Trends in the U.S. Poverty Rate after Recessions

poverty, poverty rate, recession, expansion, recovery, business cycle

Contents

Introduction

The poverty rate measures the share of people with family incomes below a dollar amount called a poverty threshold, which is scaled according to family size and the ages of the members. The rate is used to examine the number or share of people facing economic deprivation, and to gauge the level of that deprivation.

The poverty rate fluctuates over time in response to many factors, including the business cycle. That is, it rises (i.e., shows an increasing share of persons in poverty) during recessions, when jobs are scarce, and declines during economic recoveries, as work opportunities become more abundant.

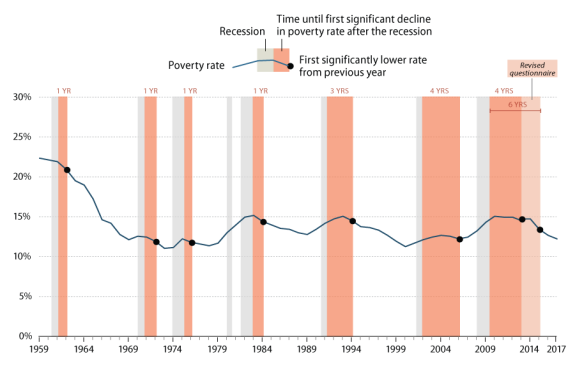

The rise and fall of the poverty rate with the business cycle occurs with a lag—the decline of the poverty rate typically occurs after the official end of a recession.1 This lagged relationship can be seen for each recession from 1969 to 2017. However, for the last three recessions the lag between the end of the recession and the decline in the poverty rate has increased by several years (see Figure 1).

This development is of potential interest to Congress because it may suggest that economic cycles have changed in a way that is hampering the ability of poor families to use work or other avenues to move out of poverty when compared to past cycles, especially those before 1991. This report documents poverty rate patterns over economic cycles, with a focus on how the poverty rate changes during economic recoveries. Because the population in poverty has a diverse set of characteristics, and multiple changes in the U.S. economy are taking place simultaneously, a definitive explanation as to why the U.S. poverty rate is less responsive to economic recoveries now compared with before the 1990s is beyond the scope of this report.

Historical Poverty Rates

As mentioned above, the poverty rate is a lagging indicator, meaning it tends to change after other changes in the economy have taken place. The lag results partially from the way poverty is measured2—it uses income from the entire year—and partially from the time it takes for businesses to decide whether personnel measures are needed to respond to a change in demand for their products: whether they need to hire workers, delay hiring, lay workers off, delay or expedite raises in pay, or change the number of hours or weeks of work offered.

During the past three economic recoveries (the expansions during the 1990s, after the 2001 recession, and after the 2007-2009 recession or "Great Recession"), the poverty rate has taken much longer to register a year-to-year decrease3 than it had after earlier recessions. Before 1991, for nearly every recession for which official poverty statistics are available, a statistically significant year-to-year decline occurred in the first or second year after the end of the recession. In contrast, after 1991 the poverty rate did not experience a year-to-year decline until approximately three to six years after the recession's end.4 Figure 1 illustrates the U.S. poverty rate from 1959 to 2017, marking periods of recession with gray shaded bars and the period from the start of recovery to the first significant decline in the poverty rate with orange shaded bars. Poverty rates are calculated based on data from the Current Population Survey Annual Social and Economic Supplement (CPS ASEC). As can be seen in the figure, before 1991 the poverty rates tend to spike during and slightly after recessions, and fall thereafter. After 1991, the poverty rates hover at an elevated level for a longer period before falling again. As noted previously, greater lengths of time elapsed between the end of the recession and the first poverty rate decline for the later recessions.

|

Figure 1. Poverty Rate, 1959 to 2017 Poverty rates in percentages |

|

|

Source: Congressional Research Service, based on poverty data from U.S. Census Bureau, Current Population Survey, 1960-2018 Annual Social and Economic Supplements, Historical Poverty Table 2, http://www2.census.gov/programs-surveys/cps/tables/time-series/historical-poverty-people/hstpov2.xls, September 13, 2017. Recession dates obtained from National Bureau of Economic Research, http://www.nber.org/cycles/cyclesmain.html. Notes: The poverty rate is an annual measure; consequently, no pink region is shown after the January-July 1980 recession because the next recession began the following year. Income questions were revised for 2013, with some households receiving the old questionnaire and others the new. As a result, the first significant poverty rate decline is estimated to have occurred either in 2013 or 2015, based on which questionnaire was used. This ambiguity is represented by the lighter shading after 2013. |

