The Secure Rural Schools and Community Self-Determination Act: Background and Issues

Changes from June 6, 2017 to April 13, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Reauthorizing theThe Secure Rural Schools and Community Self-Determination Act of 2000

: Background and Issues

Contents

- Background

- Declining Revenue-Sharing Payments Leads to Enactment of SRS

- SRS and PILT

- Bureau of Land Management O&C and CBWR Revenue-Sharing Payments

- Payments in Lieu of Taxes (PILT) Program

- Revenue-Sharing Program Concerns and

Responses - Declining Timber Receipts

- Annually Fluctuating Payments

- Linkage

- Legislative History of the Secure Rural Schools and Community Self-Determination Act of 2000, as Amended

- FY2007 Reauthorization Enacted in the 110th Congress

- Four-Year Extension Through FY2011 Enacted in the 110th Congress

- Full Funding

- Calculated Payments

- Transition Payments

- Title II and Title III Activities

- Rolling Seven-Year Average for Calculating Revenue-Sharing Payment

- One-Year Extension Through FY2012 Enacted in the 112th Congress

- One-Year Extension Through FY2013 Enacted in the 113th Congress

- Two-Year Extension Through FY2015 Enacted in the 114th Congress

- Legislative Activity in the 115th Congress

- Legislative Issues

- Offsets for New Mandatory Spending

- Geographic Distribution of SRS and PILT Payments

- Lands Covered

- Basis for Compensation

- Issues

- Payment Stability

- Linkage

- Declining Timber Receipts

- Secure Rural Schools and Community Self-Determination Act of 2000

- SRS Payment Formula

- Payment Election

- Payment Allocations: Title I, Title II, and Title III

- Resource Advisory Committees (RACs)

- Payment Data and Analysis

- FY2017 and FY2018 Payments

- FY2019 and FY2020 Payments

- Sequestration

- Legislative Issues

- Payment Formula

- Lands Covered

- Geographic Distribution of SRS and PILT Payments

Source of Funds - Authorized and Required Uses of the Payments

- Reauthorization and Duration of the Programs

Figures

- Figure 1.

Forest Service Cut Volume and Cut Value - Figure 2. FS Total Payments and Estimated Payments

- Figure 3. PILT and Forest Service Payments, FY2015

Figure 4. Source and Distribution of FSFS and BLM Total Secure Rural Schools (SRS) Payments- Figure 2. FS and BLM Total Secure Rural Schools (SRS) Payments by Title

- Figure 3. Forest Service (FS) Payments and Estimated Payments

- Figure 4. FS and BLM Payments, FY2001-FY2018

- Figure 5. PILT, BLM, and FS Payments Made in FY2019

- Figure 6. Source and Distribution of Forest Service (FS) Payments

Tables

- Table 1. Secure Rural Schools (SRS) Legislative History

- Table 2. FS and BLM Total Secure Rural Schools (SRS) Payments, FY2001-FY2019

- Table 3. Secure Rural Schools (SRS) Title Allocations

- Table 4. Forest Service (FS) Payments

- Table 5. Bureau of Land Management (BLM) Payments

- Table 6. FS, BLM, and PILT Payments Made in FY2019, by State

Appendixes

Summary

Under federal law, state and local governments receive payments through various programs due to the presence of federally owned land within their jurisdictions. Some of these payment programs are based on the revenue generated from specific land uses and activities. For example, Congress has authorized payments to the counties containing national forests—managed by the Forest Service—based on the revenue generated from those lands. In addition, Congress has authorized the 18 counties in western Oregon containing the Oregon and California (O&C) lands and Coos Bay Wagon Road (CBWR) lands—managed by the Bureau of Land Management (BLM)—to also receive a paymentPayments

Tables

Summary

Counties containing federal lands often receive payments from the federal government based on the presence of such lands. Counties containing National Forest System lands and certain Bureau of Land Management (BLM) lands historically have received payments based on the revenue generated from those lands. based on the revenue generated from those lands.

Revenue-generating activities include timber sales, recreation, grazing permits, and land use rentals, among other activities; timber sales have been the largest historical source of revenue. Starting in the 1990s, however, federal timber sales began to decline substantially—by more than 90% in some areas—, which led to substantially reduced payments to the counties. ThusIn response, Congress enacted the Secure Rural Schools and Community Self-Determination Act of 2000 (SRS; P.L. 106-393) as a temporary, optional program of payments. SRS provided payments to counties based on historic rather than current revenues from land use activities, thus minimizing the effect of reduced revenue streams on those counties.

The last authorized SRS payment was distributed in FY2016. Authorization for SRS payments originally expired at the end of FY2006, but Congress extended the program through FY2015 with several reauthorizations, starting with a one-year reauthorization for FY2007 (P.L. 110-28). In 2008, the Emergency Economic Stabilization Act (P.L. 110-343) enacted a four-year extension to SRS authorization through FY2011, with declining payments, a modified formula, and transition payments for certain areas. In 2012, Congress enacted a one-year extension through FY2012 and amended the program to slow the decline in payment levels and to tighten requirements that counties select a payment option promptly (P.L. 112-141). In 2013, Congress again enacted a one-year extension through FY2013 (P.L. 113-40). In 2014, the 114th Congress enacted a two-year extension through FY2015 (P.L. 114-10). SRS payments are disbursed after the fiscal year ends, so the FY2015 SRS payment—the last authorized payment—was made in FY2016.

Each county's SRS payment is determined by a formula based on historic revenues, area of eligible federal lands, and county incomes. Because they are based on historic, rather than current, revenue, the SRS payments are not affected by any annual fluctuations in the revenue streams from the specified lands. The total SRS payment, however, declines by 5% annually. The program is funded through mandatory spending, with funds coming first from agency receipts and then from the Treasury. SRS payments are disbursed after the fiscal year ends, so the FY2020 SRS payment—the last authorized payment—are to be made in FY2021. The SRS payment is divided into three parts, each named after its respective title in the authorizing law and each with different requirements for how the funds may be used. Title I payments are to be used in the same manner as the revenue-sharing payment (restricted to roads and schools purposes for the Forest Service payment but available for a broader range of governmental purposes for the BLM payment). Title II payments are retained by the agency to be used for projects on or to benefit the federal lands within the county. Title III payments are to be used for specified county purposes. There are different requirements for how a county may allocate its payment among the three titles, and those requirements vary depending on the total payment amount the county is set to receive. The bulk of the payment, however, is allocated to the Title I payment (around 80%-85% of the payment for most counties). Congress has continued the allocations of the total payment among titles set by each county in FY2013. With the expiration of SRS, county payments returned to a revenue-based system and are significantly lower than previous years' payments. The 115th, starting in FY2001. Congress has since extended the payments for every year except FY2016. Counties with eligible lands (national forests, O&C, and CBWR lands) can opt to receive either an SRS payment or a revenue-sharing payment, although most counties have elected to receive the SRS payment. Because a larger subset of counties are eligible, the bulk of the SRS payment goes to the lands managed by the Forest Service.

Congressional debates over reauthorization have considered the basis, level, and distribution of payments and interaction with other compensation programs (e.g., the Payments in Lieu of Taxes program); the authorized and required uses of the payments; the duration of any changes (temporary or permanent); and the source of funds (receipts, the Treasury, or other revenue source and level of compensation to counties (historical, tax equivalency, etc.); the source of funds (receipts, a new tax or other revenue source, etc.); the authorized and required uses of the payments; interaction with other compensation programs (notably Payments in Lieu of Taxes); and the duration of any changes (temporary or permanent). In addition, legislation with mandatory spending, —such as SRS, —raises policy questions about congressional control of appropriations. Current budget rules to restrain deficit spending typically impose a procedural barrier to such legislation, generally requiring offsets by additional receipts or reductions in other spending.

UnderUnder federal law, state and local governments are compensatedreceive payments through various programs due to the presence of federal landsfederally owned land within their borders. Federally owned lands cannot be taxed by state or local governments but may create demand for services from state or local entities, such as fire protection, police cooperation, or longer roads to skirt the property. Counties with national forest lands or certain Bureau of Land Management (BLM) lands have historically received a percentage of agency revenues, primarily from timber sales. In the 1990s, timber sales declined substantially from the historic levels in the late 1980s—by more than 90% in some areas—which had led to substantially reduced payments to the counties. Congress enacted the Secure Rural Schools and Community Self-Determination Act of 2000 (SRS)1 to provide a temporary, optional system to supplant the revenue-sharing programs for the national forests managed by the Forest Service (FS) in the Department of Agriculture and for certain public lands administered by the BLM in the Department of the Interior.

