The Abandoned Mine Reclamation Fund: Reauthorization Issues in the 116th Congress

Coal mining and production in the United States during the 20th century contributed to the nation meeting its energy requirements and left a legacy of unreclaimed lands. Title IV of the Surface Mining Control and Reclamation Act of 1977 (SMCRA, P.L. 95-87) established the Abandoned Mine Reclamation Fund. The Office of Surface Mining Reclamation and Enforcement (OSMRE) administers grants from the Abandoned Mine Reclamation Fund to eligible states and tribes to reclaim affected lands and waters resulting from coal mining sites abandoned or otherwise left unreclaimed prior to the enactment of SMCRA.

Title IV of SMCRA authorized the collection of fees on the production of coal, which are credited to the Abandoned Mine Reclamation Fund. The use of this funding is limited to the reclamation of coal mining sites abandoned or unreclaimed as of August 3, 1977 (the date of SMCRA enactment). Title V of SMCRA authorized the regulation of coal mining sites operating after the law’s enactment. Coal mining sites regulated under Title V are ineligible for grants from the Abandoned Mine Reclamation Fund.

The balance of the Abandoned Mine Reclamation Fund is provided by fees collected from coal mining operators based on the volume or value of coal produced, whichever is less. The coal reclamation fee collection authorization in Title IV expires at the end of FY2021. If Congress does not reauthorize the collection of reclamation fees, SMCRA directs the remaining balance of the Abandoned Mine Reclamation Fund to be distributed among states and tribes receiving grants from the fund based on the FY2022 grant amounts. The FY2022 grant amounts would depend on the fees collected in FY2021, and payments from the fund would begin in FY2023, continuing annually until the balance has been expended. As of November 11, 2018, OSMRE reported that the unappropriated balance of the Abandoned Mine Reclamation Fund was approximately $2.3 billion. Reclamation grants to eligible states and tribes receiving grants from the Abandoned Mine Reclamation Fund would continue for some years until the balance is expended if coal reclamation fees are not reauthorized.

The balance of the Abandoned Mine Reclamation Fund is several times less than the estimated unfunded reclamation costs. OSMRE recently reported estimates of the unfunded reclamation costs as $12.4 billion. Congress may consider whether and how to fund the remaining unfunded coal reclamation needs. If the fees are reauthorized, the adequacy of those receipts to pay the remaining unfunded reclamation needs would depend in part on decisions made by Congress (e.g., source of funds, duration of the fee extension, and fee rate). Additional factors include the status of domestic coal production, upon which the fees are based, and the potential emergence of additional reclamation needs. As introduced, H.R. 4248 and S. 1193 would amend SMCRA to extend the fee collection authorization at the current fee rates until September 30, 2036.

SMCRA also authorizes federal financial assistance to United Mine Workers of America (UMWA) health and pension benefit plans for retired coal miners and family members who are eligible to be covered under those plans. Two sources of federal financial assistance to UMWA plans include interest transfers from the Abandoned Mine Reclamation Fund and supplemental payments from the General Fund of the U.S. Treasury. Should Congress not reauthorize the coal reclamation fees, as the balance from the Abandoned Mine Reclamation Fund is paid down, the interest transfers from the Abandoned Mine Reclamation Fund would make a relatively smaller contribution to the UMWA plans, increasing the reliance on General Fund payments for these plans.

In the 116th Congress, House and Senate versions of the RECLAIM Act (H.R. 2156 and S. 1232) would authorize $1 billion over five years from the unappropriated balance of the Abandoned Mine Reclamation Fund for the reclamation of abandoned coal mining sites as a means of facilitating economic and community development in coal production states. Either of these bills would accelerate the expenditure of the remaining balance of the fund but would not reauthorize the reclamation fee.

The Abandoned Mine Reclamation Fund: Reauthorization Issues in the 116th Congress

Jump to Main Text of Report

Contents

- Introduction

- Abandoned Mine Reclamation Fund

- Coal Reclamation Fees

- Eligible Lands and Waters

- Reclamation Priorities

- State and Tribal Reclamation Programs

- State Certification

- Grants to Eligible States and Tribes

- Uncertified States

- Certified States and Tribes

- Prior Balance Payments

- Unfunded Reclamation Cost Estimates

- Federal Financial Assistance for UMWA Health and Pension Benefit Plans

- Interest Transfers from the Abandoned Mine Reclamation Fund

- Supplemental Payments from the General Fund of the U.S. Treasury

- Bipartisan American Miners Act of 2019

- Title IV SMCRA Appropriations: FY2008-FY2020

- Reauthorization Issues and Related Legislation

- Fee Reauthorization

- Reauthorizing Legislation

- Economic and Community Development

- Abandoned Mine Land Reclamation Economic Development Pilot Program

- RECLAIM Act

Figures

- Figure 1. Coal Reclamation Fee Receipts: FY1978-FY2019

- Figure 2. Sources of Federal Funding for AML Projects and UMWA Plans

- Figure 3. Abandoned Mine Reclamation Fund Appropriations: FY2008-FY2020

- Figure 4. General Fund Appropriations: FY2008-FY2020

- Figure A-1. Abandoned Mine Reclamation Fund Appropriations: Inflation-Adjusted FY2008-FY2019

Tables

Appendixes

Summary

Coal mining and production in the United States during the 20th century contributed to the nation meeting its energy requirements and left a legacy of unreclaimed lands. Title IV of the Surface Mining Control and Reclamation Act of 1977 (SMCRA, P.L. 95-87) established the Abandoned Mine Reclamation Fund. The Office of Surface Mining Reclamation and Enforcement (OSMRE) administers grants from the Abandoned Mine Reclamation Fund to eligible states and tribes to reclaim affected lands and waters resulting from coal mining sites abandoned or otherwise left unreclaimed prior to the enactment of SMCRA.

Title IV of SMCRA authorized the collection of fees on the production of coal, which are credited to the Abandoned Mine Reclamation Fund. The use of this funding is limited to the reclamation of coal mining sites abandoned or unreclaimed as of August 3, 1977 (the date of SMCRA enactment). Title V of SMCRA authorized the regulation of coal mining sites operating after the law's enactment. Coal mining sites regulated under Title V are ineligible for grants from the Abandoned Mine Reclamation Fund.

The balance of the Abandoned Mine Reclamation Fund is provided by fees collected from coal mining operators based on the volume or value of coal produced, whichever is less. The coal reclamation fee collection authorization in Title IV expires at the end of FY2021. If Congress does not reauthorize the collection of reclamation fees, SMCRA directs the remaining balance of the Abandoned Mine Reclamation Fund to be distributed among states and tribes receiving grants from the fund based on the FY2022 grant amounts. The FY2022 grant amounts would depend on the fees collected in FY2021, and payments from the fund would begin in FY2023, continuing annually until the balance has been expended. As of November 11, 2018, OSMRE reported that the unappropriated balance of the Abandoned Mine Reclamation Fund was approximately $2.3 billion. Reclamation grants to eligible states and tribes receiving grants from the Abandoned Mine Reclamation Fund would continue for some years until the balance is expended if coal reclamation fees are not reauthorized.

The balance of the Abandoned Mine Reclamation Fund is several times less than the estimated unfunded reclamation costs. OSMRE recently reported estimates of the unfunded reclamation costs as $12.4 billion. Congress may consider whether and how to fund the remaining unfunded coal reclamation needs. If the fees are reauthorized, the adequacy of those receipts to pay the remaining unfunded reclamation needs would depend in part on decisions made by Congress (e.g., source of funds, duration of the fee extension, and fee rate). Additional factors include the status of domestic coal production, upon which the fees are based, and the potential emergence of additional reclamation needs. As introduced, H.R. 4248 and S. 1193 would amend SMCRA to extend the fee collection authorization at the current fee rates until September 30, 2036.

SMCRA also authorizes federal financial assistance to United Mine Workers of America (UMWA) health and pension benefit plans for retired coal miners and family members who are eligible to be covered under those plans. Two sources of federal financial assistance to UMWA plans include interest transfers from the Abandoned Mine Reclamation Fund and supplemental payments from the General Fund of the U.S. Treasury. Should Congress not reauthorize the coal reclamation fees, as the balance from the Abandoned Mine Reclamation Fund is paid down, the interest transfers from the Abandoned Mine Reclamation Fund would make a relatively smaller contribution to the UMWA plans, increasing the reliance on General Fund payments for these plans.

In the 116th Congress, House and Senate versions of the RECLAIM Act (H.R. 2156 and S. 1232) would authorize $1 billion over five years from the unappropriated balance of the Abandoned Mine Reclamation Fund for the reclamation of abandoned coal mining sites as a means of facilitating economic and community development in coal production states. Either of these bills would accelerate the expenditure of the remaining balance of the fund but would not reauthorize the reclamation fee.

