The Front End of the Nuclear Fuel Cycle: Current Issues

Nuclear power contributes roughly 20% of the electrical generation in the United States. Uranium is the fundamental element in fuel used for nuclear power production. The nuclear fuel cycle is the cradle-to-grave life cycle from extracting uranium ore from the earth through power production in a nuclear reactor to permanent disposal of the resulting spent nuclear fuel.

The front-end of the nuclear fuel cycle considers the portion of the nuclear fuel cycle leading up to electrical power production in a nuclear reactor. The front-end of the nuclear fuel cycle has four stages: mining and milling, conversion, enrichment, and fabrication. Mining and milling is the process of removing uranium ore from the earth, and physically and chemically processing the ore to develop “yellow-cake” uranium concentrate. Uranium conversion produces uranium hexafluoride, a gaseous form of uranium, from uranium concentrate. Uranium enrichment physically separates and concentrates the fissile isotope U-235. The enriched uranium used in nuclear power reactors is approximately 3%-5% U-235, while weapons-grade enriched uranium is greater than 90% U-235. Nuclear fuel fabrication involves manufacturing enriched uranium fuel rods and assemblies highly specific to a nuclear power reactor.

Historically, the Atomic Energy Commission (AEC), a predecessor federal agency to the Department of Energy (DOE) and the Nuclear Regulatory Commission (NRC), promoted uranium production through federal procurement contracts between 1947 and 1971. Since the late 1980s, U.S. nuclear utilities and reactor operators have purchased increasingly more foreign-origin uranium for reactor fuel than domestically produced uranium. In 1987, about half of uranium used in domestic nuclear reactors was foreign origin. By 2018, however, 93% of uranium used in U.S. nuclear reactors was foreign origin. No uranium conversion facilities currently operate in the United States. There is one operational U.S. commercial uranium enrichment facility, which has the capacity to enrich approximately one-third of the country’s annual reactor requirements. In addition to newly mined uranium, U.S. nuclear power reactors also rely on secondary sources of uranium materials. These sources include federal and commercial stockpiles, reenrichment of depleted uranium, excess feed from underfeeding during commercial enrichment, and downblending of higher enriched uranium.

The global uranium market operates with multiple industries exchanging uranium products and services through separate, nondirect, and interrelated markets. Producers, suppliers, and utilities buy, sell, store, and transfer uranium materials. Nuclear utilities and reactor operators diversify fuel sources among primary and secondary supply, and may acquire uranium from multiple domestic and foreign suppliers and servicers. For example, a nuclear power utility in the United States may purchase uranium concentrate that has been mined and milled in Australia, converted in France, enriched in Germany, and fabricated into fuel in the United States.

On January 16, 2018, two domestic uranium producers—representatives from the uranium mining/milling industry—petitioned the U.S. Department of Commerce to conduct a Section 232 investigation pursuant to the Trade Expansion Act of 1962 (19 U.S.C. §1862) to examine whether U.S. uranium imports pose a threat to national security. The department found that uranium imports into the United States posed a threat to national security as defined under Section 232. In a July 12, 2019, memorandum, President Trump announced he did not concur with the Department of Commerce’s “finding that uranium imports threaten to impair the national security of the United States as defined under section 232 of the Act.”

The Section 232 uranium investigation into uranium imports has increased the discussion about the nuclear fuel supply chain and potential future U.S. uranium needs. Included in the July 12, 2019, memorandum, the Trump Administration established a Nuclear Fuel Working Group, to assess the challenges facing the domestic uranium industry and to consider options to “revive and expand the nuclear energy sector.” Given uncertainties regarding the long-term viability of the domestic uranium production and commercial nuclear power sectors, continued issues associated with the front-end of the nuclear fuel cycle may persist.

The Front End of the Nuclear Fuel Cycle: Current Issues

Jump to Main Text of Report

Contents

- Introduction

- Front-End of the Nuclear Fuel Cycle

- Primary Supply

- Stage 1: Mining and Milling—Production of Uranium Concentrate

- Stage 2: Conversion—Production of Uranium Hexafluoride

- Stage 3: Enrichment—Production of Enriched Uranium

- Stage 4: Fabrication—Production of Uranium Oxide, Fuel Rods, and Assemblies

- Secondary Supply

- Underfeeding

- Traders and Brokers

- Commercial Inventories

- Excess Federal Uranium Inventory

- Global Uranium Market and Fuel Supply Chains

- Uranium Imports and Exports

- Analysis of Uranium Supply to U.S. Nuclear Power Reactors

- Uranium Ores and Concentrates

- Uranium Hexafluoride

- Enriched Uranium

- Fuel Fabrication

- Uranium Purchases vs. Uranium Imports

- Current Issues

- Section 232 Investigation—Uranium Imports

- Presidential Determination

- Concerns of Uranium Producers and Local Communities

- Concerns of Nuclear Utilities and Reactor Operators and Suppliers

- Legislation and Congressional Oversight

- Policy Considerations

- Domestic Uranium Production Viability

- Nuclear Power Viability

- Tribes and Environmental Considerations

Figures

Tables

- Table 1. Uranium Imports HTS Numbers

- Table 2. Annual U.S. Imports of Uranium Ores and Concentrates by Country

- Table 3. Annual U.S. Imports of Natural Uranium Oxide by Country

- Table 4. Annual U.S. Imports of Natural Uranium Hexafluoride (UF6) by Country

- Table 5. Annual U.S. "Domestic" Exports of Natural Uranium Hexafluoride (UF6) by Country

- Table 6. Annual U.S. "Foreign" Exports of Natural Uranium Hexafluoride (UF6) by Country

- Table 7. Annual U.S. Imports of Enriched Uranium Hexafluoride (enUF6) by Country

Summary

Nuclear power contributes roughly 20% of the electrical generation in the United States. Uranium is the fundamental element in fuel used for nuclear power production. The nuclear fuel cycle is the cradle-to-grave life cycle from extracting uranium ore from the earth through power production in a nuclear reactor to permanent disposal of the resulting spent nuclear fuel.

The front-end of the nuclear fuel cycle considers the portion of the nuclear fuel cycle leading up to electrical power production in a nuclear reactor. The front-end of the nuclear fuel cycle has four stages: mining and milling, conversion, enrichment, and fabrication. Mining and milling is the process of removing uranium ore from the earth, and physically and chemically processing the ore to develop "yellow-cake" uranium concentrate. Uranium conversion produces uranium hexafluoride, a gaseous form of uranium, from uranium concentrate. Uranium enrichment physically separates and concentrates the fissile isotope U-235. The enriched uranium used in nuclear power reactors is approximately 3%-5% U-235, while weapons-grade enriched uranium is greater than 90% U-235. Nuclear fuel fabrication involves manufacturing enriched uranium fuel rods and assemblies highly specific to a nuclear power reactor.

Historically, the Atomic Energy Commission (AEC), a predecessor federal agency to the Department of Energy (DOE) and the Nuclear Regulatory Commission (NRC), promoted uranium production through federal procurement contracts between 1947 and 1971. Since the late 1980s, U.S. nuclear utilities and reactor operators have purchased increasingly more foreign-origin uranium for reactor fuel than domestically produced uranium. In 1987, about half of uranium used in domestic nuclear reactors was foreign origin. By 2018, however, 93% of uranium used in U.S. nuclear reactors was foreign origin. No uranium conversion facilities currently operate in the United States. There is one operational U.S. commercial uranium enrichment facility, which has the capacity to enrich approximately one-third of the country's annual reactor requirements. In addition to newly mined uranium, U.S. nuclear power reactors also rely on secondary sources of uranium materials. These sources include federal and commercial stockpiles, reenrichment of depleted uranium, excess feed from underfeeding during commercial enrichment, and downblending of higher enriched uranium.

The global uranium market operates with multiple industries exchanging uranium products and services through separate, nondirect, and interrelated markets. Producers, suppliers, and utilities buy, sell, store, and transfer uranium materials. Nuclear utilities and reactor operators diversify fuel sources among primary and secondary supply, and may acquire uranium from multiple domestic and foreign suppliers and servicers. For example, a nuclear power utility in the United States may purchase uranium concentrate that has been mined and milled in Australia, converted in France, enriched in Germany, and fabricated into fuel in the United States.

On January 16, 2018, two domestic uranium producers—representatives from the uranium mining/milling industry—petitioned the U.S. Department of Commerce to conduct a Section 232 investigation pursuant to the Trade Expansion Act of 1962 (19 U.S.C. §1862) to examine whether U.S. uranium imports pose a threat to national security. The department found that uranium imports into the United States posed a threat to national security as defined under Section 232. In a July 12, 2019, memorandum, President Trump announced he did not concur with the Department of Commerce's "finding that uranium imports threaten to impair the national security of the United States as defined under section 232 of the Act."

