Saudi Arabia: Background and U.S. Relations

Changes from November 22, 2017 to September 21, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Saudi Arabia: Background and U.S. Relations

Contents

- Overview

- Domestic Issues

- Leadership and Succession

- Administrative Changes, Lower Oil Prices, and Fiscal Priorities

- Gender Issues, Minority Relations, and Human Rights

- Human Rights, Gender Issues, and Minority Relations

- Human Rights Concerns

- Women's Rights Issues

- Minority Relations and Security

- Terrorism Threats and Bilateral Cooperation

- The Islamic State's Campaign

Againstagainst the Kingdom - Terrorist Financing and Material Support: Concerns and Responses

- U.S. Foreign Assistance to Saudi Arabia

- Arms Sales

and, Security Assistance, and Training- Arms Sales

- Support to Saudi Military Operations in Yemen

- Assistance to the Saudi Ministry of Interior

- U.S.-Saudi Trade

- Energy Issues

- Global Energy Trends and Saudi Policy

- Potential U.S.-Saudi Nuclear Cooperation

- Saudi Energy Consumption and Nuclear Plans

- U.S. Civil Nuclear Cooperation with Saudi Arabia

- Congressional Views, Legislation, and Administration Perspectives

- Saudi Views on Fuel Cycle Technologies

- Saudi Foreign Policy

- Iran, Iraq, and Syria

- Conflict in Yemen

- Qatar and Intra-Gulf Cooperation Council (GCC) Tensions

- Israeli-Palestinian Affairs

Security Training - Proposed Foreign Military Sales Draw Congressional Scrutiny

- Developments in the 115th Congress

- U.S. Support to the Saudi Ministry of Interior

- Consensus and Contention in the Middle East

- Saudi Arabia and Iran

- Tensions Escalate in 2016 and 2017

- Saudi Arabia's Nuclear Plans

- Confrontation with Qatar

- Saudi Military Campaigns and Policy in Yemen

- Implications for U.S.-Saudi Relations

- Syria

- Iraq

- Egypt

- The Israeli-Palestinian Conflict

- U.S.-Saudi Trade and Energy Issues

- Outlook

Figures

Tables

Summary

The kingdom of Saudi Arabia, ruled by the Al Saud family since its founding in 1932, wields significant global influence through its administration of the birthplace of the Islamic faith and by virtue of its large oil reserves. Close U.S.-Saudi official relations have survived a series of challenges since the 1940s. In recent years, shared concerns over Sunni Islamist extremist terrorism and Iranian government policies have provided some renewed logic for continued strategic cooperation. Political upheaval and conflict in the Middle East and North Africa have created new challenges, and the Trump Administration is seekinghas sought to strengthen U.S. ties to Saudi leaders as the kingdom implements a series of new domestic and foreign policy initiatives.

Successive U.S. Administrations have referred to the Saudi government as an important partner, and U.S. arms sales and related security cooperation programs have continued with congressional oversight and amid some congressional opposition. The Trump Administration, like its recent predecessors, praises Saudi government counterterrorism efforts. Since 2009, the executive branch has notified Congress of proposed foreign military sales to Saudi Arabia of major defense articles and services with a potential aggregate value of more than $136nearly $139 billion. The United States and Saudi Arabia concluded formal arms sale agreements worth more than $65 billion, from FY2009 through FY2016. Since

Since March 2015, the U.S.-trained Saudi military has used U.S.-origin weaponry, U.S. logistical assistance, and shared intelligence in support of military operations in Yemen. Some in Congress express concern about Saudi use of U.S.-origin weaponry and question Saudi commitment to combating extremism. Legislation beforeLegislation has been proposed in the 115th Congress would place conditions onto condition or disapprove of some proposed U.S. weapons sales or otherwise limit the use of funds for some U.S. involvement in YemenU.S. weapons sales and condition or direct the President to end U.S. support to Saudi operations without specific authorization (H.J.Res. 102, H.J.Res. 104, S.J.Res. 40, S.J.Res. 42, H.R. 2810). U.S. officials praise Saudi counterterrorism efforts, including action against the Islamic State.

In parallel to close security ties, official U.S. concerns aboutreports describe restrictions on human rights and religious freedom in the kingdom have in part reflected deeper concerns for the kingdom's stability. Saudi activists advance limited economic and political reform demands, continuing. Some Saudi activists advocate for limited economic and political reforms, continuing decades-long trends that have seen Saudi liberals, moderates, and conservatives pressadvance different visions for domestic change for decades. While some limited protests . Saudi leaders in 2018 reversed a long-standing ban on women's right to drive, amid some arrests of women's rights advocates and critics of social liberalization. While some limited protests and arrests have occurred since unrest swept the wider region in 2011, clashes involving Saudi security forces have not spread beyond certain predominantly Shia areas of the oil-rich Eastern Province. The Obama Administration endorsed Saudi citizens' rights to free assembly and free expression. Saudi leaders reject foreign interference in the country's internal affairs.

The death of King Abdullah bin Abd al Aziz in January 2015 brought to a close his long chapter of national leadership. His half-brother King Salman bin Abd al Aziz assumed the throne and has moved to assert his authority at home and pursue Saudi prerogatives abroad. Succession arrangements have attracted particular attention in recent years, as senior leaders in the royal family have passed away or faced reported health issues. A

Since assuming the throne in 2015, King Salman bin Abd al Aziz (age 82) has made a series of appointments and reassignments since 2015 hasthat have altered the responsibilities and relative power of leading members of the next generation of the Al Saud family, who are the grandsons of the kingdom's founder. The king's son, Crown Prince Mohammed bin Salman has emerged as a(age 33), is the central figure in Saudi policymaking, having. He has asserted control over national security forces, proposedsidelined potential rivals, proposed and begun implementing bold economic and social changes, and arrested prominent figures accused of corruption, including some fellow royal family members.

Saudi decisionmaking long appeared to be risk-averse and rooted in rulers' concerns for maintaining consensus among different constituencies, including factions of the royal family, business elites, and conservative religious figures. Crown Prince Mohammed bin Salman's assertive and more centralized leadership has challenged this model of governance. The change is leading Saudis and outsiders alike to reexamine their assumptions about the kingdom's future. Shared security challenges have long defined U.S.-Saudi relations, and questions about Saudi domestic and foreign policy may become more pertinent as Saudi leadership changes unfold and as regional conflicts and competition continue. Saudi leaders' assertiveness in confronting perceived threats and the effects of their sharpening tensions with Iran could affect U.S. security interests, including with regard to Yemen, Egypt, Bahrain, Syria, Lebanon, and Iraq. Ambitious plans for the transformation of the kingdom's economy seek to provide opportunity for young Saudis and bolster nonoil sources of revenues for the state. Abroad, the kingdom pursues a multidirectional policy and has aggressively confronted perceived threats.

ongoing U.S.-Saudi partnership, proposed arms sales and nuclear cooperation, and security commitments.

Overview

The kingdom of Saudi Arabia's relations with the United States, its stability, and its future trajectory are subjects of continuing congressional interest. In particular, Saudi leadership transitions, lowertrends in global oil prices, related Saudi budget pressures and reform plans, aggressive transnational terrorist threats, more assertive Saudi foreign policypolicies, and Saudi-Iranian tensions have fueled recent congressional discussions. U.S.-Saudi security cooperation and U.S. concern for the continuing global availability of Saudi energy supplies continue to anchor official bilateral relations as they have for decades. In this context, the Trump Administration's efforts to reinvigorate U.S.-Saudi relations have drawn increased public attention and have generated debate, as had. Previously, the Obama Administration's differences had differed with Saudi leaders over Iran, the Iranian nuclear program, and the conflicts in Syria, Iraq, and Yemen.

Amid some continuing differences on these issues, bilateral ties have been bolstered by new arms sale proposals, extensions of security force training arrangements, enhanced counterterrorismdefined since 2017 by arms sale proposals, Yemen-related security cooperation, and shared concerns about Iran, Al Qaeda, and the Islamic State organization (IS, aka ISIL/ISIS or the Arabic acronym Da'esh). From late 2012 through late 2016, the Obama Administration notified Congress of proposed Foreign Military Sales to Saudi Arabia with a potential value of more than $45 billion. President Donald Trump and Saudi officials announced agreement on some of these sales and others during the President's May 2017 trip to the kingdom, as part of a package that may potentially be worth more than $110 billion. This package of previously discussed and newly proposed defense sales is intended to address Saudi needs for maritime and coastal security improvements, air force training and support, cybersecurity and communications upgrades, missile and air defenses, and enhanced border security and counterterrorism capabilities (see "Arms Sales and, Security Assistance, and Training" below and Appendix B).