Introduction

Coal mining and production in the United States during in the 20th century contributed to the nation meeting its energy requirements and left a legacy of unreclaimed lands. Prior to the enactment of the Surface Mining Control and Reclamation Act in 1977 (SMCRA; P.L. 95-87),1 no federal law had authorized reclamation requirements for coal mining operators to restore lands and waters affected by mining practices. Title IV of SMCRA established the Abandoned Mine Lands (AML) program to address the public health, safety, and environmental hazards at these legacy abandoned coal mining sites.

The objective of reclamation under Title IV of SMCRA is to restore lands or waters adversely affected by past coal mining to a condition that would mitigate potential hazards to public health, safety, and the environment. The actions necessary to attain these objectives may vary from site to site depending on the nature of the hazards and the technical or engineering feasibility of reclamation alternatives to mitigate the hazards. The severity of the hazard would also determine the prioritization of funding for reclamation. Examples of reclamation activities include removing or stabilizing coal mining waste piles, re-contouring and re-vegetating affected lands, mitigating the potential for subsidence, filling voids or sealing tunnels, and treating acid mine drainage. The costs to complete reclamation at a particular site would depend on the scope and nature of actions necessary to mitigate the potential hazards and any technical or engineering challenges to implement the selected actions.

The Abandoned Mine Reclamation Fund, established under Section 401 of SMCRA, provides funding to eligible states and tribes for the reclamation of surface mining impacts associated with historical mining of coal. Title IV of SMCRA applies only to sites that were abandoned or left unreclaimed prior to the enactment of SMCRA on August 3, 1977, and for which there is no continuing reclamation responsibility under other federal or state law.2 SMCRA also established the Office of Surface Mining Reclamation and Enforcement (OSMRE) in the Department of the Interior.3 OSMRE is the federal office responsible for administering SMCRA in coordination with eligible states and tribes.

The balance of the Abandoned Mine Reclamation Fund is provided by fees collected on coal mining operators in coal producing states. The fee rates in current law are based on a per-ton fee for the volume of coal produced at a mine annually or the percentage value of the coal produced at a mine, whichever is less each year as determined by the Secretary of the Interior. SMCRA authorizes annual grants to eligible states and tribes for the reclamation of abandoned coal mining sites.

SMCRA also authorizes two sources of federal financial assistance to three United Mine Workers of America (UMWA) coal mineworker health benefits plans and the UMWA pension plan. These federal payments augment employer contributions to these plans. Interest transfers from the Abandoned Mine Reclamation Fund have supported the UMWA health benefit plans since FY1996, supplemented by payments from the General Fund of the U.S. Treasury since FY2008. As amended in the 116th Congress, SMCRA authorizes additional General Fund payments to support the UMWA pension plan.4

The coal reclamation fee collection authorization is set to expire at the end of FY2021 absent the enactment of legislation extending the sunset date. If the authority to collect reclamation fees is not reauthorized, SMCRA directs the remaining balance of the fund to be distributed among states and tribes receiving grants from the Abandoned Mine Reclamation Fund based on the FY2022 grant amounts. The FY2022 grant amounts would depend on the fees collected in FY2021, and payments from the fund would begin in FY2023, continuing annually until the balance has been expended. Given that scenario, reclamation grants to eligible states would continue for some years. This report discusses funding for eligible states and tribes, reclamation priorities, annual receipts and appropriations, reauthorization issues, and other related bills that would authorize the use of the existing balance of the fund.

This report does not discuss issues associated with Title V of SMCRA, which authorized the regulation of coal mining sites operating after the law's enactment. SMCRA requires coal mining operators regulated under Title V to be responsible for providing financial assurance for completing site reclamation. Coal mining sites regulated under SMCRA after August 3, 1977, are ineligible for grants from the Abandoned Mine Reclamation Fund. If financial assurances are inadequate to meet reclamation needs, the availability of federal funding to pay reclamation costs would be subject to the enactment of legislation.

Abandoned Mine Reclamation Fund

Section 401 of SMCRA established the Abandoned Mine Reclamation Fund as a trust fund within the U.S. Treasury.5 As enacted in 1977, SMCRA originally did not authorize the Abandoned Mine Reclamation Fund as an interest-bearing trust fund. The Abandoned Mine Reclamation Act of 19906 amended SMCRA for various purposes and authorized the investment of the unexpended balance of the Abandoned Mine Reclamation Fund in U.S. Treasury securities.7 The portion of the balance available for investment in U.S. Treasury securities is the amount that the Secretary of the Interior determines is not needed to meet current withdrawals. Interest began accruing on the invested balance in FY1992.

Coal Reclamation Fees

Receipts credited to the Abandoned Mine Reclamation Fund are sourced from fees collected from coal mining operators based on coal production. The coal reclamation fee rates are authorized in Section 402 of SMCRA.8 The fees are specified in current law and based on a per-ton fee for the amount of coal produced at a mine annually or the percentage value of the coal produced annually at a mine, whichever is less each year as determined by the Secretary of the Interior. The fees are 28 cents per ton of coal produced by surface mining, 12 cents per ton of coal produced by underground mining, or 10% of the value of the coal, whichever is less. The fee for lignite coal is different from non-lignite coal and is 8 cents per ton or 2% of the value of the coal, whichever is less. Congress decreased the fee rates authorized in the original enactment of SMCRA to these fee rates in the 2006 amendments to SMCRA.9

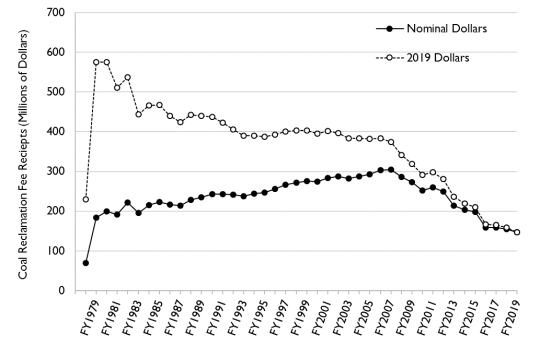

Annual receipts credited to the Abandoned Mine Reclamation Fund from these fees therefore depend on the fee rates applied to the amount or value of coal production each year. SMCRA does not set or guarantee any particular amount of receipts on an annual basis. Regardless of the fee rates, this framework may result in receipts fluctuating annually with changes in the amount or value of coal production in the United States. Coal reclamation fees generally increased until FY2007, after which the trend in fee revenue decreased from FY2008 to FY2019. During these years, coal reclamation fees collected by OSMRE decreased by approximately 49% in nominal dollars (i.e., without adjusting for inflation) (Figure 1). U.S. coal production declined during that same time period by approximately 34%.10 While the nominal coal reclamation fees collected peaked in FY2007, the inflation-adjusted value of the coal reclamation fees have generally decreased since FY1979. The extent to which the reduced fee rates in 2006 contributed to the decline in fee receipts during this time period would depend on whether the fee receipts were based on the tonnage or value of coal produced.11

|

|

Source: Compiled by CRS from the Public Budget Database accompanying the FY2021 Budget of the U.S. Government, published by the Office of Management and Budget (OMB). Nominal dollar amounts through FY2019 are actual receipts reported by OMB. CRS adjusted these amounts for inflation in FY2019 dollars using the gross domestic product Chained Price Index from the OMB Historical Tables, Table 10.1, accompanying the President's FY2021 budget request. CRS compiled fees for FY1978-FY1983 from historical Budget of the U.S. Government documents for those years. Notes: The dashed line shows the 2019 adjusted dollars. Amounts from FY1978 to FY1983 were collected under the account name "Coal mining reclamation fees" (Account Code 501510), and fees collected from FY1984 to FY2019 were collected under the account name "Abandoned Mine Reclamation Fund, Reclamation Fees" (Account Code 501560). |

Eligible Lands and Waters

Section 404 of SMCRA limits eligible lands and waters affected by coal mining to those left abandoned or unreclaimed prior to August 3, 1977, and for which there is no continuing reclamation responsibility under other federal or state laws.12 U.S. territories, states, and tribes without such lands and waters are excluded from eligibility for grants from the Abandoned Mine Reclamation Fund.

The reclamation and regulatory programs authorized in SMCRA apply only to coal production states and tribal lands, and coal has not been mined in all states, U.S. territories, and tribal lands.13 States and tribes with lands on which coal was mined prior to the enactment of SMCRA on August 3, 1977, with an OSMRE-approved reclamation program are eligible for grants from the Abandoned Mine Reclamation Fund pursuant to Section 401 of SMCRA.

Reclamation Priorities

SMCRA describes differing types and priorities of AML reclamation projects eligible for reclamation funding from the Abandoned Mine Reclamation Fund. Examples of eligible AML projects include the reclamation of land subsidence, vertical openings, hazardous equipment and facilities, dangerous highways, and acid mine drainage (AMD) that originated from historical coal mining operations. Section 403 of SMCRA directs the prioritization of AML reclamation projects under a tier of three categories:14

- 1. Priority 1 projects involve the reclamation of lands and waters to protect public health, safety, and property from extreme danger.

