National Security Space Launch

The United States is making significant efforts to pursue a strategy that ensures continued access to space for national security missions. The current strategy is embodied in the National Security Space Launch (NSSL) program. The NSSL supersedes the Evolved Expendable Launch Vehicle (EELV) program, which started in 1995 to ensure that National Security Space (NSS) launches were affordable and reliable. For the same reasons, policymakers provide oversight for the current NSSL program and encourage competition, as there was only one provider for launch services from 2006 to 2013. Moreover, Congress now requires DOD to consider both reusable and expendable launch vehicles for solicitations after March 1, 2019. To date, only expendable, or single-use, launch vehicles have been used for NSSL missions.

The NSSL program is the primary provider for NSS launches. Factors that prompted the initial EELV effort in 1995 are still manifest—significant increases in launch costs and concerns over procurement and competition. In addition, the Russian backlash over the 2014 U.S. sanctions against Russian actions in Ukraine exacerbated a long-standing undercurrent of concern over U.S. reliance on a Russian rocket engine (RD-180) for critical national security space launches. Moreover, significant overall program cost increases and unresolved questions over individual launch costs, along with legal challenges to the Air Force rocket development and launch procurement contract awards, have resulted in legislative action.

In 2015, the Air Force began taking steps to transition from reliance on the Russian made RD-180 engine used on the Atlas V rocket. Some in Congress pressed for a more flexible transition to replace the RD-180 that allowed for development of a new launch vehicle, while others in Congress sought legislation that would move the transition process forward more quickly with a focus on developing an alternative U.S. rocket engine. Transitioning away from the RD-180 to a domestic U.S. alternative provided opportunities for space launch companies that sought to compete for NSS space launches. Because of the technical, program, and schedule risk, as a worst-case scenario, the transition could leave the United States in a situation in which some of its national security space payloads lack an available certified launcher.

The Space and Missile System Center (SMC), together with the National Reconnaissance Office (NRO), released a request for proposals in May 2019 to award two domestic launch service contracts. DOD plans to select two separate space launch companies in the summer of 2020 that will be responsible for launching U.S. military and intelligence satellites through 2027. NSS launch has been a leading legislative priority in the defense bills over the past few years and may continue to be so into the future.

National Security Space Launch

Jump to Main Text of Report

Contents

Summary

The United States is making significant efforts to pursue a strategy that ensures continued access to space for national security missions. The current strategy is embodied in the National Security Space Launch (NSSL) program. The NSSL supersedes the Evolved Expendable Launch Vehicle (EELV) program, which started in 1995 to ensure that National Security Space (NSS) launches were affordable and reliable. For the same reasons, policymakers provide oversight for the current NSSL program and encourage competition, as there was only one provider for launch services from 2006 to 2013. Moreover, Congress now requires DOD to consider both reusable and expendable launch vehicles for solicitations after March 1, 2019. To date, only expendable, or single-use, launch vehicles have been used for NSSL missions.

The NSSL program is the primary provider for NSS launches. Factors that prompted the initial EELV effort in 1995 are still manifest—significant increases in launch costs and concerns over procurement and competition. In addition, the Russian backlash over the 2014 U.S. sanctions against Russian actions in Ukraine exacerbated a long-standing undercurrent of concern over U.S. reliance on a Russian rocket engine (RD-180) for critical national security space launches. Moreover, significant overall program cost increases and unresolved questions over individual launch costs, along with legal challenges to the Air Force rocket development and launch procurement contract awards, have resulted in legislative action.

In 2015, the Air Force began taking steps to transition from reliance on the Russian made RD-180 engine used on the Atlas V rocket. Some in Congress pressed for a more flexible transition to replace the RD-180 that allowed for development of a new launch vehicle, while others in Congress sought legislation that would move the transition process forward more quickly with a focus on developing an alternative U.S. rocket engine. Transitioning away from the RD-180 to a domestic U.S. alternative provided opportunities for space launch companies that sought to compete for NSS space launches. Because of the technical, program, and schedule risk, as a worst-case scenario, the transition could leave the United States in a situation in which some of its national security space payloads lack an available certified launcher.

The Space and Missile System Center (SMC), together with the National Reconnaissance Office (NRO), released a request for proposals in May 2019 to award two domestic launch service contracts. DOD plans to select two separate space launch companies in the summer of 2020 that will be responsible for launching U.S. military and intelligence satellites through 2027. NSS launch has been a leading legislative priority in the defense bills over the past few years and may continue to be so into the future.

Introduction

The National Security Space Launch (NSSL) program aims to acquire launch services and ensure continued access to space for critical national security missions. The U.S. Air Force implemented the original program in 1995—Evolved Expendable Launch Vehicle (EELV)—and awarded four companies contracts to design a cost-effective launch vehicle system. The DOD acquisition strategy was to select one company and ensure that NSS launches were affordable and reliable. The EELV effort was prompted by significant increases in launch costs, procurement concerns, and the lack of competition among U.S. companies.