The Section 232 uranium investigation into uranium imports has increased the discussion about the nuclear fuel supply chain and potential future U.S. uranium needs. Included in the July 12, 2019, memorandum, the Trump Administration established a Nuclear Fuel Working Group, to assess the challenges facing the domestic uranium industry and to consider options to "revive and expand the nuclear energy sector." Given uncertainties regarding the long-term viability of the domestic uranium production and commercial nuclear power sectors, continued issues associated with the front-end of the nuclear fuel cycle may persist.

Introduction

The United States has more nuclear power reactors than any country worldwide. The 98 operable nuclear generating units provide approximately 20% of the electrical generation in the United States.1 Uranium is the fundamental element used to fuel nuclear power production. The front-end of the nuclear fuel cycle comprises the industrial stages starting with uranium extraction from the earth and ending with power production in a nuclear reactor. Congressional interest in the front-end of the nuclear fuel cycle is associated with many factors, including (1) domestic uranium production and supply, (2) concerns about increasing reliance on uranium imports, and (3) the economic viability of U.S. nuclear power reactors.

Historically, the U.S. Atomic Energy Commission (AEC), a predecessor federal agency to the Department of Energy (DOE) and the Nuclear Regulatory Commission (NRC), promoted uranium production in the United States through federal procurement contracts between 1947 and 1971.2 The majority of domestic uranium concentrate production prior to 1971 supported the development of nuclear weapons and naval propulsion reactors. After 1971, uranium mill operators produced uranium concentrate primarily for use in commercial nuclear power reactors.

By the late 1980s, nuclear utilities and reactor operators in the United States purchased more uranium from foreign suppliers than domestic producers.3 By 2017, 93% of the uranium purchased by U.S. nuclear utilities and reactor operators originated in a foreign country. Nuclear utilities and reactor operators diversify uranium supplies among multiple domestic and foreign sources, intending to minimize fuel costs. For example, a nuclear utility in the United States may purchase uranium concentrate that has been mined and milled in Australia, converted in France, enriched in Germany, and fabricated into fuel in the United States.

Examination of the current status of the front-end of the nuclear fuel cycle highlights broad policy questions about the federal government's role in sustaining or promoting nuclear fuel production in the United States. This report describes the front-end of the nuclear fuel cycle and the global uranium marketplace, analyzes domestic sources and imports of various types of uranium materials involved in the fuel cycle, and provides a discussion about the current issues. The back-end of the nuclear fuel cycle comprises the storage of spent nuclear fuel (SNF) after it is discharged from a nuclear reactor; however, issues associated with SNF storage and disposal are not discussed in this report. This report does not discuss potential environmental, public health, and proliferation issues associated with the front-end of the nuclear fuel cycle.

Front-End of the Nuclear Fuel Cycle

The front-end of the nuclear fuel cycle is composed of four stages:

- Uranium mining and milling is the process of removing uranium ore from the earth and physically and chemically processing the ore to develop "yellowcake" uranium concentrate.

- Uranium conversion produces uranium hexafluoride (UF6), a gaseous form of uranium, from solid uranium concentrate.

- Uranium enrichment separates and concentrates the fissile isotope U-2354 in the gaseous UF6 form to produce enriched uranium capable of sustaining a nuclear chain reaction in a commercial nuclear power reactor.5

- Uranium fuel fabrication involves producing uranium oxide pellets, which are subsequently loaded into reactor-specific fuel rods and assemblies, which in turn are loaded into a nuclear power reactor.

Primary Supply

The nuclear fuel produced from processing newly mined uranium ore through fuel fabrication is referred to as primary supply. The stages from uranium mining through uranium fuel fabrication are described in the following sections.

Stage 1: Mining and Milling—Production of Uranium Concentrate

The front-end of the nuclear fuel cycle begins with mining uranium ore from the earth, through conventional (surface mining, open pits, underground) or nonconventional, in-situ recovery (ISR) methods. The type of extraction method employed depends on geology, ore body concentration, and economics. The majority of uranium resources in the United States are located in geological deposits in the Colorado plateau, Texas gulf coast region, and Wyoming basins.6 The United States has a relatively low quality and quantity7 of uranium reserves compared to the leading uranium-producing countries. For example, the Nuclear Energy Agency and the International Atomic Energy Agency rank the United States' reasonably assured uranium resources as 12th worldwide.8

Uranium milling involves physical and chemical processing of uranium ore to generate uranium concentrate (U3O8), commonly called "yellowcake" uranium. Uranium milling operations crush and grind the mined ore, which is chemically dissolved with acid or alkaline solutions and subsequently concentrated.9 Milling operations produce a large quantity of waste material, termed tailings, relative to the amount of uranium concentrate produced. NRC estimates 2.4 pounds of yellowcake uranium oxide is produced from 2,000 pounds of uranium ore.10 The tailings, or waste material, generated by uranium milling operations prior to the 1970s were largely abandoned, exposing radioactive sand-like particles to be dispersed into the air, surface, and groundwater by natural erosion and human disturbances. The enactment of the Uranium Mill Tailings Radiation Control Act (UMTRCA; P.L. 95-604) authorized a remedial action program for cleanup of abandoned mill tailings prior to 1978 and authorized a regulatory framework to manage tailings generated at sites operating after 1978. In the United States, ISR methods have replaced conventional mining and milling by pumping acid or alkaline solutions through an underground ore body. After uranium in the ore is dissolved in solution, it is pumped to the surface and processed to produce uranium concentrate.

In the first quarter of 2019, five ISR facilities are operating in the United States—all in Wyoming—with approximately 11.2 million pounds of annual production capacity, and one conventional uranium mill, located in Utah, in operation with an annual capacity of 6 million pounds of ore per day.11 Additionally, there are 13 million pounds of annual production capacity at 11 ISR operations permitted and licensed, partially permitted and licensed, developing, or on standby.12

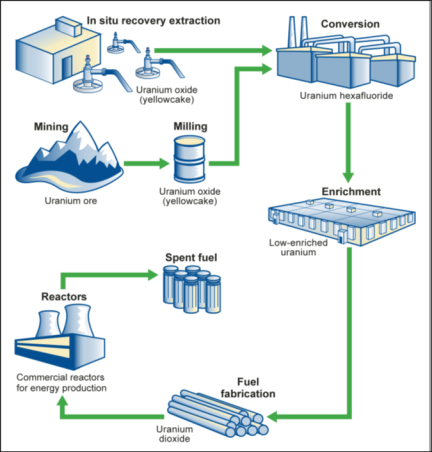

|

|

Source: U.S. Government Accountability Office, Nuclear Weapons, NNSA Should Clarify Long-Term Uranium Enrichment Mission Needs and Improve Technology Cost Estimates, GAO-18-126, February 2018. Notes: This report does not discuss issues with the storage of spent nuclear fuel (SNF) after it is discharged from a nuclear reactor. |

Stage 2: Conversion—Production of Uranium Hexafluoride

Uranium concentrate is shipped to a uranium conversion facility where UF6 is chemically produced. At room temperature, UF6 is a solid, and it transforms to a gas at higher temperatures. UF6 is described as "natural," as the isotopic composition has not been altered relative to the composition that exists in nature. According to the World Nuclear Association, there are six uranium conversion plants worldwide.13 The Honeywell plant in Metropolis, IL, is the only uranium conversion facility in the United States. It has not produced UF6 since November 2017.14

Stage 3: Enrichment—Production of Enriched Uranium

After uranium conversion, the UF6 is feed material for uranium enrichment. Natural uranium has an isotopic composition of approximately 0.71% U-235, the fissile isotope of uranium.15 Civilian nuclear power fuel is generally enriched to 3%-5% U-235.16 Uranium enrichment in the United States was largely performed using a gaseous diffusion technology until 2013. Currently, one uranium enrichment plant, which employs gas centrifuge technology, operates in the United States. The gas centrifuge technology is described below.

Inflow UF6 gas—referred to as the feed—enters a gas centrifuge. The centrifuge spins at high speeds and centrifugal forces drive the slightly more massive U-238 isotopes outward, while less massive U-235 isotopes concentrate near the center of the centrifuge. The process repeats many times in a cascade of centrifuges, gradually increasing the isotopic composition of U-235 from 0.71% to 3%-5%. During this process, the chemical composition remains as UF6, while the isotopic composition of UF6 has been modified. The product stream is enriched uranium hexafluoride (enUF6) and the waste stream—called the tails—is depleted uranium (DU).

