Digital Services Taxes (DSTs): Policy and Economic Analysis

Several countries, primarily in Europe, and the European Commission have proposed or adopted taxes on revenue earned by multinational corporations (MNCs) in certain “digital economy” sectors from activities linked to the user-based activity of their residents. These proposals have generally been labeled as “digital services taxes” (DSTs). For example, beginning in 2019, Spain is imposing a DST of 3% on online advertising, online marketplaces, and data transfer service (i.e., revenue from sales of user activities) within Spain. Only firms with 750 million in worldwide revenue and 3 million in revenues with users in Spain are to be subject to the tax. In 2020, the UK plans to implement a 3% DST that would apply only to businesses whose revenues exceed £25 million per year and groups that generate global revenues from search engines, social media platforms, and online marketplaces in excess of £500 million annually. The UK labels its DST as an “interim” solution until international tax rules are modified to allow countries to tax the profits of foreign MNCs if they have a substantial enough “digital presence” based on local users. The member states of the European Commission are also actively considering such a rule. These policies are being considered and enacted against a backdrop of ongoing, multilateral negotiations among members and nonmembers of the Organization for Economic Cooperation and Development (OECD). These negotiations, prompted by discussions of the digital economy, could result in significant changes for the international tax system.

Proponents of DSTs argue that digital firms are “undertaxed.” This sentiment is driven in part by some high-profile tech companies that reduced the taxes they paid by assigning ownership of their income-producing intangible assets (e.g., patents, marketing, and trade secrets) to affiliate corporations in low-tax jurisdictions. Proponents of DSTs also argue that the countries imposing tax should be entitled to a share of profits earned by digital MNCs because of the “value” to these business models made by participation of their residents through their content, reviews, purchases, and other contributions. Critics of DSTs argue that the taxes target income or profits that would not otherwise be subject to taxation under generally accepted income tax principles. U.S. critics, in particular, see DSTs as an attempt to target U.S. tech companies, especially as minimum thresholds are high enough that only the largest digital MNCs (such as Google, Facebook, and Amazon) will be subject to these specific taxes.

DSTs are structured as a selective tax on revenue (akin to an excise tax) and not as a tax on corporate profits. A tax on corporate profits taxes the return to investment in the corporate sector. Corporate profit is equal to total revenue minus total cost. In contrast, DSTs are “turnover taxes” that apply to the revenue generated from taxable activities regardless of costs incurred by a firm. Additionally, international tax rules do not allow countries to tax an MNC’s cross-border income solely because their residents purchase goods or services provided by that firm. Rather, ownership of assets justifies a country to be allocated a share of that MNC’s profits to tax. Under these rules and their underlying principles, the fact that a country’s residents purchase digital services from an MNC is not a justification to tax the MNC’s profits.

DSTs are likely to have the economic effect of an excise tax on intermediate services. The economic incidence of a DST is likely to be borne by purchasers of taxable services (e.g., companies paying digital economy firms for advertising, marketplace listings, or user data) and possibly consumers downstream from those transactions. As a result, economic theory and the general body of empirical research on excise taxes predict that DSTs are likely to increase prices in affected markets, decrease quantity supplied, and reduce investment in these sectors. Compared to a corporate profits tax—which, on balance, tends to be borne by higher-income shareholders—DSTs are expected to be more regressive forms of raising revenue, as they affect a broad range of consumer goods and services.

Certain design features of DSTs could also create inequitable treatment between firms and increase administrative complexity. For example, minimum revenue thresholds could be set such that primarily large, foreign (and primarily U.S.) corporations are subject to tax. Requirements to identify the location of users could also introduce significant costs on businesses.

This report traces the emergence of DSTs from multilateral tax negotiations in recent years, addresses various purported policy justifications of DSTs, provides an economic analysis of their effects, and raises several issues for Congress.

Digital Services Taxes (DSTs): Policy and Economic Analysis

Jump to Main Text of Report

Contents

- Tax Issues Highlighted by the Digital Economy

- Permanent Establishments

- Transfer Pricing

- Select International Efforts to Tax the Digital Economy

- OECD/G-20 BEPS Action Plan

- EU's Proposed DST

- Spain's DST (Effective 2019)

- The UK's Proposed DST (Effective April 2020)

- France's DST (Effective 2019)

- Policy Analysis of DSTs

- Fundamentals of a Corporate Profits Tax

- Purported Justifications for a DST

- As a Tax on Corporate Profits in the Digital Economy

- As a Measure to Counteract Tax Avoidance and Profit Shifting

- As a Method to Tax Local "User-Created Value"

- As an Excise Tax on the Digital Economy

- Economic Analysis

- Economic Efficiency

- Equity

- Vertical Equity (Progressivity)

- Differential Treatment of Firms

- Administration

- DSTs and Implications for U.S. Tax Policy

- U.S. Foreign Tax Credits and Bilateral Tax Treaties

- GILTI

- Possible Challenges at the World Trade Organization

- Multilateral Tax Reform Negotiations and U.S. Economic Policy

Figures

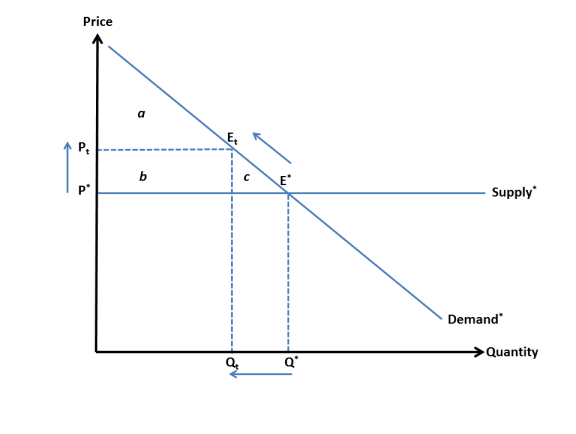

- Figure A-1. Effects of a DST on Long-Run Equilibrium in a Competitive Market with a Relatively Elastic Demand Curve

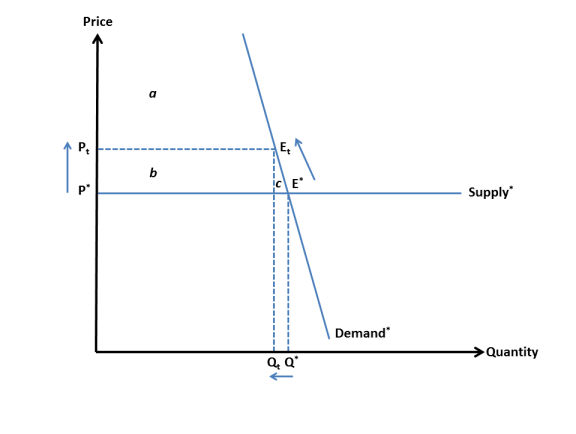

- Figure A-2. Effects of a DST on Long-Run Equilibrium in a Competitive Market with a Relatively Inelastic Demand Curve

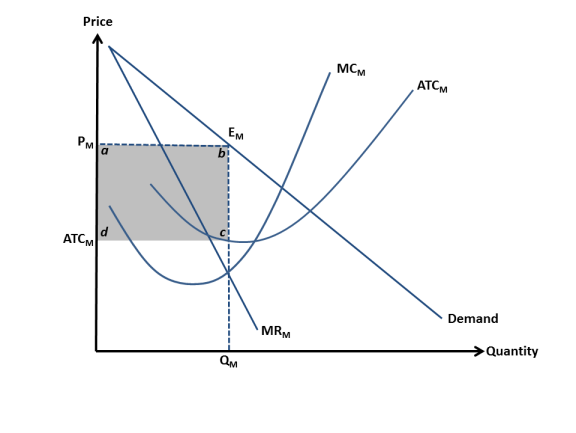

- Figure A-3. Illustrated Long-Run Equilibrium in a Monopoly Market (Before Tax)