- 2. Priority 2 projects involve the reclamation of lands and waters to protect public health and safety from adverse effects of coal mining practices.

- 3. Priority 3 projects involve the reclamation of lands and waters previously degraded by adverse effects of coal mining practices for the conservation and development of soil, water (excluding channelization), woodland, fish and wildlife, recreation resources, and agricultural productivity.15

The reclamation of Priority 2 projects may be similar in scope and nature as Priority 1 projects but generally present a lesser degree of danger. In some instances, the proximity of hazards and risks of AML lands to communities may elevate the risks to public health and safety in a way that similar circumstances would merit a lower priority if they occurred at a more isolated and remote location. However, proximity alone is not necessarily an indicator of risk if contamination may migrate from the mining site to an affected community. The geographic scope of the site may be larger than where the coal was mined, because it includes all the affected lands and waters.

AMD causes persistent water quality impairment when minerals within coal are exposed to atmospheric oxygen and water, which causes a reaction generating sulfuric acid. The production of acid creates low-pH conditions in the water, enhancing the solubility of iron, sulfate, and other trace metals from the exposed ore. Those dissolved constituents may discharge to downgradient streams and water bodies and may generate secondary minerals within the stream and on the stream beds. Streams and other ecosystems impacted by AMD can become functionally impaired. States may consider reclamation projects to abate AMD water quality issues as a higher priority if that impaired water could pose a risk to public health.

Section 402 allows states receiving grants from the Abandoned Mine Reclamation Fund to deposit up to 30% of their annual grants into an acid mine drainage abatement fund.16 The state may establish an acid mine drainage abatement fund in accordance with that state's law, and the monies in the fund are not subject to SMCRA's three-year limitation on expenditure and may accrue interest. SMCRA allows states to expend monies in their abatement fund without a time limit because water quality issues associated with AMD may persist for decades or longer.

State and Tribal Reclamation Programs

States and tribes with lands on which coal is mined may be eligible for annual grants from the Abandoned Mine Reclamation Fund to support the reclamation of abandoned coal mining sites within their respective jurisdictions. To be eligible for these federal funds, pursuant to Section 405 of SMCRA, states and tribes first must obtain OSMRE approval of their reclamation programs.17

OSMRE approval of a reclamation program depends upon the state or tribe demonstrating that it has developed its own requirements that do not conflict with the federal requirements but may be more stringent and that it has the ability to carry out these requirements in lieu of the federal government. OMSRE has approved mine reclamation programs for 25 states and three tribes.

State Certification

Pursuant to Section 411 of SMCRA, OSMRE may certify a state or tribe with an OSMRE-approved state reclamation program once it demonstrates that it has reclaimed all of its priority abandoned coal mining sites identified pursuant to Section 403.18 States and tribes may apply to OSMRE for certification, and the final determination is subject to notice in the Federal Register and public comment.19 Certified states and tribes may use annual grants for the reclamation of abandoned non-coal sites and other uses.20

Section 411 includes certain limitations.21 SMCRA prohibits certified states and tribes from spending annual payments on sites remediated under the Uranium Mill Tailings Radiation Control Act of 1978, as amended,22 and sites designated for remedial action pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act, as amended (CERCLA).23 To date, OSMRE has certified five states and three tribes as having reclaimed all of their priority coal mining sites that were abandoned or unreclaimed prior to the enactment of SMCRA on August 3, 1977.24

A state with an OSMRE-approved state reclamation program that has not reclaimed all of its priority abandoned coal mining sites is an uncertified state.25 OSMRE provides annual grants to uncertified states from the Abandoned Mine Reclamation Fund for the reclamation of the priorities described under Section 403.

Grants to Eligible States and Tribes

For uncertified states, OSMRE administers grants from the Abandoned Mine Reclamation Fund. For certified states and tribes, OSMRE administers annual payments from the General Fund in lieu of the Abandoned Mine Reclamation Fund. OSMRE administers grants among eligible states and tribes based on a statutory formula to calculate their respective shares of annual coal reclamation fee receipts. OSMRE publishes grant distribution summaries on an annual basis.26 OSMRE administered grants to states and tribes for FY2019 are presented in Table 1 and Table 2. The following sections describe the grants administered to eligible states and tribes.

The Surface Mining Control and Reclamation Act Amendments of 2006 (P.L. 109-432, Division C, Title II, of the Tax Relief and Health Care Act of 2006) authorized General Fund payments to certified states and tribes beginning in FY2008 to focus the expenditure of coal reclamation fees on the reclamation of abandoned coal mining sites. The 2006 amendments also authorized permanent appropriations of coal reclamation fees for mine reclamation grants in FY2008 and subsequent fiscal years.

Uncertified States

Just over 80% of annual coal reclamation fee collections since FY2008 are authorized as permanent (mandatory) appropriations that are distributed to eligible uncertified states during the fiscal year following their collection. Section 402 of SMCRA authorizes the distribution of the fee collections credited to the Abandoned Mine Reclamation Fund based on a statutory formula that allocates to uncertified states:

- Uncertified State Share: shares of 50% of the coal reclamation fees collected within that state.27

- Historic Coal Funds: shares of 30% of the fee collections based on historic coal production prior to the enactment of SMCRA on August 3, 1977.28 The historic coal payments are based on the total coal tonnage produced by each respective state prior to enactment. Coal reclamation fees collected in certified states and on tribal lands therefore affect the amount available in the Abandoned Mine Reclamation Fund for annual reclamation grants to uncertified states. Fees collected in certified states and on tribal lands are distributed to uncertified states as part of their historic coal payment.

- Minimum Program Make Up Funds: additional shares of the fee collections if necessary to guarantee that each uncertified state receives an annual grant of at least $3 million if its 50% state share payment and historic coal payment combined would not equal this threshold.29

The formula leaves 20% of the annual fee collections available for the minimum program make up funds and discretionary spending through annual appropriations to fund the activities of OSMRE to oversee and assist state mine reclamation programs and to administer the Abandoned Mine Reclamation Fund.

Under Section 402, any amount of the 50% state share grant to an uncertified state not expended within three years of the date when the grant was awarded would become redistributed as historic coal payments, with the exception of the AMD abatement funds discussed earlier.30

The formula does not allocate any of the fee collections to support the UMWA health or pension benefit plans. The interest that accrues on the invested balance of the Abandoned Mine Reclamation Fund via an intergovernmental transfer from the General Fund is available to support UMWA health benefit plans. Direct payments from the General Fund supplement the interest for the UMWA health benefit plans. Additionally, the UMWA pension plan is eligible for General Fund payments, but it is not eligible to receive payments from the Abandoned Mine Reclamation Fund. See the discussion in "Federal Financial Assistance for UMWA Health and Pension Benefit Plans" later in this report.

Section 401(f)(5)(B) of SMCRA authorized a four year "phase-in" period during FY2008-FY2011 for the newly established mandatory payments to uncertified states for their state share, historic coal, and minimum make up grants.31 During this period, grants to uncertified states were reduced by 50% for FY2008 and FY2009 and 25% for FY2010 and FY2011.

Certified States and Tribes

Section 411(h)(2) of SMCRA authorized certified states and tribes to receive annual payments from the General Fund equivalent to 50% of annual coal reclamation fees collected within their jurisdictions. The fees collected from coal mining operations in certified states, and on lands of certified tribes, are credited to the Abandoned Mine Reclamation Fund. However, as authorized in Section 411 of SMCRA, certified states and tribes receive their payments from the General Fund of the U.S. Treasury in lieu of the Abandoned Mine Reclamation Fund and may use these funds for addressing the impacts of non-coal mineral development.32 Unlike uncertified states, certified states and tribes are not eligible to receive historic coal payments or minimum program make up funds.

Section 411(h)(3)(B) of SMCRA authorized a three-year "phase-in" period between FY2009 and FY2011 for annual payments to certified states and tribes. During those fiscal years, annual state and tribal share payments were reduced to 25% in FY2009, 50% in FY2010, and 75% in FY2011. OSMRE paid the total amount reduced during the three-year phase-in period to certified states and tribes in two equal payments from the General Fund in FY2018 and FY2019. Certified states and tribes would no longer receive these payments in FY2020 and subsequent fiscal years because they have been fully paid out.

In 2012, Congress amended Section 411(h) of SMCRA to place an annual $15 million cap on payments to each certified state or tribe.33 The cap applied to both in lieu payments and prior balance payments (described below) to certified states and tribes. Congress increased the cap to $28 million for FY2014 and $75 million for FY2015 by amending Section 411(h) of SMCRA again in 2013.34 Wyoming was the only state whose payments were reduced in FY2013 and FY2014 because of the caps. The higher cap in FY2015 did not affect Wyoming's payment. No other certified state or tribe exceeded caps for any of these fiscal years.

