LNG as a Maritime Fuel: Prospects and Policy

The combination of growing liquefied natural gas (LNG) supplies and new requirements for less polluting fuels in the maritime shipping industry has heightened interest in LNG as a maritime fuel. The use of LNG as an engine (“bunker”) fuel in shipping is also drawing attention from federal agencies and is beginning to emerge as an issue of interest in Congress.

In 2008, the International Maritime Organization (IMO) announced a timeline to reduce the maximum sulfur content in vessel fuels to 0.5% by January 1, 2020. Annex VI of the International Convention for the Prevention of Pollution from Ships requires vessels to either use fuels containing less than 0.5% sulfur or install exhaust-cleaning systems (“scrubbers”) to limit a vessel’s airborne emissions of sulfur oxides to an equivalent level. An option for vessel operators to meet the IMO 2020 standards is to install LNG-fueled engines, which emit only trace amounts of sulfur. Adopting LNG engines requires more investment than installing scrubbers, but LNG-fueled engines may offset their capital costs with operating cost advantages over conventional fuels. Savings would depend on the price spread between LNG and fuel oil. Recent trends suggest that LNG may be cheaper in the long run than conventional fuels.

LNG bunkering requires specialized infrastructure for supply, storage, and delivery to vessels. To date, the number of ports worldwide that have developed such infrastructure is limited, although growth in this area has accelerated. Early adoption of LNG bunkering is occurring in Europe where the European Union requires a core network of ports to provide LNG bunkering by 2030. LNG bunkering is also advancing in Asia, led by Singapore, the world’s largest bunkering port. Asian countries, together with Australia and the United Arab Emirates, have about 10 coastal ports offering LNG bunkering, with another 15 projects in development.

LNG bunkering in the United States currently takes place in Jacksonville, FL, and Port Fourchon, LA—with a third facility under development in Tacoma, WA. Bunkering of LNG-fueled cruise ships using barges also is planned for Port Canaveral, FL. The relative locations of other U.S. ports and operating LNG terminals suggest that LNG bunkering could be within reach of every port along the Eastern Seaboard and in the Gulf of Mexico. On the West Coast, the ports of Los Angeles and Long Beach, CA, are near the Costa Azul LNG terminal in Ensenada, MX. Seattle and Tacoma are adjacent to the proposed Tacoma LNG project. Since 2015, Jones Act coastal ship operators have taken steps to transition their fleets to use cleaner burning fuels, including LNG. Shippers of dry goods to Alaska, Hawaii, and Puerto Rico have taken delivery or have ordered LNG-fueled and LNG-capable vessels from U.S. shipyards in Philadelphia, PA, and Brownsville, TX. Another company operates five LNG-powered offshore supply vessels built in Gulfport, MS.

Depending upon LNG conversions, the global LNG bunker fuel market could grow to several billion dollars by 2030. If U.S. LNG producers were to supply a significant share of this market—on the strength of comparatively low LNG production costs—LNG bunkering could increase demand for U.S. natural gas production, transportation, and liquefaction. Opportunities in LNG-related shipbuilding might be more limited, as most shipbuilding occurs overseas, although domestically-constructed LNG bunkering barges could be one area of economic growth. Finally, engineering and construction firms could benefit from new opportunities to develop port infrastructure for LNG storage and transfer. However, while vessel conversion to LNG fuel may increase demand for U.S.-produced natural gas, it partially could be offset by reduced demand for U.S.-produced crude oil or refined products. Furthermore, while LNG can reduce direct emissions from vessels, fugitive emissions and environmental impacts from natural gas production and transportation could reduce overall emissions benefits. While the LNG industry has experienced few accidents, the Coast Guard has been developing new standards to address unique safety and security risks associated with LNG in vessel operations.

The overarching consideration about LNG bunkering in the United States is uncertainty about how the global shipping fleet will adapt to the IMO sulfur standards over time. This uncertainty complicates decisions related to both private investment and public policy. Although Congress has limited ability to influence global shipping, it could influence the growth of LNG bunkering through the tax code and regulation, or through policies affecting the LNG industry or domestic shipping industry as a whole. Evaluating the potential implications of LNG bunkering within the context of broader energy and environmental policies may become an additional consideration for Congress. If LNG bunkering expands significantly, Congress also may examine the adequacy of existing measures to ensure the safety and security of LNG vessels, storage, and related facilities.

LNG as a Maritime Fuel: Prospects and Policy

Jump to Main Text of Report

Contents

- Introduction

- IMO Emissions Standards and LNG

- U.S. Obligations Under the IMO

- Emission Control Areas

- Emissions Control Options for Ship Owners

- Low-Sulfur Fuel Oils

- Scrubbers

- LNG-Fueled Engines

- Jones Act Fleet Choosing LNG-Fueled Engines

- LNG vs. Petroleum-Based Fuel Costs

- Building an LNG-Fueled Fleet

- LNG Engines and Greenhouse Gas Emissions

- Global Developments in LNG Bunkering

- LNG Bunkering Overseas

- LNG Bunkering in the United States

- Jacksonville, FL

- Port Fourchon, LA

- Tacoma, WA

- Port Canaveral, FL

- Other U.S. Ports with Potential for LNG Bunkering

- U.S. Regulation of LNG Bunkering

- Coast Guard Port Regulations

- FERC Siting Regulations

- Other Federal Agencies

- Global Development of LNG Supply

- Domestic Considerations

- U.S. Natural Gas Producers Seek New Markets

- Safety of LNG Bunkering in Ports

- Security Risks of LNG Bunkering

- Policy Implications

- U.S. Opportunities and Challenges

- Considerations for Congress

Figures

- Figure 1. Average Monthly Henry Hub Natural Gas Spot Price

- Figure 2. Maritime Fuels Cost Comparison

- Figure 3. LNG Bunkering Options

- Figure 4. Existing LNG Import and Export Terminals in North America

- Figure 5. Global LNG Supply and Demand 2017-2030

- Figure 6. Estimated LNG Prices in Key Global Markets – October 2018

Summary

The combination of growing liquefied natural gas (LNG) supplies and new requirements for less polluting fuels in the maritime shipping industry has heightened interest in LNG as a maritime fuel. The use of LNG as an engine ("bunker") fuel in shipping is also drawing attention from federal agencies and is beginning to emerge as an issue of interest in Congress.

In 2008, the International Maritime Organization (IMO) announced a timeline to reduce the maximum sulfur content in vessel fuels to 0.5% by January 1, 2020. Annex VI of the International Convention for the Prevention of Pollution from Ships requires vessels to either use fuels containing less than 0.5% sulfur or install exhaust-cleaning systems ("scrubbers") to limit a vessel's airborne emissions of sulfur oxides to an equivalent level. An option for vessel operators to meet the IMO 2020 standards is to install LNG-fueled engines, which emit only trace amounts of sulfur. Adopting LNG engines requires more investment than installing scrubbers, but LNG-fueled engines may offset their capital costs with operating cost advantages over conventional fuels. Savings would depend on the price spread between LNG and fuel oil. Recent trends suggest that LNG may be cheaper in the long run than conventional fuels.

LNG bunkering requires specialized infrastructure for supply, storage, and delivery to vessels. To date, the number of ports worldwide that have developed such infrastructure is limited, although growth in this area has accelerated. Early adoption of LNG bunkering is occurring in Europe where the European Union requires a core network of ports to provide LNG bunkering by 2030. LNG bunkering is also advancing in Asia, led by Singapore, the world's largest bunkering port. Asian countries, together with Australia and the United Arab Emirates, have about 10 coastal ports offering LNG bunkering, with another 15 projects in development.

LNG bunkering in the United States currently takes place in Jacksonville, FL, and Port Fourchon, LA—with a third facility under development in Tacoma, WA. Bunkering of LNG-fueled cruise ships using barges also is planned for Port Canaveral, FL. The relative locations of other U.S. ports and operating LNG terminals suggest that LNG bunkering could be within reach of every port along the Eastern Seaboard and in the Gulf of Mexico. On the West Coast, the ports of Los Angeles and Long Beach, CA, are near the Costa Azul LNG terminal in Ensenada, MX. Seattle and Tacoma are adjacent to the proposed Tacoma LNG project. Since 2015, Jones Act coastal ship operators have taken steps to transition their fleets to use cleaner burning fuels, including LNG. Shippers of dry goods to Alaska, Hawaii, and Puerto Rico have taken delivery or have ordered LNG-fueled and LNG-capable vessels from U.S. shipyards in Philadelphia, PA, and Brownsville, TX. Another company operates five LNG-powered offshore supply vessels built in Gulfport, MS.