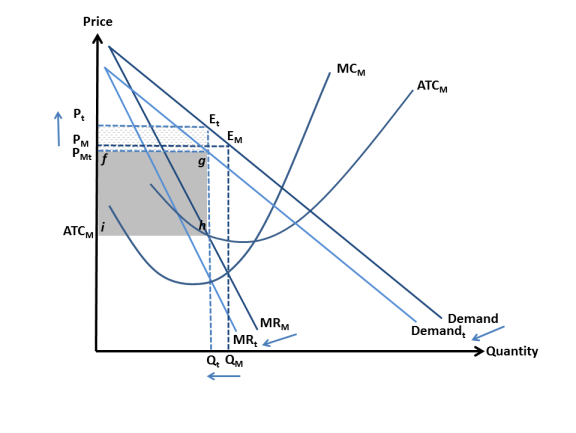

- Figure A-4. Illustrated Long-Run Equilibrium in a Monopoly Market (After Tax)

Appendixes

Summary

Several countries, primarily in Europe, and the European Commission have proposed or adopted taxes on revenue earned by multinational corporations (MNCs) in certain "digital economy" sectors from activities linked to the user-based activity of their residents. These proposals have generally been labeled as "digital services taxes" (DSTs). For example, beginning in 2019, Spain is imposing a DST of 3% on online advertising, online marketplaces, and data transfer service (i.e., revenue from sales of user activities) within Spain. Only firms with €750 million in worldwide revenue and €3 million in revenues with users in Spain are to be subject to the tax. In 2020, the UK plans to implement a 3% DST that would apply only to businesses whose revenues exceed £25 million per year and groups that generate global revenues from search engines, social media platforms, and online marketplaces in excess of £500 million annually. The UK labels its DST as an "interim" solution until international tax rules are modified to allow countries to tax the profits of foreign MNCs if they have a substantial enough "digital presence" based on local users. The member states of the European Commission are also actively considering such a rule. These policies are being considered and enacted against a backdrop of ongoing, multilateral negotiations among members and nonmembers of the Organization for Economic Cooperation and Development (OECD). These negotiations, prompted by discussions of the digital economy, could result in significant changes for the international tax system.

Proponents of DSTs argue that digital firms are "undertaxed." This sentiment is driven in part by some high-profile tech companies that reduced the taxes they paid by assigning ownership of their income-producing intangible assets (e.g., patents, marketing, and trade secrets) to affiliate corporations in low-tax jurisdictions. Proponents of DSTs also argue that the countries imposing tax should be entitled to a share of profits earned by digital MNCs because of the "value" to these business models made by participation of their residents through their content, reviews, purchases, and other contributions. Critics of DSTs argue that the taxes target income or profits that would not otherwise be subject to taxation under generally accepted income tax principles. U.S. critics, in particular, see DSTs as an attempt to target U.S. tech companies, especially as minimum thresholds are high enough that only the largest digital MNCs (such as Google, Facebook, and Amazon) will be subject to these specific taxes.

DSTs are structured as a selective tax on revenue (akin to an excise tax) and not as a tax on corporate profits. A tax on corporate profits taxes the return to investment in the corporate sector. Corporate profit is equal to total revenue minus total cost. In contrast, DSTs are "turnover taxes" that apply to the revenue generated from taxable activities regardless of costs incurred by a firm. Additionally, international tax rules do not allow countries to tax an MNC's cross-border income solely because their residents purchase goods or services provided by that firm. Rather, ownership of assets justifies a country to be allocated a share of that MNC's profits to tax. Under these rules and their underlying principles, the fact that a country's residents purchase digital services from an MNC is not a justification to tax the MNC's profits.

DSTs are likely to have the economic effect of an excise tax on intermediate services. The economic incidence of a DST is likely to be borne by purchasers of taxable services (e.g., companies paying digital economy firms for advertising, marketplace listings, or user data) and possibly consumers downstream from those transactions. As a result, economic theory and the general body of empirical research on excise taxes predict that DSTs are likely to increase prices in affected markets, decrease quantity supplied, and reduce investment in these sectors. Compared to a corporate profits tax—which, on balance, tends to be borne by higher-income shareholders—DSTs are expected to be more regressive forms of raising revenue, as they affect a broad range of consumer goods and services.

Certain design features of DSTs could also create inequitable treatment between firms and increase administrative complexity. For example, minimum revenue thresholds could be set such that primarily large, foreign (and primarily U.S.) corporations are subject to tax. Requirements to identify the location of users could also introduce significant costs on businesses.

This report traces the emergence of DSTs from multilateral tax negotiations in recent years, addresses various purported policy justifications of DSTs, provides an economic analysis of their effects, and raises several issues for Congress.

The term digital economy has fluid meaning in different policy contexts. Broadly speaking, this term can refer to any number of everyday economic activities that are connected over computers, mobile phones, or other internet-connected devices. In the realm of international tax policy, though, certain types of activities and markets have been singled out for selective taxation by some jurisdictions—primarily in Europe. Most of these digital economy business models operate in "two-sided markets" in which they provide services to individual users (sometimes at zero charge) and sell other services to businesses (e.g., advertising to users). Proponents of these "digital services taxes" (DSTs) justify them on a number of grounds, including the goal of having multinational corporations (MNCs) pay their "fair share" of taxes, taxing profits purportedly derived from consumers in their jurisdictions, or adapting traditional rules and systems of international taxation to account for new forms of "disruptive" business models that can be conducted virtually over the internet.

|

Descriptions of Selected Markets in the "Digital Economy" Online advertising services: advertising placed on search results or web pages Online intermediation services: services in which users pay for the ability to use a digital platform to sell to or interact with other users, such social networking/dating websites Online marketplaces: sites similar to online intermediation services but are typically multi-sided sales platforms where users pay for the ability to sell goods and services to other users Data transfer services: user behavioral data that is collected for sale or resale by "data brokers," often for the purposes of targeted advertising or commercial solicitation |

U.S. opposition to these unilateral taxes has been voiced by several government officials. Robert Stack, while Treasury Deputy Assistant Secretary for International Tax Affairs under President Obama, said that such efforts are primarily political efforts to target U.S. corporations.1 More recently, Treasury Secretary Steven Mnuchin has issued multiple statements in opposition to unilateral taxation of digital economy businesses.2 Some Members of the tax-writing committees in Congress have also criticized these efforts.3

This report analyzes DST proposals from an economic and policy perspective as they have been introduced, discussed, and adapted in European countries.

Tax Issues Highlighted by the Digital Economy

Some commentators and policymakers argue that MNCs in the digital economy are "undertaxed" or are not paying a "fair share" of taxes in their jurisdictions. Two issues that often underlie these sentiments are (1) the ability of digital economy MNCs to provide services without establishing a physical presence (or "permanent establishment") in the country in which their customers reside and (2) the ability of digital economy MNCs to shift their profits away from countries where they conduct real economy activity (e.g., sales, development, production) toward low-tax jurisdictions where the MNCs are conducting little to no real economic activity. Even if a country is able to establish the right to tax an MNC's profits in the digital economy (via permanent establishment rules), the profits subject to tax in that jurisdiction could be reduced via transfer pricing rules.

Permanent Establishments

A commonly held principle across international tax law is that there must be a substantial enough connection between a country and a corporation's activities to establish "nexus" in that country, enabling the country the first right to tax the corporation's income or profits earned from sales in that country.4 Specific criteria for what constitutes a permanent establishment are written into bilateral tax treaties, but they often require a fixed, physical presence within the country. Once a right to tax has been created, a country can tax a portion of the MNC's cross-border profits that can be sourced to its jurisdiction.

