The Renewable Fuel Standard (RFS): Frequently Asked Questions About Small Refinery Exemptions (SREs)

In the Energy Policy Act of 2005 (P.L. 109-58; EPAct05), Congress required the U.S. Environmental Protection Agency (EPA) to implement the Renewable Fuel Standard (RFS)—a mandate that requires U.S. transportation fuel to contain a minimum volume of renewable fuel. Since expansion of the RFS in 2007 under the Energy Independence and Security Act (P.L. 110-140; EISA), Congress has had interest in the RFS for various reasons (e.g., limited cellulosic biofuel production, EPA’s use of programmatic waiver authority, and RFS compliance costs). Over the last several months, Congress has expressed repeated interest in small refinery exemptions (SRE) from the RFS.

The RFS allows small refineries to receive an exemption from the RFS, if they can prove compliance would subject them to disproportionate economic hardship. There is no statutory definition for disproportionate economic hardship, and a small refinery may apply for an exemption at any time. When deciding whether to grant an exemption, EPA is to consult with the Secretary of Energy. This consultation comes in the form of a recommendation from the Department of Energy (DOE) to EPA. The EPA Administrator has 90 days to act on (i.e., grant or deny) an exemption. A small refinery must apply each year for an exemption from compliance for that year.

EPA categorizes the majority of small refinery exemption information as confidential business information (CBI). EPA does make publicly available some exemption information, but only in aggregate (e.g., total number of exemptions granted, total exempted volume of gasoline and diesel); there are no publicly available data on individual SREs.

There have been legal challenges about small refinery exemptions. Small refineries can and have challenged EPA’s denials of their petitions for SREs in court. Various stakeholders have also challenged EPA’s methodology for evaluating small refinery exemption petitions. In 2020, the Tenth Circuit vacated EPA’s decision to grant three small refinery exemption petitions. It is unclear how this court decision will affect how EPA evaluates SRE petitions in the future.

Congress may be interested in small refinery exemptions for multiple reasons. Foremost, Congress may seek clarification on how EPA is currently evaluating SRE petitions, and whether that has changed over time. Some in Congress have raised concerns over transparency in EPA’s decision process on SREs, as there is limited public information on the process.

Congress may also value additional information about how SREs are being accounted for in annual rulemakings for the RFS. Each year, EPA issues a final rule for the RFS with the coming year’s volume requirements (e.g., EPA is to issue the 2021 volume requirements by November 30, 2020). This final rule contains percentage standards that—once obligated parties (e.g., refiners and importers) apply them to their gasoline and diesel sales—are intended to ensure the volumes required are met. The formula for calculating the annual percentage standard includes a variable that accounts for small refinery exemptions granted by the time of the rulemaking. Depending on when the small refinery exemption is granted—prior to the release of a final rule or after—that exemption may or may not be accounted for in the annual percentage standard (to date, most SREs have been granted afterward). In December 2019, EPA announced that it will change how it calculates the annual percentage standard in order to account for volumes of gasoline and diesel that will be exempted from the renewable volume obligations. The impact small refinery exemptions have on the RFS depends on the number of SREs granted, when they are granted, and the amount of gasoline and diesel exempted. Congress may consider several items as it seeks to understand the impact of SREs on the RFS, including transparency, agency discretion, a potential RFS reset, and U.S. gasoline consumption.

The Renewable Fuel Standard (RFS): Frequently Asked Questions About Small Refinery Exemptions (SREs)

Jump to Main Text of Report

Contents

- Introduction

- Frequently Asked Questions

- 1. What is the RFS?

- 2. What is a small refinery?

- 3. What are small refinery exemptions?

- 4. What is "disproportionate economic hardship"?

- 5. What are the relevant sections in the statute that address small refinery exemption under the RFS?

- 6. What information must be submitted to EPA to petition for a small refinery exemption?

- 7. Is there a deadline to apply for an exemption?

- 8. Is there a date by which EPA is to act on an application for an exemption?

- 9. How frequently may a small refiner apply for an exemption?

- 10. How are the RFS Renewable Volume Obligations (RVOs) calculated?

- 11. How do small refinery exemptions impact annual RFS requirements (or RVOs)?

- 12. How many small refinery exemptions have been issued?

- 13. Does the statute require EPA to account for small refinery exemptions in annual standards?

- 14. How does EPA account for small refinery exemptions in the 2020 annual standards?

- 15. Have there been any legal challenges involving small refinery exemptions?

- Challenges to Small Refinery Exemption Decisions

- Challenges to EPA's Methodology

- 16. What legislative proposals has Congress introduced that address small refinery exemptions?

- 17. What other issues might one consider when discussing small refinery exemptions?

Figures

Summary

In the Energy Policy Act of 2005 (P.L. 109-58; EPAct05), Congress required the U.S. Environmental Protection Agency (EPA) to implement the Renewable Fuel Standard (RFS)—a mandate that requires U.S. transportation fuel to contain a minimum volume of renewable fuel. Since expansion of the RFS in 2007 under the Energy Independence and Security Act (P.L. 110-140; EISA), Congress has had interest in the RFS for various reasons (e.g., limited cellulosic biofuel production, EPA's use of programmatic waiver authority, and RFS compliance costs). Over the last several months, Congress has expressed repeated interest in small refinery exemptions (SRE) from the RFS.

The RFS allows small refineries to receive an exemption from the RFS, if they can prove compliance would subject them to disproportionate economic hardship. There is no statutory definition for disproportionate economic hardship, and a small refinery may apply for an exemption at any time. When deciding whether to grant an exemption, EPA is to consult with the Secretary of Energy. This consultation comes in the form of a recommendation from the Department of Energy (DOE) to EPA. The EPA Administrator has 90 days to act on (i.e., grant or deny) an exemption. A small refinery must apply each year for an exemption from compliance for that year.

EPA categorizes the majority of small refinery exemption information as confidential business information (CBI). EPA does make publicly available some exemption information, but only in aggregate (e.g., total number of exemptions granted, total exempted volume of gasoline and diesel); there are no publicly available data on individual SREs.

There have been legal challenges about small refinery exemptions. Small refineries can and have challenged EPA's denials of their petitions for SREs in court. Various stakeholders have also challenged EPA's methodology for evaluating small refinery exemption petitions. In 2020, the Tenth Circuit vacated EPA's decision to grant three small refinery exemption petitions. It is unclear how this court decision will affect how EPA evaluates SRE petitions in the future.

Congress may be interested in small refinery exemptions for multiple reasons. Foremost, Congress may seek clarification on how EPA is currently evaluating SRE petitions, and whether that has changed over time. Some in Congress have raised concerns over transparency in EPA's decision process on SREs, as there is limited public information on the process.

Congress may also value additional information about how SREs are being accounted for in annual rulemakings for the RFS. Each year, EPA issues a final rule for the RFS with the coming year's volume requirements (e.g., EPA is to issue the 2021 volume requirements by November 30, 2020). This final rule contains percentage standards that—once obligated parties (e.g., refiners and importers) apply them to their gasoline and diesel sales—are intended to ensure the volumes required are met. The formula for calculating the annual percentage standard includes a variable that accounts for small refinery exemptions granted by the time of the rulemaking. Depending on when the small refinery exemption is granted—prior to the release of a final rule or after—that exemption may or may not be accounted for in the annual percentage standard (to date, most SREs have been granted afterward). In December 2019, EPA announced that it will change how it calculates the annual percentage standard in order to account for volumes of gasoline and diesel that will be exempted from the renewable volume obligations. The impact small refinery exemptions have on the RFS depends on the number of SREs granted, when they are granted, and the amount of gasoline and diesel exempted. Congress may consider several items as it seeks to understand the impact of SREs on the RFS, including transparency, agency discretion, a potential RFS reset, and U.S. gasoline consumption.

Introduction

Congress directs the U.S. Environmental Protection Agency (EPA) to implement the Renewable Fuel Standard (RFS)—a mandate that requires U.S. transportation fuel to contain a minimum volume of renewable fuel.1 Every year obligated parties (including small refiners) demonstrate to EPA their compliance with the mandate. The EPA may grant small refineries an exemption from the RFS for a compliance period, if they can prove compliance would subject them to disproportionate economic hardship.2 Over the last few years, this programmatic action, once routine, has come under increasing scrutiny from some Members of Congress and stakeholders. The debate regarding small refinery exemptions (SREs) for the RFS has intensified, as both the number of SREs granted and the total exempted volume of gasoline and diesel has increased in recent years.3 At the core of the SRE policy discussion are three factors: (1) the SRE statutory requirements, (2) the EPA's SRE issuance process, and (3) the impact of SREs on meeting the statutory RFS volume requirements.