Depending upon LNG conversions, the global LNG bunker fuel market could grow to several billion dollars by 2030. If U.S. LNG producers were to supply a significant share of this market—on the strength of comparatively low LNG production costs—LNG bunkering could increase demand for U.S. natural gas production, transportation, and liquefaction. Opportunities in LNG-related shipbuilding might be more limited, as most shipbuilding occurs overseas, although domestically-constructed LNG bunkering barges could be one area of economic growth. Finally, engineering and construction firms could benefit from new opportunities to develop port infrastructure for LNG storage and transfer. However, while vessel conversion to LNG fuel may increase demand for U.S.-produced natural gas, it partially could be offset by reduced demand for U.S.-produced crude oil or refined products. Furthermore, while LNG can reduce direct emissions from vessels, fugitive emissions and environmental impacts from natural gas production and transportation could reduce overall emissions benefits. While the LNG industry has experienced few accidents, the Coast Guard has been developing new standards to address unique safety and security risks associated with LNG in vessel operations.

The overarching consideration about LNG bunkering in the United States is uncertainty about how the global shipping fleet will adapt to the IMO sulfur standards over time. This uncertainty complicates decisions related to both private investment and public policy. Although Congress has limited ability to influence global shipping, it could influence the growth of LNG bunkering through the tax code and regulation, or through policies affecting the LNG industry or domestic shipping industry as a whole. Evaluating the potential implications of LNG bunkering within the context of broader energy and environmental policies may become an additional consideration for Congress. If LNG bunkering expands significantly, Congress also may examine the adequacy of existing measures to ensure the safety and security of LNG vessels, storage, and related facilities.

Introduction

The combination of growing supplies of liquefied natural gas (LNG) and new requirements for less polluting fuels in the international maritime shipping industry has heightened interest in LNG as a maritime fuel. For decades, LNG tanker ships have been capable of burning boil-off gas from their LNG cargoes as a secondary fuel.1 However, using LNG as a primary fuel is a relatively new endeavor; the first LNG-powered vessel—a Norwegian ferry—began service in 2000.2

Several aspects of LNG use in shipping may be of congressional interest. LNG as an engine, or "bunker," fuel potentially could help the United States reduce harmful air emissions, it could create a new market for domestic natural gas, and it could create economic opportunities in domestic shipbuilding.3 However, U.S. ports would need specialized vessels and land-based infrastructure for LNG "bunkering" (vessel refueling) as well as appropriate regulatory oversight of the associated shipping and fueling operations. The storage, delivery, and use of LNG in shipping also has safety implications. These and other aspects of LNG bunkering may become legislative or oversight issues for Congress. One bill in the 115th Congress, the Waterway LNG Parity Act of 2017 (S. 505), would have imposed excise taxes on LNG used by marine vessels on inland waterways.4

This report discusses impending International Maritime Organization (IMO) standards limiting the maximum sulfur content in shipping fuels, the market conditions in which LNG may compete to become a common bunker fuel for vessel operators, and the current status of LNG bunkering globally and in the United States. A broader discussion of oil market implications is outside the scope of this report.5

IMO Emissions Standards and LNG

The IMO is the United Nations organization that negotiates standards for international shipping. Its standards limiting sulfur emissions from ships, adopted in 2008, have led vessel operators to consider alternatives to petroleum-based fuels to power their ships.

In 1973, the IMO adopted the International Convention for the Prevention of Pollution from Ships (MARPOL).6 Annex VI of the convention, which came into force in 2005, deals with air pollution from ships. The annex established limits on nitrogen oxide (NOx) emissions and set a 4.5% limit on the allowable sulfur content in vessel fuels.7 In 2008, the IMO announced a timeline to reduce the maximum sulfur content in vessel fuels from 4.5% to 0.5% by January 1, 2020. Annex VI requires vessel operators to either use fuels containing less than 0.5% sulfur or install exhaust gas-cleaning systems ("scrubbers") to limit a vessel's sulfur oxide (SOx) emissions to a level equivalent to the required sulfur limit.

U.S. Obligations Under the IMO

MARPOL is implemented in the United States through the Act to Prevent Pollution from Ships ().8 The United States effectively ratified MARPOL Annex VI in 2008 when President Bush signed the Maritime Pollution Prevention Act (P.L. 110-280).9 The act requires that the U.S. Coast Guard and the Environmental Protection Agency (EPA) jointly enforce the Annex VI emissions standards.10 MARPOL's Annex VI requirements are codified at 40 C.F.R. §1043. They apply to U.S.-flagged ships wherever located and to foreign-flagged ships operating in U.S. waters.

Emission Control Areas

In addition to its global sulfur standards, MARPOL Annex VI provides for the establishment of Emissions Control Areas (ECAs), which are waters close to coastlines where more stringent emissions controls may be imposed. The North American ECA limits the sulfur content of bunker fuel to 0.1% of total fuel weight, an even lower bar than that set by the IMO 2020 standards.11 This standard is enforced by Coast Guard and EPA in waters up to 200 miles from shore. Currently, most ships operating in the North American ECA meet the emissions requirements by switching to low-sulfur fuels once they enter ECA waters. The European Union also has an ECA with a 0.1% limit on sulfur in bunker fuels,12 and the Chinese government is considering putting the same standard in place.13

Emissions Control Options for Ship Owners

The IMO 2020 emissions requirement applies to vessels of 400 gross tons and over, which is estimated to cover about 110,000 vessels worldwide. However, analysts indicate that many of the smaller vessels in this group already burn low-sulfur fuel. Accounting for these smaller vessels, one estimate is that about 55,000 vessels currently burn high-sulfur fuel.14 Ship owners have two main options for meeting the emission requirements with existing engines: burn low-sulfur conventional fuel (or biofuels) or install scrubbers to clean their exhaust gases. Alternatively, ship owners may opt to install new LNG-fueled engines to comply with the IMO standard.

Low-Sulfur Fuel Oils

The simplest option for vessel owners to comply with the IMO sulfur standards, and the one that appears most popular, is switching to low-sulfur fuel oils or distillate fuels. Although switching to low-sulfur fuels would increase fuel costs compared to conventional, high-sulfur fuels, it would require little or no upfront capital cost and would allow ocean carriers to use existing infrastructure to bunker ships at ports. Anticipating widespread adoption of this approach, many analysts predict that the implementation of the IMO 2020 regulations will drive up demand for low-sulfur fuel and, therefore, significantly increase its price above current levels. Such a trend could also reduce demand for high-sulfur fuels, increasing the price spread between low- and high-sulfur bunkers fuels. Switching to lower-sulfur fuel could increase fuel cost across the industry by up to $60 billion in 2020 for full compliance with the IMO standards.15 Moreover, while it may allow vessels to meet the existing IMO sulfur standards, low-sulfur fuel does not necessarily support compliance with potential future IMO emissions standards, especially with respect to greenhouse gases (GHGs) such as carbon dioxide (CO2) discussed later in this report.

|

Biofuels Another option for vessel owners to comply with the IMO sulfur standards is employing biofuels as an engine fuel. Biofuels have low sulfur levels and potentially lower lifecycle carbon dioxide emissions, thus they are a technically viable solution to meeting the IMO emissions standards. However, in a 2017 overview of the shipping sector, the International Energy Agency (IEA) noted several challenges to biofuel penetration.16 First, the shipping sector has little knowledge of handling and using biofuels as part of its fuel supply. Second, a single large ship may consume 25 million gallons in a year, the annual production from a single medium-sized biofuel facility. Thus, biofuels may be more practical for small vessels in coastal waters or for use as auxiliary ultra-low sulfur fuel in ports than as a general-purpose bunker fuel. Third, only biodiesel derived from plant oil or pulping residues and bioethanol are currently produced at levels that can supply commercially significant volumes of fuel. Plant oil-based fuels are currently used for jet biofuels, and their use in shipping would lead to competition for feedstocks. Finally, the cost of biofuels is significantly higher than the cost of fossil fuels, including low-sulfur fuels, and is expected to remain so for the foreseeable future. IEA outlines several policies that may make biofuels more competitive in the shipping sector, including:

|

Scrubbers

Scrubbers are systems which remove sulfur from a vessel's engine exhaust emissions. A ship with a scrubber would be capable of meeting the IMO 2020 standard while using conventional high-sulfur fuel. Retrofitting a scrubber on an existing engine can cost several million dollars, however, before factoring in the lost revenue from taking the ship out of service for a month for the installation. Therefore, while using a scrubber will allow a ship to continue using (currently) cheaper high-sulfur fuel, it may take years to recover the initial investment. For example, one industry study estimates that, in the case of a typical tanker, a scrubber installation could cost $4.2 million with a payback time of approximately 4.8 years.17 Furthermore, scrubbers installed to capture sulfur emissions might have to be further refitted or replaced to comply with any future IMO standards for GHG emissions.

