Department of Transportation (DOT): FY2018 Appropriations

Changes from August 14, 2017 to September 4, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Department of Transportation (DOT): FY2018 Appropriations

Contents

- Introduction

- Understanding the DOT Appropriations Act

- Reauthorization of Air Transportation Programs

- DOT Funding Trend

- DOT FY2018 Appropriations

- Selected Issues

- Highway Trust Fund Solvency

- National Infrastructure Investment (BUILD/TIGER Grants)

- Additional Infrastructure Funding

Essential Air Service- Positive Train Control

- Railroad Rehabilitation and Infrastructure Financing (RRIF) Loan Program

Amtrak and Intercity Passenger Rail Development- Federal Transit Administration Capital Investment Grants

- The Hudson Tunnels and Amtrak's Gateway Program

- Grant to the Washington Metropolitan Area Transit Authority

Tables

- Table 1. DOT

FY2017Budget Authority , FY2017-2018

- Table 2. DOT Budget Authority Sources, FY2017 -FY2018

- Table 3. DOT Grant Accounts and Amounts, FY2017 -FY2018

- Table 4. Department of Transportation FY2017-FY2018 Detailed Budget Table

- Table 5. Recent TIGER Grant Appropriations

- Table 6. Selected Increases in Infrastructure Funding, FY2017-FY2018 Table 7. Essential Air Service Funding, FY2017-FY2018

- Table

78. Essential Air Service Program: Number of Communities and Annual Appropriations,FY2008-FY2017FY2009-FY2018

- Table

89. Federal Intercity Passenger Rail Grant Program Funding, FY2017-FY2018 - Table

910. FTA Capital Investment Grants Funding by ComponentSummary

Congress appropriated $86.2 billion for the Department of Transportation (DOT) for FY2018. This represented a $9.1 billion (11.8%) increase over the amount provided in FY2017. The principal reason for the higher spending level was increases in funding from the general fund for highways, public transportation capital investments, and passenger rail projects. The appropriation was included in an omnibus spending bill, P.L. 115-141, Title I of Division L, the DOT Appropriations Act.

The DOT appropriations bill funds federal programs covering aviation, highways and highway safety, public transit, intercity rail, maritime safety, pipelines, and related activities. Federal highway, transit, and rail programs were reauthorized in fall 2015, and their future funding authorizations were somewhat increased.

The Trump Administration proposed a $75 billion budget for DOT for FY2018, including $16.4 billion in discretionary funding and $58.7 billion in mandatory funding. That was approximately $2 billion less than was provided for FY2017. The budget request reflected the Administration's call for significant cuts in funding for transit and rail. FTA Capital Investment Grants Funding by Component

Summary

In 2017, the Trump Administration proposed a $75 billion budget for the Department of Transportation (DOT) for FY2018: $16.4 billion in discretionary funding and $58.7 billion in mandatory funding. That is approximately $2 billion less than was provided for FY2017. The budget request reflected the Administration's call for significant cuts in funding for transit and rail programs.

The DOT appropriations bill funds federal programs covering aviation, highways and highway safety, public transit, intercity rail, maritime safety, pipelines, and related activities. Federal highway, transit, and rail programs were reauthorized in fall 2015, and their future funding authorizations were somewhat increased. There is general agreement that more funding is needed for transportation infrastructure, but Congress has not been able to agree on a source that could provide the additional funding. The federal excise tax on motor fuel, which is the primary funding source for federal highway and transit programs, has not been increased in over 20 years, and does not raise enough revenue to support even the current level of spending. To address this shortfall, Congress periodically transfers money from the general fund to the Highway Trust Fund to provide sufficient funding for the programs.

The annual appropriations for DOT are combined with those for the Department of Housing and Urban Development (HUD) in the Transportation, Housing and Urban Development, and Related Agencies (THUD) appropriations bill. The House Appropriations Committee reported H.R. 3353, the THUD FY2018 appropriations bill, in which Division A isprovided FY2018 appropriations for DOT. The committee recommended $77.5 billion in new budget authority for DOT, 0.5% ($400 million) more than the comparable figure inultimately approved for FY2017 and roughly 3% ($2.4 billion) more than the Administration requested.

The Senate Appropriations Committee reported out an FY2018 THUD bill, S. 1655, which was not taken up by the full SenateCommittee on Appropriations has reported S. 1655, its FY2018 THUD bill, in which Division A is DOT appropriations. The Senate committee recommended $78.6 billion in new budget authority, 2% ($1.6 billion) more than the comparable FY2017 amount and 4.7% ($3.5 billion) more than the Administration requested.

Notable differences between the House and Senate committee bills include funding for the TIGER grant program (the House committee recommended no funding; the Senate committee recommended $550 million) and for new transit projects (beyond projects with existing grant agreements, the House committee recommended $400 million for Joint Public Transportation and Intercity Passenger Rail Projects, while the Senate committee recommended $768 million for new projects in the New Starts, Small Starts, and Core Capacity programs).

With inflation forecast at 1.7% for FY2017 and 1.9% for FY2018, the House bill would result in a slight decrease in real DOT funding, while the Senate bill would result in roughly level funding, compared to FY2017.

There is general agreement that more funding is needed for transportation infrastructure, and the Trump Administration has proposed an increase in spending on infrastructure, but Congress has not been able to agree on a source that could provide the additional funding. The federal excise tax on motor fuel, which is the primary funding source for federal highway and transit programs, has not been increased in over 20 years, and does not raise enough revenue to support even the current level of spending. To address this shortfall, Congress has transferred money from the general fund to the Highway Trust Fund on several occasions since 2008 to provide sufficient funding for the programs. Revenue estimates by the Congressional Budget Office (CBO) suggest that general fund transfers will continue to be required in future years to support the currently authorized level of highway and public transportation spending.

Introduction

The Trump Administration requested $75.1 billion1 for the Department of Transportation (DOT) for FY2018, 2.6% ($2 billion) less than DOT received in FY2017. The Administration proposed significant cuts in funding for competitive grant programs, zeroing out the TIGER infrastructure investment grant program and the Essential Air Service (EAS) program, and reducing spending on public transportation capital grants and Amtrak's long-distance trains by half or more.

Around 75% of DOT's funding is mandatory budgetary authority drawn from trust funds; the Administration's request would have drawn a slightly larger portion (78%) from mandatory budget authority, reducing the amount of discretionary budget authority in DOT's budget from $19.3 billion in 2017 to $16.4 billion for FY2018.

On July 21, 2017, the House Committee on Appropriations reported H.R. 3353. The committee recommended $77.5 billion for DOT, a 0.5% ($430 million) increase over the comparable FY2017 amount and 3% ($2.4 billion) above the Administration request.

