Tax-Exempt Bonds: A Description of State and Local Government Debt

This report provides information about state and local government debt. State and local governments issue debt instruments in exchange for the use of individuals’ and businesses’ savings. This debt obligates state and local governments to make interest payments for the use of these savings and to repay, at some time in the future, the amount borrowed. State and local governments may finance capital facilities with debt rather than out of current tax revenue to more closely align benefits and tax payments. There was just over $3 trillion in state and local debt outstanding in the third quarter of 2017.

The federal government subsidizes the cost of most state and local debt by excluding the interest income from federal income taxation. This tax exemption is granted in part because it is believed that state and local capital facilities will be underprovided if state and local taxpayers have to pay the full cost. The federal government also provides a tax preference through tax credit bonds (TCBs), which either provide investors with a federal tax credit in lieu of interest payments or a direct payment to the issuer. P.L. 115-97, the 2017 tax revision, repealed the authority to issue TCBs beginning in 2018. For more on TCBs, see CRS Report R40523, Tax Credit Bonds: Overview and Analysis.

State and local debt is issued as bonds, to be repaid over a period of time greater than one year and perhaps exceeding 20 years, and as notes, to be repaid within one year. General obligation bonds are secured by the promise to repay with general tax revenue, and revenue bonds are secured with the promise to use a specific stream of tax revenue. Most debt is issued to finance new capital facilities, but some is issued to refund a prior bond issue (usually to take advantage of lower interest rates). Tax-exempt bonds issued for some activities are classified as governmental bonds and can be issued without federal constraint because most of the benefits from the capital facilities are enjoyed by the general public. Many tax-exempt revenue bonds are issued for activities Congress has classified as private because most of the benefits from the activities appear to be enjoyed by private individuals and businesses. The annual volume of a subset of these tax-exempt private-activity bonds (PABs) is capped. For more on private activity bonds, see CRS Report RL31457, Private Activity Bonds: An Introduction.

Arbitrage bonds devote a substantial share of the proceeds to the purchase of assets with higher interest rates than that being paid on the tax-exempt bonds. Such arbitrage bonds are not tax exempt because Congress does not want state and local governments to issue tax-exempt bonds and use the proceeds to earn arbitrage profits. The arbitrage profits could substitute for state and local taxes.

A number of tax reform proposals have been introduced that would modify the tax treatment of state and local government bonds. Another policy issue is whether constraints should be relaxed on the types of activities, such as infrastructure spending, for which entities can issue tax-exempt debt. The list of activities that classify tax-exempt private-activity bonds—and whether they should be included in the volume cap—is another area of potential change or reform. The 2017 tax revision repealed authority to issue TCBs and advanced refunding bonds, but did not otherwise modify tax-exempt bonds or PABs.

Tax-Exempt Bonds: A Description of State and Local Government Debt

Jump to Main Text of Report

Contents

- What Is Debt?

- Why Do State and Local Governments Issue Debt?

- What Makes State and Local Debt Special?

- What Does Tax Exemption Cost the Federal Government?

- Why Does the Federal Government Subsidize State and Local Debt?

- Total Debt Outstanding

- Classifying State and Local Debt Instruments

- Maturity: Short-Term vs. Long-Term

- Tax and Revenue Anticipation Notes

- Security: General Obligation, Revenue, and Lease Rental Bonds

- Use of the Proceeds: New-Issue vs. Refunding Bonds

- Public Purpose vs. Private Purpose

- Private Activities Eligible for Tax Exemption

- What Are Arbitrage Bonds?

- What Are Tax Credit Bonds?

- Legislative Issues

- Suggested Readings

Figures

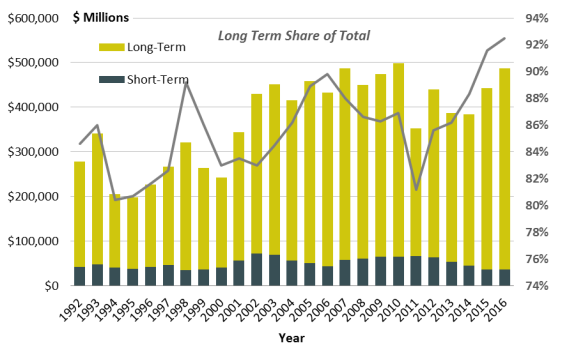

- Figure 1. Volume of State and Local Government Debt Issuances, 1992 to 2016

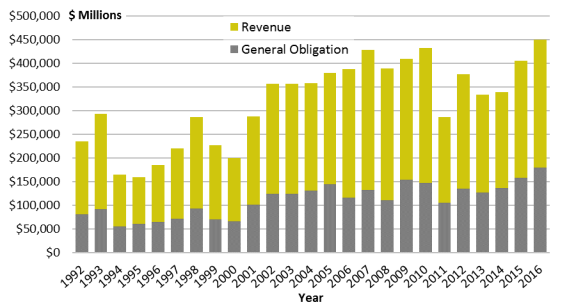

- Figure 2. Volume of Long-Term Tax-Exempt Debt: General Obligation (GO) and Revenue Bonds, 1992 to 2016

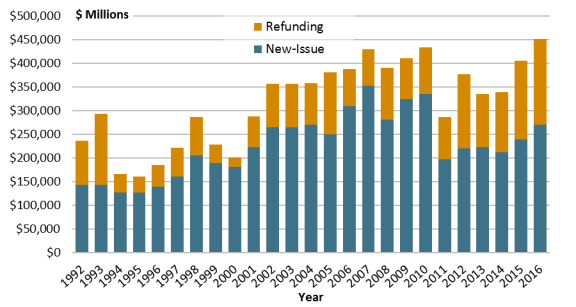

- Figure 3. Volume of Long-Term Tax-Exempt Debt: New-Issue and Refunding Bonds, 1992 to 2016

