Fifth-Generation (5G) Telecommunications Technologies: Issues for Congress

Since the first mobile phones were made available in the 1980s, telecommunication providers have been investing in mobile networks to expand coverage, improve services, and attract more users. First-generation networks supported mobile voice calls but were limited in coverage and capacity. To address those limitations, providers developed and deployed second-generation (2G) mobile networks, then third-generation (3G), and fourth-generation (4G) networks. Each generation offered improved speeds, greater capacity, and new features and services.

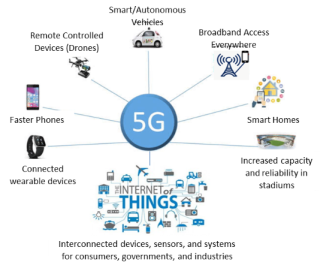

In 2018, telecommunication providers began deploying fifth-generation (5G) networks to meet growing demands for data from consumer and industrial users. 5G networks are expected to enable providers to expand consumer services (e.g., video streaming, virtual reality applications), support the growing number of connected devices (e.g., medical devices, smart homes, Internet of Things), support new industrial uses (e.g., industrial sensors, industrial monitoring systems), perform advanced data analytics, and enable the use of advanced technologies (e.g., smart city applications, autonomous vehicles).

5G is expected to yield significant economic benefits. Market analysts estimate that in the United States, 5G could create up to 3 million new jobs and add $500 billion to the nation’s gross domestic product (GDP). Globally, analysts estimate that 5G technologies could generate $12.3 trillion in sales activity across multiple industries and support 22 million jobs by 2035. Experience has shown that companies first to market with new products can capture the bulk of the revenues, yielding long-term benefits for those companies and significant economic gains for the countries where those companies are located. Hence, technology companies around the world are racing to develop 5G products, and some countries (i.e., central governments) are acting in support of 5G deployment. This competition to develop 5G products and capture the global 5G market is often called the “race to 5G.”

In the race to 5G, the United States is one of the leaders, along with China and South Korea. Each country has adopted a different strategy to lead in 5G technology development and deployment. China’s central government is supporting the deployment of 5G infrastructure in China. China has a national plan to deploy 5G domestically, capture the revenues from its domestic market, improve its industrial systems, and become a leading supplier of telecommunications equipment to the world. In South Korea, the central government is working with telecommunications providers to deploy 5G. South Korea plans to be the first country to deploy 5G nationwide, and to use the technology to improve its industrial systems. In the United States, private industry is leading 5G deployment. U.S. providers, competing against each other, have conducted 5G trials in several cities and were the first in the world to offer 5G services commercially. The U.S. government has supported 5G deployment, making spectrum available for 5G use and streamlining processes related to the siting of 5G equipment (e.g., small cells).

While each country has taken a different approach to capturing the 5G market, there are factors that drive the timeline for all deployments, including international decisions on standards and spectrum. In the United States, 5G deployment may also be affected by the lengthy spectrum allocation process, resistance from local governments to federal small cell siting rules, and limitations on trade that may affect availability of equipment.

The 116th Congress may monitor the progress of 5G deployment in the United States and the U.S. position in the race to 5G. Congress may consider policies that may affect 5G deployment, including policies related to spectrum allocation, trade restrictions, and local concerns with 5G deployment. Policies that support 5G deployment while also protecting national and local interests could provide significant consumer benefits, help to modernize industries, give U.S. companies an advantage in the global economy, and yield long-term economic gains for the United States. In developing policies, Members may consider the economic and consumer benefits of 5G technologies, as well as other interests, such as the need to preserve spectrum for other users and uses, the protection of national security and intellectual property when trading, the privacy and security of 5G devices and systems, and the respect of local authorities and concerns during 5G deployment.

Fifth-Generation (5G) Telecommunications Technologies: Issues for Congress

Jump to Main Text of Report

Contents

- Introduction

- Background on Mobile Technologies

- Factors Driving the Need for Improved Wireless Networks

- The Emergence of 5G Technologies

- Uses of 5G Technologies

- Race to 5G

- 5G Leaders

- Current 5G Deployment Status

- Factors Affecting 5G Deployment

- Standards

- Why Standards Are Important in the "Race to 5G"

- Spectrum Allocation

- Global Harmonization of Spectrum

- U.S. Actions on Spectrum

- Other Countries' Progress on Spectrum

- Equipment and Devices

- Small Cell Siting

- Viewpoints on the Rules on Small Cells

- National Security and Counterintelligence Concerns

- Security Concerns with 5G Deployments

- Security Concerns with Specific Chinese Firms

- Security Concerns with 5G Networks

- Trade Restriction Concerns

- Policy Considerations for Congress

- Conclusion

Figures

Summary

Since the first mobile phones were made available in the 1980s, telecommunication providers have been investing in mobile networks to expand coverage, improve services, and attract more users. First-generation networks supported mobile voice calls but were limited in coverage and capacity. To address those limitations, providers developed and deployed second-generation (2G) mobile networks, then third-generation (3G), and fourth-generation (4G) networks. Each generation offered improved speeds, greater capacity, and new features and services.

In 2018, telecommunication providers began deploying fifth-generation (5G) networks to meet growing demands for data from consumer and industrial users. 5G networks are expected to enable providers to expand consumer services (e.g., video streaming, virtual reality applications), support the growing number of connected devices (e.g., medical devices, smart homes, Internet of Things), support new industrial uses (e.g., industrial sensors, industrial monitoring systems), perform advanced data analytics, and enable the use of advanced technologies (e.g., smart city applications, autonomous vehicles).

5G is expected to yield significant economic benefits. Market analysts estimate that in the United States, 5G could create up to 3 million new jobs and add $500 billion to the nation's gross domestic product (GDP). Globally, analysts estimate that 5G technologies could generate $12.3 trillion in sales activity across multiple industries and support 22 million jobs by 2035. Experience has shown that companies first to market with new products can capture the bulk of the revenues, yielding long-term benefits for those companies and significant economic gains for the countries where those companies are located. Hence, technology companies around the world are racing to develop 5G products, and some countries (i.e., central governments) are acting in support of 5G deployment. This competition to develop 5G products and capture the global 5G market is often called the "race to 5G."

In the race to 5G, the United States is one of the leaders, along with China and South Korea. Each country has adopted a different strategy to lead in 5G technology development and deployment. China's central government is supporting the deployment of 5G infrastructure in China. China has a national plan to deploy 5G domestically, capture the revenues from its domestic market, improve its industrial systems, and become a leading supplier of telecommunications equipment to the world. In South Korea, the central government is working with telecommunications providers to deploy 5G. South Korea plans to be the first country to deploy 5G nationwide, and to use the technology to improve its industrial systems. In the United States, private industry is leading 5G deployment. U.S. providers, competing against each other, have conducted 5G trials in several cities and were the first in the world to offer 5G services commercially. The U.S. government has supported 5G deployment, making spectrum available for 5G use and streamlining processes related to the siting of 5G equipment (e.g., small cells).

While each country has taken a different approach to capturing the 5G market, there are factors that drive the timeline for all deployments, including international decisions on standards and spectrum. In the United States, 5G deployment may also be affected by the lengthy spectrum allocation process, resistance from local governments to federal small cell siting rules, and limitations on trade that may affect availability of equipment.

The 116th Congress may monitor the progress of 5G deployment in the United States and the U.S. position in the race to 5G. Congress may consider policies that may affect 5G deployment, including policies related to spectrum allocation, trade restrictions, and local concerns with 5G deployment. Policies that support 5G deployment while also protecting national and local interests could provide significant consumer benefits, help to modernize industries, give U.S. companies an advantage in the global economy, and yield long-term economic gains for the United States. In developing policies, Members may consider the economic and consumer benefits of 5G technologies, as well as other interests, such as the need to preserve spectrum for other users and uses, the protection of national security and intellectual property when trading, the privacy and security of 5G devices and systems, and the respect of local authorities and concerns during 5G deployment.

Introduction

Telecommunication providers and technology companies around the world have been working together to research and develop new technology solutions to meet growing demands for mobile data from consumers and industrial users. Fifth-generation (5G) mobile technologies represent the next iteration of mobile communications technologies that were designed to improve current (e.g., 3G, 4G) mobile networks. 5G networks are expected to provide faster speeds, greater capacity, and the potential to support new features and services.

