COVID-19: Selected Capital Markets Segments Supported by Federal Government Liquidity Interventions

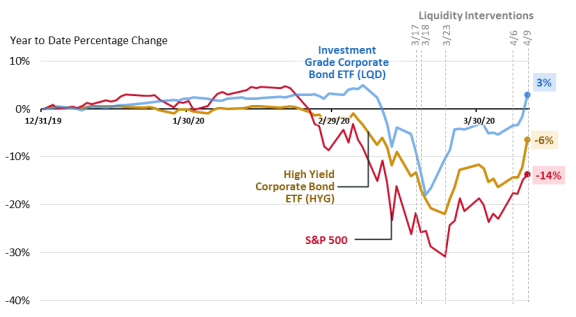

The spread of Coronavirus Disease 2019 (COVID-19) induced heavy capital markets selloffs in March 2020. In response, the Federal Reserve (Fed)—sometimes with support from the Treasury Department—has established several emergency lending facilities to provide liquidity to key capital markets segments. As of the publication of this Insight, some markets that have announced Fed liquidity support appear to have begun to stabilize. This Insight discusses the changing capital markets conditions (Figure 1) using as examples, corporate bonds, money market mutual funds (MMFs), and municipal bonds. These examples provide context for understanding capital markets functions, risks, and how they react to broad-scale liquidity interventions.

Corporate Bonds

The economic fallout from COVID-19 has exerted significant pressure on corporate bond markets. The current stress conditions are different than the 2008 financial crisis in many ways, including, as some financial authorities observe, that a major portion of the corporate debt market is in higher-risk positions. The concern in recent years has been that, during a market downturn, funding costs and availability could change, driving the already risky companies to defaults and business closures. Furthermore, the funding dislocation could drain out financial system liquidity and amplify financial and economic vulnerabilities.

To keep capital markets functioning, the Fed acted in March to provide broad liquidity support for higher credit quality "investment-grade" issuers and bonds for the first time. The bond market subsequently rebounded, but the noninvestment-grade (high-yield) bonds, which did not receive the announced support, stabilized less.

As the gap between the government-supported and nonsupported segments continued to widen in March, issuers and investors began to crowd into the supported segments of the market. There were indications of high levels of new issuance in investment-grade bonds, but virtually no new issuance in high-yield bonds in March. The pricing gap between the investment-grade and high-yield bonds had also widened to several times the norm as of March, another sign of the diversion.

Furthermore, the pandemic-induced economic halt has generated downgrade pressure for many companies. Of special concern are the lowest-quality investment-grade bonds, referred to as BBB bonds in this Insight. BBB bonds face high "fallen angel" risk—the risk that further downgrades could push them into high-yield status, reducing their liquidity and increasing their insolvency risk. Because the Fed's liquidity facilities were initially limited to investment-grade issuers, a company's loss of its investment-grade credit rating would have disqualified it from receiving support from those facilities. Around half of the investment-grade market was made up of BBB bonds as of 2019. A large number of fallen angels had already migrated into the high-yield category, including some household names like Macy's and Ford Motor.

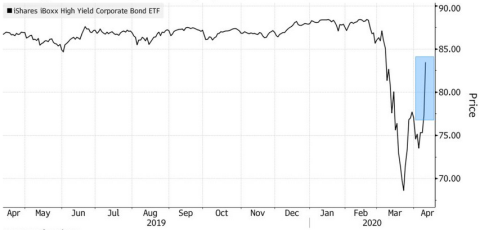

Given the scale of the pressure, the Fed eventually extended its liquidity facilities to fallen angels by broadening them to include companies that lost investment-grade credit ratings after March 22. Similarly, the Fed announced plans to further support the high-yield market by making limited purchases of exchange-traded funds (ETFs) tracking high-yield corporate debt. Following these announcements, prices for high-yield bonds rose substantially (Figure 2), possibly signaling the restoration of the market to some extent.

|

Figure 2. High-Yield Performance Since the April 9 Fed Announcement |

|

|

Source: Bloomberg. Note: Shaded area indicates price movements since the Fed announcement to expand the facilities to include recent "fallen angels" and certain bond ETFs. |

Money Market Mutual Funds

MMFs are mutual funds that invest in short-maturity, high credit-quality debt, such as commercial paper, Treasuries, municipal bonds, and certificates of deposit. They are also common investment options for households and businesses. MMFs are susceptible to sudden large redemptions (runs) because investors have an incentive to redeem shares before others do when there is a perception that the fund could suffer a loss. MMFs demonstrated during the 2008 market events that they could cause dislocation in funding markets. For more details, see CRS In Focus IF11320, Money Market Mutual Funds: A Financial Stability Case Study, by Eva Su.

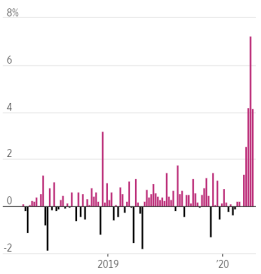

During the current pandemic-induced economic lockdown, some cash-strained investors have approached MMFs with redemption requests. Rather than wait till there are signs of the situation becoming critical, the Fed on March 18 created an MMF liquidity facility based on a facility it had deployed during the 2008 financial crisis. After this announcement, MMFs have seen waves of inflows, which is an indication that the Fed's interventions may have smoothed conditions in certain short-term credit markets (Figure 3).

|

|

Source: FactSet, Wall Street Journal. |

Municipal Bonds

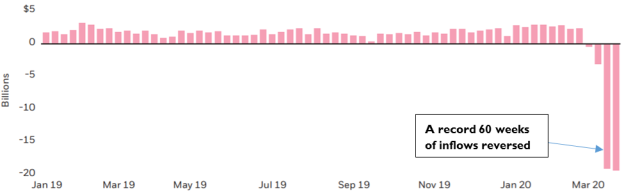

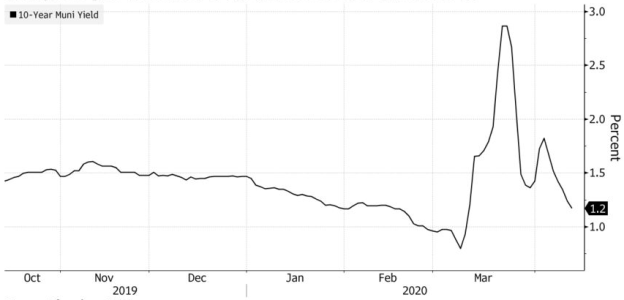

State and local governments employ 20 million workers, contribute around 8.5% of gross domestic product, and issue around $4 trillion in municipal bonds. The municipal bonds are mostly sold to finance capital projects such as bridges and schools. In addition to the pandemic-related revenue loss and spending increase, many states followed the Treasury's lead in providing a 90-day tax filing relief, thus delaying their tax revenue collections. Similar to other markets, municipal bonds faced steep selloffs in March (Figure 4). In response, the Fed included certain municipal bonds with maturities of under 12 months in some of its early liquidity facilities. It later expanded its support of state and local governments on April 9 by announcing a lending program devoted specifically to municipal debt, which will purchase certain longer-term bonds issued by states and large cities and counties. Following the Fed actions, certain municipal bonds' pricing pressure appears to have been reduced (Figure 5).

|

Figure 4. Weekly Municipal Bond Mutual Fund Flows (As of March 31, 2020) |

|

|

Source: Investment Company Institute, BlackRock. |

|

Figure 5. 10-Year Municipal Bond Yields Declined From March Selloff Levels |

|

|

Source: Bloomberg BVAL. |