In 2015, Congress removed these caps on payments to certified states and tribes by amending Section 411(h) of SMCRA. This amendment also authorized a retroactive payment for amounts that were reduced under the caps.35 Wyoming received a one-time retroactive payment of approximately $242 million in FY2016. This retroactive payment was included in the total payment to Wyoming in FY2016 as reported in the FY2018 Office of Management and Budget (OMB) budget in addition to the annual in lieu payments to certified states and tribes for FY2016.36

Prior Balance Payments

The majority of the unappropriated balance of the Abandoned Mine Reclamation Fund accumulated prior to the 2006 amendments.37 Prior to the enactment of the 2006 amendments to SMCRA, OSMRE distributed payments to both certified and uncertified states and tribes from the Abandoned Mine Reclamation Fund subject to annual appropriations. Annual appropriations were generally lower than annual coal reclamation fees collected by OSMRE prior to the 2006 amendments, resulting in an accumulation in the unappropriated balance of the Abandoned Mine Reclamation Fund.

Section 411(h)(1) of SMCRA authorized "Prior Balance" payments equivalent to state and tribal share of the unappropriated balance of past coal reclamation fee receipts through annual federal payments to both uncertified and certified states and tribes from FY2008 through FY2014 from the General Fund of the U.S. Treasury. The Prior Balance payments were fully paid out by the end of FY2014, with the exception of the state of Wyoming (discussed above), which received a retroactive payment in FY2016 for amounts owed to the state because of statutory caps that were lifted. States and tribes no longer receive these prior balance payments. The accumulated balance of past coal reclamation fees collected prior to the 2006 amendments has remained credited to the Abandoned Mine Reclamation Fund and continues to accrue interest annually from investments in U.S. Treasury securities.

Unfunded Reclamation Cost Estimates

States and tribes report site specific information to OSMRE about the reclamation of eligible AML projects. OSMRE hosts the Abandoned Mine Land Inventory System (AMLIS) database38 that presents information on total eligible mine reclamation costs by state and tribe, which may be categorized by unfunded, funded, and completed costs. The costs to complete reclamation at a particular site would depend on the scope and nature of actions necessary to mitigate the potential hazards and any technical or engineering challenges to implement the selected actions.

OSMRE tracks AML reclamation project costs under three separate categories to identify the costs of completed projects and to estimate funding needs for future projects:39

- 1. "Unfunded Costs" are based on estimates by states and tribes to implement projects for which funding is not available or has not been approved by OSMRE.

- 2. "Funded Costs" are based on estimates by states and tribes to implement projects for which funding is available and for which OSMRE has approved the funds.40

- 3. "Completed Costs" are the actual costs of projects upon completion that states or tribes report to OSMRE.

According to AMLIS, the total unfunded costs for uncertified and certified states and tribes was approximately $12.4 billion as of January 21, 2020. Of that total amount, the total unfunded cost estimates for uncertified states were approximately $12 billion, representing roughly 97% of the remaining unfunded reclamation needs.

Unfunded reclamation cost estimates depend on the number of unreclaimed sites and on the severity of the reclamation problems as defined by the "Priority" level, per Section 403, for each unclaimed site in the state (Table 1). Uncertified states reported Priority 2 costs as approximately $7.5 billion, or approximately 62% of the total uncertified unfunded reclamation costs. The remaining 38% of the unfunded costs for uncertified states are associated with Priority 1 and Priority 3 issues.

Uncertified states reported Priority 1 issues as the smallest portion of unfunded cost estimates, but these sites generally represent the most severe hazards and most urgent priorities. Uncertified states reported the total unfunded reclamation cost for Priority 1 sites as roughly $1.8 billion. Two states, Pennsylvania and West Virginia, reported combined unfunded reclamation costs as $8.4 billion, representing approximately 66% of the total unfunded reclamation costs reported for all uncertified states. Pennsylvania reported the highest unfunded reclamation costs of any state, as reclamation cost estimates exceed $5 billion.

OSMRE periodically updates funding estimates for sites in the AMLIS inventory. Thus, the number of priority sites in each funding category may change periodically. Future funding requirements may change as unforeseen contamination and remediation may be discovered or arise. Recent congressional hearing testimony by a Pennsylvania state official describes the challenges state programs face when attempting to catalog AML issues:

Identifying and categorizing AML sites was among the first objectives for the AML program at its outset, and many of the cost estimates contained in the federal eAMLIS inventory were developed when the sites were initially inventoried in the early to mid-1980s. With time, the scale and depth of the AML problem has become better understood. However, it is in the nature of AML's that previously unknown sites will continue to manifest (particularly those associated with abandoned underground mines) and that known sites will continue to degrade, both of which increase the number of sites and the total cost to complete remaining AML reclamation work. With advancements in technology, the collection of more complete maps and mining records, and increased awareness and identification of these sites by local residents, many additional AML hazards have been and will continue to be identified and added to the AML inventory.41

Annual reclamation grants to states and tribes are based on the statutory formula described previously, and these grants are not based on reclamation needs. For example, several uncertified states reported similar unfunded reclamation costs: Indiana, Illinois, Oklahoma, and Missouri. The FY2020 grants received by those states, however, varied between $2.82 million and $11.7 million.42

Comparing FY2020 grants to the total unfunded reclamation costs suggests that some states or tribes may require annual grants for additional years or decades to completely fund reclamation needs. For example, Kansas reported $810 million in unfunded reclamation costs while receiving the minimum program make up fund amount of $2.82 million in FY2020.43

States and tribes may identify additional reclamation needs post-certification (Table 2). A Wyoming state official described the ongoing reclamation challenges that the state continues to manage under their AML program. According to his written testimony, he described the state's awareness of AML issues as improved since the state achieved certification in 1984:

Wyoming became a certified state under Title IV on May 25, 1984. Wyoming became certified on the basis of the best available information at the time. Early work to develop the inventory was essentially done through "boots on the ground." As our understanding of historic mining in the state has improved our AML inventory has continued to grow.44

Table 1. Uncertified States Unfunded Reclamation Cost Estimates

Unfunded reclamation cost estimates as of 1/21/2020

|

Uncertified State |

Priority 1 |

Priority 2 |

Priority 3 |

Total Unfunded Reclamation Costs |

|

Pennsylvania |

$93,539,632 |

$3,814,569,615 |

$1,121,862,403 |

$5,029,971,650 |

|

West Virginia |

$1,380,877,013 |

$1,376,423,995 |

$561,340,935 |

$3,321,788,366 |

|

Kansas |

$0 |

$795,921,064 |

$14,375,048 |

$810,296,112 |

|

Ohio |

$120,329,363 |

$242,844,461 |

$112,532,727 |

$475,706,552 |

|

Kentucky |

$44,596,875 |

$312,107,604 |

$117,631,236 |

$474,335,715 |

|

Alabama |

$45,884,040 |

$153,321,251 |

$260,551,114 |

$459,756,404 |

|

Virginia |

$9,035,030 |

$89,398,436 |

$328,397,509 |

$426,830,976 |

|

Indiana |

$18,364,222 |

$152,526,615 |

$6,482,295 |

$177,373,132 |

|

Illinois |

$9,821,760 |

$114,374,211 |

$29,107,567 |

$153,303,538 |

|

Oklahoma |

$5,744,375 |

$92,267,453 |

$40,055,325 |

$138,067,153 |

|

Missouri |

$426,800 |

$108,299,843 |

$16,543,782 |

$125,270,425 |

|

Colorado |

$41,613,266 |

$21,764,863 |

$12,346,398 |

$75,724,527 |

|

Iowa |

$16,858,208 |

$37,565,148 |

$13,587,246 |

$68,010,602 |

|

Maryland |

$0 |

$29,242,019 |

$32,956,849 |

$62,221,818 |

|

Tennessee |

$687,275 |

$14,975,316 |

$31,485,435 |

$47,148,026 |

|

Alaska |

$314,000 |

$43,836,365 |

$1,852,500 |

$46,002,865 |

|

New Mexico |

$12,894,306 |

$22,290,740 |

$6,342,000 |

$41,557,046 |

|

North Dakota |

$0 |

$37,547,386 |

$105,000 |

$37,652,386 |

|

Arkansas |

$465,000 |

$16,586,348 |

$4,504,680 |

$21,556,028 |

|

Utah |

$2,697,950 |

$642,200 |

$500,000 |

$3,840,150 |

|

Total Uncertified |

$1,804,149,115 |

$7,476,504,934 |

$2,712,560,049 |

$11,996,413,472 |

Table 2. Certified States and Tribes Unfunded Reclamation Cost Estimates

Unfunded reclamation cost estimates as of 1/21/2020

|

Certified State or Tribe |

Priority 1 |

Priority 2 |

Priority 3 |

Total Unfunded Reclamation Costs |

|

Montana |

$576,500 |

$218,009,133 |

$6,905,000 |

$225,497,633 |

|

Wyoming |

$29,222,922 |

$141,940,612 |

$26,670,967 |

$218,471,523 |

|

Louisiana |

$4,174,198 |

$9,365,640 |

$538,500 |

$14,078,338 |

|

Texas |

$212,014 |

$7,300,271 |

$1,668,752 |

$9,181,037 |

|

Hopi Tribe |

$0 |

$0 |

$0 |

$1,500,000 |

|

Navajo Nation |

$0 |

$1,395,300 |

$43,921 |

$1,439,221 |

|

Mississippi |

$0 |

$0 |

$4,785 |

$4,785 |

|

Crow Tribe |

$0 |

$0 |

$0 |

$0 |

|

Total Certified |

$34,185,634 |

$378,010,956 |

$35,831,925 |

$470,172,537 |

Federal Financial Assistance for UMWA Health and Pension Benefit Plans

Eligible UMWA members (including family members) receive post-retirement health and pension benefits from one of three multiemployer health benefit plans and one multiemployer pension plan. These plans include the Combined Benefit Fund, the 1992 Benefit Plan, the 1993 Benefit Plan, and the 1974 UMWA pension plan.45