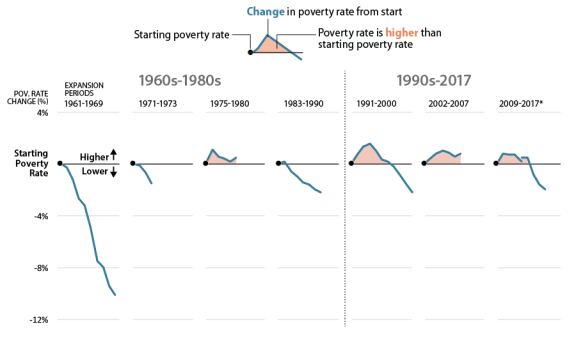

Figure 2 compares how the poverty rate behaved during each economic expansion: whether the poverty rate stayed higher than its level at the end of the last recession, and if so, for how long. While Figure 1 illustrates the poverty rates themselves, Figure 2 focuses on how much the poverty rate changed during each period illustrated. The colored lines track the difference between the poverty rate in each year after a recession and the poverty rate at the previous recession's end. Each trend line represents a different economic recovery. Lines above zero indicate higher poverty rates than at the end of the previous recession, and lines below zero indicate lower poverty rates than at the end of the previous recession. Recoveries from the 1960s through the 1980s are shown on the left; the three most recent recoveries are shown on the right. For example, during the 1961-1969 recovery, the poverty rate fell by 10.1 percentage points. During the 1991-2000 recovery, the poverty rate rose 1.6 percentage points during the first three years, then began to decline. At the end of that expansion period, the poverty rate was 2.2 percentage points lower than it was at the end of the 1990 recession.

The trend lines in the recent recoveries slope upward for a longer period and stay above zero (indicating poverty rates as high or higher than at the end of the last recession—orange-shaded areas) for a longer period than do the trend lines for the earlier recoveries.

|

Figure 2. Change in Poverty Rate since Previous Recession Percentage point difference between the poverty rate during expansion and the poverty rate at the end of the previous recession. Trend lines labeled by expansion period. |

|

|

Source: Congressional Research Service computations based on poverty data from U.S. Census Bureau, Current Population Survey, 1960-2018 Annual Social and Economic Supplements, Historical Poverty Table 2, http://www2.census.gov/programs-surveys/cps/tables/time-series/historical-poverty-people/hstpov2.xls. Recession dates obtained from National Bureau of Economic Research, http://www.nber.org/cycles/cyclesmain.html. Notes: Poverty rates are an annual measure, but recessions may end in any month. For recessions that ended from July to December, the "starting poverty rate" is the rate for that calendar year. For recessions that ended from January to June, the previous year's poverty rate was used. No trend line is shown for the recession that ended in July 1980 because the next recession began the following year, in July 1981. Income questions were revised for 2013; the series break indicates the estimates based on the old and new questionnaire. |

This change in the behavior of the U.S. poverty rate is difficult to explain fully, and may be linked to different aspects of the economy changing their behavior concurrently. It suggests that gains from economic recoveries now need to develop over a greater length of time before the population below poverty, as a group, experiences the benefits.

Author Contact Information

Footnotes

| 1. |

The dates of recessions and economic expansions are determined by the National Bureau for Economic Research (NBER). For further information, see CRS In Focus IF10411, Introduction to U.S. Economy: The Business Cycle and Growth, by Jeffrey M. Stupak. |

| 2. |

For a discussion of how poverty is defined and measured in the United States, see CRS Report R44780, An Introduction to Poverty Measurement, by Joseph Dalaker. |

| 3. |

In this report, the poverty rate is said to have declined from one year to the next only if the change is statistically significant. Not every apparent difference in poverty estimates is a real difference. Because the poverty statistics are estimates based on a survey and have margins of error, a different sample of households would likely yield a different estimate. Thus, even if the true poverty rate were exactly the same in two different years, it is possible to get survey estimates that appear different, although the difference between them would more likely be a small difference than a large difference. In order to report that a change has occurred in the poverty rate—that is, the difference between the estimates is likely not caused by sampling variability—the difference has to be large enough that fewer than 10% of all possible survey samples would produce a difference that large. Such a difference is said to be statistically significant. |

| 4. |

Dating the first year-to-year decline after the Great Recession is not perfectly straightforward because the poverty rate for 2013 reflects a revised questionnaire. This change was implemented for part of the survey sample, while the other part of the sample received the old questionnaire, so that the effect of the questionnaire change on poverty measurement could be observed. Based on the original questionnaire, the poverty rate registered 14.5%, which was a statistically significant decline from 15.0% in 2012, and represented a year-to-year decline on the fourth year after the end of the Great Recession in June 2009. The revised questionnaire, which was used in subsequent years, registered 14.8% for 2013. Using the new questionnaire for every year it was available, the poverty rate did not fall until 2015, the sixth year after the end of the Great Recession. |