The law authorizing these payments (SRS) originally expired at the end of FY2006 but was extended an additional nine years through several reauthorizations:

- The 109th Congress considered the program, but did not enact reauthorizing legislation.

- The 110th Congress extended the payments for one year through FY2007, and it then enacted legislation to reauthorize the program for four years with declining payments and to modify the formula for allocating the payments.

- The 112th Congress extended the program for one more year through FY2012 and amended the program to slow the decline in payments.

- The 113th Congress again approved a one-year extension, reauthorizing the program through FY2013, but did not reauthorize the program for FY2014 prior to its expiration.

- After FS and BLM distributed the revenue-sharing payment for FY2014, the 114th Congress reauthorized SRS for two years (through FY2015) and required the agencies to issue the FY2014 SRS payment within 45 days of enactment.

- SRS expired at the end of FY2015; payments were disbursed after the fiscal year ended, so the FY2015 payment was made in FY2016.

This report provides background information on FS and BLM revenue-sharing and SRS payments and describes the issues that Congress has debated and may continue to debate in the 115th Congress.

Background

In 1908, Congress directed FS to begin paying 25% of its gross receipts to states for use on roads and schools in the counties where national forests are located.2 Receipts come from sales, leases, rentals, or other fees for using national forest lands or resources (e.g., timber sales, recreation fees, and communication site leases). This mandatory spending program was enacted to compensate local governments for the tax-exempt status of the national forests, but the statutory compensation rate (10% of gross receipts in 1906 and 1907; 25% of gross receipts since) was not discussed in the 1906-1908 debates. This revenue- or receipt-sharing program is called Forest Service Payments to States (also referred to as the 1908 payment, or the 25% payment). The states have no discretion in assigning the funds to the county. FS determines the amount to be allocated to each county based on the national forest acreage in each county and provides that amount to the state. The states cannot retain any of the funds; they must be passed through to local governmental entities for use at the county level (but not necessarily to county governments themselves). Each state must spend the funds on road and school programs, and state law sets forth how the payments are to be allocated between road and school projects. The state laws differ widely, generally ranging from 30% to 100% for school programs, with a few states providing substantial local discretion on the split.

Congress has also enacted numerous programs to share receipts from BLM lands for various types of resource use and from various classes of land. One program—the Oregon and California (O&C) payments—accounts for more than 95% of BLM receipt-sharing.3 The O&C payments are made to the counties in western Oregon containing the revested Oregon and California grant lands that were returned to federal ownership for failure of the states to fulfill the terms of the grant. The O&C counties receive 50% of the receipts from these lands. These mandatory payments go directly to the counties for any local governmental purposes. Concerns about, and proposals to alter, FS revenue-sharing payments also typically include the O&C payments, because both are substantial payments derived largely from timber receipts.

Declining Revenue-Sharing Payments Leads to Enactment of SRS

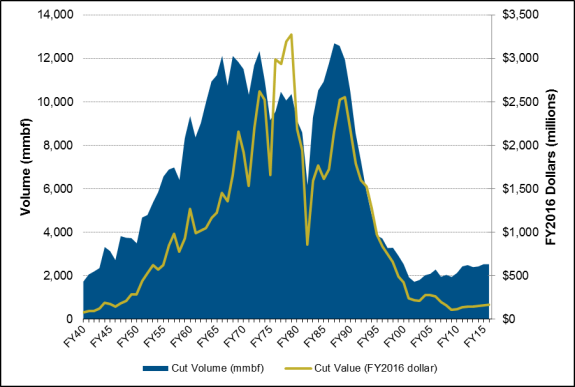

Timber sale revenue—and, consequently, revenue-sharing payments—peaked in the late 1980s. The FY1989 FS 25% payments totaled $362 million, while O&C payments totaled $110 million. FS and O&C receipts have declined substantially since FY1989, largely because of declines in federal timber sales (see Figure 1) and other factors. The decline began in the Pacific Northwest, owing to a combination of forest management policies and practices, efforts to protect northern spotted owl habitat, increased planning and procedural requirements, changing public preferences, economic and industry factors, and other developments. Provisions in the Omnibus Budget Reconciliation Act of 1993 authorized FS and BLM to make so-called owl payments to several counties in Washington, Oregon, and California.4 These payments were set at a declining percentage of the average revenue-sharing payments made to those counties between FY1986 and FY1990.5

As federal timber sales—and revenue-sharing payments—began to decline nationwide, Congress replaced the regional owl payments with the nationwide SRS program in 2000. Similar to the owl payments for the Pacific Northwest, the SRS program was an optional payment that counties could elect to receive instead of receiving the 25% receipt-sharing payment. As originally enacted, the SRS payment was calculated as an average of the three highest payments made to counties between FY1986 and FY1999. With the program extension in FY2008, the SRS payment calculation was modified to also consider county population and per capita income, and it established an annually declining payment level.

(FY2016 dollars) |

|

Note: mmbf = million board feet. |

Payments under SRS (see Table 1) were substantial and significantly greater than the receipt-sharing payments. The FS payment rose from $194 million in FY2000 (all figures in nominal dollars) to a $346 million SRS payment in FY2001.6 For the initial six years SRS was authorized, the average FS SRS payment was $360 million annually, more than $130 million above the average annual FS payment for the six years prior to the enactment of SRS (FY1995-FY2000). Over the life of the program, the FS SRS payments have averaged $337 million and the BLM SRS payments have averaged $78 million per year.7

|

FS Payment |

BLM Payment |

Total SRS Payment |

|||||

|

Title I and Title III |

Title II |

FS Total |

Title I and Title III |

Title II |

BLM Total |

||

|

FY2001 |

$346.2 |

$24.9 |

$371.1 |

$102.0 |

$7.7 |

$109.7 |

$480.8 |

|

FY2002 |

343.5 |

30.4 |

373.9 |

102.3 |

8.3 |

110.6 |

484.5 |

|

FY2003 |

356.2 |

32.6 |

388.8 |

103.3 |

8.6 |

111.9 |

500.7 |

|

FY2004 |

360.8 |

33.0 |

393.9 |

104.5 |

8.8 |

113.3 |

507.2 |

|

FY2005 |

371.3 |

33.6 |

404.9 |

107.1 |

8.9 |

115.9 |

520.9 |

|

FY2006 |

376.7 |

32.3 |

409.0 |

108.9 |

8.3 |

117.1 |

526.1 |

|

FY2007 |

381.6 |

26.5 |

408.1 |

111.9 |

5.0 |

116.9 |

525.0 |

|

FY2008 |

422.5 |

45.1 |

467.6 |

96.7 |

8.7 |

105.4 |

573.0 |

|

FY2009 |

466.1 |

51.8 |

517.9 |

87.2 |

7.7 |

94.9 |

612.8 |

|

FY2010 |

373.8 |

42.0 |

415.8 |

78.0 |

7.5 |

85.5 |

501.3 |

|

FY2011 |

291.2 |

30.7 |

321.9 |

36.3 |

3.7 |

40.0 |

361.9 |

|

FY2012 |

274.0 |

31.9 |

305.9 |

34.3 |

3.7 |

38.0 |

343.9 |

|

FY2013 |

259.0 |

30.0 |

289.0 |

36.3 |

3.3 |

39.6 |

328.6 |

|

FY2014 |

245.6 |

28.3 |

273.9 |

35.1 |

3.2 |

38.3 |

312.2 |

|

FY2015 |

234.2 |

26.8 |

261.0 |

32.6 |

3.0 |

35.6 |

296.6 |

Sources: FS FY2001-FY2005, FY2007 data: FS legislative affairs office. FS FY2006, FY2008-FY2015 data: annual Forest Service report, All Service Receipts: Title I, II, and III Region Summary (ASR-18-3), available from http://www.fs.usda.gov/main/pts/home. BLM data from annual Official Payments Made to Counties reports, available from http://www.blm.gov/or/rac/ctypaypayments.php.

Notes: SRS Title I and Title III payments are disbursed to the counties for specified purposes, while SRS Title II payments are retained by the agency to be used for projects in the counties. Data do not include FS revenue-sharing payments or other miscellaneous county payments authorized through various FS payment programs not discussed in this report, such as payments from land utilization projects.

