link to page 16 link to page 17 link to page 17 link to page 17 link to page 18 link to page 20 link to page 6 link to page 15 link to page 19 link to page 22 link to page 9 link to page 21 link to page 21 link to page 24 link to page 21 link to page 23 The Earned Income Tax Credit (EITC): Legislative History

Contents

Introduction ..................................................................................................................................... 1

Before Enactment ...................................................................................................................... 2 1975-1986: An Earnings-Based Credit for Workers with Children .......................................... 2 1990s: Expanding the Credit Amount While Limiting Eligibility ............................................ 5

Adjusting the Credit for Family Size and Expanding Availability to Childless

Workers ............................................................................................................................ 5

Targeting the Credit ............................................................................................................ 6

2000s: Adjusting the Credit for Marital Status and Family Size ............................................... 8

Reducing the “Marriage Penalty” ....................................................................................... 8 Expanding the EITC for Families with Three or More Children ........................................ 9

2010s: Addressing Some of the Administrative and Compliance Challenges with the

EITC ...................................................................................................................................... 11

Reducing Improper Payments of Refundable Credits ........................................................ 11

2020s: Temporary Income Lookbacks and Temporary Expansion of the Credit for

Childless Workers During the COVID-19 Pandemic ........................................................... 12

Income Lookbacks ............................................................................................................ 12

Temporary Expansion of the Childless EITC .......................................................................... 13

Permanent Changes to the EITC ....................................................................................... 15

Figures Figure 1. Maximum EITC Amount by Number of Qualifying Children, 1975-2022 ..................... 1 Figure 2. EITC Dollar Amounts and Recipients Over Time, 1975-2019 ...................................... 10 Figure 3. Childless EITC Amount by Income, 2021 ..................................................................... 14

Figure A-1. EITC Amount by Income, 2021 ................................................................................. 17

Tables Table 1. Key Characteristics of the EITC Under Selected Laws, 1975-2009 ................................. 4

Table A-1. EITC Tax Parameters by Marital Status and Number of Qualifying Children

for 2021 ...................................................................................................................................... 16

Table B-1. EITC Formula Parameters, 1975-2022 ........................................................................ 19

Appendixes Appendix A. Current Structure of the EITC .................................................................................. 16 Appendix B. EITC Formula Parameters 1975-2022 ..................................................................... 18

Congressional Research Service

link to page 32 The Earned Income Tax Credit (EITC): Legislative History

Contacts Author Information ........................................................................................................................ 27

Congressional Research Service

link to page 6 link to page 24 link to page 21 link to page 23

The Earned Income Tax Credit (EITC): Legislative History

Introduction The earned income tax credit (EITC), when first enacted in 1975, was a modest tax credit of up to $400 for low-income working families with children. (It was also initially a temporary tax provision.) Today, as a result of numerous legislative changes over the past 45 years—some of which are identified in Figure 1—the EITC is the largest permanent federal needs-tested antipoverty program that provides cash assistance. (Some of the annual increases in the maximum benefit, especially in recent years, have been due to the statutory inflation adjustment of the credit.)

Figure 1. Maximum EITC Amount by Number of Qualifying Children, 1975-2022

Source: See Table B-1. Notes: These amounts reflect actual maximum amounts in a given year and reflect inflation indexing of the credit’s parameters.

This report summarizes the EITC’s origins, outlines key legislative changes to the credit, and analyzes some of the congressional intentions behind these changes. An overview of the current structure of the EITC can be found in Appendix A. An overview of how the credit formula has changed over time can be found in Appendix B.

Congressional Research Service

1

The Earned Income Tax Credit (EITC): Legislative History

Figure 1, which includes the dates of key legislative changes to the credit.

Before Enactment

Before Enactment The origins of the EITC can be found in the debate in the late 1960s and 1970s over how to reform welfare—known at the time as Aid to Families with Dependent Children (AFDC).41 During this time, there was increasing concern over the growing numbers of individuals and families receiving welfare.52 In 1964, fewer than 1 million families received AFDC. By 1973, the AFDC rolls had increased to 3.1 million families. Some policymakers were interested in alternatives to cash welfare for the poor. Some welfare reform proposals relied on the "“negative income tax" ” (NIT) concept. The NIT proposals would have provided a guaranteed income to families who had no earned income (the “no earnings (the "income guarantee"” that was part of these proposals). For families with earningsearned income, the NIT would have been gradually reduced as earnings increased.63 Influenced by the idea of a NIT, President Nixon proposed in 1971 the "“family assistance plan"” (FAP)74 that "“would have helped working-poor families with children by means of a federal minimum cash guarantee."8

”5

Senator Russell Long, then chairman of the Senate Finance Committee, did not support FAP because it provided "“its largest benefits to those without earnings"9”6 and would, in his opinion, discourage people from working. Instead, Senator Long proposed a "“work bonus"” plan that would supplement the wages of poor workers. Senator Long stated that his proposed "“work bonus plan" ” was "“a dignified way"” to help poor Americans "“whereby the more he [or she] works the more he [or she] gets."10”7 Senator Long also believed his "“work bonus plan"” would "“prevent the social security tax from taking away from the poor and low-income earners the money they need for support of their families."11

”8 1975-1986: An Earnings-Based Credit for Workers with Children

The "“work bonus plan"” proposal was passed by the Senate in 1972, 1973, and 1974, but the House did not pass it until 1975. The "“work bonus plan"” was renamed the earned income tax

1 For more information on the legislative history of welfare in the United States, see CRS Report R44668, The Temporary Assistance for Needy Families (TANF) Block Grant: A Legislative History, by Gene Falk.

2 According to Ventry, “In 1960, before President Johnson deployed his forces for a war on poverty, 3.1 million received [Aid to Families with Dependent Children] AFDC. By 1969, that number had risen to 6.7 million, and would jump again to 9.0 million by 1970.” Dennis J. Ventry, “The Collision of Tax and Welfare Politics: The Political History of the Earned Income Tax Credit, 1969-1999,” National Tax Journal, vol. 53, no. 4 (December 2000), p. 988.

3 In a negative income tax system, the amount of income below a given threshold is refunded to the taxpayer at a given rate. For example, if a threshold was set at $10,000 for an individual, with a tax or refund rate of 10%, a taxpayer with $11,000 of income would pay $10 in tax ($1,000 of income x 10%). A taxpayer with $9,000 in income would receive a $10 refund ($1,000 of “negative income” x 10%). Hence, a taxpayer with zero income would receive a $1,000 refund ($10,000 of negative income x 10%). For more information on the negative income tax, see Robert A. Moffitt, The Negative Income Tax and the Evolution of U.S. Welfare Policy, NBER Working Paper Series, Working Paper 9751, June 2003.

