Transportation Infrastructure Investment as Economic Stimulus: Lessons from the American Recovery and Reinvestment Act of 2009

Congress is considering federal funding for infrastructure to revive an economy damaged by Coronavirus Disease 2019 (COVID-19). Congress previously provided infrastructure funding for economic stimulus in the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). Enacted on February 17, 2009, ARRA was a response to the “Great Recession” that officially ran from December 2007 through June 2009. This report discusses the economic impact of the transportation infrastructure funding in ARRA.

ARRA provided $48.1 billion for programs administered by the U.S. Department of Transportation (DOT), with more than half, $27.5 billion, authorized for highways. Other funding included $8.4 billion for public transportation, $8.0 billion for high-speed rail, $1.3 billion for Amtrak, $1.3 billion for aviation programs, and $1.5 billion for Transportation Investment Generating Economic Recovery (TIGER) grants, which could be used for a wide range of transportation projects. Most of the ARRA funding was distributed by DOT agencies to their usual grantees via existing formula programs. The high-speed rail funding and TIGER grants required the establishment of two new discretionary programs.

Based on approximately a decade or more of program and other data, the following are among the observations that can be made with regard to the economic effects of ARRA funding for transportation infrastructure:

Infrastructure spending was slower than other types of stimulus. ARRA transportation funding was expended more slowly than other types of assistance, such as unemployment compensation. About 9% of DOT funding was spent within the first six months of availability compared with 44% of unemployment compensation. The majority of DOT’s ARRA funding was spent in FY2010 (37%) and FY2011 (24%).

Characteristics of infrastructure funding affected expenditure timing. Funding that was distributed by DOT agencies to their usual grantees via existing formula programs was expended relatively quickly. This included most of the funding for highways, public transportation, aviation, and maritime transportation. Discretionary funds for programs established in the law, such as for the high-speed rail program and TIGER grants, took much longer to expend on construction because DOT had to design the programs, issue rules, advertise the availability of funds, and wait for applications from state and local agencies, which then had to complete their own contracting procedures to get work under way.

The level of infrastructure investment depended on nonfederal entities. State and local expenditures make up around 75% of transportation infrastructure expenditures. In some sectors, such as highways, the growth in federal spending due to ARRA was accompanied by a decline in state and local government spending.

Maintenance-of-effort requirements were difficult to enforce. The federal share of transportation projects using ARRA funds was generally 100%, but states were required to certify that they would spend amounts already planned. These maintenance-of-effort requirements in transportation were challenging to comply with and to administer.

Employment effects were modest. Employment in highway construction, for example, rose slightly in the year following the passage of ARRA. A sustained increase in employment did not begin until 2015.

Financing infrastructure did leverage state resources. ARRA included the Build America Bond (BAB) program, which permitted state and local governments to issue tax credit bonds for any type of capital investment. The attractiveness of BABs may have accelerated the timing of capital financings and, thus, capital investment. BABs had a relatively generous subsidy rate, but compared with ARRA grants, the issuance of BABs for infrastructure ensured a state funding match of 65%.

Stimulus-funded projects can provide transportation benefits. Most ARRA transportation funding went to routine projects such as highway paving and bus purchases that were quick to implement. According to DOT estimates, such projects often have higher benefit-cost ratios than large “game changing” projects that build new capacity.

Transportation Infrastructure Investment as Economic Stimulus: Lessons from the American Recovery and Reinvestment Act of 2009

Jump to Main Text of Report

Contents

- Introduction

- Transportation Infrastructure Funding in ARRA

- Observations on the ARRA Experience

- Infrastructure Spending Is Slower Than Other Types of Stimulus

- Characteristics of Infrastructure Funding Can Affect Expenditure Timing

- The Level of Infrastructure Investment Can Depend on Nonfederal Entities

- Maintenance-of-Effort Requirements Were Difficult to Enforce

- Employment Effects Were Modest

- Financing Infrastructure May Leverage State Resources

- Stimulus-Funded Projects Can Provide Transportation Benefits

Figures

Summary

Congress is considering federal funding for infrastructure to revive an economy damaged by Coronavirus Disease 2019 (COVID-19). Congress previously provided infrastructure funding for economic stimulus in the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). Enacted on February 17, 2009, ARRA was a response to the "Great Recession" that officially ran from December 2007 through June 2009. This report discusses the economic impact of the transportation infrastructure funding in ARRA.

