The Federal Income Tax: How Did P.L. 115-97 Change Marginal Income Tax Rates?

At the end of 2017, President Trump signed into law P.L. 115-97, which is commonly referred to as the Tax Cuts and Jobs Act, or TCJA. (The title of the bill as passed by the House was the Tax Cuts and Jobs Act, but it was eliminated before final passage under the reconciliation process used to consider the bill in the Senate.) This law made numerous changes to the federal income tax for individuals and businesses. Of the many changes made to individual income tax provisions, the law temporarily changed marginal tax rates. These changes are currently in effect from 2018 through the end of 2025.

What Are Marginal Income Tax Rates?

For many taxpayers, calculating federal income tax liability can be broken down into three main steps

- 1. Taxpayers calculate the amount of income subject to taxation (i.e., their taxable income).

- 2. Taxpayers apply marginal income tax rates to their taxable income to determine their "pre-tax credit" income tax liability.

- 3. Taxpayers subtract tax credits from their pre-tax credit income tax liability to determine their final income tax liability.

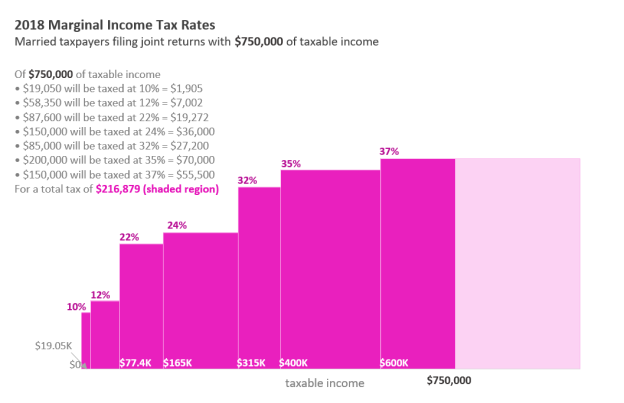

Marginal income tax rates are the tax rates applied to the last dollar of taxable income. Taxable income is often equal to total income minus the standard deduction or the sum of itemized deductions, whichever is greater. Specific marginal rates apply over discrete ranges of taxable income. For example, as illustrated below, if a married taxpayer has $750,000 of taxable income, only the amount above $600,000—or $150,000—is subject to a marginal rate of 37%, not the entire $750,000.

|

|

Note: The maximum taxable income displayed in this graphic and all subsequent graphics is $1,000,000. |

This Insight looks only at statutory marginal tax rates and not effective marginal tax rates, which may differ. Effective marginal tax rates are the amount paid in tax on the next dollar of income, taking into account interactions with other features of the tax system. Thus, effective marginal tax rates are a function of (1) a taxpayer's statutory marginal tax rate; and (2) interactions with other credits, deductions, exemptions, and special provisions in the tax code.

Of note, capital gain or dividend income is taxed at different rates. In addition, some taxpayers may be subject to the alternative minimum tax (AMT), which in addition to a different definition of taxable income has different marginal tax rates.

For a visualization of how federal income tax liability is calculated, see CRS Infographic IG10011, The U.S. Individual Income Tax System, 2018.

How Did Marginal Income Tax Rates Change?