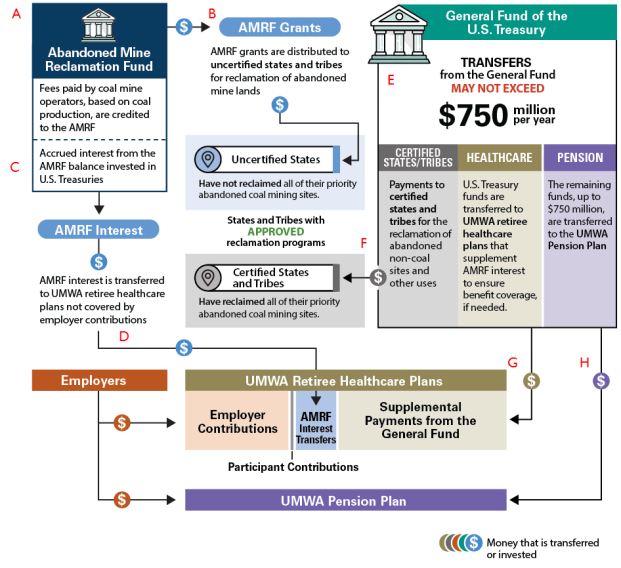

These plans are funded by premiums paid by employer contributions and two sources of federal financial assistance authorized under SMCRA. Section 402(h) authorizes transfers of interest from the Abandoned Mine Reclamation Fund to the UMWA health plans on an annual basis if the annual contributions from employers are not sufficient to cover liabilities for benefit coverage each year.46 Section 402(i) also authorizes supplemental payments from the General Fund of the U.S. Treasury on an annual basis if the interest that accrues on the balance of the Abandoned Mine Reclamation Fund is not sufficient to ensure benefit coverage each year.47 General Fund payments to the UMWA plans and to certified states and tribes combined are subject to a statutory cap of $750 million per year.

Each of these sources is authorized in SMCRA as permanent appropriations that result in direct federal spending (i.e., mandatory spending not subject to discretionary spending controlled through annual appropriations acts). Figure 2 shows the transfers of monies from the Abandoned Mine Reclamation Fund and the General Fund to eligible states and tribes for AML reclamation projects and other uses and to the UMWA plans.

Interest Transfers from the Abandoned Mine Reclamation Fund

In response to rising concern in the early 1990s about the potential insolvency of UMWA health benefit plans, the Coal Industry Retiree Health Benefit Act of 1992 (P.L. 102-486, Title XIX, Subtitle C of the Energy Policy Act of 1992) authorized the annual transfer of interest from the Abandoned Mine Reclamation Fund to three UMWA health benefit plans beginning in FY1996.

Like other federal trust funds invested in U.S. Treasury securities, the interest that accrues on the invested balance of the Abandoned Mine Reclamation Fund is derived from the General Fund of the U.S. Treasury through an intergovernmental transfer.48 Receipts from coal reclamation fees invested in U.S. Treasury securities serve as the basis for calculating the interest that accrues to the Abandoned Mine Reclamation Fund. However, the fees do not function as "principal" in the same manner as private investments. Because the interest is sourced from existing receipts in the General Fund, the interest does not increase total receipts in the U.S. Treasury.

The interest payments to the UMWA health plans are supplemented by payments from the General Fund if the interest is insufficient. The General Fund is therefore the source of receipts within the federal budget for both the interest and the supplemental payments to support the UMWA health and pension benefit plans. The General Fund consists of receipts from individual and corporate income taxes and other miscellaneous receipts not dedicated to other accounts of the U.S. Treasury. None of the coal reclamation fees credited to the Abandoned Mine Reclamation Fund are available to fund the UMWA benefit plans in current law.

Supplemental Payments from the General Fund of the U.S. Treasury

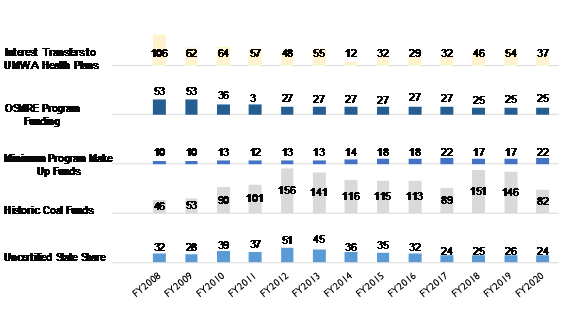

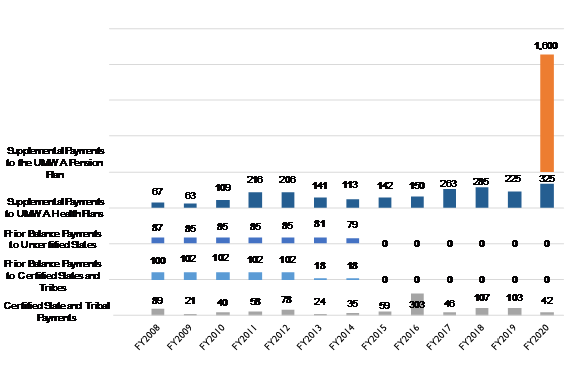

If employer contributions and the interest accrued to the Abandoned Mine Reclamation Fund are not sufficient to ensure UMWA health benefit coverage each year, the 2006 amendments to SMCRA authorized permanent appropriations for supplemental payments from the General Fund to pay the balance of benefits that would otherwise not be covered. The amendments authorized permanent appropriations for these General Fund supplemental payments beginning in FY2008 and "each fiscal year thereafter" without a termination date. The supplemental payments from the General Fund have become the larger source of federal funding to help ensure health benefit coverage under the UMWA plans (see Figure 3 and Figure 4), as the benefit obligations of the plans have exceeded the availability of interest that annually accrues on the invested balance of the Abandoned Mine Reclamation Fund.

Bipartisan American Miners Act of 2019

In the 116th Congress, the Bipartisan American Miners Act of 2019 (P.L. 116-94; Further Consolidated Appropriations Act, 2020, Division M) increased the availability of federal financial assistance to address the solvency of the UMWA health and pension benefit plans, subject to a new statutory funding cap to control federal direct spending for this purpose. The act amended Section 402(h) of SMCRA to expand the eligibility of the UMWA health benefit plans for interest transfers from the Abandoned Mine Reclamation Fund and General Fund supplemental payments. The act also amended Section 402(i) of SMCRA to authorize General Fund payments for the 1974 UMWA pension plan and increased the total spending cap on Title IV General Fund payments from $490 million to $750 million annually to help fund the UMWA pension plan.

The 2006 amendments to SMCRA authorized General Fund supplemental payments for the UMWA health benefit plans beginning in FY2008 but no federal funding for the 1974 UMWA pension plan. The 2006 amendments limited the eligibility of the UMWA health benefit plans for federal funding based on beneficiaries enrolled to receive health benefits as December 31, 2006. Funding needs for the 1993 UMWA health benefit plan continued to increase after this cut-off date as additional beneficiaries enrolled in that plan in later years. Certain coal mining company bankruptcies after 2006 also affected health benefit coverage for other retirees.

Subsequent amendments to SMCRA in the 114th and 115th Congresses expanded the populations of beneficiaries who could be eligible for federal payments to the UMWA health benefit plans. Prior to the Bipartisan American Miners Act, Section 402(h)(2)(C) of SMCRA limited General Fund supplemental payments for the 1993 UMWA health benefit plan based on funding needs to cover beneficiaries enrolled in that plan as of May 5, 2017 (with coverage retroactive to January 1, 2017) and retirees whose benefits were denied or reduced as a result of coal mining company bankruptcies commenced in 2012 and 2015.49

Since that time, funding needs to cover health benefits for additional populations of retirees have increased. The Bipartisan American Miners Act amended Section 402(h)(2)(C) of SMCRA again to expand the eligibility of the 1993 UMWA health benefit plan for General Fund supplemental payments to cover beneficiaries eligible as of January 1, 2019, and retirees whose benefits were denied or reduced as a result of coal mining company bankruptcies commenced in 2018 and 2019. This expansion of eligibility for federal funding to ensure health benefit coverage for these additional populations of beneficiaries may lead to increases in General Fund supplemental payments to the UMWA health benefit plans.

