Financing Airport Improvements

Changes from May 10, 2017 to March 15, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Financing Airport Improvements

Contents

- Introduction

- Airport Improvement Program (AIP)

- The Airport and Airway Trust Fund

- AIP Funding

- AIP Funding Distribution

- Entitlements (Formula Funds)

- Discretionary Funds

- State Block Grant Program

- The Federal Share of AIP Matching Funds

- Distribution of AIP Grants by Airport Size

- What AIP Money Is Spent On

- Letters of Intent (LOI)

- AIP Grant Assurances

- Passenger Facility Charges

- Bonds

- Congressional Issues

- Airport Capital Needs Assessments

- FAA Revises Demand Forecasts Downward

- Program Restructuring and Apportionment Changes

- Airport Privatization

- Grant Assurances

- Noise Mitigation

- Passenger Facility Charge Issues

- Alternative Minimum Tax

Figures

Tables

Summary

There are five major sources of airport capital development funding: the federal Airport Improvement Program (AIP); local passenger facility charges (PFCs) imposed pursuant to federal law; tax-exempt bonds; state and local grants; and airport operating revenue from tenant lease and other revenue-generating activities such as landing fees. Federal involvement is most consequential in AIP, PFCs, and tax-exempt financing.

The AIP has been providing federal grants for airport development and planning since the passage of the Airport and Airway Improvement Act of 1982 (P.L. 97-248). AIP funding is usually spent on projects that support aircraft operations such as runways, taxiways, aprons, noise abatement, land purchase, and safety or emergency equipment. The funds obligated for AIP are drawn from the airport and airway trust fund, which is supported by a variety of user fees and fuel taxes. Different airports use different combinations of these sources depending on the individual airport's financial situation and the type of project being considered. Although smaller airports' individual grants are of much smaller dollar amounts than the grants going to large and medium hub airports, the smaller airports are much more dependent on AIP to meet their capital needs. This is particularly the case for non-commercialnoncommercial airports, which received over 2725% of AIP grants distributed in FY2016FY2018. Larger airports are much more likely to issue tax-exempt bonds or finance capital projects with the proceeds of PFCs.

The FAA Modernization and Reform Act of 2012 (P.L. 112-95Reauthorization Act of 2018 (P.L. 115-254) provided annual AIP funding of $3.35 billion from the airport and airway trust fund for fivefor four years from FY2012 to FY2015. ThatFY2019 to FY2023. The act left the basic structure of AIP unchanged, but included a provision permitting small airports reclassified as medium hubs due to increased passenger volumes to retain eligibility for up to a 90% federal share for a two-year transition period. It allowed certain economically distressed communities receiving subsidized air service to be eligible for up to a 95% federal share of project costs and expanded the number of airports that could participate in the Airport Privatization Pilot Program from five to 10. The FAA Extension, Safety, and Security Act of 2016 (P.L. 114-190) authorized AIP funding through FY2017 at an annual level of $3.35 billion.

The 2018 reauthorization expanded the number of states that could participate in the State Block Grant Program from 10 to 20 and also expanded the existing airport privatization pilot program (now renamed the Airport Investment Partnership Program) to include more than 10 airports. The law included a provision that forbids states or local governments from levying or collecting taxes on a business at an airport that "is not generally imposed on sales or services by that State, political subdivision, or authority unless wholly utilized for airport or aeronautical purposes."The airport improvement issues Congress may faceauthorized supplemental annual funding of over $1 billion from the general fund to the AIP discretionary funds, starting with $1.02 billion in FY2019, and required at least 50% of the additional discretionary funds to be available to nonhub and small hub airports. The act included a provision permitting eligible projects at small airports (including those in the State Block Grant Program) to receive a 95% federal share of project costs (otherwise capped at 90%), if such projects are determined to be successive phases of a multiphase construction project that received a grant in FY2011.

- Should airport development funding be increased or decreased?

- Should the $4.50 ceiling on PFCs be eliminated, raised, or kept as it is?

- Could AIP be restructured to address congestion at the busiest U.S. airports, or should a large share of AIP resources continue to go to

non-commercialnoncommercial airports that lack other sources of funding? - Should Congress set tighter limits on the purposes for which AIP and PFC funds may be spent?

This report provides an overview of airport improvement financing, with emphasis on AIP and the related passenger facility charges. It also discusses some ongoing airport issues that are likely to be included in a future FAA reauthorization debate.

Introduction

The federal government supports the development of airport infrastructure in three different ways. First, the Airport Improvement Program (AIP) provides federal grants to airports for planning and development, mainly of capital projects related to aircraft operations such as runways and taxiways. Second, Congress has authorized airports to assess a local passenger facility charge (PFC) on each boarding passenger, subject to specific federal approval. PFC revenues can be used for a broader range of projects than AIP funds, including "landside" projects such as passenger terminals and ground access improvements. Third, federal law grants investors preferential income tax treatment on interest income from bonds issued by state and local governments for airport improvements (subject to compliance with federal rules). Airports may also draw on state and local funds and on operating revenues, such as lease payments and landing fees.

A federal role in airport infrastructure first developed during World War II. Prior to the war, airports were a local or private responsibility, with federal support limited to the tax exclusion of municipal bond interest. National defense needs led to the first major federal support for airport construction. After the war, the Federal Airport Act of 1946 (P.L. 79-377) continued federal aidaid, although at lower levels than during the war years. Initially, much of this spending supported conversion of military airports to civilian use. In the 1960s, substantial funding also was used to upgrade and extend runways for use by commercial jets.1

In 1970, Congress responded to increasing congestion, both in the air and on the ground at U.S. airports, by passing two laws. The first, the Airport and Airway Development Act, established the forerunner programs of AIP: the Airport Development Aid Program and the Planning Grant Program. The second, the Airport and Airway Revenue Act of 1970, dealt with the revenue side of airport development, establishing the Airport and Airway Trust Fund (AATF, also referred to as the Aviation Trust Fund, and in this report, the trust fund). The Airport and Airway Improvement Act of 1982 (P.L. 97-248; the 1982 Act) created the current AIP and reactivated the trust fund.2 For a more detailed legislative history of AIP, see Appendix A of this report.

Eight years later, amid concerns that the existing sources of funds for airport development would be insufficient to meet national airport needs, the Aviation Safety and Capacity Expansion Act of 1990 (Title IX of the Omnibus Budget Reconciliation Act of 1990, P.L. 101-508) allowed the Secretary of Transportation to authorize public agencies that control commercial airports to impose a passenger facility charge on each paying passenger boarding an aircraft at their airports.

Different airports use different combinations of AIP funding, PFCs, tax-exempt bonds, state and local grants, and airport revenues to finance particular projects. Small airports are more likely to be dependent on AIP grants than large or medium-sized airports. Larger airports are much more likely to issue tax-exempt bonds or finance capital projects with the proceeds of PFCs. Each of these funding sources places various legislative, regulatory, or contractual constraints on airports that use it. The availability and conditions of one source of funding may also influence the availability and terms of other funding sources. In a 2015 study, the U.S. Government Accountability Office (GAO) found that airport-generated net income financed about 38% of airports' capital spending, AIP 33%, PFCs 18%, capital contributions by airport sponsor (often a state or municipality) or by other sources such as an airline or tenant 6%, and state grants nearly 5%.3

Airport Improvement Program (AIP)

AIP provides federal grants to airports for airport development and planning. Participants range from very large publicly owned commercial airports to small general aviation airports that may be privately owned but are available for public use.4 AIP funding is usually limited to construction of improvements related to aircraft operations, such as runways and taxiways. Commercial revenue-producing facilities are generally not eligible for AIP funding, nor are operating costs.5 The structure of AIP funds distribution reflects congressional priorities and the objectives of assuring airport safety and security, increasing airport capacity, reducing congestion, helping fund noise and environmental mitigation costs, and financing small state and community airports.

The main financial advantage of AIP to airports is that, as a grant program, it can provide funds for capital projects without the financial burden of debt financing, although airports are required to provide a modest local match to the federal funds. Limitations on the use of AIP grants include the range of projects that AIP can fund and the requirement that recipients adhere to all program regulations and grant assurances.