MNCs can earn income from local residents without creating a permanent establishment in that jurisdiction. Rules creating a permanent establishment based on physical nexus might not be triggered by digital activities over the internet because "the internet" is not physically located in any one country. The internet is a global network of computers. For example, Google can sell advertising space on its search results to a French business without creating a permanent establishment in France. The physical servers processing the payment and posting the advertisements do not have to be located in France. In response, different countries and intergovernmental organizations have tried or proposed modifying definitions and interpretations of permanent establishment rules to include "digital presence" criteria. These criteria include users, "clicks," or other digital activities with origins in the local jurisdiction. The "Select International Efforts to Tax the Digital Economy" section of this report discusses these proposals in more detail.

Transfer Pricing

Transfer pricing rules dictate how profits from transactions between related entities within the MNC should be divided among multiple countries for tax purposes. From the U.S. perspective, transfer pricing rules are intended to prevent taxpayers from shifting income properly attributable to the United States to a related foreign company (and vice versa) through pricing that does not reflect an arm's-length result.5 In practice, though, the arm's-length standard can be difficult to administer on intra-company transactions within an MNC in which there is no market where independent parties bargain over price. Sophisticated transfer pricing strategies can result in an MNC's global profits being subject to a low effective tax rate across multiple tax jurisdictions.

MNCs in the digital economy, in particular, can use transfer pricing strategies to reduce the effective tax rate imposed on their cross-border income, because their primary sources of income are often derived from intangible assets (e.g., patents, algorithms, trademarks, and marketing licenses). These assets are more challenging for "arm's-length" pricing because it is difficult to determine the value of a comparable sale of such unique technologies and services. Additionally, intangible assets can be sold to a corporate entity in a low-tax jurisdiction at relatively low cost as they do not require the relocation of corporate headquarters or physical factories, workforces, etc.

The exact tax planning methods used by MNCs can vary, but generally they involve the parent (e.g., located in the United States) selling the income-earning ownership rights to those intangible assets to a subsidiary corporation in a low-tax jurisdiction. Early on, a firm developing a potentially profitable intangible asset in a higher-tax jurisdiction might create a subsidiary in a low-tax jurisdiction and sell or assign the ownership rights to that subsidiary. Creation of this "shell corporation" is primarily a paper transaction for the purposes of holding ownership of the profit-generating intangible asset. One way that this could happen is through a cost-sharing agreement in which a U.S. corporate owner of an existing intangible asset agrees to make the rights available to a foreign affiliate in exchange for other resources and funds to be applied toward the joint development of a new marketable product or service.6 Under a cost-sharing agreement, a foreign affiliate makes an initial buy-in payment for existing technology that, in theory, should reflect an "arm's-length" price that would be paid by an unrelated party. It then receives the income accruing to that asset. Subsequently, the foreign affiliate shares in the cost of continuing technological development. The cost-sharing payments made by the foreign affiliate to the U.S. corporation are income to the U.S. parent, and the foreign affiliate gains the right to use the advance in technology in a specified foreign market.

This results in two outcomes. First, the MNC can use transfer pricing rules to maximize costs attributable to subsidiaries in higher-tax jurisdictions. Thus, the taxable income earned by the subsidiaries in higher-tax jurisdictions is reduced to as close to zero as possible. And second, taxable income realized by the shell corporation in the lower-tax jurisdiction is increased.

For example, a U.S. corporation establishes a subsidiary in Jersey, an island in the English Channel with a standard corporate tax rate of 0%.7 The subsidiary buys an existing mobile phone technology developed by its parent U.S. corporation. The subsidiary has bought the right to earnings from marketing that technology in phones throughout Europe. The original cost-sharing payment to the parent would be subject to U.S. tax. The agreement allows the Jersey subsidiary to use updated versions of that technology in the European market from research conducted in the United States. Although the intangible assets were originally developed and improved in the United States, earnings from the mobile phone sales in Europe flow to the Jersey subsidiary and are taxed at 0%.

Select International Efforts to Tax the Digital Economy

Concerns over the ability for MNCs to avoid corporate income taxes have led to much discussion within national governments and among developed countries in international economic settings. As some of these discussions have met impasse, for various reasons, some countries have unilaterally proposed or implemented policies to tax digital economy MNCs on specific grounds.

This section of the report provides a brief historical overview of these recent discussions and select unilateral DST proposals in Europe. While efforts to tax the digital economy have not been limited to European countries, efforts to develop policy principles and justifications in support of these specific taxes on digital economy markets have primarily been driven by politicians and commentators in Europe, including the United Kingdom.8 This report will not provide a comprehensive account of each DST proposal or be updated to track the rapid pace of policy modifications and emerging proposals.

OECD/G-20 BEPS Action Plan

In 2013, members of the Organization for Economic Cooperation and Development (OECD) and G-20 initiated the Base Erosion and Profit Shifting (BEPS) Project. The result of this multiyear effort is the 2015 BEPS Action Plan, which represents the consensus of the member countries that participated in the BEPS Project. Article 1 of the BEPS Action Plan analyzes the implications that the digital economy could have for modern tax systems, including taxes on corporate profits (i.e., corporate income taxes), withholding taxes (e.g., on royalties), and value-added taxes (VATs).9

Article 1 acknowledges that "it would be difficult, if not impossible, to ring-fence the digital economy from the rest of the economy for tax purposes" given the importance of digital platforms and business models in modern economies.10 In light of this finding, though, Article 1 discusses potential new tax principles to enable countries to tax the profits earned by firms in the digital economy. Specifically, Article 1 discusses expanding on the widely accepted principle that profits should be taxed "where value is created" to include the notion that value-creating activities include user interaction. For example, YouTube profits when users post their videos and create content on its channels and generates more revenue in advertisement sales based on increased viewer traffic.11

Additionally, Article 1 considers using "significant economic presence" rather than physical presence as the standard nexus for sourcing which jurisdiction has the right to tax.12 "Significant economic presence" could be measured by a corporation's revenues earned from customers in a country.13 The various DST proposals in Europe share many of the features of digital taxation options discussed in the OECD BEPS report.

Following the release of the 2015 BEPS Action Plan, the OECD has continued work in this area with its Task Force on the Digital Economy. On March 16, 2018, the task force released an interim report reflecting three different perspectives by its members. One perspective is that user-value creation has led to a "misalignment between the location in which profits are taxed and the location in which value is created" in some digital economy business models.14 This user-created value argument, discussed more throughout this report, has been used by many proponents of DSTs. A second perspective is that the challenges of tax policy presented by the digital economy are not exclusive to specific business models and should be addressed within the existing international tax framework for business profits. A third perspective is generally satisfied with recent BEPS recommendations and the existing international tax system and does not see a need for significant reform. Despite divisions reflected in the interim report, the task force aims to create an international consensus on principles for taxing the digital economy with a goal of releasing a final report on conclusions and recommendations by 2020.15

EU's Proposed DST

In March 2018, the European Commission announced a digital tax package containing two proposals.16 The first proposal would expand the definition of permanent establishment to include cases where a company had significant economic activity through a "digital presence," thereby allowing EU members to tax profits that are generated in their jurisdiction even if a firm does not have a physical presence.17 Under the proposal, a digital platform would be deemed to have established a "virtual permanent establishment" in an EU member state if it (1) exceeds a threshold of €7 million in annual revenues in a member state, (2) has more than 100,000 users in a member state in a taxable year, or (3) has over 3,000 business contracts for digital services business users in a taxable year.18 Until that more systemic change in permanent establishment rules is adopted, the second proposal would impose an "interim tax" on certain revenue from digital activities: selling online advertising, online marketplaces (facilitating the buying and selling of goods and services between users), and sales of data generated from user-provided information. The interim DST would apply only to companies with total annual worldwide revenues of at least €750 million and EU revenues of at least €50 million. The European Commission estimated that a 3% tax rate would raise €5 billion annually for member states.19 Media reports indicate that the EU-wide proposals have stalled partly due to disagreement among member states with different economic interests and questions as to whether the proposals would be legal under EU law.20

In support of its digital tax proposals, the European Commission argues that existing tax rules do not account for how value is "created by users" in the digital economy:

Today's international corporate tax rules are not fit for the realities of the modern global economy and do not capture business models that can make profit from digital services in a country without being physically present. Current tax rules also fail to recognise the new ways in which profits are created in the digital world, in particular the role that users play in generating value for digital companies. As a result, there is a disconnect—or 'mismatch'—between where value is created and where taxes are paid.21

In discussing "value creation in the digital economy," the European Commission states:

In the digital economy, value is often created from a combination of algorithms, user data, sales functions and knowledge. For example, a user contributes to value creation by sharing his/her preferences (e.g., liking a page) on a social media forum. This data will later be used and monetised for targeted advertising. The profits are not necessarily taxed in the country of the user (and viewer of the advert), but rather in the country where the advertising algorithms has been developed, for example. This means that the user contribution to the profits is not taken into account when the company is taxed.22

Despite the policy pronouncements of the European Commission, member states of the EU disagree on both the long-term (changes to the permanent establishment rules to include digital presence factors) and interim (an EU-wide DST) proposed policies regarding the digital economy.