On July 27, 2017, the Senate Committee on Appropriations reported S. 1655. It recommended a total of $78.6 billion in new budget authority for DOT for FY2018 ($78.5 billion after scorekeeping adjustments), 2% ($1.6 billion) above the comparable FY2017 amount and 4.7% ($3.5 billion) over the Administration request.

With inflation forecast at 1.7% for FY2017 and 1.9% for FY2018,2 the House committee bill would likely result in a reduction in inflation-adjusted funding for DOT from its FY2017 level, while the Senate committee bill would result in roughly level inflation-adjusted fundingConflicts over funding levels and spending limits for federal agencies delayed action on final FY2018 appropriations until March 2018. Until that time, a series of continuing resolutions provided temporary funding for federal agencies. Finally, after passing legislation raising the spending limits for federal agencies for FY2018, Congress passed an omnibus spending bill, P.L. 115-141, which included increased spending for most agencies. Title I of Division L, the DOT Appropriations Act, provided $86.2 billion, 11.8% ($9.1 billion) more than in FY2017.

Understanding the DOT Appropriations Act

DOT's funding arrangements are unusual compared to those of most other federal agencies, in that most of its funding is mandatory budget authority coming from trust funds, and most of its expenditures take the form of grants to states and local government authorities.

For most federal agenciesDiscretionary appropriations constitute most, if not all, of theirthe annual funding is discretionary fundingfor most federal agencies. But roughly three-fourths of DOT's funding ishas come from mandatory budget authority derived from trust funds. Around one-fourth of DOT's budget authority is discretionary authority.3 Table 1 shows the 2 A significant increase in discretionary funding for DOT in its FY2018 appropriation changed that proportion slightly, increasing the share of discretionary funding to almost a third of DOT's budget. Table 1 shows the shift in the breakdown between the discretionary and mandatory funding in DOT's budget from FY2017 to FY2018.

|

Budget Authority (BA) |

FY2017 FY2018 Amount Percent of Total |

Percent of Total |

|||||||||||||||

|

DOT discretionary BA |

$19.3 |

25% | |||||||||||||||

|

DOT mandatory BA |

57.7 |

75% |

|||||||||||||||

|

DOT total budgetary resources |

$77.1 |

100%

|

DOT mandatory BA

|

57.7

|

75%

|

DOT total budgetary resources

|

$77.1

|

100%

|

|||||||||

Source: Prepared by CRS based on figures in the Comparative Statement of Budget Authority in H.Rept. 115-237the explanatory statement for Division L of P.L. 115-141.

Note: Budget authority figures in this table do not include rescissions.

Two large trust funds, the Highway Trust Fund and the Airport and Airway Trust Fund, providehave typically provided around 90% of DOT's annual funding in recent years (92% in FY2017), but in FY2018 a significant increase in discretionary budget authority resulted in the proportion drawn from trust funds dropping to 83%, despite the actual amount increasing by $1 billion(92% in FY2017; see Table 2). The scale of the funding coming from these trust funds is not entirely obvious in DOT budget tables, because most of the funding from the Airport and Airway Trust Fund is categorized as discretionary budget authority and so is combined with the discretionary budget authority provided from the general fund.

|

Source |

FY2017 FY2018 Amount % of Total DOT Budget Authority |

% of Total DOT Budget Authority |

||||||

|

Airport and Airway Trust Fund |

|

|

||||||

| $15 | .6 |

| 18% |

Highway Trust Fund (including mass transit account)

| 55 | .1 |

| 72%

65% |

Subtotal, budget authority derived from trust funds

| 70 | .9 |

| 92% |

| 71 | .9 |

| 83% |

Other

| 6 | .1 |

| 8% |

| 14 | .2 |

| 17% |

Total new budget authority

| $77 | .1 |

| 100% |

| $86 | .2 |

| 100% |

Source: Calculated by CRS using information from Title I of Division K of P.L. 115-31, the Consolidated Appropriations Act, 2017.

Note: "Other" is the difference between the total new budget authority and the funding made available from trust funds. It does not equal the bill's discretionary funding level, because most of the funding and Title I of Division L of P.L. 115-141.

Note: "Other" is the amount of new budget authority for DOT drawn from the General Fund of the Treasury and offsetting receipts rather than from transportation trust funds. The figure is smaller than the bill's discretionary funding level because most of the funding appropriated from the Airport and Airway Trust Fund is categorized as discretionary budget authority. Numbers may not add due to rounding.

Approximately 80% of DOT's funding is distributed to states, local authorities, and Amtrak in the form of grants (see Table 3). Of DOT's largest sub-agencies, only the Federal Aviation Administration, which is responsible for the operation of the air traffic control system and employs roughly 83% of DOT's 56,252 employees, many as air traffic controllers, has a budget whose primary expenditure is not grants.

|

Account |

Amount FY2018 |

|

|

Office of the Secretary: National Infrastructure Improvement (TIGER) |

$500 |

$1,500 |

|

Federal Aviation Administration: Grants-in-Aid to Airports |

3,350 |

3,350 |

|

Federal Highway Administration: Federal-aid Highway Program |

43,569 47,055 |

|

|

Federal Motor Carrier Safety Administration: Motor Carrier Safety Grants |

367 562 |

|

|

National Highway Traffic Safety Administration: Highway Traffic Safety Grants |

585 |

598 |

|

Federal Railroad Administration: Grants to Amtrak & Other Rail Grants |

1, 2,804 |

|

|

Federal Transit Administration: Formula Grants |

9,734 |

9,733 |

|

Federal Transit Administration: Capital Investment Grants (New Starts & Small Starts) |

2,413 3,479 |

|

|

Federal Transit Administration: WMATA Capital & Preventive Maintenance Grants |

150 |

150 |

|

Maritime Administration: Assistance to Small Shipyards |

10 20 |

|

|

Pipeline and Hazardous Materials Safety Administration: Emergency Preparedness Grants |

28 28 |

|

|

Total Grant Accounts |

61,943 69,279 |

|

|

Total DOT Funding |

$77,070 $86,185 |

Source: Accounts and amounts taken from Comparative Statement of Budget Authority, H.Rept. 115-237 in the explanatory statement for Division L of P.L. 115-141.

Note: Amounts shown in this table represent totals for grant-making accounts, except that where administrative expenses were broken out in the source table (e.g., Federal Highway Administration), they have been subtracted from the account total.

