U.S. Foreign-Trade Zones: Background and Issues for Congress

U.S. foreign-trade zones (FTZs) are geographic areas declared to be outside the normal customs territory of the United States. This means that, for foreign merchandise entering FTZs and re-exported as different products, customs procedures are streamlined and tariffs do not apply. For products intended for U.S. consumption, full customs procedures are applied and duties are payable when they exit the FTZ.

In 1934, in the midst of the Great Depression, Congress passed the U.S. Foreign Trade Zones Act. It was designed to expedite and encourage international trade while promoting domestic activity and investment. The U.S. FTZ program offers a variety of customs benefits to businesses which combine foreign and domestic merchandise in FTZs. Similar types of “zones” exist in 147 countries, employing roughly 90 to 100 million workers worldwide. Though some aspects differ, all have streamlined customs procedures and no duties applicable on components and raw materials combined in zones and then re-exported. The worldwide network of free trade zones facilitates the integration of economies into global supply chains.

U.S. FTZs can affect the competitiveness of U.S. companies by allowing savings through (1) duty reduction on “inverted tariff structures” (where tariffs are higher on imported components than on finished products); (2) customs and inventory efficiencies; and (3) duty exemption on goods exported from, or consumed, scrapped, or destroyed in, a zone. Though difficult to achieve, other possible alternatives, such as broad-based tariff reductions through multilateral negotiations, and overall customs reform might provide some of the same competitive advantages as zone use in a more efficient manner, while also ensuring that all importers have equal access.

Zone activity represents a significant share of U.S. trade. According to the FTZ Board’s 2018 Annual Report to Congress, foreign goods entering the United States through FTZs accounted for almost 10% of total U.S. imports. Oil/petroleum (25%), vehicles and related parts (17%), and electronics (16%) made up the majority of foreign goods entering FTZs. A majority of goods entering FTZs are used in production activities (63%), while the remaining are used in warehouse and other logistical activities (37%). Most goods (86%) arriving through FTZs were consumed in the United States; the rest were exported. The industries that account for a significant portion of zone production activity include the oil refining, automotive, electronics, and pharmaceutical sectors.

Administration of the U.S. FTZ system is overseen by the Secretaries of Commerce and the Treasury, who constitute the U.S. FTZ Board. The Board is responsible for the establishment of zones, the authorization of specific production activity, and the general oversight of zones. It also appoints an Executive Secretary, who oversees the Board’s staff. Homeland Security’s Customs and Border Protection (CBP) directly oversees FTZs and enforces regulations set by the Board. It activates the zones and secures and controls dutiable merchandise moving into and out of them. CBP oversight also includes both protection of U.S. tariff revenue and protection from illegal activity through screening, targeting, and inspections.

In 2012, the U.S. FTZ Board issued new regulations. They focused primarily on streamlining the application procedures and shortening, generally from a year to four months, the time for FTZ approval for production activity under certain circumstances.

Congressional Interest

Congress has demonstrated a continuing interest in U.S. Foreign Trade Zones (FTZs), as they (1) may help to maintain U.S. employment opportunities and the competitiveness of U.S. producers; (2) encompass a portion of U.S. trade; and (3) affect U.S. tariff revenue. U.S. FTZs account for less than one-half of 1% of all world zone workers and a small share of the U.S. workforce. However, most of this employment is in manufacturing, which has lost a significant share of its workers over the past several decades. Today, every state has at least one FTZ, and many have numerous manufacturing operations.

Current issues for Congress relating to the U.S. FTZ program may include the FTZ program in relation to the implementation of a series of tariff measures in 2018, as well as long-term issues, such as (1) whether U.S. FTZs encourage a misallocation of U.S. resources; (2) data availability issues; (3) security concerns; and (4) the U.S. employment and global competitiveness impact of FTZs. Broader considerations relating to the world zone network include (5) the effectiveness of trade zones worldwide as a tool for economic development; and (6) trade zones worldwide and worker rights.

U.S. Foreign-Trade Zones: Background and Issues for Congress

Jump to Main Text of Report

Contents

- Introduction

- Background on Free Trade Zones

- Free Trade Zones Around the World

- Similarities and Differences Among Free Trade Zones Worldwide

- Growth of Free Trade Zones Worldwide

- The U.S. Foreign-Trade Zone Program

- History

- The FTZ System Today

- Growth in FTZ Usage and Industry Concentration

- Overall Economic Benefits and Costs of FTZs

- Business Benefits and Costs of FTZ Status

- Benefits

- Costs

- The Administrative Mechanism Behind FTZs

- Application for FTZ Status

- Current FTZ and Worldwide Zone-Related Issues for Congress

- Recent Developments on U.S. Tariff Measures

- Do U.S. FTZs Encourage a Misallocation of U.S. Resources?

- Data Availability Issues Relating to FTZs

- Security Issues Relating to FTZs

- U.S. Employment and Global Competitiveness Impact of FTZs

- Effectiveness of World Trade Zones as a Tool for Economic Development

- Trade Zones Worldwide and Worker Rights

- Outlook: Future of U.S. FTZs and Zones Worldwide?

Figures

- Figure 1. Elements of Modern Trade Zones

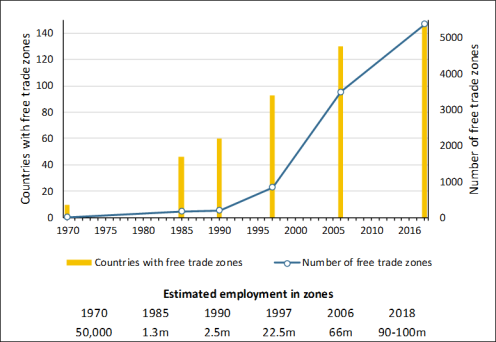

- Figure 2. Growth of World Free Trade Zones, 1970 to 2018

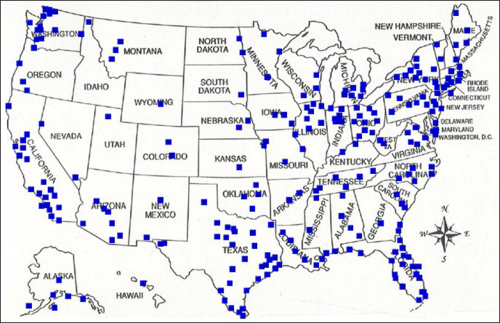

- Figure 3. U.S. Foreign-Trade Zones, by State

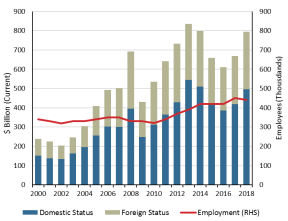

- Figure 4. FTZ Input by Status, and Employment Levels (right axis)

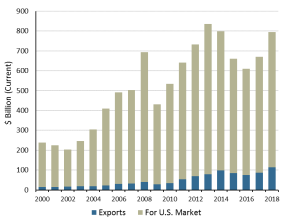

- Figure 5. FTZ Output by Destination

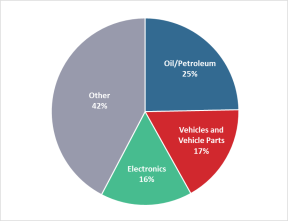

- Figure 6. Share of FTZ Foreign-status Inputs, 2018

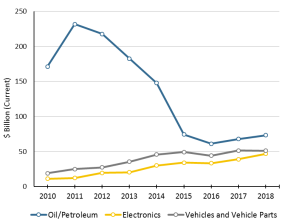

- Figure 7. FTZ Foreign-status Inputs Trend, Select Sectors

Tables

Appendixes

Summary

U.S. foreign-trade zones (FTZs) are geographic areas declared to be outside the normal customs territory of the United States. This means that, for foreign merchandise entering FTZs and re-exported as different products, customs procedures are streamlined and tariffs do not apply. For products intended for U.S. consumption, full customs procedures are applied and duties are payable when they exit the FTZ.