4 Robert J. Lampman, Nixon’s Family Assistance Plan, Institute for Research on Poverty Discussion Paper, November 1969, http://www.irp.wisc.edu/publications/dps/pdfs/dp5769.pdf.

5 CRS Report 95-542, The Earned Income Tax Credit: A Growing Form of Aid to Low-Income Workers, by James R. Storey, p. 2, available to congressional clients upon request. While the Nixon plan never became law, it was twice approved by the House.

6 V. Joseph Hotz and John Karl Scholz, “The Earned Income Tax Credit,” in Means-Tested Transfer Programs in the United States, ed. Robert A. Moffitt, (University of Chicago Press, 2003), http://www.nber.org/chapters/c10256.pdf, p. 142.

7 Congressional Record, Senate, in remarks by Mr. Long. September 30, 1972, pp. 33010-33011. 8 Congressional Record, Senate, in remarks by Mr. Long. September 30, 1972, p. 33010.

Congressional Research Service

2

link to page 15 link to page 9 The Earned Income Tax Credit (EITC): Legislative History

credit and was renamed the earned income tax credit and was enacted on a temporary basis as part of the Tax Reduction Act of 1975 (P.L. 94-12). As originally enacted, the credit was equal to 10% of the first $4,000 in earningsearned income. Hence, the maximum credit amount was $400. (which would have equaled about $950 in 2019 dollars, as illustrated in Figure 2). The credit phased out between incomes of $4,000 and $8,000. The credit was originally a temporary provision that was only in effect for one year, 1975.

In addition to encouraging work and reducing dependence on cash welfare, the credit was also viewed as a means to encourage economic growth in the face of the 1974 recession and rising food and energy prices. As the Finance Committee Report on the Tax Reduction Act of 1975 stated:9

This new refundable credit will provide relief to families who currently pay little or no stated:12

This new refundable credit will provide relief to families who currently pay little or no income tax. These people have been hurt the most by rising food and energy costs. Also, in almost all cases, they are subject to the social security payroll tax on their in almost all cases, they are subject to the social security payroll tax on their earnings. Because it will increase their after-tax earnings, the new credit, in effect, provides an added bonus or incentive for low-income people to work, and therefore, should be of importance in inducing individuals with families receiving Federal assistance to support themselves. Moreover, the refundable credit is expected to be effective in stimulating the Moreover, the refundable credit is expected to be effective in stimulating the economy because the low-income people are expected to spend a large fraction of their disposable incomes.

The same report also emphasized that the EITC’s prime objective should be “to assist in encouraging people to obtain employment, reducing the unemployment rate, and reducing the welfare rolls.”10 One indication of the extent to which this credit was meant to replace cash welfare was that the bill had originally included a provision that would have required states to reduce cash welfare by an amount equal to the aggregate EITC benefits received by their residents. This provision was ultimately dropped in the conference committee.11 In addition, since the EITC was viewed in part as an alternative to cash welfare, it was generally targeted to the same recipients—single mothers with children.12 (Low-income workers without qualifying children would not be eligible for the EITC until the 1990s, as discussed subsequently and illustrated in Table 1.)

9 Senate Committee on Finance, Tax Reduction Act of 1975, Report to Accompany H.R. 2166, 94th Cong., 1st sess., March 17, 1975, S. Rept. 94-36, p. 11.

10 Senate Committee on Finance, S. Rept. 94-36, p. 33. 11 CRS Report 95-542, The Earned Income Tax Credit: A Growing Form of Aid to Low-Income Workers, by James R. Storey, available to congressional clients upon request.

12 For more information, see “Brief History of Cash Assistance” in CRS Report R43187, Temporary Assistance for Needy Families (TANF): Size and Characteristics of the Cash Assistance Caseload, by Gene Falk.

Congressional Research Service

3

The Earned Income Tax Credit (EITC): Legislative History

Table 1. Key Characteristics of the EITC Under Selected Laws, 1975-2009

Law (PL)

94-12

95-600

98-369

99-514

101-508

103-66

107-16

111-5

Year Enacted

1975

1978

1984

1986

1990

1993

2001

2009

Year First in Effect

1975

1979

1985

1987

1991

1994

2002

2009

Credit Formula Based on:

Earned Income

X

X

X

X

X

X

X

X

Number of Children ((i.e., credit amount

X

X

X

X

varied based on family size))

Marital Status (i.e., phaseout

X

X

varies based on marital status)

incomes.

|

|

|

|

|

|

|

| |

|

$400 Enacting legislation |

$500 |

$550 |

$800 |

one, $1,057

| none, $323 one, $2,152

|

same |

0-2, same

|

|

Credit Formula Based on: |

||||||||

|

Earnings |

X |

X |

X |

X |

X |

X |

X |

X |

|

X |

X |

X |

X |

||||

|

Marital Status |

X |

X |

||||||

Credit Available to Workers without

X

X

X

Qualifying Children

|

X |

X |

X |

|||||

Credit Adjusted Annually for

X

X

X

X

X

Inflation

|

X |

X |

X |

X |

X |

Source: CRS analysis of Internal Revenue Code (IRC) § 32, P.L. 94-12, , P.L. 95-600, , P.L. 98-369, , P.L. 99-514, , P.L. 101-508, , P.L. 103-66, , P.L. 107-16, , and P.L. 111-5.

The credit was extended several times before being made permanent by the Revenue Act of 1978 (P.L. 95-600).13P.L. 111-5.

a. Statutory amounts do not reflect annual adjustments for inflation.

The same report also emphasized that the EITC's prime objective should be "to assist in encouraging people to obtain employment, reducing the unemployment rate, and reducing the welfare rolls."13 One indication of the extent to which this credit was meant to replace cash welfare was that the bill had originally included a provision that would have required states to reduce cash welfare by an amount equal to the aggregate EITC benefits received by their residents. This provision was ultimately dropped in the conference committee.14 In addition, since the EITC was viewed in part as an alternative to cash welfare, it was generally targeted to the same recipients—single mothers with children.15 (Childless low-income adults would not receive the EITC until the 1990s, discussed subsequently.)