King Salman bin Abd al Aziz Al Saud (age 82) succeeded his late half-brother King Abdullah bin Abd al Aziz following the latter's death in January 2015. King Salman later announced dramatic changes to succession arrangements left in place by King Abdullah, surprising observers of the kingdom's politics. King Salman first replaced his half-brother Crown Prince Muqrin bin Abd al Aziz with their nephew, Prince Mohammed bin Nayef bin Abd al Aziz, who was then- Interior Minister and counterterrorism chief. The king then named his own son, Prince Mohammed bin Salman bin Abd al Aziz, then- 29, as Deputy Crown Prince and Defense Minister. Later, in

In June 2017, Prince Mohammed bin Nayef was relieved of his positions and Prince Mohammed bin Salman, now 32, (age 33) was elevated further to the position of Crown Prince, placing him in line to succeed his father (see Figure 1, Figure 2, and "Leadership and Succession" below). Both princes are members of the generation of grandsons of the kingdom's late founder, King Abd al Aziz bin Abd al Rahman Al Saud (aka Ibn Saud). The succession changes and Crown Prince Mohammad bin Salman's efforts to assert his role as the shaper of the kingdom's national security and economic policies have resulted in an apparent consolidation of authority under one individual and sub-branch of the family that is unprecedented in the kingdom since its founding under the late Ibn Saud.

Shifts in Saudi foreign policy toward a more assertive posture—typified by the kingdom's military operations in neighboring Yemen and its insistence on the departure of President Bashar al Asad in Syriaa series of regional moves intended to counteract Iranian initiatives—have accompanied the post-2015 leadership changes. Saudi leaders launched military operations in Yemen following the early 2015 ouster of Yemen's transitional government by the Zaydi Shia Ansar Allah (aka Houthi) movement and backers of the late former Yemeni President Ali Abdullah Saleh (see "Saudi Military Campaigns and PolicyConflict in Yemen" below). A U.S.-facilitated, Saudi-led coalition air campaign has conducted strikes across the country since late March 2015 aimed at reversing gains made by Houthi-Saleh forces and compelling them to negotiate with U.N.-recognized transition leaders.

Concerns about Yemeni civilian deaths in Saudi airstrikes, the operation's contribution to deteriorating humanitarian conditions, and gains by Al Qaeda and Islamic State supporters have led some Members of Congress and U.S. officials to urge all parties to seek a prompt settlement. President Obama maintained U.S. logistical support for Saudi operations in Yemen but decided in 2016 to reduce U.S. personnel support and limit certain U.S. arms transfers. President Trump has chosen to proceed with precision guided munition technology sales that the Obama Administration deferred, and Secretary of State Rex Tillerson has renewed calls for a political settlement backed by military support to Yemen's internationally recognized government, coupled with a joint Saudi and Emirati ground campaign aimed at reversing Houthi gains and compelling them to negotiate with U.N.-recognized transition leaders.

|

|

|

Land: Area, 2.15 million sq. km. (more than 20% the size of the United States); Boundaries, 4,431 km (~40% more than U.S.-Mexico border); Coastline, Population: 28,571,770 (July 2017 est., ~30% non-nationals per 2015 U.N. data.); % < 25 years of age: 45.4% GDP (PPP; growth rate): $1. GDP per capita, PPP: $55,300 (2017 Budget (revenues; expenditure; balance): $ Projected Budget (revenues; expenditure; balance): $ Unemployment: 12. Oil and natural gas reserves: External Debt: $ Foreign Exchange and Gold Reserves: ~$ |

Sources: CRS using State Department, Esri, and Google Maps data (all 2013), CIA World Factbook estimates (February 2017March 2018), and Saudi government budget data (December 2016) and General Organization for Statistics.

2017) and General Organization for Statistics.

Concerns about Yemeni civilian deaths in Saudi airstrikes, the operation's contribution to grave humanitarian conditions, and gains by Al Qaeda and Islamic State supporters have led some Members of Congress and U.S. officials to urge all parties to seek a prompt settlement. President Obama maintained U.S. logistical support for Saudi operations in Yemen but decided in 2016 to reduce U.S. personnel support and limit certain U.S. arms transfers. President Trump has chosen to proceed with precision guided munition technology sales that the Obama Administration deferred. In September 2018, the Trump Administration certified conditions set by Congress on Saudi actions in Yemen and renewed calls for a political solution. A U.S. State Department travel advisory issued in April 2018 warns that "rebel groups operating in Yemen have fired long-range missiles into Saudi Arabia, specifically targeting populated areas and civilian infrastructure" and that "rebel forces in Yemen fire artillery at Saudi border towns and launch cross-border attacks against Saudi military personnel."1. In September 2016, the Senate voted to table a motion to further consider a joint resolution of disapproval on the proposed tank sale. In the 115th Congress, S.J.Res. 40 would require the Trump Administration to provide a detailed briefing and make certifications regarding Saudi civilian protection measures, the flow of humanitarian goods to Yemen, and Saudi counterterrorism efforts prior to the transfer of any air-to-ground munitions to Saudi Arabia. In (see Appendix D below).

In the 115th Congress, legislation has been enacted that prohibits the obligation or expenditure of U.S. funds for in-flight refueling operations of Saudi and Saudi-led coalition aircraft that are not conducting select types of operations if certain certifications cannot be made and maintained (Section 1290 of the FY2019 National Defense Authorization Act, P.L. 115-232, Appendix D).2 The provision is subject to an Administration national security waiver.

A similar measure would place conditions on the transfer of any air-to-ground munitions to Saudi Arabia (S.J.Res. 40), and, in June 2017, the Senate narrowly voted to reject a motion to further consider a joint resolution of disapproval (S.J.Res. 42) on proposed sales of precision guided munitions to Saudi Arabiathe kingdom. The House and Senate also have considered resolutions (H.Con.Res. 81 and S.J.Res. 54) that would direct the President to end U.S. military support for Saudi operations in Yemen unless Congress specifically authorizes the continuation of such support.

Inside the kingdom, arrests of Islamic State (IS) supporters have continued since 2014, as Islamic State affiliates have claimed responsibility for a series of deadly attacks against Saudi security forces and members of the kingdom's Shia minority across the country (see "The Islamic State's Campaign Againstagainst the Kingdom" below). A U.S. State Department travel warning issued in March 2017 notes that Saudi authoritiesSaudi authorities report having disrupted planned IS attacks on government targets in 2017 and counted 34 terrorist attacks in 2016, including an attempted IS-claimed suicide bombing against the U.S. Consulate General in Jeddah. It warns that "terrorist groups, including ISIS and its affiliates, have targeted both Saudi and Western government interests" and notes that "violence in Yemen has spilled over into Saudi Arabia on a number of occasions."1 Saudi leaders and their IS adversaries have reiterated their hostility toward each other since late 2015, with Saudi leaders proposing new transnational counterterrorism cooperation and IS leaders redeclaring war against the royal family, condemning official Saudi clerics, and urging attacks inside the kingdom.

The Obama Administration, like its predecessors, engaged the Saudi government as a strategic partner to promote regional security and global economic stability. Nevertheless, a degree of discord between the Obama Administration and Saudi leaders became apparent, driven in part by differences of opinion over Iran, Syria, and Yemen, among other issues. In January 2017, President Trump and King Salman spoke via telephone, reaffirming bilateral ties and discussing a range of proposals for further strengthening relations, particularly in terms of counterterrorism, regional stability, and economic and energy cooperation. At the conclusion of President Trump's May 2017 visit, the U.S. and Saudi governments agreed to "a new Strategic Partnership for the 21st Century in the interest of both countries by formally announcing a Joint Strategic Vision."2

Since 2011, significant shifts in the political and economic landscape of the Middle East have focused international attention on Saudi domestic policy issues and reinvigorated social and political debates among Saudis. These shifts (see "Domestic Issues" below). These regional shifts, coupled with ongoing economic, social, and political changes in the kingdom, may make sensitive issues such as political reform, unemployment, education, human rights, corruption, religious freedom, and extremism more prominent in U.S.-Saudi relations than in the past. U.S. policy initiatives have long sought to help Saudi leaders address economic and security challenges in ways consistent with U.S. interests, and recent. Recent joint U.S.-Saudi diplomatic efforts to strengthen economic, educational, and interpersonal ties have focused on improving opportunities for the kingdom's young population. Tens of thousands of Saudi students continue to pursue higher education in the United States, although numbers have declined in response to Saudi government funding changes.

