Energy Savings Performance Contracts (ESPCs) and Utility Energy Service Contracts (UESCs)

Many in Congress have expressed a continuing interest in improving energy efficiency and increasing the use of renewable energy. To facilitate investment in energy efficiency and renewable energy at federal facilities, Congress established alternative financing methods that utilize private sector resources and capabilities. Two such alternative financing methods are energy savings performance contracts (ESPCs) and utility energy service contracts (UESCs).

ESPCs and UESCs are contracts between a federal agency and another party—an energy service company or a utility, depending upon the contract type. In general, a federal agency agrees to pay an amount not to exceed the current annual utility costs for a fixed period of time to the company or utility, which finances and installs the energy-efficiency and renewable energy projects. The costs are repaid by the agency over the length of the contract. After the end of the contract, the agency benefits from any reduced energy costs as a result of the improvements.

The Department of Energy’s Federal Energy Management Program (FEMP) is the lead organization responsible for providing implementing rules and policies for ESPCs. FEMP also provides training, guidance, and technical assistance to aid federal agencies in achieving energy and water goals. Federal agencies are required to document progress toward energy-saving goals through annual reporting to the President and Congress.

FEMP compiles agency data annually. Between FY2005 and FY2017, investment in federal facility energy efficiency improvements totaled nearly $21.7 billion (in constant 2017 dollars): direct obligations funded $14.5 billion, ESPCs funded $5.7 billion, and UESCs funded $1.5 billion. A lack of consistency in reporting across agencies for projects makes it challenging to document the cost savings achieved solely from ESPCs or UESCs. The available data may provide insight into broad trends in federal energy and water consumption. Over available reporting time periods, total site-delivered energy use has declined, renewable electricity use has increased as a percentage of total electricity consumption, and water use has declined.

The Government Accountability Office (GAO) has examined alternative financing for federal energy projects, including ESPCs and UESCs. In a 2016 study, GAO reported that the Department of Defense had identified challenges in using ESPCs and UESCs for renewable energy projects, as such financing mechanisms may not realize the federal tax benefits under requirements set by the Office of Management and Budget (OMB). Prior to 2012, the Army had structured ESPCs to allow private developers to capture federal incentives by owning renewable energy projects. The Army stopped doing so after a 2012 OMB memorandum required government ownership of such renewable energy projects to avoid obligating the full cost of the project when the contract is signed. A 2017 study by GAO examined energy projects for DOD more broadly and found that the majority of these were financed using ESPCs or UESCs.

Congressional Budget Office (CBO) scoring policies for ESPCs and UESCs have changed over time. The 2018 House Budget Resolution (H.Con.Res. 71) directed CBO to score ESPCs and UESCs on a net present value basis with payments covering the period of the contract. The estimated net present value of the budget authority and any outlays would be classified as direct spending; it would not change the fact that federal agencies would continue to cover contractual payments through annual, discretionary appropriations. H.Con.Res. 71 also prohibited any savings estimated by CBO to be considered as an offset for purposes of budget enforcement. This prohibition applies to budget enforcement in the House of Representatives; CBO considers estimated savings to offset budget enforcement differently for the House of Representatives and the Senate.

Congress has revised the policies enabling ESPCs and UESCs over time, and Congress may address additional changes going forward. Issues for possible consideration include reporting requirements, definitions of terminology including federal building and energy savings, and whether to expand the applicability of ESPCs and UESCs.

Energy Savings Performance Contracts (ESPCs) and Utility Energy Service Contracts (UESCs)

Jump to Main Text of Report

Contents

- Overview

- Background

- Use of ESPCs and UESCs in Federal Energy Management

- Investments in Energy Efficiency and Renewable Energy

- Energy and Water Conservation Measures

- Assessments of ESPCs and Federal Energy Performance

- Annual Evaluations of DOE IDIQ ESPC Program

- GAO Reports on Energy Projects and Alternative Financing

- Congressional Budget Office Scoring Policies

- Possible Issues for Congress

- Recent Legislation

Figures

Summary

Many in Congress have expressed a continuing interest in improving energy efficiency and increasing the use of renewable energy. To facilitate investment in energy efficiency and renewable energy at federal facilities, Congress established alternative financing methods that utilize private sector resources and capabilities. Two such alternative financing methods are energy savings performance contracts (ESPCs) and utility energy service contracts (UESCs).

ESPCs and UESCs are contracts between a federal agency and another party—an energy service company or a utility, depending upon the contract type. In general, a federal agency agrees to pay an amount not to exceed the current annual utility costs for a fixed period of time to the company or utility, which finances and installs the energy-efficiency and renewable energy projects. The costs are repaid by the agency over the length of the contract. After the end of the contract, the agency benefits from any reduced energy costs as a result of the improvements.

The Department of Energy's Federal Energy Management Program (FEMP) is the lead organization responsible for providing implementing rules and policies for ESPCs. FEMP also provides training, guidance, and technical assistance to aid federal agencies in achieving energy and water goals. Federal agencies are required to document progress toward energy-saving goals through annual reporting to the President and Congress.

FEMP compiles agency data annually. Between FY2005 and FY2017, investment in federal facility energy efficiency improvements totaled nearly $21.7 billion (in constant 2017 dollars): direct obligations funded $14.5 billion, ESPCs funded $5.7 billion, and UESCs funded $1.5 billion. A lack of consistency in reporting across agencies for projects makes it challenging to document the cost savings achieved solely from ESPCs or UESCs. The available data may provide insight into broad trends in federal energy and water consumption. Over available reporting time periods, total site-delivered energy use has declined, renewable electricity use has increased as a percentage of total electricity consumption, and water use has declined.

The Government Accountability Office (GAO) has examined alternative financing for federal energy projects, including ESPCs and UESCs. In a 2016 study, GAO reported that the Department of Defense had identified challenges in using ESPCs and UESCs for renewable energy projects, as such financing mechanisms may not realize the federal tax benefits under requirements set by the Office of Management and Budget (OMB). Prior to 2012, the Army had structured ESPCs to allow private developers to capture federal incentives by owning renewable energy projects. The Army stopped doing so after a 2012 OMB memorandum required government ownership of such renewable energy projects to avoid obligating the full cost of the project when the contract is signed. A 2017 study by GAO examined energy projects for DOD more broadly and found that the majority of these were financed using ESPCs or UESCs.

Congressional Budget Office (CBO) scoring policies for ESPCs and UESCs have changed over time. The 2018 House Budget Resolution (H.Con.Res. 71) directed CBO to score ESPCs and UESCs on a net present value basis with payments covering the period of the contract. The estimated net present value of the budget authority and any outlays would be classified as direct spending; it would not change the fact that federal agencies would continue to cover contractual payments through annual, discretionary appropriations. H.Con.Res. 71 also prohibited any savings estimated by CBO to be considered as an offset for purposes of budget enforcement. This prohibition applies to budget enforcement in the House of Representatives; CBO considers estimated savings to offset budget enforcement differently for the House of Representatives and the Senate.