The credit was extended several times before being made permanent by the Revenue Act of 1978 (P.L. 95-600).16 This law also increased the maximum amount of the credit to $500.17 This law also increased the maximum amount of the credit to $500.14 In summary materials of that bill, the Joint Committee on Taxation (JCT) stated that the credit was made permanent because "“Congress believed that the earned income credit is an effective way to provide work incentives and relief from income and Social Security taxes to low-income families who might otherwise need large welfare payments."18”15 The modest increase in the amount of the credit in 1978 was seen as a way to take into account the increase in the cost of living since 1975 (the credit was not adjusted for inflation). Subsequent increases in the amount of the credit in 1984 (P.L. 98-369) and 1986 (P.L. 99-514) were also viewed as a way to adjust the credit for cost-of-living increases, as well as increases that had occurred to Social Security taxes.1916 (The 1986 law also permanently adjusted the credit annually for inflation going forward.)

13 The credit was extended through 1976 by P.L. 94-164; through 1977 by P.L. 94-455; and through 1978 by P.L. 95-30.

14 Under the 1978 law, the EITC was set at 10% of the first $5,000 of earnings (including net earnings from self-employment). The maximum credit of $500 was received for earnings between $5,000 and $6,000. For each dollar of AGI above $6,000, the EITC was reduced by 12.5 cents, reaching $0 at an AGI of $10,000.

15 Joint Committee on Taxation, General Explanation of the Revenue Act of 1978, March 12, 1979, JCS-7-79, p. 51. 16 Joint Committee on Taxation, General Explanation of the Tax Reform Act of 1986, May 4, 1987, JCS-10-87, p. 27.

Congressional Research Service

4

The Earned Income Tax Credit (EITC): Legislative History

1990s: Expanding the Credit Amount While Limiting Eligibility 1990s: Expanding the Credit Amount While Limiting Eligibility

In the early 1990s, legislative changes again increased the amount of the EITC. Eligibility for the credit was also expanded to include childless workers. Several years later, in light of concerns related to the increasing cost of the EITC, as well as concerns surrounding noncompliance, additional changes were made to the credit with the intention of reducing fraudulent claims, better targeting benefits, and improving administration.

Adjusting the Credit for Family Size and Expanding Availability to Childless Workers

Workers

Over time, policymakers began to turn to the EITC as a tool to achieve another goal: poverty reduction. A 1989 Wall Street Journal article described the EITC as "“emerging as the antipoverty tool of choice among poverty experts and politicians as ideologically far apart as Vice President Dan Quayle and Rep. Tom Downey, a liberal New York Democrat."20”17 Unlike other policies targeted to low-income workers, like the minimum wage, the EITC was viewed by some as better targeted to the working poor with children.2118 In addition, unlike creating a new means-tested benefit program, the EITC was administered by the IRS. This may have appealed to some policymakers who did not wish to create additional bureaucracy when administering poverty programs.19

In order to function more as a poverty reduction tool, the formula used to calculate the credit was modified. As previously discussed, the EITC as originally designed did not vary by family size. Thus, as family size increased, the credit became less effective at helping families meet their needs. The EITC was restructured to vary based on family size beginning with the Omnibus Budget Reconciliation Act of 1990 (OBRA90; P.L. 101-508) and greatly expanding with the Omnibus Budget Reconciliation Act of 1993 (OBRA93, P.L. 103-66).20 The OBRA93 formula changes for taxpayers with children phased in to their permanent levels over time.21 Following these legislative changes, the EITC was calculated such that at any given level of earned income, the credit was one size for a taxpayer with one child and larger for taxpayers with two or more children.22

17 David Wessel, “Expanded Earned-Income Tax Credit Emerges As the Anti-Poverty Program of Choice for Many,” The Wall Street Journal, July 13, 1989, p. A16.

18 In a 1989 floor statement, Rep. Petri implored his colleagues to “Reform the earned income tax credit! Target the aid directly to poor workers who are supporting families.” Thomas Petri, “Working Poor Would Benefit by Earned Income Tax Credit Reform,” Congressional Record, daily edition, vol. 135, part 26 (March 13, 1989), p. H585. 19 David Wessel, “Expanded Earned-Income Tax Credit Emerges As the Anti-Poverty Program of Choice for Many,” The Wall Street Journal, July 13, 1989, p. A16.

20 As part of the 1990 law, beginning in 1991, the credit was made larger for families with two or more children versus one child. However, these size differences were modest in comparison to what was enacted as part of the Omnibus Budget Reconciliation Act of 1993. For example, in 1992 the maximum credit for a household with one child was $1,324. For families with two children the maximum credit was $1,384, $60 more. By contrast, in 1994 the maximum credit for a taxpayer with one child was $2,038, while the maximum credit for a taxpayer with two children was $2,528.

21 The formula for taxpayers with no qualifying children was in effect beginning in 1994, the formula for taxpayers with one qualifying child phased in to its permanent level by 1995, and the formula for taxpayers with two or more qualifying children phased in to its permanent level by 1996.

22 In addition, OBRA90 included two supplemental credits that were available to some EITC recipients between 1991 and 1993. The young child supplement added five percentage points to a family’s credit rate; the child health insurance supplement added up to six percentage points. These supplemental credits were ended, effective in 1994, by OBRA93.

Congressional Research Service

5

The Earned Income Tax Credit (EITC): Legislative History

OBRA93 also—for the first time—extended the credit to workers without qualifying children, often referred to as “childless”programs.22

In order to function more as a poverty reduction tool, the formula used to calculate the credit was modified. As previously discussed, the EITC as originally designed did not vary by family size. Thus, as family size increased, the credit became less effective at helping families meet their needs. The EITC was restructured to vary based on family size beginning with the Omnibus Reconciliation Act of 1990 (OBRA90; P.L. 101-508) and greatly expanding with the Omnibus Reconciliation Act of 1993 (OBRA93, P.L. 103-66).23 Specifically, following these legislative changes, the EITC was calculated such that at any given level of earnings, the credit was one size for a taxpayer with one child and larger for taxpayers with two or more children.24

OBRA93 also—for the first time—extended the credit to childless workers. Unlike the expansion of the credit to workers with more than one child, the main rationale for this "“childless EITC"” was not poverty reduction.2523 Instead the credit was intended to partly offset a gasoline tax increase included in OBRA93.2624 The credit for childless workers was smaller than the credit for individuals with children—a maximum of $323$306 as opposed to $2,152038 for those with one child and $3,5562,528 for those with two or more children in 19961994. The childless EITC was also only available to adults aged 25 to 64 who were not claimed as dependents on anyone'’s tax return. Notably, aside from inflation adjustments, the formulas for the childless EITC and theuntil its temporary expansion under the American Rescue Plan Act in 2021 (ARPA; P.L. 117-2), the formula for the childless EITC had not been modified (parameters were annually adjusted for inflation). The EITC for individuals with one or two children havehas also remained unchanged since OBRA93.