Some nongovernment observers have called for a reassessment of U.S.-Saudi relations amid the kingdom's ongoing military campaign in Yemen and.3 They cite concern about human rights conditions in the kingdom, as well as resurgent questions about the relationship between Saudi-backed religious proselytizationreligious proselytization by some Saudis and the appeal of violent Islamist extremism. While U.S. officials have called publicly for the kingdom to seek a negotiated settlement in Yemen, allow peaceful expressions of dissent at home, and contribute to efforts against extremism abroad, the history of U.S.-Saudi relations suggests that anyhelp fight extremism abroad. Any more strident official U.S. criticisms of the kingdom's policies maytraditionally remain subjects of private U.S. diplomatic engagement rather than public officialofficial public discussion.

Saudi concerns about U.S. leadership and policies in the Middle East grew during the Administrations of Presidents George W. Bush and Barack Obama, in parallel to U.S. concerns about Saudi priorities and choices. In particular, Saudi leaders at times have signaled their displeasure with U.S. policy approaches to Egypt, Israel and the Palestinians, Bahrain, Iraq, Syria, and Iran. Saudi officials opposealso opposed the changes to U.S. sovereign immunity law that were made by the 114th Congress through the Justice Against Sponsors of Terrorism Act (S. 2040, P.L. 114-222, aka JASTA) and have sought their amendment or repeal.34

Saudi official public responses to the Joint Comprehensive Plan of Action (JCPOA) nuclear agreement with Iran were initially relatively neutral, emphasizing elements of an agreement with Iran that Saudi Arabia would support rather than expressing Saudi endorsement of the JCPOA as negotiated and agreed. King Salman eventually endorsed the JCPOA during his September 2015 visit to Washington, DC. President Trump and the king discussed "the importance of rigorously enforcing" the agreement and "addressing Iran's destabilizing regional activities" in January 2017.4 The May 2017 joint statement released following President Trump's visit to the kingdom similarly condemns Iranian "malign interference in the internal affairs of other states" and says the JCPOA "needs to be re-examined in some of its clauses.", but later called for the agreement to be reexamined and welcomed President Trump's decision to withdraw the United States from the agreement. Saudi officials have engaged in civil nuclear cooperation talks with the United States and other countries since 2017 (see "Potential U.S.-Saudi Nuclear Cooperation").

Policy differences and specific current disagreements notwithstanding, officials in both countriesU.S. and Saudi officials have long favored continuity over dramatic strategic shifts in the face of controversy, despite some Saudis' and Americans' calls for fundamental changes to the bilateral relationship. The Trump Administration, like its predecessors, engages the Saudi government as a strategic partner to promote regional security and global economic stability. The Saudi government appears to view the United States as an important security partner. At the end of President Trump's May 2017 visit, the U.S. and Saudi governments agreed to "a new Strategic Partnership for the 21st Century in the interest of both countries by formally announcing a Joint Strategic Vision."5

With a new generation of Saudi leaders assuming prominent positions in the kingdom and chaotic conditions persisting in the Middle East region, some change in U.S.-Saudi relations may prove inevitable. The Trump Administration has thus far signaled its willingness to partnerpartnered with King Salman and Crown Prince Mohammed bin Salman on their domestic policy initiatives and their approaches to Iran, Yemen, Syria, and Iraq. The success or failure of these initiatives may have considerable significance for the bilateral relationship and consequences for international security for years to come.

Domestic Issues

Saudi Arabia is a monarchy governed in accordance with a 1992 Basic Law, and its legal system is largely rooted in the Hanbali school of Sunni Islamic law as interpreted and applied by state-appointed religious judges.5 Political decisionmaking in the kingdom continues to reflect6 An appointed, 150-member national Shura Council provides limited oversight and advisory input on some government decisions, and municipal councils with both appointed and elected members serve as fora for public input into local governance.

Political decisionmaking in the kingdom long reflected a process of consensus-building among a closed elite presided over by senior members of the ruling Al Saud family. An appointed, 150-member national Shura Council provides limited oversight and advisory input on some government decisions, and municipal councils with both appointed and elected members serve as fora for public input into local governanceIn recent years, decisionmaking appears to have become more centralized under the authority of Crown Prince Mohammed bin Salman, with the apparent blessing of the king. Members of the conservative Salafist Sunni religious establishment shapehave long shaped government decisionmaking on social and legal issues, and younger members of the ruling family and prominent nonroyals have played a more publicly visible role in policy initiatives in recent years.. Some representatives of this community have endorsed swift and dramatic changes to some social policies since 2015, while others have been imprisoned for alleged foreign ties and possibly for opposing change.

The Crown Prince has presided over efforts ostensibly designed to root out corruption among elites, including prominent businessmen and members of the royal family. These efforts may also have the effect of contributing to the centralization of power. Rumored discontent among other royal family members has not manifested in demonstrable public efforts to resist or undermine the Crown Prince's agenda.7 At present, the balances of power, interests, and influence among the rising generation of leaders in the royal family are relatively opaque and appear to be evolving, subject to much international speculation.

Over time, Saudi leaders have sought to manage increasingly vocal and public demands from the country's relatively young population for improved economic opportunities, limited political participation, and improved social conditions. Efforts to do so have been balanced with the royal family's commitments to protect the kingdom's conservative Islamic traditions and address a host of regional and domestic security threats.

Security forces monitor and tightly limit political and social activism in a domestic security environment that has been defined since the mid-1990s by persistent terrorist threats and to a lesser extent since 2011 by anxiety about potential unrest and economic stagnation. Relations between some members of the Shia minority population (~10%-15%) and the government remain tense, amid periodic localized confrontations between security forces, demonstrators, and armed youth in the oil-rich Eastern Province. Efforts to improve sectarian relations are complicated by anti-Shia terrorism, official discrimination, and official Saudi concerns about perceived Iranian efforts to destabilize the kingdom by agitating Saudi Shia.

High prices in international oil markets amplified the earning power of the kingdom's oil exportsoil export earnings for most of the period from 2005 to 2014, generating significant fiscal surpluses and leaving the country with sizeable foreign reserves and low levels of official debt. Nevertheless, afterAfter 2011, the government launched large social spending programs to improve housing and infrastructure, raise public sector wages, expand education, and ease the burdens of unemployment. This spending has created some new fiscal burdens as, and state oil revenues have decreased more than nonoil revenues have grown. As of 2017grew from 2014 through 2017. At present, Saudi leaders are now simultaneously managing ambitious and politically sensitive fiscal consolidation and economic transformation initiatives, with U.S. encouragement.

Leadership and Succession

By all accounts, King Salman and other Saudi leaders are likely to continue to face complex questions about political consent, economic performance, and social reform as they push ahead with newambitious economic and social initiatives, and as power is transferred from the sons of the kingdom's founder, King Abd al Aziz bin Abd al Rahman al Saud (aka Ibn Saud), to his grandsons. The willingness and ability of the monarchy's leaders to successfully manage their relationships with each other and with competing domestic interest groups is among the factors most likely tothat will determine the country's future stability. Succession questions and intrafamily politics may have direct implications for regional stability and for U.S. national security interests.