The rate of scrubber adoption could affect the financial impacts of installing them in terms of fuel costs. Scrubbers ultimately offset some or all of their initial costs because they allow vessel operators to continue using relatively inexpensive high-sulfur fuel. However, the return on investment for scrubbers depends on the relative prices of high- and low-sulfur bunker fuels. The demand—and therefore, prices—for low-sulfur and high-sulfur fuels will be affected by how many vessels use the respective fuels under the IMO standards that take effect in 2020. For example, limited scrubber adoption could result in more vessels demanding more low-sulfur fuel oil, creating upward pressure on low-sulfur fuel prices. Under such a scenario, scrubbers would provide greater fuel cost savings for vessels that installed them. Alternatively, high-sulfur fuel could become more costly due to refinery production cutbacks (because shippers will not be allowed to burn it without scrubbers).18 In this case, the economic benefits of scrubbers would be diminished.

Given the uncertain fuel supply and demand dynamics, it is difficult for vessel operators to know how big the market distortions from scrubber installation could be or how many other operators may choose to install scrubbers.19 As of September 2018, there were approximately 660 ships retrofitted with scrubbers and over 600 ships under construction with plans to install scrubbers.20 By 2020, projecting additional construction orders, some analysts predict about 2,000 vessels could have scrubbers installed.21 However, even with higher demand for the technology, the ability of vessel owners to install scrubbers is constrained; analysts estimate that current maximum capacity for installing scrubbers is be between 300 to 500 ships per year.22

LNG-Fueled Engines

Another option for ship owners to comply with the IMO 2020 sulfur standards is to switch to engines that burn LNG as a bunker fuel. LNG-fueled vessels emit only trace amounts of sulfur oxides in their exhaust gases—well below even the 0.1% fuel-equivalent threshold in some of the ECA zones—so they would be fully compliant with the IMO standards. As a secondary benefit, using LNG as an engine fuel also would reduce particulate matter (PM) emissions relative to both high- and low-sulfur marine fuel oils.23 Furthermore, LNG vessels have the potential to emit less CO2 than vessels running on conventional, petroleum-based fuels. However, LNG vessels would have the potential to result in more fugitive emissions of methane, another GHG, because methane is the primary component of natural gas, further discussed below.

Installing an LNG-fueled engine can add around $5 million to the cost of a new ship.24 Retrofitting existing ships appears to be less desirable because of the extra space required for the larger fuel tanks (new ships can be designed with the larger fuel tanks). The costs of retraining crews to work with LNG engines could also factor into a vessel operator's decision about switching to LNG. However, apart from their lower emissions, LNG-fueled engines may offset their capital costs with fuel cost advantages over engines burning petroleum-derived fuels. These savings would depend on the price spread between natural gas and fuel oil—which has been volatile in recent years. The likelihood that switching to LNG will produce long-term fuel costs savings relative to conventional fuels is, therefore, a critical consideration for many vessel owners.

Jones Act Fleet Choosing LNG-Fueled Engines

The 1920 Merchant Marine Act (known colloquially as the Jones Act) requires that vessels engaged in U.S. domestic transport be built domestically.25 Many newly built domestic ships receive a federal loan guarantee under the Maritime Administration's so-called "Title XI" program. In 2014, the program was modified to include the use of "alternative energy technologies" to power ships as part of the relevant criteria in evaluating a loan application.26 The Maritime Administration counts LNG-fueled engines as an "alternative energy technology" and may be more likely to approve loan applications for ships with LNG-capable engines.

Since the North American ECA was established in 2015, Jones Act coastal ship operators have taken steps to transition their fleets to use cleaner burning fuels, including LNG.27 The three Jones Act operators that ship dry goods to Alaska, Hawaii, and Puerto Rico have taken delivery or have ordered LNG-fueled and LNG-capable vessels from U.S. shipyards in Philadelphia, PA, and Brownsville, TX.28 Harvey Gulf International has put into service five LNG-powered offshore supply vessels that service offshore oil rigs.29 Some Jones Act tanker operators that have recently built or ordered vessels have chosen to install LNG-ready engines while other operators have chosen to install scrubbers on their existing fleet. Ship engines and scrubbers for the Jones Act fleet do not have to be manufactured in the United States because they are not considered an integral part of the hull or superstructure of a ship.30

Seagoing barges, known as articulated tug barges, are also a significant portion of the domestic coastal fleet, especially for moving liquid cargoes. However, these vessels traditionally have burned lower-sulfur fuels and thus the ECA has not prompted fleet conversions. IMO fuel requirements do not apply to river barges operating on the nation's inland waterway system, although this fleet potentially could be a market for LNG as fuel.

Bunkering vessels (small tankers with hoses for refueling ships) in U.S. waters must also be Jones Act compliant. Barges are the predominant method for bunkering ships in U.S. ports. An LNG bunkering vessel for the Port of Jacksonville—the first Jones Act-compliant LNG bunkering vessel to enter service in the United States—was built in 2017 by Conrad Shipyards in Orange, TX.31

LNG vs. Petroleum-Based Fuel Costs

Recent energy sector trends suggest that LNG may be cheaper in the long-run than petroleum-based, low-sulfur fuels. However, these price movements are correlated to some extent. Many existing long-term LNG contracts link LNG prices to oil prices (although such contract terms are on the decline), even in the spot market.

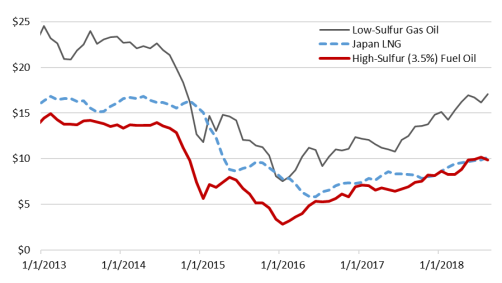

Starting in 2008, the advent of shale natural gas production dramatically decreased natural gas prices in the United States. Natural gas spot prices in the United States at the Henry Hub—the largest U.S. trading hub for natural gas—averaged around $3/MMBtu (million British Thermal Units) in 2018, about a quarter of the peak in average price a decade before, just prior to the shale gas boom (Figure 1).32

|

Figure 1. Average Monthly Henry Hub Natural Gas Spot Price Dollars per MMBtu |

|

|

Source: U.S. Energy Information Administration, "Henry Hub Natural Gas Spot Price," online database, accessed October 12, 2018, https://www.eia.gov/dnav/ng/hist/rngwhhdM.htm. Notes: MMBtu = million British thermal units |

Liquefying natural gas into LNG adds around $2/MMBtu to the production cost. Including additional producer charges and service costs would bring the total cost of LNG available at a U.S. port (based on the 2018 average price in Figure 1) to approximately $6/MMBtu.33

Shipping of LNG from the United States to Asia or Europe adds from $1 to $2/MMBtu, so, based on the 2018 average cost in Figure 1, LNG delivered to a port overseas would cost on the order of $7 to $8/MMbtu under long-term contracts, depending upon timing and location.34 Higher or lower prices could occur for specific long-term contracts and in the LNG spot market (i.e., for individual cargoes), based on the location and the supply and demand balance at the time. In general, the U.S. market will have the lowest-priced LNG. Northern Asia will have the highest LNG prices due to the region's comparative lack of pipeline gas supplies and its distance from LNG suppliers.

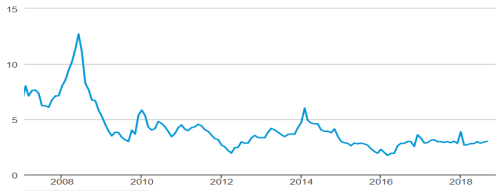

Figure 2 compares LNG spot market prices in the Japan LNG market—the highest-priced LNG market—to spot prices for two common petroleum-based bunker fuels, low-sulfur gas oil and high-sulfur fuel oil. As the figure shows, over the last five years, Japan LNG generally has been cheaper than low-sulfur fuel and more expensive than high-sulfur fuel on an energy-equivalent basis (i.e., per MMbtu). However, Japan LNG and high-sulfur fuel prices converged in 2018. As the figure shows, spot prices for LNG deliveries to the Japan market fell below $6/MMBtu in 2016 from a high above $16/MMBtu in 2013. Likewise, low-sulfur gas oil prices have doubled, and high-sulfur fuel oil prices have tripled, since 2016.

The volatility of the bunker fuel markets and the global LNG market lead to considerable unpredictability about the relative prices among fuels going forward. LNG may become increasingly price-competitive versus low-sulfur fuel as the 2020 IMO sulfur standards take effect. As discussed above, many analysts predict prices for low-sulfur gas oil, which are already higher than those for high-sulfur fuel oil, to increase significantly after 2020 due to a standards-driven rise in demand.35

Although fuel prices as shown in Figure 2 indicate favorable economics for LNG versus low-sulfur fuel, if prices for high-sulfur fuel oils collapse as some expect after the 2020 IMO regulations enter into force, it is possible that LNG could lose its price advantage over residual fuel oils. Likewise, the price spread between low-sulfur gasoil and high-sulfur fuel oil would increase, incentivizing more carriers to install scrubbers to capitalize on the savings in fuel costs by continuing to burn high-sulfur fuel. An additional complication is the variability of LNG prices by region. Many shipping lines are global operators seeking low-priced fuel worldwide, but unlike the global oil market, natural gas markets are regional. Because the price of LNG can vary significantly by region, the relative economics of LNG versus other bunker fuels would also vary by region.