ARRA provided $48.1 billion for programs administered by the U.S. Department of Transportation (DOT), with more than half, $27.5 billion, authorized for highways. Other funding included $8.4 billion for public transportation, $8.0 billion for high-speed rail, $1.3 billion for Amtrak, $1.3 billion for aviation programs, and $1.5 billion for Transportation Investment Generating Economic Recovery (TIGER) grants, which could be used for a wide range of transportation projects. Most of the ARRA funding was distributed by DOT agencies to their usual grantees via existing formula programs. The high-speed rail funding and TIGER grants required the establishment of two new discretionary programs.

Based on approximately a decade or more of program and other data, the following are among the observations that can be made with regard to the economic effects of ARRA funding for transportation infrastructure:

Infrastructure spending was slower than other types of stimulus. ARRA transportation funding was expended more slowly than other types of assistance, such as unemployment compensation. About 9% of DOT funding was spent within the first six months of availability compared with 44% of unemployment compensation. The majority of DOT's ARRA funding was spent in FY2010 (37%) and FY2011 (24%).

Characteristics of infrastructure funding affected expenditure timing. Funding that was distributed by DOT agencies to their usual grantees via existing formula programs was expended relatively quickly. This included most of the funding for highways, public transportation, aviation, and maritime transportation. Discretionary funds for programs established in the law, such as for the high-speed rail program and TIGER grants, took much longer to expend on construction because DOT had to design the programs, issue rules, advertise the availability of funds, and wait for applications from state and local agencies, which then had to complete their own contracting procedures to get work under way.

The level of infrastructure investment depended on nonfederal entities. State and local expenditures make up around 75% of transportation infrastructure expenditures. In some sectors, such as highways, the growth in federal spending due to ARRA was accompanied by a decline in state and local government spending.

Maintenance-of-effort requirements were difficult to enforce. The federal share of transportation projects using ARRA funds was generally 100%, but states were required to certify that they would spend amounts already planned. These maintenance-of-effort requirements in transportation were challenging to comply with and to administer.

Employment effects were modest. Employment in highway construction, for example, rose slightly in the year following the passage of ARRA. A sustained increase in employment did not begin until 2015.

Financing infrastructure did leverage state resources. ARRA included the Build America Bond (BAB) program, which permitted state and local governments to issue tax credit bonds for any type of capital investment. The attractiveness of BABs may have accelerated the timing of capital financings and, thus, capital investment. BABs had a relatively generous subsidy rate, but compared with ARRA grants, the issuance of BABs for infrastructure ensured a state funding match of 65%.

Stimulus-funded projects can provide transportation benefits. Most ARRA transportation funding went to routine projects such as highway paving and bus purchases that were quick to implement. According to DOT estimates, such projects often have higher benefit-cost ratios than large "game changing" projects that build new capacity.

Introduction

Congress is considering federal funding for infrastructure to revive an economy damaged by Coronavirus Disease 2019 (COVID-19). This is not the first occasion on which Congress has considered funding infrastructure for purposes of economic stimulus. This report discusses the economic impact of the transportation infrastructure funding that was provided in the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). Enacted on February 17, 2009, ARRA was a response to the recession that officially ran from December 2007 through June 2009.1 This "Great Recession" proved to be the most severe economic downturn since the Great Depression of the 1930s. The recession was relatively deep and the recovery relatively slow. The unemployment rate, for example, rose from 4.4% in May 2007 to 10% in October 2009, and did not fall below 6% again until September 2014.2

ARRA was the largest fiscal stimulus measure passed by Congress in reaction to the Great Recession.3 When enacted, the Congressional Budget Office (CBO) estimated the law would cost the federal government $787 billion from FY2009 through FY2019.4 Of this amount, infrastructure accounted for approximately $100 billion to $150 billion (13% to 19%), depending on how the term is defined (see text box, 'What is Infrastructure?').5

|

There is no agreed-upon meaning of "infrastructure." The term generally refers to long-lived, capital-intensive systems and facilities. Some definitions are limited to systems and facilities that have traditionally been provided largely by the public sector directly, such as highways and drinking water systems. Others add facilities that in the United States belong predominantly to private entities, such as electricity production and distribution, reflecting both their importance to the economy and the different public-private arrangements through which services can be provided. Some definitions include a narrow range of "core" systems, typically transportation, energy, water, and telecommunications, whereas others include facilities for such purposes as education, recreation, health, and protection of natural resources. |

Of the original $787 billion cost estimate, programs administered by the U.S. Department of Transportation (DOT) received a total of $48.1 billion, about 6% of the total. Other public works infrastructure funding in ARRA included $4.6 billion for Army Corps of Engineers projects, some of which were related to waterborne transportation; $4 billion for state clean water revolving funds; $2 billion for state drinking water revolving funds; and $2.5 billion for four major federal land management agencies. Authority for state and local governments to issue tax credit bonds for capital spending represented an additional federal subsidy of about $36 billion. These figures do not include ARRA funding for federal government buildings and facilities, communications technologies, and energy systems.