Congress has revised the policies enabling ESPCs and UESCs over time, and Congress may address additional changes going forward. Issues for possible consideration include reporting requirements, definitions of terminology including federal building and energy savings, and whether to expand the applicability of ESPCs and UESCs.

Many in Congress have expressed a continuing interest in improving energy efficiency and increasing the use of renewable energy. To facilitate investment in energy efficiency and renewable energy at federal facilities, Congress established alternative financing methods that utilize private sector resources and capabilities. Two such alternative financing methods are energy savings performance contracts (ESPCs) and utility energy service contracts (UESCs).

ESPCs and UESCs are contracts between a federal agency and another party—an energy service company or a utility, depending upon the contract type. In general, a federal agency agrees to pay an amount not to exceed the current annual utility costs for a fixed period of time to the company or utility, which finances and installs the energy-efficiency and renewable energy projects. The costs are repaid by the agency over the length of the contract. After the end of the contract, the agency benefits from any reduced energy costs as a result of the improvements.

The Department of Energy's Federal Energy Management Program (FEMP) is the lead organization responsible for providing implementing rules and policies for ESPCs. FEMP also provides training, guidance, and technical assistance to aid federal agencies in achieving energy and water goals. Federal agencies are required to document progress toward energy-saving goals through annual reporting to the President and Congress.

FEMP compiles agency data annually. Between FY2005 and FY2017, investment in federal facility energy efficiency improvements totaled nearly $21.7 billion (in constant 2017 dollars): direct obligations funded $14.5 billion, ESPCs funded $5.7 billion, and UESCs funded $1.5 billion. A lack of consistency in reporting across agencies for projects makes it challenging to document the cost savings achieved solely from ESPCs or UESCs. The available data may provide insight into broad trends in federal energy and water consumption. Over available reporting time periods, total site-delivered energy use has declined, renewable electricity use has increased as a percentage of total electricity consumption, and water use has declined.

The Government Accountability Office (GAO) has examined alternative financing for federal energy projects, including ESPCs and UESCs. In a 2016 study, GAO reported that the Department of Defense had identified challenges in using ESPCs and UESCs for renewable energy projects, as such financing mechanisms may not realize the federal tax benefits under requirements set by the Office of Management and Budget (OMB). Prior to 2012, the Army had structured ESPCs to allow private developers to capture federal incentives by owning renewable energy projects. The Army stopped doing so after a 2012 OMB memorandum required government ownership of such renewable energy projects to avoid obligating the full cost of the project when the contract is signed. A 2017 study by GAO examined energy projects for DOD more broadly and found that the majority of these were financed using ESPCs or UESCs.

Congressional Budget Office (CBO) scoring policies for ESPCs and UESCs have changed over time. The 2018 House Budget Resolution (H.Con.Res. 71) directed CBO to score ESPCs and UESCs on a net present value basis with payments covering the period of the contract. The estimated net present value of the budget authority and any outlays would be classified as direct spending; it would not change the fact that federal agencies would continue to cover contractual payments through annual, discretionary appropriations. H.Con.Res. 71 also prohibited any savings estimated by CBO to be considered as an offset for purposes of budget enforcement. This prohibition applies to budget enforcement in the House of Representatives; CBO considers estimated savings to offset budget enforcement differently for the House of Representatives and the Senate.

Congress has revised the policies enabling ESPCs and UESCs over time, and Congress may address additional changes going forward. Issues for possible consideration include reporting requirements, definitions of terminology including federal building and energy savings, and whether to expand the applicability of ESPCs and UESCs.

Overview

The federal government is the largest energy consumer in the United States, and it is one of the largest energy consumers in the world. Policymakers have highlighted the role of energy efficiency improvement in the federal sector as a mechanism to reduce energy consumption and its associated costs.

Many Members of Congress have expressed a continuing interest in improving energy efficiency and increasing the use of renewable energy. One barrier to federal agencies making such investments relates to the availability of capital given the constrained fiscal environment. As a result, agency projects that could reduce federal energy usage, expand the use of renewable energy, and reduce federal energy costs may not be pursued. To address this challenge, Congress established alternative financing methods that utilize private sector resources and capabilities to facilitate federal energy projects. Two such alternative financing methods are energy savings performance contracts (ESPCs) and utility energy service contracts (UESCs).

An ESPC is a multiyear contract between a federal agency and an energy service company. In general, under an ESPC, a federal agency agrees to pay an amount not to exceed the current annual utility costs for a fixed period of time (up to 25 years) to an energy service company, which finances and installs facility improvements. In return, the contractor assumes the performance risks of energy conservation measures during the contract period and guarantees that the improvements will generate energy cost savings sufficient to pay for the improvements over the length of the contract, as well as providing the energy services company a return on the investment. After the end of the contract, the agency benefits from reduced energy costs as a result of the improvements.1

A UESC is a contract between a federal agency and the serving utility.2 Under a UESC, the utility arranges financing for efficiency projects and renewable energy projects, and the costs are repaid by the agency over the length of the contract.3

Background

The Energy Policy Act of 1992 (EPACT, P.L. 102-486) amended the National Energy Conservation Policy Act (NECPA, P.L. 95-619) and authorized alternative financing methods for federal energy projects, among other provisions. Section 155 of EPACT (42 U.S.C. §§8287 et seq.) defined the term "energy savings performance contract" and authorized federal agencies to incur obligations through ESPCs to finance energy conservation measures, provided certain conditions were met.4 Section 152 of EPACT authorized "utility incentive programs" (codified as 42 U.S.C. §8256) and encouraged agencies to participate in programs to increase energy efficiency,5 conserve water, or manage energy demand.

ESPCs and UESCs were devised as part of a strategy to help meet federal energy and emissions reduction goals by improving the energy efficiency of federal facilities. They offer the financial resources needed to make efficiency improvements to aging buildings and facilities. For ESPCs, in return for privately financing and installing conservation measures, a contractor—referred to as an energy service company (ESCO)—would receive a specified share of any resulting cost savings. The ESCO typically guarantees a fixed amount of energy savings and cost savings throughout the term of the contract, bearing the risk of the improvement's failure to produce a projected amount of energy savings and cost savings.6 The efficiency improvement provided by the ESPC is referred to as an "energy or water conservation measure," and includes improvements such as energy- and water-saving equipment, energy savings measures such as better insulation or windows, and renewable energy systems such as solar energy panels.7 In the case of UESCs, the federal agency contracts with the utility that is providing services to finance and install energy conservation measures and to provide energy demand-reduction services. The authority for UESCs does not require utilities to guarantee savings; the repayment is based on estimated cost savings.

ESPCs and UESCs are seen as having tangible benefits for ESCOs and utilities. For an ESCO, the contract includes a guarantee of a specified amount of annual energy savings and cost savings that is sufficient to pay back the installation and financing costs. When improvements yield savings in excess of the guarantee, the agency benefits and depending upon the contract, the ESCO may also benefit. For utilities, the contracts do not require a savings guarantee although efficiency improvements can provide benefits such as reduction in demand, which can lead to cost savings for the utility. Local, state, or federal tax incentives may also be available to the contractors.