A major challenge and long-standing undercurrent of concern over U.S. reliance on a Russian rocket engine (RD-180), used on one of the primary national security rockets for critical national security space launches, was exacerbated by the Russian backlash over the 2014 U.S. sanctions against its actions in Ukraine. Moreover, significant overall NSSL program cost increases and unresolved questions over individual launch costs, along with legal challenges to the Air Force contract awards by space launch companies, prompted legislative action. In the John S. McCain National Defense Authorization Act (NDAA) for FY2019, Congress renamed the EELV to the NSSL program to reflect a wider mission that would consider both reusable and expendable launch vehicles.1

The origins of the NSSL program date back to 1995, after years of concerns within the Air Force and space launch community over increasing cost and decreasing confidence in the continued reliability of national access to space. The purpose of EELV was to provide the United States affordable, reliable, and assured access to space with two families of space launch vehicles. Initially only two companies were in competition: Boeing produced the Delta IV launch vehicle, and Lockheed Martin developed the Atlas V. Overall, the program provided critical space lift capability to support DOD and intelligence community satellites, together known as National Security Space (NSS) missions.

The EELV program evolved modestly in response to changing circumstances, and the Air Force approved an EELV acquisition strategy in November 2011, further revising it in 2013. That strategy was designed to (1) sustain two major independent rocket-powered launch vehicle families to reduce the chance of launch interruptions and to ensure reliable access to space; (2) license and stockpile the Russian-made RD-180 heavy-lift rocket engine, a critical component of the Atlas V; (3) pursue a block-buy commitment to a number of launches through the end of the decade to reduce launch costs; and (4) increase competition to reduce overall launch costs. The Air Force and others viewed the overall EELV acquisition strategy as having successfully reduced launch costs while demonstrating highly reliable access to space for DOD and the intelligence community. Others in Congress and elsewhere, however, argued that the program remained far too costly and was not as competitive as it should be.

The NSSL program is managed by the Launch Enterprise Systems Directorate of the Space and Missile Systems Center, Los Angeles Air Force Base (El Segundo, CA). The NSSL program consists of four launch vehicles: Atlas V and Delta IV Heavy (both provided by United Launch Alliance [ULA] of Denver, CO)2 and Falcon 9 and Falcon Heavy (both provided by Space Exploration Technologies Corporation [SpaceX] of Hawthorne, CA).3 NSS launches support the Air Force, Navy, and National Reconnaissance Office (NRO). More specifically, the Atlas V has launched commercial, civil, and NSS satellites into orbit, including commercial and military communications satellites, lunar and other planetary orbiters and probes, earth observation, military research, and weather satellites, missile warning and NRO reconnaissance satellites, a tracking and data relay satellite, and the X-37B space plane (a military orbital test vehicle). The Delta IV has launched commercial and military communications and weather satellites, and missile warning and NRO satellites.

The Atlas V and Delta IV Heavy launch vehicles are produced by ULA, which was formed in 2006 as a joint venture of The Boeing Company (of Chicago, IL) and Lockheed Martin (of Bethesda, MD). In addition to the launch vehicles themselves, the NSSL program consists of an extensive array of support capabilities and infrastructure to permit safe operations of U.S. launch ranges.4 ULA operates five space launch complexes, two at Cape Canaveral Air Force Station, FL (Space Launch Complex-37 and Space Launch Complex-41), and three at Vandenberg Air Force Base, CA (Space Launch Complex-2, Space Launch Complex-3F, and Space Launch Complex-6). A large number of key suppliers for ULA are spread throughout 46 states.

DOD certified SpaceX to compete for NSS launches in 2015. The Falcon 9 flew its first NSSL mission on December 23, 2018, which delivered the Global Positioning System (GPS) III to orbit. SpaceX developed a more capable launch capability in the Falcon Heavy, which DOD certified in June 2018 and later awarded NSS missions under Phase 1A of the NSSL program. SpaceX maintains three launch sites, one at Cape Canaveral Air Force Station, FL (Space Launch Complex 40); one at Kennedy Space Center (Launch Complex 39A); and one at Vandenberg Air Force Base, CA (Space Launch Complex 4E).5

On October 10, 2018, the Air Force awarded three Launch Service Agreement (LSA) Other Transaction Authority (OTA) agreements to space launch companies. The LSA OTA agreements are "public-private partnerships [that] leverage industry's commercial launch solutions to ensure those systems meet NSS requirements."6 They also "facilitate development of three NSSL launch system prototypes and maturing those launch systems prior to selecting two NSS launch service providers for launch service procurements beginning in FY2020."7 The Air Force released request for proposals (RFP) in May 2019 for Phase 2 of the NSSL program, with plans to award two separate Launch Service Procurement (LSP) contracts in the summer of 2020. The selected companies will be responsible for launching national security satellites through 2027. However, the Air Force acquisition strategy of down-selecting no more than two launch providers may mitigate short-term risk but could have second- and third-order effects for resiliency in the future.