Another uncertainty in the market for LNG bunkering is the discrepancy between the spot price for traded LNG and the price for LNG sold as bunker fuel in ports. Added costs associated with marketing, storing and transporting LNG in bunkering operations (discussed below) would likely require ports to charge a rate for LNG bunker fuel above spot market prices. These additional overhead costs are likely to vary among ports.

Building an LNG-Fueled Fleet

Before factoring in any effect of IMO standards on fuel prices, and assuming a favorable LNG-fuel oil price spread, it still could take years for the savings generated by using LNG to pay back the capital costs of switching fuels. Through May 2018, there were 122 LNG-powered vessels in operation and another 135 ordered or under construction.36 Many of the first LNG vessels delivered and ordered were Norwegian-flagged vessels, as the Norwegian government has subsidized LNG-fueled vessels with a "NOx Fund." The fund provides LNG-operated ships with an exemption from the country's tax on NOx emissions.37 As an alternative to committing to LNG as a fuel, some vessel owners may hedge their bets by opting to install "LNG-ready" engines, which can burn low-sulfur fuel oil currently, but are designed to make future LNG conversion easier.

The number of LNG ships that may be in operation by 2030 is difficult to predict. First, as noted above, growth in LNG powered vessels is likely to be driven primarily by new builds rather than retrofits.38 However, the shipping industry has experienced nearly a decade of vessel overcapacity and slow growth. Weak growth in the shipping industry could result in slower growth in vessel orders overall and, therefore, fewer orders for LNG-powered vessels. Of new vessels ordered, or set to be delivered, in 2018 or after, 13.5% (by tonnage) are LNG-fueled—up from 1.4% in 2010.39 If this trend continues, demand for LNG from the shipping industry could still be relatively high, even if overall growth in the shipping industry remains slow.

Because LNG bunkering infrastructure among global ports is currently limited, vessels that use large amounts of fuel and travel predictable routes—along which LNG is available—are the most suitable for LNG fuel. For this reason, cruise ships, vehicle ferries, and container ships initially may be the most likely vessel types to adopt LNG as bunker fuel. Order books have reflected this assessment: one quarter of all cruise ships on order by tonnage at the end of 2017 were LNG-powered.40 Likewise, a major container ship line, CMA CGM, recently announced that it was ordering nine extra-large container ships powered by LNG.41 The carrier stated that the fuel tanks will displace space for "just a few containers" and said it intends to refuel these ships just once on their round trip voyages between Asia and Europe.42

Conversely, LNG fuel adoption may be less likely for oil tankers. Half the global oil tanker fleet operates on the shipping spot market (also known as the "tramp" market), meaning that ship owners enter into contracts with cargo owners only for a single voyage.43 In this kind of trade, many oil tankers lack a consistent route. Having to limit spot contracts only to ports that may bunker LNG could reduce the arbitrage opportunities of tankers. Dry bulk cargo vessels (carrying grain, coal, and other commodities) also typically operate in the tramp market.

LNG Engines and Greenhouse Gas Emissions

LNG-powered vessels have lower direct exhaust emissions than comparable vessels using petroleum-derived fuels. However, the lifecycle—or "well-to-wake"—GHG emissions (especially of methane) and of volatile organic compound emissions from natural gas production, transportation, and liquefaction complicates the comparison.44 One study in 2015 concluded, "performing a ['well-to-wake'] GHG study on LNG used as a marine fuel is more complex than previously thought. Further studies are needed ... to investigate this subject."45 A 2016 study found that the relative GHG emissions benefits of LNG versus conventional fuel oil on a "well-to-wake" basis was highly dependent upon fugitive methane emissions in the LNG supply chain.46 A 2017 study funded by NGVA Europe, an association which promotes the use of natural gas in vehicles and ships, concluded that LNG as a bunker fuel provides a 21% well-to-wake reduction in GHG emissions compared to convention fuel oil.47 Evaluating such studies is beyond the scope of this report, although they indicate uncertainty about environmental benefits of LNG fuel, which may require further examination.

Despite concerns over lifecycle emissions from the natural gas supply chain, in the short term, ships that pair LNG engines with newer vessel designs could reduce onboard GHG emissions. However, whether these GHG emission reductions would be sufficient to meet the future standards could become another issue for ship owners. The IMO has set a provisional goal of reducing GHG emissions from ships by 50% by 2050.48 Depending upon the state of engine technology, LNG-fueled ships might become less viable if GHG limits were to be established well before 2050. Concerns about such GHG limits might lead to a decrease in orders of LNG-powered ships over time. Commercial vessels have a typical lifespan of over 20 years, so firms ordering new ships have to take into account compliance with potential standards issued decades in the future. If renewable fuels, such as biodiesel, become more available and cheaper in the coming decades, renewable fuel-powered ships may take over part of the market that LNG-powered ships could occupy.

Global Developments in LNG Bunkering

A key requirement for ocean carriers to adopt LNG as an engine fuel is the availability of LNG bunkering facilities. Because LNG is extremely cold (-260 °F) and volatile, LNG bunkering requires specialized infrastructure for supply, storage, and fuel delivery to vessels. Depending upon the specific circumstances, LNG bunkering could require transporting LNG to a port from an offsite liquefaction facility for temporary storage at the port, or building an LNG liquefaction terminal on site. Alternatively, LNG could be delivered from offsite facilities directly to vessels in port via truck or supply vessel (Figure 3). Truck-to-vessel LNG bunkering, in particular, provides some fueling capabilities without large upfront capital investments. LNG tanker trucks could also bring LNG to a storage tank built on site at the port, which could then bunker the LNG to arriving ships via pipeline. Supplying LNG using tanker trucks in this way may face capacity limitations due to truck size, road limitations, or other logistical constraints, but it has been demonstrated as a viable approach to LNG bunkering at smaller scales. The predominant method of bunkering today with high-sulfur fuel is vessel to vessel, either by a tank barge or smaller tanker.

|

|

Source: Adapted from: Danielle Holden, Liquefied Natural Gas (LNG) Bunkering Study, DNV GL, No. PP087423-4, Rev. 3, prepared for the U.S. Maritime Administration, September 3, 2014, pp. 15-17. |

The type of infrastructure needed to temporarily store (if needed) and deliver LNG within a given port would depend on the size and location of the port, as well as the types of vessels expected to bunker LNG. Truck to ship bunkering is best suited for supporting smaller and mid-sized vessels, such as ferries or offshore supply vessels (OSVs) that support offshore oil platforms. Liquefaction facilities built on site can provide the greatest capacity of any LNG bunkering option, for example, to provide fuel for large vessels in transoceanic trade. However, constructing small-scale liquefaction facilities to produce and deliver LNG on site requires considerable planning and significant capital investment, in one case on the order of $70 million for a mid-sized port.49

Each LNG bunkering option in Figure 3 may be a viable means to begin LNG bunkering service in a given port. However, ports may face practical constraints as bunkering increases in scale. For example, a container port of significant size typically has multiple terminals, so even with an on-site liquefaction facility, it may need additional infrastructure or supply vessels for moving LNG to other port locations where a cargo ship might be berthed. There may also be port capacity and timing constraints upon the movement of LNG bunkering barges trying to refuel multiple large vessels in various locations around a crowded port. To date, the LNG bunkering operations already in place or in development are comparatively small, but scale constraints could become a factor as LNG bunkering grows and might require additional bunkering-related port investments.

