Tax-Preferred College Savings Plans: An Introduction to Coverdells

A Coverdell ESA—often referred to simply as a Coverdell—is a tax-advantaged investment account that can be used to pay for both higher-education expenses and elementary and secondary school expenses. The specific tax advantage of a Coverdell is that distributions (i.e., withdrawals) from this account are tax-free, if they are used to pay for qualified education expenses. If the distribution is used to pay for nonqualified expenses, a portion of the distribution is taxable and may also be subject to a 10% penalty.

Several parameters of Coverdells were temporarily modified by the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) and were most recently scheduled to expire at the end of 2012. At the end of 2012, these modifications were made permanent by the American Taxpayer Relief Act of 2012 (P.L. 112-240; ATRA).

Two of these EGTRRA modifications which have received recent attention include an increase in the annual contribution limits and an expansion of the definition of qualified expenses. Specifically, EGTRRA increased the annual contribution limit from $500 to $2,000 per beneficiary and allowed elementary and secondary expenses to be considered qualified education expenses. Under current law, these changes are now permanent.

This report describes the mechanics of Coverdells and examines the specific tax advantages of these plans. Specifically, this report reviews the major parameters of Coverdells and then examines the income and gift tax treatment of Coverdells, using a stylized example to illustrate key concepts. The report also examines the tax treatment of rollovers and the interaction of Coverdells with other education tax benefits. Finally, the report looks at how Coverdells affect a student’s eligibility for federal need-based student aid.

Tax-Preferred College Savings Plans: An Introduction to Coverdells

Jump to Main Text of Report

Contents

- Introduction

- Did P.L. 115-97 Modify Coverdells?

- What Are Coverdells?

- Overview

- Modifications of Coverdells Made Permanent by the American Taxpayer Relief Act of 2012

- Tax Treatment of Coverdells

- Income Tax Treatment

- Contributions

- Distributions

- Calculating the Taxable Portion of a Coverdell Distribution: A Stylized Example

- Interaction with Other Tax Benefits

- Rollovers and Transfers

- Gift Tax

- Interaction of Coverdell Assets and Distributions with Federal Financial Aid

- Concluding Remarks

Summary

A Coverdell ESA—often referred to simply as a Coverdell—is a tax-advantaged investment account that can be used to pay for both higher-education expenses and elementary and secondary school expenses. The specific tax advantage of a Coverdell is that distributions (i.e., withdrawals) from this account are tax-free, if they are used to pay for qualified education expenses. If the distribution is used to pay for nonqualified expenses, a portion of the distribution is taxable and may also be subject to a 10% penalty.

Several parameters of Coverdells were temporarily modified by the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) and were most recently scheduled to expire at the end of 2012. At the end of 2012, these modifications were made permanent by the American Taxpayer Relief Act of 2012 (P.L. 112-240; ATRA).

Two of these EGTRRA modifications which have received recent attention include an increase in the annual contribution limits and an expansion of the definition of qualified expenses. Specifically, EGTRRA increased the annual contribution limit from $500 to $2,000 per beneficiary and allowed elementary and secondary expenses to be considered qualified education expenses. Under current law, these changes are now permanent.

This report describes the mechanics of Coverdells and examines the specific tax advantages of these plans. Specifically, this report reviews the major parameters of Coverdells and then examines the income and gift tax treatment of Coverdells, using a stylized example to illustrate key concepts. The report also examines the tax treatment of rollovers and the interaction of Coverdells with other education tax benefits. Finally, the report looks at how Coverdells affect a student's eligibility for federal need-based student aid.

Introduction

Did P.L. 115-97 Modify Coverdells?At the end of 2017, President Trump signed into law P.L. 115-97,1 which made numerous changes to the federal income tax for individuals and businesses.2 However, the final law did not make any changes to Coverdell education savings accounts. However, the law did change a similar tax-advantaged savings account for education—the 529 plan—which may affect the usage of Coverdells. Specifically, the law allowed taxpayers to withdraw tax-free up to $10,000 for a 529 plan per year per beneficiary for tuition expenses at public, private, and parochial schools. For more information, see CRS Report R42807, Tax-Preferred College Savings Plans: An Introduction to 529 Plans, by [author name scrubbed]. |

A Coverdell education savings account (ESA)—often referred to simply as a Coverdell—is a tax-advantaged investment account that families can use to save for their child's elementary, secondary, or college education expenses. This report provides an overview of the mechanics of Coverdells, including a summary of the key parameters of Coverdells. The report also examines the specific tax advantages of these plans. For an overview of all tax benefits for higher education, see CRS Report R41967, Higher Education Tax Benefits: Brief Overview and Budgetary Effects, by [author name scrubbed].