As is the case with most federal infrastructure investment, the infrastructure support authorized in ARRA was provided in four different ways:

- direct spending on infrastructure the federal government owns and operates, including roads and bridges on federal lands and the air traffic control system;

- grants to nonfederal entities, especially state and local agencies such as state departments of transportation and local public transportation authorities;

- tax preferences to provide incentives for nonfederal investment in infrastructure, such as the authority granted state and local governments to issue bonds to finance capital spending on infrastructure; and

- credit assistance to nonfederal entities, such as loans and loan guarantees to public and private project sponsors.

Transportation Infrastructure Funding in ARRA

ARRA funding represented a 72% supplement to DOT's regular FY2009 funding of $67.2 billion.6 More than half of the DOT spending authorized in ARRA was for highways. The highway funding was predominantly distributed by formula, and, like most of the other funding, had to be obligated by the end of FY2010—19 months after the date of enactment—and expended by the end of FY2015. Most of the funding for public transportation was also distributed by formula; the major exception was $750 million for the Federal Transit Administration's existing Capital Investment Grant program. The $8 billion for high-speed and intercity rail projects was an entirely new discretionary program. ARRA also created an entirely new discretionary program whose explicit purpose was economic stimulus, Transportation Investment Generating Economic Recovery (TIGER) grants, which could be used for a wide range of transportation projects (Table 1).

For most of these programs, the ARRA grants did not require any local match. States were required to certify that they would use these grants to supplement their planned transportation spending, rather than substituting the additional funding for their planned spending. This was known as maintenance-of-effort certification.

|

Department/Program |

Funding |

Obligation Deadline |

Expenditure Deadline |

|

Federal Highway Administration |

|||

|

Highway Infrastructure |

27,500 |

9/30/2010 |

9/30/2015 |

|

Federal Transit Administration |

|||

|

Capital Investment Grants |

750 |

9/30/2010 |

9/30/2015 |

|

Capital Assistance |

6,900 |

9/30/2010 |

9/30/2015 |

|

Fixed Guideway Infrastructure |

750 |

9/30/2010 |

9/30/2015 |

|

Federal Railroad Administration |

|||

|

Grants to Amtrak |

1,300 |

9/30/2010 |

9/30/2015 |

|

High-speed Rail |

8,000 |

9/30/2012 |

9/30/2017 |

|

Federal Aviation Administration |

|||

|

Facilities and Equipment |

200 |

9/30/2010 |

9/30/2015 |

|

Airport Grants |

1,100 |

9/30/2010 |

9/30/2015 |

|

Maritime Administration |

|||

|

Assistance to Small Shipyards |

100 |

9/30/2010 |

9/30/2015 |

|

Office of the Secretary |

|||

|

TIGER Grants |

1,500 |

9/30/2011 |

9/30/2016 |

|

Inspector General Salaries and Expenses |

20 |

9/30/2013 |

9/30/2018 |

|

Total |

48,120 |

NA |

NA |

Source: U.S. Department of Transportation, Shovel Worthy: The Lasting Impacts of the American Recovery and Reinvestment Act on America's Transportation Infrastructure, p. 6, at https://www.transportation.gov/mission/budget/arra-final-report.

Note: NA = Not applicable.