5G technologies were developed to accommodate the increasing demands for mobile data (i.e., more people using more data on more devices). 5G technologies are expected to serve current consumer demands and future applications (e.g., industrial Internet of Things, autonomous vehicles). 5G technologies are expected to yield significant consumer benefits (e.g., assisting the disabled, enabling telemedicine), industrial benefits (e.g., automated processes, increased operational efficiencies, data analytics), and economic benefits (e.g., new revenues, new jobs).

Past experience has shown that companies first to market with new technologies capture the bulk of the revenues. Hence, companies around the world are racing to develop and deploy 5G technologies, and many countries (e.g., central governments), seeing potential for economic gain, are taking action to support 5G deployment. This competition between companies and countries to lead 5G technologies and capture the bulk of the revenues is often called the "race to 5G."

In the United States, Congress has monitored the progress of 5G deployment, and the U.S. position in the race to 5G. Congress has made spectrum available for 5G use,1 and directed the federal government to identify additional spectrum for future 5G use.2 Congress has also streamlined processes for deploying 5G equipment (also known as small cells) on federal land;3 additionally, in 2018, legislation was introduced in the Senate which would have streamlined processes for deploying 5G small cells.4 To protect national security interests and to ensure the security of 5G networks, Congress restricted federal agencies from purchasing certain foreign-made telecommunications equipment.5

This report provides a background on mobile technologies, and addresses the race to 5G, focusing on three leading countries—the United States, China, and South Korea. This report discusses factors affecting 5G deployment, and U.S. actions to support 5G deployment, such as actions related to small cells and national security. Finally, this report discusses near-term policy considerations for Congress related to the deployment of 5G networks, and future policy considerations, including the privacy and security of 5G networks and devices.6

Background on Mobile Technologies

The first mobile phones appeared in the 1980s. Since then, mobile phone use has increased exponentially. The number of smartphone users in the United States has grown from nearly 63 million in 2010 to an estimated 238 million in 2018.7 Worldwide, there are an estimated 4.5 billion mobile phone users, 2.5 billion of which are smartphone users.8 More people are using more data on more mobile devices; as a result, demand for mobile data is rapidly increasing.

Telecommunication companies continually invest in their networks to provide faster, more reliable service, expand the capacity of networks to meet growing demands for data, and support new technology uses. Approximately every 10 years, a new technology solution emerges from industry studies and research that offers vastly improved speeds, supports new features and functions, and creates new markets and new revenue for providers. These technologies offer such significant improvements to networks and devices that they change the way people use mobile communications, and thus represent the next generation of mobile technology.

In mobile communications, there have been five generations of technology. Figure 1 provides an overview of the technologies. First-generation (1G) technologies brought consumers the first mobile phone. The phone and the service were expensive, and the basic analog networks offered voice-only services, and limited coverage and capacity.9 Second-generation (2G) technologies used digital networks, which supported voice and texting. Networks were expanded and phones were made more affordable, increasing adoption. Third-generation (3G) technologies supported voice, data, and mobile access to the internet (e.g., email, videos). Smartphones were introduced, and people began using mobile phones as computers for business and entertainment, greatly increasing demand for data. Fourth-generation (4G) technologies offered increased speeds, and true mobile broadband that could support music and video streaming, mobile applications, and online gaming. Providers offered unlimited data plans and mobile devices that could be used as hotspots to connect other devices to the network, further increasing demand for mobile data.

Each generation was built to achieve certain levels of performance (e.g., certain levels of speed, higher capacity, added features). To be called a "3G network" implied a specific network architecture and specific technologies were used, certain levels of speeds were offered, and new features were supported. In earlier generations, companies and countries adopted different technical standards to achieve performance requirements. In 3G and 4G, companies and countries began building networks to the same standards. This enabled equipment to be used in many countries, enabled manufacturers to achieve economies of scale, and enabled carriers to speed deployment. For example, for 4G, companies and countries adopted Long-Term Evolution (LTE) standards, which redefined the network architecture to offer greater speeds and capacity.

Fifth-generation (5G) networks utilize 5G standards, which use new technologies and deployment methods to provide faster speeds, greater capacity, and enhanced services. 5G networks are expected to meet the increasing demand for data from consumers, and to support new services. 5G was also designed to meet growing demands for data from industrial users, and to support the growing use of mobile communications technologies across multiple industries (e.g., crop management systems, public safety applications, new medical technologies).

|

1G |

2G |

3G |

4G |

5G |

|||||||||||||

|

DEPLOYED |

1980s |

1990s |

2000s |

2010 - |

2018 - |

||||||||||||

|

DEVICES |

|

|

|

|

|||||||||||||

|

FUNCTIONS |

|

|

|

|

|

||||||||||||

|

SPEED |

0.002 Mbps |

0.064 Mbps |

2-10 Mbps |

10-100 Mbps |

1000-1400 Mbps |

||||||||||||

|

TIME TO DOWNLOAD 2-HR MOVIE |

N/A |

N/A |

10-26 hours |

6 minutes |

3-4 seconds |

Source: Created by CRS, adapted from multiple sources, including Frank K. Baneseka and Stephen Dotse, "New Developments and Research Challenges for 5G," International Journal of Current Research, vol. 9, no. 2 (February 2017), p. 46627; Stephen Shankland, "How 5G will push a supercharged network to your phone, home, car," CNET, March 2, 2015, at https://www.cnet.com/news/how-5g-will-push-a-supercharged-network-to-your-phone-home-and-car/.

Notes: Graphic shows the evolution of mobile technologies, with increasing speed and functions over time, and devices supported by each generation. Speeds are approximate and can vary based on provider's signal quality, network capacity, and consumers' devices. See FCC's Communications Market Report, p. 23, at https://docs.fcc.gov/public/attachments/DOC-355217A1.pdf). In terms of cost, IG phones were about $4,000 and calls were charged by the minute (50 cents or more). 2G phones were more affordable ($1,000), which still presented barriers for consumers; providers offered reduced prices on the phones for people who signed up for a cell phone plan. 3G brought the blackberry ($400) and the iPhone ($600-$700); providers offered various voice/data plans that included the phone. 4G phones range from about $500-$1,000; the cost is often incorporated into cell phone plans. Mbps=megabits per second. Mbps refers to the speed in which information is downloaded from or uploaded to the internet. For basic use (e.g., browsing emails), users need a minimum download speed of 1Mbps. For advanced uses (e.g., streaming videos), users need a minimum speed of 5-25 Mbps. See FCC's Broadband Speed Guide at https://www.fcc.gov/reports-research/guides/broadband-speed-guide.

Factors Driving the Need for Improved Wireless Networks

Three factors are driving the need for improved wireless networks. First, there are more people using more data on more devices. Since 2016, more people worldwide have been using more data on mobile devices such as smartphones than on desktops. Globally, mobile data traffic is expected to increase sevenfold from 2016 to 2021, and mobile video is driving that increase.10 The spectrum used for mobile communications is becoming crowded and congested.11 Current networks (e.g., 3G, 4G) cannot always meet consumer demands for data, especially during periods of heavy use (e.g., emergencies). During periods of heavy use, consumers may experience slow speeds, unstable connections, delays, or loss of service.12

Second, the total number of internet-connected devices, both consumer devices (e.g., smart watches, smart meters) and industrial devices (e.g., sensors that assist with predictive maintenance), has increased. Market research indicates that in 2018 there were 17.8 billion connected devices globally; 7 billion of which were not smartphones, tablets, or laptops, but other connected devices (e.g., sensors, smart locks) that allow users to monitor and manage activities through a mobile device, such as a smartphone, further increasing demand on networks.13

Third, industries are relying on internet-connected devices in everyday business operations. Companies use devices to track assets, collect performance data, and inform business decisions. These devices, when connected, form the Internet of Things (IoT)—the collection of physical objects (e.g., health monitors, industrial sensors) that interconnect to form networks of devices and systems that can collect and compute data from many sources.14 More advanced IoT devices (e.g., autonomous cars, emergency medical systems) need networks that can provide persistent ("always-on") connections, low latency services (i.e., minimal lag time on commands), greater capacity (e.g., bandwidth) to access and share more data, and the ability to quickly compile and compute data.15 These are features that current mobile networks cannot consistently support.16

The Emergence of 5G Technologies

Since 2012, telecommunications standards development organizations (SDO), with the help of their industry partners, have been researching ways to improve mobile communication networks; link people, devices, and data through a smart network; and enable a "seamlessly connected society."17 Companies are developing new technologies that are expected to improve networks, meet the growing demand for data, support IoT applications, and enable a seamlessly connected society.