Federal law requires the Secretary of Transportation to publish a national plan for the development of public-use airports in the United States. This appears as a biannual Federal Aviation Administration (FAA) publication called the National Plan of Integrated Airport Systems (NPIAS).6 For an airport to receive AIP funds, it must be listed in the NPIAS.

AIP program structure and authorizations are set in FAA authorization acts. Modifications have been made to AIP through the years, but the basic program structure remains the same. The most recent act, the FAA Extension, Safety, and Security Act of 2016 (P.L. 114-190Reauthorization Act of 2018 (P.L. 115-254), authorized AIP funding through FY2017 at an annual level of $3.35 billionFY2023.

The Airport and Airway Trust Fund7

The trust fund was designed to assure an adequate and consistent source of funds for federal airport and airway programs. It is the primary funding source for most FAA activities in addition to federal grants to airports. These include facilities and equipment (F&E); research, engineering, and development (R, E&D); and FAA operations and maintenance (O&M).8 Congress determines how much the trust fund will be allowed to expend for various purposes, including the AIP.

The money flowing into the Airport and Airway Trust Fund comes from a variety of aviation-related taxes.9 These taxes were authorized by the Taxpayer Relief Act of 1997 (P.L. 105-34) and reauthorized by the 20162018 FAA reauthorization act. Revenue sources include the following:10

- 7.5% ticket tax ,

- $4.

1020 flight segment tax ,

- 6.25% tax on cargo waybills ,

- 4.4 cents per gallon on commercial aviation fuel ,

- 19.4 cents per gallon on general aviation gasoline ,

- 21.9 cents per gallon on general aviation jet fuel ,

- 14.1 cents per gallon fractional ownership surtax on general aviation jet fuel ,

- $18.

0060 international arrival tax,11 - $18.

0060 international departure tax , and

- 7.5% "frequent flyer" award tax

.In most years since the trust fund was established, the revenues plus interest on the unexpended balances brought in more money than was being paid out. This led to the growth in the end-of-year unexpended balances in the trust fund. At times these unexpended balances are inaccurately referred to as a surplus. In practice, FAA may have committed unexpended balances to fund particular airport projects, so those balances may not be available for other purposes.

Most air carriers have altered their pricing structures in ways that have implications for the trust fund. Ancillary fees are now commonly charged for services such as checked baggage that in the past were included in the ticket price. Such fees are not subject to the 7.5% ticket tax. Had the $4.1757 billion in baggage fees collected in 20162017 been subject to the ticket tax, the trust fund might have received about $313more than $343 million in additional revenue.12

AIP Funding

AIP spending authorized and the amounts actually made available for grants from the aviation trust fund since FY2000 are illustrated in Table 1.

Table 1. Annual AIP Authorizations and Amounts Made Available for Grants, FY2000-FY2017

($ millions, in nominal dollars)

|

Fiscal Year |

Authorization |

Grant Amounts Available |

|||||||||||||||||

|

2000 |

$2,475 |

$1,851 |

|||||||||||||||||

|

2001 |

$3,200 |

$3,140 |

|||||||||||||||||

|

2002 |

$3,300 |

$3,223 |

|||||||||||||||||

|

2003 |

$3,400 |

$3,295 |

|||||||||||||||||

|

2004 |

$3,400 |

$3,294 |

|||||||||||||||||

|

2005 |

$3,500 |

$3,384 |

|||||||||||||||||

|

2006 |

$3,600 |

$3,424 |

|||||||||||||||||

|

2007 |

$3,700 |

$3,402 |

|||||||||||||||||

|

2008 |

$3,675 |

$3,471 |

|||||||||||||||||

|

2009 |

$3,900 |

$3,385 |

|||||||||||||||||

|

2010 |

$3,515 |

$3,378 |

|||||||||||||||||

|

2011 |

$3,515 |

$3,378 |

|||||||||||||||||

|

2012 |

$3,350 |

$3,199 |

|||||||||||||||||

|

2013 |

$3,350 |

$3,192 |

|||||||||||||||||

|

2014 |

$3,350 |

$3,194 |

|||||||||||||||||

|

2015 |

$3,350 |

$3,193 |

|||||||||||||||||

|

2016 |

$3,350 |

$3,192 |

|||||||||||||||||

|

2017 |

$3,350 |

$3,186

|

2018

|

$3,350

|

$3,180

|

2019

|

$3,350

|

NA

|

2020

|

$3,350

|

NA

|

2021

|

$3,350

|

NA

|

2022

|

$3,350

|

NA

|

2023

|

$3,350 NA |

Sources: FAA, AIP Annual Report of Accomplishments, 2012-2013, and data from FAA Airports Branch. Amounts made available for grants do not include obligations used for administration expenses, the Small Community Air Service Program, and some research funding.

After trending upward from FY1982 to FY1992, grant funding approved in annual appropriations declined through the mid-1990s as part of federal deficit reduction efforts, leaving large gaps between authorized AIP spending levels and the amounts the program was actually allowed to expend. This occurred despite provisions in place since 1976 designed to ensure that federal capital spending for airports is fully funded at the authorized level (see Text Box).

The Wendell H. Ford Aviation Investment and Reform Act for the 21st Century (AIR21; P.L. 106-181), enacted in 2000, provided major increases in AIP's authorization, starting in FY2001. During FY2001-FY2006 AIP was funded near its fully authorized levels. The amount available for grants peaked at $3.47 billion in FY2008. From FY2008 through FY2011, when AIP was authorized by a series of authorization extension acts, appropriators set the program's annual obligation limitation at $3.515 billion.13 The 2012 FAA Modernization and Reform Act authorized funding through FY2015 at an annual level of $3.35 billion. In July 2016, the FAA Extension, Safety, and Security Act of 2016 (P.L. 114-190) was passed to further extend the authorization of AIP at the annual level of $3.35 billion through September 30, 2017.

|

Current AIP Funding Guarantees Historically, FAA authorization acts have included provisions designed to compel appropriators to both fully expend annual trust fund revenues and fully fund FAA's capital programs: AIP and Facilities and Equipment (F&E). The current guarantee requires that total budget resources made available from the trust fund in any year (including appropriations and obligation limitations) for AIP, F&E, research and development, and the trust fund share of FAA operations must be equal to the sum of 90% of the revenues for the year plus the amount calculated by subtracting the amount made available from the trust fund from the actual revenues received, based on the data from the fiscal year two years prior to the current fiscal year. This guarantee is enforced by making it out of order in both the House and the Senate to consider any provision that does not adhere to the guarantees. Point of order enforcement provisions have had limited success in the past. This is largely because points of order may be waived by the Rules Committee in the House and points of order are rarely raised against conference reports in the Senate. |

The 115th Congress passed a six-month extension (P.L. 115-63) of aviation funding and programs through the end of March 2018. Subsequently, the Consolidated Appropriations Act, 2018 (P.L. 115-141), provided a further extension through the end of FY2018. In addition to the annual funding of $3.35 billion, the 2018 appropriations act provided a $1.0 billion appropriation from the general fund to the AIP discretionary grants program. The Secretary of Transportation was directed to keep this supplemental funding available through September 30, 2020, and to give priority to nonprimary, nonhub, and small hub airports. These supplemental funds are not included in the AIP funding summary or discussion in this report, as FAA is in the process of evaluating applications and distributing funds.14

The FAA Reauthorization Act of 2018 (P.L. 115-254) funded AIP from FY2019 through FY2023 at an annual level of $3.35 billion. It also authorized supplemental annual funding from the general fund to the AIP discretionary grants program ($1.02 billion in FY2019, $1.04 billion in FY2020, $1.06 billion in FY2021, $1.09 billion in FY2022, and $1.11 billion in FY2023), and required at least 50% of these additional funds to be available to nonhub and small hub airports.

In February 2019, Congress passed the Consolidated Appropriations Act, 2019 (P.L. 116-6). The act provided a $500 million supplemental appropriation from the general fund to the AIP discretionary grants program and required that this money remain available through September 30, 2021.