LNG Bunkering Overseas

Early adoption of LNG bunkering occurred in Europe, where the first sulfur ECAs were created in 2006 and 2007. Through Directive 2014/94/EU, the European Union requires that a core network of marine ports be able to provide LNG bunkering by December 2025 and that a core network of inland ports provide LNG bunkering by 2030.50 This mandate has been promoted, in part, with European Commission funds to support LNG bunkering infrastructure development.51 In addition, the European Maritime Safety Agency published regulatory guidance for LNG bunkering in 2018.52 Over 40 European coastal ports have LNG bunkering capability currently in operation—primarily at locations on the North Sea and the Baltic Sea, and in Spain, France, and Turkey. These locations include major port cities such as Rotterdam, Barcelona, Marseilles, and London. Another 50 LNG bunkering facilities at European ports are in development.53

LNG bunkering is also advancing in Asia, led by Singapore, the world's largest bunkering port. Singapore has agreed to provide $4.5 million to subsidize the construction of two LNG bunkering vessels.54 The Port of Singapore plans to source imported LNG at the adjacent Jurong Island LNG terminal, loading it into the bunkering vessels for ship-to-ship fueling of vessels in port. Singapore also has signed a memorandum of understanding with 10 other partners—including a Japanese Ministry and the Chinese Port of Ningbo-Zhoushan—to create a focus group aimed at promoting the adoption of LNG bunkering at ports around the world.55 In Japan, one consortium is implementing plans to begin vessel-to-vessel LNG bunkering at the Port of Keihin in Tokyo Bay by 2020.56 Japan's NYK line, a large ship owner, recently announced that it had reached an agreement with three Japanese utilities to add LNG bunkering to ports in Western Japan.57 Asian countries, together with Australia and the United Arab Emirates, currently have around 10 coastal ports offering LNG bunkering, with another 15 projects in development.58

Some LNG bunkering operations in Europe and Asia are associated with existing LNG marine terminals, which already have LNG storage and port infrastructure in place. However, many smaller operations—including most of the projects in development—employ trucking, dedicated bunkering vessels, on-site liquefaction, and other means to extend LNG availability beyond the ports with major LNG terminals. LNG bunkering is not so advanced in South America, although with nine operating LNG marine terminals (one for export), and another six in development, South America also could support significant LNG bunkering operations in the near future.59

LNG Bunkering in the United States

LNG bunkering in the United States currently takes place in two locations—Jacksonville, FL, and Port Fourchon, LA—with a third bunkering facility under development in Tacoma, WA. The LNG facilities in these ports serve the relatively small U.S.-flag domestic market. Bunkering of LNG-fueled cruise ships also is planned for Port Canaveral, FL. However, ports in North America have significant potential to expand the nation's LNG bunkering capability.

Jacksonville, FL

Jacksonville is the largest LNG bunkering operation at a U.S. port. One bunkering facility at the port, developed by JAX LNG, initially began truck-to-ship refueling operations in 2016 for two LNG-capable container ships. (The LNG is sourced from a liquefaction plant in Macon, GA.60) In August 2018, upon delivery of the Clean Jacksonville bunker barge, the facility began to replace truck-to-ship bunkering with ship-to-ship bunkering.61 In the future, the barge plans to source LNG from a new, small-scale liquefaction plant which JAX LNG is currently constructing at the port.62 A second facility at Jacksonville's port, operated by Eagle LNG, provides LNG bunkering sourced from a liquefaction plant in West Jacksonville.63 Eagle LNG also is constructing an on-site liquefaction and vessel bunkering facility in another part of the port, expected to begin service in 2019.64 Taken together, the JAX LNG and Eagle LNG facilities is expected to establish Jacksonville as a significant LNG-bunkering location with the capability to serve not only the domestic fleet but larger international vessels as well.

Port Fourchon, LA

In 2015, Harvey Gulf International Marine (Harvey) began LNG bunkering operations in the Gulf of Mexico to fuel its small fleet of LNG-powered offshore supply vessels serving offshore oil rigs.65 Harvey has since constructed a $25 million facility at its existing terminal in Port Fourchon to store and bunker LNG sourced from liquefaction plants in Alabama and Texas. The facility can provide truck-to-ship bunkering services for LNG-fueled offshore supply vessels, tank barges, and other vessels.66 A Harvey subsidiary has ordered two LNG bunkering barges to enable ship-to-ship fueling in the future.67

Tacoma, WA

Puget Sound Energy has proposed an LNG liquefaction and bunkering facility at the Port of Tacoma, WA. Vessels traveling between Washington and Alaska typically spend the entire journey within the 200-mile North America ECA. Consequently, vessel owners operating along these routes have been interested in LNG as bunker fuel. TOTE Maritime, for example, a ship owner involved in trade between Alaska and the lower 48 states, has begun the process of retrofitting the engines of two of its container ships to be LNG-compatible.68

The proposed Tacoma LNG facility would be capable of producing up to 500,000 gallons of LNG per day and would include an 8 million gallon storage tank. The facility would serve the dual purposes of providing fuel for LNG-powered vessels and providing peak-period natural gas supplies for the local gas utility system.69 Its total construction cost reportedly is expected to be $310 million.70 Community and environmental concerns have slowed the progress of the proposal, which is still under regulatory review.71 Puget Sound Energy originally planned to put the LNG facility into service in late 2019; however, permitting issues appear likely to delay its opening until 2020 or later—if it is eventually approved.72

Port Canaveral, FL

Q-LNG Transport, a company 30% owned by Harvey, has placed orders for two LNG bunkering barges to provide ship-to-ship LNG fueling as well as "ship-to-shore transfers to small scale marine distribution infrastructure in the U.S. Gulf of Mexico and abroad."73 Q-LNG's first barge initially is expected to provide fuel to new LNG-fueled cruise ships based in Port Canaveral (and, potentially, Miami), while service from its second barge is still uncommitted.74 Initial plans are for the LNG to be sourced from the Elba Island LNG import/export terminal near Savannah, GA—approximately 230 nautical miles away—although the company may seek to develop an on-site LNG storage facility in the future.75

Other U.S. Ports with Potential for LNG Bunkering

As noted above, U.S. LNG bunkering activities thus far have been limited to a handful of vessels in domestic trade and tourism. LNG bunkering for the much larger fleet of foreign-flag ships carrying U.S. imports and exports is still to be developed. As in Europe and Asia, domestic ports located near major LNG import or export terminals may serve as anchors for expanded LNG bunkering operations. Figure 4 shows existing LNG import and export terminals in North America. LNG can be liquefied from pipeline natural gas (or imported natural gas) and stored in large quantities at these facilities. The LNG can then be bunkered on site or transported to bunkering facilities elsewhere in the region by truck, rail, or barge.

|

Figure 4. Existing LNG Import and Export Terminals in North America |

|

|

Source: Federal Energy Regulatory Commission, "North American LNG Import/Export Terminals: Existing," October 23, 2018, https://www.ferc.gov/industries/gas/indus-act/lng/lng-existing.pdf. Note: Two additional LNG import terminals in southern Mexico are not shown. |

As discussed above, the distance between Port Canaveral and Elba Island in Q-LNG's bunker sourcing plan is 230 nautical miles. Taking this distance as a measure of how far away LNG can be sourced and barged economically, it is possible to extrapolate which U.S. ports are within reach of a potential supply of LNG for vessel bunkering. Table 1 lists the top 20 U.S. container shipment ports in the United States and their proximity to existing LNG import/export terminals. Of these top 20 ports, 12 are less than 230 nautical miles from an operating LNG terminal. Distances between LNG terminals and the other East Coast ports are not much greater, suggesting that LNG for vessel bunkering could be within reach of every U.S. port along the Eastern Seaboard and in the Gulf of Mexico.

|

U.S. Customs Port |

Total Trade (TEUs) |

Closest LNG |

Distance to LNG Terminal (nautical miles) |

|

Los Angeles, CA |

6,189,161 |

Ensenada, MX |

145 |

|

Long Beach, CA |

5,009,490 |

Ensenada, MX |

140 |

|

New York, NY |

4,767,279 |

Cove Point, MD |

330 |

|

Savannah, GA |

3,162,898 |

Savannah, GA |

In port |

|

Norfolk, VA |

2,189,485 |

Cove Point, MD |

100 |

|

Houston, TX |

2,018,254 |

Freeport, TX |

75 |

|

Charleston, SC |

1,725,784 |

Savannah, GA |

80 |

|

Oakland, CA |

1,666,100 |

Ensenada, MX |

490 |

|

Tacoma, WA |

1,278,298 |

Ensenada, MX |

1,290 |

|

Seattle, WA |

987,151 |

Ensenada, MX |

1,280 |

|

Jacksonville, FL |

817,242 |

Jacksonville, FL |

In port |

|

Port Everglades, FL |

791,849 |

Jacksonville, FL |

280 |

|

Miami, FL |

768,028 |

Jacksonville, FL |

310 |

|

Baltimore, MD |

702,897 |

Cove Point, MD |

60 |

|

New Orleans, LA |

406,439 |

Pascagoula, MS |

80 |

|

Philadelphia, PA |

362,811 |

Cove Point, MD |

290 |

|

Mobile, AL |

250,575 |

Pascagoula, MS |

60 |

|

San Juan, PR |

212,583 |

Peñuelas, PR |

115 |

|

Boston, MA |

211,193 |

Everett, MA |

In port |

|

Wilmington, DE |

197,089 |

Cove Point, MA |

270 |

Sources: Maritime Administration, "U.S. Waterborne Foreign Container Trade by U.S. Customs Ports 2000–2017," spreadsheet, 2018, https://www.maritime.dot.gov/data-reports/data-statistics/us-waterborne-foreign-container-trade-us-customs-ports-2000-%E2%80%93-2017; Google Maps; Sea-Seek—Google Maps Distance Calculator, https://www.sea-seek.com/tools/tools.php.

Notes: TEU = twenty-foot equivalent unit. These figures include only loaded containers and empty containers that involve a freight charge. Mileage figures are approximate.