Use of ESPCs and UESCs in Federal Energy Management

The Department of Energy's Federal Energy Management Program (FEMP) is the lead organization responsible for providing implementing rules and policies for ESPCs.8 FEMP also provides training, guidance, and technical assistance to assist federal agencies in achieving energy goals including cost or use reduction or renewable use, greenhouse gas reduction goals, and water conservation goals as directed through legislation or executive orders.9 Federal agencies are required to document progress toward energy saving goals through annual reporting to the President and Congress; FEMP compiles these data annually.10

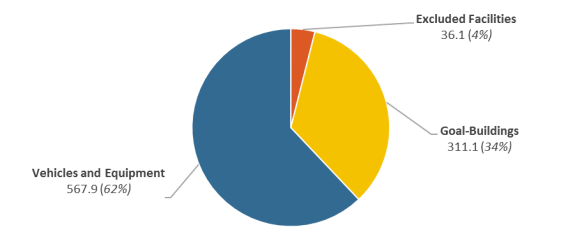

ESPCs and UESCs apply to energy use at federal facilities—not to vehicles and equipment.11 In FY2017, FEMP reports that federal agencies used 915 trillion British thermal units (Btu) of delivered electrical and thermal energy across all end-use sectors.12 Figure 1 shows the end-use sectors for energy consumption—62% of the energy consumed is from vehicles and equipment such as aircraft, ships, and on-road vehicle fleets. In FY2017, federal facilities used over 347 trillion Btu of delivered electrical and thermal energy.

|

Figure 1. FY2017 Federal Government Total Energy Consumption by End-Use Sector In Trillions of Btu |

|

|

Source: FEMP, "Federal Government Energy and Water Use in 2017," Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, https://ctsedwweb.ee.doe.gov/Annual/Report/Report.aspx. Notes: Numbers may not sum due to rounding. FEMP establishes guidelines for classifying federal buildings as "goal-buildings" or "excluded facilities." Goal-buildings are federal buildings subject to federal energy performance requirements. Excluded facilities are federal buildings not required to meet the federal building energy performance requirement for the fiscal year according to the criteria under Section 543(c)(3) of NECPA. Excluded facilities may include buildings used in performance of a national security function or buildings where process-dedicated energy (e.g., maintaining controlled environment for preservation, storage, and display of historical documents and artifacts) overwhelms other building energy consumption. |

Investments in Energy Efficiency and Renewable Energy

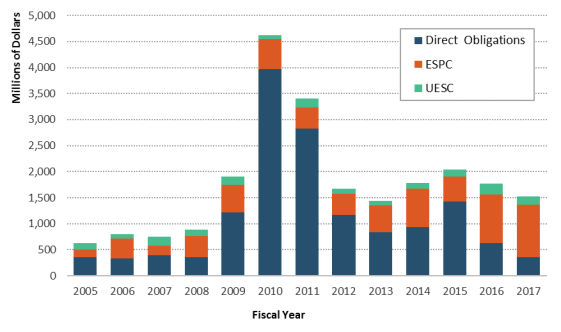

As part of annual reporting, FEMP compiles data on federal government investment in energy efficiency and renewable energy through ESPCs, UESCs, and direct obligations.13 Figure 2 depicts annual investments between FY2005 and FY2017 and shows that investments in ESPCs have fluctuated during that time period. As shown in Table 1, investment in federal facility energy efficiency improvements during that period totaled nearly $21.7 billion (in constant 2017 dollars): direct obligations funded $14.5 billion, ESPCs funded $5.7 billion, and UESCs funded $1.5 billion.

|

Figure 2. Federal Government Investment in Facility Efficiency Improvements, In millions of 2017 constant dollars |

|

|

Source: FEMP, "Investment in Energy Efficiency and Renewable Energy," Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, http://ctsedwweb.ee.doe.gov/Annual/Report/InvestmentInEnergyEfficiencyAndRenewableEnergy.aspx. |

Investment in ESPCs has been supported by executive branch actions. In 2007, the George W. Bush Administration issued Executive Order (E.O.) 13423, which established goals for agencies including to "improve energy efficiency and reduce greenhouse gas emissions of the agency, through reduction of energy intensity."14 The implementing instructions for E.O. 13423 reference several instruments—including ESPCs and UESCs—that "should be utilized to the maximum extent practical to implement energy efficiency management projects, water management projects, and renewable energy projects with energy conservation measures (ECMs) having long- and short-term payback periods that can be incorporated into life-cycle cost effective contracts."15 In 2011, the Obama Administration directed agencies to complete $2 billion in ESPCs within two years.16 In 2015, the goal was increased to $4 billion in ESPCs by 2016.17 In 2018, the Trump Administration issued E.O. 13834, which established goals for agencies including to "utilize performance contracting to achieve energy, water, building modernization, and infrastructure goals."18

Table 1. Federal Government Investment in Facility Efficiency Improvements,

by Funding Mechanism, FY2005-FY2017

In millions of 2017 constant dollars

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

Source: FEMP, "Investment in Energy Efficiency and Renewable Energy," Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, http://ctsedwweb.ee.doe.gov/Annual/Report/InvestmentInEnergyEfficiencyAndRenewableEnergy.aspx.

Notes: Rows and columns may not sum due to rounding.

By 2014, federal buildings reportedly accounted for nearly $1.1 billion in revenue for the ESCO industry (nearly 21% of total ESCO industry revenue).19 ESCOs that earned more than $300 million in annual revenue in 2014 account for 66% of federal market revenues although their overall market share is 51%.20 Collectively, 85% of the industry revenue in 2014 came from federal, state, and local government facilities; educational facilities such as universities, colleges, and K-12 schools; and healthcare facilities.21

Agencies document contracts in different ways. This inconsistency makes it challenging to report the number of contracts in the same manner that dollars are tracked and reported in Table 1. The number of contracts by mechanism is not aggregated in the same manner. According to FEMP's compliance tracking system, nearly 2,800 projects have been initiated at covered facilities to achieve energy and water savings; however, the financing mechanisms for specific projects are not identified.22 FEMP separately publishes information for Indefinite-Delivery, Indefinite-Quantity (IDIQ) ESPCs—or "umbrella contracts." These contracts were developed by FEMP to facilitate the use of ESPCs by federal agencies.23 Since the IDIQ ESPCs were established in 1998, FEMP has awarded approximately 400 projects.24 FEMP also states that it "has collected data on more than 2,100 UESC projects dating back to 1992 to help demonstrate the value, importance, and impact of the utility energy service contract (UESC) program, but it has kept individual details of the information agencies provided confidential."25 According to the Government Accountability Office (GAO), a review of the federal use of ESPCs that focused on seven selected agencies, those with the highest energy usage and greatest facility square footage, identified over $12 billion (in 2014 dollars) in awards "to more than 500 ESPCs for projects in fiscal years 1995 through 2014." 26 A separate GAO report focused on alternatively financed energy projects for the Department of Defense. The report indicates that from FY2005 to FY2016, military services entered into 245 UESC contracts and 201 ESPC contracts.27

