U.S. Farm Commodity Support: An Overview of Selected Programs

Federal efforts to bolster farm household incomes and the rural economy by providing support to producers of key crops has been a central pillar of U.S. farm policy since such programs were first introduced in the 1930s. Current farm support programs are counter-cyclical in design—that is payments are triggered when the annual market price for an eligible crop drops below a statutory minimum or when revenue is below a guaranteed level. The farm commodity program provisions in Title I of the Agricultural Act of 2014 (P.L. 113-79, the 2014 farm bill) consists of three types of support for crop years 2014-2018:

Price Loss Coverage (PLC) payments. PLC payments occur if the national average marketing year price for a “covered commodity” (e.g., wheat, corn, soybeans, rice, and peanuts, among others) is below its “reference price.” The difference between these two prices is the per-unit payment rate, which is multiplied by historical program yields and paid on 85% of historical program acres (i.e., base acres).

Agriculture Risk Coverage (ARC) payments. ARC payments occur when annual crop revenue for a county or an individual producer is below its guaranteed level based on a five-year moving average of historical crop revenue. The difference between these prices is the per-acre payment rate, which is paid on 85% of base acres.

Marketing Assistance Loans (MAL). MAL offers interim financing for a group of “loan” commodities (consisting of covered crops plus several others) that is equal to actual production multiplied by statutorily set loan rates. Additional benefits are available to producers if market prices fall below loan rates.

These three commodity support programs are in effect for the 2014-2018 crop years. The U.S. Department of Agriculture’s (USDA) Farm Service Agency (FSA) reported that ARC and PLC payments exceeded $5 billion in FY2014, and payments reached nearly $7 billion in both FY2015 and FY2016. Under current law, the Congressional Budget Office projects farm commodity program payments to exceed a combined total of $4 billion each fiscal year from 2016 to 2027.

The “covered commodities” that qualify for ARC and PLC include wheat, feed grains (corn, sorghum, barley, oats), seed cotton, rice, soybeans, other oilseeds (sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed), and peanuts. Support under MAL is available for covered commodities plus refined beet and raw cane sugar, wool, mohair, honey, dry peas, lentils, and chickpeas.

The 2014 farm bill’s Title I farm program payments are set to expire in September 2018. The upcoming farm bill discussions may address farm commodity program payments. Without a new farm bill or an extension of the current farm bill, the authority for some farm programs would expire, and some would cease to operate altogether. Accordingly, this report lists a selection of legislative proposals introduced in the 115th Congress that would impact the farm commodity program payments in Title I of the farm bill.

USDA administers these farm commodity programs. Dairy, livestock, tree crops, and sugar producers have separate programs within Title I that are outside the scope of this report.

U.S. Farm Commodity Support: An Overview of Selected Programs

Jump to Main Text of Report

Contents

- Introduction

- Fundamentals of Farm Commodity Programs

- Eligible Commodities

- Federal Support Options

- Base Acres

- Reference Prices and Loan Rates

- Coupled Versus Decoupled Payments

- Decoupled Revenue Support Programs: PLC and ARC

- Coupled Price Protection: Marketing Assistance Loan (MAL)

- Payment Limits and Adjusted Gross Income Eligibility

- Elimination of Generic Base Acres

- Insurance Program for Cotton Producers

- Introduction of "Seed Cotton" as a Covered Commodity

- 2014 Program Participation

- Program Outlays Under the 2014 Farm Bill

- Projected Participation

- Possible Issues for Congress

- Expiration of the 2014 Farm Bill

- Proposals in the 115th Congress for the Farm Commodity Programs

- Cotton as a Supported Commodity

- Yield Data Underlying ARC-CO Payments

- Definition of "Actively Engaged" in Farming

- Payment Limits

- AGI Eligibility Criteria

Figures

- Figure 1. Percent of Base Acres by Commodity

- Figure 2. Price Loss Coverage (PLC) Payment Formula

- Figure 3. Agriculture Risk Coverage-County Level (ARC-CO) Payment Formula

- Figure 4. Percentage of ARC-CO, ARC-IC, or PLC Base Acre Enrollment by Crop

- Figure 5. Program Outlays Under the 2014 Farm Bill

- Figure 6. CBO Projected Title I Programs Payments

Summary

Federal efforts to bolster farm household incomes and the rural economy by providing support to producers of key crops has been a central pillar of U.S. farm policy since such programs were first introduced in the 1930s. Current farm support programs are counter-cyclical in design—that is payments are triggered when the annual market price for an eligible crop drops below a statutory minimum or when revenue is below a guaranteed level. The farm commodity program provisions in Title I of the Agricultural Act of 2014 (P.L. 113-79, the 2014 farm bill) consists of three types of support for crop years 2014-2018:

- 1. Price Loss Coverage (PLC) payments. PLC payments occur if the national average marketing year price for a "covered commodity" (e.g., wheat, corn, soybeans, rice, and peanuts, among others) is below its "reference price." The difference between these two prices is the per-unit payment rate, which is multiplied by historical program yields and paid on 85% of historical program acres (i.e., base acres).

- 2. Agriculture Risk Coverage (ARC) payments. ARC payments occur when annual crop revenue for a county or an individual producer is below its guaranteed level based on a five-year moving average of historical crop revenue. The difference between these prices is the per-acre payment rate, which is paid on 85% of base acres.

- 3. Marketing Assistance Loans (MAL). MAL offers interim financing for a group of "loan" commodities (consisting of covered crops plus several others) that is equal to actual production multiplied by statutorily set loan rates. Additional benefits are available to producers if market prices fall below loan rates.

These three commodity support programs are in effect for the 2014-2018 crop years. The U.S. Department of Agriculture's (USDA) Farm Service Agency (FSA) reported that ARC and PLC payments exceeded $5 billion in FY2014, and payments reached nearly $7 billion in both FY2015 and FY2016. Under current law, the Congressional Budget Office projects farm commodity program payments to exceed a combined total of $4 billion each fiscal year from 2016 to 2027.

The "covered commodities" that qualify for ARC and PLC include wheat, feed grains (corn, sorghum, barley, oats), seed cotton, rice, soybeans, other oilseeds (sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed), and peanuts. Support under MAL is available for covered commodities plus refined beet and raw cane sugar, wool, mohair, honey, dry peas, lentils, and chickpeas.

The 2014 farm bill's Title I farm program payments are set to expire in September 2018. The upcoming farm bill discussions may address farm commodity program payments. Without a new farm bill or an extension of the current farm bill, the authority for some farm programs would expire, and some would cease to operate altogether. Accordingly, this report lists a selection of legislative proposals introduced in the 115th Congress that would impact the farm commodity program payments in Title I of the farm bill.

USDA administers these farm commodity programs. Dairy, livestock, tree crops, and sugar producers have separate programs within Title I that are outside the scope of this report.