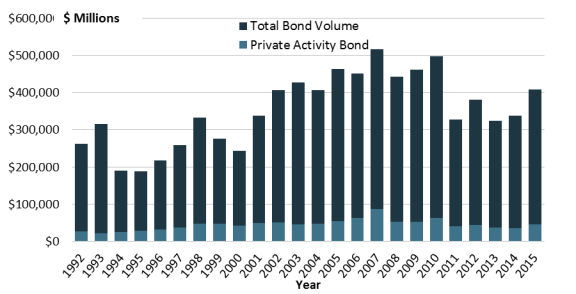

- Figure 4. New-Money and Long-Term Private-Activity Bond Volume, 1992 to 2015

Tables

Appendixes

Summary

This report provides information about state and local government debt. State and local governments issue debt instruments in exchange for the use of individuals' and businesses' savings. This debt obligates state and local governments to make interest payments for the use of these savings and to repay, at some time in the future, the amount borrowed. State and local governments may finance capital facilities with debt rather than out of current tax revenue to more closely align benefits and tax payments. There was just over $3 trillion in state and local debt outstanding in the third quarter of 2017.

The federal government subsidizes the cost of most state and local debt by excluding the interest income from federal income taxation. This tax exemption is granted in part because it is believed that state and local capital facilities will be underprovided if state and local taxpayers have to pay the full cost. The federal government also provides a tax preference through tax credit bonds (TCBs), which either provide investors with a federal tax credit in lieu of interest payments or a direct payment to the issuer. P.L. 115-97, the 2017 tax revision, repealed the authority to issue TCBs beginning in 2018. For more on TCBs, see CRS Report R40523, Tax Credit Bonds: Overview and Analysis.

State and local debt is issued as bonds, to be repaid over a period of time greater than one year and perhaps exceeding 20 years, and as notes, to be repaid within one year. General obligation bonds are secured by the promise to repay with general tax revenue, and revenue bonds are secured with the promise to use a specific stream of tax revenue. Most debt is issued to finance new capital facilities, but some is issued to refund a prior bond issue (usually to take advantage of lower interest rates). Tax-exempt bonds issued for some activities are classified as governmental bonds and can be issued without federal constraint because most of the benefits from the capital facilities are enjoyed by the general public. Many tax-exempt revenue bonds are issued for activities Congress has classified as private because most of the benefits from the activities appear to be enjoyed by private individuals and businesses. The annual volume of a subset of these tax-exempt private-activity bonds (PABs) is capped. For more on private activity bonds, see CRS Report RL31457, Private Activity Bonds: An Introduction.

Arbitrage bonds devote a substantial share of the proceeds to the purchase of assets with higher interest rates than that being paid on the tax-exempt bonds. Such arbitrage bonds are not tax exempt because Congress does not want state and local governments to issue tax-exempt bonds and use the proceeds to earn arbitrage profits. The arbitrage profits could substitute for state and local taxes.

A number of tax reform proposals have been introduced that would modify the tax treatment of state and local government bonds. Another policy issue is whether constraints should be relaxed on the types of activities, such as infrastructure spending, for which entities can issue tax-exempt debt. The list of activities that classify tax-exempt private-activity bonds—and whether they should be included in the volume cap—is another area of potential change or reform. The 2017 tax revision repealed authority to issue TCBs and advanced refunding bonds, but did not otherwise modify tax-exempt bonds or PABs.

What Is Debt?

Individuals and businesses lend their accumulated savings to borrowers. In exchange, borrowers give lenders a debt instrument. These debt instruments, typically called bonds, represent a promise by borrowers to pay interest income to lenders on the principal (the amount of money borrowed) until the principal is repaid to the lenders. When a municipal (state or local) government issues bonds, the principal (or proceeds) is typically used to finance the construction of capital facilities, but may also be used for cash management purposes when revenue collections do not match spending needs during the fiscal year.

Why Do State and Local Governments Issue Debt?

Since public capital facilities provide services over a long period of time, it makes financial and economic sense to pay for the facilities over a similarly long period of time. This is particularly true for state and local governments, whose taxpayers lay claim to the benefits from these facilities by dint of residency and relinquish their claim to benefits when they move. Given the demands a market-oriented society places on labor mobility, taxpayers are reluctant to pay today for state and local capital services to be received in the future. The state or local official concerned with satisfying the preferences of constituents may therefore elect to match the timing of the payments to the flow of services, precisely the function served by long-term bond financing. An attempt to pay for capital facilities "up front" is likely to result in a less than optimal rate of public capital formation.

State and local governments are also faced with the necessity of planning their budget one to two years in advance. This requires a balancing of revenue forecasts against forecasts of the demand for services and spending. Not infrequently, unforeseen circumstances can undermine the forecast and cause a revenue shortfall, which must be financed with short-term borrowing, or "notes." In addition, even when the forecasts are met, the timing of expenditures may precede the arrival of revenues, creating the necessity to borrow within an otherwise balanced fiscal year. Finally, temporarily high interest rates that prevail at the time bonds are issued to finance a capital project may induce short-term borrowing in anticipation of a drop in rates.1

What Makes State and Local Debt Special?

