Older Children, Adult Dependents, and Eligibility for the 2020 Recovery Rebates

Some policymakers have expressed concern that certain individuals including older children and adult dependents are not eligible for direct payments enacted as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136). The statute refers to these payments as 2020 recovery rebates. The Internal Revenue Service (IRS) refers to these payments issued in 2020 as economic impact payments. Receiving a recovery rebate in 2020 will not affect a taxpayer's 2020 income tax liability or tax refund, and taxpayers will generally not need to repay the rebate.

There are three main categories of individuals ineligible for these payments (these categories may not be mutually exclusive):

- 1. children over 16 years old and adult dependents;

- 2. certain noncitizens without Social Security numbers (SSNs) or who are nonresident aliens;

- 3. higher-income taxpayers.

This Insight provides an overview of one category of individuals who are ineligible for the 2020 recovery rebates—older children and adult dependents. This information may help inform any potential legislative debate considering another round of direct payments.

Some individuals eligible for 2020 recovery rebate payments may not receive them automatically. Individuals who do not normally file an income tax return, including many low-income childless workers, may not receive these payments unless they manually provide information to the IRS through a new web portal. (The IRS has announced that eligible Social Security beneficiaries and recipients of VA and SSI benefits who do not file tax returns will receive the $1,200 payments automatically in 2020.) In addition, certain eligible recipients with past-due child support obligations may receive a smaller payment or no payment at all. These eligible populations are not discussed further in this Insight, as the focus is on ineligible individuals.

What is a dependent for tax purposes?

An individual is considered a dependent of a taxpayer if the individual fulfills various requirements set forth in Internal Revenue Code (IRC) Section 152 and is considered either the taxpayer's qualifying child or qualifying relative.

As described in Table 1, dependents are reliant on another person for more than half of their financial support (often called the "support test"). Dependents also often have specified familial relationships with the taxpayer and often reside with the taxpayer for a significant period of time. Dependents considered qualifying children are also generally under 19 years old (or under 24 years old if students). Dependents considered qualifying relatives have very low incomes. As a result of these various requirements, dependents are often the taxpayer's custodial children, but also can include college students, disabled relatives, or a taxpayer's parents.

Some dependents are required to file federal income tax returns if their income exceeds a specified threshold (see Table 2 on the IRS website). Hence, filing a tax return does not necessarily mean an individual is not a dependent.

|

Qualifying Child |

Qualifying Relative |

|

Relationship: The child is the taxpayer's son, daughter, stepchild, foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister, or a descendant of any of them. |

Member of Household or Relationship: The individual must either (a) be a member of the taxpayer's household for the entire year; or (b) if they don't live with the taxpayer, be a relative of the taxpayer. |

|

Residence: The child must have lived with the taxpayer for more than half the year. |

Gross Income Test: The individual's gross income must be less than the personal exemption amount ($4,200 in 2019). |

|

Age: The child is either (a) under 19 years old at the end of the year; (b) under 24 years old at the end of the year and a student; or (c) any age if permanently and totally disabled. |

Age: None |

|

Support: The child must not have provided more than half of his or her own support for the year. |

Support: The taxpayer must provide more than half of the qualifying individual's support for the year. |

|

Joint Return: The child must not be filing a joint return for the year (unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid). |

Not a qualifying child: The individual cannot be claimed as a qualifying child by any taxpayer. |

Source: IRS Publication 501 and Internal Revenue Code (IRC) §152.

Can dependents receive the 2020 recovery rebates?

A person who can be claimed as a dependent on another individual's tax return is ineligible for the $1,200 direct payment. In addition, taxpayers with dependent children over 16 years old (including adult dependents) are ineligible for the $500 payment per qualifying child. Taxpayers may receive $500 for each child eligible for the child tax credit—generally a dependent child 16 years or younger. Hence, a sister who claims her disabled adult brother as a dependent in order to file as head of household is ineligible for the $500 payment because he is older than 16. Her brother is ineligible for the $1,200 payment because he is her dependent (the sister may still be eligible for the $1,200 payment herself).

The Tax Policy Center estimates that in 2019 there were almost 98 million dependents: 69.5 million were eligible for the $500 payments, while 20.4 million were ineligible as a result of the definition of dependent used in the CARES Act. An additional 8.1 million dependents were not be eligible for the $500 payment because they were dependents of higher-income taxpayers who are ineligible for the payment.

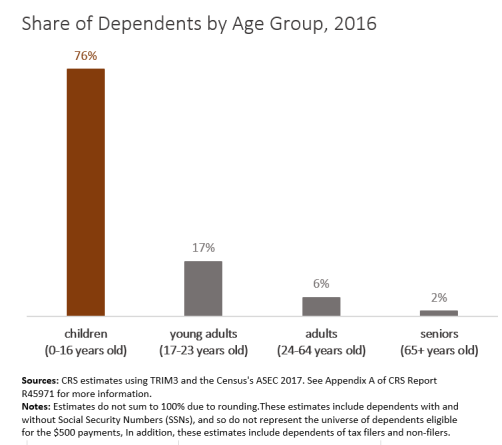

CRS analysis using Census data and the TRIM3 model (both discussed in detail in Appendix A of this CRS report), indicates that in 2016 the majority of dependents were children 16 years or younger (76%). An estimated 17% of dependents were older children (17-23 years old) and an estimated 8% were adults (including 2% who were seniors). These estimates include both dependents with and without Social Security Numbers (SSNs), and so include individuals who may be ineligible for the recovery rebates because they do not meet the SSN requirement included in the law. These estimates of dependents include dependents of tax filers as well as nonfilers.

|

Are there legislative proposals to modify dependent eligibility for the 2020 recovery rebates?

In the House, the All Dependent Children Count Act (H.R. 6420) would expand eligibility for the $500 payments to all qualifying children, effectively raising the age limit from under 17 years old to those under 19 years old (or under 24 if a student or any age if disabled).

In the Senate, the legislative text of the All Dependents Count Act would expand eligibility for the $500 payment to all dependents—qualifying children and qualifying relatives.

Acknowledgments

Conor Boyle, Analyst in Social Policy, and Jameson Carter, Research Assistant, provided analysis using TRIM3 included in this Insight.