Introduction

The farm bill is omnibus, multi-year legislation that governs an array of agricultural and food programs.1 It is typically reauthorized about every five years.2 The current 2014 farm bill (P.L. 113-79) contains 12 titles3 that address commodity program payments, farm credit, trade, agricultural conservation, research, rural development, energy, and foreign and domestic food programs, among others. The U.S. Department of Agriculture (USDA) implements the majority of the farm bill programs. This report focuses on commodity program payments authorized by Title I of the 2014 farm bill. The authority for USDA to operate farm commodity support programs comes from three permanent laws, as amended: the Agricultural Adjustment Act of 1938 (P.L. 75-430), the Agricultural Act of 1949 (P.L. 81-439), and the Commodity Credit Corporation (CCC) Charter Act of 1948 (P.L. 80-806). Congress typically amends these laws through multi-year omnibus farm bills to address current market conditions, budget constraints, and related issues and concerns.

The most recent omnibus farm bill is the Agricultural Act of 2014, referred to as the "2014 farm bill," which President Barack Obama signed into law on February 7, 2014.4 Many current farm bill provisions expire on September 30, 2018. When the 2014 farm bill expires, farm programs would revert to the permanent laws mentioned above for the majority of crops eligible for commodity support programs—"program" or "covered" crops. Under permanent law, covered commodity support was available at levels much higher than they are now, and many of the currently supported commodities might not be eligible for coverage. Reverting to permanent law leads to results incompatible with global trading rules and federal budgetary policies—and could disrupt markets for food and feed—so public pressure tends to build at the end of one farm bill to enact another.5

The two principal authorizing committees of U.S. farm policy—the House Committee on Agriculture and the Senate Committee on Agriculture, Nutrition, and Forestry—have both stated the importance of addressing the farm bill and have held numerous hearings in anticipation of preparing successor legislation to the 2014 farm bill.6

This report focuses on three principal support programs in Title I of the 2014 farm bill: the Price Loss Coverage (PLC), Agriculture Risk Coverage (ARC), and Marketing Assistance Loan (MAL) programs. Affected commodities include corn, soybeans, wheat, rice, cotton, peanuts, oats, barley, grain sorghum, pulse crops (dry peas, lentils, small chickpeas, and large chickpeas), and other oilseeds (including sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed). In addition, this report discusses potential issues for Congress—including expiration of the farm bill and the adjusted gross income eligibility threshold for commodity program payments—and presents a selection of legislation introduced in the 115th Congress that could impact the farm commodity program payments under Title I. Dairy, livestock, tree crops, and sugar producers have separate programs within Title I that are outside the scope of this report.7

Fundamentals of Farm Commodity Programs

Federal support for a limited number of basic agricultural commodities, such as wheat and cotton, began in the 1930s.8 During the Dust Bowl9 and the Great Depression, farm household incomes were low relative to their urban counterparts due largely to weak commodity prices resulting from prolonged weakness in consumer demand. The early federal farm support measures are intended to be temporary, but the principle of providing federal support for farm incomes continues to this day.

The federal government supported farm prices through their initial focus on supply control and management of commodity stockpiles. Supply controls were prominent for decades but waned after the 1980s and in 1996 were replaced with fixed, direct income support payments to producers of major field crops irrespective of market prices. The 2014 farm bill repealed these direct payments but continues payments to producers of a broad array of "covered crops" when prices are low relative to statutory price support levels or when compared with historical crop revenue.

Proponents of farm commodity programs argue that federal involvement in the sector is needed to stabilize farm incomes by shifting some of the risks inherent in farming from individual producers to the federal government. These risks could potentially include market price instability and crop failure.10 Proponents see the goal of farm policy as maintaining the economic health of the nation's farm sector so as to facilitate adequate domestic supplies of food, feed, and fiber and to allow U.S. agriculture to fully exploit its comparative advantage in producing high-quality, affordable agricultural products for the global market. Critics argue that farm commodity programs waste taxpayer dollars, distort production of certain crops, capitalize benefits to the owners of the resources, encourage concentration of production, and place smaller-scale domestic producers and farmers in foreign countries that lack government support at a comparative disadvantage.

The 2014 farm bill eliminated several 2008 farm bill commodity support payment programs (including Direct and Counter-Cyclical Payments, and the Average Crop Revenue Election program) and introduced two new programs: PLC and ARC. The new programs allow producers to participate during the 2014-2018 crop years.11 No fees are associated with program participation; however, signup is necessary.

Eligible Commodities

Under the 2014 farm bill (P.L. 113-79), "covered commodities" are crops eligible to participate in the suite of farm commodity programs, including the new ARC and PLC support programs. These crops include corn, soybeans, wheat, rice (long grain and medium grain), seed cotton,P.L. 107-17112 peanuts, oats, barley, grain sorghum, and other oilseeds (including sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed).

Federal Support Options

The 2014 farm bill provides producers a choice between either ARC or PLC, with an option to simultaneously participate in the MAL program, thus helping producers customize their price or revenue protection for farm operations (see Table 1).

|

Program |

Description |

|

Producers choose from the three decoupled revenue support programs: |

|

|

Price Loss Coverage (PLC) |

PLC payments occur if a covered commodity's national average marketing year price is below its "reference price." Payments happen on a crop-by-crop basis (using the farm's basea acreage and program yield for the particular crop) and are limited to market price declines from the reference price to the marketing loan rate. |

|

Agricultural Risk Coverage (ARC) Farmers who select ARC must then choose one of two options (ARC-CO or ARC-IC) |

County level (ARC-CO) provides revenue loss coverage at the county level for selected covered commodities on a farm. ARC-CO is not dependent on planting of the covered commodity. (In other words, payments are decoupled from actual plantings.) ARC-CO payment calculations include 85% of the specific base acres and cannot exceed 10% of the farm benchmark revenue calculated for that year. |

|

Individual (ARC-IC) provides revenue loss coverage at the whole-farm level for all acreage devoted to covered commodities across all of the producer's ARC-IC farms. ARC-IC requires planting of covered commodities (i.e., payments are coupled to actual plantings), because the ARC-IC revenue calculation includes the planted covered commodities. |

|

|

And may also participate in a coupled MAL program: |

|

|

Marketing Assistance Loans (MAL) |

MAL offers interim financing for a group of "loan commodities" (equal to covered commodities plus selected others). If market prices fall below statutory loan rates, producers are eligible for additional benefits. A producer may enroll crops in MAL alone or in combination with either PLC or ARC. |

Source: 2014 farm bill (P.L. 113-79).

Note:

a. Base acres refer to the historical planted acreage on each farm (as registered with USDA), using a multi-year average from as far back as the 1980s.

