Canada’s Dairy Supply Management System

On August 31, 2018, President Donald Trump notified Congress that he intended to sign a new trade agreement with Mexico in 90 days, and with Canada "if it is willing." Since then, United States and Canada have been negotiating to bring Canada into the agreement. Both sides have signaled that dairy, and, in particular, Canada's Class 7 milk category, remains one of the toughest obstacles to overcome. As both sides continue negotiations, this product provides a brief overview of how the Canadian government manages its dairy industry supply chains—as well as of the controversy surrounding the Class 7 category.

Canada's Supply Management System

In Canada, supply management is a government mechanism that provides stability to dairy farmers through production control and minimum support prices for their commercial products. While supply management applies to dairy, chicken and turkey products, table eggs, and broiler hatching eggs, the Canadian dairy system has proved to be one of the most contentious issues in the North American Free Trade Agreement (NAFTA) renegotiations. The system developed primarily at the provincial level in the 1960s to counter price instability, supply uncertainty, and producers' revenue fluctuations. It was implemented nationally in the 1970s. The United States has dairy safety-net programs for its producers, but they do not include a supply management system.

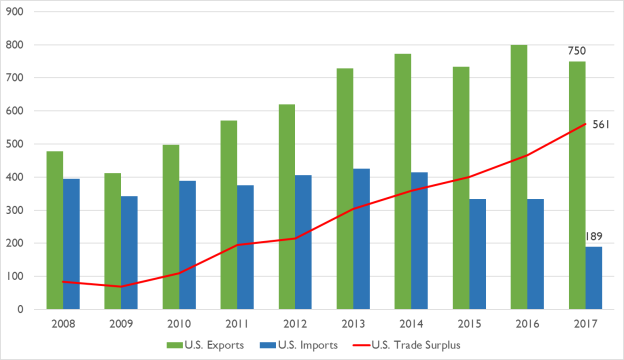

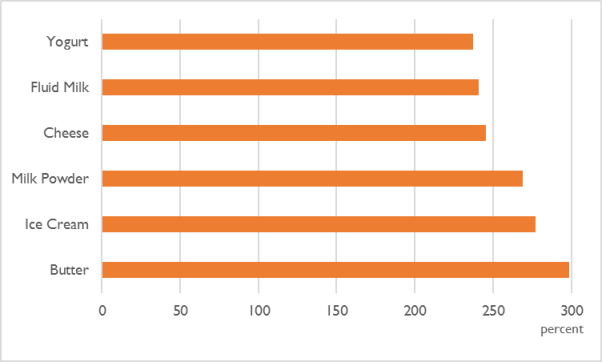

This system has long been a source of concern for the U.S. dairy industry. A certain amount of U.S. dairy products receive duty-free tariff treatment in Canada. However, U.S. dairy exporters face entry barriers, mostly in the form of tariff-rate quotas (TRQ), with over-quota tariffs as high as 313.5%, depending on the product. Nevertheless, despite its highly restrictive dairy market, in 2017 Canada remained the second-largest foreign market for U.S. dairy products, after Mexico. That year, Canada bought $750 million worth of U.S. milk, cheese and other dairy products, while Canada exported much less—$189 million—to the United States. In recent years, the United States consistently ran trade surpluses with Canada in dairy, amounting to $561 million in 2017 (Figure 1). Without the restrictive TRQs, however, many dairy analysts believe U.S. exports would be higher.

How does supply management work?

According to a study on the supply management system by the Library of the Parliament of Canada, the system rests on three pillars: (1) production control, (2) pricing mechanisms, and (3) import control.

First Pillar: Production Control

The Canadian Dairy Commission (CDC) is responsible for setting the national production quota levels based on provincial demand. Provincial boards, in turn, are responsible for allocating production among farmers, who undertake to produce within their allotted quota. The boards also negotiate prices with buyers and set quota transfer rules. Observers say a lack of transparency in Canada's formulas and allocation processes has been a major concern of dairy exporters worldwide.

Second Pillar: Pricing Mechanism

Each year the CDC sets support prices for butter and skim milk powder that are used by provincial dairy boards to set guaranteed minimum prices. Through provincial marketing boards, farmers collectively negotiate minimum "farm gate prices" with processors. This price is based on production costs and market conditions. Critics maintain that this system inflates dairy prices beyond what an open market would impose in order to keep farmers profitable.

Third Pillar: Import Control

Canada restricts imports by setting TRQs. It grants trading partners a "minimum level of access" to imports at reduced or zero tariffs and imposes high tariffs on imports above the quota (Figure 2). Critics argue that the policy makes imported goods prohibitively expensive for Canadians, leaving domestic supply as virtually the only option for consumers.

|

Figure 2.Over-Quota Tariffs for Selected Canadian Dairy Imports |

|

|

Source: CRS with data from the World Trade Organization, Tariff Download Facility (September 18, 2018). |

Class 7 Pricing

In recent years, strong demand for butter has led to an increase in milk production quotas in Canada, resulting in a surplus of skim milk supplies. To address the surplus, the Canadian dairy industry adopted a new milk pricing category in 2017 known as Class 7, which is comprised of skim milk components, primarily milk protein concentrates and skim milk powder. The result has been reduced prices for Canadian skim milk products, increased Canadian global exports of skim milk powders that previously had to be subsidized, and U.S. producers losing exports of high protein ultra-filtered (UF) milk to Canadian cheese processors.

Canadian processors had been importing U.S. UF milk because it entered Canada duty-free. UF milk was a minor product in the early 1990s, and derived products did not exist. Therefore, it was not part of the original NAFTA negotiations. This gave the U.S. dairy industry almost unrestricted access to the Canadian market for UF milk. According to the U.S. Department of Agriculture (USDA), U.S. UF milk exports to Canada totaled nearly $102 million in 2016; $49 million in 2017; and $22 million in January-July 2018, 30% lower than for the same period last year.

Outlook

In the past, Canada has granted foreign countries more access to its dairy market when negotiating trade agreements, particularly during the Trans-Pacific Partnership negotiations. Recently, some officials from Canada have signaled that Canadian trade negotiators might be prepared to make similar offers in the current NAFTA renegotiations. The Administration has stated that Canada must eliminate the Class 7 price strategy. Even if Canada eliminates it, however, the supply management system is unlikely to be dismantled or restructured in a way that addresses all of the U.S. dairy industry's concerns.

To exert greater pressure on Canada, the Trump Administration has signaled that it is prepared to move forward with Mexico alone on a revised NAFTA. It has also threatened to apply auto tariffs to Canadian exports if a deal is not reached. Some congressional leaders have warned the President that a revised trade agreement must include both Canada and Mexico, and that ultimately, Congress retains constitutional authority over the ratification of a revised trade agreement.