Low Oil Prices May Trigger Certain Tax Benefits, but Not Others

Benchmark crude oil prices—such as U.S. West Texas Intermediate (WTI)—have steeply declined since January 2020. Oil market oversupply, the result of COVID-19 travel restrictions and increased global supply levels in March and April, has exerted downward pressure on prices. Although the duration of low oil prices is uncertain, price levels for the remainder of 2020 may largely be a function of demand recovery, supply adjustments, and return to a balanced market. Energy Information Administration (EIA) price forecasts, as of April 2020, indicate that WTI spot prices may average just over $29 per barrel during calendar year 2020, less than half the price at the beginning of the year.

Some federal oil production tax incentives are triggered when a reference price of crude oil—estimated and published annually by the Internal Revenue Service (IRS)—drops below a statutory oil price level. The reference price is an "estimate of the annual average wellhead price per barrel for all domestic crude oil the price of which is not subject to regulation." Wellhead prices are unique to each oil producer and generally reflect price adjustments—relative to a benchmark price such as WTI—for crude oil quality characteristics, transportation (e.g., truck, pipeline, rail), and other considerations. Publicly available information provides a limited monthly assessment of domestic wellhead prices for calendar year 2020. EIA does not forecast wellhead prices. However, the historical relationship of annual average WTI spot prices to reference prices, combined with EIA price forecasts, may provide some indication about the likelihood that certain oil tax incentives will be triggered.

Tax Credit for Enhanced Oil Recovery (Internal Revenue Code [IRC] Section 43)

A tax credit may be claimed for certain costs associated with enhanced oil recovery. The credit encourages producers to extract domestic oil that can only be recovered using more expensive unconventional methods, at times when oil market prices alone might not lead to this oil being recovered.

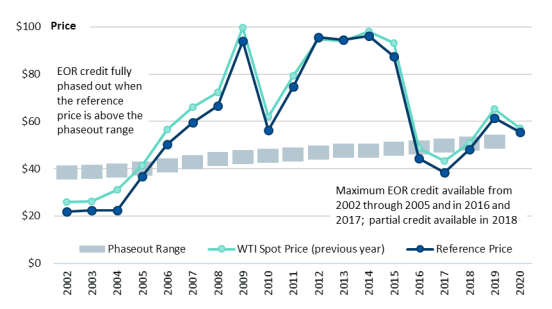

In a given tax year, the EOR credit may be available at the full 15% rate, partially available (available at a less than 15% rate), or fully phased out. This tax credit phases out once oil prices rise above $28 per barrel, as adjusted for inflation. (The base year in the inflation adjustment is 1990.) The credit phases out over a $6 range. (The size of the phaseout range is fixed, and not inflation adjusted.)

The credit first became available in 1991. The 15% tax credit for qualifying EOR costs was available in full from 1991 through 2005. The EOR credit was fully phased out (no credit was available) every year from 2006 through 2015. Low oil prices led to the EOR credit becoming available again in 2016 and 2017. A partial credit was available for 2018, and the credit was fully phased out in 2019.

For the 2019 tax year, phaseout began at a price of $48.5352 per barrel (i.e., $28 per barrel, adjusted for inflation). During that year, the reference price for oil from 2018 ($61.41) exceeded the inflation-adjusted threshold price ($48.5352) by more than $6. Thus, in 2019, the credit was fully phased out. A partial credit of 13.931% was available in 2018, because the reference price of oil from 2017 ($48.05) was in the phaseout range (which began at $47.6224). In 2018, the credit reduction amount was determined by taking the reference price less the inflation-adjusted phaseout threshold, and dividing by $6, or ([$48.05-$47.6224] ÷ $6). Using this formula, the credit was reduced by 7.127% to 13.931% (i.e., the full 15% EOR credit amount reduced by 7.127%).

Figure 1 shows the reference price for crude oil and the EOR credit phaseout range from 2002 through 2019 (the reference price for 2020 has been released, but the inflation-adjusted phaseout range is not yet available). Annual WTI spot prices are also plotted in Figure 1. Historically, the reference price for crude oil has closely tracked the WTI spot price. Based on current EIA forecasts, oil prices in 2020 could result in a reference price for oil that allows taxpayers to claim the EOR credit on 2021 tax returns.

Tax Credit for Oil and Gas Production from Marginal Wells (IRC Section 45I)

The tax credit for oil and gas production from marginal wells was enacted in 2004. The credit was intended to help maintain production from marginal wells when prices are low, supporting domestic supply during periods of price volatility. A marginal well is one that is a marginal well for the purposes of claiming percentage depletion, or one that has average daily production of no more than 25 barrel-of-oil equivalents and produces at least 95% water. Qualified crude oil or natural gas production is limited to 1,095 barrels or barrel-oil-equivalents, per well annually.

Like the EOR credit, the credit for production from marginal wells becomes available when oil or gas prices fall below specified thresholds. For oil, the credit is $3 per barrel if the reference price for oil is less than $15 per barrel. The credit is fully phased out if the reference price exceeds $18 per barrel. Amounts are adjusted for inflation. (The base year for the inflation adjustment is 2004.)

Since the credit first became available in 2005, oil prices have remained above the threshold amount. Thus, the credit has never been available for oil produced from marginal wells. For tax years beginning in 2018, the credit for oil fully phased out, because the reference price for oil exceeded $22.93. Based on current EIA forecasts, oil prices in 2020 are not anticipated to fall to levels that would allow the credit for production from marginal wells to be claimed on 2021 tax returns.

Percentage Depletion for Marginal Wells (IRC Section 613A)

Depletion deductions allow taxpayers to deduct from taxable income the value of mineral resources as they are used. Certain independent oil and gas producers (producers who are not retailers or refiners) may elect to claim percentage depletion. The base percentage depletion rate for marginal wells is 15%. If the reference price of oil falls below $20 per barrel (not adjusted for inflation), the percentage depletion allowance for marginal wells could increase above 15% to as much as 25%. Increased percentage depletion for marginal wells first became available in 1991. However, the rate of percentage depletion for marginal wells has been 15% since 2001. Based on current EIA forecasts, oil prices in 2020 are not anticipated to fall to levels that would allow additional percentage depletion for marginal wells on 2021 tax returns.