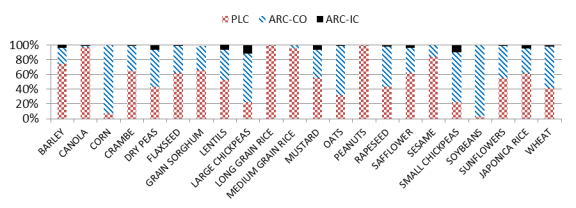

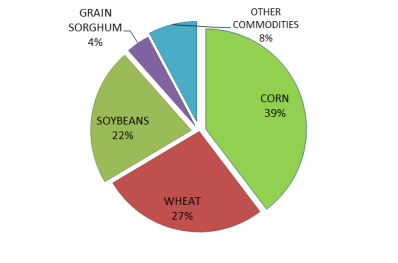

Base Acres

For the purposes of calculating ARC and PLC program payments, the term base acres refers to the historical planted acreage on each farm (as registered with USDA), using a multi-year average from as far back as the 1980s.13 USDA's Farm Service Agency (FSA) reported the percentage of base acres by commodity.14 The largest percentages include corn (39%), wheat (27%), and soybeans (22%) (Figure 1).

|

|

Source: FSA, ARC/PLC Election Data, May 2015. Notes: Election data from 2015. Percentages are rounded. The other commodities category include commodities that each comprise no more than 2% of total base acres. Other commodities are barley, rice (long and medium grain), oats, peanuts, sunflowers, canola, dry peas, lentils, flaxseed, safflower, large and small chickpeas, sesame, crambe, and rapeseed. |

Because a farmer's actual plantings may differ from farm base acres, program payments may not necessarily align with financial losses associated with market prices or crop revenue. In order to better match program payments with farm risk, the 2014 farm bill provided farmers with a one-time opportunity to update individual crop base acres by reallocating base acreage within their current planted acreage to match their actual crop mix (plantings) during 2009-2012.15 Farmers could also choose to not reallocate their base acres if they expected payments to be maximized under their existing base acres.

In cases where producers inherit land or sell cropland, base acreage is calculated for each covered commodity and transferred to the new owner. The new landowner becomes eligible for farm programs on the newly acquired land.

Reference Prices and Loan Rates

Title I of the 2014 farm bill established statutory "reference prices" and "loan rates" for marketing years16 2014-2018. Calculations for commodity payments under ARC, PLC, and MAL depend on these prices and rates (see Table 2). While covered commodities are eligible for ARC, PLC, and MAL, several commodities are only eligible for MAL coverage alone, among which are mohair, sugar, honey, upland cotton, extra long staple cotton, and wool.

|

Commodity |

Reference Prices |

Loan Rate |

|

Covered Commodity (and Loan Commodity) |

||

|

Wheat |

$5.50/bushel |

$2.94/bushel |

|

Corn |

$3.70/bushel |

$1.95/bushel |

|

Grain sorghum |

$3.95/bushel |

$1.95/bushel |

|

Barley |

$4.95/bushel |

$1.95/bushel |

|

Oats |

$2.40/bushel |

$1.39/bushel |

|

Long-grain rice |

$14.00/cwt |

$6.50/cwt |

|

Medium-grain rice |

$16.10/cwt (California medium-grain rice [temperate japonica]) |

$6.50/cwt |

|

Soybeans |

$8.40/bushel |

$5.00/bushel |

|

Minor oil seedsa |

$20.15/cwt |

$10.09/cwt |

|

Dry peas |

$11.00/cwt |

$5.40/cwt |

|

Lentils |

$19.97/cwt |

$11.28/cwt |

|

Small chickpeas |

$19.04/cwt |

$7.43/cwt |

|

Large chickpeas |

$21.54/cwt |

$11.28/cwt |

|

Peanuts |

$535/ton |

$355/ton |

|

Seed cotton |

$36.70/cwt |

$25/cwt |

|

Loan Commodity |

||

|

Upland cotton |

n/a |

$45.00 to $52.00/cwtb |

|

Extra long staple cotton |

n/a |

$79.77/cwt |

|

Wool, graded |

n/a |

$1.15/lb. |

|

Wool, nongraded |

n/a |

$0.40/lb. |

|

Mohair |

n/a |

$4.20/lb. |

|

Honey |

n/a |

$69.00/cwt |

|

Sugar, raw cane |

n/a |

$18.75/cwt |

|

Sugar, refined beets |

n/a |

$24.09/cwt |

Sources: 2014 farm bill (P.L. 113-79) and the Bipartisan Budget Act of 2018 (P.L. 115-123).

Notes: The table includes all covered commodities plus all eight additional commodities.

a. Minor oil seeds include sunflower seed, rapeseed, canola, safflower, flaxseed, mustard seed, crambe, and sesame seed. Cwt. = 100 lbs. n/a = not applicable.

b. The upland cotton loan rate calculation is based on market valuations of various cotton quality factors for the prior three years. The Commodity Credit Corporation adjusts cotton loan rates by these differentials so that cotton loan values reflect the differences in market prices for color, staple length, leaf, extraneous matter, micronaire, length uniformity, and strength.

Coupled Versus Decoupled Payments

MAL payments, when they occur, are "coupled" to actual plantings, which may tend to distort production and may influence market prices and impact world markets. In contrast, ARC and PLC payments are "decoupled" payments. They provide income transfers to producers based on historical planted acreage while allowing them to make market-based decisions each year about whether to plant, which commodities to plant, and how much to plant.17 Decoupling payments from current plantings better aligns crop support policies with World Trade Organization (WTO) rules on domestic support18 and may prevent market distortion by minimizing the influence of support programs on producers' decisions. The following sections describe the differences between the decoupled revenue support programs ARC and PLC and the coupled price protection provided by the MAL program.

Decoupled Revenue Support Programs: PLC and ARC

At the start of the 2014 farm bill, eligible producers were given a one-time choice between ARC and PLC to last for the duration of the farm bill. Out of over 240 million historical program acres (referred to as base acres), 77% of base acreage enrolled for ARC, while 23% selected PLC.19 An additional 17.6 million acres of "generic base" (former upland cotton base acres) were also available to participate but on a "coupled basis."

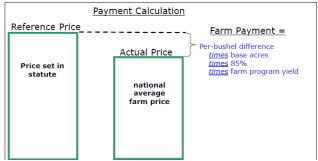

PLC payments are triggered when the national marketing-year average farm price (MYAP) for a qualifying covered commodity (referred to as the effective price) is below its statutorily fixed reference price. The difference between the reference price and the effective price equals the payment rate. If triggered, the PLC payment amount for a covered commodity is equal to the payment rate times the commodity's historical program yield times 85% of the commodity's base acres enrolled in PLC. Under the recent farm policy changes enacted under the Bipartisan Budget Act of 2018 (P.L. 115-123; BBA), the base attributed to a covered commodity has been expanded to include the covered commodity's historical base plus the portion of a producer's generic base reallocated to the covered commodity in accordance with a statutory formula in the BBA. PLC payments do not depend on the crops planted and/or considered planted.20 Figure 2 illustrates the PLC payment formula.

|

Figure 2. Price Loss Coverage (PLC) Payment Formula (Makes payment when national average farm price drops below the reference price) |

|

|

Source: CRS Report R43758, Farm Safety Net Programs: Background and Issues, coordinated by [author name scrubbed]. Note: In a declining market, the per-bushel payment rate increases until the farm price drops below the loan rate. At this point, benefits under the MAL become available. In 2018, the BBA eliminated generic base acres. |