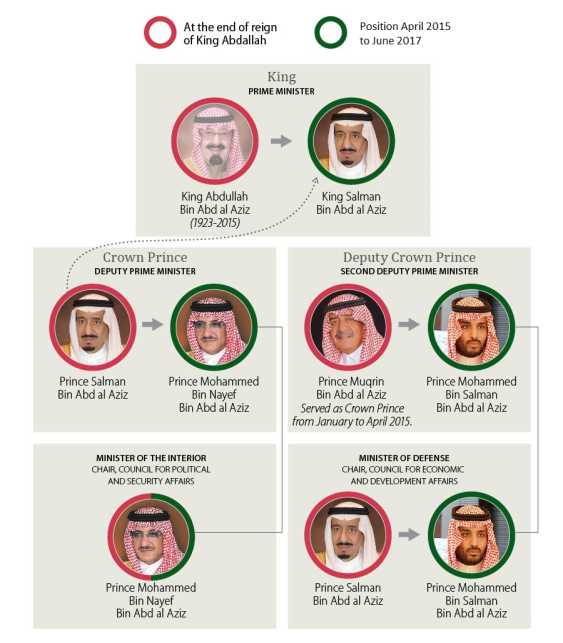

Most sources suggest that the Al Saud family has managed a recent series of leadership transition decisions without a paralyzing degree of disruptive internal dissent, and formal. Formal announcements of major changes in succession have stated that a preponderance of members of an Allegiance Council made up of senior family members has considered and endorsed transition decisions taken since its establishment during the late King Abdullah's reign. This includes key transition decisions made prior to and in the wake of King Abdullah's death in January 2015, and in conjunction with succession changes announced in April 2015 and June 2017 (see Figure 1 and Figure 2 below).6

Changes Effective January and April 2015 |

|

Source: [author name scrubbed], CRS. Official photos adapted from Saudi Arabian government sources. |

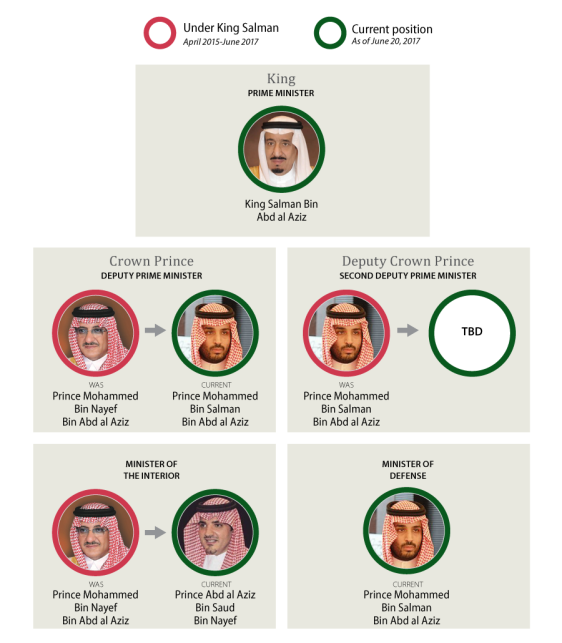

Changes Effective June 2017 |

|

|

Source: [author name scrubbed], CRS. Official photos adapted from Saudi Arabian government sources. |

As noted above, decisions taken in 2015 saw King Salman assume the throne and place

King Salman first placed two members of the next generation of the Al Saud family in line to rule. This generation—grandsons of the kingdom's founder—is more numerous and has even more complex intrafamily ties than those of its predecessors, making answers to current and future questions of governance and succession less certain. In recent years press reports and think-tank analyses have explored theThere exists potential for competition among members of this generation, as positions of influence in government have been distributed and redistributed among them.

Changes undertaken in 2015 (Figure 1) elevated Prince Mohammed bin Nayef and the king's son, Prince Mohammed bin Salman, to the line of succession at the expense of senior members of their fathers' generation. Prince Mohammed bin Nayef, who became Crown Prince, retained his duties as Minister of Interior and assumed leadership of a newly created Council for Political and Security Affairs. Then-Deputy Crown Prince Mohammed bin Salman became Defense Minister and the head of the Council for Economic and Development Affairs.

In June 2017 (Figure 2), Prince Mohammed bin Nayef was replaced as Crown Prince by Mohammed bin Salman and relieved of his position as Minister of Interior. Crown Prince Mohammed bin Salman's elevation puts him next in line for the throne, with some observers speculating. Given his age, he could rule for decades upon succession. In conjunction with the change, which was approved by the Allegiance Council, the kingdom's Basic Law was amended to prohibit kings from the generation of the grandsons of the founder from choosing successors from the same maternal line of the Al Saud family. This amendment presumably was agreed to in order to assuage concern among members of the family about the further consolidation of power among the branch of the family from which King Salman and the new Crown Prince hail.7 Some members of the royal family reportedly have objected to some changes under the leadership of King Salman and his son, the Crown Prince, in a series of intrafamily letters reported since 2015 and during meetings of the Allegiance Council.8

Some individuals expected King Salman and his appointed successors to reverse some liberal initiatives launched under King Abdullah's tenure in an attempt to shore up domestic support for his succession changes and a more independent and active Saudi foreign policy.9 In practice, King Salman's administration has taken a mixed approach. Human rights advocates have criticized a trend toward increased implementation of death sentences against convicted prisoners since early 2015, although Saudi officials contend that judicial due process has been consistently observed in all cases. Municipal elections were held as planned in December 2015 and included participation by Saudi women candidates and voters for the first time, in accordance with reforms announced by the late King Abdullah (see "Gender Issues, Minority Relations, and Human Rights" below). In 2016, the Saudi government moved to curtail the powers of the Commission for the Promotion of Virtue and the Prevention of Vice (the kingdom's "religious police"), prohibiting them from independently arresting persons suspected of crimes.

8

Changes Effective January and April 2015 Source: CRS. Official photos adapted from Saudi Arabian government sources. Notes: Succession changes in April 2015 reversed a key decision taken by King Abdullah before his death—King Abdullah had named his half-brother Prince Muqrin as Deputy Crown Prince in March 2014, and Prince Muqrin briefly served as Crown Prince after King Abdullah's death. In April 2015, Saudi authorities stated that Prince Muqrin stepped down as Crown Prince at his own choosing and credited then-new Crown Prince Mohammed bin Nayef with selecting King Salman's son Mohammed bin Salman to serve as Deputy Crown Prince, with the approval of a majority of the Allegiance Council.

Changes Effective June 2017 Source: CRS. Official photos adapted from Saudi Arabian government sources.

Crown Prince Mohammed bin Salman is asserting a public national leadership role on a range of topics, generating considerable international speculation about the potential for reported rivalry or competition to harden between him and other family members. Such potential exists, and has precedent in the family's recent past, but intrafamily dynamics historically have remained largely shielded from public view until disputes have deepened to the point that consensus breaks down.

To date there has been no clear public confirmation that leading members of the royal family have reverted to the level of overt tension and competition that characterized intrafamily relations in the mid-20th century.109 Nevertheless, some international observers have expressed concern and uncertainty about Crown Prince Mohammed bin Salman's November 2017 decision to detain and investigate 11some royal family members on corruption charges and remove the late King Abdullah's son, Prince Miteb bin Abdullah, from his position as Minister of the National Guard.

The moves appear10 These moves appeared to signal the end ofa stark end to the consensus-based approach that reportedly hashad prevailed among senior royal family members for decades, and, when considered in parallel with the Crown Prince's bold social and economic reform agendas, could invite both acceptance and opposition from different components of society and leadership circles. On November 7, State Department spokeswoman Heather Nauert said, "We continue to encourage Saudi authorities to pursue the prosecution of people they believe to have been corrupt officials, we expect them to do it in a fair and transparent manner."

Administrative Changes, Lower Oil Prices, and Fiscal Priorities

In public statements since early 2015, Saudi leaders have highlighted continuing regional security threats and domestic economic challenges and have sought to project an image of assertive engagement in implementing diplomatic, economic, and security policies. Upon taking power, King Salman reshuffled leaders of several ministries with responsibility for government programs in areas where domestic popular demands are high, in addition to abolishing several state councils and replacing them with the overarching security and economic councils described above. Further cabinet changes since have been made in areas where performance has lagged or the king has sought to launch new initiatives.

Close observers of Saudi domestic policy described the leadership and structural changes as indications of the king's desire to reinvigorate government policy approaches to pressing issues, with some observers attributing some of the changes to the king's desire to provide and secure a leadership role for his son, Crown Prince Mohammed bin Salman. The Crown Prince has outlined an ambitious program of economic reforms since late 2015, and he is widely considered a key shaper of his father's decisions.11 He has been the public face of the kingdom's ambitious Vision 2030 and National Transformation Plan agendas, which seek to transform Saudi Arabia's economy and reduce its dependence on oil revenue.12

Saudi policy changes also are being driven by the reversal of the kingdom's prevailing fiscal position—from one of repeated surpluses to one of actual and projected deficits—rooted in drastic reductions in global market prices for crude oil. Lower oil prices have prevailed since mid-2014, while Saudi oil production levels remained roughly constant through mid-2016.13 From 2011 to 2015, the kingdom approved a series of record-high annual budgets and launched major additional spending programs to meet economic and social demands. Some feared that if these demands were left unmet, they could fuel stronger calls from citizens for political change.