AIP Funding Distribution

The distribution system for AIP grants is complex. It is based on a combination of formula grants (also referred to as apportionments or entitlements) and discretionary funds.15 Each year the entitlements are first apportioned by formula to specific airports or types of airports. Once the entitlements are satisfied, the remaining funds are defined as discretionary funds. Airports apply for discretionary funds for projects in their airport master plans. Formula grants and discretionary funds are not mutually exclusive, in the sense that airports receiving formula funds may also apply for and receive discretionary funds. Grants are generally awarded directly to airports.

Legislation sets forth definitions of airports that are relevant both in discussions of the airport system in general and of AIP funding distribution in particular (see Appendix B). The statutory provisions for the allocation of both formula and discretionary funds are based on these definitions.

Entitlements (Formula Funds)

Entitlements are funds that are apportioned by formula to airports and may generally be used for any eligible airport improvement or planning project. These funds are divided into four categories: primary airports, cargo service airports, general aviation airports, and Alaska supplemental funds (see Appendix B for a full list of airport definitions). Each category distributes AIP funds by a different formula (49 U.S.C. §47114).

Most airports have up to three years to use their apportionments. Non-hubNonhub commercial service airports have up to four years. The formula distributions are contingent on an annual AIP obligation limitation of $3.2 billion or more. If this threshold is not met in a particular fiscal year, most formulas revert to prior authorized funding formulas.

Primary Airports. The apportionment for airports that board more than 10,000 passengers each year is based on the number of boardings (also referred to as enplanements) during the prior calendar year.16 The amount apportioned for each fiscal year is equal to double the amount that would be received according to the following formulas:

- $7.80 for each of the first 50,000 passenger boardings;

- $5.20 for each of the next 50,000 passenger boardings;

- $2.60 for each of the next 400,000 passenger boardings;

- $0.65 for each of the next 500,000 passenger boardings; and

- $0.50 for each passenger boarding in excess of 1 million.

The minimum allocation to any primary airport is $1 million. The maximum is $26 million.17

Cargo Service Airports. Some 3.5% of AIP funds subject to apportionment are apportioned to airports served by all-cargo aircraft with a total annual landed weight of more than 100 million pounds. The allocation formula is the proportion of the individual airport's landed weight to the total landed weight at all cargo service airports.18

General Aviation Airports. General aviation, reliever, and non-primarynonprimary commercial service airports are apportioned 20% of AIP funds subject to apportionment. From this share, all airports, excluding all nonreliever primary airports, receive the lesser of the following:

- $150,000; or

- one-fifth of the estimated five-year costs for airport development for each of these airports as listed in the most recent NPIAS.

Any remaining funds are distributed according to a state-based population and area formula. FAA makes the project decisions on the use of these funds in consultation with the states. Although FAA has ultimate control, some states view these funds as an opportunity to address general aviation needs from a state-widestatewide, rather than a local or national, perspective.19

Alaska Supplemental Funds. Funds are apportioned to airports in Alaska to assure that Alaskan airports receive at least twice as much funding as they did under the Airport Development Aid Program in 1980.20

Foregone Apportionments. Large and medium hub airports that collect a passenger facility charge of $3 or less have their AIP formula entitlements reduced by an amount equal to 50% of their projected PFC revenue for the fiscal year until they forgo or give back 50% of their AIP formula grants. In the case of PFC above the $3 level the percentage forgone is 75%. A special small airport fund, which provides grants on a discretionary basis to airports smaller than medium hub, gets 87.5% of these foregone funds. The discretionary fund gets the remaining 12.5%.

Discretionary Funds

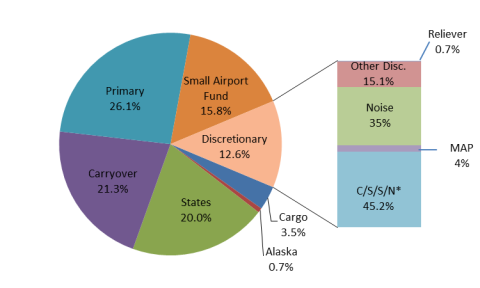

The discretionary fundfunds (49 U.S.C. §§47115-47116) includesinclude the money not distributed under the apportioned entitlements, as well as the forgone PFC revenues that were not deposited into the small airport fund. AIP discretionary funding for FY2016FY2018 was about 139.4% of the total AIP funding. Discretionary grants are approved by FAA based on project priority and other selection criteria. Figure 1 illustrates the composition of both apportioned and discretionary grants, based on FY2016FY2018 data.

Despite its name, the discretionary fund is not allocated solely at FAA's discretion. Allocations are subject to the following three set-asides and certain other spending criteria:

- Airport Noise Set-Asides. At least 35% of discretionary funds are set aside for noise compatibility planning and for carrying out noise abatement and compatibility programs.

- Military Airport Program. At least 4% of discretionary funds are set aside for conversion and dual use of up to 15 current and former military airports. The program allows funding of some projects not normally eligible under AIP.21

- Grants for Reliever Airports. There is a set-aside of two-thirds of 1% of discretionary funds for reliever airports in metropolitan areas suffering from flight delays.22

The Secretary of Transportation is also directed to see that 75% of the grants made from the discretionary fund are used to preserve and enhance capacity, safety, and security at primary and reliever airports, and also to carry out airport noise compatibility planning and programs at these airports. From the remaining 25%, the FAA is required to set aside $5 million for the testing and evaluation of innovative aviation security systems.

Subject to these limitations and the three set-asides, the Secretary of Transportation, through FAA, has discretion in distribution of grants from the remainder of the discretionary fund.23

State Block Grant Program24

Under this program, FAA provides funds directly to participating states for projects at airports classified as other than primary airports. Each participating state receives a block grant made up of the state's apportionment (formula) funds and available discretionary funds. A block grant program state is responsible for selecting and funding AIP projects at the small airports in the state. In making the selections, the participating states are required to comply with federal priorities. Each block grant state is responsible for project administration as well as most of the inspection and oversight roles normally assumed by FAA. The states that currently participate in the state block grant program are Georgia, Illinois, Michigan, Missouri, New Hampshire, North Carolina, Pennsylvania, Tennessee, Texas, and Wisconsin.

The Federal Share of AIP Matching Funds

For AIP projects, the federal government share differs depending on the type of airport.25 The federal share, whether funded by formula or discretionary grants, is as follows:

- 75% for large and medium hub airports (80% for noise compatibility projects);

- 90% for other airports;

- "not more than" 90% for airport projects in states participating in the state block grant program;

- 70% for projects funded from the discretionary fund at airports receiving exemptions under 49 U.S.C. §47134, the pilot program for private ownership of airports;

- airports reclassified as medium hubs due to increased passenger volumes may retain eligibility for up to a 90% federal share for a two-year transition period;

- certain economically distressed communities receiving subsidized air service may be eligible for up to a 95% federal share of project costs.

This cost-share structure means that smaller airports pay a lower share of AIP-funded project costs than larger airports. The airports themselves must raise the remaining share from other sources.26

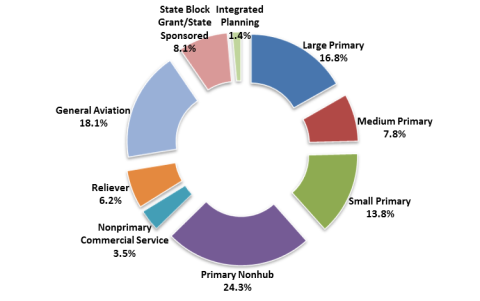

Distribution of AIP Grants by Airport Size

Although smaller airports' individual grants are of much smaller dollar amounts than the grants going to large and medium hub airports, the smaller airports are much more dependent on AIP to meet their capital needs. This is particularly the case for non-commercialnoncommercial airports, such as general aviation and reliever airports, which received over 2725% of AIP grants distributed in FY2016FY2018. Air carriers have objected to this allocation, pointing out that their passengers and freight shippers pay the vast majority of revenue flowing into the trust fund. General aviation interests, however, defend AIP grants to non-commercialnoncommercial airports. Figure 2 shows the share of AIP grants awarded in FY2016FY2018, by value, broken out by airport type.