On December 4, 2018, the economics and finance ministers of various EU member states met as part of the EU's Economic and Financial Affairs (Ecofin) Council. As part of its agenda, the Ecofin Council was scheduled to consider a vote on the EU's DST proposal. According to media reports, a vote was not formally considered, as it was apparent that multiple members held out in opposition against the DST.23 As of the publication date of this report, the issues are still under consideration by the Ecofin Council.24

Even if opponents to the broad, EU-wide DST proposed by the European Commission successfully block adoption of such a tax, this does not mean that individual members states are also barred from imposing their own national-level DSTs. Policy and political pressure for DSTs still exist within many EU member states. According to one media report, approximately 11 of the 28 EU member states were considering or had adopted DSTs before the Ecofin meeting.25

Spain's DST (Effective 2019)

In April 2018, Spain announced that it would introduce a DST of 3% to the gross income derived from certain digital services. According to a preliminary text of the proposal,26 beginning in 2019, the tax will be imposed on certain digital services, including online advertising, online marketplaces, and data transfer service (i.e., revenue from the sales of online user activities) determined from internet protocol (IP) addresses within Spain. The tax would apply only to companies with global revenues for the previous calendar year exceeding €750 million and €3 million in revenues earned in that current year from activities with users in Spain.

The UK's Proposed DST (Effective April 2020)

On October 29, 2018, the Conservative Party introduced a DST as part of its 2018 budget proposal.27 Specifically, the tax would be levied at 2% on the applicable revenues of "certain digital businesses which derive value from their UK users." Revenue subject to tax include search engines, social media platforms, and online marketplaces derived from the participation of UK users. Users is defined broadly and can include interactions (e.g., payments made or clicks) from UK participants on either side of a two-sided digital market.28 The tax would apply only to businesses whose revenues from covered business activities exceed £25 million per year and groups that generate global revenues from search engines, social media platforms, and online marketplaces in excess of £500 million annually. There would also be a safe harbor provision that exempts "loss-makers and reduces the effective rate of tax on businesses with very low profit margins." A "review clause" would be included in the DST to ensure that it is still required following further international tax reform discussions. The specifics of the DST are to be detailed in legislation to be considered by Parliament that is expected to be introduced in April 2020.29 The UK Treasury estimates that the DST will raise £400m by 2022-2023 and £440m by 2023-2024.30

According to the UK Treasury, the DST serves as "interim action" to "ensure that digital businesses pay tax that reflects the value they derive from UK users" until international corporate tax reform efforts determine a comprehensive method to tax income earned from these types of multinational corporate business models.31

France's DST (Effective 2019)

On December 17, 2018, Bruno Le Maire, Finance Minister of France, announced that the government was going to impose a DST beginning on January 1, 2019. Le Maire said that the tax is estimated to raise around €500 million annually. Details on what activities would be covered and the rate of tax were not provided but may be addressed in legislative sessions.32 Le Maire's announcement came the week after EU finance ministers did not reach agreement on an EU-wide DST at the December 2018 Ecofin meeting and shortly after President Emmanuel Macron announced billions of euros in tax cuts and spending in response to domestic social unrest.33 According to media coverage of the announcement, the decision to impose a DST seems to be motivated at least in part by a perceived unfairness in the amount of taxes paid by foreign corporations compared to domestic corporations.34

Policy Analysis of DSTs

This section of the report first identifies the fundamentals of a corporate profits tax before addressing justifications that some have offered for DSTs. DSTs have been characterized as extensions of different types of tax regimes ranging from a tax on corporate profits in the digital economy to something more like a selective or excise tax on specific types of activities that is standalone from income tax regimes. Based policy analysis, though, DSTs resemble a selective tax on revenue (akin to an excise tax) and not as a tax on corporate profits.

Fundamentals of a Corporate Profits Tax

A tax on corporate profits taxes the return to investment in the corporate sector. Investment is giving up income for consumption today for the promises of higher returns, or earnings, in the future. Investment can be made in tangible assets, such as factories or equipment, or intangible assets, such as patents or trade secrets. The earnings eventually generated by the assets owned by corporations are taxed under the corporate profits tax.

As discussed in the "Permanent Establishment" section of this report, domestic tax laws and international agreements provide the first right to tax income at its physical source—that is, where the asset is owned. The locations of a corporation's customers do not determine which country has a right to tax its income. For example, if a U.S. firm manufactures goods in the United States and exports those goods to European countries, then those European countries do not have a right to tax the earnings of the U.S. firm just because of its sale to European customers.

Under some tax regimes, countries retain the right to impose a residual tax by taxing foreign-source income (i.e., income earned from overseas) and allowing a foreign tax credit. But the right to impose that residual tax on income from foreign incorporated subsidiaries is based on a domestic corporation owning some minimum percentage of the foreign business entity (i.e., a controlled foreign corporation, or CFC). In the United States, income from foreign branches is taxed currently and eligible for a credit.35 For example, the United States could tax the income that a firm earned from overseas sales if that firm is owned in part or in full by a U.S. parent in the year that the foreign-source income was earned (i.e., "currently," or not subject to deferral). However, most countries do not exercise this residual right to tax foreign-source income outside of income that can be easily shifted to low-tax countries.36

Purported Justifications for a DST

As a Tax on Corporate Profits in the Digital Economy

European Commission authorities appear to be characterizing their DST proposal as an extension of national-level corporate income taxes.37 In contrast, the UK has framed its DST as a gross receipts tax and specifically says that it is not an income tax.38 Regardless of these mixed characterizations, a policy analysis of DSTs indicate that they do not resemble a tax on corporate profits.

First, as explained above, international tax rules do not provide countries a right to tax an MNC's cross-border income solely because their residents purchase goods or services provided by that firm. Rather, ownership of assets justifies a country to tax that MNC's profits.

Second, DSTs, as they have been introduced thus far, are not structured as taxes on corporate profits. Corporate accounting profit is equal to total revenue minus total cost. Many corporate income tax systems tax corporate profits (along some policy spectrum of resident-based or worldwide-based rules).39 In contrast, DSTs are structured as "turnover taxes" that apply to the revenue generated from taxable activities regardless of costs incurred to a firm. The first section of the Appendix provides an algebraic illustration to show that a DST may have different consequences for the after-tax accounting profits of a firm than an income tax levied at the same tax rate.

Third, DSTs are economically equivalent to excise taxes on intermediate services in the supply chains of various markets. As explained in the "Economic Efficiency" section of this report, the economic incidence of a DST is likely to be borne by purchasers of taxable services (e.g., companies paying digital economy firms for advertising, marketplace listings, or user data) and possibly consumers downstream from those transactions, depending on supply-and-demand conditions in each stage of the supply chain. It could be possible under specific market conditions (i.e., in which firms subject to the statutory incidence of a DST earn supernormal economic profits or have monopoly power) that DSTs could reduce corporate profits of firms in the digital economy. Under this scenario, even though DSTs would not still be structured as a tax on profits (from a plain reading of the implementing law), they could have the economic effect of a tax on profits. For reasons discussed later in this report, though, it would be difficult to demonstrate that digital economy firms generate supernormal economic profits or are monopolies within the larger markets in which they operate.