Expenditure consistently exceeded budgeted levels from 2006 through 2015, and by late 2014, approximately one-half of Saudi government expenditures supported "salaries, wages, and allowances."14 Expenditure rose a further 13% beyond planned levels in 2015, with the majority being attributed to salary increases, social security and retirement benefits, and other royal decrees announced by King Salman upon his accession to the throne.15 Overall revenues declined, but nonoil revenues increased nearly 30%.

The Saudi Ministry of Finance stated in December 2015 that, over the next five years, the government planned on, inter alia, "embracing a set of policies and procedures designed to achieve wide structural reforms in the national economy and reduce its dependence on oil," and "reviewing government support, including revision of energy, water, and electricity prices gradually."16 These goals are paired with a fiscal consolidation plan that seeks to balance the kingdom's budget by 2020. The 2016 budget projected a fiscal deficit of nearly $90 billion and was announced in conjunction with a series of planned budgeting and expenditure reforms.17 The actual 2016 deficit was closer to $79 billion, and is expected to decline further to ~$53 billion in 2017, with improvements stemming from reduced expenditure and higher expected oil prices. To finance the 2015-2017 deficits, Saudi officials have drawn more than $100 billion from state reserves and issued more than $30 billion in new domestic and international bonds to meet revenue needs.18

Saudi officials continue to review and revise state support to consumers and industry in the form of energy and utility subsidies, with some changes having already come into effect. Reviews of public land holdings are underway and the kingdom has announced plans to implement a value-added tax (VAT) system by 2018. In May 2016, the kingdom also announced the reorganization and consolidation of several important economic ministries in a bid to streamline operations, reduce costs, and support the implementation of planned reforms. Cuts to public sector salaries and bonuses were implemented in late 2016, but reversed in 2017 in response to improved fiscal performance.

The IMF has commended announced Saudi reform plans in the Vision 2030 and National Transformation Plan initiatives, which in part reflect long-standing IMF recommendations that Saudi officials implement structural reforms to encourage private sector growth and improve employment opportunities for young Saudis.19 Historically, Saudi policymakers have sought to accomplish these types of reforms while managing concerns for security, social stability, and cultural and religious values. In May 2017, IMF officials stated their view that the kingdom's leaders have "scope for more gradual implementation" of planned changes in order to allow citizens to adapt and preserve fiscal resources to respond to unanticipated needs.20

|

U.S. Support in Educating the Next Generation of Saudis The kingdom's investments in the education sector are an acknowledgement of the challenges related to preparing the large Saudi youth population (~45% under 25 years of age) to compete and prosper in coming decades. It also is possible that a more educated and economically engaged youth population could make new social and/or political reform demands. In this regard, joint efforts to expand the number of Saudi students enrolled in U.S. colleges and universities since the mid-2000s may have cumulative economic, social, and political effects on Saudi society in future decades. The number of Saudi students pursuing higher education in the United States increased ten-fold from 2000 to 2015, but declined by 14% to more than 52,000 Saudi students in the United States during the 2016/2017 academic year.21 In 2016, the kingdom announced plans to reduce funding for some overseas students, and the number of Saudi students enrolled in some U.S. universities has declined as scholarship program requirements have changed.22 |

Gender Issues, Minority Relations, and Human Rights

Many gender-rights issues in Saudi Arabia remain subject to domestic debate and international scrutiny. Saudi women face restrictions on travel and employment, and male guardianship rules and practices continue to restrict their social and personal autonomy. In April 2017, King Salman ordered government agencies to review guardianship rules that restrict women's access to government services and to remove those that lack a basis in Islamic law, as interpreted by the kingdom's judicial establishment.23 While in the past, Saudi officials regularly detained, fined, or arrested individuals associated with protests by advocates for Saudi women's right to drive automobiles and travel freely, in September 2017 the government directed ministries to prepare regulations that will recognize women's rights to drive.24 The late King Abdullah recognized women's right to vote and stand as candidates in 2015 municipal council elections and expanded the size of the national Shura Council to include 30 women. These moves, while controversial in the kingdom, have been seen by some outsiders as signs that managed, limited political and social reforms involving gender issues are possible.

The most recent (2016) U.S. State Department report on human rights in Saudi Arabia notes "women continued to face significant discrimination under law and custom, and many remained uninformed about their rights."25 The report states that, despite conditions in which "gender discrimination excluded women from many aspects of public life ... women slowly but increasingly participated in political life, albeit with significantly less status than men." The third nationwide municipal council elections were held in December 2015, and expanded the elected membership to two-thirds, lowered the voter registration age to 18 from 21, and were the first in which Saudi women could vote and stand as candidates. Female candidates won 21 of the 2,106 seats and 17 were appointed to seats.26

IS terrorist attacks against Shia minority communities, low-level unrest in some Shia communities in the oil-rich Eastern Province (see Ash Sharqiyah in Table 1 above), and small protests by students and families of Sunni security and political detainees have created strains on public order and overall stability. Saudi authorities continue to pursue a list of young Shia individuals wanted in connection with ongoing protests and clashes with security forces in the Eastern Province. These clashes intensified in the wake of the January 2016 execution of outspoken Shia cleric Nimr al Nimr, with arson attacks targeting public buildings in some Shia-populated areas and shooting attacks having killed and injured Saudi security personnel. Nimr had been charged with incitement to treason and alleged involvement with individuals responsible for attacks on security forces.27

The IMF has commended the reform goals articulated in Vision 2030 and the National Transformation Plan, which in part reflect long-standing IMF recommendations for structural reforms to encourage private sector growth and improve employment opportunities for young Saudis.12 Historically, Saudi policymakers have faced challenges in balancing these types of reforms with concerns for the preservation of security, social stability, and cultural and religious values.