What Are Coverdells?

Overview

A Coverdell education savings account (ESA)—often referred to simply as a Coverdell—is a tax-advantaged investment account that can be used to pay for both higher-education expenses and elementary and secondary school expenses. The specific tax advantage of a Coverdell is that distributions (i.e., withdrawals) from this account are tax-free, if they are used to pay for qualified education expenses. If the distribution is used to pay for nonqualified expenses, a portion of the distribution is taxable and may also be subject to a 10% penalty. (An overview of qualified and nonqualified expenses is provided later in this report.)

Generally, a contributor, often a parent, makes a contribution to a Coverdell for a designated beneficiary, often their child. Contributors can open a Coverdell at many banks, brokerage firms, or mutual fund companies.3 Since Coverdells are established for minors, a "responsible individual" is named to the account, generally the beneficiary's legal guardian. This responsible individual may also be a contributor to the account. While a contributor selects the initial investments for a beneficiary when they open the account, the responsible individual (if they differ from the contributor) makes investment and withdrawal decisions after the account is established.

Contributions to a Coverdell must be made in cash using after-tax dollars.4 This means contributions to Coverdells are not tax deductible to the contributor. Contributions to a Coverdell are prohibited once a beneficiary reaches 18, and the balance of the account must be liquidated when the beneficiary turns 30. However, these age limitations do not apply to special-needs beneficiaries. In addition, the total amount that can be contributed to all Coverdells for a given beneficiary is limited to $2,000 per year. Any contributor can contribute up to $2,000 into a beneficiary's Coverdell, as long as the contributor's income is below certain limits.5 Specifically, as the contributor's income exceeds $95,000 ($190,000 for married joint filers), the maximum amount the contributor can donate ($2,000) is reduced. When the contributor's income exceeds $110,000 ($220,000 for married joint filers), a contributor is prohibited from funding a Coverdell.6 (None of these amounts are adjusted annually for inflation.)

Modifications of Coverdells Made Permanent by the American Taxpayer Relief Act of 2012

Several parameters of Coverdells were temporarily modified by the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) and were initially scheduled to expire at the end of 2010. At the end of 2010, these changes were extended for 2011 and 2012 by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312). Subsequently, the American Taxpayer Relief Act of 2012 (P.L. 112-240; ATRA) made these modifications permanent beginning in 2013.

Two modifications which received recent attention7 include an increase in the annual contribution limits and an expansion of the definition of qualified expenses. Specifically, EGTRRA increased the annual contribution limit from $500 to $2,000 per beneficiary and allowed elementary and secondary expenses to be considered qualified education expenses. Upon enactment of ATRA, these and other changes were made permanent. Hence, under current law, in 2018 the annual contribution limit will remain $2,000 per beneficiary per year from all contributors and qualified expenses will include elementary and secondary expenses. The current parameters of Coverdells are outlined in Table 1 ("Parameter in Effect"). For comparison, Table 1 summarizes the parameter prior to its modification by EGTRRA ("Parameter Prior to 2001 EGTRRA Modification").

Source: Joint Committee on Taxation, Summary of Provisions Contained in the Conference Agreement for H.R. 1836, the Economic Growth and Tax Relief Reconciliation Act of 2001, May 26, 2001, JCX-50-01, Joint Committee on Taxation, Background and Present Law Relating to Tax Benefits for Education, July 25, 2012, JCX-62-12, and Joseph F. Hurley, The Best Way to Save for College: A Complete Guide to 529 Plans 2011-2012 (Pittsford, NY: JFH Innovative LLC, 2011).