, save for automatic annual inflation adjustments. Targeting the Credit

Other legislation passed later in the 1990s—The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA; P.L. 104-193) and the Taxpayer Relief Act of 1997 (P.L. 105-34)—included modifications to the EITC intended to reduce fraud, limit eligibility to individuals authorized to work in the United States, prevent certain higher-income taxpayers from claiming the credit, and improve administration of the credit.

Before and during consideration of PRWORA, Congress was increasingly concerned with the rising cost of the credit. Some policymakers attributed the increasing cost of the program to the significant legislative expansions that had occurred earlier in the decade and the expansion of EITC eligibility to childless workers.2725 In addition, there were concerns, as Speaker of the House Newt Gingrich stated, that "“as the EITC becomes more generous, it invite[s] fraud and abuse."28 ”26 A 1994 GAO report had identified significant amounts of the credit claimed in error.2927 Other policymakers were concerned that the credit was available to certain higher-income taxpayers—specifically those with little earned income, but significant unearned income (like interest income,

23 Some policymakers disagreed with expanding the EITC to childless workers. For example, Rep. Dave Camp stated that “we should not give the EITC to childless workers. For 18 of the EITC’s 19-year existence, both Republicans and Democrats agreed its benefits should go to working families with dependent children, because the whole purpose of the EITC was to help working families with young children stay off the welfare rolls.” Rep. Camp, “The 7-Year Balanced Budget Reconciliation Act of 1995,” Congressional Record, October 25, 1995, p. H10802. 24 CRS Issue Brief, Earned Income Tax Credit: Should It Be Increased to End Poverty for the Working Poor, August 10, 1993, by James R. Storey, available to congressional clients upon request.

25 For example, Rep. Camp stated, “Mr. Chairman, when the earned income tax credit was enacted in 1975, its concept was to help families move from welfare to the work force by increasing their after-tax earnings and providing relief from the burden of payroll taxes. Since then, three legislative revisions have expanded the program’s cost tenfold to almost $25 billion a year and rising.” Rep. Camp, “The 7-Year Balanced Budget Reconciliation Act of 1995,” Congressional Record, October 25, 1995, p. H10802.

26 Speaker Gingrich, “Taming the EITC,” Congressional Record, October 17, 1995, p. E1952. 27 This GAO report reported on an IRS study of a sample of EITC returns during a two-week period in January 1994. The “IRS’ preliminary analysis of the returns showed that an estimated 29 percent of the 1.3 million EIC returns filed electronically during the period had claimed too large a refund, and about 13 percent of the returns filed was estimated by the IRS as having intentionally claimed too much EIC.” General Accounting Office, Tax Administration: Earned Income Credit—Data on Noncompliance and Illegal Alien Recipients, GAO/GGD-95-27, October 1994, p. 1.

Congressional Research Service

6

The Earned Income Tax Credit (EITC): Legislative History

specifically those with little earned income, but significant unearned income (like interest income, dividends, and rent and royalty income).3028 Finally, "“Congress did not believe that individuals who are not authorized to work in the United States should be able to claim the credit."31

”29

Ultimately, PRWORA addressed these concerns by "“tighten[ing] compliance tax rules and mak[ing] it harder for some people to qualify for the credit."32”30 These changes included expanding the definition of "“investment income"” above which an individual would be ineligible for the credit,3331 expanding the definition of income used to phase out the credit so certain taxpayers with capital losses would be ineligible for the credit,3432 and denying the EITC to individuals who did not provide an SSN for work purposes.35

for themselves, their spouses (if married), and any qualifying children.33 These changes were effective beginning with the credit claimed on 1996 returns.

One year after PRWORA, Congress modified the EITC again with the intention of both improving administration and further limiting the ability of certain higher-income taxpayers to claim the credit. The Taxpayer Relief Act of 1997 (TRA97; P.L. 105-34) created penalties for taxpayers who claimed the credit incorrectly, including; the penalties were intended to improve administration of the credit. These included denying the credit to individuals for 10 years if they claimed the credit fraudulently, that were intended to improve administration of the credit.36 And if after this period and denying the credit for 2 years if an improper claim was due to reckless or intentional disregard of the rules. If, after these periods of time, the taxpayer ultimately was eligible for the credit and wished to claim it, they would need to provide the IRS with additional information (as established by the Treasury) to prove eligibilityto prove eligibility (currently on IRS Form 8862). According to the JCT, these new penalties were enacted because "“Congress believed that taxpayers who fraudulently claim the EITC or recklessly or intentionally disregard EITC rules or regulations should be penalized for doing so."37”34 In addition, TRA97 included new requirements ofon paid tax preparers that were also meant to improve administration and reduce errors.

Finally, TRA97 expanded the definition of income used in phasing out the credit, by including additional categories of passive (i.e., unearned) income. The rationale for this change, according to the JCT, was that "“Congress believed that the definition of AGI used currently [prior to

28 In describing his support for a bipartisan proposal (“Castle-Tanner”) to modify the EITC, Rep. Stenholm stated “I simply want to reiterate that Castle-Tanner ensures that scarce EITC dollars go to the working poor who need it, not to the individuals with substantial business income who do not need it.” Rep. Stenholm, “Welfare and Medicaid Reform Act of 1996,” Congressional Record, July 18, 1996, p. H7982. 29 Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 394.

30 Jeffrey L. Katz, “Welfare: Provisions of Welfare Bill,” CQ Weekly, August 3, 1996, http://www.cq.com/doc/weeklyreport-WR402516?13&search=dVNjp7ZR.

31 See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 390.

32 According to the JCT, “Congress believed it can improve the targeting of the credit by expanding the definition of income used in phasing out the credit.” See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, pp. 391-392.

33 The statutory language requiring individuals (and if applicable their spouses and children) to provide a work-related SSN also included math error authority (MEA). The MEA, related to the EITC’s SSN requirement (which is still in effect), means that “if an individual fails to provide a correct taxpayer identification number, such omission will be treated as a mathematical or clerical error.” Hence the IRS will be able to summarily recalculate the credit or if applicable, deny the credit entirely. See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 394.

34 Joint Committee on Taxation, JCS-23-97, p. 278.

Congressional Research Service

7

The Earned Income Tax Credit (EITC): Legislative History

Congress believed that the definition of AGI used currently [prior to TRA97] in phasing out the credit [was] too narrow and disregard[ed] other components of ability-to-pay."38

”35 2000s: Adjusting the Credit for Marital Status and Family Size

In the 2000s, additional changes to the EITC credit formula were enacted by Congress. These legislative changes expanded the credit for certain recipients—namely married couples and larger families.