Reauthorization of Air Transportation Programs

Since most DOT funding comes from trust funds whose revenues typically come from taxes, the periodic reauthorizations of the taxes supporting these trust funds, and the apportionment of the budget authority from those trust funds to DOT programs, are a significant aspect of DOT funding. The highway, transit, and rail programs are currently authorized through FY2020, but the authorization for the federal aviation programs iswas scheduled to expire on September 30, 2017at the end of FY2017; it was extended to the end of FY2018. Reauthorization of this program may affect both its structure and funding level.4

DOT Funding Trend

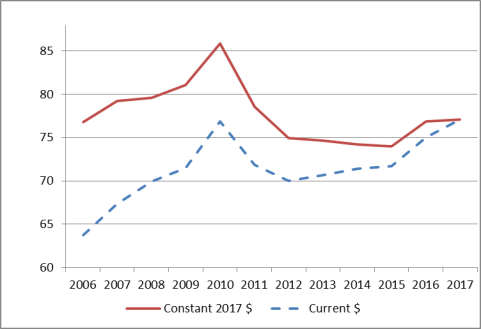

In current (nominal) dollars, DOT's nonemergency annual funding has risen from a recent low of $70 billion in FY2012 to $7786 billion in FY2017FY2018. However, adjusting for inflation tells a different story. DOT's inflation-adjusted funding peaked in FY2010 at $85.987.5 billion (in constant 20172018 dollars) and declined from that point until FY2015, then began rising again in FY2016 (see Figure 1). DOT's real funding, adjusted for inflation, was roughly the same in FY2016 and FY2017 as in FY2006; sincefrom FY2012-FY2017, DOT's inflation-adjusted funding has beenwas lower than in any year during the FY2007-FY2011 period.

|

Figure 1. DOT Funding Trend (FY2006- ( |

|

|

Source: Calculated by CRS based on figures in annual House THUD Appropriations committee reports. Current dollars are converted to constant dollars using the GDP (Chained) Price Index column in Table 10.1 (Gross Domestic Product and Deflators Used in the Historical Tables: 1940- Notes: Funding as shown in this chart equals discretionary appropriations plus limitations on obligations. It does not include emergency appropriations (for example, to repair storm damage) or rescissions of budget authority, rescissions of contract authority, and offsetting collections (which reduce the amount of discretionary budget authority shown as going to DOT without actually reducing the amount of funding available to DOT). |

DOT FY2018 Appropriations

Table 4 presents a selected account-by-account summary of FY2018 appropriations for DOT, compared to FY2017.

Table 4. Department of Transportation FY2017-FY2018 Detailed Budget Table

(in millions of current dollars)

|

Department of Transportation |

FY2017 Enacted |

FY2018 Request |

FY2018 House Reported |

FY2018 Senate Reported |

FY2018 Enacted |

||||||||||||||||||

|

Office of the Secretary (OST) |

|

|

|

|

|

||||||||||||||||||

|

Payments to air carriers (Essential Air Service)a |

|

|

|

|

|

||||||||||||||||||

|

National infrastructure investment (TIGER) |

|

|

|

|

|

||||||||||||||||||

|

Total, OST |

|

|

|

|

|

||||||||||||||||||

|

Federal Aviation Administration (FAA) |

|

|

|

|

|

||||||||||||||||||

|

Operations |

|

|

|

|

|

||||||||||||||||||

|

Facilities & equipment |

|

|

|

|

|

||||||||||||||||||

|

Research, engineering, |

|

|

|

|

|

||||||||||||||||||

|

Grants-in-aid for airports (Airport Improvement Program) (limitation on obligations) |