Congress may consider whether the strategy's cost-benefit analysis warrants further research. Should no more than two launch providers be chosen for LSP contracts in Phase 2, the companies not selected would lose the LSA funds received from the Air Force and could potentially be faced with (1) the choice of abandoning NSSL development to focus on competing in the commercial launch sector or (2) investing vast company reserves to continue development on its own. Furthermore, DOD investment in only two launch providers could mean fewer options for an increasingly diverse range of national space security missions and possibly limit competition, once again, in the launch market.

Evolution of the EELV

1990s-2011

By the early 1990s, the U.S. space industrial base supported the production of a number of launch vehicles (i.e., Titan II, Delta II, Atlas I/II/IIAS, and Titan IV) and their associated infrastructure. Although launch costs were increasing and operational and procurement deficiencies were noted by many decisionmakers, no clear consensus formed over how best to proceed. Congress took the initiative in the National Defense Authorization Act for Fiscal Year 1994 (NDAA; P.L. 103-160, §213) by directing DOD to develop a Space Launch Modernization Plan (SLMP) that would "establish and clearly define priorities, goals, and milestones regarding modernization of space launch capabilities for the Department of Defense or, if appropriate, for the Government as a whole."

The recommendations of the SLMP led DOD to implement the EELV program as the preferred alternative. The primary objective of the EELV program was to reduce costs by 25%. The program also sought to ensure 98% launch vehicle design reliability and to standardize EELV system launch pads and the interface between satellites and their launch vehicles. Congress supported these recommendations through the FY1995 NDAA (P.L. 103-337, §211), directing DOD to develop an integrated space launch vehicle strategy to replace or consolidate the then-current fleet of medium and heavy launch vehicles and to devise a plan to develop new or upgraded expendable launch vehicles. Congress recommended spending $30 million for a competitive reusable rocket technology program and $60 million for expendable launch vehicle development and acquisition.

The original EELV acquisition strategy, initiated in 1994, called for a competitive down-select8 to a single launch provider and development of a system that could handle the entire NSS launch manifest. In 1995, the Air Force selected four launch providers for the initial competition: Lockheed Martin, Boeing, McDonnell Douglas, and Alliant Techsystems. After the first round of competition, the Air Force selected Lockheed Martin and McDonnell Douglas to continue. When Boeing acquired McDonnell Douglas in 1997, Boeing took over the contract to develop an EELV. Soon thereafter, however, the Air Force revised the EELV acquisition strategy, concluding that there was now a sufficient space launch market to sustain two EELV providers.

Throughout the acquisition process, DOD maintained that competition between Lockheed Martin and Boeing was essential. At the time, the Government Accountability Office (GAO) reported that sufficient growth in the commercial launch business would sustain both companies, a premise that, in turn, would lead to lower launch prices for the government.9 But "the robust commercial market upon which DOD based its acquisition strategy of maintaining two launch companies [throughout the life-cycle of the program] never materialized, and estimated prices for future contracts, along with total program costs, increased."10

Retaining two launch providers, however, did provide DOD with some confidence in its ability to maintain "assured access to space." This confidence soon collapsed, when in the late 1990s, the United States suffered six space launch failures in less than a year. These failures included the loss of three national security satellites in 1998-1999, at a cost of over $3 billion. One, a critical national security communications satellite (MILSTAR—Military Strategic and Tactical Relay), was lost on a failed Titan IV launch in 1999. That satellite capability was not replaced until 2010 with an AEHF (Advanced Extremely High Frequency) satellite, which experienced substantial acquisition challenges and frequent changes in both design and requirements.11 The other two losses were an NRO reconnaissance satellite and a DSP (Defense Support Program) satellite. In addition to the cost, schedule, and operational impacts of these lost missions, including a classified national security loss in coverage with MILSTAR, these failures significantly influenced the transition to the EELV program, which had an initial goal to make national security space launches more affordable and reliable.

President Clinton directed a review of these failures and sought recommendations for any necessary changes. The subsequent Broad Area Review (BAR) essentially concluded that the U.S. government should no longer rely on commercial launch suppliers alone to provide confidence and reliability in the EELV program. Instead, the BAR recommended more contractor and government oversight through increasing the number of independent reviews, pursuing performance guarantees from the launch providers, and greater government involvement in the mission assurance process.12 Although these additional oversight activities eventually proved to significantly increase EELV costs,13 they also eventually led to notable improvements in launch successes.

The early 2000s saw considerable turmoil within the Air Force space community and among the EELV launch service providers due to competition in the shrinking space launch industrial base, cost increases, and the growing need for reliable access to space. During this time, the poor business prospects in the space launch market drove Lockheed and Boeing to consider leaving the market altogether. Therefore, to protect its objective of assured access to space, the U.S. government began to shoulder much of the EELV program's fixed costs.