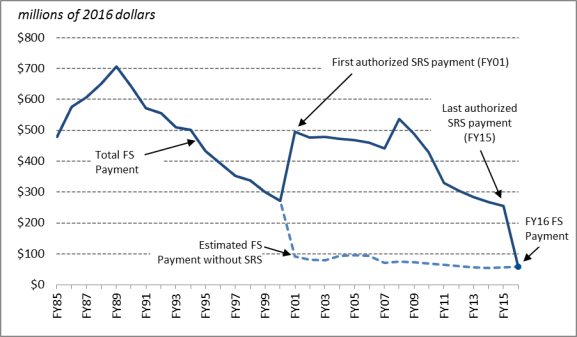

Figure 2 shows a comparison of the FS actual payments to estimates of what the payments would have been had SRS not been enacted. To illustrate, FS receipts (for revenue-sharing purposes) in FY2012 totaled $230 million.8 Without SRS, the revenue-sharing payment would have been around $58 million.9 With SRS, the payments totaled $274 million. Similarly, BLM timber receipts from western Oregon (which includes some non-O&C lands) totaled $28 million in FY2012.10 Without SRS, the 50% revenue-sharing payment would have been approximately $14 million, compared to the $34 million payment under SRS.11

SRS expired—temporarily—on October 1, 2014. With the expiration of SRS, the FY2014 payments were again to be based on a percentage of agency receipts (the rolling seven-year average of 25% for national forest lands and of 50% for O&C lands). As nonexempt, nondefense mandatory spending, the payments were subject to the annual sequestration of budgetary authority.12 The post-sequester revenue-sharing payment for FS was $50 million and $18 million for BLM. These payments were distributed in February 2015.

P.L. 114-10 was enacted on April 16, 2015. It included provisions for a "make-up" FY2014 SRS payment, and it authorized an FY2015 SRS payment.13 The FY2014 payment was set at 95% of the FY2013 payment level, but for counties that opted to receive an SRS payment, the FY2014 payment was offset by the revenue-sharing payment already distributed. In effect, the counties received their FY2014 SRS payment in two installments. The total FS SRS payment for FY2014 was $274 million; for BLM it was $38 million. Because the payments were authorized after the sequestration amount was calculated for both FY2015 and FY2016, the payments were not subject to sequestration either year.

|

|

Notes: The data presented include payments under the 25% Payments to States and SRS programs (all three titles) but do not include miscellaneous county payments authorized through various other FS payment programs not discussed in this report, such as payments from land utilization projects. |

SRS expired on October 1, 2016, without congressional reauthorization. Thus, counties received revenue-sharing payments for FY2016 (issued in early 2017). The post-sequester revenue-sharing payment was $54 million for the Forest Service and $19 million for BLM (see Figure 2).14 If SRS payments had been authorized, the FS payment to counties would have been approximately $248 million and the BLM payment would have been approximately $34 million.

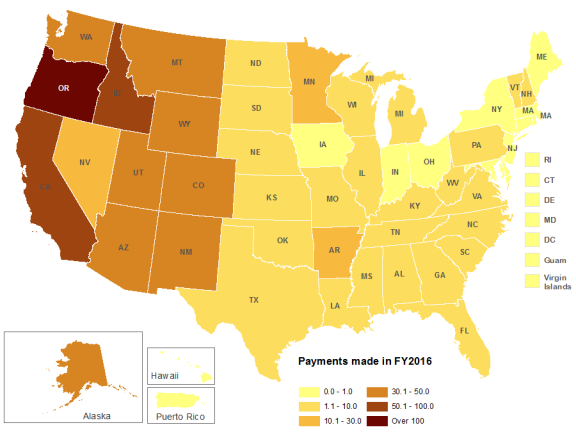

SRS and PILT

In addition to the FS and BLM receipt-sharing programs, Congress has enacted other programs to compensate for the presence of federal land. The most widely applicable program, administered by the Department of the Interior, is the Payments in Lieu of Taxes (PILT) Program.15 PILT payments to counties are calculated in dollars per acre of federal land and are based on eligible federal lands, as specified in statute. The eligible lands include national forests and O&C lands in each county (but total amounts are restricted in counties with very low populations). PILT payments are reduced (to a minimum payment per acre) by other payment programs—including FS Payments to States but not including BLM's O&C payments—so increases in FS payments may decrease a county's payments under PILT (and vice versa). This helps to explain why FY2012 PILT payments to Colorado were double the PILT payments to Oregon, even though there is more federal land in Oregon (32.6 million acres) than in Colorado (23.8 million acres).

Before 2008, annual appropriations were necessary to fund PILT. When the appropriations were less than the authorized total payments, each county received its calculated pro rata share of the appropriation. However, the 2008 and 2012 SRS amendments also made PILT payments mandatory spending for FY2008-FY2013, and the Agricultural Act of 2014 (P.L. 113-79) extended mandatory spending to FY2014. Thus, for those fiscal years, each county received 100% of its authorized PILT payment.16 For FY2015, Congress provided $439.5 million for PILT payments, 97% of the total authorized payment of $451.5 million. The FY2015 payment was provided through both mandatory spending and discretionary appropriations. For FY2016, Congress provided $452 million in discretionary appropriations (P.L. 114-113) for PILT payments, 98% of the total authorized payment. For FY2017, Congress provided $465 million in discretionary appropriations (P.L. 115-31) for PILT payments, which are expected to be paid in June 2017. The amount paid to counties is likely to be near the total authorized funding amount.

Revenue-Sharing Program Concerns and Responses

Congress, counties receiving SRS funding, and other observers have raised three principal concerns about FS and O&C revenue-sharing programs.17 These are the decline in FS and O&C receipts due to the decline in timber sales, the annual uncertainty about payment amounts, and the linkage between timber revenue and county payments.

Declining Timber Receipts

A primary concern about the revenue-sharing programs is the effect of declining revenue on counties. National forest receipts (subject to sharing) declined from their peak of $1.44 billion in FY1989 to a low of $182.3 million in FY2009—a drop of 87%. In FY2015, national forest receipts totaled $254.5 million. In some local areas, the decline was steeper; for example, payments to the eastern Oregon counties containing the Ochoco National Forest fell from $10 million in FY1991 to $309,000 in FY1998—a decline of 97% in seven years. The extent of declining revenues in individual counties is varied, ranging from minimal to substantial. Some counties in Oregon, for example, have begun exploring alternative options to generating revenue to replace the loss of timber receipts and declining SRS payments.

Annually Fluctuating Payments

Another concern has been annual fluctuations in the payments based on revenue generated. Even in areas with modest declines or increases in recent decades, payments have varied widely from year to year. From FY1985 to FY2000, the payments from each national forest fluctuated an average of nearly 30% annually—that is, on average, a county's payment in any year was likely to be nearly 30% higher or lower than its payment the preceding year. Such wide annual fluctuations imposed serious budgeting uncertainties on the counties.

Linkage

A third, longer-term concern is referred to as linkage. Some observers have noted that, because the counties receive a portion of receipts, they are rewarded for advocating receipt-generating activities (principally timber sales) and for opposing management decisions that might reduce or constrain such activities (e.g., designating wilderness areas or protecting commercial, tribal, or sport fish harvests). County governments have often been allied with the timber industry, and opposed to efforts of environmental and other interest groups to reduce timber harvests, in debates over FS management and budget decisions.

Timber sales as the source of funds was deemed appropriate in 1906 when the FS program was created (albeit, prior to creation of federal income taxes). Some interests support retaining the linkage between county compensation and agency receipts; local support for receipt-generating activities is seen as appropriate by these constituencies, because such activities usually also provide local employment and income, especially in rural areas where unemployment is often high. Others assert that ending the linkage is important so that local government officials can be independent in supporting whatever management decisions benefit their locality, rather than having financial incentives to support particular decisions.

Legislative History of the Secure Rural Schools and Community Self-Determination Act of 2000, as Amended

In 2000, Congress enacted the Secure Rural Schools and Community Self-Determination Act (SRS)18 after extensive debates and several different bill versions. (See Appendix B for an overview of historic proposals to change the revenue-sharing system prior to the enactment of SRS.)

