A New Director for the International Monetary Fund

On July 16, Christine Lagarde announced that she was resigning as International Monetary Fund (IMF) Managing Director following her nomination to succeed Mario Draghi as president of the European Central Bank. She is expected to take up the new post in November. Until a new permanent director is chosen, David Lipton, the IMF's First Deputy Managing Director, will serve as Acting Managing Director.

Ms. Lagarde's tenure at the IMF coincided with arguably the most challenging global economic landscape in recent decades. Assuming office in the middle of the global financial crisis and amidst the high-profile scandal involving her predecessor, Ms. Lagarde steered the Fund through several contentious European loan programs, secured congressional passage of a long-stalled IMF capital increase, and according to Mark Sobel, former U.S. representative to the Fund, reinvigorated IMF surveillance, boosting the policy relevance of the IMF's research and analysis.

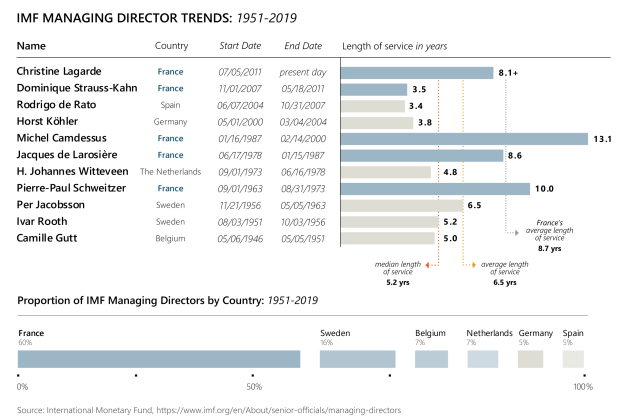

The leadership race has renewed a longstanding debate on leadership selection for the top management positions at the major multilateral organizations. Since the Fund was funded after World War II, an informal agreement between the United States and Europe has ensured that traditionally the president of the World Bank has been an American and the managing director of the IMF has been a European. This agreement reflects the political and economic balance of power at the end of World War II. At the time, the United States believed that the World Bank should be headed by an American since World Bank lending would be dependent on American financial markets. Of the eleven IMF Managing Directors to date, five have been French, including the most recent two: Christine Lagarde (2011-2019) and Dominique Strauss-Kahn (2004-2007). The selection of the new managing director would take place immediately after this year's appointment of U.S.-nominee David Malpass as World Bank president.

Over the years, the European-U.S. arrangement to split the leadership at the IMF and World Bank has generated criticism. Critics of the current selection process make three general arguments.

First, they argue that the informal agreement on IMF and World Bank leadership is no longer appropriate given shifts in global economic activity and influence. Whereas the United States and Europe dominated the postwar economy, the current international economy is more diverse. Developing and emerging market countries contribute half of global output, up from 25% in 1990. Any agreement that grants the leadership position based on nationality, critics argue, unnecessarily limits the pool of potential candidates, excluding non-Europeans that may be exceptionally competent in addressing the issues before the IMF.

Second, critics argue that the current system, where the Executive Board decides among candidates in secret, closed-door sessions, potentially undermines the legitimacy of the eventual Managing Director.

Third, critics point to a lack of congruence between the selection process and the institutions' aims of promoting best practices in global governance. Divisions among emerging market economies have historically made it difficult for countries to unite behind one credible non-European candidate. For example, during the leadership selection that elevated Christine Lagarde to the MD position, there were two potential candidates that were considered especially well-qualified, Tharman Shanmugaratnam, then-Singaporean Finance Minister, and Agustin Carstens, then Mexican central bank governor. Neither was able to garner sufficient support from other non-European economies, either within their region or globally.

IMF Guidelines

The formal guidelines for choosing the IMF Managing Director are laid out in the IMF's Articles of Agreements and By-laws. Article XII, Section 4, states that "[t]he Executive Board shall select a Managing Director who shall not be a Governor or an Executive Director." This decision may be reached by a 50% majority of the IMF's 24-member Executive Board. Section 14(c) of the Fund's By-laws provides that "[t]he contract of the Managing Director shall be for a term of five years and may be renewed for the same term or a shorter term at the discretion of the Executive Board, provided that no person shall be appointed to the post of Managing Director after he has reached his sixty-fifth birthday and that no Managing Director shall hold such post beyond his seventieth birthday."

The 2019 Selection Process

The IMF has set a September 6, 2019 deadline for applicants. The IMF Executive Board intends to complete the process by October 4. At the July 2019 meeting of European Union (EU) Finance Ministers, following Christine Lagarde's selection as the next ECB president, EU finance ministers, announced that they would nominate a single candidate to succeed Lagarde. "It is in the interests of Europe to keep the leadership at the IMF," announced French Finance Minister Bruno Le Maire shortly after the announcement of Lagarde's resignation.

Following a month of negotiations, EU Finance Ministers announced that the EU candidate would be Kristalina Georgieva, a Bulgarian economist currently serving as Chief Executive Officer of the World Bank, the number two position. Ms. Georgieva, whose candidacy was supported by France, would be the first Eastern European to lead the Fund. While Ms. Georgieva has had a distinguished tenure at both the World Bank and European Commission, she is an atypical candidate for the IMF Managing Director position, given her lack of monetary policy or financial sector experience. According to one European finance minister, speaking confidentially to CNBC, "The truth is that there is no readily available tried and tested European all-rounder." Mark Carney, the governor of the Bank of England, who has Canadian, British, and Irish citizenship was widely discussed as a possible candidate, but was viewed as not European enough. According to senior French official, French President wanted a "continental European" for the job. If Ms. Georgieva, who turned 65 last year, receives the support of the full IMF Executive Board, her nomination would require a change of the age restrictions in the Fund's bylaws. To date, no other candidates have been nominated.

Congress has no formal involvement in the selection of Fund management and past Administrations have typically supported the European candidate, as likewise European countries have supported the U.S. nominee to lead the World Bank. In 2000, the U.S. Treasury threatened to oppose the first European choice, Caio Koch-Weser, forcing European countries to nominate a second candidate, Horst Kohler, who was eventually confirmed. Similarly, President George W. Bush's nomination of Paul Wolfowitz in 2005 drew objections from leaders of France and Germany, but they ultimately decided not to put up a fight and Wolfowitz was confirmed by the World Bank Executive Board.