The federal government intervenes in the public capital market by granting the debt instruments of state and local governments a unique privilege—the exemption of interest income earned on these bonds from federal income tax. The tax exemption lowers the cost of capital for state and local governments, which should then induce an increase in state and local capital formation. The lower cost of capital arises because in most cases investors would be indifferent between taxable bonds (e.g., corporate bonds) that yield a 10% rate of return before taxes and tax-exempt bonds of equivalent risk that yield a 6.5% return. The taxable bond interest earnings carry a tax liability (35% of the interest income in most cases), making the after-tax return on the two bonds identical at 6.5%. Thus, state and local governments could raise capital from investors at an interest cost 3.5 percentage points (350 basis points) lower than a borrower issuing taxable debt.

Generally, the degree to which tax-exempt debt is favored is measured in a variety of ways. Two are fairly common: the yield spread and the yield ratio. The yield spread is the difference between the interest rate on taxable bonds (corporate bonds or U.S. Treasury bonds) and the interest rate on tax-exempt municipal bonds of equivalent risk. In recent decades, the spread between tax-exempt and taxable bonds has declined as underlying interest rates have declined. The greater the yield spread, the greater are the nominal savings to state and local governments as measured by the interest rates they would have to pay if they financed with taxable debt.

The yield ratio (which is an average rate on tax-exempt bonds divided by an average rate on a taxable bond of like term and risk) adjusts the spread for the level of interest rates. A lower ratio implies a greater savings to state and local governments relative to taxable debt. As the ratio approaches one, however, tax-exempt borrowing approaches that of taxable borrowing.

Variation in the cost of state and local borrowing relative to the cost of taxable borrowing arises from changes in the demand for and supply of both tax-exempt and taxable bonds. Demand for tax-exempt bonds depends upon the number of investors, their wealth, statutory tax rates, and alternative investment opportunities. Supply depends upon the desire of the state and local sector for capital facilities and their ability to engage in conduit financing (issuing state or local government bonds and passing the proceeds through to businesses or individuals for their private use). Almost all of the factors which influence demand and supply are affected by federal tax policy and fiscal policy.

What Does Tax Exemption Cost the Federal Government?

The direct cost to the federal government of this interest exclusion is the individual and corporate income tax revenue forgone. Consider the aforementioned case where a 35% marginal tax rate corporate investor who purchases a 6.5% tax-exempt bond with principal of $1,000 that is to be repaid after 20 years. Each year for 20 years this taxpayer receives $65 in tax-exempt interest income. Each year the federal government forgoes collecting $35 of revenue because the revenue loss is based upon the yield the taxpayer forgoes. For example, if the investor had purchased a taxable bond carrying a 10% interest rate, he would have received $100 in interest income and paid $35 in income taxes on that income.2

The annual federal revenue loss (or tax expenditure) on the outstanding stock of tax-exempt bonds issued for public purposes is reported in the Analytical Perspectives section of the Budget every year. The estimates since 1994 are displayed in Table 1.3 Because they are based upon the outstanding stock of public-purpose tax-exempt bonds, it takes time for some legislative changes to show up in these data. The amount of forgone tax revenue from the exclusion of interest income on public-purpose tax-exempt bonds is substantial; $20.5 billion in 2016. Over the 2017 to 2026 budget window, the estimated loss of revenue is expected to be $422.8 billion, or the 15th-largest tax expenditure.4

Table 1. Tax Expenditure on the Outstanding Stock of

Public Purpose Tax-Exempt Bonds: 1994 to 2017

(in billions)

|

Year |

Tax Expenditure |

Year |

Tax Expenditure |

|

1994 |

$19.6 |

2006 |

$23.0 |

|

1995 |

$20.4 |

2007 |

$23.5 |

|

1996 |

$24.9 |

2008 |

$24.6 |

|

1997 |

$19.9 |

2009 |

$23.0 |

|

1998 |

$24.6 |

2010 |

$30.4 |

|

1999 |

$27.5 |

2011 |

$26.2 |

|

2000 |

$26.8 |

2012 |

$26.0 |

|

2001 |

$27.4 |

2013 |

$28.4 |

|

2002 |

$29.9 |

2014 |

$29.1 |

|

2003 |

$31.1 |

2015 |

$29.4 |

|

2004 |

$26.2 |

2016 |

$20.5 |

|

2005 |

$26.4 |

2017 |

$28.6 |

Source: Office of Management and Budget. Analytical Perspectives: Budget of the United States Government, Table 13-1 (in budget for FY2019), various years.

Why Does the Federal Government Subsidize State and Local Debt?

When first introduced in 1913, the federal income tax excluded the interest income earned by holders of the debt obligations of states and their political subdivisions from taxable income. It was asserted by many that any taxation of this interest income would be unconstitutional because the exemption was protected by the Tenth Amendment and the doctrine of intergovernmental tax immunity. The U.S. Supreme Court rejected this claim of constitutional protection in 1988 in South Carolina v. Baker (485 U.S. 505).

Although the legal basis for the subsidy is statutory rather than constitutional, the subsidy may be justified on economic grounds. Economic theory suggests that certain types of goods and services, such as a street light, will not be provided in the "optimal" amounts by the private sector because some of the benefits are consumed collectively. The nation's welfare can be increased by public provision of these goods and services, some of which are best provided by state or local governments. Certain goods and services provided by state or local governments, however, benefit both residents, who pay local taxes, and nonresidents, who pay minimal if any local taxes. Since state and local taxpayers are likely to be unwilling to provide these services to nonresidents without compensation, it is probable that state and local services will be under provided. In theory, the cost reduction provided by the exemption of interest income compensates state and local taxpayers for benefits provided to nonresidents. This encourages the governments to provide the optimal amount of public services.