The act established an optional alternative payment system for FY2001-FY2006. At each county's discretion, the states with FS land and counties with O&C land received either the regular receipt-sharing payments or the SRS payment. Each county's SRS payment was calculated as 100% of the average of the three highest payments between FY1986 and FY1999. Title I of the act directed that counties receiving an SRS payment less than $100,000 under the alternative system could distribute the entire payment to roads and schools in the same manner as the 25% payments. However, counties receiving over $100,000 under the alternative system were required to spend 15%-20% of the payment on either (1) federal land projects proposed by local resource advisory committees and approved by the appropriate Secretary (Secretary of the Interior or Secretary of Agriculture) if the projects met specified criteria, including compliance with all applicable laws and regulations and with resource management and other plans (identified in Title II of the act) or (2) certain county programs19 (specified in Title III of the act). Funds needed to achieve the full payment were mandatory spending, and came first from agency receipts (excluding deposits to special accounts and trust funds) and then from "any amounts in the Treasury not otherwise appropriated."20

SRS was originally enacted as a temporary program, expiring after payments were made for FY2006. However, SRS has been reauthorized five times, extending the payments an additional nine years (see Table 2). The following sections describe each reauthorization process and any enacted program modifications.

|

Statute |

Duration |

Authorized Payment Level |

Major Changes |

|

FY2001-FY2006 |

Determined by formula; average annual payment was $500 million nationally |

Established program |

|

|

FY2007 |

$525 million |

$425 million was paid from discretionary appropriations |

|

|

FY2008-FY2011 |

|

Established a declining full funding amount; modified payment calculation formula; phased out transition payments; modified payment allocations; 25% payment based on rolling 7-year average |

|

|

FY2012 |

95% of FY2011 level ($344 million) |

Modified the declining full funding amount |

|

|

FY2013 |

95% of FY2012 level ($329 million) |

None |

|

|

FY2014-FY2015 |

95% of previous year funding ($312 million for FY2014, ~$297 million for FY2015) |

None |

Source: CRS.

Notes: Except for the FY2007 payment, Congress authorized the payments as mandatory spending, with a portion of the payment derived from agency revenue and the balance from the General Treasury.

a. The transition payments for specific states authorized in P.L. 110-343 for FY2008-FY2010 resulted in the total payment amount exceeding the "full funding" amount defined in the act.

FY2007 Reauthorization Enacted in the 110th Congress

SRS expired at the end of FY2006, with final payments made in FY2007. Legislation to extend the program was considered in the 110th Congress; various bills would have extended the program for one or seven years. The Emergency Supplemental Appropriations Act for FY200721 extended SRS for one year, but the bill was vetoed by President George W. Bush. However, Congress passed and the President signed a new version of the Emergency Supplemental Appropriations for FY200722 which included a one-year extension of SRS payments. P.L. 110-28 authorized payments of $100 million from receipts and $425 million from discretionary appropriations, to "be made, to the maximum extent practicable, in the same amounts, for the same purposes, and in the same manner as were made to States and counties in 2006 under that Act."23 Thus, preliminary FY2007 payments were made at the end of September 2007, with final payments made at the end of December 2007.

Four-Year Extension Through FY2011 Enacted in the 110th Congress

In October 2008, Congress passed the Emergency Economic Stabilization Act (P.L. 110-343),24 which extended SRS payments for four years (through FY2011) and made several changes to the program. Changes included providing "full funding" that declined over four years; altering the basis for calculating payments; providing transition payments for certain states; and modifying the use of SRS funds for Title II and Title III activities.25 In addition, Section 601(b) modified the original FS 25% payment program by basing the payment on the average revenue generated over the preceding seven years. These provisions are discussed in more detail below.

Full Funding

The act defined full funding for SRS in P.L. 110-343, Section 3(11).26 For FY2008, full funding was defined as $500 million; for FY2009-FY2011, full funding was 90% of the previous year's funding. However, total payments exceeded the full funding amount in the first two years: payments under SRS totaled $572.9 million in FY2008 and $612.8 million in FY2009. This occurred because the calculated payments (discussed below) are based on full funding, as defined in the bill, but the act also authorized transition payments (discussed below) in lieu of the calculated payments in eight states. Since the transition payments exceeded the calculated payments for those states, the total payments were higher than the full funding amount.

Calculated Payments

SRS payments to each state (for FS lands) or county (for O&C lands) differed significantly from the payments made under the original SRS; Table A-1 shows the dollars and share of total SRS payments in each state in FY2006 and FY2009. Title I payments were based on historic revenue-sharing payments (like SRS as originally enacted), but modified based on each county's share of federal land and relative income level. The revised payment calculations required multiple steps:

- Step 1. Determine the three highest revenue-sharing payments between FY1986 and FY1999 for each eligible county, and calculate the average of the three.27

- Step 2. Calculate the proportion of these payments in each county (divide each county's three-highest average [Step 1] by the total of three-highest average in all eligible counties, with separate calculations for FS lands and O&C lands).

- Step 3. Calculate the proportion of FS and O&C lands in each eligible county (divide each county's FS and O&C acreage by the total FS and O&C acreage in all eligible counties, with separate calculations for FS lands and O&C lands).

- Step 4. Average these two proportions (add the payment proportion [Step 2] and the acreage proportion [Step 3] and divide by 2, with separate calculations for FS lands and O&C lands). This is the base share for counties with FS lands and the 50% base share for counties with O&C lands.

- Step 5. Calculate each county's income adjustment by dividing the per capita personal income in each county by the median per capita personal income in all eligible counties.

- Step 6. Adjust each county's base share [Step 4] by its relative income (divide each county's base share or 50% base share by its income adjustment [Step 5]).

- Step 7. Calculate each county's adjusted share or 50% adjusted share as the county's proportion of its base share adjusted by its relative income [Step 6] from the total adjusted shares in all eligible counties (divide each county's result from Step 6 by the total for all eligible counties [FS and O&C combined]).

In essence, the new formula differed from the original SRS by basing half the payments on historic revenues and half on proportion of FS and O&C land, with an adjustment based on relative county income. This was done because of the concentration of payments under the original SRS to Oregon, Washington, and California (more than 75% of payments in FY2006; see Table A-1). Several counties opted out of the amended SRS system, while others opted in, because of the altered allocation. For example, in FY2006 100% of the payments to Pennsylvania were under SRS, but in FY2009 only 54% of the payments to Pennsylvania were under SRS. Conversely, in FY2006 none of the payments to New Hampshire were under SRS, but in FY2009, 44% of the payments to New Hampshire were under SRS.

In addition, the act set a full payment amount allocated among all counties that chose to participate in the program (eligible counties). Thus, the fewer counties that participated (i.e., the more that opted for the revenue-sharing payment programs), the more each participating county received.

Transition Payments

jurisdictions. Some of these payment programs are based on the revenue generated from specific land uses and activities. For example, Congress has authorized payments to the counties containing national forests—managed by the Forest Service—based on the revenue generated from those lands. In addition, Congress has authorized the 18 counties in western Oregon containing the Oregon and California (O&C) lands and Coos Bay Wagon Road (CBWR) lands—managed by the Bureau of Land Management (BLM)—to also receive a payment based on the revenue generated from those lands.