Observations on the ARRA Experience

Infrastructure Spending Is Slower Than Other Types of Stimulus

The timing of expenditures of ARRA transportation funding demonstrated that infrastructure funding is generally expended more slowly than other types of assistance, such as unemployment compensation, Medicaid payments, and Social Security payments. Of the funding allocated to DOT, about 9% was spent within the first six months or so of availability, compared with 44% of unemployment compensation (Table 2). The majority of DOT's ARRA funding was spent in FY2010 (37%) and FY2011 (24%). Another 11% was spent in FY2012. As with regular federal funding provided though DOT programs, ARRA funding was provided on a reimbursable basis. State and local governments had to complete an eligible project, or a defined part of a project, before receiving federal payment, so at least some of the intended economic effects, such as wage payments and orders for construction materials, had occurred prior to each transfer of federal grant funds to a recipient.

|

Department/Program |

FY2009 |

FY2010 |

FY2011 |

FY2012 |

FY2013 to |

|

Department of Transportation |

8.7 |

37.0 |

23.9 |

10.9 |

19.6 |

|

Build America Bonds |

0.0 |

2.8 |

11.1 |

11.1 |

77.8 |

|

Medicaid |

32.3 |

40.4 |

12.1 |

4.0 |

11.1 |

|

Unemployment compensation |

43.8 |

51.6 |

4.7 |

0.0 |

0.0 |

|

SNAP |

10.4 |

22.9 |

25.0 |

16.7 |

25.0 |

|

Education, State Stabilization Fund |

22.2 |

42.6 |

22.2 |

3.7 |

5.6 |

|

Education, other |

20.5 |

43.2 |

25.0 |

6.8 |

4.5 |

|

Department of Energy |

2.9 |

23.5 |

32.4 |

23.5 |

17.6 |

|

Social Security Administrationa |

92.9 |

0.0 |

0.0 |

0.0 |

0.0 |

Source: Congressional Budget Office, Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output in 2014, February 2015, table 1, at https://www.cbo.gov/publication/49958.

Notes: SNAP = Supplemental Nutrition Assistance Program. Percentages are based on data expressed in dollars rounded to the nearest billion; therefore, data in each row may not add to 100%.

a. CBO estimates $13 billion of $14 billion authorized was expended in FY2009. The remaining $1 billion was spent in the following years, presumably, but it is not recorded in the source table due to rounding.

There was a good deal of criticism of infrastructure spending as an economic stimulus, asserting that the expenditures were too slow. The Obama Administration emphasized that the money could be used for "shovel-ready" projects, but critics complained that there is "no such thing as shovel ready."7 CBO data show that almost half of DOT's ARRA funding was spent within about 18 months of enactment. The Obama Administration argued that the relatively slow expenditure of infrastructure funding could offer advantages in a deep and long economic downturn, such as the Great Recession, by noting that8

different types of stimulus affect the economy with different speeds. For instance, aid to individuals directly affected by the recession tends to be spent relatively quickly, while new investment projects require more time. Because of the need to provide broad support to the economy over an extended period, the Administration supported a stimulus plan that included a broad range of fiscal actions.

Characteristics of Infrastructure Funding Can Affect Expenditure Timing

Although the ARRA infrastructure funding was expended more slowly than most other types of support provided in the law, there were major differences in the rate of expenditures among infrastructure programs. Much of the highway and transit funding was distributed by DOT agencies to their usual grantees via existing formula programs, and was therefore available for use relatively quickly. Similarly, the Federal Aviation Administration distributed airport funds through the existing Airport Improvement Program, and the Maritime Administration awarded grants through its existing Assistance to Small Shipyards Program. More than 50% of funding for these programs was expended by grantees by January 2011, less than two years after the enactment of ARRA (Table 3).

Discretionary funds for programs established in the law, such as for the high-speed rail program and TIGER grants, took much longer to distribute and to use because DOT had to design the programs, issue rules, advertise the availability of funds, and wait for applications. Congress recognized that setting up new programs would take some time by including longer obligation deadlines in the law. High-speed rail funding was expended particularly slowly. DOT data showed that three years after ARRA enactment, 8% of high-speed rail funding had been expended. High-speed rail had been studied for decades, but there were almost no plans or projects that were ready for implementation. In addition, unlike other parts of DOT, the Federal Railroad Administration was inexperienced at administering large amounts of grant funds.

