Transatlantic Perspectives on Defense Innovation: Issues for Congress

The North Atlantic Treaty Organization (NATO) has a renewed focus on defense and deterrence in Europe. In the past, NATO relied at least in part on its military technological superiority over potential adversaries for defense and deterrence in Europe, but some policymakers are increasingly concerned that NATO’s technological superiority is eroding.

Russia, China, and others are modernizing their militaries, investing in new and emerging technologies, and exploring their applications for defense. In addition, NATO faces rising operating costs, and both conventional and hybrid challenges in operating domains that have expanded to include cyberspace as well as land, sea, and air. NATO must also contend with a growing group of nonstate challengers empowered by the pace of technological change and the global diffusion of technology. Increasingly dependent on ubiquitous technology, NATO is adapting to a world in which commercial investments in research and development (R&D) outpace those of governments, innovation cycles are shortening, and there is more international competition for technology and innovation.

Since 2014, the United States has promoted defense innovation as a strategy to integrate new technologies into military capabilities and strengthen U.S. technological superiority over its potential adversaries. Today, many European allies acknowledge the importance of technology and innovation in defense, and they are beginning to respond to the changing environment by committing more resources to defense, and a few have national defense innovation strategies of their own. The United Kingdom, France, and Germany—NATO’s largest European defense spenders—are investing more in R&D and reforming their defense ministries to take more risk, procure technology faster, develop innovative concepts, and strengthen their links with commercial industry. Generally speaking, however, European governments are still in the early stages of developing what are predominantly national strategies.

NATO seeks to harmonize the allies’ national strategies and defense investments, promote collaboration, and build a shared vision for the future. Its member states have sophisticated militaries, institutional frameworks for collaboration, and dynamic economies that attract talent, and support innovation. Innovation challenges persist, however, such as those related to NATO’s limited budgets and its bureaucratic processes, which make it difficult for NATO to attract the attention of commercial industry and global technology companies. NATO is also working to balance its member states’ concerns over national sovereignty with the need for more multinational cooperation, both from a cost and from an interoperability point of view. NATO also seeks to enhance interoperability among allied militaries and balance short-term priorities with preparations for future warfare. In the future, NATO might have to rely as much on its agility and on its capacity for innovation as it has relied on its military technological advantage in the past.

Congress may consider what role the United States can play to support NATO’s adaptation, and what channels Congress could pursue to exert influence over NATO’s direction. There are both risks and opportunities associated with sharing technology or developing it jointly with NATO allies, and there are questions about what the United States and its allies expect from one another in terms of technology and innovation. Technology has the potential to enhance NATO’s effectiveness, but it also has the potential to undermine interoperability or political cohesion if the United States develops a technology-driven strategy and its NATO allies either do not keep pace, or do not adapt to strategic, political, and technological change.

Transatlantic Perspectives on Defense Innovation: Issues for Congress

Jump to Main Text of Report

Contents

- Introduction

- Background

- Defense Spending Trends

- Advancing Technology

- U.S. Defense Innovation

- Defense Innovation Initiative (DII)

- Third Offset Strategy

- NATO and Defense Innovation

- NATO Institutions and Processes

- NATO Defense Planning Process

- Selected European National Perspectives

- United Kingdom

- France

- Germany

- NATO's Innovation Challenges

- Resources for Innovation

- Interoperability and Burden-Sharing

- NATO-EU Cooperation

- Political Challenges

- Potential Issues for Congress

Summary

The North Atlantic Treaty Organization (NATO) has a renewed focus on defense and deterrence in Europe. In the past, NATO relied at least in part on its military technological superiority over potential adversaries for defense and deterrence in Europe, but some policymakers are increasingly concerned that NATO's technological superiority is eroding.

Russia, China, and others are modernizing their militaries, investing in new and emerging technologies, and exploring their applications for defense. In addition, NATO faces rising operating costs, and both conventional and hybrid challenges in operating domains that have expanded to include cyberspace as well as land, sea, and air. NATO must also contend with a growing group of nonstate challengers empowered by the pace of technological change and the global diffusion of technology. Increasingly dependent on ubiquitous technology, NATO is adapting to a world in which commercial investments in research and development (R&D) outpace those of governments, innovation cycles are shortening, and there is more international competition for technology and innovation.

Since 2014, the United States has promoted defense innovation as a strategy to integrate new technologies into military capabilities and strengthen U.S. technological superiority over its potential adversaries. Today, many European allies acknowledge the importance of technology and innovation in defense, and they are beginning to respond to the changing environment by committing more resources to defense, and a few have national defense innovation strategies of their own. The United Kingdom, France, and Germany—NATO's largest European defense spenders—are investing more in R&D and reforming their defense ministries to take more risk, procure technology faster, develop innovative concepts, and strengthen their links with commercial industry. Generally speaking, however, European governments are still in the early stages of developing what are predominantly national strategies.

NATO seeks to harmonize the allies' national strategies and defense investments, promote collaboration, and build a shared vision for the future. Its member states have sophisticated militaries, institutional frameworks for collaboration, and dynamic economies that attract talent, and support innovation. Innovation challenges persist, however, such as those related to NATO's limited budgets and its bureaucratic processes, which make it difficult for NATO to attract the attention of commercial industry and global technology companies. NATO is also working to balance its member states' concerns over national sovereignty with the need for more multinational cooperation, both from a cost and from an interoperability point of view. NATO also seeks to enhance interoperability among allied militaries and balance short-term priorities with preparations for future warfare. In the future, NATO might have to rely as much on its agility and on its capacity for innovation as it has relied on its military technological advantage in the past.

Congress may consider what role the United States can play to support NATO's adaptation, and what channels Congress could pursue to exert influence over NATO's direction. There are both risks and opportunities associated with sharing technology or developing it jointly with NATO allies, and there are questions about what the United States and its allies expect from one another in terms of technology and innovation. Technology has the potential to enhance NATO's effectiveness, but it also has the potential to undermine interoperability or political cohesion if the United States develops a technology-driven strategy and its NATO allies either do not keep pace, or do not adapt to strategic, political, and technological change.

Introduction

The year 2014 was pivotal for the North Atlantic Treaty Organization (NATO, or the alliance). Russia's annexation of Crimea, the conflict in Ukraine, and instability in Europe's southern neighborhood sparked recognition of NATO's need to adapt to a changing security environment. NATO shifted its focus from what had been a global security orientation during the post-Cold War period toward a renewed focus on defense and deterrence in Europe.1 Since 2014, NATO has sought to ensure that it has the political and military tools needed to remain an "unparalleled community of freedom, peace, security and shared values" in this new environment.2

Several factors are driving NATO's desire to adapt. Among them is the challenge of protecting NATO's military technological superiority over its potential adversaries, and staying ahead of political and technological change. NATO faces both conventional and hybrid challenges,3 but threats could expand to include new challenges related to the diffusion of technology, the accelerating pace of technological change, or NATO's military and societal dependence on commercial technologies. Operating domains have already expanded to include cyberspace, land, sea, and air,4 and could soon include space.5 Policymakers from across the alliance, concerned that NATO's technological edge is eroding across domains, have urged NATO to address the risks and opportunities associated with technological change.6 In the future, NATO might have to rely as much on its agility and capacity for innovation as it has previously relied on its military technological advantage.

This report provides analysis for Congress on how NATO is responding to the technology landscape, and includes sections on

- the evolving threat environment and how NATO is affected by global trends in defense spending and advancing technology;

- U.S. defense strategy and its increasing focus on strategic competition for technological superiority and innovation;

- NATO's response, including institutional strategies as well as national responses from Europe's top-three defense spenders (the UK, France, and Germany); and

- the opportunities and the challenges that NATO faces in fostering a NATO capacity for innovation in light of technological change.