Tax Treatment of Coverdells

As previously mentioned, the specific tax advantage of Coverdells is that withdrawals from these plans are excludable from gross income, and hence not subject to income taxation, if they are used to pay for specific education expenses incurred in a given year. These expenses are referred to as adjusted qualified education expenses (AQEE-see shaded text box). Any amount withdrawn from a Coverdell account which does not go toward these expenses is subject to income taxation and may be subject to an additional 10% penalty tax.

|

Glossary of Selected Terms8 Basis: The sum of all the cash contributed or paid into the account. Designated Beneficiary: The individual for whom the account is established. This individual is ultimately the owner of the Coverdell account. If this individual is a minor, a responsible individual, generally the beneficiary's guardian, will be able to take distributions from the Coverdell. Distribution: An amount of cash withdrawn from a Coverdell account. Earnings: The total account value minus the basis. |

Logically, a taxpayer who receives a Coverdell distribution (the beneficiary or the beneficiary's guardian) would seek to minimize their income tax liability by withdrawing just enough money from their Coverdell to cover AQEE and no more. However, especially when Coverdells are used for higher education expenses, this is not as straightforward as it may seem due to a variety of factors, including the availability of other education tax benefits and student aid.9 In order to understand the complex decisions taxpayers must consider when determining the amount of money they should withdraw from a Coverdell, this section details the income tax treatment of Coverdell distributions, including the definition of AQEE, when Coverdell distributions may be taxable, and the interaction of Coverdell distributions with other education tax benefits. (An overview of basic gift tax rules is also included.)

|

Adjusted Qualified Education Expenses Qualified education expenses for Coverdells are expenses related to enrollment or attendance at either a higher education institution or elementary and secondary school. Specifically, these expenses include any of the following (or combination thereof): Qualified higher education expenses,10 which are defined as follows:

Qualified elementary and secondary school13 (i.e., K-12) education expenses, which are defined as follows:

To determine the amount of adjusted qualified education expenses, qualified higher education expenses must be reduced by the amount of any tax-free educational assistance. Tax-free educational assistance includes the tax-free portion of scholarships and fellowships, veterans' educational assistance, Pell grants, and employer-provided educational assistance. They also must be reduced by the value of expenses used to claim education tax credits. |

Income Tax Treatment

Contributors to Coverdells receive no federal income tax benefit from funding a Coverdell. Instead the recipients of Coverdell distributions may be able to exclude the entire Coverdell withdrawal from income taxation. The recipient of the Coverdell distribution (and hence the person who may be liable to pay tax on the distribution) is the designated beneficiary.16

Contributions

Contributions made to Coverdells are not deductible from income, meaning that contributions to these plans are made using after-tax dollars. In addition, there is an annual limit—$2,000—on the amount that can be contributed to all Coverdells for a given beneficiary. If contributions exceed this limit, the Coverdell beneficiary must pay a 6% excise tax on excess contributions.17 All Coverdell contributions are allowed to grow tax-free. Hence, unlike the typical bank savings account, where interest income is annually subject to income taxes, the increase in asset values in a Coverdell is not subject to current income taxes while assets remain in the account.

Distributions

Withdrawals from a Coverdell are not subject to federal income taxes if, for a given year, the distribution is used entirely to pay for adjusted qualified higher education expenses. In other words, if the amount of the distribution is less than or equal to the adjusted qualified education expenses (AQEE) incurred by the beneficiary, the entire distribution is tax free.

|

The Taxable Portion of a Coverdell Distribution

1 AQHEE (adjusted qualified higher education expenses) are qualified higher education expenses (QHEE) reduced by any tax-free educational assistance and by the portion of the expenses used to claim higher education tax credits. |

If the distribution is used to pay for nonqualified expenses, a portion of the distribution—the earnings portion—is subject to income taxation and may be subject to a 10% penalty tax. In other words, if the amount of a Coverdell withdrawal is greater than the beneficiary's AQEE, the earnings portion of the withdrawal is taxable. The earnings portion of a distribution reflects the growth of the value of the Coverdell and not amounts originally contributed, which are sometimes referred to as basis. The percentage of the earnings portion subject to taxation is equal to the ratio of the difference of the total distribution amount and AQEE to the total distribution amount (see shaded text box). To ultimately calculate the amount of tax the taxpayer will owe, the taxpayer's marginal tax rates must be applied to this taxable income.