Reducing the "“Marriage Penalty"

”

At the beginning of 2000, there was bipartisan congressional interest in reducing tax burdens of married couples generally (although the means by which they intended to achieve this goal varied).3936 For low-income taxpayers with little or no tax liability, a marriage penalty is said to occur when the refund the married couple receives is smaller than the combined refund of each partner filing as unmarried. (Marriage bonuses also arise in the U.S. federal income tax code.40) 37) In 2001, the JCT identified the structure of the EITC as one of the primary causes of the marriage penalty among low-income taxpayers.4138 Specifically, the JCT found that the phaseout range of the credit and its variation based on number of children could result in smaller credits among married EITC recipients than the combined credits of two singles. As the JCT stated in 2001,42

39

Because the [earned income credit] EIC increases over one range of income and then is phased out over another range of income, the aggregation of incomes that occurs when two individuals marry may reduce the amount of EIC for which they are eligible. This problem is particularly acute because the EIC does not feature a higher phase out range for married taxpayers than for heads of households. Marriage may reduce the size of a couple'’s EIC not only because their incomes are aggregated, but also because the number of qualifying children is aggregated. Because the amount of EIC does not increase when a taxpayer has more than two qualifying children, marriages that result in families of more than two qualifying children will provide a smaller EIC per child than when their parents were more than two qualifying children, marriages that result in families of more than two qualifying children will provide a smaller EIC per child than when their parents were unmarried. Even when each unmarried individual brings just one qualifying child into the marriage there is a reduction in the amount of EIC per child, because the maximum credit for two children is generally less than twice the maximum credit for one child.

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) ) reduced the EITC marriage penalty by increasing the income level at which the credit phased out for married couples. This "“marriage penalty relief"” was scheduled to gradually increase to $3,000

35 Joint Committee on Taxation, JCS-23-97, p. 281. 36 For a contemporaneous account of the varying approaches to reduce the marriage penalty debated in 2000, see “Senate Panel Approves Marriage Penalty Relief,” New York Times, March 31, 2000. 37 For more information on marriage penalties and bonuses more generally in the tax code, see Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, pp. 2-6 and CRS Report RL33755, Federal Income Tax Treatment of the Family, by Jane G. Gravelle.

38 The other major factor that the Joint Committee on Taxation identified as causing a marriage penalty among low-income taxpayers was the size of the standard deduction. At the time, the standard deduction for married taxpayers was less than twice the standard deduction for two singles. See Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, p. 3.

39 Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, p. 4.

Congressional Research Service

8

The Earned Income Tax Credit (EITC): Legislative History

was scheduled to gradually increase to $3,000 by 2008. In 2009, the American Recovery and Reinvestment Act (ARRA; P.L. 111-5) temporarily increased EITC marriage penalty relief to $5,000.

Expanding the EITC for Families with Three or More Children

In addition to expanding marriage penalty relief, ARRA also temporarily created a larger credit for families with three or more children by increasing the credit rate for these families from 40% to 45%. A larger credit rate of 45% (as opposed to 40%), while leaving other EITC parameters unchanged (earned income amount and phaseout threshold), resulted in a larger credit for families with three or more children.

These two ARRA modifications to the EITC were originally enacted as part of legislation meant to provide temporary economic stimulus. There was debate surrounding whether these temporary modifications should be further extended. After these changes were enacted in 2009, the Obama Administration proposed making these provisions permanent as part of its budget proposals.43,4440,41 During negotiations on the "“fiscal cliff"” legislation at the end of 2012 (The American Taxpayer Relief Act [ATRA; P.L. 112-240]), some Senators expressed a desire to have the EITC modification made permanent.4542 ATRA extended these modifications for five years, through the end of 2017. Ultimately, increased marriage penalty relief and the larger credit for families with three or more children were made permanent by the Protecting Americans from Tax Hikes Act (PATH Act; Division Q of P.L. 114-113).46

) effective beginning in 2016.43 40 The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312) extended these ARRA provisions for two years (2011 and 2012). The American Taxpayer Relief Act (ATRA; P.L. 112-240) extended the ARRA provisions for five more years (2013-2017). 41 These proposals were included in the FY2010-FY2016 Treasury Green Books. In the FY2012 and FY2013 Greenbooks, the Obama Administration proposed making the 45% credit rate for families with three or more children permanent, but did not propose extending enhanced marriage penalty relief. For more information, see U.S. Department of the Treasury, Administration’s Fiscal Year Revenue Proposals, Green Book, https://www.treasury.gov/resource-center/tax-policy/Pages/general_explanation.aspx. 42 After passage of ATRA, Senator Durbin stated “The other thing that was part of it [ATRA] was a 5-year extension—I wish it had been permanent—but a 5-year extension of the Recovery Act expansion of the earned income tax credit.” Senator Durbin, “The Fiscal Cliff,” Senate Speeches and Inserts, Congressional Record, January 1, 2013, p. S8612. 43 Press reports at the time indicated the permanent extension of these modifications to the EITC (as well modifications to the American opportunity tax credit and the child tax credit) was primarily done to attract enough votes to ensure passage of the broader bill. According to one report in Roll Call, “Democrats won permanent expansions of the child and earned income tax credits, as well as a permanent credit for higher education expenses. Those provisions, which were first enacted in the 2009 stimulus bill and not scheduled to expire until the end of 2017, were key to buying support from the White House and Senate Democrats.” Lindsey McPherson, “GOP Went Big With Tax Deal,” Roll Call, December 16, 2015, http://www.rollcall.com/218/gop-went-big-tax-deal/. Congressional Research Service 9 The Earned Income Tax Credit (EITC): Legislative History Figure 2. EITC Dollar Amounts and Recipients Over Time, 1975-2019 Congressional Research Service 10 The Earned Income Tax Credit (EITC): Legislative History Sources: Congressional Research Service. For pre-2003 data, U.S. Congress, House Committee on Ways and Means, 2004 Green Book, Background Material and Data on Programs Within the Jurisdiction of the Committee on Ways and Means, 108th Congress, 2nd session, WMCP 108-6, March 2004, pp. 13-41. For 2003 and later data, Internal Revenue Service (IRS) Statistics of Income Table 2.5. Notes: Laws are represented according to the date they went into effect, and not the date they were enacted, which could have been one year earlier. 2010s: Addressing Some of the Administrative and Compliance Challenges with the EITC

Additional changes were made to the administration of the EITC with the intention of reducing improper payments of the credit. Improper payments are an annual fiscal year measure47measure44 of the amount of the credit that is erroneously claimed and not recovered by the IRS. Improper payments can be due to honest mistakes made by taxpayers as well as fraudulent claims of the credit.