To further protect the United States' ability to deliver NSS satellites into orbit, the George W. Bush Administration conducted a number of internal reviews that culminated in the 2004 National Security Policy Directive (NSPD)-40. This directive established the requirement for "assured access to space" and obliged DOD to fund the annual fixed launch costs for both Lockheed and Boeing until such time as DOD could certify that assured access to space could be maintained without two launch providers.14

DOD thus revised its EELV acquisition strategy because of the collapse of the commercial launch market and the ongoing erosion of the space industrial base. GAO wrote that "in acknowledging the government's role as the primary EELV customer, the new strategy maintained assured access to space by funding two product lines of launch vehicles."15

In 2006, The Boeing Company and Lockheed Martin announced plans to consolidate their launch operations into a joint venture—ULA. The companies argued that by combining their resources, infrastructure, expertise, and capabilities, they could assure access to space at lower cost. DOD believed that having two launch vehicle families (Atlas V and Delta IV) under one entity (i.e., ULA) provided significant benefits that outweighed the loss of competition.16 In October 2006, the Federal Trade Commission granted ULA antitrust clearance allowing the new company to form on December 1, 2006. As a result, "unparalleled EELV mission success" ensued,17 and the tradeoff over increased costs and reduced competition outside ULA was largely deemed acceptable.

2011-Current Status

Since 2006, the Air Force has procured space launches from ULA on a sole-source basis. The former EELV program focused primarily on mission success—not cost control. GAO reported, however, that by 2010 "DOD officials predicted EELV program costs would increase at an unsustainable rate" due to possible instabilities in the launch industrial base and the inefficient buying practice of purchasing one launch vehicle at a time.18 In 2009, SpaceX, a new entrant to the space launch industrial base, became the first private company to successfully develop a liquid fuel rocket that delivered a commercial satellite to orbit. However, SpaceX was not certified to compete for national security missions until 2005.

In response, DOD recognized a need to again reorganize the way it acquired launch services. Additional studies and internal reviews evaluated alternatives to the EELV business model, which in turn led to a new EELV acquisition strategy adopted in November 2011.19 The new acquisition strategy advocated a steady launch vehicle production rate. This production rate was designed to provide economic benefits to the government through larger buys, or block-buys, of launch vehicles, providing a predictable production schedule to stabilize the space launch industrial base. The new EELV acquisition strategy also announced the government's intent to renew competition in the program.

In addition to revising its acquisition strategy, DOD undertook significant efforts to obtain greater insight into ULA program costs in advance of contract negotiations. In May 2011, DOD solicited a Request for Information to prospective launch providers. In March 2012, DOD issued a sole-source solicitation for the block-buy to ULA, and in April 2012, the EELV program incurred a critical Nunn-McCurdy cost breach.20

In December 2013, DOD followed through on its new EELV strategy, signing a contract modification with ULA committing the government to buy 35 launch vehicle booster cores over a five-year period, along with the associated infrastructure capability to launch them. DOD viewed this contract modification as a significant effort on its part to negotiate better launch prices through improved knowledge of ULA contractor costs. DOD officials expected the new contract to realize significant savings, primarily through stable unit pricing for all launch vehicles. However, some in Congress, and some analysts outside government, strongly disputed the DOD estimates of cost savings.

DOD announced that it would add up to 14 additional NSS launches to broader competition.21 However, in the FY2015 budget request, the Air Force announced that the number of EELV launches open to broader competition through FY2017 would be reduced from 14 to 7.22 Some Members of Congress, and SpaceX officials, raised questions about how many launches would ultimately be openly competed.

Perhaps resulting from turmoil associated with the Nunn-McCurdy cost breach, as well as the perceived instabilities mentioned above, the EELV acquisition strategy proceeded to a three-phased approach:

- Phase 1 (FY2013-FY2019) would consist of the sole-source block-buy awarded to ULA to procure up to 36 cores and to provide 7 years of NSS launch infrastructure capability.

- Phase 1A (FY2015-FY2017) emerged as a modification to Phase 1 that would consist of opening up competition for NSS launches to new space launch entrants (such as SpaceX).23 The Air Force said it could award up to 14 cores to a new entrant over 3 years, if a new entrant became certified.

- Phase 2 (FY2018-FY2022) envisioned full competition among all launch service providers. The operational requirements, budget, and potential for competition are currently being worked on.

- Phase 3 (FY2023-FY2030) envisioned full competition with the award of any or all required launch services to any certified provider.

The Air Force's strategy appeared to fulfill the mandates to maintain assured access to space and introduce competition into the space launch market. To date, the NSSL program has launched more than 70 successful missions in support of the Air Force, the National Reconnaissance Office, and the U.S. Navy. ULA's Delta IV and Atlas V launch vehicles (which are older than the NNSL program) have performed over 90 consecutive successful missions, whereas SpaceX has performed five successful NSS launches.