Telecommunication and technology companies experimented with new, higher-band spectrum (i.e., millimeter waves) that could provide greater bandwidth and speed. However, these waves cannot travel long distances or penetrate obstacles (e.g., trees, buildings); companies worked together to develop technologies that capitalize on the strengths of this spectrum (e.g., bandwidth and speed) and address its shortfalls through innovative technology solutions (e.g., placing smaller cell sites close together to relay signals around obstacles and over longer distances).

The research identified several solutions that offer vastly improved speeds (from 10 times to 100 times faster than 4G networks), greater bandwidth, and ultra-low latency service (i.e., 1-2 milliseconds (ms) of lag time as opposed to 50 ms for 4G).18 These solutions address many of the perceived shortcomings of existing networks and offer new features that could support and expand the use of more advanced technologies for consumers and businesses.

Uses of 5G Technologies

5G networks offer the increased bandwidth, constant connectivity, and low latency services which can enhance and expand the use of mobile technologies for consumers and businesses. Consumers are to be able to download a full-length, high-definition movie on their mobile device in seconds; engage in video streaming without interruption; and participate in online gaming anywhere.19 5G technologies are expected to create new revenue streams for technology companies and telecommunications providers.

5G technologies are also expected to support interconnected devices (e.g., smart homes, medical devices), and advanced IoT systems, such as autonomous vehicles, precision agriculture systems, industrial machinery, and advanced robotics. IoT technologies are expected to be integrated into industrial systems to automate processes and to optimize operational efficiencies.20 5G networks are expected to support the growing IoT industry, enabling device makers to develop and deploy new IoT devices and systems across multiple industries, and sell IoT products globally, yielding significant economic gains for technology companies and for the countries where those companies are located.21

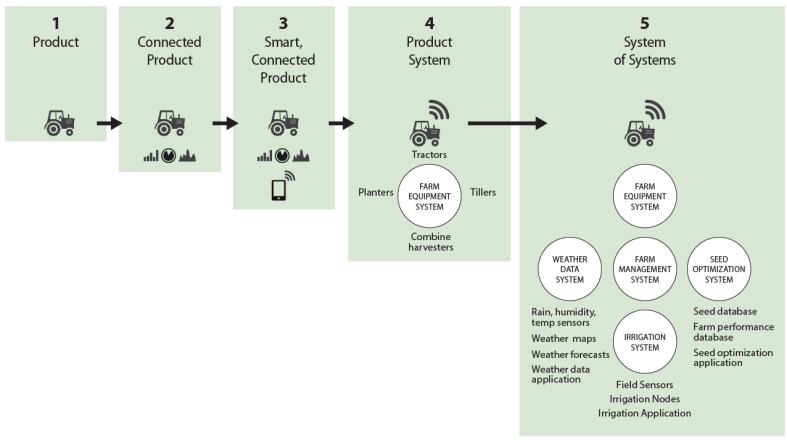

Figure 1 shows an interconnected tractor system, and the progression of a single product to a connected product to an IoT system that can process data from many sources to inform decisions.

|

|

Source: Recreated by CRS, based on a model by M. Porter and J Heppelmann, "How Small, Connected Products are Transforming Competition," Harvard Business Review, November 2014, p. 5, Note: The graphic depicts the evolution of a single product into a smart product (i.e., a product that can send performance data to a computer) to a product that enables access to data from a mobile device (e.g., smart, connected product), to a product that is part of a larger system of interconnected products. To support the IoT, and the expansion of IoT systems for industrial use, a more powerful network such as 5G would be needed. |

Race to 5G

During the deployment of 4G networks, U.S. companies took the lead in developing new technologies. U.S. companies drove industry standards, brought products to market, gained first-mover advantage, and achieved significant economic gains for themselves and the United States. Analysts conclude that "U.S. leadership on 4G added nearly $100 billion to [the U.S.] economy and brought significant economic and consumer benefits."22

Industry analysts predict 5G will generate new revenue for technology companies and for the countries where those companies are located. For example, in a study commissioned by the Cellular Telecommunications and Internet Association (CTIA), IHS Markit estimated that 5G could produce up to $12.3 trillion in global sales across multiple industries by 2035.23 In another analysis, Accenture reports that U.S. telecommunication providers are expected to invest approximately $275 billion in 5G infrastructure, which could create up to 3 million new jobs in the United States and add up to $500 billion to the nation's GDP.24

Past experience has shown that companies that are first to market capture the bulk of the economic benefits from new technologies.25 Hence, companies around the world are racing to bring 5G products to markets. Technology companies (e.g., network equipment manufacturers, chip makers, smartphone manufacturers, and software companies) are producing 5G equipment and devices for providers. Telecommunications providers are deploying 5G infrastructure and marketing new 5G products to gain domestic market share and increase revenues. Countries around the world (i.e., central governments) are supporting 5G efforts to ensure their companies are first to deploy 5G products and services, and positioned to capture the bulk of the economic benefits from the new technology—to "win the race to 5G."

5G Leaders

There have been several industry reports on countries leading in 5G. In a 2018 report, Deloitte notes that "The United States, Japan, and South Korea have all made significant strides toward 5G readiness, but none to the same extent as China."26 A 2017 study by IHS Markit, a data analytics and information services firm, examined the economic activity for seven countries: the United States, China, South Korea, Japan, Germany, United Kingdom, and France.27 The 2017 IHS Markit study concluded, that based on projected research and development (R&D) and capital expenditure (Capex) investments in 5G from 2020 to 2035, the United States and China are expected to drive and dominate 5G technologies over the next 16 years.

More recent reports paint a different picture of 5G leadership. An April 2018 report by Analysys Mason, commissioned by CTIA, concluded that with the first 5G standards approved in December 2017, there was a shift in readiness between nations.28 In the report, the United States ranked third in readiness behind China and South Korea. According to the report, China is showing greater signs of readiness due to government planning and coordination with industry. The government's "Made in China 2025" initiative (released in 2015) and its more recent five-year economic plan (China's 13th Five-Year Plan for Economic and Social Development Plan for the People's Republic of China, 2016)29 established a path to gain leadership of 5G.

China financed R&D projects, supported Chinese industry efforts to participate in standards development, and collaborated with international partners to test new equipment and technology solutions. China also provided $400 billion in 5G investments, coordinated with companies manufacturing 5G technologies, and worked with Chinese providers to deploy 5G infrastructure to achieve its goal to launch 5G by 2020.30 Analysts report that China's technology companies and telecommunications providers are committed to the national plan and 2020 timeline.31

Industry analysts have pointed to other actions by China that indicate China is positioning itself to dominate in 5G technologies. Analysts note that China has set targets to increase the use of Chinese equipment and components in its 5G networks. China wants locally-made chips to be used in 40% of smartphones sold domestically by 2025, and domestic firms to have 60% of the market in industrial sensors.32 China plans to deploy domestically; capture the revenues from its massive domestic market (e.g., consumers and industrial users);33 upgrade industrial systems to increase the efficiency, productivity, and competitiveness of Chinese technology companies; build its capacity to develop technology equipment and components; and become a leading supplier of 5G technologies to the world (e.g., network equipment and IoT devices).34

In the Analysys Mason report, South Korea was positioned ahead of the United States "based on a strong push for early 5G launch combined with government commitment to achieving 5G success."35 South Korea advanced in 5G readiness due to early investments in R&D and trial deployments at the 2018 Olympics. The early investment in 5G allowed South Korea to claim credit for the first large-scale pilot of 5G technologies.36