Congress may consider what role it can play in supporting NATO's adaptation to the changing technology environment. For decades, Congress has helped steer U.S. NATO policy and the NATO agenda itself. During the Cold War, Congress played a role in the burden-sharing debates, and it promoted NATO enlargement as a priority in U.S. NATO policy after the Cold War.7 More recently, Congress has supported U.S. efforts to promote national defense innovation,8 and it has supported a stronger U.S. military presence in Europe.9

In February 2018, a group of Senators reconstituted the NATO Observer Group. The group's revival is a signal of Senate attention, and the group is to focus on NATO's emerging challenges, including burden-sharing and defense spending, military capabilities, and NATO's preparedness for unconventional warfare.10 Congress already has strong relationships with NATO allies as a result of decades of cooperation and its active participation in the NATO Parliamentary Assembly and the Transatlantic Policy Network. Through these and other channels, Congress may be in a position to help NATO anticipate how technology will be used and by whom, and develop the right set of tools to strengthen Euro-Atlantic security.

Background

At the 2014 Wales Summit, NATO heads of state and government described 2014 as a "pivotal moment." Russia's annexation of Crimea and its aggression in Eastern Europe, they argued, presented a "fundamental" challenge to their vision of a "Europe whole, free and at peace."11 Russia's cyberattacks and political influence operations were widely seen in Europe as a violation of the established security order.12

Russia's resurgence continues. In March 2018, NATO accused Russia of a "clear pattern of reckless and unlawful behavior" to destabilize the West, including its support for separatists in Ukraine, its military presence in Moldova and Georgia, its meddling in elections, and its involvement in the war in Syria.13 In the last few years Russia has expanded its anti-Western rhetoric and shown willingness to use force in pursuit of its political objectives.14 It has modernized its military and increased investments in unmanned systems and other emerging technologies.15 Russia reportedly now has sophisticated sensors, space capabilities, and cyber capabilities, as well as long-range precision missiles,16 which can be used to deliver nuclear weapons or for anti-access/area denial (A2AD) in local conflicts. The latter undermines NATO dominance in operating domains and increases the risks associated with NATO deployments into those areas.17 Some analysts believe that Russia is reducing the once "gaping qualitative and technological gap" between Russian and NATO military forces.18

On NATO's southern flank, technologies are also reshaping the threat environment, including through the proliferation of conventional weapons, small arms, and munitions; the evolution of cybersecurity and social media; and the rapid development of technologies that can be used by terrorists or harnessed in NATO's counterterrorism or crisis-management operations. Syria is in its eighth year of war, Libya remains unstable, and poor governance, demographic pressures, and natural resource constraints threaten security. The Mediterranean has become a transit hub for refugees from war-torn countries, economic migrants, foreign fighters, and organized crime networks.19 The growing influence of China and Russia is challenging the prominence of Western actors in the Mediterranean, and nonstate groups are more empowered to shape security outcomes.20 Transnational threats, including terrorism, have become priorities for several European allies, including France and others that are more exposed to the security challenges emanating from the south.21

|

NATO Warsaw Summit Declaration 2016 "There is an arc of insecurity and instability along NATO's periphery and beyond. The Alliance faces a range of security challenges and threats that originate both from the east and from the south; from state and nonstate actors; from military forces and from terrorist, cyber, or hybrid attacks." —Warsaw Summit Communiqué, July 8-9, 2016, p. para. 5. |

Defense Spending Trends

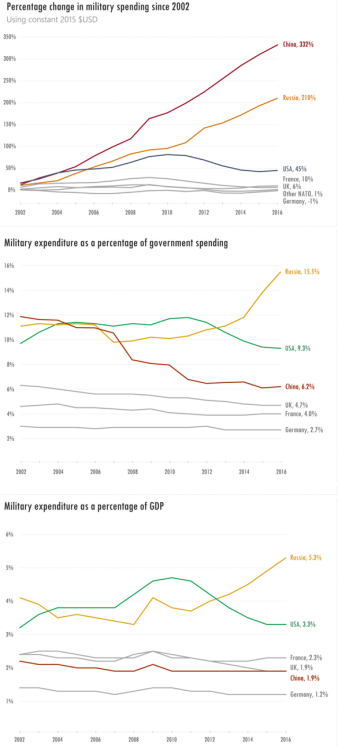

Global defense spending trends are also affecting the technology environment, and could have ramifications for NATO. The balance of spending appears to be shifting away from the Euro-Atlantic area toward other parts of the world. Between 2002 and 2016, military expenditure grew by approximately 332% in China and by 210% in Russia. In the United States, it grew by 45%. In France, however, military expenditure grew by 10% and in the UK it grew by 6%. In other places in Europe, military expenditure has actually fallen according to figures from the Stockholm International Peace Research Institute.22 Reduced military spending in Europe since the end of the Cold War has led to the relative downsizing of European militaries, aging equipment, and some readiness challenges.23 Some academics predicted that Europe would "demilitarize" after the Cold War,24 and some justified it by arguing that Europe, a "civilian power,"25 was focused on shaping global affairs through nonmilitary means such as institutional enlargement, trade agreements, and development aid.26

This pattern has begun to change. In 2014 European NATO allies recognized a need to increase their defense spending and investments. At the Wales Summit, the allies pledged to halt the decline and move toward spending 2% of their gross domestic products (GDPs) on defense, devoting 20% of that to investments in equipment and R&D over 10 years. These targets, the "Defense Investment Pledge," were formalized in Wales and have become the accepted, albeit understood to be imperfect, measure of allies' defense input and political will.27 The allies have increased their defense spending every year since 2014. Although only 3 allies met the spending target in 2014, 8 are expected to meet it in 2018, and 15 are expected to meet the spending target and 22 are expected to meet the investment targets by 2024.28 If allies continue to increase their defense spending and investment, NATO will have an opportunity to help coordinate those additional investments to achieve efficiencies. It will also have the opportunity to help channel the additional funds into the most strategically important areas.

|

|

Source: SIPRI Military Expenditure Database, https://www.sipri.org/databases. Note: Data for military expenditure by country as a share of GDP, presented according to calendar year. |

Advancing Technology

Rapidly advancing technologies add uncertainty to the security environment, thus complicating NATO's spending choices and planning requirements.29 Technological change is accelerating in many areas, including in artificial intelligence (AI) and machine learning, as well as biotechnology, materials science, and other fields, as a result of improved sensors, computing power, and other developments.30 The National Intelligence Council reports that advances in AI and automation, in particular, threaten to change industry faster than economies can adjust, and technologies with the potential to "disrupt societies" by attacking networks or critical infrastructure, for example, are set to become more affordable and more accessible to a wider range of actors.31

International competition for technology and innovation is also increasing. The United States, China, and to some extent Russia are engaged in an emerging, strategic competition in dual-use technologies. These countries have different advantages and disadvantages in terms of their investment strategies, R&D, procurement, and ability to leverage commercial industry for defense and security purposes. Commercial interaction between them has also become more "fluid" and intertwined than it was in the past.32 As international competition grows and innovation cycles shorten, NATO could find it increasingly difficult to identify the relevant technology breakthroughs, assess their applications, and anticipate how they might be used.

In their most recent strategy documents, NATO's largest defense spenders in Europe—the UK, France, and Germany—have all identified advancing technology as an important feature of the security environment.

- The most recent UK strategy, the Strategic Defense and Security Review (SDSR), includes technology as one of the four main drivers of security priorities for the coming decade.33 It focuses on cybersecurity, resilience, the use of space, and the UK's increasing dependence on "networked technology in all areas of society, business and government."34 It highlights the asymmetric and global nature of the threat, and the ways in which technology empowers individuals and nonstate groups to communicate rapidly.