On the West Coast, the ports of Los Angeles and Long Beach—the two largest U.S. ports—are relatively close to the Costa Azul LNG import terminal in Ensenada, MX. Seattle and Tacoma are far from Ensenada, but would be served by the proposed Tacoma LNG bunkering project, if constructed. LNG bunkering for Seattle and Tacoma alternatively could be sourced from an existing LNG port facility around 100 nautical miles north in Vancouver, BC, which is expanding to provide LNG bunkering services to international carriers.76 Alaska's existing LNG export terminal currently is inactive, but potentially could supply LNG bunker fuel in the Pacific Northwest as well.77Although existing LNG import or export terminals in North America could supply LNG for regional bunkering operations, such activities would require additional investment for infrastructure such as LNG transfer facilities and bunker barges. CRS is not aware of any public announcements among the LNG terminals above to develop bunkering operations. However, at least one LNG terminal owner, Cheniere Energy, which operates LNG terminals in Louisiana and Texas, identifies vessel bunkering as one source of future LNG demand growth worldwide.78

U.S. Regulation of LNG Bunkering

The IMO adopted safety standards for ships using natural gas as a bunker fuel in 2015.79 The standards, which took effect in 2017, apply to all new ships and conversions of ships (except LNG tankers, which have their own standards).80 The IMO standards address engine design, LNG storage tanks, distribution systems, and electrical systems. They also establish new training requirements for crews handling LNG and other low flashpoint fuels.81 As is the case for the sulfur standards, the IMO LNG safety standards apply to all IMO member nations, including the United States. In addition, a number of U.S. federal agencies, especially the Coast Guard and the Federal Energy Regulatory Commission, have jurisdiction over specific aspects of domestic LNG storage infrastructure and bunkering operations.

Coast Guard Port Regulations

The Coast Guard has the most prominent role in LNG bunkering, given its general authority over port operations and waterborne shipping. In 2015, the Coast Guard issued two guidelines for the handling of LNG fuel and for waterfront facilities conducting bunkering operations.82 In 2017, the Coast Guard issued additional guidelines to Captains of the Port, the local Coast Guard officials responsible for port areas, for conducting safe LNG bunkering simultaneously with other port operations. The guidelines advise on quantitative risk assessment of facilities bunkering LNG, which allows Captains of the Port to assess the risks posed to crews and facilities.

FERC Siting Regulations

The Federal Energy Regulatory Commission (FERC) plays a role in LNG bunkering due to its jurisdiction over the siting of LNG import and export terminals under the Natural Gas Act of 1938.83 Specifically, FERC asserts approval authority over the place of entry and exit, siting, construction, and operation of new LNG terminals as well as modifications or extensions of existing LNG terminals.84 Notwithstanding this siting authority, FERC reportedly does not intend to assert jurisdiction over the permitting of LNG bunkering facilities, but it may require amendment of permits it has issued for LNG import or export terminals to account for bunkering operations added afterwards.85

Other Federal Agencies

In addition to the Coast Guard and FERC, other federal agencies may have jurisdiction over specific aspects of LNG bunkering operations in U.S. ports under a range of statutory authorities. For example, the Pipeline and Hazardous Materials Safety Administration within the Department of Transportation regulates the safety of natural gas pipelines and certain associated LNG storage facilities (e.g., peak-shaving plants).86 LNG facilities also may need to comply with the Occupational Safety and Health Administration's regulations for Process Safety Management of Highly Hazardous Chemicals.87 Other federal agencies, including the Environmental Protection Agency, the U.S. Army Corps of Engineers, and the Transportation Security Administration, may regulate other aspects of LNG bunkering projects.88 CRS is not aware of new regulations to date among these agencies specifically addressing LNG bunkering.

Global Development of LNG Supply

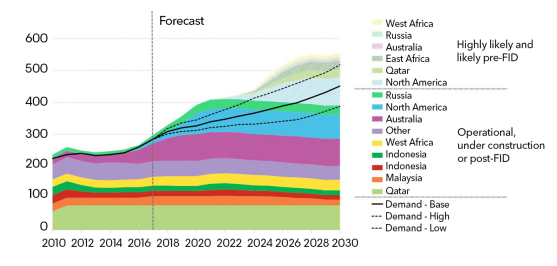

World production of LNG has been rising rapidly over the last few years, driven by growth in the natural gas sector in new regions—especially Australia and the United States. According to one industry analysis (Figure 5), global LNG supply is expected to increase from 300 to 400 million metric tons per annum (MMtpa) from 2017 to 2021 based on new LNG liquefaction projects already operating or under development.89 An additional 150 MMtpa appears likely to come online after that. Collectively, LNG supply from these new liquefaction projects could exceed projections of demand, which would put downward pressure on LNG prices. While increases in the global supply of LNG do not necessarily translate directly into an increase in LNG available for bunkering, such increases could provide options for LNG bunkering in more ports.

|

Figure 5. Global LNG Supply and Demand 2017-2030 Million Metric Tons Per Annum (MMtpa) |

|

|

Source: Courtesy of BloombergNEF, "Asia to Dominate Long-Term LNG Demand Growth," September 12, 2018, https://about.bnef.com/blog/asia-dominate-long-term-lng-demand-growth/. The use of this content was authorized in advance. Note: FID = Final Investment Decision. |

Estimating potential demand for LNG in the maritime sector is complicated and uncertain. One study of future LNG demand for bunkering, specifically, projects that LNG-powered vessels in operation and under construction as of June 2018 will require between 1.2 and 3.0 MMt of LNG per year. The study's review of several LNG consumption forecasts in the maritime sector shows a consensus projection between 20 to 30 MMt per year by 2030.90 This level of demand growth implies an increase in LNG-powered vessel construction from the current rate of around 120 ships per year to between 400 and 600 new builds per year.

If these levels were reached, they could create a significant new market for LNG suppliers. Assuming a Henry Hub spot market price of $4/MMBtu in 2030, the annual market for LNG in shipping could be worth $2.9 billion to $5.8 billion, before accounting for liquefaction and transportation charges. Some studies have projected the LNG bunkering market to be even larger and to grow more quickly.91 However, key variables—such as the prices of Henry Hub natural gas and crude oil, the number of new vessel orders, and the future costs of emissions technology—are notoriously hard to predict with accuracy. Thus, it is not assured that natural gas consumption in the maritime sector will absorb more than a small amount of the global liquefaction capacity in development.

Domestic Considerations

The IMO sulfur standards apply to ship owners globally, as does the development of new LNG supply and bunkering infrastructure. In addition to these factors, domestic LNG bunkering also may be influenced by considerations more specific to the United States. These considerations include growth of the U.S. natural gas supply, domestic shipbuilding opportunities, and LNG safety and security.

U.S. Natural Gas Producers Seek New Markets

Because of its leading role in global natural gas production, the United States has a particular interest in any new source of natural gas demand. According to the Energy Information Administration, the United States has been the world's top producer of natural gas since 2009, when it surpassed Russia.92 In 2017, increases in production outstripped increases in domestic gas consumption, leading to the United States becoming a net exporter of natural gas for the first time in nearly 60 years.93

As discussed above, North America (primarily the United States) is expected to add the most new LNG production capacity through 2030 when including projects that are operating, under construction, and likely (according to investment analysts). Past increases in U.S. LNG exports were driven by greater throughput at the Sabine Pass LNG export terminal—the only operating U.S. LNG export terminal in 2017. In March 2018, the Cove Point terminal in Maryland became the second operating U.S. LNG export terminal. Four additional projects under construction or commissioning are set to nearly triple U.S. liquefaction by the end of 2019.94 This increase in liquefaction capacity likely will motivate LNG producers to secure new buyers.

Figure 6 shows estimated LNG prices for various locations around the world as of October 2018. As the figure shows, LNG prices are substantially lower in North America than in Asia, Europe, and South America. Even after adding $1.00 to $2.00/MMBtu to transport the LNG to overseas ports, LNG produced in the United States is globally competitive at these prices. If LNG from the new liquefaction capacity coming online can be produced and delivered with similar economics, the cost advantage may create an opportunity for U.S. LNG in bunker supply. There are over 400 petroleum fuel bunkering ports in the world, but 60% of bunkering in recent years has happened in six countries: Singapore, the United States, China, the United Arab Emirates, South Korea, and the Netherlands.95 Of these countries, only the United States is a significant LNG producer. Therefore, the United States could be a favorable source of LNG for domestic bunkering and for bunkering at the other major ports.

Safety of LNG Bunkering in Ports

While the LNG industry historically has had a good safety record, there are unique safety risks associated with LNG in vessel operations. Leakage of LNG during LNG shipping or bunkering can pose several hazards. LNG is stored at temperatures below -162 °C (-260 °F), far below the -20°C at which the carbon steels typically used in shipbuilding become brittle.96 Consequently, extreme care must be taken to ensure that LNG does not drip or spill onto ship hulls or decking because it could lead to brittle fracture, seriously damaging a ship or bunkering barge.