In 1934, in the midst of the Great Depression, Congress passed the U.S. Foreign Trade Zones Act. It was designed to expedite and encourage international trade while promoting domestic activity and investment. The U.S. FTZ program offers a variety of customs benefits to businesses which combine foreign and domestic merchandise in FTZs. Similar types of "zones" exist in 147 countries, employing roughly 90 to 100 million workers worldwide. Though some aspects differ, all have streamlined customs procedures and no duties applicable on components and raw materials combined in zones and then re-exported. The worldwide network of free trade zones facilitates the integration of economies into global supply chains.

U.S. FTZs can affect the competitiveness of U.S. companies by allowing savings through (1) duty reduction on "inverted tariff structures" (where tariffs are higher on imported components than on finished products); (2) customs and inventory efficiencies; and (3) duty exemption on goods exported from, or consumed, scrapped, or destroyed in, a zone. Though difficult to achieve, other possible alternatives, such as broad-based tariff reductions through multilateral negotiations, and overall customs reform might provide some of the same competitive advantages as zone use in a more efficient manner, while also ensuring that all importers have equal access.

Zone activity represents a significant share of U.S. trade. According to the FTZ Board's 2018 Annual Report to Congress, foreign goods entering the United States through FTZs accounted for almost 10% of total U.S. imports. Oil/petroleum (25%), vehicles and related parts (17%), and electronics (16%) made up the majority of foreign goods entering FTZs. A majority of goods entering FTZs are used in production activities (63%), while the remaining are used in warehouse and other logistical activities (37%). Most goods (86%) arriving through FTZs were consumed in the United States; the rest were exported. The industries that account for a significant portion of zone production activity include the oil refining, automotive, electronics, and pharmaceutical sectors.

Administration of the U.S. FTZ system is overseen by the Secretaries of Commerce and the Treasury, who constitute the U.S. FTZ Board. The Board is responsible for the establishment of zones, the authorization of specific production activity, and the general oversight of zones. It also appoints an Executive Secretary, who oversees the Board's staff. Homeland Security's Customs and Border Protection (CBP) directly oversees FTZs and enforces regulations set by the Board. It activates the zones and secures and controls dutiable merchandise moving into and out of them. CBP oversight also includes both protection of U.S. tariff revenue and protection from illegal activity through screening, targeting, and inspections.

In 2012, the U.S. FTZ Board issued new regulations. They focused primarily on streamlining the application procedures and shortening, generally from a year to four months, the time for FTZ approval for production activity under certain circumstances.

Congressional Interest

Congress has demonstrated a continuing interest in U.S. Foreign Trade Zones (FTZs), as they (1) may help to maintain U.S. employment opportunities and the competitiveness of U.S. producers; (2) encompass a portion of U.S. trade; and (3) affect U.S. tariff revenue. U.S. FTZs account for less than one-half of 1% of all world zone workers and a small share of the U.S. workforce. However, most of this employment is in manufacturing, which has lost a significant share of its workers over the past several decades. Today, every state has at least one FTZ, and many have numerous manufacturing operations.

Current issues for Congress relating to the U.S. FTZ program may include the FTZ program in relation to the implementation of a series of tariff measures in 2018, as well as long-term issues, such as (1) whether U.S. FTZs encourage a misallocation of U.S. resources; (2) data availability issues; (3) security concerns; and (4) the U.S. employment and global competitiveness impact of FTZs. Broader considerations relating to the world zone network include (5) the effectiveness of trade zones worldwide as a tool for economic development; and (6) trade zones worldwide and worker rights.

Introduction

Members of Congress have demonstrated their interest in the U.S. Foreign-Trade Zone (FTZ) system through hearings and legislation over the past seven decades. The program may enhance the competitiveness of U.S. businesses, support employment opportunities, and impact U.S. tariff revenues. Balancing these potential gains, others argue that the program may also be trade distorting, and may play a role in misallocating resources in the economy as a whole.

This report provides a general perspective on the U.S. FTZ system. It is divided into three parts. As background, the first section discusses free trade zones worldwide. The second section focuses on the U.S. FTZ program—its history, administrative mechanism, structure, growth and industry concentration, and benefits and costs. The third section focuses on current issues for Congress relating to the U.S. FTZ program.

Background on Free Trade Zones

Free Trade Zones Around the World

Foreign-trade zones (FTZs)1 are the U.S. version of free trade zones scattered around the world. Zones elsewhere are called by many different names (See Text Box.)

|

Many Names: Variations on a Theme Free trade zones around the world are called by a number of different names, depending on the country in which they are located and the particular type of zone. In the United States, they are referred to as foreign-trade zones. Those in developing countries producing specifically for export are typically called export processing zones. They are also called special economic zones in China, industrial free zones or export free zones in Ireland, Qualifying Industrial Zones (QIZs) in Jordan and Egypt, free zones in the United Arab Emirates, and duty free export processing zones in the Republic of Korea. |

Free trade zones are a specific type of restricted access (e.g., fenced-in) industrial park housing concentrations of production facilities and related infrastructure. They are typically located at or near sea, air, or land ports.

Free trade zones have become a substantial part of the structure underpinning the global supply chain. Together, these roughly 5,300 zones in 140 countries, including the United States2, form a web that frees producers from most customs procedures and offer duty savings, thus facilitating intricate international co-production operations.

|

Examples of How the World Zone Network Functions (1) Suppose buttons from Indonesia and fabric from India are sent to a trade zone in the Philippines for assembly into a shirt which is then exported to the United States. No tariffs are payable in the Philippines, and all customs procedures are streamlined until the completed shirt enters the United States for consumption. Upon reaching the United States, if the shirt first enters a U.S. FTZ, taxes and tariffs are only payable if the shirt is imported for consumption—that is, when it exits the FTZ into the customs territory of the United States. It might enter an FTZ for cost savings purposes, for example, if more work is required (e.g., laundry labels); if some of the shirts were damaged in shipment and will be discarded; or if a company wants to store them for later use (e.g., Christmas sales) and postpone tariff payment. (2) Similarly, for the production of gasoline, imported crude oil is entered into a refinery which has applied for and received status as an FTZ subzone (i.e., a site approved for a specific company or use). The tariff structure on refined oil products varies, such that some, like gasoline, have much higher tariffs than crude oil, while others, including certain petrochemicals, have a zero tariff, and hence an inverted tariff structure. If the refined products exit the zone and are imported into U.S. customs territory, the company can choose to pay tariffs on the crude oil that initially entered the zone, or the tariffs (if any) on the refined goods. In addition, chemicals distilled from the crude may stay in the zone or be transferred to a chemical manufacturing facility which is in a nearby subzone for further refining. In the refinery process, as in other production processes in FTZs, tariffs are not payable on any waste products. Source: Examples were constructed by CRS to illustrate possible scenarios. |

Although the rules vary by country, the general mechanism that makes them function together in international co-production is that while zones are located inside the geographic boundaries of countries, they are generally declared to be outside of these countries for customs purposes. Thus, components may be shipped into a zone—and sometimes shifted around the world from zone to zone on their way to becoming a finished product—without concern for tariffs, quotas, and detailed customs procedures, until they finally exit the zone system. Only then are tariffs payable, quotas honored, and full customs procedures applicable. (See Text Box for examples of the use of one or more zones in a production chain.)

Some analysts argue that free trade zones, in bypassing many of the complexities of individual country tariff assessments and customs procedures, have been one factor facilitating global supply chains. There are an estimated 90 to 100 million people directly employed at free trade zones worldwide, including 450,000 in the United States.3 Most zones are located in developing countries, and most, but not all, of their workers are in manufacturing.

Table 1 shows a regional distribution of established free trade zones as well as zones that are reportedly in development.

|

Region |

Number of Free Trade Zones |

Zones in Development |

|

Developed Economies |

||

|

Europe |

105 |

5 |

|

North America |

262 |

– |

|

Developing Economies |

||

|

East Asia |

2,645 |

13 |

|

China |

2,543 |

13 |

|

Southeast Asia |

737 |

167 |

|

South Asia |

456 |

167 |

|

India |

373 |

142 |

|

West Asia |

208 |

24 |

|

Africa |

237 |

51 |

|

Latin America and the Caribbean |

486 |

28 |

|

Transition Economies |

237 |

18 |

|

World Total |

5,383 |

474 |

Source: UNCTAD

Notes: Number of free trade zones in North America only reflect those in the United States. Data is not available for Mexico and Canada but does not mean such programs do not exist in the countries.