Factors That Complicated EELV Acquisition Strategy

Several interrelated factors created uncertainty over the Air Force's ability to continue with the three-phased EELV acquisition strategy. These included ongoing concerns over program and launch costs, U.S. national security vulnerability from dependence on a Russian component in the EELV program (the RD-180 main engine), legal challenges to the acquisition strategy, and legislation that could change the EELV program.

Cost Growth in the EELV

In March 2012, the EELV program reported two critical Nunn-McCurdy unit cost breaches,24 which resulted in a reassessment of the program. The cost of the newly restructured program was estimated by GAO in March 2013 at $69.6 billion.25 This amount represented an increase of $34.6 billion, or about 100%, over the program's estimated cost of $35 billion from a year earlier.26 GAO identified several causes for this cost growth, including an extension of the program's life cycle from 2020 to 2030, an increase of the planned number of launch vehicles to be procured from 91 to 150 (an increase of 59%), the inherently unstable nature of demand for launch services, and instability in the industrial base.27 These causes related to changes in the scope of the program and reflected the industrial-base conditions under which the program was being undertaken; they did not appear to imply poor performance by the Air Force or the industry in executing the program. Even so, the overall increase in estimated program costs complicated the Air Force's challenge in funding the program within available resources without reducing funding for other program priorities. It also contributed to focusing attention on modifying their EELV acquisition strategy.

In addition, the costs of individual launches themselves came under renewed scrutiny. SpaceX and others asserted that the launch costs charged by ULA were significantly higher than what SpaceX would charge the U.S. government once it was certified by the Air Force to conduct NSS launches. Part of the challenge in verifying these claims, however, is that much of the detailed cost data are proprietary, not readily comparable, and some are speculative to the extent that there is little empirical data on which those costs are provided. Although the Air Force, GAO, ULA, and SpaceX have provided some launch cost data, it is not apparent the data are directly comparable or are calculated using the same cost model assumptions. In addition, because SpaceX has limited data directly related to NSS launches, its cost figures are not likely based on a long history of actual cost, performance, and reliability. Thus, the issue of reliable and consistent cost data for comparative purposes has been a source of frustration for many in Congress.

Reliance on the Russian RD-180 Main Engine

The original impetus for licensing the Russian RD-180 as the main engine for the Atlas V launch vehicle grew out of concerns associated with the 1991 collapse of the Soviet Union. At the time, the CIA and others expressed serious concern about the potential export and proliferation of Russian scientific and missile expertise to countries hostile to U.S. interests. These concerns in turn spurred a U.S.-Russian partnership to acquire some of Russia's heavy lift rocket engine capabilities, thus expanding upon existing Cold War civil space cooperation. Initially, this took the form of a license agreement between Energomash NPO and RD Amross (of Palm Beach, FL) for the coproduction of the RD-180 engine as part of the EELV acquisition strategy. This later changed in an acquisition revision to simply purchase and stockpile roughly two years' worth of the engines for the Atlas V, an approach that was then viewed as highly cost-competitive. The existing license agreement for purchasing RD-180 engines extends to 2022.

In subsequent years, some Members of Congress and policy experts occasionally expressed concern over the potential vulnerability of the EELV program based on reliance on a single critical Russian component. For instance, the FY2005 defense authorization act (P.L. 108-375, §912) directed DOD to examine future space launch requirements.28 The resulting 2006 RAND study concluded that "the use of the Russian-manufactured RD-180 engines in the Atlas V common core is a major policy issue that must be addressed in the near term."29 Similar concern was noted by GAO in 2011: "the EELV program is dependent on Russian RD-180 engines for its Atlas line of launch vehicles, which according to the Launch Enterprise Transformation Study, is a significant concern for policymakers."30

In the FY2013 defense authorization act (P.L. 112-239, §916), Congress directed DOD to undertake an "independent assessment of the national security implications of continuing to use foreign component and propulsion systems for the launch vehicles under the evolved expendable launch vehicle program." None of these concerns, however, led the Air Force to change its EELV acquisition strategy or to seek a change in legislation governing that strategy.

After Russian incursions in Ukraine triggered U.S. sanctions in 2014, Russian backlash against those sanctions heightened alarm over the potential vulnerability of the EELV program and catalyzed the desire for change. In March 2014, the United States imposed sanctions on various Russian entities and persons,31 including Deputy Prime Minister Dimitry Rogozin, the official overseeing export licenses for the RD-180 rocket engine. In retaliation, Rogozin announced that "we can no longer deliver these engines to the United States unless we receive guarantees that our engines are used only for launching civilian payloads."32 Precise details of what Rogozin meant, and whether any changes would be implemented, were unclear.

Many observers in the United States were increasingly concerned, however, that Russia could suddenly ban all exports of the engine to the United States, or ban exports for military use to some degree. To many outside of the Air Force and ULA, that uncertainty raised serious questions about the longer-term viability of the EELV program, and pointed to a need to completely shed U.S. reliance on the RD-180 as soon as practicable. Congress has since taken steps in each of the past several defense authorization bills (described below) to end this reliance and develop an alternative, domestic-produced U.S. main engine.