|

|

|

|

|

||||||||||||||||||

|

Total, FAA |

|

|

|

|

|

||||||||||||||||||

|

Federal Highway Administration (FHWA) |

|

|

|

|

|

||||||||||||||||||

|

|

|

Federal-Aid Highways: discretionary funding

|

Total, FHWA

44,005 |

|

|

|

|

|

|||||||||||||||

|

Federal Motor Carrier Safety Administration (FMCSA) |

|

|

|

|

|

||||||||||||||||||

|

Motor carrier safety operations and programs |

|

|

|

|

|

||||||||||||||||||

|

Motor carrier safety grants to states |

|

|

|

|

|

||||||||||||||||||

|

Total, FMCSA |

|

|

|

|

|

||||||||||||||||||

|

National Highway Traffic Safety Administration (NHTSA) |

|

|

|

|

|

||||||||||||||||||

|

Operations and research |

|

|

|

|

|

||||||||||||||||||

|

Highway traffic safety grants to states (limitation on obligations) |

|

|

|

|

Impaired driving/Highway-rail grade crossing safety

|

||||||||||||||||||

|

Total, NHTSA |

|

|

|

|

|

||||||||||||||||||

|

Federal Railroad Administration (FRA) |

|

|

|

|

|

||||||||||||||||||

|

Safety and operations |

|

|

|

|

|

||||||||||||||||||

|

Research and development |

|

|

|

|

|

||||||||||||||||||

|

Railroad |

|

|

|

|

|

||||||||||||||||||

|

Amtrak |

|

|

|

|

|

||||||||||||||||||

|

Northeast Corridor grants |

|

|

|

|

|

||||||||||||||||||

|

National Network |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

|

Consolidated rail infrastructure and safety improvements |

|

|

|

|

|

||||||||||||||||||

|

Federal-state partnership for State of Good Repair |

|

|

|

|

|

||||||||||||||||||

|

Restoration and enhancement grants |

|

|

|

|

|

||||||||||||||||||

|

Total, FRA |

|

|

|

|

|

||||||||||||||||||

|

|

|||||||||||||||||||||||

|

Formula grants (M) |

|

|

|

|

|

||||||||||||||||||

|

Technical assistance and training |

|

|

|

|

|

||||||||||||||||||

|

Capital Investment Grants (New Starts) |

|

|

|

|

|

Transit Infrastructure Grants

834 |

|

||||||||||||||||

|

Washington Metropolitan Area Transit Authority |

|

|

|

|

|

||||||||||||||||||

|

Total, FTA |

|

|

|

|

|

||||||||||||||||||

|

Maritime Administration (MARAD) |

|

|

|

|

|

||||||||||||||||||

|

Maritime Security Program |

|

|

|

|

|

||||||||||||||||||

|

Operations and training |

|

|

|

|

|

||||||||||||||||||

|

Assistance to small shipyards |

|

|

|

|

|

||||||||||||||||||

|

Ship disposal |

|

|

|

|

|

||||||||||||||||||

|

Maritime Guaranteed Loan Program |

|

|

|

|

|

||||||||||||||||||

|

Total, MARAD |

|

|

|

|

|

||||||||||||||||||

|

|

|||||||||||||||||||||||

|

Subtotal |

|

|

|

|

|

||||||||||||||||||

|

Offsetting user fees |

|

|

|

|

|

||||||||||||||||||

|

Emergency preparedness grants (M) |

|

|

|

|

|

||||||||||||||||||

|

Total, PHMSA |

|

|

|

|

|

||||||||||||||||||

|

Office of Inspector General |

|

|

|

|

|

||||||||||||||||||

|

Saint Lawrence Seaway Development Corporation |

|

|

|

|

|

||||||||||||||||||

|

|

|||||||||||||||||||||||

|

Appropriation (discretionary funding) |

|

|

|

|

|

||||||||||||||||||

|

Limitations on obligations (M) |

|

|

|

|

|

||||||||||||||||||

|

Subtotal—new funding |

|

|

|

|

|

||||||||||||||||||

|

Rescissions of discretionary funding |

|

|

|

|

|

||||||||||||||||||

|

Rescissions of contract authority |

|

|

|

|

|

||||||||||||||||||

|

Net new discretionary funding |

|

|

|

|

|

||||||||||||||||||

|

Net new budget authority |

|

|

|

|

|

||||||||||||||||||

Sources: Table prepared by CRS based on information in H.Rept. 115-237 and, S.Rept. 115-138, and the text and explanatory statement for Division L of P.L. 115-141. S.Rept. 115-138.

Notes: "M" stands for mandatory budget authority. Line items may not add up to the subtotals due to omission of some accounts. Subtotals and totals may differ from those in the source documents due to treatment of rescissions, offsetting collections, and other adjustments. The figures in this table reflect new budget authority made available for the fiscal year. For budgetary calculation purposes, the source documents may subtract rescissions of prior-year funding or contract authority, or offsetting collections, in calculating subtotals and totals.

a.

The Essential Air Service program receives an additional amount in mandatory budget authority; see discussion below.

b.

$3.35 billion in contract authority and $1 billion in discretionary budget authority.

c. Does not include $857 million in rescission of contract authority; the budgetary treatment of contract authority is such that a rescission reduces the appropriation level for accounting purposes but, in this case, does not reduce the funding made available for use.

Selected Issues

Highway Trust Fund Solvency

Virtually all federal highway funding and most federal transit funding comecomes from the Highway Trust Fund, whose revenues comescome largely from the federal motor fuels excise tax ("gas tax"). For several years, annual expenditures from the fund have exceeded revenues; for example, for FY2017FY2018, revenues and interest are projected to be approximately $41 billion, while authorized outlays are projected to be approximately $55 billion.554 billion, and this shortfall is expected to continue.4 Congress transferred about $143 billion, mostly from the general fund of the Treasury, to the Highway Trust Fund during the period FY2008-FY2016 to keep the trust fund solvent.65

One reason for the shortfall in the fund is that the federal gas tax has not been raised since 1993. The tax is a fixed amount assessed per gallon of fuel sold, not a percentage of the cost of the fuel sold: whetherWhether a gallon of gasfuel costs $1 or $4, the highway trust fund receives 18.3 cents for each gallon of gasoline and 24.3 cents for each gallon of diesel. Meanwhile, the value of the gas tax has been diminished by inflation (which has reduced the purchasing power of the revenue raised by the tax) and increasing automobile fuel efficiency (which reduces growth in gasoline sales as vehicles are able to travel farther on a gallon of fuel). The Congressional Budget Office (CBO) has forecast that gasoline consumption will be relatively flat through 2024, as continued increases in the fuel efficiency of the U.S. passenger fleet are projected to offset increases in the number of miles driven. Consequently, CBO expects Highway Trust Fund revenues of $39 billion to $41 billion annually from FY2018 to FY2027, well short of the annual level of projected expenditures from the fund.7

National Infrastructure Investment (BUILD/TIGER Grants)

7The Administration did not request any funding for TIGER grants for FY2018. The House committee likewise recommended no funding for FY2018, while the Senate committee recommended $550 million. The Senate bill also recommended that the portion of funding allocated to projects in rural areas be increased from 20% to 30%; the same change was included in the Senate-passed DOT appropriations bills in FY2016 and FY2017, but was not enacted. The enacted bill provided $1.5 billion for the program, increased the portion for projects in rural areas to 30%, and made planning an eligible expense. It also directed DOT to award the grants within 270 days of enactment.

The Transportation Investments Generating Economic Recovery (TIGER) grant program originated in the American Recovery and Reinvestment Act (P.L. 111-5), where it was called "national infrastructure investment" (as it has been in subsequent appropriations acts). It is a discretionary grant program intended to address two criticisms of the current structure of federal transportation funding:

- that virtually all of the funding is distributed to state and local governments, which select projects based on their individual priorities, making it difficult to fund projects that have national or regional impacts but whose costs fall largely on one or two states; and

- that most federal transportation funding is divided according to mode of transportation, making it difficult for projects in different modes to compete for funds on the basis of comparative benefit.

The TIGER program provides grants to projects of national, regional, or metropolitan area significance in various modes on a competitive basis, with recipients selected by DOT.8

Although the program is, by description, intended to fund projects of national, regional, and metropolitan area significance, in practice its funding has gone more toward projects of regional and metropolitan area significance. In large part this is a function of congressional intent, as Congress has directed that the funds be distributed equitably across geographic areas, between rural and urban areas, and among transportation modes, and has set relatively low minimum grant thresholds ($5 million for urban projects, $1 million for rural projects).

Congress has continued to support the TIGER program through annual DOT appropriations.9 It is heavily oversubscribed; for example, DOT announced that it received applications totaling $9.3 billion for the $500 million available for FY2016 grants.10

The U.S. Government Accountability Office (GAO) has reported that, while DOT has selection criteria for the TIGER grant program, it has sometimes awarded grants to lower-ranked projects while bypassing higher-ranked projects without explaining why it did so, raising questions about the integrity of the selection process.11 DOT has responded that while its project rankings are based on transportation-related criteria, such as safety and economic impact, it must sometimes select lower-ranking projects over higher-ranking ones to comply with other selection criteria established by Congress, such as geographic balance and a balance between rural and urban awards.12

CriticsSome critics argue that TIGER grants go disproportionately to urban areas. For, but for several years Congress has directed that at least 20% of TIGER funding should go to projects in rural areas; in recent years, the Senate has, which roughly equals the proportion of the U.S. population that lives in rural areas (19%, according to the 2010 Census13). In recent years, the Senate had pushed to increase that proportion to 30%. According to the 2010 Census, 19% of the U.S. population lives in rural areas.13

As Table 5 illustrates, the TIGER grant appropriation process has followed a pattern for several years, with the administrationObama Administration requesting as much as or more than Congress had previously provided; the House zeroing out the program or proposing a large cut; the Senate proposing an amount similar to the previously enactedprevious appropriation; and Congress agreeing on a final enacted amount similar to the previously enacted amount. The FY2018 appropriations process has changed the pattern slightly, in that the Trump Administration requested no funding for TIGER grants.

|

Budget Request |

House |

Senate |

Enacted |

||||||

|

FY2013 |

|

|

|

|

|||||

|

FY2014 |

|

|

|

|

|||||

|

FY2015 |

|

|

|

|

|||||

|

FY2016 |

|

|

|

|

|||||

|

FY2017 |

|

|

|

|

|||||

|

FY2018 |

|

|

|

|

Source: Committee reports accompanying Departments of Transportation, Housing and Urban Development, and Related Agencies appropriations acts, various years.