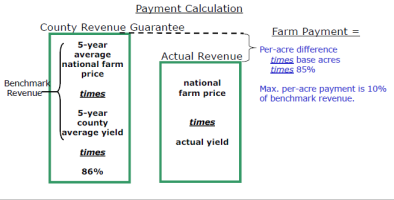

ARC-CO provides coverage for revenue losses from the historical five-year moving average revenue at the county level. ARC-CO payments for a particular covered commodity are issued when the actual county crop revenue of the covered commodity is less than the ARC-CO revenue guarantee for that covered commodity. The ARC-CO guarantee equals 86% of the previous five-year national MYAP, excluding the years with the highest and lowest prices (the ARC guarantee price), multiplied by the average historical county yield, excluding the years with the highest and lowest yields (the ARC county guarantee yield). ARC-CO payments are triggered when the actual crop revenue for the county (equal to the MYAP times the county average yield) is below its ARC-CO revenue guarantee. ARC-CO payments are then equal to the per-acre payment rate times 85% of the base acres enrolled in ARC-CO for the respective program crop. Figure 3 illustrates the ARC-CO payment formula.

|

Figure 3. Agriculture Risk Coverage-County Level (ARC-CO) Payment Formula (Makes payment when actual county-wide revenue drops below 86% of historical revenue) |

|

|

Source: CRS Report R43758, Farm Safety Net Programs: Background and Issues, coordinated by [author name scrubbed]. Notes: Five-year averages exclude high and low years. Instead of an ARC county guarantee on a crop-by-crop basis, farmers can select a farm-level guarantee for all covered crops on a farm. In this case, payment acreage is reduced to 65% of base acres, and a single, whole-farm guarantee (and payment) is calculated as a weighted average for all crops (i.e., not on a crop-by-crop basis). |

ARC-IC provides revenue loss coverage at a whole-farm level comprising of all program crop revenues. Furthermore, an ARC-IC farm is the sum of the base acreage enrolled in the individual coverage option for ARC in a state. Producers involved in multiple farms in multiple states that enroll in ARC-IC have a separate ARC-IC farm in each state. The ARC-IC farm's guarantee equals 86% of the ARC-IC farm's individual benchmark guarantee, defined as the summation of the five-year average of an ARC-IC farm's annual ARC-IC benchmark revenue for each program crop (i.e., the farm's yield for each program crop, multiplied by the higher of the crop's reference price or the MYAP), excluding the high and low annual revenues. Actual revenue is computed as the summation across all participating program crops of the ARC-IC farm's actual yield times the higher of the MYAP or the national average loan rate. The payment rate for the ARC-IC farm is capped at 10% of the farm's ARC-IC benchmark revenue.

Coupled Price Protection: Marketing Assistance Loan (MAL)

MAL offers interim financing for the "covered" and "loan" commodities listed in Table 2. If market prices fall below these statutory loan rates, additional benefits are available to producers with crops enrolled in MAL.21

MAL program benefits are available on the entire crop produced, which means a farmer receives no benefits in the event of a crop loss. Thus, MAL payments are coupled to current production. A participating producer may put a harvested loan crop under a nine-month, nonrecourse loan valued at a statutory commodity loan rate. The crop is the collateral for the loan. This effectively establishes a price guarantee, because the producer has the option of forfeiting the crop and keeping the loan in lieu of repaying the loan with interest and keeping the crop.

The nonrecourse loan gives the producer the option to either repay the loan or reclaim the crop when local market prices are above the loan rate plus interest. Alternatively, if local market prices fall below the statutorily fixed loan rate prior to loan maturity, then four potential MAL benefits become available to a producer with a crop under loan:

- A participating farmer can repay the loan at a repayment rate based on county market conditions (or posted county price) and keep the difference as a marketing loan gain.

- Rather than taking the loan when the posted county price is below the loan rate, a farmer may request a loan deficiency payment, with the payment rate equal to the difference between the loan rate and the loan repayment rate.

- As a third option, a participating farmer may use commodity certificates22 to repay the loan at the lower local market price and avoid any potential program payment limit associated with the market gain.

- As a final option, to avoid any potential program payment limits, a producer may forfeit the pledged crop to USDA at the end of the loan period and keep any gains associated with forfeiture.

Payment Limits and Adjusted Gross Income Eligibility

All three types of payments (ARC, PLC, and MAL) are subject to a combined annual payment limit of $125,000 per person across all eligible commodities, except for peanuts. Peanuts have a separate payment limit of $125,000 per person. As such, a producer of peanuts and other eligible program crops would have a combined annual payment limit of $250,000 per person. In addition, an income limit for program eligibility of $900,000 in adjusted gross income (AGI) applies.23

Elimination of Generic Base Acres

The 2014 farm bill created generic base acres in order to address the removal of upland cotton24 from eligibility for the ARC and PLC programs while simultaneously allowing ARC and PLC payments on the 17.6 million acres of cotton base acreage. Cotton was deemed an ineligible commodity in order to comply with a WTO dispute settlement decision in 2002—the "Brazil cotton case." The WTO determined that specific provisions of the U.S. cotton program were incompatible with WTO rules, which prompted Congress to alter farm program policies for cotton in the 2014 farm bill.25

Producers with generic base acres are still eligible for ARC and PLC payments on these acres but only if they plant a covered commodity on them. As a result, generic base acres are coupled to ARC and PLC payments—unlike all other program base acres, which are fully decoupled. Thus, under ARC and PLC, generic base acres are tied to the production decision, and therefore plantings on these acres are likely influenced by expected government payments.

Insurance Program for Cotton Producers

In the 2014 farm bill, Congress introduced the Stacked Income Protection Program (STAX),26 a "shallow-loss"27 revenue insurance policy for upland cotton that provides coverage for a portion of expected revenue. Cotton producers can participate in the STAX program in lieu of eligibility for ARC and PLC.28 The federal premium subsidy rate is 80% for STAX. The government also pays for delivery costs. All producing counties at the county level are eligible for STAX or on the basis of a larger geographic area if necessary. A payment rate multiplier of 120% is available if producers want to increase the amount of protection per acre.

The STAX indemnity is triggered by a revenue loss at the county level. When purchased together with an underlying crop insurance policy, the indemnity covers part of the deductible of the underlying policy—in other words, it is "stacked" on top of an existing policy. Specifically, STAX would indemnify losses in county revenue of greater than 10% of expected revenue but not more than 30%. For producers purchasing STAX in conjunction with an individual crop insurance policy, the maximum coverage under STAX cannot exceed the deductible level selected by the producer in the underlying individual policy.

Introduction of "Seed Cotton" as a Covered Commodity

The BBA, signed into law on February 9, 2018, included a provision that specified "seed cotton" as a covered commodity, thus making it eligible for the PLC and ARC programs beginning with the 2018 crop year. Seed cotton is un-ginned upland cotton that includes both lint and seed. Also, another BBA provision authorized the elimination of generic base acres effective with the 2018 crop. Instead, producers were given 90 days from enactment of the BBA (i.e., until May 10, 2018) to reallocate their generic base acres either to seed cotton base, to other program crops, or to an unassigned category according to the following formula.