LNG spilled onto water can pose a more serious hazard as it will rapidly and continuously vaporize into natural gas, which could ignite. The resulting "pool fire" would spread as the LNG spill expands away from its source and continues evaporating. A pool fire is intense, far hotter and burning far more rapidly than oil or gasoline fires, and it cannot be extinguished; all the LNG must be consumed before it goes out. Because an LNG pool fire is so hot, its thermal radiation may injure people and damage vessels or property a considerable distance from the fire itself. Many experts agree that a large pool fire, especially on water, is the most serious LNG hazard.97 Leaks of boil-off gas (the small amount of LNG that vaporizes in storage) can also release natural gas into a port area and cause fires or explosions. Major releases of LNG from large LNG carriers would be most dangerous within 500 meters of the spill and would pose some risk at distances up to 1,600 meters from the spill.98 While a bunkering barge or a vessel using LNG for fuel contains far less LNG than large LNG carriers, LNG spills in bunkering operations could still be a significant concern.

Risks associated with bunkering LNG are complicated in ports seeking to engage in "simultaneous operations" during the bunkering process. Simultaneous operations entail loading and unloading cargo and personnel from a ship, maintenance, and other logistical operations performed while a ship is bunkering. Accidents that occur during such operations (for example, the operation of heavy machinery near pipes transporting LNG) can result in a spill of LNG which can threaten workers positioned near the site of operations.

Security Risks of LNG Bunkering

LNG tankers, bunkering vessels, and land-based facilities could be vulnerable to terrorism. Bunkering tanks or vessels might be physically attacked to destroy the LNG they hold—and vessels might be commandeered for use as weapons against port or coastal targets. Potential terrorist attacks on LNG terminals or tankers in the United States have long been a key concern of the public and policymakers in the context of large scale LNG imports or exports because such attacks could cause catastrophic fires in ports and nearby populated areas. For example, a 2007 report by the Government Accountability Office stated that, "the ship-based supply chain for energy commodities," specifically including LNG, "remains threatened and vulnerable, and appropriate security throughout the chain is essential to ensure safe and efficient delivery."99 Affected communities and federal officials continue to express concern about the security risks of LNG.100 The potential risks from terrorism to LNG bunkering infrastructure may be different than those of larger LNG import or export operations due to smaller quantities of LNG involved, but the risks may become more widespread if LNG bunkering operations are established in more locations.

The Maritime Transportation Security Act (MTSA, P.L. 107-295) and the International Ship and Port Facility Security Code give the Coast Guard far-ranging authority over the security of hazardous materials in maritime shipping. The Coast Guard has developed port security plans addressing how to deploy federal, state, and local resources to prevent terrorist attacks. Under the MTSA, the Coast Guard has assessed the overall vulnerability of marine vessels, their potential to transport terrorists or terror materials, and their use as potential weapons. The Coast Guard has employed these assessments to augment port security as necessary and to develop maritime security standards for LNG port facilities.101

Policy Implications

The IMO's overall framework for controlling vessels emissions (MARPOL Annex VI) has been in place since 2005. While the United States, as an IMO member, is subject to the IMO's 2020 sulfur standards, the international standards apply equally to all parties and all vessels. The impacts of sulfur standards on bunker fuel have been an important consideration, but IMO member nations have agreed to the standards independent of any particular energy policies. Moreover, MARPOL Annex VI preceded the U.S. shale gas boom, so commitment to that initial IMO framework could not have anticipated United States' current role as a dominant energy producer. Any changes within the international shipping fleet to install sulfur scrubbers, fuel engines with LNG, or switch to other low sulfur fuels, are being driven primarily by market forces in fuel supply, shipbuilding, and shipping—not by any particular push to favor one fuel over another. Nonetheless, given its particular status, the question arises whether the standards may create an economic opportunity for the United States, in energy or otherwise. More specifically, could international adoption of LNG as a bunker fuel create an important new market for U.S. natural gas producers, shipbuilders, or infrastructure developers?

U.S. Opportunities and Challenges

As discussed above, depending upon the adoption of LNG bunkering in the global fleet, the LNG bunker fuel market could grow to several billion dollars by 2030. If U.S. LNG producers were to supply a significant share of this market—on the strength of comparatively low LNG production costs—LNG bunkering could increase demand for U.S. natural gas production, transportation, and liquefaction. Opportunities in LNG-related shipbuilding might be more limited, as most of this occurs overseas, with the exception of Jones Act vessels. In the latter case, demand for domestically-constructed LNG bunkering barges could be one significant area of economic growth. Engineering and construction firms could benefit from new opportunities to develop new port infrastructure for LNG storage and transfer. While likely limited in number, such port facilities could be complex, high value projects costing tens or hundreds of millions of dollars to complete. Such projects could create jobs in engineering, construction, and operation, which could be important to local communities.

Although LNG bunkering could present the United States with new economic opportunities, it may pose challenges as well. Rising demand for LNG in the maritime sector could increase natural gas prices for domestic consumers. In addition to being the world's largest natural gas producer, as of 2018, the United States is also the world's largest producer of crude oil and the second largest bunkering hub.102 Consequently, while vessel conversion to LNG bunkering may increase demand for U.S.-produced natural gas, it could be partially offset by reduced demand for U.S.-produced crude oil or refined products. Exactly how changing demand in one sector could affect the other is unclear. Furthermore, while LNG can reduce pollutant emissions from vessels, emissions and environmental impacts from increased natural gas production and transportation could increase overall emissions. Much of the net environmental impact depends upon practices in the natural gas industry, which are the subject of ongoing study and debate. Although new LNG bunkering infrastructure can create jobs, as the Tacoma LNG projects shows, the construction of such port facilities can be controversial for reasons of safety, security, and environmental impact.

Overarching the considerations above is uncertainty about how the global shipping fleet will adapt to the IMO sulfur standards over time. This uncertainty complicates decisions related to both private investment and public policy. LNG-fueled ships still account for only a fraction of the U.S. and global fleets, and it may take several decades for significant benefits of LNG-powered vessels to be realized. It is also possible that alternative ship fuels, including biofuels, electric engines, and hybrid engines, will become more economically viable in coming years. Given the uncertainty surrounding the future of LNG as a ship fuel, it is hard to predict the potential benefits or costs that LNG bunkering may provide to the United States.

Considerations for Congress

Until now, the private sector has added LNG-fueled vessels to fleets in the United States in a piecemeal manner under existing federal statutes and regulation. Congress could encourage the growth of LNG bunkering by various means, such as providing tax incentives to support the construction of LNG bunkering facilities and vessels, addressing any statutory or regulatory barriers to bunkering facility siting or operations, and providing funding for technical support to domestic carriers seeking to adopt LNG technology. Alternatively, Congress could seek to encourage competing bunker fuel options, such as biofuels, by incentivizing them in similar ways. In addition, Congress could also affect growth in LNG bunkering through policies affecting the LNG industry or domestic shipping industry as a whole. Changes in federal regulation related to natural gas production, or changes to the Jones Act, for example, while not directed at LNG bunkering, could nonetheless affect its economics. Therefore, evaluating the potential implications on LNG bunkering of broader energy, environmental, or economic objectives may become an additional consideration in congressional oversight and legislative initiatives. If LNG bunkering expands significantly in U.S. ports, Congress also may examine the adequacy of existing measures to ensure the safety and security of LNG vessels, storage, and related facilities.

Author Contact Information

Acknowledgments

Summer Research Assistant Joseph Schnide significantly contributed to the research, analysis, and drafting of this report.