There are various perspectives about SREs. Some Members of Congress and stakeholders have expressed their dissatisfaction with the SREs granted under the Trump Administration. For example, some biofuel organizations argue that the method used to grant SREs, the number of SREs issued in recent years, and the accounting for the exempted fuel in recent annual rulemakings, have undercut demand for biofuel, created market uncertainty, and violated the statute, among other things.4 Other Members of Congress and stakeholders contend that SREs alleviate the economic burden of complying with the mandate for some refineries, that SREs do not directly impact biofuel demand, and that SREs are a symptom of a larger policy problem, among other things.5

This report—in a question and answer format—provides information about SREs for the RFS and discusses related congressional and Executive Branch actions. More specifically, the report provides an overview of small refineries, the small refinery exemption process, challenges to EPA decisions on petitions and to its methodology for evaluating petitions, and gives a synopsis of recent RFS activity, including the new SRE projection methodology finalized by EPA. As discussed later in this report, much of the information about how EPA manages the SRE process is not publicly available because it involves confidential business information (CBI). The information provided in this report is based on a review of the statute and agency materials, as well as general knowledge about the program gleaned from various sources. The report also summarizes congressional bills that address small refinery exemptions and presents other items to consider when discussing small refinery exemptions. The report does not analyze the opportunities and challenges stakeholders may encounter from potential action taken by Congress or the Executive Branch.

Frequently Asked Questions

The following sections respond to 17 frequently asked questions about the RFS and small refinery exemptions.

1. What is the RFS?

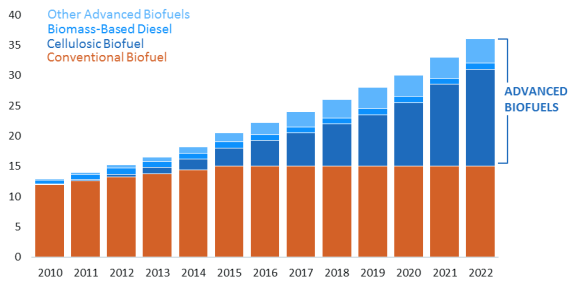

The RFS requires U.S. transportation fuel to contain a minimum volume of renewable fuel.6 The RFS statute specifies minimum annual volume targets (in billions of gallons)—requiring 12.95 billion gallons of renewable fuel in 2010 and ascending to 36 billion gallons in 2022 (Figure 1).7 The EPA Administrator has statutory authority to determine the volume amounts after 2022.8 The statute outlines the volume requirements in tables for four categories: total renewable fuel, total advanced biofuel, cellulosic biofuel, and biomass-based diesel.9 Both cellulosic biofuel and biomass-based diesel are a subset of advanced biofuel. Thus, the total renewable fuel statutory volume required for any given year equates to the sum of conventional biofuel (i.e., corn starch-based ethanol, which is unspecified in statute)10 and advanced biofuel (which is specified in statute). For each year, EPA converts the total volume requirement into a percentage standard that each obligated party must meet (based on projected gasoline and diesel consumption in that year).11

The statute requires that EPA regulate RFS compliance using a tradable credit system.12 Obligated parties (generally, refiners and importers) submit credits—called renewable identification numbers (RINs)—to EPA for each gallon in their annual obligation.13 In short, this annual obligation, referred to as the renewable volume obligation (RVO), is the obligated party's total gasoline and diesel sales multiplied by the annual renewable fuel percentage standards announced by EPA for each category of renewable fuel.14

The statute gives the EPA Administrator the authority to waive the RFS requirements, in whole or in part, if certain conditions outlined in statute prevail.15 More specifically, the statute provides a general waiver authority for the overall RFS and waivers for two types of advanced biofuel: cellulosic biofuel and biomass-based diesel.16 Also, the statute requires that the EPA Administrator modify the applicable volumes of the RFS in 2016 and the years thereafter if certain conditions are met (this action is referred to by some as the RFS "reset").17

|

|

Source: CRS analysis of the Energy Independence and Security Act of 2007 (EISA; P.L. 110-140) |

2. What is a small refinery?

A refinery is a facility that converts raw materials (e.g., crude oil) into finished products (e.g., gasoline). The statute defines a "small" refinery as "a refinery for which the average aggregate daily crude oil throughput for a calendar year (as determined by dividing the aggregate throughput for the calendar year by the number of days in the calendar year) does not exceed 75,000 barrels."18 The statutory definition does not mention ownership.

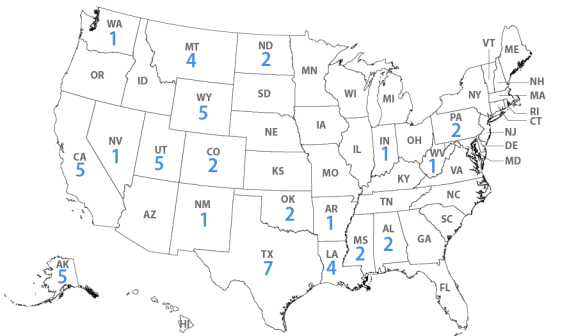

Based on the above definition, a small refinery for the RFS is any refinery that processes no more than about 3.2 million gallons of crude oil each day, or no more than about 1 billion gallons of crude oil per year.19 An analysis of U.S. Energy Information Administration (EIA) data for refineries based on calendar day operation appears to indicate that there were 53 small refineries—as defined in the RFS statute—operating as of January 1, 2019 (Figure 2).20 Further, EIA data appears to indicate there is a total of 132 operating refineries overall.21 Thus, small refineries consist of about 40% of the nation's total number of operating refineries. Additionally, the small refineries comprise about 12% of total crude oil distillation capacity in the United States.22

3. What are small refinery exemptions?

A small refinery exemption releases a small refinery from having to comply with the RFS mandate for a given compliance period.23 The exemption is only applicable to small refineries as defined in statute for the program.24 The statute mentions two instances whereby EPA may issue a small refinery exemption: (1) a temporary exemption and (2) an extension of the exemption based on disproportionate economic hardship.25 The latter instance is currently of concern to most stakeholders and is the exemption referred to in this report.

The statute required a temporary exemption for all small refineries up until calendar year 2011.26 EPA then proceeded with an exemption for 21 small refineries for an additional two years, 2011 and 2012, based on the results of a DOE study that these small refineries would suffer a disproportionate hardship if required to participate in the program.27

For petitions based on disproportionate economic hardship, the small refinery itself must petition the EPA Administrator for an exemption.28 A small refinery may only petition for an exemption based on the reason of disproportionate economic hardship.29 The EPA Administrator is to consult with the Secretary of Energy when evaluating a petition.30 This consultation comes in the form of a DOE recommendation. EPA has the ultimate authority and may accept or reject the DOE recommendation.31

4. What is "disproportionate economic hardship"?

The statute does not define disproportionate economic hardship,32 but requires DOE to complete a study to determine if RFS compliance would impose a disproportionate economic hardship on small refineries.33 DOE reports that

Disproportionate economic hardship must encompass two broad components: a high cost of compliance relative to the industry average, and an effect sufficient to cause a significant impairment of the refinery operations.34

DOE developed a scoring matrix "to evaluate the full impact of disproportionate economic hardship on small refiners and used to assess the individual degree of potential impairment."35 The matrix consists of disproportionate structural impact metrics (e.g., access to capital), disproportionate economic impact metrics (e.g., relative refining margin measure), and viability metrics (e.g., compliance cost eliminates efficiency gains).36

Congress addressed disproportionate economic hardship in the Joint Explanatory Statement accompanying the 2016 Consolidated Appropriations Act (P.L. 114-113) by stating that "If the Secretary finds that either of these two components [from the DOE March 2011 Small Refinery Exemption Study] exists, the Secretary is directed to recommend to the EPA Administrator a 50 percent waiver of RFS requirements for the petitioner."37 In report language for the 2017 appropriations bill for EPA, Congress directed EPA to follow DOE's recommendation, and to notify both Congress and DOE if the Administrator disagrees with DOE's waiver recommendation and to deliver such notification 10 days prior to issuing a decision.38

5. What are the relevant sections in the statute that address small refinery exemption under the RFS?

There are three sections in the statute most relevant to small refinery exemptions: 42 U.S.C. 7545(o)(1)(K), 42 U.S.C. 7545(o)(3)(C), and 42 U.S.C. 7545(o)(9).