- The 2017 French Strategic Review on Defense and National Security (SRDNS) also identifies technology as an emerging security challenge.35 The French strategy argues that the diffusion of technology is enabling an increasing number of nonstate actors to "export their military know-how to other areas," and that this jeopardizes Western military supremacy.36

- In Germany, the 2016 defense white book highlights cyber challenges as well as threats to supply, communications, and trade and energy as security priorities. It calls for more flexible forces, "networked action," and efforts to engage the drivers of innovation.37 One analyst asserts that it shows the German government's awareness of its diminishing deterrence capabilities vis-a-vis its potential adversaries.38

Institutionally, NATO shares similar concerns regarding the pace of technological change and the diffusion of technology. Responsibility for NATO's transformation or adaptation rests largely with NATO's military command, Allied Command Transformation (ACT) in Norfolk, VA, which is working with other NATO stakeholders to build a shared vision for the future, to identify potential capability needs for future operations, and to use that information to establish and align S&T investment priorities for the allies. Table 1 presents five global technology trends and their implications for NATO, as published in ACT's 2017 Strategic Foresight Report.

|

Trends |

Implications for NATO |

|

Rate of technological advance. The advances in technology and innovation accelerate as they are fueled by continued exponential increases in supporting computing power and advances in augmented intelligence. |

|

|

Access to technology. The ability of individuals, nonstate actors, and state actors to access technology has significantly increased. |

|

|

Global network development. Global networks will increasingly enable access to and provide information on commodities and capital assets. Global networks will increasingly be used for dissemination of post-truth information. |

|

|

Dominance of the commercial sector in technological development. The advances in defense technology developments/sales and space exploration/exploitation by commercial sectors have taken away the monopoly that used to be held by governments. |

|

|

Technological dependencies. Both society and defense and security increasingly depend on certain technologies that have become essential in everyday lives. |

|

Source: NATO Allied Command Transformation, Strategic Foresight Analysis Report, 2017, Appendix A.

U.S. Defense Innovation

U.S. policymakers have had concerns about the development and proliferation of disruptive technologies and their implications for defense for more than a decade. In the 2006 Quadrennial Defense Review Report, U.S. strategymakers officially identified China as having the "greatest potential to compete militarily with the United States and to field disruptive military technologies that could over time offset traditional U.S. military advantages absent U.S. counter strategies."39 U.S. policy toward China at the time continued to focus on encouraging China to play a constructive role on common security challenges, but U.S. strategic thinkers also focused their attention on the need for modernization and for innovation in U.S. defense strategy.

By 2014, U.S. policymakers had grown increasingly concerned about China's and Russia's comprehensive and long-term military modernization programs, and the possibility that one or the other might close the capabilities gap with the United States. Policymakers were also concerned that relatively unsophisticated militaries, militias, or other nonstate armed groups were gaining access to disruptive technologies and to weapons that were once solely possessed by governments. These developments led to a push for new concepts, and they sparked a robust debate in the United States about defense innovation or what came to be known as the "Third Offset Strategy." The debate focused on how the United States should plan its defense strategy, shape operational concepts, and organize its R&D investments and acquisition processes to "offset" the impact of disruptive technologies on the security environment and their use by potential adversaries.40

Defense Innovation Initiative (DII)

In November 2014, the Department of Defense (DOD) launched a Defense Innovation Initiative (DII) to respond to these developments. The DII would "pursue innovative ways to sustain and advance [U.S.] military superiority for the 21st Century and to improve business operations throughout the department."41

Then-Secretary of Defense Chuck Hagel described defense innovation as requiring investments by government and industry as well as a "spirit of innovation and adaptability across our defense enterprise."42 DOD leaders referenced past U.S. successes in "changing the landscape" through the development and innovative use of technology. In the 1950s President Dwight Eisenhower's buildup of the U.S. nuclear deterrent countered Soviet conventional capabilities, and in the 1970s-1980s, the United States introduced and used networked precision strike capabilities, stealth, and surveillance technologies in order to offset or nullify Soviet conventional advantages.

DOD officials argued that the United States should pursue a "Third Offset Strategy" in order to secure U.S. competitive advantage and safeguard U.S. power projection in the future.43 Given the political context of the "rebalance to Asia and the Greater Middle East,"44 and the constrained budget environment, the DII focused not only on developing new technologies and integrating them into capabilities but on finding efficiencies in their development and in their fielding.

The DII introduced several reforms, including

- efforts to reform DOD leadership development practices;

- a new long-range R&D planning program to identify, develop, and field breakthrough technologies and systems;

- reinvigorated war-gaming efforts to develop and test alternative ways of achieving strategic objectives;

- new operational concepts to employ resources to greater strategic effect and deal with emerging threats in more innovative ways; and

- an examination of business practices to be more efficient and effective through external benchmarking and focused internal reviews.45

Third Offset Strategy

Between 2014 and 2016, the Third Offset Strategy gained traction in U.S. defense circles. Senior DOD officials were concerned that Russia and China had developed "battle networks" that could potentially rival those of the United States.46 In particular, officials were concerned that those countries' command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) grids could capture what was happening in an environment and sync it with military effects, logistics, and support grids. Officials also observed that Russia and China had invested in counternetwork capabilities that could target space-based assets, networks, or other enablers for U.S. global power projection.47

To restore the U.S. advantage, DOD officials sharpened their focus on technology. Analytics firms have estimated that DOD spent roughly $27.8 billion between 2011 and 2015 on the third offset, and they expected an additional $18 billion in spending for the five years from 2016.48 It is difficult to track spending, however, because there is no account for the third offset strategy in the DOD budget. Investments focused on AI and deep-learning, human-machine collaboration, human-machine combat teaming, assisted human operations, and network-enabled, cyber-hardened weapons.49 The DOD tasked the Strategic Capabilities Office with repurposing technologies for creative use and set up the Defense Innovation Board to provide private sector advice to the Secretary. The Defense Innovation Unit Experimental (DIUx) was established as a kind of venture mechanism linking entrepreneurs with DOD problems and sponsors. The strategy sought to transform defense planning from a rational process to an "indirect approach of organizing arenas for networks, in which start-up companies and civilian corporations get to interact with government officials in order to identify incrementally suitable acquisition projects."50

Trump Administration officials no longer use the term third offset,51 but their recently published strategy documents, the National Security Strategy (NSS) and the National Defense Strategy (NDS), are relatively consistent with the concept.52 They share assumptions about the security environment, the proliferation of disruptive technologies, and the impact of innovation. They also emphasize the need to restore U.S. operational advantage, and the importance of helping DOD access commercial innovation.53 Vocabulary in the NSS and the NDS includes calls for more "agile, resilient units," as well as for more "modernization," greater "lethality," and a more robust "national security innovation base."54 The DOD, meanwhile, continues to pursue defense innovation as established under the previous Administration. The Defense Innovation Board continues to support the Secretary, and by the end of 2017 DIUx had transitioned its first pilot contracts into follow-on production.55 The Advanced Capability and Deterrent Panel has continued to push new concepts and constructs to get capabilities into the field faster, and DOD has reestablished the position of Under Secretary of Defense for Research and Engineering in a congressionally mandated effort to promote defense innovation.56

NATO and Defense Innovation

The U.S. architects of the Third Offset Strategy envisioned collaboration with allies,57 but the strategy has not been well understood among allies and partners. U.S. defense innovation strategies raise questions for the United States and its allies about their expectations of one another in terms of technology and innovation, and about their willingness to collaborate on technology development. U.S. defense innovation also prompts concerns about interoperability, about NATO's level of dependence on U.S. technology, and about the implications of technology—unmanned systems or long-range bombers, for example—on the U.S. military presence in Europe.