No Recent History of Planting Covered Commodities: If the owner of a farm has not planted any covered commodities (including seed cotton) during the 2009 through 2016 crop years, then the generic base acres shall be allocated to "unassigned crop base" and no longer be eligible for ARC or PLC payments. However, MAL coverage would still be available.

Recent History of Planting Covered Commodities: The owner of a farm with a history of planting covered commodities during the 2009 through 2016 crop years shall allocate generic base acres between seed cotton and other program crops as follows:

1. to seed cotton base acres in a quantity equal to the greater of:

a. 80% of the generic base acres on the farm; or

b. average number of seed cotton acres planted or prevented from being planted on the farm during the 2009-2012 years (not to exceed the total generic base acres on the farm); or

2. to base for covered commodities (including seed cotton) in proportion to each crop's share of planted (or prevented from being planted) acreage during 2009 to 2012.

Any residual or unassigned generic base acres (defined as any positive difference between generic base and the seed cotton base acres allocated under the first choice) are no longer eligible for program payments for any covered crop. If no program election is made, PLC is the default for all base acres (including seed cotton). Seed cotton base acres enrolled in PLC or ARC will be ineligible for the STAX beginning in 2019.

2014 Program Participation

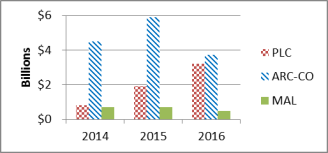

Participation in ARC and PLC varies by crop and by region. FSA reported that the 2014 ARC-CO base acre enrollment was 76% compared to PLC's 23% base acre enrollment (Figure 4). The popularity for ARC-CO was largely due to the favorable five-year price and revenue data from the 2011-2013 period used to calculate the ARC-CO payments in crop years 2014, 2015, and 2016. In particular, corn, soybeans, and wheat all reached record high farm level prices leading up to and during the 2012 drought.

Program Outlays Under the 2014 Farm Bill

The 2014 farm bill's PLC, ARC, and MAL programs cover the five crop years of 2014 through 2018; however, data on program outlays for ARC and PLC is available only for the first three years—2014-2016 (Figure 5). Program payments are funded through CCC. The combined total outlays for these three programs between 2014 and 2016 exceeded $21 billion.

In terms of individual commodities, corn, soybeans and wheat account for the majority of the payments under ARC and PLC (Table 3) and also rank as the program crops with most base acreage. However, on a per-acre basis, peanuts and rice account for the highest support rate per acre, reflecting their higher reference prices relative to corn, soybeans, and wheat.

|

2014 PLC |

2015 PLC |

2016 PLC |

2014 ARC-CO |

2015 ARC-CO |

2016 ARC-CO |

|

|

Corn |

n.p. |

$53 |

$206 |

$3,749 |

$4,066 |

$2,790 |

|

Wheat |

n.p. |

$500 |

$1,265 |

$353 |

$642 |

$648 |

|

Soybeans |

n.p. |

n.p. |

n.p. |

$325 |

$1,093 |

$200 |

|

Grain sorghum |

n.p. |

$204 |

$340 |

$36 |

$55 |

$56 |

|

Oats |

n.p. |

$7 |

$8 |

$2 |

$17 |

$21 |

|

Sunflower |

n.p. |

$5 |

$24 |

$8 |

$5 |

$6 |

|

Barley |

n.p. |

n.p. |

n.p. |

$7 |

$8 |

$5 |

|

Dry peas |

n.p. |

n.p. |

n.p. |

$1 |

$2 |

$2 |

|

Flaxseed |

n.p. |

$5 |

$6 |

<$1 |

<$1 |

$1 |

|

Peanuts |

$320 |

$520 |

$524 |

<$1 |

<$1 |

<$1 |

|

Rice, medium grain |

n.p. |

$20 |

$24 |

n.p. |

<$1 |

<$1 |

|

Rice, long grain |

$398 |

$524 |

$728 |

<$1 |

<$1 |

<$1 |

|

Canola |

$55 |

$77 |

$59 |

<$1 |

<$1 |

<$1 |

|

Safflower |

n.p. |

n.p. |

n.p. |

<$1 |

<$1 |

<$1 |

|

Lentils |

n.p. |

n.p. |

n.p. |

<$1 |

$1 |

<$1 |

|

Mustard |

n.p. |

n.p. |

n.p. |

<$1 |

<$1 |

<$1 |

|

Large chickpeas |

n.p. |

n.p. |

n.p. |

$2 |

$2 |

<$1 |

|

Small chickpeas |

n.p. |

n.p. |

n.p. |

<$1 |

<$1 |

<$1 |

|

Rapeseed |

n.p. |

n.p. |

n.p. |

n.p. |

n.p. |

<$1 |

|

Seasame |

n.p. |

n.p. |

n.p. |

n.p. |

<$1 |

<$1 |

|

Crambe |

n.p. |

n.p. |

n.p. |

n.p. |

n.p. |

n.p. |

|

Total |

$774 |

$1,915 |

$3,184 |

$4,484 |

$5,894 |

$3,731 |

Sources: Compiled by CRS. FSA, 2016 ARC/PLC Payments as of December 5, 2017; 2015 ARC/PLC Payments as of February 2, 2017; 2014 ARC/PLC Payments as of September 30, 2016.

Notes: Values and totals are rounded. n.p. = no payments made or payments were less than $1,000. PLC = Price Loss Coverage. ARC-CO = Agriculture Risk Coverage-County. During the 2014-2016 time period, FSA did not report any PLC payments made to soybeans, barley, dry peas, safflower, lentils, mustard, large chickpeas, small chickpeas, rapeseed, sesame, or crambe. Agriculture Risk Coverage-Individual is not included in this table.

Projected Participation

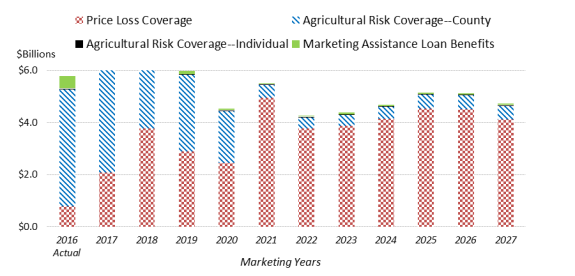

The Congressional Budget Office (CBO) projects that participation rates across program crop base acres will shift significantly between ARC and PLC through the 2027 crop marketing year if producers are given the opportunity to reallocate their base acres between programs under the next farm bill.29 CBO projects (Figure 6) an increase in PLC participation, primarily due to a forecast decline in commodity market prices (e.g. the average farm price of corn). Such a development would tend to favor PLC over ARC as a program choice due to its fixed reference price compared with the moving average reference prices under ARC.