Energy and Water Conservation Measures

The contribution to energy and water conservation from investments in ESPCs and UESCs is difficult to quantify. In describing the energy and cost savings for an ESPC project, FEMP states, "On average, comprehensive ESPC projects result in about a 19-20% reduction in energy use—and energy and energy-related costs. The average length of the contract period is 17 years, and the average project investment is about $15 million." 28

CRS was unable to determine the cost savings achieved solely from ESPCs and UESCs across the federal government. However, FEMP provides data that may provide insight into broad trends in federal energy water consumption. Between FY2003 and FY2017, the annual total site-delivered energy use declined by more than 19% (a savings of 217 trillion British thermal units).29 This decline accounts for all end-use sectors and includes reductions that may be the result of downsizing or outsourcing activities. Renewable electricity use (as a share of electricity consumption) and water savings (in gallons used) have been tracked and reported by FEMP over a shorter time period. Renewable electricity use has increased across the federal government from 3% of total electricity consumption (1,909 GWh) in FY2008 to nearly 11% (5,844 GWh) in FY2017.30 Between FY2007 and FY2017, potable water use declined by more than 25% (a savings of 43 billion gallons).31 Water use for industrial, landscaping, and agricultural (ILA) purposes has been tracked separately. ILA water use declined by more than 33% (a savings of 46 billion gallons) between FY2010 and FY2017.32

In addition to comprehensive energy and water data, annual data from selected energy and water conservation measures are available. According to FEMP's compliance tracking system, approximately 700 (or 25%) of the nearly 2,800 projects that implemented energy and water conservation measures have had follow-up measurement and verification completed. These approximately 700 projects have resulted in the following measured benefits:

- annual energy savings of 14 trillion British thermal units (Btu) (approximately 1.5% of total federal energy consumption in 2017),

- annual water savings of nearly 2.8 billion gallons,

- annual renewable electricity output of 150 GWh, and

- annual renewable thermal output of 106 billion Btu.33

It is unclear how representative these 700 projects are to the remaining 2,800 projects and if they would provide similar benefits.

|

Reporting of Federal Greenhouse Gas Emissions Energy consumption and greenhouse gas (GHG) emissions are inextricably linked. Although FEMP is not required to report GHG emissions to Congress by statute, FEMP provided information on the federal government's GHG emission inventory in annual reporting while E.O. 13514, and later E.O. 13693, were active. In May 2018, President Trump signed E.O. 13834, Efficient Federal Operations, which revoked E.O. 13693, and states that "agencies shall meet such statutory requirements in a manner that increases efficiency, optimizes performance, eliminates unnecessary use of resources, and protects the environment."34 Going forward under E.O. 13834, it is unclear whether FEMP will continue to collect and report GHG emission inventories for federal agencies. Executive Order 13514 and E.O. 13693 directed agencies to establish greenhouse gas (GHG) reduction targets.35 Agencies were directed to establish GHG reduction targets for "scopes" 1, 2, and 3 by a target date (the end of FY2025 for E.O. 13693) relative to a FY2008 baseline.36 GHG emissions from sources owned or controlled by an agency are considered scope 1 if they are directly emitted from the source (e.g., stationary sources, fleet vehicles and equipment) or scope 2 if they are indirectly emitted from the source (e.g., purchased electricity, purchased heating or cooling). GHG emissions from sources not owned or directly controlled by an agency are considered scope 3 (e.g., electricity transmission and distribution losses, business air travel, employee commuting). According to FEMP, scope 1 and 2 GHG emissions—which include emissions from federal facilities—have declined by nearly 26% between FY2008 and FY2017 across the federal government. FY2008 scope 1 and 2 emissions totaled nearly 51.4 million metric tons of carbon dioxide equivalent (MMTCO2e).37 For FY2017, scope 1 and 2 emissions totaled 38.2 MMTCO2e. FEMP does not provide sufficient information to determine the contribution that ESPCs and UESCs have made to total GHG reductions during the FY2008-FY2017 period. Table 2 presents emissions data by category; emissions from all categories with the exception of "fleets and equipment" could be attributable to a federal facility or building. Table 2. Scope 1 and 2 GHG Emissions Government-Wide from Standard Operations In million metric tons of carbon dioxide equivalent (MMTCO2e)

Source: FEMP, "Scope 1 & 2 GHG Emissions from Standard Operations, FY 2008 and FY 2017," Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, http://ctsedwweb.ee.doe.gov/Annual/Report/Scope1And2GHGEmissionsSubjectToReductionTargetsByCategoryComparedToFY2008.aspx. Notes: Numbers may not sum due to rounding. "Stationary" refers to stationary combustion sources including those associated with on-site production of electricity, heat, cooling, or steam. "Fleets and Equipment" includes data obtained for fleets, non-road vehicles (e.g., agriculture equipment), non-excluded vessels and aircraft (e.g., research aircraft), and equipment (e.g., lawnmowers). "Fugitives" refers to intentional or unintentional emissions including from equipment leaks and on-site incinerators. "Process" refers to industrial process emissions. "Electricity" refers to emissions from purchased electricity and does not include emissions from electricity losses due to transmission and distribution. "Steam and Water" includes emissions associated with the consumption of purchased steam, hot water supply, and chilled water supply. "Other" may refer to categories not specifically mentioned or non-covered GHGs with high global warming potentials. "RE use" refers to adjustments made to the emissions estimate to account for renewable energy use. "Total" refers to the sum of scope 1 and scope 2 emissions from all categories, and does not include scope 3 emissions. Emissions presented here do not include those from non-standard operations, which are considered to be from vehicles, vessels, aircraft and other equipment used by agencies in combat, combat service support, tactical or relief operations, training for such operations, law enforcement, emergency response, or spaceflight (including associated ground-support equipment), or those emissions from electric power produced and sold commercially to other parties. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Assessments of ESPCs and Federal Energy Performance

Several entities have assessed the performance of ESPCs (and to a lesser extent UESCs). The following sections highlight the findings of these assessments.

Annual Evaluations of DOE IDIQ ESPC Program

Oak Ridge National Laboratory (ORNL) has evaluated the reported energy and cost savings from the DOE IDIQ ESPC program on an annual basis for several years.38 In ORNL's report for FY2016, 172 measurement and verification (M&V) reports were reviewed.39 Although ORNL found that "the quality of the M&V reports examined varied widely," the reports contained sufficient information to compare estimated, reported, and guaranteed cost savings. During the FY2016 reporting period, these projects collectively reported the following cost savings (in current dollars):

- Estimated cost savings of more than $298 million;

- Reported cost savings of more than $296 million; and

- Guaranteed cost savings of more than $274 million.