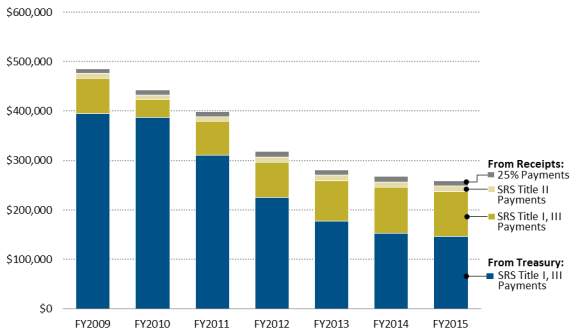

Revenue-generating activities include timber sales, recreation, grazing permits, and land use rentals, among other activities; timber sales have been the largest historical source of revenue. Starting in the 1990s, however, federal timber sales began to decline substantially, which led to substantially reduced payments to the counties. In response, Congress enacted the Secure Rural Schools and Community Self-Determination Act of 2000 (SRS; P.L. 106-393) as a temporary, optional program of payments, starting in FY2001. Congress has since extended the payments for every year except FY2016. Counties with eligible lands (national forests, O&C, and CBWR lands) can opt to receive either an SRS payment or a revenue-sharing payment, although most counties have elected to receive the SRS payment. Because a larger subset of counties are eligible, the bulk of the SRS payment goes to the lands managed by the Forest Service. Each county's SRS payment is determined by a formula based on historic revenues, area of eligible federal lands, and county incomes. Because they are based on historic, rather than current, revenue, the SRS payments are not affected by any annual fluctuations in the revenue streams from the specified lands. The total SRS payment, however, declines by 5% annually. The program is funded through mandatory spending, with funds coming first from agency receipts and then from the Treasury. SRS payments are disbursed after the fiscal year ends, so the FY2020 SRS payment—the last authorized payment—are to be made in FY2021. The SRS payment is divided into three parts, each named after its respective title in the authorizing law and each with different requirements for how the funds may be used. Title I payments are to be used in the same manner as the revenue-sharing payment (restricted to roads and schools purposes for the Forest Service payment but available for a broader range of governmental purposes for the BLM payment). Title II payments are retained by the agency to be used for projects on or to benefit the federal lands within the county. Title III payments are to be used for specified county purposes. There are different requirements for how a county may allocate its payment among the three titles, and those requirements vary depending on the total payment amount the county is set to receive. The bulk of the payment, however, is allocated to the Title I payment (around 80%-85% of the payment for most counties). Congress has continued the allocations of the total payment among titles set by each county in FY2013. When SRS payments temporarily expired for FY2016, county payments returned to the revenue-based system and were significantly lower than the payments received under SRS. With the pending expiration of SRS after the FY2020 payment, county payments are set to return to the revenue-based system. Congress may consider several options to address county payments, including reauthorizing SRS (with or without modifications), implementing other legislative proposals to address the county payments, and taking no action, among others. Congressional debates over reauthorization have considered the basis, level, and distribution of payments and interaction with other compensation programs (e.g., the Payments in Lieu of Taxes program); the authorized and required uses of the payments; the duration of any changes (temporary or permanent); and the source of funds (receipts, the Treasury, or other revenue source). In addition, legislation with mandatory spending—such as SRS—raises policy questions about congressional control of appropriations. Current budget rules to restrain deficit spending typically impose a procedural barrier to such legislation, generally requiring offsets by additional receipts or reductions in other spending. Under federal law, local governments are compensated through various programs due to the presence of federal lands within their borders. Federally-owned lands cannot be taxed, but may create demand for services from state or local entities, such as fire protection, police cooperation, or longer roads to skirt the property. Many of the compensation programs are based on revenue generated from specific land uses and activities (referred to as revenue-sharing programs throughout this report). Counties containing national forests managed by the Forest Service (FS) have historically received a percentage of agency revenues. Similarly, counties containing the Oregon and California (O&C) and Coos Bay Wagon Road (CBWR) lands, managed by the Bureau of Land Management (BLM), also have received a payment based on agency revenues. For many decades, the primary source of revenue from those lands was the sale of timber.1 In the 1990s, timber sales declined substantially from the historic levels in the 1980s—by more than 90% in some areas—which led to substantially reduced payments to the counties. In response, Congress enacted the Secure Rural Schools and Community Self-Determination Act of 2000 (SRS) to provide a temporary, optional system to supplant the FS and BLM revenue-sharing programs.2 The authorization for the SRS payments originally expired at the end of FY2006, but Congress extended the payments an additional 13 years—through FY2020, with a one-year lapse in the authorization for FY2016—through several reauthorizations. SRS is set to expire after the FY2020 payments are made, after which county payments are to return to a revenue-based system. This report provides background information on FS and BLM revenue-sharing payments and a brief overview of a related payment program—the Payments in Lieu of Taxes (PILT) program.3 Because the revenue-sharing, SRS, and PILT payments interact with each other in varying ways, proposals to amend the revenue-sharing programs or SRS have often included modifications to the PILT program as well. This report then provides on overview of the SRS payments and a discussion of some of the legislative issues facing Congress when considering these payment programs. Congress has authorized several different revenue-sharing payments for the counties containing lands managed by the FS.4 SRS affects one of those payments—the payments authorized under the Act of May 23, 1908, referred to as the "25 Percent Payments" in this report. The other payments (e.g., Payments to Counties for the national grasslands and Special Act Payments) are much narrower in scope and application and, consequently, much smaller.5 These payments are sometimes included in FS revenue-sharing payment totals, but they are not affected by the SRS payments. Congress first directed the FS to begin revenue-sharing in appropriations laws for 1906 and 1907. For those years, the requirement was for the FS to pay 10% of its gross receipts per year to states for use on roads and schools in the counties in which the national forests are located. In 1908, Congress raised the payment to 25% of gross receipts and permanently authorized the 25 Percent Payments as mandatory spending.6 The compensation rate remained at 25% of gross receipts annually for the next 100 years, until it was changed in 2008 to 25% of average gross receipts over the previous 7 years—essentially a 7-year rolling average of receipts.7 Receipts come from eligible sales, leases, rentals, or other fees for using national forest lands or resources (e.g., timber sales, recreation fees, and communication site leases), although Congress has designated some activities exempt from the revenue-sharing requirement.8 Because the payments are based on the average annual revenue generated during a seven-year period, the payment amounts cannot be calculated—and thus payments cannot be made—until after the most recent fiscal year in each period is completed (for example, payments reflecting the annual average for FY2014-FY2020 are to be made in FY2021). The 25 Percent Payments are sometimes referred to as the Payments to States program because the FS first sends the payment to the states.9 The states have no discretion in assigning the funds to the appropriate county, however. FS determines the amount of the total state payment to be allocated to each county based on each county's national forest acreage and provides that amount to the state. The states cannot retain any of the funds; the funds must be passed through to local governmental entities for use at the county level (but not necessarily to county governments themselves).10 Each state must spend the funds on road and school programs, and state law sets forth how the payments are to be allocated between road and school projects. The state laws differ widely, generally ranging from 30% to 100% for school programs, with a few states providing substantial local discretion on the split. Congress has also enacted revenue-sharing programs for BLM lands for various types of resource use, including the Oregon and California (O&C) payments and Coos Bay Wagon Road (CBWR) payments.11 The O&C payments are made to the 18 counties in western Oregon containing the revested Oregon and California grant lands, which are lands that were returned to federal ownership for failure of the state to fulfill the terms of the grant. The O&C counties receive 50% of the receipts from these lands, and the funds may be used for any local governmental purposes.12 The CBWR lands are located in two of the same counties in western Oregon that also contain O&C lands. A portion of the revenue generated from the CBWR lands also must be paid to the two counties, and those funds may be used for schools, roads, bridges, and highways.13 The O&C and CBWR payments are mandatory payments that are paid directly to the counties. The CBWR and O&C lands and payments are often grouped together, and in this report "O&C" refers to both, unless otherwise specified. In addition to the FS and BLM revenue-sharing programs, Congress has enacted other programs to compensate for the presence of federal land. The most widely applicable program, administered by the Department of the Interior, is the Payments in Lieu of Taxes (PILT) Program.14 PILT payments to counties are calculated in dollars per acre of federal land and are based on eligible federal lands, as specified in statute (the total payment amounts are restricted in counties with very low populations). The eligible lands include national forests and O&C lands, among others, in each county. PILT payments are reduced (to a minimum payment per acre) by other payment programs as specified in statute.15 The PILT payments are reduced by the FS payments but not by the O&C payments. This means that the PILT payment for counties containing national forests is affected by the FS payment (either revenue-sharing or SRS), but the PILT payment for counties containing O&C lands is not similarly affected. This also means that decreases in FS payments may increase a county's payments under PILT in the following year (and vice versa), although the difference is rarely proportionate. Proposals to amend the revenue-sharing programs or SRS have often included modifications to the PILT program. Prior to the enactment of SRS, Congress, counties containing FS and O&C lands, and other observers raised three principal concerns about FS and O&C revenue-sharing programs,16 which were payment stability and the annual uncertainty about payment amounts; the linkage between timber revenue and county payments; and the decline in FS and O&C receipts due to the decline in timber sales. SRS addresses some of these concerns, but they may again be at issue when SRS expires. One concern about the FS and O&C revenue-sharing payments was that payments would fluctuate annually based on the revenue received in the previous year. Even in areas with modest declines or increases in revenue, payments have varied widely from year to year. For example, from FY1985 to FY2000, the payments from each national forest fluctuated an average of nearly 30% annually—that is, on average, a county's payment in any year was likely to be nearly 30% higher or lower than its payment the preceding year. Such wide annual fluctuations imposed serious budgeting uncertainties on the counties. The concern over annual fluctuations led to Congress changing the compensation rate to a rolling seven-year average of receipts in 2008.17 Thus, payments increase more slowly than in the past when and where national forest receipts are rising but decline more slowly when and where receipts are falling. The extent to which this provides more stability for the counties is not clear. Since this change has been enacted, most counties have opted to receive an SRS payment instead of the revenue-sharing payment, except for the one year when the SRS payments were not authorized. Relatedly, however, the expiration and reauthorization of the SRS payments over the past few years has introduced a different kind of budgeting uncertainty for the counties, discussed further in the "Reauthorization and Duration of the Programs" section of this report. A longer-term concern is referred to as linkage. Some observers noted that because the counties received a portion of receipts, they were financially rewarded for advocating receipt-generating activities (principally timber sales) and for opposing management decisions that might reduce or constrain such activities, thus reducing the direct financial benefits from receipts (e.g., designating wilderness areas or protecting commercial, tribal, or sport fish harvests). Some interests support retaining the linkage between county compensation and agency receipts because such activities usually also provide local employment and income, especially in rural areas where unemployment is often high. Others assert that ending the linkage is important so that the direct financial incentive for maximizing receipts would be removed as one of the factors for local government officials to consider in their decisionmaking regarding use of the lands for activities other than timber sales.18 A primary concern about the FS 25 Percent Payments and O&C payments was the effect of declining timber sale revenue on counties. National forest receipts (subject to the 25% sharing) declined from their peak of $3.0 billion in FY1989 to $664.3 million in FY1999, in inflation-adjusted FY2019 dollars.19 The decline was primarily due to declining receipts from decreasing timber production. For example, FS harvested 12.0 billion board feet of timber in FY1989 (at a value of $2.72 billion in FY2019 dollars); in FY1999, FS harvested 2.9 billion board feet (at a value of $525.8 million in FY2019 dollars).20 The decline in timber sales began in the Pacific Northwest but eventually was experienced nationwide, owing to a combination of changing forest management policies and practices, increased planning and procedural requirements, changing public preferences, economic and industry factors, and other developments. BLM experienced a similar trend in receipts over the same time period. Consequently, the revenue-sharing payments to counties also declined. For example, the FY1989 FS 25 Percent Payments totaled $751.4 million (FY2019 dollars).21 By FY1993, the payment was $540.6 million (FY2019 dollars).22 Similar to the decline in timber receipts, the decline in the revenue-sharing payments also began in the Pacific Northwest. For example, payments to the counties in Oregon containing national forests decreased by 20% from FY1989 to FY1993, and payments to the counties containing the O&C lands decreased by 28%.23 In California, FS payments to counties decreased by 30% over that same time frame, and in Washington, FS payments decreased by 35%. The extent of declining revenues in individual counties within those states varied, ranging from minimal to substantial (and often was a function of the amount of applicable federal land located within the county). In 1993, Congress authorized FS and BLM to make "safety-net payments" to several counties in the Pacific Northwest, including in Oregon, California, and Washington.24 These payments were set at a declining percentage of the average revenue-sharing payments made to those counties between FY1986 and FY1990.25 As federal timber sales—and revenue-sharing payments—began to decline nationwide, however, Congress replaced the regional safety-net payments with the nationwide SRS program starting in FY2001. In 2000, Congress enacted the Secure Rural Schools and Community Self-Determination Act (SRS) after extensive debates and several different bill versions.26 The act established an optional alternative to the revenue-sharing payments for FS and O&C lands, starting with the FY2001 payment. Each county with FS or O&C land could choose to receive either the regular revenue-sharing payments or the SRS payment. Statute (Date Enacted) Duration Authorized Payment Level Major Changes P.L. 106-393 (10/30/00) FY2001-FY2006 Determined by formula; average annual payment was around $500 million total Established program P.L. 110-28 §5401 (05/25/07) FY2007 $525 million $425 million was paid from discretionary appropriations P.L. 110-343 §601 (10/03/08) FY2008-FY2011 Established an annual declining full funding amount (-10%); modified payment calculation formula; phased out transition payments; modified payment title allocations; 25% payment based on rolling seven-year average P.L. 112-141 §100101 (07/06/12) FY2012 95% of FY2011 level ($344 million) Modified the declining full funding amount to -5% annually P.L. 113-40 §10 (10/02/13) FY2013 95% of FY2012 level ($329 million) None P.L. 114-10 §524 (04/16/15) FY2014-FY2015 95% of previous year funding ($312 million for FY2014, $297 million for FY2015) None P.L. 115-141 Division O, §401 (03/23/18) FY2017-FY2018 95% of FY2015 level ($281 million for FY2017, $268 million for FY2018) Modified payment allocations P.L. 116-94 Division H, Title III (12/20/19) FY2019-FY2020 95% of the previous year funding (~$254 million estimated for FY2019, ~$241 million estimated for FY2020) None Source: Congressional Research Service (CRS). The SRS payment is divided into three parts, based on three of the titles in the authorizing law. Each county can allocate the payment among the three titles, with different requirements depending on the amount a county was set to receive. (nominal dollars in millions) FS BLM TOTAL SRS FS BLM TOTAL SRS FY2001 $371.1 $109.7 $480.8 FY2011 $321.9 $40.0 $361.9 FY2002 373.9 110.6 484.5 FY2012 305.9 38.0 343.9 FY2003 388.8 111.9 500.7 FY2013 289.0 39.6 328.6 FY2004 393.9 113.3 507.2 FY2014 273.9 38.3 312.2 FY2005 404.9 115.9 520.9 FY2015 261.0 35.6 296.6 FY2006 409.0 117.1 526.1 — — — FY2007 408.1 116.9 525.0 FY2017 249.3 281.5 FY2008 517.9 105.4 623.3 FY2018 237.5 30.1 267.6 FY2009 467.6 94.9 562.4 FY2019 225.8 FY2010 415.8 85.5 501.3 — — — — Notes: FS = Forest Service; BLM = Bureau of Land Management. Totals may not add due to rounding.