Total Debt Outstanding

State and local governments were estimated to have $3.043 trillion in debt issuances outstanding at the end of the third quarter in 2017.5 Total debt issuances have slowly increased in the past few years, but have been relatively flat since 2008, when debt outstanding equaled $2.968 trillion. Municipal debt outstanding increased from 2008 to 2010, which may have represented issuances used to cover unexpected shortfalls due to reduced revenues and increased expenditure demands following the Great Recession. The lack of growth in debt outstanding in recent years could be explained by a hesitation to engage in new long-term capital projects given the budget challenges and economic uncertainties facing municipal governments.6

Classifying State and Local Debt Instruments

State and local debt can be classified based on (1) the maturity (or term), which is the length of time before the principal is repaid; (2) the type of security, which is the financial backing for the debt; (3) the use of the proceeds for either new facilities or to refinance previously issued bonds; and (4) whether the type of activity being financed has a public or a private purpose.

The risk associated with a bond is also an important factor, as nearly every bond issued by a state or local government is rated based on the probability of default. The privately managed rating agencies incorporate all of the above factors as well as the financial health of the entity issuing the bonds when arriving upon a bond rating. The higher the default risk, the lower the rating.

Maturity: Short-Term vs. Long-Term

Tax and Revenue Anticipation Notes

State and local governments must borrow money for long periods of time and for short periods of time. Long-term debt instruments are usually referred to as bonds, and carry maturities in excess of one year. Short-term debt instruments are usually referred to as notes, and carry maturities of 12 months or less. If the notes are to be paid from specific taxes due in the near future, they usually are called tax anticipation notes (TANs); if from anticipated intergovernmental revenue, they are called revenue anticipation notes (RANs). If the notes are to be paid from long-term borrowing (e.g., bonds), they are called bond anticipation notes (BANs). Tax anticipation notes and revenue anticipation notes are often grouped together and referred to as tax and revenue anticipation notes (TRANs). Table 1 displays the volume of long-term and short-term borrowing since 1992. Long-term borrowing dominates state and local debt activity in most years, with the long-term share peaking in 2016 at 92.5% of this market.

|

Figure 1. Volume of State and Local Government Debt Issuances, 1992 to 2016 |

|

|

Source: The Bond Buyer, 2016 in Statistics: Annual Review, February 2017. |

Security: General Obligation, Revenue,

and Lease Rental Bonds

Another important characteristic of tax-exempt bonds is the security provided to the bondholder. General obligation (GO) bonds pledge the full faith and credit of the issuing government. The issuing government makes an unconditional pledge to use its powers of taxation to honor its liability for interest and principal repayment. Revenue bonds, or non-guaranteed debt, pledge only the revenue from a specific tax or the earnings from the project financed with the bonds. Should these revenues or earnings prove to be inadequate to honor these commitments, the issuing government is under no obligation to use its taxing powers to finance the shortfall. Some revenue bonds are issued with credit enhancements provided by insurance or bank letters of credit that guarantee payment upon such a revenue shortfall.

Figure 2 displays the breakdown between long-term GO and revenue bonds since 1992. The long-term market has been and continues to be dominated by revenue bonds. The revenue bond share has fluctuated between 60% and 72% from 1992 through 2016.

All tax-exempt interest income attributable to state and local governments does not appear in the form of bonds. Governments may enter into installment purchase contracts and finance leases for which the portion of the installment or lease payment to a vendor is tax exempt. For example, computer equipment or road building equipment could be leased from a vendor using a rental agreement or an installment sales contract. Under this type of agreement, the monthly payments to the vendor are large enough to cover the vendor's interest expense on the funds borrowed to purchase the equipment which was leased to the government. The portion that is attributable to interest income is not included in the vendor's taxable income. Such transactions are often referred to as municipal leasing.

|

Figure 2. Volume of Long-Term Tax-Exempt Debt: General Obligation (GO) and Revenue Bonds, 1992 to 2016 |

|

|

Source: The Bond Buyer, 2016 in Statistics: Annual Review, February 2017. |

Lease rental revenue bonds and certificates are variations on revenue bonds. An authority or nonprofit corporation issues bonds, builds a facility with the proceeds, and leases the facility to a municipality. Security for the bonds or certificates is based on the lease payments from the municipalities. When the bonds are retired, the facility belongs to the lessee (the municipality). An advantage to this type of arrangement is that many states' constitutional and statutory definitions do not consider this type of financing to be debt because the lease payments are annual operating expenses based upon appropriated monies.

The leasing technique has also been used to provide tax-exempt funds to nonprofit organizations. A municipality issues the bonds for the construction of a facility that is leased to a nonprofit hospital or university. Again, security for the bonds is based on the lease payments.

Use of the Proceeds: New-Issue vs. Refunding Bonds

Long-term tax-exempt bond issues also can be characterized by their status as new issues or refunding issues (refundings). New issues represent bonds issued to finance new capital facilities. Refundings usually are made to replace outstanding bonds with bonds that carry lower interest rates or other favorable terms. As such, the refunding bonds usually do not add to the stock of outstanding bonds or the capital stock. The proceeds of the refunding bonds are used to pay off the remaining principal of the original bond issue, which is retired. Advance refunding bonds, however, do add to the outstanding stock of bonds without adding to the stock of capital. Advance refunding bonds are issued prior to the date on which the original bonds are refunded, so that for a period of time there are two bond issues outstanding to finance the same capital facilities. The 2017 tax revision (P.L. 115-97) repealed the exclusion of interest income on advance refunding bonds issued after December 31, 2017.