Of the 172 reports reviewed, on average, ESCOs guaranteed 92% of estimated cost savings.40 On average, projects reported achieving approximately 99% of the estimated cost savings, and projects reported achieving approximately 108% of the guaranteed cost savings.41 Regarding energy savings, these projects on average reported achieving over 95% of estimated energy savings for site energy use and 98% of estimated energy savings for source energy use.42 Although energy use reductions are typically the largest source of cost savings according to ORNL, cost savings can also come from reductions in demand, water use, operations and management costs, and renovation and refurbishment costs and from improvements in the power factor.43

GAO Reports on Energy Projects and Alternative Financing

The Government Accountability Office has examined alternative financing—including ESPCs and UESCs—for federal energy projects. In 2015, GAO reviewed about $12 billion of ESPCs awarded by seven agencies from FY1995 to FY2014 and found that although most ESPCs met or exceeded expectations, "some of these savings may be overstated."44 GAO found that "the amount of savings reported but not achieved ranged from negligible to nearly half of an ESPC project's reported savings for the year, based on information provided by agencies and [GAO's] analysis of available information from the most recent measurement and verification reports for selected projects."45 ESCOs must calculate and report annual savings according to the measurement and verification plans in their ESPCs. According to GAO

Measurement and verification reports for 14 projects in our sample [of 20 nongeneralizable projects] overstated some cost and energy savings in that they reported savings that were not achieved because of agencies' actions, including (1) agencies not operating or maintaining equipment as agreed when the ESPC was awarded and (2) agencies' removal of equipment from or closure of facilities where energy conservation measures had been installed.46

GAO recommended several actions to improve oversight of ESPC projects. The Secretary of Energy's Advisory Board (SEAB) summarized GAO's recommended actions to FEMP as "improved oversight of ESPC projects through clearer reporting of savings, improved training, and systematic evaluations of portfolios, among other things."47

Projects financed through ESPCs and UESCs were also included in a study conducted by GAO in 2016 to examine how the Department of Defense (DOD) determines the costs and benefits of a sample of renewable energy projects.48 Of the 17 projects evaluated, one project relied on an ESPC (and included a power purchase agreement for power produced from a solar array) and one project relied on a UESC.49 GAO reported that "according to DOD officials, private developers can obtain federal, state, and local tax incentives, which can significantly lower their overall costs of developing renewable energy."50 Energy-efficiency tax incentives such as the federal energy-efficiency commercial buildings tax deduction (Internal Revenue Code Section 179D) have reportedly been leveraged by ESCOs to increase investment and savings for ESPC projects beyond what would be possible without the incentives.51

In the 2016 report, GAO noted that DOD did not emphasize the use of some alternative financing mechanisms for renewable projects, including ESPCs and UESCs. According to DOD, these mechanisms may not realize federal tax benefits under requirements set by the Office of Management and Budget:

Access to incentives. Some ESPCs and UESCs may not allow private developers to capture federal tax incentives because Internal Revenue Service rules stipulate that only owners of the projects or those meeting certain standards are eligible to claim key tax expenditures. According to Army officials, the Army has structured ESPCs to allow private developers to capture federal incentives by owning the embedded renewable energy projects, but it stopped doing so after a 2012 Office of Management and Budget memorandum required government ownership of such renewable energy projects to avoid obligating the full cost of the project when the contract is signed.52

In 2017, GAO examined alternative financing for energy projects for DOD more broadly—the majority of these were financed using ESPCs or UESCs. Of the nongeneralizable sample projects reviewed by GAO, projects achieved expected savings; however, GAO found that measurement and verification of savings varies across military departments.53

Congressional Budget Office Scoring Policies

Congressional Budget Office (CBO) scoring policies for ESPCs and UESCs have changed over time. Initially, the budgetary cost of ESPCs and UESCs were not scored by the CBO. Under the Budget Enforcement Act of 1990 (BEA, P.L. 101-508) pay-as-you-go (PAYGO) rules, increases in mandatory spending scored by CBO had to be offset by mandatory spending cuts or increased revenues.54 The Budget Enforcement Act of 1997 (P.L. 105-33) extended these enforcement mechanisms through FY2002. The BEA also imposed limits on discretionary spending.55

After an extensive review of whether ESPCs and UESCs imposed a future financial obligation on the federal government, CBO began scoring them as mandatory spending. This coincided with the expiration of the BEA at the end of FY2002. This scoring reflected how ESPCs and UESCs create future commitments to appropriations and was consistent with how appropriations-funded energy conservation projects would be scored throughout the budget.56 However, the operations and maintenance funds that are used to pay for the ESPCs and UESCs must be appropriated annually.

In the 115th Congress, the 2018 House Budget Resolution (H.Con.Res. 71) directed CBO to change how ESPCs and UESCs are scored. Section 5109 directs CBO to estimate provisions for ESPCs and UESCs on a net present value basis with payments covering the period of the contract (up to 25 years). According to H.Rept. 115-240, this "would have the effect of capturing any long-term budgetary savings (and costs) resulting from these contracts."57 The scoring would classify the estimated net present value of the budget authority and any outlays as direct spending, and according to the accompanying report, "it would not change the fact that Federal agencies would continue to cover contractual payments through annual, discretionary appropriations."58 According to CBO, "the provision [in H.Con.Res. 71] that prohibits any savings estimated by CBO to be considered as an offset for purposes of budget enforcement applies only to legislation considered by the House of Representatives, not the Senate."59

Possible Issues for Congress

Both the executive branch and Congress have promoted energy efficiency within federal agencies. Shared energy savings (and later ESPCs and UESCs) were included as part of an overall strategy to meet federal energy reduction goals. Since that time, ESPCs and UESCs have continued to be used to implement energy and water efficiency improvements at federal facilities. Congress has revised the policies enabling ESPCs and UESCs over time, and Congress may wish to assess additional changes going forward. Among the issues for consideration:

Should monetary savings be treated consistently for budget enforcement for both chambers of Congress?

Federal agencies are authorized to use ESPCs to finance energy conservation measures provided that guaranteed savings exceed the debt service requirements. CBO scores ESPCs as future commitments to appropriations (modified with the net present value (NPV) approach). However, CBO considers savings to offset budget enforcement differently for the House of Representatives and the Senate. For the House of Representatives, savings cannot be used to offset budget enforcement; the same limitation is not in place for the Senate.

Should Congress modify reporting requirements for federal energy management?

GAO has recommended to federal agencies that they revise guidance for future projects to include additional information in measurement and verification reports for ESPCs and UESCs to provide better understanding of performance and the extent to which the financing mechanisms are achieving expected savings.60 Additionally, with the revocation of E.O. 13693 and replacement with E.O. 13834, it is uncertain whether DOE will continue to provide annual comprehensive GHG inventory data including progress toward achieving agency scope 1, scope 2, and scope 3 GHG emission goals. Congress may wish to consider whether agencies should continue to report on GHG emissions as part of their annual energy reporting.

Should Congress clarify what is to be considered as energy-related savings or what energy conservation measures should be included in alternative financing mechanisms?

One of the three challenges facing ESPCs identified by the SEAB was a lack of uniform legal interpretations.61 GAO recommended "that the Director of OMB document, for the purposes of scoring ESPCs, (1) what qualifies as energy-related savings and (2) the allowable proportion of energy and energy-related cost savings."62 Congress may wish to define whether energy-related savings would include savings from various sources, such as efficiency improvements from energy-consuming equipment in data centers, renewable energy credits, electric vehicle charging infrastructure, or efficiency improvements from mobile sources.

Should Congress expand the use of alternative financing mechanisms such as ESPCs and UESCs to include demonstration and validation of advanced energy technologies at federal facilities or modernization of federal infrastructure?