|

Agency/Program |

Funds Awarded |

% Expended By: |

|||

|

July 31, 2009 |

Jan 30, 2010 |

Jan 30, 2011 |

Jan 30, 2012 |

||

|

Federal Aviation Administration |

|||||

|

Airport Grants |

1,060.1 |

10.3 |

55.9 |

97.3 |

99.3 |

|

Federal Railroad Administration |

|||||

|

High-Speed Rail |

7,381.2 |

0.0 |

0.0 |

2.4 |

7.5 |

|

Grants to Amtrak |

1,295.8 |

0.8 |

9.0 |

82.1 |

100.0 |

|

Federal Transit Administration |

|||||

|

Capital Investment Grant |

742.5 |

23.2 |

63.1 |

100.0 |

100.0 |

|

Fixed Guideway Formula |

742.5 |

7.9 |

18.8 |

56.5 |

79.1 |

|

Transit Capital Formula |

7,254.9 |

4.7 |

18.5 |

56.9 |

77.8 |

|

Federal Highway Administration |

|||||

|

Highway Formula |

26,362.8 |

2.6 |

22.9 |

68.2 |

87.3 |

|

Maritime Administration |

|||||

|

Small Shipyard Grants |

0.98 |

0.0 |

30.0 |

83.2 |

93.8 |

|

Office of the Secretary |

|||||

|

TIGER Grants |

1,498 |

0.0 |

0.0 |

2.9 |

31.8 |

|

Total |

46,435.5 |

2.96 |

18.81 |

55.25 |

72.07 |

Source: U.S. Department of Transportation, "ARRA 1201(c) Reports," various dates, https://www.transportation.gov/recovery.

Notes: Percentage calculations by CRS based on funds awarded. Some funds were transferred from the Federal Highway Administration to the Federal Transit Administration. Some funds appropriated were used by the administering agency for implementation and oversight.

A major exception to the general distinction between the timing of formula and discretionary program expenditures was the ARRA funding for the Federal Transit Administration's Capital Investment Grant (CIG) Program. The CIG Program, also known as New Starts, funds the construction of new fixed-guideway public transportation systems and the expansion of existing systems. Eligible projects include transit rail, such as subway/elevated rail (heavy rail), light rail, and commuter rail, as well as bus rapid transit and ferries. The agency has discretion in selecting projects to receive funds and in determining the federal contribution to each approved project. ARRA provided $750 million for the CIG Program. The Federal Transit Administration distributed these funds to 11 projects already under construction that "demonstrated some contract capacity to absorb additional revenues."9 The money was given to local transit authorities as various construction activities were completed. According to DOT, 63% of these funds were spent within one year of the ARRA's enactment and 100% were spent within two years.

In general, it was easier for state and local agencies to quickly spend funds on the types of small-scale projects that are typically made possible by formula funds. The Government Accountability Office (GAO) found that more than two-thirds of highway funds were committed for pavement improvement projects, such as resurfacing, reconstruction, and rehabilitation of existing roadways, and three-quarters of transit funds were committed to upgrading existing facilities and purchasing or rehabilitating buses. Funding for airports was used to rehabilitate and reconstruct runways and taxiways, as well as to upgrade or purchase air navigation infrastructure such as air traffic control towers and engine generators.10

The Level of Infrastructure Investment Can Depend on Nonfederal Entities

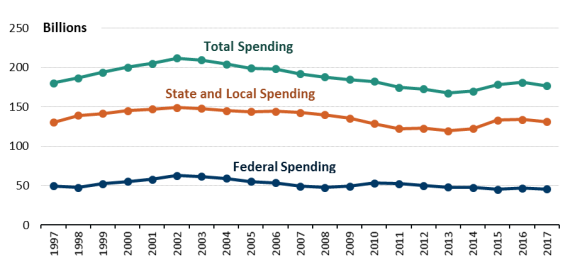

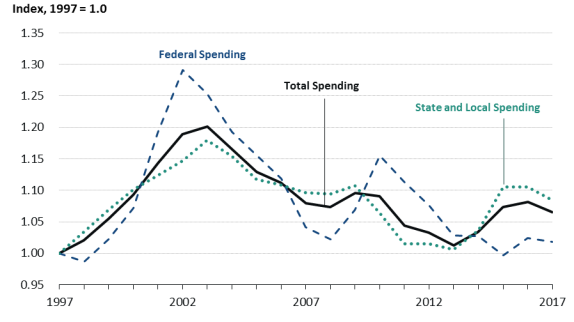

Public spending on transportation, measured in inflation-adjusted 2017 dollars, has been on a downward trend since peaking in 2003 (Figure 1). Infrastructure funding provided by ARRA interrupted that trend, buoying total spending in 2010 and 2011. Except for 2009, however, state and local expenditures, which make up around 75% of total infrastructure expenditures, continued to fall. State and local spending on transportation infrastructure, adjusted for inflation, was 8% lower in 2013 than in 2007, reflecting the long-term damage the Great Recession did to state and local budgets.11 As the stimulus from ARRA faded, 2013 saw the lowest spending on these major infrastructure systems since the late 1990s.