|

Relevant SRE Statutory Sections [42 U.S.C. 7545(o)(1)(K)] (K) Small refinery The term "small refinery" means a refinery for which the average aggregate daily crude oil throughput for a calendar year (as determined by dividing the aggregate throughput for the calendar year by the number of days in the calendar year) does not exceed 75,000 barrels. [42 U.S.C. 7545(o)(3)(C)] (C) Adjustments In determining the applicable percentage for a calendar year, the Administrator shall make adjustments- (i) to prevent the imposition of redundant obligations on any person specified in subparagraph (B)(ii)(I); and (ii) to account for the use of renewable fuel during the previous calendar year by small refineries that are exempt under paragraph (9). [42 U.S.C. 7545(o)(9)] (9) Small refineries (A) Temporary exemption (i) In general The requirements of paragraph (2) shall not apply to small refineries until calendar year 2011. (ii) Extension of exemption (I) Study by Secretary of Energy Not later than December 31, 2008, the Secretary of Energy shall conduct for the Administrator a study to determine whether compliance with the requirements of paragraph (2) would impose a disproportionate economic hardship on small refineries. (II) Extension of exemption In the case of a small refinery that the Secretary of Energy determines under subclause (I) would be subject to a disproportionate economic hardship if required to comply with paragraph (2), the Administrator shall extend the exemption under clause (i) for the small refinery for a period of not less than 2 additional years. (B) Petitions based on disproportionate economic hardship (i) Extension of exemption A small refinery may at any time petition the Administrator for an extension of the exemption under subparagraph (A) for the reason of disproportionate economic hardship. (ii) Evaluation of petitions In evaluating a petition under clause (i), the Administrator, in consultation with the Secretary of Energy, shall consider the findings of the study under subparagraph (A)(ii) and other economic factors. (iii) Deadline for action on petitions The Administrator shall act on any petition submitted by a small refinery for a hardship exemption not later than 90 days after the date of receipt of the petition. (C) Credit program If a small refinery notifies the Administrator that the small refinery waives the exemption under subparagraph (A), the regulations promulgated under paragraph (2)(A) shall provide for the generation of credits by the small refinery under paragraph (5) beginning in the calendar year following the date of notification. (D) Opt-in for small refineries A small refinery shall be subject to the requirements of paragraph (2) if the small refinery notifies the Administrator that the small refinery waives the exemption under subparagraph (A). |

6. What information must be submitted to EPA to petition for a small refinery exemption?

EPA reports that a petition for a small refinery exemption

must specify the factors that demonstrate a disproportionate economic hardship and must provide a detailed discussion regarding the hardship the refinery would face in producing transportation fuel meeting the requirements of §80.1405 and the date the refiner anticipates that compliance with the requirements can reasonably be achieved at the small refinery.39

EPA reports that to fulfill these requirements, companies would likely submit "company business plans, financial statements, tax filings, communications with potential suppliers or lenders, and other records that demonstrate the petitioner satisfies the underlying substantive requirements to be accorded relief."40 To qualify for an exemption, a refinery must meet the definition of a small refinery for both the calendar year before and during the year for which an exemption is sought.41 Submissions are not publicly available.

EPA addressed the financial and other information required for 2016 RFS small refinery exemption requests.42 In its memorandum, EPA reports it considers the findings of the DOE Small Refinery Study and a variety of economic factors when evaluating a petition. EPA reports the economic factors include, but are not limited to, profitability, net income, cash flow and cash balances, gross and net refining margins, ability to pay for small refinery improvement projects, corporate structure, debt and other financial obligations, RIN prices, and the cost of compliance through RIN purchases.43

7. Is there a deadline to apply for an exemption?

No. A small refinery may submit a petition to the EPA Administrator for a small refinery exemption at any time.44

8. Is there a date by which EPA is to act on an application for an exemption?

The EPA Administrator is required by statute to act on a petition for a small refinery exemption within 90 days of having received the petition.45 EPA reports it "will issue a decision within 90 days of receiving complete supporting information for the request from the small refinery."46 It is unclear what information must be submitted to EPA before the agency considers a petition "complete." There is no deadline as to when or whether EPA must publicly announce its decision.

9. How frequently may a small refiner apply for an exemption?

A small refiner must apply separately for an exemption for each compliance year. According to EPA, "[b]eginning with the 2013 compliance year, small refineries may petition EPA annually for an exemption from their RFS obligations."47

10. How are the RFS Renewable Volume Obligations (RVOs) calculated?

The statute specifies annual renewable fuel volume amounts (in gallons) required for each category in the RFS through 2022.48 The EPA converts the statutory volumes—or the volumes EPA has finalized using its waiver authority—into annual percentage standards to ensure that obligated parties meet the volume amount.49 Obligated parties use this annual percentage to compute their RVOs.50 The RVO is the obligated party's total gasoline and diesel sales multiplied by the annual renewable fuel percentage standards announced by EPA plus any deficit of renewable fuel from the previous year.51 It is the RVO that informs an obligated party how many gallons of the particular renewable fuel type the party must account for in order to be in compliance. The obligated party is then responsible for submitting to EPA credits (i.e., renewable identification numbers or RINs) for each gallon in its RVO.52 Once all obligated parties have demonstrated compliance by meeting their RVOs, the volume of renewable fuel required to be blended into the nation's transportation fuel supply is met, minus any SREs.

The statute contains volume amounts for four fuel categories: total renewable fuel, advanced biofuel, cellulosic biofuel, and biomass-based diesel.53 Thus, there are four annual percentage standards, one for each renewable fuel category.54 Accordingly, there are also four RVO calculations.55

There are six steps to understanding the relationship between an annual standard, an RVO, and RFS compliance:

- 1. The statute specifies a volume amount for a given year (e.g., 30 billion gallons for total renewable fuel for 2020);

- 2. EPA announces the final volume requirement which is either (a) the statutory volume amount or (b) a reduced volume requirement based on EPA's waiver authority (e.g., 20.09 billion gallons for total renewable fuel for 2020);56

- 3. EPA issues an annual percentage standard (e.g., 11.56% for total renewable fuel for 2020);

- 4. The obligated party multiplies the annual percentage standard by its operational sales to compute its RVO for a particular fuel category;

- 5. The obligated party obtains the RINs needed to meet its RVO; and

- 6. The obligated party submits its RINs to EPA to demonstrate compliance.

Obligated parties—generally, refiners and importers—must prove compliance with the RFS each year. Obligated parties include small refineries. However, if a small refinery receives a small refinery exemption, it is exempt from complying with the mandate for a given year. EPA reports "[t]he exempted refinery is not subject to the requirements of an obligated party for fuel produced during the compliance year for which the exemption has been granted."57 The small refineries that receive a small refinery exemption continue their operations, which may include blending renewable fuel and possibly acquiring RINs (which they can bank for future use or trade with other parties).

11. How do small refinery exemptions impact annual RFS requirements (or RVOs)?

The impact of small refinery exemptions on annual RFS requirements, or RVOs, depends on how much fuel is exempted and when. In general, if a small refinery exemption is granted prior to a final rule setting the annual percentage standards being released, it may be accounted for in the annual percentage standard calculation for that year.58 If the exemption is granted after the final rule has been released, EPA reports that, under its prior approach, it did not revise its annual percentage standard calculation to account for the later-granted exemptions.59 The situation where the exemption is not included in the annual percentage calculation is of concern to some stakeholders (e.g., renewable fuel producers) as the renewable fuel volumes for which the small refineries were responsible for are not redistributed to the other obligated parties, and therefore those volumes are not accounted for by the RVOs.60

For example, in December 2017, EPA set the 2018 total renewable fuel percentage standard at 10.67%.61 EPA did not include any small refinery exemptions in its percentage standard calculations for 2018.62 Further, EPA stated that any exemptions granted after 2018 would not be reflected in the 2018 percentage standards. In August 2019, EPA announced 31 small refinery exemptions for 2018.63 EPA estimates that the 31 exemptions will account for nearly 13.4 billion gallons of gasoline and diesel being exempted for the 2018 compliance period.64 If EPA were to account for the exempted 13.4 billion gallons, it would lead to a different annual percentage standard than the standard contained in the final rule. The non-exempt obligated parties would be required to meet this different standard. Some refer to this as "reallocating the waived gallons." However, as EPA has implemented the program for 2018, the remaining obligated parties will not have to meet this different standard.