The greater the difference in the isotopic composition of U-235 in the product and tails, the greater the energy requirements. Separative work units (SWUs) describe the energy required to enrich a given feed quantity to a given assay. Uranium enrichment yields a relatively higher mass of depleted uranium as the enriched uranium product.17

Stage 4: Fabrication—Production of Uranium Oxide, Fuel Rods, and Assemblies

The final step in producing usable nuclear fuel involves fuel fabrication. At fabrication plants, enriched uranium is converted to uranium oxide (UO2) powder and subsequently formed into small ceramic pellets. The pellets are loaded into cylindrical fuel rods and then combined to form fuel assemblies specific to a particular reactor. The fuel assemblies are loaded into the nuclear reactor for power production. The precise enrichment level and types of fuel rods and assemblies are specific to each reactor.

Secondary Supply

Secondary supplies describe uranium materials which may not have been directly processed through the front-end of the nuclear fuel cycle. Secondary supply may describe excess uranium from underfeeding during commercial enrichment, uranium materials held in commercial inventories, uranium held in the federal government's excess uranium inventory, and from the downblending of higher enriched uranium.18 According to DOE, secondary sources of uranium produced from reenrichment of depleted uranium and underfeeding represent the two largest sources of secondary supply in the market.19 A uranium market analyst estimated that all secondary supplies account for more than a quarter of total annual world uranium supply (48 million pounds U3O8 equivalent)20 as of December 2018.21 The relative contribution of secondary uranium supplies may vary from year-to-year.

Underfeeding

Uranium enrichment inherently involves a trade-off between energy requirements and quantity of product and tails produced. Enrichment operators aim to balance these requirements as the optimal tails assay. Under certain conditions, enrichment operators elect to underfeed, which generates tails with a lower assay relative to the optimal tails assay. Underfeeding allows the enrichment operator to supply the enriched uranium product at the assay desired, produce lower quantities of tails for storage and disposal, and use relatively less feed material. The trade-off is the higher energy requirement per enriched product. The excess feed material not enriched as a result of underfeeding is considered a secondary supply.

Traders and Brokers

Uranium traders and brokers buy, sell, and store various types of uranium materials and have no direct operational role in producing or consuming nuclear fuel cycle material. The decision to buy, hold, and sell uranium materials is dependent on market conditions. For example, in 2014 the Senate Committee on Homeland Security and Governmental Affairs examined the activities of banks and bank holding companies in physical markets for commodities, including an examination of Goldman Sachs' involvement with buying and selling physical uranium products. Goldman Sachs described its activities in the uranium market as "buying uranium from mining companies, storing it, and providing the uranium to utilities when they wanted to process more fuel for their nuclear power plants."22 Goldman's physical uranium inventory valuation peaked in 2013 at $242 million, and the company planned on exiting the market by 2018 when their contracts with utilities had ended.23 The current status of Goldman's holdings is not publicly known, as uranium sales contracts are privately negotiated. EIA provides a list of uranium sellers to owners and operators of U.S. civilian nuclear power reactors, which may include companies involved with uranium operations at various stages of the front-end of the nuclear fuel cycle.24

Commercial Inventories

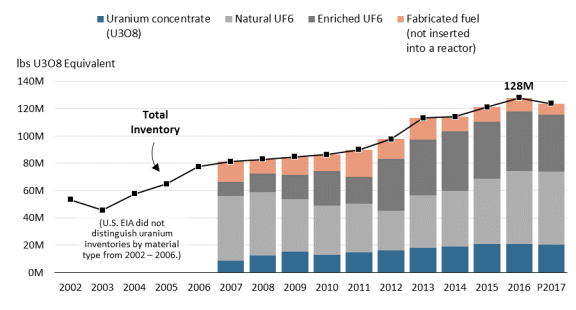

Nuclear utilities and reactor operators stockpile inventories of various types of uranium materials. The primary reasons to maintain stockpiles are economic considerations and to insulate their operations from potential supply chain disruptions. According to the U.S. Energy Information Administration (EIA), total uranium inventories for owners and operators of U.S. civilian nuclear power reactors more than doubled from 2002 to 2016 (Figure 2). EIA tracked inventory quantities of specific uranium materials from 2007 to 2016. During that time, owners and operators of U.S. civilian nuclear power reactors increased inventories of uranium concentrate and enriched UF6 by the largest relative margin. As of 2016, EIA reported the total uranium inventory for U.S. utilities was 128 million pounds U3O8(eq).25

Excess Federal Uranium Inventory

DOE maintains inventories of uranium both essential to, and excess to, national security missions.26 DOE maintains excess inventories of various types of uranium materials, which are sold on commercial markets to support cleanup services for former federal uranium enrichment facilities.27

Some have expressed concern that DOE's uranium transfers are depressing uranium prices by introducing federal uranium materials into an already oversupplied market. In 2015, the House Oversight and Government Reform Subcommittee on the Interior examined the impact of the sales of DOE's excess uranium inventory.28 The Government Accountability Office (GAO) raised concerns about the transparency of methodology used to determine uranium transfer quantities, and expressed legal concerns with some DOE uranium transfers from 2012 through 2013.29 The Secretary of Energy determines whether transfers of uranium will adversely affect the domestic production uranium industry.30 In FY2017, Secretary of Energy Rick Perry determined natural uranium hexafluoride transfer of up to 1,200 metric tons of uranium (MTU) per year would not cause adverse material impact on domestic uranium producers.31

Explanatory language in the conference report accompanying the Energy and Water, Legislative Branch, and Military Construction and Veterans Affairs Appropriations Act, 2019 (P.L. 115-244, H.Rept. 115-929) directs DOE to end the uranium transfers and explains that $60 million above the budget request is appropriated in lieu of anticipated profits from those transfers.32 The DOE FY2020 budget request decreased funding requests for the Portsmouth cleanup by approximately $52 million, indicating DOE intends to resume uranium transfers in FY2020.33

|

Uranium for Defense and Other Purposes Uranium is used in nondefense space missions, generation of medical isotopes, defense-related nuclear applications, and naval propulsion. Uranium with an assay of 20% or higher U-235 is referred to as highly enriched uranium (HEU), and weapons-grade HEU is greater than 90% U-235. The United States no longer uses enriched uranium produced through the nuclear fuel cycle as HEU for U.S. nuclear weapons. The United States discontinued production of HEU for nuclear weapons by 1964 due to the buildup of sufficient defense stockpiles and ended all production of HEU by 1992. The U.S. Navy relies exclusively on federal stockpiles of HEU for nuclear-powered naval propulsion for all U.S. aircraft carriers and submarines. In March 2016, the Obama Administration declassified the quantity of the federal stockpile of HEU overseen by the Department of Energy. As of September 2013, the Obama Administration reported the United States had 585.6 metric tons (MT) of HEU, of which 499.4 MT was specifically allocated for "for national security or non-national security programs including nuclear weapons, naval propulsion, nuclear energy, and science."34 |

Global Uranium Market and Fuel Supply Chains

The uranium market operates with multiple industries exchanging uranium products and services through separate, nondirect, and interrelated markets. Producers, suppliers, and utilities buy, sell, store, and transfer uranium materials. For example, a contract may be established between a nuclear utility and a uranium producer for a given amount of uranium concentrate production over a certain number of years. The uranium producer generates uranium concentrate, which is shipped to a conversion facility. The utility contracts with a conversion facility to convert uranium concentrate to UF6. Finally, the utility may arrange a contract for uranium enrichment services.

Uranium transactions occur through bilateral contractual agreements between buyers, sellers, and traders. Civilian nuclear power utilities purchase uranium through long-term multiyear contracts or through the spot market as a one-time purchase and delivery. For uranium materials delivered in 2018, roughly 84% were purchased through long-term contracts and about 16% through spot market purchases.35

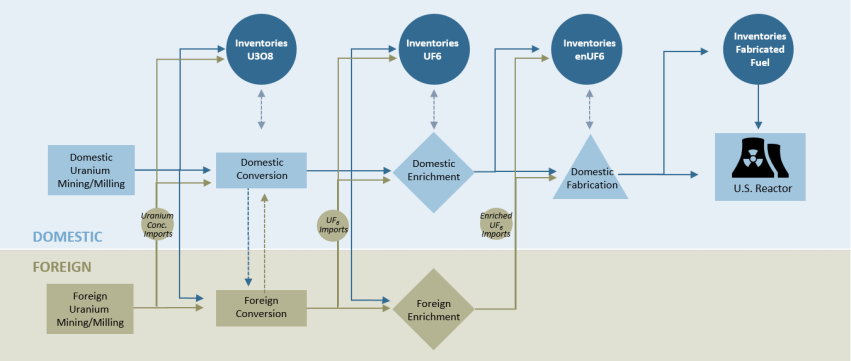

In the United States, utilities may simultaneously arrange contracts with multiple uranium producers or suppliers for a given number of years. For example, a U.S. nuclear power utility may decide to engage with a uranium producer in Canada, a uranium conversion facility in the United States, a uranium enrichment facility in Germany, and a uranium fuel fabricator in the United States (Figure 3). That same utility may arrange another contract for uranium concentrate from Australia, uranium conversion in France, uranium enrichment in the Netherlands, and uranium fuel fabrication in the United States. At the same time, the utility may also decide to acquire uranium materials from a secondary supply source or through a trader or broker. Traders or brokers may not produce uranium products or services, but they buy, sell, and store materials to utilities and other suppliers. In this way, nuclear utilities and reactor operators may seek to diversify nuclear fuel sources between primary and secondary suppliers to avoid supply disruptions.

