U.S. Gasoline Prices: No Driving, No Benefits to Consumers

Prices Plummet

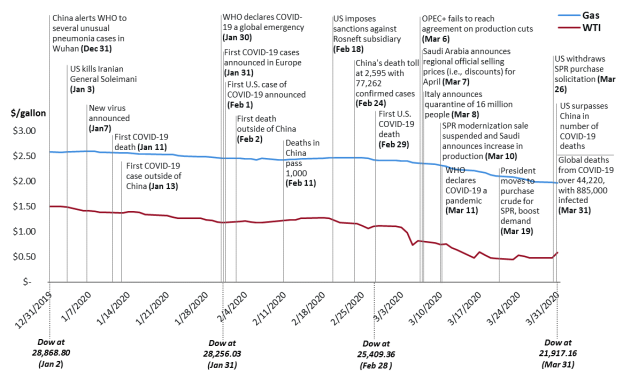

The collapse of crude oil prices is having consequences throughout the U.S. and global economies. For consumers, the effects of the price decline are felt nowhere more than in the price of gasoline. Gasoline is made from crude oil through the refining process, and the current decline in crude oil prices are a significant factor to the decrease in gasoline prices (Figure 1). There are four main components to retail gasoline prices according to the U.S. Energy Information Administration (EIA): 51% comes from crude oil prices, 20% from taxes, 18% from marketing and distribution costs, and 12% from the refining sector, although these percentages can vary by location. Crude prices and refining margins tend to change (sometimes substantially), while taxes and marketing and distribution costs are more stable components of gasoline prices. Additionally, like crude oil, gasoline is a global commodity. The United States both imports and exports, and domestic prices are influenced by international events.

Demand Down

The steep drop in crude oil prices, and consequently gasoline prices, as well as other petroleum-based commodities, is mainly attributed to a sharp drop in demand from COVID-19 and its impact on the economy, and announced price discounts and possible crude oil production increases by Saudi Arabia, other OPEC members, and other producing countries, including Russia. Between December 31, 2019, when China announced to the World Health Organization (WHO) it had unusual cases of pneumonia, and April 2, 2020, U.S. crude oil prices declined 59%, while gasoline prices dropped 24%. Retail gasoline suppliers (i.e., gas stations), tend to be slower to decrease prices than crude oil producers during times of uncertainty. This practice enables retail gasoline suppliers to benefit from falling crude oil prices. Additionally, it takes some time for gas stations to use the gasoline they already have. These gasoline stocks were likely purchased at a higher cost than replacement supplies purchased at the current low prices.

Gasoline Prices Falling

According to AAA, average U.S. gasoline prices for regular unleaded dropped below $2.00 a gallon on March 31 and fell to $1.97 per gallon on April 2. U.S. gasoline prices are at the lowest level since 2016 according to data from EIA. Some analysts are forecasting that prices will continue to drop. Cases of COVID-19 are growing in the United States, and more states are instituting travel restrictions. With these driving restrictions in place, gasoline demand is not likely to increase, despite the drop in prices. Although producers worldwide are reacting to the low prices for crude oil, market-driven production declines have not offset the increases by certain producers. These circumstances, along with other market conditions such as increases in the amount of gasoline in storage, are contributing to the view that crude oil prices, and subsequently petroleum product prices, may drop even more.

As President Trump tweeted earlier in March, lower gasoline prices are generally good for the consumer. However, the travel restrictions being instituted throughout the United States due to COVID-19 have limited the benefits of those low gasoline prices. Many people in the United States are under shelter-in-place rules, including working from home, and only have limited places to which they are allowed to drive.

Gasoline prices, according to AAA, vary widely around the United States, with Hawaii paying the highest price, $3.341 per gallon, and Wisconsin paying the least, $1.516 per gallon (see Table 1). Variations in gasoline prices reflect differences in specifications of gasoline, state and local taxes, distribution costs, and regional supply/demand balances.

|

State |

Gasoline Price ($/gallon) |

State |

Gasoline Price ($/gallon) |

|

Hawaii |

$3.341 |

South Dakota |

$1.908 |

|

California |

$3.005 |

Delaware |

$1.906 |

|

Washington |

$2.724 |

Maine |

$1.895 |

|

Oregon |

$2.677 |

Nebraska |

$1.873 |

|

Nevada |

$2.602 |

North Dakota |

$1.834 |

|

Alaska |

$2.474 |

Virginia |

$1.822 |

|

Arizona |

$2.415 |

Minnesota |

$1.815 |

|

New York |

$2.317 |

Georgia |

$1.802 |

|

Utah |

$2.313 |

North Carolina |

$1.801 |

|

Idaho |

$2.286 |

Louisiana |

$1.796 |

|

District of Columbia |

$2.264 |

Alabama |

$1.757 |

|

Pennsylvania |

$2.189 |

Iowa |

$1.736 |

|

New Jersey |

$2.167 |

South Carolina |

$1.732 |

|

Wyoming |

$2.149 |

Tennessee |

$1.730 |

|

Connecticut |

$2.119 |

Kansas |

$1.726 |

|

Rhode Island |

$2.090 |

Missouri |

$1.710 |

|

Massachusetts |

$2.079 |

Texas |

$1.705 |

|

Vermont |

$2.079 |

Arkansas |

$1.694 |

|

Maryland |

$2.009 |

Mississippi |

$1.686 |

|

Montana |

$2.007 |

Indiana |

$1.676 |

|

New Hampshire |

$2.004 |

Michigan |

$1.667 |

|

Illinois |

$2.002 |

Kentucky |

$1.643 |

|

Colorado |

$1.949 |

Ohio |

$1.603 |

|

Florida |

$1.932 |

Oklahoma |

$1.518 |

|

New Mexico |

$1.929 |

Wisconsin |

$1.516 |

|

West Virginia |

$1.926 |

Source: AAA, https://gasprices.aaa.com/state-gas-price-averages/.

Note: AAA prices include taxes. AAA does not report gasoline prices in U.S. territories.

Supplies Declining

Production of gasoline or what EIA refers to as finished motor gasoline has dropped to levels not seen since 2005. Since March 6, 2020, when OPEC failed to reach a production cut agreement, production of finished motor gasoline has dropped 25%. Should driving not increase, especially as the traditional peak driving season approaches, there may be additional downward pressure on production.