Some analysts rank China above the United States in 5G readiness, while other analysts assert that the competitive market in the United States spurs innovation, which could give the United States an edge in the global 5G market. Still others note that given the focus on 5G deployment by several Asian nations (e.g., China, South Korea, and Japan);37 the large Asian market; and the rapid rate of migration to new technologies in Asia, Asia may emerge as a 5G leader.38

Current 5G Deployment Status

The Chinese government has advanced on its plan: investing in R&D, participating and leading in 5G standards development to benefit Chinese firms, engaging in international 5G projects to build knowledge, building capacity to provide 5G equipment, and reserving spectrum for 5G use.39

A 2018 study found that since 2015, China has outspent the United States by $24 billion in 5G infrastructure, having built 350,000 new cell sites, while U.S. companies have built 30,000 in the same timeframe.40 Recent reports indicate that after first 5G technical specifications were released in December 2017, Chinese providers began deploying 5G cell sites at a rapid pace,41 and announced plans to launch 5G in 2019, ahead of the 2020 timeline. Industry observers called this the "China Surge,"42 and concluded that China was positioning to win the race to 5G.43

South Korea is also moving forward on spectrum. In June 2018, South Korea auctioned both mid-band and high-band spectrum for 5G use.44 And in July 2018, government officials announced its telecommunications providers would work together to build out a nationwide 5G network.45 Officials argued that a coordinated approach would reduce duplication, save costs, speed deployment, and enable South Korea to be the first to launch a nationwide 5G network. Telecommunication providers committed to the plan and to launching 5G on the same day—a day the government is calling "Korea 5G Day."46 According to articles from December 2018, South Korea's providers launched fixed 5G to business users on December 1, 2018,47 and announced plans to launch mobile 5G for consumers in March 2019 when 5G phones become available.48

In the United States, private telecommunication providers are driving deployment. For example, Verizon launched fixed 5G services in four cities on October 1, 2018.49 AT&T launched mobile 5G services in 12 cities on December 21, 2018, with at least 19 more cities targeted in 2019.50 T-Mobile is building out 5G networks in 30 cities and plans to launch 5G services after 5G cell phones are released in 2019.51 Sprint is moving ahead with its plans to deploy 5G in 9 cities in the first half of 2019.52 Analysts assert that the United States ranks near the top in readiness due to industry investment in 5G trial deployments and aggressive timelines for commercial deployment.53 In the United States, Congress has supported 5G deployment by identifying spectrum for 5G use and easing regulations related to the placement of 5G equipment. The FCC has developed a comprehensive strategy to free spectrum for 5G use and accelerate deployment.

In the race to 5G, countries are leading in different ways and in different aspects. China assumed a top-down approach, and is leading on infrastructure deployment; however, China faces the same challenges as other countries in terms of spectrum (e.g., managing incumbent users, avoiding interference)—activities that take time.54 South Korea has auctioned 5G spectrum and is committed to being the first to deploy 5G nationwide; however, its cooperative approach to deployment may thwart competition and innovation needed to develop new 5G products and compete in the global 5G market. In the United States, industry is leading 5G efforts. The government has supported private deployment efforts by identifying and allocating spectrum for 5G use and reducing regulatory barriers for siting of 5G equipment.55 However, the lengthy spectrum allocation process, competing demands for spectrum, and local resistance to 5G cell siting regulations may slow 5G deployment in the United States; further, a purely market-based approach to deployment may not ensure that all areas and all industries will have access to 5G.

Some industry analysts contend that the race to 5G has just started and is more of a marathon than a sprint, noting "Europe was quicker to roll out 2G, and Japan was the first with 3G, but that hardly deterred Apple and Google from dominating the smartphone market."56 5G technologies have many areas of growth, and opportunities to achieve revenues from both the sale of the technology at initial deployment and the sale of products and services after deployment (e.g., innovative applications, subscription services, IoT devices). Industry analysts note that in the race to dominate the global 5G market, months may not matter; but if the United States falls years behind in deploying 5G networks and developing new 5G technologies, devices, and services, that may affect its ability to compete in the global technology market for many years to come.57

There are factors affecting 5G deployment in all countries, including international decisions on standards and spectrum, and factors affecting deployment in the United States such as resistance to the placement of 5G infrastructure and trade restrictions.

Factors Affecting 5G Deployment

There are several factors affecting all 5G deployments, including international decisions on standards and spectrum; the management of spectrum (e.g., auctioning spectrum, reconfiguring users to accommodate 5G, establishing agreements to share spectrum); the availability of 5G equipment and devices; and the installation of small cells needed to provide 5G services.

Standards

In earlier cellular networks, countries and companies built networks, equipment, and devices to different standards; as a result, not all equipment worked on all networks or in all countries. Technology companies and telecommunication providers saw value in developing standards, to enable technology companies to build to one standard, bring products to market faster, sell equipment globally, achieve economies of scale, and reduce the cost of equipment.

Two organizations central to this effort for 5G are the 3rd Generation Partnership Project (3GPP) and the United Nations International Telecommunications Union (ITU).58 3GPP is a collaboration of seven telecommunication SDOs from Japan, China, Europe, India, Korea, and the United States. 3GPP has more than 370 members from leading companies from many nations. Members include leading telecommunication providers (e.g., AT&T, China Mobile, SK Telecom), technology companies (e.g., Intel, Qualcomm, Samsung, Ericsson, Huawei, ZTE), and government agencies. 3GPP is one of many organizations working to build consensus on technical specifications for mobile communications (3G, 4G, and 5G).59

3GPP members have worked together to develop, test, and build specifications for 5G technologies. In 2018, 3GPP approved two 5G technical specifications:60

- In December 2017, 3GPP approved the "Non-Standalone version of the New Radio standard," which supports enhanced mobile broadband (eMBB). These specifications allow carriers to supplement existing 4G networks with 5G technologies to improve speed and reduce latency.61

- In June 2018, 3GPP completed the "Stand-Alone version of the New Radio standard." This specification supports the independent deployment of 5G, using core networks that are designed to support advanced IoT devices and functions.62

These specifications are important because they define how 5G networks will be designed and deployed, because they set technical specifications for 5G equipment, and because they have support from a wide array of stakeholders. 3GPP plans to submit these 5G specifications to the ITU in June 2019 as part of the global standards development process.63 If the ITU ratifies the specifications, those specifications would be recognized as the global standard for the technology. Other SDOs submit specifications to ITU as well; however, 3GPP is recognized as the major standards contributor.64 Thus, many companies and countries are moving forward on 5G plans based on approved 3GPP specifications.65

3GPP is now focused on technical specifications and performance requirements for advanced functions (e.g., 5G for vehicle-to-vehicle communication, industrial IoT). These specifications are expected to be finalized by 3GPP in 2019; thus, networks, equipment, and devices that can support advanced 5G functions are not expected to arrive until 2020 or later.

Why Standards Are Important in the "Race to 5G"

During the development of 3G technologies, China adopted its own standard to avoid dependence on western technology. While equipment built to those standards was successful in China, the standards were not accepted globally, and equipment could not be successfully exported.66 Other countries participated in international projects, contributed to international standards, and implemented standards-based networks.

By participating in SDOs, a company can shape standards, and ensure that the final standards and requirements for equipment align to its preferred specifications for the product. Companies that are able to gain acceptance of their preferred standards through the standards development process have a head start in bringing products to market and gaining first-mover advantage. This approach is "much more economical than trying to retrofit a product (and its manufacturing process) after a standard is approved."67 Many countries support industry efforts to participate in standards development. FCC Commissioner O'Rielly noted, "If standards properly reflect and include our industries' amazing efforts, they promote U.S. technologies and companies abroad, bringing investment, revenues, and jobs to this country."68

For 5G, China played a more cooperative role in standards development, participating in SDOs, leading technical committees, conducting 5G R&D, contributing to 5G specifications, and participating in international projects.69 Some experts assert that through its participation in SDOs, China is advancing its preferred standards and positioning itself to dominate the global 5G market.70 As an example, analysts note that many network operators are adopting the 5G Non-Stand Alone standard to leverage their legacy 4G networks as a first step to building out 5G. China is supporting the 5G Stand-Alone standard which would require operators to rebuild core networks and buy new base stations and equipment, and move all countries toward more advanced IoT devices (which China is focused on providing).71 However, in the development of standards for 5G, SDO members supported both Non-Stand-Alone and Stand-Alone specifications, which enabled them to leverage 4G networks, improve 4G services with 5G technologies, and provide better services as companies plan out 5G deployments.