Similarities and Differences Among Free Trade Zones Worldwide

Free trade zones around the world are similar in the way they function to facilitate trade. However, they vary in size, economic development purposes, physical characteristics, government incentives and regulatory structure, and the final dispensation of their products. Oversight of zones also differ across countries–they could be wholly managed by public or private entities, through public-private partnerships, or even through cross-border cooperation between governments. Zones may represent large shares of the country's manufacturing employment and occupy huge geographic areas, as with special economic zones in China; or they may be small enclaves housing a few businesses. In developing countries with little infrastructure, they may be self-sufficient city-like industrial complexes with housing, dining, and banking, as well as production and/or transport. On the other hand, zones in developed countries with extensive infrastructure and modern facilities are more narrowly limited to production and/or transport. In the United States, instead of being tied to a physical area near port facilities, FTZ designation can be brought to a company at a specific location. All zones typically include streamlined customs procedures and exemption or deferral of tariffs and quotas on stored inventory. Those in developing countries are more likely to have additional incentives such as subsidies, more flexible labor market regulations, and additional tax exemptions with the aim to attract investment and grow industrial sectors for integration into global supply chains.4 While developing countries typically produce for export, they are increasingly likely to consume ("import") substantial shares of products made in their free trade zones as their economies develop.

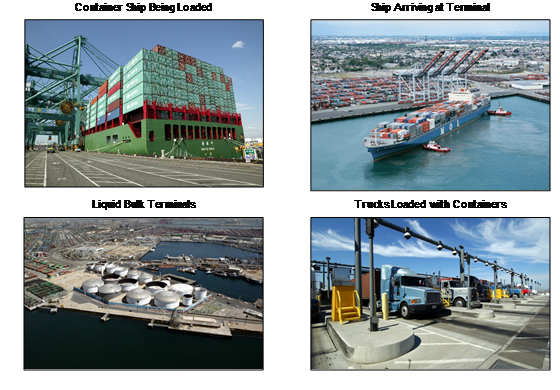

Elements common to many free trade zones can be seen in Figure 1, below. They include container ships, which can often hold 1,000 to 1,500 containers each, and their automated loading operations; liquid storage tanks (for oil or chemicals, for example); and facilities for transferring individual containers to trucks or to railroad cars.

|

|

Source: Stock photos from the "LA the Port of Los Angeles" newsroom at http://www.portoflosangeles.org/newsroom. |

Growth of Free Trade Zones Worldwide

The growth of zone use over time has resulted from a combination of factors including an initial conceptual design that has stood the test of time; an international mechanism for teaching governments how to establish zones that would attract foreign investors; and major advancements in technology that have supported the globalization of production. Figure 2 shows the rate at which these factors combined to significantly increase zone use since the 1970s.

Modern day zone growth began with an "experiment" in 1959, for reuse of the Shannon, Ireland, airport.5 Designed as a job creation program, the Shannon project's success brought one of its entrepreneurs to the United Nations Industrial Development Organization (UNIDO) as an advisor to promote the concept. He reportedly prepared a manual on zone creation and participated in a number of zone-establishing missions in various countries.6 The U.S. government reportedly helped spread the concept of world processing zones when, between 1983 and 1995, five U.S. agencies provided loans and investment support for zone development: the U.S. Agency for International Development (USAID); the Overseas Private Investment Corporation (OPIC); the Export-Import Bank; the Department of State; and the Department of Commerce.7 Technological developments, including the advancements in information and communications technology (ICT) and in transportation, such as container shipping, encouraged and supported the growth of zones worldwide. The Organization for Economic Cooperation and Development (OECD) also identifies the emphasis on export-oriented and foreign direct investment-oriented growth, the transfer of labor intensive production activities from developed to developing countries, and the growing division of labor in production chains that formed complex global production networks as other driving forces of free trade zone growth.8

|

|

Source: United Nations and ILO data. See "Africa, Industrial Policy, and Export Processing Zones: Lessons from Asia," by Howard Stein, Center for Afroamerican and African Studies, University of Michigan, July 2008; ILO, Economic and Social Effects of Multinational Enterprises in Export Processing Zones, 1988, p. 1-2; and UNCTAD, "Special Economic Zones", World Investment Report 2019, June 2019, p. 128. Notes: ILO reported 20 total zones in 1970, but that number does not include the 9 zones in the United States. |

The U.S. Foreign-Trade Zone Program

History

The U.S. FTZ Program was created by the Foreign Trade Zones Act in 1934 (P.L. 73-397, 19 U.S.C. 81a-81u),9 in the midst of the Great Depression. It was designed to accelerate U.S. trade in the wake of the restrictive impact of the Smoot-Hawley Tariff Act of 1930, which raised U.S. tariffs on imported goods as high as 53%.10 It created the FTZ Board, which was given the power to approve applications for zone status. The act also entitled each U.S. port of entry to at least one zone, and prescribed physical conditions and standards for each zone, activities permissible in zones, the applicability of all U.S. laws to zones, and requirements for zone operation and recordkeeping.

The FTZ program started slowly. By the time the Shannon experiment was underway 25 years later in 1959, it was still quite small. Gradually, several factors accelerated zone use, including both internal changes to the program itself and external world factors.

Internally, four major things happened. The first and likely the most significant of these factors was changing the program to allow for manufacturing. When the FTZ Act was passed in 1934, it prohibited manufacturing in zones because some feared it would promote imports of cheaper components to be used in the U.S. manufacturing process and harm domestic manufacturers of the same components. That model, however, failed to attract many users. Then, in 1950, Congress amended the FTZ Act to permit manufacturing in zones. Two years later, in 1952, the FTZ Board took that amendment one step further and issued new regulations, which allowed FTZ sites to be designated at a company's facility as a subzone. It was a way to allow businesses located outside a zone's area to have access to FTZ benefits. Additional FTZ growth was encouraged by two U.S. Treasury Department administrative decisions in 1980 and 1982. These clarified that manufacturers need not pay duty on either value-added or brokerage or transportation fees connected with imported goods.11

External factors that accelerated FTZ use by U.S and foreign multinational corporations included (1) increased international price competition that led U.S. businesses to seek new ways of saving costs;12 (2) greater education of businesses in the ways in which they could save money through zone use; and (3) advancements in technology which made cooperative global production possible.

The FTZ System Today

Today, companies can operate within a FTZ that has a defined area or it can have zone status brought directly to its facilities. Zones may be used for manufacturing, warehousing and other logistical activities. A majority of goods entering FTZs are used in production activities (63%), while the remaining are used in warehouse and other logistical activities (37%). As of 2018, there were 195 FTZs active during the year, with a total of 330 active manufacturing operations. See Table A-1 for a summary of zone activity.

All states have at least one zone. Hence, every state has some involvement in the zone system in which foreign and domestic status inputs are combined to make other products. The majority of inputs into zones are of domestic origin (63% or $497 billion), with the remaining inputs (37% or $297 billion) coming from imports. The zone system accounts for 10% of all imports entering the United States and employs roughly 440,000 workers, representing about 3% of U.S. manufacturing workers in 2018—most but not all FTZ employees are in manufacturing. See Text Box A-1 for details on how FTZs function in terms of moving goods into and out of zones.13

Growth in FTZ Usage and Industry Concentration

Between 2000 and 2018, the value of total goods received in FTZs increased from $238 billion to $794 billion (in current dollars). Figures 4 and 5, examine the contributions of foreign and domestic inputs, and figures 6 and 7 examine the contributions of foreign inputs alone, to zone output. From these graphs, several additional observations can be made about zone usage and industry concentration between 2000 and 2018.