|

Figure 2. |

|

|

Source: Data from FAA Airports Branch. |

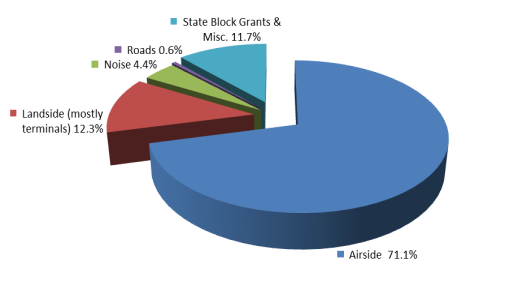

What AIP Money Is Spent On

Figure 3 displays AIP grants awarded by type of project for FY2016FY2018. For the most part, AIP development grants support "airside" development projects such as runways, taxiways, aprons, navigation aids, lighting, and airside safety projects. Substantial AIP funds also go for state block grants and noise planning and abatement. AIP spending on roads is generally restricted to roads on or entering airport property.27

|

|

Source: Data from FAA Airports Branch. |

Letters of Intent (LOI)

In cases in which a primary or reliever airport may want to begin an AIP-eligible project without waiting for the funds to become available, FAA is authorized to issue a letter of intent (LOI).28 If it does so, the LOI states that eligible project costs, up to the allowable federal share, will be reimbursed according to a schedule set forth in the letter.

Although the LOI technically does not obligate the federal government, it is an indication of FAA's approval of the scope and timing of the project, as well as the federal intent to fund the project in future years. Because most primary airports fund their major development projects with tax-exempt revenue bonds, the evidence of federal support that the LOI provides is likely to lead to favorable bond interest rates.29 The airport may proceed with the project with assurance that all AIP-allowable costs specified in the LOI will remain eligible for reimbursement over the life of the LOI. Both entitlement and discretionary funds are used to fulfill LOIs. The FAA limits the total of discretionary funds in all LOIs subject to future obligation to roughly 50% of forecast available discretionary funds.

LOIs have certain eligibility restrictions. They can only be issued to cover projects at primary and reliever airports. The proposed airport development project or action must "enhance airfield capacity in terms of increased aircraft operations, increased aircraft seating or cargo capacity, or reduced airfield operational delays." For large and medium hub airports, the project must enhance "system-wide airport capacity significantly."30

AIP Grant Assurances

Airports' grant applications are conditioned on assurances regarding future airport operations. Examples of such assurances include making the airport available for public use on reasonable conditions and without unjust economic discrimination (against all types, kinds, and classes of aeronautical activities); charging air carriers making similar use of the airport substantially comparable amounts; maintaining a current airport layout plan; making financial reports to the FAA; and expending airport revenue only on capital or operating costs at the airport.31 Within the AIP context, assurances are a means of guaranteeing the implementation of federal policy.

Obligations derived from airports' assurances extend beyond the formal closure of AIP grant-supported projects. Obligations related to the use, operation, and maintenance of an airport remain in effect for the expected life of the improvement, up to 20 years. In the case of the purchase of land with AIP funds, the federal obligations do not expire.32 Airports may request that FAA release them from their AIP contractual obligations. Typically, as a condition of the release, the airport sponsor must either reimburse the federal government for the AIP grants (in the case of land grants, the federal share of the fair market value of the land) or reinvest the amount in an approved AIP project (see Text Box). When airport managers or interest groups express concerns about the "strings attached" to AIP funding, they are usually referring to AIP grant assurances.33

|

Release of Airport Obligations Regarding Land All AIP land grants include the obligation to operate the airport property as an airport in perpetuity.34 Changes in use of airport property to

In all cases, the Secretary is to give preference to the following in descending order: 1. reinvestment in an approved noise compatibility project; 2. reinvestment in an approved project eligible under the discretionary fund special apportionment category set-asides (49 U.S.C. §47117 (e)); 3. reinvestment in an approved project eligible under 49 U.S.C. §47114, §47115, §47117 (apportionments, discretionary fund, and use of apportioned amounts, respectively); 4. transfer of funds to an eligible sponsor of another public airport to be reinvested in an approved noise compatibility project at that airport; 5. payment to the Secretary for deposit in the Airport and Airway Trust Fund. In the case of an airport that is to be replaced by a new or replacement airport, |

Passenger Facility Charges

In 1990, federal deficits and expected tight budgets led to concerns that the Airport and Airway Trust Fund and other existing sources of funds for airport development would be insufficient to meet national airport needs. This led to authorization of a new user charge, the Passenger Facility Charge (PFC). The PFC was seen as a complementary funding source to AIP. The Aviation Safety and Capacity Expansion Act of 199037 allowed the Secretary of Transportation to authorize public agencies that control commercial airports to impose a fee on each paying passenger boarding an aircraft at their airports. Initially, there was a $3 cap on each airport's PFC and a $12 limit on the total PFCs that a passenger could be charged per round trip.

The PFC is a state, local, or port authority fee, not a federally imposed tax deposited into the Treasury.38 Because of the complementary relationship between AIP and PFCs, PFC provisions are generally folded into the sections of FAA reauthorization legislation dealing with AIP. The money raised from PFCs must be used to finance eligible airport-related projects. Unlike AIP funds, PFC funds may be used to service debt incurred to carry out projects.39

Legislation in 2000 raised the PFC ceiling to $4.50, with an $18 limit on the total PFCs that a passenger can be charged per round trip. To impose a PFC above $3 an airport has to show that the funded projects will make significant improvements in air safety, increase competition, or reduce congestion or noise impacts on communities, and that these projects could not be fully funded by using the airport's AIP formula funds or AIP discretionary grants. Large and medium hub airports imposing PFCs above the $3 level forgo 75% of their AIP formula funds. PFCs at large and medium hub airports may not be approved unless the airport has submitted a written competition plan to the FAA, which includes information about the availability of gates, leasing arrangements, gate-use requirements, controls over airside and ground-side capacity, and intentions to build gates that could be used as common facilities.

The FAA Modernization and Reform Act of 2012 included minor changes to the PFC program. The act made permanent the trial program that authorized non-hubnonhub small airports to impose PFCs. The act also required GAO to study alternative means of collecting PFCs without including the PFC in the ticket price.40 The FAA Extension, Safety, and Security Act of 2016 did not include significant changes to the PFC program.

Unlike AIP grants, of which over 70% in FY2016Reauthorization Act of 2018 did not include significant changes to the PFC program and maintained the $4.50 PFC cap, with a maximum charge of $18 per round-trip flight. It did include a provision, however, that required a qualified organization to conduct a study assessing the infrastructure needs of airports and existing financial resources for commercial service airports and to make recommendations on the actions needed to upgrade the national aviation infrastructure system.

Unlike AIP grants, of which over 67% in FY2018 went to airside projects (runways, taxiways, aprons, and safety-related projects), PFC revenues are heavily used for landside projects, such as terminals and transit systems on airport property, and for interest payments. Table 2 shows the AIP grant awards and PFC approvals by project type in FY2016FY2018. Annual system-wide PFC collections grew from $85.4 million in 1992 to aboutover $3.24 billion in 20162018.41

Table 2. Project Expenditures from PFC and AIP Funds

Distribution of PFC Approvals and AIP Grants, FY2016

|

Type of Project |

Percentage of PFC |

Percentage of AIP |

|

Airside |

|

|

|

Landside |

|

12. |

|

Noise |

0. |

4. |

|

Roads/Access |

|

|

|

Interest on bonds |

|

— |

|

Unclassified, state block grants, misc. |

— |

|

|

Total |

100.0% |

100.0% |

Source: FAA, Airports Branch.

The PFC statutory language lends itself to a broader interpretation of "capacity enhancing" projects, and the implementing regulations are less constraining than those for AIP funds. Air carriers, which historically have preferred funding to be dedicated to airside projects, must be notified and provided with an opportunity for consultation about airports' proposals to fund projects with PFC revenues. They are generally less involved in the PFC project planning and decision-makingdecisionmaking process than is the case with AIP projects. The difference in the pattern of project types may also be influenced by the fact that larger airports, which collect most of the PFC revenue, tend to have substantial landside infrastructure, whereas smaller airports that are much more dependent on AIP funding have comparatively limited landside facilities.