Reducing Improper Payments of Refundable Credits

The Protecting Americans from Tax Hikes Act (PATH Act; Division Q of P.L. 114-113) included a variety of provisions intended to reduce improper payments of refundable credits, including improper payments of the EITC.4845 First, the law included a provision that would preventprevented retroactive claims of the EITC after the issuance of Social Security numbers.4946 As previously discussed, a taxpayer must provide an SSN for themselves, their spouses (if married), and any qualifying children. The lawPATH Act stated that the credit will be denied to a taxpayer if the SSNs of the taxpayer, their spouse (if married), and any qualifying children were issued after the due date of the tax return for a given taxable year. For example, if a family had SSNs issued in June 2017, the family could (if otherwise eligible) claimhave claimed the EITC on its 2017 income tax return (which iswas due in April 2018), but could not amendhave amended its 2016 income tax return and claimclaimed the credit on its 2016 return (which iswas due in April 2017).50

47

In addition, the law also included a provision requiring the IRS to hold income tax refunds until February 15 if the tax return included a claim for the EITC (or the additionalrefundable portion of the child tax credit, known as the ACTC).51).48 This provision was coupled with a requirement that employers furnish the IRS with W-2s and information returns on nonemployee compensation (e.g., 1099-MISCsNECs) earlier in the filing season. These legislative changes were made "“to help prevent revenue loss due to identity

44 Improper payments and the improper payment rate must by law be reported annually by a variety of agencies for a variety of programs (P.L. 107-300 as amended by P.L. 111-204 and P.L. 112-248). For more information about the legal requirements of agencies concerning improper payments, see U.S. Government Accountability Office, Improper Payments: Government-Wide Estimates and Reduction Strategies, GAO-14-737T, July 9, 2014, pp. 2-3, http://www.gao.gov/assets/670/664692.pdf.

45 For more information on improper payments of the EITC, see CRS Report R43873, The Earned Income Tax Credit (EITC): Administrative and Compliance Challenges, by Margot L. Crandall-Hollick.

46 Section 204 of P.L. 114-113. 47 In internal agency memoranda issued in 2000, the IRS Office of Chief Counsel concluded that amendments made to the EITC statute by the Internal Revenue Service Restructuring and Reform Act of 1998 (P.L. 105-206) allowed taxpayers who received an SSN to retroactively claim the EITC for any open tax years, assuming all other criteria for claiming the credit were met. See IRS Office of Chief Counsel Memorandum 200032013 (May 9, 2000), https://www.irs.gov/pub/irs-wd/0032013.pdf; IRS Office of Chief Counsel Memorandum 200028034 (June 9, 2000), https://www.irs.gov/pub/irs-wd/0028034.pdf.

48 See Section 201 of P.L. 114-113.

Congressional Research Service

11

link to page 21 link to page 21 The Earned Income Tax Credit (EITC): Legislative History

to help prevent revenue loss due to identity theft and refund fraud related to fabricated wages and withholdings."52 With”49 It was believed that allowing the IRS more time to cross-check income on information returns with income used to determine the amount of the EITC, it is believed that this will help reduce erroneous payments of the EITC by the IRS would help reduce erroneous EITC payments. Previous research by the IRS has indicated that the most frequent EITC error was incorrectly reporting income, and the largest error (in dollars) was incorrectly claiming a child for the credit.53

Appendix A.

Current Structure of the EITC

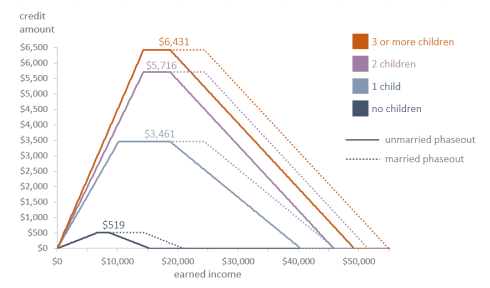

There are eight formulas currently in effect to calculate the EITC (four for unmarried individuals and four for married couples, depending on the number of children they have), illustrated in Table A-1.54

|

Number of Qualifying Children |

0 |

1 |

2 |

3 or more |

|

unmarried tax filers (single and head of household filers) |

||||

|

credit rate |

7.65% |

34% |

40% |

45% |

|

earned income amount |

$6,780 |

$10,180 |

$14,290 |

$14,290 |

|

maximum credit amount |

$519 |

$3,461 |

$5,716 |

$6,431 |

|

phase-out amount threshold |

$8,490 |

$18,660 |

$18,660 |

$18,660 |

|

phase-out rate |

7.65% |

15.98% |

21.06% |

21.06% |

|

income where credit = 0 |

$15,270 |

$40,320 |

$45,802 |

$49,194 |

|

married tax filers (married filing jointly) |

||||

|

credit rate |

7.65% |

34% |

40% |

45% |

|

earned income amount |

$6,780 |

$10,180 |

$14,290 |

$14,290 |

|

maximum credit amount |

$519 |

$3,461 |

$5,716 |

$6,431 |

|

phase-out amount threshold |

$14,170 |

$24,350 |

$24,350 |

$24,350 |

|

phase-out rate |

7.65% |

15.98% |

21.06% |

21.06% |

|

income where credit = 0 |

$20,950 |

$46,010 |

$51,492 |

$54,884 |

Source: IRS Revenue Procedure 2018-18 and Internal Revenue Code (IRC) Section 32.

For any of the eight formulas, the credit has three value ranges similar to those illustrated in Figure A-1, for an unmarried taxpayer with one child. First, the credit increases to its maximum value from the first dollar of earnings until earnings reach the "earned income amount." Over this "phase-in range" the credit value is equal to the credit rate multiplied by earnings. When earnings are between the "earned income amount" and the "phaseout threshold"—referred to as the "plateau"—the credit amount remains constant at its maximum level. For each dollar over the "phaseout threshold," the credit is reduced by the phaseout rate until the credit equals zero. This final range of income over which the credit falls in value is referred to as the "phaseout range."

|

|

|

Source: Congressional Research Service, based on information in IRS Revenue Procedure 2018-18 and Internal Revenue Code Section 32. |

Author Contact Information

Footnotes

| 1. |

|

| 2. | 52 For more information on the changes made to the tax code by P.L. 115-97, see CRS Report R45092, The 2017 Tax Revision (P.L. 115-97): Comparison to 2017 Tax Law, coordinated by Molly F. Sherlock and Donald J. Marples. |

| 3. |

53 For more information, see Michael Ng and David Wessel, Up Front | The Hutchins Center Explains: The Chained CPI, The Brookings Institution, December 7, 2017, https://www.brookings.edu/blog/up-front/2017/12/07/the-hutchins-center-explains-the-chained-cpi/ |

| 4. | .