- More goods entering U.S. FTZs have domestic status (Figure 4). Domestic status goods includes both goods that were produced in the United States and goods that may have been produced abroad but have entered U.S. customs territory for consumption (meaning duty has been paid on those goods). Foreign status goods are imported and have not entered the United States for consumption. The mix of goods in FTZs indicate that zones are often used to combine domestic inputs with foreign inputs in production activity.

- U.S. employment in zones (Figure 4, red line) has remained relatively steady since 2000. It increased slightly between 2010 and 2014, in line with the increase in goods entering FTZs, but has remained steady since then. In 2018, U.S. FTZs employed over 440,000 workers, around 3% of U.S. manufacturing jobs. It should be noted that most, not all, workers in FTZs work in manufacturing.

- Most U.S. FTZ outputs are consumed in the United States. This is in contrast to export processing zones commonly found in developing countries, and from which most outputs are exported. Figure 5 shows that most of zone output enters the U.S. domestic market and a relatively small share of it is exported.14 The total exports originating from U.S. FTZs account for roughly 5% of total U.S. exports.

- Imports of oil/petroleum into U.S. FTZs have decreased since 2011, but are still the largest share of foreign-status goods. Figure 6 shows the current shares of inputs in 2018, by major sector. Oil/petroleum account for roughly 25% of all foreign products brought into zones. This is followed by vehicles and vehicle parts (17%), and electronics (16%). Figure 7 shows a noticeable decrease in oil/petroleum imports into FTZs while automotive and electronics imports steadily increased. The decline in oil/petroleum imports into FTZs may be due to increased U.S. production (between 2011 and 2018, daily production increased by 47%) and fewer imports from OPEC countries, which are normally subject to tariffs, as imports by volume from these countries decreased by 37% between 2011 and 2018. Meanwhile, Canada, which has duty-free access to the U.S. market under the North American Free Trade Agreement (NAFTA), became the largest source of petroleum imports into the United States.15

Overall Economic Benefits and Costs of FTZs

FTZs primarily benefit some manufacturing firms and potentially could benefit the economy as a whole through potential lower costs. Savings from tariff reduction, administrative efficiencies, tax benefits, and duty deferral may help U.S. corporations maintain operations in the United States, and may attract foreign producers to establish manufacturing facilities in the United States. In turn, proponents of the FTZ program argue it could help communities hold onto their manufacturing bases and secondary service sector support systems and the jobs that go with them.16 Consumers may benefit from any cost savings for businesses that may be passed along indirectly through lower prices. Federal, state, and local tax revenues may benefit from increased activity that the FTZs may generate, although goods stored or exported from zones are not subject to state and local ad-valorem taxes (see below).

Balancing these benefits of zone use are four potential costs to the U.S. economy. First, granting tariff reductions on imported components might disadvantage domestic producers of competing components whose products would otherwise be somewhat protected by the tariffs. Second, if certain producers in an industry obtain zone status to save production costs, this could put other domestic producers of the final products in the same industry at a competitive disadvantage. Third, the tariff benefits companies enjoy by operating in FTZs can also result in some loss or deferral of tariff revenue for the United States.17 Finally, some economists might argue that FTZs result in a market distortion—a misallocation of resources to benefit a small number of businesses in few sectors. This issue is explored in greater detail in the "Current FTZ and Worldwide Zone-Related Issues for Congress" section.

FTZ regulations try to avoid potential "costs" of the FTZ program through the FTZ application procedures. The application process, administered by the FTZ Board, is explained in greater detail later in this section.

Business Benefits and Costs of FTZ Status

Specific benefits of zones for individual corporations producing in zones come from the law itself and the regulations implementing it. Costs come from administrative requirements involved in applying for and maintaining zone status, which includes monitoring of zones by the Customs and Border Protection, and reporting requirements by the U.S. FTZ Board. There are no precise estimates of the actual market value of the potential costs and benefits of FTZs in the United States or trade zones worldwide.

|

Sources of Cost Savings for U.S. Foreign-Trade Zone Users Duty reduction on Inverted Tariff Situations: With specific authority, zone users may choose the lower duty rate when a product is entered into customs territory (for importation) in inverted tariff situations (when the tariff rate on foreign inputs is higher than the tariff rate applied to the finished product produced in the zone). Duty Deferral: Cash flow savings can result because customs duties are paid only when and if the goods are transferred from the zone to U.S. customs territory for consumption. Duty Exemption on Exports: No duty is payable on goods which are exported from a zone or which are scrapped or destroyed in a zone. Duty Drawback Elimination: Zones eliminate the need for duty drawback. That is, the refunding of duties previously paid on imported and then re-exported merchandise. Tax Savings: Goods stored in zones and goods exported are not subject to state and local ad valorem taxes, such as personal property taxes, where applicable. Zone-to-Zone Transfer: Zones can transfer merchandise "in-bond" (i.e., insured) from one zone to another. Customs duties may be deferred until the product's eventual entry into U.S. customs territory. Customs Inventory Control Efficiencies: Cost savings (especially cash-flow savings) can occur from zone efficiencies affecting inventory control. These efficiencies include customs procedures such as direct delivery and weekly entries. Source: U.S. Foreign-Trade Zones Board. |

Benefits

Text Box 3 describes seven potential benefits for companies using FTZs. Most of the financial benefits come from three of the seven sources: duty reduction on inverted tariff situations, customs inventory control efficiencies, and duty exemption on exports. Other benefits include duty deferral, drawback elimination, tax savings, quota storage, and zone-to-zone transfer. Overall profits from FTZ use result from the combination of tiny savings per unit and high volume production.

Duty Reduction on Inverted Tariff Situations. Of all FTZ benefits, "duty reduction on inverted tariff situations" is generally the one most heavily used by businesses. It likely accounts for more than 50% of the total money saved from zone use, according to the FTZ Board.18 Duty reduction on imports results because FTZ users can typically choose to pay either the tariff rate for the imported components or the finished goods.19 Savings can be considerable. In 2011, a Volkswagen production plant in Chattanooga, TN that was granted FTZ status estimated it could save $1.9 million, or $13 per car in inverted tariff savings, on producing 150,000 cars annually.20 In the oil industry, most inverted tariff benefits accrue to just a small sector—the petrochemical industry, which accounts for about 15% to 17% of total refinery yield.21 Due to the potential impact on domestic suppliers, prior FTZ Board authorization is required for these types of savings. There are no independent estimates of the cost savings derived from the FTZs.

Customs and Inventory Efficiencies. Customs and inventory efficiencies, especially those obtained through "bundling" of entries (which are reports of individual shipments of goods entering or leaving zones), are another significant source of savings for FTZ users. In addition to time and paperwork savings, "bundling" allows an importer to file one entry for an entire week and pay a single merchandise processing fee (up to $485) instead of a separate entry and merchandise processing fee for each shipment. In this way, large-operation zone users can cut their processing fees by about 90%.22 The National Association of Foreign Trade Zones (NAFTZ) estimates that FTZs handle more than 10% of U.S. imports each year in terms of dollar value, but account for less than 1% of the actual number of import filings made with Customs and Border Protection (CBP), because of "bundling." For a large company with 10 warehouses across the United States, each with several hundred deliveries per week, for example, bundling efficiencies could mean a reduction in processing fees from roughly "$2 million a year to about $25,000 per year."23

Duty Exemption. Merchandise can be re-exported from a zone without the payment of duties, providing another significant source of savings to U.S. exporters. In addition, no duty is payable on goods that are imported into zones and ultimately consumed, scrapped, or destroyed in the zone. For example, damaged packages or broken bottles can be removed from shipments of packaged or bottled goods.24

Costs

According to the FTZ Board, the costs of FTZ use, and the "red tape" involved in order to take advantage of zone opportunities, can be substantial, particularly for small and medium-sized enterprises (SMEs). Therefore, companies need to carefully weigh the potential costs and benefits of zone use before applying for FTZ status. There are startup costs and maintenance costs. Because of this, according to an FTZ trade interest group, FTZs work best when a company can potentially see a return of 100% to 200% on investment in zone use. If the investment return is smaller, it may not be worth the startup and continuing costs.25

Startup costs include (1) the application process (detailed in the next section);26 (2) background checks for importers; (3) a physical security system—usually a fenced-in system with locks, guards, and cameras; (4) an inventory control system and related software to track the movement of products (which must be in place before CBP officially activates the operation); and (5) consultants, for those who prefer their assistance in setting up and managing a zone.