Note: Enacted figures do not reflect subsequent reductions due to sequester reductions or rescissions.

a.

Recommended by House Appropriations Committee.

b.

Recommended by Senate Appropriations Committee.

The FY2018 enacted legislation included significant increases in funding for infrastructure for aviation, highways, passenger rail, and transit, in some cases beyond the authorized levels, in other cases provided in newly created accounts.

Table 6. Selected Increases in Infrastructure Funding, FY2017-FY2018(millions of dollars)

Program

| FY2017 |

| FY2018 |

BUILD Transportation (TIGER) grants

| $500 |

| $1,500 |

FAA Discretionary Grants

| — |

| 1,000 |

FHWA Highway Infrastructure Programs Grants to States

| — |

| 2,525 |

FRA Grants (including Amtrak)

| 1,593 |

| 2,804 |

FTA Transit Infrastructure Grants

| — |

| 834 |

Source: Prepared by CRS based on text and explanatory statement for Division L of P.L. 115-141.

Notes: Selected accounts represent newly created accounts or accounts receiving percentage increases greater than 75%.

Essential Air Service14

The Essential Air Service program is funded through a combination of mandatory and discretionary budget authority. In addition to the annual discretionary appropriation, there is a mandatory annual authorization, estimated at $119 million for FY2018,15 financed by overflight fees collected from commercial airlines by FAA. These overflight fees apply to international flights that fly through U.S. airspace, but do not land in or take off from the United States. The fees are to be reasonably related to the costs of providing air traffic services to such flights.

As Table 67 shows, the Trump Administration requested no discretionary funding for the EAS program in FY2018, proposing to use only the available mandatory funding for the program; it estimated that $119 million in mandatory funding would be available in FY2018. That would result in a reduction of 56% ($153 million) from the total FY2017 appropriation. The House committee bill recommendsrecommended a $150 million discretionary appropriation, as was provided in FY2017; combined with the estimated mandatory funding, that would represent a 2.3% ($6 million) increase over FY2017. The Senate committee bill recommendsrecommended a $155 million discretionary appropriation; combined with the estimated mandatory funding, that would result in a 4.2% ($11 million) increase.

The enacted bill provided $155 million in discretionary funding, identical to the Senate bill; combined with an increase in the mandatory funding, EAS received a total of $286 million, a $22 million (8.7%) increase over FY2017.

Table 7|

FY2017 Enacted |

FY2018 Request |

|

FY2018 Senate-Reported |

FY2018 Enacted |

|||||||

|

Appropriation |

|

|

|

|

|

||||||

|

Mandatory supplement |

|

|

|

|

|

||||||

|

Total |

|

|

|

|

|

Source: H.Rept. 115-237, S.Rept. 115-138, the text and explanatory statement for Division L of P.L. 115-141, and S.Rept. 115-268. and S.Rept. 115-138.

Note: The House report gives a figure of $263 million for the FY2017 enacted level, with $113 million in mandatory funding, as does the DOT FY2018 Budget Estimate; the Senate report gives a figure of $250 million, with $100 million in mandatory funding.

The EAS program seeks to preserve commercial air service to small communities by subsidizing service that would otherwise be unprofitable. The cost of the program in real terms has doubled since FY2008, in part because route reductions by airlines resulted in new communities being added to the program (see Table 78). Congress made changes to the program in 2012, including allowing no new entrants,16 capping the per-passenger subsidy for a community at $1,000, limiting communities that are less than 210 miles from a hub airport to a maximum average subsidy per passenger of $200, and allowing smaller planes to be used for communities with few daily passengers.17

Table 78. Essential Air Service Program: Number of Communities and Annual Appropriations, FY2008-FY2017

|

2008 | 2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

||||||||||

|

# of EAS communities |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Budget (millions of current $) |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Budget (millions of constant 2017 $) |

|

|

|

|

|

|

|

|

|

|

Source: Prepared by CRS based on information from Office of the Secretary, U.S. Department of Transportation, FY2015 Budget Estimate, p. EAS/PAC -2; FY2014: H.Rept. 113-464, p. 12; FY2015: H.Rept. 114-129; FY2016: S.Rept. 114-243; 2017 number of EAS communities figurein 2017 and 2018 is approximate, from U.S. Department of Transportation, Essential Air Service, https://www.transportation.gov/policy/aviation-policy/small-community-rural-air-service/essential-air-service.

Note: Budget figures deflated using the "Total Non-Defense Outlays" column from Table 10.1—Gross Domestic Product and Deflators Used in the Historical Tables 1940-2022, from the Budget of the United States 2018, Historical Tables. NA = not available.

Supporters of the EAS program contend that preserving airline service to small communities was a commitment Congress made when it deregulated airline service in 1978, anticipating that airlines would reduce or eliminate service to many communities that were too small to make such service economically viable. Supporters also contend that subsidizing air service to smaller communities promotes economic development in rural areas. Critics of the program note that the subsidy cost per passenger is relatively high,18 that many of the airports in the program have very few passengers,19 and that some of the airports receiving EAS subsidies are little more than an hour's drive from major airports.

Positive Train Control

In 2008, Congress directed railroads to install positive train control (PTC) on certain segments of the national rail network by the end of 2015.20 PTC is a communications and signaling system that is capable of preventing incidents caused by train operator or dispatcher error.21 Freight railroads have reportedly spent billions of dollars thus far to meet this requirement, but most of the track required to have PTC installed was not in compliance at the end of 2015; in October 2015 Congress extended the deadline to the end of 2018—with an option for individual railroads to extend to 2020 with Federal Railroad Administration (FRA) approval.22

Congress provided $50 million in FY2010 and again in FY2016 for grants to railroads to help cover the expenses of installing PTC, and $199 million in FY2017 to help commuter railroads implement PTC. The Trump Administration's FY2018 budget request did not include any funding for the cost of PTC implementation, nor did the House or Senate Appropriations Committees recommend any funding for this purpose. The enacted FY2018 bill provided $250 million for PTC implementation under the Consolidated Rail Infrastructure and Safety Improvements grant program, and made up to $50 million of Amtrak's National Network grant available for PTC projects on state-supported routes where PTC is not required by law.