As a Measure to Counteract Tax Avoidance and Profit Shifting

Proponents of DSTs argue that profits earned by MNCs in the digital economy are not adequately taxed on a worldwide basis, as many of these firms have reduced their effective tax rates through international tax planning strategies. As discussed earlier in the "Tax Issues Highlighted by the Digital Economy" section of this report, two prongs of these tax planning strategies include avoiding permanent establishments in higher-tax jurisdictions and using transfer pricing to shift profits to lower-tax jurisdictions. Other strategies that help MNCs, both inside the digital economy and outside, avoid income tax include debt and earnings stripping, avoiding withholding taxes, and contract manufacturing.40

Critics of basing DSTs on this position could make several arguments. First, revenues lost from profit shifting are lost revenues to the country with the right to tax the corporation that owns the asset, not the country that is home to the corporation's customers. Although many developed economies are concerned with ensuring that profits are taxed from their proper source under international tax laws, a country that imposes a DST on foreign MNCs' income (in which they have no right to tax) is not consistent with the rationale of recouping revenue lost from the profit-shifting practices of that country's firms.

Second, tax strategies enabling MNCs to pay little to no tax have been used by a broad array of firms that rely on intangible assets for the majority of their profits, and these firms are not limited to industries in the "digital economy." For example, European Commission authorities recently opened investigations into tax benefits conferred by its members on McDonald's (over royalty payments made by franchisees for use of the company's brand) and Starbucks (over royalty payments for coffee roasting "know-how" and the price of its unroasted beans).41 Thus, it can be argued that DSTs arbitrarily target firms within the digital economy for allegedly excessive profit shifting.

Third, tax policies in a number of countries have recently changed or are scheduled to change in ways that will reduce incentives for profit shifting. These changes will most likely affect firms with the most aggressive profit-shifting strategies, including some digital economy firms. In the United States, a number of provisions enacted in P.L. 115-97 have reduced or will likely reduce economic incentives for U.S. MNCs to engage in profit shifting and tax avoidance. In addition to reducing the top marginal corporate tax rate from 35% to 21%42—and, thus, the potential tax savings from profit shifting—P.L. 115-97 contains several other policy changes discouraging profit shifting, such as

- "Thin capitalization" rules limiting the benefits to earnings and debt stripping, such as reducing the share deductions of interest from 50% to 30% of adjusted taxable income for businesses with gross receipts greater than $25 million and eliminating a safe harbor that exempted firms without high debt-to-equity ratios.43

- A new tax on "global intangible low-taxed income" (GILTI), effectively imposing a 10.5% minimum tax rate on the intangible income of CFCs in years 2018-2025 and 13.125% after 2025.44 In other words, if U.S. corporations are largely the center of concerns about digital economy MNCs not paying a "fair share" of their worldwide profits in tax, then GILTI provides a "floor" in the amount of tax owed by firms that previously sought out tax homes for their intangible assets in countries that imposed low or zero income tax.

- A "deemed repatriation" tax on accumulated post-1986 earnings at rates of 15.5% (if held in cash) and 8% (other, noncash assets), with applicable foreign tax credits similarly reduced.45 In other words, retained earnings of U.S. MNCs that were held abroad (often in low-tax jurisdictions) are now subject to tax.46

- U.S. firms that invert are subject to a number of penalties, such as higher tax rates on the stock compensation of the inverting company's executives, a recapture of the deemed repatriation rate on post-1986 earnings (subjecting these earnings instead to 35% instead of 8% or 15.5%), and application of ordinary individual income tax rates instead of lower qualified dividend/long-term capital gains rates on certain dividends issued from the new foreign parent of the inverting U.S. company.47

Some European countries have taken efforts to change policies that were characterized by some as enabling tax avoidance among digital economy MNCs. For example, Ireland is phasing out tax provisions by 2020 behind the "double Irish sandwich."48 Some digital economy firms reportedly used this tax planning strategy to reduce the effective rate of tax on their cross-border income (e.g., advertising sales in Europe) and shift their profits to "tax havens" that impose no tax on corporate income.49 Furthermore, the Netherlands is considering imposing a withholding tax on royalty payments to low-tax jurisdictions by 2021.50 Although tax-minimizing international tax planning still exists, policy changes have reduced the benefits of using past strategies that raised concerns of MNCs routing income through a complicated series of international business entities for the primary purpose of reducing tax owed.

Fourth, DST proposals are unlikely to affect profit-shifting behavior. As explained above, a tax on corporate profits, in a very general sense, taxes corporate income minus the costs of production. In contrast, DSTs are imposed on gross revenue derived from certain business activities (or "turnover") and do not take into account costs or net profits earned by the taxable firm.51 Thus, economic incentives for MNCs to shift profits remain unchanged by DSTs as they do not affect profit-maximizing decisions at the margins.

As a Method to Tax Local "User-Created Value"

As discussed in the "Select International Efforts to Tax the Digital Economy" section of this report, statements by the European Commission and United Kingdom claim that tax regimes are not adequately taxing the "value" created by user contributions and behavioral data that forms a key part of the business models of firms in the digital economy.

The user-based value creation argument says that some digital platforms benefit from "network effects," in which the contributions of one user benefit other users and draw more users to utilize the platform.52 For example, a UK user creates a video on YouTube that is widely shared or promoted among other UK users. The increased user traffic benefits YouTube because more users are seeing advertisements that it has placed on its site. Thus, the video content creator has created "value" to YouTube by generating more advertising revenue to the platform. As another example, Yelp is a website and mobile application that allows users to provide restaurant and business reviews. Yelp generates revenue primarily from targeted advertising placed on its website. As more users provide higher-quality reviews, more users will rely on Yelp. Thus, the quality of user contributions creates "value" for Yelp's business model by increasing advertising revenue.

Critics of this user-based "value-creation" argument could make various rebuttals. First, business models in the digital economy do not raise novel or "disruptive" challenges to income tax frameworks. In the digital economy, it is common for firms to operate in two-sided markets, where they sell or provide services to two sets of customers. For example, a social media company could use revenue earned from customers on one side of the market (advertising sales to businesses) to subsidize the free provision of services to customers on the other side of the market (individual platform users). A company providing free health and athletic tracking services can charge lower prices for a wearable device if it can sell aggregated user data to another marketer. This method of earning income across two-sided markets, though, is not new. For example, the advent of radio and television broadcasting in the 1900s operated on the same business model, where individual users consumed free programming in exchange for listening or viewing advertisements from sponsors. Just because French households along the border with Italy listen to Italian advertisements on an Italian radio station does not give France the right to tax the Italian radio station's advertising revenues. By analogy, just because French households are able to view online advertisements placed by a U.S. company on a U.S.-owned social media platform does not give France the right to tax the U.S. social media firm's advertising revenue.

Second, the "value created" in the digital economy is achieved by the innovations and assets of the companies themselves, not by the actions of a single user. The companies—not the customers—bear the risk associated with investments in innovative technologies and platforms. They hire the workers, conduct the research, and develop the software, algorithms, and patentable innovations. For example, a key capability of many digital economy platforms is the ability to aggregate large amounts of data points across millions (if not billions) of users and repurpose that information for targeted adverting or directly selling goods and services. The technology enabling the aggregation of the user data and identifying patterns in consumer behavior is what adds value for resale to potential advertisers or retailers.