Maintenance costs after full zone status is in effect include (1) greater oversight by CBP officials;27 (2) at least one full-time person to manage a zone; (3) a "bond" payment, which is held by the government as a guarantee against potential tariffs owed on products in FTZs;28 and (4) annual fees paid to grantees for zone use. The FTZ Act requires zone grantees to operate zones as public utilities, but grantees are able to charge zone users for costs associated with managing the zone. Fees for zone users range from several thousand dollars up to $10,000 or more a year.29

The Administrative Mechanism Behind FTZs30

Several U.S. agencies are involved in administering the FTZ program. The FTZ Board is responsible for the establishment, maintenance, and administration of zones under the FTZ Act. The FTZ Board consists of two members: the Secretary of Commerce and the Secretary of the Treasury. The Secretary of Commerce is the chairman and executive officer, and appoints the executive secretary (chief operating officer) of the FTZ Board, who is supported by a staff of eight. The Secretary of the Treasury's responsibilities relate to the protection of the revenue as well as tariff and trade policy considerations.

The Department of Homeland Security's Customs and Border Protection (CBP) acts as an advisor to the FTZ Board and is responsible for direct oversight of zone activity and ensuring compliance with the FTZ Act and all laws and regulations pertaining to zone use. CBP is responsible for activating FTZs, securing them, controlling dutiable merchandise moving into and out of them, and protecting and collecting the revenue. CBP is also responsible for ensuring that there is no evasion or violation of U.S. laws and regulations governing imported and exported merchandise, and ensuring that the zones program is free from terrorist activity. To this end, CBP, which is not normally onsite at the zones, must sign off on every shipment into and out of a zone. CBP also provides audits and compliance reviews of zone activity, including oversight of safeguards for checking container seals and other security measures. Homeland Security's Immigration and Customs Enforcement (ICE) is involved in a voluntary partnership with companies in FTZs to combat unlawful employment, although the same immigration and labor laws apply in FTZs as in any other U.S. location.31

Other agencies involved in the oversight of zone shipments include the Department of Agriculture and the U.S. Food and Drug Administration.

Application for FTZ Status

The FTZ Board does not own or operate any zones. Rather, it grants authority to applicants to establish, operate, and maintain zones. Once a zone has been established, the organization that applied for the zone is known as the "grantee." Grantees may be public or private entities, including local governments, port authorities, and economic development organizations. They provide and maintain facilities in connection with the zone according to regulations established by the FTZ Board. Under FTZ regulations, they are required to operate the zones as public utilities, with fair and reasonable rates, make annual reports to the FTZ Board on their activities, and provide uniform treatment under like conditions to zone users.

The latest changes to U.S. FTZ Regulations were issued in 2012 and were designed primarily to streamline the application process for manufacturers and distributors who want to operate in an FTZ or establish a subzone. Currently, a company can obtain FTZ designation for its facility in as little as 30 days, although up to a five-month process may be required in certain circumstances. The five-month process is still a significant reduction from the 10 to 12 months that would have been required in the past. The revised regulations also reduce the timeline for applications for production authority from 12 months to 4 months (120 days), in part by reducing the amount of information required in many instances. If issues are raised by concerned parties during the 120-day application process, the applicant must then follow a lengthier in-depth procedure, similar to what was required in the past. Major differences between old and new procedures are summarized in Text Box 4 (below).

|

Old and Revised 2012 Procedures for FTZ Production Authority Revised Procedures The revised regulations set up a 120-day (approximately four-month) timeline for all new applications to set up manufacturing operations inside FTZs. Under the revised procedures, fewer types of information are required to be submitted. Required information includes: (1) the name of the company; After the application is submitted to the FTZ Board, the executive secretary appoints an examiner who checks the application, posts it on the FTZ Board website, and opens a comment period so all interested parties (government, industry specialists, and other non-governmental organizations) can respond to any "public interest" issues. That is, any concerns that the FTZ would not be in the public interest could be raised at this time. Because the FTZ Board is small, the comments received are important in the review process. To supplement this information, the examiner may also consult industry specialists in government and consider the result of prior application in the industry. The examiner prepares a report with recommendations to the FTZ Board. Approval may be subject to specific restrictions to allow or limit certain activities to avoid a negative impact on domestic suppliers or competitors. If issues are raised, applications can be subject to a more stringent 12-month process (see below). Old Procedures (Still Used If Issues are Raised in the 120-Day Production Review Process) These procedures (which take about one year to conclude) require the applying company to show how the proposed manufacturing activity would contribute to the U.S. economy through job creation or other means. Applicants would be required to provide information on "economic factors," including: (1) employment impact; The FTZ Board would then undertake a detailed analysis to determine whether allowing a manufacturing activity would displace or cause harm to an existing U.S. company. Source: Summarized from material included on the FTZ Board website. |

Current FTZ and Worldwide Zone-Related Issues for Congress32

Current zone-related issues for Congress reflect the supply-chain role of free trade zones in a complex, increasingly integrated world. Congressional issues have both U.S. and worldwide aspects. Domestic issues include the FTZ program in relations to recent implementation of a series of tariff measures in addition to long-term issues such as whether FTZs represent a misallocation of U.S. resources; whether data relating to zone use are sufficient; and the extent to which U.S. FTZ zone use affects U.S. employment and the competitiveness of U.S. firms. Internationally, congressional issues relate to the effectiveness of trade zones worldwide as a tool for economic development and global competitiveness and U.S. influence on worker rights issues in zones around the world through trade policy.

Recent Developments on U.S. Tariff Measures

Many manufacturing companies rely on integrated global supply chains and changes to the U.S. tariff regime may be costly for U.S. businesses. Some companies are reportedly exploring the FTZ program as a solution to mitigate increased costs from Section 201, 232, and 301 tariffs implemented in 2018 by the Trump Administration.33 As a result, there may be concern that the program may be used to evade tariffs. However, duty exemption under the FTZ program only apply to goods that are eventually re-exported and all goods that enter the U.S. market for consumption is subject to applicable duty rates. Furthermore, goods identified in the Section 201, 232, and 301 tariffs must enter zones under privileged foreign status.34 Privileged foreign status goods maintain their initial tariff classification even when they may be used as inputs during the production of a final product and are subject to duty rates based on that classification when they enter the U.S. market for consumption.

Do U.S. FTZs Encourage a Misallocation of U.S. Resources?

As noted above, the U.S. FTZ system was established in the 1930s with the goal of spurring U.S. commerce in the wake of the Great Depression and the high tariff regime established by the Smoot-Hawley Tariff Act. Today, U.S. tariff levels are among the lowest in the world and U.S. commerce is highly connected with the global economy. Given the changes that have occurred since its passage, Congress may choose to consider whether the FTZ system today still fulfills the original intent of the FTZ Act and furthermore, if it remains the best vehicle through which to do so.

From a theoretical standpoint, efficiencies that reduce the cost of production increase productivity and benefit the overall economy—more is produced with less. When the FTZ system provides such gains in productivity to U.S. firms, the U.S. economy benefits. A problem may arise, however, to the extent that these FTZ benefits are not available to all U.S. producers. As with any system that confers specific benefits to some but not all producers in an economy, the FTZ system may cause a misallocation of productive resources. These potential distortions could be avoided by simply providing FTZ benefits to all U.S. firms. The regulations do not exclude any firms from applying for FTZ status so the benefits are technically available to all U.S. firms; a fraction of them use the FTZ system. As mentioned previously, given the high startup and maintenance costs associated with FTZ use, the system is most likely to benefit large firms with a high volume of production. The FTZ Board has tried to address some of these concerns regarding the accessibility of the program, especially to small and medium-sized enterprises, by simplifying its application procedure.