Although the Air Force committed in principle to this ultimate outcome, some in Congress questioned if Air Force efforts were proceeding at an acceptable pace. As the Air Force pursues the congressional mandates to eliminate dependence on the RD-180 engine and continue to transition to a truly competitive launch market, it foresees major challenges. These include ULA's recent retirement of the Delta IV Medium in August 2019, the fact that SpaceX is currently the only other space launch provider awarded NSS mission requirements, and restrictions on acquisition of the RD-180 engine during this interim period that affect the Atlas V launch schedules.

Legislative and Industry Options to Replace the RD-180

In spring 2014, DOD formed a commission to bring together various experts to examine the risks, costs, and options for dealing with the potential loss of the Russian RD-180 rocket engine in the EELV program.33 The 2014 Mitchell Commission recommended accelerating purchases of the RD-180 under the existing licensing agreement to preserve the EELV Phase 1 block-buy schedule and to facilitate competition in Phases 1A and Phase 2. The commission did not recommend coproducing the RD-180 in the United States, but instead recommended spending $141 million to begin development of a new U.S. liquid rocket engine to be available by 2022, to coincide with the end of Phase 2 in the EELV acquisition strategy.

Congress has remained supportive of sustaining current space access capabilities while working toward developing a U.S.-made main rocket engine to replace the RD-180. The FY2015 NDAA34 permitted ULA to use RD-180 Russian engines purchased before Russia's intervention in Ukraine for continued national security space launch missions if the Secretary of Defense determined it was in the national security interest of the United States to do so. The FY2016 NDAA35 increased this number to nine RD-180s in order to help maintain competitors in the NSS launch market for a longer period, while the market transitions away from the RD-180 and toward a new domestic-produced rocket engine.

The FY2017 NDAA36 increased the number of the Russian RD-180 rocket engines authorized to be used to a total of 18 rocket engines, beginning with the enactment of the FY2017 NDAA and ending on December 31, 2022. The defense bills since the FY2017 NDAA have not amended the total number of Russian RD-180 rocket engines authorized to be used.

The NSSL Program Today

The Air Force identified four main priorities in NSSL: mission success, innovative mission assurance, transitioning to new launch vehicles, and assured access for future space architectures.37

DOD expects to achieve cost saving through acquisitions and operability improvements that consist of the use of common components and infrastructure, standard payload interfaces, standardized launch pads, and reducing on-pad processing. To improve acquisitions, the program offers block buys of launch vehicles and competition between certified providers. The competitions are accomplished through two contract vehicles: Launch Service Agreements (LSA) and Launch Service Procurement (LSP) awards:

- Launch Service Agreement (LSA) awards are a set of three Air Force RDT&E awards intended to facilitate the development of three domestic launch system prototypes. DOD awarded LSA's to ULA, Northrop Grumman, and Blue Origin in October 2018.

- Launch Service Procurement (LSP) is an ongoing procurement competition that is currently in Phase 2. The second phase is a 5-year procurement of approximately 34 launches starting in 2022. The Air Force plans to select two space launch providers in 2020.

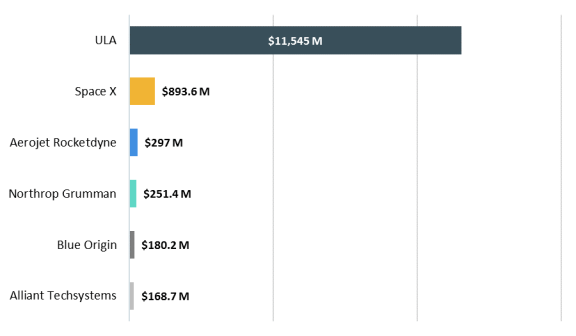

United Launch Alliance, Northrop Grumman, SpaceX, and Blue Origin have submitted bids for phase two, with each company proposing their rocket designs: Vulcan, OmegA, Falcon, and New Glenn, respectively. The two companies selected will share the NSSL notional manifest for the next five years. Phase 1 and Phase 1A awards were made to ULA and SpaceX. DOD has identified 18 active contracts for the NSSL program with obligations awarded to six companies (see Figure 1).

ULA and SpaceX are currently the only space launch providers certified to launch NSS payloads into orbit. The main focus for ULA is on developing a next-generation launch vehicle called the Vulcan. In July 2014, ULA signed commercial contracts with multiple U.S. liquid rocket engine manufacturing companies to investigate next-generation engine concepts. ULA selected Blue Origin (Kent, WA) BE-4 engine to power its Vulcan launch vehicle.

Conclusion

Although there are important differences in how to achieve it, widespread support appears to exist across the space community and within Congress for the NSS requirement for robust competition and assured access to space. The recurring challenge since the start of the NSSL program has been how best to pursue this requirement while driving down costs through competition and ensuring launch reliability and performance. The Air Force decision of down-selecting no more than two launch providers and award two separate Launch Service Procurement (LSP) contracts in the summer of 2020 is not without potential implications and could have second- and third-order effects. Congress may consider the following:

- Directing the Air Force to provide a report on the cost-benefit analysis of selecting more than two launch providers.