The Bipartisan American Miners Act of 2019 also authorized annual General Fund payments to the 1974 UMWA pension plan to address the solvency of that plan. The act established a new cap of $750 million annually on the aggregate amount of General Fund payments to certified states and tribes, UMWA health benefit plans, and the UMWA pension plan combined.50 The cap serves as a mechanism to control federal direct spending from the U.S. Treasury. After in lieu payments to certified states and tribes and supplemental payments to the UMWA health benefit plans each fiscal year, the act authorizes any remaining amount within the $750 million annual cap to be transferred to the UMWA pension plan.

If the aggregate annual certified state and tribal payments and the supplemental payment for the UMWA health plans would exceed $750 million in a fiscal year, the UMWA health plans would be reduced to the cap, and the UMWA pension plan would not receive a federal payment that fiscal year. SMCRA gives funding priority to certified state and tribal payments that would not be reduced by the $750 million annual cap unless the amount for this purpose alone otherwise would exceed the cap.51 Given that certified state and tribal payments are based on shares of coal reclamation fees, these payments would not reach the cap unless coal production in certified state and tribal lands were to rise several fold compared to recent fiscal years.

Supplemental payments to UMWA health plans may vary depending on the availability of interest accrued on the unappropriated balance of the Abandoned Mine Reclamation Fund, the annual funding needs of the plans, and the amount available within the $750 million annual cap for supplemental payments. General Fund payments to the 1974 UMWA pension plan would also depend on how much funding is remaining each year within the $750 million annual cap after certified state and tribal payments and the supplemental payment to the UMWA health benefit plans.

Title IV SMCRA Appropriations: FY2008-FY2020

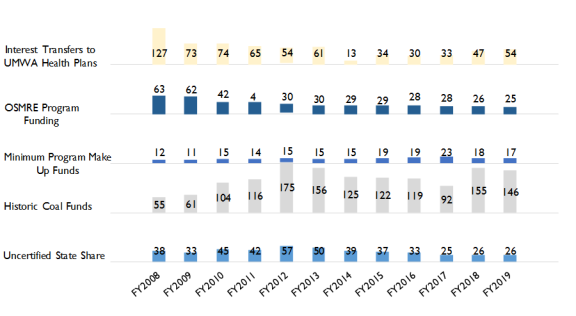

Appropriations from the Abandoned Mine Reclamation Fund include uncertified state shares, historic coal funds, minimum program make up funds, interest transfers to UMWA health benefit plans, and OSMRE administrative program funding (Figure 3 and Figure A-1). Annual grants to uncertified states from the Abandoned Mine Reclamation Fund are permanent appropriations except for the OSMRE program funding, which Congress provides to OSMRE through annual appropriations. Total appropriations from the Abandoned Mine Reclamation Fund from FY2008 to FY2020 have totaled approximately $3.1 billion (Table 3).

Permanent appropriations from the General Fund of the U.S. Treasury include in lieu state share payments to certified states and tribes and UMWA supplemental payments. The General Fund also provided prior balance payments to certified states and tribes and uncertified states in several installments from FY2008 through FY2014, with a retroactive payment to the state of Wyoming in FY2016 (See the discussion of "Prior Balance Payments" earlier in this report). From FY2008 to FY2020, General Fund payments authorized in Title IV of SMCRA totaled approximately $6.0 billion (Table 3). Appropriations vary from year to year based on statutory requirements (such as the phase-in reductions and payments), the amount of coal fees collected in a given year (which determine the amount available for state and tribal payments), and the amount of supplement payments required for UMWA health benefit plans (Figure 4).

The Bipartisan American Miners Act of 2019 authorized annual payments from the General Fund to the UMWA pension plan retroactively back to FY2017 and subsequent fiscal years, among other provisions. The FY2020 payment of $1.6 billion to the UMWA pension plan included cumulative payments from FY2017 through FY2020. The amount available for each of these fiscal years was subject to the $750 million annual cap and was based on the remainder within the cap after the certified state and tribal payments and the supplemental payments for the UMWA health benefit plans. The $1.6 billion payment to the UMWA pension plan in FY2020 was the largest annual General Fund payment authorized under Title IV of SMCRA (Figure 4). For FY2021 and subsequent fiscal years, General Fund payments to certified states and tribes and the UMWA health and pension benefit plans will remain subject to the $750 million annual cap. Certified state and tribal payments would cease after FY2022 in current law absent the reauthorization of coal reclamation fees upon which these payments are based.

Since FY2008, supplemental payments to UMWA health benefit plans from the General Fund have contributed a greater amount than have interest transfers from the Abandoned Mine Reclamation Fund (Table 3). Absent reauthorization of the coal reclamation fees, as the balance from the Abandoned Mine Reclamation Fund is paid down after FY2023, the interest payments would continue to have a relatively smaller contribution to UMWA health plans. Thus, the supplemental payments from the General Fund for the UMWA health plans would continue to contribute a larger share of contributions to the plans as the amount of interest payments decrease.

From FY2008 to FY2020, UMWA health and pension plans received approximately $3.91 billion of the total $6.04 billion in General Fund payments authorized in Title IV of SMCRA (Table 3). That amount was nearly twice the total amount of grants paid to uncertified states from the Abandoned Mine Reclamation Fund (approximately $2.03 billion from the aggregate of the uncertified state shares, historic coal funds, and minimum program make up funds for FY2008 to FY2020) for the reclamation of abandoned coal mining sites during that same time period. Whereas funding for reclamation grants is dependent on coal reclamation fee collections, most of the UMWA plan funding is tied to the $750 million annual cap on General Fund payments, which are not financed with these fees. OMB estimates that coal reclamation fee receipts would continue to decline through FY2021, after which time the fee collection authority expires in current law.52

The Budget Control Act of 201153 provides a measure to control federal spending by placing a percent reduction on permanent appropriations to remain within prescribed caps. The percent reduction may vary each year depending on how much of a reduction is needed to remain within the cap. Sequestration reductions apply to permanent appropriations from General Fund and Abandoned Mine Reclamation Fund permanent appropriations as of FY2013.54

Congress has also appropriated monies from the General Fund for the Abandoned Mine Land Reclamation Economic Development Pilot Program. These appropriations have been authorized in annual appropriations and are not authorized in Title IV of SMCRA.55

Table 3. Appropriations Authorized in Title IV of SMCRA: FY2008-FY2020

Calculated using nominal dollars

|

Description |

Appropriation Type |

Total Appropriations: FY2008-FY2020 |

|

|

Abandoned Mine Reclamation Fund Appropriations |

Rounded to Millions of Dollars |

||

|

Uncertified State Share |

Permanent |

$434 |

|

|

Historic Coal Funds |

Permanent |

$1,398 |

|

|

Minimum Program Make Up Funds |

Permanent |

$200 |

|

|

OSMRE Program Fundinga |

Annual |

$414 |

|

|

Interest Transfers to UMWA Health Plans |

Permanent |

$634 |

|

|

Total |

$3,081 |

||

|

General Fund Appropriations |

|||

|

Certified State and Tribe Share |

Permanent |

$1,006b |

|

|

Prior Balance Payments to Certified States and Tribes |

Permanent |

$543 |

|

|

Prior Balance Payments to Uncertified States |

Permanent |

$588 |

|

|

Supplemental Payments to UMWA Health Plans |

Permanent |

$2,305 |

|

|

Supplemental Payments to the UMWA Pension Plan |

Permanent |

$1,600c |

|

|

Total |

|||

Source: Compiled by CRS from the OMB Appendix to the President's annual budget requests and OSMRE annual AML grant summaries. Values may not sum due to rounding.