Railroad Rehabilitation and Infrastructure Financing (RRIF) Loan Program

The RRIF loan program provides direct loans and loan guarantees to state and local governments, government-sponsored entities, and railroads for rehabilitation or development of rail facilities and equipment. The program's resources are relatively lightly used; it is authorized to make up to $35 billion in loans, but has less than $5 billion outstanding, and has made only four loans since 2012. One of the factors that has been cited as reducing the attractiveness of the program is the requirement that loan recipients pay a credit risk premium to offset the risk of their defaulting on their loan. For the first time, the FY2018 appropriation act provided funding ($25 million) to subsidize the cost of the credit risk premium.

Amtrak and Intercity Passenger Rail Development

The Passenger Rail Reform and Investment Act of 2015 (Title XI of P.L. 114-94) reauthorized Amtrak while changing the structure of its federal grants: instead of getting separate grants for operating and capital expenses, it now receives separate grants for the Northeast Corridor and the rest of its national network. This act also authorized three new programs to make grants to states, public agencies, and rail carriers for intercity passenger rail development:

- Consolidated Rail Infrastructure and Safety Improvement Grants

- Federal-State Partnership for State of Good Repair Grants

- Restoration and Enhancement Grants

The Administration's FY2018 budget requested a total of $811 million for intercity passenger rail funding: $760 million for grants to Amtrak and $51 million for two of the new grant programs.

The House Appropriations Committee recommended $1.4 billion for Amtrak and a total of $525 million for two of the new grant programs.

The Senate committee recommended $1.6 billion for Amtrak and a total of $124 million for the three new grant programs (see Table 89). It specified that $41 million of the $124 million recommended for the grant programs could be used to initiate or restore intercity passenger rail services, and advised Amtrak and other stakeholders to seek that funding for restoration of Amtrak's Gulf Coast service, which was interrupted in 2007 and never fully restored. It also noted that funding under the Federal-State Partnership for State of Good Repair program could be used for Amtrak's Hudson Tunnel replacement project (without naming that project).

The final FY2018 act provided $1.9 billion for Amtrak, an increase of 30% ($447 million) over FY2017, and a total of $863 million for the new grant programs.

Table 9Table 8. Federal Intercity Passenger Rail Grant Program Funding, FY2017-FY2018

(in millions of dollars)

Source: Authorized level: Title XI of P.L. 114-94; Amtrak independent request: https://www.amtrak.com/ccurl/372/30/Amtrak-FY18-General-Legislative-Annual-Report-FINAL.pdf; funding: H.Rept. 115-237 and S.Rept. 115-138.

Notes: Amtrak submits a budget request directly to Congress each year, separate from DOT's request for Amtrak funding. NA ("not applicable"): these accounts are not included in Amtrak's independent budget request.

The $98 million provided for the three new intercity passenger rail grants in FY2017 was the first funding provided for intercity passenger rail (other than annual grants to Amtrak and the occasional grants for PTC implementation) since the 111th Congress (2009-2010), which provided $10.5 billion for DOT's high-speed and intercity passenger rail grant program. From FY2011 to FY2016, Congress provided no funding for intercity passenger rail development, and in FY2011 it rescinded $400 million that had been appropriated for that purpose but not yet obligated.

Federal Transit Administration Capital Investment Grants

The majority of the Federal Transit Administration's (FTA's) roughly $12 billion in funding is funneled to state and local transit agencies through several programs that distribute the funding by formula. Of the few transit grant programs that are discretionary (i.e., awarding funding to applicants selectively, usually on a competitive basis), the largest is the Capital Investment Grants program (often referred to as the New Starts program, as that is the largest and best known of its component grant programs). It funds new fixed-guideway transit lines23 and extensions to existing lines. The program has three components: New Starts funds capital projects with total costs over $300 million that are seeking more than $100 million in federal funding; Small Starts funds capital projects with total costs under $300 million that are seeking less than $100 million in federal funding; and Core Capacity grants are for projects that will increase the capacity of existing systems. There is also an Expedited Project Delivery Pilot, intended to provide funding for eight projects eligible for any of the three programs that require no more than a 25% federal share and are supported, in part, by a public-private partnership.

Grant funds for large projects are typically disbursed over a period of years. Much of the funding for this program each year is committed to projects already under construction with multiyear grant agreements signed in previous years.

For FY2018, the Trump Administration requested $1.2 billion for Capital Investment Grants, 50% ($1.323 billion) less than the $2.4 billion provided in FY2017. The Administration stated an intention to approve no new projects, only to provide funding to projects that had previously been approved for funding. The Administration request noted that there were "66 projects in the program seeking funding, more than at any time in the program's 30-year history—a clear indication of the intense demand from communities around the United States for new and expanded transit services."24

The House Committee on Appropriations recommended $1.8 billion, which is 42% ($521 million) more than requested but 27% ($660 million) below the FY2017 level. The House committee did not recommend funding for any new projects during FY2018, save for funding that appears to be provided for Amtrak's Hudson Tunnel project.

The Senate Committee on Appropriations recommended $2.1 billion, 73% ($901 million) more than requested but 12% ($280 million) below the FY2017 level.

|

Component |

FY2017 Enacted |

FY2018 Request |

FY2018 House Reported |

FY2018 Senate Reported |

FY2018 Enacted |

||||||

|

New Startsa |

|

|

|

|

|

||||||

|

With signed FFGA |

|

|

|

|

|

||||||

|

Anticipated to sign FFGA in FY2017 |

|

|

|

|

|

||||||

|

Small Starts |

|

|

|

|

|

||||||

|

Grants already awarded |

|

|

|

|

|

||||||

|

New grants |

|

|

|

|

|

||||||

|

Core Capacity |

|

|

|

|

|

||||||

|

With signed FFGA |

|

|

|

|

|

||||||

|

Anticipated to sign FFGA during |

|

|

|

|

|

||||||

|

Expedited Project Delivery Pilot |

|

|

|

|

|

||||||

|

Joint Public Transportation and Intercity Rail Projects |

|

|

|

|

|

||||||

|

Total |

|

|

|

|

|

||||||

|

Total Appropriation |

|

|

|

|

|

Source: U.S. House of Representatives, Consolidated Appropriations Act, 2017, Committee Print of the Committee on Appropriations on H.R. 244/P.L. 115-31 (Legislative Text and Explanatory Statement), https://www.gpo.gov/fdsys/pkg/CPRT-115HPRT25289/pdf/CPRT-115HPRT25289.pdf; U.S. Department of Transportation, Federal Transit Administration Budget Estimate for FY2018, pp. CIG 5-6; H.R. 3353 and H.Rept. 115-237; S. 1655 and S.Rept. 115-138.