Bonds

Bonds have long been a major source of funding for capital projects at primary airports. According to Bond Buyer, a trade publication, airports raised $13approximately $17.4 billion in 8684 bond issues in 20162018, a substantial increase over the $11.514.7 billion raised in 122116 issues in 20152017.42

Most airport-related bonds are classified as tax-exempt private activity bonds (PABs). These bonds, issued by a local government or public authority, allow the use of landing fees, charges on airport users, and property taxes on privately controlled on-airport buildings, such as cargo facilities, to service debt without obligating tax revenue. Their tax-exempt status enables airports to raise funds more cheaply than would otherwise be the case because investors enjoy a federal income tax exclusion on interest paid on the bonds. In some cases, revenue from PFCs may be used to service the bonds. PABs may be used to build facilities that are directly related and essential to servicing aircraft, enabling aircraft to take off and land, and transferring passengers or cargo to or from aircraft.

Normally, airport bonds might be classified as taxable PABs because they are used to finance facilities where more than 90% of the activity is private and more than 90% of the repayment is from revenue generated by the facility.43 Issuers of taxable PABs must pay higher interest rates than required on tax-exempt bonds, to compensate investors for the taxes due on interest income. Congress therefore created an exception allowing airports that are owned by governmental entities to issue "qualified" PABs that are tax-exempt.44 The majority of airport bonds are considered by the Internal Revenue Service to be "qualified" PABs.

Some recent proposals would allow privately owned airports to receive the same tax-preferred treatment of their bonds as airports owned by public authorities. A possible precedent for this is the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (P.L. 109-59, §1143; SAFETEA-LU), which allowed for up to $15 billion in tax-exempt bond financing for highways or freight transfer facilities that would otherwise not qualify for tax-exempt financing. Many of the supporters of the SAFETEA-LU provisions envisioned expanded eligibility for PABs as a means of facilitating public-private partnerships between a public authority and an outside investor. In the airport context, this would be analogous to an airport authority agreeing to a long-term lease with a private investor who would have the ability to enter the market for tax-exempt bonds to finance improvements at the airport and, perhaps, also to finance the purchasing costs of the lease itself.

Congressional Issues

By statute, the safe operation of airports is the highest aviation priority. Other priorities established by Congress include increasing capacity to the maximum feasible extent, minimizing noise impacts, and encouraging efficient service to state and local communities (i.e., support for general aviation airports). But there are significant disagreements about the appropriate degree of federal participation in airport development and finance and about the specific types of expenditure that should be given priority within AIP. Airline and airport operators tend to view the fully authorized funding of the program as a good thing. An alternative view, however, is that too much has been spent on AIP, particularly at smaller airports that do not play a significant role in commercial aviation.

Airport Capital Needs Assessments

The assessment of airport capital needs is fundamental to determining the appropriate federal support needed to foster a safe and efficient national airport system.45 The federal government's interest goes beyond capacity issues to include implementation of federal safety and noise policies.

Both FAA and the Airports Council International-North America (ACI-NA) have issued projections of airports' long-term financial needs. In its most recent NPIAS report, FAA estimated that the national system's capital needs for FY2017-FY2021FY2019-FY2023 will total $32.535.1 billion (an annual average of $6.5approximately $7 billion).46 The ACI-NA infrastructure needs survey resulted in an estimate of $99.9128.1 billion over the same years (an annual average of $20approximately $25.6 billion).47 The main reason for the widely differing estimates was disparate views on what kinds of airport projects to include.

The NPIAS report was based on information taken from airport master plans and state system plans, but FAA planners screened out planned projects not justified by aviation activity forecasts or not eligible for AIP grants. Only designated NPIAS airports were included in the FAA study. Implicit in this methodology is that the planning has been carried through to the point where financing is identified. Not all projects used to develop the NPIAS estimates are actually completed, or, in some cases even begun, within the range of years covered in the NPIAS estimates. ACI-NA argues that the NPIAS underestimates AIP eligible needs because not all such needs will be in the current airport plans.48

The ACI-NA study reflects the broader business view of major airport operators and casts a substantially wider net. It includes projects funded by PFCs, bonds, or state or local funding; airport-funded air traffic control facilities; airport- or TSA-funded security projects; "necessary" AIP-ineligible projects such as parking facilities, hangars, revenue portions of terminals, and off-airport roads/transit facilities; and AIP-eligible projects not reported to FAA in the belief that there would be a low probability of receiving additional AIP funding. Its 2017-20212019-2023 infrastructure needs survey, for example, included major airport terminal projects that are ineligible for AIP grants. The ACI-NA study also includes projects without identified funding sources. The ACI-NA estimate is higher than the FAA estimate because of the wider net it casts and because it is adjusted for projected inflation.

The estimates are important because the primary AIP reauthorization issue is the program's appropriate level of funding. Because the ACI-NA airport needs projection includes much that is not eligible for AIP grants, its accuracy may not be as critical in evaluating appropriate AIP funding levels as that of the NPIAS projections. On the other hand, the broader ACI-NA estimate may be more significant for policy choices related to bond issuance and PFCs, since these sources fund a broader range of projects than AIP.

FAA Revises Demand Forecasts Downward

In 2004, then-FAA Administrator Marion C. Blakey stated that the agency's goal was to increase total capacity at the top 35 U.S. airports by 30% over a 10-year period. FAA's Operational Evolution Plan (OEP) is intended to increase the capacity and efficiency of the National Airspace System (NAS) over a 10-year period to keep up with the expected growth in demand for air travel and air cargo. In support of that goal, FAA released a study focused on the 35 busiest airports, Capacity Needs in the National Airspace System: An Analysis of Airport and Metropolitan Area Demand and Operational Capacity in the Future (also referred to as FACT1). The study projected 18 airports would need additional capacity by 2020.

In 2007, FACT1 was updated by a second study, FACT2.49 FACT2 expanded the study to include 21 non-OEP airports that were identified as having the potential to be capacity constrained or were in capacity-constrained metropolitan areas. The study examined airports that would need capacity increases and also projected which airports would need capacity increases in 2015 and 2025. It identified four airports plus the New York metropolitan area that needed additional capacity in 2007.50 It further identified 14 hub airports as likely to be capacity-constrained in 2025.51 FACT2 found that, in comparison to FACT1, many non-OEP airports "... have higher capacities than originally presumed and thus less need for additional capacity."52

A further update, FACT3, was released in January 2015. FACT3 forecasted that the 2007-2009 recession, volatile fuel costs, airline consolidation, and replacement of many 50-seat regional jets with larger aircraft would result in 32% fewer operations and about 23% fewer enplanements in 2025 at the 30 core airports than forecast in FACT2. It projected that airport delays would remain concentrated at a few major hub airports, notably the three New York City-area airports, Philadelphia International Airport, and Hartsfield-Jackson Atlanta International Airport. 53

This study may have implications for the reauthorization of AIP. The large runway projects that are the focus of the OEP can require long lead times—10 or more years from concept to initial construction is not unusual. At large and medium hub airports, runway projects are usually paid for, in part, by AIP funds. Therefore, some projects needed by 2025 may require AIP funding in earlier years. Because large and medium airports that levy PFCs must forgo either 50% or 75% of their AIP formula entitlement funds, most federal funding for their runway projects would probably need to take the form of AIP discretionary funds.

The pool of discretionary funds is primarily the remainder of annual funding after the entitlement formula requirements are satisfied. Of the forgone PFC funds, 87.5% are reserved for the small airport fund and are also not available for OEP airports. If the AIP budget is constrained in the future, either under a reauthorization bill or during the annual appropriations process, and the entitlement formulas remain as they are, the discretionary portion of the AIP budget may be squeezed, limiting large airports' ability to draw on AIP funds for major capacity expansion projects.

Program Restructuring and Apportionment Changes

Many of the attributes of AIP's programmatic structure are similar to those of the 1982 act that created the program. Over the years these attributes have been modified based on perceived needs and on the practical politics of passing the periodic FAA reauthorization bills that contain the AIP provisions. These considerations make a major overhaul of the AIP structure unlikely, but may leave room for programmatic adjustments in the distribution of apportionments.