Even before specifications were finalized, some companies and countries advanced 5G plans and launched 5G services. For example, China began deploying 5G infrastructure before 5G specifications were approved, and Verizon launched fixed 5G services using proprietary standards. While these efforts provide some advantages in future deployments, in that companies can prepare for and learn from these deployments, there are also risks. For example, last-minute revisions to the specifications may require China to upgrade those pre-standard 5G sites.

To offer mobile 5G technologies, companies need 5G phones, which were under development. So while companies began deploying 5G networks once specifications were approved, they would have to wait for 5G phones to offer mobile 5G services. Since 5G phones were slated for release around the same time (spring 2019), most major carriers in the leading countries announced launch dates that were within months of each other. South Korea is expected to launch mobile 5G services in March 2019.72 T-Mobile announced it would launch mobile 5G services in early 2019,73 as did Verizon.74 AT&T announced plans to offer a 5G smartphone in the first half of 2019.75 Sprint is expected to launch nationwide 5G in the first half of 2019.76 China Mobile announced plans to introduce 5G service by the end of 2019—ahead of its 2020 target date.77

Approval of technical specifications is an important milestone in the race to 5G. With approved specifications, technology companies can begin to manufacture equipment and devices. Once equipment become available, telecommunication companies can begin to build out networks and plan their launch of 5G services.

Spectrum Allocation

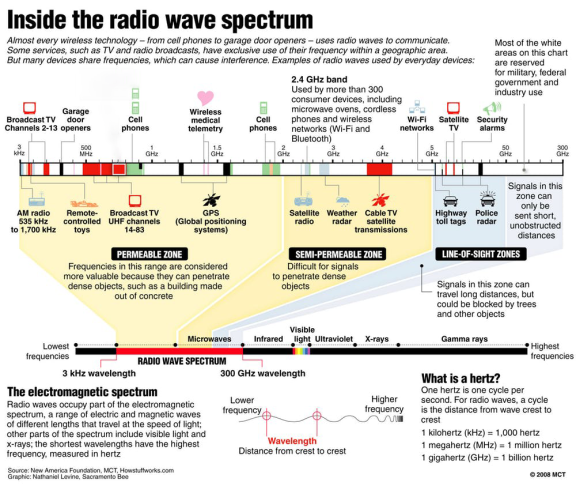

Another factor driving 5G deployment is spectrum. All wireless technologies use the electromagnetic spectrum to communicate. Spectrum refers to the radio frequencies used to communicate over the airwaves.

Most countries have spectrum management agencies. In the United States, the FCC manages spectrum allocation for nonfederal users while the National Telecommunications and Information Administration (NTIA) manages spectrum for federal users. Agencies may assign the rights to use specific frequencies to certain users (e.g., public safety users), or sell the rights to use specific frequencies (e.g., telecommunication companies, broadcasters). Companies deploy infrastructure (e.g., towers, equipment) that will enable communications on their assigned frequencies. Error! Reference source not found. provides an overview of U.S. spectrum allocations in 2008 as an example of how the U.S. spectrum is allocated for various communications (e.g., mobile communications) and for other wireless uses (e.g., garage door openers, satellite radio, GPS).

Most mobile devices (e.g., cell phones) use frequencies under 6 gigahertz (GHz) because the frequencies in this segment of the spectrum are conducive to wireless communications. For example, frequencies in this segment of the spectrum can travel long distances enabling coverage across wider areas, and can penetrate buildings and walls easily. However, as more people are using more mobile devices for more purposes, this segment of the spectrum (below 6 GHz) is becoming crowded, which can result in slower speeds, slower connections, and dropped calls.

|

|

Source: Philip Branch, "Wireless Spectrum Is for Sale ... but What Is It?" The Conversation, February 26, 2013, at https://theconversation.com/wireless-spectrum-is-for-sale-but-what-is-it-11794. Notes: The graphic shows the propagation characteristics of various bands of spectrum (e.g., "signals in this zone can only be sent short unobstructed distances") and the users operating in the various frequency bands (e.g., cell phones, satellites, GPS). The graphic is dated 2008; however, many of the users remain the same. In terms of 5G, the United States is targeting low-band spectrum (e.g., 600 MHz), mid-band spectrum (e.g., 2.5 GHz, 3.5 GHz,3.7-4.2 GHz), and high-band spectrum (e.g., 28 GHz, 24 GHz, 37 GHz, 39 GHz, 47 GHz). The graphic shows some of the users operating in the bands targeted for 5G, and the spectrum reserved for military, federal, and other industry use (in white), where there may be competing spectrum needs. |

In 2015, companies began looking at new spectrum bands that could support mobile communications. Industry researchers identified waves between 30 GHz and 300 GHz (also known as millimeter waves or MMW) that offered greater bandwidth (e.g., higher capacity to handle more traffic) and increased speeds. Telecommunication providers had not considered MMW for mobile communications because the waves are shorter, cannot travel far, cannot travel well through buildings, and tend to be absorbed by trees and rain. Researchers proposed the use of small cells, placed close together, to relay shorter waves across longer distances, and to interconnect them to provide a high-speed network to specific areas, such as a city or a stadium.78 Typically, telecommunications equipment is designed to function on certain frequencies. Equipment and device manufacturers consider the characteristics of the assigned frequency bands and engineer equipment to take advantage of frequency strengths and mitigate weaknesses.

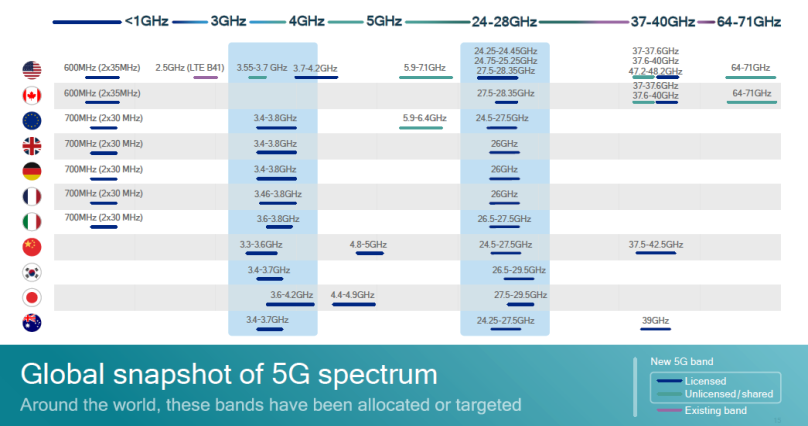

5G relies on multiple spectrum bands. 5G leverages low-band spectrum (below 1 GHz), mid-band spectrum (1 GHz-6 GHz), and high-band (MMW) spectrum. 5G calls for deployment of 5G technologies in high band spectrum (MMW) spectrum to offer ultra-fast services to high-density areas. 5G technologies deployed in mid-band spectrum offer improved capacity and coverage, faster service, and new features to existing customers. 5G technologies deployed in low-band spectrum can provide the widespread coverage needed for many IoT applications.

Studies have shown that delays in spectrum allocation can delay deployments, and put countries at a disadvantage in technology markets.79 Hence, countries are working to identify spectrum in all three bands for 5G. They are also working together, and with industry, to harmonize spectrum (i.e., ensure all countries are using similar frequency bands) to create economies of scale, reduce costs for manufacturers and providers, and promote compatibility (e.g., roaming) across systems.

Global Harmonization of Spectrum

Companies around the world are interested in identifying common spectrum for 5G deployment. This would help ensure all companies deploy in the same bands, so that equipment works in all regions. According to one expert, "Harmonized global spectrum is important because with a commonality of spectrum the 5G ecosystem can optimize resources to achieve economies of scale, [reduce the cost of equipment and devices, and] spur rapid proliferation and adoption."80 Exact harmonization is not necessary; similar ranges of frequencies can support global harmonization. This provides countries (i.e., government agencies responsible for allocating spectrum) with flexibility to accommodate existing users who may be operating in certain bands, and cannot be easily relocated (e.g., military agencies).