Fiscal Balance Program Update 2018 Source: Saudi Arabian government, Vision 2030: Fiscal Balance Program, 2018. Note: The Saudi riyal is pegged to the U.S. dollar at a rate of 1 USD to 3.75 SAR. The kingdom's fiscal position reversed from one of repeated surpluses from 2005 through 2013 to one of actual and projected deficits in 2014. This change was rooted in lower global market prices for crude oil and major Saudi spending initiatives introduced to meet domestic economic and social demands. From 2011 to 2015, the kingdom approved a series of record-high annual budgets and expanded financial support for citizens, possibly due to government concerns that a failure to meet popular economic needs could lead to demands for political change. When oil prices turned sharply lower between mid-2014 and mid-2017, Saudi officials turned to borrowing and deficit spending of accumulated reserves while reducing oil production levels in a bid to support global market price increases. From 2014 through 2017, Saudi officials drew more than $235 billion from state reserves and national government debt increased from 5.8% of GDP to 17.2%, as new domestic and international bonds were issued to help meet revenue needs.15 Higher oil prices since mid-2017 have eased the kingdom's immediate fiscal burden, though IMF staff recommend that the kingdom plan for a range of oil revenue scenarios and maintain fiscal discipline.16 According to the IMF, Saudi officials plan to continue public stimulus spending, coupled with administrative and legal changes to encourage private sector and nonoil sources of economic growth and government revenue. They continue to review and revise state support to consumers and industry in the form of energy and utility subsidies, with some changes having already come into effect. Reviews of public land holdings are ongoing, and the kingdom has implemented a value-added tax (VAT) system. Officials also have reorganized and consolidated several important economic ministries in a bid to streamline operations, reduce costs, and support the implementation of planned reforms. Cuts to public sector salaries and bonuses were implemented in late 2016, but reversed in 2017 in response to improved fiscal performance. U.S. Support in Educating the Next Generation of Saudis The kingdom's investments in education are an acknowledgement of the challenges related to preparing the large Saudi youth population (~45% under 25 years of age) to compete and prosper in coming decades. The late King Abdullah initiated a state-sponsored scholarship program responsible for sending thousands of young Saudis abroad for undergraduate and graduate education. The number of Saudi students pursuing higher education in the United States increased ten-fold from 2000 to 2015, and exceeded 58,000 according to Saudi figures in March 2018.17 In 2016, the kingdom announced plans to reduce funding for some overseas students, and the number of Saudi students enrolled in some U.S. universities has declined as scholarship program requirements and funding commitments have changed.18 The growth in the number of Saudi students enrolled in U.S. colleges and universities that occurred after the mid-2000s may have cumulative economic, social, and political effects on Saudi society in future decades. This includes the possibility that a more educated and economically engaged youth population could make new social and/or political reform demands of Saudi leaders. The 2017 State Department Country Reports on Terrorism states that "The United States continued to support Saudi Arabia in reforms it is undertaking by: facilitating Saudi nationals' study in the United States and promoting educational exchanges," among other steps. According to the U.S. State Department's 2017 report on human rights in Saudi Arabia, Saudi law provides that "the State shall protect human rights in accordance with Islamic sharia."19 Saudi law does not provide for freedom of assembly, expression, religion, the press, or association; rather, the government strictly limits each of these. The kingdom remains an absolute monarchy, and its citizens do not choose their government through election. Political parties are prohibited, as are any groups deemed to be in opposition to the government. A Specialized Criminal Court presides over trials of suspects in terrorism cases, including cases involving individuals accused of violating restrictions on political activity and public expression contained in counterterrorism and cybercrimes laws adopted since 2008. A government Human Rights Commission (HRC) is responsible for monitoring human rights conditions, fielding complaints, referring cases of violations for criminal investigation, and interacting with foreign entities on issues of human rights concern. While Saudi authorities have created new space for some social and entertainment activities in recent years, they also have moved to further restrict the activities of groups and individuals advocating for political change and campaigning on behalf of individuals detained for political or security reasons, including advocates for the rights of terrorism suspects. Some young Saudis who have produced social media videos criticizing the government and socioeconomic conditions in the kingdom also have reportedly been arrested. In September 2018 Saudi prosecutors announced plans to prosecute for cybercrime individuals who produce or distribute content that "mocks, provokes or disrupts public order, religious values and public morals."20 King Salman, like the late King Abdullah, has moved to restrict and redefine some of the responsibilities and powers of the Commission for the Promotion of Virtue and Prevention of Vice (CPVPV), often referred to by non-Saudis as "religious police," in response to some public concerns. A government-endorsed entity, the CPVPV assumed a prominent public role in enforcing standards of religious observance and gender segregation norms for decades. In April 2016, the government formally stripped the CPVPV of certain arrest powers, required its personnel to meet certain educational standards, and instructed them to improve their treatment of citizens. The commission remains in operation, in cooperation with security forces, and its role in society, while less visible, remains a subject of debate.21 Periodic incidents involving CPVPV personnel and the government's moves to embrace certain types of entertainment and social gatherings shape related discussion and debate among Saudi citizens and public figures. Critics of the kingdom's record on human issues have highlighted the fact that since the 1990s, authorities have periodically detained, fined, or arrested individuals associated with protests or public advocacy campaigns. This includes some advocates for Saudi women's rights that the government has recently moved to recognize, such as rights to drive automobiles, travel freely, or to enjoy fewer guardianship-related legal restrictions (see "Women's Rights Issues" below). Since 2016, Saudi officials have more frequently described their motives for detentions and investigations in gender-related and other human rights cases as being based on concerns about activists' relations with foreign third parties. Saudi authorities broadly reject most international calls for specific action on human rights-related cases, which they perceive to be attempts to subvert Saudi sovereignty or undermine the kingdom's judicial procedures. Arrests and public punishments of human rights advocates have attracted increased international attention to contentious social and human rights issues in recent years, and, in February 2017, Human Rights Watch issued a report reviewing what it described as a "stepped up" campaign against activists. 22 Cases discussed in international media include the following: The Badawis' cases have complicated Saudi Arabia's bilateral relationships with Canada and some European governments pressing for their release. In August 2018, Saudi Arabia expelled Canada's ambassador to the kingdom and recalled its ambassador from Ottawa after the Canadian embassy called for the release of Raif and Samar Badawi and other jailed activists.26 Saudi authorities further suspended plans to invest in Canada and recalled Saudi students. The Saudi government particularly objected to Canada's call for the "immediate release" of detained individuals, describing it as "blatant interference in the kingdom's domestic affairs, against basic international norms and all international protocols" and a "major, unacceptable affront to the kingdom's laws and judicial process, as well as a violation of the kingdom's sovereignty."27 U.S. State Department spokeswoman Heather Nauert called on Canada and Saudi Arabia to resolve their dispute diplomatically and encouraged the Saudi government "to address and respect due process and also publicize information on some of its legal cases."28 In parallel, press reports and human rights advocates have noted the detention of several religious figures who are presumed to be critical of the government and recent social reforms, and, in some cases, who are accused by Saudi authorities of linkages with the Muslim Brotherhood.29 This includes prominent conservative religious figures such as Salman al Awda, Safar al Hawali, Ali al Omari, Nasir al Umar, Awad al Qarni, and Abd al Aziz al Fawzan. Several have been harsh critics of U.S. policy in the past, and some, like Awda and Hawali, were associated with the Islamist "awakening" (sahwa) movement of the 1990s. Saudi prosecutors have announced their intention to seek the death penalty against some of the detainees for their involvement with the International Union of Muslim Scholars, which the kingdom considers a terrorist organization because of its ties to neighboring Qatar (see "Qatar and Intra-Gulf Cooperation Council (GCC) Tensions" below). Public backlash in the kingdom and beyond could be considerable in light of the transnational media visibility that several of the accused have long enjoyed and their large, global social media followings.30 Many women's rights issues in Saudi Arabia remain subject to domestic debate and international scrutiny. Saudi women face restrictions on travel and employment, and male guardianship rules and practices continue to restrict women's social and personal autonomy.31 The most recent (2017) U.S. State Department report on human rights in Saudi Arabia notes that "women continued to face significant discrimination under law and custom, and many remained uninformed about their rights."32 The report states that, despite conditions in which "gender discrimination excluded women from many aspects of public life ... women slowly but increasingly participated in political life, albeit at a disadvantage." The late King Abdullah recognized women's right to vote and stand as candidates in 2015 municipal council elections and expanded the size of the national Shura Council to include 30 women. The third nationwide municipal council elections were held in December 2015, and expanded the elected membership to two-thirds, lowered the voter registration age to 18 from 21, and were the first in which Saudi women could vote and stand as candidates. Female candidates won 21 of the 2,106 seats, and 17 were appointed to seats.33 In April 2017, King Salman ordered government agencies to review guardianship rules that restrict women's access to government services and to remove those that lack a basis in Islamic law, as interpreted by the kingdom's judicial establishment.34 The guardianship rules remain under review. In September 2017, the government directed ministries to prepare regulations to recognize women's rights to drive, and in June 2018, Saudi women began driving with state approval. These moves, while controversial in the kingdom, have been seen by some outsiders as signs that managed, limited political and social reforms involving gender issues are possible. The implemented and proposed changes nevertheless have been accompanied by the detention of some of their most prominent female proponents.35 Saudi authorities allege the detainees have inappropriate ties to foreign entities. Saudi authorities continue to pursue a list of young Shia individuals wanted in connection with ongoing protests and clashes with security forces in the Eastern Province. These clashes intensified in the wake of the 2016 execution of outspoken Shia cleric Nimr al Nimr, with arson attacks targeting public buildings in some Shia-populated areas and shooting attacks having killed and injured Saudi security personnel. Nimr had been charged with incitement to treason and alleged involvement with individuals responsible for attacks on security forces.37 In line with the firm approach evident in Nimr's 2014 death sentence, Saudi courts have handed down lengthy jail terms and travel bans for Shia protestors and activists accused of participating in protests and attacking security force personnel over the last several years. Islamic State-linked anti-Shia terrorist attacks (see below) and continuing views among some Saudi Shia of the state as being discriminatory and encouraging of anti-Shia extremism contribute to tensions. In line with the firm approach evident in Nimr's October . Taken in conjunction with the Crown Prince's bold social, economic, and foreign policy agendas, these steps may meet with different responses from various family members and components of Saudi society.

Economic Reform, Fiscal Priorities, and Administrative Changes

As of 2018, Crown Prince Mohammed bin Salman presides over the kingdom's national economic transformation initiatives, and, under his father's auspices, he has directed changes to the leadership of security and administrative bodies across the Saudi government. Saudi Arabia's Vision 2030 initiative, National Transformation Plan, and Fiscal Balance Plan (Figure 3) seek to reshape the economy and reduce government and social dependence on oil revenue.11 Authorities have introduced some taxes, reduced energy subsidies, and taken other fiscal measures to improve the kingdom's state finances, tailoring implementation and in some cases offering temporary financial support to citizens to ease burdens at the household level.