Uranium Imports and Exports

The U.S. International Trade Commission (ITC) categorizes imports and exports by the Harmonized Tariff Schedule (HTS).36 ITC reports uranium imports relevant to the nuclear fuel cycle in different HTS categories and subcategories (see Table 1). For this report, CRS provides data from only the top five importing or exporting countries from 1992 through January 2019. Other countries may have contributed lesser amounts of uranium imports or exports over that time period, but those data were not included in this report.

|

Uranium Import Type |

Table |

Harmonized Tariff Schedule Number |

Full Description |

|

|

Uranium Ores and Concentrates |

2612.10.00.00 |

Uranium ores and concentrates |

||

|

Natural Uranium Oxide |

2844.10.20.10 |

Natural uranium and its compounds; alloys, ceramic-metal composites ("cermets"), ceramic products and mixtures containing natural uranium or natural uranium compounds: Uranium compounds Oxide |

||

|

Natural Uranium Hexafluoride (UF6) |

Natural uranium and its compounds; alloys, ceramic-metal composites ("cermets"), ceramic products and mixtures containing natural uranium or natural uranium compounds: Uranium compounds Hexafluoride |

|||

|

Enriched Uranium Hexafluoride (enUF6) |

2844.20.00.20 |

Uranium enriched in U-235 and its compounds; plutonium and its compounds; alloys, ceramic-metal composites ("cermets"), ceramic products and mixtures containing uranium enriched in U-235, plutonium or compounds of these products. Fluorides |

||

Source: U.S. International Trade Commission, Harmonized Tariff Schedule of the United States (2018) Revision 14, Chapter 26: Ores, Slag, and Ash, https://hts.usitc.gov/current. U.S. International Trade Commission, Harmonized Tariff Schedule of the United States (2018) Revision 14, Chapter 28: Inorganic Chemicals; Organic or Inorganic Compounds of Precious Metals, of Rare-earth Metals, of Radioactive Elements or of Isotopes, https://hts.usitc.gov/current.

Notes: HTS numbers describe relevant front-end of the nuclear fuel cycle uranium imports.

|

|

Source: CRS generated a conceptual diagram depicting uranium material flows at the front-end of the nuclear fuel cycle. Notes: The figure shows a simplified version of the nuclear fuel supply chain for domestic nuclear power reactors. "Domestic" and "Foreign" are used here consistent with DOE's interpretations of the terms. Domestic refers to physical facilities operating within the United States, regardless of a foreign corporation ownership. In some instances, domestic uranium producers, suppliers, enrichers, and utilities operating in the United States have foreign ownership or are subsidiaries of foreign corporations. The term foreign is used to describe any non-U.S. based facility or material origin. Foreign inventories may exist in other countries, but are not shown here. |

Analysis of Uranium Supply to U.S. Nuclear Power Reactors

Since the late 1980s, U.S. nuclear utilities and reactor operators have purchased increasingly more foreign-origin uranium for reactor fuel than domestically produced uranium.37 Historically, the AEC, a predecessor federal agency to DOE and NRC, promoted uranium production through federal procurement contracts between 1947 and 1971.38 After 1971, uranium mill operators produced uranium concentrate primarily for the production of civilian nuclear energy. In 1987, about half of uranium used in domestic nuclear reactors was foreign origin; by 2018, EIA reported 93% of uranium used in domestic nuclear reactors was foreign origin.

The DOE recognizes the term domestic as physical facilities operating within the United States, regardless of a foreign corporation ownership.39 Several domestic uranium producers, suppliers, enrichers, and utilities operating in the United States have foreign ownership or are subsidiaries of foreign corporations. On the other hand, DOE does not consider brokers and traders of already milled, converted, or enriched uranium as part of the domestic industry, as they are not associated with physical production of those materials. The term foreign is used to describe any non-U.S. based facility or material origin.

The following sections describe domestic uranium sources and foreign imports associated with the front-end of the nuclear fuel cycle by year and country. Uranium materials sourced from various countries may be associated with that country's natural resources, operational fuel cycle facilities, and trade agreements with the United States. For example, Australia, one of the largest exporters of uranium concentrate to the United States, has the largest reasonably assured uranium resources worldwide, but it does not have a commercial nuclear power plant in operation.40 On the other hand, some overseas producers may not have the geologic resources to mine and mill uranium concentrate, but they may operate conversion or enrichment operations.

Uranium Ores and Concentrates

Uranium extraction worldwide has shifted away from conventional (underground or surface mining) to unconventional (ISR) methods. In 2016, ISR facilities produced about half of the annual global uranium concentrate.41 ISR methods are less capital-intensive operations relative to conventional mining methods, yet the uranium ore must be hosted within a geological formation suitable for extraction by ISR.

Preliminary data for domestic uranium concentrate production in the United States in 2018 totaled approximately 1.5 million pounds,42 the lowest domestic uranium concentrate production since the early 1950s.43 Domestic uranium concentrate production outlook remains low for 2019. EIA estimated the first-quarter domestic production of uranium concentrate was 58,000 pounds, approximately four times lower than any reported quarter since 1996.44

Uranium ore and concentrates are imported into the United States from countries with considerable uranium production programs. According to the World Nuclear Association, the largest uranium-producing countries in the world in 2017 were, in order of uranium concentrate production: Kazakhstan, Canada, Australia, Namibia, Niger, Russia, Uzbekistan, China, the United States, and Ukraine.45

Uranium concentrate imports are presented in Table 2 and Table 3. As a practical matter, CRS combines "uranium ore and concentrates" (Table 2) and "natural uranium oxide" (Table 3) as similar materials produced from uranium mining and milling.46 In 2018, the United States imported the largest quantities of uranium concentrate from Canada and Australia at 4.2 million kg (11 million pounds U3O8(eq)) and 1.1 million kg (2.9 million pounds U3O8(eq)), respectively.47

The United States does not currently have an operational uranium conversion facility to convert uranium concentrate to UF6.48 Consequently, uranium concentrate imported into the United States must be exported to a foreign country capable of conversion and enrichment services or stored in inventories.

|

Country |

1992-2019 (January)

|

Imports in 2018 |

Peak Year Imports |

Total Imports |

|

Australia |

|

1,053,113 |

5,898,453 |

49,845,128 |

|

Namibia |

|

166,058 |

2,187,298 |

14,252,373 |

|

Kazakhstan |

|

0 |

1,934,508 |

11,013,935 |

|

Uzbekistan |

|

0 |

1,032,019 |

3,037,092 |

|

Russia |

|

0 |

251,171 |

846,093 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Countries are shown by cumulative imports from 1992 to January 2019.

|

Country |

1992-2019 (January)

|

Imports in 2018 |

Peak Year Imports |

Total Imports 1992-2019 (January) |

|

Canada |

|

4,228,409 |

6,395,213 |

78,716,952 |

|

Australia |

|

0 |

4,372,159 |

31,664,943 |

|

South Africa |

|

153,565 |

1,381,455 |

11,243,954 |

|

Uzbekistan |

|

0 |

1,844,669 |

8,650,325 |

|

Kazakhstan |

|

320,020 |

944,936 |

7,363,865 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Countries are shown by cumulative imports from 1992 to January 2019.