- Drafting legislative in the NDAA for FY2021 authorizing additional funds that allows the Air Force to diversify its launch provider options by continuing to provide development funds through LSA awards to launch companies not selected for LSP contracts in Phase 2.

- Directing the Air Force to provide a report on the cost saving and associated risk using both reusable and expendable launch vehicles for future solicitations.

Lastly, efforts to transition away from the RD-180 to a domestic U.S. alternative engine or launch vehicle are not without technical, program, or schedule risks. Even with a smooth, on-schedule transition away from the RD-180 to an alternative engine or launch vehicle, the performance and reliability record achieved with the RD-180 to date would likely not be replicated until well beyond 2030 because the RD-180 has approximately 81 consecutive successful civil, commercial, and NSS launches since 2000.

Author Contact Information

Acknowledgments

The author wishes to thank Steven Hildreth, former CRS Specialist in U.S. and Foreign National Security Programs and original author of National Security Space Launch at a Crossroads.

Footnotes

| 1. |

H.R. 5515 (P.L. 115-232, §1603). |

| 2. |

Nine Atlas V variants have flown: Atlas V 400 series (401, 411, 421, and 431) and Atlas V 500 series (501, 521, 531, 541, and 551). Five Delta IV variants have flown: the Delta IV Medium, three variants of the Delta IV Medium-Plus, and the Delta IV Heavy. All Delta IV variants are retired, except for the Delta IV Heavy. |

| 3. |

Both Falcon 9 (six on contract) and Falcon Heavy (two on contract) have flown. |

| 4. |

The NSSL system includes launch vehicles, launch capability, a standard payload interface, support systems, mission integration (includes mission unique requirements), flight instrumentation and range interfaces, special studies (alternative upper- and lower-stage rocket propulsion sub-systems, mission feasibility analysis, secondary payloads, dual integration, special flight instrumentation, loads analysis, etc.), post-flight data evaluation and analysis, mission assurance, infrastructure, critical component engineering, Government Mission Director support, system/process and reliability improvements, training, and other technical support. The system also includes launch site operations activities, activities in support of assured access, systems integration and tests, and other related support activities. In addition, the program is working to develop two or more domestic, commercially viable space launch providers that meet all National Security Space launch requirements. See Department of Defense, Selected Acquisition Report (SAR), National Security Space Launch (NSSL), Defense Acquisition Management Information Retrieval (DAMR), RCS: DD-A&T(Q&A)823-176, Washington, DC, March 29, 2019, https://www.esd.whs.mil/Portals/54/Documents/FOID/Reading%20Room/Selected_Acquisition_Reports/19-F-1098_DOC_71_NSSL_SAR_Dec_2018.pdf. |

| 5. | |

| 6. |

See Department of Defense, Selected Acquisition Report (SAR), National Security Space Launch (NSSL), Defense Acquisition Management Information Retrieval (DAMR), RCS: DD-A&T(Q&A)823-176, Washington, DC, March 29, 2019, https://www.esd.whs.mil/Portals/54/Documents/FOID/Reading%20Room/Selected_Acquisition_Reports/19-F-1098_DOC_71_NSSL_SAR_Dec_2018.pdf. |

| 7. |

Ibid. |

| 8. |

This refers to the competitive process that DOD mandates for the procurement of major systems and subsystems to choose the final source (or sources) that will eventually deliver the production system from an initial supplier base of two or more competing firms. |

| 9. |

U.S. Government Accountability Office, Evolved Expendable Launch Vehicle: Introducing Competition into NSS Launch Acquisition, Testimony before the Committee on Appropriations, U.S. Senate, Subcommittee on Defense, GAS-14-259T, March 5, 2014, p. 2. |

| 10. |

Ibid. |

| 11. |

U.S. Government Accountability Office, Defense Acquisitions: Space System Acquisition Risks and Keys to Addressing Them. Letter to Hon. Jeff Sessions and the Hon. Bill Nelson, June 1, 2006, p. 5, http://www.gao.gov/assets/100/94232.pdf. |

| 12. |

Maj Gen Ellen M. Pawlikowski, USAF, "Mission Assurance—A Key Part of Space Vehicle Launch Mission Success," High Frontier (Air Force Space Command), May 2008, p. 7., http://www.nro.gov/news/articles/2008/2008-05.pdf. |

| 13. |

Stewart Money, Competition and EELV: Challenges and Opportunities in New Launch Vehicle Acquisition, Pt. 1, Future In-Space Operations Presentation, May 9, 2012, p. 16. |

| 14. |

The White House, U.S. Space Transportation Policy, NSPD-40, Washington, DC, January 6, 2005, http://fas.org/irp/offdocs/nspd/nspd-40.pdf. |