Figure 3 shows the changes in new-issue and refunding municipal bonds from 1992 through 2016. The volume of refunding shares varies widely, depending to a great extent on changes in the relative magnitudes of taxable and tax-exempt interest rates. Note that the 1993 increase in the top marginal individual income tax rates may have increased the demand for tax-exempt bonds (see Figure 2). Higher tax rates make tax-exempt bonds more attractive relative to taxable bonds, all other things being equal. The increased demand and accompanying lower interest rates may have prompted state and local governments to replace outstanding issues with refunding bonds that carried lower interest rates. In contrast, refundings dropped considerably in 1999 and 2000. The decline could have been in response to higher interest rates or to strong economic conditions in most states which minimized the need for debt finance generally. The story is reversed from 2001 to 2003 as the economy slowed and state budgets were strained by lower tax revenue collections. Refundings issues in 2003 were more than double the amount of new issues in 2000. In 2005, GO bonds and refunding bond volume peaked, likely reflecting the historically low interest rates on tax-exempt debt. The low rate environment since 2011 has also pushed up the share of refunding issues.

|

Figure 3. Volume of Long-Term Tax-Exempt Debt: New-Issue and |

|

|

Source: The Bond Buyer, 2016 in Statistics: Annual Review, February 2017. |

Public Purpose vs. Private Purpose

An important characteristic of tax-exempt bonds is the purpose or activity for which the bonds are issued. Most of the tax legislation pertaining to tax-exempt bonds over the last 30 years reflects an effort to restrict tax preferences to bonds issued for activities that satisfy some broadly defined "public" purpose, that is, for which federal taxpayers are likely to receive substantial benefits. Bonds are considered to be for a public purpose if they satisfy either of two criteria: less than 10% of the proceeds are used directly or indirectly by a non-governmental entity; or less than 10% of the bond proceeds are secured directly or indirectly by property used in a trade or business. Bonds that satisfy either of these tests are termed "governmental" bonds and can be issued without federal limit. Bonds that fail both of these tests are termed "private-activity" bonds (PABs) because they provide significant benefits to private individuals or businesses. These projects are ineligible for tax-exempt financing.

Activities which fail the two tests but are considered to provide both public and private benefits have been termed eligible or qualified PABs. These selected activities can be financed with tax-exempt bonds. Table 2 provides the dollar value of new issues of tax-exempt private-activity bonds and their share of total private-activity volume capacity for 2014 and 2015. Figure 4 provides historical data on the portion of PAB volume to total bond volume.

|

Allocation in Billions |

Percent of Capacity Available |

|||

|

Capacity Allocation |

2015 |

2016 |

2015 |

2016 |

|

Total Volume Capacity Available |

$90,036.20 |

$97,361.10 |

100.00% |

100.00% |

|

New Volume Capacity |

$34,878.90 |

$35,141.00 |

38.74% |

36.09% |

|

Carry Forward from Previous Years |

$58,478.60 |

$63,903.30 |

64.95% |

65.64% |

|

Total Carryforward to Next Year |

$54,584.90 |

$62,444.30 |

60.63% |

64.14% |

|

Total PABs Issued |

$13,139.80 |

$20,384.10 |

14.59% |

20.94% |

|

Mortgage Revenue |

$4,566.30 |

$4,465.10 |

5.07% |

4.59% |

|

Multi-family Housinga |

$6,605.80 |

$14,002.60 |

7.34% |

14.38% |

|

Exempt Facilities |

$7,614.10 |

$14,782.00 |

8.46% |

15.18% |

|

Other Activities |

$27.10 |

$28.40 |

0.03% |

0.03% |

|

Student Loans |

$688.10 |

$930.70 |

0.76% |

0.96% |

|

Industrial Development |

$244.30 |

$177.90 |

0.27% |

0.18% |

|

Abandon Capacity |

$10,460.10 |

$9,570.70 |

11.62% |

9.83% |

Source: "CDFA's 2015 Annual Volume Cap Data," August 2016; and "CDFA's 2016 Annual Volume Cap Data," September 2017. The data are available at http://www.cdfa.net/.

a. Multifamily housing bonds are an allowable use of exempt facility bonds and are also included in the "Exempt Facility" category.

Private Activities Eligible for Tax Exemption

All tax-exempt private-activity bonds are subject to restrictions that do not apply to governmental bonds, chief among them was the now-repealed ability to issue advance refundings and the inclusion of the interest income in the alternative minimum income tax base. In addition, the annual dollar value of all bonds issued for most of these activities by all governmental units within a state is limited to the greater of $105 per resident or $311.38 million in 2018. The cap has been adjusted for inflation since 2004. The annual volume cap applies to the total of bonds issued primarily for but not limited to multi- and single-family housing, industrial development, exempt facilities,7 student loans, and bond-financed takeovers of investor-owned utilities (usually electric utilities).

|

Figure 4. New-Money and Long-Term Private-Activity Bond Volume, 1992 to 2015 |

|

|

Source: Source: The 1992 to 1995 data are from Nutter, Sarah, "Tax-Exempt Private-Activity Bonds, 1988-1995," SOI Bulletin, Summer 1999; Belmonte, Cynthia, "Tax-Exempt Bonds, 2003-2004," SOI Bulletin, Fall 2006; Belmonte, Cynthia, "Tax-Exempt Bonds, 2005," SOI Bulletin, Fall 2007; and for later years the IRS data are available at http://www.irs.ustres.gov/taxstats/article/0,,id=97029,00.html. Total long-term bond volume data are from the Bond Buyer, 2016 in Statistics: Annual Review, February 2017. |

Bonds issued for several activities classified as private are not subject to the volume cap if the facilities are governmentally owned.8 These activities are airports, docks, and wharves; nonprofit organization facilities; high-speed inter-urban rail facilities; and solid waste disposal facilities that produce electric energy. Table 3 below reports the estimated tax expenditure for selected private activities that qualify for financing with tax-exempt debt.