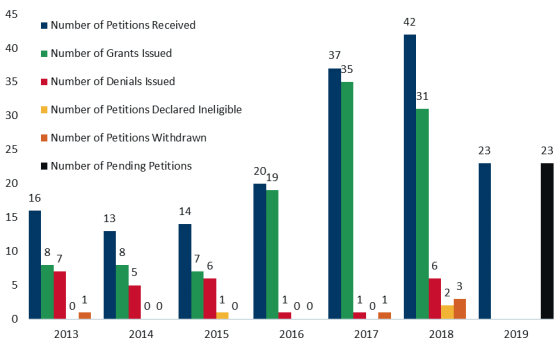

12. How many small refinery exemptions have been issued?

Since 2013, the number of small refinery exemptions issued based on disproportionate economic hardship has varied, ranging from 7 to 31 in a given year (Figure 3).65 EPA reports it has not yet received any SRE petitions for 2020.66

|

Figure 3. Annual RFS Small Refinery Exemptions Processed 2013-2019 |

|

|

Source: CRS analysis based on U.S. Environmental Protection Agency, RFS Small Refinery Exemptions, February 27, 2020, https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rfs-small-refinery-exemptions. |

13. Does the statute require EPA to account for small refinery exemptions in annual standards?

The statute requires that EPA adjust the annual percentage standard to "account for the use of renewable fuel during the previous calendar year by small refineries that are exempt under paragraph (9) [Small refineries]."67 In 2010, EPA reported that it considers the amount of renewable fuel used in such instance would be negligible and assigns it a value of zero.

CAA section 211(o) requires that the small refinery adjustment also account for renewable fuels used during the prior year by small refineries that are exempt and do not participate in the RFS2 program. Accounting for this volume of renewable fuel would reduce the total volume of renewable fuel use required of others, and thus directionally would reduce the percentage standards. However, as we discussed in RFS1, the amount of renewable fuel that would qualify, i.e., that was used by exempt small refineries and small refiners but not used as part of the RFS program, is expected to be very small. In fact, these volumes would not significantly change the resulting percentage standards. Whatever renewable fuels small refineries and small refiners blend will be reflected as RINs available in the market; thus there is no need for a separate accounting of their renewable fuel use in the equations used to determine the standards. We proposed and are finalizing this value as zero.68

In 2018, EPA stated that, regarding Clean Air Act direction that the agency account for renewable fuel used by exempt small refineries, EPA complies through the RIN trading program.69 In 2019, EPA further explained that

the use of renewable fuel by exempt small refineries is accounted for by the RIN system. That is, since exempt small refineries have no obligation to comply with the applicable percentage standards, they can sell all the RINs associated with any renewable fuel they use. These RINs become part of the overall pool of RINs available to all obligated parties. Thus, no additional adjustment needs to be made to comply with this statutory provision.70

Some stakeholders argue that the amounts exempted in recent years are not negligible, and that reallocating these exempted volumes (as opposed to accounting for them through the RIN trading program) would lead to total renewable fuel consumption closer to the amount finalized by EPA for that year.71 Others contend that reallocating small refinery exemptions "punishes complying parties and creates an unlevel playing field among competing refineries putting additional pressure on the blendwall and increasing the overall cost of the program."72

14. How does EPA account for small refinery exemptions in the 2020 annual standards?

In recent years, the number of SREs granted and the total exempted volume of gasoline and diesel has changed, which could indicate the old methodology may no longer suffice. In December 2019, EPA issued a final rule that changes how it calculates the annual percentage standard to account for volumes of gasoline and diesel that will be exempted from the renewable volume obligations.73 In this final rule, EPA adopted the percentage standard calculation change it proposed in October 2019.74 In the final rule, EPA reports it is finalizing "a projection methodology based on a 2016–18 annual average of exempted volumes had EPA strictly followed DOE recommendations in those years.…"75 EPA is to do this by amending two factors in the annual percentage standard calculation from:

- 1. GEi = the amount of gasoline projected to be produced by exempt small refineries and small refiners, in year i and

- 2. DEi = the amount of diesel fuel projected to be produced by exempt small refineries and small refiners in year i.

to

- 1. GEi = the total amount of gasoline projected to be exempt in year i, in gallons, per §§80.1441 and 80.1442 and

- 2. DEi = the total amount of diesel projected to be exempt in year i, in gallons, per §§80.1441 and 80.1442.76

EPA reports this calculation modification leads to higher percentage standards, which "would have the effect of ensuring that the required volumes of renewable fuel are met when small refineries are granted exemptions from their 2020 obligations after the issuance of the final rule, provided EPA's projection of the exempted volume is accurate."77 Further, EPA reports that "[b]y projecting exempted volumes in advance of issuing annual standards, we can issue a single set of standards for each year without the need for periodic revisions and the associated uncertainty for obligated parties."78 Lastly, EPA reports that—for petitions for 2019 and going forward—it "intends to grant relief consistent with DOE's recommendations where appropriate" (e.g., grant 50% relief where DOE recommends 50% relief).79 In the past, EPA has granted full exemptions to small refinery petitions where DOE recommended 50% relief.80

15. Have there been any legal challenges involving small refinery exemptions?81

Yes. The legal challenges have generally taken one of two forms: (1) refineries challenging the EPA's denial of an exemption petition or (2) parties challenging EPA's methodology for granting and accounting for small refinery exemptions. As discussed below, individual challenges to EPA's exemption denials have at times succeeded, but courts have generally dismissed methodological challenges on procedural grounds.

Challenges to Small Refinery Exemption Decisions

Several individual refineries have challenged EPA's denials of their exemption petitions. For example, in December 2019 Suncor Energy petitioned for review of its denied exemption petition with the U.S. Court of Appeals for the Tenth Circuit.82 Refineries have specifically challenged EPA's adoption of DOE's scoring index (as noted in question 4), its reliance on DOE's refinery-specific assessments, and EPA's independent analysis.83 DOE's scoring matrix assesses whether a small refinery would incur a "disproportionate economic hardship" from complying with the RFS standard using two sets of components: disproportionate impacts metrics and viability metrics.84 Challenges to exemption denials have generally focused on the viability metrics.85

In general, courts have upheld as reasonable EPA's adoption of the DOE's scoring matrix, including its use of viability as a metric.86 The D.C. and the Eighth Circuits have each held that EPA reasonably interpreted the statutory phrase "disproportionate economic hardship" to require, as reflected in DOE's scoring matrix, that the refinery's viability be affected to demonstrate "hardship."87 However, the Tenth Circuit subsequently held that EPA cannot give such weight to viability, and particularly to the long-term threat of closure, that it effectively reads "disproportionate" out of "disproportionate economic hardship" in the statute.88

Courts have allowed EPA to rely on DOE's assessments but invalidated exemption denials for errors in the refinery-specific analyses. For example, the D.C. Circuit vacated and remanded an exemption denial because EPA's independent analysis contained two miscalculations that could have affected its ultimate decision to deny the exemption petition.89 Similarly, the Fourth Circuit vacated and remanded an exemption denial after finding that EPA had relied on a DOE assessment that was facially deficient.90 The court held that while EPA could rely on DOE's assessment and need not conduct its own independent analysis of DOE's conclusions concerning a specific exemption request, EPA cannot "blindly adopt [those] conclusions" or rely on a report that is "facially-flawed."91

Several biofuels associations challenged EPA's decision to grant three small refinery exemption petitions on a number of grounds.92 The Tenth Circuit vacated EPA's decisions for three reasons. First, the court interpreted the phrase "extension of the exemption," found in the statutory language authorizing small refinery exemption petitions, to require that the small refinery have received the exemption each year to be eligible.93 Second, the court concluded that EPA erred in its analysis by considering sources of economic hardship other than those associated with RFS compliance.94 The court held that the statute only allowed the exemption to be granted on the basis of disproportionate economic hardship from RFS compliance, not other economic factors such as a downturn in industry profit margins.95 Finally, the court held that when evaluating whether a small refinery incurs disproportionate economic hardship from RFS compliance—specifically from having to purchase RINs—EPA must take into account its position that refineries are able to pass the cost of RINs on to consumers in the fuel's price.96 The court acknowledged that EPA could either depart from this position, which it has previously taken, with an adequate explanation or could explain why the theory did not apply to the small refinery at issue in the petition.97 But the court held that failing to address the theory at all or how it affected EPA's analysis was arbitrary and capricious.98

Challenges to EPA's Methodology

Parties have raised multiple challenges to how EPA administers the small refinery exemptions. To date, each of these challenges has been dismissed or transferred to another court on procedural grounds without reaching the merits of the parties' arguments.