If the ultimate goal is a greater reduction in U.S. tariffs, FTZs provide one, if not the most efficient, way to do so. Tariffs themselves can cause a misallocation of resources, and though economic theory would suggest the U.S. economy benefits when tariffs are eliminated, such action may be politically infeasible. Companies in import-sensitive industries may be negatively impacted by the reduction of tariffs and may have a strong incentive to maintain tariff protection. The FTZ system and its application process, which allows for public comment, provides a mechanism by which tariffs are, in effect, lowered only in industries without strong domestic opposition. Given that tariff rates in the United States are not equal across products, it is unclear whether lowering one specific tariff line would create more or less distortion. Congress could more efficiently provide tariff free access to the U.S. market by lowering tariffs across the board, which would guarantee equal access by all U.S. firms. Such broad-based tariff reductions have typically occurred in the United States through multilateral trade liberalization negotiations in the World Trade Organization (WTO).35

Like the specific tariff benefits, one could also argue that the logistical benefits provided by the FTZ program create distortions. FTZ users benefit from more streamlined customs procedures and lower merchandise processing fees, while those outside zones do not. Again, some may question whether the program is truly accessible. Merchandise processing fees are based on a percentage of the total import value, but are subject to a cap. Larger importers would reach that cap more quickly and have a stronger incentive to pay the upfront costs of establishing an FTZ.

Broader customs reform applicable to all importers could provide similar benefits without the risk of distortions. But, given the background checks and heightened security associated with operating an FTZ, providing all firms with the logistical benefits of FTZ use may not be feasible. CBP has discussed permitting importers to file one entry form per month, regardless of whether the company has FTZ status, as part of a "simplified summary" process.36 However, this proposal has reportedly run into logistical problems relating to the actual implementation of such a system across the broad spectrum of U.S. importers. Even if the vast majority of importers are deemed to be low risk, the sheer number of total importers means that even a small percent of high risk companies would involve a huge resource burden to ensure compliance. Weekly entry filing continues to be a unique benefit to FTZ users. Ensuring the safety and security of U.S. imports in a cost-effective manner, while also facilitating timely trade, remains an ongoing challenge.

Data Availability Issues Relating to FTZs

Every shipment into and out of foreign-trade zones must be authorized by CBP. The documents that a company submits to CBP include the classification, country of origin, and the value of the merchandise. While this information is provided to CBP for every shipment and used by CBP to maintain oversight of the zone activity, this level of information is not publicly available. Public reports tracking the identity of products moving into and out of zones are incomplete, although two agencies publish data relating to FTZs. The Commerce Department (Bureau of the Census) publishes data on imports (foreign products) entered into zones. The U.S. FTZ Board publishes data on both foreign and domestic products entered into zones, and final products leaving zones for U.S. consumption and for export, respectively. The two agencies produce some estimates of zone use from different sources using different methods. While their final estimates are reasonably close on certain measurements, other data pertaining to FTZ use are lacking for both groups. (See Table 2, which compares data from the two sources and identifies missing data.) Missing data, more importantly than slightly inconsistent data, can complicate policy recommendations.

|

FTZ Data |

Census Data |

|

|

Reported Data on Merchandise Entering FTZs |

|

|

|

Reported Data on Merchandise Leaving FTZs |

|

|

|

No Data are Reported Publicly on: |

|

|

Source: For FTZ data: U.S. Foreign-Trade Zones Board Report to Congress, (various years); for Census data: USITC Dataweb, and interviews with Census and FTZ Board representatives.

The FTZ Board collects its data from zone users and publishes in its Annual Report to Congress summary data on "foreign" and "domestic status" inputs into FTZs later shipped to the United States or exported to places abroad. It also publishes more detailed industry-level data, specifically for foreign status inputs.37

The Census Bureau collects its data from importers and exporters, tracking the movement of products into or out of the United States in general.38 For FTZs in particular, Census publishes detailed data by Harmonized Tariff Schedule (HTS) codes on imports into FTZs and bonded warehouses, along with data on import charges owed on these imports.39 While Census does not regularly publish data by HTS code on merchandise that leaves FTZs for consumption in the United States, or for export, these data may be obtained upon special request.

Neither the FTZ Board nor the Census Bureau collects or publishes industry-specific data on (1) domestic inputs into zones; (2) goods transferred from zone to zone; (3) value added in zones; or (4) the relationship between the actual character of goods entering and goods exiting FTZs. These data are reported by companies to CBP and are used for protecting the revenue, ensuring compliance with U.S. laws and regulations, and ensuring the secure movement of merchandise in the United States. However, they are not available publicly for other uses.

Security Issues Relating to FTZs

Security issues relating to imports are a continuing concern for CBP. The agency undertakes periodic reviews of companies, including companies bringing goods into and out of FTZs, along with the products they transport and process. CBP has reportedly developed a complex targeting system in its continuing effort to balance competing goals of facilitating trade, providing port security, and collecting trade revenues.40

Compared to products that are imported for consumption directly into the United States, FTZs incorporate additional screening and security measures. Following approval for FTZ status by the FTZ Board, all companies must apply to CBP to use a zone before they can begin operations. Part of that process, known as "activation," includes a background check on key employees, a review of the security of the facility, and assessing the integrity of the inventory control and recordkeeping system. A company must also produce a detailed procedures manual explaining how all merchandise is handled at every stage of its movement through the zone. The storage of merchandise in a zone exposes that merchandise to audit and inspection for the length of time that it remains within the zone, often significantly longer than if it had been entered and cleared into commerce upon arrival at a U.S. port.

In 2017, GAO examined CBP's ability to assess and respond to compliance risks across the FTZ program and reported that CBP has not conducted a program-wide compliance risk assessment, partly due to the lack of centrally compiled data on compliance reviews. As a result, CBP may not be able to thoroughly determine the program's overall risk level, which may impact CBP's ability to efficiently enforce regulations and collect tariff revenue. CBP has since started storing compliance review data in a central system and conducted a program-wide risk assessment using FY2018 data. It is also in the process of updating its FTZ Compliance Review handbook with best practices and updated risk assessment tools.41

Another security assessment involving zones globally was undertaken by an international inter-governmental group, the Financial Action Task Force (FATF)/Organization for Economic Cooperation and Development (OECD).42 Its findings are reported in Money Laundering Vulnerabilities of Free Trade Zones, a report released in March of 2010. Two of its case studies identified smuggling and tax evasion activities involving a U.S. company and a U.S. FTZ, respectively. Final recommendations in the report did not differentiate between those for zones in the world at large and those relating to U.S. FTZs. However, they focused, among other things, on the factors which could remedy weaknesses in both groups, including (1) improvement in systems relating to the collection, quality, and international exchange of trade data; (2) greater use of electronic customs filing and reporting systems with universally compatible data fields; and (3) licensing, regulating, and monitoring of entities acting as customs brokers and persons operating bonded warehouses.43

A 2018 report by the OECD Task Force on Countering Illicit Trade's (TF-CIT) assessed existing governance frameworks to counter illicit trade and noted that lightly regulated zones are the main issue in attracting illicit activities, especially when governments do not provide adequate oversight over the zones or zones are operated by private parties. The report recognizes that the U.S. FTZ program enforces regulations, unlike other similar programs that may function under a more opaque environment. Recommendations in the report include developing a formal definition and international framework of free trade zones, increasing government oversight to ensure compliance, and improving trade facilitation measures with customs authorities, especially in developing countries that rely heavily on free trade zones as an economic development tool.44

U.S. Employment and Global Competitiveness Impact of FTZs

Proponents of FTZs continually point to their job-creating and trade-creating potential. FTZs employ 440,000 workers in the United States, most of them in manufacturing. This represents around 3% of total U.S. manufacturing employment.45

Nevertheless, factors affecting U.S. employment in relatively smaller ways may be of interest to Congress. Since 1997, manufacturing employment declined 27%, while manufacturing output increased by 20%.46 Most analysts agree that two factors have contributed to this decline: (1) productivity gains in domestic operations; and (2) movement of U.S. manufacturing facilities abroad due to lower operating costs. There continues to be debates over which of these factors has had a greater influence and how to improve the situation.