Third, user contributions can be viewed as inputs to digital economy business models. It can be argued that the value of a single user's data or input is worth little to no market value in isolation. This is why users are generally willing to let companies track and collect these data without charge. Even if digital business models that allow individual users to monetize and sell their individual data grow, any income earned by individual users would be subject to tax under existing tax systems. For example, property owners on Airbnb are subject to income taxes and other hospitality fees levied by their national and local governments. YouTube "influencers" that are sponsored by companies pay personal income tax on those earnings to their home countries.

Fourth, user contributions can be viewed as a substitute for money exchanged by consumers for the provision of digital services. "Direct provision," in this context, has the same meaning as "sale of" digital services, except there is no money exchanged in the transaction (i.e., bartering). For example, take the market for data generated by user-provided information. Google users agree to have Google track their search queries in exchange for the free use of Google's search engine. Similarly, Facebook users agree to have their likes, posts, and network connections tracked and aggregated for sale to advertisers in exchange for the use of Facebook's social media platform at zero cost.

These transactions, it is argued, maximize the economic welfare of both consumers and producers. Consumers benefit because the behavioral data of any one user has little to zero market value (as discussed above), but consumers do value the provision of digital goods and services. Producers of digital services benefit because they are able to generate revenue from repurposing aggregated user data in exchange for operating their digital platforms at little to no cost to users. As another example, Amazon's business model can be viewed like a catalog retail merchant that features the goods of different manufacturers. A catalog retail merchant earns income by selling space to manufacturers for the privilege of featuring their products in the merchant's catalog. The catalog merchant's customers place an order, and the goods—which are typically manufactured from outside of the jurisdiction where the customer is located—are then shipped to the customer. The customers did not "create value" in that business-to-business transaction via their subscription and purchases of the catalog. By analogy, just because a final consumer of goods sold via Amazon resides in the UK or France does not give those countries the right to tax Amazon's revenues.

Fifth, the distinction that customers in the digital economy create value while customers in other industries do not could be viewed as arbitrary.53 Consumers engage in a countless array of activities that enhance a company's "value" in the course of everyday life. Customer reviews and referrals for services—everything from dog walkers to dry cleaners to dentists—have existed for years and can increase a business's revenues. However, consumers usually do not expect a share of those revenues, nor does the act of providing a review give the country in which that customer resides a right to tax the service provider's profits. Additionally, consumers promote certain brands and companies simply by using their goods or services. This sort of "free marketing" improves the reputation of the brand or firm but does not trigger tax liability based on the location of the consumer. The flow of users to one digital economy platform or another are similar in that mass consumer attraction drives revenue. What the digital economy has changed, though, is the speed and scope in which consumer actions can be relayed to others.

As an Excise Tax on the Digital Economy

Excise taxes are typically justified by economic principles or as revenue-raising measures. From an economic perspective, there are four common types of excise taxes: (1) sumptuary (or "sin") taxes, (2) regulatory or environmental taxes, (3) benefit-based taxes (or user charges), and (4) luxury taxes.54 The first two categories of excise taxes attempt to correct for a perceived "market failure" in which the actions of individuals in the market have negative spillover effects to society. The third category is typically used to limit the burden of funding a government program that tends to benefit a relatively defined or narrow set of beneficiaries. The fourth category, largely repealed in the United States, uses specific taxes as a means to raise revenue in a more progressive manner.

Based on these classifications of excise taxes, it appears that a DST primarily serves as a revenue raising measure. The use of digital platforms does not appear to create negative spillovers to society, creating the economic justification for use of excise taxes to raise the price of individual transactions as a means to reduce the burden on society. DSTs do not appear to be a benefit-based tax, as proponents have not called for dedicating the revenue to specific government programs that benefit digital economy MNCs subject to tax. DSTs also do not appear to be clearly a more progressive method of financing government activities compared to income taxes or broad-based consumption taxes (e.g., value-added taxes) that are common in Europe. As discussed below in the "Vertical Equity (Progressivity)" section of this report, DSTs could be a regressive method of financing government spending in the countries that impose them.

Economic Analysis

This section analyzes DST proposals under the standard tax evaluation criteria used by economists. These criteria are used to understand how a tax affects consumer demand and producer supply, whether a tax aligns with common notions of fairness, and administrative issues that could increase tax compliance costs for taxpayers or affect the ability of governments to collect revenue from a tax.

Economic Efficiency

Economic efficiency is typically defined as optimal production and distribution of resources in a market. Taxes typically impede, or distort, that optimal allocation of resources by raising the price of the taxed activity. Central to estimating the magnitude of these distortions is determining who bears the economic burden, or incidence, of the tax. The economic incidence of a tax can differ from the statutory incidence (i.e., who is obligated by law to pay the tax) depending on conditions in the affected market. Once the economic incidence of a tax is established, the exact distortions to consumers and producers can be determined as well as any other economic activity that is typically discouraged by a tax.

The statutory incidence of the DST is borne by firms that provide covered services. For example, under the Spanish DST, companies that sell online advertising services, provide platforms for online marketplaces and intermediation services, and data transfer services—all to users with IP addresses within Spain's jurisdiction—will be subject to the DST (providing that they meet the threshold requirements). The economic incidence of such a tax could vary depending on the structure and characteristics of those individual markets, as explained in more technical detail in the Appendix.

Under one scenario, digital economy firms providing services subject to the DST are perfectly competitive, and the economic burden is borne by the consumers of the digital services in the form of higher prices over the long term. For example, Spain levies its DST on firms that place digital advertisements, based on the revenue earned from showing advertisements on the search results and web pages of users with Spanish IP addresses. In a perfectly competitive market, firms providing digital advertisements earn zero economic profit in that they could not earn a higher rate of return via alternative investments. When faced with the DST, these advertising firms can either (a) exit the industry and pursue higher returns in other industries that are not subject to tax or (b) pass along the tax in the form of higher prices to businesses that purchase the advertising services. The firms purchasing digital advertising could be Spanish companies, but they could also be foreign firms purchasing advertisements that are ultimately targeted to Spanish users.55 In this case, the imposition of a DST in a competitive market will increase the price of taxable services and lead to a decline in the quantity demanded. The exact magnitude of these changes will depend on the responsiveness, or "elasticity," of the companies purchasing the internet advertising to changes in price.

Assuming that companies purchasing the advertising services are also operating in a perfectly competitive market, they are faced with the same options as the firms that sell internet advertising: exit the industry or pass the tax along to consumers of their goods. Higher prices could result in lower consumer demand for the advertised product. The magnitude of this reduced demand depends on the responsiveness of consumer demand to changes in price (i.e., the price elasticity of demand). Thus, a DST imposed on intermediary services can have ripple effects downstream within markets. Under perfect competition, the economic incidence of an upstream DST is ultimately borne by the final consumers of those advertised products.

Under an alternative scenario, sellers of digital services (e.g., Google, Facebook, Amazon) could be monopolies, or a small number of firms could have "market power" (the ability to influence the price for their services prevailing in the market), and at least part of the tax is borne by these firms in the form of reduced economic profits. Firms can derive market power from a number of factors. For example, lack of competition could enable one firm to have a significant effect on the prevailing rate of digital advertising services. Also, the presence of complements and substitutes could affect market power.56 In contrast to firms in perfectly competitive markets, firms that have market power are able to earn positive economic profits, also known as "supernormal profits," because they are able to set a price above their marginal cost of production.57

Some have argued that digital economy firms are more likely to generate supernormal profits because the marginal cost of scaling production of their business model is relatively low, if not costless. For example, the marginal cost for Facebook to display an advertisement to a user is basically zero. Others argue that some firms generate supernormal profits because they are operating in an oligopoly or near-monopoly. For example, most search results are conducted through Google, and Facebook has the most users among social media platforms. These arguments, though, may not provide clear indication of supernormal profits. A variation of the first argument could have been made during the rise of the retail catalog industry, where the marginal cost of producing a single magazine and mailing it to a consumer was relatively small. However, the presence of competing catalog retailers should have driven the prices of firms down close to their marginal costs (which encompass more than just the cost of printing one additional catalog). The second argument could be seen to misidentify the structure of "two-sided markets" in which many digital economy firms provide services to individual users as well as businesses. For example, Google provides search engine results to individual users (at no cost) and sells advertising space on those search results to businesses. Even if Google dominates the search engine market, it still competes against other firms, such as Facebook, for digital advertising. Digital economy firms also compete with nondigital economy methods of providing advertising services (e.g., television, print, and radio), which could constrain their ability to set prices well above their marginal cost of production.