First, in 2018 the Producers of Renewables United for Integrity Truth and Transparency (PRUITT) challenged in the D.C. Circuit how EPA remedied small refinery exemptions it granted on remand after the relevant compliance year had ended.99 Specifically, PRUITT challenged EPA's decision to issue 2018 RINs to two Wyoming refineries whose 2014 and 2015 exemption petitions were granted after a court vacated and remanded EPA's initial denials in 2017.100 EPA issued the 2018 RINs to compensate for the 2014 and 2015 RINs that the refineries had retired for compliance before the exemptions were granted.101 EPA issued 2018 RINs because the 2014 and 2015 RINs the refineries used for compliance had since expired.102 The D.C. Circuit transferred this portion of the petition to the Tenth Circuit because EPA's issuance of the 2018 replacement RINs to the Wyoming refineries was regionally rather than nationally applicable.103 Litigation is ongoing.104

PRUITT also challenged EPA's interpretation of the statutory provision that small refineries "may at any time petition [EPA] for an extension of the exemption."105 The agency had interpreted that provision to allow it to grant exemptions after it sets the annual standards.106 The petitioner alleged that EPA violated its statutory duty to ensure the required volumes of renewable fuels are met by granting "retroactive" exemptions.107 The court dismissed this claim for lack of jurisdiction108 and, accordingly, did not reach the merits of this argument.109

Rather than challenging EPA's ability to grant exemptions after it sets the annual standards, the National Biodiesel Board (NBB) challenged how EPA accounts for these exemptions as part of the 2018 rulemaking setting the annual standards.110 EPA adjusts the annual standards for any exemptions granted before the standards are set, which by statute must occur by November 30th the prior year.111 But EPA does not account for those exemptions granted later, either by adjusting the standards retroactively or by accounting for them prospectively using projections.112 NBB alleged that this approach violates the statute because it does not "ensure" that the volumes are met.113 The petitioner argued that EPA should project small refinery exemptions EPA was "reasonably likely to grant" after the standards are set, adjust the percentages accordingly, and then adjust for any deficiencies in EPA's projections by incorporating the shortfall into the following year's annual standards.114

The D.C. Circuit held that NBB had not preserved this challenge to the 2018 rule because it had failed to raise the argument with "reasonable specificity" during the public comment period, as the Clean Air Act requires.115 Although other parties had submitted comments regarding how EPA accounts for small refinery exemption volumes, the court determined that those comments either requested that EPA "cease granting retroactive exemptions" or "adjust the applicable volumes for the same year in which the retroactive exemptions are later granted."116 The court concluded that these comments were sufficiently different from NBB's argument that EPA had not had an opportunity to address the argument in its final rule.117 Accordingly, the D.C. Circuit held that NBB had forfeited the issue.118

Finally, based on media reports that EPA was increasing the number of exemptions granted, the American Biofuels Association challenged EPA's "decision to modify the criteria or lower the threshold by which [it] determines whether to grant small refineries an exemption."119 The number of filed and granted exemptions was not public when the lawsuit was filed.120 EPA subsequently created a small refinery exemption "dashboard" on its website and, in August 2019, issued a formal memorandum documenting its revised standards for granting small refinery exemptions.121 In the memorandum, EPA explains that it now only requires small refineries to experience either the disproportionate impacts or viability impairment to qualify for the exemption, whereas previously it required small refineries to demonstrate both criteria.122 In addition, EPA announced that it would grant full waivers when the Department of Energy recommended partial waivers, on the basis that this approach was more consistent with congressional intent.123

The D.C. Circuit dismissed American Biofuels Association's petition for lack of jurisdiction because the petition was based on a general pattern in agency decisionmaking rather than challenging a particular final agency action as required by the Administrative Procedure Act.124 The court noted, however, that EPA had acknowledged in oral argument that the August 2019 Memorandum is a final agency action that could be challenged if timely filed.125

16. What legislative proposals has Congress introduced that address small refinery exemptions?

Some members in the 116th Congress have introduced bills that address small refinery exemptions. Table 1 provides a summary of each bill.

|

Bill |

Summary |

|

|

|

|

|

|

|

|

|

Source: CRS analysis of bills from Congress.gov.

17. What other issues might one consider when discussing small refinery exemptions?

The statute gives the EPA Administrator the authority to grant small refinery exemptions, if a small refinery can prove that compliance would subject it to disproportionate economic hardship.126 Some Members of Congress contend this authority is being applied improperly and could harm rural economies (e.g., biofuel producers).127 Others contend that the use of the authority protects small refineries and employment in the oil industry.128 Below are items Congress may consider as it debates EPA's authority to issue small refinery exemptions.

- Transparency. Information about certain parts of the small refinery exemption process is limited. For example, it is unclear who is applying for an exemption, what specific information is included in an SRE application, or how an application is evaluated. Further, it is not clear if the same criteria to evaluate an application are used consistently year-to-year. Lastly, EPA does not regularly announce when it has issued an SRE. The statute does not require EPA to share such information publicly. EPA considers an SRE application to contain confidential business information as it includes proprietary information which if disclosed could cause harm to the applicant. EPA states that it "treats both the names of individual petitioners and EPA's decisions on those individual petitions as Confidential Business Information (CBI) under FOIA Exemption 4 (5 U.S.C. § 522(b)(4)) pending a final CBI determination by the Office of General Counsel."129 With such transparency issues, it could be difficult for Congress to conduct oversight of EPA's authority to grant small refinery exemptions.

- Application and decision timeline. Small refinery exemptions are not applied for or granted on a schedule. A small refinery may petition the EPA for an exemption at any time. In theory, once an exemption is issued for a certain year, the small refinery is no longer obligated to meet its RVO for that year. In actuality, the small refinery may not be able to receive the benefit of the exemption for the year it was granted (e.g., if an SRE is granted after the end of a compliance period and the small refinery has already complied with its obligation). Instead, in some cases the small refinery has been credited the RINs it retired to demonstrate compliance with the year that was exempted, and it may use those RINs in a future year. Also, it is not clear what information must be submitted to EPA for the agency to consider a petition "complete"—which would start the 90-day timeline for EPA to make a decision. The current application and decision timeline for small refinery exemptions may contribute to an ultimate annual volume requirement that may not match what was announced in a final rule.

- Inclusion of SREs in annual standards. The statute requires the EPA Administrator to adjust the percentage standards (i.e., annual volume amounts) for a given year by accounting for renewable fuel from the previous calendar year by small refineries that received an exemption.130 EPA accounts for volumes attributable to exempt small refineries in its formula for calculating the annual percentage standards.131 EPA complies with this provision through the RIN trading program.132

Because SRE petitions can be submitted at any time, EPA has two time periods during which it may address SREs in annual standard calculations: prior to a final rule being issued and after a final rule has been issued. EPA reports in its annual rulemaking if it has approved any SREs prior to issuing a final rule and adjusted its calculation accordingly. For instance, in the 2019 final rule, EPA states:

at this time no exemptions have been approved for 2019, and therefore we have calculated the percentage standards for 2019 without any adjustment for exempted volumes. We are maintaining our approach that any exemptions for 2019 that are granted after the final rule is released will not be reflected in the percentage standards that apply to all gasoline and diesel produced or imported in 2019.133

Since 2011 it has been EPA's policy to not account for the SREs that it issues following the release of a final rule.134 EPA justifies its position based on the November 30th statutory deadline for setting annual percentage standards and the need to provide the regulated community with certainty and advance notice of the standards.135 Based on a review of the RFS final rules from 2014 to the present, most or all SREs have been granted after the November 30th deadline.136 In 2019, EPA changed how it calculates the annual percentage standard in order to account for volumes of gasoline and diesel that will be exempted from the renewable volume obligations (see question 14). This may be an issue for Congress if Congress intended small refinery exemptions to be accounted for prior to the release of a final rule.

- Agency discretion. The statute gives the EPA Administrator certain discretion to evaluate an SRE petition. Data provided by EPA in its small refinery exemption dashboard (Figure 3) suggests the Trump Administration has received more SRE petitions and approved more SREs than the Obama Administration on an annual basis. The extent to which discretion should be a factor in the granting of small refinery exemptions may be an issue for Congress.

- RFS reset. The statute requires that the EPA Administrator modify the applicable volumes of the RFS in future years starting in 2016 if certain conditions are met (the aforementioned RFS "reset").137 According to the Office of Management and Budget (OMB), this "reset" has been triggered for total renewable fuel, advanced biofuel, and cellulosic biofuel.138 It is unclear when or how EPA will carry out such a reset. Congress may consider the impact a reset would have on many parts of the RFS, including small refinery exemptions.