FTZ trade groups argue that FTZ operations can encourage job retention and job growth. More broadly, advocates argue that FTZ use enhances the global competiveness of firms located in the United States. They argue that importers can, in some cases, save production and transportation costs by setting up new final assembly operations in U.S. FTZs or by gaining FTZ designation for existing plants.47 For example, in the automotive industry, Nissan estimates that annual FTZ benefits, net of the additional costs of operating an FTZ site, can be as much as $8.3 million a year.48 The company argues that without the FTZ benefits it might move U.S. production to other countries, though such a decision would likely also depend on a number of other factors, perhaps more significant than FTZ status. As with the ongoing debate regarding the drop in manufacturing employment, determining whether any specific action causes net job growth or loss is challenging, particularly because these actions often have direct as well as indirect effects.

Effectiveness of World Trade Zones as a Tool for Economic Development

As noted above (see "Growth of Free Trade Zones Worldwide"), the United States has been involved in promoting free trade zones worldwide through a number of different avenues. Some might argue that world export processing zones and a focus on exports do not necessarily contribute to economic development. Economists argue that export-led growth works best as a development tool when the world economy is growing quickly. They point out that it works less well when world economic growth (led by consumers in developed, high-import countries) slows. In such a case, export-led growth can be cyclical and destabilizing. Therefore, developing a domestic economy that depends more on domestic consumer demand adds an element of stability that could benefit developing countries over the long run.

Others may argue that an initial lack of strong domestic demand is precisely why countries may benefit from a focus on exports in the early stages of development. The specific goods a developing country is most efficient in producing may be not be demanded domestically or not at the scale necessary to achieve maximum efficiency. Hence, some argue that economic development may occur much faster with export processing zones than without them. In addition to the tariff benefits, the infrastructure components of zones attract foreign investment that might not otherwise occur. Theoretically, industries in the host country would also experience positive spillover effects from the foreign investment and specialization knowledge that occurs in zones. The challenge, however, as growth begins, is for a country to (1) continually diversify into producing higher value-added goods; (2) find ways to continually upgrade the skills of the workforce to produce those goods; and (3) encourage domestic consumption of some of the goods produced in zones. Countries that have followed this model by government planning toward this goal have been most successful.49

Some economists also argue that it would be more efficient and less market distorting to work within the WTO to eliminate tariffs worldwide to help promote international economic development than to continue to promote export processing zones. While this may be true, history has shown that the process of eliminating tariffs is very slow, and while this would solve the issue of differing tariffs across countries, it does not speak to the infrastructure and customs simplification benefits of free trade zones in developing countries. Some may argue that a greater global focus on trade capacity building and ensuring that developing countries have the means to process, track, and transport traded goods could help with this ongoing challenge. Support for the ratification and implementation of the WTO Trade Facilitation Agreement, which includes providing technical assistance to developing economies, is one way to support such goals.

Overall, economic impact of free trade zones is generally hard to observe, mainly due to the lack of comprehensive data across countries. Case studies can provide insight into characteristics of specific free trade zone programs that are considered to be a successful tool for economic development, but it is hard to apply those same characteristics across all countries. Concerns have also been raised regarding the social and environmental impacts of free trade zones due to the opaque nature of regulations and enforcement in some programs. However, the OECD reported recently that a few zone programs have become more effective at enforcing regulations, especially environmental regulations, to attract investors. UNCTAD's Framework for Sustainable Economic Zones aims to encourage zone operators to switch to better social and environmental practices.50

Trade Zones Worldwide and Worker Rights

Congress has an impact on worker rights in trade zones worldwide through U.S. trade preference laws and free trade agreements. Trade preference laws traditionally require, among other things, that as a condition of continued eligibility for trade benefits, countries must be taking steps to afford their workers "internationally recognized worker rights."51 Almost all U.S. free trade agreements include language pledging to uphold a similar list of worker rights, and all but three of the agreements52 include language stating that Parties agree not to "waive or derogate from" their statutes or regulations in order to attract trade with and/or investment by the other Party.53

However, there may be a grey area on the applicability of the trade preference program and free trade agreement provisions to free trade zones, at least under some free trade agreements. While the United States has suspended trade preferences to certain countries because of labor violations,54 the applicability of labor provisions in free trade agreements specifically to trade zones in other countries has never been tested under dispute resolution procedures.55

Depending on laws of a specific country, zones could be an unclear area for labor requirements under free trade zones. One U.S. free trade agreement partner country, Jordan, in the past, permitted relaxed labor standards in its free trade zones. The fact that Jordan had different labor standards in its free trade zones than in other parts of its country came to light in 2006, when a watchdog organization, the National Labor Committee, published a report documenting problematical labor conditions in Jordan's free trade zones.56 The case was eventually handled through discussions between U.S. and Jordanian labor representatives, and Jordan took a number of steps to eliminate the problems. Since this case was handled informally, it did not establish a precedent to address labor standards in the free trade zones of countries with which the United States has free trade agreements. Whether the issue of labor standards in free trade zones will be addressed in future trade agreements is not known.57

International organizations have issued guidelines addressing labor issues in free trade zones, to varying degrees. For example, WTO rules and good practices on export policy do not address the issue of worker rights specifically.58 At the 1996 WTO Singapore Ministerial, the WTO member countries voted to renew their commitment to the observance of internationally recognized core labor standards and named the ILO as the "competent body" to set and deal with these standards.59 OECD Guidelines for Multinational Enterprises include labor guidelines. However, they do not mention export processing zones or free trade zones specifically.

The ILO has issued a number of reports on working conditions in export processing zones, the most recent in 2017. The report said that "[p]roblems persist in the protection of fundamental principles and rights at work" in free trade zones, despite most countries having ratified ILO conventions.60 These issues may be due to certain countries' pursuit of a low-wage strategy in free trade zone development where labor laws are not applied or not enforced. For example, unionization in free trade zones is explicitly prohibited by law in some countries identified in the ILO report. Gender discrimination, occupational safety, and poor working conditions also continue to be issues. However, the report also noted that, in certain countries, wages within zones are generally higher on average than wages outside of them and zone workers are sometimes legally entitled to certain social benefits, such as social security and healthcare. The report noted that although most countries' labor legislation extends to free trade zones, enforcement is the biggest issue as the related government body provides little to no oversight (sometimes due to lack of capacity) or governments choose not to enforce the laws at all.

Outlook: Future of U.S. FTZs and Zones Worldwide?

From time to time, concerns have arisen within the trade community about the future of free trade zones, including U.S. FTZs. Will they disappear with continuing trade liberalization and continuing reductions in tariffs?

The future role of zones in the global manufacturing supply chain largely depends on many unknown and evolving factors. For example, after the 1993 North American Free Trade Agreement (NAFTA) led to ultimate tariff elimination for trade among the United States, Mexico, and Canada, questions arose as to whether maquiladoras61 along the U.S.-Mexican border would diminish in importance, and entire FTA partner countries would become, in essence vast "free trade zones" for trade with each other. Data since then, however, show that free trade zone use has remained popular in developing and developed countries alike because of its diverse benefits, and that, in fact, latest data shows that there are at least 3,700 firms employing at least 1.2 million workers in zones in Mexico.62

More than 15 years after these questions were voiced, export processing zones have continued to expand in terms of countries hosting them, corporations investing in them, and workers being hired to labor in them. Between 1997 and 2006, the number of free trade zones worldwide quadrupled, and the number of workers employed in them tripled. For FTZs in the United States, the direction of growth is the same as world export processing zones, but the expansion has been more modest, with relatively little growth in employment. Between 2000 and 2018, the number of active zones increased but the number of firms using zones decreased (from 3,600 to 3,300). However, it has also resulted in an increase in employment (from 340,000 to 440,000) and the current dollar value of merchandise received in zones tripled.63 (See Table A-2.)