Calculating the Taxable Portion of a Coverdell Distribution: A Stylized Example

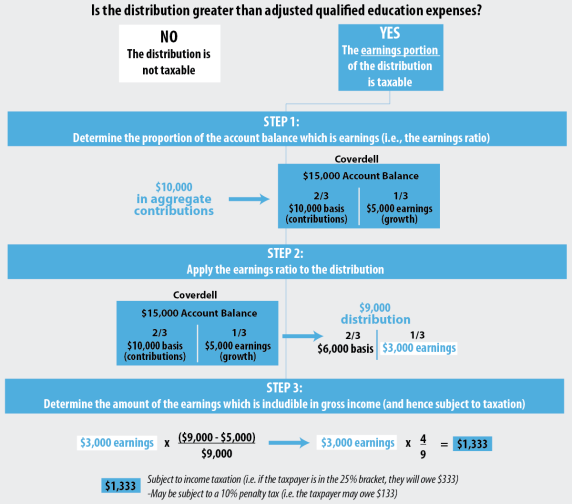

Mr. Smith establishes a Coverdell for his daughter Sara. He makes an annual contribution of $1,000 over 10 years to Sara's Coverdell, for $10,000 in aggregate contributions. When Sara attends college, the account balance is $15,000 (i.e., the account balance has increased in value by $5,000) and Sara takes a $9,000 distribution to pay for her fall 2018 tuition payment of $9,000. But Sara also receives a $4,000 tax-free scholarship. Hence, Sara has $5,000 in AQEE in 2018 ($9,000 in tuition payments minus $4,000 in tax-free aid). Sara receives the $9,000 distribution and pays for $5,000 of AQEE using this distribution, thus she is liable to pay any income tax for the portion of the distribution used for nonqualified expenses.

The steps to calculate the taxable portion of the distribution—and it is taxable because adjusted qualified education expenses ($5,000) are less than the Coverdell distribution ($9,000)—are outlined in Figure 1.

First, Sara must calculate the proportion of the distribution which is earnings. Since one-third of the account balance ($5,000) reflects earnings (two-thirds of the account balance reflects $10,000 of contributions), one-third of the distribution is attributable to earnings. Second, Sara applies the earnings ratio (in this case, one-third) to the distribution. Hence, of the $9,000 distribution, one-third or $3,000 reflects earnings. Finally, Sara calculates the proportion of the $3,000 earnings portion which is subject to taxation. The percentage of the earnings portion which is subject to taxation is equal to the ratio of the difference of the total distribution amount ($9,000) and AQEE ($5,000) to the total distribution amount ($9,000). Ultimately, as Figure 1 illustrates, of the $9,000 distribution, $1,333 of it is includible in Sara's income and thus subject to taxation.

|

Figure 1. Calculating the Taxable Portion of a Coverdell Distribution: A Stylized Example |

|

|

Source: Congressional Research Service using information obtained from The Internal Revenue Service, Publication 970: Tax Benefits for Education, http://www.irs.gov/pub/irs-pdf/p970.pdf and Joseph F. Hurley, The Best Way to Save for College: A Complete Guide to 529 plans 2011-2012 (Pittsford, NY: JFH Innovative LLC, 2011). |

Interaction with Other Tax Benefits

In addition to Coverdells, there are a variety of other tax benefits taxpayers may use to lower their tax bill based on higher education expenses. Notably, taxpayers may be eligible to claim either the American Opportunity Tax credit (AOTC),18 the Lifetime Learning credit, or the tuition and fees deduction.19 A taxpayer cannot claim more than one of these tax benefits for the same student in a given year.