- U.S. gasoline consumption. The RFS is a volume mandate, not a percentage mandate. The statutory renewable fuel volumes required to be blended are not tied to U.S. gasoline consumption rates. A general guideline is that most passenger vehicles in the U.S. are equipped to handle E10 (a fuel mixture comprised of 10% ethanol and 90% gasoline). Some might interpret this passenger vehicle acceptance rate as indicating that renewable fuel production should be about 10% of the conventional fuel market. Others might interpret this as an opportunity to push for more renewable fuel use (e.g., E15 year-round, flex-fuel vehicles). In any case, this means the statutory volumes could call for renewable fuel volume amounts that are out of alignment with actual gasoline consumption. It also means that EPA has the authority—which it has used multiple times—to reduce the RFS statutory volume amounts to more closely match actual conditions.139 Gasoline consumption has trended downwards for years for a variety of reasons (e.g., fuel economy standards, behavioral choices, economic conditions) and is currently steady, while the statutory renewable fuel portion trends upwards. In short, if the RFS cannot in real-time respond to gasoline consumption changes, it could be argued that the RFS renewable fuel targets become more difficult for some to achieve. If the targets are more difficult to achieve, RFS compliance may become a concern for some (e.g., an increase in compliance costs). This compliance burden may lead to more small refineries requesting an exemption. This may be an issue for Congress, if Congress wants market conditions, not projections, to play a role in renewable fuel use.

Author Contact Information

Footnotes

| 1. |

42 U.S.C. §7545(o). |

| 2. |

42 U.S.C. §7545(o)(9). |

| 3. |

Rep. Abby Finkenauer, "Small Refinery Exemption Waivers to be Investigated After Finkenauer-Led Bipartisan Request," press release, January 10, 2020, https://finkenauer.house.gov/media/press-releases/small-refinery-exemption-waivers-be-investigated-after-finkenauer-led; U.S. Congress, House Committee on Energy and Commerce, Subcommittee on Environment and Climate Change, Protecting the RFS: The Trump Administration's Abuse of Secret Waivers, 116th Cong., October 29, 2019; U.S. Congress, House Committee on Science, Space, and Technology, Science and Technology at the Environmental Protection Agency, 116th Cong., September 19, 2019; Sen. Fischer, "Midwest Senators Submit Comments on EPA's Supplemental Rule on RFS Deal," press release, November 7, 2019, https://www.fischer.senate.gov/public/index.cfm/2019/11/midwest-senators-submit-comments-on-epa-s-supplemental-rule-on-rfs-deal; Senator Smith, "U.S. Senators Smith, Klobuchar, Stabenow, Durbin, Peters, Baldwin, and Brown Call for Stronger Renewable Fuel Standard: Senators Say Abuse of Small Refinery Hardship Waivers Reduces Demand for Renewable Fuels, Hurts Farmers in Minnesota and Across Nation," press release, August 26, 2019, https://www.smith.senate.gov/us-senators-smith-klobuchar-stabenow-durbin-peters-baldwin-and-brown-call-stronger-renewable-fuel; U.S. Senate Committee on Environment and Public Works, "Senators: Secretary of Agriculture Lacks Legal Authority over Small Refineries Under Biofuel Mandate," press release, July 1, 2019, https://www.epw.senate.gov/public/index.cfm/2019/7/senators-secretary-of-agriculture-lacks-legal-authority-over-small-refineries-under-biofuel-mandate; Sen. Cruz, "Sens. Cruz, Barrasso, Inhofe, Toomey, Kennedy, Wicker, Lee, Enzi, Cassidy Urge Administration to Uphold the Rule of Law and Block Senate Democrats' Efforts to Roll Back President Trump's Energy Independence Accomplishments," press release, June 26, 2019, https://www.cruz.senate.gov/?p=press_release&id=4552. |

| 4. |

Renewable Fuels Association, "RFA: Refinery Waivers Undermine Renewable Fuels, Rural Economy and Government Transparency," press release, October 29, 2019, https://ethanolrfa.org/2019/10/rfa-refinery-waivers-undermine-renewable-fuels-rural-economy-and-government-transparency/; National Farmers Union, "NFU Urges Greater Transparency in EPA's Granting of Small Refinery Exemptions," press release, October 29, 2019, https://nfu.org/2019/10/29/nfu-urges-greater-transparency-in-epas-granting-of-small-refinery-exemptions/; Growth Energy, "Growth Energy Files Federal Lawsuit Against EPA on Small Refinery Exemptions," press release, February 11, 2019, https://growthenergy.org/2019/02/11/growth-energy-files-federal-lawsuit-against-epa-on-small-refinery-exemptions/. |

| 5. |

American Fuel & Petrochemical Manufacturers, "U.S. EIA Data: Small Refinery Exemptions ≠ Lower Ethanol Demand," press release, July 1, 2019, https://www.afpm.org/newsroom/blog/us-eia-data-small-refinery-exemptions-lower-ethanol-demand; Patrick Kelly, RFS Public Hearing: API Testimony, American Petroleum Institute, July 30, 2019, https://www.api.org/~/media/Files/News/Testimony_Speeches/2019/API%202020%20RFS%20Oral%20Testimony.pdf; LeAnn Johnson Koch, Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021, and Response to the Remand of the 2016 Standards; Supplemental Notice of Proposed Rulemaking, Small Refiners Coalition, November 29, 2019, https://www.regulations.gov/contentStreamer?documentId=EPA-HQ-OAR-2019-0136-0733&attachmentNumber=1&contentType=pdfhttps://www.regulations.gov/contentStreamer?documentId=EPA-HQ-OAR-2019-0136-0324&attachmentNumber=1&contentType=pdf. |

| 6. |

42 U.S.C. §7545(o). The RFS was established by the Energy Policy Act of 2005 (P.L. 109-58; EPAct05) and was expanded in 2007 by the Energy Independence and Security Act (P.L. 110-140; EISA). The RFS is an amendment to the Clean Air Act. For more information on the RFS, see CRS Report R43325, The Renewable Fuel Standard (RFS): An Overview, by Kelsi Bracmort. |

| 7. |

42 U.S.C. §7545(o)(2)(B). |

| 8. |

42 U.S.C. §7545(o)(2)(B)(ii). The statute requires the EPA Administrator to coordinate with the Secretaries of Energy and Agriculture and to take into account several factors (e.g., the impact of the production and use of renewable fuels on the environment). |

| 9. |

42 U.S.C. §7545(o)(2)(B). |

| 10. |

Conventional biofuel equates to the difference between the total renewable fuel category and the advanced biofuel category. |

| 11. |

42 U.S.C. §7545(o)(3)(B); 40 C.F.R. §80.1405. |

| 12. |

42 U.S.C. §7547(o)(5). |

| 13. |

40 C.F.R. §80.1406. |

| 14. |

40 C.F.R. §80.1407. |

| 15. |

42 U.S.C. 7545(o)(7). |

| 16. |

42 U.S.C. 7545(o)(7)(A); 42 U.S.C. 7545(o)(7)(D); 42 U.S.C. 7545(o)(7)(E). |

| 17. |

42 U.S.C. 7545(o)(7)(F). |

| 18. |

42 U.S.C. 7545(o)(1)(K). |

| 19. |

This calculation is based on the conversion rate that 1 barrel of crude oil is equal to 42 gallons. A barrel of crude oil produces many petroleum products, not just gasoline. For instance, EIA reports that one 42-gallon barrel of crude oil produces about 20 gallons of motor gasoline, 12 gallons of distillate fuel, and 4 gallons of jet fuel. U.S. Energy Information Administration, Oil: Crude and Petroleum Products Explained, December 11, 2019, https://www.eia.gov/energyexplained/oil-and-petroleum-products/refining-crude-oil.php. |

| 20. |

Refinery analysis completed by CRS analyst Heather Greenley. For mapping purposes, CRS used EIA data based on stream days to determine throughput on a calendar day schedule. U.S. Energy Information Administration, Refinery Capacity Report, June 21, 2019, https://www.eia.gov/petroleum/refinerycapacity/. |

| 21. |

U.S. Energy Information Administration, "Refinery Capacity Report," June 2019, https://www.eia.gov/petroleum/refinerycapacity/refcap19.pdf |

| 22. |

U.S. Energy Information Administration, Number and Capacity of Petroleum Refineries, June 21, 2019, https://www.eia.gov/dnav/pet/pet_pnp_cap1_dcu_nus_a.htm. |

| 23. |

42 U.S.C. 7545(o)(9). The calendar year is the compliance period for the RFS. |

| 24. |

42 U.S.C. 7545(o)(1)(K). |

| 25. |

42 U.S.C. 7545(o)(9)(A) and 42 U.S.C. 7545(o)(9)(B). |

| 26. |

42 U.S.C. 7545(o)(9)(A)(i). |

| 27. |

U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: 2012 Renewable Fuel Standards; Final Rule," 77 Federal Register 1340, January 9, 2012. |