Uranium Hexafluoride

The production of UF6 is the second stage of the front-end of the nuclear fuel cycle. The United States currently has one commercial conversion facility, the Honeywell International, Inc. plant in Metropolis, IL.49 The facility suspended operations in 2018 due to "a worldwide oversupply of uranium hexafluoride" and is currently being maintained at a "ready-idle" status.50 With the Honeywell facility on standby, the United States does not have a domestic uranium conversion facility in operation. The Honeywell facility in Metropolis continues to be operated by ConverDyn Corporation as a warehouse and international trading platform for UF6 and uranium concentrate.51 According to ConverDyn, 62 million pounds of UF6 are stored at the facility as of 2018.52 According to the World Nuclear Association, the majority of commercial uranium conversion capacity is located in Canada, China, France, Russia, and the United States.53

Since 1992, the United States' largest import source of UF6 was from Canada (137 million kg). The next highest country providing UF6 imports to the United States over that time period was the United Kingdom (5.6 million kg) (Table 4).

The export trade data for UF6 provide additional insight into the international flow of UF6, which is feed material for commercial uranium enrichment. The ITC has two types of export classifications, Domestic Exports and Foreign Exports. These definitions are not the same as the definitions for these terms as interpreted by DOE and described previously.

- Domestic exports are "goods that are grown, produced, or manufactured in the United States and commodities of foreign origin that have been changed in the United States, including changes made in a U.S. Foreign Trade Zone, from the form in which they were imported, or which have been enhanced in value by further processing or manufacturing in the United States." (Table 5)

- Foreign Exports "(re-exports) consist of commodities of foreign origin that have previously been admitted to U.S. Foreign Trade Zones or entered the United States for consumption, including entry into a CBP [U.S. Customs and Border Protection] bonded warehouse, and which, at the time of exportation, are in substantially the same condition as when imported." (Table 6)

The incidence of domestic exports may demonstrate domestic uranium concentrate that has undergone uranium conversion in the United States prior to export. Another explanation is that the incidence of domestic exports may indicate foreign mined and milled uranium concentrate imported into the United States that was converted and exported.

The incidence of foreign exports may indicate UF6 imported into the United States that was reexported for enrichment services in a foreign country. This interpretation is consistent with the comments provided by ConverDyn, which stated that Honeywell operates as a "global trading warehouse."54 Since 2010, UF6 foreign exports have totaled roughly 32 million kg to four countries: Russia, Germany, Netherlands, and the United Kingdom.

|

Country |

1992-2019 (January)

|

Imports in 2018 |

Peak Year Imports |

Total Imports |

|

Canada |

|

217 |

12,493,720 |

137,432,434 |

|

United Kingdom |

|

0 |

3,250,128 |

5,583,099 |

|

Australia |

|

0 |

457,172 |

821,149 |

|

South Africa |

|

0 |

300,097 |

519,985 |

|

Germany |

|

0 |

115,630 |

459,734 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Countries are shown by cumulative imports from 1992 to January 2019. Imports from Australia, South Africa, and Germany are not in relatively high enough quantities to display on the figure.

Table 5. Annual U.S. "Domestic" Exports of Natural Uranium Hexafluoride (UF6) by Country

HTS 2844.10.20

|

Country |

1992-2019 (January)

|

Exports in 2018 |

Peak Year Exports |

Total Exports |

|

Netherlands |

|

49,340 |

5,434,525 |

17,513,009 |

|

United Kingdom |

|

0 |

2,550,280 |

11,998,839 |

|

Russia |

|

78,284 |

2,589,205 |

7,165,895 |

|

France |

|

0 |

1,487,524 |

4,394,351 |

|

Germany |

|

390,386 |

657,849 |

3,541,880 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Exports of goods that are grown, produced, or manufactured in the United States and commodities of foreign origin that have been changed in the United States, including changes made in a U.S. Foreign Trade Zone, from the form in which they were imported, or which have been enhanced in value by further processing or manufacturing in the United States.

Countries are shown by cumulative imports from 1992 to January 2019.

Table 6. Annual U.S. "Foreign" Exports of Natural Uranium Hexafluoride (UF6) by Country

HTS 2844.10.20

|

Country |

1992-2019 (January)

|

Exports in 2018 |

Peak Year Exports |

Total Exports |

|

Russia |

|

400,049 |

3,084,745 |

12,619,102 |

|

Germany |

|

1,803,712 |

2,087,390 |

7,546,865 |

|

Netherlands |

|

838,194 |

2,131,500 |

6,121,173 |

|

United Kingdom |

|

0 |

2,159,387 |

5,908,899 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Exports of foreign goods (reexports) consist of commodities of foreign origin that have previously been admitted to U.S. Foreign Trade Zones or entered the United States for consumption, including entry into a CBP bonded warehouse, and which, at the time of exportation, are in substantially the same condition as when imported.

Countries are shown by cumulative imports from 1992 to January 2019. Only four countries had foreign exports from 1992 to 2019 (January).

Enriched Uranium

Historically, the federal government operated gaseous diffusion uranium enrichment facilities at Oak Ridge, TN,55 Paducah, KY, and Portsmouth, OH, which supplied enriched uranium for defense purposes during World War II and the Cold War. The federal government used uranium enrichment services at these sites to produce enriched uranium for private contracts to commercial nuclear power plants after 1967. As of 2019, these enrichment sites have ceased operations and are undergoing decontamination and decommissioning managed by DOE's Office of Environmental Management. DOE's estimated program life-cycle costs for decontamination and decommissioning collectively for the three sites range from $70.8 billion to $78.3 billion.56

As of 2019, the Urenco gas centrifuge uranium enrichment facility near Eunice, NM, is the only operational uranium enrichment facility in the United States. The Urenco facility has the capacity to supply approximately one-third of the annual requirements for U.S. reactors.57 Several other domestic uranium enrichment facilities began NRC licensing, though no enrichment facilities are proceeding with construction.58

According to the World Nuclear Association, the majority of commercial uranium enrichment services are performed in China, France, Germany, the Netherlands, Russia, the United Kingdom, and the United States.59 Smaller-capacity uranium enrichment plants are located in several other countries. Urenco operates uranium enrichment facilities in the United Kingdom, Germany, and the Netherlands.60

According to the ITC trade data, the top five countries exporting enriched UF6 to the United States in 2018 were the Netherlands (785,046 kg), Germany (591,108 kg), Russia (547,768 kg), and the United Kingdom (461,187 kg) (Table 7).

Between 1993 and 2013, downblended61 Russian HEU supplied approximately half of the enriched uranium used in U.S. domestic reactors under the Russian HEU agreement, known as the Megatons to Megawatts program.62 This U.S.-Russian agreement provides for the purchase of 500 MT of downblended HEU from dismantled Russian nuclear weapons and excess stockpiles for commercial nuclear fuel in the United States.63 After the Megatons to Megawatts program expired in 2013, imports of enriched uranium from Russia decreased by approximately 50% (Table 7). Today, the enriched uranium from Russia imported into the United States comes from mined and milled uranium concentrate, not from downblended uranium from weapons. The enriched uranium which is imported from Russia, or any other country, may have been mined and processed in various other countries, including material exported from the United States.64

|

Country |

1992-2019 (January)

|

Imports in 2018 |

Peak Year Imports |

Total Imports |

|

Russia |

|

547,768 |

1,235,535 |

20,036,341 |

|

United Kingdom |

|

461,187 |

982,980 |

10,689,617 |

|

Netherlands |

|

785,046 |

785,046 |

7,886,118 |

|

France |

|

0 |

986,876 |

6,831,553 |

|

Germany |

|

591,108 |

591,108 |

6,221,151 |

Source: U.S. Census Bureau Trade Data. (U.S. Census Bureau does not recommend a formal way of citing data used from its website; see https://www.census.gov/about/policies/citation.html.)

Notes: Countries are shown by cumulative imports from 1992 to January 2019.

Fuel Fabrication

Three fuel fabrication facilities are located in the United States: (1) Global Nuclear Fuel Americas plant in Wilmington, NC, (2) Westinghouse Columbia Fuel Fabrication Facility in Columbia, SC, and (3) Framatome facility in Richland, WA.65 Fuel fabrication facilities are located in multiple countries, and may offer various services (conversion, pelletizing, rod/assembly) and capacity of those services.66

Uranium Purchases vs. Uranium Imports

ITC data separates uranium material by the type and quantity that physically entered or exited the United States. ITC data does not estimate the amount of uranium materials purchased by utilities for a given year. ITC data does not infer the quantities of uranium materials used, stored, or processed by a nuclear utility and reactor operator. ITC data differs from the EIA data reporting, which may combine purchases by country for uranium concentrate, uranium hexafluoride, and enriched uranium as equivalents of U3O8.

The EIA data indicates the country of origin of uranium purchased by U.S. nuclear utilities and reactor operators. EIA data does not necessarily indicate that those materials were directly imported into the United States as a given uranium material from that country.