One such adjustment might shift AIP funds to enhancing capacity at large and medium hub airports. There are several ways Congress might accomplish this. One would be to eliminate the requirement that large and medium hub airports that impose the maximum PFCs forgo 75% of their entitlements. This change would give larger airports a greater share of entitlement funding, but at the cost of reducing AIP grants to small airports. Alternatively, changes in the statutory set-asides of discretionary funds could give FAA more flexibility to use that money for capacity enhancement, but might reduce funding for noise mitigation and other purposes.

Changes in the last several FAA authorization acts increased entitlements and broadened the range of landside projects eligible for AIP grants. These changes generally benefitted airports smaller than medium hub size. In particular, the increased amount of apportioned funds has limited the availability of funds for discretionary grants at major airports. Further changes giving airports increased flexibility in the use of their entitlements might benefit smaller airports not served by commercial aviation, in line with the national goal of having an "extensive" national airport system,54 but this use of funds might conflict with the goal of reducing congestion at major commercial airports.

The current apportionment system relies on a $3.2 billion funding level trigger mechanism to lift most of the apportionments to twice their formula level. This has been in place for two reauthorization cycles. Should that trigger be breached, entitlements for all airports would be reduced drastically. The entitlement formulas may not be sustainable, without depleting discretionary funds, in the absence of additional funding for AIP.

One way to reduce the amount of trust fund revenue needed for AIP would be to allow large and medium hub airports to opt out of AIP and rely exclusively on PFCs to finance capital projects. This would require raising or eliminating the federal cap on PFCs. These "defederalized" airports could then be released from some or all of the AIP grant assurances under which they now operate, such as land use requirements and airport revenue use restrictions.55 If airports exit the program, AIP spending could be reduced or could be redirected to other NPIAS airports.

Airport Privatization56

Airport privatization denotes a change in ownership from a public entity (such as a local government or an airport authority established by a state government) to a private one. In a number of countries, such as Great Britain, government-owned airports have been privatized by sale to private owners. In the United States, some airports have allowed private ownership of certain on-airport facilities or management functions, but the ownership of all major airports remains in the hands of government entities.

The Airport Privatization Pilot Program (49 U.S.C. §47134; Section 149 of the Federal Aviation Reauthorization Act of 1996, P.L. 104-264, as amended) authorizes FAA to exempt up to 10 airports from certain federal restrictions on the use of airport revenue off-airport. Participating airports may be also exempted from certain requirements on the repayment of federal grants. Privatized airports may still participate in the AIP, but at a lower federal share (70%).

The Airport Privatization Pilot Program (APPP) The pilot program was renamed the Airport Investment Partnership Program (AIPP) in the 2018 FAA reauthorization act and expanded to admit more than 10 airports.

The AIPP provides that at primary airports, the airport sponsor may only recover from the sale or lease an amount approved by at least 65% of the scheduled air carriers serving the airport, as well as by both scheduled and unscheduled air carriers that together account for 65% of the total landed weight at the airport for the year. The requirement that air carriers approve the use of airport revenue for non-airportnonairport purposes, such as profit distribution, may have served to limit interest in the program.57

To date, only two airports have completed the privatization process established under the provisions of the APPPAIPP. One of those, Stewart International Airport in New York State, subsequently reverted to public ownership when it was purchased by the Port Authority of New York and New Jersey. Luis Muñoz Marín International Airport in San Juan, PR, is now the only commercial service airport operating under private management after privatization under the APPP. As of April 20172018, there are three applicants under active FAA consideration: Hendry County Airglades Airport in Clewiston, FL; Westchester Airport in White Plains, NY; and St. Louis Lambert International Airport in St. Louis, MO.58

There is no certainty that any AIP cost savings from privatization would be retained for use by the other AIP-eligible airports. AIP spending is determined by the authorization and appropriations process, and Congress could choose to use any savings to reduce the program size, to marginally assist in deficit reduction, to reduce general fund portions of FAA operations funding, or to make money available for spending elsewhere.

Grant Assurances

Debate over FAA reauthorization generally brings forth proposals to alter the AIP grant assurances, such as ensuring that workers on airport construction projects receive prevailing wages set under the Davis-Bacon Act and pledging to use airport revenue solely for spending on airport operations and capital costs. If AIP spending remains constrained, critics are likely to argue that the grant assurances raise the cost of projects to increase airport capacity and complicate the closure and reuse of underutilized airports or airports that are locally unpopular due to noise or safety concerns.

Noise Mitigation

Historically, a basic funding issue is whether to change the existing discretionary fund set-aside for noise mitigation and abatement. The noise set-aside, however, has been increased in previous reauthorization acts and is now 35% of discretionary funding. Demand to use AIP funds for noise mitigation could increase if Congress grants FAA the flexibility to fund noise mitigation projects that are outside the DNL59 65 decibel (dB) noise impact area, but this could divert resources from capacity and safety projects. A related issue is whether to make the planning for noise-mitigating air traffic control procedures at individual airports eligible for AIP funding.

Passenger Facility Charge Issues

The central issue related to PFCs is whether to raise the $4.50 per enplaned passenger ceiling or to eliminate the ceiling altogether. In general, airports argue for increasing or eliminating the ceiling, whereas most air carriers and some passenger advocates oppose higher limits on the PFCs. A 2015 GAO study analyzed the effects by raising the PFC cap under three scenarios: setting the cap at $6.47, $8.00, or $8.50. The study found raising PFC would significantly increase airport funding, but could also marginally slow passenger growth and therefore the growth in revenues to the trust fund.60

PFC supporters feel that the PFC is more reliable than AIP funding, which is subject to the authorization and appropriations process. They also argue that PFCs are pro-competitiveprocompetitive, helping airports build gates and facilities that both encourage new entrant carriers and allow incumbent carriers to expand. Advocates of an increase in the cap also argue that over time, the value of the PFC has been eroded by inflation and an adjustment is therefore necessary.

The permissible uses of revenues are an ongoing point of contention. Airport operators, in particular, would like more freedom to use PFC funds for off-airport projects, such as transportation access projects, and want the process of obtaining FAA approval to be streamlined. Carriers, on the other hand, often complain that airports use PFC funds to finance proposals of dubious value, especially outside airport boundaries, instead of high-priority projects that offer meaningful safety or capacity enhancements. The major air carriers are also unhappy with their limited influence over project decisions, as airports are required only to consult with resident air carriers instead of having to get their agreement on PFC-funded projects.

Alternative Minimum Tax

Unlike interest income from governmental bonds, which is not subject to the alternative minimum tax (AMT), interest from private activity bonds is still subject to the AMT. ACI-NA has proposed broadening the definition of governmental airport bonds to, in effect, include either all airport bonds or at least those bonds issued for public-use projects that meet AIP or PFC eligibility requirements.61

Opponents of such changes express concerns that these changes would reduce U.S. Treasury revenues.62 Some also argue it would make more sense to change the AMT as part of a tax bill rather than including a specific exemption for income on airport bonds in an FAA reauthorization bill. In either case, such a change would not be under the jurisdiction of the congressional committees that will have jurisdiction over most reauthorization provisions. Changes to the AMT would be under the jurisdiction of the congressional tax-writing committees, the House Committee on Ways and Means and the Senate Committee on Finance.

