Pandemic Weakening Milk Prices; Industry Calls for Policy Action

Milk price prospects for U.S. dairy producers in 2020 have weakened as the U.S. economy deteriorates under the expanding Coronavirus 2019 (COVID-19) pandemic. The year began with a positive outlook for the dairy industry that included higher milk prices and increased income for dairy producers in 2020, according to the U.S. Department of Agriculture (USDA). The dairy industry has gone through several years of relatively low milk prices, leading some dairy farms to exit the industry and two large dairy processors to file for bankruptcy. In 2019, according to USDA, the number of licensed dairy herds declined from 37,468 to 34,187, a nearly 9% drop. Almost every state lost dairies last year.

As a safety net for dairy producers, Congress enacted Section 1401 of the 2018 farm bill (P.L. 115-334) establishing the Dairy Margin Coverage (DMC) program. The program guarantees dairy producers could receive payments when the margin or difference narrows between the USDA-reported all milk price and a calculated feed ration value based on the prices of corn, soybean meal, and alfalfa hay. The DMC replaced the 2014 farm bill's (P.L. 113-79's) Margin Protection Program (MPP). The MPP program made very few payments to dairy producers during the 2015-2017 period ($12 million), and many producers considered the program ineffective as a safety net during years of relatively low milk prices. Congress amended MPP in the Bipartisan Budget Act of 2018 (BBA; P.L. 115-123) which resulted in higher MPP payments in 2018 ($253 million).

Building on these BBA changes, the DMC program expanded the margin guarantee by allowing producers to select a margin, ranging from $4.00 to $9.50 per hundredweight (cwt; 100 pounds) of milk at a lower premium cost. Producer-paid premiums for higher levels of margin coverage were significantly reduced in DMC compared with MPP to provide a greater incentive for dairy producers to participate in the program. For each month when the actual margin falls below a producer's selected DMC margin, the producer receives a payment from USDA for the difference between the two for the dairy's monthly milk production history.

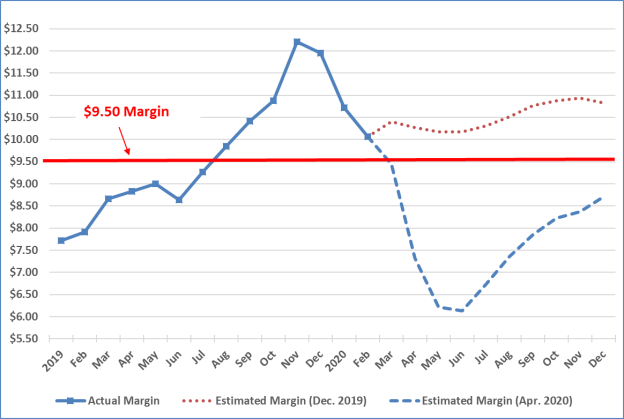

As a result of these program changes, 82% of dairy operations participated in the DMC in 2019, with most selecting the highest margin level of $9.50. Dairies received DMC payments of more than $312 million in 2019, compared to about $265 million during the 2015-2018 period under MPP. USDA made margin payments during the first six months of 2019, when the margin averaged $8.57. Higher all milk prices during the last half of the year resulted in an average margin of $10.46 per cwt, well above $9.50, which negated any payments. Against the backdrop of higher milk prices in the latter half of 2019, and an expectation that milk prices would rise further in 2020, 48% of dairy operations signed up for DMC for the 2020 calendar year program.

The economic impacts of COVID-19 on dairy markets have drastically altered the outlook for milk prices. Milk purchases at retail were strong in March 2020, but probably insufficient to offset the loss of milk and dairy product sales due to the closure of schools and reduced food service demand. The National Milk Producers Federation (NMPF) estimates the eroding outlook for milk prices since mid-February could result in losses of $6 billion in total gross farm income for dairy producers in 2020.

Prices for the CME April Class III milk futures contract (milk used for cheese and indicative of future milk prices) dropped 20% from a contract high of $18.00 per cwt on January 24, 2020, to $14.45 per cwt on April 1, 2020. Figure 1 shows how expectations have changed for dairy margins for the remainder of 2020 based on USDA's DMC Decision Tool, which calculates daily forecasts of milk and feed prices. Dairy producers may use the Decision Tool to determine how to participate in the DMC program. Heading into 2020, most dairy analysts expected the all milk-feed value margin to be well above the top margin level of $9.50 per cwt, with only slight possibilities of DMC payments during the year; thus contributing to the drop-off in participation in 2020.

The CARES Act (P.L. 116-136) provides USDA with $9.5 billion to "support agricultural producers impacted by coronavirus, including producers of specialty crops, producers that supply local food systems, including farmers' markets, restaurants, and schools, and livestock producers, including dairy producers." USDA is in the process of developing a program of emergency relief for dairy producers, and other producers economically harmed by the coronavirus pandemic, and is receiving policy suggestions from dairy industry stakeholders.

On April 6, 2020, the NMPF and the International Dairy Foods Association (IDFA), which represent milk producers and dairy processors, respectively, released a proposed plan of how USDA could support the dairy industry. These two groups say that milk supplies exceed demand by 10%, and expect this surplus to increase with the spring flush (a seasonal increase in milk production).

A key provision of the plan is that milk producers cut milk production by 10% from their March 2020 output. For dairies that cut production, the plan also proposes that USDA pay producers $3 per cwt on 90% of milk production. These payments would occur from April through September 2020, except for months in which the average of Class III and Class IV prices (prices representing cheese and butter/nonfat dry milk, respectively) exceed $16 per cwt. The plan also calls for USDA to indemnify dairy producers who dump or remove milk from commercial use because of disruptions in the dairy market, and reopen signup for the DMC program to give producers a second opportunity to enroll.

For dairy processors, the plan calls for USDA to provide recourse (repayable) loans to support processors holding excessive stocks during this time of market disruption, and to offer forgivable loans if processors follow certain conditions, such as continuing to buy milk from producers and maintaining staffing.

The plan also requests that USDA make substantial purchases of dairy products for food banks to help stabilize dairy markets and increase food security. Further, the industry asks that USDA grant state-based flexibility (e.g., restrictions on dairy product container size and fat content) for feeding programs such as Women, Infants, and Children (WIC) and Summer Food Service program for students. Also, the plan requests that USDA increase funding for the Supplemental Nutrition Assistance Program (SNAP), and for several other feeding programs, including international food aid.

In response to the plan, the American Dairy Coalition has called for regionalization of the production cuts, reasoning that seasonal production falls in the south during the summer, so northern tier dairy producers would bear the brunt of cuts to meet the 10% target compared with March production. Also, some analysts have questioned whether the DMC program enrollment should be reopened to milk producers (April 3, 2020, AgriTalk Live) because it would be a precedent for farm programs that generally operate with set deadlines for signup.