Notes:

a. OSMRE Program Funding appropriations are for the agency to administer the SMCRA Title IV program, including environmental restoration, technology development and transfer, financial management, and executive direction.

b. The certified states and tribes amount reported here includes the cumulative "FAST Act" (P.L. 114-94) payments of approximately $242 million in FY2016, which was listed in the FY2018 OMB budget as part of the in lieu payments to Wyoming. That amount consisted of a combination of previously withheld prior balance fund and state share in lieu payments to Wyoming.

c. According to OSMRE, the first supplemental payment to the UMWA Pension Plan would occur in FY2020.

|

Figure 3. Abandoned Mine Reclamation Fund Appropriations: FY2008-FY2020 Millions of dollars, nominal dollars (not adjusted for inflation) |

|

|

Source: Compiled by CRS from the OMB Appendix to the President's annual budget requests and OSMRE annual AML grant summaries. Notes: The values shown are millions of dollars, rounded to the nearest million dollars. The inflation-adjusted version is located in the appendix (Figure A-1). OSMRE program funding appropriations are for the agency to administer the SMCRA Title IV program, which includes environmental restoration, technology development and transfer, financial management, and executive direction. |

|

Figure 4. General Fund Appropriations: FY2008-FY2020 Millions of dollars, nominal dollars (not adjusted for inflation) |

|

|

Source: Compiled by CRS from the OMB Appendix to the President's annual budget requests and OSMRE annual AML grant summaries. Nominal dollar amounts through FY2018 are actual obligations reported by OMB. Notes: The values shown are millions of dollars, rounded to the nearest million dollar. From FY2008 to FY2019, appropriations for certified state and tribal payments and supplemental payments to UMWA health plans were subject to a $490 million cap. The Bipartisan American Miners Act of 2019 increased the $490 million cap to $750 million retroactively beginning in FY2017. Thus, the one-time payment in FY2020 was the cumulative amount of money that would have been paid to the UMWA pension plan with the remaining monies following payments to certified states and tribes and UMWA health plan payments up to the statutory cap of $750 million for FY2017-FY2020. Nominal dollars are presented here to compare with the spending cap, as the previous $490 million was not adjusted annually for inflation. The certified states and tribes amount reported here includes the cumulative "FAST Act" (P.L. 114-94) payments of approximately $242 million in FY2016, which was listed in the FY2018 OMB budget as part of the in lieu payments to Wyoming. That amount consisted of a combination of previously withheld prior balance fund and state share payments to Wyoming. |

Reauthorization Issues and Related Legislation

Congress previously reauthorized the fee under the Surface Mining Control and Reclamation Act Amendments of 2006,56 and that authorization is set to expire at the end of FY2021. Some Members of Congress have introduced legislation in the 116th Congress that would reauthorize the coal reclamation fee and authorize funds from the existing balance of the Abandoned Mine Reclamation Fund for economic and community development. Various issues are discussed in the following sections.

Fee Reauthorization

Given that the balance of the Abandoned Mine Reclamation Fund is less than 20% of the estimated unfunded reclamation needs, Congress may consider whether and how to fund the remaining coal reclamation needs. Abandoned coal mining sites that remain unreclaimed are expected to continue to pose hazards to public health, safety, and the environment. If the coal reclamation fees are not reauthorized beyond FY2021, Section 401 of SMCRA57 directs the unappropriated balance of the Abandoned Mine Reclamation Fund to be distributed among eligible states over a series of fiscal years beginning in FY2023 based on what the state received in FY2022 as its share of fee collections from the prior year. Those payments would continue in that same amount each fiscal year thereafter until the balance of the fund is expended. In FY2020, OSMRE reported that the unappropriated balance of the Abandoned Mine Reclamation Fund was approximately $2.2 billion. Reclamation grants to eligible states therefore would likely continue for some years, even if coal reclamation fees were not reauthorized after FY2021.

If the fee collection is not reauthorized, the fees collected in FY2022 will dictate the annual rate of grants to eligible states starting in FY2023 until the unappropriated balance is expended. Those amounts are based on coal production or the value of the coal produced in FY2022, whichever is less.

If the coal reclamation fees are not reauthorized, one potential option for Congress would be to appropriate from the General Fund to meet remaining needs after the balance of the Abandoned Mine Reclamation Fund is expended. Congress was faced with a similar issue in the debate over the reauthorization of Superfund excise taxes for the Superfund Trust Fund under CERCLA (P.L. 96-510).58 From the enactment of CERCLA in 1980 through FY1995, the balance of the Superfund Trust Fund was provided by revenues from the collection of a Superfund excise tax on petroleum, chemical feedstocks, corporate income, transfers from the General Fund, and other receipts. The authority to collect those Superfund excise taxes expired in FY1995, leaving revenues from the General Fund as the primary source of money to the Superfund Trust Fund.

Reauthorizing Legislation

The Abandoned Mine Land Reclamation Fee Extension Act (S. 1193), introduced in the 116th Congress, would amend Section 402(b) of SMCRA, extending the fee collection authorization date until September 30, 2036. As introduced, S. 1193 would authorize OSMRE to collect coal reclamation fees under Section 402, and OSMRE would begin fixed payments from the unappropriated balance on the Abandoned Mine Reclamation Fund to uncertified states beginning in FY2023 based upon their FY2022 grants, according to Section 401(f)(2)(B).

The Surface Mining Control and Reclamation Act Amendments of 2019 (H.R. 4248) would amend Section 402(b) of SMCRA and Section 401(f) of SMCRA. This bill would extend the fee collection authorization date until September 30, 2036, and grants to eligible states and tribes would continue to be paid out annually according to the statutory formula until after FY2037. The bill would also increase the minimum payments to uncertified states from $3 million to $5 million and authorize compensation to uncertified states from the Abandoned Mine Reclamation Fund for the total amount reduced by sequestration between FY2013 and FY2018.

In FY2020, 11 uncertified states together received approximately $21.9 million in minimum program make up funds, and 3 other uncertified states received less than $5 million. Raising the cap would increase payments to uncertified states receiving less than the current $3 million cap and may change the number of uncertified states eligible for minimum program make up funds. The extent to which more uncertified states become eligible would depend on future coal production in that state, coal production in certified states contributing to historic payments, and the value of coal generated.

In the event the Congress enacts legislation reauthorizing the coal reclamation fee, the adequacy of those receipts to pay for the remaining unfunded reclamation costs would depend on domestic coal production, the duration of fee extension, and the emergence of additional reclamation needs. Given that the unfunded reclamation costs may be updated or subject to change based on the discovery or the occurrence of new health and safety or environmental issues, predicting the duration to reauthorize the fees to fund the remaining unfunded reclamation costs is challenging. Additionally, eligible states and tribes continuously update unfunded costs estimates as new problems are discovered or arise.

Economic and Community Development

Other legislation introduced in the 116th Congress would use a portion of the unappropriated balance of the Abandoned Mine Reclamation Fund to provide funding for AML reclamation projects that promote economic and community development, as well as the purposes and priorities of reclamation described in Section 403 of SMCRA. However, some have argued expending funding for AML projects to prioritize economic and community development deviates from the original congressional intent of prioritizing the reclamation of lands and waters impacted by historic coal mining sites to address health and safety issues.

Abandoned Mine Land Reclamation Economic Development Pilot Program

Congress authorized the Abandoned Mine Land Reclamation Economic Development Pilot Program (AML Pilot Program) in the Consolidated Appropriations Act, 2016 to determine the feasibility of reclaiming abandoned coal mining sites to facilitate economic and community development.59 Congress provides funding for the AML pilot program through annual appropriations from the General Fund of the U.S. Treasury, not from the Abandoned Mine Reclamation Fund financed with coal reclamation fees. From FY2016 to FY2020, Congress has appropriated a total $540 million from the General Fund to the AML pilot program.60

For states and tribes that receive discretionary appropriations for the AML pilot program, those funds are in addition to the permanent appropriations as reclamation grants to eligible states and tribes from the Abandoned Mine Reclamation Fund.

Annual appropriations have limited the use of AML pilot program grants to fund reclamation projects only in Appalachian counties of eligible states in areas where the project would have the potential to facilitate economic or community development.61 SMCRA authorizes the broader use of grants from the Abandoned Mine Reclamation Fund to fund reclamation projects in any counties within an eligible state.

RECLAIM Act

In the 116th Congress, House and Senate versions of the Revitalizing the Economy of Coal Communities by Leveraging Local Activities and Investing More Act of 2019 (RECLAIM Act) have been introduced (H.R. 2156 and S. 1232). Those bills would authorize $1 billion over five years from the existing unappropriated balance of the Abandoned Mine Reclamation Fund for the reclamation of abandoned coal mining sites as a means to facilitate economic and community development in states and tribes with eligible reclamation programs under Title IV of SMCRA.

The RECLAIM Act would distribute $195 million annually to uncertified states based on historic payments and averaged state share grants. House and Senate versions of the RECLAIM Act differ by the allocation of these funds to uncertified states. For uncertified states to obligate RECLAIM monies on AML projects, the state would be required to demonstrate that those projects satisfy the reclamation priorities described in Section 403 and would contribute to future economic or community development. Both introduced versions of the RECLAIM Act would provide $5 million annually to certified states and tribes. Certified states and tribes would submit an application for funds, and OSMRE would determine the distribution of those funds based on the demonstration of needs.

Neither introduced version of the RECLAIM Act would reauthorize the collection of the coal reclamation fees. RECLAIM grants to eligible states and tribes would be in addition to the annual grants paid to states and tribes. If the RECLAIM Act were enacted and the fee collection authority were not reauthorized, the unappropriated balance of the Abandoned Mine Reclamation Fund would be paid out sooner compared to a scenario where neither RECLAIM nor fee reauthorization legislation were enacted.

Both House and Senate versions of the RECLAIM Act would increase the minimum program make up funds to uncertified states from the Abandoned Mine Reclamation Fund from $3 million to $5 million annually.

Appendix.