| 15. |

U.S. Government Accountability Office, Evolved Expendable Launch Vehicle: Introducing Competition into National Security Space Acquisitions, GAO-14-259T, March 5, 2014, http://www.gao.gov/products/GAO-14-259T. |

| 16. |

Ibid. |

| 17. |

Ibid. |

| 18. |

Ibid. |

| 19. |

Ibid. |

| 20. |

See CRS Report R41293, The Nunn-McCurdy Act: Background, Analysis, and Issues for Congress, by Moshe Schwartz and Charles V. O'Connor. The Nunn-McCurdy Act (10 U.S.C. §2433) requires DOD to report to Congress whenever a major defense acquisition program experiences cost overruns that exceed certain thresholds. The purpose of the act was to help control cost growth in major defense systems by holding the appropriate Pentagon officials and defense contractors publicly accountable and responsible for managing costs. A program that experiences cost growth exceeding any of the established thresholds is said to have a Nunn-McCurdy breach. There are two types of breaches: significant breaches and critical breaches. A "significant" breach is when the Program Acquisition Unit Cost (the total cost of development, procurement, and construction divided by the number of units procured) or the Procurement Unit Cost (the total procurement cost divided by the number of units to be procured) increases 15% or more over the current baseline estimate or 30% or more over the original baseline estimate. A "critical" breach occurs when the program acquisition or the procurement unit cost increases 25% or more over the current baseline estimate or 50% or more over the original baseline estimate. |

| 21. |

U.S. Government Accountability Office, Evolved Expendable Launch Vehicle: Introducing Competition into National Security Space Acquisitions, GAO-14-259T, March 5, 2014, http://www.gao.gov/products/GAO-14-259T. |

| 22. |

The Air Force cited decreased demand for satellites, payload weight increases in some missions beyond new entrant capabilities, and the long-term commitment the Air Force has with ULA. |

| 23. |

Lt. Gen. Pawlikowski (Commander, Space and Missile Systems Center, Air Force Space Command) said, "The whole reason for doing the certification of new entrants is seeking to see if we can leverage the commercial launch market. We're not doing this so we can have another vendor or two more vendors that are 100 percent reliant on national space missions. If we do that, we won't save any money." Aaron Mehta, "Despite Lawsuits, Disagreement, SpaceX and USAF Moving Forward," Defense News, June 28, 2014, online edition, http://www.defensenews.com/article/20140628/DEFREG02/306280021/Despite-Lawsuits-Disagreements-SpaceX-USAF-Moving-Forward. |

| 24. |

See CRS Report R41293, The Nunn-McCurdy Act: Background, Analysis, and Issues for Congress, by Heidi M. Peters and Charles V. O'Connor |

| 25. |

U.S. Government Accountability Office, Defense Acquisitions: Assessments of Selected Weapon Programs, GAO-13-294SP, March 2013, p. 60. |

| 26. |

U.S. Government Accountability Office, Evolved Expendable Launch Vehicle: DOD is Addressing Knowledge Gaps in Its New Acquisition Strategy, GAO-12-822, July 2012, p. 1. |

| 27. |

U.S. Government Accountability Office, Defense Acquisitions: Assessments of Selected Weapon Programs, GAO-13-294SP, March 2013, p. 60. |

| 28. |

P.L. 108-375. See Section 912. |

| 29. |

Forrest McCartney et al., National Security Launch Report, RAND National Defense Research Institute, Santa Monica, CA, 2006, p. 33. |

| 30. |

U.S. Government Accountability Office, Evolved Expendable Launch Vehicle: DOD Needs to Ensure New Acquisition Strategy is Based on Sufficient Information, GAO-11-641, September 2011, p. 22, http://www.gao.gov/new.items/d11641.pdf. |

| 31. |

CRS Insight IN10048, U.S. Sanctions on Russia in Response to Events in Ukraine, coordinated by Dianne E. Rennack. |

| 32. | |

| 33. |

RD-180 Availability Risk Mitigation Study Summary, Mitchell Commission, http://www.spacepolitics.com/wp-content/uploads/2014/05/Mitchell_Report_May2014.pdf. |

| 34. |

FY2015 NDAA (P.L. 113-291), §1608. Prohibition on contracting with Russian suppliers of rocket engines for the Evolved Expendable Launch Vehicle Program. |

| 35. |

FY2016 NDAA (P.L. 114-92), §1607. Exception to the prohibition on contracting with Russian suppliers for the Evolved Expendable Launch Vehicle Program. |

| 36. |

FY2017 NDAA (P.L. 114-328), §1608. |

| 37. |

See Selected Acquisition Report (SAR), RCS: DD-A&T (Q&A)823-176, National Security Space Launch (NSSL), Defense Acquisition Management Information Retrieval (DAMIR) https://www.esd.whs.mil/Portals/54/Documents/FOID/Reading%20Room/Selected_Acquisition_Reports/19-F-1098_DOC_71_NSSL_SAR_Dec_2018.pdf. |