(FY2001-FY2018) Notes: FS = Forest Service; BLM = Bureau of Land Management. When SRS was first enacted, each county's payment was calculated as the average of the three highest revenue-sharing payments received by the county between FY1986 and FY1999. The total authorized payment for FY2001-FY2006 was the sum of the payments calculated for each participating county for each year. When the program was reauthorized in FY2008, however, Congress modified the program in several ways, including by establishing a new payment formula and specifying the total authorized payment level. The payment formula is still based on historic revenue-sharing payments, but it also takes into account each county's share of federal land and relative income level. Under the modified formula, the total SRS payment level—defined as full funding—is set at $500 million for FY2008, and this full funding amount declines annually (originally by 10%, later changed to 5%).31 The full funding amount is allocated among all counties that elect to receive an SRS payment in lieu of the revenue-sharing payment (eligible counties). Thus, the fewer counties that participate (i.e., the more that opt for the revenue-sharing payment programs rather than SRS), the more each eligible county receives. Each eligible county's payment is calculated using multiple steps: In essence, the new formula differed from the original SRS formula by basing half the payment on relative historic revenue and half on relative proportion of FS and O&C land, with an adjustment based on relative county income. This was done because the majority of payments under the original SRS went to Oregon, Washington, and California (more than 65% of payments in FY2006). Because of the altered allocation, several counties opted out of the amended SRS system, and others opted in. FY2008-FY2010 Transition Payments Initially, each county could elect to receive the revenue-sharing payment or the SRS payment and could transmit that election to the respective Governor, who transmitted the elections to the appropriate Secretary (for FS, the Secretary of Agriculture; for BLM, the Secretary of the Interior).34 Although the election was good for two years, a county could opt to receive an SRS payment one year and the revenue-sharing payment the following year.35 However, the authority to make such an election expired at the end of FY2013, and an extension has not been included in the three reauthorizations that since have been enacted. Those counties that opted to receive an SRS payment in FY2013 have continued to receive an SRS payment (for those years that payments are authorized). Counties that opted to receive a revenue-sharing payment in FY2013 continue to receive the revenue-sharing payment and have not had the opportunity to opt in to SRS. Most (90%) counties have elected to receive the SRS payment.