Under the existing structure, SEAB notes that "ESCOs and other third-party financers have an incentive to minimize risk on individual projects," which can lead "these entities to use older, proven technology, rather than the kinds of innovative technologies coming out of the DOD and GSA test bed programs."63

Should Congress renew the energy-efficiency commercial buildings tax deduction (Section 179D)?

ESCOs have reportedly leveraged energy-efficiency tax incentives to increase investment and savings for ESPC projects.64 Section 1331 of the Energy Policy Act of 2005 (P.L. 109-58) established an energy-efficiency commercial buildings tax deduction. Internal Revenue Code Section 179D provides a tax deduction for implementing energy-efficiency improvements to commercial buildings. As amended, Internal Revenue Code Section 179D allows the tax deduction to be assigned to the person responsible for designing the energy-efficiency improvement—an ESCO in the case of an ESPC—if the property is owned by a federal, state, or local government. The Bipartisan Budget Act of 2018 (P.L. 115-123) extended the deduction through 2017.65 Congress may wish to consider whether to renew this tax provision.

Recent Legislation

In the 115th Congress, several bills would address various issues concerning ESPCs and UESCs. Identical bills, H.R. 723 and S. 239, "Energy Savings Through Public-Private Partnerships Act of 2017," were introduced in January 2017 and seek to facilitate the use of ESPCs and UESCs by implementing several changes to NECPA. Section 543(f)(4) of NECPA states that

Not later than 2 years after the completion of each evaluation under paragraph (3), each energy manager may (A) implement any energy- or water-saving measure that the Federal agency identified in the evaluation conducted under paragraph (3) that is life cycle cost-effective; and (B) bundle individual measures of varying paybacks together into combined projects.

The bills would replace "may" with "shall," which would require energy managers to bundle individual energy- or water-saving measures that are found to be life cycle cost-effective into combined projects to be implemented no later than two years after evaluating a facility for energy and water efficiency measures. The bills would also expand annual reporting requirements to the President and to Congress by requiring additional information on ESPCs and UESCs including

- the investment value of the contracts,

- guaranteed energy savings compared to the actual energy savings for the previous year,

- plan for entering into contracts for the coming year, and

- an explanation for any previously submitted contracting plans that were not implemented.

The bills would also make definitional changes:

- "Energy conservation measures" would be expanded to include energy consuming devices and required support structures.

- "Federal buildings" would not include dams, reservoirs, or hydropower facilities.

- "Energy savings" would include "the use, sale, or transfer of energy incentives, rebates, or credits," and any revenue generated from reducing energy or water use.

H.R. 723 and S. 239 would also clarify that federal agencies would not be able to limit recognition of cost savings from operation and maintenance improvements associated with energy- or water-conservation measures. According to CBO, the budgetary effects under the two bills are the same.66 However, as the prohibition on applying savings as an offset under H.Con.Res. 71 only applies to legislation considered by the House of Representatives, CBO's cost estimate states that "while H.R. 723 would have no effect on direct spending for purposes of budget enforcement in the House, S. 239 would be considered as reducing net direct spending in the Senate."67

Similar versions of the bills have been introduced in previous Congresses.68 The provisions within H.R. 723 and S. 239 are identical to Section 1006 of S. 2012 (114th Congress). S. 2012 was passed by the Senate with the provisions; however the House passed an amended version that did not include the same language. A conference committee did not reach an agreement on S. 2012.69

In the 115th Congress, the "Energy and Natural Resources Act of 2017" (S. 1460), introduced in June 2017, would also amend NECPA to facilitate the use of ESPCs and UESCs.70 Similarly to H.R. 723 and S. 239, the bill would require energy managers to bundle and implement energy- or water-saving measures that are found to be life cycle cost-effective. S. 1460 would also modify annual reporting requirements for federal agencies regarding ESPCs and UESCs. The bill would clarify that the ESPCs and UESCs are to be considered by the Office of Management and Budget as best practices for meeting performance goals for energy-efficient and energy-saving information technology. Similar language regarding ESPCs and UESCs for implementing energy-efficient and energy-saving information technology is included in H.R. 306, "Energy Efficient Government Technology Act," introduced in January 2017, and in S. 385 and H.R. 1443, two companion bills entitled the "Energy Savings and Industrial Competitiveness Act of 2017."71 S. 1460 would also authorize a Federal Smart Building Program that would be required to leverage existing financing mechanisms including ESPCs, UESCs, and direct appropriations to implement smart building technology and demonstrate the costs and benefits of smart buildings. The bill would authorize a science laboratories infrastructure program that would be required to make use of existing financing mechanisms.

Author Contact Information

Footnotes

| 1. |

The authority for ESPCs is found in 42 U.S.C. §8287 et seq. as discussed in "Background." |

| 2. |

A utility is an organization supplying customers with electricity, gas, water, or sewerage. |

| 3. |

The authority for UESCs is found in 42 U.S.C. §8256 as discussed in "Background." For the Department of Defense, an additional authority for UESCs is in 10 U.S.C. §2913. "Renewable energy sources" as defined in 42 U.S.C. §8259 "includes, but is not limited to, sources such as agriculture and urban waste, geothermal energy, solar energy, and wind energy." |

| 4. |

According to 42 U.S.C. §8287c, an "energy savings performance contract" means "a contract that provides for the performance of services for the design, acquisition, installation, testing, and, where appropriate, operation, maintenance, and repair, of an identified energy or water conservation measure or series of measures at 1 or more locations." Prior to the Energy Policy Act of 1992, NECPA made reference to "federal energy conservation shared savings" where federal agencies were authorized to contract for energy savings for a maximum of 25 years. |

| 5. |

"Energy efficiency" can be considered as using less energy to produce a product or to achieve the same level of service. |

| 6. |

The agency cannot pay an annual amount that exceeds the pre-improvement annual utility cost; therefore, the sum of the improvement's cost and its reduced level of energy cost cannot exceed the pre-improvement energy cost. |

| 7. |

According to 42 U.S.C. §8287c, "energy or water conservation measure" means "(A) an energy conservation measure, as defined in section 551 [42 U.S.C. §8259]; or (B) a water conservation measure that improves the efficiency of water use, is life-cycle cost-effective, and involves water conservation, water recycling or reuse, more efficient treatment of wastewater or stormwater, improvements in operation or maintenance efficiencies, retrofit activities, or other related activities, not at a Federal hydroelectric facility." Section 551(4) of the National Energy Conservation Policy Act [42 U.S.C. §8259(4)] defines "energy conservation measures," to mean "measures that are applied to a Federal building that improve energy efficiency and are life cycle cost effective and that involve energy conservation, cogeneration facilities, renewable energy sources, improvements in operations and maintenance efficiencies, or retrofit activities." |

| 8. |

See 10 C.F.R. Part 436, Subpart B. FEMP is authorized by statute to establish appropriate procedures and methods for use by federal agencies with regard to the ESPC program. See 42 U.S.C. §8287(b)(1)(A); 10 C.F.R. §436.30(a). |