Reasons previously identified by the OECD as supporting the growth of world export processing zones as policy tools could continue: (1) the emphasis on export-oriented growth; (2) the emphasis on foreign direct investment-oriented growth; (3) the transfer of production of labor intensive industries from developed to developing countries; and (4) the growing international division of labor and incidence of global production networks.64

Major factors which could increase the use of free trade zones around the world, including U.S. FTZs, are (1) continuing improvements in technology, which will extend recent advancements in communication tools, computer capabilities, and the transport industry; (2) advancements and improvements in security monitoring; (3) new efficiencies for zone users including advancements in automated, electronic tracking of goods and services traded internationally; and (4) external trends. Possible external trends that could give a significant boost to U.S. FTZs, specifically, could include those events or forces that would encourage a return of basic manufacturing to the United States and a boost to U.S. exports.

If all trade barriers and security issues were eliminated between all countries, exports and imports could move as easily among countries as between U.S. states. As a result, the need for the zones worldwide would be greatly diminished. However, as long as international tariff and non-tariff barriers remain, along with the need for heightened security to deal with issues such as terrorism and money laundering, the U.S. FTZ system and other zone programs abroad are more likely to continue and even, possibly, expand.

Appendix.

|

Total Merchandise Received |

Final Dispensation of FTZ Products ($Bil.) |

|||||

|

Active FTZsa |

Active Manufacturing Operations |

Foreign Inputs |

Domestic Inputs |

Exported |

Domestically |

|

|

TOTAL |

195 |

330 |

$297 |

$497 |

$113 |

$681 |

Source: CRS analysis, from Foreign-Trade Zones Board, 80th Annual Report, November, 2019.

a. Active FTZs have at least one site or subzone in operation. The FTZ Board states there are over 500 subzones approved.

b. Foreign inputs excludes foreign-origin items that are duty-paid prior to entering the FTZ.

c. Exports and domestically consumed products do not include value added. They are based solely on material inputs.

d. May include some products previously held in warehouses in previous years.

|

How FTZs Function: Shipment of Goods Into and Out of FTZs Ports of entry are the level at which Customs and Border Patrol (CBP) enforces import and export laws and regulations and implements immigration policies and programs. Entry of goods into a zone requires a permit from the port director and signature by the zone operator for its admission. An additional copy of the permit is transmitted to the Census Bureau. For goods shipped into FTZs:

For goods leaving FTZs:

Source: U.S. Customs and Border Protection: Importing into the United States: A Guide for Commercial Importers, November, 2006, various pages. |

|

CBP Forms Required for FTZ and Non-FTZ Users For all FTZ and Non-FTZ Users:

Additional for FTZ Users:

Source: CBP, Foreign-Trade Zones Manual, p. 203, and discussions with the U.S. FTZ Board and the Census. |

|

1993 |

2000 |

2010 |

2013 |

2018 |

|

|

Employees in Zones |

292,000 |

340,000 |

320,000 |

390,000 |

440,000 |

|

Active FTZ Projects |

122 |

145 |

168 |

177 |

195 |

|

Firms Using a Zone |

2,700 |

2,420 |

2,400 |

3,050 |

3,300 |

|

Total domestic and foreign Merchandise Received (Current $ Bil.) |

$104 |

$238 |

$534 |

$836 |

$794 |

Source: U.S. FTZ Board, Annual Reports.

Note: Between 2000 and 2018, the number of active zones increased but the number of firms using zones decreased (from 3,600 to 3,300). However, it has also resulted in an increase in employment (from 340,000 to 440,000) and the current dollar value of merchandise received in zones tripled.

Author Contact Information

Acknowledgments

This report was originally written by Mary Jane Bolle and Brock Williams, CRS Specialists in International Trade and Finance.

Footnotes

| 1. |

For general information on foreign-trade zones see the Department of Commerce, International Trade Administration's Frequently Asked Questions section of the Foreign-Trade Zones Board website at http://ia.ita.doc.gov/ftzpage/info/ftzstart.html. |

| 2. |

United Nations Conference on Trade and Development (UNCTAD), "Special Economic Zones", World Investment Report 2019, June 2019; due to the broad nature for the definition of free trade zones, UNCTAD's estimates are based on three criteria defined in the report on page 133. |

| 3. |

The worldwide range is estimated by UNCTAD for its World Investment Report 2019 using previous estimations by FIAS (2018) and ILO (2017). The report does not break down zone employment by region or country, but does provide examples of several countries; see UNCTAD, "Special Economic Zones," p. 184 for more information. |

| 4. |

Subsidies may conflict with some World Trade Organization (WTO) rules, and more flexible labor market regulations may conflict with "best practices" as outlined by the International Labor Organization and the OECD. See, for example, OECD. Export Processing Zones: Past and Future Role in Trade and Development, by Michael Engman, Osamu Onodera, and Enrico Pinali, Trade Policy Working Paper No. 53, 2007, p. 8. |

| 5. |

Free trade zones had been used in the Roman Empire and during the Middle Ages, primarily for storage, trans-shipment, and re-export of goods produced elsewhere. ILO, Economic and Social Effects of Multinational Enterprises in Export Processing Zones, 1988, p. 1-3. |

| 6. |

Ibid., p. 1-3. Later, the World Export Processing Zones Association (WEPZA), originally established by UNIDO, was spun off to become a U.S.-run private, non-profit organization dedicated to assisting the successful development of export processing zones throughout the world. Source: WEPZA website at WEPZA.org. |

| 7. |

Walter H. and Dorothy B. Diamond, Tax-Free Trade Zones of the World, Unz & Co., 1997, Introduction, p. 33. Between 1977 and 1997, this continually updated three-volume set provided technical information for each country. |

| 8. |

OECD, Export Processing Zones: Past and Future Role in Trade and Development, by Michael Engman, Osamu Onodera, and Enrico Pinali, OECD Trade Policy Working Paper, No. 53, 2007, p. 8. |

| 9. |

Regulations issued by the U.S. Foreign-Trade Zones Board for establishing and maintaining a foreign-trade zone can be found at 15 CFR 400. |

| 10. |

Beth V. and Robert M. Yarbrough, The World Economy: Trade and Finance (Harcourt Brace, 1991), p. 368. |

| 11. |

GAO, Foreign-Trade Zones Growth Primarily Benefits Users Who Import for Domestic Commerce, GAO/GGD 84-52, March 2, 1984, p. 12. |

| 12. |

U.S. Congress, House, Committee on Government Operations, Foreign-Trade Zones (FTZ) Program Needs Restructuring, House Report 101-363, November 16, 1989, p. 11. |

| 13. |

Except as otherwise indicated, data in the above two paragraphs are from 80th Annual Report of the Foreign-Trade Zones Board to the Congress of the United States, November 2019. |

| 14. |

These data exclude value added, for which no figures are available. |

| 15. |

U.S. Energy Information Administration, "Oil: crude and petroleum products explained," https://www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php. |

| 16. |

The Trade Partnership, "Appendix B: Company use of FTZs", The U.S. Foreign-Trade Zones Program: Economic Benefits to American Communities, February 2019, p. 48-50; this study was commissioned by the National Association of Foreign-Trade Zones, an advocacy group for the U.S. FTZ program. |

| 17. |

No estimates are available on the value of tariffs foregone each year because of FTZ use. However, tariffs are still payable on the share of FTZ imports that are ultimately entered into the United States for consumption. The U.S Customs and Border Protection reportedly collected about $3 billion in duties from FTZs. |

| 18. |

This estimate is made by the FTZ Board based on information contained in new zone and subzone applications. Calculating actual savings would require more extensive reporting on the part of zone users. |

| 19. |

If the importer elects to pay the tariff rate as it would apply to the imported component, he claims "privileged" status; If he elects to pay the tariff rate as it would apply to the finished product, he claims "non-privileged" status. Example: If an importer claims "privileged status" on carburetors and fan belts entered into zones for incorporation into cars, then he would pay the "carburetors" and "fan belt," tariff rates, respectively, on the imported value of these components when the auto actually leaves the zone. If he claims "non-privileged status," he would pay the tariff rate applicable to the finished auto on the combined value of the carburetor and the belts when the finished auto exits the zone. |

| 20. |

Volkswagen Could Save Nearly $2 million a Year in Tariffs, Timesfreepress.com, March 19, 2011. |

| 21. |