(FY2001-FY2018) Notes: FS = Forest Service; BLM = Bureau of Land Management. Regardless of the allocation, however, the bulk of each county's payment is allocated to Title I payments, and those funds are to be used in the same manner as the revenue-sharing payment (for roads and schools purposes for the FS payment; schools, roads, bridges, and highways for the CBWR lands; or any governmental purpose for the O&C lands). The Title II payment is not made to the county, but is retained by the agency to be used for projects on the federal lands within the county and supported by local Resource Advisory Committees (RACs; see "Resource Advisory Committees (RACs)" for further information). The Title III payment is made to the county, and the funds are to be used for specified county projects, such as community wildfire preparedness planning and to reimburse county expenditures for emergency services related to the federal lands.36 The authority to initiate projects under Title II or Title III expires on September 30, 2022; project funds not obligated by September 30, 2023, are to be returned to the Treasury.37 The authority for RACs to initiate projects and to obligate Title II funds had expired at the end of FY2013 and FY2014, respectively, but has been reauthorized and extended in each of the three previous SRS reauthorizations. SRS Payment Use of Funds Allocation Requirements Title I Secure Payments Same as specified in the revenue-sharing laws; for roads and school purposes for counties containing national forests, or for any governmental purpose for O&C lands. (16 U.S.C. §7112d(1)(A)) 80%-85%, except counties with minor distributions (less than $100,000) may allocate up to 100% Title II Special Projects on Federal Lands The authority to initiate projects expires at the end of FY2022; the authority to obligate funds expires at the end of FY2023. (16 U.S.C. §§7121-7128) 0%-20% Title III County Funds The authority to initiate projects expires at the end of FY2022; the authority to obligate funds expires at the end of FY2023. (16 U.S.C. §§7141-7144) 0%-20% for all other counties Source: CRS, compiled from 16 U.S.C. §§7101-7153. Notes: The authorized uses and allocation requirements are as of the FY2019 reauthorization (P.L. 116-94, Division H, Title III). The allocation requirements are codified at 16 U.S.C. §7112d(1). Counties may also allocate up to 20% of the payment to be returned to the Treasury (16 U.S.C. §§7112(d)(1)(B)(iii), 7112(d)(1)C(iii)). In the original SRS authorization, counties with minor distributions (less than $100,000 in annual payments) could allocate 100% of the payment to Title I purposes. Counties receiving more than $100,000 in annual payments, however, could allocate only 80%-85% of their payment to Title I. The remaining 15%-20% of the payment could be allocated to Title II or Title III purposes, or the funds could be returned to the Treasury. The allocation requirements were changed, however, in the FY2008 reauthorization.38 Starting in FY2008, counties with modest distributions (annual payments between $100,000 and $350,000) could continue to allocate any portion of the remaining 15%-20% to Title II or Title III, as previously authorized. Counties with distributions above $350,000 were limited to allocating up to 7% of the payment to Title III. (Counties with minor distributions could continue to allocate 100% of the payment to Title I.) The legislative text was changed in the FY2017 reauthorization by defining counties with major distributions (payments more than $350,000 annually), but this did not result in any substantive changes to the allocation system.39 In the previous three reauthorizations, however, Congress has continued the payment allocations the counties made for the FY2013 payment. This means that counties have had the same payment allocations since that time and have not had the option to make any changes. SRS authorized both FS and BLM to establish RACs to improve collaborative relationships and to provide recommendations for Title II projects.40 Both agencies had established advisory committees for various purposes prior to the enactment of SRS. For instance, BLM's preexisting advisory councils in Oregon are charged with administering the duties of the RACs as established by SRS.41 RACs also must operate in accordance with the provisions of the Federal Advisory Committee Act.42 Pursuant to SRS, each unit of eligible federal land has access to a RAC, although the Secretary concerned may combine RACs as needed. For example, a single RAC may cover multiple national forests, or a single RAC may cover part of a national forest while other RACs cover the rest.43 RACs generally must consist of 15 members appointed by the respective Secretary and representing a broad and balanced range of specified community interests (i.e., 5 members each from user interests, environmental interests, and the general public). A majority of the members must be present for a meeting to achieve a quorum, and a majority of the members representing each community interest must agree for a project to be approved and for project funds to be obligated. Because many of the RACs have been unable to meet the membership or project agreement requirements, they have been unable to approve projects. In some cases, the funds were returned to the Treasury because they were not obligated before the authority to obligate funds expired or was reauthorized. For example, over $9 million of Title II funds were returned to the Treasury at the end of FY2014.44 However, the Agriculture Improvement Act of 2018 (the 2018 farm bill) authorized the Secretary concerned to reduce the membership requirement to nine members if there are not enough qualified candidates.45 In addition, the 2018 farm bill established a pilot program in Montana and Arizona to allow the Secretary concerned to name a designee to appoint RAC members through FY2023 (rather than requiring the Secretary to make the appointment).46 In any given year, a combination of different FS and BLM payments may be authorized and made. Some of these payments are made entirely to counties (e.g., the FS 25 Percent Payments), whereas the agencies retain a portion of the SRS payment. Because the agency, type of payment, and payment recipient vary by year, it may sometimes be unclear which data are being reported. This is particularly an issue for the FS payment because even when SRS payments are authorized, some counties may still receive a 25 Percent Payment. This is less of an issue for the BLM payment, however, because all 18 eligible counties have elected to receive the SRS payment. Payment Terminology The following definitions reflect how the different payments are defined and referred to in this report (note that other sources may use different terms or report the data differently). For the payments in which both Forest Service (FS) and Bureau of Land Management (BLM) lands are applicable, the appropriate agency will be specified in the text. BLM payment reflects the payments made to the counties containing the Oregon and California (O&C) and Coos Bay Wagon Road (CBWR) lands as authorized for that year. For years prior to FY1993, this was the respective revenue-sharing payment; starting in FY1993, this was the BLM safety-net payment. For years starting in FY2001, however, this generally refers to the BLM Secure Rural Schools and Community Self-Determination Act (SRS) Title I and Title II payments. BLM total payment includes the BLM payment plus the SRS Title II payment retained by the agency. FS 25 Percent Payments are the revenue-sharing payments authorized through the Act of May 23, 1908. Data for the 25 Percent Payments may also include the Special Act Payments as specified, such as the Payments to Minnesota Counties. For the years FY1993 through FY2000, the data for the 25 Percent Payments also includes the FS safety-net payments. FS payment reflects the payments authorized to be made to eligible counties for that year. Prior to FY2001, this includes the FS 25 Percent Payment and the FS safety-net payment. Starting in FY2001, this includes the FS revenue-sharing payment plus the SRS Title I and Title II payments, except in FY2016, when SRS payments were not authorized. FS total payment includes the FS county payment plus the SRS Title II payment retained by the agency. Revenue-sharing payment for the FS includes the 25 Percent Payments. For the BLM, this includes the O&C and CBWR payments. Safety-net payment includes payments made from FY1993 to FY2000 to certain counties in Washington, Oregon, and California for both FS and BLM (for Oregon, only BLM). SRS Title I, II, or III payment reflects the payment made pursuant to one or more of the SRS titles, as specified in the text. SRS total payment includes the sum of the Title I, Title II, and Title III payments. (nominal dollars in millions) Secure Rural Schools (SRS) Title I Title II Title III Total FY2001 $15.6 $311.7 $24.9 $34.5 $371.1 $386.7 $361.8 FY2002 17.7 313.7 30.4 29.8 373.9 391.6 361.2 FY2003 11.2 326.6 32.6 29.5 388.8 400.0 367.3 FY2004 11.0 330.4 33.0 30.4 393.9 404.8 371.8 FY2005 8.8 340.0 33.6 31.3 404.9 413.7 380.0 FY2006 8.6 343.2 32.3 33.5 409.0 417.6 385.3 FY2007 8.1 345.0 26.5 36.6 408.1 416.2 389.7 FY2008 11.8 439.8 51.8 26.3 517.9 529.7 477.9 FY2009 15.9 397.5 45.1 25.0 467.6 483.5 438.4 FY2010 15.9 353.4 42.0 20.4 415.8 431.7 389.7 FY2011 16.4 276.3 30.7 15.0 321.9 338.3 307.7 FY2012 17.4 259.9 31.9 14.1 305.9 323.3 291.4 FY2013 17.2 245.8 29.9 13.2 289.0 306.2 276.3 FY2014 17.2 233.0 28.3 12.6 273.9 291.0 262.7 FY2015 17.4 222.1 26.8 12.1 261.0 278.4 251.6 FY2016 64.4 0.0 0.0 0.0 0.0 64.4 64.4 FY2017 18.4 212.2 25.5 11.5 249.3 267.7 242.1 FY2018 18.3 202.2 24.4 11.0 237.5 255.8 231.5 FY2019 18.8 192.3 23.2 10.4 225.8 244.6 221.4 Notes: Totals may not add due to rounding. (nominal dollars in millions) Secure Rural Schools (SRS) SRS Total Title I Title II Title III FY2001 $— $93.2 $7.7 $8.8 $109.7 $102.0 FY2002 — 94.0 8.3 8.3 110.6 102.3 FY2003 — 95.1 8.6 8.2 111.9 103.3 FY2004 — 96.3 8.8 8.2 113.3 104.5 FY2005 — 98.6 8.9 8.5 115.9 107.1 FY2006 — 99.5 8.3 9.3 117.1 108.9 FY2007 — 99.3 5.0 12.5 116.9 111.9 FY2008 — 89.6 8.7 7.1 105.4 96.7 FY2009 — 80.6 7.7 6.5 94.9 87.2 FY2010 — 72.7 7.5 5.4 85.5 78.0 FY2011 — 34.0 3.7 2.3 40.0 36.3 FY2012 — 32.3 3.7 2.0 38.0 34.3 FY2013 — 33.7 3.3 2.6 39.6 36.3 FY2014 — 32.5 3.2 2.5 38.3 35.1 FY2015 — 30.2 3.0 2.3 35.6 32.6 FY2016 0.0 0.0 0.0 0.0 20.5 FY2017 1.2 0.9 31.3 FY2018 — 25.6 2.5 2.0 30.1 27.6 Notes: Totals may not add due to independent rounding. As of the date of publication of this report, BLM has not released data on its FY2019 payments. O&C = Oregon and California; CBWR = Coos Bay Wagon Road.