Participation decisions have an effect on projected budget baselines. These projected program costs become part of the farm bill baseline available to write the next farm bill. For example, in June 2017, CBO projected that ARC, PLC, and MAL payouts through the 2027 period will be between $4 billion and $6 billion each year.30 This compares with payments of between $5 billion and $8 billion for crop years 2014 through 2016 under the 2014 farm bill (Table 3).

|

Figure 6. CBO Projected Title I Programs Payments (2016-2027) |

|

|

Source: CBO, June 2017 Baseline for Farm Programs. Notes: CBO projects payments for ARC-IC from 2016 through 2027 would range from $18 million to $29 million. The marketing year is defined as the 12-month period starting with the month when the harvest of a specific crop typically begins. For a list of major crop marketing years, see ERS, https://www.ers.usda.gov/data-products/feed-grains-database/documentation/. |

Possible Issues for Congress

Following the introduction of new commodity support programs in the 2014 farm bill, a number of issues have emerged around these programs that could factor into congressional consideration of the next farm bill. Moreover, Congress may consider how these programs perform during a period of lower crop prices and reduced farm income. Other issues around commodity support programs that have come up in the past—such as payment limits and income eligibility limits—may continue to be of interest for some Members and to various stakeholders. Several of these issues are summarized below, along with selected legislative proposals that address commodity support programs.

Expiration of the 2014 Farm Bill

Farm commodity programs have evolved over time via successive farm bills that update and supersede prior policies. However, a set of non-expiring provisions remain in statute and are known as "permanent law." These provisions were enacted primarily in the Agriculture Adjustment Act of 1938 and the Agricultural Act of 1949, as amended by subsequent farm bills.

Many of the programs authorized by the 2014 farm bill will expire in 2018 unless Congress provides for an extension or reauthorizes them. Without congressional action, farm commodity program payments would revert to permanently authorized legislation from the 1930s and 1940s. The commodity support provisions of the 1938 and 1949 permanent laws are commonly viewed as being radically different from current policy—and inconsistent with today's farming practices, marketing system, and international trade agreements—while also being potentially costly to the federal government.31 Having these permanent laws as the legislative default has in the past tended to bring focus to efforts to reauthorize the farm bill.

Proposals in the 115th Congress for the Farm Commodity Programs

The upcoming farm bill discussions may address ARC, PLC, and MAL payments. A number of bills introduced in the 115th Congress address various aspects of farm commodity programs, several of which would affect payments to producers. A selection of these bills, along with a brief description of how they would impact commodity support programs, is in Table 4.

|

Title |

Sponsor |

Description |

|

(S. 77) Stop Paying U.S. in Peanuts Act |

Flake |

Would repeal the forfeiture rule for peanuts under the nonrecourse marketing assistance loan program. |

|

(S. 1259) Commodity Program Improvement Act of 2017 |

Thune |

Proposes ARC-CO payments be made for the county in which the land is physically located. In addition, proposes updating base acres using a new formula and revised marketing loan provisions. |

|

(S. 1998) ARC-CO Improvement Act |

Heitkamp |

Addresses county yield data disparities for farm commodity program payments. |

|

(H.R. 4425) Food and Farm Act |

Blumenauer |

Proposes to eliminate ARC and PLC, the $125,000 payment limit, and the separate payment limit for peanut farmers. Would reduce the AGI eligibility cap for commodity program payments from $900,000 to $500,000. |

|

(S. 2263) Fruit and Vegetable Planting Flexibility Act of 2017 |

Donnelly |

Would amend the 2014 farm bill to require base acres planted to fruits, vegetables, and wild rice to be considered planted to a covered commodity for purposes of any recalculation of base acres. |

|

(H.R. 4904) Lessening Regulatory Burdens on our Farmers Act of 2018 |

LaHood |

Would allow producers a one-time filing for ARC/PLC enrollment for the duration of the next farm bill, instead of revisiting ARC/PLC paperwork each year. |

Source: CRS and Congress.gov.

Cotton as a Supported Commodity

An issue that received substantial attention in the 2014 farm bill is the treatment of cotton under Title I. Beginning with the 2014 farm bill, cotton was no longer a covered commodity and thus not eligible for PLC or ARC payments. Cotton has two co-products, the lint (fiber) and the seed. Cottonseed is separated from the lint at the gin and transported to a cottonseed crushing mill or fed directly to cattle. Once crushed, the oil can be used as a table-ready food product, while the meal is typically fed to livestock and poultry. Cottonseed is distinct from "seed cotton," which is un-ginned upland cotton that includes both lint and seed.

The 2014 farm bill lowered the MAL loan rate incrementally in an attempt to resolve a long-running trade dispute with Brazil.32 In addition, the 2014 farm bill created STAX, as well as two temporary payment programs—Cotton Transition Assistance Payments33 and Cotton Ginning Cost-Share payments.34

Subsequent to the enactment of the 2014 farm bill, the National Cotton Council (NCC), along with other farm advocacy groups, requested that seed cotton be made eligible for commodity support program payments. NCC considered this a "critically needed policy to restore eligibility for cotton in the Title I ARC and PLC programs of the farm bill."35 Others claimed that the seed cotton designation as a covered commodity was unnecessary and would likely revive the WTO dispute with Brazil.36

In the BBA, signed into law on February 9, 2018, Congress included a provision that specified "seed cotton" as a covered commodity, thus making it eligible for the PLC and ARC programs beginning with the 2018 crop year. However, even after the enactment of the BBA, there are still claims that this seed cotton provision will likely revive a future WTO dispute.37

Yield Data Underlying ARC-CO Payments

Since the enactment of the 2014 farm bill, the data used to calculate the ARC-CO payments have become a matter of concern for producers and commodity groups. These stakeholders have specifically identified disparities with crop county yield data underlying the ARC-CO payment calculations. Two bills introduced in the 115th Congress—S. 1259 and S. 1998—seek to address these data concerns about yield.

Survey data of crop yields collected by USDA's National Agricultural Statistics Service (NASS) assist in the ARC-CO payment calculations. A NASS requirement for estimating a county yield is that it must receive at least 30 producer survey responses in a given county or that the survey responses represent at least 25% of a county's harvested acreage for the crop in question. Otherwise, NASS bases the county yield on crop insurance yield data from USDA's Risk Management Agency.

On May 5, 2017, Senator John Thune introduced the "Commodity Program Improvement Act of 2017" (S. 1259), which would base ARC-CO payments on the payment rate in the county where the acres are located.38 Because each county has a different ARC-CO payment rate, some producers with multi-county farms contend that their current ARC-CO payments do not reflect the correct county-level payment calculation.

On October 24, 2017, Senator Heidi Heitkamp introduced the "ARC-CO Improvement Act" (S. 1998), which would forgo NASS survey data in favor of federal crop insurance data when making yield calculations for ARC-CO payments. Eight farm commodity advocacy groups39 have announced their support for Senator Heitkamp's proposal, including, the American Soybean Association.40

Definition of "Actively Engaged" in Farming

To be eligible for most farm payments, a person must be "actively engaged" in farming. The 2014 farm bill generally defines actively engaged as making a significant contribution of (1) capital, equipment, or land and (2) personal labor or active personal management.41 Also, profits are to be commensurate with the level of contributions, and contributions must be at risk. Legal entities can be actively engaged if members collectively contribute personal labor or active personal management. Special FSA classifications allow landowners to be considered actively engaged if they receive income based on the farm's operating results without providing labor or management.