To determine if any of their Coverdell distribution is taxable, a taxpayer must reduce their Coverdell qualifying education expenses by any amounts used to claim either the AOTC or the Lifetime Learning credit. The qualified higher education expenses as defined for Coverdell plans are not identical to the qualified higher education expenses of education tax credits. The qualified higher education expenses common to both Coverdells and education tax credits are tuition and fees, and hence these are the expenses which taxpayers may (mistakenly) try to use to claim both an education tax credit and a tax-free Coverdell distribution. (Other expenses, like room and board, which are a qualified expense for Coverdells, are not a qualified expense for education tax credits and hence would not be used to claim an education tax credit.) For example, if an eligible taxpayer has $6,000 of tuition payments (and for simplicity, assuming that this is all of their education expenses), of which they use $4,000 to claim the AOTC, the amount of qualifying education expenses used to determine if their Coverdell distribution is tax-free is $2,000 ($6,000-$4,000). Hence if a Coverdell distribution is less than or equal to $2,000 none of the distribution is subject to taxation because the distribution covers all of their AQEE.

Instead of an education tax credit, a taxpayer may choose to both take a Coverdell distribution and claim the tuition and fees deduction20 for the same student in the same year. Taxpayers who take a Coverdell distribution and also choose to claim the tuition and fees deduction must reduce the amount of expenses used for the tuition and fees deduction by the total distribution amount.21 For example, if a student takes a $6,000 Coverdell distribution for $8,000 of higher education tuition in a given year, the total amount they can deduct using the tuition and fees deduction is $2,000 ($8,000-$6,000).

If a beneficiary receives both a distribution from a 529 plan and a Coverdell in the same year, and the combined total of these two distributions is greater than qualified higher education expenses, the beneficiary must allocate the qualified expenses between both the Coverdell and 529 distribution to determine how much of the earnings portion of each distribution is taxable.22

Rollovers and Transfers

Any distribution from a Coverdell for a given beneficiary which is rolled over to another Coverdell either for the same beneficiary or a member of the beneficiary's family23 is tax free.24 Generally only one rollover per Coverdell is allowed during a 12-month period. If the designated beneficiary of an account is changed to a member of the beneficiary's family, the transfer of funds is not taxable as long as the new beneficiary is under age 30 or is a special needs beneficiary (the exemption on age limits for special needs beneficiaries is scheduled to expire at the end of 2012). In addition, assets from a Coverdell can be rolled over to a 529 plan without incurring federal taxation.25

Gift Tax

A contribution to a Coverdell is generally not subject to the gift tax since the maximum amount that can be contributed to a beneficiary ($2,000) is less than the annual gift tax exclusion. For 2018, the annual gift tax exclusion is $15,000. In addition, any contributions to a Coverdell are excluded from the contributor's gross estate for the purposes of the estate tax.

Interaction of Coverdell Assets and Distributions with Federal Financial Aid26

In addition to the tax advantages of Coverdells, these plans are also treated more favorably than other types of college savings or investments when determining a student's eligibility for federal need-based student aid.27 Specifically, Coverdells generally have a minimal impact on a student's federal expected family contribution (EFC). The EFC is the amount that, according to the federal need analysis methodology, can be contributed by a student and the student's family toward the student's cost of education. All else being equal, the higher a student's EFC, the lower the amount of federal student need-based aid he or she will receive. A variety of financial resources are reported by students and their families on the Free Application for Federal Student Aid (FAFSA). These resources are assessed at differing rates under the federal need analysis methodology.28

Distributions29 from Coverdell plans are generally not considered income in the federal need analysis calculation and are therefore not reported on the FAFSA, although the value of the Coverdell is considered an asset in the federal need analysis methodology and should be reported on the FAFSA.

When calculating a student's EFC, the federal need analysis methodology considers a percentage of the student's assets and a percentage of the parents' assets reported on the FAFSA. A student's assets are assessed at a flat rate of 20%, while parents' assets are assessed on a sliding scale, resulting in a maximum effective rate of up to 5.64%.30 Therefore, the ownership of the asset is important when determining how it will affect a student's EFC. For students who are classified as dependent students for FAFSA purposes (which differs from the classification of dependent for tax purposes),31 Coverdells are considered an asset of the parent, as long as the custodial ownership of the plan belongs either to the parent or student. Therefore, dependent students benefit from a lower assessment rate on Coverdells, which, all else being equal, results in a lower EFC and the potential for more federal need-based student aid. For students who are classified as independent students for FAFSA purposes, Coverdells are treated as an asset of the student, as long as the custodial ownership of the plan belongs either to the student or student's spouse (if applicable). Coverdells that are owned by someone other than the student, parent, or spouse are not reported as an asset on the FAFSA, but distributions from these Coverdells are reported as untaxed income for the beneficiary on the FAFSA.32 In general, income is assessed at a higher rate compared to assets in the federal need analysis methodology.