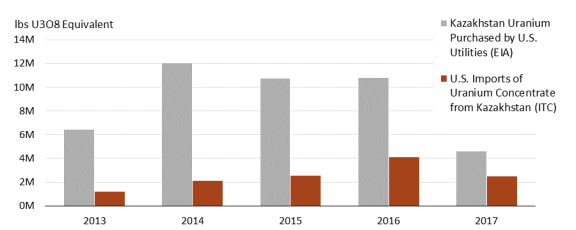

Comparing ITC and EIA data for the country of Kazakhstan provides some insight into the flow of uranium materials through the global nuclear fuel cycle. According to the World Nuclear Association, Kazakhstan has been the world's leading producer of uranium concentrate since 2009 and produced 21,700 tons of uranium in 2018.67

|

|

Source: CRS summarized data from U.S. Census Bureau Trade Data and U.S. Energy Information Administration, Table 3. Uranium purchased by owners and operators of U.S. civilian nuclear power reactors by origin country and delivery year, 2013-2017, https://www.eia.gov/uranium/marketing/html/table3.php. Notes: Uranium hexafluoride and enriched uranium were not imported to the U.S. from Kazakhstan between 2013-2017. ITC data do not indicate whether uranium concentrate imports from Kazakhstan were exclusively mined or milled in Kazakhstan. CRS converted uranium concentrate data to U3O8 equivalents by assuming 1 kg U3O8 (eq) = 0.848 kg U and 2.2 lbs. U3O8 (eq) = 1 kg U3O8 (eq). |

Between 2013 and 2017, uranium concentrate imports from Kazakhstan into the United States were 18% to 54% of the uranium purchases by U.S. nuclear utilities and reactor operators (Figure 4). The difference between the uranium purchased by utilities and the uranium concentrate imported into the United States may represent some portion of the origin material which was converted, enriched, and/or stockpiled in other countries prior to being imported into the United States, in the same form or as a different uranium material.68

For example, a portion of Kazakhstan uranium purchased by U.S. utilities may have been produced as uranium concentrate in Kazakhstan and subsequently transported to conversion facilities in France for the production of UF6. After conversion, the UF6 may have been then transported to an enrichment facility in the Netherlands for the production of enriched UF6. Finally, the enriched UF6 may have been imported into the United States for fuel fabrication and ultimately used in a U.S. nuclear reactor. This comparison of the reported EIA and ITC data with uranium purchases and imports from Kazakhstan illustrates how enriched UF6 is imported from countries such as Germany, the United Kingdom, and the Netherlands, whereas U.S. nuclear utilities and reactor operators reportedly purchased no uranium originating from those countries.69 Uranium purchases and imports may vary from year to year.

Current Issues

On January 16, 2018, two U.S. domestic uranium mining companies petitioned the U.S. Department of Commerce (DOC) to investigate whether uranium imports from foreign state-owned enterprises, such as those in Russia, China, and Kazakhstan, pose a threat to national security.70 The investigation into uranium import restrictions sparked a debate between uranium producers; uranium mine and mill operators; and nuclear utilities, reactor operators, and suppliers. Uranium producers asserted that a heavy reliance on foreign uranium constitutes a national security risk and threatens the viability of domestic uranium production. Conversely, nuclear utilities and reactor operators contended that increased fuel costs from trade restrictions would place additional financial burdens on nuclear utilities, potentially causing the premature shutdown of economically marginal nuclear power plants.

Stakeholders on both sides of the debate generally agreed that the proposed quotas would increase fuel costs for nuclear utilities and increase revenues for domestic uranium mining. For example, a report sponsored by the Nuclear Energy Institute (NEI) concluded that a 25% quota could increase fuel costs by $500 million to $800 million annually and potentially higher in the years immediately following implementation.71 An economic study funded by the petitioners estimated uranium mining revenues from a 25% quota would increase by $551 million to $690 million per year and would increase fuel costs by $0.41 per megawatt-hour (MWh).72 Another study estimated that the $0.41 per MWh increase in fuel costs for nuclear generators would translate to approximately $317 million per year.73

The uranium Section 232 investigation also raised policy questions about Congress's role under Section 232. Under current federal law, trade actions imposed by the President under Section 232 do not require congressional approval apart from actions related to petroleum imports.74

Section 232 Investigation—Uranium Imports

Section 232 of the Trade Expansion Act of 1962 (19 U.S.C. §1862) provides the President with the ability to impose restrictions on certain imports based on an affirmative determination by DOC that the product under investigation "is being imported into the United States in such quantities or under such circumstances as to threaten to impair the national security."75 The industry petition called for the President to enact a quota, pursuant to Section 232, on uranium imports such that "25% of the average historical consumption will be reserved for newly produced U.S. uranium." On July 18, 2018, DOC began an investigation into uranium imports under Section 232.76 The Department of Commerce's Bureau of Industry and Security (BIS) accepted public comments until September 10, 2018.

The statute establishes a process and timelines for a Section 232 investigation, but does not provide a clear definition of "national security," allowing the executive branch to use a broad interpretation, and the potential scope of any investigation can be expansive. DOC submitted a report to the President on April 14, 2019.77 The report has not been made public.

Presidential Determination

According to a presidential memorandum released by the Trump Administration on July 12, 2019, DOC determined "uranium is being imported into the United States in such quantities and under such circumstances as to threaten to impair the national security of the United States as defined under section 232 of the Act."78 The President did not concur with DOC findings that "uranium imports threaten to impair the national security of the United States as defined under section 232 of the Act."79

However, the President expressed significant concerns regarding national security, calling for a "fuller analysis of national security considerations with respect to the entire nuclear fuel supply chain...." The memorandum established a Nuclear Fuel Working Group, cochaired by the Assistant to the President for National Security Affairs and the Assistant to the President for Economic Policy, which will also include representatives from other executive branch agencies. The working group will "examine the current state of domestic nuclear fuel production to reinvigorate the entire nuclear fuel supply chain," and provide a report to the President within 90 days of the memorandum.

The Department of Commerce conducted a Section 232 investigation for uranium imports in 1988.80 The investigation was initiated at a time when U.S. utilities imported 37.5% of the actual or projected domestic uranium requirements from foreign sources for two consecutive years. No trade actions were imposed as a result of that investigation.

Concerns of Uranium Producers and Local Communities

Trade restrictions on uranium imports were generally supported by domestic uranium producers, national and state mining associations, and other companies associated with uranium production.81 Some elected officials, including the U.S. Senators from Wyoming, one of the largest uranium-producing states, supported trade actions on uranium imports.82 The Section 232 petition asserts that the long-term viability of the domestic uranium production industry is threatened by unfair market practices by foreign state-owned enterprises. Supporters of the petition anticipate trade quotas would provide domestic uranium producers relief by increasing the price of uranium, and subsequently increasing domestic uranium production. According to advocates of this approach, increased uranium prices and production may offer direct and indirect employment opportunities and economic stimulus to local economies.

The Wyoming Mining Association (WMA) offered support to uranium import actions in its comment letter:

WMA believes the petition sets forth a compelling case that the current state of the domestic uranium mining industry is not simply a result of foreign competition legitimately underpricing domestic producers. It now is clear that foreign, state-mandated and state-supported uranium production is thwarting our domestic industry's ability to compete in an oversupplied and underpriced market.83

One of the domestic uranium producers who submitted the Section 232 petition to DOC expressed concern with the President's determination to not take actions on uranium imports.84 An Energy Fuels statement also suggests that the petition "has been very successful."85 The company further stated, "We are very pleased to have gained the attention and action of the Administration to address the energy and national security issues raised in the petition and Department of Commerce investigation."86

Another U.S. uranium producer, Cameco, agreed with the President's determination to not take actions on uranium imports under Section 232.87 Cameco has uranium assets in the United States, Canada, and Kazakhstan. Cameco operates the largest operational uranium recovery capacity in the United States, the Smith Ranch-Highland ISR operation in Wyoming.

Concerns of Nuclear Utilities and Reactor Operators and Suppliers

Representatives from nuclear utilities and reactor operators, industry trade groups, think tanks, converters, enrichers, and foreign governments opposed the trade actions on uranium imports proposed by the petitioners.88 Nuclear utilities and reactor operators asserted that quotas on uranium imports may increase fuel costs, causing financially vulnerable nuclear reactors to shut down earlier than currently planned. The Ad Hoc Utilities Group (AHUG), collectively representing U.S. nuclear generators,89 asserted, "Imports assure the security of nuclear fuel supply and the reliability of the electric grid. Nuclear generators source from a diverse set of suppliers at all stages of the nuclear fuel cycle with the majority of supply coming from the U.S. and our allies in Canada, Australia, and Western Europe."90

Operators of U.S. conversion and enrichment facilities in the United States publicly expressed concern with uranium import quotas.91 Malcolm Critchley, the marketing agent for ConverDyn, stated that quotas "would undoubtedly cause suppliers to divert uranium [from Honeywell].... to other locations outside of the United States if the supplier did not have a known domestic customer at the time of import."