|

Figure 1. Annual Public Investment in Transportation Infrastructure Adjusted for Inflation |

|

|

Source: Congressional Budget Office, Public Spending on Transportation and Infrastructure, 1956 to 2017, October 2018, at https://www.cbo.gov/publication/54539. |

In some infrastructure sectors, such as highways, the growth in federal spending due to ARRA did not outweigh the decline in state and local government spending. Consequently, highway infrastructure spending fell over the period 2009 through 2013 (Figure 2). Of course, there is no way to know exactly how highway spending would have changed in the absence of ARRA. Federal spending would have been lower, but it is possible that state and local government spending would have been higher if federal funding had not been available.

Maintenance-of-Effort Requirements Were Difficult to Enforce

Because of the Great Recession, state and local governments experienced a dramatic reduction in tax revenue even as demand for government services increased. For this reason, many jurisdictions found it difficult to maintain pre-recession levels of spending for at least some types of transportation infrastructure, leaving the possibility that additional federal dollars would simply replace state and local dollars. The federal share of transportation projects using ARRA funds was generally 100%, but states were required to certify that they would spend amounts already planned. This maintenance-of-effort requirement was in force from ARRA's enactment in February 2009, by which time the recession had been under way for over a year, through September 30, 2010.

In its analysis of ARRA, GAO found that the maintenance-of-effort requirements in transportation were challenging to comply with and to administer. For example, governors had to certify maintenance of effort in several transportation programs, some administered by the state and some administered by local governments and independent authorities. Within each state, these various programs typically had different and complex revenue sources. In many cases, states did not have a way to identify planned expenditures. Because of ambiguities in the law and practicalities that come to light with experience, DOT issued maintenance-of-effort guidance to the states seven times in the first year after ARRA enactment.12

Some research on the effects of highway funding in ARRA on state highway spending found that, despite the maintenance-of-effort requirement, there was substantial substitution of federal dollars for state dollars. One analysis found that for every dollar of federal aid in ARRA for highways, on average, overall spending increased by 19 cents, meaning states decreased their own spending by 81 cents.13

Employment Effects Were Modest

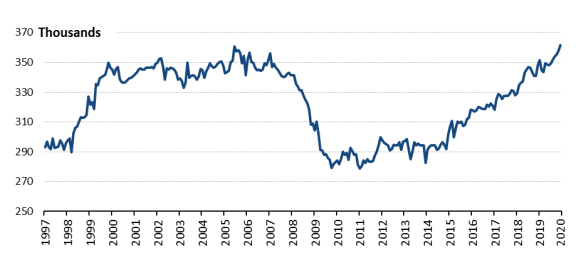

In many infrastructure sectors, the employment effects of ARRA funding were relatively modest. In highway construction, for example, employment dropped sharply from the end of 2007 through 2009. There was a slight increase through 2010, presumably related to the ARRA funding, but a sustained increase in employment did not begin again until 2015. The number of highway construction workers reached pre-recession levels in 2018 (Figure 3).

Although employment in highway construction was much higher before the recession began in late 2007, employment might have fallen further in the absence of ARRA funding. The transportation funding in ARRA, therefore, may have allowed state and local governments to maintain a certain level of employment in the transportation construction sector. Additionally, it likely permitted state and local governments to maintain employment in other, nontransportation, sectors by shifting state expenditures from transportation to other purposes.14 The slow recovery of highway construction jobs suggests the sector could have productively absorbed more funding after the ARRA funding had largely been expended, particularly during the 2013, 2014, and 2015 construction seasons.

Financing Infrastructure May Leverage State Resources

The financial crisis and the accompanying recession affected state and local credit markets. Among other things, declines in employment and business activity made it difficult for state and local governments to raise funds through the sale of tax-exempt municipal bonds whose repayment depended on tax revenue. Limited access to financing or to financing at much higher costs may have contributed to a decline in state and local government infrastructure investment. In more normal economic times, municipal bonds account for about 10% of the capital invested in highways and public transportation.15