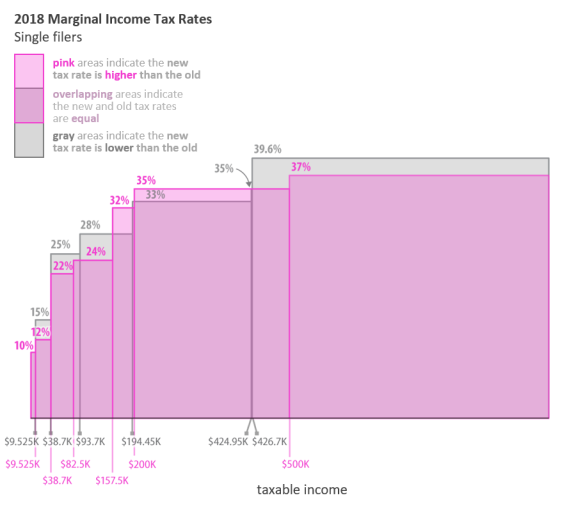

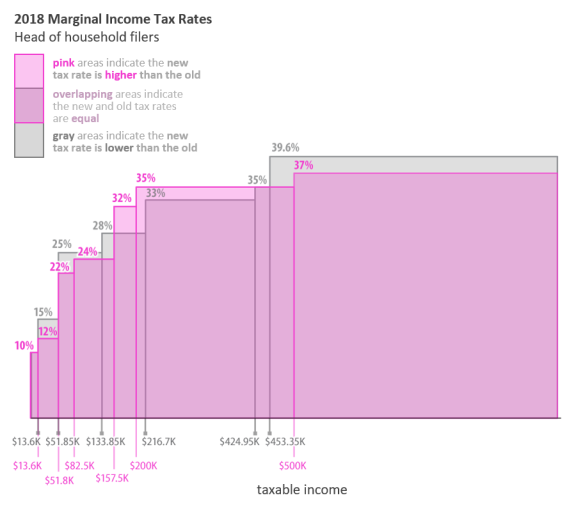

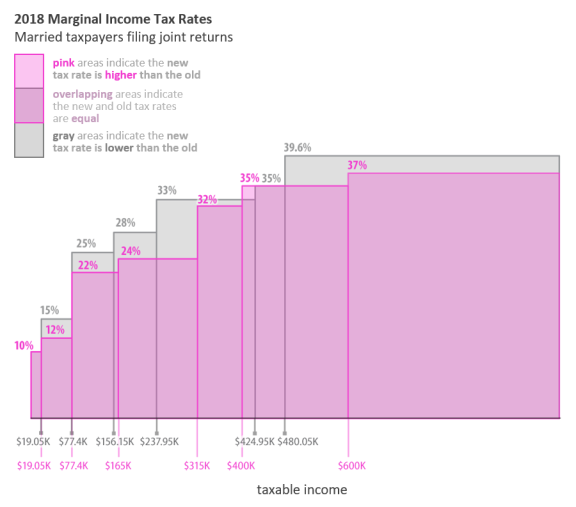

Below are visualizations of marginal income tax rates in 2018 before and after the changes made by the TCJA (P.L. 115-97). The pre-TCJA rates are gray (what the 2018 marginal tax rates would have been, had P.L. 115-97 not become law), while the new marginal tax rates are pink. The three figures reflect the tax rates for taxpayers who file their federal income taxes as single filers (generally unmarried individuals without dependents), head of household filers (generally unmarried individuals with dependents, like a single parent), and married couples who file jointly (most married couples file their taxes this way).

Several patterns are visible in these figures

- First, the lowest-income taxpayers generally see no change in their marginal tax rates since the 10% tax bracket is unchanged by the law. This is illustrated when the height of the pink and gray rectangles are the same.

- Second, for many medium- and upper-income taxpayers, their marginal tax rates are often lower. This is illustrated when the height of a pink rectangle is below the height of a gray rectangle for a given range of taxable income.

- Third, for single and head of household filers, and to a lesser extent married joint filers, there is a range of taxable income subject to higher marginal tax rates under the new tax law. This is illustrated when the height of a pink rectangle is above the height of a gray rectangle for a given range of taxable income.

Each of these points is discussed in detail for a given filing status.

Importantly, marginal tax rates are not the only factor that determines whether an individual has a lower or higher tax liability as a result of P.L. 115-97. A broad constellation of factors can result in taxpayers receiving a tax cut or a tax increase as a result of the TCJA. These factors include, but are not limited to, where the taxpayer lives, the number of children they have, whether they incurred significant medical expenses, and whether they own a home.

Single Filers

|

For single filers, the TCJA left unchanged, reduced, or increased marginal income tax rates over different ranges of taxable income. For the lowest-income taxpayers, the 10% tax bracket was unchanged by the law and applied to the first $9,525 of taxable income. For taxable income greater than $9,525 up to $157,500, marginal rates are lower under the TCJA. Marginal rates are higher under the TCJA between $157,500 and $424,950 of taxable income (excluding a rate reduction between $195,450 and $200,000 of taxable income). The marginal tax rate on taxable income between $424,950 and $426,700 was unchanged by the TCJA. For taxable income above $426,700, marginal rates are lower under TCJA.

Head of Household Filers

|

For head of household filers, the TCJA left unchanged, reduced, or increased marginal income tax rates over different ranges of taxable income. For the lowest-income taxpayers, the 10% tax bracket was unchanged by the law and applies to the first $13,600 of taxable income. For taxable income greater than $13,600 up to $157,500, marginal rates are lower under the TCJA. Marginal rates are higher under TCJA between $157,500 and $424,950 of taxable income. The marginal tax rate on taxable income between $424,950 and $453,350 was unchanged by the TCJA. For taxable income above $453,350, marginal rates are lower under TCJA.

Married Couples Filing Jointly

|

For married couples filing jointly, the TCJA left unchanged, reduced, or increased marginal income tax rates over different ranges of taxable income. For the lowest-income taxpayers, the 10% tax bracket was unchanged by the law and applies to the first $19,050 of taxable income. For taxable income greater than $19,050 up to $400,000, marginal rates are lower under the TCJA. The marginal income rate is higher under TCJA between $400,000 and $424,950 of taxable income. The marginal tax rate on taxable income between $424,950 and $480,050 was unchanged by the TCJA. For taxable income above $480,050, marginal rates are lower under TCJA.

Acknowledgments

Kevin Borden created the data visualizations used in this Insight.