| 9. |

FEMP tracked and reported greenhouse gas emissions in adherence to Executive Order (E.O.) 13693, which was rescinded in May 17, 2018, and replaced with E.O. 13834. Executive Order 13834 directs federal agencies to manage their buildings, vehicles, and overall operations to meet statutory requirements related to energy and environmental performance. |

| 10. |

Reporting requirements on energy management for federal agencies are detailed in 10 CFR §436.106. In addition, FEMP also tracked progress in performance contracting as E.O. 13693 (revoked as of May 17, 2018) included a goal to "implement performance contracts for Federal buildings." Executive Order 13834, which replaced E.O. 13693, similarly includes a goal to "utilize performance contracting to achieve energy, water, building modernization, and infrastructure goals." FEMP tracks and reports these data within the Comprehensive Annual Energy and Water Use Report database, which reflects findings reported to the DOE as of June 1, 2018, and is available at https://www.energy.gov/eere/femp/federal-facility-reporting-requirements-and-performance-data. |

| 11. |

Other requirements in various federal laws and executive orders apply to federal vehicle fleets. |

| 12. |

FEMP, Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, https://ctsedwweb.ee.doe.gov/Annual/Report/Report.aspx. |

| 13. |

10 C.F.R. §436, Federal Energy Management and Planning Programs. |

| 14. |

Executive Order 13423, "Strengthening Federal Environmental, Energy, and Transportation Management," 72 Federal Register 3919-3923. |

| 15. |

Council on Environmental Quality, Instructions for Implementing Executive Order 13423, "Strengthening Federal Environmental, Energy, and Transportation Management," March 29, 2007, https://www.fedcenter.gov/Bookmarks/index.cfm?id=29149. |

| 16. |

The White House, Presidential Memorandum on Implementation of Energy Savings Projects and Performance-Based Contracting for Energy Savings, December 2011, https://obamawhitehouse.archives.gov/the-press-office/2011/12/02/presidential-memorandum-implementation-energy-savings-projects-and-perfo. |

| 17. |

Executive Order 13693, "Planning for Federal Sustainability in the Next Decade," 80 Federal Register 15869-15884, March 25, 2015. |

| 18. |

Executive Order 13834, "Efficient Federal Operations," 83 Federal Register 23771-23774. |

| 19. |

E. Stuart et al., "Understanding Recent Market Trends of the US ESCO Industry," Energy Efficiency, vol. 11, no. 6 (August 2018), pp. 1303-1324. |

| 20. |

Ibid. |

| 21. |

Ibid. |

| 22. |

"Covered facilities" is defined within the Energy Independence and Security Act (EISA) of 2007 (P.L. 110-140, 42 U.S.C. §8253(f)(2)(B)) as "The Secretary shall develop criteria, after consultation with affected agencies, energy efficiency advocates, and energy and utility service providers, that cover, at a minimum, Federal facilities, including central utility plants and distribution systems and other energy intensive operations, that constitute at least 75% of facility energy use at each agency." Project funds reported in the system were awarded between FY2006 and FY2018. FEMP, EISA 432 Compliance Tracking System, https://ctsedwweb.ee.doe.gov/CTSDataAnalysis/ComplianceOverview.aspx, accessed October 2, 2018. |

| 23. |

Under IDIQ ESPCs agencies are able to award more than one contract to more than one contractor from a single solicitation within stated limits and during a fixed period. |

| 24. |

Between FY1998 and August of 2018, DOE awarded 387 IDIQ ESPCs. See DOE, FEMP, "Awarded DOE IDIQ Energy Savings Performance Contract Projects," https://www.energy.gov/eere/femp/awarded-doe-idiq-energy-savings-performance-contract-projects. In addition to DOE, the U.S. Army Corps of Engineers awards IDIQ ESPCs; see U.S. Government Accountability Office, Energy Savings Performance Contracts: Additional Actions Needed to Improve Federal Oversight, GAO-15-432, June 2015, p. 9, https://www.gao.gov/products/GAO-15-432. |

| 25. |

FEMP, "Utility Energy Service Contract Project Data Collection," https://www.energy.gov/eere/femp/utility-energy-service-contract-project-data-collection. |

| 26. |

The seven agencies were the Air Force, Army, and Navy within the Department of Defense; the Departments of Energy, Justice, and Veterans Affairs; and the General Services Administration, which according to GAO collectively represented 80% of the government's energy use in 2013. GAO, Energy Savings Performance Contracts: Additional Actions Needed to Improve Federal Oversight, GAO-15-432, June 2015, p. 13, https://www.gao.gov/products/GAO-15-432. |

| 27. |

According to GAO, the number of alternatively financed projects includes "ESPCs, UESCs, and PPAs [Power Purchase Agreements] from the Army, Air Force, Navy, and Marine Corps." GAO refers to "to each individual ESPC or UESC project as a separate contract, even if multiple projects are under a single contract." See GAO, Defense Infrastructure: Additional Data and Guidance Needed for Alternatively Financed Energy Projects, GAO-17-461, June 20, 2017, pp. 12-13, https://www.gao.gov/products/GAO-17-461. |

| 28. |

FEMP, Frequently Asked Questions About ESPC Strategy, December 6, 2016, p. 6, https://www.energy.gov/sites/prod/files/2016/12/f34/faq_espc_strategy.pdf. |

| 29. |

FEMP, "Total Site-Delivered Energy Use in All End-Use Sectors, by Federal Agency (Billion Btu)," Comprehensive Annual Energy Data and Sustainability Performance, https://ctsedwweb.ee.doe.gov/Annual/Report/TotalSiteDeliveredEnergyUseInAllEndUseSectorsByFederalAgencyBillionBtu.aspx. |

| 30. |

FEMP, "Federal Government Renewable Electricity Use (As a Percentage of Electricity Consumption)," Comprehensive Annual Energy Data and Sustainability Performance https://ctsedwweb.ee.doe.gov/Annual/Report/TableauView.aspx?id=33. |

| 31. |

FEMP, "Goal Building Potable Water Use and Cost (in Adjusted Constant FY 2017 Dollars)," Comprehensive Annual Energy Data and Sustainability Performance, https://ctsedwweb.ee.doe.gov/Annual/Report/FederalGoalBuildingPotableWaterUseAndCost.aspx. |

| 32. |

FEMP, "Federal Agency Industrial, Landscaping and Agricultural Water Use," Comprehensive Annual Energy Data and Sustainability Performance, https://ctsedwweb.ee.doe.gov/Annual/Report/FederalAgencyIndustrialLandscapingAndAgriculturalWaterUse.aspx. |

| 33. |

Measured benefits from the approximately 700 projects were obtained from FEMP, "Project Follow-up Activity," EISA 432 Compliance Tracking System, data as of October 2, 2018, https://ctsedwweb.ee.doe.gov/CTSDataAnalysis/Default.aspx?ReturnUrl=%2fCTSDataAnalysis%2fComplianceOverview.aspx. Total federal energy consumption in 2017 as reported in FEMP, Comprehensive Annual Energy Data and Sustainability Performance, v1.1.8.1, 2018, https://ctsedwweb.ee.doe.gov/Annual/Report/Report.aspx |