The ITU works with countries and industries to set standards and harmonize regulations and spectrum use worldwide. In 2019, the ITU is expected to discuss 5G spectrum at its World Radiocommunication Conference (WRC-19).81 Stakeholders involved in the development of 5G technologies agree that 5G needs spectrum in three key frequency ranges to operate effectively:

- sub-1 GHz to support widespread coverage across urban, suburban, and rural areas, provide in-building coverage, and support IoT devices and services;

- 1-6 GHz to provide additional capacity and coverage, including the 3.3-3.8 band, which is expected to form the basis of many initial 5G services; and

- above 6 GHz, including MMW, to provide ultra-high broadband speeds.82

Figure 3 shows 5G spectrum targets worldwide, and commonalities in spectrum that may help to inform global harmonization of spectrum for 5G.

|

Figure 3. Worldwide 5G Spectrum Allocations and Targets Spectrum bands targeted or allocated for 5G in various countries |

|

|

Source: Editorial Team, "5G Frequency Bands," everythingRF Newsletter, February 16, 2018, at https://www.everythingrf.com/community//5g-frequency-bands. Graphic used with permission from everythingRF. Notes: This chart shows the frequency bands that have been targeted for 5G deployment in different countries (as of February 2018). Many countries have identified low-band spectrum (below 1 GHz) to support 5G; some have not. Most countries have identified mid-band spectrum (between 1 GHz and 6 GHz) and high-band spectrum (over 6 GHz) for 5G use. The blue shading represents where there is commonality in spectrum allocation across countries which may inform ITU decisions regarding global harmonization of spectrum. |

U.S. Actions on Spectrum

The FCC has auctioned spectrum previously; hence telecommunication providers have substantial spectrum holdings in different bands, including frequency bands targeted for 5G. For example, T-Mobile is deploying 5G using its 600 MHz spectrum, and Verizon was able to launch 5G services using its 28 GHz spectrum.83

In 2018, Congress took action to identify additional spectrum for 5G use. In the Consolidated Appropriations Act, 2018, signed into law on March 23, 2018, Congress enacted two provisions related to spectrum. The Repack Airwaves Yielding Better Access for Users of Modern Services Act of 2018 (RAY BAUM'S Act of 2018), encourages the repurposing of federal spectrum to support 5G.84 The Making Opportunities for Broadband Investment and Limiting Excessive and Needless Obstacles to Wireless (MOBILE NOW) Act, directs the NTIA to study the impact of deploying in MMW band on federal users.85

The FCC initiated an auction of the 28 GHz band on November 14, 2018.86 The auction of the 24 GHz band is to follow. The FCC is preparing additional high-band spectrum for auction.87 With these auctions, the FCC will have released almost 5 GHz of high-band spectrum for 5G.88 The FCC stated it has "assigned more high-band spectrum for 5G than any country in the world," noting the United States is 4 GHz ahead of China in high-band spectrum for 5G.89

The FCC has also initiated proceedings to identify mid-band spectrum (e.g., 2.5 GHz, 3.5 GHz, and 3.7-4.2 GHz) for 5G use.90 The FCC has identified under-utilized mid-band spectrum that could support 5G, and is examining ways in which mid-band spectrum can be shared between users (e.g., educational, satellite, federal). The FCC is working with the NTIA to identify federal mid-band spectrum that can be repurposed for or shared to support commercial 5G use.

The FCC has also granted applications to deploy in the low band (600 MHz), and has targeted changes for the 800 MHz and 900 MHz bands to support 5G use. Further, the FCC has identified additional spectrum for unlicensed (e.g., Wi-Fi) use that will be needed to support 5G networks.

Although the FCC is striving to free up spectrum for 5G use, the United States has a complex spectrum allocation process that requires a lengthy rulemaking process, auction process, and relocation process, which takes time. Industry advocates have urged policymakers to plan, collaborate, and set timelines to expedite the availability of spectrum, and coordinate spectrum auctions so providers can plan spectrum acquisitions and deployments.91

The Trump Administration has focused on 5G planning. On September 28, 2018, the White House held a "5G Summit" with industry and government officials to discuss policies that would help ensure faster deployment of 5G technologies.92 On October 25, 2018, President Trump signed a Presidential Memorandum calling for a National Spectrum Strategy to assess current and future spectrum needs and support the deployment of 5G through incentives and reduced regulations.93

Even as the FCC is moving forward on multiple proceedings, U.S. telecommunications executives are arguing that more mid-band spectrum is needed to support 5G deployment.94 Some policymakers have called for additional spectrum and reduced regulations to spur 5G deployment.95 Others have stressed the need to ensure 5G benefits are available to all people.96

Other Countries' Progress on Spectrum

In comparison, South Korea simultaneously completed auctions of high-band (28 GHz) and mid-band (3.5 GHz) spectrum in June 2018. South Korea's Ministry of Science and Information and Communications Technology (ICT) allowed operators to start using the 5G frequencies in December 2018, in preparation of the country's launch of mobile 5G planned for March 2019.

China reserved spectrum for 5G use in 2017, and sought public comment on the planned use of the mid-band spectrum (3.4-3.6 GHz), and millimeter wave spectrum (24.75-27.5 GHz and 37-42.5 GHz) for 5G. During its public comment process, China noted the potential for disruption to existing users, which is a common issue in spectrum allocation. Experts assert that China has an advantage over the United States in freeing spectrum for 5G, in that it can "exert much stronger control over existing spectrum users."97 Industry experts have noted that China has eliminated "regulatory red tape to expedite deployment and make it easier for industry to access large blocks of higher frequency spectrum bands."98 In December 2018, China reportedly allocated large swathes of mid-band spectrum to its three state-owned mobile operators, "preparing the way for large-scale networks testing in 2019, and the launch of commercial 5G services by 2020."99

Equipment and Devices

Just as telecommunications providers are racing to deploy 5G, technology companies and device makers are racing to be the first to deploy 5G equipment and phones, to achieve the economic benefits expected from 5G technologies.

U.S. equipment manufacturers are developing 5G equipment and devices. In a July 2018 Senate hearing, Qualcomm announced that it is "on track to deliver chips that support 5G in both sub-6 GHz and millimeter wave spectrum in time to enable 5G data-only devices to launch before the end of 2018 and for the first 5G smartphones … to launch in the first half of 2019."100

U.S. equipment manufacturers are benefitting from the race to 5G, supplying other countries with 5G technologies, including China. For example, the American chip-maker, Intel, is working with Chinese telecommunications providers.101 Similarly, technology suppliers from other countries are supporting U.S. deployments. For example, T-Mobile signed a $3.5 billion agreement with the Swedish telecommunications equipment maker Ericsson to support T-Mobile's 5G plans.102

Most device makers have announced that 5G phones will be available in 2019. While both Verizon and AT&T launched 5G networks in select areas and offered some 5G services, neither offered access to 5G on a smartphone because 5G smartphones were not yet available. With the adoption of 5G specifications, 5G devices are in production and expected to be available in 2019.

As a result, most providers have announced plans to launch 5G services in 2019, after devices are released. For example, both Verizon and AT&T have announced a launch of new Samsung 5G devices in the first half of 2019.103 South Korean device-maker LG announced that its 5G smartphone is expected to be available in the first half of 2019, as a Sprint exclusive.104

Technology experts have cautioned that since providers are using different spectrum bands to deploy 5G, the first 5G phones may be carrier exclusive (i.e., may only contain one carrier's frequencies). Experts note that "nobody has figured out how to cram the 28 GHz [spectrum] that Verizon and T-Mobile are using, and AT&T's 39 GHz into one box yet. And while T-Mobile and Verizon are using similar 28 GHz bands, T-Mobile is also putting 5G on the 600 MHz band, which Verizon is not."105

The telecommunications industry is global and co-dependent. Providers partner with technology companies and device makers from around the world to move forward on 5G deployment. The availability of 5G devices will drive adoption and revenues for all telecommunications providers. Hence, the availability of equipment and devices is an important factor in the race to 5G.