2014 death sentence, Saudi courts have handed down lengthy jail terms and travel bans for Shia protestors and activists accused of participating in protests and attacking security force personnel over the last several years. Islamic State-linked anti-Shia terrorist attacks (see below) and continuing views among some Saudi Shia of the state as being discriminatory and encouraging of anti-Shia extremism contribute to tensions. In May 2017, Saudi security forces traded fire with armed individuals in Nimr's home village of Al Awamiya, and one Saudi soldier was killed. Explosions and gunfire have periodically killed and injured Saudi security officers in nearby Qatif in June and July 2017.

While Saudi authorities have created new space for some social and entertainment activities, they also have moved to further restrict the activities of groups and individuals advocating for political change and campaigning on behalf of individuals detained for political or security reasons, including advocates for the rights of terrorism suspects. In March 2013, Saudi authorities convicted two prominent human rights activists and advocates for detainee rights, Mohammed al Qahtani and Abdullah al Hamid, on a range of charges, including "breaking allegiance" to the king.28 Some young Saudis who have produced social media videos criticizing the government and socioeconomic conditions in the kingdom also have reportedly been arrested. In February 2017, Human Rights Watch issued a report reviewing what it described as a "stepped up" campaign against activists.29

Some prominent arrests and public punishments have attracted attention to contentious social and human rights issues since 2015. In January 2015, Saudi blogger Raif Badawi began receiving public flogging punishments following his conviction for "insulting Islam," a charge levied in response to Badawi's establishment of a website critical of certain Saudi religious figures and practices. Badawi was sentenced in May 2014 to 1,000 lashes (to be administered in 20 sessions of 50 lashes) and 10 years in prison. After the first session, his subsequent punishments were delayed for medical reasons.30 The case has complicated Saudi Arabia's bilateral relationships with Canada and some European governments pressing for Badawi's release. Badawi's sister Samar also is a human rights advocate—Saudi authorities questioned her in January 2016 and released her, reportedly calling her back for questioning in February 2017.31 Her former husband is a prominent human rights activist and lawyer who also was jailed in 2014 on a range of charges related to his advocacy.32

At the same time, King Salman, like the late King Abdullah, has moved to restrict and redefine some of the responsibilities and powers of the Commission for the Promotion of Virtue and Prevention of Vice (CPVPV), often referred to by non-Saudis as "religious police," in response to public concerns. In April 2016, the government formally stripped the CPVPV of certain arrest powers, required its personnel to meet certain educational standards, and instructed them to improve their treatment of citizens. The commission remains in operation, in cooperation with security forces, and its role in society remains a subject of debate. Periodic incidents involving CPVPV personnel and the government's moves to embrace certain types of entertainment and social gatherings shape related discussion and debate among Saudi liberals and conservatives.

International Religious Freedom: Country of Particular Concern DesignationSaudi Arabia has been designated since 2004 as a country of particular concern under the International Religious Freedom Act of 1998 (P.L. 105-292, as amended) for having engaged in or tolerated particularly severe violations of religious freedom. Most recently, on October 31, 2016, Secretary of State John Kerryand around Awamiyah and Qatif since mid-2017. Saudi security operations and clashes with armed locals resulted in the destruction of areas of Al Awamiya in August 2017, and government-sponsored reconstruction efforts are now underway.38 U.S. travel advisories warn U.S. citizens to avoid these areas of the Eastern Province because of related tensions and the potential for renewed violence.

As of November 2017, the Trump Administration had not yet updated the 2016 list of Countries of Particular Concern pursuant to the act.

Terrorism Threats and Bilateral Cooperation

The Saudi Arabian government states that it views Al Qaeda, Al Qaeda affiliates, the Islamic State (aka ISIS/ISIL or the Arabic acronym Da'esh), other Salafist-jihadist groups, and their supporters as direct threats to Saudi national security. In February 2017, the State DepartmentThe U.S. government has described the Saudi government as "a strong partner in regional security and counterterrorism efforts."33 The U.S. government,"40 and has reported that the Saudi government has taken increased action since 2014 to prevent Saudis from travelling abroad in support of extremist groups or otherwise supporting armed extremists. At the March 2016 Nuclear Security Summit, Saudi Arabia pledged $10 million to support the creation of a center focused on preventing nuclear terrorism at IAEA headquarters in Vienna, Austria.

The aggressive expansion of the Islamic State in neighboring Iraq and in Syria and the group's attacks inside Saudi Arabia raised Saudis' level of concern about the group, and may be leading the Saudi government to seek stronger partnerships with the United States, select Syrian opposition forces, Iraqi Sunnis, and select regional countries. Saudi leaders also seek regional and U.S. support for their efforts to confront what they describe as Iranian efforts to destabilize Yemen through support for the Ansar Allah/Houthi movement (see "Saudi Military Campaigns and Policy in Yemen" below).

Amid the Islamic State's rise, Saudi and U.S. officials have stated that Al Qaeda in the Arabian Peninsula (AQAP), based in Yemen and led by Saudi nationals, also poses a continuing terrorist threat to the kingdom. Following the January 2016 execution In 2016, the Saudi Ministry of Interior reported that there were "2,093 Saudis fighting with terrorist organizations in conflict zones, including ISIS, with more than 70 percent of them in Syria."41

Saudi and U.S. officials agree that the Islamic State and Al Qaeda in the Arabian Peninsula (AQAP)—based in Yemen and led by Saudi nationals—pose continuing terrorist threats to the kingdom. From 2014 through 2017, the aggressive expansion of the Islamic State in neighboring Iraq and in Syria and the group's attacks inside Saudi Arabia created alarm in the kingdom. Following the January 2016 execution by the Saudi government of dozens of convicted AQAP suspects, including some prominent ideologues, Al Qaeda leader Ayman al Zawahiri released a statement condemning the Saudi governmentKingdom and calling for revenge. Some observers, including some Members of Congress, have expressed concern about the apparent strengthening of AQAP during the course of the ongoing conflict in Yemen.

In December 2015, Crown Prince Mohammad bin Salman announced that the kingdom would lead a 34-nation coalition of predominantly Muslim countries to confront and defeat terrorist threats.34 After an initial period of clarification and refinement, the Islamic Military Alliance to Fight Terrorism initiative reportedly has attracted the support of 41 countries with a coalition force to be commanded by former Pakistan army chief General Raheel Sharif.35 Questions about the arrangement's purpose, resources, forces, and limits remain to be fully answered. In May 2017, participants announced they had identified "a reserve force of 34,000 troops to support operations against terrorist organizations in Iraq and Syria when needed."36 Some Saudi officials appear to want the coalition to confront terrorist threats and threats posed by nonstate actors to member countries, while some coalition members, notably Pakistan, appear to want to proscribe clearer boundaries on coalition activities, in part to avoid antagonizing Iran.37

The Islamic State's Campaign Against42

Persistent terrorist threats appear to be one factor that has led the Saudi government to seek stronger partnerships with the United States. Since 2017, Saudi officials have announced plans to contribute to stabilization efforts in Syria and have reengaged with Iraqi leaders in line with U.S. preferences.43 Saudi leaders also seek support from their regional neighbors and from the United States to confront what they describe as efforts by Iran and their Hezbollah allies to destabilize Yemen through support for the Ansar Allah/Houthi movement (see "Conflict in Yemen" below).