| 28. |

42 U.S.C. 7545(o)(9)(B)(i). For more information on the history of SREs, see U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: 2013 Renewable Fuel Standards," 78 Federal Register 49825, August 15, 2013. |

| 29. |

42 U.S.C. 7545(o)(9)(B)(i). |

| 30. |

42 U.S.C. 7545(o)(9)(B)(ii). |

| 31. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7019, 7052, February 6, 2020. |

| 32. |

Sinclair Wyoming Refining, et al. v. EPA, 14 (Tenth Circuit 2017). |

| 33. |

42 U.S.C. 7545(o)(9)(A)(ii)(I). |

| 34. |

U.S. Department of Energy, Small Refinery Exemption Study: An Investigation into Disproportionate Economic Hardship, March 2011, p. 3, https://www.epa.gov/sites/production/files/2016-12/documents/small-refinery-exempt-study.pdf. |

| 35. |

U.S. Department of Energy, Small Refinery Exemption Study: An Investigation into Disproportionate Economic Hardship, March 2011, p. 32, https://www.epa.gov/sites/production/files/2016-12/documents/small-refinery-exempt-study.pdf. |

| 36. |

U.S. Department of Energy, Small Refinery Exemption Study: An Investigation into Disproportionate Economic Hardship, March 2011, p. 32-33 and 36, https://www.epa.gov/sites/production/files/2016-12/documents/small-refinery-exempt-study.pdf. |

| 37. |

"Small Refinery Exemption," Explanatory Statement for Consolidated Appropriations Act 2016, Congressional Record, vol. 161 (December 17, 2015), p. H10105. |

| 38. |

U.S. Congress, Senate Committee on Appropriations, Department of the Interior, Environment, and Related Agencies Appropriations Bill, 2017, S. 3068, 114th Cong., 2nd sess., June 16, 2016, S.Rept. 114-281, p. 70; Explanatory Statement for the Consolidated Appropriations Act, 2017 (P.L. 115-31), Congressional Record, vol. 163 (May 3, 2017), p. H3874. |

| 39. |

40 C.F.R. §80.1441(e)(2)(i) |

| 40. |

U.S. Environmental Protection Agency, Renewable Fuel Standard Exemptions for Small Refineries, December 4, 2019, https://www.epa.gov/renewable-fuel-standard-program/renewable-fuel-standard-exemptions-small-refineries#background. |

| 41. |

40 C.F.R. §80.1441(e)(2)(iii) |

| 42. |

U.S. Environmental Protection Agency, Financial and Other Information to Be Submitted with 2016 RFS Small Refinery Hardship Exemption Requests, December 6, 2016, https://www.epa.gov/sites/production/files/2016-12/documents/rfs-small-refinery-2016-12-06.pdf. |

| 43. |

Ibid. |

| 44. |

42 U.S.C. 7545(o)(9)(B)(i); 40 C.F.R. §80.1441(e)(2). |

| 45. |

42 U.S.C. 7545(o)(9)(B)(iii); 40 C.F.R. §80.1441(e)(2)(ii). The term "act" should not be interpreted as "decide on." |

| 46. |

U.S. Environmental Protection Agency, Renewable Fuel Standard Exemptions for Small Refineries, December 4, 2019, https://www.epa.gov/renewable-fuel-standard-program/renewable-fuel-standard-exemptions-small-refineries. |

| 47. |

U.S. Environmental Protection Agency, RFS Small Refinery Exemptions, December 4, 2019, https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rfs-small-refinery-exemptions. |

| 48. |

42 U.S.C. 7545(o)(2)(B). After 2022, the EPA Administrator determines the annual volume amounts. |

| 49. |

42 U.S.C. 7545(o)(3). The equations EPA uses to calculate the annual percentage standards are available at 40 C.F.R. §80.1405(c). |

| 50. |

40 C.F.R. §80.1407. |

| 51. |

40 C.F.R. §80.1407. |

| 52. |

For more information on RINs and RFS compliance, see CRS Testimony TE10026, Background on Renewable Identification Numbers under the Renewable Fuel Standard, by Brent D. Yacobucci. |

| 53. |

42 U.S.C. 7545(o)(2)(B). |

| 54. |

U.S. Environmental Protection Agency, Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021, Final Rule, TABLE I.F–1—FINAL 2020 PERCENTAGE STANDARDS, February 6, 2020. |

| 55. |

40 C.F.R. §80.1407. |

| 56. |

The statutory deadline for EPA to announce the final requirement is November 30th of the previous year for all of the renewable fuel categories, except biomass-based diesel which must be announced 14 months before the year for which the applicable volume is to apply. |

| 57. |

U.S. Environmental Protection Agency, RFS Small Refinery Exemptions, December 4, 2019, https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rfs-small-refinery-exemptions. |

| 58. |

40 C.F.R. §80.1405(c). |

| 59. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7049, February 6, 2020. In the 2020 RFS final rule, EPA finalized a change as to how it calculates the annual percentage standard in order to account for volumes of gasoline and diesel that will be exempted (as noted in question 14). |

| 60. |

Renewable Fuels Association, EPA's Final 2020 Volume Obligations Must Restore Lost Gallons, August 30, 2019, https://ethanolrfa.org/2019/08/epas-final-2020-volume-obligations-must-restore-lost-gallons/. |

| 61. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2018 and Biomass-Based Diesel Volume for 2019, Final Rule," 82 Federal Register 58491, December 12, 2017. |

| 62. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2018 and Biomass-Based Diesel Volume for 2019, Final Rule," 82 Federal Register 58523, December 12, 2017. |

| 63. |

U.S. Environmental Protection Agency, EPA Announces Biofuel and Small Refinery Exemption Priorities, August 9, 2019, https://www.epa.gov/newsreleases/epa-announces-biofuel-and-small-refinery-exemption-priorities. |

| 64. |

U.S. Environmental Protection Agency, RFS Small Refinery Exemptions, November 17, 2019, https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rfs-small-refinery-exemptions. |

| 65. |

U.S. Environmental Protection Agency, RFS Small Refinery Exemptions, February 27, 2020, https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rfs-small-refinery-exemptions. |

| 66. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7052, February 6, 2020. |

| 67. |

42 U.S.C. 7545(o)(3)(C)(ii). |

| 68. |

U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: Changes to Renewable Fuel Standard Program; Final Rule," 75 Federal Register 14717, March 26, 2010. The term RFS2 refers to the RFS as expanded under EISA. The term RFS1 refers to the RFS as established by EPAct05. |

| 69. |

U.S. Environmental Protection Agency, email to CRS on November 1, 2018. |

| 70. |

U.S. Environmental Protection Agency, email to CRS on November 14, 2019. |

| 71. |

National Biodiesel Board, "NBB Letter to EPA's Wheeler Highlights Economic Damage from Refinery Exemptions," press release, June 21, 2019, https://www.nbb.org/news-resources/press-releases/2019/06/21/NBB-Letter-to-EPA-s-Wheeler-Highlights-Economic-Damage-from-Refinery-Exemptions; Growth Energy, "Growth Energy Files Federal Lawsuit Against EPA on Small Refinery Exemptions," press release, February 4, 2019, https://growthenergy.org/2019/02/04/growth-energy-files-federal-lawsuit-against-epa-on-small-refinery-exemptions/. |

| 72. |

Patrick Kelly, RFS Public Hearing: API Testimony, American Petroleum Institute, July 30, 2019, https://www.api.org/~/media/Files/News/Testimony_Speeches/2019/API%202020%20RFS%20Oral%20Testimony.pdf. The blendwall is the upper limit to the total amount of ethanol that can be blended into U.S. gasoline and still maintain automobile performance and comply with the Clean Air Act. |

| 73. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register, February 6, 2020. |

| 74. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021, and Response to the Remand of the 2016 Standards; Supplemental Notice of Proposed Rulemaking," 84 Federal Register, October 28, 2019. |

| 75. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7051, February 6, 2020. |

| 76. |

The equations EPA uses to calculate the annual percentage standards are available at 40 C.F.R. §80.1405(c). U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7049, February 6, 2020. |

| 77. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7050, February 6, 2020. |

| 78. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7051, February 6, 2020. |

| 79. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2020 and Biomass-Based Diesel Volume for 2021 and Other Changes," 85 Federal Register 7019, February 6, 2020. |

| 80. |

U.S. Environmental Protection Agency, Decision on 2018 Small Refinery Exemption Petitions Memorandum, August 9, 2019. |