In response to the problems in the municipal credit markets, ARRA included the Build America Bond (BAB) program, which permitted state and local governments to issue tax credit bonds from April 2009 through the end of 2010 to raise funds that could be used for any type of capital investment. Unlike traditional municipal bonds, which provide a subsidy to bondholders by exempting interest payments from federal income taxation and thereby allow issuers to sell bonds at low interest rates, BABs offered a higher taxable yield to investors; the federal government subsidized 35% of the issuer's interest costs.16 This subsidy rate was generally seen as generous, thereby reducing borrowing costs for state and local governments. Because the interest on BABs was taxable, the bonds were attractive to investors without federal tax liability, such as pension funds, enlarging the pool of possible investors. The taxable bond market is about 10 times the size of the traditional tax-exempt bond market. This larger market may have contributed to the reduction in borrowing costs. BABs were also considered more efficient than traditional municipal bonds because all of the federal subsidy went to the state or local government issuer. With traditional tax-exempt municipal bonds, some of the subsidy goes to investors.17

There were 2,275 BAB issuances over the 21 months of eligibility, for a total of $181 billion. About 30% of BAB funding went to educational facilities, followed by water and sewer projects (13.8%), highways (13.7%), and transit (8.7%).18 Without the BAB program, some of this capital would have been raised using traditional tax-exempt bonds, although likely at a higher cost to state and local government issuers. The Department of the Treasury stated that BAB issuance surged in the last quarter of 2010, suggesting that issuers were accelerating the timing of capital financings and, thus, capital investment.19 Although BABs had a generous subsidy rate relative to other municipal bonds, their structure ensured that issuers paid 65% of the interest costs, effectively requiring state and local governments to pay a larger share of infrastructure costs than under ARRA grant programs. Because the federal subsidy is paid to the issuer as the interest is due to the investor, the cost to the federal government of BABs was spread over the subsequent years (Table 2).

Stimulus-Funded Projects Can Provide Transportation Benefits

Because the purpose of ARRA was to stimulate the economy, the law included time limits on the obligation and expenditure of transportation funds. As noted earlier, about half of the transportation funds appropriated by ARRA were expended by the end of FY2010, within 20 months of the law's enactment. Much of this funding went to routine projects such as highway paving and bus purchases that were quick to implement. Larger projects that required more detailed environmental reviews and complex design work were not "shovel-ready," leading to assertions that ARRA did not "fund investments that would provide long-term economic returns."20

In its examination of ARRA transportation expenditures, GAO found that the focus on quick implementation did change the mix of highway projects chosen. Some state officials stated that the deadlines "prohibited other, potentially higher-priority projects from being selected for funding."21 However, others noted that ARRA funding allowed them to complete so-called "state-of-good-repair" projects, presumably leaving greater financial capacity to undertake larger projects in the future. Furthermore, economic research shows that smaller state-of-good-repair projects often have higher benefit-cost ratios than new, large "game changing" projects whose benefits are often more speculative.22

In its biennial examination of the highway and public transportation systems, DOT typically finds that, for the United States as a whole, too little is spent on state-of good-repair projects versus building new capacity. In its latest report, DOT examined actual spending in 2014 and various investment scenarios for the period 2015 through 2034. DOT found that state-of-good-repair spending was 76% of total highway spending in 2014, whereas to maximize economic benefits about 79% should go to such projects. For public transportation, DOT found that 64% to 74% of total infrastructure spending should be devoted to state-of-good repair projects, whereas 60% was used for that purpose in 2014.23

Author Contact Information

Footnotes

| 1. |

National Bureau of Economic Research, "US Business Cycle Expansions and Contractions," at https://www.nber.org/cycles.html. |

| 2. |

Bureau of Labor Statistics, "Labor Force Statistics from the Current Population Survey: Unemployment Rate (Seasonally Adjusted)," at https://www.bls.gov/cps/; Evan Cunningham, "Great Recession, Great Recovery? Trends from the Current Population Survey," Monthly Labor Review, April 2018, at https://www.bls.gov/opub/mlr/2018/article/great-recession-great-recovery.htm. |

| 3. |

Other measures included the Economic Stimulus Act of 2008 (P.L. 110-185) and the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312). |

| 4. |

The cost was subsequently revised to $836 billion. Costs can change because some programs depend on the behavior of beneficiaries. For example, the cost of tax credit bonds depends on the amount issued by state and local governments. Congressional Budget Office, "Summary of Estimated Cost of the Conference Agreement for H.R.1, the American Recovery and Reinvestment Act of 2009," February 13, 2009; Congressional Budget Office, Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output in 2014, February 2015. |