| 34. |

Executive Order 13834, "Efficient Federal Operations," 83 Federal Register 23771-23774, May 17, 2018. |

| 35. |

Executive Order 13514, "Federal Leadership in Environmental, Energy, and Economic Performance," 74 Federal Register 52115-52127, October 8, 2009; Executive Order 13693, "Planning for Federal Sustainability in the Next Decade," 80 Federal Register 15869-15884, March 25, 2015 |

| 36. |

E.O. 13514 directed agencies to establish similar GHG reduction goals to be achieved by FY2020 relative to a FY2008 baseline. |

| 37. |

CO2-equivalents equate an amount of a GHG to the amount of CO2 that could have a similar impact on global temperature over a specific time period (typically 25 or 100 years). |

| 38. |

ORNL, Reported Energy and Cost Savings from the DOE ESPC Program: FY2016, ORNL/SPR-2018/803; ORNL, Reported Energy and Cost Savings from the DOE ESPC Program: FY2015, ORNL/SPR-2017/18; and ORNL, Reported Energy and Cost Savings from the DOE ESPC Program: FY2014, ORNL/SPR-2015/110. |

| 39. |

ORNL, Reported Energy and Cost Savings from the DOE ESPC Program: FY2016, ORNL/SPR-2018/803. |

| 40. |

Within the ESPC, an ESCO typically guarantees a dollar amount of cost savings for an entire project for each contract year; the majority of projects report cost savings that are greater than the guaranteed amount in the contract. |

| 41. |

Ibid., p. 13. |

| 42. |

Ibid. "Site energy use" refers to the energy that is consumed directly at a facility. "Source energy" refers to the site energy plus energy delivery and production losses. |

| 43. |

Ibid., p. 3. Demand refers to the rate at which energy is consumed. Utilities may charge for electricity demand based on the highest average demand during a specific period of time; therefore, reducing the demand can realize additional cost savings. The power factor is the ratio of the real electrical power flowing to the load to the apparent power in the circuit. |

| 44. |

GAO, Energy Savings Performance Contracts: Additional Actions Needed to Improve Federal Oversight, GAO-15-432, June 17, 2017, p. 21, https://www.gao.gov/products/GAO-15-432. |

| 45. |

Ibid., p. 27. |

| 46. |

Ibid., p. 24. |

| 47. |

Secretary of Energy Advisory Board (SEAB). SEAB Report of the Task Force on Federal Energy Management, September 22, 2016, p. 40. |

| 48. |

GAO, DOD Renewable Energy Projects: Improved Guidance Needed for Analyzing and Documenting Costs and Benefits, GAO-16-487, September 8, 2016, https://www.gao.gov/products/GAO-16-487. |

| 49. |

Ibid., p. 21. |

| 50. |

Ibid., p. 11. |

| 51. |

E. Stuart et al., "Understanding Recent Market Trends of the US ESCO Industry," Energy Efficiency, vol. 11, no. 6 (August 2018), pp. 1303-1324. |

| 52. |

Ibid., p. 17. The 2012 Office of Management and Budget (OMB) memorandum refers to, Addendum to OMB Memorandum M-98-13 on Federal Use of Energy Savings Performance Contracts (ESPCs) and Utility Energy Service Contracts (UESCs), Memorandum M-12-2I (Sept. 28, 2012). The 2012 memorandum describes several conditions for annual scoring including that any onsite energy source be applied to a federal building, improve energy efficiency, be life cycle cost effective, and involve "energy conservation, cogeneration facilities, renewable energy sources, improvements in operations and maintenance efficiencies, or retrofit activities." |

| 53. |

GAO, Defense Infrastructure: Additional Data and Guidance Needed for Alternatively Financed Energy Projects, GAO-17-461, June 20, 2017, p.19, https://www.gao.gov/products/GAO-17-461. |

| 54. |

For more information on the BEA of 1990, BEA of 1997, and PAYGO, see CRS Report R41901, Statutory Budget Controls in Effect Between 1985 and 2002, by Megan S. Lynch. |

| 55. |

Discretionary spending authority is established annually by Congress through the appropriations process. |

| 56. |

CBO, Using ESPCs to Finance Federal Investments in Energy-Efficient Equipment, February 5, 2015, p. 2, https://www.cbo.gov/publication/49869. |

| 57. |

U.S. Congress, House Committee on the Budget, Concurrent Resolution on the Budget-Fiscal Year 2018, report to accompany H.Con.Res. 71, 115th Cong., 1st sess., July 21, 2017, H.Rept. 115-240 (Washington: GPO, 2017), p. 326. |

| 58. |

Ibid. |

| 59. |

CBO, Cost Estimate: H.R. 723 Energy Savings Through Public-Private Partnerships Act of 2017, February 16, 2018, p. 8, https://www.cbo.gov/publication/49869. |

| 60. |

See GAO-17-461, p. 40 and GAO-15-432, pp. 38-39. |

| 61. |

SEAB identified 3 challenges: (1) lack of contracting personnel, (2) lack of uniform legal interpretations (when and how to apply the Federal Acquisition Regulations to ESPCs), and (3) lack of quality data; see SEAB, SEAB Report of the Task Force on Federal Energy Management, September 22, 2016, p. 43. |

| 62. |

GAO-15-432, pp. 38-39. |

| 63. |

SEAB, SEAB Report of the Task Force on Federal Energy Management, September 22, 2016, p. 104. The test bed programs mentioned refer to DOD's Energy Test Bed and GSA's Green Proving Ground. |

| 64. |

E. Stuart et al., "Understanding Recent Market Trends of the US ESCO Industry," Energy Efficiency, vol. 11, no. 6 (August 2018), pp. 1303-1324. |

| 65. |

For more information on the energy-efficiency commercial buildings tax deduction or other energy related tax provisions, see CRS Report R44990, Energy Tax Provisions That Expired in 2017 ("Tax Extenders"), by Molly F. Sherlock, Donald J. Marples, and Margot L. Crandall-Hollick. |

| 66. |

CBO, Cost Estimate: H.R. 723 Energy Savings Through Public-Private Partnerships Act of 2017, February 16, 2018, p. 8, https://www.cbo.gov/publication/49869. |

| 67. |

Ibid. |

| 68. |

See H.R. 1629 (114th Congress) and H.R. 2689 (113th Congress). |

| 69. |

For further information, see CRS Report R44291, Energy Legislation: Comparison of Selected Provisions in S. 2012 as Passed by the House and Senate, by Brent D. Yacobucci, and CRS Report R44569, Energy Legislation: Comparable Provisions in S. 2012 as Passed by the House and Senate, by Mark Holt and Brent D. Yacobucci. |

| 70. |

For more information on S. 1460, see CRS Insight IN10736, S. 1460: A New Energy and Resources Bill for the 115th Congress, by Brent D. Yacobucci and Pervaze A. Sheikh. |

| 71. |

For more information on S. 385 (introduced in February 2017) and H.R. 1443 (introduced in March 2017), see CRS Report R44911, The Energy Savings and Industrial Competitiveness Act: S. 385 and H.R. 1443, by Corrie E. Clark. |