When faced with the DST, a monopolist or firms with market power bear at least some of the tax in the form of lower profit.58 This analysis is explained in more detail in the Appendix. How much of the tax is passed along to companies buying the advertising placement (and their customers) depends on the elasticities of supply and demand in those markets. Like the analysis in the competitive market, consumers in the affected industries reduce their demand in response to higher prices.

The ultimate implication of the analyses above is that DSTs introduce distortions in various markets by reducing the financial return to capital in digital economy industries or by raising the cost of goods and services intermediated through digital platforms. Investment in affected markets would be expected to decrease. An example of the former would shift investment out of digital economy firms (e.g., as retailers purchase more print, television, or radio advertisement instead of internet advertisement or increased sales via brick-and-mortar or catalog outlets instead of digital), while an example of the latter would involve a reduction in demand of the final goods. The exact magnitude of these changes will vary based on the responsiveness of supply and demand in those various markets.59 Distortions can also arise in different ways depending on how a particular country's DST is applied to different firms. These issues are described more in the "Differential Treatment of Firms" section below.

Equity

Vertical Equity (Progressivity)

The principle of vertical equity generally implies that taxpayers with a greater ability to pay the tax should generally pay a greater share of their household income in taxes compared to households with a lesser ability. A tax is "progressive" if higher income households pay a greater share of their income in tax than lower-income households, whereas the opposite is true in a regressive tax system.

If the economic incidence of DSTs resemble that of an excise tax rather than a tax on corporate profits, as discussed in the "Economic Efficiency" section, this finding also has an impact on the vertical equity analysis of DSTs. A review of the economic literature shows that the majority of the corporate income tax is borne by capital (i.e., the corporation's shareholders) with the residual being borne by labor, or workers.60 Capital, here in the form of stock ownership, tends to be disproportionately concentrated in higher-income households.61 In contrast, excise taxes are commonly borne by consumers in the form of higher prices. Excise taxes are often regressive, as lower-income households bear a higher share of their pre-tax income on consuming goods and services than higher-income households.62

The exact equity effects of DSTs could vary based on different abilities for intermediate firms to pass the tax along to consumers, the nature of the goods and services that they sell, and the responsiveness of consumers in those relative markets. For example, assume that Facebook charges higher prices for advertising on the social media platform to companies, and companies are able to pass those higher advertising costs in full to their customers in the form of higher prices. If one of those companies sells luxury cars and another sells consumer household goods, the DST has more progressive effects in the former case and more regressive effects in the latter. In the aggregate, though, there is little reason to assume that final consumers of goods and services sold through taxable activities in digitized business models are disproportionately higher-income. Thus, it can be expected that a DST affecting a broad range of goods and services is more likely to be regressive than not, especially when compared to a tax on corporate profits.

Differential Treatment of Firms

DSTs create unequal economic treatment between similarly situated firms inside and outside of the digital economy. Firms outside of the digital economy can earn just as much global or local revenue as firms taxed under DSTs without being subject to an additional layer of tax on their revenue. Firms outside or inside the digital economy can also engage in profit shifting and "aggressive" transfer pricing to reduce their taxes owed in a country.

DSTs, as they have been presented thus far, also create inequalities for firms of similar size based on certain exemptions and thresholds. For example, each of the specific European DST proposals use different or multiple thresholds based on total cross-border profits, revenue generated from covered business activities, "clicks" or interaction based from local users, etc. While proponents of these DSTs with minimum thresholds might have other policy goals in mind (e.g., exempting smaller businesses from potentially costly tax compliance burdens), the exact levels at which these thresholds are drawn among larger MNCs are arbitrary from a policy perspective. Critics of DSTs would argue that the thresholds are drawn to exclude domestic MNCs or to target the taxes to a narrow set of foreign MNCs.

Regardless of their rationale, these thresholds create concerns of inequitable treatment between different sectors. In the situation where the tax is fully passed along to consumers, digital firms either charge a higher price (reducing demand) or exit the industry. Where the MNCs subject to the statutory incidence of the tax bear at least a portion of the economic incidence of the DST, then they face a lower return to business investment in that country compared to firms not subject to the DST.

Additionally, the UK DST's proposed exemption or "safe harbor" for "low profit" firms could create another layer of equity concerns.63 If the exemption is based on low profits as calculated by UK tax rules, then firms that are not subject to the UK corporate income tax (because they do not have a permanent establishment in the UK) will not be eligible for the exemption. In other words, if a firm must be subject to the UK corporate income tax to be eligible for exemption then, by definition, the exemption is not available to foreign MNCs. MNCs with similar amounts of global revenue would be subject to different effective tax rates on their worldwide consolidated earnings (across all related entities) based on whether they were subject to UK income taxes or not. An alternative exemption being considered by the UK, based on global consolidated profits, could have some administrative issues, as discussed in the next section of this report.

Administration

DSTs present several administrative challenges to both the public and private sectors. With regard to the public sector, lawmakers and revenue-collecting agencies will have to clarify exactly what types of activities are subject to tax and which parties bear the statutory burden of paying tax. These decisions affect the costs of administering the tax or the gross revenue collected by the tax. With regard to the private sector, the decisions made by lawmakers and agencies could affect the costs of complying with DST regimes.

Technology could present administrative challenges to the implementation of DST proposal. First, some digital economy platforms allow users to opt out of having their data tracked or resold to third parties. Without this information a digital service provider may be able to fulfill a user's desire for privacy, but the absence of the information limits the provider's ability to apply proper taxes based on the customer's jurisdiction. "Do not track" or internet browser plugins that make it more difficult for companies to track users' activities could affect the measurement of data collected from local users. Second, users could reroute their internet traffic to servers outside of the country imposing the DST and mask their physical location.

Virtual private network services (VPNs) allow users to access websites while making it appear that their IP addresses are from locations other than their actual locations. VPNs connect users to servers located in different parts of the world. Websites will see that a user's web traffic is originating from the VPN server, which could or could not be in the same jurisdiction as the user. Typically, VPNs are used for anonymity reasons or to bypass firewalls and website censors imposed in certain jurisdictions.64 VPNs are not sufficient to protecting a user's IP address, as other unmasking techniques (some requiring more effort) can be used. Still, users could use VPNs located outside of the taxing jurisdiction to reduce the flow of user activity attributed to IPs within the taxing jurisdiction, thereby reducing revenue collected from "local" user activity. Even if this does not completely eliminate the revenue base for a DST, VPN use still results in mismeasurement of the amount of revenue attributed to local users.

Overall, lawmakers writing DSTs would likely need to consider specifying what level of enforcement would be sufficient for companies to make good faith efforts to source their revenues to local users. More due diligence required by companies to determine the source of their users or unmask user efforts designed to preserve their privacy will impose higher costs to the companies. A lower standard might require fewer resources from firms and be less intrusive on user privacy but reduce the amount of tax raised from local users. Thus, DSTs could present policy tradeoffs between individual privacy concerns and tax revenue collection.