54 For more information |

| 5. |

According to Ventry, "In 1960, before President Johnson deployed his forces for a war on poverty, 3.1 million received [Aid to Families with Dependent Children] AFDC. By 1969, that number had risen to 6.7 million, and would jump again to 9.0 million by 1970." Dennis J. Ventry, "The Collision of Tax and Welfare Politics: The Political History of the Earned Income Tax Credit, 1969-1999," National Tax Journal, vol. 53, no. 4 (December 2000), p. 988. |

| 6. |

In a negative income tax system, the amount of income below a given threshold is refunded to the taxpayer at a given rate. For example, if a threshold was set at $10,000 for an individual, with a tax or refund rate of 10%, a taxpayer with $11,000 of income would pay $10 in tax ($1,000 of income x 10%). A taxpayer with $9,000 in income would receive a $10 refund ($1,000 of "negative income" x 10%). Hence, at taxpayer with zero income would receive a $1,000 refund ($10,000 of negative income x 10%). For more information on negative income tax, see Robert A. Moffitt, "The Negative Income Tax and the Evolution of U.S. Welfare Policy," NBER Working Paper Series | Working Paper 9751, June 2003. |

| 7. |

Robert J. Lampman, "Nixon's Family Assistance Plan," Institute for Research on Poverty Discussion Paper, November 1969, http://www.irp.wisc.edu/publications/dps/pdfs/dp5769.pdf. |

| 8. |

CRS Report 95-542, The Earned Income Tax Credit: A Growing Form of Aid to Low-Income Workers, by James R. Storey, p. 2, available to congressional clients upon request. While the Nixon plan never became law, it was twice approved by the House. |

| 9. |

V. Joseph Hotz and John Karl Scholz, "The Earned Income Tax Credit," in Means-Tested Transfer Programs in the United States, ed. Robert A. Moffitt, (University of Chicago Press, 2003), http://www.nber.org/chapters/c10256.pdf, p. 142. |

| 10. |

Congressional Record, Senate, in remarks by Mr. Long. September 30, 1972, pp. 33010-33011. |

| 11. |

Congressional Record, Senate, in remarks by Mr. Long. September 30, 1972, p. 33010. |

| 12. |

Senate Committee on Finance, Tax Reduction Act of 1975, Report to Accompany H.R. 2166, 94th Cong., 1st sess., March 17, 1975, S. Report 94-36, p. 11. |

| 13. |

Senate Committee on Finance, S. Rept. 94-36, p. 33. |

| 14. |

CRS Report 95-542, The Earned Income Tax Credit: A Growing Form of Aid to Low-Income Workers, by James R. Storey, available to congressional clients upon request. |

| 15. |

For more information, see "Brief History of Cash Assistance" in CRS Report R43187, Temporary Assistance for Needy Families (TANF): Size and Characteristics of the Cash Assistance Caseload, by Gene Falk. |

| 16. |

The credit was extended through 1976 by P.L. 94-164; through 1977 by P.L. 94-455; and through 1978 by P.L. 95-30. |

| 17. |

Under the 1978 law, the EITC was set at 10% of the first $5,000 of earnings (including net earnings from self-employment). The maximum credit of $500 was received for earnings between $5,000 and $6,000. For each dollar of AGI above $6,000, the EITC was reduced by 12.5 cents, reaching $0 at an AGI of $10,000. |

| 18. |

Joint Committee on Taxation, General Explanation of the Revenue Act of 1978, March 12, 1979, JCS-7-79, p. 51. |

| 19. |

Joint Committee on Taxation, General Explanation of the Tax Reform Act of 1986, May 4, 1987, JCS-10-87, p. 27. |

| 20. |

David Wessel, "Expanded Earned-Income Tax Credit Emerges As the Anti-Poverty Program of Choice for Many," The Wall Street Journal, July 13, 1989, p. A16. |

| 21. |

In a 1989 floor statement, Rep. Petri stated implored his colleagues to "Reform the earned income tax credit! Target the aid directly to poor workers who are supporting families." Thomas Petri, "Working Poor Would Benefit by Earned Income Tax Credit Reform," Congressional Record, daily edition, vol. 135, part 26 (March 13, 1989), p. H585. |

| 22. |

David Wessel, "Expanded Earned-Income Tax Credit Emerges As the Anti-Poverty Program of Choice for Many," The Wall Street Journal, July 13, 1989, p. A16. |

| 23. |

As part of the 1990 law, beginning in 1991, the credit was made larger for families with two or more children versus one child. However, these size differences were modest in comparison to what was enacted as part of the Omnibus Reconciliation Act of 1993. For example, in 1992, the maximum credit for a tax filer with one child was $1,324. For families with two children the maximum credit was $1,384, $60 more. By contrast, in 1994, the maximum credit for a taxpayer with one child was $2,038, while the maximum credit for a taxpayer with two children was $2,528. |

| 24. |

In addition, OBRA90 included two supplemental credits that were available to some EITC recipients between 1991 and 1993. The young child supplement added five percentage points to a family's credit rate; the child health insurance supplement added up to six percentage points. These supplemental credits were ended effective in 1994, by OBRA93. |

| 25. |

Some policymakers disagreed with expanding the EITC to childless workers. For example, Rep. Dave Camp stated that " ... we should not give the EITC to childless workers. For 18 of the EITC's 19-year existence, both Republicans and Democrats agreed its benefits should go to working families with dependent children, because the whole purpose of the EITC was to help working families with young children stay off the welfare rolls." Rep. Camp, "The 7-Year Balanced Budget Reconciliation Act of 1995," Congressional Record, October 25, 1995, p. H10802. |

| 26. |

CRS Issue Brief, Earned Income Tax Credit: Should It Be Increased to End Poverty for the Working Poor, August 10, 1993, by James R. Storey, available to congressional clients upon request from the author of this report. |

| 27. |

For example, Rep. Camp stated, "Mr. Chairman, when the earned income tax credit was enacted in 1975, its concept was to help families move from welfare to the work force by increasing their after-tax earnings and providing relief from the burden of payroll taxes. Since then, three legislative revisions have expanded the program's cost tenfold to almost $25 billion a year and rising." Rep. Camp, "The 7-Year Balanced Budget Reconciliation Act of 1995," Congressional Record, October 25, 1995, p. H10802. |