Notes: NS = Not Specified. FFGA=Full Funding Grant Agreement. Typically, the total funding allocated to the component grant programs is slightly less than the total appropriation to allow for oversight costs (typically 1% of the total program appropriation, though that may include unused funds from previous years). In FY2017, the component funding totaled more than the appropriation due to $118 million in recaptured funding that Congress directed FTA to use for the program.

a.

The Administration request included $112 million for two New Starts projects whose status during FY2018 was uncertain at the time the request was submitted: the Caltrain Peninsula Corridor Electrification Project, the FFGA for which was planned to be signed during FY2017, and the Maryland National Capital Purple Line, the FFGA for which was under review due to litigation.

Perhaps due to concerns about whether the Administration would make use of the grant funding provided in excess of the requested amount, both the House and Senate committee bills included language directing DOT to carry out the Capital Investment Program as described in statute.

A New Starts grant, by statute, can be up to 80% of the net capital project cost. Since FY2002, DOT appropriations acts have included a provision directing FTA not to sign any full funding grant agreements for New Starts projects that would provide a federal share of more than 60%.25 The House-reported bill included a provision prohibiting grant agreements with a federal share greater than 50%. That provision was not included in the Senate-reported bill.

The enacted bill followed the House lead in reducing the federal share, with a provision prohibiting New Starts grant agreements with a federal share greater than 51%.Critics of lowering the federal share provided for New Starts projects note that the federal share for highway projects is typically 80%, and in some cases is higher. They contend that the higher federal share makes highway projects relatively more attractive than public transportation projects for communities considering how to address transportation problems. Advocates of this provision note that the demand for New Starts funding greatly exceeds the amount available, so requiring a higher local match allows FTA to support more projects with the available funding. They also assert that requiring a higher local match likely encourages communities to estimate the costs and benefits of proposed transit projects more carefully, reducing the risk of subsequent cost overruns and of project ridership falling short of expectations.

The Hudson Tunnels and Amtrak's Gateway Program

Among the challenges to funding transportation infrastructure is that most federal transportation funding is distributed by mode, and most of the funding is distributed to states by formula. There are grant programs reserved for highways, for public transportation, for rail, and for airport development, but sponsors of projects involving multiple modes may have difficulty amassing significant amounts of federal funding. And while Congress provides some $55 billion annually for surface transportation programs, the vast majority of that funding is automatically divided among the states, making it difficult for a state to accumulate the funding needed for a major project in addition to meeting its other needs. One project that is highlighting this situation is Amtrak's Gateway Program, and specifically the Hudson Tunnel replacement project.

Amtrak's Gateway Program is a set of projects intended to increase capacity and reliability of rail service between northern New Jersey and Manhattan, the most heavily used section of intercity and commuter rail track in the nation. The program would replace bridges, expand track capacity from two to four parallel tracks, and, most critically, add a new rail tunnel under the Hudson River. The existing tunnel, the only link connecting the Northeast Corridor from New Jersey to New York, is over a century old, was flooded with seawater during Hurricane Sandy, and is deteriorating. The estimated cost of the Gateway Program is at least $24 billion, and likely will increase as project planning advances;26 the estimated cost of just the new Hudson Tunnel is $11.1 billion.27

Since the new tunnel would carry both intercity and commuter rail traffic, it is eligible for DOT funding from both the intercity rail program and the public transportation Capital Investment Grants program. But other than the annual grants to keep Amtrak going, relatively little funding has been available in recent for intercity rail projects: the largest rail grant program in FY2017 was funded at $68 million. The Capital Investment Grants program has significantly more funding to award—$2.4 billion in FY2017—but competition for that funding is intense, and the largest grant awarded to a project in the past 10 years was $2.6 billion.28

In 2016, under the previousObama Administration, media reports indicated an agreement had been reached between DOT, Amtrak, and the states of New Jersey and New York to share the costs of building the new Hudson Tunnel, with one-third to be covered each by DOT/Amtrak, New Jersey/New Jersey Transit, and New York State. The Trump Administration's position on sharing the cost of the new tunnel is unknown. In any case, it would be up to Congress to provide the money.

The House Appropriations Committee did not mention the Gateway Program or Hudson Tunnel project in its FY2018 THUD committee report, nor did it provide a significant amount of additional funding to any grant program. The committee recommended zeroing out the TIGER Grant Program, which could be one source of money for the Hudson Tunnel project, and cutting funding to the Capital Investment Grants program, another potential source, by $660 million from its FY2017 level. But the committee report noted that its Capital Investment Grants program funding recommendation included $400 million for new projects that meet the criteria of 49 U.S.C. §5309(q): "joint public transportation and intercity passenger rail projects."

The Senate Appropriations Committee did not recommend any specific funding for the Hudson Tunnel replacement. It noted that FRA's Federal-State State of Good Repair grant program could be a source of funding for projects similar to those in the Gateway Program, and encouraged Amtrak to use the $358 million recommended for its Northeast Corridor account to continue its Gateway Project. The enacted bill did not mention the Gateway Program or Hudson Tunnel project. But it provided Amtrak almost $300 million more than Amtrak requested for its Northeast Corridor, and increased funding for FRA's State of Good Repair program from $25 million in FY2017 to $250 million for FY2018, as well as increased funding for the TIGER grant program and FTA's Capital Investment Grants program.

Grant to the Washington Metropolitan Area Transit Authority

The Passenger Rail Investment and Improvement Act of 2008 authorized $1.5 billion over 10 years in grants to the Washington Metropolitan Area Transit Authority (WMATA) for preventive maintenance and capital grants, to be matched by funding from the District of Columbia and the states of Maryland and Virginia. Under this agreement, Congress has provided $150 million to WMATA in each of the past nine years.