Footnotes

| 1. |

Boil-off gas is LNG that regasifies during storage and transportation. LNG is stored at atmospheric pressure at temperatures of -162 °C (-260 °F). Boil-off gas is allowed to escape in order to prevent the pressure in the tank from rising. LNG tankers still use high-sulfur fuel oil as their primary fuel. LNG tankers that burn boil-off gas as a secondary fuel are equipped with dual-fuel engines, which allow them to use both fuel oil and LNG. |

| 2. |

DNV GL, Highlight Projects in the LNG as Fuel History, fact sheet, 2016, https://www.dnvgl.com/Images/LNG%20as%20fuel%20highlight%20projects_new_tcm8-6116.pdf. |

| 3. |

"Bunkers" are a ship's engine fuel tanks (as distinguished from storage tanks holding liquid cargo). |

| 4. |

The bill sought to amend the Internal Revenue Code of 1986 to provide for an energy equivalent of a gallon of diesel in the case of LNG for purposes of the Inland Waterways Trust Fund financing rate. Barge carriers using the inland waterways system contribute to its funding via payment of a cents-per-gallon fuel tax. |

| 5. |

For discussion of broader maritime fuel market issues under the new IMO standards, see CRS In Focus IF10945, Maritime Fuel Regulations, by Robert Pirog. |

| 6. |

"MARPOL" is short for "marine pollution." |

| 7. |

International Maritime Organization, "Prevention of Air Pollution from Ships: MARPOL Annex VI—Proposal to Initiate a Revision Process," MEPC 53/4/4, April 15, 2005, p. 2, https://www.epa.gov/sites/production/files/2016-09/documents/marpol-propose-revision-4-05.pdf. |

| 8. |

33 U.S.C. §§1901-19012. |

| 9. |

The White House, Office of the Press Secretary, "President Bush Signs H.R. 802 and H.R. 3891 into Law," press release, July 21, 2008, https://georgewbush-whitehouse.archives.gov/news/releases/2008/07/20080721-7.html. |

| 10. |

Bunkerspot, "United States: MARPOL Annex VI Ratified," 2008, https://www.bunkerspot.com/latest-news/27972-old-bs-9159. |

| 11. |

International Maritime Organization, "Information on North American Emission Control Area (ECA) Under MARPOL Annex VI," MEPC. 1/Circ. 723, May 13, 2010. |

| 12. |

European Maritime Safety Agency, "Sulphur Directive," web page, accessed October 1, 2018, http://www.emsa.europa.eu/main/air-pollution/sulphur-directive.html. |

| 13. |

International Bunker Industry Association, "China Announces New Emission Control Areas (ECAs)," December 30, 2015, http://ibia.net/china-announce-new-emission-control-areas-ecas/. |

| 14. |

Hedi Grati, "Bunker Fuel in 2020," IHS Markit, web article, November 7, 2017, https://ihsmarkit.com/research-analysis/imo.html. |

| 15. |

Jack Jordan and Paul Hickin, "Tackling 2020: The Impact of the IMO and How Shipowners Can Deal with Tighter Sulfur Limits," Platts, May 2017, p. 3. |

| 16. |

International Energy Agency, "Biofuels for the Marine Shipping Sector: An Overview and Analysis of Sector Infrastructure, Fuel Technologies and Regulations," IEA Bioenergy, 2017, https://www.ieabioenergy.com/publications/biofuels-for-the-marine-shipping-sector/. |

| 17. |

Jack Jordan and Paul Hickin, "Tackling 2020: The Impact of the IMO and How Shipowners can Deal with Tighter Sulfur Limits," Platts, May 2017, p. 5. |

| 18. |

Eugene A. Van Rynbach, Karl E. Briers, and Nicholas J. DelGatto, Analysis of Fuel Alternatives for Commercial Ships in the ECA Era, Revision 6, Herbert Engineering Corp., March 5, 2018, p. 5. |

| 19. |

Martyn Lasek, "What Does IMO's 0.50% Sulphur Cap Decision Mean for the Bunker Supply Chain?," Ship and Bunker, April 28, 2017. |

| 20. |

Marine Log, "Decision Time," November 2018, p. 30. |

| 21. |

Libby George and Ahmad Ghaddar, "Shipping's 2020 Low Sulphur Fuel Rules Explained," Reuters, May 17, 2018. |

| 22. |

Ibid. |

| 23. |

Heather Thomson, James J. Corbett, and James J. Winebrake, "Natural Gas as a Marine Fuel," Energy Policy, Vol. 87, 2015, p. 154. |

| 24. |

Reuters, "New Fuel Rules Push Shipowners to Go Green with LNG," August 15, 2018. |

| 25. |

For further discussion of the Jones Act, see CRS Report R44831, Revitalizing Coastal Shipping for Domestic Commerce, by John Frittelli. |

| 26. |

U.S. Maritime Administration, Title XI Maritime Guaranteed Loan Program: Proposed Policy: Other Relevant Criteria for Consideration when Evaluating the Economic Soundness of Applications, Docket no. MARAD-2014-0011, 46 CFR Part 298, March 26, 2014, pp. 10075-10077. |

| 27. |

In 2009, Congress exempted Jones Act carriers operating exclusively within the Great Lakes from complying with fuel sulfur standard. See P.L. 111-88 §442. |

| 28. |

Joseph Bonney, "Matson: Speculative Jones Act Capacity Would Pull Down Rates," Journal of Commerce, August 1, 2017; Matson, "Matson Christens First Aloha Class Vessel 'Daniel K. Inouye' at Philly Shipyard," press release, July 2, 2018. |

| 29. |

"Harvey Gulf Takes Delivery of Fifth LNG-Powered OSV," LNG World News, February 23, 2018. |

| 30. |

Coast Guard, National Vessel Documentation Center, U.S. Build Determination Letters; https://www.dco.uscg.mil/Our-Organization/Deputy-for-Operations-Policy-and-Capabilities-DCO-D/National-Vessel-Documentation-Center/. |

| 31. |

JAX LNG, "LNG Bunker Barge Under Construction," press release, December 23, 2016, http://jaxlng.com/lng-bunker-barge/. |

| 32. |

Energy Information Agency, Henry Hub Natural Gas Spot Price, June 27, 2018, https://www.eia.gov/dnav/ng/hist/rngwhhdM.htm." |

| 33. |

See an example cost calculation in Chris Pedersen, "LNG Prices and Pricing Mechanisms," slide presentation, Platts, February 6, 2017, https://www.platts.com/IM.Platts.Content/ProductsServices/ConferenceandEvents/americas/liquefied-natural-gas/presentations2017/Chris_Pederson.pdf. |

| 34. |

Timera Energy, "Deconstructing LNG Shipping Costs," February 26, 2018, https://timera-energy.com/deconstructing-lng-shipping-costs/. |

| 35. |

Martijn Rats and Amy Sergeant, "The Coming Scramble for Middle Distillates—Raising Oil Price Forecast to $90," Morgan Stanley, May 15, 2018, p. 1. |

| 36. |

Mike Corkhill, "Big Boys Join the LNG-Fuelled Fleet," LNG World Shipping, May 8, 2018. |

| 37. |

Geir Høibye, "Norwegian NOx Fund as a Driving Force for LNG Use," Business NOx Fund, presentation to the Viking Line Seminar, January 16, 2014, http://www.lngbunkering.org/sites/default/files/2014%20_The_NOx_Fund__.pdf. |

| 38. |

Chris N. Le Fevre, "A Review of the Demand Prospects for LNG as a Marine Fuel," The Oxford Institute for Energy Studies, Paper NG 133, June 2018, p. 17. |

| 39. |

Ibid, p. 11. |

| 40. |

Allan E Jordan, "LNG-Powered Cruise Ships Lead the Way," Maritime Executive, October 30, 2017. |

| 41. |

Gus Trompiz, "Shipping Firm CMA CGM Chooses LNG to Power New Vessels," Reuters, November 7, 2017. |

| 42. |

Energy Monitor Worldwide, "LNG to Go Mainstream Within Container Sector," November 16, 2018. |

| 43. |

International Maritime Organization, Studies on the Feasibility and Use of LNG as a Fuel for Shipping, 2016, p. 44. |

| 44. |

For more discussion about methane and VOC emissions from the natural gas lifecycle, see CRS Report R42986, Methane and Other Air Pollution Issues in Natural Gas Systems, by Richard K. Lattanzio. |

| 45. |

Max Kofod and Torsten Mudt, "Well-to-Wake Greenhouse Gas Emissions from LNG in Marine Applications," MTZ Industrial, September 2015, p. 70. |

| 46. |

Sujith Kollamthodi et al., The Role of Natural Gas and Biomethane in the Transport Sector, ED 61479, No. 1, prepared for Transport and Environment, February 16, 2016, p. 22, https://www.transportenvironment.org/sites/te/files/publications/2016_02_TE_Natural_Gas_Biomethane_Study_FINAL.pdf. |

| 47. |

thinkstep AG, Greenhouse Gas Intensity from Natural Gas in Transport, prepared for NGVA Europe, June 2017, http://ngvemissionsstudy.eu/. |

| 48. |

International Maritime Organization, "UN Body Adopts Climate Change Strategy for Shipping," Briefing 06, April 13, 2018, http://www.imo.org/en/MediaCentre/PressBriefings/Pages/06GHGinitialstrategy.aspx. |

| 49. |

Nicholas Newman, "The World Is Going Big on Small-Scale End-Use LNG Projects," KNect365 Energy Blog, December 8, 2017, https://knect365.com/energy/article/7b4f6e2b-f2fc-49eb-823d-f6672b1dcdf0/the-world-is-going-big-on-small-scale-end-use-lng-projects. |

| 50. |

European Union, "Directive 2014/94/EU of the European Parliament and of the Council," Article 6, Sections 1 and 2, October 22, 2014 |

| 51. |

"EU Approves Investment in LNG-bunkering Studies Across Europe," LNG World News, April 25, 2017. |

| 52. |

European Maritime Safety Agency, Guidance on LNG Bunkering to Port Authorities and Administrations, January 31, 2018. |

| 53. |