Small Cell Siting

As stated, deployment of 5G systems will rely on a range of technologies and different bands of spectrum. 5G systems using low- to mid-band spectrum can install new 5G equipment on existing cell sites (4G cell sites). This will increase the speed and functionality of existing 4G networks, but will likely not achieve the ultra-fast speeds provided by millimeter wave bands.

For deployments that leverage higher bands, particularly above 6 GHz, a much higher density of cell sites is needed as the signals cannot travel as far or through obstacles. To overcome these challenges, providers will place many smaller cell sites (also called small cells) close together to relay signals further distances and around obstacles.

Small cells are low-powered radio access nodes with ranges of between 10 meters to two kilometers (in comparison, macro cell towers can cover up to 20 miles or around 32 kilometers). The lower end of small cell nodes is similar to today's Wi-Fi access points. Often compared in size to a pizza box or backpack, small cells can be installed on existing structures, such as buildings, poles, or streetlights. When attaching small cells to existing infrastructure, installation and operation requires connection to a power source, backhaul (e.g., fiber optic cable connection or wireless connection to a core network), and a permit for use of the space. Installations on existing structures can expand to include multiple small cells for use by different wireless carriers, wires, and adjacent boxes housing batteries or cooling fans. Small cells can also be placed in locations without such existing infrastructure, in which case construction of a pole with a power source and backhaul (i.e., wired connections) is required.

|

|

Source: Daniel Bean, "5G Will Mean More Cell Towers in Your Neighborhood. Here's What They'll Look Like and How They'll Work," Circa, June 8, 2018, at https://www.circa.com/story/2018/06/08/business/5g-will-mean-more-cell-towers-in-your-neighborhood-heres-what-theyll-look-like-and-how-theyll-work. Notes: This figure shows two examples of 5G small cell deployments, attached to street lights; one cell site sits on the side of the pole and one sits on the top of the pole. 5G requires installment of many (potentially thousands) of small cells in targeted areas (e.g., stadiums, cities, industrial sites) to achieve ultra-fast 5G speeds. |

In the United States, constructing new wireless towers or attaching equipment to pre-existing structures generally requires providers to obtain approval from federal, state, or local governmental bodies, depending on the location and current owner of the land or structure. The FCC has promulgated rules to ensure all people have access to communications services and to guide approval processes. Past FCC rules

- require localities to act on cell siting applications in a reasonable period of time;106

- grant the FCC authority to regulate terms and rates of pole attachments unless states elect to regulate poles themselves;107

- restrict state or local entities from prohibiting telecommunications services;108

- grant state and local entities authorities to manage rights-of-way and charge reasonable fees for access to rights-of-way;109 and

- require state and local entities to approve eligible facilities requests.110

5G small cell installation have sparked debate over the balance between streamlining siting regulations to facilitate 5G deployment nationwide and maintaining local authorities to review placement of cell sites in communities. U.S. industry executives claim that current regulations and local approvals required for placement of telecommunications equipment adds time and cost to deployment, which puts U.S. carriers at a disadvantage in 5G deployment.111 Local governments and residents have cited concerns about management of rights-of-way, fees charged to providers for access, and the impact of small cells on property values and health and safety.112

At the September 26, 2018, Commission meeting, the FCC approved new rules aimed at facilitating the deployment of wireless infrastructure for 5G networks.113 In its ruling, the FCC

- clarified when a state or local regulation of wireless infrastructure deployment effectively prohibits service; the FCC declared that a state or local government that restricts the entry of a new provider into a service area or inhibits a new service (e.g., 5G) materially inhibits service (which is not permitted under FCC rules);

- concluded that state and local governments should be able to charge fees that are no greater than a reasonable approximation of objectively reasonable costs for processing applications and for managing deployments in the rights-of-way for 5G deployments;

- identified acceptable fee levels for small wireless facility deployments; and

- provided guidance defining criteria for determining whether certain state and local non-fee requirements—such as aesthetic and undergrounding requirements—constitute an effective prohibition of service (which is not permitted under FCC rules).114

Further, the FCC

- established two new shot clocks for small wireless facilities which require localities to make decisions on cell siting applications within 60 days for collocation of equipment on preexisting structures and 90 days for new builds;

- codified the existing 90- and 150-day shot clocks for wireless facility deployments that do not qualify as small cells that were established in 2009;

- stated that all state and local government authorizations necessary for the deployment of personal wireless service infrastructure are subject to those shot clocks; and

- adopted a new remedy for missed shot clocks by finding that a failure to act within the new small wireless facility shot clock constitutes a prohibition on the provision of telecommunication services to an area, which is not allowed under FCC rules.

The FCC noted that easing cell siting regulations will help to speed 5G deployment, encourage private sector investment in 5G networks, and give the United States an advantage in the global race to dominate the 5G market.115

Viewpoints on the Rules on Small Cells

Prior to the FCC vote on the small cell siting rules in September 2018, nine Members of Congress wrote a letter to the FCC urging the FCC to remove the item from its September meeting agenda. The letter urged the FCC to "hit pause" on the issue to consider the perspectives of cities and municipalities, and to seek a solution that balances the interests of localities and industry.116

FCC Commissioner Carr, who led the effort to streamline the small cell placement process, invoked the race to 5G in his support of the rules, noting, "We're not the only country that wants to be first to 5G. One of our biggest competitors is China. They view 5G as a chance to flip the script. They want to lead the tech sector for the next decade. And they are moving aggressively to deploy the infrastructure needed for 5G."117

Industry officials praised the FCC's rules on the day of the vote, noting, "The FCC's action today addresses key obstacles to deploying 5G across the country by reducing unnecessary government red tape."118 Industry representatives noted that high fee rates and long approval processes cost providers money, delayed the deployment of telecommunications infrastructure, and resulted in fewer sites proposed, and less investment in and services to communities.119

FCC Commissioner Rosenworcel, who dissented in part, asserted the rules amounted to federal overreach and an override of state and local authorities and worried that "litigation that follows will only slow our 5G future."120 According to Rosenworcel, the FCC's decision "irresponsibly interferes with existing agreements and ongoing deployments across the country." She cited a recently approved partnership in San Jose, CA, that led to 4,000 small cells on city-owned light poles and $500 million of private investment to support broadband deployment.

Many local governments opposed the ruling, saying the rules exceed the FCC's authorities, and preempt local authorities to manage public property, protect public health and safety, and manage small cell installments.121 Several localities have stated they would experience a loss in revenue due to the FCC's rules.122 The National Association of Counties and the National League of Cities, in a joint statement, noted, "The FCC's impractical actions will significantly impede local governments' ability to serve as trustees of public property, safety and well-being. The decision will transfer significant local public resources to private companies, without securing any guarantee of public benefit in return."123

On January 14, 2019, the FCC rules related to small cells went into effect.124 Various parties are challenging the rules in federal court.125

Small cell siting is a key issue in U.S. 5G deployment. FCC rules designed to advance national interests (e.g., accelerate 5G deployment, achieve the full benefits from 5G technologies) are conflicting with authorities and regulations designed to protect other interests (e.g., public safety, health, ensuring equal access to advanced technologies). Policies that enable U.S. companies to deploy 5G infrastructure and allow state and local entities to manage the placement of 5G small cells in communities could speed deployment of 5G technologies in the United States and enable the United States to achieve the broader consumer and economic benefits from 5G.