Appendix A. Legislative History of Federal Grants-in-Aid to Airports

Prior to World War II the federal government viewed airports as a local responsibility. During the 1930s, it spent about $150 million a year on airports through work relief agencies such as the Works Progress Administration (WPA). The first federal support for airport construction was granted during World War II. After the war, the Federal Airport Act of 1946 (P.L. 79-377) created the Federal Aid to Airports Program, using funds appropriated annually from the general fund. Initially much of this spending supported conversion of military airports to civilian use. In the 1960s substantial funding went to upgrade and extend runways for use by commercial jets. By the end of the 1960s, congestion, both in the air and on the ground at U.S. airports, was seen as evidence that airport capacity was inadequate.63

Airport and Airway Development and Revenue Acts of 1970 (P.L. 91-258)

In 1970, Congress responded to the capacity concerns by passing two acts. The first, the Airport and Airway Development Act (Title I of P.L. 91-258), established the Airport Development Aid Program (ADAP) and the Planning Grant Program (PGP), and set forth the programs' grant criteria, distribution guidelines, and authorization of grant-in-aid funding for the first five years of the program. The second, the Airport and Airway Revenue Act of 1970 (Title II of P.L. 91-258), established the Airport and Airway Trust Fund. Revenues from levies on aviation users and fuel were dedicated to the fund. Under the 1970 acts the trust fund could pay capital costs and, when excess funds existed, could also help cover FAA's administrative and operations costs.64

Airport and Airway Development and Revenue Acts Amendments of 1971 (P.L. 92-174)

The Nixon Administration's FAA budget requests for FY1971 and FY1972 under the new trust fund system brought it into immediate conflict with Congress over the budgetary treatment of trust fund revenues.65 The Administration treated the new financing system as a user-pay system, whereas many Members of Congress viewed the trust fund as primarily a capital fund.66 The 1971 Amendments Act made the trust fund a capital-only account (although only through FY1976), disallowing the use of trust fund revenues for FAA operations.67

Airport and Airway Development Amendments Act of 1976 (P.L. 94-353)

The 1976 act made a number of adjustments to the ADAP and reauthorized the Airport and Airway Trust Fund through FY1980. The act again allowed the use of trust fund resources for the costs of air navigation services (a part of operations and maintenance). However, in an attempt to assure adequate funding of airport grants, the act included "cap and penalty" provisions which placed an annual cap on spending for costs of air navigation systems and a penalty that reduced these caps if airport grants were not funded each year at the airport program's authorized levels. This cap was altered multiple times in reauthorization acts in the following decades.68 ADAP grants totaled about $4.1 billion from 1971 through 1980. Congress did not pass authorizing legislation for ADAP during FY1981 and FY1982, during which the aviation trust fund lapsed, although spending for airport grants continued.69

Airport and Airway Improvement Act of 1982 (P.L. 97-248)

The 1982 act created the current AIP and reactivated the Airport and Airway Trust Fund. It altered the funding distribution among the newly defined categories of airports,70 extending aid eligibility to privately owned general aviation airports, increasing the federal share of eligible project costs, and earmarking 8% of total funding for noise abatement and compatibility planning. The act also required the Secretary of Transportation to publish a national plan for the development of public-use airports in the United States. This biannual publication, the National Plan of Integrated Airport Systems (NPIAS), identifies airports that are considered important to the national aviation system. For an airport to receive AIP funds it must be listed in the NPIAS.

Although the 1982 Actact was amended often in the 1980s and early 1990s, the general structure of AIP remained the same. The Airport and Airway Safety and Capacity and Expansion Act of 1987 (P.L. 100-223; 1987 Actact) authorized significant spending increases for AIP and added a cargo service apportionment. It also included provisions to encourage full funding of AIP at the authorized level.71 Title IX of P.L. 101-508, the Omnibus Budget Reconciliation Act of 1990 (OBRA1990), included the Aviation and Airway Safety and Capacity Act of 1990, which allowed airports, under certain conditions, to levy a Passenger Facility Charge (PFC) to raise revenue and also established the Military Airport Program (MAP), which provided AIP funding for capacity and/or conversion-related projects at joint-use or former military airports. The Airport Noise and Capacity Act of 1990 (OBRA 1990, Title IX, Subtitle D) set a national aviation noise policy. OBRA1990 included the Revenue Reconciliation Act of 1990, which reauthorized the Aviation Trust Fund and adjusted some of the aviation taxes. The Federal Aviation Reauthorization Act of 1994 (P.L. 103-305) reauthorized AIP for two more years and again made modifications in the cap and penalty provisions.72

Federal Aviation Reauthorization Act of 1996 (P.L. 104-264)

The 1996 reauthorization of the AIP made a number of adjustments to entitlement funding and discretionary set-aside provisions. It also included directives concerning intermodal planning, cost reimbursement rules, letters of intent, and the small airport fund. A demonstration airport privatization program and a demonstration program for innovative financing techniques were established. The demonstration status of the state block grant program was removed. The act did not reauthorize the taxes that supported the Airport and Airway Trust Fund. This was done by the Taxpayer Relief Act of 1997 (P.L. 105-34), which extended, subject to a number of modifications, the existing aviation trust fund taxes through September 30, 2007.

The Wendell H. Ford Aviation Investment and Reform Act for the 21st Century of 2000 (AIR21; P.L. 106-181)

The enactment of AIR21 was the culmination of two years of legislative effort to pass a multi-yearmultiyear FAA reauthorization bill.73

The initial debate focused on provisions to take the aviation trust fund off-budget or erect budgetary "firewalls" to assure that all trust fund revenues and interest would be spent each year for aviation purposes. These proposals, however, never emerged from the conference committee. Instead, the enacted legislation included a so-called "guarantee" that all of each year's receipts and interest credited to the trust fund would be made available annually for aviation purposes.

AIR21 did not make major changes in the structure or functioning of AIP. It did, however, greatly increase the amount available for airport development projects. The AIP funding authorization rose from $1.9 billion in FY2000 to $3.4 billion in FY2003. The formula funding and minimums for primary airports were doubled starting in FY2001. The state apportionment for general aviation airports was increased from 18.5% to 20%. The noise set-aside was increased from 31% to 34% of discretionary funding and a reliever airport discretionary set-aside of 0.66% was established.

AIR21 also increased the PFC maximum to $4.50 per boarding passenger. In return for imposing a PFC above the $3 level, large and medium hub airports would forgo 75% of their AIP formula funds. This had the effect of making a greater share of AIP funding available to smaller airports.

Vision 100: Century of Aviation Reauthorization Act of 2003 (P.L. 108-176; H.Rept. 108-334)

Vision 100, signed by President George W. Bush on December 12, 2003, included significant changes to AIP. The law codified the AIR21 spending "guarantees" through FY2007. It increased the discretionary set -aside for noise compatibility projects from 34% to 35%. It increased the amount that an airport participating in the Military Airport Program (MAP) could receive to $10 million for FY2004 and FY2005, but in FY2006 and FY2007 it returned the maximum funding level to $7 million. The act allowed non-primarynonprimary airports to use their entitlements for revenue-generating aeronautical support facilities, including fuel farms and hangars, if the Secretary of Transportation determines that the sponsor has made adequate provisions for the airside needs of the airport. The law permitted AIP grants at small airports to be used to pay interest on bonds issued to finance airport projects. The act included a trial program to test procedures for authorizing small airports to impose PFCs. Vision 100 repealed the authority to use AIP or PFC funds for most airport security purposes.

FAA Modernization and Reform Act of 2012 (P.L. 112-95)

The 2012 FAA reauthorization act funded AIP for four years from FY2012 to FY2015 at an annual level of $3.35 billion. A new provision, Section 138, permitted small airports reclassified as medium hubs due to increased passenger volumes to retain eligibility for up to a 90% federal share for a two-year transition period. This provision also allows certain economically distressed communities receiving subsidized air service to be eligible for up to a 95% federal share of project costs.

The 2012 act maintained the $4.50 PFC cap, with a maximum charge of $18 per round -trip flight. It included a provision that instructed GAO to study alternative means for collecting PFCs.74 The act also expanded the number of airports that could participate in the airport privatization pilot program from 5 to 10. This law was extended through July 15, 2016.

The FAA Extension, Safety, and Security Act of 2016 (P.L. 114-190)

The 2016 FAA extension act funded AIP through FY2017 at an annual level of $3.35 billion. A new provision, Section 2303, provided temporary relief to small airports that had 10,000 or more passenger boardings in 2012 but had fewer than 10,000 during the calendar year used to calculate the AIP apportionment for FY2017. This provision allowed such airports to receive apportionment for FY2017 an amount based on the number of passenger boardings at the airport during calendar year 2012.