The Islamic State's Campaign against the Kingdom

Since 2014, IS supporters have claimed responsibility for several attacks inside the kingdom, including attacks on security officers and Shia civilians.3844 Claims for the attacks have come on behalf of members of IS-affiliated "provinces" or (wilayah) named for the central Najd region and the western Hijaz region of the Arabian Peninsula.3945 In June 2015, an IS-affiliated Saudi suicide bomber blew himself up in a Kuwaiti mosque, killing more than two dozen people and wounding hundreds.4046 On January 29, 2016, attackers struck a Shia mosque in Al Ahsa, killing two people and wounding seven others. An IS-claimed attack in April 2016 west of Riyadh killed a senior Saudi police official, and in July 2016, a series of three IS-linked suicide bombings targeted the U.S. Consulate General in Jeddah, the Prophet's Mosque in Medina, and a Shia mosque in the Eastern Province. Saudi officials have arrested more than 1,600 suspected IS supporters (including more than 400 in July 2015) and claim to have foiled several planned attacks.41 In December 2016, the Saudi Ministry of Interior reported that there were "2,093 Saudis fighting with terrorist organizations in conflict zones, including ISIS, with more than 70 percent of them in Syria."42

The Islamic State arguably poses a unique political threat to Saudi Arabia in addition to the tangible security threats that its supporters have demonstrated through the recent attacks. IS leaders claim to have established a caliphate to which all pious Sunni Muslims owe allegiance, and they directly challenge the legitimacy of the Al Saud family, who have long described themselves as the custodians of Islam's holiest sites and rulers of a state uniquely built on and devoted to the propagation of Salafist interpretations of Sunni Islam. In May 2015, IS leader Abu Bakr al Baghdadi 48 The Saudi government's use of state-backed clerics to denounce the Islamic State signals Saudi rulers' antipathy toward the group, but IS figures dismiss these clerics as apostates and "palace scholars."

IS leader Abu Bakr al Baghdadi has aggressively challenged Saudi leaders' credentials as defenders of Islam and implementers of Salafist Sunni principles, calling them "the slaves of the Crusaders and allies of the Jews" and accusing them of abandoning Sunni Palestinians, Syrians, Iraqis, and others.43

In a series of videos released in mid-December 2015, Islamic State-controlled "provinces" launched a coordinated media campaign condemning the Al Saud family as apostate tyrants, promising attacks in the kingdom, and encouraging IS supporters to rise up and overthrow the Saudi government. The videos promised to free prisoners held in Saudi jails and condemned the Al Saud for protecting Shia in the kingdom and for cooperating with the United States and others in military operations targeting Muslims. Themes, terms, threats, and promises were largely consistent among the December 2015 videos, which were released by most of the self-declared IS "provinces" in Iraq and Syria as well as "provinces" in Yemen, Libya, and Egypt.

Some analysts have examined the similarities and differences between the kingdom's official "Wahhabist" brand of Sunni Islam and the ideology espoused by the Islamic State.52 IS ideologues draw on the writings of Mohammed Ibn Abd al Wahhab and other clerics who have played a historic role in Saudi Arabia's official religious establishment, but pro-IS ideologues differ from official Saudi clerics in their hostility toward the Al Saud family and on other matters.IS critiques of the Al Saud may have resonance among some Saudis who disagree with the government's policies or those49 Islamic State propaganda also has included features claiming to justify the assassination of several prominent Saudi clerics and exhorting its followers to do so.50 In August 2018, IS leader Al Baghdadi challenged supporters in the Arabian Peninsula to rise up, reject the influence of Saudi state-aligned scholars, and resist what he described as Saudi leaders' plans to Westernize the kingdom "in a systematic campaign" to make believers "into infidels."51

who have volunteered to fight in conflicts involving other Muslims over the last three decades. Saudi leaders argue that it is the Islamic State that lacks legitimacy, and some Saudi observers compare the group's ideology to that of other violent, deviant groups from the past and present.44 The Saudi government's use of state-backed clerics to denounce the Islamic State signals Saudi rulers' antipathy toward the group, but IS figures mock these clerics as apostates and "palace scholars."

The January 2016 edition of the Islamic State's English-language magazine Dabiq contained a feature claiming to justify the assassination of several prominent Saudi clerics, exhorting its followers to do so. Some analysts have examined the similarities and differences between the kingdom's official "Wahhabist" brand of Sunni Islam and the ideology espoused by the Islamic State. IS ideologues draw on the writings of Mohammed Ibn Abd al Wahhab and other clerics who have played a historic role in Saudi Arabia's official religious establishment, but pro-IS ideologues differ from official Saudi clerics in their hostility toward the Al Saud family and on other matters.45

Terrorist Financing and Material Support: Concerns and Responses

According to U.S. government reports, financial support for terrorism from Saudi individuals remains a threat to the kingdom and the international community, even though the Saudi government has "affirmedreaffirmed its commitment to countering terrorist financing in the Kingdom and sought to further establish itself as a leader in disrupting terrorist finance within the Gulf region."46 The U.S. government the Gulf region."55 Official U.S. views of Saudi counterterrorism policy have evolved since the terrorist attacks of September 11, 2001 (see Appendix C), and the U.S. government now credits its Saudi counterparts with taking terrorism threats seriously and praises Saudi cooperation in several cooperative initiatives, including Saudi Arabia's leadership alongside Italy and the United States in the multilateral Counter-ISIL Finance Group.

Overall, according to the State Department's 20162017 Country Reports on Terrorism entry on Saudi Arabia,

Despite serious and effective efforts to counter the funding of terrorism within the Kingdom, some individuals and entities in Saudi Arabia probably continued to serve as sources of financial support for terrorist groups. While the Kingdom has maintained strict supervision of the banking sector, tightened the regulation of the charitable sector, and stiffened penalties for financing terrorism, some funds are allegedly collected in secret and illicitly transferred out of the country in cash, sometimes by pilgrims performing Hajj and Umrahunder the cover of religious pilgrimages. To address this issue, the MOISaudi government continued efforts to counter bulk cash smuggling in 2016. Regional turmoil and the sophisticated use of social media have enabled charities outside of Saudi Arabia with ties to violent extremiststerrorists to solicit contributions from Saudi donors, but the government has demonstrated a willingnessworked to pursue and disrupt such funding streams.47

Saudi authorities have forbidden Saudi citizens from travelling to Syria to fight and have taken steps to limit the flow of privately raised funds from Saudis to armed Sunni groups and charitable organizations in Syria. In January 2014, the kingdom issued a decree setting prison sentences for Saudis found to have travelled abroad to fight with extremist groups, including tougher sentences for any members of the military found to have done so. The decree was followed by the release in March 2014 of new counterterrorism regulations under the auspices of the Ministry of Interior outlawing support for terrorist organizations including Al Qaeda and the Islamic State as well as organizations such as the Muslim Brotherhood.4857 The regulations drew scrutiny and criticism from human rights advocates concerned about further restrictions of civil liberties.

In August 2014, Saudi Grand Mufti Shaykh Abd al Aziz bin Abdullah bin Mohammed al Al Shaykh declared "the ideas of extremism ... and terrorism" to be the "first enemies of Muslims," and stated that all efforts to combat Al Qaeda and the Islamic State were required and allowed because those groups "consider Muslims to be infidels."4958 The statement, coupled with state crackdowns on clerics deviating from the government's antiterrorism messaging, appears to signal the kingdom's desire to undercut claims by the Islamic State, Al Qaeda, and their followers that support for the groups and their violent attacks is religiously legitimate. During President Trump's May 2017 visit to Riyadh, photos from the inauguration of the Saudis' new Global Center for Combating Extremist Ideology attracted significant international attention. In conjunction with the government's expanded efforts to dissuade Saudi citizens from supporting the Islamic State and other extremist groups, Saudi security entities continue to arrest cells suspected of plotting attacks, recruiting, or fundraising for some terrorist groups.

U.S. training and security support to Saudi Arabia remains overwhelmingly Saudi funded via Foreign Military Sales and other contracts, reflecting Saudi ability to pay for costly programs (and limiting opportunities for Congress to affect cooperation through appropriations legislation). Saudi Arabia receives roughly $10,000 per year in International Military Education and Training (IMET) assistance authorized by the Foreign Assistance Act of 1961. This nominal amount makes Saudi Arabia eligible for a discount on training that it purchases through the Foreign Military Sales program.59

The Bush Administration requested limited IMET funding for Saudi Arabia from FY2003 through FY2009, and the Obama Administration similarly requested annually that Congress appropriate a small amount of IMET assistance. Successive Administrations have argued that the discount supports continued Saudi participation in U.S. training programs, which in turn supports the maintenance of important military-to-military relationships and improves Saudi capabilities. President Trump's FY2018 budget request sought $10,000 in IMET for Saudi Arabia, but for FY2019 did not specifically request the funds (without explanation). The Senate Appropriations Committee report on the FY2019 State Department and Foreign Operations appropriations bill (S. 3108, S.Rept. 115-282) recommends that $10,000 in IMET assistance be provided for Saudi Arabia.