| 28. |

Speaker Gingrich, "Taming the EITC," Congressional Record, October 17, 1995, p. E1952. |

| 29. |

This GAO report reported on an IRS study of a sample of EITC returns during a two-week period in January 1994. The "IRS' preliminary analysis of the returns showed that an estimated 29 percent of the 1.3 million EIC returns filed electronically during the period had claimed too large a refund, and about 13 percent of the returns filed was estimated by the IRS as having intentionally claimed too much EIC." General Accounting Office, Tax Administration: Earned Income Credit—Data on Noncompliance and Illegal Alien Recipients, GAO/GGD-95-27, October 1994, p. 1. |

| 30. |

In describing his support for a bipartisan proposal ("Castle-Tanner") to modify the EITC, Rep. Stenholm stated "I simply want to reiterate that Castle-Tanner ensures that scarce EITC dollars go to the working poor who need it, not to the individuals with substantial business income who do not need it." Rep. Stenholm, "Welfare and Medicaid Reform Act of 1996," Congressional Record, July 18, 1996, p. H7982. |

| 31. |

Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 394. |

| 32. |

Jeffrey L. Katz, "Welfare: Provisions of Welfare Bill," CQ Weekly, August 3, 1996, http://www.cq.com/doc/weeklyreport-WR402516?13&search=dVNjp7ZR. |

| 33. |

See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 390. |

| 34. |

According to the JCT, "Congress believed it can improve the targeting of the credit by expanding the definition of income used in phasing out the credit." See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, pp. 391-392. |

| 35. |

The statutory language requiring individuals (and if applicable their spouses and children) to provide a work-related SSN also included math error authority (MEA). The MEA, related to the EITC's SSN requirement (which is still in effect), means that "if an individual fails to provide a correct taxpayer identification number, such omission will be treated as a mathematical or clerical error." Hence the IRS will be able to summarily recalculate the credit or if applicable, deny the credit entirely. See Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in the 104th Congress, December 18, 1996, JCS-12-96, p. 394. |

| 36. |

In addition, a taxpayer who erroneously claimed the credit due to reckless or intentional disregard of rules or regulations would be ineligible to claim the EITC for a subsequent period of two years. Joint Committee on Taxation, General Explanation of Tax Legislation Enacted in 1997, December 17, 1997, JCS-23-97, p. 278. |

| 37. |

Joint Committee on Taxation, JCS-23-97, p. 278. |

| 38. |

Joint Committee on Taxation, JCS-23-97, p. 281. |

| 39. |

For a contemporaneous account of the varying approaches to reduce the marriage penalty debated in 2000, see "Senate Panel Approves Marriage Penalty Relief," New York Times, March 31, 2000. |

| 40. |

For more information on marriage penalties and bonuses more generally in the tax code see Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, pp. 2-6 and CRS Report RL33755, Federal Income Tax Treatment of the Family, by Jane G. Gravelle. |

| 41. |

The other major factor that the Joint Committee on Taxation identified as causing a marriage penalty among low-income taxpayers was the size of the standard deduction. At the time, the standard deduction for married taxpayers was less than twice the standard deduction for two singles. See Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, p. 3. |

| 42. |

Joint Committee on Taxation, Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, the Child Tax Credit, and the Alternative Minimum Tax, March 7, 2001, JCX-8-01, p. 4. |

| 43. |

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312) extended these ARRA provisions for two years (2011 and 2012). The American Taxpayer Relief Act (ATRA; P.L. 112-240) extended the ARRA provisions for five more years (2013-2017). |

| 44. |

These proposals were included in The FY10-FY2016 Treasury Green Books. In the FY2012 and FY2013 Greenbooks, the Obama Administration proposed making the 45% credit rate for families with three or more children permanent, but did not propose extending enhanced marriage penalty relief. For more information, see U.S. Department of the Treasury, Administration's Fiscal Year Revenue Proposals, Green Book, https://www.treasury.gov/resource-center/tax-policy/Pages/general_explanation.aspx. |

| 45. |

After passage of ATRA, Senator Durbin stated "The other thing that was part of it [ATRA] was a 5-year extension—I wish it had been permanent—but a 5-year extension of the Recovery Act expansion of the earned income tax credit." Senator Durbin, "The Fiscal Cliff," Senate Speeches and Inserts, Congressional Record, January 1, 2013, p. S8612. |

| 46. |

|

| 47. |

Improper payments and the improper payment rate must by law be reported annually by a variety of agencies for a variety of programs (P.L. 107-300 as amended by P.L. 111-204 and P.L. 112-248). For more information about the legal requirements of agencies concerning improper payments, see U.S. Government Accountability Office, Improper Payments: Government-Wide Estimates and Reduction Strategies, GAO-14-737T, July 9, 2014, pp. 2-3, http://www.gao.gov/assets/670/664692.pdf. |

| 48. |

For more information on improper payments of the EITC, see CRS Report R43873, The Earned Income Tax Credit (EITC): Administrative and Compliance Challenges, by Margot L. Crandall-Hollick. |

| 49. |

Section 204 of P.L. 114-113. |

| 50. |

In internal agency memoranda issued in 2000, the IRS Office of Chief Counsel concluded that amendments made to the EITC statute by the Internal Revenue Service Restructuring and Reform Act of 1998 (P.L. 105-206) allowed taxpayers who received an SSN to retroactively claim the EITC for any open tax years, assuming all other criteria for claiming the credit were met. See IRS Office of Chief Counsel Memorandum 200032013 (May 9, 2000), https://www.irs.gov/pub/irs-wd/0032013.pdf; IRS Office of Chief Counsel Memorandum 200028034 (June 9, 2000), https://www.irs.gov/pub/irs-wd/0028034.pdf. |

| 51. |

See Section 201 of P.L. 114-113. |

| 52. |

IRS Taxpayer Advocate, Expediting a Refund, January 11, 2018, https://taxpayeradvocate.irs.gov/get-help/expediting-a-refund. In addition, see Internal Revenue Service, New Federal Tax Law May Affect Some Refunds Filed in Early 2017; IRS to Share Details Widely with Taxpayers Starting This Summer, March 9, 2018, https://www.irs.gov/tax-professionals/new-federal-tax-law-may-affect-some-refunds-filed-in-early-2017. |

| 53. |

For more information see CRS Report R43873, The Earned Income Tax Credit (EITC): Administrative and Compliance Challenges, by Margot L. Crandall-Hollick. |

| 54. |

For a detailed overview of the current structure of the EITC, see CRS Report R43805, The Earned Income Tax Credit (EITC): An Overview, by Gene Falk and Margot L. Crandall-Hollick. |