NATO faces some of the same challenges that led the United States to pursue defense innovation. Namely, it confronts a major state rival with sophisticated military capabilities as well as an expanding group of nonstate challengers with potential access to disruptive technologies. Its networks—command and control, communications, intelligence, surveillance and reconnaissance (ISR)—and the national assets that comprise those networks, may be increasingly vulnerable to competitors or others with access to disruptive technology.58 In the face of these challenges, NATO allies are increasingly aware of the importance of agility, resilience, and innovation.

NATO depends on the allies for capabilities, and the changing technology environment could affect their willingness to share technology or develop it jointly. On one hand, technology can reduce NATO's reliance on the allies for certain capabilities. NATO has been operating a fleet of Airborne Warning & Control System (AWACS) aircraft for command and control, air and maritime surveillance, for example, and a new Allied Ground Surveillance system is coming into service on behalf of the alliance.59 This system could reduce NATO's reliance on a handful of member states for ground surveillance, and enable NATO to produce its own comprehensive assessments of situations on the ground. Technology could also offer NATO an affordable, open-source intelligence or ISR capability, when traditionally it has had to rely on the intelligence that member states have been willing to provide. Technology could equally divide the alliance, on the other hand, as some allies are developing sensitive technologies in areas like cybersecurity, which they are less comfortable sharing. This has prompted concern among some NATO officials about allies' potential reluctance to share technology widely. As a result NATO officials push continuously to develop processes and procedures that integrate such technologies into NATO structures and to assess how they might be tested in a contingency.60

|

NATO Warsaw Communiqué In the 2016 NATO Warsaw Summit Communiqué the allies pledged to build a "stronger defense industry across the alliance" to advance the "military and technological advantage of allied capabilities through innovation."61 |

If the allies continue to increase defense spending, more funding is expected to become available in Europe for R&D and capabilities development. A NATO debate about defense innovation could help set priorities in such a way that manages risk and enhances interoperability across the Atlantic. Such a debate could help reduce duplication in Europe and balance short-term priorities with preparations for future warfare. As is the case in the United States, operational costs are expected to continue rising for European militaries. Defense innovation could help allies develop tools to control costs while finding ways to counter the asymmetric use of inexpensive technologies against allied forces. If the United States continues to pursue a technology-driven defense strategy and European countries do not, interoperability and alliance cohesion could be reduced. For the United States, working with allies could become more constraining or risky, and Europeans could face trade-offs between buying more technology from the United States and investing in their own R&D, both of which would have consequences for European and transatlantic industry and for European autonomy vis-a-vis the United States.

NATO Institutions and Processes

In the past NATO has successfully responded to new challenges through strategic and organizational change.62 Generally speaking, it is the member states that steer NATO through "critical junctures" or crisis situations through political leadership in the North Atlantic Council (NAC), the alliance's main decisionmaking body. NATO institutions, however, also have some agency in facilitating their own transformation, and some have the specific mandate to help NATO adapt on science and technology (S&T) issues. On the military side, NATO rebranded the Supreme Allied Commander Atlantic as ACT, and gave it responsibility for transformation.63 On the civilian side, it tasked the Science and Technology Organization (STO) to lead on S&T issues. The latter is composed of three main entities:

- Office of the Chief Scientist;

- Collaboration Support Office in Paris, which links 5,000 scientists and engineers with one another and helps shape commercial strategies to ensure technologies meet NATO standards and are available to NATO; and

- Center for Maritime Research and Experimentation, which conducts research and technology development for the maritime domain.64

At the Brussels Headquarters, NATO's Defense Investment Division advises the allies on issues related to defense procurement, interoperability, standards, and industry. The division oversees the Conference of National Armaments Directors (CNAD), which works on armaments cooperation and is supported by the NATO Industrial Advisory Group (NIAG), which convenes senior industrialists to provide the CNAD with insights on industry trends and emerging technologies. In recent years the CNAD has hosted a growing number of discussions about defense innovation, and those allies with innovation strategies (e.g., the United States, UK, Canada, and the Netherlands) are briefing their peers and sharing best practices.65 The group is limited in what it can accomplish, however, because some allies lack the will, the authorities, the industrial capacity, or the relevant startup communities to contribute.66

The NATO Parliamentary Assembly, which supports links between NATO and allies' national parliaments, has been particularly active in this area. Its Science and Technology Committee adopted reports on NATO's eroding technological advantage and on the implications of the Internet of Things for NATO at its October 2017 meeting in Romania.67 The committee hosted panel discussions at which the Chief Scientist argued that NATO's edge had already eroded in part due to the growth in commercial R&D, which surpassed government R&D investments. In particular, he singled out the cyber domain as an area in which NATO faced daily challenges resulting from the accelerating pace of technological change.68 He also spoke of a need for innovation in the way technology is used, arguing for a culture change when it comes to S&T adaptation, providing incentives to program managers to insert technology quickly and to be willing to fail.69 In 2018, the committee plans three reports covering NATO and defense innovation; cybersecurity and information warfare; and the implications of the dark web, bitcoin, and encryption for terrorism and for counterterrorism efforts.70

|

NATO Innovation in the 1980s In the 1980s, NATO faced the challenge of deterring numerically superior Warsaw Pact forces. The United States was exploring ways to use precision and other new technologies for operational advantage. U.S. concepts were picked up by the allies and fed into NATO's "Follow-On Forces Attack" concept.71 This concept envisioned NATO attacking the ground forces intended to support initial attackers against NATO defenses. It touched on strategic, political, military, and technological questions. While Europeans initially interpreted the concept as requiring them to spend more on U.S. systems, it developed in such a way as to incorporate cooperative arrangements for developing and producing systems.72 To support NATO through this process, the House Committees on Foreign Affairs and Armed Services and the Senate Armed Services Committee asked the Office of Technology Assessment (which was disbanded in Congress in 1994) to "help bring some insight into the array of problems, so that the United States [could] more clearly understand and effectively support agreed NATO policy." Two accompanying reports were produced for Congress: the July 1986 Technologies for NATO's Follow-On Forces Attack Concept, and the June 1987 New Technology for NATO: Implementing Follow-On Forces Attack.73 |

NATO Defense Planning Process

The NATO Defense Planning Process (NDPP) is the alliance's primary means of translating collective political ambition into requirements for capabilities and apportioning them to member states. This four-year cyclical process, outlined in Figure 2, begins with national defense ministers' political guidance, from which a framework for NATO capability requirements is derived. These requirements are then translated into targets and then apportioned to the member states through a decisionmaking process of consensus minus one. A relatively small portion is apportioned to NATO through common funding.74 The allies participate on a voluntary basis, however, and they are not sanctioned for missing their targets or allotted requirements. Designed to deliver NATO requirements without jeopardizing national sovereignty over defense planning, the NDPP has been praised for its ability to protect national sovereignty and criticized for failing to fill NATO's capability shortfalls.

|

|

Source: https://www.nato.int/cps/en/natolive/topics_49202.htm. |

NATO institutions use the NDPP to transform the alliance by harmonizing planning and filling capability shortfalls. NATO's ACT works in part through the production of Strategic Foresight Analysis Reports to create a shared perspective on the future environment that synthesizes views from academics, think tanks, and industry representatives across the alliance.75 ACT has a futures team, which is working on long-term capability development initiatives and aims to use the priorities of NATO's largest defense spenders—the United States, the UK, France, and Germany—to inform smaller allies and support multinational collaboration. Some officials at ACT believe that extending the NDPP's planning horizon would help the alliance to get ahead of national defense planning processes and therefore steer national decisionmaking more effectively toward NATO requirements.