U.S. uranium enrichers shared these concerns. Melissa Mann, the president of Urenco USA—the only uranium enrichment operation in the United States—noted that with the ceased operations at Honeywell and the Department of Energy termination of its barter program, "there is currently no source of natural UF6 in the United States."92 Urenco receives deliveries of UF6 from Cameco's Port Hope facility in Canada and Orano's Comhurex II in France. She cautioned, "Should remedies in the uranium Section 232 investigation be imposed that disrupt deliveries of UF6 to [New Mexico], operation of the facility—and the $5 billion investment in the plant—could be jeopardized," and "the lack of feed material to enrich would also jeopardize delivery of low enriched uranium to fuel fabricators, putting at risk utility reactor reload schedules and reactor operations."93

Some utilities have dismissed claims about the dependence on foreign-sourced uranium and vulnerability to supply chain disruptions. For example, Dominion Energy noted that concerns with foreign supply disruptions were exaggerated because "in the past five years, our only delays or interruptions in nuclear fuel component deliveries have been from U.S. based fuel cycle suppliers."94

Legislation and Congressional Oversight

In March 2018, the Trump Administration imposed tariffs on foreign imports of steel and aluminum pursuant to Section 232. This was the first implementation of trade actions under Section 232 since 1986. Some Members of Congress have questioned whether the Administration's use of Section 232 on steel and aluminum imports is an appropriate use of the trade statute and relies upon broad interpretations of the definition of national security. Bills have been introduced in both chambers (H.R. 1008 and S. 365) in the 116th Congress that would amend Section 232 to provide for congressional disapproval of certain trade actions with the enactment of a disapproval resolution.

The uranium Section 232 investigation was discussed in a September 6, 2018, hearing by the Senate Appropriations Committee, Subcommittee on Commerce, Justice, Science, and Related Agencies. At that hearing, Richard Ashooh, Commerce Assistant Secretary for Export Administration at BIS, suggested that the uranium investigation had prompted the agency to consider "creative ideas" outside of using import restrictions.95

On February 5, 2019, the House Committee on Natural Resources requested from the uranium producers that had submitted the petition to the Department of Commerce, "All documents and communications ... relating to the Department of Commerce Section 232 Investigation on uranium."96

Policy Considerations

As a broad policy matter, Congress may consider the federal role in issues associated with the front-end of the nuclear fuel cycle. The uranium materials and service industry delivers fuel for commercial nuclear power reactors, which is largely traded and purchased under private contracts in a global marketplace. Similar to other energy markets, uranium supply is an issue on which Congress may or may not elect to intervene.

As discussed previously, the United States ceased production of HEU for weapons in 1964, due to the determination of sufficient stockpiles. Fuel for nuclear naval propulsion is supplied by government HEU stockpiles, and the production of HEU for naval propulsion ended by 1992. Questions about the sufficiency of the defense uranium stockpile and future uranium requirements for defense and other purposes are beyond the scope of this report.

Domestic Uranium Production Viability

The financial viability in the short term and long term for domestic uranium producers—uranium miners and millers—in the United States remains uncertain. Domestic uranium production experienced a sharp decline during the early 1980s, and has remained at comparatively low levels over the past 25 years.

Recently, global demand for uranium has been depressed due to a number of factors, including the continued shutdown of most Japanese nuclear power reactors following the Fukushima Daiichi accident.97 In 2018, domestic uranium concentrate production was 1.5 million pounds, down approximately 40% from 2017, and at the lowest annual production levels since 1950.98 U.S. uranium producers have dealt with poor market conditions by decreasing production and imposing employment layoffs.99 Domestic uranium producers have reportedly engaged in purchasing uranium concentrate on the market at lower spot market prices to fill delivery obligations at relatively higher contract prices.100 States have proposed legislation intended to provide some financial relief for domestic uranium producers.101

Nuclear Power Viability

U.S. nuclear power plants face economic issues and a general uncertainty over their long-term economic viability.102 Of the 98 operating nuclear reactors, 12 are scheduled to shut down, prior to license expiration, by 2025.103 The Plant Vogtle nuclear expansion project in Georgia, currently the only new construction of nuclear power reactors in the United States, is reportedly billions of dollars over budget and years behind schedule.104 A 2018 report by the Union of Concerned Scientists asserts that roughly one-third of nuclear power plants are unprofitable and modest changes in costs may have profound impacts on other nuclear power plants' economic viability.105

Tribes and Environmental Considerations

Some Native American tribes and public interest groups in the United States opposed trade actions on uranium imports due to concerns that uranium import restrictions would promote increased domestic uranium mining and milling operations.106 These groups suggested the health and environmental issues associated with historical uranium mining and milling have not been adequately addressed. Persistent soil, surface and groundwater contamination associated with historical uranium mining and milling remains a concern for some communities. For example, federal, state, and tribal agencies manage environment impacts associated with historical uranium mining and milling operations that occurred on Navajo Nation lands.107

Given environmental impacts associated with historical domestic uranium mining and milling operations, Congress may consider examining potential long-term environmental or public health consequences of expanding domestic uranium production and the adequacy of bonding and long-term financial assurance requirements for current or future uranium production operations undergoing site reclamation and decommissioning.

Author Contact Information

Footnotes

| 1. |

U.S. Energy Information Administration, Monthly Energy Review - December 2018, DOE/EIA‐0035 (2018/12), December 2018, p. 157. |

| 2. |

U.S. Department of Energy, Office of Environmental Management, Linking Legacies, Connecting the Cold War Nuclear Weapons Production Processes to Their Environmental Consequences, January 1997, p. 51. |

| 3. |

U.S. Energy Information Administration, Monthly Energy Review, Figure 8.2: Production and Trade, 1949-2018, March 2019, p. 148, https://www.eia.gov/totalenergy/data/monthly/pdf/sec8_4.pdf. |

| 4. |

Uranium is found naturally on earth with approximately 0.71% of the isotope with an atomic weight of 235 (U-235), and more than 99% of the isotope with an atomic weight of 238 (U-238). Commercial nuclear power plants in the United States require fuel with a U-235 concentration of 3-5% U-235, which is necessary to sustain a nuclear reaction (i.e., "fissile"). |

| 5. |

Low enriched uranium (LEU) is uranium with an isotopic composition of U-235 above natural uranium and below 20%. U-235 composition between 3%-5% is necessary to fuel today's commercial light-water reactors. Highly enriched uranium (HEU) is uranium with an isotopic composition of U-235 that is 20% of greater. See International Atomic Energy Agency, IAEA Safeguards Glossary, https://www.iaea.org/sites/default/files/iaea_safeguards_glossary.pdf. |

| 6. |

International Uranium Resources Evaluation Project, World Uranium, Geology and Resource Potential, 1980, p. 378. |

| 7. |

The quality and quantity of uranium resources refers to uranium deposits with a relatively high ore grade and total mass. |

| 8. |

The five countries with the highest total reasonably assured resources are Australia, Canada, Kazakhstan, Namibia, and Niger. Nuclear Energy Agency and the International Atomic Energy Agency, Uranium 2018; Resources, Production and Demand, "The Red Book," December 2018, p. 26. |

| 9. |

See U.S. Nuclear Regulatory Commission, Conventional Uranium Mills, May 15, 2017, https://www.nrc.gov/materials/uranium-recovery/extraction-methods/conventional-mills.html. |

| 10. |

See U.S. Nuclear Regulatory Commission, Final Generic Environmental Impact Statement on Uranium Milling, NUREG-0706, September 1980, pp. 3-14, 15. |

| 11. |

The EIA reports total operational capacity differently for conventional uranium mills and ISR facilities, as short tons and lbs. U3O8, respectively. Conventional uranium mills process ore that has been physically mined and the ore grades, and amount of uranium concentrate produced, may not be precisely known until processing. For ISR operations, the uranium concentrate produced will be proportional to the concentration of dissolved uranium in the recovered solution. U.S. Energy Information Agency, Domestic Uranium Production Report - Quarterly, Table 3 and Table 4, May 2019. |

| 12. |

U.S. Energy Information Agency, Domestic Uranium Production Report - Quarterly, Table 4, May 2019. |

| 13. |

World Nuclear Association, Conversion and Deconversion, updated January 2019, http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/conversion-enrichment-and-fabrication/conversion-and-deconversion.aspx. |