Recently, Congress has further expanded the types of private activities eligible for tax-exempt financing and has increased the capacity for selected activities and issuers. A brief description of legislation that Congress has enacted since 2001 follows below.

|

Private Activity |

2016 Tax Expenditure |

Percentage of Total |

|

Total of Selected Activities |

$9,680 |

100.00% |

|

Energy Facilities |

$10 |

0.10% |

|

Water, Sewerage, and Hazardous Waste Disposal |

$420 |

4.34% |

|

Small-Issues |

$150 |

1.55% |

|

Owner-Occupied Mortgage Subsidy |

$1,200 |

12.40% |

|

Rental Housing |

$1,030 |

10.64% |

|

Airports, Docks, and Similar Facilities |

$680 |

7.02% |

|

Student Loans |

$440 |

4.54% |

|

Private Nonprofit Educational Facilities |

$2,260 |

23.35% |

|

Hospital Construction |

$3,480 |

35.95% |

|

Veterans' Housing |

$10 |

0.10% |

Source: Office of Management and Budget. Analytical Perspectives: Budget of the United States Government, Fiscal Year 2018, Table 13-1, pp. 130-134.

Economic Growth and Tax Relief Reconciliation Act of 2001

As part of the Economic Growth and Tax Relief Reconciliation Act of 2001 (P.L. 107-16), a new type of tax-exempt private-activity bond was created beginning on January 1, 2002. The act expanded the definition of "an exempt facility bond" to include bonds issued for qualified public educational facilities. Bonds issued for qualified educational facilities are not counted against a state's private-activity volume cap. However, the qualified public educational facility bonds have their own volume capacity limit equal to the greater of $10 multiplied by the state population or $5 million.

Job Creation and Worker Assistance Act of 2002

The Job Creation and Worker Assistance Act of 2002 (JCWA; P.L. 107-147) created the New York Liberty Zone (NYLZ) in the wake of the September 11, 2001, terrorist attacks. The legislation included several tax benefits for the NYLZ intended to foster economic revitalization within the NYLZ. Specifically, the so-called "Liberty Bond" program allows New York State (in conjunction and coordination with New York City) to issue up to $8 billion of tax-exempt private-activity bonds for qualified facilities in the NYLZ. Qualified facilities follow the exempt facility rules within Section 142 of the IRC. The original deadline to issue the bonds was January 1, 2005, but was extended to January 1, 2014, by the American Taxpayer Relief Act (P.L. 112-240).

American Jobs Creation Act

In 2004, the American Jobs Creation Act (P.L. 108-357) created bonds for "qualified green building and sustainable design projects." The bonds are exempt from the state volume cap and are instead limited to an aggregate of $2 billion for bonds issued between January 1, 2005, and October 1, 2009.

The Safe, Accountable, Flexible, Efficient, Transportation Equity Act of 2005

This legislation created a new type of tax-exempt private activity bond for the construction of rail to highway (or highway to rail) transfer facilities. The national limit is $15 billion and the bonds are not subject to state volume caps for private activity bonds. The Secretary of Transportation allocates the bond authority on a project-by-project basis.

Gulf Opportunity Zone Act of 2005

The hurricanes that struck the Gulf region in late summer 2005 prompted Congress to create a tax-advantaged economic development zone intended to encourage investment and rebuilding in the Gulf region. The Gulf Opportunity Zone (GOZ) was comprised of the counties where the Federal Emergency Management Agency (FEMA) declared the inhabitants to be eligible for individual and public assistance. Based on proportion of state personal income, the Katrina-affected portion of the GOZ represents approximately 73% of Louisiana's economy, 69% of Mississippi's, and 18% of Alabama's.

Specifically, the "Gulf Opportunity Zone Act of 2005" (GOZA 2005, P.L. 109-135) contained two provisions that expanded the amount of private-activity bonds outstanding and language to relax the eligibility rules for mortgage revenue bonds. The most significant is the provision that increased the volume cap for private-activity bonds issued for Hurricane Katrina recovery in Alabama, Louisiana, and Mississippi (identified as the Gulf Opportunity Zone, or "GO Zone"). GOZA 2005 added $2,500 per person in the federally declared Katrina disaster areas in which the residents qualified for individual and public assistance.

The increased volume capacity added approximately $2.2 billion for Alabama, $7.8 billion for Louisiana, and $4.8 billion for Mississippi in aggregate over five years. The legislation defined "qualified project costs" that are eligible for bond financing as (1) the cost of any qualified residential rental project (26 §142(d)); and (2) the cost of acquisition, construction, reconstruction, and renovation of (i) nonresidential real property (including fixed improvements associated with such property); and (ii) public utility property (26 §168(i)(10)), in the GOZ. The additional capacity was to have been issued before January 1, 2011.