In recent years ACT has increased its collaboration with STO scientists and engineers in a number of areas, including in research on achieving operational effects and in defining NATO's future force needs through the alliance's Framework for Future Alliance Operations (FFAO).76 ACT's strategic foresight work, in turn, is informing the STO products, such as its Technology Trends Report,77 S&T Priorities,78 and technology-monitoring process. The STO aims to help shape NATO capabilities for the future by identifying priority S&T areas for allied investments. The STO's most recent S&T priority areas are listed in Table 2. According to a senior NATO official, STO is planning to update NATO's Science and Technology Strategy, and publish an updated list of long-term requirements under the NDPP.79

|

Precision Engagement |

Communications and Networks |

|

Advanced Human Performance and Health |

Autonomy |

|

Cultural, Social & Organizational Behaviors |

Power & Energy |

|

Information Analysis & Decision Support |

Platforms & Materials |

|

Data Collection & Processing |

Advanced Systems Concepts |

Source: 2016 NATO Science and Technology Priorities Document.

To support NATO's adaptation to the technology environment, NATO is also building an in-house capacity to promote innovation. The NATO Innovation Hub (IH) was launched in 2013 in Norfolk, VA, to develop tools, networks, and human skillsets to support NATO projects through open innovation, which it defines as crowdsourcing understanding, solution design, and implementation through a worldwide experts' network.80 Housed under ACT, the IH is NATO's means of reaching out to a wide range of people from diverse backgrounds for help in designing solutions for NATO problems in an open way. IH is currently working with public-private partnerships that have similar missions across NATO's member states,81 including the UK's Defence and Security Accelerator, the German Cyber and Information Space Command ("Kommando Cyber- und Informationsraum"), and the U.S. MD5,82 SofWerx,83 and H4Di Hacking for Defense.84 ACT is also working to integrate technologies into concepts development, education, and training, but officials highlight the limitations of technology absent a shared understanding of the environment and of NATO's operational objectives.

Some NATO officials are concerned, however, that ACT's and STO's work on strategic foresight, S&T priorities, and innovation has not received adequate attention at NATO Headquarters, either at the political level or among the national delegations to the alliance. They argue that the relative lack of attention is largely due to the alliance's focus on a wide range of more urgent challenges and short-term priorities that relate to preparing for contingencies in NATO's south and east.85 Other officials argue that this is also due to the challenges related to NATO's defense planning process and to national preoccupations with their own security priorities and to their concerns about national sovereignty in defense. Some officials contend that NATO's international bureaucracy has lost its influence with national delegations over time, and that it is the national delegations to NATO that handle much of the alliance's day-to-day business.86

Selected European National Perspectives

Historically, European states have tended to focus on preserving national self-sufficiency in defense.87 In recent years, however, some European governments have begun to realize that their defense aspirations are inhibited by relatively limited national defense budgets, duplication, and inefficiencies across the European continent.88 Many European states are now taking steps to increase their defense budgets and, at the same time, balance commitments to national sovereignty in defense with efforts to increase practical cooperation with European partners. The UK and France remain committed to preserving full-spectrum national capabilities; however, like other governments in Europe, they are working to determine which technologies they would like to develop nationally, which they could develop jointly with European partners, and which they are prepared to buy off-the-shelf in the global market.89

The United States, the UK, France, and Germany together represent approximately 85% of NATO's total defense spending.90 They broadly share the assessments of the security environment that led to the development of the U.S. Third Offset Strategy, and they have strategic and industrial interests in promoting defense innovation, at least at the national level. If NATO is to develop a coherent approach to defense innovation or a response to developments in the United States, it will likely depend on one or more of these large member states showing political leadership and driving change at the NATO level. Given limited resources, however, these governments and others in Europe are focused on short-term priorities, including support for operations and readiness challenges. When it comes to defense innovation, investments in R&D, and reforms to improve access to commercial innovation, European nations are in the early stages of formulating predominantly national strategies.

United Kingdom

The UK is one of a handful of European NATO member states with a national strategy for defense innovation. In 2016 the UK government identified defense innovation as vital to maintaining the British armed forces' military technological edge in the future,91 and it launched a Defense Innovation Initiative. The initiative introduced multiple lines of effort to promote defense R&D, to leverage other R&D investments, and to engage commercial centers of innovation.92

Much like the U.S. Third Offset Strategy, the UK initiative sought to transform the British defense enterprise through organizational and cultural changes to create more appetite for risk and to link government and commercial actors by fostering open innovation. The initiative was also expected to reverse more than a decade of UK underinvestment in R&D, improve government-industry relationships, and help the government engage small to medium-sized enterprises (SMEs) more effectively.93 The strategy comprised the following:

- "a new Innovation and Research InSight Unit to 'draw on horizon scanning and market intelligence from across government, academia, industry and international partners,'

- a Defence and Security Accelerator organization to 'accelerate ideas from conception through to application,' by linking suppliers and inventors with users and investors,' and

- an Innovation Fund 'of around £800 million over ten years, to provide the freedom to pursue and deliver innovative solutions.'"94

British defense analysts assert that the drivers for this strategy included a recognized need to protect UK assets in a world of ubiquitous precision weapons,95 as well as a long-standing strategic interest in maintaining interoperability with U.S. military forces.96 The analysts also argue, however, that the strategy faces significant limitations, and that it has not been a high priority for the UK Ministry of Defence (MoD).97 The amount of funding dedicated to this strategy is considered relatively modest: the £800 million fund represents just 1% of the expected UK procurement budget for the decade, meaning the challenge comes in ensuring the funding is "meaningfully spent."98 Implementation also depends on the MoD's ability to leverage commercial R&D and work with industry to capitalize on its investments in the UK equipment plan. Translating the UK vision for innovation into practical steps that lead to organizational and culture change in the ministry could present further challenges.

Negotiations on the UK's pending exit from the EU have taken center stage in UK government and politics. "Brexit" has presented complex challenges, and the UK's political parties are divided, externally and internally, over the negotiations. Political and economic uncertainty related to Brexit could affect UK defense and the future role of the UK in European security. To adapt British defense strategy in light of the changes in the UK and in response to uncertainty in the security environment, the UK government is conducting a National Security Capabilities Review, and it is expected to publish a further review, the Modernizing Defense Program (MDP), in the summer of 2018.99 The forthcoming MDP review may not incorporate a strategy for defense innovation per se, but it is expected to sharpen the UK's focus on leveraging technology and capabilities to maintain UK armed forces' "credibility" over the next decade.100

|

Nordic-Baltic Innovation Centers States in the Nordic and Baltic region have a strategic interest in the U.S. defense innovation agenda and in any emerging European dimension. Certain technologies—especially in the cyber arena—have particular implications for the region, both in terms of conventional deterrence vis-a-vis Russia but also with respect to hybrid challenges that they face. Estonia, for example, has become a world leader in cybersecurity and hosts NATO's Center of Excellence on that topic. Nordic countries have also taken steps to develop a robust and vibrant defense technology base. Sweden, a NATO partner, has become a European defense innovation hub through its work in unmanned systems and undersea technology. Norway is an innovator in military effects, including through the development of the Naval Strike missile, the Joint Strike Missile, and air-to-ground missiles.101 |

France

President Emmanuel Macron's government published a new national defense strategy to outline its vision in the context of a changing security environment. Generally speaking, the strategy seeks to balance a traditional focus on preserving national independence and power projection with an ambition for pragmatic cooperation with European partners in pursuit of "European strategic autonomy."102