WMATA faces a number of difficulties. It is dealing with a backlog of maintenance needs due to inadequate maintenance investment over many years, and it has experienced several fatal incidents, most recently in January 2015. A number of other incidents have raised questions about the safety culture of the agency. An investigation that found numerous instances of mismanagement of federal funding led FTA to restrict WMATA's use of federal funds. An FTA audit of WMATA's safety practices in 2015 produced many recommendations for change, and in October 2015 FTA assumed oversight of WMATA's safety compliance practices from the Tri-State Oversight Committee, the agency created by the governments of the District of Columbia, Maryland, and Virginia to oversee WMATA safety performance. FTA continues to exercise safety oversight of WMATA, conducting inspections, leading accident investigations, and directing that federal funds received by WMATA are used to improve safety. In February 2017, FTA notified leaders of the three jurisdictions that it would withhold 5% of their FY2017 transit Urbanized Area formula funds until they meet the requirements to create a new State Safety Oversight Program to replace the Tri-State Oversight Committee.29 The jurisdictions passed legislation establishing a new safety oversight agency soon after, but the agency must be in operation before FTA will release the funding.30 The National Transportation Safety Board has recommended that oversight of WMATA's rail operations be assigned to FRA, which has a long history of safety enforcement, rather than FTA, which is primarily a grant management agency. However, Congress would have to act to give FRA authority to oversee WMATA, while FTA already has such authority.

For FY2018, the final year of the grant authorization, both the House and Senate Appropriations Committees recommended the full $150 million annual grant for WMATA. The Senate committee report expresses frustration at the slow progress WMATA has made in providing wireless service throughout its system, which Congress mandated in 2008. The Senate committee report also notes that the FY2018 grant is the final installment of the $1.5 billion funding commitment Congress made in 2008, but that WMATA's budget assumes that the annual funding will continue to be provided.

The enacted bill provided the $150 million, and made grants to WMATA contingent on improvements to its safety management system.Author Contact Information

Footnotes

| 1. |

This number, calculated from H.Rept. 115-237, may differ slightly from the figure in DOT budget documents because of variations in the treatment of offsetting collections, mandatory funding, rescissions, and other budgetary considerations. |

||

| 2. |

| ||

| 3. |

|

||

|

For more information, see CRS Report |

|||

|

Congressional Budget Office, "Projections of Highway Trust Fund Accounts—CBO's |

|||

|

Congressional Budget Office, "Approaches to Make Highway Spending More Productive," February 2016, p. 1, https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50150-Federal_Highway_Spending-OneCol.pdf. |

|||

|

Congressional Budget Office, "Projections of Highway Trust Fund Accounts—CBO's |

|||

| 7.

|

|

8.

In the spring of 2018 the Administration changed the name of the TIGER grant program to BUILD (Better Utilizing Investments to Leverage Development) Transportation grants. |

For more information, see DOT's |

| 9. |

Congress refers to the program as "National Infrastructure Investment" in appropriations acts. |

||

| 10. |

U.S. Department of Transportation, "U.S. Transportation Secretary Foxx Announces TIGER Awards Nearly $500 Million in Grants to Projects Focused on Safety and Economic Opportunity," July 29, 2016, https://www.transportation.gov/briefing-room/us-transportation-secretary-foxx-announces-tiger-awards-nearly-500-million-grants. |

||

| 11. |

U.S. Government Accountability Office, Surface Transportation: Actions Needed to Improve Documentation of Key Decisions in the TIGER Discretionary Grant Program, GAO-14-628R, May 28, 2014. |

||

| 12. |

Ibid., p. 6. |

||

| 13. |

U.S. Census Bureau, Frequently Asked Questions: "What percentage of the U.S. population is urban or rural?," https://ask.census.gov/faq.php?id=5000&faqId=5971. |

||

| 14. |

For more information about EAS, see CRS Report R44176, Essential Air Service (EAS), by [author name scrubbed]. |

||

| 15. |

The amount made available to the EAS program from the fees may exceed $100 million, if the fees provide sufficient revenue. |

||

| 16. |

This limitation does not apply to Alaska or Hawaii. Approximately 60 (34%) of the EAS communities are in Alaska; |

||

| 17. |

The program had previously required airlines to use 15-passenger aircraft at a minimum. |

||

| 18. |

To remain eligible for the program, a community's subsidy per passenger must not exceed $1,000. The per-passenger subsidy in FY2016 varied among communities, from $9 to $778. Information on EAS communities' subsidy per passenger is in Appendix A of CRS Report R44176, Essential Air Service (EAS), by [author name scrubbed]. |

||

| 19. |

In 2012, 27 EAS communities averaged fewer than 10 passengers per day. In 2012, Congress disqualified airports averaging fewer than 10 passengers per day unless they are more than 175 miles from the nearest hub airport: P.L. 112-95, Title IV, Subtitle B. One community lost service due to this requirement, while several communities have failed to reach the threshold but have been granted waivers. See CRS Report R44176, Essential Air Service (EAS), by [author name scrubbed]. |

||

| 20. | |||

| 21. |

See CRS Report R42637, Positive Train Control (PTC): Overview and Policy Issues, by [author name scrubbed]. |

||

| 22. |

Positive Train Control Enforcement and Implementation Act of 2015, §1302 of P.L. 114-73. |

||

| 23. |

Fixed-guideway refers to systems in which the vehicle travels on a fixed course; for example, subways and light rail. |

||

| 24. |

U.S. Department of Transportation, Federal Transit Administration FY2018 Budget Estimate, p. CIG – 9, https://www.transportation.gov/sites/dot.gov/files/docs/mission/budget/281181/fy-2018-cj-budget-final52417.pdf. |

||

| 25. |

There was no similar provision in the FY2017 THUD Appropriations Act or its explanatory statement, but the explanatory statement directed that language in the House and Senate Committee reports, unless contradicted in the final explanatory statement, should apply; the House Committee report included a provision prohibiting FFGAs where the federal share would be greater than 50%, while the Senate Committee report did not include a similar provision. |

||

| 26. |

The $24 billion estimate, announced in 2016, included an estimate of $7.7 billion for the new Hudson Tunnel and repair of the existing tunnel; the June 2017 estimate for the new tunnel and repair of the old tunnel is $13 billion, which could increase the overall program cost to $29 billion. Emma G. Fitzsimmons, "Amtrak Says New York Region's Rail Projects Could Cost Up to $23.9 Billion," New York Times, January 20, 2016. |

||

| 27. |

The rehabilitation of the existing tunnel is estimated to cost another $1.8 billion, for a total project cost of $13 billion; |

||

| 28. |

For the Long Island Rail Road's East Side Access project. New Jersey Transit's Access to the Region's Core Project, which would have included new tunnels under the Hudson River, was recommended for a $3.0 billion grant, but the project was subsequently canceled by New Jersey. |

||

| 29. | |||

| 30. |

Faiz Siddiqui, "Regional Leaders Aim to Launch Metro Safety Commission by End of Year," Washington Post, July 23, 2017, https://www.washingtonpost.com/local/trafficandcommuting/regional-leaders-target-end-of-year-to-launch-metro-safety-commission/2017/07/23/6aa6aabe-6d75-11e7-b9e2-2056e768a7e5_story.html?utm_term=.ac21d1796992. |