| 81. |

This section was written by CRS legislative attorney Erin H. Ward. |

| 82. |

Petition for Review, Suncor Energy v. EPA, No. 19-9612 (10th Cir. December 24, 2019). This report references a significant number of decisions by federal appellate courts of various regional circuits. For purposes of brevity, references to a particular circuit in the body of this report (e.g., the Tenth Circuit) refer to the U.S. Court of Appeals for that particular circuit. |

| 83. |

See generally Hermes Consolidated, LLC v. EPA, 787 F.3d 568 (D.C. Cir. 2015); Lion Oil Co. v. EPA, 792 F.3d 978 (8th Cir. 2015); Sinclair Wyo. Refining Co. v. EPA, 887 F.3d 986 (10th Cir. 2017); Ergon-West Va., Inc. v. EPA, 896 F.3d 600 (4th Cir. 2018). |

| 84. |

See, e.g., Hermes Consol., 787 F.3d at 574. See also "4. What is "disproportionate economic hardship"?" |

| 85. |

Id. at 574-75; Lion Oil Co., 792 F.3d at 984; Ergon-West Va., 896 F.3d at 609. |

| 86. |

See, e.g., Hermes Consol., 787 F.3d at 574-75. |

| 87. |

Id.; Lion Oil Co., 792 F.3d at 984. |

| 88. |

Sinclair Wyo. Refining Co., 887 F.3d at 995-99. |

| 89. |

Hermes Consol., LLC, 787 F.3d at 579-80. |

| 90. |

Ergon-West Va., Inc., 896 F.3d at 613. |

| 91. |

Id. |

| 92. |

Renewable Fuels Ass'n v. EPA, No. 18-9533, Slip Op. at 64-65 (10th Cir. 2020). |

| 93. |

Id. at 67-79. |

| 94. |

Id. at 87-89. |

| 95. |

Id. |

| 96. |

Id. at 91-97. |

| 97. |

Id. |

| 98. |

Id. |

| 99. |

Producers of Renewables United for Integrity Truth and Transparency v. EPA, 778 F. App'x 1, 16 (D.C. Cir. 2019). |

| 100. |

Id. at 2-3. |

| 101. |

Id. |

| 102. |

Id. at 3. RINs are only valid for the year in which they are generated and the following compliance year. 40 C.F.R. § 80.1427(a)(6)(i). |

| 103. |

Producers of Renewables United for Integrity Truth and Transparency, 778 F. App'x at 3-4. The Clean Air Act provides that petitions for review of agency actions with local or regional applicability be heard only by the U.S. Court of Appeals with jurisdiction over that locality or region. 42 U.S.C. § 7607(b)(1). The statute only affords the D.C. Circuit jurisdiction over agency actions with national applicability. Id. |

| 104. |

Docket, Producers of Renewables United for Integrity Truth and Transparency v. EPA, No. 19-9532 (10th Cir. 2019). |

| 105. |

42 U.S.C. § 7545(o)(9)(B)(i) (emphasis added). |

| 106. |

Producers of Renewables United for Integrity Truth and Transparency, 778 F. App'x at 4. |

| 107. |

Id. |

| 108. |

Under the Clean Air Act, any petitions for review of agency action must be filed within 60 days or, if "based solely on grounds arising after such sixtieth day," within 60 days of such grounds arising. 42 U.S.C. § 7607(b)(1). The court noted that the Producers of Renewables United for Integrity Truth and Transparency did not challenge any particular exemption grant but challenged EPA's regulations interpreting the statute, promulgated in 2010, and its subsequent rulemakings. Producers of Renewables United for Integrity Truth and Transparency, 778 F. App'x at 4. The court held that the petitions had not been filed within 60 days of these agency actions or the grounds petitioners identified as arising later, namely EPA having granted "many more exemptions than before." Id. Accordingly, it held the petition was untimely, depriving the court of jurisdiction to hear the case. Id. at 5. |

| 109. |

Producers of Renewables United for Integrity Truth and Transparency, 778 F. App'x at 5. |

| 110. |

Am. Fuel & Petrochemical Manufacturers v. EPA, 937 F.3d 559, 588 (D.C. Cir. 2019). |

| 111. |

40 C.F.R. § 80.1405; 75 Federal Register 14,670, 14,716-17 (March 26, 2010). |

| 112. |

40 C.F.R. § 80.1405; 75 Federal Register 14,670, 14,716-17 (March 26, 2010). |

| 113. |

Am. Fuel & Petrochemical Manufacturers, 937 F.3d at 588. |

| 114. |

Id. |

| 115. |

Id.; see also 42 U.S.C. § 7607(d)(7)(B). |

| 116. |

Am. Fuel & Petrochemical Manufacturers, 937 F.3d at 588-89. |

| 117. |

Id. |

| 118. |

Id. at 589. |

| 119. |

Pet. for Review, Adv. Biofuels, Inc. v. EPA, No. 18-1115, at 1 (D.C. Cir. 2018). |

| 120. |

Adv. Biofuels Ass'n. v. EPA, No. 18-1115, 2019 WL 6217965, at *2 (D.C. Cir. Nov. 12, 2018). |

| 121. |

Id. at *2-3. |

| 122. |

Anne Idsal, Acting Assistant Administrator, Office of Air & Radiation, Decision on 2018 Small Refinery Exemption Petitions 1 (Aug. 9, 2019) (hereinafter "August 2019 Memorandum"); see also Adv. Biofuels Ass'n, 2019 WL 6217965, at *3. |

| 123. |

August 2019 Memorandum, supra note 117, at 2; see also Adv. Biofuels Ass'n, 2019 WL 6217965, at *3. |

| 124. |

Adv. Biofuels Ass'n, 2019 WL 6217965, at *1. |

| 125. |

Id. at *4. |

| 126. |

42 U.S.C. 7545(o)(9). |

| 127. |

For example, see Sen. Chuck Grassley, "Bipartisan Group of Senators Request EPA Cease Issuing RFS 'Hardship' Waivers and Disclose Information to Congress," press release, April 17, 2018, https://www.grassley.senate.gov/news/news-releases/bipartisan-group-senators-request-epa-cease-issuing-rfs-hardship-waivers-and. |

| 128. |

Sen. John Kennedy, "Sen. Kennedy Asks Agriculture Secretary Perdue to Stop Threatening Thousands of Louisiana Energy Jobs," press release, June 28, 2019, https://www.kennedy.senate.gov/public/2019/6/sen-kennedy-asks-agriculture-secretary-perdue-to-stop-threatening-thousands-of-louisiana-energy-jobs. |

| 129. |

U.S. Environmental Protection Agency, Email to CRS on February 7, 2018. |

| 130. |

42 U.S.C. §7547(o)(3)(C). |

| 131. |

40 C.F.R. §80.1405(c). |

| 132. |

Email from U.S. Environmental Protection Agency to CRS, November 1, 2018. See also U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: Changes to Renewable Fuel Standard Program; Final Rule," 75 Federal Register 14717, March 26, 2010. |

| 133. |

U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2019 and Biomass-Based Diesel Volume for 2020," 83 Federal Register 63740, December 11, 2018. |

| 134. |

U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: 2011 Renewable Fuel Standards; Final Rule," 75 Federal Register 76804, December 9, 2010; U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: 2013 Renewable Fuel Standards; Final Rule," 78 Federal Register 49825, August 15, 2013; U.S. Environmental Protection Agency, Renewable Fuel Standard Program—Standards for 2018 and Biomass-Based Diesel Volume for 2019: Response to Comments, EPA-420-R-17-007, December 2017, p. 216. |

| 135. |

U.S. Environmental Protection Agency, "Regulation of Fuels and Fuel Additives: 2011 Renewable Fuel Standards; Final Rule," 75 Federal Register 76804, December 9, 2010. |

| 136. |

A review of the RFS final rules indicate that EPA has not approved any SREs prior to issuing a final rule for 2015 through 2019. EPA reports the percentage standards for 2014 do reflect the gasoline and diesel volumes associated with three small refinery exemptions. U.S. Environmental Protection Agency, "Renewable Fuel Standard Program: Standards for 2014, 2015, and 2016 and Biomass-Based Diesel Volume for 2017; Final Rule," 80 Federal Register 77511, December 14, 2015. |

| 137. |

42 U.S.C. 7545(o)(7)(F). |

| 138. |

U.S. Office of Management and Budget, Renewable Fuel Standard Program: Modification of Statutory Volume Targets, RIN: 2060-AU28, 2019, https://www.reginfo.gov/public/do/eAgendaViewRule?pubId=201910&RIN=2060-AU28. |

| 139. |

CRS Report R44045, The Renewable Fuel Standard (RFS): Waiver Authority and Modification of Volumes, by Kelsi Bracmort. |