The second provision allowed for advance refunding of certain tax-exempt bonds. Under GOZA 2005, governmental bonds issued by Alabama, Louisiana, and Mississippi could be advance refunded an additional time and exempt facility private-activity bonds for airports, docks, and wharves once. Private-activity bonds are otherwise not eligible for advance refunding (see earlier discussion of advance refunding).

The Housing and Economic Recovery Act of 2008

In response to the housing crisis of 2008, Congress included two provisions in the Housing and Economic Recovery Act of 2008 (HERA; P.L. 110-289) that were intended to assist the housing sector. First, HERA provided that interest on qualified private activity bonds issued for (1) qualified residential rental projects, (2) qualified mortgage bonds, and (3) qualified veterans' mortgage bonds would not be subject to the AMT. In addition, HERA also created an additional $11 billion of volume cap space for bonds issued for qualified mortgage bonds and qualified bonds for residential rental projects. The cap space was designated for 2008 but could have been carried forward through 2010.

The American Recovery and Reinvestment Act of 2009

In response to the financial crisis and economic recession, Congress included several bond-related provisions in the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). Three provisions were intended to make bond finance less expensive for the designated projects. One expanded the definition of qualified manufacturing facilities (under §144(a)(12)(C)) to include the creation and production of intangible property including patents, copyrights, formulae, etc. Before ARRA, only tangible property was eligible. The second created a new category of private activity bond called "recovery zone facility bonds." The bonds were to be used for investment in infrastructure, job training, education, and economic development in economically distressed areas. The bonds, which were subject to a separate national cap of $15 billion, were allocated to the states based on the decline in employment in 2008. The bonds were eligible to be issued in 2009 and 2010.

A third provision provided $2 billion for tribal governments to issue tax-exempt bonds for economic development purposes. The tax code currently allows tribal governments to issue debt for "essential government services" only. Many economic development projects would not have qualified absent this ARRA provision.

What Are Arbitrage Bonds?

Many individuals and businesses make money by engaging in arbitrage, borrowing money at one interest rate and lending that borrowed money to others at a higher interest rate. The difference between the rate at which one borrows and the rate at which one lends produces arbitrage earnings. At its most basic level, it is the primary activity of commercial banks—pay depositors an interest rate of "x" and use the deposits to make commercial, automobile, and home loans at "x + y" interest rate. In this context, arbitrage is a time-honored and appropriate financial market activity.

That is not the case in the tax-exempt bond market. State and local governments do not pay federal income tax, and absent federal constraint, have unlimited capacity to issue debt at low interest rates and reinvest the bond proceeds in higher-yielding taxable debt instruments, thereby earning arbitrage profits. Unchecked, state and local governments could substitute arbitrage earnings for a substantial portion of their own citizens' tax effort.

Congress has decided that such arbitrage should be limited, and that tax-exempt bond proceeds must be used as quickly as possible to pay contractors for the construction of the capital facilities for which the bonds were issued. Since it is impossible for bonds to be issued precisely when contractors must be paid for their expenses incurred in building public capital facilities, the tax law provides a three-year period to spend an increasing share of the bond proceeds. Bond issues that have unspent proceeds in excess of the allowed amounts during this three-year spend-down schedule must rebate any arbitrage earnings to the Department of the Treasury. Bond issues are considered to be taxable arbitrage bonds if a governmental unit, in violation of the arbitrage restriction in the tax code, invested a substantial portion of the proceeds "to acquire higher yielding investments, or to replace funds which were used directly or indirectly to acquire higher yielding investments."9

What Are Tax Credit Bonds?

Tax Credit Bonds (TCBs) are an alternative to tax-exempt bonds that offer investors a federal tax credit or the issuer a direct payment proportional to the bond's value in lieu of a federal tax exemption. Most TCBs currently in circulation were designated for a specific purpose, location, or project. TCB issuers use the proceeds for public school construction and renovation; clean renewable energy projects; refinancing of outstanding government debt in regions affected by natural disasters; conservation of forest land; investment in energy conservation; and for economic development purposes.

The 2017 tax revision (P.L. 115-97) repealed the authority to issue new TCBs after December 31, 2017. TCBs that provided for new issuances in 2017 include Qualified Zone Academy Bonds (QZABs) and Qualified School Construction Bonds (QSCBs); the authority to issue other TCBs had expired prior to the 2017 tax revision. Bonds that are no longer issued may still be held by the public and thus receive a federal tax credit or direct payment. For more information on tax credit bonds, see CRS Report R40523, Tax Credit Bonds: Overview and Analysis.

Legislative Issues

Legislative interest has typically focused on altering the tax treatment of state and local debt to provide a more economically efficient subsidy with a lower federal revenue cost. There are three primary types of proposals that include changes to state and local government bonds—capping the preference, eliminating the preference, and changing the preference to a direct issuer subsidy. These three types have each featured in legislative proposals from recent years. An early version of the 2017 tax revision (H.R. 1) that was passed in the House included provisions that would repeal authority to issue PABs and eliminate the use of tax-exempt bonds to fund professional sports stadiums. P.L. 115-97 as enacted did not include those provisions, however. The Congressional Budget Office (CBO) "Revenue Options" report proposed eliminating the tax exemption for new qualified private activity bonds which would generate a budget savings of $28 billion over the 2017 to 2026 budget window.10 The direction of future changes to the federal tax code will likely dictate which modifications, if any, are made to the tax treatment of state and local government debt.

Suggested Readings

Hilhouse, Albert M. Municipal Bonds: A Century of Experience (New York: Prentice-Hall, 1936).

The classic history of the use and development of municipal bonds from their introduction in the 19th century.