The 2014 farm bill instructed USDA to write regulations that define significant contribution of active personal management to more clearly and objectively implement existing law. USDA issued these regulations on December 16, 2015.42 The regulation43 applied starting with the 2015 crop year. The regulation specifically exempted entities comprised solely of lineal family members.44

Looking to the upcoming debate over the next farm bill, the National Sustainable Agriculture Coalition has advocated for further tightening the definition of actively engaged, particularly as concerns large farm operations.45 On the other hand, the American Farm Bureau Federation—the largest farm organization in the United States—and some other advocacy groups have proposed modifications to the definition of actively engaged for purposes of payment limit eligibility. These proposed changes would more broadly define family by including non-lineal family members such as first or second cousins.46

Payment Limits

The cumulative benefits across certain farm programs are subject to specific annual payment limits that can be received by an individual or legal entity. Much attention in recent farm bills has focused on the annual payment limits for Title I commodity programs. Payment limits were first included in the 1970 farm bill (P.L. 91-524) but have evolved substantially since that initial effort.47

The 2014 farm bill sets an annual cap of $125,000 per person on the total payments under the PLC, ARC, and MAL programs. The limit applies to the total from all covered commodities except peanuts, which has its own separate limit of $125,000. All limits may be doubled if the producer has a spouse. Proposals to alter payment limits have been advanced by some Members of Congress and are also included in the President's FY2019 budget. For example, a bill introduced by Representative Earl Blumenauer, the "Food and Farm Act" (H.R. 4425), would eliminate the $125,000 payment limit and the separate payment limit for peanuts and would also eliminate the two largest commodity support programs—ARC and PLC. In addition, the President's FY2019 budget also proposes to eliminate peanut payments.48

AGI Eligibility Criteria

Another issue that could come up for debate is the AGI limit on eligibility for commodity program benefits. The President's FY2019 budget proposes lowering the AGI cap for eligibility for commodity program payments to $500,000 from $900,000.49 Several large farm groups and commodity associations are opposed to lowering the AGI limit to qualify for farm program benefits.50 The AGI for an individual producer—or a farm entity—is determined by averaging the AGI declared on federal tax forms for the three tax years prior to the most recent tax year.

Limits on eligibility based on income were first introduced in 2002.51 The 2002, 2008, and 2014 farm bills have each addressed the AGI limit using a different approach:

- The 2002 farm bill established that producers with an AGI exceeding $2.5 million were not eligible for certain program benefits.

- The 2008 farm bill established separate AGI limits for farm income ($750,000) and off-farm income ($500,000).

- The 2014 farm bill re-established the AGI limit as a single limit on all income (on-farm and off-farm) of $900,000 (three-year average) or double that amount for married couples filing separate tax returns. A producer with an AGI in excess of $900,000 is not eligible for benefits under ARC-CO, ARC-IC, PLC, or MAL.

Author Contact Information

Footnotes

| 1. |

See CRS In Focus IF10187, Farm Bill Primer: What Is the Farm Bill?, by [author name scrubbed] and [author name scrubbed]. |

| 2. |

Seventeen farm bills have been enacted since 1930 (2014, 2008, 2002, 1996, 1990, 1985, 1981, 1977, 1973, 1970, 1965, 1956, 1954, 1949, 1948, 1938, and 1933). |

| 3. |

The farm bill's sections are called titles. |

| 4. |

CRS In Focus IF10187, Farm Bill Primer: What Is the Farm Bill?, by [author name scrubbed] and [author name scrubbed]. |

| 5. |

CRS Report R42442, Expiration and Extension of the 2008 Farm Bill, by [author name scrubbed], [author name scrubbed], and [author name scrubbed]. |

| 6. |

The House Committee on Agriculture list of hearings can be found at https://agriculture.house.gov/calendar/?Timeframe=All. The Senate Committee on Agriculture, Nutrition, and Forestry list of hearings can be found at https://www.agriculture.senate.gov/hearings. |

| 7. |

See CRS Report RS21212, Agricultural Disaster Assistance, by [author name scrubbed]; CRS In Focus IF10750, Farm Bill Primer: Dairy Safety Net, by [author name scrubbed]; CRS In Focus IF10689, Farm Bill Primer: Sugar Program, by [author name scrubbed]; and CRS Report R43632, Specialty Crop Provisions in the 2014 Farm Bill (P.L. 113-79), by [author name scrubbed]. |

| 8. |

The Agricultural Adjustment Act of 1933 (P.L. 73-10, https://www.loc.gov/law/help/statutes-at-large/73rd-congress/session-1/c73s1ch25.pdf) was emergency legislation signed by President Franklin D. Roosevelt to provide farmers relief from drought and severe dust storms. P.L. 73-10 addressed farm support programs, including provisions for wheat, cotton, field corn, hogs, rice, tobacco, and milk. Ensuing 1934 and 1935 amendments lengthened the list of eligible commodities for federal support. |

| 9. |

Impacting much of the Great Plains during the 1930s, the Dust Bowl was a combination of prolonged periods of drought and dust storms that reduced U.S. agricultural production. |

| 10. |

Another federal program that addresses the risk of crop failure and price instability is the federal crop insurance program. See CRS In Focus IF10638, Farm Bill Primer: The Farm Safety Net, coordinated by [author name scrubbed]. |

| 11. |

For background on commodity support programs that Congress eliminated upon passage of the 2014 farm bill, see CRS Report R43448, Farm Commodity Provisions in the 2014 Farm Bill (P.L. 113-79), coordinated by [author name scrubbed]. |

| 12. |

Seed cotton is un-ginned upland cotton that includes both lint and seed. Congress designated it as a covered commodity (and eligible to participate in either ARC or PLC during the 2018 crop year) on February 9, 2018, under the Bipartisan Budget Act of 2018 (P.L. 115-123, Division F, §6101). |

| 13. |

Base acre provisions since 1981 through the 2002 farm bill () are described in Edwin Young et al., Economic Analysis of Base Acre and Payment Yield Designations Under the 2002 U.S. Farm Act, USDA Economic Research Service (ERS), September 2005, pp. 36-41, https://www.ers.usda.gov/webdocs/publications/44861/29668_err12_002.pdf?v=41334. |

| 14. |

FSA, ARC/PLC Election Data, May 2015. |

| 15. |

An example of base acre reallocation can be found at https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2014/base_acre_reallocate_arc_plc.pdf. |

| 16. |

A marketing year is defined as the 12-month period starting with the month when the harvest of a specific crop typically begins. For a list of major crop marketing years, see USDA Economic Research Service: https://www.ers.usda.gov/data-products/feed-grains-database/documentation/. |

| 17. |

ERS, Decoupled Payments in a Changing Policy Setting, Agricultural Economic Report No. 838, November 2004, https://www.ers.usda.gov/webdocs/publications/41708/30390_aer838_002.pdf?v=41271. |

| 18. |

Further explanation of decoupling payments can be found on WTO's Domestic Support webpage: https://www.wto.org/english/tratop_e/agric_e/ag_intro03_domestic_e.htm. |