Two features of the UK's proposed DST create additional administrative challenges. An exemption based on low UK-source profits could also have unintended consequences for proponents of the DST in the form of reduced revenue. Some digital economy MNCs do have subsidiaries physically located in Europe. For example, these firms might have the purpose of providing customer service or call centers that speak the local language or market the company's lines of business. Generally, these types of business activities are low profit margin. If a digital economy MNC does have a permanent establishment in the UK that earns close to zero profits, thereby owing little to no income tax in the UK, does the tax situation of this local subsidiary justify an exemption for the entire MNC controlled group? If so, the MNC could still be technically generating millions of British pounds in revenue from sales to UK customers over the internet. In contrast, an MNC that does not have a UK subsidiary but also has millions in revenue from sales to UK customers would not be eligible for the low-profit exemption. The clear tax planning implication of such an interpretation of the low-profit exemption is that MNCs should establish a low-profit subsidiary in the UK as a means to claim the low-profit margin exemption. If allowed, then the UK DST would likely raise little to no revenue.

Alternatively, the UK could base its low-profit exemption based on worldwide profits of the MNC. In the United States, corporations are required to report a number of tax-related calculations and information on their annual Securities and Exchange Commission filings for shareholders. Among these tax-related data are their effective tax rate and tax paid across all jurisdictions where the firm is subject to tax. However, the tax data reported under financial accounting rules typically varies from actual tax paid. This phenomenon is described as "book-tax differences."65 For example, different rules for depreciation are typically used for accounting purposes compared to actual tax policy in a jurisdiction (e.g., if the lawmakers in that country decided to speed up cost recovery with the intent of increasing business investment). Thus, an exemption based on financial disclosure forms may not accurately reflect taxable income.

DSTs and Implications for U.S. Tax Policy

U.S. Foreign Tax Credits and Bilateral Tax Treaties

U.S. corporations are allowed to claim a tax credit against U.S. corporate income tax liability for income taxes paid to foreign jurisdictions.66 The rationale is to prevent double taxation of foreign-source income.

DSTs are taxes on revenue earned from specific business activities and should not be eligible for U.S. foreign tax credit treatment for several reasons. First, such taxes are not income taxes under common bilateral tax treaty language. Statements from some countries imposing DSTs, such as the UK, indicate that they do not intend DST payments to be creditable against taxes that an MNC might owe in its home country. Nor are DSTs "in lieu of income taxes," as the countries imposing DSTs do have a corporate income tax system.67

The Internal Revenue Service (IRS) could clarify that U.S. bilateral income tax treaties do not provide for a foreign tax credit against U.S. tax for U.S. corporations that make DST payments to foreign jurisdictions. If the IRS does not do so, then Congress could enact legislation denying a U.S. foreign tax credit for such payments. Denying a foreign tax credit could increase the total taxes paid by U.S. MNCs in jurisdictions around the world, but allowing DST payments to be creditable would effectively force the U.S. Treasury (and U.S. taxpayers) to subsidize tax rates imposed by foreign jurisdictions.

GILTI

Policymakers who sympathize with the premise that MNCs in the digital economy are unfairly able to shift profits to low-tax jurisdictions could still disagree with the unilateral response of foreign countries to impose DSTs. The tax on GILTI serves as an alternative policy tool intended to impose higher effective tax rates on U.S. firms in the digital economy. For example, in the 115th Congress, the No Tax Break for Outsourcing Act (H.R. 5108; S. 2459) would have increased the GILTI tax rate to 21% and eliminated the deduction for the return on tangible assets derived by domestic corporations from serving foreign markets in computing GILTI tax liability, among other provisions.68

Possible Challenges at the World Trade Organization

As discussed, above, DSTs have the same economic effects as an excise tax. It is not controversial for countries to levy excise taxes on imported as well as domestically consumed goods or services. Such taxes are considered to not distort trade. However, some DST proponents have not explicitly labeled them as "excise taxes," making it unclear how these taxes should be viewed in terms of international agreements.

Regardless of the label attached to them, some commentators argued that DSTs violate restrictions on tariffs under the rules of the World Trade Organization. For example, some scholars argue that the high-revenue thresholds for taxation and the exclusion of certain revenues earned by European firms effectively discriminate against the digital exports of U.S. firms.69

Multilateral Tax Reform Negotiations and U.S. Economic Policy

Many proponents of DSTs argue that they are "interim measures" until the international community adopts broader reforms in international tax rules. As mentioned in the discussion of the European Commission's DST proposal, the commission prefers changes, both inside and outside of the EU, in the permanent establishment rules to incorporate some measure of "digital presence." This goal aligns with the EU's goal of a consolidated tax base among its members and formulary apportionment of corporate tax revenue based on a set of factors (e.g., sales, assets, employment), which would result in a shift away from tax allocation based on assets. The form and rationale of DSTs appear to better comport with a formulary apportionment tax being pursued in the EU than a traditional national corporate income tax.70

The inability for consensus to impose a DST at the European Commission level could lead more individual member states to unilaterally impose their own DSTs. Even if the United States objects to unilateral DSTs, these sovereign countries are generally able to impose their own tax systems (within the boundaries of any other international agreements, such as EU membership).

Congress could consider creating "carrots" or "sticks" affecting the policy choices of DST proponents. Tax policy and legal scholars have debated the merits of "potential compromises" that would not require fundamental rewrites of international tax rules.71 Some of these options would rely on the executive branch for day-to-day negotiations at a bilateral or multilateral level (e.g., at the OECD). Any modification to existing or new tax treaties, though, would require Senate approval. Congress could also direct the executive branch to impose incentives (and disincentives) that would affect key sectors of the EU economy. An evaluation of these emerging ideas and concepts is, however, beyond the scope of this report.

Appendix. Technical Appendix

DSTs Are Not Structured as Taxes on Profits

Corporate profit is generally defined as:

(1) π=TR-TC

Where π is profit, TR is total revenue, and TC is total cost. This is before taxes.

After tax corporate profit, πt, for a firm after imposition of a percentage tax (t) on corporate profit, is defined as:

2 πt=(1-t)(TR-TC)

In contrast, a DST (dst) is levied as a percent of total, gross revenue yielding an after tax profit, πdst, of:

3 πdst=(1-dst)TR-TC

Algebraically, equations (2) and (3) are not equivalent. To further illustrate, the following amounts can be substituted: TR = $1,000, TC = $500, and t = 0.03 (or a 3% tax rate). Using these parameters, πt based on a 3% profit tax would be:

4 πt=(1-0.03)($1,000-$500)

5 πt=$485

Using these parameters, πdst based on a 3% DST revenue tax would be:

6 πdst=(1-0.03)$1,000-$500

7 πdst=$470

As shown above, after-tax profit for a corporation subject to a 3% income tax rate (equation 5) is greater than after-tax profit for a corporation subject to a 3% DST (equation 7) in lieu of an income tax. The two taxes are not the same.

Effects of a DST on Supply-Demand Conditions in Digital Markets

To analyze the economic effects of a DST, the different markets in which digital economy firms operate must be conceptualized. In a general sense, the consumers or buyers in these markets are those that pay money to the supplier or seller for the provision of a service. Many firms in digital economies operate in "two-sided markets" in which they provide services to two different consumers: individual users and businesses. While both sides of these markets could be relevant for calculating DST liability, the markets for the latter group of services are the starting point for analyzing the economic effects of a DST, because these business-to-business transactions are where the statutory incidence of a DST is typically first imposed. For example, in the market for internet advertisements, a clothing company could be the consumer and Google or Facebook could be the seller or supplier. In the market for marketplace sales, a vendor could be the consumer and Amazon could be the seller or supplier. In the market for user data sales, a data transfer firm could be the consumer and Facebook, Google, or Fitbit could the supplier.

From an economic perspective, there are two extremes of market structure: perfect competition and monopoly. Most market structures lie somewhere in between. Monopolies rarely exist, and they are typically regulated. For reasons explained below, there are specific reasons why monopolies are likely not to exist in the markets in which DSTs apply. However, firms could have market power if there are barriers to entry.

The following analyses examine how a DST would apply, over the long run, in the two extremes of market structure for a digital economy firm facing a downward sloping demand curve.

Analysis of a DST in a Competitive Market