U.S. Senate. Committee on the Budget. Tax Expenditures: Compendium of Background Material on Individual Provisions. S.Prt. 113-32. 113th Congress, 2nd session, December 2014.

Provides description, revenue loss estimate, and economic analysis of the effects of governmental bonds and each major category of private-activity bond.

Zimmerman, Dennis. The Private Use of Tax-Exempt Bonds: Controlling Public Subsidy of Private Activity (Washington: The Urban Institute Press, 1991).

Provides institutional background: history, legal framework, and industry characteristics. Provides discussion of tax-exempt bonds as an economic policy tool affecting: intergovernmental fiscal relations, the federal budget deficit, efficient resource allocation, and tax equity. Provides a history and economic analysis of tax-exempt bond legislation from 1968 to 1989.

Appendix. Auction Rate Securities

Auction Rate Securities (ARSs) are long-term debt obligations with the unique feature of adjustable or variable interest rates.11 In contrast to long-term, fixed rate securities, issuers go to auction periodically (anywhere from every 7 to 35 days) to reset the interest rate on the debt outstanding. The auction mechanism and interest rate parameters vary by issuer (and issue), though most use what is termed a "Dutch auction" where each bidder submits a bid for the amount they are willing to purchase at a given interest rate. All bids are ordered from lowest interest rate to highest interest rate and the rate where the market clears, that is, where all bonds would be purchased, establishes the new ARS rate received by all bidders.

ARSs typically have a "call option" where the issuer can buy the ARS back at par (face value) at any scheduled auction and then retire the debt. Most ARSs are insured by the issuer because they do not carry a "put" option that would allow bondholders to sell the bonds at a specified price to the issuer or a designated third party. The bond insurance reduces risk and thus interest rate, making the bonds less costly to issuers. For this reason, ARSs are heavily influenced by credit ratings, and typically require bond insurance to make them marketable.12

The existing holders of ARSs offer bids as well as new bidders. If all bids of both existing bond holders and new participants fail to clear the market, the auction is termed a "failed auction." In this scenario, the original agreement with the bondholder stipulates a "reservation" interest rate the issuer must pay in the event of a failed auction at least until the next successful auction. Because the reservation rate is typically higher than market interest rates, issuers of ARSs would prefer to avoid paying the reservation rate.

The issuance of ARSs grew considerably from 1988 through 2007. In 1988, the Bond Buyer identified one ARS issue valued at $25 million; none were issued in 1987.13 In 2004, the peak year, 438 ARS bonds valued at $42.5 billion were issued. No ARSs have been issued since 2007, roughly corresponding to the beginning of the financial crisis, when 322 were sold for a total value of $38.7 billion.

Author Contact Information

Acknowledgments

The author wishes to thank [author name scrubbed] and [author name scrubbed], who originally wrote this report.

Footnotes

| 1. |

Though severely restrictive constitutional and statutory limitations were placed on state and local borrowing in the 19th century, courts and taxpayers have ignored that legacy in modern times. For more information, see Zimmerman, Dennis, The Private Use of Tax Exempt Bonds: Controlling the Public Subsidy of Private Activity (Washington, The Urban Institute Press, 1991), pp. 17-27. |

| 2. |

The decision about preferred alternatives is critical to estimates of the revenue loss from tax-exempt bonds. An entire range of financial and real assets exists with different yields, risk, and degree of preferential taxation. It is not true that the municipal bond purchaser's preferred alternative is always a taxable bond. |

| 3. |

These estimates are derived by summing the revenue loss estimates for each activity listed in the tax expenditures budget. Technically, this is incorrect because each activity's revenue loss is calculated in isolation, and there are interactive effects. Nonetheless, without an estimate of the interactive effects' impact on revenue loss, the summing employed here provides the best available order of magnitude. |

| 4. |

Office of Management and Budget. Analytical Perspectives: FY2018 Budget of the United States Government, Table 13-3. |

| 5. |

Board of Governors of the Federal Reserve System, Financial Accounts of the United States, Table D.3 Debt Outstanding by Sector, released December 7, 2017. |

| 6. |

For a more detailed discussion of municipal debt issuance trends, see Edwards, Nora, "An Overview of Local Government General Obligation Bonds Issuance Trends – 2016," California Debt and Investment Advisory Commission, August 2016. |

| 7. |

Exempt facilities subject to the volume cap are the following: mass commuting facilities, water furnishing, sewage treatment, solid waste disposal, residential rental projects, electric energy or gas furnishing, local district heating or cooling provision, and hazardous waste disposal and 25% of high-speed rail facility bonds. 26 I.R.C. §141(e), §142(a), and §146(g). |

| 8. |

This does not mean governmental ownership in the conventional sense. It simply means that lease arrangements for private management and operation of bond-financed facilities must be structured to deny accelerated depreciation benefits to the private operator, lease length must conform to the facility's expected service life, and any sale of the facility to the private operator must be made at fair market value. 26 I.R.C. §146(g). |

| 9. |

26 I.R.C. §148(a). |

| 10. |

Congressional Budget Office, "Options for Reducing the Deficit: 2017 to 2026," December 2016, p. 134. Available at https://www.cbo.gov/budget-options/2016. |

| 11. |

For more see CRS Report RL34672, Auction-Rate Securities, by [author name scrubbed]. |

| 12. |

For more information on ARSs, see Douglas Skarr, California Debt and Investment Advisory Commission, "Auction Rate Securities," Issue Brief, August 2004. |

| 13. |

The Bond Buyer 2007 Yearbook, SourceMedia Inc., New York, NY. |