| 19. |

FSA, ARC/PLC Election Data, May 2015, https://www.fsa.usda.gov/programs-and-services/arcplc_program/index. |

| 20. |

FSA, ARC and PLC Enrollment, August 2017, https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2017/arcplc_enrollment_aug2017.pdf. |

| 21. |

For details on benefits under the MAL, see CRS Report R44914, Farm Safety-Net Payments Under the 2014 Farm Bill: Comparison by Program Crop, by [author name scrubbed]. |

| 22. |

A commodity certificate exchange is a paper certificate issued by the USDA with a dollar denomination that can be exchanged in kind or on paper for commodities in USDA inventory to repay a MAL loan at the lower USDA price. |

| 23. |

An individual's or entity's AGI (from federal tax forms) is the average from the previous three tax years, excluding the most recent tax year. |

| 24. |

Upland cotton is the most widely planted species of cotton in the United States. |

| 25. |

CRS Report RL32571, Brazil's WTO Case Against the U.S. Cotton Program, by [author name scrubbed]. |

| 26. |

For more information on STAX see, CRS Report R43494, Crop Insurance Provisions in the 2014 Farm Bill (P.L. 113-79), coordinated by [author name scrubbed]. |

| 27. |

Shallow loss is defined as a loss that is less than the deductible on individual farm insurance. |

| 28. |

For details on STAX, see USDA, Risk Management Agency. Stacked Income Protection Program (STAX). https://www.rma.usda.gov/policies/stax/ |

| 29. |

In June 2017, the CBO updated its projection of producer participation in PLC and ARC through 2027. The projections assume no change in farm bill policy over this period but assume that farmers would enroll differently after the enrollment period of the 2014 farm bill expires and if a new farm bill allows enrollment changes. |

| 30. |

CBO Agricultural Baseline Projections, June 29, 2017. Note that these CBO projections preceded seed cotton's inclusion as a program crop by the BBA, as discussed earlier in this report. ARC-IC and MAL programs have very low projected outlays. |

| 31. |

See CRS Report R42442, Expiration and Extension of the 2008 Farm Bill, by [author name scrubbed], [author name scrubbed], and [author name scrubbed]. |

| 32. |

CRS Report RL32571, Brazil's WTO Case Against the U.S. Cotton Program, by [author name scrubbed]. |

| 33. |

See CRS Report R44914, Farm Safety-Net Payments Under the 2014 Farm Bill: Comparison by Program Crop, by [author name scrubbed]. |

| 34. |

See FSA, "Cotton Ginning Cost Share Program," https://www.fsa.usda.gov/programs-and-services/cgcs/index. |

| 35. |

NCC, "NCC Applauds House Passage of Supplemental Funding Bill with Cotton Policy," press release, December 22, 2017, http://www.cotton.org/news/releases/2017/sup.cfm. |

| 36. |

Scott Faber, "Do Cotton Farmers Need More Subsidies?," Environmental Working Group, December 20, 2017, https://www.ewg.org/agmag/2017/12/do-cotton-farmers-need-more-subsidies#.WnNsaYjwaUk. |

| 37. |

Sara Gustafson, "2018 Farm Bill: Protecting the U.S. Cotton Industry Poses Risks for Developing Countries," International Food Policy Research Institute, January 31, 2018, http://www.ifpri.org/blog/2018-farm-bill-protecting-us-cotton-industry-poses-risks-developing-countries. |

| 38. |

Office of Senator John Thune, "Thune's Latest Farm Bill Proposal Would Modernize and Target Commodity Assistance," press release, May 25, 2017, https://www.thune.senate.gov/public/index.cfm/press-releases?ID=FCCC304B-D9FB-4184-86B[phone number scrubbed]9B83288D. |

| 39. |

American Farm Bureau Federation, American Soybean Association, National Association of Wheat Growers, National Corn Growers Association, National Farmers Union, National Sunflower Association, USA Dry Pea and Lentil Council, and U.S. Canola Association. See Farm Futures, "8 Groups Unite to Praise Proposed Changes to ARC Program," October 24, 2017, http://www.farmfutures.com/farm-policy/8-groups-unite-praise-proposed-changes-arc-program. In addition, the American Farm Bureau Federation publicly supported this bill: American Farm Bureau Federation, "Farm Bureau Supports Farm Program Fix," October 24, 2017, https://www.fb.org/newsroom/farm-bureau-supports-farm-program-fix. |

| 40. |

American Soybean Association, "ASA Welcomes ARC-CO Improvement Act," October 25, 2017, https://soygrowers.com/asa-welcomes-arc-co-improvement-act/. |

| 41. |

CRS Report R44656, USDA's Actively Engaged in Farming (AEF) Requirement, by [author name scrubbed]. |

| 42. |

USDA, "Payment Limitation and Payment Eligibility; Actively Engaged in Farming," 80 Federal Register 78119, December 16, 2015. |

| 43. |

7 C.F.R. 1400.201. |

| 44. |

CRS Report R44739, U.S. Farm Program Eligibility and Payment Limits, by [author name scrubbed] and [author name scrubbed]. |

| 45. |

National Sustainable Agriculture Coalition, "Release: USDA Issues Rule to Allow Unlimited Subsidies for MEGA Farms," December 15, 2015, http://sustainableagriculture.net/blog/payment-limits-final-rule/ |

| 46. |

American Farm Bureau Federation, "The Definition of Actively Engaged for Payment Limit Eligibility Must Be Changed, April 2017, https://www.fb.org/files/2018FarmBill/Definition_of_Actively_Engaged_for_Payment_Limit_Eligibility.pdf. |

| 47. |

Ron L. Durst, Effects of Reducing the Income Cap on Eligibility for Farm Program Payments, ERS, September 2007, https://www.ers.usda.gov/webdocs/publications/44179/11144_eib27_1_.pdf?v=41746. |

| 48. |

Office of Management and Budget, Budget of the U.S. Government: FY2019, https://www.whitehouse.gov/wp-content/uploads/2018/02/budget-fy2019.pdf. |

| 49. |

Office of Management and Budget, Budget of the U.S. Government: FY2019. |

| 50. |

National Corn Growers Association, 2016 Policy and Position Papers, March 5, 2016, http://www.ncga.com/upload/files/documents/pdf/Policy-and-Position-Papers-FINAL-March-2016.pdf; American Soybean Association, "Soy Growers Oppose Unprecedented Cut to Crop Insurance, Farm Programs in the White House Budget," press release, February 13, 2018, https://soygrowers.com/soy-growers-oppose-unprecedented-cut-crop-insurance-farm-programs-white-house-budget/; American Farm Bureau Federation, "Oppose Means Testing on Crop Insurance," https://www.fb.org/files/2018FarmBill/Oppose_Means_Testing_on_Crop_Insurance.pdf. |

| 51. |

Ron Durst and Robert Williams, "Farm Bill Income Cap for Program Payment Eligibility Affects Few Farms," ERS, August 1, 2016, https://www.ers.usda.gov/amber-waves/2016/august/farm-bill-income-cap-for-program-payment-eligibility-affects-few-farms/. |