Because SRS payments were not authorized for FY2016, the counties received a revenue-sharing payment of $84.9 million ($64.4 million for FS; $20.5 million for BLM).58 Had SRS been authorized, the SRS payment would have been $254.7 million (95% of the FY2015 payment). When SRS payments were reauthorized for FY2017, the full funding amount was set at 95% of the FY2015 payment amount. SRS payments were reauthorized for FY2017 and FY2018 in the Stephen Sepp Wildfire Suppression Funding and Forest Management Activities Act, enacted as Division O of the Consolidated Appropriations Act, 2018 (P.L. 115-141, commonly referred to as the FY2018 omnibus).60 The reauthorization was signed into law on March 23, 2018, after the FS and BLM had distributed the FY2017 revenue-sharing payments to the states and counties. Because the revenue-sharing payment had already been distributed for the year, the reauthorization included provisions for a "make-up" FY2017 SRS payment.61 This make-up payment was set at 95% of the FY2015 SRS payment level, since there had been no payment for FY2016 on which to base or calculate the annual decline. The counties received a payment that was the difference between the revenue-sharing payment they already received and their authorized SRS payment. In effect, the counties received their FY2017 SRS payment in two installments. The FS SRS payment (Title I and III) was $223.7 million for FY2017, and the payment was $213.2 million for FY2018.62 BLM does not officially include the $18.5 million revenue-sharing payment made prior to the reauthorization of the SRS payment for FY2017 as part of the total SRS payment for that year. Instead, BLM reports the FY2017 SRS total payment to be $14.0 million.63 This is a departure from how the FY2014 SRS payment was reported, which was also reauthorized after the revenue-sharing payment had been disbursed. For consistency purposes in this report, the revenue-sharing payment will be included in the Title I payment. Thus, the BLM SRS payment was $31.3 million for FY2017 and was $27.6 million for FY2018.64 Combined, the FS and BLM SRS payment was $255.0 million in FY2017 and $240.8 million in FY2018.65 SRS payments were reauthorized for FY2019 and FY2020 in the Further Consolidated Appropriations Act, FY2020 (P.L. 116-94, Division H, Title III). The reauthorization also extended the deadlines for the authority to initiate projects under Title II or Title III but did not include any other changes to the program or the payments.66 Those counties that opted to receive an SRS payment for FY2013 are to automatically receive the FY2019 payment, and the payment is to be allocated among the titles based on the allocations made by the county in FY2013. Unlike the previous two reauthorizations, this reauthorization was enacted before the revenue-sharing payments had been disbursed. Full funding for the FY2019 total payment amount is to be 95% of the FY2018 payment, estimated to be approximately $254 million. The FS SRS total payment was $225.8 million for FY2019.67 Full funding for the FY2020 total payment is estimated to be approximately $241 million (95% of the FY2019 payment). As nonexempt, nondefense mandatory spending, the revenue-sharing payments and the SRS payments may be subject to an annual sequestration of budgetary authority through FY2029 pursuant to the Budget Control Act of 2011.68 The extent that the payments are subject to sequestration has been controversial, starting with the sequestration order issued for FY2013.69 Generally, whether the revenue-sharing payments and the SRS payments were subject to annual sequestration depended on the timing of the enactment of the SRS reauthorization in relation to the calculation and publication of the sequestration order for the applicable year.70 Because the FY2014-FY2015 and FY2017-FY2018 reauthorizations were enacted after the sequestration orders were issued for those years, both FS and BLM—eventually—interpreted that the payments were not subject to sequestration for those fiscal years. At different times, however, both FS and BLM have withheld funds for sequestration during those years and have later reversed their decisions and remitted the funds. For example, FS initially withheld 6.2% of the FY2018 SRS payment for sequestration and then reversed the decision and issued those funds later in the year. Similarly, BLM initially interpreted the revenue-sharing payment for FY2016 as being subject to sequestration but later reversed the decision and issued a "pop-up" payment to cover the difference a couple of years later. It is unclear how sequestration will be treated for the FY2019 and FY2020 payments. Congress may consider several options to address the expiration of the SRS payments at the end of FY2020. These include reauthorizing SRS, with or without modifications, implementing other legislative proposals to address FS or BLM payments, or taking no action (thus continuing the revenue-based system that took effect upon the program's expiration). Several issues have been raised about payment programs generally and SRS specifically, including the Each of these issues are discussed in the following sections. If Congress were to reauthorize SRS, modify it, or both (or the FS and BLM payment programs generally), there would be a range of potential fiscal impacts. If the legislative option were to include any new mandatory spending, then it could be subject to congressional pay-as-you-go (PAYGO) or other budgetary rules. If the new mandatory spending were to result in an increase in the deficit (in excess of the baseline), these rules would require budgetary offsets through increasing revenue or decreasing other spending.71 Alternatively, Congress may choose to waive or set aside these rules. Congress has at times provided such a waiver by including a specific type of provision, called a reserve fund, for SRS in the annual budget resolution. Several SRS reauthorizations, however, have been included in large legislative packages and as such have been offset by unrelated programs. Further, Congress might consider funding the program through the regular annual discretionary appropriations process (the program was funded through discretionary appropriations once, for FY2007). This would provide less certainty of funding from year to year, as funding for the program would compete with other congressional priorities within overall budget constraints. In general, any legislative option that results in a higher authorized payment (whether through SRS or another payment program) would either require a larger offset or would increase the federal deficit. Depending on the specific changes, however, many or most of the counties would receive higher payments. Modifications that result in a lower authorized payment would have the opposite potential fiscal impact to the Treasury but would also likely result in lower payments to the counties. The original SRS formula was based entirely on the revenue generated historically by the eligible lands. The total authorized payment was the sum of the payments calculated for each participating county and fluctuated annually based on participation. Congress amended the formula to also take into account each county's share of federal land and relative income level and established an annually declining payment level. Though the payment level declines by 5% annually, the formula does not include any adjustment for inflation. Congress may consider modifying the SRS payment formula in a variety of ways. These include relatively minor changes, such as by adjusting the annual decline so that the payments continue to decrease annually but at a different rate, or so that payments increase annually, or so that payments are set at a constant rate. Another modification could be adding an inflation adjustment to the formula. Alternatively, Congress may consider more comprehensive modifications, such as using a different historical revenue range, or adjusting the formula by other factors (e.g., population). In addition, some have proposed combining SRS, PILT, and other revenue-sharing payment programs.72 SRS provides payments to the counties containing national forests (managed by the FS) and the O&C lands (managed by BLM). Federal lands managed by other agencies, as well as other lands managed by FS or BLM, were not included in SRS. For example, national forests and national grasslands are both part of the National Forest System managed by the FS, although the laws authorizing their establishment differ. Both are subject to a revenue-sharing requirement with the counties containing those lands—although the counties containing national grasslands receive 25% of net receipts—and were excluded from SRS. The counties containing national forests receive 25% of gross receipts averaged over the previous seven years and were included in SRS. It is unclear why the national grassland payments were not included in SRS; it is also unclear why the national grasslands payments are based on net receipts, and the national forests payments are based on gross receipts. Counties containing other types of federal lands may receive little or no compensation. PILT provides compensation to counties containing a broad array of federal lands, but many lands—inactive military bases, Indian trust lands, and certain wildlife refuge lands, for example—are excluded from PILT. The counties containing the national forests and O&C lands, however, get PILT payments in addition to the SRS or revenue-sharing payments. Congress could consider several options related to extending a compensation program to all tax-exempt federal lands and trust lands, although determining the basis of compensation likely would generate significant debate.73 The preponderance of payments going to western states is in large part reflective of the large percentage of federal lands located within those states.75