Concluding Remarks

Students and their families may have a variety of resources to choose from when they finance their education expenses, including Coverdells. While Coverdells may encourage some families to save for and fund their child's future education expenses, they may also introduce additional complexity in financial planning.

Author Contact Information

Footnotes

| 1. |

The original title of the law, the Tax Cuts and Jobs Act, was stricken before final passage because it violated what is known as the Byrd rule, a procedural rule that can be raised in the Senate when bills, like the tax bill, are considered under the process of reconciliation. The actual title of the law is "To provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018." For more information on the Byrd rule, see CRS Report RL30862, The Budget Reconciliation Process: The Senate's "Byrd Rule", by [author name scrubbed] |

| 2. |

For more information on the changes made to the tax code by P.L. 115-97, see CRS Report R45092, The 2017 Tax Revision (P.L. 115-97): Comparison to 2017 Tax Law, coordinated by [author name scrubbed] and [author name scrubbed]. |

| 3. |

For a list of Coverdell providers, see http://www.savingforcollege.com/coverdell_esa_providers/. |

| 4. |

In other words, contributions cannot be made in the form of securities. |

| 5. |

A contributor can include the beneficiary. |

| 6. |

A contributor can gift the $2,000 to another individual, including the beneficiary, and have that intermediary individual contribute to the Coverdell if the intermediary's income is below the income limits of $95,000-$110,000 ($190,000-$220,000 for married joint filers). In addition, corporations, who may also contribute to Coverdells, are not subject to these income limits. |

| 7. |

For example, see Ron Lieber, "Private Tuition Tax Break Nears End," The New York Times, July 27, 2012, and Jaime Levy Pessin, "Beware Rule Changes on Coverdells," The Wall Street Journal, April 5, 2010. |

| 8. |

Adapted from Joseph F. Hurley, The Best Way to Save for College: A Complete Guide to 529 Plans 2011-2012 (Pittsford, NY: JFH Innovative LLC, 2011), p. 9. |

| 9. |

Timing issues may also introduce more complexity. Specifically, education expenses are incurred over an academic year, which does not correspond with a tax year (tax years are generally calendar years). |

| 10. |

Qualified higher education expenses for Coverdells are defined identically to qualified higher education expenses for 529 plans. |

| 11. |

A student is considered "enrolled half-time" if he or she is enrolled for at least half the full-time workload for his or her course of study, as determined by the educational institution's standards. |

| 12. |

Room and board expenses cannot be more than the greater of (1) the allowance of room and board that was included in the cost of attendance for federal financial aid purposes for a particular academic period and living arrangement of the student or (2) the actual amount of room and board charged if the student resided in housing owned or operated by the eligible educational institution. |

| 13. |

A qualifying elementary or secondary school is any public, private, or religious school that provides elementary or secondary education as determined under state law. |

| 14. |

These expenses must be incurred by the Coverdell's designated beneficiary in connection with enrollment or attendance at an eligible elementary or secondary school. |

| 15. |

This does not include expenses for computer software designed for sports, games, or hobbies unless the software is predominantly educational in nature. |

| 16. |

The beneficiary's guardian may receive the distribution on behalf of the beneficiary and hence may be liable to pay any applicable taxes. This will likely occur if the distribution is being used to pay for elementary and secondary school expenses, since the beneficiary's guardian will receive the distribution and not the child. |

| 17. |

Excess contributions are the total of two amounts: (1) contributions to any designated beneficiary's Coverdell for the year that is more than $2,000 and (2) excess contributions for the preceding year, reduced by both distributions during the year and the contribution limit for the current year minus the amount contributed for the current year. The excise tax does not apply if excess contributions made for a given year (and any earnings on them) are distributed before June 1st of the following year. The excise tax does not apply to any rollover contribution. |