National Security and Counterintelligence Concerns

On December 18, 2017, the Trump Administration released its first National Security Strategy (NSS).126 In the context of the NSS's broader discussion of "rejuvenating" domestic economic competitiveness as one pillar of U.S. national security, the Administration identified the enhancement of American infrastructure as a priority action, to include "[improving] America's digital infrastructure by deploying a secure 5G capability nationwide."127

Security Concerns with 5G Deployments

Concern over the rollout of 5G technology from a U.S. national security and intelligence standpoint has been directed at (1) a perceived lack of market diversity that some have argued would result in increased risk to the global telecommunications supply chain; and (2) concern over the potential vulnerability of 5G networks to targeting by foreign intelligence services.128 In a February 13, 2018, statement for the record prepared for a Senate Select Committee on Intelligence (SSCI) open hearing, Director of National Intelligence Daniel Coats stated

The global shift to advanced information and communications technologies (ICT) will increasingly test U.S. competitiveness because aspiring suppliers around the world will play a larger role in developing new technologies and products. These technologies include next-generation, or 5G, wireless technology; the internet of things; new financial technologies; and enabling [artificial intelligence] and big data for predictive analysis. Differences in regulatory and policy approaches to ICT-related issues could impede growth and innovation globally and for U.S. companies.129

Some analysts and experts have highlighted the substantial investment in 5G technologies made by Chinese companies such as ZTE Corporation and Huawei Technologies Co., Ltd.—and the ties of such companies to the government of China—in raising concerns regarding China's relative position vis-à-vis the U.S. in 5G network development.130 Those who share this view believe China's ambition is 5G dominance using several methods, including continued investment in networks, products, and standards that support critical infrastructure and services that will rely on 5G technology; shaping industry standards, regulations, and policies; and "extracting concessions from large multinationals in exchange for market access."131 FBI Director Christopher Wray has also highlighted the potential threat associated with any increase in the integration of Chinese-made or designed devices and 5G cellular network equipment into the United States telecommunications network, stating that

We're deeply concerned about the risks of allowing any company or entity that is beholden to foreign governments that don't share our values to gain positions of power inside our telecommunications networks. That provides the capacity to exert pressure or control over our telecommunications infrastructure. It provides the capacity to maliciously modify or steal information. And it provides the capacity to conduct undetected espionage.132

Others have pointed to the legal leverage the Chinese intelligence services have over companies like Huawei and ZTE to underscore concern over the potential threat Chinese firms could bring to 5G networks:

If Huawei or ZTE were to win a contract to supply 5G equipment under market terms, the political and legal environment in China would prevent either company from refusing a subsequent entreaty from either the Chinese intelligence services or military for access to the technology or services…. The [Chinese] government treats Chinese companies operating abroad as subject to [Chinese] law, and multiple new Chinese laws dictate that telecoms operators must provide the Chinese intelligence services with unfettered access to networks for intercept, which raises concerns about Huawei or ZTE 5G support facilities being used for intelligence operations.133

Security Concerns with Specific Chinese Firms

During the 112th Congress, the House Permanent Select Committee on Intelligence (HPSCI) conducted an investigation into the U.S. national security issues posed by Huawei and ZTE, with the committee's report on the results of the investigation highlighting "the potential security threat posed by Chinese telecommunications companies with potential ties to the Chinese government or military."134 It found, "in particular, to the extent these companies are influenced by the state, or provide Chinese intelligence services access to telecommunication networks, the opportunity exists for further economic and foreign espionage by a foreign nation-state already known to be a major perpetrator of cyber espionage" and other forms of state-sponsored and corporate espionage.135 The HPSCI report concludes with a number of recommendations. Among them: (1) The intelligence community should remain focused on the threat of penetration of the U.S. telecommunications market by Chinese companies; and (2) the Committee on Foreign Investment in the United States (CFIUS) should block acquisitions, takeovers, and mergers that involve Chinese companies Huawei and ZTE.136

In March 2018, CFIUS blocked the takeover of Qualcomm Inc. of the United States—a leader in 5G research and development funding—by Broadcom of Singapore. A U.S. Treasury Department letter of March 5 explaining this decision noted that a takeover of Qualcomm by Broadcom "could pose a risk to the national security of the United States."137 Although details of the national security concerns are classified, they relate to

Broadcom's relationships with third party foreign entities and the national security effects of Broadcom's business intentions with respect to Qualcomm. [Because of] well-known U.S. national security concerns about Huawei and other Chinese telecommunications companies, a shift to Chinese dominance in 5G would have substantial negative national security consequences for the United States.

Additionally, Section 889 of the John S. McCain National Defense Authorization Act (NDAA) for Fiscal Year (FY) 2019 (P.L. 115-232) prohibits the heads of federal agencies from procuring telecommunications equipment or services from Huawei, ZTE Corporation, and other telecommunications companies linked to the government of China that could pose a counterintelligence and national security threat to the United States.138

On January 28, 2019, the U.S. Department of Justice announced criminal charges against Huawei, its Chief Financial Officer, and two affiliates.139

Security Concerns with 5G Networks

Many observers are concerned about the vulnerabilities of 5G networks to exploitation by foreign intelligence services. An individual's ability to use 5G-enabled networks and systems for positive purposes also suggests this same technology can be exploited by foreign intelligence to manipulate perceptions and behavior.

That manipulation is likely to take various forms, including efforts to deceive and confuse people in various ways about what is happening and what the truth is … overloading people's senses with useless or irrelevant information so that we cannot accurately discern what adversaries are doing or what is important; and putting misinformation before us to erroneously confirm pre-existing biases and cause us to misperceive reality and to choose the wrong courses of action. They will also try to stoke long-standing animosities and fears so that Americans fight with each other and look foolish to the world we are supposed to be leading.140

The amount of personal information available for exploitation will expand exponentially with 5G technology, along with doubts as to the security of the networks. This raises concerns among privacy advocates and national security professionals. National security professionals foresee significant challenges for the U.S. intelligence, military, and diplomatic communities in terms of their ability to interact freely and discreetly with foreign nationals who may be deterred by the threat of an aggressive counterintelligence posture.141

Trade Restriction Concerns

Some analysts argue that policies directed at discouraging Chinese investment in the United States not only contradict longstanding U.S. policy of encouraging China to participate in international standards processes, but also may be counterproductive. They suggest that to regard China's influence in 5G technology and standards development as a potential threat to national security may effectively encourage China to create national standards that may act as technical barriers to trade that, in and of themselves, threaten U.S. national security.142 Technological innovation in the private sector, to include 5G, relies on cooperation between the United States and China, they maintain.143 These critics also note that the Trump Administration's trade policy, which includes tariffs on Chinese telecommunications equipment, threatens to significantly increase the costs and slow the deployment of 5G infrastructure.

Fencing off the U.S. technology sector from one-sixth of the world's population, they suggest, will only cede ground to Chinese competitors, drive up costs for U.S. consumers, and reduce the competitiveness of leading U.S. technology companies, all while isolating the United States from the places where innovation is happening.144

Policy Considerations for Congress

Congress and other U.S. policymakers are faced with deciding how to address both interest in promoting U.S. competitiveness in the global race to 5G, and an efficient domestic 5G deployment. Congress may consider the role of the federal government in industrial policy and promotion, and the role of the federal government in domestic deployment of 5G technologies.

In the rollout of previous technologies, U.S. telecommunications companies invested in research and development, participated in international projects to test the technologies, contributed to standards, and planned business strategies. This market-based approach sparked competition and innovation that gave the United States an edge in previous technologies. For 5G, other countries (i.e., central governments) have engaged in centralized planning and coordination with industry to gain a lead in the race to 5G. Congress may monitor U.S. progress on 5G deployment and technologies, consider whether there is a need for more planning and coordination with industry, and assess whether additional government involvement would help or hinder the efforts of U.S. companies in the global race to 5G.

In terms of domestic deployment, Congress may be asked to consider the benefits and risks of 5G deployment. Nationally, 5G technologies are expected to create new revenues and new jobs. 5G technologies have also raised national security concerns, individual privacy concerns, and questions about how to assess the security of foreign-made equipment.

Congress may consider policies that protect U.S. telecommunications networks, including policies that impose trade restrictions or economic sanctions on foreign technology providers, or policies limiting foreign participation in 5G build-outs. Congress may weigh how various policy approaches address threats to national security (e.g., threats to telecommunications networks, industrial systems, critical infrastructure, and government networks; cybersecurity threats; threats to privacy). Congress may also consider how trade policies may alter the ability of U.S. companies to deploy networks domestically, and to purchase and sell equipment abroad.

5G technologies are also expected to offer new services for consumers (e.g., telehealth to rural areas, new services for the disabled). However, localities have raised concerns regarding the siting of 5G small cells (e.g., authorities to make decisions about public rights-of-way, fees, ensuring rural access, health and safety). While some stakeholders are seeking U.S. government support to speed 5G deployment, others are calling on the U.S. government to assess 5G risks and concerns before deploying. Congress may consider how to weigh these competing interests and concerns.