| 14. |

U.S. Nuclear Regulatory Commission, Honeywell Metropolis Works - Licensee Performance Review of Licensed Activities (Nuclear Regulatory Commission Inspection Report 40-3392/2018-001), Adams Accession Number - ML18064A065, March 2, 2018. |

| 15. |

The nucleus of an element is composed of protons and neutrons. An isotope is an element consisting of nuclei with the same number of protons but differing numbers of neutrons. The total number of protons is the atomic number. The total number of protons and neutrons is the atomic mass number. The relative atomic mass is the mean of the atomic mass numbers and relative abundance for all isotopes of an element. The enrichment level of uranium isotopes is described by percent U-235, which describes the relative abundance of U-235 atoms in a sample. For practical nuclear fuel cycle applications, this percentage is commonly called the uranium assay. |

| 16. |

Uranium enriched for civilian nuclear power production is commonly referred to as low-enriched uranium (LEU). |

| 17. |

As of August 9, 2017, NRC estimated that DOE stored approximately 750,000 metric tons (MT) of depleted uranium. U.S. Nuclear Regulatory Commission, Background Information on Depleted Uranium, last updated August 9, 2017, https://www.nrc.gov/waste/llw-disposal/llw-pa/uw-streams/bg-info-du.html. |

| 18. |

U.S. Department of Energy, Analysis of Potential Impacts of Uranium Transfers on the Domestic Uranium Mining, Conversion, and Enrichment Industries, April 26, 2017, p. 45. |

| 19. |

U.S. Department of Energy, Secretarial Determination for the Sale or Transfer of Uranium, April 26, 2017, https://www.energy.gov/sites/prod/files/2017/04/f34/2017%20Secretarial%20Determination%20and%20Analysis%20Public.pdf. |

| 20. |

U3O8 equivalents—U3O8(eq)—is a unit of measurement used to normalize the components of uranium concentrate, uranium hexafluoride, and enriched uranium. |

| 21. |

See "UxC's Nick Carter predicts 'gradual upward movement' of uranium price," The Northern Miner, January 26, 2019. |

| 22. |

U.S. Congress, Senate Committee on Homeland Security and Governmental Affairs, Permanent Subcommittee on Investigations, Wall Street Bank Involvement With Physical Commodities, 114th Cong., December 5, 2014, p. 132. |

| 23. |

See id. pp. 117 and 131. |

| 24. |

U.S. Energy Information Administration, Uranium Marketing Annual Report, Table 24. Uranium sellers to owners and operators of U.S. civilian nuclear power reactors, 2015-2017, May 31, 2018, https://www.eia.gov/uranium/marketing/html/table24.php. |

| 25. |

U.S. Energy Information Administration, Uranium Marketing Annual Report, May 31, 2018. |

| 26. |

Multiple offices within DOE coordinate the management of these materials, including the Office of Nuclear Energy, the Office of Environmental Management, and the National Nuclear Security Administration. |

| 27. |

For example, the Portsmouth Gaseous Diffusion Plant in Piketon, OH, operated from 1954 to 2001, initially produced highly enriched uranium for nuclear weapons and naval propulsion and research, as well as LEU for commercial nuclear power reactors. The DOE Office of Environmental Management (EM) manages the decontamination and decommissioning of the site. DOE estimates decontamination and decommissioning of the Portsmouth plant will be completed by 2039-2041 with a life-cycle cost ranging from $17.5 billion to $18.5 billion. See U.S. Department of Energy, FY2019 Congressional Budget Request, Environmental Management Volume 5, DOE/CF-0142, March 2018, pp. 77 and 110. |

| 28. |

U.S. Congress, House Committee on Oversight and Government Reform, Subcommittee on the Interior, Examining the Department of Energy's Excess Uranium Management Plan, 114th Cong., 1st sess., April 22, 2015, HRG-2015-CGR-0015. |

| 29. |

U.S. Government Accountability Office, Department of Energy: Management of Excess Uranium, GAO-15-475T, April 22, 2015. |

| 30. |

42 U.S.C. §2297h-9(d). |

| 31. |

U.S. Department of Energy, Secretarial Determination for the Sale or Transfer of Uranium, April 26, 2017, https://www.energy.gov/sites/prod/files/2017/04/f34/2017%20Secretarial%20Determination%20and%20Analysis%20Public.pdf. |

| 32. |

U.S. Congress, House Committee on Appropriations, Energy and Water Development and Related Agencies for the Fiscal Year Ending September 30, 2019, and for Other Purposes, 115th Cong., 2nd sess., H.Rept. 115-929, p. 160. ("Portsmouth.—The conferees includes $60,000,000 above the budget request for Portsmouth cleanup, which is equivalent to the amount of proceeds that the Department planned to generate through bartering arrangements in order to fund additional cleanup in fiscal year 2019. The Department shall not barter, transfer, or sell uranium in order to generate additional funding for Portsmouth cleanup that is in excess of the amount of funding provided in this Act.") |

| 33. |

U.S. Department of Energy, FY 2020 Congressional Budget Request, Environmental Management, March 2019, p. 146, https://www.energy.gov/sites/prod/files/2019/04/f61/doe-fy2020-budget-volume-5_0.pdf. ("Decrease reflects an offset by the resumption of uranium transfers (barter) pending renewal of Secretarial Determination needed to continue deactivation of the second Process building (X333).") |

| 34. |

The White House, FACT SHEET: Transparency in the U.S. Highly Enriched Uranium Inventory, March 31, 2016, https://obamawhitehouse.archives.gov/the-press-office/2016/03/31/fact-sheet-transparency-us-highly-enriched-uranium-inventory. |

| 35. |

U.S. Energy Information Administration, 2018 Uranium Marketing Annual Report, Table 7, May 2019. |

| 36. |

U.S. International Trade Commission, Purpose of the Harmonized Tariff Schedule, https://www.usitc.gov/elearning/hts/menu/. |

| 37. |

U.S. Energy Information Administration, Monthly Energy Review, Figure 8.2 Uranium Overview, April 2019, https://www.eia.gov/totalenergy/data/monthly/pdf/sec8_4.pdf. |

| 38. |

U.S. Department of Energy, Office of Environmental Management, Linking Legacies, Connecting the Cold War Nuclear Weapons Production Processes to Their Environmental Consequences, January 1997, p. 51. |

| 39. |

See, U.S. Department of Energy, Analysis of Potential Impacts of Uranium Transfers on the Domestic Uranium Mining, Conversion, and Enrichment Industries, April 26, 2017, p. 20. ("DOE interprets the word "domestic" to refer to activities taking place in the United States, regardless of whether the entity undertaking those activities is itself foreign. Hence, a facility operating in the United States would be part of "domestic industry" even if the facility is owned by a foreign corporation. DOE believes that the phrase "uranium mining, conversion or enrichment industry" includes only those activities concerned with the actual physical processes of mining, converting, and/or enriching uranium.") |

| 40. |

Nuclear Energy Agency and the International Atomic Energy Agency, Uranium 2018; Resources, Production and Demand, "The Red Book," December 2018, p. 26. |

| 41. |

World Nuclear Association, In Situ Leach Mining of Uranium, October 2017, http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/in-situ-leach-mining-of-uranium.aspx. |

| 42. |

U.S. Energy Information Agency, Domestic Uranium Production Report - Quarterly, Figure 1, May 2019. |

| 43. |

U.S. Energy Information Administration, Monthly Energy Review, Table 8.2 Uranium Overview, April 2019, https://www.eia.gov/totalenergy/data/monthly/pdf/sec8_4.pdf. |

| 44. |

U.S. Energy Information Administration, U.S. Domestic Uranium Production Report 1st Quarter 2019, Table 1, May 1, 2019, https://www.eia.gov/uranium/production/quarterly/pdf/qupd_tbl1.pdf. |

| 45. |

World Nuclear Association, World Uranium Mining Production, Updated March 2019, http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx. |

| 46. |

CRS is uncertain how "uranium ores and concentrates" are defined by the U.S. ITC, as "concentrate" is the physical and chemical product from "ore" processing. "Natural uranium oxide" is also used to describe uranium concentrate. For example, in some descriptions, the World Nuclear Association describes the product of uranium milling, "uranium oxide concentrate," World Nuclear Association, Uranium Mining Overview, February 2019, http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/uranium-mining-overview.aspx. Similar descriptions of "uranium oxide concentrate" have been used in other reports, see Nuclear Energy Agency and the International Atomic Energy Agency, Uranium 2018; Resources, Production and Demand, "The Red Book," December 2018. |

| 47. |