| 18. |

For more information on this provision, see CRS Report R42561, The American Opportunity Tax Credit: Overview, Analysis, and Policy Options, by [author name scrubbed]. |

| 19. |

This provision expired at the end of 2017. |

| 20. |

The above-the-line tuition and fees deduction expired at the end of 2017. Hence, under current law a taxpayer will not be able to claim this deduction on a 2018 tax return. |

| 21. |

This differs from 529 plans. Taxpayers who take a 529 distribution and also choose to claim the tuition and fees deduction must reduce the amount of expenses used for the tuition and fees deduction by the earnings portion of the 529 distribution. IRC §530(d)(2)(D). |

| 22. |

To illustrate this rule, assume a beneficiary is not claimed as a dependent and receives no tax-free education assistance. Assume also that her qualified higher education expenses are $3,000 and that she takes an $800 distribution from her Coverdell and $4,200 from her 529 plan for a total distribution from both plans of $5,000. The IRC does not specify how to allocate these expenses (i.e., proportional to the size of the distributions or split equally), but the IRS does state in Publication 970 that taxpayers can use any "reasonable method" in allocating expenses. In Publication 970, the IRS suggest dividing up the adjusted qualified higher education expenses (AQHEE) proportionally to the relative size of each distribution. In this case 16% ($800 of the Coverdell distribution/$5,000 total distribution) of the AQHEE (16% of 3,000 is $480) is attributed to Coverdells and 84% ($4,200 529 plan distribution/$5,000 total distribution) of the AQHEE (84% of $3,000 is $2,520) is attributed to the 529 distribution. Hence, 40% of the earnings of the Coverdell distribution is taxable ($800 total Coverdell distribution-$480 of AQHEE)/ ($800 total Coverdell distribution)=40%. With respect to the 529 distribution, 40% of the earnings portion of the distribution is taxable ($4,200 total 529 distributions-$2520 AQHEE)/($4,200 total 529 distributions)=40%. |

| 23. |

Similar to the definition of family used for a 529 plan, the beneficiary's family for a Coverdell includes the following: the beneficiary's son, daughter, stepchild, foster child, adopted child (or decedent of any of these children); brother, sister, stepbrother, stepsister; father, mother, or their ancestors; son or daughter of a brother or sister; brother or sister of father or mother; son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law, or the spouse of any of the individuals previously listed (including the beneficiary's spouse); and first cousin. |

| 24. |

A distribution from Coverdell A is considered "rolled over" to Coverdell B if the distribution is paid to Coverdell B within 60 days of being distributed from Coverdell A. |

| 25. |

Assets from a 529 cannot be rolled over tax-free into a Coverdell. |

| 26. |

For further description of federal need analysis, see CRS Report R42446, Federal Pell Grant Program of the Higher Education Act: How the Program Works, Recent Legislative Changes, and Current Issues, by [author name scrubbed]. |

| 27. |

The treatment of Coverdells in the financial aid formula is identical to the treatment of 529 plans. |

| 28. |

The details of the federal need analysis methodology are beyond the scope of this report. |

| 29. |

Additionally, distributions from Coverdells are not considered a resource when calculating other estimated financial assistance (EFA) during the federal aid packaging process. For more information on EFA and the packaging of aid, see the AY2012-13 Federal Student Aid Handbook, Volume 3, at http://ifap.ed.gov/fsahandbook/1213FSAHbVol3.html. |

| 30. |

Parental assets are also protected by an asset protection allowance, which means that a certain amount of assets are not considered in evaluating the effective family contribution (EFC). |

| 31. |

For the purposes of taxes, IRC §152 defines dependents, which includes (but is not limited to) a requirement that the dependent has the same principal residence as the taxpayer for more than half the year, and that the dependent has not provided over one-half of their support. In contrast, students under 24 are generally considered dependents for financial aid purposes. If certain criteria are met, the student is considered an independent student for financial aid purposes. A student can determine their dependency status for financial aid at http://www.finaid.org/calculators/dependency.phtml. |

| 32. |

For more information, see http://www.finaid.org/savings/loophole.phtml. |