Published in October 2017, the Strategic Review on Defense and National Security (the Review)103 shows France's growing concerns about the risk of high-technology warfare, interstate competition for technology, and the disruptive effects of digital innovation. The Review calls for more military agility and responsiveness, as well as for more investments in space, cybersecurity, and electronic warfare capabilities.104 It also calls for an organizational and cultural change at the Ministry of Armed Forces in order to improve the ministry's ability to access and leverage private sector innovation.105

The Review lays the groundwork for the Military Programming Law for 2019-2025 (LPM) and budget, which also offer insights into French ambition for defense innovation. The Review and the LPM build on prior efforts to support French SMEs and research labs that are working on sensitive, dual-use technologies and link them with defense contractors and with the services.106 Also, the budget for "upstream studies and innovation in research and development" is expected to increase from €730 million in 2018 to €1 billion by 2022.107 The LPM also calls for an average of €1.8 billion to be devoted each year to designs and preparations for future armament programs. The Ministry of Armed Forces is planning reforms to enable its procurement office, Direction Générale de l'Armement (DGA), to improve access to digital innovation and commercial industry. French analysts assert, however, that while the LPM does usher in new investments, especially in cybersecurity, its overall focus is on equipping the French military for more short-term priorities and current operations, and ensuring that aging platforms are replaced.108

France also has strategic and industrial interests in defense innovation. It is committed to preserving its capabilities for global power projection and yet it faces a growing risk of A2AD threats in the areas in which it operates.109 For France, defense innovation could strengthen its operational advantage while enhancing its national industrial base and protecting its global market share. In addition, defense innovation could help maintain interoperability with U.S. forces while protecting against technological dependence on the United States. At the same time, however, addressing public concerns about terrorism and migration has taken priority, and a high operational tempo of late has placed considerable strain on the French armed forces.110 Some French analysts expect that equipment, maintenance, and other support for current operations will remain France's priority for the short term, possibly at the expense of preparations for future warfare. They also argue that the significant efforts to boost spending have been pushed to the end of the five-year period, indicating some uncertainty about its implementation.111

|

Italy and Spain Italy and Spain are among Europe's larger defense powers. Both have industrial capacity and interests in defense innovation, but neither had a formal response to the U.S. Third Offset Strategy. Italy and Spain are frontline states on Europe's southern shores, supporters of EU defense initiatives, and contributors to EU operations across Africa and the Middle East. Italy has an ambition to maintain its ability to contribute to high-intensity, full-spectrum operations in its neighborhood, and its 2015 white paper identified the need for continuous adaptation, faster procurement, and stronger links between commercial and defense industry. Spain, despite being on the lower end of the NATO spectrum in terms of defense spending, is closer than many allies to its investment targets. Italy and Spain both have funding for defense innovation and are likely to be interested in opportunities for their prime contractors and their small to medium-sized enterprises. Efforts to promote border security and Mediterranean stability and resilience, and to curb illegal immigration, however, are likely to remain their security priorities for the foreseeable future. |

Germany

Germany's most recent defense strategy, the 2016 White Book,112 outlines a growing ambition for Germany to make substantial contributions to European security while building resilience into societies, economies, and institutions.113 The 2016 White Book also shows the German government's awareness that its conventional deterrence capabilities are eroding, and of the importance of defense R&D and commercially developed technologies in securing superiority in defense.114

As Europe's largest economy, Germany has the industrial capacity to make significant contributions to defense innovation.115 Its industry is competitive and established in U.S. supply chains,116 and it generates high-technology capabilities and revenue that can in turn finance more innovation. One analyst has remarked that Germany is leading Europe in some technologies deemed critical for defense innovation in the United States. Germany's research on autonomous vehicles, for example, is "breaking new records" on German roads, and Germany hosts leading hubs for software (Darmstadt), manufacturing (Aachen), and aerospace (Munich and Hamburg).117 Germany has also made strides in defensive cybercapabilities. A new Cyber Innovation Hub helps bridge commercial startups with the German armed forces, focusing on disruptive technologies, information technology, and other digital products and services.118 The government's 2015 defense industry strategy calls for expanding funding for R&D, defining Germany's national enabling technologies, and increasing cooperation with European partners. It also calls for more public dialogue on the importance of industry for German foreign and security policy.119

German politics and public opinion, however, will also shape Germany's contributions to a defense innovation agenda. Since World War II, successive German governments have taken a more cautious and multilateral approach to defense than other European governments.120 In 2015, 25% of Germans felt that Germany should play a more active military role in helping maintain peace and stability, and 69% felt Germany should limit its military role in world affairs.121 German analysts point to a deep-seated concern in the German public consciousness about defense research and its potential to undermine peace. As a result, defense innovation is largely cut off from Germany's "national innovation ecosystem," and there is a "systematic and deliberate firewall" between civilian and defense research.122 This tension is also present in government. The Defense Ministry stresses the importance of defense research and commercial industry to cope with current challenges, but the Ministry of Education and Research has traditionally opposed closer links between defense and commercial research.123

In the near term, analysts expect Germany to focus defense policy on addressing current national readiness shortfalls and preparing for contingencies in Eastern Europe.124 Looking ahead, Germany has committed to budget increases, but personnel costs are expected to continue to account for a large portion of the increase, alongside modernization, maintenance, and training.125 According to some analysts, if Chancellor Merkel decides to increase defense spending and make the case to the German people for a stronger national defense, then that action itself would constitute an innovation in European and transatlantic defense and security, albeit not of a technological nature.

|

Poland For Poland, the strategic priority is defending the homeland against potential Russian aggression and addressing instability in NATO's Eastern Flank.126 Poland has announced significant increases to its defense budget and plans to spend 2.5% of GDP on defense by 2030, exceeding NATO's target.127 Poland and others more exposed to Russia and an unstable East have a strategic interest in supporting any U.S. or NATO initiative that could strengthen NATO's deterrence or operational advantage. They also have an interest in high standards of NATO interoperability, since a contingency would likely require rapid decisionmaking and reinforcement. |

NATO's Innovation Challenges

Even as some NATO allies develop defense innovation strategies, NATO faces a series of obstacles to coordinating these initiatives, aligning national perspectives, and forging a unified approach. Without legal or financial mechanisms to steer the allies in a particular direction, or the ability to effect a step change across the alliance, NATO relies on its efforts to build and share knowledge among the allies, set agendas, establish priorities, and promote multinational cooperation. Generally speaking, NATO's innovation challenges relate to

- securing resources for innovation and engaging commercial industry;

- balancing short-term priorities with preparations for the future;

- preserving interoperability and transatlantic burden-sharing;

- harmonizing defense planning processes, including with the EU; and

- using allies' diversity to foster more effective innovation.

Resources for Innovation

During the Cold War, the United States and its NATO allies maintained defense spending and investment levels sufficient to ensure their military technological superiority. Large U.S. public investment programs in technology and innovation supported U.S. economic success and spurred innovation.128 The U.S. government was a driver for innovation through the internet, biotech, and shale gas, for example, in part because of its willingness to invest in early stages of the innovation cycle.129 Analysts have concluded that long-term government funding for defense and civilian R&D are key ingredients for the development of dual-use technology.130 Since the end of the Cold War, however, the United States shifted attention away from government-led innovation and toward "consumption markets."131 As a result it faces new challenges that relate to cost pressures, limited budgets, the shift from "defense spin-offs to consumer-market spin-ons" in technology, and rising international competition.132

Since 2014, NATO allies have been increasing their defense spending and investment budgets, with Canada and the European allies spending more on defense in 2017 for the third consecutive year.133 In addition to more funding, NATO has other strengths to leverage, including hosting high-performing universities and research labs as well as dynamic and open economies that attract talent. These strengths could potentially give NATO access to a wide network of innovative entrepreneurs and ideas. At the same time, however, European governments continue to be constrained by relatively limited budget environments and resources for defense R&D. The budgetary context that allowed for the Third Offset Strategy in the United States, for example, does not exist anywhere in Europe. For some European governments, relatively small increases in defense spending require a convincing political narrative. Even then, the resources devoted to defense are often allocated toward more pressing short-term priorities such as readiness and current operations.