The FAA Reauthorization Act of 2018 (P.L. 115-254) The 2018 FAA reauthorization act funded AIP for five years from FY2019 through FY2023 at an annual level of $3.35 billion. It also authorized supplemental annual funding from the general fund to the AIP discretionary funds—$1.02 billion in FY2019, $1.04 billion in FY2020, $1.06 billion in FY2021, $1.09 billion in FY2022, and $1.11 billion in FY2023—and required at least 50% of the additional discretionary funds to be available to nonhub and small hub airports.75 The act included a provision permitting eligible projects at small airports (including those in the State Block Grant Program) to receive 95% federal share of project costs (otherwise capped at 90%), if such projects are determined to be successive phases of a multiphase construction project that received a grant in FY2011. The 2018 reauthorization expanded the number of states that could participate in the State Block Grant Program from 10 to 20 and also expanded the existing airport privatization pilot program (now renamed the Airport Investment Partnership Program) to include more than 10 airports. The law included a provision that forbids states or local governments from levying or collecting taxes on a business on an airport that "is not generally imposed on sales or services by that State, political subdivision, or authority unless wholly utilized for airport or aeronautical purposes." Commercial Service Airports76Appendix B.

Definitions of Airports Included in the NPIAS

Commercial Service Airports75

Publicly owned airports that receive scheduled passenger service and board at least 2,500 passengers each year (509506 airports).

Primary Airports. Airports that board more than 10,000 passengers each year. There are four subcategories:

- Large Hub Airports. Board 1% or more of system-wide boardings (30 airports, 72% of all enplanements)

- Medium Hub Airports. Board 0.25% but less than 1% (31 airports,

1516% of all enplanements) - Small Hub Airports. Board 0.05% but less than 0.25% (72 airports, 8% of all enplanements)

- Non

-hub Primary Airports. Board more than 10,000 but less than 0.05% (249247 airports,43% of all enplanements)

Non-primary Commercial Service Airports. Board at least 2,500 but no more than 10,000 passengers each year (127126 airports, 0.1% of all enplanements).

Other Airports

General Aviation Airports. General aviation airports do not receive scheduled commercial or military service but typically do support business, personal, and instructional flying; agricultural spraying; air ambulances; on-demand air-taxies; and/or charter aircraft service (2,564554 airports).

Reliever Airports. Airports designated by the FAA to relieve congestion at commercial airports and provide improved general aviation access (259261 airports).

Cargo Service Airports. Airports served by aircraft that transport cargo only and have a total annual landed weight of over 100 million pounds. An airport may be both a commercial service and a cargo service airport.

New Airports

EightSeven airports are anticipated to be built between 20172019 and 20212023. They include two primary airports, two non-primarynonprimary commercial service airports, and fourthree general aviation airports.

Author Contact Information

Footnotes

| 1. |

For a general discussion of the U.S. airport system, see Seth B. Young and Alexander R. Wells, Airport Planning & Management, (New York: McGraw Hill, 2011 ed.), pp. 1-95. |

|

| 2. |

The authorization of the trust fund had lapsed during FY1981 and FY1982. See "Airport and Airway Development Amendments Act of 1976 (P.L. 94-353)" in Appendix A of this report. |

|

| 3. |

Government Accountability Office, Airport Finance: Information on Funding Sources and Planned Capital Development, GAO-15-306, May 20, 2015, pp. 6-11. |

|

| 4. |

General aviation airports do not serve military (with a few Air National Guard exceptions) or scheduled commercial service aircraft but typically do support one or more of the following: business/corporate, personal, instructional flying; agricultural spraying; air ambulances; on-demand air taxies; charter aircraft. See Appendix A for airport definitions. |

|

| 5. |

For detailed guidance on allowable costs under AIP, see Chapter 3 of the AIP Handbook, at |

|

| 6. |

Federal Aviation Administration (FAA), Report to Congress: National Plan of Integrated Airport Systems (NPIAS) |

|

| 7. |

For more information about the Airport and Airway Trust Fund, see CRS Report R44749, The Airport and Airway Trust Fund (AATF): An Overview, by |

|

| 8. |

O&M also receives some funding from the Treasury general fund. Air traffic system capital maintenance and improvement falls primarily under the F&E category. The trust fund was originally both a capital account and, when excess funds existed, a user-pay system to help support FAA's administrative and operations costs. |

|

| 9. |

U.S. Internal Revenue Code, §§4041, 4081, 4091, 4261-4263, 4271, 9502. See also P.L. 105-34, §§1031-1032. |

|

| 10. |

The rates for the flight segment tax and the international arrival and departure taxes are adjusted annually. |

|

| 11. |

Both the international arrival and departure taxes have been adjusted for inflation (rounded to the nearest 10 cents) on an annual basis since January 1, 1999. The rate for U.S. flights to and from Alaska or Hawaii that applies to a domestic segment is only applied to departures and is $9. |

|

| 12. |

Bureau of Transportation Statistics, Baggage Fees by Airline |

|

| 13. |

The obligation limitation or limitation on obligations is used to control annual AIP spending in place of an appropriation. The obligation limitation is a limit on the total amount of AIP contract authority that can be obligated in a single fiscal year. For practical purposes, the obligation limitation is analogous to an appropriation. |

|

| 14. |

See |

|

| 15. |

See 49 U.S.C. Chapter 471 and FAA, Airport Improvement Program Handbook, |

|

| 16. |

Passenger enplanements include originating passengers as well as those changing aircraft. |

|

| 17. |

In a year in which the amount made available is below $3.2 billion, the amounts apportioned to primary airports are not doubled, the minimum apportionment returns to $650,000, and the maximum apportionment is $22 million. |

|

| 18. |

In a year in which the amount made available is below $3.2 billion, not more than 8% of cargo service apportionment may be apportioned to any one airport. Landed weight is the weight of the aircraft and its contents at landing. |

|

| 19. |

In any year in which the amount made available under §48103 is less than $3.2 billion, the formula reverts back to the amounts determined by the area and population formula set forth in §47114 (d) (1) & (2). |

|

| 20. |

In any year in which the amount made available under §48103 is less than $3.2 billion, Alaska Supplemental funds will be apportioned based on the way in which amounts were apportioned in the fiscal year ending September 30, 1980. |

|

| 21. |

The program is commonly referred to as MAP; see http://www.faa.gov/airports/aip/military_airport_program/. |

|

| 22. |

Reliever airports are high-capacity general aviation airports meant to provide general aviation pilots with alternatives to using congested hub airports. Reliever airports must have 100 or more based aircraft or 25,000 annual itinerant operations. The FAA NPIAS report 2017-2021 included 259 reliever airports in the United States. |

|

| 23. |

For a description of FAA's process for selecting projects, see 29th AIP Annual Report of Accomplishments, https://www.faa.gov/airports/aip/grant_histories/annual_reports/media/fy2012-aip-report-to-congress.pdf. |

|

| 24. |

49 U.S.C. §47128. For program requirements, see 14 C.F.R. Part 156. |

|

| 25. |

49 U.S.C. §47109. |

|

| 26. |

Higher federal shares are available to airports in states with large amounts of federal land; see 49 U.S.C. §47109(b). |

|

| 27. |

For detailed AIP eligibility criteria and allowable costs, see FAA, Airport Improvement Program Handbook, |

|

| 28. |

49 U.S.C. §47110. Also see http://www.faa.gov/airports/aip/loi/. |

|

| 29. |

The interest on these bonds is not an allowable AIP cost. |

|

| 30. |

FAA, Airport Improvement Program Handbook, Ch. 10, |

|

| 31. |

49 U.S.C. §47107. The layout plan must be approved by the Secretary of Transportation, as must any revision or modification. This, in effect, means that any AIP project must be written into the airport's plan. The nondiscrimination provision protects a wide variety of users, including, for example, nighttime users and cargo carriers. |

|

| 32. |

Assurances that no carrier will receive exclusive rights, that airport revenue will be used at the airport and that the airport will comply with civil rights protections continue in perpetuity. |

|

| 33. |

For a listing of the grant assurances, see http://www.faa.gov/airports/aip/grant_assurances/. |

|

| 34. |

In cases where land was purchased with assistance under AIP's forerunner programs the language of the grants must be reviewed to determine the status of the sponsor's obligations. |

|

| 35. |