Author Contact Information

Footnotes

| 1. |

30 U.S.C. Chapter 25. |

| 2. |

30 U.S.C. §1231-1244. |

| 3. |

30 U.S.C. §1211. |

| 4. |

P.L. 116-94; Further Consolidated Appropriations Act, 2020, Division M. |

| 5. |

30 U.S.C. §1231. |

| 6. |

P.L. 101-508, Title VI, Subtitle A, of the Omnibus Budget Reconciliation Act of 1990. |

| 7. |

P.L. 101-508 amended SMCRA to reauthorize coal reclamation fees through September 30, 1995, revise the funding formula for distribution of grants to eligible states and tribes, expand eligible uses of grants, and authorize the certification of states and tribes that have reclaimed all of their priority abandoned coal mining sites. |

| 8. |

30 U.S.C. §1232(a). |

| 9. |

The originally enacted fee rates were 35 cents per ton of coal produced by surface mining, 15 cents per ton of coal produced by underground mining, or 10% of the value of the coal, whichever is less. The fee for lignite coal is different from non-lignite coal and is 10 cents per ton or 2% of the value of the coal, whichever is less. See P.L. 95-87. |

| 10. |

Total U.S. coal production in FY2008 (1,171,808,669 short tons) was compared to FY2017 (774,609,357 short tons). FY2018 data is not yet available. U.S. Energy Information Administration, Annual Coal Report 2017, November 2018, p. xii, https://www.eia.gov/coal/annual/pdf/acr.pdf. |

| 11. |

OSMRE's annual budget justification provides a description of how coal mining operators deposit coal reclamation fees using the Coal Fee Collection Management System, OSMRE's coal fee auditing, and the annual coal fees deposits. See OSMRE, Budget Justifications and Performance Information Fiscal Year 2021, pp. 97-100, https://edit.doi.gov/sites/doi.gov/files/uploads/fy2021-osmre-budget-justification.pdf. |

| 12. |

30 U.S.C. §1234. |

| 13. |

30 U.S.C. §1291. Section 701 of SMCRA defines the term state to include "a State of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Virgin Islands, American Samoa, and Guam." |

| 14. |

30 U.S.C. §1233(a). |

| 15. |

30 U.S.C. §1233(a)(3). |

| 16. |

30 U.S.C. §1232(g)(6)(A). |

| 17. |

30 U.S.C. §1235. |

| 18. |

30 U.S.C. §1240a. |

| 19. |

30 C.F.R. §875.13. |

| 20. |

30 U.S.C. §1240a(b). |

| 21. |

30 U.S.C. §1240a(d). |

| 22. |

42 U.S.C. Chapter 88. |

| 23. |

42 U.S.C. Chapter 103. |

| 24. |

Certified states and tribes are (in alphabetic order) Crow Tribe, Hopi Tribe, Louisiana, Mississippi, Montana, Navajo Nation, Texas, and Wyoming. OSM has certified three tribes (Hopi Tribe, Crow Tribe, and Navajo Nation) and no tribes have uncertified programs. Throughout the remainder of the report, CRS describes this as certified states and tribes and uncertified states. |

| 25. |

Twenty states remain uncertified: Alabama, Alaska, Arkansas, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Missouri, New Mexico, North Dakota, Ohio, Oklahoma, Pennsylvania, Tennessee, Utah, Virginia, and West Virginia. |

| 26. |

OSMRE, "Grant Resources," https://www.osmre.gov/resources/grants.shtm. |

| 27. |

30 U.S.C. §1232(g)(1). |

| 28. |

30 U.S.C. §1232(g)(5). |

| 29. |

30 U.S.C. §1232(g)(8). |

| 30. |

30 U.S.C. §1232(g)(1)(D). |

| 31. |

30 U.S.C. §1231(f)(5)(B). |

| 32. |

30 U.S.C. §1240a(h)(1)(D)(i). |

| 33. |

P.L. 112-141, Div. F, Title I, §100125. |

| 34. |

P.L. 113-40, the Helium Stewardship Act of 2013. |

| 35. |

P.L. 114-94, Fixing America's Surface Transportation (FAST) Act. See 30 U.S.C. §1240a(h)(1)(C)(ii). |

| 36. |

Office of Management and Budget, Budget of the U.S. Government, FY2018, Appendix, p. 613, https://www.govinfo.gov/content/pkg/BUDGET-2018-APP/pdf/BUDGET-2018-APP.pdf. |

| 37. |

P.L. 109-432, Division C, Title II, of the Tax Relief and Health Care Act of 2006. |

| 38. |

See OSMRE, "e-AMLIS Advanced Query," https://amlis.osmre.gov/QueryAdvanced.aspx. |

| 39. |

OSMRE, "Welcome to the Abandoned Mine Land Inventory System (e-AMLIS)," https://amlis.osmre.gov/About.aspx. |

| 40. |

These figures may change during construction. |

| 41. |

Statement of John Stefanko, Deputy Secretary, Office of Active and Abandoned Mine Operations, Pennsylvania Department of Environmental Protection, on behalf of the Interstate Mining Compact Commission and National Association of Abandoned Mine Land Programs, legislative hearing on H.R. 4248, the Surface Mining Control and Reclamation Act Amendments of 2019, House Committee on Natural Resources, November 14, 2019, https://naturalresources.house.gov/imo/media/doc/Testimony%20-%20John%20Stefanko%20-%20EMR%20Leg%20Hrg%2011.14.19.pdf. |

| 42. |

OSMRE publishes annual grant distributions under Title IV of SMCRA for eligible states and tribes. For the FY2020 grant distribution, see OSMRE, "Fiscal Year 2020 Grant Distribution," https://www.osmre.gov/resources/grants/docs/FY20GrantDist.pdf. |

| 43. |

See OSMRE, "Fiscal Year 2020 Grant Distribution." |

| 44. |

Testimony of Alan Edwards, Administrator, Wyoming Abandoned Mine Land Program and Deputy Director, Wyoming Department of Environmental Quality, legislative hearing on H.R. 4248, the Surface Mining Control and Reclamation Act, House Committee on Natural Resources, November 14, 2019, https://naturalresources.house.gov/imo/media/doc/Testimony%20-%20Alan%20Edwards%20-%20EMR%20Leg%20Hrg%2011.14.19.pdf. |

| 45. |

See CRS In Focus IF11366, Health and Pension Benefits for United Mine Workers of America Retirees: Recent Legislation, by John J. Topoleski. |

| 46. |

30 U.S.C. §1232(h). |

| 47. |

30 U.S.C. §1232(i). |

| 48. |

For information on the financial management of federal trust funds, see U.S. General Accounting Office (since renamed the Government Accountability Office), Federal Trust and Other Earmarked Funds: Answers to Frequently Asked Questions, GAO-01-199SP, January 2001, http://www.gao.gov/products/GAO-01-199SP. |

| 49. |

30 U.S.C. §1232(h)(2)(C). |

| 50. |

30 U.S.C. §1232(i)(3)(A). |

| 51. |

Under that scenario, SMCRA directs supplemental payments to UMWA health benefit plans under Section 402(i)(1) to be adjusted (30 U.S.C. §1232(i)(1)). Section 402(i)(3)(B) omits adjustments to payments to certified states and tribes (30 U.S.C. §1232(i)(3)(B)). |

| 52. |

See the Public Budget Database accompanying the FY2021 Budget of the U.S. Government published by OMB. |

| 53. | |

| 54. |

Sequestration reductions have ranged from 5.10% to 7.3% per year from FY2013 to FY2019. |

| 55. |

See the discussion on "Abandoned Mine Land Reclamation Economic Development Pilot Program" presented later in this report. |

| 56. |

P.L. 109-432, Division C, Title II, of the Tax Relief and Health Care Act of 2006. |

| 57. |

30 U.S.C. §1231. |

| 58. |

See CRS Report R41039, Comprehensive Environmental Response, Compensation, and Liability Act: A Summary of Superfund Cleanup Authorities and Related Provisions of the Act, by David M. Bearden. |

| 59. |

The explanatory statement accompanying the Consolidated Appropriations Act, 2016, describes the goals and intent of the AML pilot program. U.S. Congress, House Committee on Appropriations, Department of the Interior, Environment, and Related Agencies Appropriations Bill, 2016, 114th Cong., 1st sess., June 16, 2015, H.Rept. 114-170, p. 36. ("State AML programs, in consultation with State economic and community development authorities, shall develop a list of eligible AML projects in Appalachian counties that have a nexus to economic and community development, and select qualifying AML projects that have the potential to create long-term economic benefits.") |

| 60. |

CRS aggregated appropriations for FY2016 ($90 million), FY2017 ($105 million), FY2018 ($115 million), FY2019 ($115 million), and FY2020 ($115 million). For FY2016, the $90 million was reported in the explanatory statement accompanying the Consolidated Appropriations Act, 2016 (Congressional Record, December 17, 2015, Book III, p. H10217). Each of the following fiscal year appropriations were reported in respective enacted bills. |

| 61. |

Congress designated Appalachian counties in statute in the definition of the term Appalachian Region codified at 40 U.S.C. §14102. |