Relatively limited budgets combined with NATO's bureaucratic processes and a risk-averse culture are likely to continue to present challenges for NATO in its efforts to build relationships with large technology companies or other sources of innovation. NATO's capacity has also been reduced over time through reductions to the command structure.134 Defense Ministers recently agreed to reverse the downsizing trend by introducing two new military command centers, but the new staff is expected to focus on maritime security, troop movements, and contingency planning for Eastern and Southern Europe.

Interoperability and Burden-Sharing

A potential contingency in eastern or southern Europe could require rapid decisionmaking and rapid NATO reinforcements. As the alliance mobilizes, the allies' expectations of one another for burden-sharing and the potentially fast pace of conflict could raise NATO's requirements for interoperability and speed.

Burden-sharing and interoperability are not new challenges for NATO. During the Cold War, a gap opened up between the United States, which invested in global power projection capabilities, and most European nations, which, with the partial exception of the UK and France, prioritized personnel over procurement as they prepared to fight on home soil.135 That gap deepened with the U.S.-led "Revolution in Military Affairs" in the 1990s, which was largely unsuccessful in generating political consensus in Europe.136 The transatlantic capabilities gap that resulted has affected NATO's post-Cold War operations. In Kosovo, for example, U.S. technological superiority created problems for NATO in both communications and conducting operations.137 Even Europe's most capable powers—the UK and France—had to rely on U.S. enablers such as ISR, targeting, and extra munitions in NATO's 2011 Libya operation.138 Concerns around burden-sharing and dependence led U.S. officials to warn allies of a "dwindling appetite" in Washington "to expend increasingly precious funds on behalf of nations that are unwilling ... to be serious and capable partners in their own defense."139

Transatlantic burden-sharing continues to be a priority for the Trump Administration. While European allies are increasing their defense budgets, they are unlikely to close the capabilities gap with the United States any time soon because that gap reflects decades of spending patterns as well as historical experience and strategic culture.140 The risk is that the gap could deepen if the United States continues to pursue a technology-driven strategy and Europeans do not, or if the United States moves faster than its NATO allies on fielding new technologies.141 In particular, a technology gap could present challenges to the interoperability of NATO forces, especially if the future battlefield demands faster decisionmaking, more rapid troop movements, or an immediate response to a crisis situation in close proximity to or even inside NATO territory.

NATO officials are working on processes to integrate national technologies and assets into NATO networks and structures, and they are evaluating how those networks could be tested in a crisis situation.142 As technology advances and international competition grows, this challenge could become both more difficult and more important for NATO. It could also increase the pressure on NATO to ensure that technology transfer moves in both directions across the Atlantic, as there is a conviction in Europe that not only should European militaries "buy American," but NATO should help European companies gain access to the U.S. defense market, too.143

NATO-EU Cooperation

In 2016 the EU launched a Global Strategy that reignited ambitions for European strategic autonomy, and that ambition has dominated the debate about EU defense. As a result, questions now exist for European allies about the strategic relationship between EU and NATO structures and processes. In 2016 officials from the EU and NATO signed a Joint Declaration that lays out 42 actions in seven areas of cooperation ranging from countering hybrid threats and cybersecurity to defense capabilities, industry and research, and exercises and capacity building.144 They are now working toward implementation, but questions remain as to how NATO and the EU will relate to one another in strategic terms. If the EU aspires to strategic autonomy, then what role does NATO play? Conversely, what is the purpose of the EU's Common Security and Defense Policy if it does not achieve autonomy and continues, in practice, to rely on NATO for collective defense and security?145

The Joint Declaration makes clear that both NATO and the EU have an interest in building "stronger defense industry and greater defense research and industrial cooperation within Europe and across the Atlantic."146 The two institutions, however, have different strategic priorities and different sets of tools to foster cooperation. While NATO works through the Defense Investment Division and other stakeholders to encourage transatlantic cooperation, the EU has the European Defense Agency and a set of unique legal and financial tools to promote defense-industrial cooperation and spur innovation in the EU.147 In 2017, the EU launched a European Defense Fund, which by 2020 is expected to generate €5.5 billion per year from the EU budget for investments in defense capabilities development.148 Although it represents only 1% of the EU budget, the fund provides a financial incentive in Europe for multinational cooperation on capabilities development for the first time.149

The EU also launched Permanent Structured Cooperation (PESCO), which is a treaty-based, political framework to help the EU member states develop capabilities jointly and in a way that will make them available for EU military operations.150 Another recent EU initiative, the Coordinated Annual Review on Defense, is designed to address the EU's identified capability shortfalls while fostering cooperation and ensuring coherence and transparency between defense spending plans.151 These initiatives on the part of the EU have sparked debate in Brussels about prioritization, governance, and the role of third-party countries (such as the UK) and companies owned in part by third-party countries in EU projects. It will be up to NATO and the EU to work out how their initiatives relate to one another, and it will be up to the European allies to work out whether one institution or the other offers a better platform for cooperation on S&T issues, capabilities development, and innovation.

Political Challenges

NATO's member states are unique in their historical experiences and security priorities, and they will likely only invest in capabilities that they see as addressing their security needs. For the United States, the primary drivers for defense innovation are Chinese and Russian military modernization and a sense of strategic competition for technology and innovation. While many European allies broadly accept U.S. assessments of the global security environment, including the rise of China, their assessments of China's rise differ from those of the United States. France and Germany, for example, are more focused on managing Chinese investments in Europe, and Europeans are generally much more concerned by challenges from Russia and the Middle East. NATO allies are also divided over whether they see Russia as more of a conventional or a hybrid challenge, and over balancing NATO focus on the east with efforts to address challenges in the south. NATO has tried to communicate the indivisibility of Euro-Atlantic security through the "360 Degree Approach" outlined at the Warsaw Summit, but its efforts face continuing challenges.152 Others point to a transatlantic rift or a "wearing down" of a sense of collective identity in NATO with U.S. public opinion appearing uncommitted and European public perceptions of a "wider Atlantic" than in the past.153

While studies show diversity can be a driver for innovation in the workplace,154 it could restrict a NATO agenda if the allies cannot achieve a common understanding of the threat environment and a shared vision for how technology and innovation can address security challenges. European leaders are under pressure to address the immediate security challenges that concern their constituencies, which for some European allies include Russia and Ukraine and for others include refugees, migration, and the spread of terrorism. Generally speaking, short-term priorities take precedent in Europe. Discussions about technology and future warfare are beginning to take place in some national governments and in NATO institutions. According to a senior NATO official, however, these discussions need to take place at the strategic level in the North Atlantic Council, and political leadership from one or more of the major allies is likely to be required to foster cohesion and drive change at the NATO level.155

Potential Issues for Congress

Looking ahead, NATO might have to rely as much on its agility and capacity for innovation as it has previously relied on its military technological advantage. A key question for Congress relates to what role the United States should play in NATO to help allies make more effective use of increased defense spending, build flexibility and responsiveness while protecting interoperability, and capitalize on commercial investments in technology and innovation.