| 5. |

The largest components of the bill were unemployment assistance ($224 billion), tax relief for individuals and businesses ($190 billion), and transfers to state and local government for health care and education ($174 billion). Alan S. Blinder and Mark Zandi, "How the Great Recession was Brought to an End," July 27, 2010, https://www.economy.com/mark-zandi/documents/End-of-Great-Recession.pdf. |

| 6. |

CRS Report R40537, American Recovery and Reinvestment Act of 2009 (P.L. 111-5): Summary and Legislative History, by Clinton T. Brass et al. |

| 7. |

Garrett Jones and Daniel M. Rothchild, "No Such Thing As Shovel Ready: The Supply Side of the Recovery Act," George Mason University, Mercatus Center, Working Paper, No. 11-18, September 2011. |

| 8. |

Obama Administration, Economic Report of the President, February 2010, p. 52. |

| 9. |

Federal Transit Administration, "American Recovery and Reinvestment Act of 2009 Public Transportation Capital Investment Grants Program Appropriation and Allocations," 74 Federal Register, 21843-21850. |

| 10. |

Government Accountability Office, Recovery Act: Funding Used for Transportation Infrastructure Projects, but Some Requirements Proved Challenging, GAO-11-600, June 2011. |

| 11. |

Tracy Gordon, "State and Local Budgets and the Great Recession," Russell Sage Foundation and Stanford Center on Poverty and Inequality, at https://web.stanford.edu/group/recessiontrends-dev/cgi-bin/web/sites/all/themes/barron/pdf/StateBudgets_fact_sheet.pdf. |

| 12. |

Government Accountability Office, Recovery Act: Funding Used for Transportation Infrastructure Projects, but Some Requirements Proved Challenging, GAO-11-600, June 2011. |

| 13. |

Bill Dupor, "So, Why Didn't the 2009 Recovery Act Improve the Nation's Highways and Bridges?," Federal Reserve Bank of St. Louis Review, Second Quarter 2017, 99(2), pp. 169-182. |

| 14. |

Timothy G. Conley and Bill Dupor, "The American Recovery and Reinvestment Act: Solely a Government Jobs Program?," Journal of Monetary Economics, Vol. 60, 2013, pp. 535-549. |

| 15. |

CRS Report R43308, Infrastructure Finance and Debt to Support Surface Transportation Investment, by William J. Mallett and Grant A. Driessen. |

| 16. |

BABs and other tax credit bonds created by ARRA were the first tax credit bonds to offer an issuer direct payment option. BABs could also be issued with the credit going to the investor. BAB issuers all chose the direct payment over the investor credit. For more on the implementation of tax credit bonds, see CRS Report R40523, Tax Credit Bonds: Overview and Analysis, by Grant A. Driessen. |

| 17. |

CRS Report R43308, Infrastructure Finance and Debt to Support Surface Transportation Investment, by William J. Mallett and Grant A. Driessen. |

| 18. |

Robert Puentes, Patrick Sabol, and Joseph Kane, "Revive Build America Bonds (BABs) to Support State and Local Investments," Brookings Institution, August 2013. |

| 19. |

U.S. Department of the Treasury, "Treasury Analysis of Build America Bonds Issuance and Savings," May 16, 2011, at https://www.treasury.gov/initiatives/recovery/Documents/BABs%20Report.pdf. |

| 20. |

T. Peter Ruane, "Infrastructure Package: Avoid the Mistakes of Obama 'Stimulus,'" The Hill, January 10, 2018. |

| 21. |

Government Accountability Office, Recovery Act: Funding Used for Transportation Infrastructure Projects, but Some Requirements Proved Challenging, GAO-11-600, June 2011, p. 28. |

| 22. |

UK Department for Transport, The Eddington Transport Study: Main Report, Volume 3, 2006, pp. 131-132, at https://webarchive.nationalarchives.gov.uk/20070701080518/http://www.dft.gov.uk/about/strategy/eddingtonstudy/. |

| 23. |

For highways, state-of-good repair includes resurfacing, rehabilitation, or reconstruction of existing highway lanes and bridges and safety enhancements, traffic control facilities, and environmental enhancements. System expansion includes the construction of new highways and bridges and the addition of lanes to existing highways. Department of Transportation, Status of the Nation's Highways, Bridges, and Transit: Conditions and Performance, 23rd Edition, November 2019, p. 7-6 and p. 7-27, https://www.fhwa.dot.gov/policy/23cpr/. |