A second question is: What role might Congress play in that effort? For decades, Congress has played an important role in shaping U.S. NATO policy and steering the NATO agenda itself. It helped shape the Cold War burden-sharing debates by exerting pressure on allies to increase their defense spending, and it used a combination of oversight and legislation to promote post-Cold War NATO enlargement as a priority in U.S. policy toward the alliance.156 The NATO Parliamentary Assembly has facilitated a transatlantic dialogue among legislators for decades,157 as has the nongovernmental Transatlantic Policy Network.158 In February 2018, a group of Senators reconstituted the NATO Observer Group to help strengthen congressional relations with NATO in light of evolving challenges.159 Other channels exist, or could be reconstituted to suit current circumstances.

In defining Congress's role, there are a number of questions that could be considered:

- Congress has generally supported defense innovation in the United States by authorizing and appropriating funding for R&D and mandating DOD reform to bring commercial technology, talent, and innovation into the Department. Should DOD efforts require a NATO component or a framework for allied participation?

- Does Congress accept that European innovation can play a role in the U.S. military renewal?160 Might Congress consider balancing U.S. technology exports to Europe with a willingness to facilitate technology imports from Europe? Or revising export controls to facilitate joint R&D and industrial collaboration? What are the risks and opportunities?

- For European allies, increases in defense spending could be expected to support European firms and strengthen European autonomy. This could mean fewer opportunities for U.S. firms, but it could also mean more European capabilities. What posture should Congress take toward these possibilities? Also, what can Congress do to help allies invest more effectively, especially in terms of R&D and procurement?

- Global commercial investments in R&D are growing, and commercial innovation is increasingly important for defense and security. Government and commercial actors contribute to different parts of the innovation cycle,161 and they can leverage one another's advantages in areas like intelligence and cybersecurity. Can Congress help NATO reach a broader group of technology stakeholders by building links or facilitating public-private partnerships?

- The United States National Technology and Industrial Base now includes the United States, the UK, Australia, and Canada.162 What are the risks and opportunities associated with closer collaboration with these partners? Might Congress consider expanding this base to include another tier group of NATO allies or a wider group of associated countries?

- What role can Congress play in expanding NATO's access to commercial technology and innovation? Should the United States pursue this agenda with a small group of NATO allies or seek coherence at the NATO level?

- Europeans feel pressure from Washington to take more responsibility for their security and to have capabilities to manage crises in their neighborhood. They have also, at times, seen U.S. dissatisfaction with EU initiatives that could potentially close markets to U.S. industry. Congress may wish to reconcile U.S. narratives in its messaging to NATO and to the EU.163

Author Contact Information

Footnotes

| 1. |

CRS Report R44550, NATO's Warsaw Summit: In Brief, by [author name scrubbed]. |

| 2. |

NATO Warsaw Summit Communiqué, July 9, 2016, point 2. |

| 3. |

On hybrid challenges, see Bastian Geigerich, "Hybrid warfare and the changing character of conflict," Connections QJ, vol. 15, no. 2 (2016), pp. 65-72. |

| 4. |

NATO Cooperative Cyber Defence Centre of Excellence, NATO Recognizes Cyberspace as a 'Domain of Operations' at Warsaw Summit, Incyder news, Talinn, Estonia, July 21, 2016, https://ccdcoe.org/nato-recognises-cyberspace-domain-operations-warsaw-summit.html. |

| 5. |

Julianne Smith, Jim Townsend, and Rachel Rizzo, NATO's 2018 summit: Key summit deliverables and five initiatives where the U.S. can make a difference, Center for a New American Security, March 30, 2018. |

| 6. |

NATO Parliamentary Assembly, Military tech edge at risk, NATO member governments warned, News, Bucharest, Romania, October 9, 2017, https://www.nato-pa.int/news/military-tech-edge-risk-nato-member-governments-warned. See also Tomas Marino (General Rapporteur), Maintaining NATO's technology edge: Strategic adaptation and defense research & development, NATO Parliamentary Assembly Science and Technology Committee, 080 STC 17 E, March 2017. |

| 7. |

James M. Goldgeier, "The U.S. decision to enlarge NATO," Brookings Review, Summer 1999. |

| 8. |

CRS In Focus IF10790, What Next for the Third Offset Strategy?, by [author name scrubbed]. |

| 9. |

The National Defense Authorization Act for FY2018 (P.L. 115-91) supported the Administration's funding request for the European Deterrence Initiative (EDI), but called for future funding requests for EDI to be included as part of the Department of Defense's base budget rather than the Overseas Contingency Operations (OCO) fund. |

| 10. |

Joe Gould, "US senators revive NATO Observer Group to signal ally support, Russian deterrence," Defense News, February 28, 2018, Europe. |

| 11. |

Wales Summit Declaration, https://www.nato.int/cps/en/natohq/official_texts_112964.htm. |

| 12. |

"A Global Strategy for the European Union's Foreign and Security Policy, Share Vision, Common Action: A Stronger Europe," June 2016, p. 3. See also Karl-Heinz Kamp, Why NATO needs a new strategic concept, ETH Zurich Center for Security Studies, December 9, 2016. |

| 13. |

Robin Emmott, "After nerve agent attack, NATO sees pattern of Russian interference," Reuters, March 15, 2018. |

| 14. |

Richard Sokolsky, The new NATO-Russia military balance: Implications for European security, Carnegie Endowment for International Peace, Task Force White Paper, March 13, 2017. On Russia's perspective, see Andrew Monaghan, Preparing for war? Moscow facing an arc of crisis, Strategic Studies Institute, U.S. Army War College, The Letort Papers, Carlisle, PA, December 2016. |

| 15. |

Samuel Bendett, "Get ready, NATO: Russia's new killer robots are nearly ready for war," The National Interest, March 7, 2017. |

| 16. |

Richard Sokolsky, op. cit., p. 5. See also John Louth, Trevor Taylor, and Andrew Tyler, Defense innovation and the UK: Responding to the risks identified by the U.S. third offset strategy, Royal United Services Institute, RUSI Occasional Paper, London, UK, July 2017, p. vii. |

| 17. |

For more details on the evolving missile threat from Russia, see the CSIS Missile Threat website: https://missilethreat.csis.org/country/russia/. |

| 18. |

Scott Boston, Michael Johnson, Nathan Beauchamp-Mustafaga, et al., Assessing the Conventional Force Imbalance in Europe: Implications for Countering Russian Local Superiority, RAND Corporation, 2018. See also David A. Shlapak and Michael W. Johnson, "Outnumbered, Outranged, and Outgunned: How Russia Defeats NATO," War on the Rocks, April 21, 2016. |

| 19. |

Peter Engelke, Lisa Aronsson, and Magnus Nordenman, Mediterranean futures 2030: Toward a Transatlantic Security Strategy, Atlantic Council, Washington, DC, January 17, 2017. |

| 20. |

Ibid. See also National Intelligence Council, Global Trends 2030: Alternative Worlds, December 2012. |

| 21. |

CRS In Focus IF10561, Terrorism in Europe, by [author name scrubbed]. |

| 22. |

CRS calculations from Stockholm International Peace Research Institute's military expenditures database. |

| 23. |

Michael Shurkin, The abilities of the British, French, and German armies to generate and sustain armored brigades in the Baltics, RAND Corporation, 2017. |

| 24. |

Martin Shaw, Post-Military Society: Militarism, Demilitarization and War at the end of the Twentieth Century (Philadelphia, PA: Temple University Press, 1991). |

| 25. |

Jan Orbie, "Civilian Power Europe: Review of the Original and Current Debates," Cooperation and Conflict, vol. 41, no. 1 (March 1, 2006), pp. 123-128. |

| 26. |

Ibid., Andrew Moravcsik, "The Quiet Superpower," Newsweek, June 17, 2002. |

| 27. |

See CRS Report RL30150, NATO Common Funds Burdensharing: Background and Current Issues, by [author name scrubbed]. |